|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, May 3, 2021

House Passes $47.7

Billion Budget

Gov Proposes Expanding Seat

Belt Law

Jump directly

to CLT's Commentary on the News

|

Most Relevant News Excerpts

(Full news reports follow Commentary)

|

|

One critic is calling a set of road bills filed on Monday by

Gov. Charlie Baker a “scary” plan that would expand police

officers’ ability to pull over drivers and allow red-light

cameras to be used in traffic enforcement.

“This will keep residents of Massachusetts safe and ensure

that fewer travelers are killed on our roads,” Baker said,

speaking at the State House. “This legislation includes

important provisions to ensure that the rules of the road

are followed and strict consequences if they’re not.”

Topping Baker’s legislation is an initiative to allow

so-called primary enforcement of seat belt laws, which would

allow officers to pull over motorists they believe aren’t

buckled up.

“It’s scary. It’s a bad idea,” said Chip Ford,

executive director of Citizens for Limited Taxation.

Massachusetts now enforces seat belt laws as secondary

enforcement, meaning police cannot pull over drivers for

seat belt use, but can write citations for drivers not

wearing seat belts who are pulled over for other reasons.

Ford predicted a backlash from opponents who will be worried

about racial stereotyping in an era when there is growing

concern over police accountability.

“In this climate, I don’t know how they can pursue it,” Ford

said.

The legislation would also allow cities and towns to use

red-light cameras for traffic enforcement, which Ford called

a “precursor” to insurance surcharges.

The Boston Herald

Monday, April 26, 2021

Critic decries ‘scary’ Charlie Baker bill

to expand police ability

to pull over motorists, allow red-light cameras

The Howie Carr Show

Monday, April 26, 2021

In this hour, Howie talks with Chip Ford, Executive Director

at Citizens for Limited Taxation

about stricter penalties for drivers.

Gov. Baker filed legislation that he says will “make

Massachusetts roadways and streets safer for all travelers

and will help reduce roadway fatalities across the state.” A

key section allows police officers to issue tickets for seat

belt violations even if the driver is not first stopped for

another violation as required under current law....

“This road safety package we’re filing today addresses some

of the most pressing issues that are facing commuters, and

we are confident that passing this bill will help reduce

roadway deaths and injuries and improve our transportation

system safety,” Baker said.

“Gov. Baker apparently is feeling control withdrawal with

the unavoidable loosening of his pandemic lockdown

mandates,” said Chip Ford, executive director of

Citizens for Limited Taxation. “To compensate, he’s

lurched to his ‘suite of safety reforms’ to reclaim control

over his subjects … What a difference from Republican Gov.

Bill Weld, who vetoed the second mandatory seat belt law in

1994. Baker, a Weld administration protégé no less, now

intends to break the promise made by advocates of the law

that the state’s seat belt law isn’t and will never become

the sole reason for stopping a motorist: ‘primary

enforcement.’ It's not surprising that this and Baker’s

red-light camera ‘reform’ both generate revenue for the

state, or that it is proposed by an alleged Republican. This

is of course Massachusetts.”

Beacon Hill Roll Call

April 26-30, 2021

Baker Files Legislation On Driving And

Roadway Laws

Gov. Charlie Baker pitched his new omnibus road safety

legislation as a way to improve the state's

almost-worst-in-the-nation seatbelt use and cut down on

traffic deaths that have not abated during a stretch of

pandemic-era decreased travel.

Some civil rights and transportation advocates caution,

however, that the route to safer roads Baker proposed (H

3706) is too punitive and could exacerbate racial profiling

of drivers -- a fear that Baker acknowledged.

The Vision Zero Coalition, which works to prevent traffic

deaths, criticized Baker's proposal to allow police to pull

motorists over solely for failing to wear a seatbelt and to

expand penalties on those who drive with suspended licenses.

"If you read the whole bill, there is not attention or care

to the potential for racial profiling," said Stacy Thompson,

executive director of the Livable Streets Alliance that is

part of the coalition. "In other states, we know that Black

folks are more likely to be pulled over for not wearing a

seatbelt. It's like another law on the books that doesn't

protect the most vulnerable and has been proven to cause

more harm to Black and brown people." ...

Rep. William Straus, who co-chairs the Legislature's

Transportation Committee, told the News Service on Wednesday

that he believes lawmakers are unlikely to tackle the

governor's wide-ranging road safety bill as an omnibus

package. Doing so would be a "massive undertaking," he said,

and instead the Legislature will focus on the sections that

have the best prospects for success.

Straus said primary seatbelt enforcement has "always been a

controversial issue," noting the feedback circulating in the

public and around Beacon Hill this session about the

potential for racial profiling.

"It's got to be aired out and discussed as to whether

primary enforcement of seatbelt laws becomes a pretextual

excuse for pulling someone over," Straus said. "There are

strong views on this one, so that will take a lot of work."

...

Thompson said the evolving national climate over the past

two years, featuring massive protests against racial

injustice and police violence, prompted her group to take a

more active role in opposing expanded seatbelt policing.

"We have never supported primary seatbelts, but we've never

been this vocal in opposition," Thompson said. "The national

conversation and context has changed so much that we think

it is literally our job to fight this stuff."

ACLU of Massachusetts Executive Director Carol Rose slammed

Baker's proposal as well, describing it as too focused on

expanding law enforcement authority. Instead, she said,

lawmakers and the administration should refocus on reforming

how police interact with the public.

State House News Service

Wednesday, April 28, 3031

Baker Seatbelt Reform Knocked Over

Profiling Concerns

Racial Justice Impacts Weighed in Road Safety Debate

A state constitutional amendment promoted by the

Massachusetts Teachers Association and the Service Employees

International Union adding a 4 percent surtax to all annual

income above $1 million could devastate innovative startups

dependent on Boston’s financial services industry for

funding, ultimately hampering the region’s recovery from the

COVID-19 economic recession, according to a new study

published by Pioneer Institute.

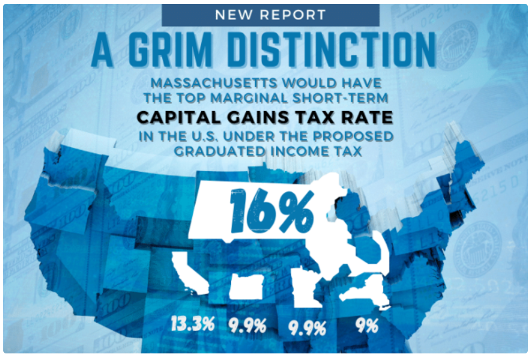

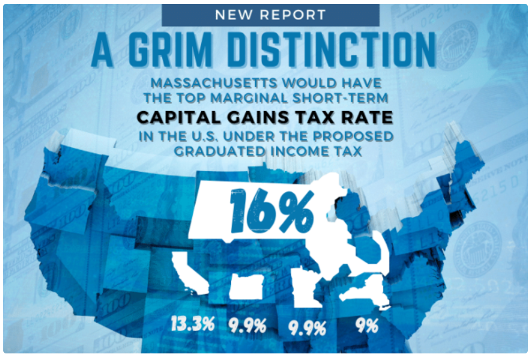

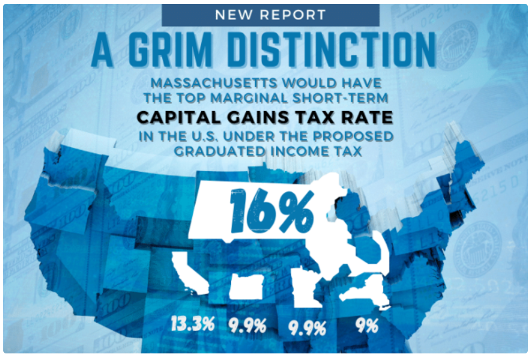

If passed, the surtax would give Massachusetts the highest

short-term capital gains tax rate in the nation and the

highest long-term capital gains tax rate in New England.

“The particularly punitive aspect of this proposal for

investors is that, unlike at the federal level, capital

gains can push you into a higher tax bracket under the

surtax,” said Greg Sullivan, who co-authored A Grim

Distinction: Massachusetts would have top marginal

short-term capital gains tax rate in the U.S. under the

proposed graduated income tax, with Andrew Mikula. “That

could be a significant deterrent to people who would

otherwise have invested in small businesses as they emerge

from the COVID crisis.”

Pioneer Institute

Monday, April 26, 2021

Study Warns Massachusetts Tax

Proposal Would Deter Investment,

Stifling the “Innovation Economy”

The proposed millionaires tax in Massachusetts could

“devastate” innovative startups dependent on Boston’s

financial services industry for funding, according to a

Pioneer Institute

study released on Monday.

That potential impact of the proposed 4% surtax to all

annual income above $1 million would hurt the state’s

recovery from the coronavirus pandemic economic recession,

Pioneer’s authors conclude in yet another study that hammers

the millionaires tax.

The surtax would give Massachusetts the highest short-term

capital gains tax rate in the nation (16%) and the highest

long-term capital gains tax rate in New England (9%).

“Raising taxes on capital gains via a graduated income tax

could devastate the financial services industry in Boston,

which has played a key role in fueling the region’s

innovation economy, as reflected in the numerous tech

start-ups in Kendall Square and the Seaport District,”

co-authors Greg Sullivan and Andrew Mikula wrote in the

report....

Last week, Pioneer published a study that said the

millionaires tax would “adversely impact” a significant

number of small-business owners in the Bay State.

The surtax would apply to as many as 13,430 of the state’s

pass-through entities — which are often small businesses

structured as S corporations, sole proprietorships and

partnerships, Pioneer wrote.

“This proposal couldn’t come at a worse time,” Sullivan said

Monday. “It would affect small- and medium-sized businesses

as they’re trying to come out of COVID, and as it looks like

they’re about to get walloped by a huge capital gains tax at

the federal level.”

The Boston Herald

Monday, April 26, 2021

Massachusetts millionaires tax could

‘devastate’ startups in Greater Boston: Report

The Bay State would have the highest short-term capital

gains tax rate in the U.S.

A Beacon Hill watchdog group wants lawmakers to delay voting

on a constitutional amendment to tax the state's wealthiest

residents.

In written testimony, the Massachusetts Taxpayers Foundation

asks legislative leaders to postpone a second and final vote

on the proposed amendment, which seeks a 4% surtax on the

portion of an individual's annual income above $1 million.

A "yes" vote would send the question to voters.

Eileen McAnneny, the foundation's president, said with the

economy still in flux, and the long-term effect of the

pandemic on the workplace unclear, lawmakers should halt the

push to tax top earners.

"Once they vote on this, there's no turning back," she said.

"We're just asking them not to do it until next year, until

we have a better sense of where things are."

The pandemic has upended the workplace, and McAnneny said

wealthy people no longer feel tied to a specific geographic

location.

She said that's a dynamic that wasn't in play when lawmakers

initially approved the "millionaires tax" nearly two years

ago.

"People have more options now about where they choose to

live and work," she said. "So the impact of this could be

more detrimental than we thought."

Backers say the measure has broad support, so there's no

reason to delay presenting it to voters.

The (Newburyport) Daily News

Tuesday, April 27, 2021

Watchdog seeks delay on 'millionaires

tax' vote

Proponents of taxing the rich in the service of shoring up

the state’s education, transportation and infrastructure are

well meaning, but shortsighted.

Schools and transportation agencies need funding to address

problems exacerbated by the pandemic, but adding a surcharge

to annual income above $1 million sets us up for a further

economic fall.

The measure, which could appear on the 2022 ballot, adds a

4% tax on incomes above $1 million for the purpose of

providing funds for public education, roads and bridges, and

public transportation. The tax would be in addition to the

state’s 5.05% flat income tax, for a total tax rate of 9.05%

on income above $1 million.

It seems simple enough to those who back such a move: We

need money, you have money, it’s only fair you give it to

us.

All of which ignores real-world fallout.

A new study published by the Pioneer Institute found that

the tax hike amendment could devastate innovative startups

who rely on Boston’s financial services industry for

funding. This in turn would hinder the region’s

post-pandemic recovery.

If passed, the surtax would give Massachusetts the highest

short-term capital gains tax rate in the nation and the

highest long-term capital gains tax rate in New England.

Good news for realtors in New Hampshire, not so much for the

Bay State.

A Boston Herald editorial

Tuesday, April 27, 2021

Wealthy tax hike robs Peter to pay Paul

Pioneer Institute Executive Director Jim Stergios

submitted public testimony to

the Massachusetts Legislature’s Joint Committee on Revenue

Pioneer Institute

7 Reasons to Reject the Graduated Tax and Instead Focus on

Growing Jobs

April 28, 2021

As a proposed tax on top earners inches toward the 2022

ballot, some lawmakers want to build a dam to hold back

future increases.

A bipartisan plan before the Legislature's Revenue Committee

would ask voters to amend the state Constitution by capping

the personal income tax rate at 6.25% to prevent the levy

from rising above that level. The flat tax rate went down to

5% in January 2019.

Senate Minority Leader Bruce Tarr, R-Gloucester, the bill's

primary sponsor, said a separate proposal to amend the

Constitution to place a 4% surcharge on individuals making

more than $1 million per year creates the need for

safeguards to prevent the personal income tax rate from

rising.

"If we are going to go to that point, and put a tax rate

into the Constitution, then we should also have a limit on

how high it can be increased," he said.

To put the question before voters, Tarr's plan must be

approved by at least 50% of the House and Senate, meeting

together in two consecutive constitutional conventions. The

earliest it could appear on the ballot would be 2022....

Last year, a group of 90 economists wrote to Gov. Charlie

Baker and other top elected officials to make the case for

raising the state's income tax rate by one percentage point,

which they said will drum up more than $2.5 billion a year.

"These tax rates could be phased back as the economy returns

to its pre-recession level," the left-learning Massachusetts

Budget and Policy Center wrote....

Massachusetts voters overwhelmingly approved a ballot

question in 2000 to cut the personal income tax rate to 5%.

At the time the rate was 5.85%.

Two years after its passage, however, the Legislature

outraged supporters of the rollback by freezing the personal

income tax at 5.3% to plug budget shortfalls.

Lawmakers approved a process to reduce the tax rate if

growth in the state’s annual revenue met certain benchmarks.

But it took nearly two decades for the rate to come down to

5%, which happened in January 2019.

Tarr's proposal faces long odds on Beacon Hill, where

lawmakers are on the hunt for tax revenue to offset revenue

losses caused by the pandemic.

Chip Ford, of the group Citizens for Limited

Taxation, which advocated for the 2000 tax cut, said

he's doubtful the Democratic-controlled Legislature will act

on it.

"He's one of only three Republicans in the Senate," Ford

said. "It's a great idea, but I don't see this thing is

going anywhere."

The (Lawrence) Eagle-Tribune

Tuesday, April 27, 2021

Tarr seeks cap on state's income

tax rate

The first day of the House's fiscal year 2022 budget debate

ended more than 13 hours after it began on Monday with a

unanimous vote to add more than $10.9 million in spending to

the $47.6 billion budget proposal for education, local aid,

social services and veterans programs.

The vote on the first bulk amendment of the week capped a

day that featured very little debate and long periods of

inactivity on the floor as members, many of them

participating remotely this week, took part in three

separate private Zoom meetings to discuss hundreds of

amendments that had been separated into categories. In

addition to the topics dealt with in the first bulk

amendment, House lawmakers have also met to discuss

amendments related to health and human services, elder

affairs, public safety and the judiciary.

The annual budget debate began with the traditional

discussion of revenue amendments, of which there were only

17. The House voted to eliminate the 2022 sunset date on the

controversial film tax credit, expand the conservation land

tax credit program from $2 million to $5 million and extend

the historic rehabilitation tax credit by five years through

2027.

Later in the evening, the first consolidated amendment -

Consolidated A - emerged for consideration dealing with

186 amendments across four categories.

State House News Service

House Session Summary - Monday, April 26, 2021

First Day of House Budget Debate Ends

with Vote to Spent $10.9M

on Schools, Social Services and Veterans

The House tacked tens of millions of dollars in spending

onto its $47.6 billion fiscal year 2022 budget during its

second day of debate on Tuesday, working mostly behind

closed doors -- or more accurately, in private Zoom meetings

-- to compile amendment bundles that can be addressed with

single votes. Tuesday's nearly 11-hour session featured only

a few stretches of activity on the House floor, mostly when

lawmakers spoke in favor of and then approved three

different consolidated amendments.

Consolidated B •

Consolidated C

•

Consolidated D

State House News Service

House Session Summary - Tuesday,

April 27, 2021

The House tacked $4.87 million more onto its fiscal 2022

budget bill Wednesday with a mega-amendment that also

includes pay raises and throws the brakes on a Baker

administration transportation reform that has already

progressed through the procurement phase.

The

consolidated amendment [E] would impose a two-year

moratorium on the Baker administration's planned

consolidation within the Human Services Transportation

System, which provides millions of rides annually to

low-income and disabled residents.

State House News Service

Wednesday, April 28, 2021

House Amendment Targets Transportation

Reform, Includes Pay Raises

The House voted 160-0 to approve its fiscal 2022 budget

after 2:30 a.m Thursday, after adding tens of millions of

dollars to its bottom line across three days.

Through

its consolidated amendment process, the House took seven

roll call votes to add more than $59 million to what began

as a $47.65 billion bill. The final bottom line landed at

$47.716 billion, according to Speaker Ronald Mariano's

office.

The three consolidated amendments adopted Wednesday -- one

for constitutional officers, state administration and

transportation, one dealing with housing, energy and

environmental affairs and one involving labor and economic

development -- passed unanimously.

The $7.3 million energy, environment and housing amendment

also included language that Telecommunications, Utilities

and Energy Committee Chair Jeff Roy described as a

clarification of the climate policy law passed earlier this

year. Roy said the amendment clarifies the Legislature's

intent of procuring 5,600 megawatts of offshore wind "and

nothing less."

Before engrossing the bill, representatives also agreed to a

final amendment, worth over $7 million dollars, that was

described as technical and contained local earmarks. The

House plans to next meet in an informal session on Monday,

and before adjourning Mariano thanked representatives for

their patience "as we ground our way through" a partially

remote budget process.

State House News Service

House Session Summary - Wednesday, April 28, 2021

House Passes $47.7 Billion Budget

By Katie Lannan

State representatives said their second pandemic-era

spending plan charts “a path toward economic recovery” after

they unanimously passed a $47.7 billion state budget in the

wee hours of Thursday morning, capping three marathon days

of debate.

“This budget meets the needs of our residents who have

endured an unprecedented level of health and economic

challenges over the past year. The House continues to

support the services and programs that have proven to be

essential for so many, while making targeted investments to

grow the Massachusetts economy,” Speaker Ronald Mariano said

in a statement.

The fiscal 2022 budget process remains on time — which is

notable considering lawmakers delayed passage of the current

year’s spending plan by months last year in an attempt to

get a full grasp on the economic damage wrought by the

coronavirus pandemic....

The budget passed Thursday was about $60 million fatter than

the one budget writers proposed last week. Despite boosting

spending by about $1.8 billion over the current year, it

includes no new taxes and bumps up spending to some social

services programs prioritized by lawmakers amid the

coronavirus pandemic....

Members waded through more than 1,157 amendments, packaging

the majority of proposals into mega-amendments following

behind-closed-doors debate reminiscent of the former Speaker

Robert DeLeo’s reign.

Seven consolidated amendments were ultimately adopted, the

largest among them an $11.9 million labor and economic

development package.

Members separately approved $7.1 [million] in mostly local

spending....

Offering a “heartfelt thanks” to members for their patience

after the final vote came in just after the clock struck

2:30 a.m. on Thursday, the Quincy Democrat closed the books

on his first state budget process as speaker.

The process now moves to the Senate where members are

already predicting a showdown over a controversial film tax

credit that costs taxpayers upward of $80 million per year.

The two chambers will then reconcile any differences before

the budget moves to Gov. Charlie Baker’s desk sometime in

June.

The Boston Herald

Thursday, April 29, 2021

Massachusetts House unanimously

passes $47.7 billion budget

Massachusetts grew by enough people over the past decade to

keep all nine U.S. House seats as the state's population

climbed to more than 7 million over the past decade, but

Secretary of State William Galvin said Monday that the

process of redrawing Congressional districts still will be

challenging.

The U.S. Census Bureau released state population totals and

Congressional apportionment data on Monday, giving state

officials an early glimpse of what might be in store this

year as they wait for more specific community-level counts

later in the summer. The population totals govern not just

how many seats in Congress a state has, but also how

trillions of dollars in federal formula funding gets

allocated.

The 2020 Census effort, which was rife with political and

pandemic challenges, counted 7,029,917 people living in

Massachusetts, a 7.4 percent increase over the past decade

that outpaced the 4.1 percent average in the Northeast and

equaled the growth rate of the country as a whole.

The state may have avoided a fate similar to 10 years ago

when it lost a seat, but the growth likely means that

western Massachusetts districts represented by U.S. Rep

Richard Neal and U.S. Rep. Jim McGovern may need to be

expanded to grab more population, while the footprint of

eastern districts close to Boston may need to shrink or

shift west, Galvin said....

The state added 482,288 people since the decennial count in

2010, ensuring that its delegation to the House will remain

the same size while six southern and western states added

seats and seven other states, including New York, lost

representation in Congress.

"Today is good news for Massachusetts. Ten years ago we lost

a seat in Congress and we lost the influence it provided.

Today we know that we will not lose a seat and we will not

lose an electoral vote," Galvin said after the data was

released.

Massachusetts has not added a Congressional seat in over 110

years. The state had 16 members of Congress in 1910 and has

either held steady or lost seats every decade as more and

more of the House's 435 seats went to southern and western

states. The last time the size of the delegation did not

change was in 2000 when the state controlled 10 seats.

Galvin fought over the past year to make sure the U.S.

Census bureau did everything it could to capture the state's

student and immigrant populations, and he said the count

released Monday exceeded his estimates....

While the rate of growth in Massachusetts between 2010 and

2020 far outpaced the 3.1 percent growth recorded in the

previous decade, Acting U.S. Census Bureau Director Ron

Jarmin said the U.S. population grew to 331,449,281, a 7.4

percent rate increase over 2010 that was the second slowest

in recorded history behind only the 1930s.

Some states that were expected to lose seats, like Rhode

Island, did not, while others known to be growing rapidly

did not see their representation increase as predicted....

The South grew the fastest over the last decade (10.2

percent) followed by the West (9.2 percent), the Northeast

(4.1 percent) and the Midwest (3.1 percent).

Utah was fastest growing state, while three states - West

Virginia, Mississippi and Illinois - lost population,

officials said. Massachusetts is now the 15th largest state

in the country (down from 14th) and is still the fifth

densest state, with 901.2 people per square mile, and the

21st fastest growing state.

In total, seven Congressional seats will shift between 13

states based on the 2020 population count. Six states -

Texas (2), Colorado, Montana, Florida, North Carolina and

Oregon - will gain seats, while seven states - California,

Illinois, Michigan, New York, Ohio, Pennsylvania and West

Virginia - will lose seats. New York was 89 people short of

keeping its 27 seats in the House, Census officials said.

State House News Service

Monday, April 26, 2021

Uneven Growth Creates Mass. Redistricting

Challenge

Census: Mass. Population Grew 7.4 Percent in Last Decade

Economic activity is surging, based on an assortment of

metrics, and state tax collections continue to run well

ahead of budget benchmarks, with a telling report on April

receipts due out next week ...

The combination of strong tax collections, a rebounding

economy and an historic infusion of federal funds, with the

potential for much more based on President Joe Biden's

ambitious tax-and-spend plans, means Beacon Hill is not at a

loss for revenue to spend and instead challenged mostly by

how quickly to dish it out and where to spend it. The

revenue glut also comes at an interesting time politically

for the Legislature, which must convene a Constitutional

Convention in May when they could decide whether to send to

the 2022 statewide ballot an amendment adding a 4 percent

surtax on household income above $1 million.

It has been estimated that the new wealth tax could add $2

billion a year to the state's revenue kitty. Under the

amendment, revenue from the tax increase must only be spent

on education and transportation, two areas that are a major

focus of Biden's already approved American Rescue Act, and

his pending multi-trillion-dollar bills to invest in

infrastructure and domestic programs. The amendment,

together with Biden's plans to raise taxes on the wealthy

and corporations, represent a one-two punch to both raise

money for big spending plans with competitiveness

implications and to address growing income inequality in the

United States ...

APRIL REVENUES: Department of Revenue is expected to

announce total tax collections for the month of April,

typically the most significant month for tax revenues. When

it last updated its expectations in January, DOR was

projecting that it would collect $3.48 billion from

taxpayers in April but it has since moved the tax filing

deadline to May 17 to comport with the federal deadline,

meaning that some of what had been expected in April is

likely to bleed into May.

Nine months through fiscal year 2021, Massachusetts state

government has collected $22.588 billion in taxes from

people and businesses, which is $1.524 billion or 7.2

percent more than it did during the same nine mostly

pre-pandemic months of fiscal year 2020. For the last three

months, actual tax collections have blown DOR's monthly

benchmarks out of the water. The last month Massachusetts

saw a year-over-year decline in tax collections was

September.

Wednesday, May 5, 2021

RETROFITTING HOMES LEGISLATIVE BRIEFING: Mass Renews

Alliance hosts a legislative briefing to discuss legislation

(S 2226 / H 3365) that would call for retrofitting 1 million

Massachusetts homes over a 10-year period with greener

heating and electrical systems, prioritizing low-income

households and communities of color. (Wednesday, 10 a.m.)

...

State House News Service

Friday, April 30, 2021

Advances - Week of May 2, 2021

I appreciate the thoughtfulness of Sun Chroncile columnist

Bill Gouveia and his weekly contribution to the conversation

on local governments.

Indeed, I enjoyed his recent piece on Proposition 2½ 1/2

(“The Story Behind Prop. 2½,” City & Town, April 19),

however, I do disagree and offer the following thoughts and

points.

Since Prop. 2½ was adopted, inflation has averaged less than

2% annually. This is also true of the inflation component

that makes up the wage base.

Yes, inflation has wavered from time to time but that is one

reason why we pay for town services together.

One purpose for government is to share the expenses of

services so that the yearly volatility of costs are not

absorbed by residents and businesses. Therefore Prop. 2½ has

done its job on both counts.

A second reason for Prop. 2½ is to cap otherwise unlimited

spending growth. Government struggles with limiting its

spending. Very few towns are not taxing to the limit today

or even before COVID.

Similar to how a speed limiter can be used to limit the top

speed of a vehicle with an untrustworthy driver, today’s

municipal government needs to be restrained or residents

will face out of control spending efforts. To put the sole

decision of exceeding spending caps in the hands of a town

council, a select board or a mayor would be tragic for

taxpayers....

Additionally, while most infrastructure improvements within

the town can be planned and properly budgeted for, there are

occasionally unforeseen expenses that must be met.

But these are the exception and, by themselves, not a reason

to throw out a reasonable spending restraint such as Prop.

2.5.

In particular, select boards are generally not good at

strong financial management.

For whatever reason, perhaps the zeal to be re-elected or

lacking the necessary financial skill set, select boards

tend to think near-term and be reactive rather than think

strategically and long-term....

While there are pros and cons of the town meeting form of

government, one reason to end Prop . 2½ would be to

encourage resident participation in town meetings and

elections.

The upper bound of the law gives comfort to the taxpayer,

allowing them to feel less inclined to participate in their

local government.

Fear of out of control spending may be the incentive

necessary to turn 2% town meeting attendance into 50%

attendance. Even if this were so, there would still be

little immediate remedy for poor financial management by a

town council or select board. You can’t easily change the

old and ineffective guard quickly. It takes years.

Prop. 2½ has indeed kept up with inflation and gives

taxpayers comfort that their money is being appropriately

used, probably, but also has the residual of increased

apathy.

The Attleboro Sun Chronicle

Tuesday, April 27, 2021

How Prop. 2½ leads to voter apathy

By Steve Schoonveld |

Chip Ford's CLT

Commentary

For you to appreciate

why I'm still seemingly involved with the mandatory seat belt law from

thirty-five years ago, if you weren't around back then you need some

background. Believe me, it's not of my choosing to still be the

"go-to" guy whenever it comes up, but I'm still in reporters' Rolodexes

and get the calls. Here's a little of the back history which

explains why:

• Minding my own business and

enjoying my sign-painting business and life all around, in

1985 I became involved with my first political activity

beyond voting: Collecting signatures on a petition for

repeal of the Massachusetts mandatory seat belt law (MSBL).

Back then I didn't even know there was such a process!

After sufficient signatures were turned in, WRKO radio

talk-show host and repeal advocate Jerry Williams talked me

into coming into the station to discuss what was next to get

the law repealed, then he talked me into starting a ballot

committee. Having never done anything like that, I had

no idea what I was getting myself into. His

short-lived promise that I would never need to do any public

speaking ended on my way out of the studio, where I was

corralled by talk show host Moe Lauzier and roped into my

first (of hundreds to come) radio talk show the following

Saturday morning.

• I became comfortable

(confident) pubic speaking and debating over time. We

won our repeal campaign on the 1986 ballot but that was just

the beginning. Every spring starting in 1987 another

bill was introduced to bring back the mandatory seat belt

law, and I'd have to hike into the State House to defend our

victory before the Public Safety Committee. The major

auto and insurance industries had established a national

lobby group called Traffic Safety Now. Apparently I

needed to start an organization to counter it. What

can be more immediate than "Now"? My new group became

Freedom First. Over the next couple of years I

chartered Freedom First groups in twenty-two other states,

was flown out by their rooky leaders to testify before their

state legislatures which were considering MSBL laws of their

own, was taken around by my new friends to all their local

media outlets as their de facto spokesman. Freedom

First in Iowa, Freedom First in New Mexico, Freedom First in

Colorado, Freedom First in South Dakota, Freedom First in

Nebraska, etc. — I did a whole lot of travelling back then

at their expense for my transportation but on my own time;

at my request I was put up in one of their homes for my stay wherever

I went so I could better absorb local customs and

considerations.

• In October 1989 I was the only

opponent in the country invited to testify in Washington DC

before a U.S. Senate transportation sub-committee

considering a national MSBL. It never passed

out of that committee.

• The annual Rite of Spring

continued every year, defending Massachusetts motorists,

until the Legislature finally passed the second MSBL

in 1994 over Gov. Weld's veto at my request. Jerry

Williams and I launched our second repeal ballot

campaign almost ten years after the first, put it on the

1994 ballot. But on a chaotic ballot with no

explanations of what any of the nine ballot questions would

do, confused voters approved the seat belt law (thinking a

"Yes" vote was for repeal, but repeal required a "No" vote).

I threw up my hands, tossed in the towel on the MSBL — the

voters had spoken. Freedom First had moved on to other

issues such as drunk driving roadblocks, implied consent,

breathalyzer tests, privacy rights — and

reining-in-government issues such as a legislative pay raise

repeal, limited legislative sessions, and term limits.

• During that period Freedom

First and I teamed up with CLT on many issues and became

close allies, almost partners; CLT actually hired me as a

consultant for its last graduated income tax opposition

campaign in 1994 (while I was also leading the repeal of the

second seat belt law and pushing term limits,

all on the ballot that year). In 1996 CLT's

then-board of directors invited me to merge my Freedom First

organization with Citizens for Limited Taxation. One

of my demands if a merger was to happen was that the limited

government interests I'd been fighting for over the past

decade would be included among our mutual goals, thus the

merged organization legally became Citizens for Limited

Taxation & Government — Barbara Anderson and I become

its co-directors. After the then-recent Gingrich

Revolution of 1994 Newt was fond of saying "You can't have

limited government without limited taxation, and you can't

have limited taxation without limited government." Our

merger of Citizens for Limited Taxation and Freedom First

reflected that philosophy and fit the times. (We soon

decided to go back to just CLT when the name CLT&G became

too unwieldy a mouthful, but the website I established in

1996 remains cltg.org.)

• Thirty-five years later I

still get the calls whenever a mandatory seat belt law issue

arises. If you didn't already, now you know why.

In response to Beacon Hill Roll Call's

request for a comment on Baker's "suite of safety reforms"

including motorists being stopped on the suspicion of not

wearing a seat belt I replied:

“Gov. Baker apparently is feeling control withdrawal

with the unavoidable loosening of his pandemic lockdown

mandates,” said Chip Ford, executive director of

Citizens for Limited Taxation. “To compensate,

he’s lurched to his ‘suite of safety reforms’ to reclaim

control over his subjects … What a difference from

Republican Gov. Bill Weld, who vetoed the second

mandatory seat belt law in 1994. Baker, a Weld

administration protégé no less, now intends to break the

promise made by advocates of the law that the state’s

seat belt law isn’t and will never become the sole

reason for stopping a motorist: ‘primary enforcement.’

It's not surprising that this and Baker’s red-light

camera ‘reform’ both generate revenue for the state, or

that it is proposed by an alleged Republican. This is of

course Massachusetts.”

Then there was this interview with Howie Carr on last

Monday:

The Pioneer Institute is demolishing

the latest proposed graduated income tax (aka, "Millionaires

Tax" of "Fair Share Amendment) scheme with its in depth

analysis of its costs, results, and other ramifications if

it is ever adopted. Last Monday it released its latest

report.

The

following day the Boston Herald editorial ("Wealthy tax hike

robs Peter to pay Paul") summed it up perfectly:

"It seems simple enough to those who back such a move:

We need money, you have money, it’s only fair you give

it to us."

The day the

report was released The Boston Herald reported on it ("Massachusetts

millionaires tax could ‘devastate’ startups in Greater

Boston: Report — The Bay State

would have the highest short-term capital gains tax rate in

the U.S."):

The proposed millionaires tax in

Massachusetts could “devastate” innovative startups

dependent on Boston’s financial services industry for

funding, according to a Pioneer Institute

study released on Monday.

That potential impact of the

proposed 4% surtax to all annual income above $1 million

would hurt the state’s recovery from the coronavirus

pandemic economic recession, Pioneer’s authors conclude

in yet another study that hammers the millionaires tax.

The surtax would give Massachusetts

the highest short-term capital gains tax rate in the

nation (16%) and the highest long-term capital gains tax

rate in New England (9%).

“Raising taxes on capital gains via

a graduated income tax could devastate the financial

services industry in Boston, which has played a key role

in fueling the region’s innovation economy, as reflected

in the numerous tech start-ups in Kendall Square and the

Seaport District,” co-authors Greg Sullivan and Andrew

Mikula wrote in the report....

Last week, Pioneer published a

study that said the millionaires tax would “adversely

impact” a significant number of small-business owners in

the Bay State.

The surtax would apply to as many

as 13,430 of the state’s pass-through entities — which

are often small businesses structured as S corporations,

sole proprietorships and partnerships, Pioneer wrote.

“This proposal couldn’t come at a

worse time,” Sullivan said Monday. “It would affect

small- and medium-sized businesses as they’re trying to

come out of COVID, and as it looks like they’re about to

get walloped by a huge capital gains tax at the federal

level.”

The

Massachusetts Taxpayers Foundation weighed in on it as well.

On Tuesday

The (Newburyport) Daily News reported ("Watchdog seeks delay

on 'millionaires tax' vote"):

A Beacon Hill watchdog group wants

lawmakers to delay voting on a constitutional amendment

to tax the state's wealthiest residents.

In written testimony, the

Massachusetts Taxpayers Foundation asks legislative

leaders to postpone a second and final vote on the

proposed amendment, which seeks a 4% surtax on the

portion of an individual's annual income above $1

million.

A "yes" vote would send the

question to voters.

Eileen McAnneny, the foundation's

president, said with the economy still in flux, and the

long-term effect of the pandemic on the workplace

unclear, lawmakers should halt the push to tax top

earners.

"Once they vote on this, there's no

turning back," she said. "We're just asking them not to

do it until next year, until we have a better sense of

where things are."

The pandemic has upended the

workplace, and McAnneny said wealthy people no longer

feel tied to a specific geographic location.

She said that's a dynamic that

wasn't in play when lawmakers initially approved the

"millionaires tax" nearly two years ago.

"People have more options now about

where they choose to live and work," she said. "So the

impact of this could be more detrimental than we

thought."

Backers say the measure has broad

support, so there's no reason to delay presenting it to

voters.

On Friday

Pioneer Institute Executive Director Jim Stergios submitted

public testimony to the Massachusetts Legislature’s Joint

Committee on Revenue opposing this latest shot at imposing a

graduated income tax on Massachusetts taxpayers, The

Takers getting their foot in the door after

failing

in their past five attempts

(in 1962, 1968, 1972, 1976, and 1994):

Pioneer Institute

April 28, 2021

7 Reasons to Reject the Graduated Tax and Instead Focus on

Growing Jobs

Another

constitutional amendment has been proposed, this one to cap

the state income tax at 6.25%. Think it'll go anywhere

in the Legislature?

The (Lawrence) Eagle-Tribune reported on Tuesday ("Tarr

seeks cap on state's income tax rate"):

As a proposed tax on top earners

inches toward the 2022 ballot, some lawmakers want to

build a dam to hold back future increases.

A bipartisan plan before the

Legislature's Revenue Committee would ask voters to

amend the state Constitution by capping the personal

income tax rate at 6.25% to prevent the levy from rising

above that level. The flat tax rate went down to 5% in

January 2019.

Senate Minority Leader Bruce Tarr,

R-Gloucester, the bill's primary sponsor, said a

separate proposal to amend the Constitution to place a

4% surcharge on individuals making more than $1 million

per year creates the need for safeguards to prevent the

personal income tax rate from rising.

"If we are going to go to that

point, and put a tax rate into the Constitution, then we

should also have a limit on how high it can be

increased," he said.

To put the question before voters,

Tarr's plan must be approved by at least 50% of the

House and Senate, meeting together in two consecutive

constitutional conventions. The earliest it could appear

on the ballot would be 2022....

Last year, a group of 90 economists

wrote to Gov. Charlie Baker and other top elected

officials to make the case for raising the state's

income tax rate by one percentage point, which they said

will drum up more than $2.5 billion a year.

"These tax rates could be phased

back as the economy returns to its pre-recession level,"

the left-learning Massachusetts Budget and Policy Center

wrote....

Massachusetts voters overwhelmingly

approved a ballot question in 2000 to cut the personal

income tax rate to 5%. At the time the rate was 5.85%.

Two years after its passage,

however, the Legislature outraged supporters of the

rollback by freezing the personal income tax at 5.3% to

plug budget shortfalls.

Lawmakers approved a process to

reduce the tax rate if growth in the state’s annual

revenue met certain benchmarks. But it took nearly two

decades for the rate to come down to 5%, which happened

in January 2019.

Tarr's proposal faces long odds on

Beacon Hill, where lawmakers are on the hunt for tax

revenue to offset revenue losses caused by the pandemic.

Chip Ford, of the group

Citizens for Limited Taxation, which advocated for

the 2000 tax cut, said he's doubtful the

Democratic-controlled Legislature will act on it.

"He's one of only three Republicans

in the Senate," Ford said. "It's a great idea, but I

don't see this thing is going anywhere."

The

"temporary" income tax increase of 1989 was "temporary" only

in that it was hiked to 5.95 percent —

then was hiked again "temporarily" the next year to 6.25

percent. "It took CLT thirty years to get it back down

to its historic 5 percent," I pointed out to the reporter,

Christian Wade, during the interview. "Cap it right

where it is at 5 percent and I'll be impressed." It's

not going to happen at Sen. Tarr's proposed 6.25 percent so

why doesn't he take a real stand and swing for the

bleachers?

After a week of wrangling over the

1,157 proposed amendments, late at night (as usual) in the

wee hours of Thursday morning

the House unanimously passed its $47.7 billion state budget.

It increased spending by about $1.8 billion over the current

year, as it usually always does —

and that version hasn't even reached the state Senate, where

spending is traditionally bloated significantly even more.

Expect the FY 2022 budget to exceed $49 Billion before it

reaches Gov. Baker in June, July, August, whatever-whenever.

The Boston Herald reported on Thursday

— after no doubt getting some sleep

— ("Massachusetts House

unanimously passes $47.7 billion budget"):

State representatives said their

second pandemic-era spending plan charts “a path toward

economic recovery” after they unanimously passed a $47.7

billion state budget in the wee hours of Thursday

morning, capping three marathon days of debate.

“This budget meets the needs of our

residents who have endured an unprecedented level of

health and economic challenges over the past year. The

House continues to support the services and programs

that have proven to be essential for so many, while

making targeted investments to grow the Massachusetts

economy,” Speaker Ronald Mariano said in a statement.

The fiscal 2022 budget process

remains on time — which is notable considering lawmakers

delayed passage of the current year’s spending plan by

months last year in an attempt to get a full grasp on

the economic damage wrought by the coronavirus

pandemic....

The budget passed Thursday was

about $60 million fatter than the one budget writers

proposed last week. Despite boosting spending by about

$1.8 billion over the current year, it includes no new

taxes and bumps up spending to some social services

programs prioritized by lawmakers amid the coronavirus

pandemic....

Members waded through more than

1,157 amendments, packaging the majority of proposals

into mega-amendments following behind-closed-doors

debate reminiscent of the former Speaker Robert DeLeo’s

reign.

Seven consolidated amendments were

ultimately adopted, the largest among them an $11.9

million labor and economic development package.

Members separately approved $7.1

[million] in mostly local spending....

Offering a “heartfelt thanks” to

members for their patience after the final vote came in

just after the clock struck 2:30 a.m. on Thursday, the

Quincy Democrat closed the books on his first state

budget process as speaker.

The process now moves to the Senate

where members are already predicting a showdown over a

controversial film tax credit that costs taxpayers

upward of $80 million per year.

The two chambers will then

reconcile any differences before the budget moves to

Gov. Charlie Baker’s desk sometime in June.

I spent much of last week digging into

the so-called "consolidated amendments" where all those

1,157 amendments proposed by individual legislators get

bundled, buried from view. Most refer to just a

section of Massachusetts General Laws it wants to change,

sending you down a rabbit hole to see just what it actually

refers to. If you think that's easy give it a try

yourself. I couldn't find the next stealth attack on

Proposition 2½ as I expected, but it'll show up somewhere

I'm sure. Maybe you can find something I missed?

Here are the "consolidated amendments" for your education

and opportunity. See if you can find something I

missed:

Consolidated A

Consolidated B

Consolidated C

Consolidated D

Consolidated E

The State

House News Service reported on Monday ("Uneven Growth

Creates Mass. Redistricting Challenge

— Census: Mass. Population Grew 7.4 Percent in Last

Decade"):

Massachusetts grew by enough people

over the past decade to keep all nine U.S. House seats

as the state's population climbed to more than 7 million

over the past decade, but Secretary of State William

Galvin said Monday that the process of redrawing

Congressional districts still will be challenging.

The U.S. Census Bureau released

state population totals and Congressional apportionment

data on Monday, giving state officials an early glimpse

of what might be in store this year as they wait for

more specific community-level counts later in the

summer. The population totals govern not just how many

seats in Congress a state has, but also how trillions of

dollars in federal formula funding gets allocated.

The 2020 Census effort, which was

rife with political and pandemic challenges, counted

7,029,917 people living in Massachusetts, a 7.4 percent

increase over the past decade that outpaced the 4.1

percent average in the Northeast and equaled the growth

rate of the country as a whole.

The state may have avoided a fate

similar to 10 years ago when it lost a seat, but the

growth likely means that western Massachusetts districts

represented by U.S. Rep Richard Neal and U.S. Rep. Jim

McGovern may need to be expanded to grab more

population, while the footprint of eastern districts

close to Boston may need to shrink or shift west, Galvin

said....

The state added 482,288 people

since the decennial count in 2010, ensuring that its

delegation to the House will remain the same size while

six southern and western states added seats and seven

other states, including New York, lost representation in

Congress.

"Today is good news for

Massachusetts. Ten years ago we lost a seat in Congress

and we lost the influence it provided. Today we know

that we will not lose a seat and we will not lose an

electoral vote," Galvin said after the data was

released.

Massachusetts has not added a

Congressional seat in over 110 years. The state had 16

members of Congress in 1910 and has either held steady

or lost seats every decade as more and more of the

House's 435 seats went to southern and western states.

The last time the size of the delegation did not change

was in 2000 when the state controlled 10 seats.

Galvin fought over the past year to

make sure the U.S. Census bureau did everything it could

to capture the state's student and immigrant

populations, and he said the count released Monday

exceeded his estimates....

While the rate of growth in

Massachusetts between 2010 and 2020 far outpaced the 3.1

percent growth recorded in the previous decade, Acting

U.S. Census Bureau Director Ron Jarmin said the U.S.

population grew to 331,449,281, a 7.4 percent rate

increase over 2010 that was the second slowest in

recorded history behind only the 1930s.

Some states that were expected to

lose seats, like Rhode Island, did not, while others

known to be growing rapidly did not see their

representation increase as predicted....

The South grew the fastest over the

last decade (10.2 percent) followed by the West (9.2

percent), the Northeast (4.1 percent) and the Midwest

(3.1 percent).

Utah was fastest growing state,

while three states - West Virginia, Mississippi and

Illinois - lost population, officials said.

Massachusetts is now the 15th largest state in the

country (down from 14th) and is still the fifth densest

state, with 901.2 people per square mile, and the 21st

fastest growing state.

In total, seven Congressional seats

will shift between 13 states based on the 2020

population count. Six states - Texas (2), Colorado,

Montana, Florida, North Carolina and Oregon - will gain

seats, while seven states - California, Illinois,

Michigan, New York, Ohio, Pennsylvania and West Virginia

- will lose seats. New York was 89 people short of

keeping its 27 seats in the House, Census officials said

I see the

big takeaway as: "The state added 482,288 people since

the decennial count in 2010 ... Galvin fought over the past

year to make sure the U.S. Census bureau did everything it

could to capture the state's student and immigrant

populations, and he said the count released Monday exceeded

his estimates." Do you suppose all those loaded

U-Haul trucks barreling out of the state helped, or was it

more likely the wave of Galvin's "immigrants" and visiting

college students that kept the Bay State population

relatively stable?

Most

interesting stats, though for the life of me I don't know

how Massachusetts is considered the

15th largest state in the country:

"The South grew the fastest over

the last decade (10.2 percent) followed by the West (9.2

percent), the Northeast (4.1 percent) and the Midwest

(3.1 percent).

"Utah was fastest growing state,

while three states - West Virginia, Mississippi and

Illinois - lost population, officials said.

Massachusetts is now the 15th largest state in the

country (down from 14th) and is still the fifth densest

state, with 901.2 people per square mile, and the 21st

fastest growing state.

"In total, seven Congressional

seats will shift between 13 states based on the 2020

population count. Six states - Texas (2), Colorado,

Montana, Florida, North Carolina and Oregon - will gain

seats, while seven states - California, Illinois,

Michigan, New York, Ohio, Pennsylvania and West Virginia

- will lose seats. New York was 89 people short of

keeping its 27 seats in the House, Census officials

said."

In its Advances for the coming week the State House News

Service noted on Friday:

Economic activity is surging, based

on an assortment of metrics, and state tax collections

continue to run well ahead of budget benchmarks, with a

telling report on April receipts due out next week ...

The combination of strong tax

collections, a rebounding economy and an historic

infusion of federal funds, with the potential for much

more based on President Joe Biden's ambitious

tax-and-spend plans, means Beacon Hill is not at a loss

for revenue to spend and instead challenged mostly by

how quickly to dish it out and where to spend it. The

revenue glut also comes at an interesting time

politically for the Legislature, which must convene a

Constitutional Convention in May when they could decide

whether to send to the 2022 statewide ballot an

amendment adding a 4 percent surtax on household income

above $1 million.

It has been estimated that the new

wealth tax could add $2 billion a year to the state's

revenue kitty. Under the amendment, revenue from the tax

increase must only be spent on education and

transportation, two areas that are a major focus of

Biden's already approved American Rescue Act, and his

pending multi-trillion-dollar bills to invest in

infrastructure and domestic programs. The amendment,

together with Biden's plans to raise taxes on the

wealthy and corporations, represent a one-two punch to

both raise money for big spending plans with

competitiveness implications and to address growing

income inequality in the United States ...

APRIL REVENUES: Department of

Revenue is expected to announce total tax collections

for the month of April, typically the most significant

month for tax revenues. When it last updated its

expectations in January, DOR was projecting that it

would collect $3.48 billion from taxpayers in April but

it has since moved the tax filing deadline to May 17 to

comport with the federal deadline, meaning that some of

what had been expected in April is likely to bleed into

May.

Nine months through fiscal year

2021, Massachusetts state government has collected

$22.588 billion in taxes from people and businesses,

which is $1.524 billion or 7.2 percent more than it did

during the same nine mostly pre-pandemic months of

fiscal year 2020. For the last three months, actual tax

collections have blown DOR's monthly benchmarks out of

the water. The last month Massachusetts saw a

year-over-year decline in tax collections was September.

The News Service's Advances also noted upcoming on

Wednesday:

RETROFITTING HOMES LEGISLATIVE BRIEFING: Mass Renews

Alliance hosts a legislative briefing to discuss

legislation (S 2226 / H 3365) that would call for

retrofitting 1 million Massachusetts homes over a

10-year period with greener heating and electrical

systems, prioritizing low-income households and

communities of color. (Wednesday, 10 a.m.)

You ready

to retrofit you house to "save the planet"? Might want

to begin thinking about it, planning ahead.

In last

week's CLT Update I included the latest column by Attleboro

Sun Chronicle's

Bill Gouveia

again attacking Proposition 2½

and my response to him. An op-ed column appeared in

that paper on Tuesday written by

Steve Schoonveld, "How Prop. 2½ leads to voter apathy," also

in response to Gouveia's hit piece. The writer, Steve

Schoonveld, is a member of the Mansfield Select Board.

Here's an excerpt from it (the full column appears below in

Full News Reports):

I appreciate the thoughtfulness of

Sun Chroncile columnist Bill Gouveia and his weekly

contribution to the conversation on local governments.

Indeed, I enjoyed his recent piece

on Proposition 2½ (“The Story Behind Prop. 2½,” City &

Town, April 19), however, I do disagree and offer the

following thoughts and points.

Since Prop. 2½ was adopted,

inflation has averaged less than 2% annually. This is

also true of the inflation component that makes up the

wage base.

Yes, inflation has wavered from

time to time but that is one reason why we pay for town

services together.

One purpose for government is to

share the expenses of services so that the yearly

volatility of costs are not absorbed by residents and

businesses. Therefore Prop. 2½ has done its job on both

counts.

A second reason for Prop. 2½ is to

cap otherwise unlimited spending growth. Government

struggles with limiting its spending. Very few towns are

not taxing to the limit today or even before COVID.

Similar to how a speed limiter can

be used to limit the top speed of a vehicle with an

untrustworthy driver, today’s municipal government needs

to be restrained or residents will face out of control

spending efforts. To put the sole decision of exceeding

spending caps in the hands of a town council, a select

board or a mayor would be tragic for taxpayers....

Additionally, while most

infrastructure improvements within the town can be

planned and properly budgeted for, there are

occasionally unforeseen expenses that must be met.

But these are the exception and, by

themselves, not a reason to throw out a reasonable

spending restraint such as Prop. 2.5.

In particular, select boards are

generally not good at strong financial management.

For whatever reason, perhaps the

zeal to be re-elected or lacking the necessary financial

skill set, select boards tend to think near-term and be

reactive rather than think strategically and

long-term....

While there are pros and cons of

the town meeting form of government, one reason to end

Prop . 2½ would be to encourage resident participation

in town meetings and elections.

The upper bound of the law gives

comfort to the taxpayer, allowing them to feel less

inclined to participate in their local government.

Fear of out of control spending may

be the incentive necessary to turn 2% town meeting

attendance into 50% attendance. Even if this were so,

there would still be little immediate remedy for poor

financial management by a town council or select board.

You can’t easily change the old and ineffective guard

quickly. It takes years.

Prop. 2½ has indeed kept up with

inflation and gives taxpayers comfort that their money

is being appropriately used, probably, but also has the

residual of increased apathy.

Still Feeling "Lucky In Kentucky"

For those

interested in following my escape over two years ago to my

sanctuary state (also one of the four "commonwealths" in the

nation) of Kentucky, I'm still feeling "Lucky

In Kentucky", as I wrote in my first column (and only

one so far though I've been invited to submit more, but I

work for CLT 12-hours a day, seven days a week so haven't

found the time). I've said it before: "The

Massachusetts Way" isn't the only way and it

doesn't need to be. The Kentucky state

legislature, called the General Assembly, has already shut

down for the year, prorogued sine die on March 30.

As "No man's life, liberty, or property are safe while the

legislature is in session," we Kentuckians under its state

constitution are safe until next January. No

legislating can or will occur until then. Legislators

have completed business for 2021, went home and have been

there for over a month now. The way things ought to

— and can

—

be!

For those

so inclined, you can read about the results of this year's

completed Kentucky legislative session

at the bottom of the full news reports.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports Follow

(excerpted above) |

|

The Boston Herald

Monday, April 26, 2021

Critic decries ‘scary’ Charlie Baker bill to expand police

ability

to pull over motorists, allow red-light cameras

By Erin Tiernan

One critic is calling a set of road bills filed on Monday by

Gov. Charlie Baker a “scary” plan that would expand police

officers’ ability to pull over drivers and allow red-light

cameras to be used in traffic enforcement.

“This will keep residents of Massachusetts safe and ensure

that fewer travelers are killed on our roads,” Baker said,

speaking at the State House. “This legislation includes

important provisions to ensure that the rules of the road

are followed and strict consequences if they’re not.”

Topping Baker’s legislation is an initiative to allow

so-called primary enforcement of seat belt laws, which would

allow officers to pull over motorists they believe aren’t

buckled up.

“It’s scary. It’s a bad idea,” said Chip Ford,

executive director of Citizens for Limited Taxation.

Massachusetts now enforces seat belt laws as secondary

enforcement, meaning police cannot pull over drivers for

seat belt use, but can write citations for drivers not

wearing seat belts who are pulled over for other reasons.

Ford predicted a backlash from opponents who will be worried

about racial stereotyping in an era when there is growing

concern over police accountability.

“In this climate, I don’t know how they can pursue it,” Ford

said.

The legislation would also allow cities and towns to use

red-light cameras for traffic enforcement, which Ford called

a “precursor” to insurance surcharges.

According to Baker’s announcement, “Cameras would be

restricted to collecting photographs only upon a violation

and only of the vehicle license plates. Violations would

include running a red light and making an illegal turn on a

red light.”

Despite a drop in traffic amid the pandemic, Massachusetts

saw 334 roadway deaths in 2020, which Baker said was “almost

even” with the 336 deaths in 2019.

The package of bills also includes a provision that would

build on Haley’s Law — a 2014 law named after 20-year-old

Haley Cremer who was struck and killed by a driver with a

suspended license — to increase penalties for drivers who

cause injuries when they’re driving with suspended licenses.

“She was 20 and just entering the prime of her life,” Marc

Cremer, Haley Cremer’s father, said in an emotional address

on Monday. “This was no random accident. This was

preventable.”

“If enacting penalties commensurate with the recklessness

and negligence of this behavior prevents one crash — and it

will — we will save another family, more likely many

families, from the horror my wife, daughter and I live with

every day,” Marc Cremer continued. “Driving a vehicle in

Massachusetts is not a right, it’s a privilege.”

Another provision of the bill would require drivers to pass

bicyclists safely by allowing a 3-foot buffer when there is

no physical barrier protecting riders.

The Howie Carr Show

Monday, April 26, 2021

In this hour, Howie talks with Chip Ford, Executive Director

at Citizens for Limited Taxation

about stricter penalties for drivers.

Beacon Hill Roll Call

Volume 46 - Report No. 18

April 26-30, 2021

By Bob Katzen

BAKER FILES LEGISLATION ON DRIVING AND ROADWAY LAWS – Gov.

Baker filed legislation that he says will “make

Massachusetts roadways and streets safer for all travelers

and will help reduce roadway fatalities across the state.” A

key section allows police officers to issue tickets for seat

belt violations even if the driver is not first stopped for

another violation as required under current law.

Other provisions include increasing penalties for

individuals who cause personal injury while driving on a

non-administratively suspended license; allowing cities and

towns to place red light cameras at intersections to take a

photograph of the vehicle’s license plate only upon a

traffic violation including running a red light and making

an illegal turn on a red light; and requiring a driver to

maintain a three-foot “safe passing distance” and to travel

at a speed that is reasonable and proper when passing a

bicyclist or pedestrian when there isn’t any physical

separation like a protected bike lane or curb.

“This road safety package we’re filing today addresses some

of the most pressing issues that are facing commuters, and

we are confident that passing this bill will help reduce

roadway deaths and injuries and improve our transportation

system safety,” Baker said.

“Gov. Baker apparently is feeling control withdrawal with

the unavoidable loosening of his pandemic lockdown

mandates,” said Chip Ford, executive director of

Citizens for Limited Taxation. “To compensate, he’s

lurched to his ‘suite of safety reforms’ to reclaim control

over his subjects … What a difference from Republican Gov.

Bill Weld, who vetoed the second mandatory seat belt law in

1994. Baker, a Weld administration protégé no less, now

intends to break the promise made by advocates of the law

that the state’s seat belt law isn’t and will never become

the sole reason for stopping a motorist: ‘primary

enforcement.’ It's not surprising that this and Baker’s

red-light camera ‘reform’ both generate revenue for the

state, or that it is proposed by an alleged Republican. This

is of course Massachusetts.”

State House News Service

Wednesday, April 28, 3031

Baker Seatbelt Reform Knocked Over Profiling Concerns

Racial Justice Impacts Weighed in Road Safety Debate

By Chris Lisinski

Gov. Charlie Baker pitched his new omnibus road safety

legislation as a way to improve the state's

almost-worst-in-the-nation seatbelt use and cut down on

traffic deaths that have not abated during a stretch of

pandemic-era decreased travel.

Some civil rights and transportation advocates caution,

however, that the route to safer roads Baker proposed (H

3706) is too punitive and could exacerbate racial profiling

of drivers -- a fear that Baker acknowledged.

The Vision Zero Coalition, which works to prevent traffic

deaths, criticized Baker's proposal to allow police to pull

motorists over solely for failing to wear a seatbelt and to

expand penalties on those who drive with suspended licenses.

"If you read the whole bill, there is not attention or care

to the potential for racial profiling," said Stacy Thompson,

executive director of the Livable Streets Alliance that is

part of the coalition. "In other states, we know that Black

folks are more likely to be pulled over for not wearing a

seatbelt. It's like another law on the books that doesn't

protect the most vulnerable and has been proven to cause

more harm to Black and brown people."

Massachusetts law currently requires seatbelt use, but it is

a secondary enforcement law, meaning police can only cite

motorists for failing to wear a seatbelt when they have

already stopped the vehicle for another primary traffic

violation such as speeding.

Thirty-four other states have laws allowing primary

enforcement of seatbelt use, according to Baker.

More than half of the people killed on Massachusetts

roadways were not wearing seatbelts at the time of the

accident, Highway Safety Division Director Jeff Larason said

on Monday, noting that the Bay State ranks 46th out of 50

states in rate of seatbelt use.

Thompson said she agrees that state law should continue to

mandate seatbelt use, but she does not believe it should

qualify as a primary reason police can stop a driver, on

similar footing to speeding, texting or other behaviors that

put others at risk.

The governor acknowledged that his proposal might raise some

worries, calling for lawmakers to work with the

administration to find an amenable solution.

"While I believe this is essential to road safety, I am

aware of concerns that such a law could be misused or

misapplied and look forward to working together to address

those concerns," Baker wrote in a letter to the House and

Senate alongside his bill.

Rep. William Straus, who co-chairs the Legislature's

Transportation Committee, told the News Service on Wednesday

that he believes lawmakers are unlikely to tackle the

governor's wide-ranging road safety bill as an omnibus

package. Doing so would be a "massive undertaking," he said,

and instead the Legislature will focus on the sections that

have the best prospects for success.

Straus said primary seatbelt enforcement has "always been a

controversial issue," noting the feedback circulating in the

public and around Beacon Hill this session about the

potential for racial profiling.

"It's got to be aired out and discussed as to whether

primary enforcement of seatbelt laws becomes a pretextual

excuse for pulling someone over," Straus said. "There are

strong views on this one, so that will take a lot of work."

Baker also proposed primary seatbelt enforcement last

lawmaking session, but his suggestion did not meet with the

same criticism it did this week.

Thompson said the evolving national climate over the past

two years, featuring massive protests against racial

injustice and police violence, prompted her group to take a

more active role in opposing expanded seatbelt policing.

"We have never supported primary seatbelts, but we've never

been this vocal in opposition," Thompson said. "The national

conversation and context has changed so much that we think

it is literally our job to fight this stuff."