|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Sunday, June 27, 2021

Shameless Greed Rules

The Week

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

Through mid-June, the Department of Revenue collected

nearly 80 percent of the tax revenue it anticipates

bringing in during this final month of a remarkable

fiscal year that has already exceeded all expectations

and appears likely to produce a significant surplus.

In its mid-month report to the Legislature, DOR said it

had collected $2.003 billion from taxpayers between June

1 and June 15, up $768 million or 62.2 percent compared

to the same period in June 2020. DOR's latest monthly

benchmark for June projected a monthly total of $2.578

billion....

With the second half of June remaining to be counted,

DOR has collected $32.454 billion so far in fiscal year

2021, which ends June 30. That's $3.364 billion more

than the Baker administration's most recent estimate for

the full 12-month fiscal year and $1.3 billion more than

the pre-pandemic estimate of $31.15 billion in tax

revenue for fiscal year 2021.

It is also $2.334 billion more than the consensus

revenue agreement of $30.12 billion the governor, House

and Senate used to craft their fiscal year 2022 budget

proposals. The six lawmakers currently negotiating a

compromise fiscal year 2022 budget could wield

considerable power by increasing the revenue assumption

to give themselves additional money to spend, save or

turn back in the form of tax relief...

The fiscal year 2021 tax collections, which have

obliterated the Baker administration's expectations for

the last several months, look to be headed towards a

significant surplus. That would present another pot of

mostly untethered money for the governor and Legislature

to manage while also deciding how to spend more than $5

billion in federal aid received as part of the American

Rescue Plan Act.

State House News Service

Wednesday, June 23, 2021

Annual Tax Collections Beating

Estimate By $3.4 Bil, And Counting

Total Federal Awards to Massachusetts: $113 Billion

The federal government is expected to provide

approximately $113 billion in aid to Massachusetts in

response to the COVID-19 pandemic. Funding has been

given to three groups: businesses and individuals,

public entities, and Commonwealth agencies.

• Businesses and individuals received about $51 billion

through programs like the Paycheck Protection Program

for businesses and stimulus checks for individuals.

• Public entities other than Commonwealth agencies

received about $10 billion through programs like the

Coronavirus Local Fiscal Recovery Fund for municipal and

county governments, and Federal Transit Authority grants

to Regional Transportation Authorities.

• Commonwealth agencies received about $49 billion,

primarily to support COVID-related Unemployment

Insurance benefits, expansions of existing programs like

the Community Development Block Grant, and new programs

like the Coronavirus Relief Fund and the Coronavirus

State Fiscal Recovery Fund.

• Additionally, new federally-administered initiatives

like funding of COBRA coverage and the expansion of the

child tax credit are expected to provide nearly $4

billion to Commonwealth residents.

Massachusetts Department of Revenue

Division of Local Services/

Executive Office for Administration and Finance

Friday, June 25, 2021

"Total Federal Awards to Massachusetts:

$113 Billion"

With Massachusetts on track to end the year with a

multi-billion dollar surplus, Gov. Charlie Baker on

Wednesday proposed a two-month sales tax holiday that

would give consumers a break from the state's 6.25

percent sales tax in August and September in an effort

to drive shoppers to local businesses.

The major tax relief proposal would cost the state an

estimated $900 million in forgone revenue, but the

Republican governor said it would also be a way for the

state to show appreciation to business owners and

consumers who have contributed to the surplus by finding

ways to support each other during the COVID-19 pandemic.

Baker said he would file legislation Wednesday to expand

the annual sales tax holiday from a two-day weekend in

August to a two-month event, believing it would help

give the state's economy "some momentum as we come out

of this sort of pandemic doldrums that we've been in."

As it stands now, the tax-free holiday has been set for

the weekend of Aug. 14 and Aug. 15.

"It would be a really big deal, not just for taxpayers,

but also for all those Main Street businesses have

really had it probably toughest of all on the economic

side since the beginning of the pandemic," Baker said at

a State House press conference.

Through May, the state had collected more than $3.9

billion in excess of projections for the fiscal year and

that trend has continued in June with the Department of

Revenue reporting that through the middle of the month

the state had already collected 80 percent of what it

expected for the full month.

Baker hesitated to make a guess on how large the surplus

will be when the fiscal year ends on June 30 and the

books are balanced, but he said it was clear that there

would be "significant" excess revenue to be spent, saved

or returned to taxpayers....

Another chunk of the surplus is expected to find its way

into savings.

The Department of Revenue on Tuesday certified for the

comptroller $2.3 billion in capital gains taxes

collected so far in fiscal 2021, which exceeds a

threshold set by state law resulting in an automatic

transfer of $852 million to the state's stabilization

fund. That transfer, the administration said, pushed the

balance in the state's "rainy day" fund to $4.3 billion.

State House News Service

Wednesday, June 23, 2021

Baker Seeks Two-Month Sales Tax

Holiday

Consumers, Businesses Would Share in Bulging Surplus

Gov. Charlie Baker on Thursday continued to pitch his

new idea for a two-month sales tax holiday this summer

even after the $900 million tax relief proposal landed

with a bit of a thud on Beacon Hill where many Democrats

panned the short-term tax break and supporters voiced

skepticism about its chances....

But the idea of suspending sales tax collections in

August and September to help give the retail economy a

jolt encountered swift pushback from legislators who

would have to sign off on the plan.

"We did do a weekend of sales tax holiday and I think

that is sufficient for now. There's a lot of need in the

state," Senate President Karen Spilka said.

Senate Ways and Means Chairman Michael Rodrigues and

Economic Development Committee Chairman Eric Lesser both

called the sales tax holiday a "political gimmick," and

other lawmakers enumerated the various ways they hoped

to spend surplus dollars....

With Baker recommending the tax holiday run August

through September, legislative leaders must decide in

the coming weeks whether the proposal has any legs. If

they don't accept it, Democrats in the House and Senate

could choose to shorten the duration or, as House

Minority Leader Brad Jones put it, let it "die a death

of inaction." ...

The state ended May with $3.9 billion more than it had

projected to collect over the first 11 months of the

fiscal year, and midway through June the Department of

Revenue reported collecting 80 percent of what it

expected for the full month.

Baker said the unexpected strength of tax collections,

including capital gains taxes, has pushed the state's

reserved balance to more than $4.3 billion

"I think we owe some of this to the people of

Massachusetts and to some of the small businesses. They

had a terrible year," Baker said Thursday during an

interview on GBH's "Boston Public Radio." ...

Retail groups were among those cheering Baker's

proposal.

Jon Hurst, president of the Retailers Association of

Massachusetts, called the proposal "a smart, exciting,

and progressive economic incentive that will benefit our

small businesses and our consumers just when they need

it."

The Massachusetts Fiscal Alliance also countered the

idea that allowing people to keep more of the money they

earn should be seen as a gimmick.

"Massachusetts is collecting more tax money than they

ever dreamed of, and Massachusetts taxpayers are among

the most generous in the country. State House

politicians should share some of the riches with the

taxpayers and not keep it all for themselves to spend in

a self-centered and reckless way," MassFiscal spokesman

Paul Craney....

Baker, Jones and other supporters of the extended tax

holiday noted that the tax relief would come at a time

when government is not only running a surplus, but

lawmakers are debating how to spend more than $5 billion

in federal COVID-19 aid, and cities, towns and schools

received billions more through the American Rescue Plan

Act.

State House News Service

Thursday, June 24, 2021

Lights Quickly Dim on Baker’s Tax

Relief Plan

Spilka: Sales Tax Holiday Weekend "Sufficient For Now"

Gov. Charlie Baker’s plan to slash sales taxes statewide

for two months appears dead-on-arrival in the state’s

Democrat-led Legislature, where lawmakers dismissed the

measure as a “gimmick.”

But the Republican governor signaled he isn’t giving up

without a fight, taking the chance to swing back at

critical lawmakers not once, but twice on Thursday in

person and on GBH radio....

Baker on Wednesday announced legislation that would

expand the state’s sales tax holiday, which is

traditionally two days, into a two-month affair. Cutting

the state’s 6.25% sales tax for eight weeks would save

shoppers and businesses an estimated $900 million, he

said.

State Sen. Eric Lesser, D-Longmeadow, said the proposal

would “do almost nothing to help out local retailers,”

joining a growing list of Democratic lawmakers who

oppose the plan.

“Now that COVID is ending, demand is at record levels.

Our local businesses need more workers and better

infrastructure, not political gimmicks. Extra funds

should be used to reduce class sizes, repair crumbling

roads and bridges, improve broadband internet, or use to

pay down debt,” Lesser said.

The Boston Herald

Thursday, June 24, 2021

Charlie Baker’s 2-month sales tax holiday

appears dead on arrival

in Democrat-led Massachusetts Legislature despite

business support

The debate over Gov. Charlie Baker’s proposed two-month

sales tax holiday has turned into a partisan,

interest-driven dispute.

Baker, a Republican who has not yet announced whether he

will run for reelection, portrayed the tax holiday as a

way to keep more money in the hands of consumers, while

helping small businesses. “We are proud to offer this

proposal to keep money in the hands of taxpayers and

promote economic development amidst Massachusetts’

recovery from the COVID-19 public health emergency,”

Secretary of Administration and Finance Michael

Heffernan said in a statement.

Businesses that would benefit from increased sales are,

unsurprisingly, supportive. Retailers Association of

Massachusetts president Jon Hurst, in a statement

included in the governor’s press release, called it “a

smart, exciting, and progressive economic incentive that

will benefit our small businesses and our consumers just

when they need it.”

But liberal groups panned the move as a gimmick that

would divert an unexpected budget surplus away from

other government spending priorities. “The tax dollars

the Commonwealth would lose from this 2-month sales tax

holiday could support local schools by accelerating

funding for the Student Opportunity Act, provide

opportunities for affordable childcare that will help

businesses and families, and encourage travel by

enabling transit authorities to stop collecting

burdensome bus fares,” said Marie-Frances Rivera,

president of the liberal-leaning Massachusetts Budget

and Policy Center....

The presidents of the Massachusetts Teachers Association

and American Federation of Teachers-Massachusetts issued

a joint statement criticizing Baker for wanting to boost

big box stores and online retailers instead of investing

in colleges, public schools, and transportation. Merrie

Najimy of the MTA and Beth Kontos of AFT Massachusetts

called it “Baker's billion-dollar giveaway.”

On one hand, the debate is coming down to the typical

Republican versus Democrat dynamic, with Baker favoring

lower taxes and putting more money into the hands of

consumers, and Democrats wanting more government

spending to shore up public infrastructure.

CommonWealth Magazine

Friday, June 25, 2021

Two-month sales tax holiday may not

make economic sense

“Gov. Baker’s proposal to return some of taxpayers’

overpayment, considering the historic hardships imposed

on citizens over the past 15 months, is proper and

compassionate,” said Chip Ford, executive

director of Citizens for Limited Taxation (CLT).

“The usual resistance to even this small tax relief

proposal when the state finds itself awash in an

unexpected $4 billion-plus revenue surplus and $5

billion-plus in additional federal grants, every cent

provided by taxpayers, is shameful and demonstrates why

we’ve always asserted at CLT: ‘More is never enough and

never will be.’”

Beacon Hill Roll Call

June 21-25, 2021

Two-Month Sales Tax Holiday In July And

August

The House on Tuesday rejected Gov. Charlie Baker's

request to immediately spend $2.8 billion in federal

COVID-19 relief money, choosing to follow through with

the plan of Democratic leaders to sweep most of the $5.3

billion the state received into a separate fund as they

consider how to deploy the money.

The action by the House reflects not only a disagreement

between the governor and Legislature over process, but

also about how quickly the federal funds should be spent

to assist in the state's economic recovery.

Baker last Thursday offered a compromise that would have

allowed him to immediately spend more than half of the

funding the state received through the American Rescue

Plan Act, and give the Legislature more time to

deliberate over how to spend the remaining $2.3

billion....

While Baker did not say whether he would veto the bill

should it again reach his desk, it's likely Democrats in

the Legislature will have enough votes to override the

governor.

"We can all agree a number of those are well conceived

and worthy. We don't deny that. We just think it's

important all 160 members of this body and 40 in our

sister body have a chance to have their voice heard,"

said Rep. Dan Hunt, the chair of the House Committee on

Federal Stimulus and Census Oversight, about the

governor's priorities.

Hunt said that over the course of several months after

the "July holiday" the House planned to have multiple

hearings on different subject matters to gather input on

how the money should be spent. Mariano and Spilka said

the hearings would be led by the Joint Committee on Ways

and Means....

The governor has said he currently does not need

legislative approval to spend the federal aid, but when

asked last week why he didn't just start spending the

money now he said he wanted to work with the

Legislature.

"I think we're trying to pursue this in what I would

describe as a good faith manner," Baker said.

State House News Service

Tuesday, June 22, 2021

Admin Worried About Holdup As House

Dems Vote to Stash Fed Aid

Reflective Process Planned For Biden's Rescue Plan $$$

The power struggle over who will hold the purse strings

as Massachusetts doles out the latest round of federal

coronavirus relief dollars continues on Beacon Hill,

where state representatives reached a deal they say

would give the governor “some latitude” around how the

cash gets spent.

“Our actions this week will preserve the funds while

allowing all parties to participate in the discussion

and help make decisions about how to allocate these

resources,” House Speaker Ronald Mariano and Senate

President Karen Spilka said in a joint statement on

Tuesday.

Democratic leaders are looking to to sweep most of the

$5.3 billion the state received in unrestricted funds

through President Biden’s American Rescue Plan into a

separate fund as they consider how to spend the

money....

If the bill passes, it will tie Baker’s hands when it

comes to spending more.

The Boston Herald

Tuesday, June 22, 2021

Power struggle between Charlie

Baker, Dems

over spending federal coronavirus aid rages

House officials said they wanted to make spending

decisions using a very public process, and move away

from giving the governor license to use the sweeping

executive powers he exercised during the pandemic.

Baker said spending a good chunk of the money quickly

was important to spurring the state’s economic recovery,

but Rep. Dan Hunt, the chair of the House Committee on

Federal Stimulus and Census Oversight, said there was no

rush, that the money under federal guidelines could be

portioned out over four years....

What will be interesting to watch is if House and Senate

leaders can keep members in check during the budget

process, and avoid turning the one-time federal money

into a special interest gravy train.

The numbers are astounding. The state received $5.28

billion in unrestricted federal aid under the American

Rescue Plan.

CommonWealth Magazine

Tuesday, June 22, 2021

House votes to put fed funds

through budget-like process

Gives Baker control of just $200m, not $2.8b

Gov. Charlie Baker keeps setting them up, and the

Legislature keeps knocking 'em down.

Last week, it was a plan to spend $2.8 billion in

federal relief money on what Baker hoped would be

slam-dunk priorities -- housing, job training, parks.

The response from House and Senate Democrats? Nope, at

least not yet.

The Republican governor came right back this week with a

pitch to use $900 million from an expected surplus at

the end of fiscal 2021 (which concludes next Wednesday)

to cover a two- month sales tax holiday in August and

September.

Why provide sales tax relief for two days on Aug. 14 and

Aug. 15 when the state can afford sales tax relief for

two months, Baker said. Well, it turns out legislative

Democrats could think of a few reasons, all but popping

the governor's sales tax holiday balloon before it could

float away.

"We did do the weekend already, and I think that's

sufficient," Senate President Karen Spilka said....

Of course, there was a touch of irony that the

Legislature would criticize the governor for not

proposing to spend the projected surplus on investments

in education, housing and infrastructure at the same

time they were voting down his plan to spend billions on

education, housing and infrastructure.

State House News Service

Friday, June 25, 2021

Weekly Roundup - Bowling for

Compromise

Reports of the death of the Transportation and Climate

Initiative appear greatly exaggerated.

In one sign of life, the Rhode Island Senate on Tuesday

approved legislation that would make the Ocean State a

founding member of the regional program to cut

planet-warming emissions from cars and trucks.

The 38-to-7 vote comes a couple of weeks after

Connecticut legislators and Gov. Ned Lamont failed to

reach an agreement on including a TCI bill in the state

budget, prompting calls from opponents that the

cap-and-invest program was all but dead.

While there was hope that the Connecticut legislature

would take up the multi-state proposal when it

reconvened, that special session came and went last week

without any action on what environmental advocates say

is a crucial step in fighting climate change....

The vote came over the objections of senators from rural

districts who say the fees will amount to a gas tax that

will be passed down to consumers, and that their

constituents will bear the burden because they rely more

on their cars to get around.

“Morally, it would be cruel to impose this fuel tax on

Rhode Islanders,” said Sen. Jessica de la Cruz, a North

Smithfield Republican....

Whether the legislation goes any further is up to the

House. Rep. Terri Cortvriend’s bill has been submitted

to the Committee on Finance, but a hearing hasn’t been

scheduled yet and is unlikely to be put on the calendar

before the General Assembly adjourns for the summer.

Cortvriend, a Portsmouth Democrat, has said she expects

a hearing in the fall if the session reconvenes.

The Providence Journal

Tuesday, June 22, 2021

Regional initiative to cut road

emissions wins RI Senate approval

“The breadth of research covered in this paper really

highlights the variety of ways in which income tax hikes

can leave states vulnerable to wealth flight and fiscal

and economic harm,” said Andrew Mikula, author of

Tax Flight of the Wealthy: An Academic Literature Review.

“Besides physical relocation out of Massachusetts, such

policies are also deterring innovators from coming here

to begin with, and encouraging stock-based salaries that

are used to delay tax payments.” ...

Pioneer’s new policy brief also highlights nuances

in past studies that have downplayed the role of tax

hikes in the migration decisions of the wealthy. For

example, a 2016 paper by Cornell University Professor

Cristobal Young claims that “when Florida is excluded,

there is virtually no” correlation between income tax

rates and migration patterns in the United States.

However, underpinning this headline-worthy line is that

Young doesn’t rule out that there is an “especially

appealing combination” of tax avoidance and geography

driving the so-called Florida effect. In addition, the

database used in Young’s paper only includes households

that earned over $1 million in the year before they

move, a severe limitation that misses households that

migrate for the purpose of avoiding taxes on the

anticipated sale of a valuable asset....

“Research data allow us to put some hard numbers on the

devastating and perhaps permanent impact of a graduated

income tax – as much as $2 billion in lost taxable

income,” said Pioneer Institute Executive Director Jim

Stergios. “And calculating the impact on state tax

revenues ignores the enormous human toll: lost jobs and

less security for homeowners. The long-term effects may

include, as is abundantly clear in the case of

Connecticut, anemic growth in state tax receipts and

therefore fewer resources for social programs and public

investments.”

Pioneer Institute

Thursday, June 17, 2021

Study Says Massachusetts Surtax

Proposal

Could Reduce Taxable Income in the State by Over $2

Billion

“We need to hold the millionaires accountable. It’s

time. This is about fairness, equality, equity,”

Rosalinda Midence told the Herald moments after riling

up a group of ralliers in Nubian Square on Monday night.

Midence said the 4-cent surtax on all state income over

$1 million would “level the playing field” for working

Bay Staters who lose a disproportionate amount of their

wages to income taxes by raising an additional $2

billion from millionaires.

She’s one of the dozens of speakers who have stood to

support the Fair Share Amendment measure at a series of

14 rallies across the state this month organized by the

Raise Up Massachusetts Coalition.

The group is the same one behind the successful

campaigns of other progressive measures including

raising the state minimum wage and pressuring the

Legislature to take up — and pass — the Family Medical

Leave Act....

The measure appears popular among Bay State voters, with

a recent poll from Boston-based MassINC Polling Group

showing 72% back the wealth tax....

Ralliers like Midence said they “get angry” when they

see the pushback to something she describes as “justice

for the poor and middle class.”

The Boston Herald

Monday, June 21, 2021

Battle of Massachusetts millionaires’

tax pits

grassroots organizing against blitz of opposition

reports

It started with plastic bags and plastic straws, now

they’re coming for your takeout.

On Tuesday, leaders of the Joint Committee on Public

Health and representatives of the food container

industry duked it out during a hearing on bills to

restrict the use of polystyrene food containers and

utensils, according to the State House News Service.

To hear advocates from the Massachusetts Public Interest

Research Group (MASSPIRG) and Environment Massachusetts,

and Rep. Dave Rogers tell it, single-use plastic

products like foam cups and takeout containers should be

banned because of the health and environmental risks

associated with them.

“I think we all know very well that single-use plastic

products including polystyrene foam cups and takeout

containers are a major source of pollution in our

rivers, streams and oceans.... Ben Hellerstein, state

director for Environment Massachusetts, said. For all

these reasons and more, there’s more than 100

communities across Massachusetts that have already taken

action to restrict the use of plastic products.”

Of course they have, this is Massachusetts.

A Boston Herald editorial

Wednesday, June 23, 2021

Ban takeout containers? Not so fast

The cracks started appearing a few years after

Massachusetts voters in 2016 approved a ballot

initiative that effectively mandated that all eggs sold

in the state come from cage-free hens.

The law, backed by nearly 8 of 10 voters, was pushed by

top animal welfare groups in order to create what they

argued were more humane standards for animals.

Now, warning of an “Egg-mageddon” — a severe egg

shortage that would send prices spiking — lawmakers are

moving to change the measure before it goes into effect

in 2022.

The Boston Globe

Friday, June 25, 2021

Warning of a coming ‘Egg-mageddon’

|

Chip Ford's CLT

Commentary

The embarrassment of riches

continues to flood and overflow state coffers.

According to the State House News Service on Wednesday ("Annual

Tax Collections Beating Estimate By $3.4 Bil, And Counting"):

Through mid-June, the Department of

Revenue collected nearly 80 percent of the tax revenue

it anticipates bringing in during this final month of a

remarkable fiscal year that has already exceeded all

expectations and appears likely to produce a significant

surplus.

In its mid-month report to the

Legislature, DOR said it had collected $2.003 billion

from taxpayers between June 1 and June 15, up $768

million or 62.2 percent compared to the same period in

June 2020. DOR's latest monthly benchmark for June

projected a monthly total of $2.578 billion....

With the second half of June

remaining to be counted, DOR has collected $32.454

billion so far in fiscal year 2021, which ends June 30.

That's $3.364 billion more than the Baker

administration's most recent estimate for the full

12-month fiscal year and $1.3 billion more than the

pre-pandemic estimate of $31.15 billion in tax revenue

for fiscal year 2021.

It is also $2.334 billion more than

the consensus revenue agreement of $30.12 billion the

governor, House and Senate used to craft their fiscal

year 2022 budget proposals. The six lawmakers currently

negotiating a compromise fiscal year 2022 budget could

wield considerable power by increasing the revenue

assumption to give themselves additional money to spend,

save or turn back in the form of tax relief...

The fiscal year 2021 tax

collections, which have obliterated the Baker

administration's expectations for the last several

months, look to be headed towards a significant surplus.

That would present another pot of mostly untethered

money for the governor and Legislature to manage while

also deciding how to spend more than $5 billion in

federal aid received as part of the American Rescue Plan

Act.

Then on Friday I received a

notice from the DOR's Division of Local Service of a

report released by the Baker administration's Secretary of

Administration and Finance's office (emphasis added):

Total Federal Awards to

Massachusetts: $113 Billion

The federal government is expected

to provide approximately $113 billion in aid to

Massachusetts in response to the COVID-19 pandemic.

Funding has been given to three groups: businesses and

individuals, public entities, and Commonwealth agencies.

• Businesses and individuals

received about $51 billion through programs like the

Paycheck Protection Program for businesses and stimulus

checks for individuals.

• Public entities other than

Commonwealth agencies received about $10 billion through

programs like the Coronavirus Local Fiscal Recovery Fund

for municipal and county governments, and Federal

Transit Authority grants to Regional Transportation

Authorities.

• Commonwealth agencies received

about $49 billion, primarily to support COVID-related

Unemployment Insurance benefits, expansions of existing

programs like the Community Development Block Grant, and

new programs like the Coronavirus Relief Fund and the

Coronavirus State Fiscal Recovery Fund.

• Additionally, new

federally-administered initiatives like funding of COBRA

coverage and the expansion of the child tax credit are

expected to provide nearly $4 billion to Commonwealth

residents.

The report further noted the

sources of the federal government's largesse:

The federal

government has enacted at least six pieces of

legislation in response to the public health emergency

caused by COVID-19. Three pieces of legislation were

enacted in March 2020, the largest and most notable of

which was the Coronavirus Aid, Relief, and Economic

Security Act (the “CARES Act”). This $2.2 trillion

package included numerous initiatives, including but not

limited to the Paycheck Protection Program (PPP),

economic impact payments ($1,200 payments to qualified

individuals), Economic Injury Disaster Loans (EIDL),

Provider Relief Funds for health care providers, the

Coronavirus Relief Fund (CvRF) for state and local

governments, and an array of other new initiatives and

expansions to existing programs. Additionally, the

Consolidated Appropriations Act, 2021 was enacted on

December 27, 2020. This law authorized $900 billion in

additional COVID-related assistance.

Most

recently, the American Rescue Plan Act of 2021 (“ARPA”)

was signed into law on March 11, 2021. This law provides

$1.9 trillion for continued COVID-19 response and

recovery, including $350 billion for the Coronavirus

State and Local Fiscal Recovery Funds.

On Wednesday the State House

News Service reported ("Baker Seeks

Two-Month Sales Tax Holiday Consumers, Businesses Would

Share in Bulging Surplus"):

With Massachusetts on track to end

the year with a multi-billion dollar surplus, Gov.

Charlie Baker on Wednesday proposed a two-month sales

tax holiday that would give consumers a break from the

state's 6.25 percent sales tax in August and September

in an effort to drive shoppers to local businesses.

The major tax relief proposal would

cost the state an estimated $900 million in forgone

revenue, but the Republican governor said it would also

be a way for the state to show appreciation to business

owners and consumers who have contributed to the surplus

by finding ways to support each other during the

COVID-19 pandemic.

Baker said he would file

legislation Wednesday to expand the annual sales tax

holiday from a two-day weekend in August to a two-month

event, believing it would help give the state's economy

"some momentum as we come out of this sort of pandemic

doldrums that we've been in."

As it stands now, the tax-free

holiday has been set for the weekend of Aug. 14 and Aug.

15.

"It would be a really big deal, not

just for taxpayers, but also for all those Main Street

businesses have really had it probably toughest of all

on the economic side since the beginning of the

pandemic," Baker said at a State House press conference.

Through May, the state had

collected more than $3.9 billion in excess of

projections for the fiscal year and that trend has

continued in June with the Department of Revenue

reporting that through the middle of the month the state

had already collected 80 percent of what it expected for

the full month.

Baker hesitated to make a guess on

how large the surplus will be when the fiscal year ends

on June 30 and the books are balanced, but he said it

was clear that there would be "significant" excess

revenue to be spent, saved or returned to taxpayers....

Another chunk of the surplus is

expected to find its way into savings.

The Department of Revenue on

Tuesday certified for the comptroller $2.3 billion in

capital gains taxes collected so far in fiscal 2021,

which exceeds a threshold set by state law resulting in

an automatic transfer of $852 million to the state's

stabilization fund. That transfer, the administration

said, pushed the balance in the state's "rainy day" fund

to $4.3 billion.

The very next day the News

Service followed up ("Lights Quickly

Dim on Baker’s Tax Relief Plan Spilka: Sales Tax Holiday

Weekend 'Sufficient For Now'"):

Gov. Charlie Baker on Thursday

continued to pitch his new idea for a two-month sales

tax holiday this summer even after the $900 million tax

relief proposal landed with a bit of a thud on Beacon

Hill where many Democrats panned the short-term tax

break and supporters voiced skepticism about its

chances....

But the idea of suspending sales

tax collections in August and September to help give the

retail economy a jolt encountered swift pushback from

legislators who would have to sign off on the plan.

"We did do a weekend of sales tax

holiday and I think that is sufficient for now. There's

a lot of need in the state," Senate President Karen

Spilka said.

The Boston Herald also on

Thursday reported ("Charlie Baker’s 2-month

sales tax holiday appears dead on arrival

in Democrat-led Massachusetts Legislature despite business

support"):

Gov. Charlie Baker’s plan to slash

sales taxes statewide for two months appears

dead-on-arrival in the state’s Democrat-led Legislature,

where lawmakers dismissed the measure as a “gimmick.”

...

State Sen. Eric Lesser,

D-Longmeadow, said the proposal would “do almost nothing

to help out local retailers,” joining a growing list of

Democratic lawmakers who oppose the plan.

“Now that COVID is ending, demand

is at record levels. Our local businesses need more

workers and better infrastructure, not political

gimmicks. Extra funds should be used to reduce class

sizes, repair crumbling roads and bridges, improve

broadband internet, or use to pay down debt,” Lesser

said.

By Friday all the usual

suspects were lined up, the conclusion was coming into

sight.

CommonWealth Magazine reported ("Two-month

sales tax holiday may not make economic sense"):

The debate over Gov. Charlie

Baker’s proposed two-month sales tax holiday has turned

into a partisan, interest-driven dispute....

But liberal groups panned the move

as a gimmick that would divert an unexpected budget

surplus away from other government spending priorities.

“The tax dollars the Commonwealth would lose from this

2-month sales tax holiday could support local schools by

accelerating funding for the Student Opportunity Act,

provide opportunities for affordable childcare that will

help businesses and families, and encourage travel by

enabling transit authorities to stop collecting

burdensome bus fares,” said Marie-Frances Rivera,

president of the liberal-leaning Massachusetts Budget

and Policy Center....

The presidents of the Massachusetts

Teachers Association and American Federation of

Teachers-Massachusetts issued a joint statement

criticizing Baker for wanting to boost big box stores

and online retailers instead of investing in colleges,

public schools, and transportation. Merrie Najimy of the

MTA and Beth Kontos of AFT Massachusetts called it

“Baker's billion-dollar giveaway.”

On one hand, the debate is coming

down to the typical Republican versus Democrat dynamic,

with Baker favoring lower taxes and putting more money

into the hands of consumers, and Democrats wanting more

government spending to shore up public infrastructure.

The usual More Is Never Enough

suspects lined up and assumed the position. "No tax

cuts, not now not ever."

When asked for my response by

Beacon Hill Roll Call ("Two-Month Sales Tax

Holiday In July And August") I replied:

“Gov.

Baker’s proposal to return some of taxpayers’

overpayment, considering the historic hardships imposed

on citizens over the past 15 months, is proper and

compassionate,” said Chip Ford, executive

director of Citizens for Limited Taxation (CLT).

“The usual resistance to even this small tax relief

proposal when the state finds itself awash in an

unexpected $4 billion-plus revenue surplus and $5

billion-plus in additional federal grants, every cent

provided by taxpayers, is shameful and demonstrates why

we’ve always asserted at CLT: ‘More is never enough and

never will be.’”

I closed the last

CLT Update

with my observation:

With some

$10 Billion of "free money" floating around the State

House to get in the way is to get trampled. Gov. Baker

is trying to play fair, spending half himself and

leaving the other half to legislative leaders.

Unfortunately Charlie doesn't realize that More Is Never

Enough (MINE) and never will be. Now we shall see just

how much all his "bipartisanship" has been worth when

there's a fortune on the table.

Within just a couple of days we

had our answer.

On Tuesday the State House News

Service reported ("Admin Worried About

Holdup As House Dems Vote to Stash Fed Aid"):

The House on Tuesday rejected Gov.

Charlie Baker's request to immediately spend $2.8

billion in federal COVID-19 relief money, choosing to

follow through with the plan of Democratic leaders to

sweep most of the $5.3 billion the state received into a

separate fund as they consider how to deploy the money.

The action by the House reflects

not only a disagreement between the governor and

Legislature over process, but also about how quickly the

federal funds should be spent to assist in the state's

economic recovery....

While Baker did not say whether he

would veto the bill should it again reach his desk, it's

likely Democrats in the Legislature will have enough

votes to override the governor....

The governor has said he currently

does not need legislative approval to spend the federal

aid, but when asked last week why he didn't just start

spending the money now he said he wanted to work with

the Legislature.

"I think we're trying to pursue

this in what I would describe as a good faith manner,"

Baker said.

The Boston Herald reported on

Tuesday ("Power struggle between

Charlie Baker, Dems over spending federal coronavirus aid

rages"):

The power struggle over who will

hold the purse strings as Massachusetts doles out the

latest round of federal coronavirus relief dollars

continues on Beacon Hill, where state representatives

reached a deal they say would give the governor “some

latitude” around how the cash gets spent.

“Our actions this week will

preserve the funds while allowing all parties to

participate in the discussion and help make decisions

about how to allocate these resources,” House Speaker

Ronald Mariano and Senate President Karen Spilka said in

a joint statement on Tuesday.

Democratic leaders are looking to

to sweep most of the $5.3 billion the state received in

unrestricted funds through President Biden’s American

Rescue Plan into a separate fund as they consider how to

spend the money....

If the bill passes, it will tie

Baker’s hands when it comes to spending more.

Within the above News Service

report it was noted:

The

House and Senate had initially proposed to sweep the

more $5.28 billion in ARPA aid received by Massachusetts

into a fund that Baker could not touch without their

approval, but over the past several weeks $394 million

of the relief money has been committed.

Baker

has already spent $109 million on local aid for four

cities -- Chelsea, Everett, Methuen and Randolph --

shortchanged aid by federal funding formulas and $75

million is needed to subsidize the state's new COVID-19

emergency sick leave law.

The

House vote on Tuesday also left Baker with $10 million

to cover the cost of a new "VaxMillions" vaccine

Lottery, which is offering fully vaccinated residents a

chance to win one of five $1 million prizes, or one of

five $300,000 scholarships for entrants under 18.

One

wrinkle added to the debate Tuesday was an amendment

offered by Hunt and Ways and Means Chairman Aaron

Michlewitz and unanimously approved in the House that

directs Baker to spend $200 million "to protect against

emerging public health threats or to support new,

heightened, or emergency public health response efforts

against the 2019 novel coronavirus and variants

thereof."

CommonWealth Magazine observed on Tuesday ("House

votes to put fed funds through budget-like process;

Gives Baker control of just $200m, not $2.8b"):

. . . What will be interesting to

watch is if House and Senate leaders can keep members in

check during the budget process, and avoid turning the

one-time federal money into a special interest gravy

train.

The numbers are astounding. The

state received $5.28 billion in unrestricted federal aid

under the American Rescue Plan.

We can see where this is

going, as usual. Gov. Baker got $200 million of the

$5.28 Billion, the Legislature gets to squander the rest.

That's what Democrats consider "bipartisan."

The Providence Journal on

Tuesday reported a spark of hope remains for the

Transportation and Climate Initiative (TCI) in Rhode Island

("Regional initiative to cut road

emissions wins RI Senate approval"):

Reports of the death of the Transportation and Climate

Initiative appear greatly exaggerated.

In one sign of life, the Rhode Island Senate on Tuesday

approved legislation that would make the Ocean State a

founding member of the regional program to cut

planet-warming emissions from cars and trucks....

The vote came over the objections of senators from rural

districts who say the fees will amount to a gas tax that

will be passed down to consumers, and that their

constituents will bear the burden because they rely more

on their cars to get around....

Whether the legislation goes any further is up to the

House. Rep. Terri Cortvriend’s bill has been submitted

to the Committee on Finance, but a hearing hasn’t been

scheduled yet and is unlikely to be put on the calendar

before the General Assembly adjourns for the summer.

Cortvriend, a Portsmouth Democrat, has said she expects

a hearing in the fall if the session reconvenes.

So far it remains only the City of Washington in the

District of Columbia and the Commonwealth of Massachusetts

that are committed to this "multi-state" TCI stealth gas tax,

aka, "Baker's Boondoggle."

Pioneer Institute released another report last week, this one

debunking previous studies by others, asserting it own potential

(likely?)

consequences of the graduated income tax ballot question,

aka, "The Fair Share Amendment" or "Millionaires Tax."

In "Study

Says Massachusetts Surtax Proposal —

Could Reduce Taxable Income in the State by Over $2

Billion" Pioneer asserts:

Many of the individual research

papers described in the report focus on particular

sub-groups of the wealthy, such as chief executive

officers at major corporations and particularly

innovative “star scientists.”

“The breadth of research covered in

this paper really highlights the variety of ways in

which income tax hikes can leave states vulnerable to

wealth flight and fiscal and economic harm,” said Andrew

Mikula, author of Tax Flight of the Wealthy: An Academic

Literature Review. “Besides physical relocation out of

Massachusetts, such policies are also deterring

innovators from coming here to begin with, and

encouraging stock-based salaries that are used to delay

tax payments.”

The Pioneer Institute study ties

the results of these academic pieces into Massachusetts’

current graduated income tax proposal. . . .

Pioneer’s new policy brief also

highlights nuances in past studies that have downplayed

the role of tax hikes in the migration decisions of the

wealthy. For example, a 2016 paper by Cornell University

Professor Cristobal Young claims that “when Florida is

excluded, there is virtually no” correlation between

income tax rates and migration patterns in the United

States.

However, underpinning this

headline-worthy line is that Young doesn’t rule out that

there is an “especially appealing combination” of tax

avoidance and geography driving the so-called Florida

effect. . . .

“Research data allow us to put some

hard numbers on the devastating and perhaps permanent

impact of a graduated income tax – as much as $2 billion

in lost taxable income,” said Pioneer Institute

Executive Director Jim Stergios. “And calculating the

impact on state tax revenues ignores the enormous human

toll: lost jobs and less security for homeowners. The

long-term effects may include, as is abundantly clear in

the case of Connecticut, anemic growth in state tax

receipts and therefore fewer resources for social

programs and public investments.”

What will the "More Is Never

Enough" Takers cabal do when their millionaires tax

windfall not only doesn't materialize, but instead causes

overall revenue to decrease?

It doesn't take much

imagination to answer that, does it? Bend over

taxpayers.

"It Doesn't Need

To Be 'The Massachusetts Way'"!

The Boston Globe reported on

Friday ("Warning of a coming ‘Egg-mageddon’"):

The

cracks started appearing a few years after Massachusetts

voters in 2016 approved a ballot initiative that

effectively mandated that all eggs sold in the state

come from cage-free hens.

The

law, backed by nearly 8 of 10 voters, was pushed by top

animal welfare groups in order to create what they

argued were more humane standards for animals.

Now,

warning of an “Egg-mageddon” — a severe egg shortage

that would send prices spiking — lawmakers are moving to

change the measure before it goes into effect in

2022....

“The

entirety of this is so out-of-state egg producers can

get into the Massachusetts market without meeting the

standards that the voters put in in 2016,” Mitchell

said.

Senator Anne Gobi, a Spencer Democrat, concurred.

“I

think it was the wrong move of the Senate to overturn

the will of the people by overturning a vote,” said the

senator.

Lewis,

the senator who introduced the legislation, said he

thinks it is “likely” the House of Representatives will

take up the bill, which he believes is “fully consistent

with the intent of voters.” The lower chamber passed

similar changes as part of its annual budget in 2019.

Governor Charlie Baker has not taken a position on the

measure.

But if

the change to the ballot measure becomes law, it won’t

be the first time legislators have tinkered with

voter-passed laws arguing that leaving the status quo

would be bad for everyone. For example, lawmakers first

delayed and then reworked the 2016 measure legalizing

recreational marijuana sales.

Set aside that the Legislature

was thrilled to stomp all over the voters' mandate in 2002

when it "froze" CLT's rollback of the "temporary" income tax

hike that passed overwhelmingly on the 2000 ballot until just last year. Boston

Globe reporter Jasper Goodman, a 2018 high school grad, is

too young to remember if even know.

That was one of the reasons I

chose Kentucky when I could have bailed out and relocated

anywhere. A much lower cost of living here, for

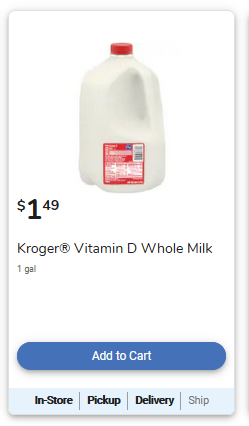

example I paid $1.09 for a gallon of milk a week ago,

compared to well-over $3.00 in Massachusetts (thanks in part to the

Massachusetts law that

sets an artificially fixed minimum price on the price of

milk):

(a) "No milk dealer shall distribute or sell in any

market within the commonwealth milk obtained from a

producer or from another milk dealer if such milk was

acquired from the producer within the commonwealth at a

cost less than the price fixed by the commissioner to be

paid for milk so acquired and distributed...."

Check out this

cost-of living comparison between Boston, MA and Bowling

Green, KY.

|

|

|

Massachusetts

Today |

Kentucky

Today |

Reminiscent of German Lutheran

pastor Martin Niemöller's famous

"First the came . . ." poem, The Boston Herald editorial

on Wednesday ("Ban takeout containers?

Not so fast") noted:

It

started with plastic bags and plastic straws, now

they’re coming for your takeout.

On

Tuesday, leaders of the Joint Committee on Public Health

and representatives of the food container industry duked

it out during a hearing on bills to restrict the use of

polystyrene food containers and utensils, according to

the State House News Service.

To

hear advocates from the Massachusetts Public Interest

Research Group (MASSPIRG) and Environment Massachusetts,

and Rep. Dave Rogers tell it, single-use plastic

products like foam cups and takeout containers should be

banned because of the health and environmental risks

associated with them.

“I

think we all know very well that single-use plastic

products including polystyrene foam cups and takeout

containers are a major source of pollution in our

rivers, streams and oceans.... Ben Hellerstein, state

director for Environment Massachusetts, said. For all

these reasons and more, there’s more than 100

communities across Massachusetts that have already taken

action to restrict the use of plastic products.”

Of

course they have, this is Massachusetts.

No silly bans on plastic bags

or straws here in the Bluegrass State. Kentucky

doesn't even require annual motor vehicle inspections. I'm the only one with an

inspection sticker on the windshield of my vehicle, if a bit

faded, still there since my 2018 exodus from Massachusetts

— as a reminder of what I fled. Just being so left alone is truly a

blessing, one I think most Kentuckians don't fully

appreciate because it's what they are accustomed to.

Occasionally I mention these

contrasts because I think most of us accept the familiar,

feel that how things are done where we live is how they're

done elsewhere, even everywhere; that they are the norm.

Admittedly even I am surprised at how remarkably wrong that

is, was for me until I escaped and now observe from the

outside with a new perspective. It makes me more

aggravated, frustrated, even angrier over what Massachusetts

government gets away with — and

that the politicians doing it to you keep being

re-elected.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports

(excerpted above) |

|

State House News Service

Wednesday, June 23, 2021

Annual Tax Collections Beating Estimate By $3.4 Bil, And

Counting

By Colin A. Young

Through mid-June, the Department of Revenue collected nearly

80 percent of the tax revenue it anticipates bringing in

during this final month of a remarkable fiscal year that has

already exceeded all expectations and appears likely to

produce a significant surplus.

In its mid-month report to the Legislature, DOR said it had

collected $2.003 billion from taxpayers between June 1 and

June 15, up $768 million or 62.2 percent compared to the

same period in June 2020. DOR's latest monthly benchmark for

June projected a monthly total of $2.578 billion.

"The month-to-date increase is mostly due to increases in

withholding, income estimated payments, corporate and

business taxes, sales and use tax, and estate tax," Revenue

Commissioner Geoffrey Snyder wrote. Snyder said collections

are generally weighted towards the end of the month and

urged caution when interpreting mid-month results.

With the second half of June remaining to be counted, DOR

has collected $32.454 billion so far in fiscal year 2021,

which ends June 30. That's $3.364 billion more than the

Baker administration's most recent estimate for the full

12-month fiscal year and $1.3 billion more than the

pre-pandemic estimate of $31.15 billion in tax revenue for

fiscal year 2021.

It is also $2.334 billion more than the consensus revenue

agreement of $30.12 billion the governor, House and Senate

used to craft their fiscal year 2022 budget proposals. The

six lawmakers currently negotiating a compromise fiscal year

2022 budget could wield considerable power by increasing the

revenue assumption to give themselves additional money to

spend, save or turn back in the form of tax relief.

The fiscal year 2021 tax collections, which have obliterated

the Baker administration's expectations for the last several

months, look to be headed towards a significant surplus.

That would present another pot of mostly untethered money

for the governor and Legislature to manage while also

deciding how to spend more than $5 billion in federal aid

received as part of the American Rescue Plan Act.

Gov. Charlie Baker is scheduled to make an announcement

related to the fiscal year 2021 budget Wednesday at 1 p.m.

from the State House.

Massachusetts Department of Revenue

Division of Local Services

June 25, 2021

— Excerpts follow (Full

Report

here) —

Executive Office for Administration and Finance

About COVID-19 Federal Funds

This page provides information about federal funds provided

to the Commonwealth in response to the COVID-19 public

health emergency.

The Commonwealth of Massachusetts’ Executive Office for

Administration and Finance (A&F) Federal Funds Office (FFO)

has been charged by the Governor with overseeing COVID-related

federal funding in a manner that optimizes federal funding,

targets the administration’s priorities, and minimizes

compliance risk.

This page provides information about:

• Federal funds provided to the Commonwealth in response to

the COVID-19 public health emergency, including the

Coronavirus Relief Fund and the Coronavirus State Fiscal

Recovery Fund;

• Federal funds distributed to municipalities and school

districts; and

• FFO's role in compliance for federal funds, including

compliance resources for municipalities and state agencies.

About COVID-19 Federal Funding

The federal government has enacted at least six pieces of

legislation in response to the public health emergency

caused by COVID-19. Three pieces of legislation were enacted

in March 2020, the largest and most notable of which was the

Coronavirus Aid, Relief, and Economic Security Act (the

“CARES Act”). This $2.2 trillion package included numerous

initiatives, including but not limited to the Paycheck

Protection Program (PPP), economic impact payments ($1,200

payments to qualified individuals), Economic Injury Disaster

Loans (EIDL), Provider Relief Funds for health care

providers, the Coronavirus Relief Fund (CvRF) for state and

local governments, and an array of other new initiatives and

expansions to existing programs. Additionally, the

Consolidated Appropriations Act, 2021 was enacted on

December 27, 2020. This law authorized $900 billion in

additional COVID-related assistance.

Most recently, the American Rescue Plan Act of 2021 (“ARPA”)

was signed into law on March 11, 2021. This law provides

$1.9 trillion for continued COVID-19 response and recovery,

including $350 billion for the Coronavirus State and Local

Fiscal Recovery Funds.

Total Federal Awards to Massachusetts: $113 Billion

The federal government is expected to provide approximately

$113 billion in aid to Massachusetts in response to the

COVID-19 pandemic. Funding has been given to three groups:

businesses and individuals, public entities, and

Commonwealth agencies.

• Businesses and individuals received about $51 billion

through programs like the Paycheck Protection Program for

businesses and stimulus checks for individuals.

• Public entities other than Commonwealth agencies received

about $10 billion through programs like the Coronavirus

Local Fiscal Recovery Fund for municipal and county

governments, and Federal Transit Authority grants to

Regional Transportation Authorities.

• Commonwealth agencies received about $49 billion,

primarily to support COVID-related Unemployment Insurance

benefits, expansions of existing programs like the Community

Development Block Grant, and new programs like the

Coronavirus Relief Fund and the Coronavirus State Fiscal

Recovery Fund.

• Additionally, new federally-administered initiatives like

funding of COBRA coverage and the expansion of the child tax

credit are expected to provide nearly $4 billion to

Commonwealth residents.

Funds are specifically prohibited from being used for:

• Offsetting tax cuts; or

• Public pension funds.

—

Full Report —

State House News Service

Wednesday, June 23, 2021

Baker Seeks Two-Month Sales Tax Holiday

Consumers, Businesses Would Share in Bulging Surplus

By Matt Murphy

With Massachusetts on track to end the year with a

multi-billion dollar surplus, Gov. Charlie Baker on

Wednesday proposed a two-month sales tax holiday that would

give consumers a break from the state's 6.25 percent sales

tax in August and September in an effort to drive shoppers

to local businesses.

The major tax relief proposal would cost the state an

estimated $900 million in forgone revenue, but the

Republican governor said it would also be a way for the

state to show appreciation to business owners and consumers

who have contributed to the surplus by finding ways to

support each other during the COVID-19 pandemic.

Baker said he would file legislation Wednesday to expand the

annual sales tax holiday from a two-day weekend in August to

a two-month event, believing it would help give the state's

economy "some momentum as we come out of this sort of

pandemic doldrums that we've been in."

As it stands now, the tax-free holiday has been set for the

weekend of Aug. 14 and Aug. 15.

"It would be a really big deal, not just for taxpayers, but

also for all those Main Street businesses have really had it

probably toughest of all on the economic side since the

beginning of the pandemic," Baker said at a State House

press conference.

Through May, the state had collected more than $3.9 billion

in excess of projections for the fiscal year and that trend

has continued in June with the Department of Revenue

reporting that through the middle of the month the state had

already collected 80 percent of what it expected for the

full month.

Baker hesitated to make a guess on how large the surplus

will be when the fiscal year ends on June 30 and the books

are balanced, but he said it was clear that there would be

"significant" excess revenue to be spent, saved or returned

to taxpayers.

"It's also a way for us to say, as I think we should, thank

you to all the people who create that tax revenue through

their creativity and imagination over the course of the last

year," Baker said.

To take effect, the proposal would need to get through the

Democrat-controlled Legislature where lawmakers in both the

House and Senate were already questioning the governor's

decision to prioritize tax relief over investments in things

like student debt relief or public transit.

Several said the developing surplus should instead be put

toward public investments.

"There is no evidence that we need to incentivize

purchasing. Consumer demand is high. Instead of an extended

sales tax holiday, let's put funds towards our future:

relieve student debt, support public higher education,

address rent relief post-pandemic. I could make a long

list," Rep. Mindy Domb, of Amherst, said on Twitter.

"Or we could fix the T, repair our crumbling bridges, reduce

class sizes, and pay down our debt," Sen. Eric Lesser

tweeted.

And Brookline Rep. Tommy Vitolo said the money would be

better spent on transit, education, housing, state and local

government, building energy efficiency or paying down

pension debt.

"C'mon, man," Vitolo said tweeted.

While some legislators may be skeptical of the plan,

Retailers Association of Massachusetts President Jon Hurst

called it a "great idea."

"It's a great progressive pro-consumer and pro-small

business concept," Hurst said, adding, "This would be good

for consumers, good for businesses and the icing on the cake

would be that New Hampshire would hate it."

Hurst said that despite the strength of consumer activity

during the pandemic a large portion of dollars spent by

Massachusetts consumers went out of state for online

purchases that could be delivered to a shopper's door, and

not to local businesses.

"This could be a really important reminder to our consumers

that they need to shop like jobs depend on it, because quite

frankly they do," Hurst said.

Lt. Gov. Karyn Polito, who joined Baker at the press

conference, said the sales tax relief would be felt the most

in low-income communities where residents pay larger

portions of their household income on sales taxes.

Under Baker's plan, the governor said the MBTA and the

School Building Authority would not see their budgets

impacted by the tax holiday. Both agencies receive a

dedicated portion of every dollar in sales taxes collected

by Massachusetts.

The traditional August sales tax holiday applies to

purchases under $2,500, and does not extend to meals, motor

vehicles, boats, telecommunications services, utilities,

tobacco, marijuana or alcohol.

Another chunk of the surplus is expected to find its way

into savings.

The Department of Revenue on Tuesday certified for the

comptroller $2.3 billion in capital gains taxes collected so

far in fiscal 2021, which exceeds a threshold set by state

law resulting in an automatic transfer of $852 million to

the state's stabilization fund. That transfer, the

administration said, pushed the balance in the state's

"rainy day" fund to $4.3 billion.

In 2019 when the state last ended a fiscal year with a

surplus, Baker proposed a mix of tax relief and new

spending, including $175 million to expand for two years a

dependent tax credit for families with children and those

who care for elderly or disabled relatives.

The House and Senate, however, did not go along with his

plan.

While it remains to be seen how legislative leadership will

react to this latest tax proposal, the governor has been at

odds with the Legislature over how and how quickly to spend

more than $5 billion in federal relief aid.

Baker last week proposed to immediately spend more than half

of the funding the state received through the American

Rescue Plan Act, or about $2.8 billion, on a combination of

housing, job training water and sewer infrastructure and

other priorities.

The remainder of the money, he suggested, could become part

of a more deliberative process guided by the Legislature as

they sort through ideas for how best to spend the one-time

aid.

That plan, however, was rejected by the House on Tuesday,

and Democratic leaders said they instead want to hold a

series of hearings over the next few months to gather input

from lawmakers and others about how roughly $4.89 billion

should be used.

"We know that our colleagues in the Legislature are working

their process on our proposal, but we remain committed to

taking quick action to put these federal dollars to work and

will continue to pursue this plan to invest in these crucial

priorities in the communities that were hit hardest by the

pandemic," Baker said.

The governor would not say whether he would veto the bill

working its way back to his desk to give the Legislature

more control over the funding, or if he would seek to commit

some of the money before it gets swept into an account

beyond his reach to spend without legislative approval.

"I think we made a pretty clear statement in the proposal

that we made that we want to be collaborative on this one,"

Baker said.

State House News Service

Thursday, June 24, 2021

Lights Quickly Dim on Baker’s Tax Relief Plan

Spilka: Sales Tax Holiday Weekend "Sufficient For Now"

By Matt Murphy

Gov. Charlie Baker on Thursday continued to pitch his new

idea for a two-month sales tax holiday this summer even

after the $900 million tax relief proposal landed with a bit

of a thud on Beacon Hill where many Democrats panned the

short-term tax break and supporters voiced skepticism about

its chances.

Baker filed legislation proposing to use some of the

"significant" surplus expected when the fiscal year ends

next week on an expanded sales tax holiday. The governor's

bill would turn what is traditionally a two-day, tax-free

weekend in August -- Aug. 14 and Aug. 15 this year -- into a

two-month reprieve from the state's 6.25 percent sales tax.

But the idea of suspending sales tax collections in August

and September to help give the retail economy a jolt

encountered swift pushback from legislators who would have

to sign off on the plan.

"We did do a weekend of sales tax holiday and I think that

is sufficient for now. There's a lot of need in the state,"

Senate President Karen Spilka said.

Senate Ways and Means Chairman Michael Rodrigues and

Economic Development Committee Chairman Eric Lesser both

called the sales tax holiday a "political gimmick," and

other lawmakers enumerated the various ways they hoped to

spend surplus dollars.

"Whether it's investing in childcare, emerging workforce

needs, K-12 education, public health, or families in need,

there are no shortage of ways to responsibly invest to

support an equitable economic recovery, however a short-term

political gimmick is not one of them," Rodrigues said.

With Baker recommending the tax holiday run August through

September, legislative leaders must decide in the coming

weeks whether the proposal has any legs. If they don't

accept it, Democrats in the House and Senate could choose to

shorten the duration or, as House Minority Leader Brad Jones

put it, let it "die a death of inaction."

Evan Horowitz, executive director of the Center for State

Policy Analysis at Tufts, also questioned the wisdom of

injecting an economy already showing signs of overheating

with more capital.

"Outside the political questions, there's also the economic

question: is now the right time for this stimulus? I think

the consensus is probably not. We're running an economy

right now that's very hot," Horowitz said.

Horowitz noted the inflated prices of goods like lumber,

supply chain constraints for microchips and the trouble many

businesses are having recruiting labor.

"Injecting stimulus this summer compounds all of these

problems. It's giving people money to spend when high

spending is actually an economic concern, not a virtue," he

said.

Baker has described his proposal as not only a way to help

small, local businesses rebound from months of restrictions

imposed during the COVID-19 pandemic, but also a way to say

thank you to consumers who continued to spend and helped

contribute to the surplus.

The state ended May with $3.9 billion more than it had

projected to collect over the first 11 months of the fiscal

year, and midway through June the Department of Revenue

reported collecting 80 percent of what it expected for the

full month.

Baker said the unexpected strength of tax collections,

including capital gains taxes, has pushed the state's

reserved balance to more than $4.3 billion

"I think we owe some of this to the people of Massachusetts

and to some of the small businesses. They had a terrible

year," Baker said Thursday during an interview on GBH's

"Boston Public Radio."

Asked whether he'd consider limiting the tax break to

purchases made at small, local sellers, Baker said, "Well

that's an interesting idea. Certainly happy to talk to the

Legislature about that."

Retail groups were among those cheering Baker's proposal.

Jon Hurst, president of the Retailers Association of

Massachusetts, called the proposal "a smart, exciting, and

progressive economic incentive that will benefit our small

businesses and our consumers just when they need it."

The Massachusetts Fiscal Alliance also countered the idea

that allowing people to keep more of the money they earn

should be seen as a gimmick.

"Massachusetts is collecting more tax money than they ever

dreamed of, and Massachusetts taxpayers are among the most

generous in the country. State House politicians should

share some of the riches with the taxpayers and not keep it

all for themselves to spend in a self-centered and reckless

way," MassFiscal spokesman Paul Craney.

But few supporters, if any, seemed optimistic about the

bill's chances.

Jones said members of the House GOP caucus he had spoken

with about the governor's proposal were "very receptive,"

but he was skeptical the Democratic leaders would allow the

bill to come up for a vote.

"I'd certainly vote for it. I just honestly don't expect it

will get to the floor for a vote and I don't know if there

will be another chance for us to offer it," Jones said.

The Reading Republican called the proposal a "reasonable

way" to recognize taxpayers, and said it should help small

local businesses, even if some consumers choose to shop in

"Big Box" stores.

"Maybe someone who was stuck in quarantine and burned out

their TV on Netflix will go get a TV," Jones said.

Marie-Frances Rivera, president of the Massachusetts Budget

and Policy Center, said it "makes good sense" to shift the

tax system away from a 6.25 percent sales tax "that fall

most heavily on low-income households." However, she added:

"Unfortunately, spending the surplus this way forecloses the

ability to make investments that will transform

opportunities for everyone in our Commonwealth –

particularly for our low-income and BIPOC communities."

Rivera said the money could instead be used to accelerate

the state's seven-year funding plan for the Student

Opportunity Act, lower the cost of child care or allow

regional transit authorities to eliminate bus fares.

The heads of the state's two largest teachers unions also

said the surplus could be better invested in schools and

transportation. Massachusetts Teachers Association President

Merrie Najimy and American Federation of Teachers

Massachusetts President Beth Kontos said Baker's plan would

"boost the profits of large, out-of-state big-box stores and

online retailers."

Baker, Jones and other supporters of the extended tax

holiday noted that the tax relief would come at a time when

government is not only running a surplus, but lawmakers are

debating how to spend more than $5 billion in federal

COVID-19 aid, and cities, towns and schools received

billions more through the American Rescue Plan Act.

The governor last week proposed spending $2.8 billion in

Rescue Plan funds to boost the local economy, but the House

and Senate rejected that plan and returned him a bill to

deposit the ARPA aid into a fund for now.

Horowitz said a better plan for the surplus instead of

piling stimulus money on top of stimulus money might be to

either narrowly target the funds at populations that

struggled the most during the pandemic or give it to loan

programs and agencies like MassDevelopment that will deploy

the resources over many years.

— Sam Doran and Michael

Norton contributed reporting

CommonWealth Magazine

Friday, June 25, 2021