|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

46 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Sunday, August 23, 2020

Baker to Accept

Trump's Deal

Jump directly

to CLT's Commentary on the News

|

Most Relevant News Excerpts

(Full news reports follow

Commentary)

|

|

Unemployment

benefit checks for the more than 500,000 left jobless in

Massachusetts amid the coronavirus pandemic could soon be

growing $400 fatter.

Gov. Charlie Baker

on Tuesday signaled he intends to accept President Trump’s

plan to boost unemployment benefits.

“If this program

is there and it turns out to be the only thing that’s there,

I don’t think Massachusetts should pass on that,” he said.

The president

signed an executive order Aug. 8 to extend additional

benefits of $300 or $400 per week — depending on which plan

governors choose — to the unemployed after Congress failed

to strike a deal to extend a federally funded $600 weekly

benefit that expired in July.

Under Trump’s

plan, states are required to ante up 25% of the added cost,

or $100 per claimant in order to access the extra federal

benefit dollars — a requirement that has confused

cash-strapped states.

Baker said he

would have to dip into emergency aid provided in the CARES

Act to fund the unemployment extension. Alternatively,

states could count the first $100 they pay in weekly

benefits to meet the requirement — which would reduce the

weekly boost to claimants from $400 to $300....

New Hampshire on

Tuesday became the first New England state to sign onto the

plan after Gov. Chris Sununu announced his intention to

apply.

The Boston Herald

Wednesday, August 19, 2020

Charlie Baker says Massachusetts will accept Trump plan

to extend unemployment benefits

As Gov. Charlie

Baker said he intends to accept President Trump’s plan to

boost unemployment weekly benefits by as much as $400,

fiscal watchdogs tell the Herald that the plan requiring

states to pay $100 each week is “highly problematic.”

Massachusetts —

with the highest unemployment rate in the country at 17.4% —

simply doesn’t have the money, said Greg Sullivan of the

Pioneer Institute....

As Bay State

officials stare at a $6 billion structural deficit amid

plummeting tax revenue, adding this program would be quite

difficult, said Eileen McAnneny of the Massachusetts

Taxpayers Foundation.

“The state would

be hard-pressed to find that money,” she said, noting the

numerous competing needs during the coronavirus crisis.

Baker this week

signaled the state would apply to receive funds under the

new program.

Trump recently

signed an executive order to extend additional benefits of

$300 or $400 per week — depending on which plan governors

choose — to the unemployed after Congress failed to strike a

deal to extend a federally funded $600 weekly benefit.

Under Trump’s

plan, states are required to ante up 25% of the added cost,

or $100 per claimant in order to access the extra federal

benefit dollars.

“They’re asking

the states that are getting deeper and deeper in the red to

pony up additional funds,” said UMass Amherst economics

professor emeritus David Kotz. “How are they going to

do that?”

“Massachusetts

just doesn’t have extra money to put into unemployment

compensation,” he added.

Baker said he

would have to dip into emergency aid provided in the CARES

Act to fund the unemployment extension....

The Massachusetts

Unemployment Trust Fund is facing a projected deficit of

$3.2 billion by the end of the year, and $6.2 billion by the

end of 2021, Sullivan noted.

Instead of the

state paying 25% of the added cost for the unemployment

benefits, Sullivan is keeping his fingers crossed that

Congress will pass a $400 compromise when they reconvene.

“We just don’t

have the ability to deficit spend like Congress can do,” he

said.

But the fed can’t

print money forever, said Chip Ford of the

Citizens for Limited Taxation.

“They can’t keep

paying out more and more,” he said. “People need to

get back to work.”

The Boston Herald

Thursday, August 20, 2020

New $400 unemployment plan called ‘highly problematic’

for Massachusetts amid coronavirus crisis

The Bay State has the highest unemployment rate in the U.S.

Massachusetts had

the nation’s highest unemployment rate in July — 16.1% —

followed by New York at 15.9%, according to a U.S. Bureau of

Labor Statistics report released Friday.

Bay State

unemployment was down from 17.4% in June but still far above

July’s national unemployment rate of 10.2%, which was down

from 11.1% in June.

“Massachusetts

continues to lead the rest of the country in the percentage

of people out of work. It’s not a statistic to be

proud of,” said Paul Craney, spokesman for the Massachusetts

Fiscal Alliance.

Gov. Charlie Baker

and the legislative leaders “need to do everything they can

to reopen the state economy and instill confidence in the

private sector,” Craney said. “Looking forward, our

leaders must promise not to raise taxes, increase spending

or enact more harmful regulations if they really wish to see

our economy start to recover … it’s time they wake up to the

reality that they are forcing businesses and residents to

live every day.”

Robert Murphy,

professor of economics at Boston College, said

Massachusetts’ unemployment rate likely is remaining high

because it has more service jobs than manufacturing jobs.

“Some of those

hospitality jobs may be gone for good because those

employers just couldn’t hold on any longer,” Murphy said....

Jon B. Hurst,

president of the Retailers Association of Massachusetts,

said in a recent survey of the group’s 4,000 members, many

said they expect to lay off even more people....

From July 2019 to

July 2020, the Bureau of Labor Statistics estimates

Massachusetts lost 452,600 jobs, with the largest percentage

losses in leisure and hospitality, other services, trade,

transportation and utilities, and construction.

The Boston Herald

Friday, August 21, 2020

Massachusetts had the nation’s highest unemployment rate in

July

Folks are the salt

of the earth. They man the governor’s snitch lines, they

count up how many are congregating in the backyards and then

write up the fines for anyone having too much fun.

They scream at you

for not wearing a mask. They cut off the water and the

power in gyms whose owners try to reopen.

Folks are on the

public payroll. Some wear white lab coats and have

Ph.D.s, which they think makes them doctors. Folks

always tell Joe Biden’s BFF Charlie Parker what a wonderful

job he’s doing, and they never mention that we have the

third highest death rate in the nation, or the 5,658 deaths

on his watch in his nursing homes.

Folks have never

missed a paycheck these last five months.

Then there are the

people. You know who they are — they’re angry, just

because they’ve lost their jobs, their barrooms are shut

down and their kids can’t go back to school. And

perhaps most importantly, they’re fed up with being yelled

at by “folks.”

The unemployment

for people in Maskachusetts is 17.4%, the worst in the

nation. For folks, it’s zero....

“The crowding and

the behavior that our folks saw out there last weekend

simply can’t continue. If people can’t space out …

then we’ll have to limit the number of people who can be

there.”

Do you want to

loot and riot? That’s fine with Charlie Parker, as he

made clear after the mayhem in Boston. If you want to

work out at a gym, or have a beer on the golf course, you’re

people. Looting, though, is for folks.

“The vast majority

of the folks who participated in those demonstrations were

wearing masks.”

George Orwell

wrote that some animals were more equal than others.

In Charlie Parker’s Fourth Reich, folks are more equal than

people....

Remember that:

people must abide by the rules. And folks set the

rules for the people.

“Folks,” the

governor tells us, “are trying to do the right thing.”

People, on the

other hand, are always throwing “these parties (that) are

too big, too crowded, and people are simply not responsible

about face coverings or any of the major metrics.”

How dare people

not follow any of Tall Deval’s major metrics! Call 911

— call the folks....

Bob Dylan once

described the world as “one big prison yard. Some of

us are prisoners, and some of us are guards.”

Nothing’s changed

in Maskachusetts except the terminology. Nowadays,

some of us are people, and the rest of us are folks.

The Boston Herald

Tuesday, August 18, 2020

Charlie Baker’s ‘folks’ masking as COVID cops

By Howie Carr

One-third of

households in the state still need to be counted for the

United States Census, according to the state's overseer of

the count, which is slated to end field operations a month

earlier than previously planned.

Secretary of State

William Galvin said the uncounted households are

disproportionately in urban areas. Census workers

originally had until October to finish tallying residents

but U.S. Census Bureau Director Steven Dillingham announced

in early August that field data collection would end on

Sept. 30.

"I'm particularly

concerned about the early end to the census that has been

announced by the Bureau. Once again, a politically

motivated effort quite clearly," Galvin said at a Tuesday

press conference. "I know the Attorney General and I,

we've had communication about that, probably suing on that

too."

Galvin said 65.8

percent of the households in Massachusetts have

self-reported. Cities like Worcester, Lawrence,

Boston, and Fall River are areas Galvin said he wants to

make sure get counted. Staff members from the

secretary of state's office traveled to Lawrence to work

with the U.S. Census Bureau, Galvin said, using handheld

tablets to count people.

State House News

Service

Wednesday, August 19, 2020

Wary of Census Undercounts, Galvin Working With Cities

Congress and

the Trump administration deserve kudos for quickly

providing stimulus totaling $3.6 trillion. Conservatives

may worry about skyrocketing interest payments on the

national debt, but inflation will be the bigger

problem....

The Federal

Reserve has increased holdings of Treasuries and other

assets by about $3 trillion by printing money to pay for

those. Nearly all the interest the Fed earns on new

assets is remitted to the Treasury, so the net effect on

interest paid by Uncle Sam to private investors is

negligible.

Consequently,

virtually the whole stimulus was paid by running the

printing presses....

Increasing the

money supply must result in either more goods produced

or higher prices. If unemployment is low, inflation will

result, but underutilized capacity is currently

plentiful.

In April and

May, consumer prices generally fell and were hardly up

over the prior 12 months. Prices appear so tame that

some macroeconomists advocate that the Fed should push

interest rates below zero to further boost the economy,

but that would be a mistake.

The facts on

the ground will change as businesses reopen.

Already,

consumers are expecting more inflation and investors are

demanding higher premiums on ordinary Treasuries over

inflation-indexed bonds....

Food prices

have already jumped — it appears that grocery stores and

restaurants have different suppliers and requirements

for items like meat, milk, eggs, and vegetables. Some

suppliers are dumping milk and disposing of eggs, while

others get premium prices for what they have.

Theaters and

domestic cleaning services are charging more.

With the

shutdown, clearance sales, often online, for apparel and

many other household items pushed down prices but with

many stores permanently closed, prices will rebound.

With the

shutdown, clearance sales, often online, for apparel and

many other household items pushed down prices but with

many stores permanently closed, prices will rebound....

As the economy

recovers — even with some structural unemployment in

industries like air travel and restaurants — supply

bottlenecks will emerge as consumer dollars move to new

uses. Without more discipline at the Fed, inflation

could easily get out of control.

NewsMax

Finance

Tuesday, July 7, 2020

The Fed Should Plan for Increased Inflation Now |

Chip Ford's CLT

Commentary

CORRECTION: CLT member Sarah B.

quickly contacted me upon receiving the last CLT Update, pointing out:

"I know $3.4

billion is a lot to you, but I think Nancy Pelosi is asking for

$3.4 Trillion. Everything that has been spent is in

the trillions over the coronavirus. I think the billions

have been left behind a long time ago."

So true. A billion is

1,000 millions. A trillion is 1,000 billions.

Quite a difference, but when you're never going to pay any

of it back, not so much. At the rate the U.S.

government is spending money (and the Federal Reserve Bank

is complicit in financing unfathomable federal deficit

spending) how long will it be before we're discussing

quadrillions (1,000 trillions)?

I was able to

correct my slip-up before publishing it to the CLT website.

Thanks Sarah!

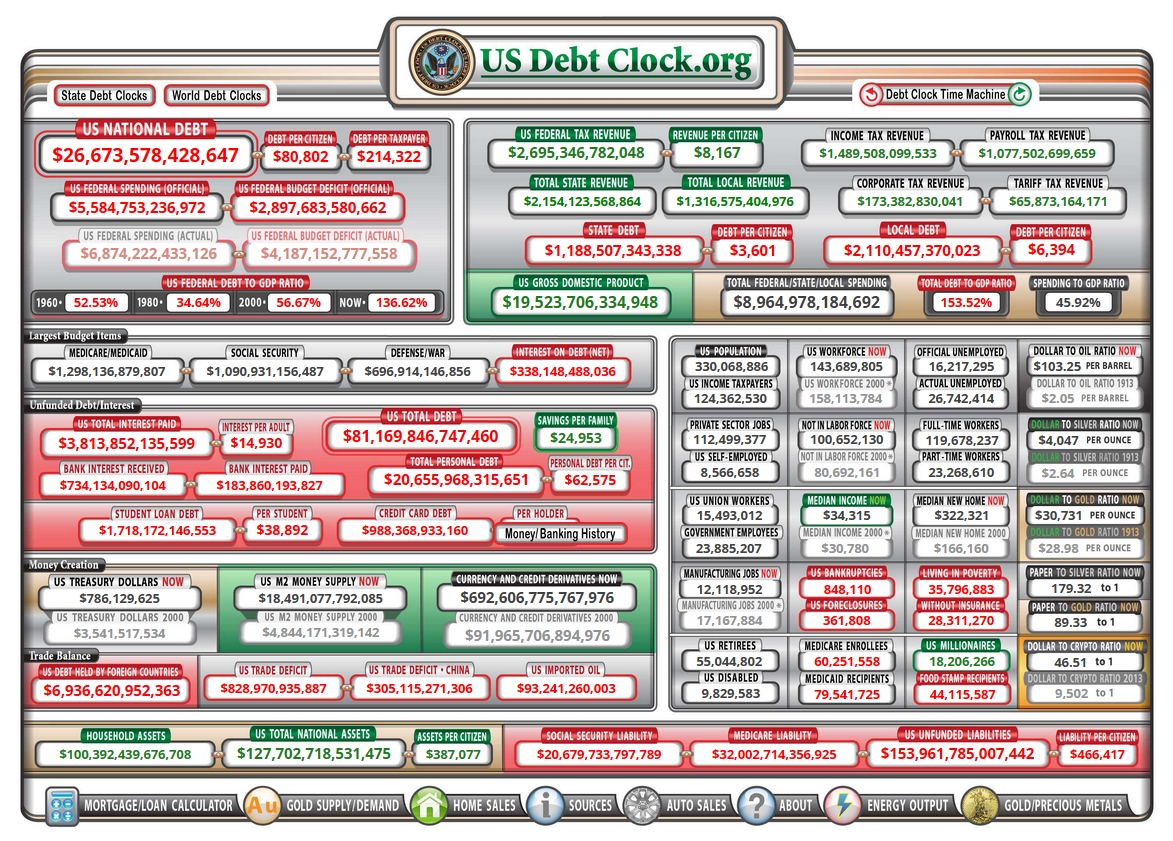

CLICK IMAGES TO ENLARGE

With this in mind, I was called this

week by Boston Herald reporter Rick Sobey for my take on the state's

unemployment situation and His Majesty Charlie Baker's decision to

"accept" the Trump administration's unilateral plan to extend

federal unemployment benefits. We had a lengthy discussion,

but few of my comments made it into his report on Thursday ("New $400 unemployment plan called ‘highly problematic’

for Massachusetts amid coronavirus crisis;

The Bay State has the highest unemployment rate in the U.S.").

I told Rick that Gov. Baker needs to

ease up on his lockdown, that the state's unemployment trust fund

has run out of money. (It is predicted to run a $3.2 billion

deficit by the end of the year, and $6.2 billion by the end of

2021.) Baker and his lockdown cabal must loosen the chokehold

on employment. "Since jobs have been outlawed only outlaws

have jobs," I told Rick with a smile. I said I think President

Trump's executive order, bypassing the dysfunctional U.S. House, was

smart, noting that it's now pretty obvious to most that the generous

$600 each week of federal unemployment benefits, on top of state

unemployment benefits, was providing more income to the unemployed

than when they were employed.

Nobody can blame the unemployed for

taking the deal and increasing their income —

free money is hard to resist. But it is depressing any kind of

economic recovery when workers decline returning to their jobs

because they're making more by remaining unemployed than working.

Trump's deal is to reduce the federal

hand-out from $600 to $400 a week, and require the state to pick up

25% of the cost if the state wishes to participate in the federal

hand-out. After some wrestling with it Gov. Baker has

indicated that he'll accept the president's deal. Once again

— free money is hard to resist.

The worst part of the unemployment

crisis is that while the state's unemployment trust fund is digging

a deeper hole paying out benefits for the highest unemployment

rate in the nation —

former-employers are no longer paying into the trust fund, as

they no longer have employees they must cover. This is the

Law of Diminishing Returns in action, and if the lockdown goes

on the eventual outcome will not be pretty for any.

Holding out for federal bailouts is

just whistling past the graveyard, I added. The federal

government doesn't have any money either. It's not

borrowing the trillions, they just get The Fed to print up

trillions more. In fact it's even easier today as printing

presses aren't necessary — it takes

just a few keystrokes on some Federal Reserve computer and voilà

— instant trillions of dollars appear

on balance sheets. All this "printing" out of thin air can

only lead to inflation, steadily devaluing the dollar toward

worthless. Thanks to the Federal Reserve bank interest rates

are already at near-zero, keeping down the government's cost of

borrowing multi-trillions but crushing savers and those on fixed

incomes.

Here's an excerpt

from Rick Sobey's report (full report below):

As Gov. Charlie

Baker said he intends to accept President Trump’s plan to

boost unemployment weekly benefits by as much as $400,

fiscal watchdogs tell the Herald that the plan requiring

states to pay $100 each week is “highly problematic.”

Massachusetts —

with the highest unemployment rate in the country at 17.4% —

simply doesn’t have the money, said Greg Sullivan of the

Pioneer Institute....

As Bay State

officials stare at a $6 billion structural deficit amid

plummeting tax revenue, adding this program would be quite

difficult, said Eileen McAnneny of the Massachusetts

Taxpayers Foundation.

“The state would

be hard-pressed to find that money,” she said, noting the

numerous competing needs during the coronavirus crisis.

Baker this week

signaled the state would apply to receive funds under the

new program.

Trump recently

signed an executive order to extend additional benefits of

$300 or $400 per week — depending on which plan governors

choose — to the unemployed after Congress failed to strike a

deal to extend a federally funded $600 weekly benefit.

Under Trump’s

plan, states are required to ante up 25% of the added cost,

or $100 per claimant in order to access the extra federal

benefit dollars.

“They’re asking

the states that are getting deeper and deeper in the red to

pony up additional funds,” said UMass Amherst economics

professor emeritus David Kotz. “How are they going to

do that?”

“Massachusetts

just doesn’t have extra money to put into unemployment

compensation,” he added.

Baker said he

would have to dip into emergency aid provided in the CARES

Act to fund the unemployment extension....

The Massachusetts

Unemployment Trust Fund is facing a projected deficit of

$3.2 billion by the end of the year, and $6.2 billion by the

end of 2021, Sullivan noted.

Instead of the

state paying 25% of the added cost for the unemployment

benefits, Sullivan is keeping his fingers crossed that

Congress will pass a $400 compromise when they reconvene.

“We just don’t

have the ability to deficit spend like Congress can do,” he

said.

But the fed can’t

print money forever, said Chip Ford of the Citizens for Limited Taxation.

“They can’t keep

paying out more and more,” he said. “People need to

get back to work.”

CLICK IMAGE TO VIEW ACTIVE STATISTICS

Interest rates are low and

falling. In a normal market, prospects of

inflation would fall.

But this isn’t a normal

market.

The Federal Reserve is

providing money to bond markets. It’s

buying billions of dollars of corporate bonds.

And that’s hiding inflation.

Money & Markets

July 9, 2020

Inflation Isn’t Dead. It’s Hiding Behind the Fed

By Michael Carr

. . .

Implicit in that reasoning is the idea that inflation,

if when it starts to “overshoot,” can be tamed just like

that. History would suggest that’s not how it

works.

But

also implicit in that reasoning is that what the economy

(and employment) needs is interest-rate suppression.

While, with government debt as astronomically high as it

is, I can see why Washington — in the broad sense of

that term — would like to keep rates as low as possible,

it would be a mistake, in my view, (1) to overestimate

the extent to which ultra-low interest rates will juice

up the economy and (2) to underestimate the

malinvestment that may now lie ahead, not to speak of

the damage to pension funds, retirees, and those who

rely on fixed incomes.

The

Spectator

July 17, 2020

Federal Reserve & Inflation: A Change for the Worse?

If you’ve read my articles

in the last few weeks, you may have noticed I’ve

been writing about inflation more lately.

I’m doing so because your income

portfolios—especially your bonds!—are at risk as

a result of recent money printing.

My recent monetary focus

has taken many readers by surprise. After all,

we haven’t seen sustained inflation in 40 years.

Nothing like a four-decade lull to lure an

investor into a false sense of “60/40 retirement

portfolio” security!

But even though we’re

staring at day-to-day deflation right now, with

lockdowns hitting demand for most products

beyond the essentials, make no mistake: the

ingredients for inflation are there. Most

obvious: the massive increase in the money

supply, which has soared by $3 trillion since

March, thanks to Federal Reserve Chairman Jay

Powell’s printing press corporate-bond-buying

program.

Forbes Magazine

July 22, 2020

Inflation Is Coming. Here’s How I’m Getting

Ready

By Brett Owens

. . . The huge need of the

U.S. Treasury to finance the CARES act money

dumps put $7.35 billion of Treasury paper into

dealer inventories. By law, the Treasury

is prohibited from selling its debt directly to

the Fed. The wise crafters of the 1913

Federal Reserve Act did not want the central

bank to cater to the whims of the Congress or

President, fearing that the two could go on a

money printing spree! To get around this

prohibition, the Treasury sells to the Wall

Street money center dealers who parcel it out to

the public. Since today’s Fed has publicly

pledged to “keep interest rates accommodative,”

i.e., low, the Fed must now step in and begin

purchasing Treasury paper in the marketplace,

lest rates continue their uptrend.

Forbes Magazine

Monday, August 17, 2020

The Inflation Scare

By Robert Barone

Rick Sobey's report noted:

"Baker said he

would have to dip into emergency aid provided in the CARES

Act to fund the unemployment extension."

On July 21 the State House News Service

reported:

The state received $2.7 billion in COVID-19 relief funds under the CARES

Act and the Baker administration has been doling out that money.

There are strings attached as the federal funds can only cover

expenditures that had not been budgeted as of March 27, 2020 when the

CARES Act was enacted. The money may not supplant state or

municipal spending, and also may only cover expenditures incurred on or

after March 1, 2020, and up to December 30, 2020.

On August 6 the News Service

reported:

About $2.163

billion in July revenue will be counted towards fiscal 2021,

including an estimated $50 million in corporate and business

taxes that were deferred from the spring when state waived

penalties for late filing and payment, DOR said. Once the

numbers are adjusted for tax deferrals, tax collections

last month were about $88 million or 4.3 percent higher than the

equivalent tax collections in July 2019, DOR said. . . .

The state also has $3.5 billion stashed

away in its rainy day fund that could be used to address budget

shortfalls in fiscal year 2020 and beyond.

Have at your dipping away Charlie

— but better yet, free Maskachusetts

hostages, employers and workers. Allow the economy to pick itself

up, dust itself off, and get going again.

Howie Carr's column in The

Boston Herald on Tuesday ("Charlie Baker’s ‘folks’ masking as COVID cops")

reveals His Royal Majesty Baker's dystopian Maskachusetts.

Here's an excerpt from it (full column below):

Folks are the salt

of the earth. They man the governor’s snitch lines, they

count up how many are congregating in the backyards and then

write up the fines for anyone having too much fun.

They scream at you

for not wearing a mask. They cut off the water and the

power in gyms whose owners try to reopen.

Folks are on the

public payroll. Some wear white lab coats and have

Ph.D.s, which they think makes them doctors. Folks

always tell Joe Biden’s BFF Charlie Parker what a wonderful

job he’s doing, and they never mention that we have the

third highest death rate in the nation, or the 5,658 deaths

on his watch in his nursing homes.

Folks have never

missed a paycheck these last five months.

Then there are the

people. You know who they are — they’re angry, just

because they’ve lost their jobs, their barrooms are shut

down and their kids can’t go back to school. And

perhaps most importantly, they’re fed up with being yelled

at by “folks.”

The unemployment

for people in Maskachusetts is 17.4%, the worst in the

nation. For folks, it’s zero....

George Orwell

wrote that some animals were more equal than others.

In Charlie Parker’s Fourth Reich, folks are more equal than

people....

Remember that:

people must abide by the rules. And folks set the

rules for the people.

“Folks,” the

governor tells us, “are trying to do the right thing.”

People, on the

other hand, are always throwing “these parties (that) are

too big, too crowded, and people are simply not responsible

about face coverings or any of the major metrics.”

How dare people

not follow any of Tall Deval’s major metrics! Call 911

— call the folks....

Bob Dylan once

described the world as “one big prison yard. Some of

us are prisoners, and some of us are guards.”

Nothing’s changed

in Maskachusetts except the terminology. Nowadays,

some of us are people, and the rest of us are folks.

The State House News

Service reported on Wednesday ("Wary of Census Undercounts, Galvin Working With Cities):

One-third of

households in the state still need to be counted for the

United States Census, according to the state's overseer of

the count, which is slated to end field operations a month

earlier than previously planned.

Secretary of State

William Galvin said the uncounted households are

disproportionately in urban areas. Census workers

originally had until October to finish tallying residents

but U.S. Census Bureau Director Steven Dillingham announced

in early August that field data collection would end on

Sept. 30.

"I'm particularly

concerned about the early end to the census that has been

announced by the Bureau. Once again, a politically

motivated effort quite clearly," Galvin said at a Tuesday

press conference. "I know the Attorney General and I,

we've had communication about that, probably suing on that

too."

Galvin said 65.8

percent of the households in Massachusetts have

self-reported. Cities like Worcester, Lawrence,

Boston, and Fall River are areas Galvin said he wants to

make sure get counted. Staff members from the

secretary of state's office traveled to Lawrence to work

with the U.S. Census Bureau, Galvin said, using handheld

tablets to count people.

Secretary of State Bill Galvin

is frantically scrambling to find as many warm bodies in

Massachusetts as he can uncover as the 2020 census window is

slamming shut next month. He's sent his legions of

body-counters out to the so-called "gateway cities" across

the state like ICE agents, rounding up "international

immigrants" that make up the Bay State's only population

influx. The desperation is telling.

In the

first CLT Update of 2020 I wrote:

Massachusetts

continues to lose its productive taxpayer population according

to a recently released U.S. Census Bureau report. The Bay State

Diaspora continues.

"Despite the overall

increase, Massachusetts was one of 27 states that lost

population through net domestic migration, the movement of

people to other states," the State House News Service reported

last week. "Domestic migration drove the population decrease in

the Northeast, the Census Bureau said.... The South, meanwhile,

experienced the largest regional population growth from 2018 to

2019, rising by more than 1 million people to 125,580,448,

primarily due to natural increase and domestic migration."

Just a year ago, on

December 19, 2019, the State House News Service reported ("Bay

State population growth tops in New England"):

Population growth in Massachusetts

is outpacing that of other New England states, according

to the U.S. Census Bureau, and Secretary of State

William Galvin is now predicting that the state should

be able to hold on to all nine seats in Congress with an

accurate head count in 2020.

New data released on Wednesday

showed that the population in Massachusetts grew by

38,903 people to 6.9 million between July 1, 2017 and

July 1, 2018. The 0.6 percent growth rate equaled the

population growth in the country, and ranked

Massachusetts 22nd among all other states and first in

New England.

Galvin said that while the state

continues to lose residents to other states, those loses

are more than offset by international immigration.

"These numbers show how important it is that we ensure

every person in Massachusetts is counted in the 2020

Census, whether or not they are United States citizens,"

Galvin said.

After the 2010 Census,

Massachusetts lost one seat in Congress. Galvin said the

state should be able to avoid a repeat of that with an

accurate population count.

"The population numbers make it

clear that Massachusetts should retain all of our

congressional representation, as long as we have a fair

and accurate count," Galvin said. "I will continue to

pursue all legal options to prevent the current

administration from inserting questions about

citizenship status into the 2020 Census, in their effort

to shortchange states like ours by dissuading our

immigrant population from being counted."

The

Associated Press added:

Galvin said that according to the

new numbers, the driving factor behind Massachusetts'

population growth appears to be international

immigration.

He said while Massachusetts

continues to lose population by residents moving to

other states, the loss is offset by twice that number of

people moving to the state from other countries.

In

my commentary for that CLT Update I wrote:

Secretary of State William Galvin

is giddy. "He said while Massachusetts continues to

lose population by residents moving to other states, the

loss is offset by twice that number of people moving to

the state from other countries."

He thinks this will help the Bay

State hang onto its nine U.S. Congressional seats

despite the mass exodus of former-taxpayers, replaced by

immigrants legal and otherwise. "I will continue to

pursue all legal options to prevent the current

administration from inserting questions about

citizenship status into the 2020 Census, in their effort

to shortchange states like ours by dissuading our

immigrant population from being counted," he vowed.

A net increase in warm bodies does

not equate with a net increase

— or

even a balance —

in revenue coming into the state's coffers.

Just-defeated for re-election Rep.

Jim Lyons (R-Andover)

managed to pry from the Patrick administration's

clutching hands its accounting records that showed

Massachusetts taxpayers were spending "at least $93

million a year" on free health care for illegal aliens.

(CLT Update; Nov. 2, 2011, "$93M

for illegals' health care — 'the tip of the iceberg'")

Subsequent reports indicate that total taxpayer spending

on illegal aliens is actually over $2 billion a

year.

Nothing has

improved over the past year —

the exodus of taxpaying citizens continues. There's no need

to wonder why "revenue" needs to be continually increased on

those who remain. Somebody has to make up for the

transfer of wealth shortfall —

and that somebody is you and other productive

taxpayers.

Wouldn't it be just awful if Massachusetts

loses another seat in Congress, is reduced to eight U.S.

Representatives when the decennial census is concluded?

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports Follow

(excerpted above) |

|

The Boston

Herald

Wednesday, August 19, 2020

Charlie Baker says Massachusetts will accept Trump plan

to extend unemployment benefits

By Erin Tiernan

Unemployment benefit checks for the more than 500,000 left

jobless in Massachusetts amid the coronavirus pandemic could

soon be growing $400 fatter.

Gov. Charlie Baker on Tuesday signaled he intends to accept

President Trump’s plan to boost unemployment benefits.

“If this program is there and it turns out to be the only

thing that’s there, I don’t think Massachusetts should pass

on that,” he said.

The president signed an executive order Aug. 8 to extend

additional benefits of $300 or $400 per week — depending on

which plan governors choose — to the unemployed after

Congress failed to strike a deal to extend a federally

funded $600 weekly benefit that expired in July.

Under Trump’s plan, states are required to ante up 25% of

the added cost, or $100 per claimant in order to access the

extra federal benefit dollars — a requirement that has

confused cash-strapped states.

Baker said he would have to dip into emergency aid provided

in the CARES Act to fund the unemployment extension.

Alternatively, states could count the first $100 they pay in

weekly benefits to meet the requirement — which would reduce

the weekly boost to claimants from $400 to $300.

Baker said he disagrees with Trump’s plan to ask FEMA to

administer $44 billion from the government’s $70 billion

Disaster Relief Fund — which typically pays for clean-up

after extreme weather events like hurricanes and tornadoes.

“I don’t think this is the right way to do this,” Baker said

Tuesday. “I worry a lot that we’re taking money from federal

reimbursements for emergency services provided associated

with the first four months of COVID under FEMA to fund this

program,” Baker said.

New Hampshire on Tuesday became the first New England state

to sign onto the plan after Gov. Chris Sununu announced his

intention to apply.

Arizona, Colorado, Iowa, Louisiana, Missouri, New Mexico and

Utah are the first states to receive federal approval for

funding.

South Dakota is the only state so far to decline the

benefit.

Speaking from the State House, Baker told reporters “we did

submit a letter to the feds saying that we would apply to

receive funds under that program.”

A spokesman for the governor’s office later clarified the

administration has signaled to federal officials that they

intend to apply to participate in the program.

It’s unclear if Trump has the constitutional authority to

extend federal unemployment benefits by executive order.

The Boston

Herald

Thursday, August 20, 2020

New $400 unemployment plan called ‘highly problematic’

for Massachusetts amid coronavirus crisis

The Bay State has the highest unemployment rate in the U.S.

By Rick Sobey

As Gov. Charlie Baker said he intends to accept President

Trump’s plan to boost unemployment weekly benefits by as

much as $400, fiscal watchdogs tell the Herald that the plan

requiring states to pay $100 each week is “highly

problematic.”

Massachusetts — with the highest unemployment rate in the

country at 17.4% — simply doesn’t have the money, said Greg

Sullivan of the Pioneer Institute.

“The federal government is asking a state to pay a gigantic

amount of money when it’s flat broke,” Sullivan said.

“This proposal is highly problematic for Massachusetts,” he

added. “It’s tough to imagine how the state can come up with

this money.”

As Bay State officials stare at a $6 billion structural

deficit amid plummeting tax revenue, adding this program

would be quite difficult, said Eileen McAnneny of the

Massachusetts Taxpayers Foundation.

“The state would be hard-pressed to find that money,” she

said, noting the numerous competing needs during the

coronavirus crisis.

Baker this week signaled the state would apply to receive

funds under the new program.

Trump recently signed an executive order to extend

additional benefits of $300 or $400 per week — depending on

which plan governors choose — to the unemployed after

Congress failed to strike a deal to extend a federally

funded $600 weekly benefit.

Under Trump’s plan, states are required to ante up 25% of

the added cost, or $100 per claimant in order to access the

extra federal benefit dollars.

“They’re asking the states that are getting deeper and

deeper in the red to pony up additional funds,” said UMass

Amherst economics professor emeritus David Kotz. “How are

they going to do that?”

“Massachusetts just doesn’t have extra money to put into

unemployment compensation,” he added.

Baker said he would have to dip into emergency aid provided

in the CARES Act to fund the unemployment extension.

But the state has several other pressing needs that it needs

to fund, including schools and universities, Sullivan said.

“Along with every other state, we just don’t have the money

here in Massachusetts,” he said. “Everything is hitting all

at once.”

If states don’t chip in the $100, it would reduce the weekly

boost to claimants from $400 to $300.

The Massachusetts Unemployment Trust Fund is facing a

projected deficit of $3.2 billion by the end of the year,

and $6.2 billion by the end of 2021, Sullivan noted.

Instead of the state paying 25% of the added cost for the

unemployment benefits, Sullivan is keeping his fingers

crossed that Congress will pass a $400 compromise when they

reconvene.

“We just don’t have the ability to deficit spend like

Congress can do,” he said.

But the fed can’t print money forever, said Chip Ford

of the Citizens for Limited Taxation.

“They can’t keep paying out more and more,” he said. “People

need to get back to work.”

— Erin Tiernan contributed

to this report.

The Boston

Herald

Friday, August 21, 2020

Massachusetts had the nation’s highest unemployment rate in

July

By Marie Szaniszlo

Massachusetts had the nation’s highest unemployment rate in

July — 16.1% — followed by New York at 15.9%, according to a

U.S. Bureau of Labor Statistics report released Friday.

Bay State unemployment was down from 17.4% in June but still

far above July’s national unemployment rate of 10.2%, which

was down from 11.1% in June.

“Massachusetts continues to lead the rest of the country in

the percentage of people out of work. It’s not a statistic

to be proud of,” said Paul Craney, spokesman for the

Massachusetts Fiscal Alliance.

Gov. Charlie Baker and the legislative leaders “need to do

everything they can to reopen the state economy and instill

confidence in the private sector,” Craney said. “Looking

forward, our leaders must promise not to raise taxes,

increase spending or enact more harmful regulations if they

really wish to see our economy start to recover … it’s time

they wake up to the reality that they are forcing businesses

and residents to live every day.”

Robert Murphy, professor of economics at Boston College,

said Massachusetts’ unemployment rate likely is remaining

high because it has more service jobs than manufacturing

jobs.

“Some of those hospitality jobs may be gone for good because

those employers just couldn’t hold on any longer,” Murphy

said. “But I would expect to see some improvement,

especially once people feel more confident that the virus is

under control and we’re going to have a vaccine by the end

of the year or certainly early next year.”

Michael Klein, professor of international economics at the

Fletcher School at Tufts University, cautioned against

drawing too many conclusions from any one jobs report.

“Ultimately, the success of the economy turns on the success

of dealing with the pandemic,” Klein said. “And there’s too

much uncertainty about that, especially with students about

to go back to school.”

Jon B. Hurst, president of the Retailers Association of

Massachusetts, said in a recent survey of the group’s 4,000

members, many said they expect to lay off even more people.

“Their biggest problem is that consumer traffic and sales

haven’t picked up,” Hurst said. “We have to convince the

consumer that it’s safe to go out and shop, and that jobs

depend on it.”

From July 2019 to July 2020, the Bureau of Labor Statistics

estimates Massachusetts lost 452,600 jobs, with the largest

percentage losses in leisure and hospitality, other

services, trade, transportation and utilities, and

construction.

The Boston

Herald

Tuesday, August 18, 2020

Charlie Baker’s ‘folks’ masking as COVID cops

By Howie Carr

All of Gov. Charlie Baker’s world is divided into two parts.

People, and folks.

Folks are the salt of the earth. They man the governor’s

snitch lines, they count up how many are congregating in the

backyards and then write up the fines for anyone having too

much fun.

They scream at you for not wearing a mask. They cut off the

water and the power in gyms whose owners try to reopen.

Folks are on the public payroll. Some wear white lab coats

and have Ph.D.s, which they think makes them doctors. Folks

always tell Joe Biden’s BFF Charlie Parker what a wonderful

job he’s doing, and they never mention that we have the

third highest death rate in the nation, or the 5,658 deaths

on his watch in his nursing homes.

Folks have never missed a paycheck these last five months.

Then there are the people. You know who they are — they’re

angry, just because they’ve lost their jobs, their barrooms

are shut down and their kids can’t go back to school. And

perhaps most importantly, they’re fed up with being yelled

at by “folks.”

The unemployment for people in Maskachusetts is 17.4%, the

worst in the nation. For folks, it’s zero.

Here’s Charlie Parker at a spring press conference

describing his favorite “folks” who are dealing with COVID,

which would be health care folks and some folks in municipal

government and state government, and then “folks who work

with vulnerable populations.”

We used to call ‘em hacks. Now they’re folks.

Thank goodness Tall Deval has enough folks on the payroll to

keep an eye on these people who are behaving like this is

still a free country.

Remember the recent horror at the M Street Beach in South

Boston? People were having fun, a fact the governor found

“particularly oppressive.” Fortunately, his folks were there

to put a halt to such frivolity.

“The crowding and the behavior that our folks saw out there

last weekend simply can’t continue. If people can’t space

out … then we’ll have to limit the number of people who can

be there.”

Do you want to loot and riot? That’s fine with Charlie

Parker, as he made clear after the mayhem in Boston. If you

want to work out at a gym, or have a beer on the golf

course, you’re people. Looting, though, is for folks.

“The vast majority of the folks who participated in those

demonstrations were wearing masks.”

George Orwell wrote that some animals were more equal than

others. In Charlie Parker’s Fourth Reich, folks are more

equal than people.

Take Karyn Polito, the lieutenant governor. If she and her

family were people, they’d have been in big trouble for that

kegger they threw out at the compound on Lake Quinsigamond.

But they’re folks, plus Pay to Play has meetings, as Tall

Deval pointed out.

Being governor, Charlie has to make sure people do whatever

the hell he tells them to, no matter how absurd. That’s

where the folks come in.

“The response we’ve gotten from the folks we talk to is that

people are abiding by the rules … the place where you get

into the biggest trouble with respect to all of this is not

abiding by the rules, not doing the things that we’ve been

advised by many folks in the public health and health care

and epidemiological communities are the things that we need

to do to stay safe. People need to abide by the rules.”

Remember that: people must abide by the rules. And folks set

the rules for the people.

“Folks,” the governor tells us, “are trying to do the right

thing.”

People, on the other hand, are always throwing “these

parties (that) are too big, too crowded, and people are

simply not responsible about face coverings or any of the

major metrics.”

How dare people not follow any of Tall Deval’s major

metrics! Call 911 — call the folks.

“I was on a call this morning with a bunch of folks from the

health care community … We work pretty hard with some folks

to put together a pretty robust uh testing infrastructure

for colleges and universities … If you just look at the data

that’s on the weekly report that’s put out by um by the

folks at the Command Center.”

People, if you’re not at the public trough, you can’t be

folks, with one exception. The exception is, if you live in

a “community,” meaning, where a lot of illegals live. Those

are the communities getting free testing, in addition to

everything else they get for free, just like always.

“I certainly want the folks um who are living in those

communities and the folks who shop or whatever in those

communities to know what they uh, what their circumstances

(are) so that people will take appropriate precautions.”

Take appropriate precautions, folks, or the governor will

treat you like he treats people — like dogs.

Bob Dylan once described the world as “one big prison yard.

Some of us are prisoners, and some of us are guards.”

Nothing’s changed in Maskachusetts except the terminology.

Nowadays, some of us are people, and the rest of us are

folks.

State House

News Service

Wednesday, August 19, 2020

Wary of Census Undercounts, Galvin Working With Cities

By Chris Van Buskirk

One-third of households in the state still need to be

counted for the United States Census, according to the

state's overseer of the count, which is slated to end field

operations a month earlier than previously planned.

Secretary of State William Galvin said the uncounted

households are disproportionately in urban areas. Census

workers originally had until October to finish tallying

residents but U.S. Census Bureau Director Steven Dillingham

announced in early August that field data collection would

end on Sept. 30.

"I'm particularly concerned about the early end to the

census that has been announced by the Bureau. Once again, a

politically motivated effort quite clearly," Galvin said at

a Tuesday press conference. "I know the Attorney General and

I, we've had communication about that, probably suing on

that too."

Galvin said 65.8 percent of the households in Massachusetts

have self-reported. Cities like Worcester, Lawrence, Boston,

and Fall River are areas Galvin said he wants to make sure

get counted. Staff members from the secretary of state's

office traveled to Lawrence to work with the U.S. Census

Bureau, Galvin said, using handheld tablets to count people.

"We're working closely with local municipalities where

undercounts are a real problem and trying to make sure that

they all get counted," he said. "We're ahead of the country

but that's a small consolation when we're still looking at a

third of the households in Massachusetts."

NewsMax Finance

Tuesday, July 7, 2020

The Fed Should Plan for Increased Inflation Now

By Peter Morici

Congress and the Trump administration deserve kudos for quickly

providing stimulus totaling $3.6 trillion. Conservatives may

worry about skyrocketing interest payments on the national debt,

but inflation will be the bigger problem.

When the Treasury sells bonds, it may drive up interest rates

but how much depends on investor appetite for U.S. securities.

These days that is quite large, as an aging global population is

driving up savings, default prospects for developing country

bonds are rising, and corporations are bulking up on liquidity

to cope with pandemic-related uncertainties.

The net impact on the federal debt held by the public will be

less than $3.6 trillion, because some of the stimulus are loans

that will be repaid, and more spending will boost GDP and tax

revenues.

The Federal Reserve has increased holdings of Treasuries and

other assets by about $3 trillion by printing money to pay for

those. Nearly all the interest the Fed earns on new assets is

remitted to the Treasury, so the net effect on interest paid by

Uncle Sam to private investors is negligible.

Consequently, virtually the whole stimulus was paid by running

the printing presses.

Financial talking heads like to repeat Milton Freidman's

admonition that inflation is always a monetary phenomenon, but

that is not quite the same thing as saying more money always

causes inflation.

Increasing the money supply must result in either more goods

produced or higher prices. If unemployment is low, inflation

will result, but underutilized capacity is currently plentiful.

In April and May, consumer prices generally fell and were hardly

up over the prior 12 months. Prices appear so tame that some

macroeconomists advocate that the Fed should push interest rates

below zero to further boost the economy, but that would be a

mistake.

The facts on the ground will change as businesses reopen.

Already, consumers are expecting more inflation and investors

are demanding higher premiums on ordinary Treasuries over

inflation-indexed bonds.

Americans still will be eating at home more, and fast-food and

takeout prices are already rising briskly. Restaurants operating

even at Phase 3 levels will have to bear more overhead and

charge more to keep staff and diners safe while serving fewer

customers.

Folks will be flying less but Zooming more. Planes at two-thirds

capacity will require higher fares or airlines will take another

trip through bankruptcy.

Zoom was a novelty and free before the pandemic, but now that

schools and businesses rely on it, better security and

functionality are required. Microsoft, Google, and others have

jumped in and high-quality software will require paying more, or

those businesses will get it out of us by boosting prices

someplace else.

Food prices have already jumped — it appears that grocery stores

and restaurants have different suppliers and requirements for

items like meat, milk, eggs, and vegetables. Some suppliers are

dumping milk and disposing of eggs, while others get premium

prices for what they have.

Theaters and domestic cleaning services are charging more.

With the shutdown, clearance sales, often online, for apparel

and many other household items pushed down prices but with many

stores permanently closed, prices will rebound.

Oil prices were depressed by inadequate demand and a foolish

price war between Russia and Saudi Arabia, but as the economy

recovers so are gasoline sales. OPEC, Russia, and U.S. shale

fields have cut production and gas rose to $2.13 a gallon in

late-June from an April low of $1.77. Those prices will likely

go to at least $2.50.

More stimulus is likely coming to aid state and municipal

governments and for extended unemployment benefits. However, the

latter should be limited to tax revenues lost owing to the

pandemic — the National Association of Governors requested $500

billion. That amount, not much greater sums advocated by

Democrats, should be appropriated, and unemployed workers should

not be better paid to stay at home than to accept jobs.

The Federal Reserve does not have to accommodate it all by

buying so many bonds and printing more money. It could keep its

target overnight bank borrowing rate near zero, but still let

the yields on 10-year Treasuries rise from below to above 1

percent without much harm to lending for new homes and

businesses.

As the economy recovers — even with some structural unemployment

in industries like air travel and restaurants — supply

bottlenecks will emerge as consumer dollars move to new uses.

Without more discipline at the Fed, inflation could easily get

out of control.

Peter Morici is an economist and business professor at the

University of Maryland, and a national columnist. |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

BACK TO CLT

HOMEPAGE

|