|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, January 25, 2021

Mass. State

Government Most Popular in U.S.

Jump directly

to CLT's Commentary on the News

|

Most Relevant News Excerpts

(Full news reports follow Commentary)

|

|

Opponents of a controversial carbon tax that will push

up the price of gas are lobbying a consortium of

mid-Atlantic states to reject an agreement Massachusetts

struck last month with several other states in an effort

to doom the deal.

“TCI is a poor

concept that is fundamentally regressive, economically

damaging and places an unnecessary financial burden on

people who can least afford it. Please reject it,”

Massachusetts-based Citizens for Limited Taxation

wrote in an open letter signed by 20 other groups.

The

Transportation Climate Initiative championed by Gov.

Charlie Baker aims to reduce motor vehicle pollution by

at least 26% and generate over $1.8 billion in

Massachusetts by 2032, according to a deal Massachusetts

signed with Rhode Island, Connecticut and Washington,

D.C. It will up the price of gas by 5 to 7 cents per

gallon, according to state estimates. Eight other states

are still considering the deal.

Chip Ford

of CLT told the Herald he’s concerned over the “lack of

accountability” the program creates and said tax

increases should be a function of the Legislature, not

the governor alone. He hopes that if other states fail

to sign on, the program will run out of gas.

He also argued

the cap-and-invest program would cost low-income

residents the most, as companies will pass costs along

to the consumer.

The Boston

Herald

Monday, January 18, 2021

TCI opponents push other states to reject

controversial carbon tax

Politics is

not all toxic. Here in Massachusetts, voters hold

political leaders in very high regard. The state

Legislature has climbed to 65 percent approval in a poll

we released last week, the highest we have seen in our

polling going back over a decade. Gov. Charlie Baker

sports a 73 percent approval rating and has been in the

70s and 80s for most of his term. Taken together, we

have what may be the most popular governor and the most

popular legislature in the country.

We’ve been

riding high for a little while now. A 2018 nationwide

poll found the Massachusetts Legislature atop the list

of most popular legislative bodies. And nationwide polls

tracking approval ratings have often found Baker at or

near the top of the most popular governors. Putting the

two together shows how much of an outlier Massachusetts

truly is....

Why this is

uniquely the case here in Massachusetts is not entirely

clear. It’s not the fact that Massachusetts is more or

less a one party state, though we certainly are. Other

than the governor, the state Republican Party barely

exists, and spends much of its time and energy in full

scale war with itself. But the high ratings are not just

Democratic voters appreciating Democratic leaders. There

are plenty of states with unified control where voters

hold their leaders in modest regard....

There is not

an obvious way we are different that explains why this

is. No matter what characteristic we look at (geography,

size, party distribution, etc) there are other states

that fit the same model where the numbers are not as

high. It’s also not unambiguously good, since it creates

incentives for stasis and incrementalism when the need

for change is both immense and immediate.

Our polling

throughout the pandemic finds voters with a long to-do

list for political leaders. The challenge is lighting a

fire under lawmakers with so little heat coming from

voters. Action on legislation sometimes comes from

friction between the two branches, but with voters

largely content (or not paying attention), the governor

and the Legislature have settled into a pattern of homey

incrementalism.

CommonWealth

Magazine

Tuesday, January 19, 2021

Voters hold Beacon Hill in high esteem

Mass. governor, lawmakers lead nation in popularity

Freedom from

income taxes is a New Hampshire delight: The Granite

State is one of nine that don’t tax ordinary income. Of

course, that benefit doesn’t apply to New Hampshire

residents who commute to work across the Massachusetts

border. Income earned inside Massachusetts by an

out-of-state resident is subject to Massachusetts taxes.

What about a

New Hampshire resident who used to commute to

Massachusetts?

A no-brainer,

surely. If you don’t live in Massachusetts, and you no

longer work in Massachusetts, then Massachusetts has no

right to tax your earnings. What could be more

self-evident?

Until last

spring, that was the law. The Massachusetts Department

of Revenue itself said so: “Compensation for services

rendered by a non-resident wholly outside Massachusetts,

even though payment may be made from an office or place

of business in Massachusetts,” the department affirmed

in a 1984 ruling, “is not subject to the individual

income tax.” And if a New Hampshire resident employed by

a Massachusetts company divided his hours between

Massachusetts and New Hampshire? In that case, “only

that portion of his salary attributable to his work in

Massachusetts will be taxed.”

Then came the

pandemic. Massachusetts declared an emergency and

ordered non-essential workplaces to close. Many of the

84,000 New Hampshire residents who had been commuting to

jobs in the Bay State switched to working from home.

Under the rule that had been in place for decades,

Massachusetts could no longer tax their income.

So it invented

a new rule.

In April, the

Department of Revenue published an “emergency

regulation” declaring that any income earned by a

nonresident who used to work in Massachusetts but was

now telecommuting from out of state “will continue to be

treated as Massachusetts source income subject to

personal income tax.” For the first time ever,

Massachusetts was claiming the authority to tax income

earned by persons who neither lived nor worked in

Massachusetts....

New Hampshire

isn’t fighting alone. Fourteen other states have filed

briefs urging the Supreme Court to take up its

complaint. They urge the justices to reassert and

reinvigorate a basic principle of the Constitution’s

federal system: that the power of states to tax

nonresidents’ income does not extend past their own

borders....

According to

the National Taxpayers Union, at least 2.1 million

Americans who previously crossed state lines for work

are now working from home because of COVID-19

restrictions. When the pandemic ends, remote work is

expected to remain far more common than it used to be.

The unfairness of what Massachusetts began doing last

spring, and of what a few other states have been doing

for much longer, will grow more galling. Only the

Supreme Court has the power to shut down such

overreaching. Now, thanks to New Hampshire, it has the

opportunity.

The Boston

Globe

Saturday, January 16, 2021

Why New Hampshire is suing

Massachusetts

The pandemic has kept Granite State commuters home.

The Bay State wants to tax their income anyway.

By Jeff Jacoby

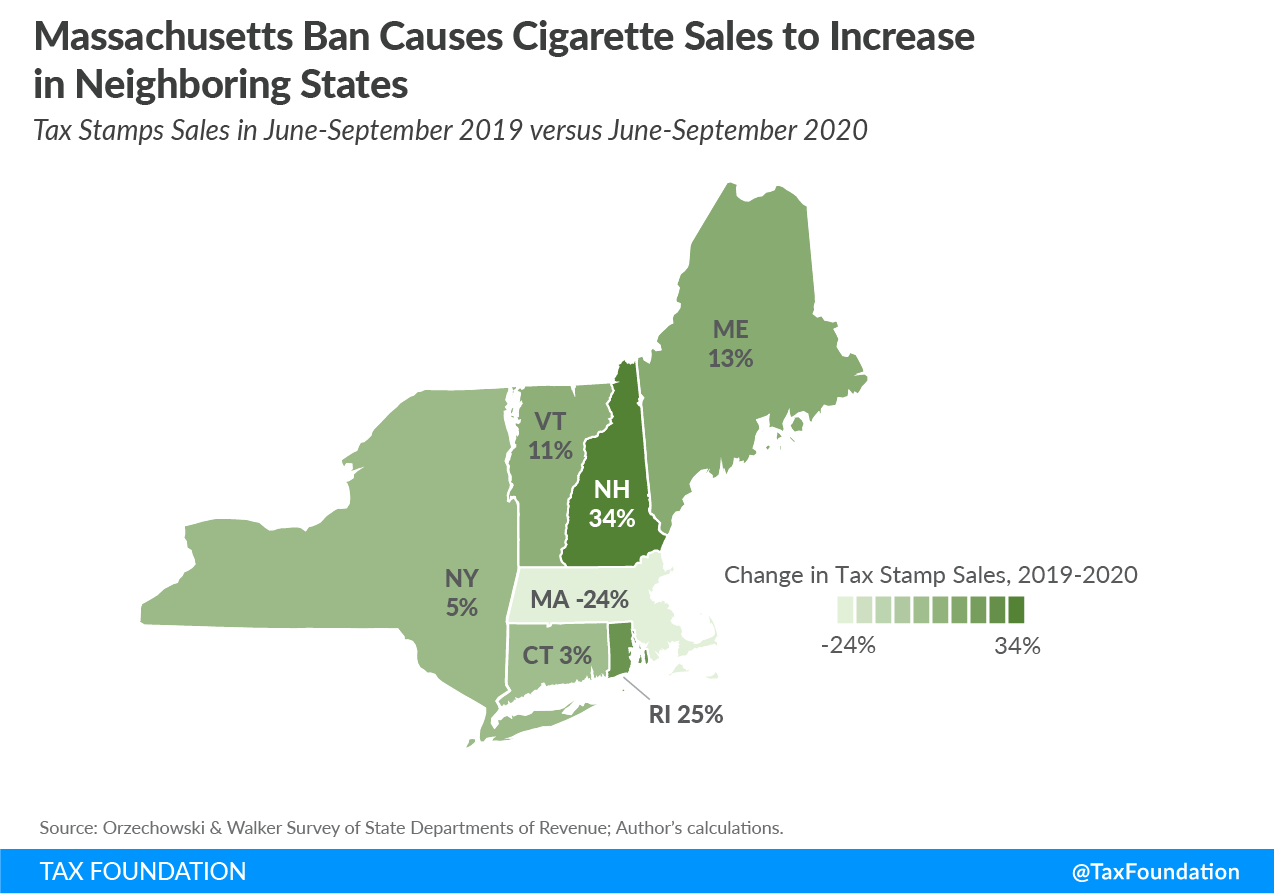

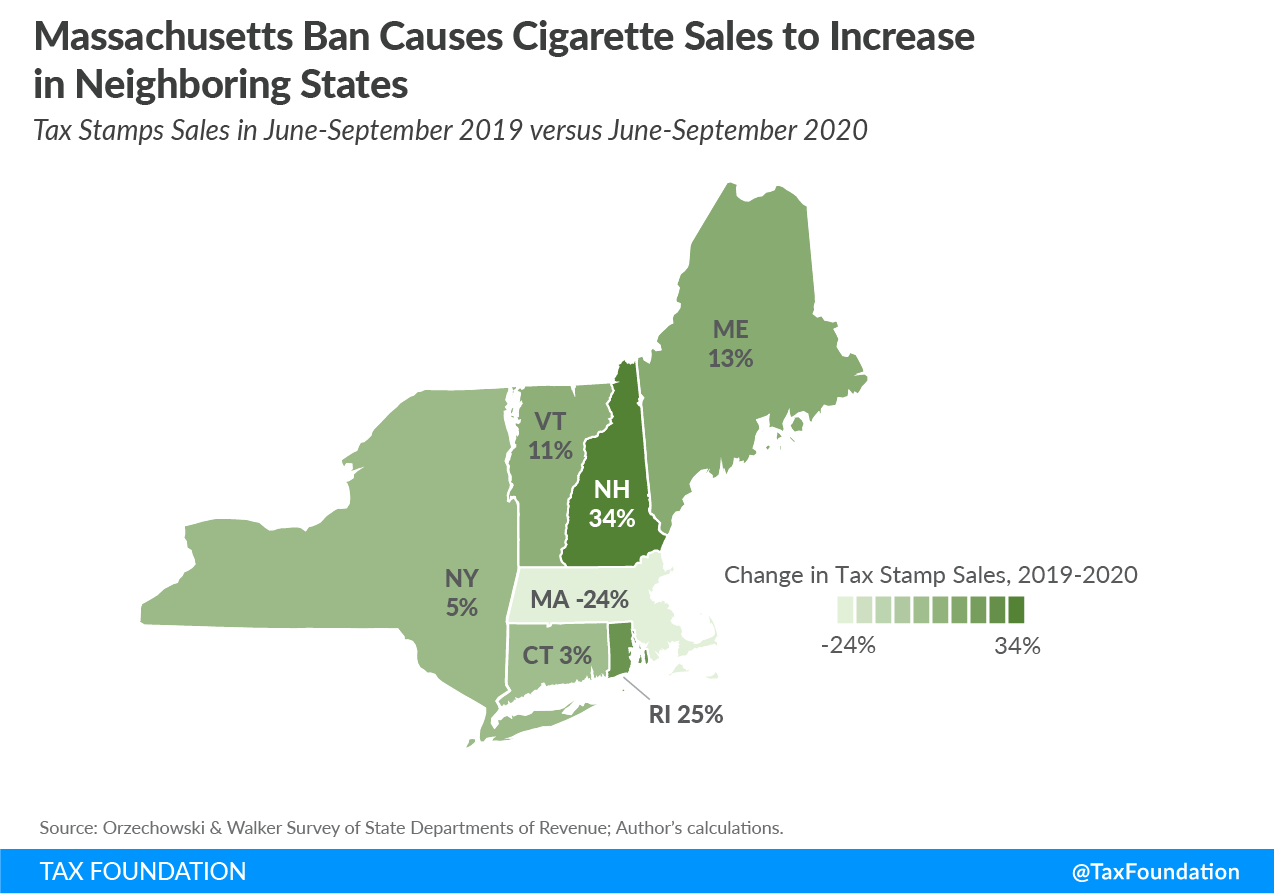

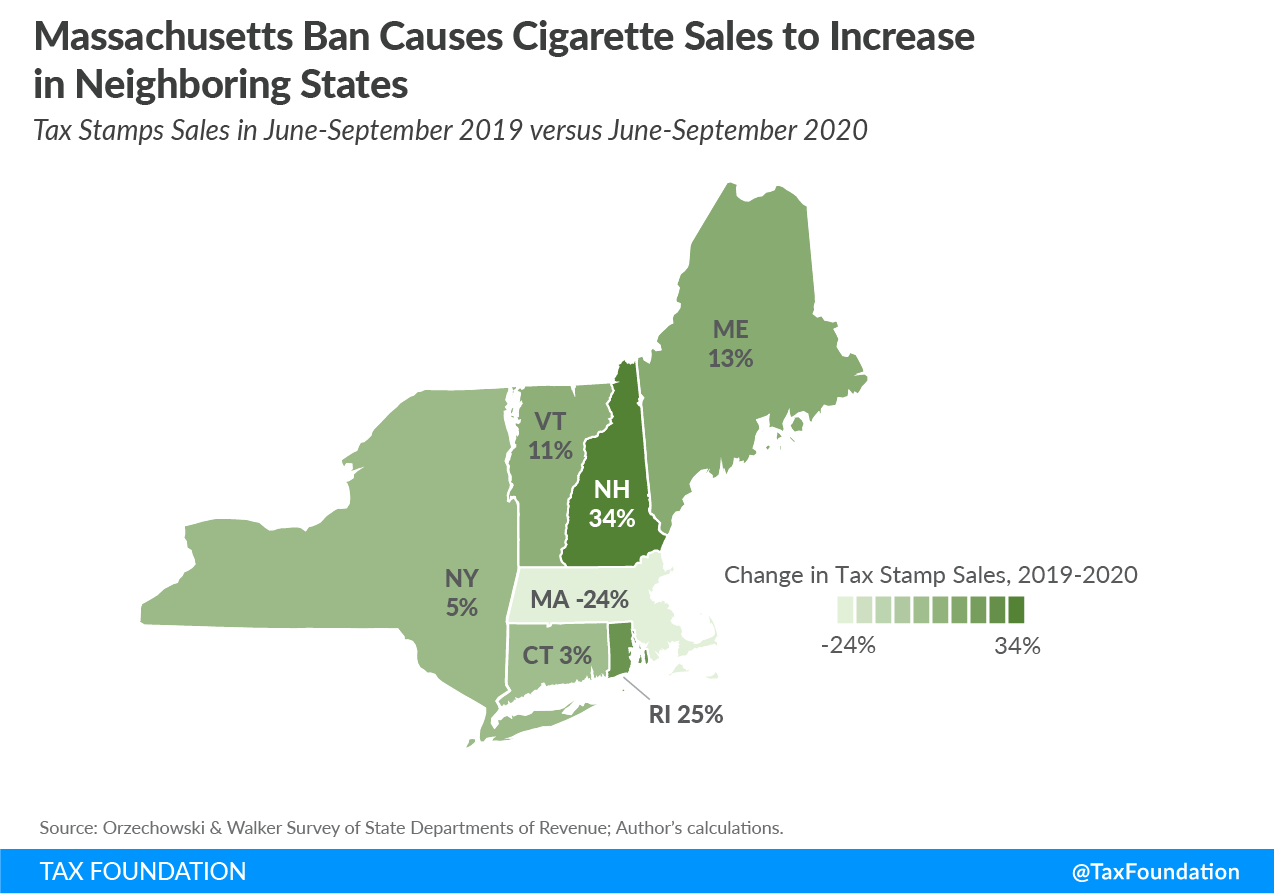

Since June 1,

2020, Massachusetts has banned the sale of flavored

tobacco products, including menthol cigarettes. When

signing the ban into law, Gov. Charlie Baker (R) argued

that the ban, which is the broadest in the country, was

enacted to limit youth uptake of nicotine products.

While youth uptake is a very real concern which deserves

the public’s attention, outright bans could impede

historically high smoking cessation rates. Lawmakers

must thread the needle between protecting adult smokers’

ability to switch and barring minors’ access to nicotine

products.

Aside from

public health concerns, a ban on flavored tobacco,

especially when including cigarettes, has significant

tax implications and could result in unintended

consequences such as increased smuggling. In

Massachusetts, more than 21 percent of cigarettes smoked

were purchased out of state in 2018 (latest data)....

Seven months

into Massachusetts’ flavor ban, early data is available

for the real-world effects. If we only look at

Massachusetts, the figures may look like a public health

success story at first: sales of cigarette tax stamps in

the Bay State have declined 24 percent comparing

June-November 2020 to the same months of 2019. In the

first half of 2020, Massachusetts only experienced a

decline of roughly 10 percent compared to the first half

of 2019.

Those numbers

would seem to back up the best argument for implementing

a ban: limiting use of tobacco and nicotine.

Unfortunately, if we dig a little deeper, it becomes

evident that Massachusetts’ flavor ban has not limited

use, just changed where Bay Staters purchase cigarettes.

In fact, sales of cigarette tax stamps in the Northeast

(Massachusetts as well as Connecticut, Maine, New

Hampshire, New York, Rhode Island, and Vermont) have

stayed remarkably stable, even increased a bit,

following Massachusetts’ ban when compared to sales in

2019....

If we look at

individual states, we can see that increases are skewed.

The increase in sales in the Northeast region is most

notable in Rhode Island and New Hampshire, but all have

seen increased sales immediately following the ban.

Unsurprisingly, New Hampshire benefits the most as that

is already the state in the nation with the highest

outflow of cigarettes.

The declining

and increasing sales obviously impact excise tax revenue

in all these states. Massachusetts collected $557

million in cigarette and other tobacco products (OTP)

excise taxes in FY 2019 ($515 million from cigarettes).

For FY 2020, sales decreased 10 percent in the first

half of 2020 which translates to a decline in revenue of

roughly $50 million.

While this is

still in the early days, assuming FY 2021’s accelerated

decline of over 20 percent continues through the rest of

the fiscal year, the cost of the flavor ban could end up

being approximately $120 million for FY 2021 (not

including sales tax losses). Over $100 million is a

significant cost to the state, especially considering

that sales are simply shifting to other states, not

actually being eliminated.

In December

2019, the Massachusetts Department of Revenue estimated

the ban would decrease collections by the slightly lower

$93 million in FY 2021. Whichever proves right, that

revenue is now being collected by Massachusetts

neighbors....

All in all,

early signs indicate that the ban will not decrease

tobacco consumption in the state. It is not in the

interest of Massachusetts to pursue a public health

measure that merely sends tax revenue to its neighboring

states without improving public health—nor should this

approach be copied by other states.

Tax

Foundation

Tuesday, January 19, 2021

Massachusetts Flavored Tobacco Ban

Has Severe Impact on Tax Revenue

Gov. Charlie

Baker signed the Legislature’s transportation bond bill

into law on Friday, but used his line-item veto to

remove proposals raising fees on Uber and Lyft rides,

establishing means-tested fares on public transit, and

an initiative pushed by Senate President Karen Spilka

that would prohibit increases in Turnpike tolls to help

pay for the Allston I-90 interchange project.

The $16

billion bond bill authorizes the state to borrow money

to finance all sorts of ongoing transportation projects,

including bridge repairs, road improvements, and public

transit initiatives such as the Green Line extension and

South Coast Rail. The bill passed by the Legislature in

the wee hours of January 6 also contained a number of

new policy initiatives that Baker decided to scrap.

Because the Legislature that passed the bill is no

longer in session, the governor’s vetoes cannot be

overridden....

Baker also

vetoed a provision directing that all revenue from the

governor’s transportation climate initiative, which

places a price on the carbon contained in vehicle fuels,

should go into the state’s Commonwealth Transportation

Fund. Rep. William Straus of Mattapoisett, the House’s

point person on transportation, inserted the provision

to clarify where the revenues should go.

Straus has

said he believes the state constitution requires the

revenues to go into the transportation fund. Baker, who

has said half of the money would go to public transit,

disagreed. “I believe it is more appropriate for a

significant portion of this funding to be available for

more flexible emissions reduction and equity

investments,” he said.

CommonWealth

Magazine

Friday, January 15, 2021

Baker vetoes key policy

initiatives in transportation bond bill

Governor

Charlie Baker, who proposed a fee increase on Uber and

Lyft trips twice in 2020, on Friday vetoed a proposal to

do just that, while approving a broader borrowing

package that will authorize up to $16 billion in

spending on transportation projects.

The

transportation bond bill will fund a wide array of

projects, such as reconfiguration of the roads near the

Cape Cod bridges, construction of South Coast Rail

commuter service to New Bedford and Fall River, and the

electrification of parts of the commuter rail, as well

as many other smaller-scale road, bridge, and transit

projects. In a statement, Baker said the bill will allow

“significant investments for building and modernizing a

statewide transportation system for our residents,

businesses and communities.”

But while

approving of the bulk of the measure passed by the

Legislature, Baker vetoed a number of policy proposals

in it that lawmakers attached to the bill, including

ones to explore reduced transit fares for low-income

riders, and congestion pricing for highway driving....

Representative

William Straus, who led the House’s negotiations on the

bill, questioned whether the state can afford the level

of borrowing in the transportation bill without the

revenue from ride-hail fees, which were projected to

raise an additional $95 million a year if ridership

returned to 2019 levels.

“If at the end

of the day, the administration’s approach is to borrow

money but not support the revenue that backs it up,

that’s an unusual approach,” Straus said....

Because

lawmakers passed the bill in the closing hours of the

last Legislative session, they do not have the

opportunity to override Baker’s veto. Straus, the state

representative, said he expects to discuss these issues

again during the new session.

The Boston

Globe

Friday, January 15, 2021

Baker vetoes Uber, Lyft fee increase as

he signs off on $16 billion in transportation borrowing

The climate

and emissions reduction bill vetoed by Gov. Charlie

Baker last week has been refiled by House and Senate

leaders in the hopes of quickly returning the

legislation to the governor, only this time with the

opportunity to override a veto if it comes.

The bill,

which was negotiated last session between the House and

Senate over five months of private talks, was refiled by

Sen. Michael Barrett and Rep. Thomas Golden late Tuesday

afternoon in the Senate, but Senate President Karen

Spilka's office said there were no concrete plans yet

for a vote on the bill....

If the

Legislature were to act quickly to reenact the same

climate bill, Baker could return the legislation with

amendments, which he was unable to do after Jan. 6 when

the 191st General Court dissolved.

"One way or

another the governor is going to have the opportunity to

participate. The usual course here would be for a bill

to go to him that he could sign or return with

amendments. That's the usual parliamentary route," said

Barrett, who negotiated the bill with Golden, and who is

the chief sponsor on the new bill (S 9).

"Rest assured

that we look forward to hearing from him and that his

ideas will get respectfully considered," Barrett said.

Another issue

the governor had with the bill included a requirement

for utilities to procure more offshore wind power, which

the Republican said could interfere with interstate

talks to procure clean energy regionally.

He also said

the Legislature missed an opportunity to invest in

climate resiliency to prepare for sea level rise,

flooding, droughts and other affects of climate change.

He proposed to pay for these investment by increasing

real estate transfer taxes.

State House

News Service

Tuesday, January 19, 2021

Bill Filed to Restart Talks on

Climate, Emissions

Gov. Charlie

Baker has been taking criticism for his veto of the

climate and greenhouse gas emissions bill, as well as

measures included in omnibus economic development and

transportation bills, but the Democrats who run the

Legislature left themselves in a vulnerable position by

leaving some of last session's most important business

until the final days and even hours available for

lawmaking....

But by waiting

to send major bills to Baker until the final days of the

two-year session and turning Jan. 5 into an all-night

session, Democrats who possess super-majorities in both

chambers gave up their advantage and left themselves

without an opportunity to flex their power and override

the governor's vetoes.

The last of

the big vetoes were handed down Friday when Baker, while

signing a $16.5 billion transportation bond bill, hacked

off a series of proposals.

After House

and Senate Democrats failed during the last session to

find common ground on new transportation revenues, they

tried to salvage fee increases on transportation

networking companies by stuffing them into the bond

bill, only to see Baker nix that measure with a veto....

After voting

in July to extend formal sessions, the House and Senate

had months to finalize the bills while leaving

themselves time to deal with Baker amendments or vetoes,

as they were able to do with abortion and policing

reform bills.

But as the

last month of session wound down in December, and

pressure intensified to reach agreements, the House was

distracted by a late-session leadership change, with

former Speaker Robert DeLeo stepping down and

representatives electing Rep. Ronald Mariano to succeed

him. It's unclear if the upheaval affected House-Senate

conference committee talks, but Democrats did box

themselves out by leaving key matters until the final

days of session.

State House

News Service

Tuesday, January 19, 2021

Long Session Ends with Deluge of

Baker Vetoes

December Speaker Change Preceded Dems' Frantic Finish

The state's

unemployment rate ticked back up in December, climbing

to 7.4 percent and again rising above the national

average, the Executive Office of Labor and Workforce

Development announced Friday morning....

At 7.4

percent, the Massachusetts unemployment rate is worse

than the national average rate of 6.7 percent. It is

also more than two and a half times the rate from one

year ago, 2.8 percent, according to EOLWD.

Massachusetts

has lagged most other states when it comes to recovering

jobs lost at the outset of the pandemic and some trends

in the state's labor market data "implying deeper labor

market challenges" were highlighted this week in a

report from Fitch Ratings.

State House

News Service

Friday, January 22, 2021

Mass. Jobless Rate Rose in December

to 7.4 Percent

After four

years of watching Donald Trump govern by tweet,

President Joe Biden took to the medium from which Trump

is now banned on Wednesday morning with a message of his

own.

"It's a new

day in America," Biden tweeted.

He was right,

of course. Biden was about to institute a mask mandate

on federal property, order the United States back into

the Paris climate accord and stop building a wall along

the border with Mexico.

But the

inauguration of Joseph Robinette Biden as the 46th

president of the United States also ensured that it will

soon be a new day in Massachusetts, with state-federal

relations about to undergo a complete reset....

As Donald

Trump departed Washington, he broke from tradition once

again by skipping his successor's inauguration, and

telling a small group of supporters at Andrews Air Force

Base that he would be "back in some form."

"So, have a

good life. We will see you soon. Thank you. Thank you

very much. Thank you very much," Trump said, making his

last public statement as president before jetting off to

Florida.

The

Massachusetts Republican Party responded to the occasion

by thanking Trump for four years of service, while Baker

waited until after Biden swore his oath of office to

make his only public statement of the day -- a welcome

to the new administration.

State House

News Service

Friday, January 22, 2021

Weekly Roundup - Friends in High

Places

Have you

noticed something missing from the home page of your

local news outlet in the last couple of days?

COVID-19 has

gone MIA.

If not quite

totally vanished, the coronavirus is certainly fading

from the front pages. No more apocalyptic headlines

about “cases” and “infections” which usually mean … not

very much.

A year ago, it

was the greatest threat to humankind since the Black

Death. Now it’s on the verge of becoming just another

seasonal virus.

What could

possibly have changed over the last couple of days to

reduce a yearlong torrent of unhinged, fact-free

hysteria to a mere trickle?

We all know

the answer to that question: Trump is gone. There is no

longer any upside to promoting the panic because 45 is

no longer president.

Mission

Accomplished!

Any bad news

now belongs to Dementia Joe. Ergo, no bad news....

Just as “the

homeless” disappear whenever a Democrat takes office,

along with rising gas prices or drone bombing of

“wedding parties” in terrorist states, seldom will be

heard a discouraging word about COVID-19 until further

notice.

If you doubt

that the air is rapidly deflating out of almost a year’s

worth of breathless hysteria in the alt-left media, just

Google “New COVID-19 cases decline.”

Here’s a small

sampling over the last 72 hours:

From CNN: “New

Covid-19 cases declined 11% after hitting a peak last

week.”

Wall Street

Journal: “Newly Reported U.S. Coronavirus Cases Decline

Again.”

National

Panhandler Radio: “Current, Deadly U.S. Coronavirus

Surge Has Peaked.”

At least until

the mid-term elections, when the Democrats will be

needing to ramp up mail-in voting yet again, because it

worked so well in November in the rotten boroughs where

voter turnout sometimes exceeded 100%.

That’s why Big

COVID is hedging its bets just a bit, allowing such

future potential horrors as “mutant strain B.1.1.7” to

start warming up in the bullpen — just in case.

This is

nothing new. Recall how Big Pharma didn’t announce that

the vaccines were ready to go until Nov. 5, when it was

too late to benefit Trump....

More a century

ago, H.L. Mencken, the Sage of Baltimore, exactly summed

up how COVID-19 would be used by the Democrats:

“The whole aim

of practical politics is to keep the populace alarmed

(and hence clamorous to be led to safety) by menacing it

with an endless series of hobgoblins, all of them

imaginary.” ...

COVID-19?

Nothing to see here, folks, move along.

The Boston

Herald

Friday, January 21, 2021

Without Trump to blame, coronavirus

turns the corner

By Howie Carr |

Chip Ford's CLT

Commentary

The Boston Herald on Monday, January 18, 2021 reported on

our TCI opposition coalition's joint

news release ("TCI

opponents push other states to reject controversial carbon tax"):

Opponents of a controversial carbon

tax that will push up the price of gas are lobbying a

consortium of mid-Atlantic states to reject an agreement

Massachusetts struck last month with several other

states in an effort to doom the deal.

“TCI is a poor concept that is

fundamentally regressive, economically damaging and

places an unnecessary financial burden on people who can

least afford it. Please reject it,” Massachusetts-based

Citizens for Limited Taxation wrote in an open

letter signed by 20 other groups.

The Transportation Climate

Initiative championed by Gov. Charlie Baker aims to

reduce motor vehicle pollution by at least 26% and

generate over $1.8 billion in Massachusetts by 2032,

according to a deal Massachusetts signed with Rhode

Island, Connecticut and Washington, D.C. It will up the

price of gas by 5 to 7 cents per gallon, according to

state estimates. Eight other states are still

considering the deal.

Chip Ford of CLT told the

Herald he’s concerned over the “lack of accountability”

the program creates and said tax increases should be a

function of the Legislature, not the governor alone. He

hopes that if other states fail to sign on, the program

will run out of gas.

He also argued the cap-and-invest

program would cost low-income residents the most, as

companies will pass costs along to the consumer.

I also participated in an interview

with Alan Zarek, news director for WSAR 1480 AM in New Bedford,

about the news release and our view of TCI.

I gave a presentation on Proposition 2½

and the many assaults upon it over just the past decade during

a Zoom conference meeting Friday among leaders of many statewide

business and political organizations. CLT was thanked and

praised by many of them for our relentless defense of Prop 2½

since passage of our tax limitation law in 1980.

I came across a report by Commonwealth

Magazine I found to be startling, very alarming, and quite

discouraging. It explained why the political situation in

Massachusetts seems to be deteriorating so steadily. If

accurate — and I have no reason to

question its conclusions — it does not

bode well for Bay State taxpayers.

On Tuesday it reported ("Voters hold Beacon Hill in

high esteem; Mass. governor, lawmakers lead nation in popularity"):

Politics is not all toxic.

Here in Massachusetts, voters hold political leaders in

very high regard. The state Legislature has

climbed to 65 percent approval in a poll we released

last week, the highest we have seen in our polling going

back over a decade. Gov. Charlie Baker sports a 73

percent approval rating and has been in the 70s and 80s

for most of his term. Taken together, we have what

may be the most popular governor and the most popular

legislature in the country.

We’ve been riding high for a little

while now. A 2018 nationwide poll found the

Massachusetts Legislature atop the list of most popular

legislative bodies. And nationwide polls tracking

approval ratings have often found Baker at or near the

top of the most popular governors. Putting the two

together shows how much of an outlier Massachusetts

truly is....

Why this is uniquely the case here

in Massachusetts is not entirely clear. It’s not

the fact that Massachusetts is more or less a one party

state, though we certainly are. Other than the

governor, the state Republican Party barely exists, and

spends much of its time and energy in full scale war

with itself. But the high ratings are not just

Democratic voters appreciating Democratic leaders.

There are plenty of states with unified control where

voters hold their leaders in modest regard....

There is not an obvious way we are

different that explains why this is. No matter

what characteristic we look at (geography, size, party

distribution, etc) there are other states that fit the

same model where the numbers are not as high. It’s

also not unambiguously good, since it creates incentives

for stasis and incrementalism when the need for change

is both immense and immediate.

Our polling throughout the pandemic

finds voters with a long to-do list for political

leaders. The challenge is lighting a fire under

lawmakers with so little heat coming from voters.

Action on legislation sometimes comes from friction

between the two branches, but with voters largely

content (or not paying attention), the governor and the

Legislature have settled into a pattern of homey

incrementalism.

It's a classic example of dropping a

frog into a bucket of comfortable water then gradually bringing it

to boil, instead of dropping it live into a bubbling-hot pot.

Incrementalism: Slowly, gradually cooking a reluctant meal to

completion to avoid any resistance.

I guess I'm not really shocked. It's

one of the reasons I felt the only escape from being cooked alive was to

flee the kitchen.

Token Boston Globe conservative

columnist Jeff Jacoby had a good take on the latest tax

controversy between New Hampshire and Taxachusetts. In

his Saturday column ("Why New Hampshire is suing

Massachusetts") he wrote:

Freedom from income taxes is a New Hampshire delight: The

Granite State is one of nine that don’t tax ordinary income. Of

course, that benefit doesn’t apply to New Hampshire residents

who commute to work across the Massachusetts border. Income

earned inside Massachusetts by an out-of-state resident is

subject to Massachusetts taxes.

What about a New Hampshire resident who used to commute to

Massachusetts?

A

no-brainer, surely. If you don’t live in Massachusetts, and you

no longer work in Massachusetts, then Massachusetts has no right

to tax your earnings. What could be more self-evident?

Until last spring, that was the law. The Massachusetts

Department of Revenue itself said so: “Compensation for services

rendered by a non-resident wholly outside Massachusetts, even

though payment may be made from an office or place of business

in Massachusetts,” the department affirmed in a 1984 ruling, “is

not subject to the individual income tax.” And if a New

Hampshire resident employed by a Massachusetts company divided

his hours between Massachusetts and New Hampshire? In that case,

“only that portion of his salary attributable to his work in

Massachusetts will be taxed.”

Then came the pandemic. Massachusetts declared an emergency and

ordered non-essential workplaces to close. Many of the 84,000

New Hampshire residents who had been commuting to jobs in the

Bay State switched to working from home. Under the rule that had

been in place for decades, Massachusetts could no longer tax

their income.

So it invented a new rule.

In April, the Department of Revenue published an “emergency

regulation” declaring that any income earned by a nonresident

who used to work in Massachusetts but was now telecommuting from

out of state “will continue to be treated as Massachusetts

source income subject to personal income tax.” For the first

time ever, Massachusetts was claiming the authority to tax

income earned by persons who neither lived nor worked in

Massachusetts....

New Hampshire isn’t fighting alone. Fourteen other states have

filed briefs urging the Supreme Court to take up its complaint.

They urge the justices to reassert and reinvigorate a basic

principle of the Constitution’s federal system: that the power

of states to tax nonresidents’ income does not extend past their

own borders....

According to the National Taxpayers Union, at least 2.1 million

Americans who previously crossed state lines for work are now

working from home because of COVID-19 restrictions. When the

pandemic ends, remote work is expected to remain far more common

than it used to be. The unfairness of what Massachusetts began

doing last spring, and of what a few other states have been

doing for much longer, will grow more galling. Only the Supreme

Court has the power to shut down such overreaching. Now, thanks

to New Hampshire, it has the opportunity.

In Massachusetts rapacious

government greed has no limits, and self-serving politicians have no

shame. Supposedly they are the most popular in the nation,

celebrated around the state for their character and methods.

Too many Bay Staters have frighteningly low standards.

Sometimes, if not usually, the state's

insatiable greed and overreaching stretches backfire. Such is

the case with the state's ban on flavored tobacco products,

according the the Washington DC-based Tax Foundation. An

excerpt from

its report released on Tuesday ("Massachusetts

Flavored Tobacco Ban Has Severe Impact on Tax Revenue"):

Since June 1, 2020, Massachusetts

has banned the sale of flavored tobacco products,

including menthol cigarettes. When signing the ban into

law, Gov. Charlie Baker (R) argued that the ban, which

is the broadest in the country, was enacted to limit

youth uptake of nicotine products. While youth uptake is

a very real concern which deserves the public’s

attention, outright bans could impede historically high

smoking cessation rates. Lawmakers must thread the

needle between protecting adult smokers’ ability to

switch and barring minors’ access to nicotine

products....

Seven months into Massachusetts’

flavor ban, early data is available for the real-world

effects. If we only look at Massachusetts, the figures

may look like a public health success story at first:

sales of cigarette tax stamps in the Bay State have

declined 24 percent comparing June-November 2020 to the

same months of 2019. In the first half of 2020,

Massachusetts only experienced a decline of roughly 10

percent compared to the first half of 2019....

Unfortunately, if we dig a little

deeper, it becomes evident that Massachusetts’ flavor

ban has not limited use, just changed where Bay Staters

purchase cigarettes. In fact, sales of cigarette tax

stamps in the Northeast (Massachusetts as well as

Connecticut, Maine, New Hampshire, New York, Rhode

Island, and Vermont) have stayed remarkably stable, even

increased a bit, following Massachusetts’ ban when

compared to sales in 2019....

If we look at individual states, we

can see that increases are skewed. The increase in sales

in the Northeast region is most notable in Rhode Island

and New Hampshire, but all have seen increased sales

immediately following the ban. Unsurprisingly, New

Hampshire benefits the most as that is already the state

in the nation with the highest outflow of cigarettes.

The declining and increasing sales

obviously impact excise tax revenue in all these states.

Massachusetts collected $557 million in cigarette and

other tobacco products (OTP) excise taxes in FY 2019

($515 million from cigarettes). For FY 2020, sales

decreased 10 percent in the first half of 2020 which

translates to a decline in revenue of roughly $50

million.

While this is still in the early

days, assuming FY 2021’s accelerated decline of over 20

percent continues through the rest of the fiscal year,

the cost of the flavor ban could end up being

approximately $120 million for FY 2021 (not including

sales tax losses). Over $100 million is a significant

cost to the state, especially considering that sales are

simply shifting to other states, not actually being

eliminated.

There was a great gnashing of teeth on

Beacon Hill last week over Gov. Baker's vetoes of the Legislature's

long past-due major bills. You can read the full news reports

below (CommonWealth Magazine's "Baker vetoes key policy initiatives

in transportation bond bill"; the Boston Globe's "Baker vetoes

Uber, Lyft fee increase as he signs off on $16 billion in

transportation borrowing"; the State House News Service's "Bill

Filed to Restart Talks on Climate, Emissions.")

The State House News Service accurately

laid the blame on Tuesday in its report "Long

Session Ends with Deluge of Baker Vetoes":

Gov. Charlie Baker has been taking criticism for his veto of the

climate and greenhouse gas emissions bill, as well as measures

included in omnibus economic development and transportation

bills, but the Democrats who run the Legislature left themselves

in a vulnerable position by leaving some of last session's most

important business until the final days and even hours available

for lawmaking....

But by waiting to send major bills to Baker until the final days

of the two-year session and turning Jan. 5 into an all-night

session, Democrats who possess super-majorities in both chambers

gave up their advantage and left themselves without an

opportunity to flex their power and override the governor's

vetoes.

The last of the big vetoes were handed down Friday when Baker,

while signing a $16.5 billion transportation bond bill, hacked

off a series of proposals.

After House and Senate Democrats failed during the last session

to find common ground on new transportation revenues, they tried

to salvage fee increases on transportation networking companies

by stuffing them into the bond bill, only to see Baker nix that

measure with a veto....

After voting in July to extend formal sessions, the House and

Senate had months to finalize the bills while leaving themselves

time to deal with Baker amendments or vetoes, as they were able

to do with abortion and policing reform bills.

But as the last month of session wound down in December, and

pressure intensified to reach agreements, the House was

distracted by a late-session leadership change, with former

Speaker Robert DeLeo stepping down and representatives electing

Rep. Ronald Mariano to succeed him. It's unclear if the upheaval

affected House-Senate conference committee talks, but Democrats

did box themselves out by leaving key matters until the final

days of session.

The Massachusetts unemployment rate is

back on the increase, reported the State House News Service on

Friday ("Mass. Jobless Rate

Rose in December to 7.4 Percent"):

The state's unemployment rate ticked back up in December,

climbing to 7.4 percent and again rising above the national

average, the Executive Office of Labor and Workforce Development

announced Friday morning....

At 7.4 percent, the Massachusetts unemployment rate is worse

than the national average rate of 6.7 percent. It is also more

than two and a half times the rate from one year ago, 2.8

percent, according to EOLWD.

Massachusetts has lagged most other states when it comes to

recovering jobs lost at the outset of the pandemic and some

trends in the state's labor market data "implying deeper labor

market challenges" were highlighted this week in a report from

Fitch Ratings.

In its preliminary

report on Thursday the News Service noted:

While

Massachusetts' official unemployment rate improved in November,

Fitch said its own adjusted unemployment rate for the state got

worse, "implying deeper labor market challenges." Massachusetts,

Iowa and Vermont are the only three states that have a

Fitch-adjusted jobless rate that is five percentage points or

more higher than the official number.

Boston Herald columnist

and WRKO talkshow host Howie Carr has this all figured out.

Vast employment improvements are coming soon to a depressed nation.

With Biden now installed as the new president there will be little

if any need to continue the draconian lockdowns

— mission accomplished.

From his Friday column ("Without Trump

to blame, coronavirus turns the corner"):

Have you noticed something missing

from the home page of your local news outlet in the last

couple of days?

COVID-19 has gone MIA.

If not quite totally vanished, the

coronavirus is certainly fading from the front pages. No

more apocalyptic headlines about “cases” and

“infections” which usually mean … not very much.

A year ago, it was the greatest

threat to humankind since the Black Death. Now it’s on

the verge of becoming just another seasonal virus.

What could possibly have changed

over the last couple of days to reduce a yearlong

torrent of unhinged, fact-free hysteria to a mere

trickle?

We all know the answer to that

question: Trump is gone. There is no longer any upside

to promoting the panic because 45 is no longer

president.

Mission Accomplished!

Any bad news now belongs to

Dementia Joe. Ergo, no bad news....

Just as “the homeless” disappear

whenever a Democrat takes office, along with rising gas

prices or drone bombing of “wedding parties” in

terrorist states, seldom will be heard a discouraging

word about COVID-19 until further notice.

If you doubt that the air is

rapidly deflating out of almost a year’s worth of

breathless hysteria in the alt-left media, just Google

“New COVID-19 cases decline.”

Here’s a small sampling over the

last 72 hours:

From CNN: “New Covid-19 cases

declined 11% after hitting a peak last week.”

Wall Street Journal: “Newly

Reported U.S. Coronavirus Cases Decline Again.”

National Panhandler Radio:

“Current, Deadly U.S. Coronavirus Surge Has Peaked.”

At least until the mid-term

elections, when the Democrats will be needing to ramp up

mail-in voting yet again, because it worked so well in

November in the rotten boroughs where voter turnout

sometimes exceeded 100%.

That’s why Big COVID is hedging its

bets just a bit, allowing such future potential horrors

as “mutant strain B.1.1.7” to start warming up in the

bullpen — just in case.

This is nothing new. Recall how Big

Pharma didn’t announce that the vaccines were ready to

go until Nov. 5, when it was too late to benefit

Trump....

More a century ago, H.L. Mencken,

the Sage of Baltimore, exactly summed up how COVID-19

would be used by the Democrats:

“The whole aim of practical

politics is to keep the populace alarmed (and hence

clamorous to be led to safety) by menacing it with an

endless series of hobgoblins, all of them imaginary.”

...

COVID-19? Nothing to see here,

folks, move along.

Sounds right in line with what many of

us have long suspected, dare I say expected.

As I noted above in my "how to boil a

frog" analogy above, sometimes the best thing a potential meal

ticket can do is jump out of the pot before the temperature gets too

hot. The contrast between Massachusetts and Kentucky is

becoming more and more stark. By members' requests some weeks

ago I provided a few comparisons (Observations

from the Bluegrass State on November 29 and

A Tale of Two

Commonwealths on December 6).

As I informed readers in A Tale of

Two Commonwealths, last month I contacted my state Senator, Mike

Wilson, with

my advice and recommendations for reining in the Kentucky

Democrat governor's unilateral China Virus pandemic decrees.

I'm satisfied that this is the direction the state Senate is taking.

For those interested, I'm providing

more insight and an update below, following

the full news reports. While Kentucky is overwhelmingly

conservative Republican (as you will see below) somehow voters

elected a Democrat as governor in 2019, by only some 5,000 votes

statewide. The General Assembly (legislature) is now acting to

limit if not remove his overreach response to the China Virus

pandemic. (As a part-time legislature this is the first

opportunity it has had to act on anything since last March.)

For many decades I've been a strong

advocate for part-time legislatures with fixed, limited sessions.

Anything more inevitably leads to mission creep; witness The

Peoples’ Republic of Taxachusetts where legislators have far too

much free time on their hands so create stupid laws.

Over that time I have been directly involved with two petitions

drives to limit sessions in the Massachusetts Legislature to six

months.

Admittedly the possibility of a

governor going rogue, unrestricted by legislative checks and

balances, had never crossed my mind and apparently those of others.

Of course until the past year there hadn't been the

likelihood of a governor seizing such unrestrained power.

But when you compare Kentucky with

Massachusetts and its compliant "fulltime" legislators

— what difference has limited vs.

year-around sessions made?

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports Follow

(excerpted above) |

|

The Boston Herald

Monday, January 18, 2021

TCI opponents push other states to reject controversial carbon

tax

By Erin Tiernan

Opponents of a controversial carbon tax that will push up the

price of gas are lobbying a consortium of mid-Atlantic states to

reject an agreement Massachusetts struck last month with several

other states in an effort to doom the deal.

“TCI is a poor concept that is fundamentally regressive,

economically damaging and places an unnecessary financial burden

on people who can least afford it. Please reject it,”

Massachusetts-based Citizens for Limited Taxation wrote

in an open letter signed by 20 other groups.

The Transportation Climate Initiative championed by Gov. Charlie

Baker aims to reduce motor vehicle pollution by at least 26% and

generate over $1.8 billion in Massachusetts by 2032, according

to a deal Massachusetts signed with Rhode Island, Connecticut

and Washington, D.C. It will up the price of gas by 5 to 7 cents

per gallon, according to state estimates. Eight other states are

still considering the deal.

Chip Ford of CLT told the Herald he’s concerned over the

“lack of accountability” the program creates and said tax

increases should be a function of the Legislature, not the

governor alone. He hopes that if other states fail to sign on,

the program will run out of gas.

He also argued the cap-and-invest program would cost low-income

residents the most, as companies will pass costs along to the

consumer.

The state has yet to lay out its plans for spending the roughly

$160 million that will be raised annually through the program. A

minimum of 35% of the proceeds will be reinvested in communities

most affected by air pollution, but Stacy Thompson of the

Liveable Streets Alliance said it isn’t enough.

“Even the best case scenario for TCI is just not enough to meet

the full scope of the transportation challenges we’re facing,”

Thompson said.

Baker spearheaded the TCI agreement and touted the December

agreement as a major victory for his administration. But the

Republican governor has since issued a series of vetoes that

Thompson called “an economic slap in the face.” Baker struck

down the Legislature’s attempts to impose a series of benchmarks

that would have set the state on a course to achieve is

“net-zero” carbon goals for 2050 and gutted its efforts to cut

costs for low-income MBTA riders by levying higher fees on

ride-hailing apps like Uber and Lyft.

“There’s a disconnect,” Thompson said. “We’re not matching

resources to the needs of the state and that should worry

people.”

The state has committed to a public process to determine how

reinvestment funds are spent but has yet to lay out those plans.

CommonWealth

Magazine

Tuesday, January 19, 2021

Voters hold Beacon Hill in high esteem

Mass. governor, lawmakers lead nation in popularity

By Steve Koczela

Politics is not all toxic. Here in Massachusetts, voters hold

political leaders in very high regard. The state Legislature has

climbed to 65 percent approval in a poll we released last week,

the highest we have seen in our polling going back over a

decade. Gov. Charlie Baker sports a 73 percent approval rating

and has been in the 70s and 80s for most of his term. Taken

together, we have what may be the most popular governor and the

most popular legislature in the country.

We’ve been riding high for a little while now. A 2018 nationwide

poll found the Massachusetts Legislature atop the list of most

popular legislative bodies. And nationwide polls tracking

approval ratings have often found Baker at or near the top of

the most popular governors. Putting the two together shows how

much of an outlier Massachusetts truly is. Maryland — another

blue state with a moderate Republican governor — is the only

other state that comes close. A few states do not appear on this

chart due to insufficient sample sizes for their state

legislature polls. The gubernatorial polling was done in 2019

before the elections that year.

Massachusetts is also heads and shoulders above the federal

government, where Donald Trump is closing out his term with a

job approval in the 30s. If that sounds bad, Congress hasn’t

topped 30 percent job approval in more than 10 years.

Why this is uniquely the case here in Massachusetts is not

entirely clear. It’s not the fact that Massachusetts is more or

less a one party state, though we certainly are. Other than the

governor, the state Republican Party barely exists, and spends

much of its time and energy in full scale war with itself. But

the high ratings are not just Democratic voters appreciating

Democratic leaders. There are plenty of states with unified

control where voters hold their leaders in modest regard.

The truth may be that we don’t dislike politics or politicians

here the way popular culture suggests we should. Even during

campaigns, candidates locked in hard-fought races often come out

looking good. Both Congresswoman Ayanna Pressley and her

opponent (now former) Congressman Michael Capuano were well

liked despite a spirited campaign. Same with Scott Brown and

Elizabeth Warren, Joe Kennedy III and Ed Markey, and Tito

Jackson and Marty Walsh among many other examples. Running for

office in Massachusetts doesn’t have to leave your name and

reputation in tatters.

There is not an obvious way we are different that explains why

this is. No matter what characteristic we look at (geography,

size, party distribution, etc) there are other states that fit

the same model where the numbers are not as high. It’s also not

unambiguously good, since it creates incentives for stasis and

incrementalism when the need for change is both immense and

immediate.

Our polling throughout the pandemic finds voters with a long

to-do list for political leaders. The challenge is lighting a

fire under lawmakers with so little heat coming from voters.

Action on legislation sometimes comes from friction between the

two branches, but with voters largely content (or not paying

attention), the governor and the Legislature have settled into a

pattern of homey incrementalism.

For now, Massachusetts voters continue to hold Beacon Hill in

high esteem. That’s a rare bright spot in an otherwise dismal

political landscape. Let’s see how long it lasts.

— Steve Koczela is the president

and Rich Parr is the research director at the MassINC Polling

Group.

The Boston

Globe

Saturday, January 16, 2021

Why New Hampshire is suing Massachusetts

The pandemic has kept Granite State commuters home.

The Bay State wants to tax their income anyway.

By Jeff Jacoby

Freedom from income taxes is a New Hampshire delight: The

Granite State is one of nine that don’t tax ordinary income. Of

course, that benefit doesn’t apply to New Hampshire residents

who commute to work across the Massachusetts border. Income

earned inside Massachusetts by an out-of-state resident is

subject to Massachusetts taxes.

What about a New Hampshire resident who used to commute to

Massachusetts?

A no-brainer, surely. If you don’t live in Massachusetts, and

you no longer work in Massachusetts, then Massachusetts has no

right to tax your earnings. What could be more self-evident?

Until last spring, that was the law. The Massachusetts

Department of Revenue itself said so: “Compensation for services

rendered by a non-resident wholly outside Massachusetts, even

though payment may be made from an office or place of business

in Massachusetts,” the department affirmed in a 1984 ruling, “is

not subject to the individual income tax.” And if a New

Hampshire resident employed by a Massachusetts company divided

his hours between Massachusetts and New Hampshire? In that case,

“only that portion of his salary attributable to his work in

Massachusetts will be taxed.”

Then came the pandemic. Massachusetts declared an emergency and

ordered non-essential workplaces to close. Many of the 84,000

New Hampshire residents who had been commuting to jobs in the

Bay State switched to working from home. Under the rule that had

been in place for decades, Massachusetts could no longer tax

their income.

So it invented a new rule.

In April, the Department of Revenue published an “emergency

regulation” declaring that any income earned by a nonresident

who used to work in Massachusetts but was now telecommuting from

out of state “will continue to be treated as Massachusetts

source income subject to personal income tax.” For the first

time ever, Massachusetts was claiming the authority to tax

income earned by persons who neither lived nor worked in

Massachusetts.

Not surprisingly, New Hampshire strenuously objected to its

neighbor’s unprecedented tax grab. When Massachusetts refused to

reconsider, New Hampshire turned to the Supreme Court, which

adjudicates lawsuits between states. The justices are expected

to decide this month whether to take the case.

Massachusetts, naturally, wants the justices to give New

Hampshire the brush-off. A brief filed by Attorney General Maura

Healey disparages New Hampshire’s complaint as lacking

“seriousness and dignity” and insists that Massachusetts “is not

injuring New Hampshire itself” by withholding millions of

dollars in taxes from the paychecks of New Hampshire residents.

If any of those residents object to being taxed by

Massachusetts, Healey’s brief suggests, they can always file for

an abatement. If that doesn’t work, they can always appeal to

the Appellate Tax Board. Why should the Supreme Court concern

itself with what amounts, at most, to the personal tax gripes of

New Hampshire telecommuters?

But Massachusetts has indeed injured New Hampshire itself. It

has launched what amounts to an attack on a fundamental aspect

of New Hampshire’s sovereign identity — its principled refusal

to tax the income earned in New Hampshire by New Hampshire

residents. It was one thing for Massachusetts to withhold taxes

from New Hampshire residents for income earned within the

borders of Massachusetts. But with its new tax rule,

Massachusetts is reaching over the border to extract taxes,

thereby undermining a core New Hampshire policy.

“Through its unprecedented action,” the New Hampshire brief

argues, “Massachusetts has unilaterally imposed an income tax

within New Hampshire that New Hampshire, in its sovereign

discretion, has deliberately chosen not to impose.”

New Hampshire isn’t fighting alone. Fourteen other states have

filed briefs urging the Supreme Court to take up its complaint.

They urge the justices to reassert and reinvigorate a basic

principle of the Constitution’s federal system: that the power

of states to tax nonresidents’ income does not extend past their

own borders.

To be fair, Massachusetts isn’t the first state to violate the

principle. A few states, including New York and Pennsylvania,

have for years been taxing nonresidents for income they earn

working at home. Resentment by other states has been heating up

for years. Now the pandemic, by transforming tens of millions of

employees into work-from-home telecommuters overnight, may have

pushed the issue past the boiling point.

States with no income tax, like New Hampshire, aren’t the only

ones affected when their work-from-home residents are taxed by

another state. So are states that do tax income, because they

commonly provide a credit to residents for taxes paid to other

states. That protects their own citizens from double taxation —

but it also means the loss of billions of dollars that would

otherwise be available to fund public services. In one of the

briefs supporting New Hampshire’s litigation, New Jersey,

Connecticut, Hawaii, and Iowa call this “the Hobson’s Choice to

which they are put: doubly tax residents’ income or suffer

fiscal consequences.”

According to the National Taxpayers Union, at least 2.1 million

Americans who previously crossed state lines for work are now

working from home because of COVID-19 restrictions. When the

pandemic ends, remote work is expected to remain far more common

than it used to be. The unfairness of what Massachusetts began

doing last spring, and of what a few other states have been

doing for much longer, will grow more galling. Only the Supreme

Court has the power to shut down such overreaching. Now, thanks

to New Hampshire, it has the opportunity.

Tax

Foundation

Tuesday, January 19, 2021

Massachusetts Flavored Tobacco Ban Has Severe Impact on Tax

Revenue

By Ulrik Boesen

Since June 1, 2020, Massachusetts has banned the sale of

flavored tobacco products, including menthol cigarettes. When

signing the ban into law, Gov. Charlie Baker (R) argued that the

ban, which is the broadest in the country, was enacted to limit

youth uptake of nicotine products. While youth uptake is a very

real concern which deserves the public’s attention, outright

bans could impede historically high smoking cessation rates.

Lawmakers must thread the needle between protecting adult

smokers’ ability to switch and barring minors’ access to

nicotine products.

Aside from public health concerns, a ban on flavored tobacco,

especially when including cigarettes, has significant tax

implications and could result in unintended consequences such as

increased smuggling. In Massachusetts, more than 21 percent of

cigarettes smoked were purchased out of state in 2018 (latest

data).

Tobacco excise taxes are already an unstable source of tax

revenue. Further narrowing the tobacco tax base by banning a

portion of tobacco sales altogether could worsen the instability

of this revenue source while driving up the costs of

administration and law enforcement associated with the ban,

especially if the lost revenue is made up by raising the tax

rate on the remaining tobacco tax base.

Other states that are considering implementing a similar ban may

want to consider the lessons from Massachusetts. Maryland is one

of these states, but if its experience mirrors Massachusetts, it

could prove an extraordinarily expensive exercise. In fact, the

bill could be even larger in Maryland than in Massachusetts as,

according to industry data, 55 percent of smokers in the state

smoke menthol products (in Massachusetts that figure was only 34

percent).

Seven months into Massachusetts’ flavor ban, early data is

available for the real-world effects. If we only look at

Massachusetts, the figures may look like a public health success

story at first: sales of cigarette tax stamps in the Bay State

have declined 24 percent comparing June-November 2020 to the

same months of 2019. In the first half of 2020, Massachusetts

only experienced a decline of roughly 10 percent compared to the

first half of 2019.

Those numbers would seem to back up the best argument for

implementing a ban: limiting use of tobacco and nicotine.

Unfortunately, if we dig a little deeper, it becomes evident

that Massachusetts’ flavor ban has not limited use, just changed

where Bay Staters purchase cigarettes. In fact, sales of

cigarette tax stamps in the Northeast (Massachusetts as well as

Connecticut, Maine, New Hampshire, New York, Rhode Island, and

Vermont) have stayed remarkably stable, even increased a bit,

following Massachusetts’ ban when compared to sales in 2019.

From June 1, 2020 to September 30, 2020, 230,797,000 stamps were

sold in the region. For the same period in 2019, that number was

225,897,000. This slight increase trends against the national

figures, where sales in 2020 were projected to decline around 2

percent. In other words, Massachusetts sales plummeted, but not

because people quit smoking—only because those sales went

elsewhere.

If we look at individual states, we can see that increases are

skewed. The increase in sales in the Northeast region is most

notable in Rhode Island and New Hampshire, but all have seen

increased sales immediately following the ban. Unsurprisingly,

New Hampshire benefits the most as that is already the state in

the nation with the highest outflow of cigarettes.

The declining and increasing sales obviously impact excise tax

revenue in all these states. Massachusetts collected $557

million in cigarette and other tobacco products (OTP) excise

taxes in FY 2019 ($515 million from cigarettes). For FY 2020,

sales decreased 10 percent in the first half of 2020 which

translates to a decline in revenue of roughly $50 million.

While this is still in the early days, assuming FY 2021’s

accelerated decline of over 20 percent continues through the

rest of the fiscal year, the cost of the flavor ban could end up

being approximately $120 million for FY 2021 (not including

sales tax losses). Over $100 million is a significant cost to

the state, especially considering that sales are simply shifting

to other states, not actually being eliminated.

In December 2019, the Massachusetts Department of Revenue

estimated the ban would decrease collections by the slightly

lower $93 million in FY 2021. Whichever proves right, that

revenue is now being collected by Massachusetts neighbors.

Furthermore, these figures only account for cigarettes.

According to Massachusetts’ own Illegal Tobacco Task Force,

smokeless tobacco is commonly smuggled into the state due to the

state’s high excise rates (210 percent of wholesale value).

Because of the flavor ban, this smuggling activity is expected

to increase. The available data for FY 2021 (through November

2020) indicates that legal sale of smokeless tobacco and OTP in

the state is already down 35 percent compared to the previous

year.

State tax coffers are not all that is impacted by this ban,

however. Bans impact the large number of small business owners

operating vape shops, convenience stores, and gas stations.

Policymakers should not lose sight of the law of unintended

consequences as they set tax rates and regulatory regimes for

nicotine products.

All in all, early signs indicate that the ban will not decrease

tobacco consumption in the state. It is not in the interest of

Massachusetts to pursue a public health measure that merely

sends tax revenue to its neighboring states without improving

public health—nor should this approach be copied by other

states. In addition, the ban on flavored tobacco highlights the

complications of contradictory tax and regulatory policy, the

instability of excise taxes that go beyond pricing in the cost

of externalities, and the public risks of driving consumers into

the black market through excessive taxation or regulation.

CommonWealth

Magazine

Friday, January 15, 2021

Baker vetoes key policy initiatives in transportation bond bill

New Uber, Lyft fees and Spilka toll restriction scrapped

By Bruce Mohl

Gov. Charlie Baker signed the Legislature’s transportation bond

bill into law on Friday, but used his line-item veto to remove

proposals raising fees on Uber and Lyft rides, establishing

means-tested fares on public transit, and an initiative pushed

by Senate President Karen Spilka that would prohibit increases

in Turnpike tolls to help pay for the Allston I-90 interchange

project.

The $16 billion bond bill authorizes the state to borrow money

to finance all sorts of ongoing transportation projects,

including bridge repairs, road improvements, and public transit

initiatives such as the Green Line extension and South Coast

Rail. The bill passed by the Legislature in the wee hours of

January 6 also contained a number of new policy initiatives that

Baker decided to scrap. Because the Legislature that passed the

bill is no longer in session, the governor’s vetoes cannot be

overridden.

One key policy initiative in the bill called for replacing the

current 20-cent fee on Uber and Lyft rides with a 40-cent fee on

shared rides and a $1.20 fee on non-shared rides. The proposal

also added a $1 fee on rides in luxury vehicles and a special

20-cent transit fee on all rides originating and ending in 14

communities in the Greater Boston area. The Metropolitan Area

Planning Council estimated the fees would raise upwards of $56

million at current traffic levels.

Baker said the proposal was premature. “This proposal would

create a complicated fee structure that is based on pre-pandemic

assumptions,” he said in a letter to the Legislature. “Before

instituting fees that are aimed at incentivizing certain travel

behaviors, we need to understand what ridership and congestion

patterns are going to look like after the pandemic.”

In similar fashion, Baker deleted a proposal authorizing the

MBTA and possibly regional transit authorities to implement

means-tested fares – fares based on the income level of the

rider. Even though the governor’s MBTA Fiscal and Management

Control Board is pushing for means-tested fares, Baker said the

legislative provision was also premature.

“More study is needed to understand how transit authorities can

implement fare systems that depend on gathering information

about riders’ incomes and to understand what the revenue loss

would be and how that revenue would be replaced,” Baker said.

“No means-tested fares can be implemented until the MBTA and

RTAs have a financially sustainable plan in place to replace the

lost revenue.”

The Spilka provision, which would bar toll increases to pay for

the roughly $1 billion Allston project, was tacked on to a much

larger section directing how mitigation for the disruptive

project should be handled. In his letter, Baker did not address

the toll issue but said the section of the bill he was excising

contained conditions that could not be met. He said he would

work with the Legislature to address concerns raised by the

section.

Baker also vetoed a provision directing that all revenue from

the governor’s transportation climate initiative, which places a

price on the carbon contained in vehicle fuels, should go into

the state’s Commonwealth Transportation Fund. Rep. William

Straus of Mattapoisett, the House’s point person on

transportation, inserted the provision to clarify where the

revenues should go.

Straus has said he believes the state constitution requires the

revenues to go into the transportation fund. Baker, who has said

half of the money would go to public transit, disagreed. “I

believe it is more appropriate for a significant portion of this

funding to be available for more flexible emissions reduction

and equity investments,” he said.

Baker also vetoed a provision establishing a congestion pricing

commission, saying much more needs to be understood about the

future of work before congestion pricing can be considered.

Straus and his Senate counterpart, Joseph Boncore of Winthrop,

could not immediately be reached for comment.

Transportation advocates panned the governor’s vetoes,

particularly his veto.of new Uber and Lyft fees and his

dismantling of the proposal for means-tested fares. “Many of the

governor’s vetoes are counter to his own proposals and are

inconsistent with recommendations from the 2018 Commission on

the Future of Transportation,” said Rick Dimino, president and

CEO of the business group A Better City.

Transit Is Essential, a coalition of 60 organizations, lamented

the vetoes, singling out the rejection of means-tested fares.

The group urged legislative leaders to react to the

transportation bond bill vetoes the same way they did to the

veto of the climate change bill. “We urge the Massachusetts

Legislature to act swiftly to pass these provisions again and to

take action on stable, recurring revenue dedicated to transit

statewide,” the group said in a statement.

The Boston

Globe

Friday, January 15, 2021

Baker vetoes Uber, Lyft fee increase as he signs off on $16

billion in transportation borrowing

Governor also rejects a low-income fare discount on the MBTA.

By Adam Vaccaro

Governor Charlie Baker, who proposed a fee increase on Uber and

Lyft trips twice in 2020, on Friday vetoed a proposal to do just

that, while approving a broader borrowing package that will

authorize up to $16 billion in spending on transportation

projects.

The transportation bond bill will fund a wide array of projects,

such as reconfiguration of the roads near the Cape Cod bridges,

construction of South Coast Rail commuter service to New Bedford

and Fall River, and the electrification of parts of the commuter

rail, as well as many other smaller-scale road, bridge, and

transit projects. In a statement, Baker said the bill will allow

“significant investments for building and modernizing a

statewide transportation system for our residents, businesses

and communities.”

But while approving of the bulk of the measure passed by the

Legislature, Baker vetoed a number of policy proposals in it

that lawmakers attached to the bill, including ones to explore

reduced transit fares for low-income riders, and congestion

pricing for highway driving.

Most surprising, though, was the governor’s rejection of the

Legislature’s increase in fees on ride-hail trips, to $1.20 for

trips taken by single riders, and to 40 cents for shared rides

in order to encourage more carpooling. A separate surcharge

would have added 20 cents for rides taken within some Greater

Boston communities.

Baker himself had proposed an 80-cent fee increase months before

the Legislature even considered it, and he resurfaced the idea

as recently as October. But, in a letter to lawmakers, the

governor suggested part of his issue was with the differential

pricing between solo trips and shared trips.

“This proposal would create a complicated fee structure that is

based on pre-pandemic assumptions,” Baker wrote. “Before

instituting fees that are aimed at incentivizing certain travel

behaviors, we need to understand what ridership and congestion

patterns are going to look like after the pandemic.”

The move baffled some transportation advocates, who had cheered

Baker’s prior support for increasing the fees to help fund

public transit.

“This decision is a head-scratcher given it’s a proposal he’s

expressed support for in the past,” said Chris Dempsey, director

of the advocacy organization Transportation for Massachusetts.

“He can quibble with the details, but blocking this change

ultimately leaves us with the status quo which he was the first

to say wasn’t working.”

And Representative William Straus, who led the House’s

negotiations on the bill, questioned whether the state can

afford the level of borrowing in the transportation bill without

the revenue from ride-hail fees, which were projected to raise

an additional $95 million a year if ridership returned to 2019

levels.

“If at the end of the day, the administration’s approach is to

borrow money but not support the revenue that backs it up,

that’s an unusual approach,” Straus said.

Baker also cited changes in commuting habits during the pandemic

as he vetoed a proposal to study congestion pricing, which uses

tolls to discourage driving during heavy-traffic periods. In his

letter, he said it’s unclear whether congestion will even remain

a major issue long-term as more people have begun working

remotely during the pandemic.

Also vetoed was a requirement that the MBTA implement a fare

discount for low-income riders, a policy that agency officials

have long promised to enact. In his letter, Baker said he

supports a low-income fare program, but that it cannot go into

place until the MBTA has a plan to fill the revenue it would

lose.

Mela Miles, director of the T Riders Union at the Roxbury

nonprofit Alternatives for Community and Environment, was

frustrated that Baker did not allow the fare measure to stand.

“It’s dismissive. Insensitive. Out of touch with reality, in the

middle of a pandemic when people have lost their jobs,” she

said. “I wish he could be a little more connected to the people

it was being done for, and understand how important that is and

not just look at the bottom line.”