Democrats from Andover, Wellesley and

Gloucester have dropped their bid to pass a constitutional

amendment that authorizes the Legislature to establish a

graduated income tax structure.

Sen. Barry Finegold of Andover and Reps.

Alice Peisch of Wellesley and Ann-Margaret Ferrante of

Gloucester had proposed the amendment to a constitutional

amendment that adds a 4 percent income surtax on household

income above $1 million per year.

The amendment was listed as withdrawn in the

hours before the Constitutional Convention resumes at 1 p.m.

The graduated income tax amendment would

have explicitly permitted the Legislature to create

additional income tax rates in order to provide tax relief

to low-income residents and raise income taxes on higher

income residents.

The main amendment (H 86) would shift

Massachusetts away from its uniform income tax rate, by

forcing taxpayers with incomes above $1 million to pay an

effective 9 percent income tax rate.

The current 5.05 percent income tax rate is

set to fall to 5 percent on Jan. 1, 2020.

State House News Service

Wednesday, June 12, 2019

Graduated income tax amendment withdrawn

By Michael P. Norton

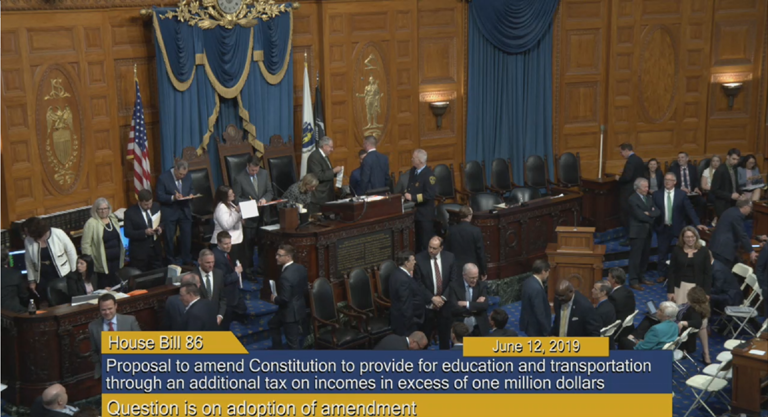

Lawmakers across both branches voted 147-48

during a Constitutional Convention on Wednesday to agree to

a constitutional amendment that adds a 4 percent surtax on

all household income above $1 million, bringing the measure

closer to a ballot question as soon as November 2022.

Republicans, who all voted against the

amendment except for Sen. Patrick O'Connor of Weymouth, had

filed several amendments to the proposed measure calling for

changes to how the tax increases would be applied and how

the new revenue would be used, but all were withdrawn or

rejected.

The constitutional amendment must be agreed

to again by a Constitutional Convention in the 2021-2022

session in order to appear before votes on the November 2022

statewide ballot. Legislators did not take up any other

constitutional amendments Wednesday, and they will resume

the Constitutional Convention on Nov. 13.

State House News Service

Constitutional Convention - Wednesday, June 12, 2019

The Legislature voted overwhelmingly in

favor on Wednesday of amending the state constitution to

raise income taxes on the wealthy, a first step toward a new

tax that supporters say could generate as much as $2 billion

in new revenue to spend on transportation and education.

House and Senate members voted 147-48 in

favor of an amendment (H 86) that would impose a 4 percent

surtax on annual income greater than $1 million, well more

than the 101 votes needed to advance.

While supporters said wealthier residents

can afford to help the state invest more in infrastructure

and public schools, opponents and business groups have

warned that its passage could drive employers out of state.

Critics have also cast doubt on revenue

estimates.

"We're supposed to be world leaders. You

don't do that if you don't have an educated workforce," said

Rep. James O'Day, the sponsor of the amendment. "You don't

do that if you can't get your workforce to work on time

because you're sitting on the Mass Pike for two plus hours.

Those things have to stop."

The debate and vote took place almost a year

to the day that the Supreme Judicial Court last summer

struck down a citizen petition to implement the same new tax

on the wealthy. This proposal will not face the same

scrutiny because it's been filed by a legislator....

The so-called "millionaires tax" will need

to be passed again at a Constitutional Convention in the

2021-2022 session in order to go before voters on the

November 2022 ballot. The amendment is required because the

state's constitution currently mandates that a tax on income

be applied evenly to all residents.

The House voted 112-43 and the Senate voted

35-6 to pass the amendment.

Eleven House Democrats joined all 32 House

Republicans in opposing the amendment, including multiple

lawmakers from the Springfield area.

Reps. Brian Ashe of Longmeadow, Ann-Margaret

Ferrante of Gloucester, Michael Finn of West Springfield,

William Galvin of Canton, Colleen Garry of Dracut, Danielle

Gregoire of Marlborough, Christopher Markey of Dartmouth,

Thomas Petrolati of Ludlow, Angelo Puppolo of Springfield,

John Velis of Westfield and Jonathan Zlotnik of Gardner all

voted no.

On the Senate side, Sen. Patrick O'Connor, a

Weymouth Republican, was the only senator to cross party

lines, casting his vote in favor of the income surtax while

the other five Senate Republicans voted against it....

Lawmakers batted down a number of suggested

changes to the proposal over the course of the debate, with

leadership pressing to make sure the final proposal mirrored

the one from last session that polled well among voters....

Minority Leader Brad Jones, a North Reading

Republican, tried to amend the proposal to guarantee that

any money collected from the millionaires tax would be spent

in addition to state funds already put toward education and

transportation, not in lieu of those funds as part of a

"bait and switch."

"Part of the reason we need to do this is

because our track record as legislators in respecting the

will of the voters on tax matters is not particularly good,"

Jones said, noting that the income tax rate has still not

been lowered fully to 5 percent, as called for under a 2000

ballot law.

Sen. Adam Hinds said he appreciated the

"intent" of the Jones amendment, but argued that the

proposal should not be changed. The amendment failed on a

40-132 vote.

Similar arguments for keeping the proposal

intact were made throughout the debate as several amendments

were withdrawn and 13 recommended changes were rejected.

Before the debate even began, Rep. Alice

Peisch, a Wellesley Democrat and the co-chair of the

Education Committee, withdrew her proposal that would have

opened the door for the Legislature to impose a fully

graduated income tax with as many tax brackets as it wanted.

Peisch declined to comment in the hallway

about her amendment and her decision to withdraw, but Sen.

Jason Lewis, who co-sponsored the "Fair Share" amendment,

said it was important to keep the proposal "simple and

clear."

State House News Service

Wednesday, June 12, 2019

Wealth tax advances to next session on 147-48 vote

JONES AMENDMENT 1 - Ensuring that funds

appropriated are in addition to and not in lieu of funds

already appropriated for such purposes

Rep. Jones said I think this amendment is

about as straightforward and should be as agreeable as

possible, which says, if we're going to pass the fair share

amendment, that the new dollars raised from taxing

millionaires that are going to be spent on transportation

and education should be in addition to money we already

spend in those areas. They shouldn't be in lieu of. The new

money should be on top.

We can't create a bait-and-switch, a

scenario where this fair share amendment passes - this

millionaire's tax - and the $2 billion raised gets spent in

those areas, and then we back out money we currently spend

in those areas and spend it elsewhere.

The gentleman from West Boylston talked

about transportation and education. If he really believes

that's what this amendment is all about, he should be

joining with me in supporting this amendment so we protect

the investments we already make and work to guarantee

additional monies raised add to that.

The argument is all this money is guaranteed

to go to transportation and education. Yet the attorney

general arguing before the SJC said no, that's not true,

there's no guarantee it will. Chief Justice Gants said it

may or may not result in an increase in funding for those

areas.

Even with this further amendment there's

still no complete guarantee, but there would be one more

step to avoid a bait-and-switch. So we don't say we took in

that $2 billion and spending it on education, but last

year's education funding has been taken out and placed

somewhere else.

Our track record as a Legislature relative

to respecting the will of the voters on tax matters is not

particularly good. In 2000 voters said they wanted to be at

5 percent by now. In 2002 the Legislature substituted a

different plan, and guess what, 17 years later we're still

not at 5 percent despite what the voters said. So frankly

the Legislature's track record frankly stinks.

If you really believe in the underlying

proposal you should absolutely support this amendment. So

you can go to the public and say this money is in addition

to existing funding. While I realize in life there are no

absolute guarantees, this amendment would hold our feet to

the fire a little more so.

Rep. Jones requested a roll call vote. There

was sufficient support.

Rep. Hinds said while I appreciate the

intent of the amendment, I'm not sure this is the way

forward we should be moving today. One of the challenges

before us is to bolster our economy. I agree with that. We

have seen no shortage of evidence of the need for these

investments. But we must be clear on our role here today and

reflect generally on why we're considering this once again

in this body.

The public has been educated on the exact

amendment we're considering. To make changes at this stage

is against the democratic imperative of making sure the

public is educated on this. If we start making changes here,

we raise legal issues and we should avoid that. I hope for a

no vote.

Rep. Tarr said I hope the amendment is

adopted and for exactly the reason explained by the

gentleman just at the microphone.

We've had month after month of debate on the

amendment now pending. A component of every discussion,

public and private, has been the money generated by this

amendment would be used exclusively for transportation and

education. That's exactly what the North Reading gentleman's

amendment says.

My friend from Pittsfield says we should do

nothing. This particular amendment complements and supports

the discussion we've held. Just as we believe in truth in

advertising, we should also have truth in legislating.

The gentleman's very simple amendment says

exactly what's been said all along in this discussion, that

the revenues generated by the proposal would be used to add

to, not to be supplanted for, the amount of revenue we are

already spending on those things.

How many times have we heard we are going to

have a net gain? A net gain. How many times have we heard

we'll have an increase in net amount of spending for

transportation and education?

Well, we've been educated. The result of the

education is the formulation of this amendment. All left to

do now is approve this amendment and say, we mean what we've

been saying.

By a ROLL CALL VOTE of 40-156, AMENDMENT

REJECTED. Senators voted 6-33; representatives voted 34-123.

State House News Service

Constitutional Convention - Wednesday, June 12, 2019