|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, October 25, 2021

Governments Are Flush

But Still Demand More Taxes

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

H-3039 allows cities

and towns to implement a local excise tax of

3-cents-per-gallon on gas and diesel fuel sold

within its borders. One cent of the tax would go to

each of the following: the maintenance, repair,

upkeep, construction or improvement of roads,

bridges, sidewalks, bikeways, public parking areas

or roadside drainage; the Massachusetts Bay

Transportation Authority or regional transportation

authority serving the city or town; and projects

which promote and improve non-single occupancy motor

vehicle transportation including pedestrian

facilities, bicycle facilities, senior

transportation programs, telecommuting programs and

carpool programs.

“I filed this

legislation after three of the municipalities I

represent filed home rule petitions requesting that

a gasoline tax be authorized,” said co-sponsor Rep.

Smitty Pignatelli (D-Lenox). “I'm a firm believer

that if the state government cannot provide the

necessary funds for communities to maintain their

transportation infrastructure, we should not stand

in the way of solutions that allow communities to

make these decisions and get needed revenue for

themselves.”

“This legislation gives

municipalities the ability to raise additional

revenue and the flexibility to address their most

pressing transportation needs,” said co-sponsor Rep.

Tommy Vitolo (D-Brookline). “Across the

commonwealth, our transportation systems need

improvement and [this bill] helps communities

implement local solutions.”

“A local gas tax is

nothing more than another sneaky attempt to raise

municipal revenue outside and above the restrictions

of Proposition 2½,” said Chip Ford, executive

director of Citizens for Limited Taxation.

“The state can certainly provide the funds to

maintain transportation infrastructure if Beacon

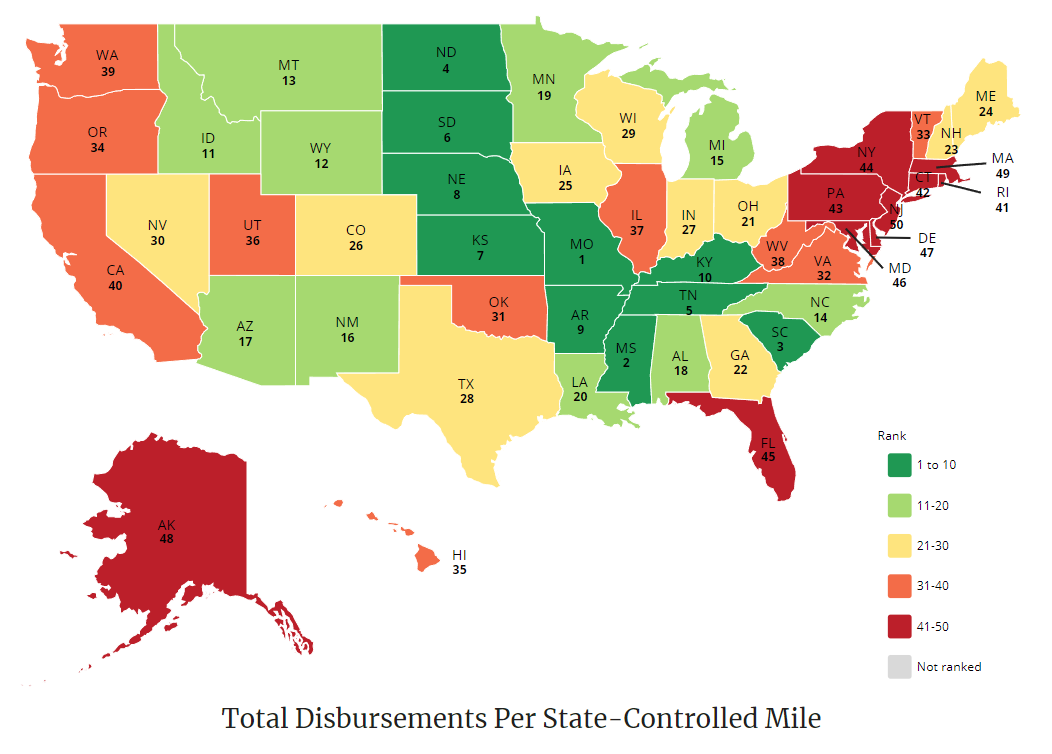

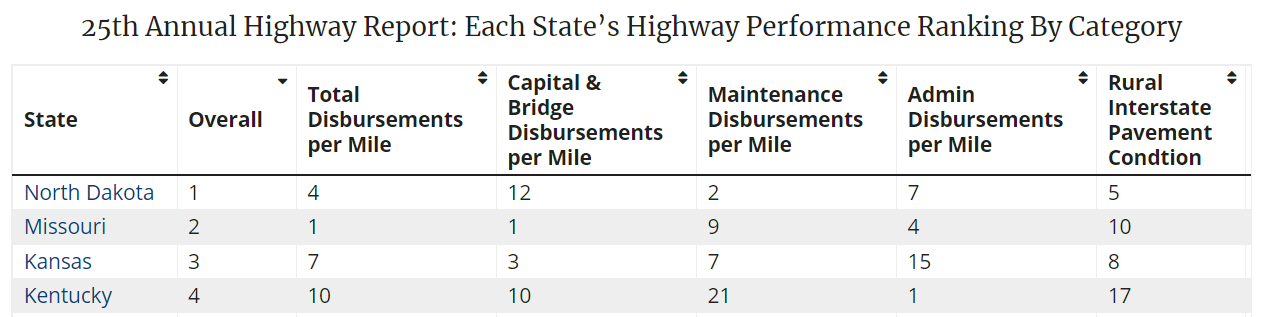

Hill prioritizes it,” added Ford. “Reason

Foundation's 25th Annual Highway Report (2020) ranks

Massachusetts 49th (second highest) in total

spending per road mile. Its state-controlled highway

miles (3,659) is the fourth smallest highway system

in the nation yet just its administrative cost per

mile alone is second-highest.”

Beacon

Hill Roll Call

October 18-22, 2021

Allow Cities and Towns to Impose a

3-Cents-per-Gallon Gas Tax (H-3039)

By Bob Katzen

Rep. Kay Khan, a Newton

Democrat, has filed two bills to tax sugary

beverages (H-2972) and double the excise taxes on

beer, wine and liquor (H-2973).

Khan told the Committee

on Revenue Monday that she thought the time for both

ideas had come, with the state spending $2.6 billion

every year in response to alcoholism and addiction,

and other cities finding success with sugar taxes.

"I just think that we

need to be really looking at this very seriously,"

Khan said.

Neither idea is new,

but Sen. Adam Hinds, the co-chair of the Committee

on Revenue, said the fact that Massachusetts doesn't

tax alcohol sales "jumped out to a lot of us" who

served on the Tax Expenditure Review Commission, and

he described Massachusetts as an "outlier." ...

Khan's bill would not

change the application of the sales tax, but would

double the excise tax rates assessed on beer, wine

and liquor. Hinds said those rates have not been

adjusted in decades, and remain among the lowest in

the country even among states that also charge sales

taxes on alcohol....

The alcohol excise tax

proposal, however, encountered opposition from the

Massachusetts Package Stores Association, which said

it could threaten the existence of locally-owned

alcohol retailers.

Rob Mellion, executive

director of the MPSA, said . . . higher excise taxes

would also make it that much harder to compete with

New Hampshire, which doesn't tax alcohol and already

counts on Massachusetts for at least 28 percent of

its sales. He said New Hampshire routinely markets

to Massachusetts consumers because of the price

differential.

"When you raise the

excise tax, you've just given them a new campaign,"

Mellion said....

Khan's other bill would

impose a tiered tax structure on sugary drinks based

on volume and sugar content, putting Massachusetts

in the company of cities like San Francisco,

Washington, D.C., Philadelphia and Seattle that have

taxes on soda and other drinks to encourage

healthier choices.

State

House News Service

Monday, October 18, 2021

Drink Taxes Pitched To Boost

Health, Addiction Treatment

Voters Rejected Alcohol Tax Plan in 2010

Massachusetts Department of Revenue

Division of Local Services

FREE CASH —

DEFINITION

Free cash is a revenue

source that results from the calculation, as of July

1, of a community's remaining, unrestricted funds

from its operations of the previous fiscal year

based on the balance sheet as of June 30. It

typically includes actual receipts in excess of

revenue estimates and unspent amounts in

departmental budget line items for the year just

ending, plus unexpended free cash from the previous

year. Free cash is offset by property tax

receivables and certain deficits, and as a result,

can be a negative number.

In our January 7th,

2021 article entitled “Counting Free Cash – Another

Update,” we noted yet another new record in total

statewide certifications of $1.915 billion as of

7/1/2019. This was a 9.2% increase over the amount

certified as of July 1, 2018, and well above the

2.5% increase that July 1, 2018 totaled over July 1,

2017.

In that same article,

we questioned whether the legislation that extended

appropriation of July 1, 2019 free cash beyond June

30, 2020, plus the general economic slowdown due to

the pandemic would lead to a significant reduction

in total free cash certified as of July 1, 2020. The

crystal ball foreseeing local government’s fiscal

future was not completely clear at that time. With

all the data now in, we’ll determine if the trend of

a consistent annual increase in total certified free

cash continued....

The streak continues.

July 1, 2020 certified free cash totaled

$1,950,974,770. The $35.8 million increase, however,

was only 1.9% over free cash certified as of July 1,

2019. This total did continue a trend in total free

cash over $1 billion that began as of July 1, 2012

as shown in the graph below. Certifications have

increased from July 1, 2009 to July 1, 2020 by about

$1.3 billion.

In this certification

period, 349 communities were certified. Of these,

five were certified in the negative ranging from

$104,193 to $2,402,830. The greatest increase in

free cash was Boston at $13.9 million, while

Cambridge had the greatest decrease at $36.8

million. Across the board, we saw a median increase

of $432,477 and median decrease of $409,413....

As of this writing,

almost 100 cities and towns have free cash certified

as of July 1, 2021 and many results show a

significant increase over their amount certified as

of July 1, 2020. We remain cautiously optimistic

that this good financial news will continue and

prove initial thoughts of a significant free cash

reduction in this new certification period false.

Emergency federal and state financial assistance to

local governments in response to the pandemic

continues to provide a measure of financial support,

which has been a factor in the increases in free

cash realized to date.

City &

Town

A Publication of the Massachusetts Department of

Revenue's

Division of Local Services

October 21, 2021

An Update on Free Cash

. . . Of course, the

falling leaves, cooler nights and the impending

arrival of November means the clock is really

ticking on the Legislature to make some decisions.

Baker signed a $303

million closeout budget on Wednesday that allows for

about $1.5 billion in surplus tax revenue from

fiscal 2021 to be deposited in an escrow account for

legislators to decide at a later date how to spend.

The move to temporarily set aside last year's

surplus was unique and made, according to Democratic

leaders, in order to allow Comptroller William

McNamara to balance the books for last year without

rushing the Legislature to make decisions on how to

spend the extra cash.

Of course, what it

looks like to be in a rush in the real world versus

on Beacon Hill are two different things.

Gov. Charlie Baker

filed a budget to spend the surplus back in August,

and even before that he put forward a plan to spend

just over half of the state's American Rescue Plan

Act funds.

House and Senate

leaders are now looking this fall at how to allocate

both pots of money, worth around $6.3 billion

combined, all while monitoring Washington to try to

avoid overlapping with the trillions of dollars

Congressional Democrats are looking to throw at

infrastructure, child care and Medicaid, if they can

only just reach agreement amongst themselves.

Baker said he was

optimistic that the Legislature was preparing a

"pretty, pretty comprehensive and pretty

significant" ARPA spending bill, and he reupped his

recommendation that $1 billion from the surplus be

used replenish the unemployment insurance system.

That spending bill

could very well be the next major item to find

itself on the House calendar. But this week it was

the decennial redistricting map drawn by Assistant

House Majority Leader Michael Moran that was up for

a vote.

State

House News Service

Friday, October 22, 2021

Weekly Roundup - Get It, Got It,

Good

Beacon Hill leaders

continue to juggle pandemic management with

legislative wrangling, but with formal sessions due

to cease for the year on Nov. 17, they now have less

than a month to deliver on their fall agenda....

Democrats on Beacon

Hill have been known to extend conference committee

deliberations for months on major spending bills,

but they are leaving themselves only weeks to come

to terms on a bill allocating a portion of federal

COVID-19 relief funding, a critical piece of

legislation that budget writers have described as a

"once-in-a-generation opportunity."

If they want to put a

good chunk of the $4.8 billion in American Rescue

Plan Act funds to work soon, it's looking more

likely that Democrats will need to ram a bill

through in the next few weeks, potentially limiting

opportunities for major amendments and longer

negotiations.

House Democrats are

scheduled to huddle as a caucus Monday to talk about

ARPA spending legislation, signaling that a proposal

is likely imminent. The House has also scheduled a

formal session for Thursday, with a potential formal

penciled in for Friday.

Gov. Charlie Baker said

this week that he's expecting a "comprehensive" bill

to emerge soon in the Legislature. The ARPA bill is

perhaps overshadowing other near-term spending

choices.

Lawmakers and Baker

this week agreed on a $300 million bill to close out

the books on fiscal 2021, but legislative leaders

have described a fall timeline to consider $1.5

billion in unobligated fiscal 2021 surplus funds

that are now sitting in a new fund.

By socking the money

away, the Legislature avoided having it swept into

the state's reserves and it's possible that the

surplus dollars will be allocated in one exercise

that also involves ARPA funds, although conflating

the two bills could raise ARPA spending

accountability issues.

State

House News Service

Friday, October 22, 2021

Advances - Week of Oct. 24, 2021

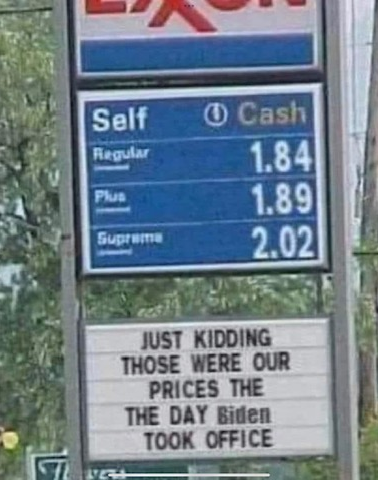

Gas prices continue to

contribute to inflation concerns, rising nine cents

per gallon in the last week and cutting further into

household budgets across Massachusetts.

AAA Massachusetts

reported Monday that the average price of a gallon

of gas hit $3.27 in its latest weekly survey. That's

up from $3.10 a month ago and just $2.10 a year ago.

"Compared to the price

of gas a year ago, it now costs consumers about $17

more to fill up their vehicles," AAA's Mary Maguire

said. "And unfortunately, it doesn't look like

drivers will be finding relief at the pump any time

soon."

The last time prices in

Massachusetts were this high was October of 2014 at

$3.32 per gallon, according to AAA, which said

increasing crude oil prices are the "primary factor"

behind the higher prices at the pump....

While calls for

increased investments in transit and transportation

have continued, gas tax talks on Beacon Hill have

died down after the House in 2020 passed legislation

raising more than $600 million in new transportation

revenues, a package that died without a vote in the

Senate. The House bill had featured a 5-cent

increase in the gas tax and a 9-cent increase in the

tax on diesel fuel....

The chief

transportation revenue proposal with some momentum

still behind it is the proposed surtax on household

incomes above $1 million a year. That proposal is

scheduled to appear as a constitutional amendment on

the November 2022 ballot, where it faces an

up-or-down vote.

Supporters of the idea

say it will force higher-income households to pay

their "fair share" of taxes and deliver as much as

$2 billion to be shared between education and

transportation investments. Opponents say the

measure, if passed, could drive wealth and revenue

out of Massachusetts and eventually lead to higher

taxes on other high earners through a graduated

income tax structure.

Baker, who hasn't said

if he'll seek a third term in 2022, opposes the

income surtax. Baker last month warned that

companies "can locate anywhere" and questioned

estimates of expected surtax revenues and promises

that they would only be spent on education and

transportation.

State

House News Service

Monday, October 18, 2021

AAA: Average Gas Fill-Up Cost Up $17

In Past Year

Feds: Boston-Area Consumer Price Index Rose 4

Percent

As the State House News

Service reported, soaring gas prices are adding to

inflation worries, rising 9 cents a gallon in the

last week. AAA Massachusetts reported Monday that

the average price of a gallon of gas hit $3.27 in

its latest weekly survey. That’s up from $3.10 a

month ago and just $2.10 a year ago.

“Compared to the price

of gas a year ago, it now costs consumers about $17

more to fill up their vehicles,” AAA’s Mary Maguire

said. “And unfortunately, it doesn’t look like

drivers will be finding relief at the pump any time

soon.”

Just what we need

before Thanksgiving and holiday trips to see family.

Driving to find the perfect Christmas tree, piling

in the car to tour the houses bedecked in festive

lights — it’ll cost a pretty penny this year.

The last time prices in

Massachusetts were this high was October of 2014 at

$3.32 per gallon, according to AAA, which said

increasing crude oil prices are the “primary factor”

behind the higher prices at the pump.

Oil — the fuel Biden

and his fellow Democrats love to demonize, but on

which the country depends....

The Biden

administration has requested OPEC increase its

exports.

Dependence on OPEC was

one of the reasons the Keystone XL Pipeline contract

was a good idea — it would have given America a

stronger measure of energy independence.

Is it any wonder that

amid a host of legal woes, Donald Trump still has

the support of 47% of registered voters in another

run for the White House, according to a new Hill-HarrisX

poll?

A Boston

Herald editorial

Tuesday, October 19, 2021

Biden tries talk therapy on

gas prices

Democrats scaled back a

proposal to require banks to send to the IRS more

information about customers’ accounts in hopes of

salvaging the idea, raising to $10,000 from $600 the

key reporting threshold and adding an exemption that

would spare many workers and retirees.

The core idea

remains—banks would be required to provide

information that could help the IRS more easily find

tax cheating. But amid opposition from the

financial-services industry and many Republicans,

Sens. Ron Wyden (D., Ore.) and Elizabeth Warren (D.,

Mass.) proposed changes on Tuesday that would reduce

the number of accounts affected. The plan seeks to

generate hundreds of billions of dollars in owed but

unpaid taxes that could help pay for new federal

programs under consideration in Congress.

Democrats want banks,

other financial institutions and peer-to-peer

services such as Venmo to report annual totals of

account inflows and outflows to the Internal Revenue

Service. That would give the tax agency a window

into income streams that are more opaque than wages

and interest. The IRS already gets information on

wages and interest from banks and employers and

cross-checks that data against tax returns.

The additional account

details wouldn’t provide direct evidence of tax

cheating, but they would create a data trove that

tax authorities could use to decide who gets

audited. It could also be a deterrent to

people—particularly business owners—who are

considering not reporting all of their income....

Banks, credit unions,

Republican lawmakers, business owners and

conservative groups such as Americans for Tax Reform

have been building opposition to the plan for

months. They warn that the requirement would put

taxpayer information at risk if IRS computer systems

were breached and they have described the proposal

as snooping and surveillance.

“Even with the

modifications announced today, this proposal still

goes too far by forcing financial institutions to

share with the IRS private financial data from

millions of customers not suspected of cheating on

their taxes,” Rob Nichols, president and CEO of the

American Bankers Association, said Tuesday....

The current proposal

doesn’t require banks to share transaction-level

data. But the IRS could use the account information

to request information about specific withdrawals

and deposits, said Richard Hunt, CEO of the Consumer

Bankers Association, a trade group for retail banks.

“[The IRS] can’t deduce

who is avoiding paying their taxes without peering

through every financial transaction,” Mr. Hunt said.

“Bankers cannot become agents of the IRS.” ...

Rep. Drew Ferguson (R.,

Ga.), a member of the House Ways and Means

Committee, said the revised proposal still raised

privacy concerns.

“It does not matter if

the amount is $1, $600 or $10,000, Americans don’t

want the IRS snooping into their bank accounts,” Mr.

Ferguson said on Fox News on Tuesday.

The Wall

Street Journal

Tuesday, October 19, 2021

Democrats Try to Salvage IRS

Bank-Account Reporting With Scaled-Back Plan

Key reporting threshold would go to $10,000 from

$600; banks, GOP say plan is unworkable

Democrats walked into a

political ditch with their plan to let the Internal

Revenue Service snoop on American banks accounts,

and so far they’re doing a lousy job of scrambling

to get out.

This week Senate

Democrats backed by the Biden Treasury released a

revised proposal that raises the threshold for

financial institutions to report to the IRS on

individual accounts to $10,000 from the previously

mooted $600. The proposal also tries to dodge the

charge of snooping on Everyman by exempting wage

income from “certain payroll companies” and Social

Security checks.

The details are murky,

but most Americans could still get ensnared in this

dragnet unless they pay bills and buy goods in cash.

Democrats say banks will only have to report total

annual inflows and outflows, not discrete

transactions. But nearly all Americans spend more

than $10,000 a year.

The real political goal

here is to create a mechanism for triggering

audits—probably through an algorithm—so the IRS can

rifle through all of a taxpayer’s business and other

financial records....

Senate Democrats say

their plan would be “virtually cost-free” for banks.

Big banks can handle the compliance burdens, but the

burden is greater for community banks that provide

most lending to small businesses.

Banks will also be in

the awkward position of helping the government

police their customers. Recall how liberals howled

about the National Security Agency antiterror

program that required telecom companies to share

phone metadata with the feds. Now Democrats want

financial institutions to help the tax collector

track your cash flow. Vows of privacy at the IRS

aren’t worth much after the recent leaks of taxpayer

data to ProPublica.

The IRS already has

enough data to go after the wealthy and genuine tax

cheats. It wants to look at everyone’s bank account

so its agents have another excuse to audit and

squeeze more money from non-wealthy Americans.

The Wall

Street Journal

Thursday, October 21, 2021

The $10,000 IRS Tax Dragnet

Treasury wants to snoop on bank accounts to trigger

more audits.

Some state school board

associations are challenging the National School

Boards Association’s (NSBA) recent letter to

President Joe Biden.

The NSBA

compared parents to domestic terrorists and

called for the president to direct the federal

government to “deal with the growing number of

threats of violence and acts of intimidation

occurring across the nation.”

Several days later, the

Department of Justice (DOJ)

announced it was tasking FBI agents and U.S.

attorneys to convene to discuss strategies for

addressing threats against school administrators,

board members, teachers, and staff....

The Massachusetts

Association of School Committees and the Arizona

School Boards Association also indicated approval of

the DOJ’s order....

The Kentucky School

Boards Association said the national letter doesn’t

reflect its opinion.

Kim Schelling, the

group’s executive director, said it believes

strongly in “the value of local control” and that

“engaging with local constituents is a hallmark of

democracy and disagreement expressed publicly is not

new for school board members.”

While certain behaviors

that have been reported are troubling, such as

disruptions of school board meetings, they “appear

to represent the isolated actions of a small number

of people,” she added.

“Illegal acts,

violence, and intimidation of any public officials

will not be tolerated, and districts will continue

to work closely with local law enforcement to

address issues of public safety,” Schelling wrote,

adding that the state group will likely need to see

“corrective action” from NSBA’s leadership to remain

a part of the national association.

The Epoch

Times

Monday, October 11, 2021

Some School Board Associations

Denounce National Group’s Letter Over Threats

|

|

Local municipal, state,

and federal — governments at all levels

demand more from taxpayers. Always more. And More

Is Never Enough (MINE) and more never will be enough until

governments at all levels have taken every cent we have leaving us

impoverished then continue to squeeze us for even more. Even

when governments clearly don't need more from us they scheme

to take it anyway — because today that is what governments

do. The political elites are convinced they can spend

your money better and more wisely than you can.

One

the local level, state legislators have filed a bill to provide

cities and towns the power to impose their own gas tax on top

of the state and federal gas tax — on top of the surging price of

crude oil thanks to President Dementia and his America Last cabal.

Beacon Hill Roll Call reported on Saturday ("Allow

Cities and Towns to Impose a 3-Cents-per-Gallon Gas Tax"):

H-3039 allows cities and

towns to implement a local excise tax of

3-cents-per-gallon on gas and diesel fuel sold

within its borders. One cent of the tax would go

to each of the following: the maintenance,

repair, upkeep, construction or improvement of

roads, bridges, sidewalks, bikeways, public

parking areas or roadside drainage; the

Massachusetts Bay Transportation Authority or

regional transportation authority serving the

city or town; and projects which promote and

improve non-single occupancy motor vehicle

transportation including pedestrian facilities,

bicycle facilities, senior transportation

programs, telecommuting programs and carpool

programs.

“I filed this legislation

after three of the municipalities I represent

filed home rule petitions requesting that a

gasoline tax be authorized,” said co-sponsor

Rep. Smitty Pignatelli (D-Lenox). “I'm a firm

believer that if the state government cannot

provide the necessary funds for communities to

maintain their transportation infrastructure, we

should not stand in the way of solutions that

allow communities to make these decisions and

get needed revenue for themselves.”

“This legislation gives

municipalities the ability to raise additional

revenue and the flexibility to address their

most pressing transportation needs,” said

co-sponsor Rep. Tommy Vitolo (D-Brookline).

“Across the commonwealth, our transportation

systems need improvement and [this bill] helps

communities implement local solutions.”

My response to Beacon

Hill Roll Call request for a comment was:

“A local gas tax is

nothing more than another sneaky attempt to raise municipal

revenue outside and above the restrictions of Proposition 2½,”

said Chip Ford, executive director of Citizens for

Limited Taxation. “The state can certainly provide the funds

to maintain transportation infrastructure if Beacon Hill

prioritizes it,” added Ford. “Reason

Foundation's 25th Annual Highway Report (2020) ranks

Massachusetts 49th (second highest) in total spending per road

mile. Its state-controlled highway miles (3,659) is the fourth

smallest highway system in the nation yet just its

administrative cost per mile alone is second-highest.”

As I

keep saying, it doesn't need to be "The Massachusetts Way."

Compare total disbursements for the Bay State (second-highest

spending at #49 of all 50 states (spending almost five times above

the national average for administrative costs alone) with

others — for instance, my "sanctuary state" of Kentucky (#10 from

the bottom), with the lowest administrative cost of all 50:

Then

there are the relentless taxes professed to being imposed "for the

children" or other such "noble" causes for your own good while

raking in more of your whatever discretionary income you might still

have as the true objective.

The State House News Service reported last Monday ("Drink

Taxes Pitched To Boost Health, Addiction Treatment

Voters Rejected Alcohol Tax Plan in 2010"):

Rep. Kay Khan, a Newton

Democrat, has filed two bills to tax sugary

beverages (H-2972) and double the excise taxes

on beer, wine and liquor (H-2973).

Khan told the Committee on

Revenue Monday that she thought the time for

both ideas had come, with the state spending

$2.6 billion every year in response to

alcoholism and addiction, and other cities

finding success with sugar taxes.

"I just think that we need

to be really looking at this very seriously,"

Khan said.

Neither idea is new, but

Sen. Adam Hinds, the co-chair of the Committee

on Revenue, said the fact that Massachusetts

doesn't tax alcohol sales "jumped out to a lot

of us" who served on the Tax Expenditure Review

Commission, and he described Massachusetts as an

"outlier." ...

Khan's bill would not

change the application of the sales tax, but

would double the excise tax rates assessed on

beer, wine and liquor....

Khan's other bill would

impose a tiered tax structure on sugary drinks

based on volume and sugar content, putting

Massachusetts in the company of cities like San

Francisco, Washington, D.C., Philadelphia and

Seattle that have taxes on soda and other drinks

to encourage healthier choices.

"The

Best Legislature Money Can Buy" with far too much spare time on

their "full-time" hands is never at a loss for ideas on how to

siphon in more revenue by whatever means is necessary. It's

pretty much all they think about with all that free time available.

All

this plundering amidst more revenue pouring into the state's

treasury than they can spend fast enough. It its Weekly

Roundup on Friday the State House News Service noted:

House and Senate

leaders are now looking this fall at how to

allocate both pots of money, worth around $6.3

billion combined, all while monitoring

Washington to try to avoid overlapping with the

trillions of dollars Congressional Democrats are

looking to throw at infrastructure, child care

and Medicaid, if they can only just reach

agreement amongst themselves.

On

Friday in its Advances for this week ahead the News Service

reported:

Beacon Hill leaders

continue to juggle pandemic management with

legislative wrangling, but with formal sessions

due to cease for the year on Nov. 17, they now

have less than a month to deliver on their fall

agenda....

Democrats on Beacon Hill

have been known to extend conference committee

deliberations for months on major spending

bills, but they are leaving themselves only

weeks to come to terms on a bill allocating a

portion of federal COVID-19 relief funding, a

critical piece of legislation that budget

writers have described as a

"once-in-a-generation opportunity."

If they want to put a good

chunk of the $4.8 billion in American Rescue

Plan Act funds to work soon, it's looking more

likely that Democrats will need to ram a bill

through in the next few weeks, potentially

limiting opportunities for major amendments and

longer negotiations.

That

compares to the bankroll accumulated by municipal, city and town

governments.

The Massachusetts Department of Revenue's Division

of Local Services issued an update on Thursday to the municipalities

regarding the record-setting amounts of "free cash" left over to

most of them from the last fiscal year. According to the

Division "Free

Cash" is:

. . . a revenue

source that results from the calculation, as of July 1, of a

community's remaining, unrestricted funds from its operations of

the previous fiscal year based on the balance sheet as of June

30. It typically includes actual receipts in excess of revenue

estimates and unspent amounts in departmental budget line items

for the year just ending, plus unexpended free cash from the

previous year. Free cash is offset by property tax receivables

and certain deficits, and as a result, can be a negative number.

In other

words, free cash is the same as surplus revenue

— more taxes extracted

from city and town taxpayers than cities and towns

found necessary to spend.

In Division of Local Services's

Thursday issue of "City & Town — A

Publication of the Massachusetts Department of Revenue's Division of

Local Services, An Update on Free Cash:

In our January 7th, 2021

article entitled “Counting Free Cash – Another

Update,” we noted yet another new record in

total statewide certifications of $1.915 billion

as of 7/1/2019. This was a 9.2% increase over

the amount certified as of July 1, 2018, and

well above the 2.5% increase that July 1, 2018

totaled over July 1, 2017.

In that same article, we

questioned whether the legislation that extended

appropriation of July 1, 2019 free cash beyond

June 30, 2020, plus the general economic

slowdown due to the pandemic would lead to a

significant reduction in total free cash

certified as of July 1, 2020. The crystal ball

foreseeing local government’s fiscal future was

not completely clear at that time. With all the

data now in, we’ll determine if the trend of a

consistent annual increase in total certified

free cash continued....

The streak continues. July

1, 2020 certified free cash totaled

$1,950,974,770. The $35.8 million increase,

however, was only 1.9% over free cash certified

as of July 1, 2019. This total did continue a

trend in total free cash over $1 billion that

began as of July 1, 2012 as shown in the graph

below. Certifications have increased from July

1, 2009 to July 1, 2020 by about $1.3 billion.

In this certification

period, 349 communities were certified. Of

these, five were certified in the negative

ranging from $104,193 to $2,402,830. The

greatest increase in free cash was Boston at

$13.9 million, while Cambridge had the greatest

decrease at $36.8 million. Across the board, we

saw a median increase of $432,477 and median

decrease of $409,413....

As of this writing, almost

100 cities and towns have free cash certified as

of July 1, 2021 and many results show a

significant increase over their amount certified

as of July 1, 2020. We remain cautiously

optimistic that this good financial news will

continue and prove initial thoughts of a

significant free cash reduction in this new

certification period false. Emergency federal

and state financial assistance to local

governments in response to the pandemic

continues to provide a measure of financial

support, which has been a factor in the

increases in free cash realized to date.

Nonetheless, Rep.

Smitty Pignatelli (D-Lenox) and Rep. Tommy Vitolo

(D-Brookline) have filed a bill H-3039 to empower cities and towns

to impose a local excise tax of 3-cents-per-gallon on gas and diesel

fuel sold within its city or town lines.

Your salary over the past

year has been cut by 5.4% Every dime you've saved over your

lifetime is today worth 5.4% less than it was a year ago. And

it's going to get worse long before it can possibly get any better.

Never mind

inflation, some economists are now daring to talk of stagflation

— when incomes are stagnant while

purchasing power steadily declines.

A Boston Herald editorial on Tuesday

("Biden tries talk therapy on gas prices")

observed:

As the State

House News Service reported, soaring gas prices are adding to

inflation worries, rising 9 cents a gallon in the last week. AAA

Massachusetts reported Monday that the average price of a gallon

of gas hit $3.27 in its latest weekly survey. That’s up from

$3.10 a month ago and just $2.10 a year ago.

“Compared to

the price of gas a year ago, it now costs consumers about $17

more to fill up their vehicles,” AAA’s Mary Maguire said. “And

unfortunately, it doesn’t look like drivers will be finding

relief at the pump any time soon.”

Just what we

need before Thanksgiving and holiday trips to see family.

Driving to find the perfect Christmas tree, piling in the car to

tour the houses bedecked in festive lights — it’ll cost a pretty

penny this year.

The last time

prices in Massachusetts were this high was October of 2014 at

$3.32 per gallon, according to AAA, which said increasing crude

oil prices are the “primary factor” behind the higher prices at

the pump.

Oil — the fuel

Biden and his fellow Democrats love to demonize, but on which

the country depends....

The Biden

administration has requested OPEC increase its exports.

Dependence on

OPEC was one of the reasons the Keystone XL Pipeline contract

was a good idea — it would have given America a stronger measure

of energy independence.

Is it any

wonder that amid a host of legal woes, Donald Trump still has

the support of 47% of registered voters in another run for the

White House, according to a new Hill-HarrisX poll.

It

would appear that we've gotten the attention of the

Democrat-Socialists in Congress — at least enough to get them

running for cover if not abandoning their assault on taxpayer

privacy.

The Wall Street Journal reported on Tuesday ("Democrats

Try to Salvage IRS Bank-Account Reporting With Scaled-Back Plan—Key

reporting threshold would go to $10,000 from $600; banks, GOP say

plan is unworkable"):

Democrats scaled back a

proposal to require banks to send to the IRS

more information about customers’ accounts in

hopes of salvaging the idea, raising to $10,000

from $600 the key reporting threshold and adding

an exemption that would spare many workers and

retirees.

The core idea remains—banks

would be required to provide information that

could help the IRS more easily find tax

cheating. But amid opposition from the

financial-services industry and many

Republicans, Sens. Ron Wyden (D., Ore.) and

Elizabeth Warren (D., Mass.) proposed changes on

Tuesday that would reduce the number of accounts

affected....

Democrats want banks, other

financial institutions and peer-to-peer services

such as Venmo to report annual totals of account

inflows and outflows to the Internal Revenue

Service. That would give the tax agency a window

into income streams that are more opaque than

wages and interest. The IRS already gets

information on wages and interest from banks and

employers and cross-checks that data against tax

returns.

The additional account

details wouldn’t provide direct evidence of tax

cheating, but they would create a data trove

that tax authorities could use to decide who

gets audited. It could also be a deterrent to

people—particularly business owners—who are

considering not reporting all of their

income....

Banks, credit unions,

Republican lawmakers, business owners and

conservative groups such as Americans for Tax

Reform have been building opposition to the plan

for months. They warn that the requirement would

put taxpayer information at risk if IRS computer

systems were breached and they have described

the proposal as snooping and surveillance.

“Even with the

modifications announced today, this proposal

still goes too far by forcing financial

institutions to share with the IRS private

financial data from millions of customers not

suspected of cheating on their taxes,” Rob

Nichols, president and CEO of the American

Bankers Association, said Tuesday....

The current proposal

doesn’t require banks to share transaction-level

data. But the IRS could use the account

information to request information about

specific withdrawals and deposits, said Richard

Hunt, CEO of the Consumer Bankers Association, a

trade group for retail banks.

“[The IRS] can’t deduce who

is avoiding paying their taxes without peering

through every financial transaction,” Mr. Hunt

said. “Bankers cannot become agents of the IRS.”

...

Rep. Drew Ferguson (R.,

Ga.), a member of the House Ways and Means

Committee, said the revised proposal still

raised privacy concerns.

“It does not matter if the

amount is $1, $600 or $10,000, Americans don’t

want the IRS snooping into their bank accounts,”

Mr. Ferguson said on Fox News on Tuesday.

In its editorial on

Thursday ("The $10,000 IRS

Tax Dragnet—Treasury

wants to snoop on bank accounts to trigger more

audits") the Journal added:

Democrats walked into a

political ditch with their plan to let the

Internal Revenue Service snoop on American banks

accounts, and so far they’re doing a lousy job

of scrambling to get out.

This week Senate Democrats

backed by the Biden Treasury released a revised

proposal that raises the threshold for financial

institutions to report to the IRS on individual

accounts to $10,000 from the previously mooted

$600. The proposal also tries to dodge the

charge of snooping on Everyman by exempting wage

income from “certain payroll companies” and

Social Security checks.

The details are murky, but

most Americans could still get ensnared in this

dragnet unless they pay bills and buy goods in

cash. Democrats say banks will only have to

report total annual inflows and outflows, not

discrete transactions. But nearly all Americans

spend more than $10,000 a year.

The real political goal

here is to create a mechanism for triggering

audits—probably through an algorithm—so the IRS

can rifle through all of a taxpayer’s business

and other financial records....

Senate Democrats say their

plan would be “virtually cost-free” for banks.

Big banks can handle the compliance burdens, but

the burden is greater for community banks that

provide most lending to small businesses.

Banks will also be in the

awkward position of helping the government

police their customers. Recall how liberals

howled about the National Security Agency

antiterror program that required telecom

companies to share phone metadata with the feds.

Now Democrats want financial institutions to

help the tax collector track your cash flow.

Vows of privacy at the IRS aren’t worth much

after the recent leaks of taxpayer data to

ProPublica.

The IRS already has enough

data to go after the wealthy and genuine tax

cheats. It wants to look at everyone’s bank

account so its agents have another excuse to

audit and squeeze more money from non-wealthy

Americans.

I

suspect this is far more devious than just chasing down tax

avoiders. I believe the authoritarians see this as a means to

root around in every expenditure made by any opponent of the regime.

They are a very patient lot that will settle for even a foot in the

door if they must. Incrementally they will push that door

wider open over time. Look how they've expanded The Patriot

Act and their illicit use of FISA courts.

On the topic of

authoritarians, in the

CLT Update of October 11, 2021 I wrote:

Back to the "fascist-like,

authoritarian Biden era of mandates" and tasking the FBI to

intimidate parents at local school committee meetings, on the

national front the United States of America continues to circle

the drain under the Dementia Joe Biden administration's cabal.

On Monday,

Biden's alleged "moderate" Attorney General Merrick Garland

responded to a September 28 letter from the National School

Boards Association calling on the Justice Department to shut

down parents' opposition to critical race theory, mask mandates

for children, and other objectionable curricula being imposed on

their children. The NSBA requested that the

Patriot Act be implemented to confront "these heinous

actions . . . the equivalent to a form of domestic terrorism."

This

too is experiencing push back by patriotic Americans.

The Epoch Times reported on October 11, 2021

("Some School Board Associations Denounce

National Group’s Letter Over Threats"):

Some state school board

associations are challenging the National School

Boards Association’s (NSBA) recent letter to

President Joe Biden.

The NSBA

compared parents to domestic terrorists and

called for the president to direct the federal

government to “deal with the growing number of

threats of violence and acts of intimidation

occurring across the nation.”

Several days later, the

Department of Justice (DOJ)

announced it was tasking FBI agents and U.S.

attorneys to convene to discuss strategies for

addressing threats against school

administrators, board members, teachers, and

staff....

The Massachusetts

Association of School Committees and the Arizona

School Boards Association also indicated

approval of the DOJ’s order....

The Kentucky School

Boards Association said the national letter

doesn’t reflect its opinion.

Kim Schelling, the group’s

executive director, said it believes strongly in

“the value of local control” and that “engaging

with local constituents is a hallmark of

democracy and disagreement expressed publicly is

not new for school board members.”

While certain behaviors

that have been reported are troubling, such as

disruptions of school board meetings, they

“appear to represent the isolated actions of a

small number of people,” she added.

“Illegal acts, violence,

and intimidation of any public officials will

not be tolerated, and districts will continue to

work closely with local law enforcement to

address issues of public safety,” Schelling

wrote, adding that the state group will likely

need to see “corrective action” from NSBA’s

leadership to remain a part of the national

association.

This

also provides another sterling example of how everything needs not

be The Massachusetts Way. It now turns out, as was

suspected, that a couple of officers at the top of the

National School Boards

Association colluded with officials in the Biden administration and

U.S. Justice Department prior to igniting this assault on parents of

school children

—

and that unauthorized action is fracturing the organization.

|

|

|

|

Chip Ford

Executive Director |

|

|

Beacon Hill Roll

Call

Volume 46 - Report No. 43

October 18-22, 2021

Allow Cities and Towns to Impose a 3-Cents-per-Gallon Gas

Tax (H-3039)

By Bob Katzen

REVENUE COMMITTEE HEARING – The Revenue Committee held a

virtual hearing on several tax-related measures including:

ALLOW CITIES AND TOWNS TO IMPOSE A 3-CENTS-PER-GALLON GAS

TAX (H-3039) – Allows cities and towns to implement a local

excise tax of 3-cents-per-gallon on gas and diesel fuel sold

within its borders. One cent of the tax would go to each of

the following: the maintenance, repair, upkeep, construction

or improvement of roads, bridges, sidewalks, bikeways,

public parking areas or roadside drainage; the Massachusetts

Bay Transportation Authority or regional transportation

authority serving the city or town; and projects which

promote and improve non-single occupancy motor vehicle

transportation including pedestrian facilities, bicycle

facilities, senior transportation programs, telecommuting

programs and carpool programs.

“I filed this legislation after three of the municipalities

I represent filed home rule petitions requesting that a

gasoline tax be authorized,” said co-sponsor Rep. Smitty

Pignatelli (D-Lenox). “I'm a firm believer that if the state

government cannot provide the necessary funds for

communities to maintain their transportation infrastructure,

we should not stand in the way of solutions that allow

communities to make these decisions and get needed revenue

for themselves.”

“This legislation gives municipalities the ability to raise

additional revenue and the flexibility to address their most

pressing transportation needs,” said co-sponsor Rep. Tommy

Vitolo (D-Brookline). “Across the commonwealth, our

transportation systems need improvement and [this bill]

helps communities implement local solutions.”

“A local gas tax is nothing more than another sneaky attempt

to raise municipal revenue outside and above the

restrictions of Proposition 2½,” said Chip Ford,

executive director of Citizens for Limited Taxation.

“The state can certainly provide the funds to maintain

transportation infrastructure if Beacon Hill prioritizes

it,” added Ford. “Reason Foundation's 25th Annual Highway

Report (2020) ranks Massachusetts 49th (second highest) in

total spending per road mile. Its state-controlled highway

miles (3,659) is the fourth smallest highway system in the

nation yet just its administrative cost per mile alone is

second-highest.”

“According to the Reason Foundation’s annual highway report,

Massachusetts ranked as the second most expensive state in

the country for how much taxpayers spend on roads,” said

Paul Craney, spokesman for the Massachusetts Fiscal

Alliance. “Massachusetts is the second most expensive state

for its administrative cost and cost for maintenance. In

those categories, Massachusetts is paying three or four

times the national average. Clearly the problem is how our

state spends money. Taxpayers are generous enough and they

should not pay a penny more in gas taxes.”

State House News

Service

Monday, October 18, 2021

Drink Taxes Pitched To Boost Health, Addiction Treatment

Voters Rejected Alcohol Tax Plan in 2010

By Matt Murphy

Former Gov. Deval Patrick tried repeatedly without success

to tax soda and voters in 2010 rejected higher taxes on

alcohol, but supporters of slapping new levies on sugary and

alcoholic beverages testified Monday that the two policies

combined could bring in up to $435 million in additional

revenue for public health, nutrition and substance use

treatment.

Rep. Kay Khan, a Newton Democrat, has filed two bills to tax

sugary beverages (H-2972) and double the excise taxes on

beer, wine and liquor (H-2973).

Khan told the Committee on Revenue Monday that she thought

the time for both ideas had come, with the state spending

$2.6 billion every year in response to alcoholism and

addiction, and other cities finding success with sugar

taxes.

"I just think that we need to be really looking at this very

seriously," Khan said.

Neither idea is new, but Sen. Adam Hinds, the co-chair of

the Committee on Revenue, said the fact that Massachusetts

doesn't tax alcohol sales "jumped out to a lot of us" who

served on the Tax Expenditure Review Commission, and he

described Massachusetts as an "outlier."

"Was the intention of the policy to tax alcohol lower than

anything else? If it was, then interesting. But I doubt it,"

Hinds said, telling Khan, "I really appreciate you raising

this."

Hinds said the Tax Expenditure Review Commission estimated,

with the help of the Department of Revenue, that taxing

alcohol at the same 6.25 percent rate as sales of other

products would net the state over $120 million. Voters in

2010, however, repealed a law that would have applied the

newly raised sales tax rate to alcohol, with 52 percent

opposing the tax change.

Khan's bill would not change the application of the sales

tax, but would double the excise tax rates assessed on beer,

wine and liquor. Hinds said those rates have not been

adjusted in decades, and remain among the lowest in the

country even among states that also charge sales taxes on

alcohol.

Doubling the excise taxes, Khan said, would generate $67

million in new taxes and allow the state to invest more in

substance use treatment and prevention.

"We really need to address this in a substantial way," she

said.

The alcohol excise tax proposal, however, encountered

opposition from the Massachusetts Package Stores

Association, which said it could threaten the existence of

locally-owned alcohol retailers.

Rob Mellion, executive director of the MPSA, said package

stores are confronting a climate of "chaos and disruption"

in the COVID-19 era as more consumers move online, putting

local retailers in competition with larger, and sometimes

out-of-state, chains. He said loopholes in the law allow

third-party delivery services to purchase alcohol from other

states, and then deliver within Massachusetts.

"It's unpoliceable," Mellion said of the alleged illegal

out-of-state alcohol sales online. "If you raise the excise

tax, you're just going to push more people to do it more."

Mellion said higher excise taxes would also make it that

much harder to compete with New Hampshire, which doesn't tax

alcohol and already counts on Massachusetts for at least 28

percent of its sales. He said New Hampshire routinely

markets to Massachusetts consumers because of the price

differential.

"When you raise the excise tax, you've just given them a new

campaign," Mellion said.

Khan's other bill would impose a tiered tax structure on

sugary drinks based on volume and sugar content, putting

Massachusetts in the company of cities like San Francisco,

Washington, D.C., Philadelphia and Seattle that have taxes

on soda and other drinks to encourage healthier choices.

Khan, a former nurse, said sugary drinks like Coca-Cola are

the largest source of added sugar in American diets, and

lead to higher rates of obesity, diabetes, cancer, stroke,

tooth decay and heart disease.

Allyson Perron, director of government relations for the

American Heart Association in Massachusetts, also testified

in support, arguing that sugar taxes have been shown to be

effective in reducing consumption in cities like

Philadelphia.

Twenty-seven House and Senate lawmakers have signed on to

Khan's sugary drink tax proposal, which she filed with Rep.

Jon Santiago and Sen. Jason Lewis. It would add a tax of 1

cent to 3 cents per ounce to drinks, depending on the sugar

content. Drinks with less than 7.5 grams of sugar per 12

ounces would not be taxed.

Khan estimated the tax could be worth as much as $368

million that could be invested in public health, nutrition

programs, and clean drinking water in schools.

"Three-hundred sixty eight million is a lot of money that

could be poured into better health services," Khan said.

Patrick, when he was governor from 2007 until 2014,

repeatedly filed sugar tax proposals as part of his annual

budget submissions to the Legislature, but the idea never

gained traction.

City &

Town

A Publication of the Massachusetts Department of Revenue's

Division of Local Services

October 21, 2021

An Update on Free Cash

By Deborah Wagner — Bureau of

Accounts Director

In our January 7th, 2021 article entitled “Counting Free

Cash – Another Update,” we noted yet another new record in

total statewide certifications of $1.915 billion as of

7/1/2019. This was a 9.2% increase over the amount certified

as of July 1, 2018, and well above the 2.5% increase that

July 1, 2018 totaled over July 1, 2017.

In that same article, we questioned whether the legislation

that extended appropriation of July 1, 2019 free cash beyond

June 30, 2020, plus the general economic slowdown due to the

pandemic would lead to a significant reduction in total free

cash certified as of July 1, 2020. The crystal ball

foreseeing local government’s fiscal future was not

completely clear at that time. With all the data now in,

we’ll determine if the trend of a consistent annual increase

in total certified free cash continued.

July 1, 2020 Certifications

The streak continues. July 1, 2020 certified free cash

totaled $1,950,974,770. The $35.8 million increase, however,

was only 1.9% over free cash certified as of July 1, 2019.

This total did continue a trend in total free cash over $1

billion that began as of July 1, 2012 as shown in the graph

below. Certifications have increased from July 1, 2009 to

July 1, 2020 by about $1.3 billion.

In this certification period, 349 communities were

certified. Of these, five were certified in the negative

ranging from $104,193 to $2,402,830. The greatest increase

in free cash was Boston at $13.9 million, while Cambridge

had the greatest decrease at $36.8 million. Across the

board, we saw a median increase of $432,477 and median

decrease of $409,413.

Did outliers have any effect on the statewide total? July 1,

2020 certifications for Boston and Cambridge were $428

million and $210 million, respectively, or about one-third

of the total. The same can be said for their certifications

as of July 1, 2019. If their certifications are removed from

the last two fiscal periods, the statewide total for the

remaining communities reveals a 4.7% increase compared with

the 1.9% noted in the above Free Cash Certification chart.

Despite the rise seen in the statewide total, not every

community experiences an increase from the previous period,

as shown in the graph below. Note that in only one fiscal

period shown (7/1/17 vs 7/1/16) did the number of

communities with a decrease in certified free cash exceed

those with an increase in certified free cash.

The Effect of the Pandemic on July 1, 2019 Certifications

Normally, free cash cannot be appropriated until it has been

certified by the Director of Accounts; any unappropriated

balance expires after the next June 30 and is unavailable

for appropriation after June 30 and must then be recertified

after a new balance sheet has been submitted and reviewed as

of July 1.

However, Section 6 of Chapter 53 of the Acts of 2020, "An

Act to Address Challenges Faced by Municipalities and State

Authorities Resulting From COVID-19,” extended the free cash

certification time period beyond June 30 as a funding source

for the FY2021 expenditures of a city, town or district if

its annual budget was delayed beyond June 30, 2020 due to

the COVID-19 emergency.

This extension authorized an appropriation of the July 1,

2019 free cash certification until the earlier of the

setting of the FY2021 tax rate or a new certification is

approved as of July 1, 2020. This extension had to be first

granted by the Director of Accounts. Extensions were granted

for 123 towns; no special purpose districts applied. A

review of the Tax Rate Recaps approved for these 123 towns

revealed that 61 took advantage of their extension.

Therefore, although 62 others were prepared, their extension

proved unnecessary. For the 61 towns, an additional $61.1

million was appropriated from July 1, 2019 certified free

cash after July 1, 2020.

Very Early Indications

As of this writing, almost 100 cities and towns have free

cash certified as of July 1, 2021 and many results show a

significant increase over their amount certified as of July

1, 2020. We remain cautiously optimistic that this good

financial news will continue and prove initial thoughts of a

significant free cash reduction in this new certification

period false. Emergency federal and state financial

assistance to local governments in response to the pandemic

continues to provide a measure of financial support, which

has been a factor in the increases in free cash realized to

date.

In January, we will have an article on free cash

certifications for the as of 7/1/21 period, as we will have

more data available then. For all cities, towns and special

purpose districts, please re-read our City & Town article on

Fiscal Stress – A Diminishing Level of Reserves, December 6,

2018 on how to improve free cash position and for policies

on generating and using free cash.

State House News

Service

Friday, October 22, 2021

Weekly Roundup - Get It, Got It, Good

Recap and analysis of the week in state government

By Matt Murphy

Millions have gotten it, and more want it, mostly for their

children. There are boosters with evolving eligibility

standards and the possibility for mixing and matching.

Others flat out still refuse to get it.

The COVID-19 vaccine landscape is becoming more complex by

the day, but tens of thousands of state employees started

their work week on Monday under a simple directive: Prove it

(vaccination) or lose it (job).

Deadline day arrived for more than 42,000 state employees

who call Gov. Charlie Baker their boss, and the

administration reported that 40,462 active employees, or

95.2 percent, complied with Baker's executive order

requiring them to show proof of vaccination, request a

health or religious exemption or risk losing their job.

That left just over 1,500 public employees who failed comply

with the executive order, and it had Baker feeling pretty

good about his decision to enforce a vaccine mandate.

"The fact that 95 percent of our employees have attested to

either being vaccinated or having to file for an exemption

-- and the vast, vast, vast majority have been vaccinated --

I think is an indication from the state workforce that they

agree with us," Baker said on Monday, after meeting with

legislative leaders.

Although the question of enforcement remains an open one.

Technically, anyone who missed the Sunday deadline to show

proof of vaccination should be serving a five-day

suspension, but Baker said agencies are reaching out to

those employees trying to understand their situations.

The State Police Association of Massachusetts has been among

the most vocal opponents of Baker's vaccine mandate, and on

Monday union leadership said it had 299 members in limbo,

including 200 waiting on decisions about their waiver

applications and 99 in plain defiance of the order who had

not yet been disciplined.

Baker said remaining exemption requests would be processed

in the next two weeks, and in the meantime he was "not

concerned" about meeting staffing needs at the State Police,

or any other agency.

Senate President Karen Spilka said she wasn't concerned

about discipline or staffing either because 100 percent of

Senate members and staff responded by her Oct. 15 deadline

to get vaccinated, allowing her to think about moving ahead

with a hybrid work model for the branch. Not too far behind,

the House COVID-19 Working Group finalized its Nov. 1

vaccine deadline and masking rules for the State House.

While boosting vaccination rates among adults remains a

goal, the attention of lawmakers and the administration is

also drifting toward making sure children have access. With

federal approval expected within weeks for 5- to

11-year-olds to get a COVID-19 shot, the House and Senate

had an oversight hearing to make sure Massachusetts is

ready.

Health and Human Services Secretary Marylou Sudders said she

expects 515,000 children to become eligible by next month,

and anticipates 360,000 doses being received and made

available at over 700 locations by the first week in

November.

Of course, the falling leaves, cooler nights and the

impending arrival of November means the clock is really

ticking on the Legislature to make some decisions.

Baker signed a $303 million closeout budget on Wednesday

that allows for about $1.5 billion in surplus tax revenue

from fiscal 2021 to be deposited in an escrow account for

legislators to decide at a later date how to spend. The move

to temporarily set aside last year's surplus was unique and

made, according to Democratic leaders, in order to allow

Comptroller William McNamara to balance the books for last

year without rushing the Legislature to make decisions on

how to spend the extra cash.

Of course, what it looks like to be in a rush in the real

world versus on Beacon Hill are two different things.

Gov. Charlie Baker filed a budget to spend the surplus back

in August, and even before that he put forward a plan to

spend just over half of the state's American Rescue Plan Act

funds.

House and Senate leaders are now looking this fall at how to

allocate both pots of money, worth around $6.3 billion

combined, all while monitoring Washington to try to avoid

overlapping with the trillions of dollars Congressional

Democrats are looking to throw at infrastructure, child care

and Medicaid, if they can only just reach agreement amongst

themselves.

Baker said he was optimistic that the Legislature was

preparing a "pretty, pretty comprehensive and pretty

significant" ARPA spending bill, and he reupped his

recommendation that $1 billion from the surplus be used

replenish the unemployment insurance system.

That spending bill could very well be the next major item to

find itself on the House calendar. But this week it was the

decennial redistricting map drawn by Assistant House

Majority Leader Michael Moran that was up for a vote.

On the House side, Moran and the Special Committee on

Redistricting made some changes before it went to the floor

to strengthen two of the 33 majority-minority districts on

the map in New Bedford and Framingham.

The final product passed 158-1 with strong bipartisan

support.

Things have not been so smooth in the Senate, where Senate

President Pro Tempore William Brownsberger's map for the 40

members of that branch has been picked apart and subjected

to threats of lawsuits.

Brownsberger heard that feedback and drew a brand new

majority-minority district that includes Brockton, Avon and

half of Randolph, upending the district currently

represented by Sen. Michael Brady and meeting advocates part

way.

He also reconsidered initial plans to split Ward 16 in

Boston, but did not fundamentally alter plans to

controversially split Haverhill between two districts to

create a new majority-minority district anchored in

Lawrence.

Rather than push for a vote this week, the Senate will

consider the revised plan next Thursday as members of

Congress and the Governor's Council also continue to wait to

see how legislative leaders might alter their

constituencies.

Without redistricting to consider, senators passed two other

bills, neither of which knocked anything off Democrats'

stated agenda for the fall.

One bill, similar to legislation that passed last session,

would require middle and high schools to teach students

about genocide. The other focused on making it easier and

faster for military spouses to transfer professional

licenses into Massachusetts when their families are

relocated here.

The week also brought news of more delays in the Green Line

Extension, though the MBTA project remains on budget, which

is saying something.

After pushing back the planned opening of the new Union

Square station in Somerville from October to December this

summer, T General Manager Steve Poftak said the agency was

tacking another three months onto that timeline.

"Excuse me while I go break every object I can find. I

understand these things happen, but I don't have to like

it," Somerville Mayor Joe Curtatone tweeted, reflecting on

the fact that the delay means he will no longer be mayor

when the first trolleys roll through Union Square.

The Green Line's Lechmere and Union Square stations will now

open in March, and Poftak said, "I do have a real high level

of confidence that this will be the last delay ... "

Meanwhile, the second branch of the extension into Medford

was on a May 2022 opening trajectory, and Poftak is clinging

to hope that will remain possible.

STORY OF THE WEEK: For over 1,500 state workers, their job

was not worth a shot in the arm.

State House News

Service

Friday, October 22, 2021

Advances - Week of Oct. 24, 2021

Beacon Hill leaders continue to juggle pandemic management

with legislative wrangling, but with formal sessions due to

cease for the year on Nov. 17, they now have less than a

month to deliver on their fall agenda.

-- REDISTRICTING: The House approved its plan to redraw 160

district boundaries this week and the Senate on Wednesday

plans to tackle its map reconfiguring the 40 Senate

districts. The wait continues for proposed maps adjusting

the state's nine Congressional districts and its eight

Governor's Council districts. Look for the Senate next week

to quickly sign off on the proposed House districts since

those need to be in place soon to give candidates time to

establish residency one year ahead of the 2022 elections.

-- ARPA SPENDING BILL | SURPLUS SPENDING BILL: Democrats on

Beacon Hill have been known to extend conference committee

deliberations for months on major spending bills, but they

are leaving themselves only weeks to come to terms on a bill

allocating a portion of federal COVID-19 relief funding, a

critical piece of legislation that budget writers have

described as a "once-in-a-generation opportunity."

If they want to put a good chunk of the $4.8 billion in

American Rescue Plan Act funds to work soon, it's looking

more likely that Democrats will need to ram a bill through

in the next few weeks, potentially limiting opportunities

for major amendments and longer negotiations.

House Democrats are scheduled to huddle as a caucus Monday

to talk about ARPA spending legislation, signaling that a

proposal is likely imminent. The House has also scheduled a

formal session for Thursday, with a potential formal

penciled in for Friday.

Gov. Charlie Baker said this week that he's expecting a

"comprehensive" bill to emerge soon in the Legislature. The

ARPA bill is perhaps overshadowing other near-term spending

choices.

Lawmakers and Baker this week agreed on a $300 million bill

to close out the books on fiscal 2021, but legislative

leaders have described a fall timeline to consider $1.5

billion in unobligated fiscal 2021 surplus funds that are

now sitting in a new fund.

By socking the money away, the Legislature avoided having it

swept into the state's reserves and it's possible that the

surplus dollars will be allocated in one exercise that also

involves ARPA funds, although conflating the two bills could

raise ARPA spending accountability issues.

-- VOTING REFORMS: The House has yet to take up a

Senate-approved bill making mail-in and early voting

permanent and expanding opportunities for unregistered

voters to register and cast a ballot in one go, both on an

election day itself and during the preceding early voting

periods.

Prospective voters seeking to take advantage of same-day

registration under the Senate's bill would need to appear in

person when their local polling place or an early voting

site in their city or town is open, complete an application,

submit proof or residence such as a driver's license and

attest in writing that they are a U.S. citizen at least 18

years old who is eligible to vote. Anyone who cannot present

the identification required would be allowed to cast a

provisional ballot.

While creating new registration options, the Senate bill

leaves in place the registration deadline in current law --

20 days before an election and 10 days before a special town

meeting.

The House last year rejected a same-day registration

proposal, citing a desire to prevent long lines at polling

places at a time when public officials were looking to limit

close contacts to discourage the spread of COVID-19.

A vote on registration reforms in the House in the coming

weeks would likely lead to a different result, although the

change could make House elections more unpredictable for

incumbents by making it more risky for them to target only

registered voters in low-turnout primaries.

The temporary mail-in voting and expanded early voting

authorization is set to expire Dec. 15 -- before the Jan. 11

special election to fill the Senate seat vacated by former

Sen. Joe Boncore -- unless lawmakers act again to expand the

pandemic-era provisions.

-- SPORTS BETTING: Through their silence, senators by now

have made their voices heard on legalizing sports betting:

they do not appear keen on tackling it.

The House has twice signed off on legalization bills and

neighboring states have already waded into the new gaming

frontier.

In July, Sen. Eric Lesser said the Senate was ready to

tackle the issue and told New England Sports Network viewers

that Massachusetts "should really hope and aim to get this

going by the end of the calendar year."

The House bill in the three months since its passage has

remained in the Senate Ways and Means Committee. Senate

President Karen Spilka recently did not include a sports

betting bill on her own list of fall priorities, which does

include a mental and behavioral health care bill that has

yet to emerge in the Senate.

Several senators, including Spilka, opposed the original

push to legalize casinos in Massachusetts, and that branch

more strongly resisted the casino push than the House before

agreeing to go along with legalization.

The News Service hosts an event Tuesday morning on sports

betting that will feature Lesser and his House counterpart

on the Economic Development and Emerging Technologies

Committee, Rep. Jerald Parisella.

-- INITIAL SHOTS FOR KIDS, BOOSTERS FOR OTHERS: Initial

shipments totalling 360,000 doses of Pfizer's pediatric

COVID-19 vaccine are expected to begin flowing into

Massachusetts next week as state government, health care

providers and pharmacies prepare to begin vaccinating some

515,000 kids aged 5 through 11 who are expected to become

eligible in early November.

The shots will become available at roughly 700 locations,