|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, April 26, 2021

More ramifications of a Grad Tax,

and more

Jump directly

to CLT's Commentary on the News

|

Most Relevant News Excerpts

(Full news reports follow Commentary)

|

|

The state constitutional amendment promoted by the

Massachusetts Teachers Association and the Service Employees

International Union to add a 4 percent surtax to all annual

income above $1 million will adversely impact a significant

number of pass-through businesses, ultimately slowing the

Commonwealth’s economic recovery from COVID-19, according to

a new study published by Pioneer Institute.

If the surtax passes, it will apply to as many as 13,430 of

the state’s pass-through entities. These are often small

businesses structured as S corporations, sole

proprietorships and partnerships, which pay taxes via their

owners’ personal returns. Proponents claim the surtax would

only affect Massachusetts’ highest-paid corporate

executives, but in reality, many independent business owners

will also be directly affected.

“The past year has been a historically difficult time for a

lot of ‘Main Street’ business owners in Massachusetts,” said

Nina Weiss, who authored “The Graduated Income Tax Trap – A

Tax on Small Businesses,” with Greg Sullivan. “This is a

time when we should be prioritizing the resilience of the

state’s economy and getting people back to work, not raising

taxes on small businesses.”

Before the pandemic, Massachusetts saw significant growth

driven by pass-through entities. From 2010 to 2018, the

number of pass-through employers in the Commonwealth grew by

11.3 percent. By 2018, they accounted for 57.1 percent of

Massachusetts’ private sector workforce. Nationally,

pass-through entities represent 95 percent of businesses....

“Promoters of the surtax always point to its impact on some

nebulous ‘millionaire,” said Pioneer Institute Executive

Director Jim Stergios. “The tax will impact many more people

and small businesses, and through them, tens of thousands of

employees. The state economy is at a crossroads, and our

elected leaders will either prioritize job creation and

investments in our future, or at the expense of recovering

small businesses, they will choose to prioritize public

sector employment, which is a relatively small portion of

the Massachusetts workforce.”

Pioneer Institute

Tuesday, April 20, 2021

The Graduated Income Tax Trap:

A Tax On Small Businesses

From 2010 to 2018, the number of pass-through employers in

the state grew by 11.3%. By 2018, they accounted for 57.1%

of Massachusetts’ private sector workforce.

“The past year has been a historically difficult time for a

lot of ‘Main Street’ business owners in Massachusetts,” said

Nina Weiss, who wrote the

Pioneer report with Greg Sullivan. “This is a time when

we should be prioritizing the resilience of the state’s

economy and getting people back to work, not raising taxes

on small businesses.”

The millionaires tax could also deter future entrepreneurs

from starting businesses here, they write in the report.

Lawmakers this session are likely to advance a ballot

initiative that would propose a constitutional amendment to

impose the surtax.

The Boston Herald

Tuesday, April 20, 2021

Massachusetts millionaires tax would ‘adversely impact’ many

small businesses: Report

It would slow the state’s recovery from COVID-19, according

to the report

As President Joe Biden makes his move to tax the rich, the

rich are getting ready to move — literally.

According to Bloomberg, Biden will propose almost doubling

the capital gains tax rate for wealthy individuals to 39.6%

to help pay for a spate of social spending, according to

people familiar with the proposal.

For those earning $1 million or more, the new top rate,

coupled with an existing surtax on investment income, means

that federal tax rates for wealthy investors could be as

high as 43.4%.

Hikes such as this have been anticipated by top bracketeers

since Biden won the 2020 election, sparking speculation and

exploration of leaving to more tax-friendly countries.

The number of US citizens looking to renounce nationality

will increase “dramatically” an adviser handling high net

worth individuals told

WealthBriefing.com....

According to Americans Overseas, a Europe-based organization

specializing in U.S. tax preparation, a record 6,705

Americans gave up their citizenship in 2020, up by 260% from

2019.

As the number of wealthy individuals thins as more seek to

avoid being in the high tax bull’s-eye, the question then

becomes who to soak next to pay for new social programs?

The middle class should sleep with one eye open.

A Boston Herald editorial

Friday, April 23, 2021

When the taxes move higher, the taxed get moving

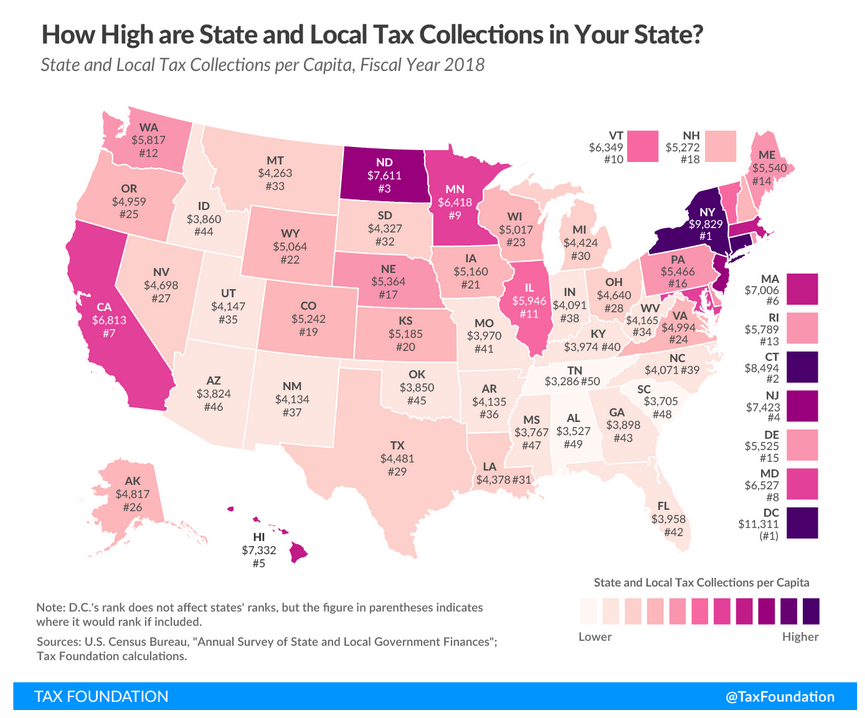

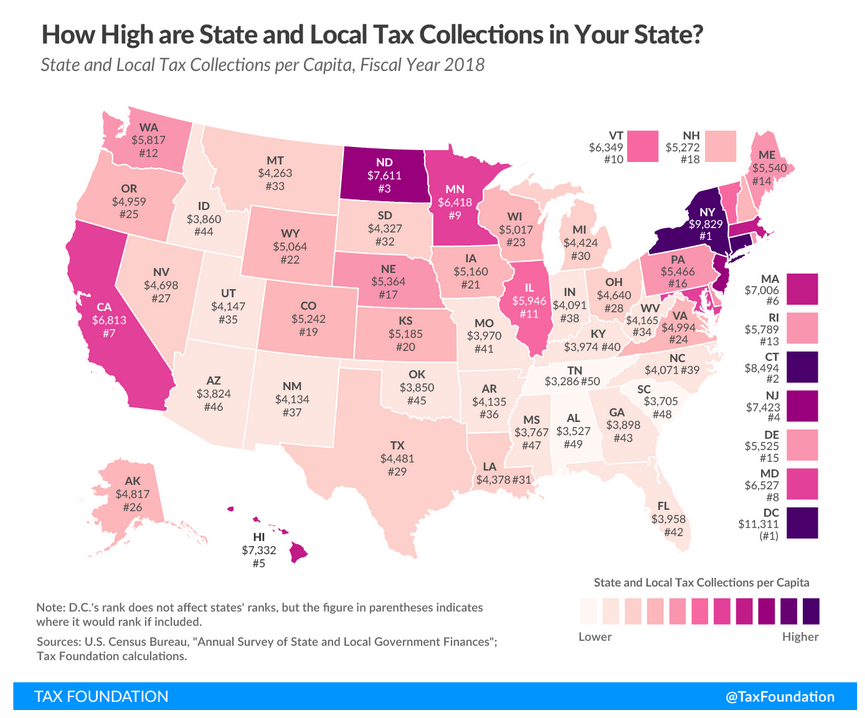

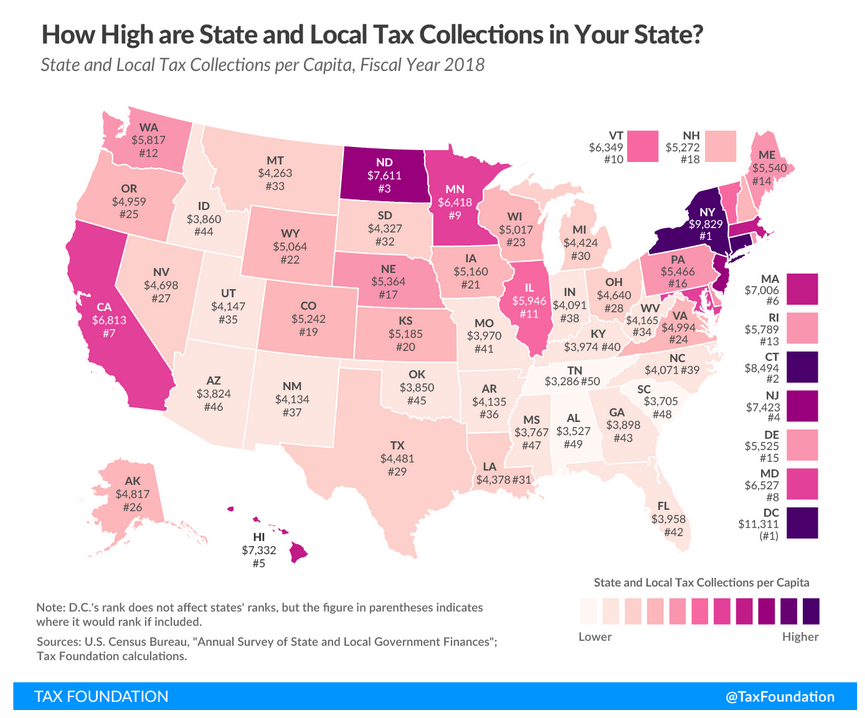

If you live in Massachusetts, odds are you pay a lot more in

state and local taxes than the average American does.

Massachusetts residents ranked sixth in state and local

taxes paid in fiscal year 2018, according to

data released by the Tax Foundation last week. The

average Bay Stater paid $7,006 in state and local taxes.

That also ranked second among New England states. Only

Connecticut ranked ahead ($8,494) — and second in the

country overall.

“As state lawmakers begin the budget process, they should be

cautious that Massachusetts taxpayers are already among the

most generous in New England and in the country,”

Massachusetts Fiscal Alliance spokesman Paul Craney said in

a press release on the matter. “Even if State House leaders

do not include any new tax hikes in this year’s budget, our

taxpayers are already stretched thin. Sustained increases in

state spending, continued refusals to make state government

more efficient, and no tax relief are all contributing

factors to Massachusetts getting to this point.”

The New Boston Post

Wednesday, April 21, 2021

Massachusetts Residents Have One Of The Highest Tax Burdens

In The Country

Since MassFiscal was founded in 2012, we have sounded the

alarm to the state’s rapid level of growth under former

Speaker Robert DeLeo and now it appears Speaker Ron Mariano

will follow in his footsteps. Speaker Mariano was first

sworn into office in 1992, and for nearly 29 years he has

consistently voted to increase the size of state government.

He has never shown any regard for paying down the state’s

debt, lowering the cost of doing business or living in

Massachusetts. Last week, Speaker Mariano’s House Ways and

Means Committee released its first initial state budget

coming in at $47.6 billion. That puts the total at $1.3B, or

a 2.6% increase over last year’s spending according to The

Massachusetts Taxpayers Foundation.

Speaker Mariano is a career politician who voted for the

controversial 2017 pay raise and he’s seen his

taxpayer-funded paycheck increase nearly 64% during the last

five years. In comparison, the state budget has increased

over 20% during that time. It is clear, the leadership may

change, but their insatiable appetite for spending taxpayer

money never changes.

A big question we anticipate every year during budget season

tends to be “Are there any new taxes?” Luckily, for now, we

can say no. So, how is Speaker Mariano going to pay for his

hefty new budget? He relies on the continued increases in

tax revenue collections (56.6% of total budget resources),

as well as some increased reimbursements from the Biden

administration....

Last year, the state dipped into the rainy-day fund, as no

one knew what the early days of the pandemic would bring.

However, the state collected more tax money than what they

anticipated and now the Biden administration is showering

Massachusetts with billions of dollars.

Speaker Mariano and his leadership team should never

consider continuing the practice of increasing state

spending and dipping into the state’s depleted rainy-day

fund while tax collections are coming in ahead, but they do

it because no one objects. There’s hardly any debate, let

alone transparency in the budget process.

The speaker’s budget doles out cash with some skeptical

practices like additional spending on reimbursing school

districts to help them “stabilize” for a significant

decrease in enrollment. Yes, that’s right, fewer students to

teach but more money to teach them. For the Massachusetts

Teachers’ Union and their sympathetic lawmakers, this is

economics.

Overall, if you are used to worse budgets and are thinking

“it could be worse,” well, we still have time for that. The

House is expected to debate the budget soon. If history

repeats itself, it will mean a whole lot of closed-door

horse trading and very little actual debate in the public

eye. Followed with a rubber-stamped vote of approval by the

Democratic majority and no dissent by Republican Minority

Leader Jones and his Republican leadership team. Let’s hope

I am wrong, and Jones finds a newfound courage that was

missing under the previous speaker.

The Boston Herald

Tuesday, April 20, 2021

Speaker Mariano stays course on costly mega-budgets

By Paul Craney

Quasi-state agencies — home to pay that tops $700,000 — are

viewed as “shrouded in secrecy” with many still not sharing

their payrolls with the comptroller’s office.

The Herald has just posted 16 of the quasi wages from the

likes of Massport and the Convention Center Authority to

pension and housing boards. But at least a dozen more remain

in the dark.

“The Legislature should come down very hard and require some

level of transparency,” said Greg Sullivan of the Pioneer

Institute, a former state inspector general. “These agencies

were created for a public purpose, but they consider

themselves to be above the rest of the state.”...

Pioneer’s Sullivan said he was on a task force set up by

former Gov. Deval Patrick to look into quasi-state agencies.

He was a state inspector general then, but all his

recommendations went to the Legislature — where they have

gathered dust.

“These agencies are shrouded in secrecy,” he added, “and act

as if they are a fourth branch of government.”

The Boston Herald

Tuesday, April 20, 2021

Massachusetts quasi-state agencies clock sky-high pay

Primary Enforcement of the Seat Belt Law (S-1591)

— Allows police officers

to issue tickets for seat belt violations even if the driver

is not first stopped for another violation as required under

current law. Other provisions prevent officers from

searching the vehicle or occupants solely because of the

seat belt violation and prohibit a seat belt violation from

resulting in a surcharge on motor vehicle insurance

premiums. The fine for drivers and passengers over the age

of 16 who violate the law would be increased from $25 to

$50. The current additional $25 fine on the driver for each

passenger between the ages of 12 and 16 who is not wearing a

seatbelt would also rise to $50....

“The Rite of Spring has now arrived with another mandatory

seat belt law bill,” said Chip Ford, executive

director of Citizens for Limited Taxation, who got

his start in political activism leading the ballot campaign

to repeal the non-primary seat belt law in 1986. “Like a

persistent weed it sprouts anew each spring and needs to be

eradicated,” Ford added. “Another law was immediately

proposed in 1987 and every spring thereafter until it was

again imposed in 1994, again with the promise it would never

become a primary offense. Yet that too has tenaciously

bloomed year after year. If that promise is broken, the next

step — always the goal of the insurance industry lobby —

will be imposition of the insurance surcharge. Experience

has painfully taught us the value of a legislative promise.”

Beacon Hill Roll Call

April 12-16, 2021

Primary Enforcement of the Seat Belt Law (S-1591)

The Bay State has banned civilians from purchasing or owning

assault weapons and high-capacity magazines for decades, but

companies like Smith & Wesson, headquartered in Springfield,

can still build them here and sell them elsewhere.

Backed by parents who lost children to mass shootings and

the Stop Handgun Violence organization, a group of

Democratic lawmakers launched an effort Tuesday to change

that dynamic, filing legislation that would extend the

existing assault weapon ban to cover their manufacture for

civilian use as well.

The proposal drew immediate criticism from gun ownership

advocates, who described it as misguided and insufficient to

address underlying causes of violence.

Sandy Phillips, whose daughter, Jessica Redfield Ghawi, was

killed in the Aurora shooting, said Tuesday that gun

violence victims and their families have been unable to

convince manufacturers to stop producing military-style

weapons.

"These weapons are made in your state, but they can't be

sold in your state, so in effect, Massachusetts is exporting

bloodshed to the rest of the country," Phillips said at a

virtual press conference alongside Massachusetts lawmakers.

"There are no reasons other than the pleas of Americans for

them to do anything to stop the carnage. Legislation is the

only way."

The bill (HD 4192 / SD 2588) filed Tuesday would prohibit

Massachusetts companies such as Smith & Wesson from

manufacturing assault weapons and high-capacity magazines

covered under the state's existing ban on their purchase and

possession. Anything manufactured to be sold to law

enforcement, the military or foreign governments would be

exempt from the newly proposed ban, and handguns -- which

are used in a vast majority of gun violence -- would not be

affected.

Massachusetts first implemented a state ban on assault

weapons in 1998, when a similar federal law was already in

place. In 2004, Republican Gov. Mitt Romney signed a

permanent ban into law shortly before the federal policy

expired.

Supporters described the ability of Massachusetts companies

to manufacture weapons they are banned from selling in the

state as a "loophole" in the current law. Lawmakers who

filed the new bill said banning the manufacture of most

assault weapons would help reduce the toll of gun violence,

particularly mass shootings, elsewhere in America....

Jim Wallace, executive director of the Gun Owners Action

League, said his group opposes the latest proposal and the

state's existing ban on the purchase of assault weapons.

"We oppose the ban itself because it's not based on anything

that's actually safety-related," Wallace said in an

interview on Tuesday. "It's more political agenda and what I

call social bigotry against gun owners by people who don't

understand what's going on." ...

Smith & Wesson, which did not respond to an immediate

request for comment, is one of the top firearm manufacturers

nationwide. In the most recent financial quarter, the

company reported selling more than 600,000 guns and

accessories, more than double its sales a year ago, WBUR

reported last week....

It's also unclear what impact the manufacturing ban would

have on the state's economy and jobs outlook, in large part

because the production breakdown between assault weapons and

other permissible weapons and devices is not widely known.

Asked about the chances that Smith & Wesson or another

company could leave Massachusetts in response to the bill,

Manuel Oliver, whose son, Joaquin, died in the Parkland

shooting, replied that the focus should be on saving

lives....

The bill could emerge as the center of the first major gun

control debate under House Speaker Ronald Mariano, who rose

to the top position following former Speaker Robert DeLeo's

departure in December.

Decker noted that Mariano, as majority leader, played an

important role in generating support for previous gun

control legislation, and he recently called on Congress to

follow the lead of Massachusetts and pass more restrictive

national gun laws.

State House News Service

Tuesday, April 20, 2021

State Gun Makers Accused of “Exporting Bloodshed” to the

Nation

Calls Build for Ban on Assault Weapon Manufacturing

What a snob!

Ever met someone and had that reaction? Maybe it’s the way

they hold their glass of wine, instructing you on how to

properly appreciate the aroma. Or the smug way they inform

you that actually, the artist Edward Munch’s name doesn’t

rhyme with bunch.

It could also be the way they manage to insert their

illustrative ivy league education into every conversation.

Whatever it is, when you see it you know.

Since we like to rank things here, we set out to find where

in the US snobbiness reigns prime— and where snobbery will

make you stand out like a sore thumb.

Snobbiest States:

1. Massachusetts

2. Vermont

3. Connecticut

4. New York

5. New Hampshire

6. Rhode Island

7. California

8. Oregon

9. Maine

10. Virginia

Looks like the northeast may have a smug problem.

Keep reading to see where all 50 states landed and what

makes these 10 states so snobby.

Zippia — The Career Expert

April 16, 2021

The Snobbiest States

The next time you’re scratching a lottery ticket, do raise

your pinkie — we’ve got a reputation to uphold.

According to the career site Zippia, Massachusetts is the

snobbiest state in America....

What we do have, as Zippia’s data underscores, is a large

number of elites — those with lofty degrees from A-list

colleges and well-paying careers at universities or in

politics who consider themselves more than qualified to

decide how the non-elite should live.

No wonder we drink so much wine.

A Boston Herald editorial

Wednesday, April 21, 2021

Just who are you calling snobs?

When lawmakers file into the House Chamber or tune in

virtually Monday, the next step of the budget process will

get underway as representatives plan to take up the House

Ways and Means fiscal 2022 budget proposal (H 4000). With

over 1,150 amendments filed, the debate should play out over

several days, starting with amendments that would impact the

amount of revenue the state can expect to collect next year.

Thursday's session was pro forma, without a single vote

taken. The House is back at 10 a.m. on Monday for a full

formal session.

State House News Service

Thursday, April 22, 2021

House Session Summary - Thursday, April 22, 2021

House In and Out Ahead of Next Week's Budget Debate

The situation in Plainville regarding cuts in services and

the recent decision by voters to not increase taxes to fund

those services is a great illustration of the real power and

effects of a law many people today don’t even remember and

even fewer understand — Proposition 2½.

That particular tax-cutting law was passed in the early

1980s when property taxes in local communities throughout

Massachusetts were soaring out of control. Prior to

Proposition 2½, the mayor/city council or the town meeting

in a community would vote a budget each year. The only limit

to what they could spend was whatever the legislative branch

would approve. If town meeting voted through a large tax

increase to fund projects or departments, then it was done.

Even though it was the people themselves through town

meeting that were voting these increases, it was declared

something had to be done to protect them against themselves.

So, led by a group called Citizens for Limited Taxation, a

proposal was put on the ballot limiting the total amount a

town could raise by taxation (called the tax levy) by 2½

percent each year, plus any new construction or growth the

previous year.

Some believe the 2½ percent figure was the result of

detailed study and research. But it was just a number those

petitioners felt was proper. Nowhere in their proposal was

there a mechanism for adjusting the percentage over time in

response to inflationary factors.

Today, folks in Massachusetts seem to think the 2½ percent

number was in the original state constitution, rather than

simply an arbitrary choice....

And overrides. Which in the minds of most people translates

into failure. They might as well have designated them

“Disgrace Taxes.” In this state, an override attempt is

almost universally seen as an admission of mismanagement or

malfeasance, rather than a necessary correction.

Proposition 2½ did not target spendthrift politicians who

were fleecing the local property taxpayers. The law was

aimed squarely at the citizens and taxpayers themselves.

Their power to decide their own budgets at the local

legislative level was removed. It was a one-size-fits-all

solution to 351 separate and unique problems. But it did

slow the growth of property taxes.

So now towns like Plainville too often concentrate on

staying within artificial limits rather than addressing real

needs.

And now you know why overrides aren’t called “growth

adjustments.”

The Attleboro Sun Chronicle

Monday, April 19, 2021

The story behind 2½

by Bill Gouveia

A quiet settled over Beacon Hill and the State House this

week. And for a change, it was supposed to be that way.

The rhythms of the State House, and the bars, restaurants

and lunch counters that cater to the capitol crowd, have

been off beat for more than a year. The building itself is

still closed to the public.

But as another Patriots' Day came and went without marathon

runners to cheer up Heartbreak Hill and to cheer to the

Boylston Street finish line, at least the school-vacation

lull felt familiar.

The House on Thursday literally gaveled into session,

recited the Pledge of Allegiance and adjourned, the branch's

leaders busy preparing, as they would have been prior to the

pandemic, for their annual budget debate.

More than 1,150 amendments have been proposed to the $47.6

billion spending plan that will hit the floor Monday, and

aside from encouraging remote participation, House Speaker

Ron Mariano's office is preparing for a typical multi-day

affair.

With the Legislature abiding by the school calendar, Gov.

Charlie Baker hit the road toward the end of the week after

welcoming the national champion UMass Amherst men's hockey

team to the State House on Tuesday for an outdoor

celebration of their first title....

White House senior advisor Andy Slavitt called attention on

Friday to the list, which includes every New England state

except Rhode Island, along with New Jersey, New Mexico and

Hawaii.

"All of them have turned the corner on the number of cases &

hospitalizations. Well done. Let's all get there," Slavitt

tweeted.

Incidentally, it was Rhode Island that was also getting

picked on a day earlier by the conservative Massachusetts

Fiscal Alliance as part of the group's efforts to urge Baker

to lift all remaining COVID-19 restrictions on businesses,

such as capacity limits.

New Rhode Island Gov. Dan McKee had just announced that,

like some other states in the region, the Ocean State would

gradually remove all capacity limits on businesses by

Memorial Day and eliminate the outdoor mask mandate.

"Even Rhode Island gets it. Their state is just a beach with

two US Senators," said Mass Fiscal spokesman Paul Craney.

Baker hinted that he would have more to say next week about

the next steps in the state's reopening strategy, but said

he wanted to be careful that whatever he orders next doesn't

"create a bounce in the wrong direction."

"I expect we'll have some stuff to say before the end of

April, but at this point in time ... People need to continue

to follow the rules and the guidance," Baker said.

State House News Service

Friday, April 23, 2021

Weekly Roundup - The Old Normal

Most of the Beacon Hill action next week will take place in

the House... and from wherever each representative dials in.

Though the House budget debate is returning to its usual

slot on the calendar this April, that could be one of the

only normal parts of the process as the House considers the

Ways and Means Committee's $47.65 billion budget for fiscal

year 2022, which starts July 1.

The House will gavel in at 10 a.m. Monday and expects to

begin roll call votes at 11 a.m. Representatives have been

told to plan for budget sessions starting at 10 a.m. on

Monday, Tuesday and Wednesday, and to hold Thursday and

Friday open for potential sessions. Though some lawmakers

will be present in the House Chamber, Speaker Ron Mariano's

office urged reps to participate remotely because of the

persistently high number of COVID-19 cases in Massachusetts.

The private amendment haggling sessions that used to take

place in the Members Lounge will take place remotely again

this year. Debate will begin with any amendments that would

alter the budget's revenue base before the Ways and Means

Committee begins the process of consolidating amendments

into bundles to more efficiently dispense with the

proposals.

The Massachusetts Taxpayers Foundation analyzed the 1,157

amendments that representatives suggested for the Ways and

Means Committee's spending plan. Of those amendments, 945

have a known fiscal impact. If the House were to adopt every

one of those amendments, the branch would add $1.04 billion

in additional spending during the floor debate, MTF said....

END OF SOME RESTRICTIONS?: Gov. Baker hinted Thursday that

he'll have some kind of an announcement related to personal

and economic COVID-19 restrictions to make next week.

Business groups like the Retailers Association of

Massachusetts have been clamoring for the governor to loosen

restrictions and Baker could use his speech to the Metro

South Chamber of Commerce next Friday to deliver the news.

The governors in neighboring New Hampshire, Connecticut and

Rhode Island have all made announcements about the end of

certain COVID-19 mitigation strategies -- like the

requirement to wear a mask when outdoors -- but Baker said

he remains focused on the state's vaccine rollout. "I expect

we'll have some stuff to say before the end of April, but at

this point in time ... people need to continue to follow the

rules and the guidance," he said.

New Hampshire last week allowed its public mask mandate to

expire, Connecticut announced plans to phase out all

business restrictions by May 19 and Rhode Island Gov. Daniel

McKee said Thursday he will incrementally increase capacity

limits for all businesses in the Ocean State until they are

eliminated by Memorial Day weekend....

CENSUS DATA RELEASE: The number of Congressional seats that

each state will have for the next decade will become clear

next week when the U.S. Census Bureau releases the

apportionment data that the federal government uses to

divide the 435 seats in the U.S. House of

Representatives....

After losing one seat following the 2010 Census,

Massachusetts this cycle is expected to retain its nine

House seats, all of which are currently held by Democrats.

State House News Service

Friday, April 23, 2021

Advances - Week of April 25

With states around Massachusetts beginning to loosen some of

their personal and economic COVID-19 restrictions, Gov.

Charlie Baker said Thursday that the state's vaccination

program remains his top priority, though he'll likely have

more to say about reopening by the end of the month.

New Hampshire last week dropped its public mask mandate,

Connecticut announced plans to phase out all business

restrictions by May 19 and new Rhode Island Gov. Daniel

McKee said Thursday he would incrementally increase capacity

limits for all businesses in the Ocean State until they are

eliminated by Memorial Day weekend....

"I expect we'll have some stuff to say before the end of

April, but at this point in time, I'm with the mayor. People

need to continue to follow the rules and the guidance,"

Baker responded when asked about reopening after a tour of a

Berkshire regional vaccinate site with Pittsfield Mayor

Linda Tyer.

Jon Hurst, president of Retailers Association of

Massachusetts, recently argued that with Massachusetts among

the national leaders in vaccinations the state should roll

back all remaining business restrictions by Memorial Day.

State House News Service

Thursday, April 22, 2021

Further Reopening Not Top-of-Mind for Baker

Guv 'Going to Continue to Press' for More Vaccine Doses

Too bad the movie title “Groundhog Day” is already taken,

because it would be the perfect description of a film about

Gov. Charlie Baker’s endless reruns of self-pitying,

sanctimonious, delusional, hysterical, disingenuous press

conferences.

For my radio show, I’ve collected hundreds of sound cuts

from the bumbling beta male who Joe Biden calls Charlie

Parker, or the stiff who Sen. Ed Markey calls Charlie Bacon.

Parker says the same thing, over and over and over again.

But nothing ever changes. The goal posts keep shifting....

He sounds like LBJ babbling about Vietnam. Yet Charlie Baker

never gets called out on any of this. His handling of this

has been a disaster at every turn, yet he brags about his

managerial prowess, and the amen chorus that is the Boston

media laps it up with a spoon....

On Sept. 9, 2020, Charlie delivered at least his fifth

update on COVID-19’s vacation status.

“As we’ve said, COVID didn’t take the summer off and we

don’t expect it to take off the fall, either. We’ll still be

fighting until there’s a treatment or a vaccine.”

Now, of course, the vaccine won’t be nearly enough. On

Thursday, Charlie Parker changed the rules yet again and

said his subjects will all be needing a booster because,

well, the show must go on.

Just as we can’t even begin to think about dismantling the

police state apparatus — it all depends on the variants, or

is it mutants, or is it double mutant-variants? ...

It’s getting warmer, right? People — excuse me, “folks” —

just want to relax and enjoy themselves, especially since

the only real danger they face is from Charlie’s senseless

lockdowns and Karen vigilantes.

So Charlie keeps shouting out his diktats — fun is still

verboten in Maskachusetts, comrades! You must remain

miserable and afraid — or else!

“Don’t let a few nice days step on that!”

That was May 25, 2020.

“We do need to be vigilant and keep our guard up with regard

to COVID generally as the weather gets nicer.”

That was March 17, 2021.

On Feb. 18, 2021, Bacon said his hair was on fire. Surely,

given his mendacity over the past year, he meant to say his

pants were on fire. But of all the hundreds of whoppers he’s

put out over the last 14 months, this one from Dec. 15,

2020, may be the biggest:

“I can’t emphasize enough that this is not forever. This is

once. One time, one month, one year.”

Would that it were, as John Kerry used to say — would that

it were. Actually, we are now in the second year, the 14th

month of this farce and it totally feels like forever.

When will Groundhog Day Part II ever end?

The Boston Herald

Sunday, April 25, 2021

Massachusetts in coronavirus ‘Groundhog Day’ with Charlie

Baker

By Howie Carr |

Chip Ford's CLT

Commentary

Last Monday Pioneer

Institute released another of its reports after studying the latest

incarnation of a graduated income tax constitutional amendment, aka the

"Millionaires Tax," or "Fair Share Amendment. Pioneer is doing a

masterful job of digging deep into its ramifications if ever adopted.

This morning before getting back to work on this Update started on

Saturday I checked my email and found another Pioneer report released

today ("Study Warns Massachusetts Tax Proposal Would Deter Investment,

Stifling the 'Innovation Economy'”). I want to get this Update out

ASAP so will report to you on the newest report next week later.

In its report released

last week ("The Graduated Income

Tax Trap: A Tax On Small Businesses) Pioneer Institute found:

The state constitutional amendment promoted by

the Massachusetts Teachers Association and the Service Employees

International Union to add a 4 percent surtax to all annual income

above $1 million will adversely impact a significant number of

pass-through businesses, ultimately slowing the Commonwealth’s

economic recovery from COVID-19, according to a new study published

by Pioneer Institute.

If the surtax passes, it will apply to as many

as 13,430 of the state’s pass-through entities. These are often

small businesses structured as S corporations, sole proprietorships

and partnerships, which pay taxes via their owners’ personal

returns. Proponents claim the surtax would only affect

Massachusetts’ highest-paid corporate executives, but in reality,

many independent business owners will also be directly affected.

“The past year has been a historically

difficult time for a lot of ‘Main Street’ business owners in

Massachusetts,” said Nina Weiss, who authored “The Graduated Income

Tax Trap – A Tax on Small Businesses,” with Greg Sullivan. “This is

a time when we should be prioritizing the resilience of the state’s

economy and getting people back to work, not raising taxes on small

businesses.”

Before the pandemic, Massachusetts saw

significant growth driven by pass-through entities. From 2010 to

2018, the number of pass-through employers in the Commonwealth grew

by 11.3 percent. By 2018, they accounted for 57.1 percent of

Massachusetts’ private sector workforce. Nationally, pass-through

entities represent 95 percent of businesses....

“Promoters of the surtax always point to its

impact on some nebulous ‘millionaire,” said Pioneer Institute

Executive Director Jim Stergios. “The tax will impact many more

people and small businesses, and through them, tens of thousands of

employees. The state economy is at a crossroads, and our elected

leaders will either prioritize job creation and investments in our

future, or at the expense of recovering small businesses, they will

choose to prioritize public sector employment, which is a relatively

small portion of the Massachusetts workforce.”

A Boston Herald

editorial on Tuesday ("Massachusetts

millionaires tax would ‘adversely impact’ many small businesses:

Report") noted:

From 2010 to 2018, the number of

pass-through employers in the state grew by 11.3%. By

2018, they accounted for 57.1% of Massachusetts’ private

sector workforce.

“The past year has been a

historically difficult time for a lot of ‘Main Street’

business owners in Massachusetts,” said Nina Weiss, who

wrote the

Pioneer report with Greg Sullivan. “This is a time

when we should be prioritizing the resilience of the

state’s economy and getting people back to work, not

raising taxes on small businesses.”

The millionaires tax could also

deter future entrepreneurs from starting businesses

here, they write in the report.

Lawmakers this session are likely

to advance a ballot initiative that would propose a

constitutional amendment to impose the surtax.

Beacon Hill pols'

insatiable gluttony for always more taxes regardless of economic

consequences will inevitably bring on the collapse of the Commonwealth

of Massachusetts.

The Washington DC-based

Tax Foundation released a

report last week as well comparing tax burdens in the fifty states.

Massachusetts ranked sixth-highest in the nation at

$7,006 in state and local taxes per average Massachusetts resident.

In all of the New England states only Connecticut was worse, at $8,494

per Nutmeg State resident.

The New Boston Post reported on Wednesday ("Massachusetts

Residents Have One Of The Highest Tax Burdens In The Country"):

If you live in Massachusetts, odds

are you pay a lot more in state and local taxes than the

average American does.

Massachusetts residents ranked

sixth in state and local taxes paid in fiscal year 2018,

according to

data released by the Tax Foundation last week. The

average Bay Stater paid $7,006 in state and local taxes.

That also ranked second among New England states. Only

Connecticut ranked ahead ($8,494) — and second in the

country overall.

“As state lawmakers begin the

budget process, they should be cautious that

Massachusetts taxpayers are already among the most

generous in New England and in the country,”

Massachusetts Fiscal Alliance spokesman Paul Craney said

in a press release on the matter. “Even if State House

leaders do not include any new tax hikes in this year’s

budget, our taxpayers are already stretched thin.

Sustained increases in state spending, continued

refusals to make state government more efficient, and no

tax relief are all contributing factors to Massachusetts

getting to this point.”

When I looked over the

chart and information — as I always do now

when coming across such state comparisons — I was

rewarded to find that Kentucky ranks 40th at $3,974 per resident; $3,032

less than taken from Bay State taxpayers ranked at #6. (My property tax here is

$1,400/year compared to the $6,000 I was paying to the Town of

Marblehead while a subject of Massachusetts, which alone is a savings of

$4,600 every year.) It doesn't need to be The Massachusetts Way.

In a Boston Herald

op-ed column on Tuesday ("Speaker

Mariano stays course on costly mega-budgets") MassFiscal

spokesman Paul Craney wrote:

Since MassFiscal was founded in

2012, we have sounded the alarm to the state’s rapid

level of growth under former Speaker Robert DeLeo and

now it appears Speaker Ron Mariano will follow in his

footsteps. Speaker Mariano was first sworn into office

in 1992, and for nearly 29 years he has consistently

voted to increase the size of state government. He has

never shown any regard for paying down the state’s debt,

lowering the cost of doing business or living in

Massachusetts. Last week, Speaker Mariano’s House Ways

and Means Committee released its first initial state

budget coming in at $47.6 billion. That puts the total

at $1.3B, or a 2.6% increase over last year’s spending

according to The Massachusetts Taxpayers Foundation.

Speaker Mariano is a career

politician who voted for the controversial 2017 pay

raise and he’s seen his taxpayer-funded paycheck

increase nearly 64% during the last five years. In

comparison, the state budget has increased over 20%

during that time. It is clear, the leadership may

change, but their insatiable appetite for spending

taxpayer money never changes.

A big question we anticipate every

year during budget season tends to be “Are there any new

taxes?” Luckily, for now, we can say no. So, how is

Speaker Mariano going to pay for his hefty new budget?

He relies on the continued increases in tax revenue

collections (56.6% of total budget resources), as well

as some increased reimbursements from the Biden

administration....

Last year, the state dipped into

the rainy-day fund, as no one knew what the early days

of the pandemic would bring. However, the state

collected more tax money than what they anticipated and

now the Biden administration is showering Massachusetts

with billions of dollars.

Speaker Mariano and his leadership

team should never consider continuing the practice of

increasing state spending and dipping into the state’s

depleted rainy-day fund while tax collections are coming

in ahead, but they do it because no one objects. There’s

hardly any debate, let alone transparency in the budget

process.

The speaker’s budget doles out cash

with some skeptical practices like additional spending

on reimbursing school districts to help them “stabilize”

for a significant decrease in enrollment. Yes, that’s

right, fewer students to teach but more money to teach

them. For the Massachusetts Teachers’ Union and their

sympathetic lawmakers, this is economics.

Overall, if you are used to worse

budgets and are thinking “it could be worse,” well, we

still have time for that. The House is expected to

debate the budget soon. If history repeats itself, it

will mean a whole lot of closed-door horse trading and

very little actual debate in the public eye. Followed

with a rubber-stamped vote of approval by the Democratic

majority and no dissent by Republican Minority Leader

Jones and his Republican leadership team. Let’s hope I

am wrong, and Jones finds a newfound courage that was

missing under the previous speaker.

I was called this

morning by Christian Wade, Statehouse reporter for The Salem News and

its sister newspapers, on a constitutional amendment proposed by Senate

Minority Leader Bruce Tarr (R-Gloucester) that would cap the income tax

at not more than 6.25 percent (S-23)

that is being heard today before the Joint Committee on Revenue.

What did I think about it?

I told Christian that

any cap is better than no cap, but 6.25 percent is where the "temporary"

income tax hike of 1989 was set a year later in 1990 and it took CLT two

statewide petition drives and thirty years to get it back down to 5

percent just last year. I added that besides that, the three

Republicans in the Senate and 30 in the House are not going to drive a

constitutional amendment to limit taxes through a supermajority of

tax-hungry "woke" Democrats, so aren't we really both wasting our time

discussing it?

The Boston Herald

reported on Tuesday ("Massachusetts

quasi-state agencies clock sky-high pay"):

Quasi-state agencies — home to pay that tops

$700,000 — are viewed as “shrouded in secrecy” with many still not

sharing their payrolls with the comptroller’s office.

The Herald has just posted 16 of the quasi

wages from the likes of Massport and the Convention Center Authority

to pension and housing boards. But at least a dozen more remain in

the dark.

“The Legislature should come down very hard and

require some level of transparency,” said Greg Sullivan of the

Pioneer Institute, a former state inspector general. “These agencies

were created for a public purpose, but they consider themselves to

be above the rest of the state.”...

Pioneer’s Sullivan said he was on a task force

set up by former Gov. Deval Patrick to look into quasi-state

agencies. He was a state inspector general then, but all his

recommendations went to the Legislature — where they have gathered

dust.

“These agencies are shrouded in secrecy,” he

added, “and act as if they are a fourth branch of government.”

Is there anyone out there still wondering why taxes need to

keep increasing? What'll happen to all those salaries

and gravy-train pensions when the state completely implodes,

financially collapses?

It can't

go on forever — and it won't.

My

political baptism by fire occurred in 1985-86. I was happily

wiling away my life as a freelance sign-painter without a care in the

world. A talk-radio junkie of sorts, I somehow got roped in by

WRKO's Jerry Williams to help with repealing the mandatory seat belt

law. The next thing I knew I was leading the repeal ballot

committee, starving and working around the clock for freedom.

Thirty five years later and little has changed but that I'm now

executive director of Citizens for Limited Taxation working around the

clock for taxpayers in a state I managed to escape.

Beacon Hill Roll Call reported on Friday (Week of April

12-16, 2021 — Primary Enforcement of the

Seat Belt Law [S-1591]):

Primary Enforcement of the Seat Belt Law (S-1591) —

Allows police officers to issue tickets for seat belt

violations even if the driver is not first stopped for

another violation as required under current law. Other

provisions prevent officers from searching the vehicle

or occupants solely because of the seat belt violation

and prohibit a seat belt violation from resulting in a

surcharge on motor vehicle insurance premiums. The fine

for drivers and passengers over the age of 16 who

violate the law would be increased from $25 to $50. The

current additional $25 fine on the driver for each

passenger between the ages of 12 and 16 who is not

wearing a seatbelt would also rise to $50....

“The Rite of Spring has now arrived

with another mandatory seat belt law bill,” said Chip

Ford, executive director of Citizens for Limited

Taxation, who got his start in political activism

leading the ballot campaign to repeal the non-primary

seat belt law in 1986. “Like a persistent weed it

sprouts anew each spring and needs to be eradicated,”

Ford added. “Another law was immediately proposed in

1987 and every spring thereafter until it was again

imposed in 1994, again with the promise it would never

become a primary offense. Yet that too has tenaciously

bloomed year after year. If that promise is broken, the

next step — always the goal of the insurance industry

lobby — will be imposition of the insurance surcharge.

Experience has painfully taught us the value of a

legislative promise.”

One thing certain about liberals, progressives, and

Democrats in general: They never surrender, just keep

coming back for more, more, always more, one bite at a time

if that's what it takes for however long it takes to have

their way — decades if

necessary. Mandatory seat belt laws, a graduated

income tax, whatever they lust for. "Not only no but

even Hell No!" is never acceptable for them.

Another

example of liberal intransigence was reported by the State House News

Service on Tuesday ("State Gun Makers

Accused of “Exporting Bloodshed” to the Nation —

Calls Build for Ban on Assault Weapon Manufacturing"), another

example of coming back for more, more, always more until they have it

all. It's no longer enough for them to ban firearms in The

People's Republic of Maskachusetts but now they want to ban

manufacturing of them for sale outside the state:

The Bay State has banned civilians

from purchasing or owning assault weapons and

high-capacity magazines for decades, but companies like

Smith & Wesson, headquartered in Springfield, can still

build them here and sell them elsewhere.

Backed by parents who lost children

to mass shootings and the Stop Handgun Violence

organization, a group of Democratic lawmakers launched

an effort Tuesday to change that dynamic, filing

legislation that would extend the existing assault

weapon ban to cover their manufacture for civilian use

as well.

The proposal drew immediate

criticism from gun ownership advocates, who described it

as misguided and insufficient to address underlying

causes of violence.

Sandy Phillips, whose daughter,

Jessica Redfield Ghawi, was killed in the Aurora

shooting, said Tuesday that gun violence victims and

their families have been unable to convince

manufacturers to stop producing military-style weapons.

"These weapons are made in your

state, but they can't be sold in your state, so in

effect, Massachusetts is exporting bloodshed to the rest

of the country," Phillips said at a virtual press

conference alongside Massachusetts lawmakers. "There are

no reasons other than the pleas of Americans for them to

do anything to stop the carnage. Legislation is the only

way."

The bill (HD 4192 / SD 2588) filed

Tuesday would prohibit Massachusetts companies such as

Smith & Wesson from manufacturing assault weapons and

high-capacity magazines covered under the state's

existing ban on their purchase and possession. Anything

manufactured to be sold to law enforcement, the military

or foreign governments would be exempt from the newly

proposed ban, and handguns -- which are used in a vast

majority of gun violence -- would not be affected.

Massachusetts first implemented a

state ban on assault weapons in 1998, when a similar

federal law was already in place. In 2004, Republican

Gov. Mitt Romney signed a permanent ban into law shortly

before the federal policy expired.

Supporters described the ability of

Massachusetts companies to manufacture weapons they are

banned from selling in the state as a "loophole" in the

current law.

"Mitt

Romney signed a permanent ban into law." That must have been

before he became "severely

conservative" while running as the Republican nominee for U.S.

president in 2012 — though he claimed he

was such while serving as governor of Massachusetts. What an

incredible fraud he became, but that's what gets a pass in Massachusetts

as a "Republican."

"What

a snob!" That's how Zippia — The Career Expert

reported on Massachusetts in its April 16 report "The Snobbiest States"

a new distinction for the Bay State:

What a snob!

Ever met someone and had that

reaction? Maybe it’s the way they hold their glass of

wine, instructing you on how to properly appreciate the

aroma. Or the smug way they inform you that actually,

the artist Edward Munch’s name doesn’t rhyme with bunch.

It could also be the way they

manage to insert their illustrative ivy league education

into every conversation. Whatever it is, when you see it

you know.

Since we like to rank things here,

we set out to find where in the US snobbiness reigns

prime— and where snobbery will make you stand out like a

sore thumb.

Snobbiest States:

1.

Massachusetts

2. Vermont

3. Connecticut

4. New York

5. New Hampshire

6. Rhode Island

7. California

8. Oregon

9. Maine

10. Virginia

Looks like the northeast may have a

smug problem.

Keep reading to see where all 50 states landed and

what makes these 10 states so snobby.

In defense, The Boston Herald quickly retorted in its

editorial on Wednesday ("Just

who are you calling snobs?"):

The next time you’re scratching a

lottery ticket, do raise your pinkie — we’ve got a

reputation to uphold.

According to the career site Zippia,

Massachusetts is the snobbiest state in America....

What we do have, as Zippia’s data

underscores, is a large number of elites — those with

lofty degrees from A-list colleges and well-paying

careers at universities or in politics who consider

themselves more than qualified to decide how the

non-elite should live.

No wonder we drink so much wine.

As I write

the House is in formal session beginning the debate of its fiscal year

2022 state budget, along with its 1,150 proposed amendments. On

Thursday the State House News Service reported ("House

In and Out Ahead of Next Week's Budget Debate"):

When lawmakers file into the House Chamber or tune in

virtually Monday, the next step of the budget process

will get underway as representatives plan to take up the

House Ways and Means fiscal 2022 budget proposal (H

4000). With over 1,150 amendments filed, the debate

should play out over several days, starting with

amendments that would impact the amount of revenue the

state can expect to collect next year. Thursday's

session was pro forma, without a single vote taken. The

House is back at 10 a.m. on Monday for a full formal

session.

In its

Advances on Friday, the News Service added:

Most of the Beacon Hill action next

week will take place in the House... and from wherever

each representative dials in. Though the House budget

debate is returning to its usual slot on the calendar

this April, that could be one of the only normal parts

of the process as the House considers the Ways and Means

Committee's $47.65 billion budget for fiscal year 2022,

which starts July 1.

The House will gavel in at 10 a.m.

Monday and expects to begin roll call votes at 11 a.m.

Representatives have been told to plan for budget

sessions starting at 10 a.m. on Monday, Tuesday and

Wednesday, and to hold Thursday and Friday open for

potential sessions. Though some lawmakers will be

present in the House Chamber, Speaker Ron Mariano's

office urged reps to participate remotely because of the

persistently high number of COVID-19 cases in

Massachusetts.

The private amendment haggling

sessions that used to take place in the Members Lounge

will take place remotely again this year. Debate will

begin with any amendments that would alter the budget's

revenue base before the Ways and Means Committee begins

the process of consolidating amendments into bundles to

more efficiently dispense with the proposals.

The Massachusetts Taxpayers

Foundation analyzed the 1,157 amendments that

representatives suggested for the Ways and Means

Committee's spending plan. Of those amendments, 945 have

a known fiscal impact. If the House were to adopt every

one of those amendments, the branch would add $1.04

billion in additional spending during the floor debate,

MTF said.

There is

more of interest in the full news reports below, such as Gov. Baker's

resistance to loosening of his tenacious grip on pandemic control, and

Boston Herald columnist Howie Carr's reaction in his latest column,

"Massachusetts in coronavirus ‘Groundhog Day’ with Charlie Baker."

I'll leave that to you if you're interested in reading further, as

there's already enough for many to digest.

In

closing, I'm thinking of my former colleagues and our departed friends,

Barbara Anderson and Chip Faulkner.

Chip

Faulkner was always battling with his Wrentham neighbor in Norfolk and

local columnist, liberal

Bill Gouveia, so when I came across Gouveia's latest attack

on Proposition 2½ it grabbed my attention. After reading it, I

emailed him to correct his typical error. Here's his latest

column:

The Attleboro Sun

Chronicle

Monday, April 19, 2021

The story behind 2½

by Bill Gouveia

The situation in Plainville regarding cuts in

services and the recent decision by voters to not increase taxes to

fund those services is a great illustration of the real power and

effects of a law many people today don’t even remember and even

fewer understand — Proposition 2½.

That particular tax-cutting law was passed in

the early 1980s when property taxes in local communities throughout

Massachusetts were soaring out of control. Prior to Proposition 2½,

the mayor/city council or the town meeting in a community would vote

a budget each year. The only limit to what they could spend was

whatever the legislative branch would approve. If town meeting voted

through a large tax increase to fund projects or departments, then

it was done.

Even though it was the people themselves

through town meeting that were voting these increases, it was

declared something had to be done to protect them against

themselves.

So, led by a group called Citizens for

Limited Taxation, a proposal was put on the ballot limiting the

total amount a town could raise by taxation (called the tax levy) by

2½ percent each year, plus any new construction or growth the

previous year.

Some believe the 2½ percent figure was the

result of detailed study and research. But it was just a number

those petitioners felt was proper. Nowhere in their proposal was

there a mechanism for adjusting the percentage over time in response

to inflationary factors.

Today, folks in Massachusetts seem to think the

2½ percent number was in the original state constitution, rather

than simply an arbitrary choice....

And overrides. Which in the minds of most

people translates into failure. They might as well have designated

them “Disgrace Taxes.” In this state, an override attempt is almost

universally seen as an admission of mismanagement or malfeasance,

rather than a necessary correction.

Proposition 2½ did not target spendthrift

politicians who were fleecing the local property taxpayers. The law

was aimed squarely at the citizens and taxpayers themselves. Their

power to decide their own budgets at the local legislative level was

removed. It was a one-size-fits-all solution to 351 separate and

unique problems. But it did slow the growth of property taxes.

So now towns like Plainville too often

concentrate on staying within artificial limits rather than

addressing real needs.

And now you know why overrides aren’t called

“growth adjustments.”

I wrote to

Bill:

Bill, in your

column “The story behind 2½” you incorrectly asserted:

"Today,

folks in Massachusetts seem to think the 2½ percent number was

in the original state constitution, rather than simply an

arbitrary choice.

"The

question passed, and the legislature added to it an 'override

provision' which allowed communities to vote exemptions to the

limit for certain things. Hence was the concept of 'overrides'

born, and that has hung over this local area like a shroud of

doom for 40 years."

Actually Bill,

overrides were part of Proposition 2½ as drafted and presented to

the voters on the 1980 ballot. You can read it for yourself here:

http://cltg.org/cltg/Prop_2/1980_Voter_Guide.pdf

I’m always

happy to educate those who opine on our Proposition 2½.

Chip Ford

Executive Director

Citizens for Limited Taxation

I've got to think that Chipster is looking down and laughing at my

picking up his cudgel and keeping Gouveia honest.

A Twitter

post by Boston Globe columnist Jeff Jacoby was brought to my attention a

few days ago. CLT has a Twitter account but I don't have the time

to waste playing around with it, so missed this when it was put out.

It is another wonderful tribute to Barbara that I want to share with

you.

Click image above to read Jeff Jacoby's

remembrances

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports Follow

(excerpted above) |

|

Pioneer Institute

Tuesday, April 20, 2021

The Graduated Income Tax Trap:

A Tax On Small Businesses

Study Shows the Adverse Effects of Graduated Income Tax

Proposal on Small Businesses

The state constitutional amendment promoted by the

Massachusetts Teachers Association and the Service Employees

International Union to add a 4 percent surtax to all annual

income above $1 million will adversely impact a significant

number of pass-through businesses, ultimately slowing the

Commonwealth’s economic recovery from COVID-19, according to

a new study published by Pioneer Institute.

If the surtax passes, it will apply to as many as 13,430 of

the state’s pass-through entities. These are often small

businesses structured as S corporations, sole

proprietorships and partnerships, which pay taxes via their

owners’ personal returns. Proponents claim the surtax would

only affect Massachusetts’ highest-paid corporate

executives, but in reality, many independent business owners

will also be directly affected.

“The past year has been a historically difficult time for a

lot of ‘Main Street’ business owners in Massachusetts,” said

Nina Weiss, who authored

“The Graduated Income Tax Trap – A Tax on Small Businesses,”

with Greg Sullivan. “This is a time when we should be

prioritizing the resilience of the state’s economy and

getting people back to work, not raising taxes on small

businesses.”

Before the pandemic, Massachusetts saw significant growth

driven by pass-through entities. From 2010 to 2018, the

number of pass-through employers in the Commonwealth grew by

11.3 percent. By 2018, they accounted for 57.1 percent of

Massachusetts’ private sector workforce. Nationally,

pass-through entities represent 95 percent of businesses.

Academic research has confirmed that business activity among

pass-throughs is heavily influenced by tax policy. A 2000

National Bureau of Economic Research paper pointed to the

federal Tax Reform Act of 1986 as a major factor in the

modern renaissance of pass-through entities. A more recent

study of several European countries found that greater tax

progressivity is associated with lower rates of business

formation among the wealthy.

Business groups in Connecticut and New Jersey have

first-hand experience of the effects of higher income tax

rates, which can deter business owners from hiring more

employees or purchasing new equipment. Regarding the 2020

millionaires tax passed in New Jersey, the Tax Foundation

suggests that “when many businesses are struggling to

survive and meet payroll, cutting into the profits of

businesses that are staying afloat is the opposite of an

economic recovery strategy.” In 2019, Connecticut even tried

to target only pass-through businesses for an income tax

hike, stoking significant opposition from multiple trade

groups, including the Connecticut Society of CPAs.

“Promoters of the surtax always point to its impact on some

nebulous ‘millionaire,” said Pioneer Institute Executive

Director Jim Stergios. “The tax will impact many more people

and small businesses, and through them, tens of thousands of

employees. The state economy is at a crossroads, and our

elected leaders will either prioritize job creation and

investments in our future, or at the expense of recovering

small businesses, they will choose to prioritize public

sector employment, which is a relatively small portion of

the Massachusetts workforce.”

The Boston Herald

Tuesday, April 20, 2021

Massachusetts millionaires tax would ‘adversely impact’ many

small businesses: Report

It would slow the state’s recovery from COVID-19, according

to the report

By Rick Sobey

The proposed millionaires tax in Massachusetts would

“adversely impact” a significant number of small business

owners, ultimately hampering the state’s economic recovery

from the coronavirus pandemic, according to a new study

published by Pioneer Institute.

A proposed state constitutional amendment would add a 4%

surtax to all annual income above $1 million.

If the surtax passes, it would apply to as many as 13,430 of

the state’s pass-through entities — which are often small

businesses structured as S corporations, sole

proprietorships and partnerships.

“Promoters of the surtax always point to its impact on some

nebulous ‘millionaire,’ ” said Pioneer Institute Executive

Director Jim Stergios. “The tax will impact many more people

and small businesses, and through them, tens of thousands of

employees.”

From 2010 to 2018, the number of pass-through employers in

the state grew by 11.3%. By 2018, they accounted for 57.1%

of Massachusetts’ private sector workforce.

“The past year has been a historically difficult time for a

lot of ‘Main Street’ business owners in Massachusetts,” said

Nina Weiss, who wrote the Pioneer report with Greg Sullivan.

“This is a time when we should be prioritizing the

resilience of the state’s economy and getting people back to

work, not raising taxes on small businesses.”

The millionaires tax could also deter future entrepreneurs

from starting businesses here, they write in the report.

Lawmakers this session are likely to advance a ballot

initiative that would propose a constitutional amendment to

impose the surtax.

Proponents of the tax — who call it the “Fair Share

Amendment” — say the measure could bolster education and

transportation funding by $2 billion.

“The Pioneer Institute’s latest missive rehashes an old

argument for why multi-millionaires shouldn’t pay their fair

share of state taxes,” Raise Up Massachusetts, the coalition

behind the amendment, said in a statement. “It’s either

intentionally designed to mislead or the Pioneer Institute

is confused. The Fair Share Amendment wouldn’t increase the

taxes of any businesses, only a few multi-millionaire

business owners.

“The Fair Share Amendment is simple: taxpayers with total

income of more than a million dollars in a single year would

pay an extra 4 percentage points on their second million,

and every million after that,” the coalition added. “Whether

their income is from salaries, stocks, bonds or a

‘pass-through entity’ is irrelevant to the current or

proposed tax rate. Owners of S-corporations and other

pass-through entities would continue to pay income taxes

only on their business’s profits, after subtracting all its

costs.”

Residents could vote on the ballot question in November

2022.

The Boston Herald

Friday, April 23, 2021

A Boston Herald editorial

When the taxes move higher, the taxed get moving

As President Joe Biden makes his move to tax the rich, the

rich are getting ready to move — literally.

According to Bloomberg, Biden will propose almost doubling

the capital gains tax rate for wealthy individuals to 39.6%

to help pay for a spate of social spending, according to

people familiar with the proposal.

For those earning $1 million or more, the new top rate,

coupled with an existing surtax on investment income, means

that federal tax rates for wealthy investors could be as

high as 43.4%.

Hikes such as this have been anticipated by top bracketeers

since Biden won the 2020 election, sparking speculation and

exploration of leaving to more tax-friendly countries.

The number of US citizens looking to renounce nationality

will increase “dramatically” an adviser handling high net

worth individuals told

WealthBriefing.com.

David Lesperance, a Canadian-born adviser, said, “It must be

remembered that since the start of the pandemic, many U.S.

missions (where one must renounce citizenship) have been

closed or operating at a reduced capacity. For example, I

recently received an email from the U.S. Embassy in Berne,

Switzerland, saying they had a waiting list of 400 people

for renunciation appointments … and that is only one of 307

US foreign missions! So, in summary, the rate of

expatriation will continue to accelerate dramatically,” he

said.

According to Americans Overseas, a Europe-based organization

specializing in U.S. tax preparation, a record 6,705

Americans gave up their citizenship in 2020, up by 260% from

2019.

As the number of wealthy individuals thins as more seek to

avoid being in the high tax bull’s-eye, the question then

becomes who to soak next to pay for new social programs?

The middle class should sleep with one eye open.

The New Boston Post

Wednesday, April 21, 2021

Massachusetts Residents Have One Of The Highest Tax Burdens

In The Country

If you live in Massachusetts, odds are you pay a lot more in

state and local taxes than the average American does.

Massachusetts residents ranked sixth in state and local

taxes paid in fiscal year 2018, according to

data released by the Tax Foundation last week. The

average Bay Stater paid $7,006 in state and local taxes.

That also ranked second among New England states. Only

Connecticut ranked ahead ($8,494) — and second in the

country overall.

“As state lawmakers begin the budget process, they should be

cautious that Massachusetts taxpayers are already among the

most generous in New England and in the country,”

Massachusetts Fiscal Alliance spokesman Paul Craney said in

a press release on the matter. “Even if State House leaders

do not include any new tax hikes in this year’s budget, our

taxpayers are already stretched thin. Sustained increases in

state spending, continued refusals to make state government

more efficient, and no tax relief are all contributing

factors to Massachusetts getting to this point.”

The Boston Herald

Tuesday, April 20, 2021

Speaker Mariano stays course on costly mega-budgets

By Paul Craney

Since MassFiscal was founded in 2012, we have sounded the

alarm to the state’s rapid level of growth under former

Speaker Robert DeLeo and now it appears Speaker Ron Mariano

will follow in his footsteps. Speaker Mariano was first

sworn into office in 1992, and for nearly 29 years he has

consistently voted to increase the size of state government.

He has never shown any regard for paying down the state’s

debt, lowering the cost of doing business or living in

Massachusetts. Last week, Speaker Mariano’s House Ways and

Means Committee released its first initial state budget

coming in at $47.6 billion. That puts the total at $1.3B, or

a 2.6% increase over last year’s spending according to The

Massachusetts Taxpayers Foundation.

Speaker Mariano is a career politician who voted for the

controversial 2017 pay raise and he’s seen his

taxpayer-funded paycheck increase nearly 64% during the last

five years. In comparison, the state budget has increased

over 20% during that time. It is clear, the leadership may

change, but their insatiable appetite for spending taxpayer

money never changes.

A big question we anticipate every year during budget season

tends to be “Are there any new taxes?” Luckily, for now, we

can say no. So, how is Speaker Mariano going to pay for his

hefty new budget? He relies on the continued increases in

tax revenue collections (56.6% of total budget resources),

as well as some increased reimbursements from the Biden

administration.

Speaker Mariano’s budget also calls for draining a portion

of the state’s rainy-day fund to pay for the increase in

spending. This was done last year, and is being tried again

this year under the speaker’s plan. If Republican House

Minority Leader Brad Jones ever wanted to object to anything

the speaker does, this should be on the list.

Last year, the state dipped into the rainy-day fund, as no

one knew what the early days of the pandemic would bring.

However, the state collected more tax money than what they

anticipated and now the Biden administration is showering

Massachusetts with billions of dollars.

Speaker Mariano and his leadership team should never

consider continuing the practice of increasing state

spending and dipping into the state’s depleted rainy-day

fund while tax collections are coming in ahead, but they do

it because no one objects. There’s hardly any debate, let

alone transparency in the budget process.

The speaker’s budget doles out cash with some skeptical

practices like additional spending on reimbursing school

districts to help them “stabilize” for a significant

decrease in enrollment. Yes, that’s right, fewer students to

teach but more money to teach them. For the Massachusetts

Teachers’ Union and their sympathetic lawmakers, this is

economics.

Overall, if you are used to worse budgets and are thinking

“it could be worse,” well, we still have time for that. The

House is expected to debate the budget soon. If history

repeats itself, it will mean a whole lot of closed-door

horse trading and very little actual debate in the public

eye. Followed with a rubber-stamped vote of approval by the

Democratic majority and no dissent by Republican Minority

Leader Jones and his Republican leadership team. Let’s hope

I am wrong, and Jones finds a newfound courage that was

missing under the previous speaker.

— Paul Diego Craney is the

spokesperson of Massachusetts Fiscal Alliance.

The Boston Herald

Tuesday, April 20, 2021

Massachusetts quasi-state agencies clock sky-high pay

Herald has just posted 16 of the quasi wages

By Joe Dwinell

Quasi-state agencies — home to pay that tops $700,000 — are

viewed as “shrouded in secrecy” with many still not sharing

their payrolls with the comptroller’s office.

The Herald has just posted 16 of the quasi wages from the

likes of Massport and the Convention Center Authority to

pension and housing boards. But at least a dozen more remain

in the dark.

“The Legislature should come down very hard and require some

level of transparency,” said Greg Sullivan of the Pioneer

Institute, a former state inspector general. “These agencies

were created for a public purpose, but they consider

themselves to be above the rest of the state.”

The top quasi-state is Massport, home to Logan International

Airport and Boston’s massive port operation. Top pay there

goes to the $403,581 director of aviation. But 644 earned

$100,000 or more last year, payroll records show.

Massport has struggled, as have most airports, during the

pandemic with layoffs and furloughs, as the Herald reported

this past fall. But the 2020 payroll, posted to

bostonherald.com, shows 23 top managers earning $200,000 or

more.

The state’s Pension Reserves Investment Management Board, or

MassPRIM, manages the pension benefits for retired state

employees. Those jobs come with lofty pay, payroll records

show.

The top earner is the executive director, at $789,033, with

three other top executives pulling down more than $400,000

per year each, records show.

The Convention Center, MCCA, in the Seaport pays the

executive director $170,000.

The Mass Educational Financing Authority, MEFA, pays the

chief operating and financial officer $341,909, records

show. Anyone looking to finance a college loan will

recognize that agency.