|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, April 5, 2021

"Millionaires" Grad

Tax Would Hit Middle-Class Retirees

Jump directly

to CLT's Commentary on the News

|

Most Relevant News Excerpts

(Full news reports follow Commentary)

|

|

A new

study from the Pioneer Institute says the so-called

“millionaires tax” that’s regularly discussed on Beacon Hill

wouldn’t just dip into the pockets of the wealthiest few,

but would also nail middle-class people cashing out for

retirement.

“Despite its purported goal of taxing only the uber-rich,

the graduated income tax would fail to protect people of

more modest means from overtaxation on one-time

windfalls,” wrote study authors Greg Sullivan & Andrew

Mikula. “It has the ability to push those with

significant capital gains and valuable asset sales into

higher tax brackets, punishing owners of retirement nest

eggs and desirable real estate. In practice, these

‘one-time millionaires,’ who cash in on a lifetime of

work and sacrifice in anticipation of retirement,

out-number those who consistently have seven-figure

salaries or stock market windfalls.” ...

The graduated income tax proposal — dubbed the

millionaires tax” or the “fair share amendment” — would

slap an additional 4% income tax on annual income over

$1 million.

The Boston Herald

Thursday, April 1, 2021

Study says Massachusetts ‘millionaires

tax’ wouldn’t just hit the mega-rich

By Sean Philip Cotter

In recent decades, Massachusetts policymakers have

worked hard to shed the “Taxachusetts” label that

plagued the Commonwealth into the 1990s. Once at 6.25

percent, the state income tax had fallen to 5 percent by

2020, while corporate tax rates have been flat.

Massachusetts tax policy has prioritized stability and

predictability so far in the 21st century. But since

2015, a graduated income tax proposal has sought to

undermine those priorities under the guise of a “fair”

tax only on the super-wealthy.

Despite its purported goal of taxing only the uber-rich,

the graduated income tax would fail to protect people of

more modest means from overtaxation on one-time

windfalls. It has the ability to push those with

significant capital gains and valuable asset sales into

higher tax brackets, punishing owners of retirement nest

eggs and desirable real estate. In practice, these

“one-time millionaires,” who cash in on a lifetime of

work and sacrifice in anticipation of retirement,

outnumber those who consistently have seven-figure

salaries or stock market windfalls.

Further, because of the tax treatment of pass-through

business income, many of these “onetime millionaires”

could be small business owners still reeling from the

economic effects of COVID-19. Now, in the midst of the

pandemic and its potentially devastating aftermath, is

not the time to burden small business owners, the core

of the state’s economy....

To understand who exactly would be affected by the

so-called “Fair Share” tax proposed by the legislature

at the behest of the MTA and the SEIU [Massachusetts

Teachers Association and the Service Employees

International Union], it is critical to ascertain how

often so-called “millionaires” earn $1 million or more

in a year. Fortunately, the Tax Foundation’s data on the

persistence of millionaires allows us to do just that.

According to the Tax Foundation’s “Income Mobility and

the Persistence of Millionaires, 1999 to 2007,” fully

half of U.S. taxpayers who reported gross annual income

of $1 million or more at least once over a nine-year

period did so only once. Nearly two-thirds did so two or

fewer times, and almost three-quarters did so three or

fewer times. Fewer than 20 percent did so in a majority

of the nine years and fewer than 6 percent earned $1

million or more every year.

This data exposes a potential vulnerability of the

proposed graduated income tax, showing it to be more of

a “retirement tax,” as many people rely on recouping the

value from home equity or a stake in a business to pay

for their retirement. In fact, Massachusetts displays

the very same concentration of “one-time millionaires.”

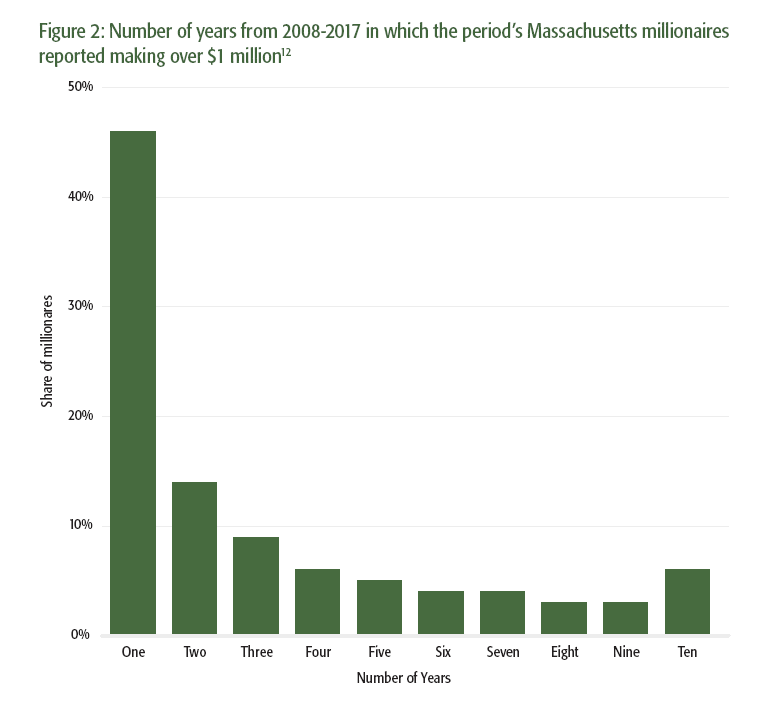

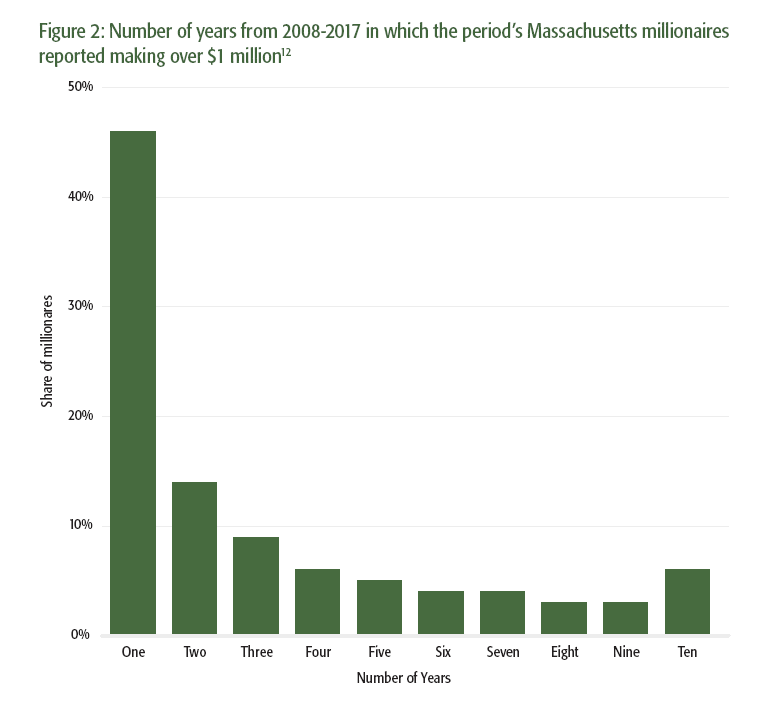

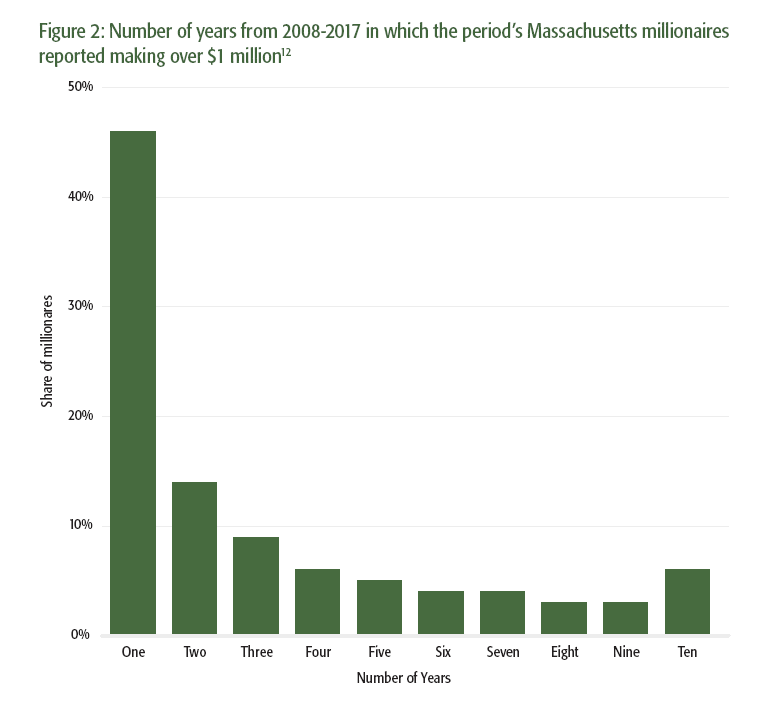

In the Commonwealth, 46 percent of households with

incomes over $1 million did so only once in 10 years and

fully 60 percent did so twice or less in the 10-year

period ended in 2017 (see Figure 2).

This data alone does not prove that many “millionaires”

are retirees, or whether those who are using the income

to pay for retirement try to avoid taxes on that income.

However, other IRS data shows that after similar

graduated income tax levies passed in other states,

out-migration exploded among people of retirement age.

The so-called “Fair Share” tax would apply to — and

dampen the retirement plans of — a significant number of

people who worked a lifetime and who are not consistent

millionaires....

Pioneer Institute

The Graduated Income Tax Trap: A

retirement tax on small business owners

April 1, 2021

The welfare-industrial complex has a very simple theory

about why they’re finally going to pass the graduated

income tax in Massachusetts next year: They believe that

after 60 years, they have at last succeeded in dumbing

down the state electorate to the point that a majority

will actually vote against their own best interests — to

impoverish themselves.

Sadly, the hacks are probably correct.

This time around, the soak-the-middle-class scheme has

been rebranded as a “millionaires tax,” because

supposedly only taxpayers who will have their state

income taxes jacked up from 5% to 9% a year are those

making over a million dollars a year.

And the extra billions, which will only come from people

making a lot more money than you, will go to really

worthy projects, like “infrastructure” and education —

“for the children,” don’t you know.

Wink wink, nudge nudge....

That ignorance is what the hackerama is banking on. They

think at least 50%-plus one of the state’s voters are in

fact that feeble-minded. And the evidence backs them up.

The non-working classes have been diligently attempting

to impose this graduated-income tax on the commonwealth

since 1962. Consider the declining results for the

productive classes.

In 1962, the same year that a Massachusetts native, JFK,

pushed through a federal tax cut by pointing out that “a

rising tide lifts all boats,” his home-state

constituents rejected the proposed state tax increase,

83-17.

In 1968 the hacks tried again — 70% voted thumbs down.

In 1972, even as Massachusetts was the only state to

vote for acid, amnesty and abortion, 67% said no new

taxes.

In 1976, the payroll patriots tried again. No — 73%.

In 1994 — the taxpaying majority (64.6%) once more voted

no.

In 2018, the hackerama tried to put the Trojan horse

back on the ballot via some back-door maneuver. But the

Supreme Judicial Court, hardly a bulwark against lunacy

of any sort, told Beacon Hill to forget about it.

For those of you keeping score at home, that makes the

hackerama 0-6. But like an antibiotic-resistant STD, the

graduated-income tax is baaaaaaack again, one

legislative vote away from being back on the ballot in

2022.

The Pioneer Institute put out a new study last week,

stressing the obvious: “’Millionaires’ tax’ wouldn’t

just hit the mega-rich.’”

But is anyone paying attention anymore? That’s the

problem....

Of course, should the hacks finally win on their seventh

try, we will be told that the new, higher tax rate is

“settled law,” and should never, ever be tampered with

again by anything so unseemly as a repeal effort.

And even if the electorate did eventually vote to

repeal, the legislature would probably ignore it.

Remember Mike Dukakis’ “temporary” income tax increase

of 1989? By 2000, the voters repealed the “temporary”

law in a landslide, 60-40, but the rate didn’t go back

down to 5% until 30 years after its “temporary”

enactment....

If you’ve always dreamed of being a millionaire, just

vote for the “millionaires tax,” because by 2024 at the

latest, you will indeed be a millionaire — at least for

Massachusetts tax purposes. Once the graduated income

tax is on the books, they can pick off everybody who

works for a living, one income quintile at a time.

There’s an old saying: “Don’t tax you, don’t tax me. Tax

that guy behind the tree.”

In Maskachusetts in 2023, that guy behind the tree will

run away. Then the tree itself will be chopped down.

Then anyone who can’t run away will be chopped down, and

fed into an economic wood chipper.

That is the one promise the hacks will keep —

guaranteed.

The Boston Herald

Saturday, April 3, 2021

Massachusetts electorate’s ignorance

might just get ‘millionaires tax’ passed

By Howie Carr

Department of Revenue is expected to announce March tax

collections [on Monday]. DOR expects that it will

collect $2.413 billion in taxes in March, which would be

a drop of $246 million from March 2020, but actual

collections have been shattering the agency's benchmarks

in recent months....

Now eight months through fiscal year 2021, Massachusetts

state government has collected $19.527 billion in taxes

from people and businesses, which is $1.123 billion or

6.1 percent more than it did during the same eight

pre-pandemic months of fiscal year 2020....

DOR considers March a "mid-size month" for tax

collections, usually ranking sixth out of the 12 months.

Through March 15, DOR had already collected $1.689

billion, which is up $107 million or 6.7 percent

compared to the same half month period in March 2020.

State House News Service

Friday, April 2, 2021

Advances - Week of April 4, 2021

One of the great puzzles of the past year is that the

world was devastated by a plague and Massachusetts tax

revenues were...pretty much OK. Month after month, the

state is collecting far more money than expected,

dissolving initial fears of a multi-billion dollar

deficit and leading to a new realization that state

finances are relatively healthy.

This remarkable turn-of-events raises two fundamental

questions. First, how have state tax revenues held up so

well amid the lockdowns, joblessness, and main street

woes? Second, should experts and policy wonks have

foreseen this surprising outcome? ...

Between April and June, the state did experience a

sizable drop in tax revenue.

But an unexpected thing happened when spring turned to

summer and the state's new fiscal year (FY 2021) began.

Monthly reports from the Department of Revenue started

showing relatively healthy-looking tax collections. And

far from a temporary blip, that overperformance has

continued right up to the present.

As of the end of February, Massachusetts is on pace to

collect $31.5 billion, vastly more tax revenue than

expected — indeed, more than we were collecting before

the pandemic struck.

Why did tax revenues remain strong? ...

Between stimulus checks, PPP loans, bailouts for

hard-hit sectors, public health spending, and a host of

other cash infusions, federal aid has helped sustain

people's incomes and encourage spending. And in that

way, it also bolstered the state tax system.

Consider the state income tax. For tax purposes,

unemployment benefits generally count as income, just

like a paycheck. So when the federal government

introduced expanded unemployment insurance — with many

laid-off workers receiving more money in benefits than

they ever received from their jobs — that raised state

income tax receipts. (More recently, the state has

decided to refund some of these taxes paid on

unemployment benefits — not least because other revenue

streams are returning.)

Or, think about what people do when they get money from

the federal government, be it through unemployment

benefits, direct stimulus checks, or a paycheck

backstopped by PPP loans. They turn around and spend

some of that money at local grocery stores and online

marketplaces, which generates sales tax for

Massachusetts....

Why couldn't we foresee it? ...

Trouble is, the early pessimism wasn't just wrong but

enduringly so. It was a stake we had put in the ground,

and even when monthly updates showed surprisingly strong

tax revenues, we still felt tied to that stake.

Perhaps the best example is the notion — heard echoing

through the virtual corridors of the State House last

fall — that the real challenge was going to be next year

(FY22). We had predicted a catastrophe; and if tax

collections didn't actually look catastrophic, that only

proved the real emergency was still out there somewhere,

waiting to derail us....

Pretty soon, last year's deficit fears will seem like

ancient history. But when economic uncertainty returns,

as we all know it will, I hope we remember some of the

lessons of this pandemic year: keep an eye on the feds;

slow the process down; don't expect the next recession

to look like the last one.

But I also hope that forecasters — myself included — are

quicker to incorporate new information and more ready to

regularly share their shifting sense of what's going on.

CommonWealth Magazine

Sunday, April 4, 2021

Why tax forecasts during COVID

have been so wrong

The heating oil industry is fired up about a proposal to

take away energy-efficiency rebates from its customers

as part of a state-led effort to wean homeowners off

fossil fuels.

At issue are priorities endorsed March 24 by the Energy

Efficiency Advisory Council that include phasing out

Mass Save rebates for new oil-fired systems for heat and

hot water, as well as no-interest loans for homeowners

to install them, as soon as January. Rebates for natural

gas-fired and propane installations would be ratcheted

back significantly.

“It’s simply not fair,” said Michael Ferrante, president

of the Massachusetts Energy Marketers Association. “I

wouldn’t say it’s going to cripple the industry. But

it’s going to hurt us. And it’s going to hurt heating

oil customers.”

The proposal from the council, which is chaired by the

state energy resources commissioner, follows

recommendations issued by the Baker administration in

December for Massachusetts to reach “net-zero” carbon

emissions by 2050. The changes also line up with

aggressive goals to reduce greenhouse gas emissions that

were included in a sweeping climate law passed by the

Legislature and signed by Governor Charlie Baker last

week. One provision allows municipalities to adopt

net-zero building codes for new construction, which

could effectively block fossil-fuel hookups in future

projects.

Significant changes in how buildings are heated will be

needed if Massachusetts is to reach its 2050 emissions

goal. State officials and environmentalists hope to

encourage the use of electric heat pumps in homes and

discourage fossil fuels. The ramifications could be huge

for the 700,000-plus homeowners in the state who use

heating oil — as well as for the companies that serve

them.

Massachusetts electricity rates, meanwhile, are among

the highest in the United States, nearly double the

national average....

Ending oil rebates is one of many proposed changes to

the Mass Save program, which is regulated by the state

and funded by surcharges on electricity and natural gas

bills. They will now be used by the state’s major

electric and natural gas utilities as they formulate a

plan for the next three years, with an eye toward

incorporating climate benefits.

The Boston Globe

Thursday, April 1, 2021

‘It’s going to hurt us’: Heating oil

industry fights effort to eliminate state’s rebates

Mass Save’s popular incentives, including no-interest

loans, could end in January

[Connecticut] Gov. Ned Lamont was warmly greeted by

Mayor Erin Stewart, the Republican who recently

announced she would not challenge Lamont for governor in

2021. On Tuesday, they had common cause — if only to a

point.

Stewart agreed to appear outside a gleaming new

apartment building constructed on a city lot that she

says was unmarketable until the construction across the

street of CTfastrak, the busway much maligned in GOP

circles.

The Republican mayor and Democratic governor each are

boosters of transit-oriented development, a popular and

politically safe approach to creating cities that are

less reliant on gasoline-powered vehicles, the largest

single source of greenhouse gases in Connecticut.

But Lamont has gone a giant step further by signing onto

a regional Transportation and Climate Initiative as a

way to reduce greenhouse gases and raise money for

transit — a concept bitterly opposed by many leaders of

Stewart’s GOP.

In promoting TCI, as the initiative is known, the Lamont

administration is working to succeed where it failed

horribly two years ago in seeking support for highway

tolls as a means to modernize Connecticut’s creaky

infrastructure....

Stewart kept her distance from TCI, which is opposed by

the leaders of the House and Senate Republican

minorities in the General Assembly....

TCI is a cap-and-invest program and will bring revenue

into the state – an estimated $89 million in 2023,

increasing to as much as $117 million in 2032.

Connecticut, Rhode Island and Massachusetts, the three

states responsible for 73% of transportation emissions

in New England, have signed a memorandum of

understanding committing to the initiative.

Legislation is necessary to go forward, and the

legislature’s Environment Committee is expected to vote

on the plan Wednesday. It is opposed by the trucking

industry and fuel marketers as an added cost to

businesses and consumers....

In public-hearing testimony this month, House Minority

Leader Vincent J. Candelora, R-North Branford, opposed

the initiative as an added cost, but he also said it

appeared that once created, TCI’s costs would have no

legislative oversight.

“Considering that the average American is struggling to

stay afloat due to the economic effects of the COVID-19

pandemic, now is not the proper time to be pursuing this

policy,” Candelora told the committee.

Senate Minority Leader Kevin Kelly of Stratford and his

deputy, Sen. Paul Formica of East Lyme, submitted joint

testimony casting themselves as committed to clean air,

if unwilling to endorse higher costs on gasoline brought

by Senate Bill 884, the TCI measure.

“We share that goal of cleaner air,” they said.

“However, we must protect middle class families’ wallets

in the process, and Senate Bill 884 does not protect

middle class families’ wallets.”

On Tuesday, Kelly said Republicans could achieve the

same goals without any added costs.

“The reality for Connecticut middle-class families is

that purchasing gasoline and food is still a necessity

and increasing taxes on both is extremely regressive,”

Kelly said. “It’s also misleading to suggest that the

TCI gas tax will lead to cleaner air in Connecticut as

states to our west are not moving forward with their own

clean air reforms.”

The Connecticut Mirror

Tuesday, March 30, 2021

Opposed by GOP, Lamont campaigns for

climate initiative

Desperate Democrats led by Attorney General Maura Healey

are flailing away at a weakened Gov. Charlie Baker in

hopes of taking back the Corner Office in 2022 for the

first time in eight years. Whether it’s working is

questionable.

Healey, flush with campaign cash and popularity within

the party, is directing a multipronged, not-so-stealth

gubernatorial campaign — ripping Baker on everything

from coronavirus vaccine delivery to opioids even though

the governor is undecided on running for a third term.

Baker is not even a cinch to win his own party’s

primary. Conservatives — including the Republican

party’s own chairman — have publicly challenged him on

moving too far liberal for their liking.

Baker’s popularity has taken a hit, according to the

most recent polling, as critics have pounced on the

state’s rocky early rollout of the COVID-19 vaccine and

failing to prioritize some vulnerable populations.

But Democrats take him for granted at their own peril.

He’s still more popular than Democratic statewide

elected officials and would have the bully pulpit of the

governor’s office throughout the 2022 campaign.

If Baker decides not to run for a third term, his

lieutenant governor, Karyn Polito, would be the early

favorite though she would likely face a stiff challenge

from the conservative wing of the party. Former state

lawmaker and failed U.S. Senate candidate Geoff Diehl is

considering a gubernatorial campaign.

On the Democratic side, Healey is clearly the party’s

first choice to eject Republicans from the governor’s

office, though other Democrats led by Somerville Mayor

Joseph Curtatone, Harvard professor Danielle Allen and

former state Sen. Ben Downing are also plotting

campaigns.

The attorney general has been crisscrossing the state —

using her publicly funded office by the way — in a

campaign-like tour of heavily Democratic areas like

Brockton and Worcester.

The Boston Herald

Monday, March 29, 2021

Desperate Democrats led by Maura

Healey flailing away at weakened Charlie Baker

No one misses Donald Trump more than Maura Healey.

Because with Trump gone, she has no one to sue.

Attorney General Healey, 50, a progressive Democrat,

sued Donald Trump close to 50 times during his four

years as president, and a made a big deal out of it each

time.

Now she is complaining about three lawsuits Republican

attorneys general have filed against President Joe

Biden, including challenging Biden’s failed immigration

policy as well as his shutting down the Keystone XL

pipeline that threw thousands out of work.

Healey, who spent the past four years trashing Trump and

his agenda, said, “Donald Trump may be out of the White

House, but Republican attorneys general across the

country are still doing his bidding and conspiring to

block President Biden’s agenda at every turn.” ...

While there is no public estimate of how much taxpayer

money Healey spent on her lawsuits against Trump — most

of which went nowhere — Healey gained a lot of publicity

for “standing up” to Trump.

Surely it would be wickedly unfashionable in the woke

world of progressives if Healey filed suit against Biden

even though he is ultimately responsible — just as Trump

was — for the sad plight, even death, of immigrant

children led to the border and abandoned by Mexican

traffickers.

But odds of the Democrat attorney general filing suit

against the Democrat president range from nil to none.

But with Trump gone as her main political target, Healey

has redirected her attention toward Gov. Baker, using

Baker’s distribution of the COVID-19 as a thin veil to

go after him. Charlie Baker has become her Donald

Trump....

The Boston Herald

Thursday, April 1, 2021

With Trump gone, Maura Healey turns ire

on Baker

By Peter Lucas

A deeply Democratic district stayed Democratic on

Tuesday — but it’s a lot less left wing than it was.

The successor to former House Speaker Robert DeLeo

(D-Winthrop) in the Massachusetts House of

Representatives will be former Winthrop town council

president Jeff Turco. The Democrat had no problem

winning the Tuesday, March 30 special general election

triggered by DeLeo’s December 2020 resignation to take a

job teaching about legislation and public policy at

Northeastern University. The seat has been vacant since

then.

The self-described “moderate” Turco trounced his two

opponents, Paul Caruccio, a Republican, of Winthrop, and

Winthrop resident Richard Fucillo, an unenrolled

candidate. Turco got 57.3 percent of the vote (1,861

votes) while Caruccio got 14.3 percent (466 votes) and

Fucillo got 14.6 percent (473 votes), according to

multiple reports....

Turco was the subject of controversy during the primary

for some of his conservative leanings.

Turco has said in the past that he voted for former

President Donald Trump in 2016. He gave money to U.S.

Senator Susan Collins (R-Maine) in 2020. He has

expressed opposition to abortion. He also has criticized

U.S. Senator Elizabeth Warren (D-Massachusetts) and

former President Barack Obama.

In response to his primary win four weeks ago, Planned

Parenthood Advocacy Fund of Massachusetts said it will

help run someone against Turco in 2022.

“Jeff Turco is dangerous and has no place on Beacon

Hill,” the fund tweeted. “And if he wins, we’ll be there

in 2022 to primary him and elect a candidate who will

champion the sexual and reproductive rights of their

community.”

The New Boston Post

Tuesday, March 30, 2021

Conservative Democrat Jeff Turco Easily

Wins State Rep Seat in Winthrop and Revere

A year ago, when it became clear the coronavirus was a

major threat to public health, Gov. Charlie Baker

declared a state of emergency and took charge by using

the executive authority of his position. He ordered

businesses shut down, schools closed and dictated mask

mandates, limits on the size of gatherings and dozens of

other restrictions on daily life and business.

The power Baker wielded – and still uses – came by way

of the 1950 Civil Defense Act, allowing him to issue

executive orders without legislative approval during a

state of emergency. And it was, without a doubt, an

emergency....

State Sen. Diana DiZoglio, D-Methuen, is one lawmaker

behind bills filed to limit the governor’s reach. She

said recently she believes the Legislature needs to

exercise oversight or review of executive orders in a

reasonable period of time.

“This is not a dictatorship,” DiZoglio told State House

News Service. “The governor has taken a top-down,

authoritative approach to the COVID-19 response and as a

result many residents have not been heard. It’s too much

for any one person and one administration to handle when

dealing with emergencies of this scale and length.”

DiZoglio is proposing a 60-day limit on the governor’s

emergency orders, requiring him to go before the House

and Senate for extensions. The Civil Defense Act doesn’t

require any such review or impose a time limit.

On the House side, Rep. Nick Boldyga, R-Southwick, filed

a bill similar to what DiZoglio proposes that would

impose a 30-day sunset on emergency orders and mandates.

Boldyga’s bill would give state courts jurisdiction to

hear cases challenging state and local emergency

orders....

The question of limiting a governor’s power during a

state of emergency isn’t unique to Massachusetts. Dozens

of state legislatures have filed more than 200 bills and

resolutions to scale back, restrict or provide more

oversight over their governors’ power during the

pandemic.

Here in the Bay State, it’s past time for the

Legislature to act in this pandemic and that means

curtailing the governor’s emergency power before they’re

needed again.

A Salem News editorial

Wednesday, March 31, 2021

Time to rein in the governor's power |

Chip Ford's CLT

Commentary

The big news this week for taxpayers

— and voters —

arrived on Thursday in a

new study

released by the Pioneer Institute on the effects of a graduated income

tax in Massachusetts, the proposed constitutional amendment called "The

Fair Share Amendment" or "Millionaires Tax. The Boston Herald

reported on Thursday ("Study says

Massachusetts ‘millionaires tax’ wouldn’t just hit the mega-rich"):

A new

study from the Pioneer Institute says the so-called

“millionaires tax” that’s regularly discussed on Beacon Hill

wouldn’t just dip into the pockets of the wealthiest few,

but would also nail middle-class people cashing out for

retirement.

“Despite its purported goal of taxing

only the uber-rich, the graduated income tax would fail to

protect people of more modest means from overtaxation on

one-time windfalls,” wrote study authors Greg Sullivan &

Andrew Mikula. “It has the ability to push those with

significant capital gains and valuable asset sales into

higher tax brackets, punishing owners of retirement nest

eggs and desirable real estate. In practice, these ‘one-time

millionaires,’ who cash in on a lifetime of work and

sacrifice in anticipation of retirement, out-number those

who consistently have seven-figure salaries or stock market

windfalls.” ...

The graduated income tax proposal —

dubbed the millionaires tax” or the “fair share amendment” —

would slap an additional 4% income tax on annual income over

$1 million.

Excerpts from Pioneer Institute study, "The

Graduated Income Tax Trap: A retirement tax on small business

owners," revealed:

In recent decades, Massachusetts

policymakers have worked hard to shed the “Taxachusetts”

label that plagued the Commonwealth into the 1990s. Once at

6.25 percent, the state income tax had fallen to 5 percent

by 2020, while corporate tax rates have been flat.

Massachusetts tax policy has prioritized stability and

predictability so far in the 21st century. But since 2015, a

graduated income tax proposal has sought to undermine those

priorities under the guise of a “fair” tax only on the

super-wealthy.

Despite its purported goal of taxing

only the uber-rich, the graduated income tax would fail to

protect people of more modest means from overtaxation on

one-time windfalls. It has the ability to push those with

significant capital gains and valuable asset sales into

higher tax brackets, punishing owners of retirement nest

eggs and desirable real estate. In practice, these “one-time

millionaires,” who cash in on a lifetime of work and

sacrifice in anticipation of retirement, outnumber those who

consistently have seven-figure salaries or stock market

windfalls.

Further, because of the tax treatment

of pass-through business income, many of these “onetime

millionaires” could be small business owners still reeling

from the economic effects of COVID-19. Now, in the midst of

the pandemic and its potentially devastating aftermath, is

not the time to burden small business owners, the core of

the state’s economy....

To understand who exactly would be

affected by the so-called “Fair Share” tax proposed by the

legislature at the behest of the MTA and the SEIU

[Massachusetts Teachers Association and the Service

Employees International Union], it is critical to ascertain

how often so-called “millionaires” earn $1 million or more

in a year. Fortunately, the Tax Foundation’s data on the

persistence of millionaires allows us to do just that.

According to the Tax Foundation’s “Income Mobility and the

Persistence of Millionaires, 1999 to 2007,” fully half of

U.S. taxpayers who reported gross annual income of $1

million or more at least once over a nine-year period did so

only once. Nearly two-thirds did so two or fewer times, and

almost three-quarters did so three or fewer times. Fewer

than 20 percent did so in a majority of the nine years and

fewer than 6 percent earned $1 million or more every year.

This data exposes a potential

vulnerability of the proposed graduated income tax, showing

it to be more of a “retirement tax,” as many people rely on

recouping the value from home equity or a stake in a

business to pay for their retirement. In fact, Massachusetts

displays the very same concentration of “one-time

millionaires.” In the Commonwealth, 46 percent of households

with incomes over $1 million did so only once in 10 years

and fully 60 percent did so twice or less in the 10-year

period ended in 2017 (see Figure 2).

This data alone

does not prove that many “millionaires” are retirees, or

whether those who are using the income to pay for retirement

try to avoid taxes on that income. However, other IRS data

shows that after similar graduated income tax levies passed

in other states, out-migration exploded among people of

retirement age. The so-called “Fair Share” tax would apply

to — and dampen the retirement plans of — a significant

number of people who worked a lifetime and who are not

consistent millionaires....

This is a new insight, one I don't

recall having been considered before. The greatest number

of victims of this "millionaires" money grab will one-time road

kill, retirees and small-business owners checking out into

retirement, selling off their lifetime-accumulated assets.

The Takers' — the usual suspects,

the teachers' union and "Woke" leftist unions

— call this "fairness."

Of course this is and has always

been just another Trojan Horse intended to slip inside the

constitutional gate to eliminate the flat-tax, in which everyone

pays the same tax rate on all income; replace it with the

long-lusted for graduated income tax with different rates on

different income brackets.

Boston Herald columnist and WRKO

radio talk host Howie Carr has a different concern

— one which should concern all of

us today. In his column on Saturday ("Massachusetts

electorate’s ignorance might just get ‘millionaires tax’

passed") he wrote:

The welfare-industrial complex has a

very simple theory about why they’re finally going to pass

the graduated income tax in Massachusetts next year: They

believe that after 60 years, they have at last succeeded in

dumbing down the state electorate to the point that a

majority will actually vote against their own best interests

— to impoverish themselves.

Sadly, the hacks are probably correct.

This time around, the

soak-the-middle-class scheme has been rebranded as a

“millionaires tax,” because supposedly only taxpayers who

will have their state income taxes jacked up from 5% to 9% a

year are those making over a million dollars a year.

And the extra billions, which will only

come from people making a lot more money than you, will go

to really worthy projects, like “infrastructure” and

education — “for the children,” don’t you know.

Wink wink, nudge nudge....

That ignorance is what the hackerama is

banking on. They think at least 50%-plus one of the state’s

voters are in fact that feeble-minded. And the evidence

backs them up.

The non-working classes have been

diligently attempting to impose this graduated-income tax on

the commonwealth since 1962. Consider the declining results

for the productive classes.

In 1962, the same year that a

Massachusetts native, JFK, pushed through a federal tax cut

by pointing out that “a rising tide lifts all boats,” his

home-state constituents rejected the proposed state tax

increase, 83-17.

In 1968 the hacks tried again — 70%

voted thumbs down.

In 1972, even as Massachusetts was the

only state to vote for acid, amnesty and abortion, 67% said

no new taxes.

In 1976, the payroll patriots tried

again. No — 73%.

In 1994 — the taxpaying majority

(64.6%) once more voted no.

In 2018, the hackerama tried to put the

Trojan horse back on the ballot via some back-door maneuver.

But the Supreme Judicial Court, hardly a bulwark against

lunacy of any sort, told Beacon Hill to forget about it.

For those of you keeping score at home,

that makes the hackerama 0-6. But like an

antibiotic-resistant STD, the graduated-income tax is

baaaaaaack again, one legislative vote away from being back

on the ballot in 2022.

The Pioneer Institute put out a new

study last week, stressing the obvious: “’Millionaires’ tax’

wouldn’t just hit the mega-rich.’”

But is anyone paying attention anymore?

That’s the problem....

Of course, should the hacks finally win

on their seventh try, we will be told that the new, higher

tax rate is “settled law,” and should never, ever be

tampered with again by anything so unseemly as a repeal

effort.

And even if the electorate did

eventually vote to repeal, the legislature would probably

ignore it. Remember Mike Dukakis’ “temporary” income tax

increase of 1989? By 2000, the voters repealed the

“temporary” law in a landslide, 60-40, but the rate didn’t

go back down to 5% until 30 years after its “temporary”

enactment....

If you’ve always dreamed of being a

millionaire, just vote for the “millionaires tax,” because

by 2024 at the latest, you will indeed be a millionaire — at

least for Massachusetts tax purposes. Once the graduated

income tax is on the books, they can pick off everybody who

works for a living, one income quintile at a time.

There’s an old saying: “Don’t tax you,

don’t tax me. Tax that guy behind the tree.”

In Maskachusetts in 2023, that guy

behind the tree will run away. Then the tree itself will be

chopped down. Then anyone who can’t run away will be chopped

down, and fed into an economic wood chipper.

That is the one promise the hacks will

keep — guaranteed.

Howie made one mistake in that

column when he wrote: "Of course, should the hacks

finally win on their seventh try, we will be told that the new,

higher tax rate is 'settled law,' and should never, ever be

tampered with again by anything so unseemly as a repeal effort."

In my Boston Herald Comment on his

column I noted:

The

graduated income tax proposal (being sold as a "millionaires

tax") is a constitutional amendment, and

constitutional amendments are not subject to repeal.

If it is

adopted and is embedded into the state constitution, it

would require the years-long and arduous process of another

constitutional amendment to make it go away.

Constitutional amendments require significant support in the

Legislature —

and an actual vote, twice over two

legislative sessions (four years)

— which

will never happen to abolish a graduated income tax.

The Legislature only supports constitutional amendments

which benefit themselves (such as the one they effortlessly

placed on the ballot providing them with automatic pay

raises, sold to low-information voters as 'preventing

legislators from ever voting themselves another pay grab').

Remember

the proposed constitutional amendment for term limits

proposed by the people after months of hard work collecting

the necessary signatures? That citizens petition saw

more dodges and weaves in the Legislature than a goat-roping

before it was blocked from making it onto the ballot:

http://cltg.org/cltg/Death_of_Term_Limits.htm

If the

state's constitutional flat tax (everyone pays the same rate

on taxable income) is ever replaced with a graduated income

tax amendment — IT WILL BE FOREVER AND WILL

INEVITABLY IMPACT ALL TAXPAYERS.

Citizens for Limited Taxation was founded in 1975 by Edward F.

King specifically to oppose the fourth assault on the state

constitution to impose a graduated income tax, which we defeated

on the 1976 ballot. The Takers came back for their

fifth attempt on the 1994 ballot where CLT again defeated its

efforts. Now they're back for their sixth assault

(seventh if the high court's 2018

rejection of it is counted).

Barbara Anderson

holding a lawn sign for CLT's successful 1994 grad tax

opposition ballot campaign

In its "Advances

- Week of April 4, 2021" the State House News Service reported

on Friday:

Department of Revenue is expected to

announce March tax collections [on Monday]. DOR expects that

it will collect $2.413 billion in taxes in March, which

would be a drop of $246 million from March 2020, but actual

collections have been shattering the agency's benchmarks in

recent months....

Now eight months through fiscal year

2021, Massachusetts state government has collected $19.527

billion in taxes from people and businesses, which is $1.123

billion or 6.1 percent more than it did during the same

eight pre-pandemic months of fiscal year 2020....

DOR considers March a "mid-size month"

for tax collections, usually ranking sixth out of the 12

months. Through March 15, DOR had already collected $1.689

billion, which is up $107 million or 6.7 percent compared to

the same half month period in March 2020.

I'm not the only one scratching my

head wondering how this can be possible despite the state's

pandemic response of shutting and locking down the economy for a

year. One of the economic soothsayer-groups which read the

tea leaves, gazes into crystal balls, and produces economic

forecasts for the year ahead upon which the state budget is set

thinks they have it figured out. Evan Horowitz, executive

director of the Center for State Policy Analysis at Tisch

College at Tufts University, wrote in CommonWealth Magazine on

Sunday ("Why tax

forecasts during COVID have been so wrong"):

One of the great puzzles of the

past year is that the world was devastated by a plague

and Massachusetts tax revenues were...pretty much OK.

Month after month, the state is collecting far more

money than expected, dissolving initial fears of a

multi-billion dollar deficit and leading to a new

realization that state finances are relatively healthy.

This remarkable turn-of-events

raises two fundamental questions. First, how have state

tax revenues held up so well amid the lockdowns,

joblessness, and main street woes? Second, should

experts and policy wonks have foreseen this surprising

outcome? ...

Between April and June, the state

did experience a sizable drop in tax revenue.

But an unexpected thing happened

when spring turned to summer and the state's new fiscal

year (FY 2021) began. Monthly reports from the

Department of Revenue started showing relatively

healthy-looking tax collections. And far from a

temporary blip, that overperformance has continued right

up to the present.

As of the end of February,

Massachusetts is on pace to collect $31.5 billion,

vastly more tax revenue than expected — indeed, more

than we were collecting before the pandemic struck.

Why did tax revenues remain strong?

...

Between stimulus checks, PPP loans,

bailouts for hard-hit sectors, public health spending,

and a host of other cash infusions, federal aid has

helped sustain people's incomes and encourage spending.

And in that way, it also bolstered the state tax system.

Consider the state income tax. For

tax purposes, unemployment benefits generally count as

income, just like a paycheck. So when the federal

government introduced expanded unemployment insurance —

with many laid-off workers receiving more money in

benefits than they ever received from their jobs — that

raised state income tax receipts. (More recently, the

state has decided to refund some of these taxes paid on

unemployment benefits — not least because other revenue

streams are returning.)

Or, think about what people do when

they get money from the federal government, be it

through unemployment benefits, direct stimulus checks,

or a paycheck backstopped by PPP loans. They turn around

and spend some of that money at local grocery stores and

online marketplaces, which generates sales tax for

Massachusetts....

Why couldn't we foresee it? ...

Trouble is, the early pessimism

wasn't just wrong but enduringly so. It was a stake we

had put in the ground, and even when monthly updates

showed surprisingly strong tax revenues, we still felt

tied to that stake.

Perhaps the best example is the

notion — heard echoing through the virtual corridors of

the State House last fall — that the real challenge was

going to be next year (FY22). We had predicted a

catastrophe; and if tax collections didn't actually look

catastrophic, that only proved the real emergency was

still out there somewhere, waiting to derail us....

Pretty soon, last year's deficit

fears will seem like ancient history. But when economic

uncertainty returns, as we all know it will, I hope we

remember some of the lessons of this pandemic year: keep

an eye on the feds; slow the process down; don't expect

the next recession to look like the last one.

But I also hope that forecasters —

myself included — are quicker to incorporate new

information and more ready to regularly share their

shifting sense of what's going on.

Oops, all the economic experts were

wrong, even more so than usual. I'm still not convinced

Horowitz has covered all the bases —

that unemployment checks make up for the shutdown of the state

economy or that "free" money from the state and Washington more

than makes up for the massive loss of economic activity.

If that's the case then much of that government bail-out

largesse is bailing out government, laundered through its

unemployed victims.

On the climate mitigation costs

front, we learned on Thursday of another cost of the progressive

jihad. The Boston Globe reported ("‘It’s

going to hurt us’: Heating oil industry fights effort to

eliminate state’s rebates"):

The heating oil industry is fired up

about a proposal to take away energy-efficiency rebates from

its customers as part of a state-led effort to wean

homeowners off fossil fuels.

At issue are priorities endorsed March

24 by the Energy Efficiency Advisory Council that include

phasing out Mass Save rebates for new oil-fired systems for

heat and hot water, as well as no-interest loans for

homeowners to install them, as soon as January. Rebates for

natural gas-fired and propane installations would be

ratcheted back significantly.

“It’s simply not fair,” said Michael

Ferrante, president of the Massachusetts Energy Marketers

Association. “I wouldn’t say it’s going to cripple the

industry. But it’s going to hurt us. And it’s going to hurt

heating oil customers.”

The proposal from the council, which is

chaired by the state energy resources commissioner, follows

recommendations issued by the Baker administration in

December for Massachusetts to reach “net-zero” carbon

emissions by 2050. The changes also line up with aggressive

goals to reduce greenhouse gas emissions that were included

in a sweeping climate law passed by the Legislature and

signed by Governor Charlie Baker last week. One provision

allows municipalities to adopt net-zero building codes for

new construction, which could effectively block fossil-fuel

hookups in future projects.

Significant changes in how buildings

are heated will be needed if Massachusetts is to reach its

2050 emissions goal. State officials and environmentalists

hope to encourage the use of electric heat pumps in homes

and discourage fossil fuels. The ramifications could be huge

for the 700,000-plus homeowners in the state who use heating

oil — as well as for the companies that serve them.

Massachusetts electricity rates,

meanwhile, are among the highest in the United States,

nearly double the national average....

Ending oil rebates is one of many

proposed changes to the Mass Save program, which is

regulated by the state and funded by surcharges on

electricity and natural gas bills. They will now be used by

the state’s major electric and natural gas utilities as they

formulate a plan for the next three years, with an eye

toward incorporating climate benefits.

Government's

punishment of undesired behavior such as how you heat and cool

you home has begun, first by removing previous incentives to

"break your will" before "turning

the screws" to crush any resistance that remains.

So far Baker's

Transportation and Climate Initiative (TCI) "boondoggle" is

spinning wheels and treading water. Of the dozen northeast

states initially considering joining his coalition only two

others have signed on — Rhode

Island and Connecticut (and the city of Washington, D.C.)

— and only Massachusetts doesn't require a

vote by its state legislature. You may recall that the

Baker administration once asserted that success of TCI depended

on reaching a "critical mass" of participating states.

There are now only three governors of the dozen invited states

that have agreed. Whether or not the other two governors

are given approval to participate by their respective

legislatures remains questionable.

The Connecticut Mirror reported last

Tuesday ("Opposed by GOP, Lamont campaigns for climate

initiative"):

. . . But [Connecticut Gov. Ned] Lamont

has gone a giant step further by signing onto a regional

Transportation and Climate Initiative as a way to reduce

greenhouse gases and raise money for transit — a concept

bitterly opposed by many leaders of Stewart’s GOP.

In promoting TCI, as the initiative is

known, the Lamont administration is working to succeed where

it failed horribly two years ago in seeking support for

highway tolls as a means to modernize Connecticut’s creaky

infrastructure....

Stewart kept her distance from TCI,

which is opposed by the leaders of the House and Senate

Republican minorities in the General Assembly....

TCI is a cap-and-invest program and

will bring revenue into the state – an estimated $89 million

in 2023, increasing to as much as $117 million in 2032.

Connecticut, Rhode Island and Massachusetts, the three

states responsible for 73% of transportation emissions in

New England, have signed a memorandum of understanding

committing to the initiative.

Legislation is necessary to go forward,

and the legislature’s Environment Committee is expected to

vote on the plan Wednesday. It is opposed by the trucking

industry and fuel marketers as an added cost to businesses

and consumers....

In public-hearing testimony this month,

House Minority Leader Vincent J. Candelora, R-North

Branford, opposed the initiative as an added cost, but he

also said it appeared that once created, TCI’s costs would

have no legislative oversight.

“Considering that the average American

is struggling to stay afloat due to the economic effects of

the COVID-19 pandemic, now is not the proper time to be

pursuing this policy,” Candelora told the committee.

Senate Minority Leader Kevin Kelly of

Stratford and his deputy, Sen. Paul Formica of East Lyme,

submitted joint testimony casting themselves as committed to

clean air, if unwilling to endorse higher costs on gasoline

brought by Senate Bill 884, the TCI measure.

“We share that goal of cleaner air,”

they said. “However, we must protect middle class families’

wallets in the process, and Senate Bill 884 does not protect

middle class families’ wallets.”

On Tuesday, Kelly said Republicans

could achieve the same goals without any added costs.

“The reality for Connecticut

middle-class families is that purchasing gasoline and food

is still a necessity and increasing taxes on both is

extremely regressive,” Kelly said. “It’s also misleading to

suggest that the TCI gas tax will lead to cleaner air in

Connecticut as states to our west are not moving forward

with their own clean air reforms.”

In the end, Gov. Baker and

Massachusetts may stand alone in support of his Transportation

and Climate Initiative — and that

is the goal of our multi-state anti-TCI coalition. Without

"critical mass" it falls flat on its face. We have another

monthly Zoom conference among our partners later today, after

which I should know more.

On the political front it's looking

more like the Democrats' candidate to run against the Baker/Polito

administration — whether that will be Charlie or Karyn —

will likely be the ambitious

Attorney General Maura Healey. The Boston Herald

reported last Monday ("Desperate Democrats led by Maura Healey

flailing away at weakened Charlie Baker"):

Desperate Democrats led by Attorney

General Maura Healey are flailing away at a weakened

Gov. Charlie Baker in hopes of taking back the Corner

Office in 2022 for the first time in eight years.

Whether it’s working is questionable.

Healey, flush with campaign cash

and popularity within the party, is directing a

multipronged, not-so-stealth gubernatorial campaign —

ripping Baker on everything from coronavirus vaccine

delivery to opioids even though the governor is

undecided on running for a third term.

Baker is not even a cinch to win

his own party’s primary. Conservatives — including the

Republican party’s own chairman — have publicly

challenged him on moving too far liberal for their

liking....

If Baker decides not to run for a

third term, his lieutenant governor, Karyn Polito, would

be the early favorite though she would likely face a

stiff challenge from the conservative wing of the party.

Former state lawmaker and failed U.S. Senate candidate

Geoff Diehl is considering a gubernatorial campaign.

On the Democratic side, Healey is

clearly the party’s first choice to eject Republicans

from the governor’s office, though other Democrats led

by Somerville Mayor Joseph Curtatone, Harvard professor

Danielle Allen and former state Sen. Ben Downing are

also plotting campaigns.

The attorney general has been

crisscrossing the state — using her publicly funded

office by the way — in a campaign-like tour of heavily

Democratic areas like Brockton and Worcester.

Boston Herald veteran political

columnist Peter Lucas observed on Thursday ("With

Trump gone, Maura Healey turns ire on Baker"):

No one misses Donald Trump more

than Maura Healey.

Because with Trump gone, she has no

one to sue.

Attorney General Healey, 50, a

progressive Democrat, sued Donald Trump close to 50

times during his four years as president, and a made a

big deal out of it each time.

Now she is complaining about three

lawsuits Republican attorneys general have filed against

President Joe Biden, including challenging Biden’s

failed immigration policy as well as his shutting down

the Keystone XL pipeline that threw thousands out of

work.

Healey, who spent the past four

years trashing Trump and his agenda, said, “Donald Trump

may be out of the White House, but Republican attorneys

general across the country are still doing his bidding

and conspiring to block President Biden’s agenda at

every turn.” ...

While there is no public estimate

of how much taxpayer money Healey spent on her lawsuits

against Trump — most of which went nowhere — Healey

gained a lot of publicity for “standing up” to Trump.

Surely it would be wickedly

unfashionable in the woke world of progressives if

Healey filed suit against Biden even though he is

ultimately responsible — just as Trump was — for the sad

plight, even death, of immigrant children led to the

border and abandoned by Mexican traffickers.

But odds of the Democrat attorney

general filing suit against the Democrat president range

from nil to none.

But with Trump gone as her main

political target, Healey has redirected her attention

toward Gov. Baker, using Baker’s distribution of the

COVID-19 as a thin veil to go after him. Charlie Baker

has become her Donald Trump....

On a politically positive note

(admittedly more difficult to find as the days pass),

former-House Speaker Bob DeLeo's seat was filled in a special

election last week and the winner was a conservative Democrat.

I didn't know any of those still existed, thought the species

was extinct.

The New Boston Post reported on Tuesday ("Conservative

Democrat Jeff Turco Easily Wins State Rep Seat in Winthrop and

Revere"):

A deeply Democratic district stayed

Democratic on Tuesday — but it’s a lot less left wing than

it was.

The successor to former House Speaker

Robert DeLeo (D-Winthrop) in the Massachusetts House of

Representatives will be former Winthrop town council

president Jeff Turco. The Democrat had no problem winning

the Tuesday, March 30 special general election triggered by

DeLeo’s December 2020 resignation to take a job teaching

about legislation and public policy at Northeastern

University. The seat has been vacant since then.

The self-described “moderate” Turco

trounced his two opponents, Paul Caruccio, a Republican, of

Winthrop, and Winthrop resident Richard Fucillo, an

unenrolled candidate. Turco got 57.3 percent of the vote

(1,861 votes) while Caruccio got 14.3 percent (466 votes)

and Fucillo got 14.6 percent (473 votes), according to

multiple reports....

Turco was the subject of controversy

during the primary for some of his conservative leanings.

Turco has said in the past that he

voted for former President Donald Trump in 2016. He gave

money to U.S. Senator Susan Collins (R-Maine) in 2020. He

has expressed opposition to abortion. He also has criticized

U.S. Senator Elizabeth Warren (D-Massachusetts) and former

President Barack Obama.

In response to his primary win four

weeks ago, Planned Parenthood Advocacy Fund of Massachusetts

said it will help run someone against Turco in 2022.

“Jeff Turco is dangerous and has no

place on Beacon Hill,” the fund tweeted. “And if he wins,

we’ll be there in 2022 to primary him and elect a candidate

who will champion the sexual and reproductive rights of

their community.”

Before you get

too excited recognize that newly-minted state Rep. Turco

was one of four candidates in the crowded primary and won

with just 36.2 percent of the vote. That pretty much made

him the heir-apparent in a Democrat stronghold district.

It would have been man-bites-dog news if anyone but the

last Democrat standing had taken the seat. Still, better a

moderate/conservative Democrat than another "Progressive."

Add The Salem News to the growing call to restrict the unbridled

power of potentially tyrannical governors of the future.

From its editorial on Wednesday ("Time to rein in the governor's

power"):

A year ago, when it became clear the

coronavirus was a major threat to public health, Gov.

Charlie Baker declared a state of emergency and took charge

by using the executive authority of his position. He ordered

businesses shut down, schools closed and dictated mask

mandates, limits on the size of gatherings and dozens of

other restrictions on daily life and business.

The power Baker wielded – and still

uses – came by way of the 1950 Civil Defense Act, allowing

him to issue executive orders without legislative approval

during a state of emergency. And it was, without a doubt, an

emergency....

State Sen. Diana DiZoglio, D-Methuen,

is one lawmaker behind bills filed to limit the governor’s

reach. She said recently she believes the Legislature needs

to exercise oversight or review of executive orders in a

reasonable period of time.

“This is not a dictatorship,” DiZoglio

told State House News Service. “The governor has taken a

top-down, authoritative approach to the COVID-19 response

and as a result many residents have not been heard. It’s too

much for any one person and one administration to handle

when dealing with emergencies of this scale and length.”

DiZoglio is proposing a 60-day limit on

the governor’s emergency orders, requiring him to go before

the House and Senate for extensions. The Civil Defense Act

doesn’t require any such review or impose a time limit.

On the House side, Rep. Nick Boldyga,

R-Southwick, filed a bill similar to what DiZoglio proposes

that would impose a 30-day sunset on emergency orders and

mandates. Boldyga’s bill would give state courts

jurisdiction to hear cases challenging state and local

emergency orders....

The question of limiting a governor’s

power during a state of emergency isn’t unique to

Massachusetts. Dozens of state legislatures have filed more

than 200 bills and resolutions to scale back, restrict or

provide more oversight over their governors’ power during

the pandemic.

Here in the Bay State, it’s past time

for the Legislature to act in this pandemic and that means

curtailing the governor’s emergency power before they’re

needed again.

"Those who fail to learn from

history are doomed to repeat it." It's too late to rectify

the heavy-handed, liberty-crushing magisterial response to the

Wuhan Chinese pandemic, but there's hope perhaps that it won't

and can't be allowed to happen again.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports Follow

(excerpted above) |

|

The Boston Herald

Thursday, April 1, 2021

Study says Massachusetts ‘millionaires tax’ wouldn’t just

hit the mega-rich

By Sean Philip Cotter

A new study from the Pioneer Institute says the so-called

“millionaires tax” that’s regularly discussed on Beacon Hill

wouldn’t just dip into the pockets of the wealthiest few,

but would also nail middle-class people cashing out for

retirement.

“Despite its purported goal of taxing only the uber-rich,

the graduated income tax would fail to protect people of

more modest means from overtaxation on one-time windfalls,”

wrote study authors Greg Sullivan & Andrew Mikula. “It has

the ability to push those with significant capital gains and

valuable asset sales into higher tax brackets, punishing

owners of retirement nest eggs and desirable real estate. In

practice, these ‘one-time millionaires,’ who cash in on a

lifetime of work and sacrifice in anticipation of

retirement, out-number those who consistently have

seven-figure salaries or stock market windfalls.”

The graduated income tax proposal — dubbed the millionaires

tax” or the “fair share amendment” — would slap an

additional 4% income tax on annual income over $1 million.

The Massachusetts Supreme Judicial Court in 2018 threw out a

move to get the measure on the ballot for a referendum, but

the proponents have kept at it, and the Legislature is

expected to vote in the coming months on whether to put it

on the ballot in 2022.

Advocates for the measure say this would require the

wealthiest few to pay their “fair share,” and that this move

could then provide funding for various state programs.

Pioneer, which tends fiscally conservative and favors

smaller government, said in the report that there could be

unintended consequences. For one, it could come down heavily

on people looking to sell property or a business and retire.

“This surtax would devastate the retirement plans of many

Massachusetts residents,” said Pioneer Institute Executive

Director Jim Stergios. “Proponents of the tax haven’t

thought about the incentive it creates to change one’s

domicile to low- or no-tax states as Massachusetts residents

approach retirement, nor the deterrent it would create to

investment.”

The report also posited that it could hinder economic

recovery efforts by discouraging investment, and it could

chase seniors out of the state.

Pioneer Institute

The Graduated Income Tax Trap: A retirement tax on small

business owners

April 1, 2021

by Andrew Mikula and Greg Sullivan

[Excerpts]

This report finds that, if passed, a constitutional amendment to

impose a graduated income tax would raid the retirement plans of

Massachusetts residents by pushing their owners into higher tax

brackets on the sales of homes and businesses. The study aims to

help the public fully understand the impact of the proposed new

tax.

Introduction

In recent decades, Massachusetts policymakers have worked hard

to shed the “Taxachusetts” label that plagued the Commonwealth

into the 1990s. Once at 6.25 percent, the state income tax had

fallen to 5 percent by 2020, while corporate tax rates have been

flat. Massachusetts tax policy has prioritized stability and

predictability so far in the 21st century. But since 2015, a

graduated income tax proposal has sought to undermine those

priorities under the guise of a “fair” tax only on the

super-wealthy.

Despite its purported goal of taxing only the uber-rich, the

graduated income tax would fail to protect people of more modest

means from overtaxation on one-time windfalls. It has the

ability to push those with significant capital gains and

valuable asset sales into higher tax brackets, punishing owners

of retirement nest eggs and desirable real estate. In practice,

these “one-time millionaires,” who cash in on a lifetime of work

and sacrifice in anticipation of retirement, outnumber those who

consistently have seven-figure salaries or stock market

windfalls.

Further, because of the tax treatment of pass-through business

income, many of these “onetime millionaires” could be small

business owners still reeling from the economic effects of

COVID-19. Now, in the midst of the pandemic and its potentially

devastating aftermath, is not the time to burden small business

owners, the core of the state’s economy.

What is the Graduated Income Tax?

For the past several years, Massachusetts has been considering a

state constitutional amendment that would levy a four percent

surtax on annual personal income over $1 million. The first

attempt to do so, filed by initiative petition, failed a

Massachusetts Supreme Judicial Court challenge in 2018 before

re-emerging as a legislative petition and receiving initial

approval at a constitutional convention in 2019. A vote on final

approval by the legislature is expected in the spring of 2021.

If passed, it will appear on the statewide ballot in the fall of

2022.

Proponents of the amendment, led by the Massachusetts Teachers

Association and the Service Employees International Union,

together with advocacy and religious groups, call it the “Fair

Share Amendment,” a nod to their frequent assertions that the

measure would require only the very wealthy to pay what

proponents believe is their “fair share” of taxes.

Opponents argue that it would endanger the long-term economic

well-being of Massachusetts by prompting high-income residents

and businesses to relocate to states that have lower income tax

rates and discouraging high-income individuals and businesses

from coming

to Massachusetts in the first place. They believe that COVID-19

may exacerbate these relocation effects, as the pandemic has

made telecommuting much more prevalent, at least in the short

term....

The impact on homeowners

The proposed surtax does not include a safeguard to prevent

capital gains from the sale of a home, after exclusion of

$250,000 for single filers or $500,000 for joint filers, on the

sale of a principal residence or long-held small business

property from pushing a taxpayer into the 9 percent tax bracket.

This is contrary to how taxes are treated at the federal level,

where capital gains cannot force a taxpayer into a higher

bracket. The graduated income tax will thus ensnare many

families few would consider to be “millionaires” who have large

amounts of capital gains in a single year due to the sale of a

long-owned home or small business.

By including capital gains in the computation of annual income

that exceeds the $1 million threshold, the graduated income tax

effectively taxes the extraordinary escalation of Massachusetts

housing prices that has occurred in recent decades. One example

of such growth occurred in the city of Cambridge, where the

median price of a single-family home has more than quadrupled in

24 years, from $327,000 in January 1996 to $1.47 million in

January 2020, while the Consumer Price Index rose by 67 percent.

Seniors and small business owners who have owned their homes or

business property for many years and are relying on decades of

appreciation upon retirement will find themselves among those

subject to the 4 percent surcharge, even if their ordinary

income otherwise falls well below the million-dollar threshold.

The Retirement Tax

To understand who exactly would be affected by the so-called

“Fair Share” tax proposed by the legislature at the behest of

the MTA and the SEIU, it is critical to ascertain how often

so-called “millionaires” earn $1 million or more in a year.

Fortunately, the Tax Foundation’s data on the persistence of

millionaires allows us to do just that. According to the Tax

Foundation’s “Income Mobility and the Persistence of

Millionaires, 1999 to 2007,” fully half of U.S. taxpayers who

reported gross annual income of $1 million or more at least once

over a nine-year period did so only once. Nearly two-thirds did

so two or fewer times, and almost three-quarters did so three or

fewer times. Fewer than 20 percent did so in a majority of the

nine years and fewer than 6 percent earned $1 million or more

every year.

This data exposes a potential vulnerability of the proposed

graduated income tax, showing it to be more of a “retirement

tax,” as many people rely on recouping the value from home

equity or a stake in a business to pay for their retirement. In

fact, Massachusetts displays the very same concentration of

“one-time millionaires.” In the Commonwealth, 46 percent of

households with incomes over $1 million did so only once in 10

years and fully 60 percent did so twice or less in the 10-year

period ended in 2017 (see Figure 2).

This

data alone does not prove that many “millionaires” are retirees,

or whether those who are using the income to pay for retirement

try to avoid taxes on that income. However, other IRS data shows

that after similar graduated income tax levies passed in other

states, out-migration exploded among people of retirement age.

The so-called “Fair Share” tax would apply to — and dampen the

retirement plans of — a significant number of people who worked

a lifetime and who are not consistent millionaires....

Conclusion

The bottom line is that individuals with consistent annual

incomes of $1 million or more are not the only ones who will be

subject to this “Fair Share” tax. Instead, included in

Massachusetts’ new top income tax bracket will be many middle

class citizens who wisely invested in a business or real estate

at the right time and merely want to remain comfortable in their

old age by cashing in on those investments. Thus, the so-called

“millionaires tax” is really a retirement tax for many who will

be subject to it in a given year, and only in part a tax on the

super-wealthy. Before the Massachusetts legislature moves this

constitutional amendment forward, the following facts must be

considered:

1. The graduated income tax proposal will take a

significant bite out of the retirement nest eggs of many

small business owners and longtime homeowners.

2. The surtax could hinder economic recovery

efforts from COVID-19 by discouraging capital investment

and making it harder for business owners to hire back

workers.

3. A sizable plurality of Massachusetts

million-dollar earners only have a seven-figure annual

income once in a 10-year period, an indication that most

people affected by the surtax will not be the uber-wealthy

technology magnates and hedge fund managers usually

associated with the term “millionaire.”

4. When California levied a similar tax hike on

high income earners in 2012, it experienced a 14-fold

increase in annual net taxable income losses due to

seniors leaving the state, amounting to nearly $1.3

billion in 2013 alone. In 2018, this number had still

failed to return to pre-tax hike levels.

Without subjecting the graduated income tax proposal to further

scrutiny, the Massachusetts legislature risks significantly

damaging the economy, spurring cycles of capital disinvestment

and lower productivity that reach all corners of the states, and

destabilizing the budgets of both the state government and

countless senior citizens.

The Boston Herald

Saturday, April 3, 2021

Massachusetts electorate’s ignorance might just get

‘millionaires tax’ passed

By Howie Carr

The welfare-industrial complex has a very simple theory about

why they’re finally going to pass the graduated income tax in

Massachusetts next year: They believe that after 60 years, they

have at last succeeded in dumbing down the state electorate to

the point that a majority will actually vote against their own

best interests — to impoverish themselves.

Sadly, the hacks are probably correct.

This time around, the soak-the-middle-class scheme has been

rebranded as a “millionaires tax,” because supposedly only

taxpayers who will have their state income taxes jacked up from

5% to 9% a year are those making over a million dollars a year.

And the extra billions, which will only come from people making

a lot more money than you, will go to really worthy projects,

like “infrastructure” and education — “for the children,” don’t

you know.

Wink wink, nudge nudge.

If you actually believe any of this, you probably still think

that Elizabeth Warren is a Cherokee princess, that Dr. Anthony