|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, October 11, 2021

State's

"Embarrassment of Riches" Continues To Pile Up

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

Massachusetts

Department of Revenue (DOR) Commissioner Geoffrey

Snyder today announced that preliminary revenue

collections for September totaled $3.992 billion,

which is $848 million or 27.0% more than actual

collections in September 2020, and $501 million or

14.3% more than benchmark.

FY2022 year-to-date

collections totaled approximately $8.751 billion,

which is $1.501 billion or 20.7% more than

collections in the same period of FY2021, and $525

million or 6.4% more than year-to-date benchmark.

Commonwealth of Massachusetts

Department of Revenue

Tuesday, October 5, 2021

Press Release: September

Revenue Collections Total $3.992 Billion

Monthly collections up $848 million or 27.0% vs.

September 2020 actual

State tax collectors

brought in $3.992 billion of revenue in September,

way up from September 2020 and half a billion

dollars more than what the Baker administration was

expecting to collect.

The Department of

Revenue announced Tuesday afternoon that the

September haul was $848 million or 27 percent

greater than actual collections in September 2020

and $501 million or 14.3 percent greater than the

month's benchmark. September typically brings in

about 10 percent of the state's annual tax revenue,

DOR said.

"September collections

increased in all major tax types relative to

September 2020 collections, including withholding,

non-withholding, sales and use tax, corporate and

business tax, and 'all other tax'," Revenue

Commissioner Geoffrey Snyder said. "The increase in

withholding is likely related to improvements in

labor market conditions while the increase in

non-withholding tax collections is due to an

increase in income estimated payments. The sales and

use tax increase reflects continued strength in

retail sales and the easing of COVID-19

restrictions."

Since fiscal year 2022

began on July 1, DOR has collected $8.751 billion

from residents and businesses. The year-to-date

total is $1.501 billion or 20.7 percent greater than

actual collections during the same time period of

fiscal 2021 and $525 million or 6.4 percent above

the administration's year-to-date benchmark.

State

House News Service

Tuesday, October 5, 2021

State Tax Receipts Running

Half A Billion Over Benchmarks

With tax collections

continuing to exceed expectations, Gov. Charlie

Baker on Wednesday pushed lawmakers to act on his

plan to use part of the surplus from last year to

deliver unemployment insurance relief to small

businesses.

Baker in August filed a

nearly $1.6 billion spending bill that would direct

$1 billion of a roughly $5 billion surplus toward

the trust fund used to pay unemployment claims.

Other surplus money would be used to bolster the

state's reserves, fund union contracts and support

rate increases for human services providers.

Due to the effects of

the COVID-19 pandemic on the economy, the

Legislature authorized up to $7 billion in borrowing

to help small businesses avoid steep increase in the

unemployment insurances taxes they pay to cover

benefits, but that would still need to be repaid

over time....

The surplus Baker has

proposed to spend on small business relief was from

fiscal year 2021, which ended on June 30, but tax

revenues have continued to come in strong in fiscal

year 2022 and beat projections by $500 million in

September.

Beacon Hill Democrats

have not said whether they intend to use some of the

surplus to reduce the unemployment insurance

liability for small businesses, or if they might tap

into the nearly $5 billion in American Rescue Plan

Act funds to reduce the size of the tab facing

employers over the next 20 years.

Some business groups,

including Associated Industries of Massachusetts,

have urged the Legislature to use both sources of

funding for UI, while the Massachusetts Budget and

Policy Center said targeted grants and loans would

be a better way to support employers.

On the day of the

Legislature's final ARPA hearing Tuesday, the state

chapter of the National Federation of Independent

Business said it was "unfair" to demand that

employers pay back the full $7 billion deficit that

resulted from pandemic layoffs, urging the

Legislature to follow the lead of more than 30 other

states that have used some ARPA funds to replenish

their UI systems.

State

House News Service

Wednesday, October 6, 2021

Baker Plugs UI Rate Relief

For Small Biz

Numbers-crunching

aside, let’s just say that fiscal 2022 so far has

been a banner year for the state treasury.

But numbers do tell the

story of this embarrassment of riches, and the

implications this surfeit might have on the

millionaires tax referendum’s prospects.

The state collected

$3.992 billion in tax revenue in September, far

exceeding September 2020 and half a billion dollars

more than the Baker administration was expecting to

collect.

The Department of

Revenue announced Tuesday that September’s haul was

$848 million, 27%, more than actual collections in

September 2020, and $501 million, 14.3%, above the

month’s estimates....

Since the July 1 start

of fiscal 2022, the DOR has collected $8.751 billion

from residents and businesses. The year-to-date

total is $1.501 billion, 20.7%, greater than actual

collections during the same time period of fiscal

2021, and $525 million, 6.4%, above the

administration’s year-to-date goal.

During fiscal 2021,

Massachusetts state government collected $5 billion

more from residents, workers and businesses than it

was expecting, leading to a sizable surplus.

The $34.137 billion

total for fiscal 2021 was $5.047 billion, 17.3%,

above the state’s benchmark and $4.528

billion,15.3%, more than the actual amount collected

in fiscal year 2020.

That $5 billion-plus

fiscal 2021 total also matches the $5 billion in

federal American Rescue Plan funds the state has yet

to allocate....

Given what’s already

transpired, that fiscal 2022 revenue estimate might

need to be revised higher.

The only people on

Beacon Hill not excited by these gaudy tax receipts

are the lawmakers and special-interest groups behind

that so-called millionaires tax. A joint session of

state lawmakers in June took a final procedural

step, voting 159-41 to clear the way for the

proposal to be placed on the ballot after years of

prior attempts stymied by political and court

battles.

At the time, the surtax

appeared to have the backing of the state’s voters;

a poll by Boston-based MassINC Polling Group showed

that 72% supported the wealth tax.

Lawmakers have promised

the estimated $2 billion in added revenue will

target transportation infrastructure and

public-school needs, but opponents argue the gains

won’t outweigh the potential loss of job-creating

entrepreneurs and relocated businesses.

That 4% surcharge on

yearly income exceeding $1 million becomes less

necessary — and more punitive — after each

successive revenue-beating month. And if that’s the

case, why should voters in the 2022 statewide

elections approve that ballot question —

overwhelming backed by Democrats — when the state’s

awash in cash?

That’s a valid ballot

question.

A Boston

Herald editorial

Saturday, October 9, 2021

Cash-flush state dilutes case for

millionaires tax

The Senate on Wednesday

went on record supporting the permanent adoption of

COVID-era voting allowances like expanded early

voting and voting-by-mail, and also adopted policies

like same-day registration that go beyond the

changes made to accommodate elections during a

pandemic.

The bill passed 36-3

along party lines after Democrats rejected an

alternative the Republican senators offered to

address many of the same issues. Democrats pitched

the bill (S 2545), which would also build into the

system additional supports for people with

disabilities, as a way to remove obstacles to the

ballot box and to maintain options that proved

popular when available to voters in 2020....

"We're living in a

dangerous moment. Dozens of states are restricting

access to the ballot box and citing baseless

politically-motivated claims of election fraud as a

justification for doing so," Sen. Cynthia Creem

said.

Just as Democrats in

states like Texas were unable to stop legislative

efforts to change state laws around voting and

elections, the Republican minority in the

Massachusetts Senate was unsuccessful Wednesday in

generating support for a proposed rewrite of the

voting reforms bill.

The alternative from

the chamber's three Republicans, which failed on a

3-35 party-line vote, would have required annual

notification of each voter's own registration status

from the secretary of state, moved the voter

registration deadline from 20 days before an

election to five days before, and provided for at

least one weekday evening of early voting beyond

what the underlying bill proposed. It also would

have allowed any registered voter to request a

ballot to vote early by mail for any election but

would have required the request to be made under the

penalties of perjury.

Minority Leader Bruce

Tarr called it "a prescription for how to go further

and make sure that we have two things. Number one,

increased voter participation. And number two,

increased security and integrity around elections."

He said he thought it was "important that everyone

understand what we are proposing and the many areas

of commonality that we share." ...

The bill put forward by

Senate leadership already included reforms that

would direct sheriffs and other corrections

officials to help eligible incarcerated voters learn

their rights and apply for and cast ballots by mail,

but senators went beyond that with the adoption

Wednesday of a Sen. Adam Hinds amendment that more

explicitly spells out what steps correction

facilities must take to educate and facilitate

voting among the eligible incarcerated

population....

The bill now heads to

the House of Representatives, which has already

considered some parts of the Senate bill in other

forms. But House Speaker Ronald Mariano said this

week that representatives will "need another vote"

on election reforms this session....

Baker has supported

mail-in voting, and signed the laws implementing and

extending pandemic-era voting options, but he is

opposed to same-day voter registration....

At the outset of

debate, Tarr questioned the Legislature's ability to

enact a permanent mail-in voting option without

changing the state Constitution -- and raised the

specter of consulting the state's highest court on

the matter.

Tarr recounted that

when Finegold and then-Senate President Therese

Murray had sought to permanently expand early and

absentee voting in 2013, they had done so by

proposing an amendment to the Constitution. He also

referenced a constitutional amendment filed this

spring by Reps. Michael Moran and Kevin Honan to

allow for no-excuse absentee voting.

Finegold responded: "We

will say that we in the Legislature do find that

mail-in voting is important for the people of the

commonwealth. And we do believe the Constitution

allows it."

Tarr replied that he

hoped the Legislature would "not play dice with the

Constitution, and that we will do what it takes to

make sure that we are either compliant, or effect

changes that would allow the statutes that we enact

to be compliant."

"I become a little bit

nervous when I hear that the Legislature has deemed

something constitutional, when in fact there exists

a significant constitutional question," said Tarr,

adding that perhaps he and Finegold could join

together in the future to seek an advisory opinion

from the Supreme Judicial Court.

State

House News Service

Wednesday, October 6, 2021

Senate Approves Bill to Make

Voting Reforms Permanent

Rejects Republican Alternative, Registration

Amendments

The timing may have

been curious, but even Gov. Charlie Baker said he

didn't find the announcement all that surprising.

About 30 minutes before

Nathan Eovaldi threw the first pitch in a

winner-take-all playoff game against the Yankees at

Fenway Park, former President Donald Trump sent out

an email announcing his "Complete and Total

Endorsement!" of Geoff Diehl for governor, knocking

the incumbent as a RINO in the process.

So how did Baker

respond? "Let's go @redsox!" the governor tweeted

just after 8 p.m.

Diehl started his

campaign for governor over the summer trying not to

be the Trump guy. Though everyone knew the former

president had his support, Diehl wanted to stand on

his own two feet. He said he couldn't say for sure

whether the 2020 election had been stolen, and that

both parties had a problem with respecting the

results of elections.

Fast forward a couple

of months and Diehl this week claimed the 2020

election was rigged, as he called on Gov. Baker to

reject permanent voting by mail and embrace a

GOP-backed voter ID ballot initiative - both

unlikely scenarios.

Less than a day after

making that statement, Diehl was on the phone with

Trump himself, accepting the former president's

endorsement. What followed was a deluge of armchair

analysis over whether Trump's support for Diehl

would help or hurt Baker, while Baker himself seemed

to shrug it off....

Speaking of the

November recess, House and Senate leaders have about

five weeks to draft and vote on a plan to spend at

least some of the state's $4.8 billion in American

Rescue Plan Act funds, and they passed a major

milestone in that process this week.

The House and Senate

Ways and Means committees held their final public

hearing on ARPA on Tuesday, taking testimony from

people like Auditor Suzanne Bump, who called for a

"rural rescue plan" for communities in western

Massachusetts where she said population decline and

business retreat have made it hard for them to

maintain basic infrastructure, like roads and fire

stations.

The Senate's Committee

on Reimagining Massachusetts: Post Pandemic

Resiliency also published its first report this week

outlining billions of dollars in ideas for how to

spend the money, and Bump and Inspector General

Glenn Cunha argued for some funding to be set aside

to audit how the money gets spent....

State

House News Service

Friday, October 8, 2021

Weekly Roundup - Voting,

Scrambled

Will Joe Biden now

endorse Charlie Baker?

Unlikely. It is a

Republican primary for governor we are talking

about, and an endorsement by the Democrat president

of a GOP governor — even if he is a RINO — would do

more harm than good.

Biden is a train wreck

of a president who has plummeted so far down in the

polls that Republican Gov. Charlie Baker may have to

endorse him.

Besides, there are

already three Democrats running for governor, with

the possibility of Attorney General Maura Healey

becoming the fourth. And right now, it is not known

whether Baker will even seek a third term.

If he does,

conservative Republican Geoff Diehl, 52, who was

endorsed Monday by Donald Trump, will be waiting to

knock him off in the GOP primary. If Baker doesn’t

run, then Diehl has a path to the Republican

nomination for governor.

Diehl was co-chair of

the Trump re-election campaign in Massachusetts.

The former president’s

endorsement is no small thing. That is because it is

a Republican primary we are talking about and not a

general November election. It will help Diehl raise

funds.

There are only 469,000

registered Republicans in Massachusetts, most of

whom probably voted for Trump in the last

election....

Diehl said, “I am

inspired by the president’s (Trump) America First

agenda, which he backed up by delivering on his

promises during his time in the White House.”

“Like President Trump,

I want to ensure a strong economy … I want families

to feel safe,” Diehl said. Like Trump, he added, “I

want people to feel like government isn’t working

against them and that they can enjoy the individual

freedoms our state and country were founded on.”

We are in a

fascist-like, authoritarian Biden era of mandates.

Now the FBI is tasked with monitoring the behavior

of parents at local school committee meetings as in

the old Soviet Union. Watch what you say, comrade.

A Diehl “Massachusetts

First” campaign will appeal to a lot of people.

The

Boston Herald

Saturday, October 9, 2021

Baker, Biden, Trump and Diehl all

on political dance card

By Peter Lucas

Thousands of state

employees next week face vaccination deadlines while

legislative leaders slow-walk their fall agenda with

just over five weeks remaining before the holiday

recess.

Legislators appear

poised to release redrawn House and Senate district

lines, and top Democrats are drafting major spending

bills to allocate American Rescue Plan Act funds and

the fiscal 2021 state budget surplus.

The Senate this week

approved and shipped to the House a major voting

reform bill, after earlier this fall sending over a

sex education bill with hopes that the House will

finally tackle that perennial policy proposal.

House leaders meantime

are eager to see the Senate take up one of its

priorities, legalizing sports betting. Gov. Charlie

Baker has a student nutrition bill on his desk and

his appointees to a new MBTA Board are likely making

plans for their first public get-together....

The Senate has only a

pair of informal sessions on its schedule for next

week, indicating major legislative activity appears

unlikely in that branch....

The Legislature for

years has resisted attempts to beef up seatbelt law

enforcement by giving police more power, but the

push for a primary enforcement bill continues,

picking up again on Wednesday before the Public

Safety Committee.

State

House News Service

Friday, October 8, 2021

Advances - Week of Oct. 10, 2021

Last week, Dollar Tree,

one of the few dollar stores that lived up to the

promise of its name, announced a shocking

development. Its costs had risen so high in recent

weeks that it could no longer hold the line at a

single buck. Instead, it regretted to announce, many

items would now cost either $1.25 or $1.50.

Wall Street was delighted. Dollar Tree shares shot

up. But the news was an especially vivid reminder of

the clear and present danger of inflation, coming

for the very customer base that could afford it the

least.

The signs of higher costs passed on to consumers are

everywhere: menu items at restaurants, grocery

totals at the checkout, pain at the fuel pump,

shipping prices for containers, lumber costs, real

estate prices, rising labor expenses for small

businesses, on and on. There have been disagreements

about whether this is a temporary phenomenon of

COVID-19 recovery and associated federal spending

(which tends to be the liberal position and is the

official prediction of the Federal Reserve), or a

serious threat, especially given the stubborn

supply-chain problems that don’t seem to be

improving. That’s a theory gaining traction among

many business executives (and even some of the

voices at the Fed).

But all this overlooks a crucial and

much-underestimated factor. Many Americans,

especially those under 40 and including many

reporters and a hefty chunk of the Twitterati, have

no personal experience of what inflation can do to

an economy, or to a citizen saving for retirement.

They fear not the growling wolf. Thus those who see

its dangers have some educating to do....

The problem with inflation is that it slashes the

actual value of people’s savings accounts, making a

retirement that once seemed secure far more

tentative.

Younger people have no idea what it was like in the

high-inflation years of the 1970s, of course. They

don’t have a sense of costly mortgages hammering

their chances of getting a loan or of watching their

hard-won savings get eaten away by ballooning

prices. They may well get a crash course in that

understanding in coming weeks and months, but part

of the current progressive orthodoxy is still that

the danger of inflation is overstated. Too many

people have bought that hook, line and sinker.

Yet that Dollar Tree price increase suggests

otherwise. Imagine how hard that must have been for

the company’s executives, given that their entire

identity was wrapped up in that very barrier.

Those with some worn tread on their tires who

understand the dangers of inflation have some

teaching to do. The wolf is at the door.

A Boston

Herald editorial

Monday, October 4, 2021

Inflation a growling wolf at

the door

AG Garland has told the

FBI and US Attorneys’ Offices to meet and

“strategize” on ways to deal with parents who have

the nerve to protest critical race theory. Actually,

they want to figure out how to deal with parents who

have the nerve to be involved in their child’s

education.

How dare they!

The DOJ said: “Citing

an increase in harassment, intimidation and threats

of violence against school board members, teachers

and workers in our nation’s public schools, today

Attorney General Merrick B. Garland directed the FBI

and U.S. Attorneys’ Offices to meet in the next 30

days with federal, state, Tribal, territorial and

local law enforcement leaders to discuss strategies

for addressing this disturbing trend. These sessions

will open dedicated lines of communication for

threat reporting, assessment and response by law

enforcement.”

The “task force”

includes everything except the kitchen sink:

• Criminal Division

• National Security Division

• Civil Rights Division

• Executive Office for U.S. Attorneys

• FBI

• Community Relations service

• Office of Justice Programs

The federal government

is involving the Criminal Division and National

Security Division to handle those pesky parents.

Legal

Insurrection

Monday, October 4, 2021

AG Garland Weaponizes FBI Against Parents Protesting

Critical Race Theory, Mask Mandates |

|

Last Monday the

Massachusetts Department of Revenue issued a press release ("September

Revenue Collections Total $3.992 Billion —

Monthly collections up $848 million or 27.0% vs. September

2020 actual") which opened with:

Massachusetts Department of

Revenue (DOR) Commissioner Geoffrey Snyder today

announced that preliminary revenue collections

for September totaled $3.992 billion, which is

$848 million or 27.0% more than actual

collections in September 2020, and $501 million

or 14.3% more than benchmark.

FY2022 year-to-date

collections totaled approximately $8.751

billion, which is $1.501 billion or 20.7% more

than collections in the same period of FY2021,

and $525 million or 6.4% more than year-to-date

benchmark.

The next day the State

House News Service reported ("State

Tax Receipts Running Half A Billion Over Benchmarks"):

State tax collectors

brought in $3.992 billion of revenue in

September, way up from September 2020 and half a

billion dollars more than what the Baker

administration was expecting to collect....

Since fiscal year 2022

began on July 1, DOR has collected $8.751

billion from residents and businesses. The

year-to-date total is $1.501 billion or 20.7

percent greater than actual collections during

the same time period of fiscal 2021 and $525

million or 6.4 percent above the

administration's year-to-date benchmark.

Last fiscal year (July

1, 2020-June 30, 2021) in the midst of the Wuhan

Chinese Pandemic the state raked in over $5 Billion

in excess revenue above the prior fiscal year

— far above its "benchmark"

predictive expectations — which the

Legislature and governor are still struggling to

agree on how to spend or squander. That came

on top of close to $5 Billion in "free" federal

Covid-19 "relief" money that is still being held

back from being allocated. In the first three

months of the current fiscal year the state has

collected

"$1.501 billion or 20.7% more than collections in

the same period of FY2021."

On Wednesday the State House News

Service noted ("Baker Plugs UI Rate Relief

For Small Biz"):

With tax collections

continuing to exceed expectations, Gov. Charlie

Baker on Wednesday pushed lawmakers to act on

his plan to use part of the surplus from last

year to deliver unemployment insurance relief to

small businesses.

Baker in August filed a

nearly $1.6 billion spending bill that would

direct $1 billion of a roughly $5 billion

surplus toward the trust fund used to pay

unemployment claims. Other surplus money would

be used to bolster the state's reserves, fund

union contracts and support rate increases for

human services providers.

Due to the effects of the

COVID-19 pandemic on the economy, the

Legislature authorized up to $7 billion in

borrowing to help small businesses avoid steep

increase in the unemployment insurances taxes

they pay to cover benefits, but that would still

need to be repaid over time....

The surplus Baker has

proposed to spend on small business relief was

from fiscal year 2021, which ended on June 30,

but tax revenues have continued to come in

strong in fiscal year 2022 and beat projections

by $500 million in September.

Beacon Hill Democrats have

not said whether they intend to use some of the

surplus to reduce the unemployment insurance

liability for small businesses, or if they might

tap into the nearly $5 billion in American

Rescue Plan Act funds to reduce the size of the

tab facing employers over the next 20 years.

Some business groups,

including Associated Industries of

Massachusetts, have urged the Legislature to use

both sources of funding for UI, while the

Massachusetts Budget and Policy Center said

targeted grants and loans would be a better way

to support employers.

On the day of the

Legislature's final ARPA hearing Tuesday, the

state chapter of the National Federation of

Independent Business said it was "unfair" to

demand that employers pay back the full $7

billion deficit that resulted from pandemic

layoffs, urging the Legislature to follow the

lead of more than 30 other states that have used

some ARPA funds to replenish their UI systems.

When the Wuhan CCP

Pandemic arrived in Massachusetts Gov. Baker

commanded that all businesses (except large box

stores, liquor stores, and a very few other rare

exceptions) with the acquiescence of a silent

Legislature only too happy to avoid the headlights.

Suddenly it somehow became the responsibility and

burden of those victimized small businesses to fund

the extraordinary and long-extended unemployment

benefits caused by the state's draconian lockdown

orders — a sudden and

additional $7 Billion business expense has been

added to their struggle to survive. The state

caused the unemployment crisis. With the

"embarrassment of riches" over-flowing the state's

coffers, making small businesses as whole as

possible must be a strong priority.

Regarding that "embarrassment of

riches," The Boston Herald's Saturday editorial ("Cash-flush

state dilutes case for millionaires tax") raises another

important issue:

Numbers-crunching aside,

let’s just say that fiscal 2022 so far has been

a banner year for the state treasury.

But numbers do tell the

story of this embarrassment of riches, and the

implications this surfeit might have on the

millionaires tax referendum’s prospects.

The state collected $3.992

billion in tax revenue in September, far

exceeding September 2020 and half a billion

dollars more than the Baker administration was

expecting to collect.

The Department of Revenue

announced Tuesday that September’s haul was $848

million, 27%, more than actual collections in

September 2020, and $501 million, 14.3%, above

the month’s estimates....

Since the July 1 start of

fiscal 2022, the DOR has collected $8.751

billion from residents and businesses. The

year-to-date total is $1.501 billion, 20.7%,

greater than actual collections during the same

time period of fiscal 2021, and $525 million,

6.4%, above the administration’s year-to-date

goal.

During fiscal 2021,

Massachusetts state government collected $5

billion more from residents, workers and

businesses than it was expecting, leading to a

sizable surplus.

The $34.137 billion total

for fiscal 2021 was $5.047 billion, 17.3%, above

the state’s benchmark and $4.528 billion,15.3%,

more than the actual amount collected in fiscal

year 2020.

That $5 billion-plus fiscal

2021 total also matches the $5 billion in

federal American Rescue Plan funds the state has

yet to allocate....

Given what’s already

transpired, that fiscal 2022 revenue estimate

might need to be revised higher.

The only people on Beacon

Hill not excited by these gaudy tax receipts are

the lawmakers and special-interest groups behind

that so-called millionaires tax. A joint session

of state lawmakers in June took a final

procedural step, voting 159-41 to clear the way

for the proposal to be placed on the ballot

after years of prior attempts stymied by

political and court battles.

At the time, the surtax

appeared to have the backing of the state’s

voters; a poll by Boston-based MassINC Polling

Group showed that 72% supported the wealth tax.

Lawmakers have promised the

estimated $2 billion in added revenue will

target transportation infrastructure and

public-school needs, but opponents argue the

gains won’t outweigh the potential loss of

job-creating entrepreneurs and relocated

businesses.

That 4% surcharge on yearly

income exceeding $1 million becomes less

necessary — and more punitive — after each

successive revenue-beating month. And if that’s

the case, why should voters in the 2022

statewide elections approve that ballot question

— overwhelming backed by Democrats — when the

state’s awash in cash?

That’s a valid ballot

question.

The "Millionaires Tax"

is classic Massachusetts socialist government and

special interests greed in action. More Is

Never Enough (MINE) and never will be. I don't care

how much the revenue surplus is and then some, they

will find ways to spend it faster that it comes in

— especially when it's OPM

(Other People's Money). "Don't tax you,

don't tax me, tax that fellow behind the tree" is

why a graduated income tax scheme, if ever imposed,

will be the death of productive Massachusetts

residents and taxpayers — and

why this foot-in-the-door constitutional amendment

ballot question must be defeated.

Speaking of the state constitution, on

Wednesday the state Senate expanded the voting process. The

State House News Service reported ("Senate

Approves Bill to Make Voting Reforms Permanent—Rejects

Republican Alternative, Registration Amendments"):

The Senate on Wednesday

went on record supporting the permanent adoption

of COVID-era voting allowances like expanded

early voting and voting-by-mail, and also

adopted policies like same-day registration that

go beyond the changes made to accommodate

elections during a pandemic.

The bill passed 36-3 along

party lines after Democrats rejected an

alternative the Republican senators offered to

address many of the same issues. Democrats

pitched the bill (S 2545), which would also

build into the system additional supports for

people with disabilities, as a way to remove

obstacles to the ballot box and to maintain

options that proved popular when available to

voters in 2020....

The bill now heads to the

House of Representatives, which has already

considered some parts of the Senate bill in

other forms. But House Speaker Ronald Mariano

said this week that representatives will "need

another vote" on election reforms this

session....

At the outset of debate,

Tarr questioned the Legislature's ability to

enact a permanent mail-in voting option without

changing the state Constitution -- and raised

the specter of consulting the state's highest

court on the matter.

Tarr recounted that when

Finegold and then-Senate President Therese

Murray had sought to permanently expand early

and absentee voting in 2013, they had done so by

proposing an amendment to the Constitution. He

also referenced a constitutional amendment filed

this spring by Reps. Michael Moran and Kevin

Honan to allow for no-excuse absentee voting.

Finegold responded: "We

will say that we in the Legislature do find that

mail-in voting is important for the people of

the commonwealth. And we do believe the

Constitution allows it."

Tarr replied that he hoped

the Legislature would "not play dice with the

Constitution, and that we will do what it takes

to make sure that we are either compliant, or

effect changes that would allow the statutes

that we enact to be compliant."

"I become a little bit

nervous when I hear that the Legislature has

deemed something constitutional, when in fact

there exists a significant constitutional

question," said Tarr, adding that perhaps he and

Finegold could join together in the future to

seek an advisory opinion from the Supreme

Judicial Court.

It would appear that

before this vast expansion of the historic process

for voting quite possibly could violate the state

constitution. Sen. Tarr seems to be saying

"pass it over our objections and we'll see you in

court." We'll see what happens.

Geoff Diehl's campaign to become the

next governor or Massachusetts got a boost at least among Republicans this

week when he was

endorsed by former-president Donald Trump, which

led to more speculation considering that Charlie Baker still hasn't

decided whether or not he'll run for a third term. The News

Service on Friday reported in its Weekly Roundup:

The timing may have been

curious, but even Gov. Charlie Baker said he

didn't find the announcement all that

surprising.

About 30 minutes before

Nathan Eovaldi threw the first pitch in a

winner-take-all playoff game against the Yankees

at Fenway Park, former President Donald Trump

sent out an email announcing his "Complete and

Total Endorsement!" of Geoff Diehl for governor,

knocking the incumbent as a RINO in the process.

So how did Baker respond?

"Let's go @redsox!" the governor tweeted just

after 8 p.m.

Diehl started his campaign

for governor over the summer trying not to be

the Trump guy. Though everyone knew the former

president had his support, Diehl wanted to stand

on his own two feet. He said he couldn't say for

sure whether the 2020 election had been stolen,

and that both parties had a problem with

respecting the results of elections.

Fast forward a couple of

months and Diehl this week claimed the 2020

election was rigged, as he called on Gov. Baker

to reject permanent voting by mail and embrace a

GOP-backed voter ID ballot initiative - both

unlikely scenarios.

Less than a day after

making that statement, Diehl was on the phone

with Trump himself, accepting the former

president's endorsement. What followed was a

deluge of armchair analysis over whether Trump's

support for Diehl would help or hurt Baker,

while Baker himself seemed to shrug it off.

Veteran Massachusetts

political reporter and columnist Peter Lucas wrote

in his Saturday Boston Herald column ("Baker,

Biden, Trump and Diehl all on political dance card"):

Will Joe Biden now endorse

Charlie Baker?

Unlikely. It is a

Republican primary for governor we are talking

about, and an endorsement by the Democrat

president of a GOP governor — even if he is a

RINO — would do more harm than good.

Biden is a train wreck of a

president who has plummeted so far down in the

polls that Republican Gov. Charlie Baker may

have to endorse him.

Besides, there are already

three Democrats running for governor, with the

possibility of Attorney General Maura Healey

becoming the fourth. And right now, it is not

known whether Baker will even seek a third term.

If he does, conservative

Republican Geoff Diehl, 52, who was endorsed

Monday by Donald Trump, will be waiting to knock

him off in the GOP primary. If Baker doesn’t

run, then Diehl has a path to the Republican

nomination for governor.

Diehl was co-chair of the

Trump re-election campaign in Massachusetts.

The former president’s

endorsement is no small thing. That is because

it is a Republican primary we are talking about

and not a general November election. It will

help Diehl raise funds.

There are only 469,000

registered Republicans in Massachusetts, most of

whom probably voted for Trump in the last

election....

Diehl said, “I am inspired

by the president’s (Trump) America First agenda,

which he backed up by delivering on his promises

during his time in the White House.”

“Like President Trump, I

want to ensure a strong economy … I want

families to feel safe,” Diehl said. Like Trump,

he added, “I want people to feel like government

isn’t working against them and that they can

enjoy the individual freedoms our state and

country were founded on.”

We are in a fascist-like,

authoritarian Biden era of mandates. Now the FBI

is tasked with monitoring the behavior of

parents at local school committee meetings as in

the old Soviet Union. Watch what you say,

comrade.

A Diehl “Massachusetts

First” campaign will appeal to a lot of people.

The Federal Reserve and

the disastrous Biden administration continue to

whistle past the graveyard insisting that the steady

rise of inflation is only "temporary" but they've

been asserting this for months now and it's still

climbing.

CNN Business on October 1

reported:

Stripping out food

and energy prices, which tend to be volatile, the inflation

measure stood at 3.6%, where it has been since June. It remains

the fastest rate of so-called core inflation since March 1991

and well above the Federal Reserve's target of 2%.

What's with "stripping

out food and energy prices"? That's precisely

where the most extreme inflationary price hikes are

hitting consumers the hardest!

A Boston Herald editorial last Monday

("Inflation a growling wolf at the door")

noted:

Last week, Dollar Tree,

one of the few dollar stores that lived up to the

promise of its name, announced a shocking

development. Its costs had risen so high in recent

weeks that it could no longer hold the line at a

single buck. Instead, it regretted to announce, many

items would now cost either $1.25 or $1.50.

Wall Street was delighted. Dollar Tree shares shot

up. But the news was an especially vivid reminder of

the clear and present danger of inflation, coming

for the very customer base that could afford it the

least....

The problem with inflation is that it slashes the

actual value of people’s savings accounts, making a

retirement that once seemed secure far more

tentative.

Younger people have no idea what it was like in the

high-inflation years of the 1970s, of course. They

don’t have a sense of costly mortgages hammering

their chances of getting a loan or of watching their

hard-won savings get eaten away by ballooning

prices. They may well get a crash course in that

understanding in coming weeks and months, but part

of the current progressive orthodoxy is still that

the danger of inflation is overstated. Too many

people have bought that hook, line and sinker.

Yet that Dollar Tree price increase suggests

otherwise. Imagine how hard that must have been for

the company’s executives, given that their entire

identity was wrapped up in that very barrier.

Those with some worn tread on their tires who

understand the dangers of inflation have some

teaching to do. The wolf is at the door.

While the Fed has cut

then held bank interest rates (on your savings) at

near zero percent, inflation has reduced your

savings by about 5 percent year-over-year by

devaluing the dollar's value through inflation.

With prices on a steady increase each of your

dollars buys less and less.

The only positive ray of light comes

from a prediction on Social Security benefits. According to

the October 6 report by TIPSwatch ("Coming

October 13: The most significant inflation report in a decade"):

I have been projecting that the

2022 COLA looks likely to fall into a range of 5.8% to 6.2%. The

July and August inflation reports have been in line with that

projection. At this point, the data seem to point to a 5.8%

increase in the Social Security COLA, but that will rise if

inflation continues to surge in September’s inflation report.

That is, unless the

Biden administration and Social Security

administrators can find (if they even bother) some

excuse for denying an honest

cost-of-living-adjustment (COLA) relative to actual

inflation.

Back to the "fascist-like, authoritarian

Biden era of mandates" and tasking the FBI to intimidate parents at

local school committee meetings, o n the national front the

United States of America continues to circle the drain under the

Dementia Joe Biden administration's cabal.

On Monday, Biden's

alleged "moderate" Attorney General Merrick Garland responded to a

September 28 letter

from the National School Boards Association calling on the Justice

Department to shut down parents' opposition to critical race theory,

mask mandates for children, and other objectionable curricula being

imposed on their children. The NSBA requested that the

Patriot Act be implemented to confront "these heinous actions .

. . the equivalent to a form of domestic terrorism."

The Justice Department

suspiciously

responded almost immediately, leading many to suspect

pre-arranged collusion. The Attorney General issued his response a mere five days later.

In his

memo Garland

instructed the Justice Department, FBI, National Security

Division, Civil Rights Division, Counterterrorism Division and other

Justice Department agencies to move in and suppress this uprising of

citizen audacity. Scary stuff indeed.

Townhall on Saturday

published a column ("Garland

Chills Parental Speech") by Jonathan Emord in which he noted:

Garland acted with reckless haste

to implement the anti-parent agenda demanded by the National

School Board Association (NSBA). Without any investigation to

establish the validity of NSBA’s claims, he accepted them as

valid and issued an immediate order. Garland did so on October 4

just five days after the NSBA insisted that Biden have DOJ and

the FBI act against parents protesting Critical Race Theory and

mask mandates.

The NSBA

letter to Biden asks for parents to be treated like domestic

terrorists and be investigated by DOJ and the FBI. In his

October 4 memorandum, Garland responded by ordering the DOJ and

FBI to coordinate with local law enforcement in all 14,000

public school districts. He ordered DOJ to employ “authority and

resources” to identify parents who make “threats” against

“school administrators, board members, teachers and staff” and

prosecute them “when appropriate.” He thereby marched in near

perfect lock step with the substantive demands of the NSBA.

How far this nation has

fallen, and so quickly.

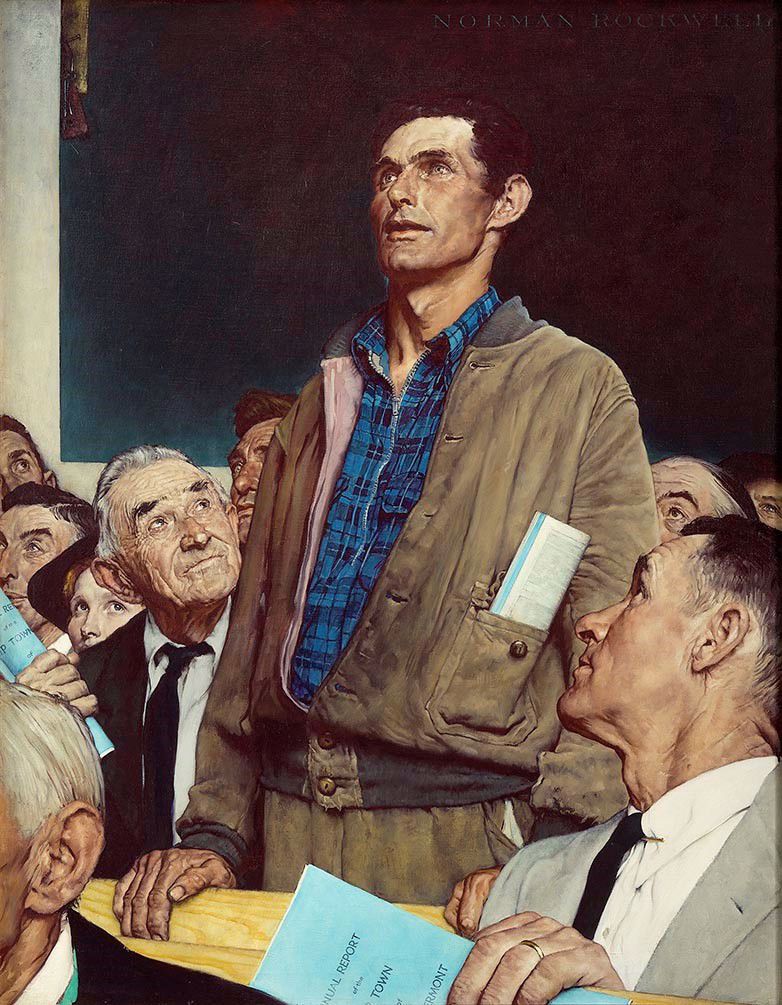

The Norman Rockwell

painting below, one among the series of his "Four Freedoms," "provided

crucial aid to the [WWII] war effort and took their place among the most

indelible images in the history of American art."

I suppose AG Garland, the

FBI, and the totalitarian Marxist militias can soon be expected to march on Stockbridge,

Massachusetts, Rockwell's home and museum, to desecrate this American

icon as well, black-holing this depiction of one of the "Four Freedoms"

highlighted by Democrat president Franklin Delano Roosevelt.

No, this certainly is

not your grandfather's Democrat Party, nor even "progressive"

president FDR's.

Norman Rockwell,

Freedom of Speech, 1943, oil on canvas,

illustration for The Saturday Evening Post, February 20, 1943

Norman Rockwell:

American Freedom is the first comprehensive exhibition

devoted to Norman Rockwell’s iconic depictions of the Four

Freedoms outlined by Franklin Delano Roosevelt: Freedom of

Speech, Freedom of Worship, Freedom from Fear, and Freedom

from Want. The presentation explores how Rockwell’s 1943

paintings came to be embraced by millions of Americans.

These works of art provided crucial aid to the war effort

and took their place among the most indelible images in the

history of American art.

|

|

|

|

Chip Ford

Executive Director |

|

|

Commonwealth of

Massachusetts

Department of Revenue

Monday, October 5, 2021

Press Release:

September Revenue Collections Total $3.992 Billion

Monthly collections up $848 million or 27.0% vs. September

2020 actual; $501 million above benchmark

BOSTON, MA — Massachusetts Department of Revenue (DOR)

Commissioner Geoffrey Snyder today announced that

preliminary revenue collections for September totaled $3.992

billion, which is $848 million or 27.0% more than actual

collections in September 2020, and $501 million or 14.3%

more than benchmark. [1]

FY2022 year-to-date collections totaled approximately $8.751

billion, which is $1.501 billion or 20.7% more than

collections in the same period of FY2021, and $525 million

or 6.4% more than year-to-date benchmark.

“September collections increased in all major tax types

relative to September 2020 collections, including

withholding, non-withholding, sales and use tax, corporate

and business tax, and ‘all other tax’,” said Commissioner

Snyder. “The increase in withholding is likely related to

improvements in labor market conditions while the increase

in non-withholding tax collections is due to an increase in

income estimated payments. The sales and use tax increase

reflects continued strength in retail sales and the easing

of COVID-19 restrictions.”

In general, September is a significant month for revenues

because many individuals and corporations are required to

make estimated payments. Historically, roughly 10% of annual

revenue, on average, has been received during September.

Given the brief period covered in the report, September and

year-to-date results should not be used as a predictor for

the rest of the fiscal year.

Details:

• Income tax collections for September were $2.040 billion,

$216 million or 11.8% above benchmark, and $325 million or

19.0% more than September 2020.

• Withholding tax collections for September totaled $1.190

billion, $78 million or 7.0% above benchmark, and $115

million or 10.7% more than September 2020.

• Income tax estimated payments totaled $806 million for

September, $114 million or 16.6% more than benchmark, and

$208 million or 34.8% more than September 2020.

• Income tax returns and bills totaled $84 million for

September, $32 million or 61.7% more than benchmark, and $4

million or 5.1% more than September 2020.

• Income tax cash refunds in September totaled $41 million

in outflows, $8 million or 25.6% above benchmark, and $2.5

million or 6.4% more than September 2020.

• Sales and use tax collections for September totaled $695

million, $6 million or 0.9% above benchmark, and $94 million

or 15.6% more than September 2020.

• Meals tax collections, a sub-set of sales and use tax,

totaled $118 million, $15 million or 14.1% above benchmark,

and $28 million or 31.1% more than September 2020.

• Corporate and business tax collections for the month

totaled $1.001 billion, $249 million or 33.0% above

benchmark, and $379 million or 61.1% more than September

2020.

• “All other” tax collections for September totaled $256

million, $30 million or 13.4% above benchmark, and $49

million or 23.7% more than September 2020.

[1] With the recent enactment of the FY2022 budget, monthly

revenue benchmarks were developed for the August 2021

through June 2022 period only.

###

State House News

Service

Tuesday, October 5, 2021

State Tax Receipts Running Half A Billion Over Benchmarks

By Colin A. Young

State tax collectors brought in $3.992 billion of revenue in

September, way up from September 2020 and half a billion

dollars more than what the Baker administration was

expecting to collect.

The Department of Revenue announced Tuesday afternoon that

the September haul was $848 million or 27 percent greater

than actual collections in September 2020 and $501 million

or 14.3 percent greater than the month's benchmark.

September typically brings in about 10 percent of the

state's annual tax revenue, DOR said.

"September collections increased in all major tax types

relative to September 2020 collections, including

withholding, non-withholding, sales and use tax, corporate

and business tax, and 'all other tax'," Revenue Commissioner

Geoffrey Snyder said. "The increase in withholding is likely

related to improvements in labor market conditions while the

increase in non-withholding tax collections is due to an

increase in income estimated payments. The sales and use tax

increase reflects continued strength in retail sales and the

easing of COVID-19 restrictions."

Since fiscal year 2022 began on July 1, DOR has collected

$8.751 billion from residents and businesses. The

year-to-date total is $1.501 billion or 20.7 percent greater

than actual collections during the same time period of

fiscal 2021 and $525 million or 6.4 percent above the

administration's year-to-date benchmark.

During fiscal year 2021, Massachusetts state government

collected more than $5 billion more from residents, workers

and businesses than it was expecting, leading to a sizeable

surplus. The $34.137 billion total for fiscal 2021 was

$5.047 billion or 17.3 percent above the state's benchmark

and $4.528 billion or 15.3 percent more than the actual

amount collected in fiscal year 2020.

By the time fiscal 2022 ends after June 30, 2022, DOR

expects that it will have collected $34.401 billion in tax

revenue. Revenues for the month of October, which DOR said

is "among the lower months for revenue collection," are due

to be announced Nov. 3. DOR has set the monthly collection

benchmark at $2.248 billion.

State House News

Service

Wednesday, October 6, 2021

Baker Plugs UI Rate Relief For Small Biz

By Matt Murphy

With tax collections continuing to exceed expectations, Gov.

Charlie Baker on Wednesday pushed lawmakers to act on his

plan to use part of the surplus from last year to deliver

unemployment insurance relief to small businesses.

Baker in August filed a nearly $1.6 billion spending bill

that would direct $1 billion of a roughly $5 billion surplus

toward the trust fund used to pay unemployment claims. Other

surplus money would be used to bolster the state's reserves,

fund union contracts and support rate increases for human

services providers.

Due to the effects of the COVID-19 pandemic on the economy,

the Legislature authorized up to $7 billion in borrowing to

help small businesses avoid steep increase in the

unemployment insurances taxes they pay to cover benefits,

but that would still need to be repaid over time.

"Thanks to a strong recovery and smart budgeting, MA has a

surplus - it's time for lawmakers to return those surplus

tax dollars and pass our plan to deliver small business

relief," Baker tweeted, sharing a CommonWealth Magazine

article about September tax collections.

The surplus Baker has proposed to spend on small business

relief was from fiscal year 2021, which ended on June 30,

but tax revenues have continued to come in strong in fiscal

year 2022 and beat projections by $500 million in September.

Beacon Hill Democrats have not said whether they intend to

use some of the surplus to reduce the unemployment insurance

liability for small businesses, or if they might tap into

the nearly $5 billion in American Rescue Plan Act funds to

reduce the size of the tab facing employers over the next 20

years.

Some business groups, including Associated Industries of

Massachusetts, have urged the Legislature to use both

sources of funding for UI, while the Massachusetts Budget

and Policy Center said targeted grants and loans would be a

better way to support employers.

On the day of the Legislature's final ARPA hearing Tuesday,

the state chapter of the National Federation of Independent

Business said it was "unfair" to demand that employers pay

back the full $7 billion deficit that resulted from pandemic

layoffs, urging the Legislature to follow the lead of more

than 30 other states that have used some ARPA funds to

replenish their UI systems.

Retailers Association of Massachusetts President Jon Hurst

also retweeted the governor Wednesday.

The budget bill to close out fiscal year 2021 is due this

month, with Comptroller William McNamara needing the plan to

be enacted and signed by Baker before he can close the

state's books. The deadline for that to happen is Oct. 31.

The Boston

Herald

Saturday, October 9, 2021

A Boston Herald editorial

Cash-flush state dilutes case for millionaires tax

Numbers-crunching aside, let’s just say that fiscal 2022 so

far has been a banner year for the state treasury.

But numbers do tell the story of this embarrassment of

riches, and the implications this surfeit might have on the

millionaires tax referendum’s prospects.

The state collected $3.992 billion in tax revenue in

September, far exceeding September 2020 and half a billion

dollars more than the Baker administration was expecting to

collect.

The Department of Revenue announced Tuesday that September’s

haul was $848 million, 27%, more than actual collections in

September 2020, and $501 million, 14.3%, above the month’s

estimates.

September typically brings in about 10% of the state’s

annual tax revenue, DOR said.

“September collections increased in all major tax types

relative to September 2020 collections, including

withholding, non-withholding, sales and use tax, corporate

and business tax, and ‘all other tax,’ ” Revenue

Commissioner Geoffrey Snyder told the State House News

Service.

“The increase in withholding is likely related to

improvements in labor market conditions while the increase

in non-withholding tax collections is due to an increase in

income estimated payments. The sales and use tax increase

reflects continued strength in retail sales and the easing

of COVID-19 restrictions.”

Since the July 1 start of fiscal 2022, the DOR has collected

$8.751 billion from residents and businesses. The

year-to-date total is $1.501 billion, 20.7%, greater than

actual collections during the same time period of fiscal

2021, and $525 million, 6.4%, above the administration’s

year-to-date goal.

During fiscal 2021, Massachusetts state government collected

$5 billion more from residents, workers and businesses than

it was expecting, leading to a sizable surplus.

The $34.137 billion total for fiscal 2021 was $5.047

billion, 17.3%, above the state’s benchmark and $4.528

billion,15.3%, more than the actual amount collected in

fiscal year 2020.

That $5 billion-plus fiscal 2021 total also matches the $5

billion in federal American Rescue Plan funds the state has

yet to allocate.

By the time fiscal 2022 ends on June 30, DOR expects to

collect $34.401 billion in tax revenue. Revenues for the

month of October, which DOR said is “among the lower months

for revenue collection,” are due to be announced Nov. 3.

DOR has set the monthly collection benchmark at $2.248

billion.

Given what’s already transpired, that fiscal 2022 revenue

estimate might need to be revised higher.

The only people on Beacon Hill not excited by these gaudy

tax receipts are the lawmakers and special-interest groups

behind that so-called millionaires tax. A joint session of

state lawmakers in June took a final procedural step, voting

159-41 to clear the way for the proposal to be placed on the

ballot after years of prior attempts stymied by political

and court battles.

At the time, the surtax appeared to have the backing of the

state’s voters; a poll by Boston-based MassINC Polling Group

showed that 72% supported the wealth tax.

Lawmakers have promised the estimated $2 billion in added

revenue will target transportation infrastructure and

public-school needs, but opponents argue the gains won’t

outweigh the potential loss of job-creating entrepreneurs

and relocated businesses.

That 4% surcharge on yearly income exceeding $1 million

becomes less necessary — and more punitive — after each

successive revenue-beating month. And if that’s the case,

why should voters in the 2022 statewide elections approve

that ballot question — overwhelming backed by Democrats —

when the state’s awash in cash?

That’s a valid ballot question.

State House News

Service

Wednesday, October 6, 2021

Senate Approves Bill to Make Voting Reforms Permanent

Rejects Republican Alternative, Registration Amendments

By Colin A. Young

The Senate on Wednesday went on record supporting the

permanent adoption of COVID-era voting allowances like

expanded early voting and voting-by-mail, and also adopted

policies like same-day registration that go beyond the

changes made to accommodate elections during a pandemic.

The bill passed 36-3 along party lines after Democrats

rejected an alternative the Republican senators offered to

address many of the same issues. Democrats pitched the bill

(S 2545), which would also build into the system additional

supports for people with disabilities, as a way to remove

obstacles to the ballot box and to maintain options that

proved popular when available to voters in 2020.

"In 2020, for the first time in Massachusetts history,

residents had the choice to vote by mail, to vote during

[an] extended early voting window, or to vote in person on

Election Day. These reforms, which received overwhelming

bipartisan support, helped increase civic engagement and

enabled residents to vote safely, securely and easily," Sen.

Barry Finegold, who chairs the Committee on Election Laws

for the Senate, said.

With early and mail-in voting options in place last year,

3,657,972 votes were cast in the Nov. 3 election, topping

the state's previous record by nearly 300,000 votes and

representing roughly 76 percent turnout, Secretary of State

William Galvin's office said. Finegold said 42 percent of

people voted by mail last year and another 23 percent cast

their ballots during early voting.

"In the face of an ongoing pandemic, Massachusetts did not

simply protect voting rights. We reinvigorated our

democracy," he said.

Echoing what Senate President Karen Spilka last week

referred to as "an anti-democratic, fundamentally

un-American darkness" that she said "is spreading across the

United States," a number of Senate Democrats on Wednesday

referenced debates around voting rights in more conservative

states.

"We're living in a dangerous moment. Dozens of states are

restricting access to the ballot box and citing baseless

politically-motivated claims of election fraud as a

justification for doing so," Sen. Cynthia Creem said.

Just as Democrats in states like Texas were unable to stop

legislative efforts to change state laws around voting and

elections, the Republican minority in the Massachusetts

Senate was unsuccessful Wednesday in generating support for

a proposed rewrite of the voting reforms bill.

The alternative from the chamber's three Republicans, which

failed on a 3-35 party-line vote, would have required annual

notification of each voter's own registration status from

the secretary of state, moved the voter registration

deadline from 20 days before an election to five days

before, and provided for at least one weekday evening of

early voting beyond what the underlying bill proposed. It

also would have allowed any registered voter to request a

ballot to vote early by mail for any election but would have

required the request to be made under the penalties of

perjury.

Minority Leader Bruce Tarr called it "a prescription for how

to go further and make sure that we have two things. Number

one, increased voter participation. And number two,

increased security and integrity around elections." He said

he thought it was "important that everyone understand what

we are proposing and the many areas of commonality that we

share."

"I would hope that we would adopt this particular

substitution and begin the process of a bipartisan agreement

to be able to move forward to be proactive, to not be

content with creating a situation where we receive voter

participation, but one in which we go out and proactively

create voter participation," Tarr said.

Sen. Ryan Fattman said the GOP rewrite also would have

enhanced election accuracy by increasing random auditing,

bolstered election security by doubling penalties for

illegal voting and unlawful distribution of absentee

ballots, and required that the state reimburse cities and

towns for early voting costs.

The bill put forward by Senate leadership already included

reforms that would direct sheriffs and other corrections

officials to help eligible incarcerated voters learn their

rights and apply for and cast ballots by mail, but senators

went beyond that with the adoption Wednesday of a Sen. Adam

Hinds amendment that more explicitly spells out what steps

correction facilities must take to educate and facilitate

voting among the eligible incarcerated population.

A few hours before the Senate gaveled in to debate its

election reform bill, advocates pitched the Joint Committee

on Election Laws on legislation (H 836/S 474) that mirrors

the Hinds amendment.

"People who are incarcerated on misdemeanor convictions, who

are civilly committed and who are incarcerated pretrial are

all eligible to vote in the commonwealth. But we've created

a system of de facto disenfranchisement of this population,

disproportionately impacting Black and brown communities and

undermining their voting power," Jesse White, policy counsel

at Prisoners' Legal Services of Massachusetts, told the

committee Wednesday morning.

People serving sentences for felony convictions in

Massachusetts are ineligible to vote in state and

Congressional elections while incarcerated, the result of a

constitutional amendment approved by 64 percent of statewide

voters on the 2000 ballot. But between 7,000 and 9,000 other

people each year are held on misdemeanor convictions or as

they await trial and remain eligible to vote, Creem said.

"We all feel a sense of pride and connection in our

community when we vote ... Enabling eligible incarcerated

individuals to feel that connection should be viewed as an

important component of successful rehabilitation and

reintegration and, due to the disproportionate percentage of

minorities in our prisons, it should be viewed as an issue

of racial justice," Creem said as the Senate began its

debate Wednesday afternoon.

Middlesex County Sheriff Peter Koutoujian said Tuesday that

making sure "any incarcerated individual who is eligible to

vote has the ability to do so" is a top priority for him and

his office, which has "fully incorporated voter registration

into our reentry programming."

In 2016 and 2018, Koutoujian partnered with the League of

Women Voters to conduct voter education drives, register new

voters and help eligible voters get absentee ballots. In

2020, the sheriff's office worked directly with eligible

voters since LWV volunteers were limited by pandemic health

and safety restrictions.

"Our staff works diligently to ensure that returning

citizens understand their voting rights and the value of

civic engagement to a full and successful reentry into

society. Since November 2019, we have helped 192 individuals

register to vote as part of the reentry process," Koutoujian

said. "Many of those who registered did not know they would

be eligible to vote upon their release and several were

registering for the first time in their lives."

Sen. Sonia Chang-Diaz offered two amendments -- both of

which were rejected on voice votes -- related to the

registration of incarcerated voters. One (#8) would have

directed jails, prisons and facilities run by the Department

of Youth Services to enter into agreements with the state to

become automatic voter registration sites. A second

amendment (#9) would have made pre-registration to vote part

of the re-entry process for anyone preparing to be released

at the end of their sentence for a felony conviction.

Geoff Foster, executive director of the Common Cause

Massachusetts voting rights advocacy group, said he's

noticed "a strong focus to prioritize voting rights and

election reforms in Massachusetts" during this legislative

session and told lawmakers that Hinds' jail-based voting

proposal is critical "because it highlights and centers

equity in the debate about our democracy."

Referring to the VOTES Act that the Senate would dive into

later Wednesday, Foster added, "We also hope and ask that if

that bill moves to the House, that this particular provision

of jail-based voting be a top priority for all of you."

At the outset of debate, Tarr questioned the Legislature's

ability to enact a permanent mail-in voting option without

changing the state Constitution -- and raised the specter of

consulting the state's highest court on the matter.

Tarr recounted that when Finegold and then-Senate President

Therese Murray had sought to permanently expand early and

absentee voting in 2013, they had done so by proposing an

amendment to the Constitution. He also referenced a

constitutional amendment filed this spring by Reps. Michael

Moran and Kevin Honan to allow for no-excuse absentee

voting.

Finegold responded: "We will say that we in the Legislature

do find that mail-in voting is important for the people of

the commonwealth. And we do believe the Constitution allows

it."

Tarr replied that he hoped the Legislature would "not play

dice with the Constitution, and that we will do what it

takes to make sure that we are either compliant, or effect

changes that would allow the statutes that we enact to be

compliant."

"I become a little bit nervous when I hear that the

Legislature has deemed something constitutional, when in

fact there exists a significant constitutional question,"

said Tarr, adding that perhaps he and Finegold could join

together in the future to seek an advisory opinion from the

Supreme Judicial Court.

The bill now heads to the House of Representatives, which

has already considered some parts of the Senate bill in

other forms. But House Speaker Ronald Mariano said this week

that representatives will "need another vote" on election

reforms this session.

"Obviously, we'll wait and see what comes over in the form

of the bill that we'll get from the Senate," Mariano said

earlier this week. "We have taken a vote on the same-day

amendment. We'll see what happens when we begin the debate."

The House rejected a same-day voter registration proposal

last year and this June approved a supplemental budget

amendment that would have permanently authorized mail-in

voting and early voting before biennial elections.

Baker has supported mail-in voting, and signed the laws

implementing and extending pandemic-era voting options, but

he is opposed to same-day voter registration.

"We have lots and lots of opportunities for people to

register right up until Election Day and a lot of processes

that are pretty easy to use to get there," Baker said in a

radio interview last month. "But I want municipalities and

the commonwealth on Election Day to focus on one thing and

one thing only, which is counting the votes."

Existing mail-in voting and expanded early voting provisions

expire Dec. 15 without action to extend or replace them.

— Sam Doran contributed

reporting.

State House News

Service

Friday, October 8, 2021

Weekly Roundup - Voting, Scrambled

Recap and analysis of the week in state government

By Matt Murphy

The timing may have been curious, but even Gov. Charlie

Baker said he didn't find the announcement all that

surprising.

About 30 minutes before Nathan Eovaldi threw the first pitch

in a winner-take-all playoff game against the Yankees at

Fenway Park, former President Donald Trump sent out an email

announcing his "Complete and Total Endorsement!" of Geoff

Diehl for governor, knocking the incumbent as a RINO in the

process.

So how did Baker respond? "Let's go @redsox!" the governor

tweeted just after 8 p.m.

Diehl started his campaign for governor over the summer

trying not to be the Trump guy. Though everyone knew the

former president had his support, Diehl wanted to stand on

his own two feet. He said he couldn't say for sure whether

the 2020 election had been stolen, and that both parties had

a problem with respecting the results of elections.

Fast forward a couple of months and Diehl this week claimed

the 2020 election was rigged, as he called on Gov. Baker to

reject permanent voting by mail and embrace a GOP-backed

voter ID ballot initiative - both unlikely scenarios.

Less than a day after making that statement, Diehl was on

the phone with Trump himself, accepting the former

president's endorsement. What followed was a deluge of

armchair analysis over whether Trump's support for Diehl

would help or hurt Baker, while Baker himself seemed to

shrug it off.

"In some respects, I'm not surprised for a whole bunch of

reasons," Baker said. "But the bottom line is I'm really

focused on Covid, focused on getting people back to work and

focused on making sure that kids have the opportunity to go

to school in person this year and trying to get us back to

what I would describe as normal as fast as possible.”

This week, that included expanding the mission of the

National Guard to drive buses in four more school districts:

Haverhill, Revere, Worcester and Wachusett Regional.

Baker's biggest challenge in a Republican primary, should he

decide to run, will arguably be making sure the independents

who are his bread-and-butter constituency vote in the GOP

primary, rather than in the Democratic contest. Trump's

endorsement, however, could prove useful for Diehl with

fundraising outside of Massachusetts. And Diehl could use

the help.

The former state lawmaker pulled in just $11,511 in

September, while Baker posted his best month of the year

with $173,348 in donations.

But let's also assume for a moment that Trump's support does

translate to votes for Diehl. Will either of them trust the

count if the ballots came by mail, or from jail?

The Senate this week voted to make sure Massachusetts

residents have as many options as possible to cast their

ballots in 2022 and beyond, passing a version of the VOTES

Act that would expand early voting, make voting by mail

permanent and allow for same-day voter registration.

Not one of the Senate's three Republicans backed the bill,

and Senate Minority Leader Bruce Tarr questioned its

constitutionality.

The overwhelmingly Democrat-controlled branch also voted for

a Sen. Adam Hinds amendment that would require sheriffs and