|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Sunday, February 7, 2021

"We have to break

your will . . . I can’t even say that publicly.”

Jump directly

to CLT's Commentary on the News

|

Most Relevant News Excerpts

(Full news reports follow Commentary)

|

|

The state’s

$130,000-a-year undersecretary for climate change is being

blasted by a fiscal watchdog for saying the administration

needs to “break” the will of taxpayers when it comes to

heating homes and driving cars.

The video

shows David Ismay, Gov. Charlie Baker’s Under Secretary

for Climate Change, telling Vermont climate advocates

that it’s time to go after homeowners and motorists to

help reduce emissions.

At the end of

the clip, he adds: “I can’t even say that publicly.” ...

In the video

posted by MassFiscal Alliance, Ismay says the state

needs to “break their will” and “turn the screws on”

ordinary people to force changes in their consumption of

heating fuels and gasoline. Ismay described the ordinary

people as the “person across the street” and the “senior

on fixed income.” ...

Paul Diego

Craney, spokesman for MassFiscal, said the video clip

provides a “sneak peek into the minds of regulators”

with Ismay’s choice of words.

Ismay’s direct

quote is: “So let me say that again, 60% of our

emissions that need to be reduced come from you, the

person across the street, the senior on fixed income,

right… there is no bad guy left, at least in

Massachusetts to point the finger at, to turn the screws

on, and you know, to break their will, so they stop

emitting. That’s you. We have to break your will. Right,

I can’t even say that publicly.”

The remarks

were made on January 25, 2021 at the Vermont Climate

Council meeting.

Craney added

it’s “frightening to think an official so high up in the

Baker administration is bragging to an out of state

group about the economic pain he wants to inflict on the

very people who he’s supposed to work for.”

The Boston

Herald

Friday, February 5, 2021

Charlie Baker

climate official blasted for comments to ‘break your

will’ over emissions

During the

Zoom call, Ismay said, “So let me say that again, 60

percent of our emissions that need to be reduced come

from you, the person across the street, the senior on

fixed income, right … there is no bad guy left, at least

in Massachusetts to point the finger at, to turn the

screws on, and you know, to break their will, so they

stop emitting. That’s you. We have to break your will.

Right, I can’t even say that publicly.”

The New

Boston Post

Friday, February 5, 2021

Charlie Baker Climate

Undersecretary:

State Must Break People’s Will To Reduce Climate

Emissions

MassFiscal

sharply criticized Ismay's remarks, and when Baker was

asked during a Friday press conference about the topic

he said he and Lt. Gov. Karyn Polito watched the video

in the morning and spoke to Energy and Environmental

Affairs Secretary Kathleen Theoharides about it.

Baker also

pointed to his veto last month of a wide-ranging climate

change response bill the Legislature sent him and the

concerns he raised about the costs it would create.

"First of all,

no one who works in our administration should ever say

or think anything like that," Baker said. "Secondly,

Secretary Theoharides is going to have a conversation

with him about that. And third, one of the main reasons

we didn't sign the climate bill when it got to our desk

was because we were specifically concerned about the

impact it was going to have on people's ability to pay

for many of the pieces that were in it, which means it

also doesn't represent administration policy or

position."

State House

News Service

Friday, February 5, 2021

Video Captures Climate

Official Commenting on Need to “Break” Consumers

Until now, did

you even know that the state had a $130,000-a-year

“undersecretary of climate change?”

Or that his

job description includes, in the bragging coat holder’s

own words, “breaking the will” of the working classes of

Massachusetts by raising the cost of fuel so high that

they can no longer afford to either heat their homes or

drive their cars?

Can somebody

say Transportation Climate Initiative?

Meet David

Ismay, a 49-year-old blow-in drifter and bust-out lawyer

from California who is now living the high life in a

mansion in Chestnut Hill.

Here is how

Ismay described his dream job, at a conference last

month with a bunch of similarly entitled, trust-funded

ersatz hippies from Vermont:

“Sixty percent

of our emissions that need to be reduced come from you,

the person across the street, the senior on fixed

income, right? There is no bad guy left in Massachusetts

to point the finger at, to turn the screws on and, you

know, break their will so they stop emitting.

“That’s you.

We have to break your will. Right? I can’t even say that

publicly.”

I offered

Ismay a chance to come on my radio show Friday to

discuss his stated goals of “breaking the will” of and

“turning the screws on” people who actually work for a

living....

For the last

year, Parker himself has done little else except try to

“break the will” of those who elected him, with his

hysterical overreactions to a seasonal virus that other

governors have managed to handle without decimating

their state’s economies.

This is why

Ismay still has a job today. Asked Friday about Ismay’s

dark, fascistic musings, his boss shrugged them off.

“Um,” Charlie

Parker said, “first of all, no one who works in our

administration should be saying or thinking anything

like that – ever.”

So this was

the old D.C. definition of a gaffe — inadvertently

blurting out the truth.

“Secretary

Theoharides is going to have a conversation with, um,

him about that.”

In other

words, Charlie Parker, a supercilious Harvard snot who

lives on a palatial estate in Swampscott and hasn’t lost

a single penny of his $250,000-a-year pay during the

dystopian disaster he’s authored, instructs Climate

Katie, a Dartmouth puke who lives in her own mansion in

chi-chi Arlington and likewise hasn’t given up a penny

of her $170,405.81-a-year salary, to have a chat with

the Rhodes scholar who hasn’t even bothered to change

his old cell phone number from the 510 area code in

radical-chic Berkeley, Calif.

For a year

now, all of them have been relishing this

once-in-a-lifetime opportunity to break the will of

everyone who, unlike them, wasn’t born with a silver

spoon in their mouths.

Ismay’s only

mistake was letting the cat out of the bag to a bunch of

his fellow Bernie Sanders acolytes.

The Boston

Herald

Saturday, February 6, 2021

Massachusetts climate hack fits in well

with Charlie Baker & Co.

By Howie Carr

Greg Sullivan,

the state's former inspector general and the research

director at the conservative-leaning Pioneer Institute,

said the ongoing exodus of wealth from Massachusetts to

low-tax states like Florida and New Hampshire could be

amplified in coming years.

The popularity

of new work arrangements that no longer tether workers,

or their employers, to geographic location could make it

easier for workers to seek housing or lifestyle changes

elsewhere, he said.

The outcome of

a proposed surtax on income over $1 million and a

Supreme Court case in which New Hampshire is challenging

Gov. Charlie Baker's right to tax the income of workers

living in New Hampshire, but working remotely for

Massachusetts companies, could also become factors.

"My concern

has to do with the competitiveness of the state,"

Sullivan said.

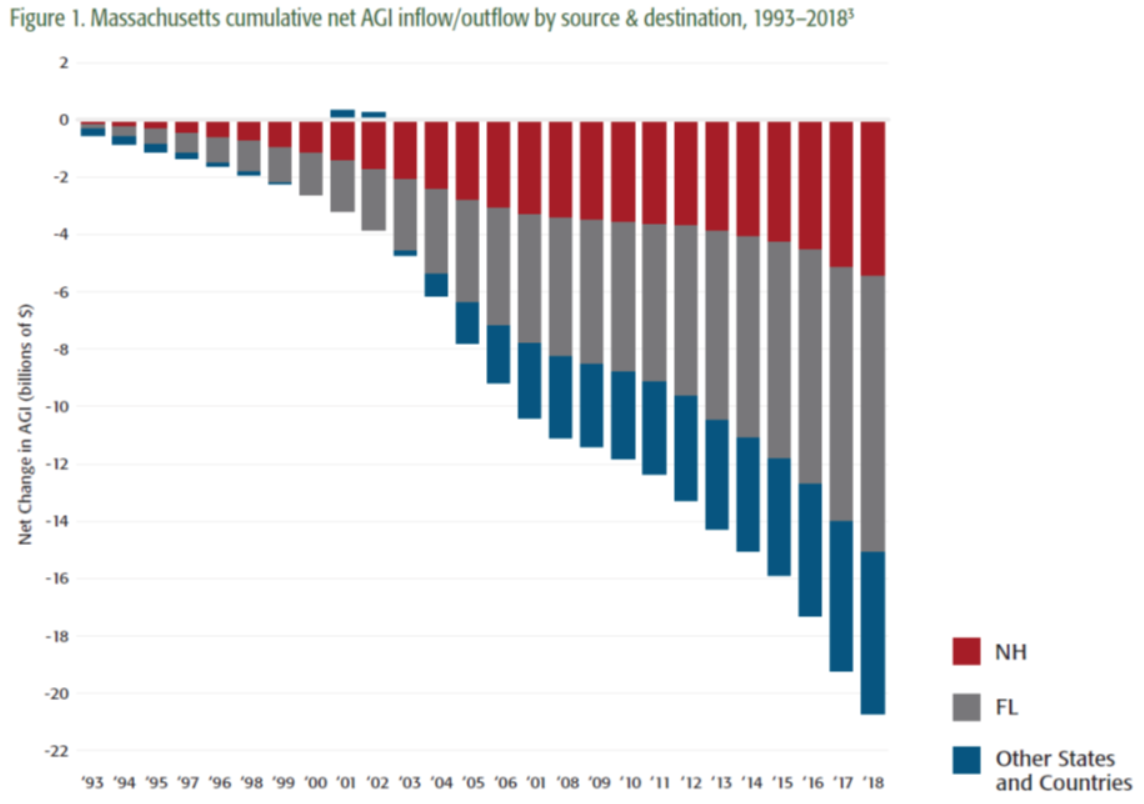

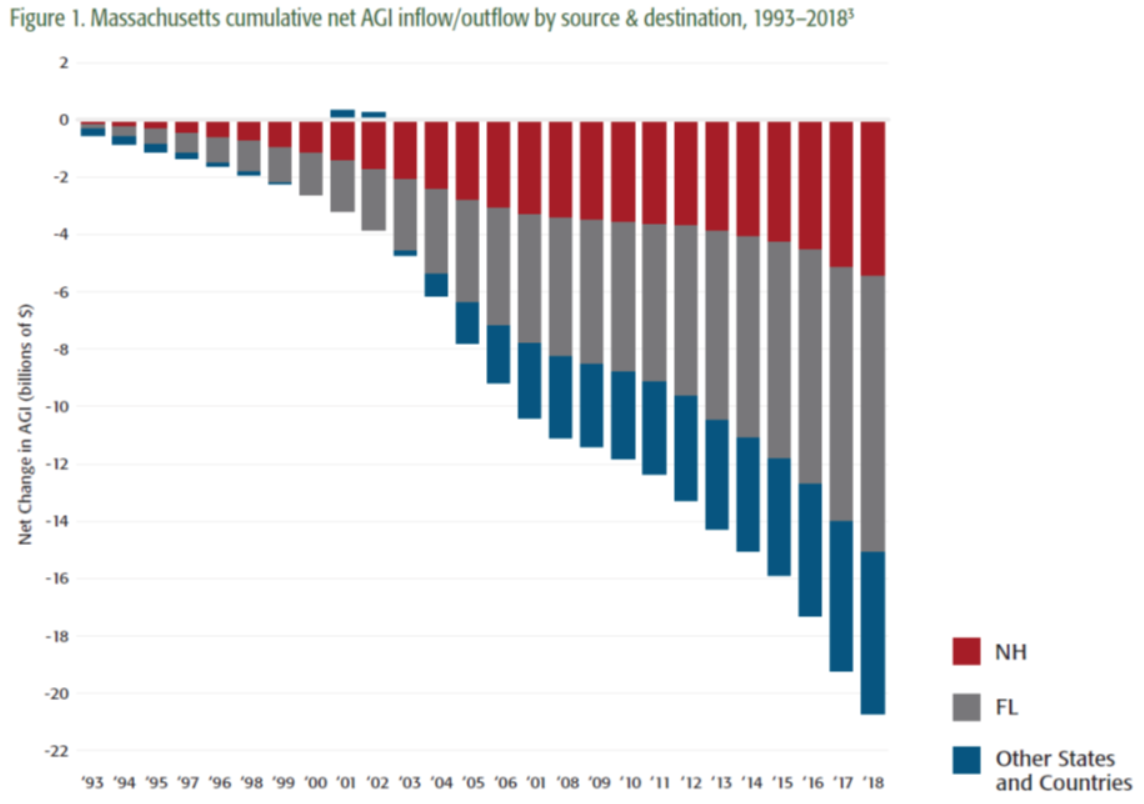

Sullivan and

the Pioneer Institute published a report this week that

found between 1993 and 2018 a total of $20.7 billion in

adjusted gross income left Massachusetts, with 46.5

percent of that wealth going to Florida and 26 percent

to New Hampshire.

Both Florida

and New Hampshire have no income taxes, and in Florida

residents do not pay capital gains or estate taxes. The

average taxpayer who left Massachusetts for Florida in

2018 earned $120,325, while those leaving for New

Hampshire earned less, or about $64,992.

The state

Legislature will decide, potentially by the spring,

whether to put a question on the 2022 ballot that would

impose a 4 percent surtax on all income above $1

million. The tax on wealthier residents has been pitched

by proponents as a revenue generator for education and

transportation, worth up to $2 billion a year.

But critics

have long said it could prompt employers to steer clear

of Massachusetts and wealthy residents to move out of

state.

"I think that

there's no question that the post-COVID continued growth

of work from home arrangements creates a real risk for a

state like Massachusetts just because there are so many

reasons why someone would want to move to New

Hampshire," Sullivan said.

"The proposed

surtax could exacerbate that," Sullivan said....

The wealth tax

will need to be advanced again at a Constitutional

Convention in the 2021-2022 session in order to go

before voters on the statewide November ballot in 2022.

While there was some turnover on Beacon Hill this

session, the Legislature easily advanced the proposal

147-48 in June of 2019 and new Speaker Ron Mariano

supported the measure two years ago, after initially

voting against it....

Sullivan said

tax policy alone is not necessarily driving wealth out

of the state. He also cited the high cost of living,

density and weather as contributing factors.

While Florida

has seen more than 70 percent in wealth migration into

the state come from taxpayers earning $200,000 or more,

Pioneer's research found that less than 40 percent of

taxpayers leaving Massachusetts fell in that same income

bracket.

Immigration

has also helped to offset population decline in

Massachusetts, according the Pioneer report, but on

average an immigrant moving to Massachusetts earned

$36,809 in 2018 compared to an average adjusted gross

income of $87,628 for taxpayers who left Massachusetts

for other states.

After Florida

and New Hampshire, the remaining 27 percent of the

income leaving Massachusetts went to a mix of warm or

lower cost-of-living states like California, Maine,

North Carolina and Texas.

State House

News Service

Tuesday, February 2, 2021

Remote Work Growth Adds

Dimension to Tax Debate

Study Examined Income Flows Out of Massachusetts

Wealthy

residents and businesses are leaving the state at a

troubling rate — an exodus that could grow now that

working remotely is gaining widespread acceptance, a new

Pioneer Institute report states.

Massachusetts

has seen a net loss of $20 billion to other states,

especially New Hampshire and Florida where taxes are

much lower, the report warns.

“COVID has

dramatically accelerated working from home and that’s

bad news for the state,” said Pioneer Institute Research

Director Greg Sullivan, who co-authored the report on

“Do the Wealthy Migrate from High-Tax States?”

The Pioneer

report found wealthy residents have been packing up and

moving out of state over the last 25 years, taking with

them much-needed taxable income. The report found that

some $20.7 billion in adjusted gross income left

Massachusetts between 1993 and 2018.

That news hits

as Massachusetts’ Democratic lawmakers have proposed a

hike in taxes on the rich to bolster funding for

education and transit. Another vote, Sullivan says, is

expected to come up again this spring....

The Pioneer

study adds high rates of immigration have bolstered

Massachusetts’ economic health and kept its population

stable. But that’s not going to help the bottom line

forever.

“The

legislature needs to be very careful in the new

post-pandemic environment, when talent is more mobile,”

said Pioneer Institute Executive Director Jim Stergios.

“Businesses look at the business climate closely —

especially tax issues — when they think about location.

I’d hate to see us follow in Connecticut’s footsteps

toward economic decline.”

States that

have lost taxable income to Massachusetts are in the

Northeast, with New York, Connecticut, and New Jersey

contributing the most, the report adds. Illinois, Ohio,

and Michigan, lost smaller amounts.

But wealth

migration out of Massachusetts is a “nightmare

scenario,” Sullivan adds, that will only get worse in

our “Zoom economy.”

The Boston

Herald

Tuesday, February 2, 2021

Taxes driving wealth out of

Massachusetts and into Florida, New Hampshire: report

When the going

gets taxed, the taxed get going — right out of

Massachusetts....

What

destinations are on the GPS? According to the study,

many choose Florida and New Hampshire.

Pioneer

Institute Research Director Greg Sullivan and research

assistant Andrew Mikula mined data from the IRS and

found a strong trend of wealthy residents leaving

high-tax states for low-tax ones.

Even when the

economy was on the upswing.

“Because of

our stable tax environment and concentration of talent,

Massachusetts has outperformed most states and outpaced

the nation in job growth since the Great Recession,”

said Pioneer Institute Executive Director Jim Stergios.

“Yet even during that period of growth we were shedding

almost a billion dollars a year to low-tax states like

Florida and New Hampshire.”

One way the

rich stay that way is keeping their eyes out for a

bargain. Why pay more in taxes when you don’t have to?

Especially when your tax burden is already hefty. The

Heritage Foundation reported that, according to 2016 IRS

data, the top 10% of income earners pay almost 70% of

federal income taxes.

A Boston

Herald editorial

Tuesday, February 2, 2021

Wealthy have options to avoid

tax hikes

A white paper

released Monday by the Pioneer Institute compares the

adjusted gross income changes in Massachusetts and

Florida and concludes that snowbirds are not only

seeking the sun, but “the data also show a strong

correlation between state taxes and migration.” In other

words, states like Florida and New Hampshire that have

no personal income tax are seeing more people from

Massachusetts with annual gross incomes of $200,000 or

more moving in than we are seeing from those states.

And, as wealthier Bay Staters move south or north over

the border, Massachusetts loses the personal income tax

revenue those higher-income people were contributing.

It’s not

shocking that wealthier people -- who are more mobile --

would be drawn to states with no personal income tax.

But the loss of millions in state tax revenue is no

small matter....

While

Massachusetts still has a growing population, most of

that comes from the steady influx of people from other

countries, as opposed to migrants from other states.

“Migration

within the United States has seen Massachusetts shedding

residents every year since 2011,” the white paper says,

with 50,000 more Bay Staters moving to other states

every year during the mid-2000s than those who moved

from other states to Massachusetts....

So the high

number of immigrants should offset what we’re losing,

right? In terms of population, maybe, but there’s a big

difference in the adjusted gross income the majority of

immigrants bring with them versus the adjusted gross

income of Bay Staters leaving Massachusetts for points

south.

The report

says the average adjusted gross income of an immigrant

moving to Massachusetts in 2018 was $36,809, while

taxpayers leaving Massachusetts took with them an

average adjusted gross income of $87,628 that year.

A Salem News

editorial

Wednesday, February 3, 2021

Sun, lack of taxes might tip the

balance

January tax

collections obliterated the Baker administration's

expectations, coming in almost a half-billion dollars

above the Department of Revenue's already-upgraded

monthly benchmark and helping to brighten the state's

financial picture heading into a fresh round of budget

deliberations.

DOR collected

$3.347 billion from taxpayers last month, which is $392

million or 13.3 percent greater than what the state

collected in January 2020 and $429 million or 14.7

percent above DOR's benchmark for the month, which had

already been boosted by $180 million from an earlier

estimate....

January is the

fourth-largest revenue month of the year for

Massachusetts, and tax collectors usually bring in a

shade more than 10 percent of their annual haul during

the month.

Now seven

months through fiscal year 2021, Massachusetts state

government has collected $764 million more in taxes from

people and businesses than it did during the same seven

pre-pandemic months of fiscal year 2020. The last month

Massachusetts saw a year-over-year decline in tax

collections was September....

If collections

come in at exactly the DOR benchmarks from February

through May, the state would enter June having collected

about $2.159 billion more than it had collected to that

point of fiscal year 2020.

State House

News Service

Wednesday, February 3, 2021

January Tax Haul Far

Surpasses Pre-Pandemic Receipts

Receipts Rising, Not Falling as Forecast Predicted

Following

market volatility and uncertainty at play through much

of the first half of 2020, a strong second-half

performance for the Massachusetts state pension fund --

the largest six-month return in its 37-year history --

helped drive the fund up to an all-time high of $86.9

billion by the end of 2020.

The Pension

Reserves Investment Trust (PRIT) Fund saw a return of

16.4 percent from July 1 through Dec. 31, outperforming

its benchmark for that period of 12.5 percent. That

topped the record for a half-year return of 15.7 percent

that had stood since June 1986, officials said

Tuesday....

Michael

Trotsky, executive director and chief investment officer

of the Massachusetts Pension Reserves Investment

Management Board, presented the fund performance report

during a meeting of PRIM's Investment Committee on

Tuesday morning but reminded committee members that the

positive results "mask hardships and uncertainties" that

persist in the economy and society.

"The strong

market return seems like a cruel irony because it does

not capture the hardships that so many in our country

are facing. Sometimes, we all know, markets do not seem

logical. So let's please review today's results with

appropriate humility and let's be gratified that we're

doing our important part to grow the assets used to

support more than 300,000 beneficiaries," Trotsky said.

"A strong return, so to speak, is a shot in the arm to

pension security for our beneficiaries in this time of

so much struggle and uncertainty."...

"Each week, I

notice more businesses folding and I notice more and

more homeless on the streets as I walk from the train

station to the office. It actually often feels dangerous

right in the Financial District, right where our offices

are," he said. "And believe me, it does not seem like

the Boston of a year ago and it breaks my heart."

The fund's

calendar year performance equates to an investment gain

of $9.6 billion for the PRIT Fund.

"Nearly $10

billion in one year ... staggering," Trotsky said.

State House

News Service

Tuesday, February 2, 2021

State Pension Fund Returns

Soar Amidst Pandemic

PRIT Fund Assets Rose Nearly $10 Billion in 2020

Lawmakers did

not reach an agreement on the current state budget until

five months into the fiscal year amid the uncertainty

inflicted by the pandemic, but the Senate's budget chief

said Wednesday he believes the next cycle will follow a

"more traditional process."

Sen. Michael

Rodrigues told human service providers that preparations

are underway in the Legislature to roll out fiscal year

2022 budget bills after Gov. Charlie Baker released his

proposal last week....

The Westport

Democrat recounted some of the factors that pushed Baker

and lawmakers to seek several short-term interim budgets

instead of an annual plan last summer and fall,

including uncertainty over federal aid and early

forecasts from economists that tax revenues could fall

billions of dollars below expectations.

"Now, we're

beyond that. We're already working on FY22, " Rodrigues

said, later adding, "We are hoping that by July 1, we're

going to have an FY22 budget signed by the governor."

The state

received about $12.8 billion in federal revenues in

fiscal 2020 and is projected to receive about $13.97

billion this fiscal year. For fiscal 2022, the state has

slotted in $12.56 billion in federal aid.

State House

News Service

Wednesday, February 3, 2021

Rodrigues Hoping for Signed

Budget by July 1

The creation

of three new legislative committees to focus on the

state's COVID-19 response, racial equality and

cybersecurity will come at a cost of $137,672 to

taxpayers, according to a News Service calculation based

on the 2017 pay law.

House Speaker

Ron Mariano and Senate President Karen Spilka announced

Wednesday night that they intended to create three new

standing joint House-Senate committees to start the new

session...

With the

creation of those committees comes new chairmanships and

vice chairmanships for Mariano and Spilka to award, each

with their own stipends. Based on the 2017 law that

increased pay for legislators and other public

officials, committee chairs can earn between $17,042 and

$73,851 on top of their base salaries, depending on

which committees they lead....

This pay

structure could not be immediately confirmed with Senate

leaders. Senate rules limit members to collecting a

maximum of two stipends for their assigned

responsibilities, while House members can collect just

one stipend, according to that branch's rules.

The stipends

started at $15,000 for a chair and $5,200 for a vice

chair in 2017, but have been adjusted biennially in

accordance with the law based on statewide salary and

wage changes as recorded by the Bureau of Economic

Analysis in the United States Department of Commerce.

Treasurer

Deborah Goldberg certified an 8.32 percent increase in

stipend pay in 2019 and another 4.89 percent increase

this year. Legislators also saw their base pay increase

in January by 6.46 percent to $70,536 for the next two

years, based on the state's Constitution.

State House

News Service

Thursday, February 4, 2021

Lawmakers creating more

paid leadership positions

3 new committees will cost taxpayers $137,672 in

stipends

Gov. Charlie

Baker is making another attempt to cap expanding sick

time banks for state employees that have taxpayers on

the hook for tens of millions of dollars.

Baker’s plan,

tucked into his preliminary $45.6 billion budget, would

limit a vast number of state employees to accruing 1,000

hours of sick leave, or about six months’ worth. The

limit is expected to save the state more than $8 million

a year.

Baker has

argued that capping sick time accruals will save

taxpayers money and align state benefits with those of

other states and the private sector.

The cap would

only affect the executive branch. As of Friday at least

5,400 employees whose departments answer to the governor

had banked 1,000 hours of sick time or more, according

to the Baker administration. That's roughly 12% of the

executive branch's workforce.

Those figures

don’t include quasi-governmental agencies, the state

court system or the five-campus University of

Massachusetts, the state’s second-largest employer with

more than 24,000 employees.

Beacon Hill

watchdogs say the state's current policy is

unsustainable, especially with a sizable portion of the

workforce set to retire in coming years.

"Sick pay

shouldn't roll over, year after year," said David Tuerck,

president of the Beacon Hill Institute. "It only drives

up the overall cost of the state budget."

That's because

retiring state employees are allowed to cash out 20% of

their unused time....

In 2017, state

Inspector General Greg Cunha found more than 10,400

employees — about 12% of the state’s 90,000-member

workforce — sitting on 1,000 hours or more of unused

time. That represented a liability of more than $117

million for taxpayers.

Baker's

efforts to reel in the state's payroll liabilities face

resistance in the Legislature, which is reviewing his

budget. Similar proposals by the governor have been

flatly rejected in the past by the Democrat-controlled

House and Senate.

The Salem

News

Saturday, February 6, 2021

Baker seeks to limit sick pay for

state workers

Geoff Diehl,

the former state lawmaker and Republican State Committee

member, has given up his role as finance committee

chairman for the party to focus on recruiting new

candidates and helping to organize fundraisers....

Diehl has not

ruled out being a candidate himself in 2022, keeping

open the possibility that he would run for governor. The

former Whitman legislator ran against U.S. Sen.

Elizabeth Warren in 2018, and played a role in former

President Donald Trump's 2016 campaign in Massachusetts.

Diehl said he

thought his energy would be "best spent devoted to

making sure we make the necessary preparations ahead of

the upcoming midterms."

"Our party's

commitment to freedom, economic opportunity, and

personal responsibility has never been more important

than it is now, and the work to push that message begins

now," Diehl said....

Gov. Charlie

Baker, who despite being a Republican has largely broken

away from the state party, has not yet said whether he

would seek a third term.

State House

News Service

Friday, February 5, 2021

Diehl Departing Finance Committee Role

at MassGOP |

Chip Ford's CLT

Commentary

CLICK ABOVE GRAPHIC

TO WATCH AND HEAR FOR YOURSELF

The state’s

$130,000-a-year undersecretary for climate change is being

blasted by a fiscal watchdog for saying the administration needs

to “break” the will of taxpayers when it comes to heating homes

and driving cars.

The video shows

David Ismay, Gov. Charlie Baker’s Under Secretary for Climate

Change, telling Vermont climate advocates that it’s time to go

after homeowners and motorists to help reduce emissions.

At the end of the

clip, he adds: “I can’t even say that publicly.” ...

In the video posted

by MassFiscal Alliance, Ismay says the state needs to “break

their will” and “turn the screws on” ordinary people to force

changes in their consumption of heating fuels and gasoline.

Ismay described the ordinary people as the “person across the

street” and the “senior on fixed income.” ...

Paul Diego Craney,

spokesman for MassFiscal, said the video clip provides a “sneak

peek into the minds of regulators” with Ismay’s choice of words.

Ismay’s direct

quote is: “So let me say that again, 60% of our emissions that

need to be reduced come from you, the person across the street,

the senior on fixed income, right… there is no bad guy left, at

least in Massachusetts to point the finger at, to turn the

screws on, and you know, to break their will, so they stop

emitting. That’s you. We have to break your will. Right, I can’t

even say that publicly.”

The remarks were

made on January 25, 2021 at the Vermont Climate Council meeting.

Craney added it’s

“frightening to think an official so high up in the Baker

administration is bragging to an out of state group about the

economic pain he wants to inflict on the very people who he’s

supposed to work for.”

The Boston Herald

Friday, February 5, 2021

Charlie Baker climate official blasted for comments to ‘break

your will’ over emissions

Obviously David Ismay,

Gov. Charlie Baker’s Undersecretary for Climate Change and a

graduate of the U.S. Naval Academy at Annapolis missed the class

that taught the phrase "Loose lips sink ships." Howie Carr

called it on the mark Saturday in his Boston Herald column ("Massachusetts

climate hack fits in well with Charlie Baker & Co."):

So this was

the old D.C. definition of a gaffe — inadvertently

blurting out the truth. . . . Ismay’s only mistake

was letting the cat out of the bag to a bunch of his

fellow Bernie Sanders acolytes.

Mass Fiscal Alliance

uncovered the video (thanks to a Vermont colleague in our

multi-state anti-TCI coalition) and released it to the media

on Friday morning. Part of MassFiscal's message:

Ismay’s comments

are simply reprehensible. He describes his target as ordinary

people in Massachusetts like the elderly on fixed incomes and

the person across the street. They’re his target simply

because they cannot change their lifestyles enough to be

acceptable to his climate agenda. The weapon he intends to

use to “turn the screws” on them is the new climate legislation

and administrative tax increases like the Transportation and

Climate Initiative, which seek to drive up costs in order to

“break their will” and force decreases in consumption.

It’s frightening to

think an official so high up in the Baker administration is

bragging to an out of state group about the economic pain he

wants to inflict on the very people who he’s supposed to work

for. Remarks like this have no place in state government.

Ismay should be dismissed from his position in state government,

as he’s clearly demonstrated he does not have the best interests

of the residents of Massachusetts at heart.

Nothing more needs to be added.

Baker's response? The State

House News Service reported later on Friday ("Video

Captures Climate Official Commenting on Need to “Break” Consumers"):

MassFiscal sharply criticized

Ismay's remarks, and when Baker was asked during a

Friday press conference about the topic he said he and

Lt. Gov. Karyn Polito watched the video in the morning

and spoke to Energy and Environmental Affairs Secretary

Kathleen Theoharides about it....

"First of all, no one who works in

our administration should ever say or think anything

like that," Baker said. "Secondly, Secretary

Theoharides is going to have a conversation with him

about that. And third, one of the main reasons we

didn't sign the climate bill when it got to our desk was

because we were specifically concerned about the impact

it was going to have on people's ability to pay for many

of the pieces that were in it, which means it also

doesn't represent administration policy or position."

So what are the consequences for such

a threat that allegedly "doesn't represent administration policy or

position" but which appears to precisely advance the Baker

administration's obsessive goal? Baker will probably promote

him another rank.

Massachusetts continues to shed

productive taxpayers, especially those of higher-income. They

are being replaced by low-income immigrants. "Immigration

has also helped to offset population decline in Massachusetts,"

according a

Pioneer Institute report issued on Monday, "but on average an

immigrant moving to Massachusetts earned $36,809 in 2018 compared to

an average adjusted gross income of $87,628 for taxpayers who left

Massachusetts for other states." You do the math.

The State House News Service reported

on Tuesday ("Remote Work Growth Adds Dimension to Tax Debate; Study

Examined Income Flows Out of Massachusetts"):

Greg Sullivan, the state's former

inspector general and the research director at the

conservative-leaning Pioneer Institute, said the ongoing

exodus of wealth from Massachusetts to low-tax states

like Florida and New Hampshire could be amplified in

coming years.

The popularity of new work

arrangements that no longer tether workers, or their

employers, to geographic location could make it easier

for workers to seek housing or lifestyle changes

elsewhere, he said.

The outcome of a proposed surtax on

income over $1 million and a Supreme Court case in which

New Hampshire is challenging Gov. Charlie Baker's right

to tax the income of workers living in New Hampshire,

but working remotely for Massachusetts companies, could

also become factors.

"My concern has to do with the

competitiveness of the state," Sullivan said.

Sullivan and the Pioneer Institute

published a report this week that found between 1993

and 2018 a total of $20.7 billion in adjusted gross

income left Massachusetts, with 46.5 percent of that

wealth going to Florida and 26 percent to New Hampshire.

Both Florida and New Hampshire have

no income taxes, and in Florida residents do not pay

capital gains or estate taxes. The average

taxpayer who left Massachusetts for Florida in 2018

earned $120,325, while those leaving for New Hampshire

earned less, or about $64,992.

The state Legislature will decide,

potentially by the spring, whether to put a question on

the 2022 ballot that would impose a 4 percent surtax on

all income above $1 million. The tax on wealthier

residents has been pitched by proponents as a revenue

generator for education and transportation, worth up to

$2 billion a year.

But critics have long said it could

prompt employers to steer clear of Massachusetts and

wealthy residents to move out of state.

"I think that there's no question

that the post-COVID continued growth of work from home

arrangements creates a real risk for a state like

Massachusetts just because there are so many reasons why

someone would want to move to New Hampshire," Sullivan

said.

"The proposed surtax could

exacerbate that," Sullivan said....

The wealth tax will need to be

advanced again at a Constitutional Convention in the

2021-2022 session in order to go before voters on the

statewide November ballot in 2022. While there was

some turnover on Beacon Hill this session, the

Legislature easily advanced the proposal 147-48 in June

of 2019 and new Speaker Ron Mariano supported the

measure two years ago, after initially voting against

it....

Sullivan said tax policy alone is

not necessarily driving wealth out of the state.

He also cited the high cost of living, density and

weather as contributing factors.

While Florida has seen more than 70

percent in wealth migration into the state come from

taxpayers earning $200,000 or more, Pioneer's research

found that less than 40 percent of taxpayers leaving

Massachusetts fell in that same income bracket.

Immigration has also helped to

offset population decline in Massachusetts, according

the Pioneer report, but on average an immigrant moving

to Massachusetts earned $36,809 in 2018 compared to an

average adjusted gross income of $87,628 for taxpayers

who left Massachusetts for other states.

After Florida and New Hampshire,

the remaining 27 percent of the income leaving

Massachusetts went to a mix of warm or lower

cost-of-living states like California, Maine, North

Carolina and Texas.

The Boston Herald on Tuesday added

("Taxes driving wealth out of Massachusetts and into Florida, New

Hampshire: report"):

. . . That news hits as

Massachusetts’ Democratic lawmakers have proposed a hike

in taxes on the rich to bolster funding for education

and transit. Another vote, Sullivan says, is expected to

come up again this spring....

“The legislature needs to be very

careful in the new post-pandemic environment, when

talent is more mobile,” said Pioneer Institute Executive

Director Jim Stergios. “Businesses look at the

business climate closely — especially tax issues — when

they think about location. I’d hate to see us

follow in Connecticut’s footsteps toward economic

decline.” ...

But wealth migration out of

Massachusetts is a “nightmare scenario,” Sullivan adds,

that will only get worse in our “Zoom economy.” ...

Progressives who want the wealthy to pay even more to

fund free college, free healthcare and a host of other

programs would be wise to keep the mobility trend in

mind.

On Wednesday The

Salem News editorial ("Sun, lack of taxes might tip the

balance") opined:

While Massachusetts still has a

growing population, most of that comes from the steady

influx of people from other countries, as opposed to

migrants from other states.

“Migration within the United States

has seen Massachusetts shedding residents every year

since 2011,” the white paper says, with 50,000 more Bay

Staters moving to other states every year during the

mid-2000s than those who moved from other states to

Massachusetts....

So the high number of immigrants

should offset what we’re losing, right? In terms

of population, maybe, but there’s a big difference in

the adjusted gross income the majority of immigrants

bring with them versus the adjusted gross income of Bay

Staters leaving Massachusetts for points south.

The report says the average

adjusted gross income of an immigrant moving to

Massachusetts in 2018 was $36,809, while taxpayers

leaving Massachusetts took with them an average adjusted

gross income of $87,628 that year.

Upon release of

the Department of Revenue's

January collections report, The State House News Service

reported on Wednesday ("January

Tax Haul Far Surpasses Pre-Pandemic Receipts; Receipts

Rising, Not Falling as Forecast Predicted"):

January tax collections obliterated the Baker administration's

expectations, coming in almost a half-billion dollars above the

Department of Revenue's already-upgraded monthly benchmark and

helping to brighten the state's financial picture heading into a

fresh round of budget deliberations.

DOR collected $3.347 billion from taxpayers last month, which is

$392 million or 13.3 percent greater than what the state

collected in January 2020 and $429 million or 14.7 percent above

DOR's benchmark for the month, which had already been boosted by

$180 million from an earlier estimate....

January is the fourth-largest revenue month of the year for

Massachusetts, and tax collectors usually bring in a shade more

than 10 percent of their annual haul during the month.

Now seven months through fiscal year 2021, Massachusetts state

government has collected $764 million more in taxes from people

and businesses than it did during the same seven pre-pandemic

months of fiscal year 2020. The last month Massachusetts saw a

year-over-year decline in tax collections was September....

If collections come in at exactly the DOR benchmarks from

February through May, the state would enter June having

collected about $2.159 billion more than it had collected to

that point of fiscal year 2020.

Did you catch that?

"Massachusetts state government has collected $764 million more

in taxes from people and businesses than it did during the same

seven pre-pandemic months of fiscal year 2020" when businesses

were wide open and everyone who wanted a job was working.

No wonder Gov. Baker wants to keep the

economy locked down for as long as he possibly can! The fewer

businesses open, the fewer "folks" working, the better the state

coffers seem to be doing. Imagine how much Maskachusetts could

rake in if every resident was confined to his home in perpetuity

never to see the light of day!

Honestly, I have no idea how this

works but it gets even crazier. On Tuesday the

State House News Service reported ("State Pension Fund

Returns Soar Amidst Pandemic; PRIT Fund Assets Rose Nearly $10

Billion in 2020"):

Following market volatility and

uncertainty at play through much of the first half of

2020, a strong second-half performance for the

Massachusetts state pension fund -- the largest

six-month return in its 37-year history -- helped drive

the fund up to an all-time high of $86.9 billion by the

end of 2020.

The Pension Reserves Investment

Trust (PRIT) Fund saw a return of 16.4 percent from July

1 through Dec. 31, outperforming its benchmark for that

period of 12.5 percent. That topped the record for

a half-year return of 15.7 percent that had stood since

June 1986, officials said Tuesday....

The fund's calendar year

performance equates to an investment gain of $9.6

billion for the PRIT Fund.

And —

believe it or not — it gets even

better yet! How can that possibly be? On

Wednesday the State House News Service reported ("Rodrigues

Hoping for Signed Budget by July 1"):

. . . The state

received about $12.8 billion in federal revenues in fiscal 2020

and is projected to receive about $13.97 billion this fiscal

year. For fiscal 2022, the state has slotted in $12.56

billion in federal aid.

Wait until China hears about all

this — they'll be demanding their

Wuhan Virus back, or at least a royalty from Massachusetts for

providing it!

But before China can swoop in for its

reparations, with all this cash piling up in otherwise empty State

House corridors legislators jumped in to do what they do best:

feather their own nests. On Thursday the News Service reported

("Lawmakers creating

more paid leadership positions; 3 new committees will cost taxpayers

$137,672 in stipends"):

House Speaker Ron Mariano and

Senate President Karen Spilka announced Wednesday night

that they intended to create three new standing joint

House-Senate committees to start the new session...

With the creation of those

committees comes new chairmanships and vice

chairmanships for Mariano and Spilka to award, each with

their own stipends. Based on the 2017 law that

increased pay for legislators and other public

officials, committee chairs can earn between $17,042 and

$73,851 on top of their base salaries, depending on

which committees they lead....

This pay structure could not be

immediately confirmed with Senate leaders. Senate

rules limit members to collecting a maximum of two

stipends for their assigned responsibilities, while

House members can collect just one stipend, according to

that branch's rules.

The stipends started at $15,000 for

a chair and $5,200 for a vice chair in 2017, but have

been adjusted biennially in accordance with the law

based on statewide salary and wage changes as recorded

by the Bureau of Economic Analysis in the United States

Department of Commerce.

Treasurer Deborah Goldberg

certified an 8.32 percent increase in stipend pay in

2019 and another 4.89 percent increase this year.

Legislators also saw their base pay increase in January

by 6.46 percent to $70,536 for the next two years, based

on the state's Constitution.

It didn't take them long amidst the

embarrassment of plague riches to take care of themselves, did it.

At this rate pretty soon every legislator will be a chairman of his

or her own committee, or two. You've got to hand it to the

greedy pols — if you're a self-dealing,

insatiable bottom-feeder. Taking so little heat from

constituents after conspiring to plunder taxpayers with

their obscene pay

grab of 2017 as their first order of business upon return that

January only encouraged them to enrich themselves more.

"Hey, when you've got it spend it

fast. There's always more where that came from," has long been

the Beacon Hill creed. As the top of the state government heap

gets fatter the wealth is spread around; the coat-holders and hired

help need a taste of the largesse too. The Salem News reported

yesterday ("Baker seeks to limit sick pay for state workers"):

Gov. Charlie Baker is making

another attempt to cap expanding sick time banks for

state employees that have taxpayers on the hook for tens

of millions of dollars.

Baker’s plan, tucked into his

preliminary $45.6 billion budget, would limit a vast

number of state employees to accruing 1,000 hours of

sick leave, or about six months’ worth. The limit

is expected to save the state more than $8 million a

year.

Baker has argued that capping sick

time accruals will save taxpayers money and align state

benefits with those of other states and the private

sector.

The cap would only affect the

executive branch. As of Friday at least 5,400

employees whose departments answer to the governor had

banked 1,000 hours of sick time or more, according to

the Baker administration. That's roughly 12% of

the executive branch's workforce.

Those figures don’t include

quasi-governmental agencies, the state court system or

the five-campus University of Massachusetts, the state’s

second-largest employer with more than 24,000 employees.

Beacon Hill watchdogs say the

state's current policy is unsustainable, especially with

a sizable portion of the workforce set to retire in

coming years.

"Sick pay shouldn't roll over, year

after year," said David Tuerck, president of the Beacon

Hill Institute. "It only drives up the overall

cost of the state budget."

That's because retiring state

employees are allowed to cash out 20% of their unused

time....

In 2017, state Inspector General

Greg Cunha found more than 10,400 employees — about 12%

of the state’s 90,000-member workforce — sitting on

1,000 hours or more of unused time. That

represented a liability of more than $117 million for

taxpayers.

Baker's efforts to reel in the

state's payroll liabilities face resistance in the

Legislature, which is reviewing his budget.

Similar proposals by the governor have been flatly

rejected in the past by the Democrat-controlled House

and Senate.

What's a mere $117 million liability

in the big picture of Massachusetts taxing, spending, and debt?

Doesn't everyone get to cash in "unused sick time"

—

when and if, that is, they have a job that's open for business?

"Similar proposals by the governor

have been flatly rejected in the past by the Democrat-controlled

House and Senate." Of course they have. It's not

their money they're squandering. Their well-earned

attitude is "It comes out of those stupid taxpayers' pockets and

they keep voting for more abuse, so let's give them more of what

they want!"

Political Watch

On Friday the

State House News Service reported ("Diehl Departing Finance

Committee Role at MassGOP"):

Geoff Diehl, the former state

lawmaker and Republican State Committee member, has

given up his role as finance committee chairman for the

party to focus on recruiting new candidates and helping

to organize fundraisers....

Diehl has not ruled out being a

candidate himself in 2022, keeping open the possibility

that he would run for governor. The former Whitman

legislator ran against U.S. Sen. Elizabeth Warren in

2018, and played a role in former President Donald

Trump's 2016 campaign in Massachusetts....

Gov. Charlie Baker, who despite

being a Republican has largely broken away from the

state party, has not yet said whether he would seek a

third term.

Do I hear footsteps

sneaking up on Charlie Baker? They seem to be getting louder .

. .

Just wondering. Do

you ever regret being among the most politically informed citizens

of the Commonwealth? Have you ever considered the axiom

"Ignorance is bliss" and pondered if this might be so, wondered what

you're missing? I do, but it's too late for me now.

I have always lived by the

admonition of the ancient Greek statesman and warrior Pericles:

"Just because you do not take an interest in politics doesn't mean

that politics won't take an interest in you." He had nothing

to say about bliss, unfortunately.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports Follow

(excerpted above) |

|

The Boston

Herald

Friday, February 5, 2021

Charlie Baker climate official blasted for comments to

‘break your will’ over emissions

By Joe Dwinell and Sean Philip Cotter

The state’s

$130,000-a-year undersecretary for climate change is being

blasted by a fiscal watchdog for saying the administration needs

to “break” the will of taxpayers when it comes to heating homes

and driving cars.

The video shows David Ismay, Gov. Charlie Baker’s Under

Secretary for Climate Change, telling Vermont climate advocates

that it’s time to go after homeowners and motorists to help

reduce emissions.

At the end of the clip, he adds: “I can’t even say that

publicly.”

Ismay a return Herald request for comment Friday morning.

Asked about the video during a press conference, Baker said he

and Lt. Gov. Karyn Polito had seen the video earlier that

morning that Climate Secretary Kathleen Theoharides, Ismay’s

boss, is also aware of it.

“First of all, no one who works in our administration should

ever say or think anything like that — ever,” the governor said.

“Secondly, Secretary Theoharides is going to have a conversation

with him about that.”

Baker continued, “And the third — and one of the main reasons we

didn’t sign the climate bill when it got to our desk was because

we were specifically concerned about the impact that it’s going

to have on people’s ability to pay for many of the pieces that

were in it, which means it also doesn’t represent the

administration policy or position.”

In the video posted by MassFiscal Alliance, Ismay says the state

needs to “break their will” and “turn the screws on” ordinary

people to force changes in their consumption of heating fuels

and gasoline. Ismay described the ordinary people as the “person

across the street” and the “senior on fixed income.”

In the clip, he starts by saying there is “no bad guy left” in

Massachusetts and that 60% of emissions comes from “residential

heating and passenger vehicles.”

This all comes as sweeping climate policy legislation is being

pushed that would force net-zero carbon emissions by 2050, set

interim emission reduction targets, establish appliance energy

efficiency standards and authorize additional purchases of

offshore wind power. Baker has until Sunday to sign, reject or

amend that bill.

Also part of the debate is the Transportation Climate Initiative

championed Baker that aims to reduce motor vehicle pollution by

at least 26% and generate over $1.8 billion in Massachusetts by

2032, according to a deal Massachusetts signed with Rhode

Island, Connecticut and Washington, D.C.

It will up the price of gas by 5 to 7 cents per gallon,

according to state estimates. Eight other states are still

considering the deal.

Paul Diego Craney, spokesman for MassFiscal, said the video clip

provides a “sneak peek into the minds of regulators” with

Ismay’s choice of words.

Ismay’s direct quote is: “So let me say that again, 60% of our

emissions that need to be reduced come from you, the person

across the street, the senior on fixed income, right… there is

no bad guy left, at least in Massachusetts to point the finger

at, to turn the screws on, and you know, to break their will, so

they stop emitting. That’s you. We have to break your will.

Right, I can’t even say that publicly.”

The remarks were made on January 25, 2021 at the Vermont Climate

Council meeting.

Craney added it’s “frightening to think an official so high up

in the Baker administration is bragging to an out of state group

about the economic pain he wants to inflict on the very people

who he’s supposed to work for.”

The New Boston

Post

Friday, February 5, 2021

Charlie Baker Climate Undersecretary:

State Must Break People’s Will To Reduce Climate Emissions

By Tom Joyce

David Ismay, the state undersecretary for climate change under

Massachusetts Republican governor Charlie Baker, said in a

recent Zoom call that the Commonwealth needs to “break their

will” when referring to ordinary people and their use of fossil

fuels.

Ismay made the remarks in a Zoom call with the Vermont Climate

Council on Monday, January 25.

The Massachusetts Fiscal Alliance obtained a clip of the meeting

and posted it on the alliance’s YouTube channel.

During the Zoom call, Ismay said, “So let me say that again, 60

percent of our emissions that need to be reduced come from you,

the person across the street, the senior on fixed income, right

… there is no bad guy left, at least in Massachusetts to point

the finger at, to turn the screws on, and you know, to break

their will, so they stop emitting. That’s you. We have to break

your will. Right, I can’t even say that publicly ….”

The “60 percent of our emissions” he refers to in the video come

from residential heating and passenger vehicles, he says.

Ismay could not immediately be reached for comment Friday

afternoon.

Ismay’s comments were condemned by MassFiscal in a statement

from spokesman Paul Craney.

“Ismay’s comments are simply reprehensible. He describes his

target as ordinary people in Massachusetts like the elderly on

fixed incomes and the person across the street,” Craney said in

the written statement. “They’re his target simply because they

cannot change their lifestyles enough to be acceptable to his

climate agenda. The weapon he intends to use to ‘turn the

screws’ on them is the new climate legislation and

administrative tax increases like the Transportation and Climate

Initiative, which seek to drive up costs in order to “break

their will” and force decreases in consumption.”

“It’s frightening to think an official so high up in the Baker

administration is bragging to an out of state group about the

economic pain he wants to inflict on the very people who he’s

supposed to work for,” Craney added. “Remarks like this have no

place in state government. Ismay should be dismissed from his

position in state government, as he’s clearly demonstrated he

does not have the best interests of the residents of

Massachusetts at heart.”

The press office for Governor Charlie Baker could not be reached

for comment on Friday.

State House News

Service

Friday, February 5, 2021

Video Captures Climate Official Commenting on Need to “Break”

Consumers

By Chris Lisinski

Gov. Charlie Baker called out an official in his environment

secretariat on Friday, describing comments that Undersecretary

for Climate Change David Ismay made last month about pushing

consumers to reduce carbon emissions as something that "no one

who works in our administration should ever say."

The right-leaning Massachusetts Fiscal Alliance published a

video clip Thursday of Ismay addressing the Vermont Climate

Council at a Jan. 25 virtual meeting.

"Sixty percent of our emissions come from residential heating

and passenger vehicles," Ismay said, according to the video.

"Let me say that again: 60 percent of our emissions that need to

be reduced come from you, the person (inaudible) the street, the

senior on fixed income. There is no bad guy left, at least in

Massachusetts, to point the finger at, turn the screws on, and

break their will so they stop emitting. That's you, we have to

break your will."

"I can't even say that publicly. What I'm trying to say is --"

Ismay continued before the video posted by MassFiscal ends

mid-sentence.

MassFiscal sharply criticized Ismay's remarks, and when Baker

was asked during a Friday press conference about the topic he

said he and Lt. Gov. Karyn Polito watched the video in the

morning and spoke to Energy and Environmental Affairs Secretary

Kathleen Theoharides about it.

Baker also pointed to his veto last month of a wide-ranging

climate change response bill the Legislature sent him and the

concerns he raised about the costs it would create.

"First of all, no one who works in our administration should

ever say or think anything like that," Baker said. "Secondly,

Secretary Theoharides is going to have a conversation with him

about that. And third, one of the main reasons we didn't sign

the climate bill when it got to our desk was because we were

specifically concerned about the impact it was going to have on

people's ability to pay for many of the pieces that were in it,

which means it also doesn't represent administration policy or

position."

The climate bill is back on Baker's desk after the House and

Senate approved a re-filed version of it now that the

Legislature is into a new two-year session.

The Boston

Herald

Saturday, February 6, 2021

Massachusetts climate hack fits in well with Charlie Baker & Co.

By Howie Carr

Until now, did you even know that the state had a

$130,000-a-year “undersecretary of climate change?”

Or that his job description includes, in the bragging coat

holder’s own words, “breaking the will” of the working classes

of Massachusetts by raising the cost of fuel so high that they

can no longer afford to either heat their homes or drive their

cars?

Can somebody say Transportation Climate Initiative?

Meet David Ismay, a 49-year-old blow-in drifter and bust-out

lawyer from California who is now living the high life in a

mansion in Chestnut Hill.

Here is how Ismay described his dream job, at a conference last

month with a bunch of similarly entitled, trust-funded ersatz

hippies from Vermont:

“Sixty percent of our emissions that need to be reduced come

from you, the person across the street, the senior on fixed

income, right? There is no bad guy left in Massachusetts to

point the finger at, to turn the screws on and, you know, break

their will so they stop emitting.

“That’s you. We have to break your will. Right? I can’t even say

that publicly.”

I offered Ismay a chance to come on my radio show Friday to

discuss his stated goals of “breaking the will” of and “turning

the screws on” people who actually work for a living.

Naturally, he declined.

How moronic is Ismay, going all Jonathan Gruber like this?

The answer is, he’s a Rhodes scholar, one of those perennial

bum-kissing student-leader types who, post-Oxford, flit from one

la-de-da no-heavy-lifting sinecure to another, always trading

off their allegedly prestigious credentials, never accomplishing

much of anything, but somehow always failing … upward.

This is why Ismay fits in so perfectly in the administration of

the man Joe Biden calls Gov. Charlie Parker, as well as his

direct boss, the environmental secretary Climate Katie

Theoharides. Birds of a feather …

For the last year, Parker himself has done little else except

try to “break the will” of those who elected him, with his

hysterical overreactions to a seasonal virus that other

governors have managed to handle without decimating their

state’s economies.

This is why Ismay still has a job today. Asked Friday about

Ismay’s dark, fascistic musings, his boss shrugged them off.

“Um,” Charlie Parker said, “first of all, no one who works in

our administration should be saying or thinking anything like

that – ever.”

So this was the old D.C. definition of a gaffe — inadvertently

blurting out the truth.

“Secretary Theoharides is going to have a conversation with, um,

him about that.”

In other words, Charlie Parker, a supercilious Harvard snot who

lives on a palatial estate in Swampscott and hasn’t lost a

single penny of his $250,000-a-year pay during the dystopian

disaster he’s authored, instructs Climate Katie, a Dartmouth

puke who lives in her own mansion in chi-chi Arlington and

likewise hasn’t given up a penny of her $170,405.81-a-year

salary, to have a chat with the Rhodes scholar who hasn’t even

bothered to change his old cell phone number from the 510 area

code in radical-chic Berkeley, Calif.

For a year now, all of them have been relishing this

once-in-a-lifetime opportunity to break the will of everyone

who, unlike them, wasn’t born with a silver spoon in their

mouths.

Ismay’s only mistake was letting the cat out of the bag to a

bunch of his fellow Bernie Sanders acolytes.

But imagine the hubris of the state government of Maskachusetts

presuming to cure “climate change,” whatever that might entail.

After all, this is the same incompetent government that has

presided over the deaths of one of every eight nursing-home

residents in the state — the highest per-capita death toll in

the nation.

The commonwealth has also shed 9.1% of its entire workforce —

the fourth highest job-loss toll in the U.S.

Yet these same hacks, none of whom have been laid off, give

themselves raises and bonuses while not even bothering to come

to work, instead wallowing in unprecedented levels of greed and

corruption — the State Police, the Registry of Motor Vehicles,

the MBTA, Massport, UMass, etc.

Now Charlie Parker has totally botched the rollout of the

vaccination program, again dropping the state into the bottom

quintile, behind even Mississippi in efficient delivery of

inoculations. But all that really matters is that we have an

“undersecretary of climate change.”

Why stop there, though? Shouldn’t Climate Katie, with her very

impressive master’s degree from UMass-Boston, be tackling other

intractable problems of nature that have bedeviled mankind

through the ages?

Doesn’t Massachusetts need an “undersecretary of volcanoes?”

Perhaps deputy commissioner of earthquakes, or clerk of

sunspots? Senior administrator of continental drift?

One final question: It’s supposed to snow Sunday. If Boston gets

more than a dusting, what are the odds that the esteemed

undersecretary of climate change gets Monday off as a

nonessential state employee?

Breaking the will of the people may have to wait until Tuesday.

A snow day comes first!

State House News

Service

Tuesday, February 2, 2021

Remote Work Growth Adds Dimension to Tax Debate

Study Examined Income Flows Out of Massachusetts

By Matt Murphy

The combination of new remote working opportunities made popular

during the COVID-19 pandemic and higher income taxes on wealthy

residents could land like a one-two punch on the chin of the

Massachusetts economy and state finances, the author of a new

study said.

Greg Sullivan, the state's former inspector general and the

research director at the conservative-leaning Pioneer Institute,

said the ongoing exodus of wealth from Massachusetts to low-tax

states like Florida and New Hampshire could be amplified in

coming years.

The popularity of new work arrangements that no longer tether

workers, or their employers, to geographic location could make

it easier for workers to seek housing or lifestyle changes

elsewhere, he said.

The outcome of a proposed surtax on income over $1 million and a

Supreme Court case in which New Hampshire is challenging Gov.

Charlie Baker's right to tax the income of workers living in New

Hampshire, but working remotely for Massachusetts companies,

could also become factors.

"My concern has to do with the competitiveness of the state,"

Sullivan said.

Sullivan and the Pioneer Institute published a report this week

that found between 1993 and 2018 a total of $20.7 billion in

adjusted gross income left Massachusetts, with 46.5 percent of

that wealth going to Florida and 26 percent to New Hampshire.

Both Florida and New Hampshire have no income taxes, and in

Florida residents do not pay capital gains or estate taxes. The

average taxpayer who left Massachusetts for Florida in 2018

earned $120,325, while those leaving for New Hampshire earned

less, or about $64,992.

The state Legislature will decide, potentially by the spring,

whether to put a question on the 2022 ballot that would impose a

4 percent surtax on all income above $1 million. The tax on

wealthier residents has been pitched by proponents as a revenue

generator for education and transportation, worth up to $2

billion a year.

But critics have long said it could prompt employers to steer

clear of Massachusetts and wealthy residents to move out of

state.

"I think that there's no question that the post-COVID continued

growth of work from home arrangements creates a real risk for a

state like Massachusetts just because there are so many reasons

why someone would want to move to New Hampshire," Sullivan said.

"The proposed surtax could exacerbate that," Sullivan said.

Gov. Baker has not taken a position on the surtax, but in his

State of the Commonwealth address last week he talked about the

importance of adapting smartly to "the future of work" after the

COVID-19 pandemic is under control.

The wealth tax will need to be advanced again at a

Constitutional Convention in the 2021-2022 session in order to

go before voters on the statewide November ballot in 2022. While

there was some turnover on Beacon Hill this session, the

Legislature easily advanced the proposal 147-48 in June of 2019

and new Speaker Ron Mariano supported the measure two years ago,

after initially voting against it.

Neither Rep. Jim O'Day nor Sen. Jason Lewis, the principal

sponsors of the Constitutional amendment in both branches, could

be reached for comment Tuesday to discuss if and how the

pandemic has impacted their views on wealth taxes.

Sullivan said tax policy alone is not necessarily driving wealth

out of the state. He also cited the high cost of living, density

and weather as contributing factors.

While Florida has seen more than 70 percent in wealth migration

into the state come from taxpayers earning $200,000 or more,

Pioneer's research found that less than 40 percent of taxpayers

leaving Massachusetts fell in that same income bracket.

Immigration has also helped to offset population decline in

Massachusetts, according the Pioneer report, but on average an

immigrant moving to Massachusetts earned $36,809 in 2018

compared to an average adjusted gross income of $87,628 for

taxpayers who left Massachusetts for other states.

After Florida and New Hampshire, the remaining 27 percent of the

income leaving Massachusetts went to a mix of warm or lower

cost-of-living states like California, Maine, North Carolina and

Texas.

The greatest influx of wealth to Massachusetts over the same

15-year period came from New York, Connecticut, New Jersey,

Pennsylvania and Illinois, according to Pioneer.

"The big picture takeaway is that Massachusetts and New England

states, really, has been in pattern of losing large amounts of

income to other states," Sullivan said.

Also Tuesday, Sen. Elizabeth Warren announced she is joining the

U.S. Senate Committee on Finance and plans to introduce

legislation implementing a nationwide wealth tax of 2 cents on

every dollar earned over $50 million, with an additional surtax

on wealth over $1 billion.

The Boston

Herald

Tuesday, February 2, 2021

Taxes driving wealth out of Massachusetts and into Florida, New

Hampshire: report

By Joe Dwinell

Wealthy residents and businesses are leaving the state at a

troubling rate — an exodus that could grow now that working

remotely is gaining widespread acceptance, a new Pioneer

Institute report states.

Massachusetts has seen a net loss of $20 billion to other

states, especially New Hampshire and Florida where taxes are

much lower, the report warns.

“COVID has dramatically accelerated working from home and that’s

bad news for the state,” said Pioneer Institute Research

Director Greg Sullivan, who co-authored the report on “Do the

Wealthy Migrate from High-Tax States?”

The Pioneer report found wealthy residents have been packing up

and moving out of state over the last 25 years, taking with them

much-needed taxable income. The report found that some $20.7

billion in adjusted gross income left Massachusetts between 1993

and 2018.

That news hits as Massachusetts’ Democratic lawmakers have

proposed a hike in taxes on the rich to bolster funding for

education and transit. Another vote, Sullivan says, is expected

to come up again this spring.

He warns the post-pandemic economy will see companies be more

mobile and searching for the best deals they can — all while

employees could be free to choose where they want to live also.

Sullivan cited Tesla as Exhibit No. 1.

Tesla CEO and SpaceX entrepreneur Elon Musk, now considered the

richest person on Earth, has moved his base of operations to

Texas. He shunned California and its high income tax.

The brain drain from Massachusetts, the Pioneer report states,

has resulted in no-income-tax states like Florida capturing 46%

of the lost wealth and New Hampshire 26%.

“We saw this trend slow down temporarily during the Great

Recession, when people became less mobile,” Sullivan said. “But

it’s since come roaring back, and the magnitude is staggering.”

The Pioneer study adds high rates of immigration have bolstered

Massachusetts’ economic health and kept its population stable.

But that’s not going to help the bottom line forever.

“The legislature needs to be very careful in the new

post-pandemic environment, when talent is more mobile,” said

Pioneer Institute Executive Director Jim Stergios. “Businesses

look at the business climate closely — especially tax issues —

when they think about location. I’d hate to see us follow in

Connecticut’s footsteps toward economic decline.”

States that have lost taxable income to Massachusetts are in the

Northeast, with New York, Connecticut, and New Jersey

contributing the most, the report adds. Illinois, Ohio, and

Michigan, lost smaller amounts.

But wealth migration out of Massachusetts is a “nightmare

scenario,” Sullivan adds, that will only get worse in our “Zoom

economy.”

The Boston

Herald

Tuesday, February 2, 2021

A Boston Herald editorial

Wealthy have options to avoid tax hikes

When the going gets taxed, the taxed get going — right out of

Massachusetts.

That’s the gist of a new Pioneer Institute study which found

that wealthy residents have been packing up and moving out of

state over the last 25 years, taking with them much-needed

taxable income. The report found that some $20.7 billion in

adjusted gross income left Massachusetts between 1993 and 2018.

What destinations are on the GPS? According to the study, many

choose Florida and New Hampshire.

Pioneer Institute Research Director Greg Sullivan and research

assistant Andrew Mikula mined data from the IRS and found a

strong trend of wealthy residents leaving high-tax states for

low-tax ones.

Even when the economy was on the upswing.

“Because of our stable tax environment and concentration of

talent, Massachusetts has outperformed most states and outpaced

the nation in job growth since the Great Recession,” said

Pioneer Institute Executive Director Jim Stergios. “Yet even

during that period of growth we were shedding almost a billion

dollars a year to low-tax states like Florida and New

Hampshire.”

One way the rich stay that way is keeping their eyes out for a

bargain. Why pay more in taxes when you don’t have to?

Especially when your tax burden is already hefty. The Heritage

Foundation reported that, according to 2016 IRS data, the top

10% of income earners pay almost 70% of federal income taxes.

Progressives who want the wealthy to pay even more to fund free

college, free healthcare and a host of other programs would be

wise to keep the mobility trend in mind.

Back in November, Massachusetts’ Democratic lawmakers proposed a

hike in taxes on the rich to bolster funding for education and

transit.

Cambridge Rep. Mike Connolly’s amendment would have spiked the

tax rate for unearned income — bank interest, profit from stock

and real estate sales, real estate rent income and other capital

gains revenue — from 5% up to 9% as part of the House’s fiscal

2021 budget.

The proposal failed.

Which is not to say that it, or some other variation of

legislation to increase taxes on high-income residents, won’t

make a return appearance.

The economy — both state and national — is reeling because of

the coronavirus pandemic, and the wealthy are in the crosshairs

of progressives looking for cash.

But just as big-bucks Bay Staters can fill out a change of

address form when their Massachusetts taxes start rising, so too

do wealthy households across the country.