|

and the

Citizens Economic Research Foundation

Post Office Box 1147 ●

Marblehead, Massachusetts 01945 ●

(508)

915-3665

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

44 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Friday, June 8, 2018

A challenging time for

embattled taxpayers

|

The House 149-2, approved and sent to the Senate a local

option bill allowing a city or town to authorize the

creation of community benefit districts which would permit

owners of contiguous property in a city or town to form a

district and impose taxes to pay for additional services,

improvements, events and other projects and activities

within the district. The districts would be operated by a

nonprofit board....

Rep. Denise Provost (D-Somerville), one of only two

representatives to vote against the bill, said this new

option allows certain property owners to create their own

fiefdoms and the ability to assess other property owners for

purposes determined by themselves. “These are the kind of

activities for which local government exists,” said Provost.

“Why would we want to have a class of … private, parallel

quasi-governments to perform these functions? Is the

democracy, transparency and accountability of local elected

government a problem?”

“Homeowners, family-owned businesses and their employees

could be negatively impacted by groups who manipulate or

misuse the powers created under this bill that privatizes

some of local government's management and expense of tax

dollars, community development and community services

functions,” said Rep. Michelle DuBois (D-Brockton).

“Block by block they're coming for taxpayers,” said

Chip Ford, executive director of Citizens for Limited

Taxation. “Will the Legislature next propose also taxing

us at the street level, then backyard by backyard? Today

such speculation is not so far-fetched.”

Beacon Hill Roll Call

Week of May 28-June 1, 2018

A Neighborhood Can Band Together and Form a District with

Taxing Power (H-4546)

By Bob Katzen

Property owners would be allowed to create

special taxing districts to pay for neighborhood services

and improvements under a proposal working its way through

Beacon Hill, but fiscal watchdogs caution the move amounts

to a cash grab by developers.

The bipartisan proposal, approved by the

House last week, allows "community benefit districts" in

which property owners create a nonprofit board to make

neighborhood upgrades — like added security, beautification

projects or cultural programs — funded through a property

assessment.

"This would empower communities by giving

them another way to improve their downtowns and Main

Streets," said Sen. Brendan Crighton, a Lynn Democrat and

primary sponsor of the Senate's version of the bill. "There

are a lot of towns and cities — specifically gateway cities

— that stand to benefit from this."

Gov. Charlie Baker, a Republican, has vetoed

two similar proposals. He has called the assessments "the

functional equivalent of new property taxes."

But Crighton and other supporters say the

Baker administration is slowly warming to the idea as

lawmakers have amended it over the years....

Some fiscal watchdogs oppose the proposal,

arguing that it would lead to additional layers of local

taxation and government in a state already overtaxed.

"Effectively it's an end-run around the

restrictions of Proposition 2½ by dividing

municipalities into ‘community benefit districts’ that can

then additionally tax individual sub-divisions of cities and

towns — a new neighborhood tax," said Chip Ford,

executive director of Citizens for Limited Taxation.

The Salem News

Wednesday, June 6, 2018

Special taxing districts eyed for neighborhood projects

Baker opposed to idea as 'new property tax'

The state Legislature is cooking up another

piece of warm “money” pie — complete with a cherry on top —

for its friends.

From the same group that voted themselves an

18-percent pay raise comes an end-of-the-budget-season

“gift” to state and municipal retirees seeking to earn more

taxpayer-funded income as “double-dippers.” They want to

cash their public pensions — plus be able to pad them with

less restrictive rules on how may hours they can work in

retirement doing their former jobs.

You’ve read that right. Police officers,

firefighters, teachers and others who chose to retire early

from their jobs with public pensions want to work more and

earn more on the public dole. It appears both the

Democratic-controlled House and Senate are planning to

oblige them....

At present, retirees — both state and local

government — are limited to working 960 hours per year. A

bill passed by the Senate would raise the cap to 1,200

hours; the House version would pack on a generous 56 percent

increase to 1,500 hours. The bills were tucked into each

chamber’s proposed $41.5 billion state budget, and need to

be reconciled to become law....

Few government retirees leave the job early

unless they’ve maxed out their pension benefits or have

something else in the works — most likely another

decent-paying position. By raising the cap, lawmakers are

creating a “double-dipping” statute plain and simple. It’s

no secret this is an election year. For lawmakers facing a

competitive race, there are 120,000 state and teacher

retirees — and thousands more on the municipal side — whose

backs can be scratched with a double-dipping bonus....

In our view, this issue deserves more study

on its overall impact on state and local government

operations — and taxpayers. If this proposal reaches Gov.

Charlie Baker’s desk, he should veto it until citizens are

assured that lawmakers aren’t introducing a public payroll

abuse that will be the object of future reform.

A Boston Herald editorial

Sunday, June 3, 2018

Public pension changes a giveaway to retirees

Retailers in Massachusetts need help, a fact

made abundantly clear in a report released on Beacon Hill

last week.

The report, compiled by a state Senate task

force, did a fine job outlining the obstacles facing the Bay

State retail industry. The question remains, however,

whether the Democrat-dominated Legislature will do anything

to lend a hand....

State Sen. Michael Barrett, who served on

the task force, told the State House News Service last month

that the panel would not be making recommendations.

"The press will be frustrated," he said.

"They'll want us to make the call on issues like the tax

holiday, like the training wage, and if we're not prepared

to make the call, we need to clarify that."

Fortunately, there are already a handful of

initiatives before lawmakers that would help boost the

retail industry. Reinstating the sales tax holiday would be

a relatively easy first step. The late-summer reprieve from

the 6.25 percent Massachusetts sales tax usually occurs over

an August weekend. Retail business leaders have it

positioned for a statewide vote on the November ballot, but

lawmakers don't need to wait. They can make it happen now.

It would be distressing to see the work of

the task force simply shelved alongside the dozens of

similar reports compiled by, and then ignored by, the

Legislature.

A Salem News editorial

Tuesday, June 5, 2018

Help for retailers can start with sales tax holiday

By the end of the day Thursday, the

Massachusetts Legislature is expected to have approved more

than $6 billion in borrowing in just more than two weeks.

The House and Senate have already approved a

housing bond bill and action in the House on Wednesday left

two more borrowing bills -- one dealing with capital needs

and the other focused on the life sciences industry -- a

Senate vote away from Gov. Charlie Baker's desk.

The borrowing blitz began when the House and

Senate approved a housing bond bill on May 23, authorizing

$1.8 billion over five years to finance affordable housing

development and improvements at public housing facilities.

Baker signed that into law May 31....

If Baker signs both Thursday, he and the

Legislature will have OK'ed $6.14 billion in borrowing in

about 15 days.

State House News Service

Wednesday, June 6, 2018

Lawmakers, Baker on pace to add $6 Billion in borrowing

The two different versions of $41 billion

spending plans for fiscal 2019 are now officially in the

hands of six lawmakers, who voted Thursday morning to take

their negotiations behind closed doors.

Senate Ways and Means Committee Chair Karen

Spilka, who helms the conference committee with House Ways

and Means Chair Jeffrey Sánchez, said she hopes the

negotiations on the budget for the fiscal year that starts

in 24 days will be "very fruitful, productive and somewhat

swift." ...

Spilka briefly hosted Sánchez and fellow

conferees Sens. Joan Lovely and Vinny deMacedo and Reps.

Stephen Kulik and Todd Smola, along with several staffers,

in a conference room in her office. The panel met in open

session for less than 10 minutes before agreeing to continue

their talks in private....

Spilka said education and "regional

empowerment" were among main priorities in the Senate's

plan....

The Senate, on a 25-13 vote, also agreed to

a Sen. Jamie Eldridge amendment prohibiting law enforcement

officers from asking about immigration status and limiting

local law enforcement's cooperation with federal immigration

enforcement. The House budget does not address immigration

enforcement.

Jonathan Paz, a member of Progressive

Massachusetts and the Safe Communities Coalition, dropped

off a painting of the Statue of Liberty at Spilka's office

Thursday morning. He said his goal was to highlight that the

conferees were meeting in private, leaving observers with

little insight into how they were discussing the immigration

policy attached to the budget.

"This is a back-room meeting, and immigrant

lives are being leveraged," he told the News Service....

Spilka is expected to ascend to the Senate

presidency later this session, a fact that appeared to be on

her vice chair's mind Thursday morning.

"Madam president, I mean Madam

President-elect, Madam Chair," Sen. Lovely said, addressing

Spilka as she introduced a motion that the committee close

its negotiations to the public.

State House News Service

Thursday, June 7, 2018

Facing July 1 deadline, negotiators embark on state budget

talks

Raise Up Massachusetts said Thursday it has

reached an impasse in its negotiations with business

lobbying groups over a $15-per-hour minimum wage, throwing

the possibility of a “grand bargain” compromise on multiple

ballot proposals into doubt.

Raise Up, a coalition of labor unions and

their allies, has been in talks with lawmakers and

organizations like the Retailers Association of

Massachusetts and Associated Industries of Massachusetts to

find middle ground on three ballot questions: a minimum wage

increase, required paid family and medical leave, and a cut

to the state sales tax. Raise Up supports the wage and

paid-leave proposals, while the retailers group is pushing

the sales tax measure. The two sides are seeking to reach a

legislative compromise, rather than allow the proposals to

go directly to voters in November.

On Thursday, Raise Up sent a letter to House

Speaker Robert DeLeo and Senate President Harriette

Chandler, saying that the minimum-wage talks had hit a

“standstill.” The retailers want a special minimum wage for

teenagers, as well as the elimination of an existing

requirement that businesses pay workers 1.5 times their

normal wages on Sundays and holidays. But Raise Up said it

wouldn’t budge on those issues....

The so-called millionaires’ tax, which would

raise income taxes on those who earn $1 million or more

annually, is not on the table during the negotiations.

Because the proposal is a constitutional amendment, the

legislature cannot pass it into law. Instead, the proposal

must be approved by voters.

However, the Supreme Judicial Court is

considering whether the tax is constitutional. Its ruling,

which is expected any day now, could affect the “grand

bargain” negotiations, since it could change the leverage

both sides believe they have.

The effective deadline for any legislative

compromise in July 3, the date by which the sponsors of the

ballot questions must submit their final round of signatures

in support of the initiatives to the state.

Boston Business Journal

Thursday, June 7, 2018

Ballot talks at ‘standstill’ as labor group holds firm on

minimum wage

Negotiators trying to assemble a "grand

bargain" to settle sales tax reduction, paid family and

medical leave benefits, and a minimum wage increase appear

on the verge of receiving a piece of information that's

potentially critical to their talks. The Supreme Judicial

Court appears to be taking its full allotment of time to

render a decision on whether a citizen-backed constitutional

amendment imposing a 4 percent surtax on household income

above $1 billion is properly certified for the November

ballot, or should be discarded without a vote.

But just as negotiators on the three initiative petitions

are looking at early July as their deadline for a deal, time

is also running out on the high court, which aims to render

decisions on cases it hears within 115 to 130 days of oral

arguments. A standing order says that cases "should be

decided within 130 days after argument" and both sides

squared off in oral arguments on Feb. 6. The

130-day mark falls on Saturday, June 16.

Opponents of the 4 percent surtax on incomes over $1

million, argue that the format of the amendment violates the

state constitution by bundling multiple unrelated policies

into one question. Supporters of the question say it could

raise roughly $2 billion that would be directed to pay for

transportation and education. The case filed by leaders of

business groups is called Christopher Anderson & others v.

Maura Healey & another. At 8 a.m. through its

Twitter feed, the Office of the Reporter of Decisions

notifies the public of decisions that will be published two

hours later at 10 a.m. every weekday. The

proposed sales tax cut is worth about $1.2 billion a year,

and negotiators weighing multiple ballot proposals, each

carrying significant fiscal and economic implications, are

eagerly awaiting the SJC's ruling. The

supporters of the $15 minimum wage and paid leave ballot

proposals plan a "week of action," starting with a 2 p.m.

rally on Monday. State House News Service

Friday, June 8, 2018

Advances - Week of June 10, 2018

|

|

Chip Ford's CLT

Commentary

On April 11th we warned that The Takers

would soon be assaulting CLT's Proposition 2½

again ("A

calm before the storm?"), but this latest approach, I

must admit, is novel. Instead of directly attacking

the law itself, they've devised a scheme to run around it in

a way so devious that nobody ever could have foreseen.

Instead of again

attempting to change, weaken, and subvert our

property tax-limitation law ― which CLT has managed to fend

off in the past, most recently in

2013 and before that in

2010 ― this time they intend to simply create an

entire new layer of government, with its own power to

tax separately and additionally.

You've got to give

them points for creativity, and persistence.

So should we don the

armor and prepare for battle again ― or are you worn down,

disinterested, and ready to stand down and let them have

their way at last?

From the disappointing

response to our last mailing, I suspect the fighting spirit,

sufficient taxpayer resistance, has waned and for most must

be over, gone.

Apparently sensing

this apathy, the state is plowing ahead with more and more

spending, bigger and more expansive government. This

week the Governor and Legislature just borrowed another $6

Billion to spend, a huge sum (with accruing interest) which

doesn't grow on trees. That $6 Billion plus interest

will need to be repaid and, like everything else state

government borrows and spends, it is us productive taxpayers

who will pay the bill.

At publication of the

State House News Service report on Wednesday the

House and Senate had already approved a housing bond bill

authorizing $1.8 billion of borrowing.

After the Senate met on Thursday, the

State House News Service further reported:

"The

Senate voted 33-5 to enact the $473 million life

sciences bill (H 4501), and voted 38-0 to enact

$3.87 billion in borrowing and spending on state

facility repairs and other capital needs (H 4549)."

$6.14 billion borrowed in 15 days.

What do you suppose

your "fair share" will be of that $6.14 Billion now added to

the state's debt?

Meanwhile legislators

are still taking care of their friends on Bacon Hill.

According to the Boston Herald editorial:

"From

the same group that voted themselves an 18-percent

pay raise comes an end-of-the-budget-season 'gift'

to state and municipal retirees seeking to earn more

taxpayer-funded income as 'double-dippers.' They

want to cash their public pensions — plus be able to

pad them with less restrictive rules on how may

hours they can work in retirement doing their former

jobs."

This further assault on taxpayers is in the

Senate's budget now in conference committee, an amendment

(#5) by Sen. Michael Rodrigues, "Post-retirement earnings

cap increase." It was adopted by the state Senate on

May 22, right before the Senate offhandedly rejected rolling

back the sales tax to 5 percent and the income tax to 5

percent. As has become the rule rather than the

exception ― again there were

no roll call votes. None of us will ever know how

our senator voted on any of those. That's the way they

want it, cultivating their constituents as mushrooms, kept

in the dark and well fertilized until the fall harvest.

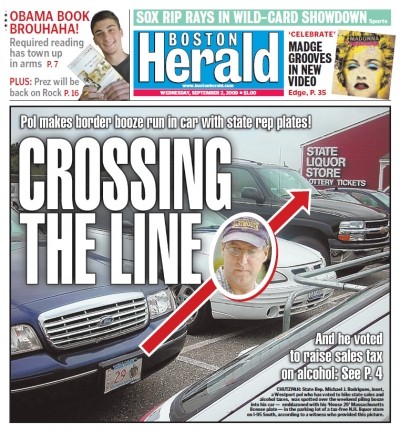

CLT members may recall the double-dipper

amendment's sponsor, Michael J. Rodrigues of Westford, from

2009. He was a state representative then, when an alert

CLT member caught and photographed him filling his trunk

with liquor at a New Hampshire state liquor store

― right after he voted to

increase the alcohol tax on the rest of us.

Any day now the state Supreme Judicial

Court's decision will come down on the constitutionality of

the sixth graduated income tax ballot question. Also

known by its advocates as the "Millionaires Tax," or the

"Fair Share Amendment," it directs how the new revenue raised

would be spent, which clearly should be

unconstitutional and prohibit the question from the ballot.

It would appear that the sales tax rollback

will be on the ballot. The Retailer's Association has

been using its threat as a negotiation lever while dealing

with Raise Up Massachusetts, the latest incarnation of

The Takers usual coalition. Raise Up Massachusetts

is the sponsor of the graduated income tax ballot question,

the $15-per-hour minimum wage ballot question, the required

paid family leave ballot question, and the required paid

medical leave ballot question. The Retailers

Association is fighting tooth and nail to save its

Massachusetts small business members from bankruptcy and

extinction, but the only thing The Takers aren't

taking is prisoners.

The Takers want it all, or nothing.

Voters should give them the latter.

But this is, after all, Massachusetts and

recent polls show The Takers walking away with their

plunder, crushing small businesses. The best ray of

hope is that those same polls show the sales tax rollback

winning big too. But if small businesses are forced to

close we'll still need to drive to New Hampshire,

out-of-state, to buy anything. Either nothing will be

available here, or anything that is will be too expensive.

And my friends are surprised that I'm

looking at shutting down CLT soon and moving out-of-state

while I still can?

My father, William "Woody" Ford, a WWII and

Battle of the Bulge veteran, passed away at 99 years old on

Wednesday ― appropriately on

the 74th anniversary of the D-Day invasion. I've got

to get back to our family's funeral arrangements but wanted

to get this out to you.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

Beacon Hill Roll Call

Week of May 28-June 1, 2018

A Neighborhood Can Band Together and Form a

District with Taxing Power (H-4546)

By Bob Katzen

The House 149-2, approved and sent to the Senate

a local option bill allowing a city or town to

authorize the creation of community benefit

districts which would permit owners of

contiguous property in a city or town to form a

district and impose taxes to pay for additional

services, improvements, events and other

projects and activities within the district. The

districts would be operated by a nonprofit

board.

“Community benefit districts are another tool

that municipalities can use to help grow their

local economies and build good neighborhoods

where people can live, work and play,” said the

bill’s sponsor Sen. Brendan Crighton (D-Lynn).

“This nationally proven model will create

opportunities in downtowns, main streets and

town centers across the commonwealth.”

“The Massachusetts Smart Growth Alliance

believes that community benefit districts can be

a game changer,” said Andre Leroux, Executive

Director MA Smart Growth Alliance. “Cities and

towns in Massachusetts are struggling to

maintain basic services for residents and

businesses, much less provide the amenities that

world-class, walkable places need to thrive. The

bill establishes a way for communities to

organize a public-private-nonprofit partnership

to support their downtown, Main Street, cultural

district, historic area or other important

place. It’s really about empowering local people

to tackle their own challenges.”

Rep. Denise Provost (D-Somerville), one of only

two representatives to vote against the bill,

said this new option allows certain property

owners to create their own fiefdoms and the

ability to assess other property owners for

purposes determined by themselves. “These are

the kind of activities for which local

government exists,” said Provost. “Why would we

want to have a class of … private, parallel

quasi-governments to perform these functions? Is

the democracy, transparency and accountability

of local elected government a problem?”

“Homeowners, family-owned businesses and their

employees could be negatively impacted by groups

who manipulate or misuse the powers created

under this bill that privatizes some of local

government's management and expense of tax

dollars, community development and community

services functions,” said Rep. Michelle DuBois

(D-Brockton).

“Block by block they're coming for taxpayers,”

said Chip Ford, executive director of

Citizens for Limited Taxation. “Will the

Legislature next propose also taxing us at the

street level, then backyard by backyard? Today

such speculation is not so far-fetched.”

The Salem News

Wednesday, June 6, 2018

Special taxing districts eyed for neighborhood

projects

Baker opposed to idea as 'new property tax'

By Christian M. Wade, Statehouse Reporter

Property owners would be allowed to create

special taxing districts to pay for neighborhood

services and improvements under a proposal

working its way through Beacon Hill, but fiscal

watchdogs caution the move amounts to a cash

grab by developers.

The bipartisan proposal, approved by the House

last week, allows "community benefit districts"

in which property owners create a nonprofit

board to make neighborhood upgrades — like added

security, beautification projects or cultural

programs — funded through a property assessment.

"This would empower communities by giving them

another way to improve their downtowns and Main

Streets," said Sen. Brendan Crighton, a Lynn

Democrat and primary sponsor of the Senate's

version of the bill. "There are a lot of towns

and cities — specifically gateway cities — that

stand to benefit from this."

Gov. Charlie Baker, a Republican, has vetoed two

similar proposals. He has called the assessments

"the functional equivalent of new property

taxes."

But Crighton and other supporters say the Baker

administration is slowly warming to the idea as

lawmakers have amended it over the years.

For one, Crighton said lawmakers have included

an "opt-out" provision for churches, soup

kitchens and other tax-exempt groups that don't

want to participate, as well as exemptions for

economically challenged businesses that can't

afford to pay into the system.

"However, we believe that the nonprofits will

want to be partners because of the benefits that

they would receive as well," he said.

Some fiscal watchdogs oppose the proposal,

arguing that it would lead to additional layers

of local taxation and government in a state

already overtaxed.

"Effectively it's an end-run around the

restrictions of Proposition 2½ by

dividing municipalities into ‘community benefit

districts’ that can then additionally tax

individual sub-divisions of cities and towns — a

new neighborhood tax," said Chip Ford,

executive director of Citizens for Limited

Taxation.

The idea’s supporters, which include the

Massachusetts Municipal Association and many

regional chambers of commerce, say local

governments would be required to hold public

hearings before creating the districts and put a

proposal before a city council or governing body

for approval.

"This isn't something that can just be imposed

on property owners," said Rep. Ann-Margaret

Ferrante, D-Gloucester. "There's a local

approval process."

Ferrante said the added revenue would help many

cash-strapped cities and towns afford

improvements and services such as snowplowing.

"In these economic times, it's very difficult

for communities to meet all the needs and

requests of their residents," she said. "This

would help with that."

Community development groups support the move,

saying it would help business districts improve

the quality of life for shoppers and residents.

"We think this is really important to the

evolution and growth of our towns and cities

that we have shopping districts that are

vibrant, safe and clean," said Joseph Kriesberg,

president of the Massachusetts Association of

Community Development Corporations, a

Boston-based advocacy group.

"The best analogy would be a condo association

pooling its money to maintain common areas," he

said. "It's a model that's worked well in other

states."

The Boston Herald

Sunday, June 3, 2018

A Boston Herald editorial

Public pension changes a giveaway to retirees

The state Legislature is cooking up another

piece of warm “money” pie — complete with a

cherry on top — for its friends.

From the same group that voted themselves an

18-percent pay raise comes an

end-of-the-budget-season “gift” to state and

municipal retirees seeking to earn more

taxpayer-funded income as “double-dippers.” They

want to cash their public pensions — plus be

able to pad them with less restrictive rules on

how may hours they can work in retirement doing

their former jobs.

You’ve read that right. Police officers,

firefighters, teachers and others who chose to

retire early from their jobs with public

pensions want to work more and earn more on the

public dole. It appears both the

Democratic-controlled House and Senate are

planning to oblige them.

Why are former state workers who chose to

retire early now saying they can’t make ends

meet?

Except for state judges, there’s no mandatory

retirement age in public service. No one kicked

the former employees out of their public jobs,

so why are they returning to public service

seeking more part-time hours?

At present, retirees — both state and local

government — are limited to working 960 hours

per year. A bill passed by the Senate would

raise the cap to 1,200 hours; the House version

would pack on a generous 56 percent increase to

1,500 hours. The bills were tucked into each

chamber’s proposed $41.5 billion state budget,

and need to be reconciled to become law.

Currently, the retirees’ workweek is capped at

18 hours on the public payroll. It would

increase to 23 hours (Senate) and 29 hours

(House) under the competing legislative schemes.

Proponents say the higher cap would offer cities

and towns the option of hiring a part-timer over

a full-timer in order to save money. Opponents

argue that the original double-dipping law was

put on the books to prevent workers from

exploiting the system — and this expansion of

hours only exacerbates it.

That’s the opinion of Kevin Blanchette, a former

state representative and now the chief executive

of the Worcester Regional Retirement System.

“With some of these folks, they retire early and

go right back to work in the same job,” he told

The Boston Globe. “It raises, for me, the

question of, why retire at all?”

The system’s already lopsided and the expanded

cap is no reform.

Few government retirees leave the job early

unless they’ve maxed out their pension benefits

or have something else in the works — most

likely another decent-paying position. By

raising the cap, lawmakers are creating a

“double-dipping” statute plain and simple. It’s

no secret this is an election year. For

lawmakers facing a competitive race, there are

120,000 state and teacher retirees — and

thousands more on the municipal side — whose

backs can be scratched with a double-dipping

bonus. But what if it backfires? What if state

agencies and municipalities start hiring more

retirees to fill positions — thus eliminating

full-time jobs — in order to cut salaries and

benefit costs?

It would be the smart thing to do, so,

conceivably, it could happen. Will it lead to

better overall government? Your guess is as good

as ours.

In our view, this issue deserves more study on

its overall impact on state and local government

operations — and taxpayers. If this proposal

reaches Gov. Charlie Baker’s desk, he should

veto it until citizens are assured that

lawmakers aren’t introducing a public payroll

abuse that will be the object of future reform.

The Salem News

Tuesday, June 5, 2018

A Salem News editorial

Help for retailers can start with sales tax

holiday

Retailers in Massachusetts need help, a fact

made abundantly clear in a report released on

Beacon Hill last week.

The report, compiled by a state Senate task

force, did a fine job outlining the obstacles

facing the Bay State retail industry. The

question remains, however, whether the

Democrat-dominated Legislature will do anything

to lend a hand.

First, the challenges:

-- The online marketplace is making things

difficult for traditional retailers. "E-commerce

and the rise of technology, evolving consumer

preferences and demographic factors are changing

the Massachusetts retail sector," the task force

wrote in its report. One only needs to look to

the recent decision to close Sears, one of the

longtime anchor stores at the Northshore Mall,

for recent evidence of the shift to mobile

shopping.

-- Brick-and-mortar retailers in Massachusetts

have to charge a sales tax. In most cases,

online retailers do not. Neither do businesses

north of the border in New Hampshire. And Bay

State legislators have consistently rejected

calls for an August sales tax holiday.

-- Restrictive zoning has made it difficult for

new business to grow in the state's downtowns,

and the Legislature has kept a tight hold on

liquor licenses, artificially stifling the

growth of the hospitality industry.

-- The state's high cost of living — everything

from health and child care to housing costs — is

putting an increasing burden on retailers and

their employees. State policy, the task force

writes, isn't making things easier: "Existing

and future mandates, including minimum wage,

premium pay and health care assessments, are

contributing to rising costs of operation for

Massachusetts retailers."

-- While the number of mandates multiplies, the

report notes, little is being done at the state

level to help spur innovation because officials

don't see it as "a strategic sector." A mere 3

percent of workplace training grants went to

retail businesses, and the teen employment

initiative YouthWorks placed about 3 percent of

its participants in summer retail jobs in 2016,

according to the report.

There's the rub. Retail is a bread-and-butter

industry. It doesn't spark the imagination like

green energy, financial services or biotech. It

makes up a relatively modest 4 percent of the

economic activity in the state. But it is a

job-creator and a moneymaker. It deserves more

attention from lawmakers. "Direct retail

spending by travelers and tourists in

Massachusetts totaled $1.7 billion in 2015,

generating $220 million in payroll and 7,800

jobs," the task force notes in its report. "In

2016, the restaurant and food service industry

accounted for over 330,000 jobs in

Massachusetts, and 10 percent of the employment

in the state."

We are left to wonder why the state Legislature

has not done more to help boost the industry.

Even the senators on the task force seem to be

trying to lower expectations.

State Sen. Michael Barrett, who served on the

task force, told the State House News Service

last month that the panel would not be making

recommendations.

"The press will be frustrated," he said.

"They'll want us to make the call on issues like

the tax holiday, like the training wage, and if

we're not prepared to make the call, we need to

clarify that."

Fortunately, there are already a handful of

initiatives before lawmakers that would help

boost the retail industry. Reinstating the sales

tax holiday would be a relatively easy first

step. The late-summer reprieve from the 6.25

percent Massachusetts sales tax usually occurs

over an August weekend. Retail business leaders

have it positioned for a statewide vote on the

November ballot, but lawmakers don't need to

wait. They can make it happen now.

It would be distressing to see the work of the

task force simply shelved alongside the dozens

of similar reports compiled by, and then ignored

by, the Legislature.

State House News Service

Wednesday, June 6, 2018

Lawmakers, Baker on pace to add $6 Billion in

borrowing

By Colin A. Young

By the end of the day Thursday, the

Massachusetts Legislature is expected to have

approved more than $6 billion in borrowing in

just more than two weeks.

The House and Senate have already approved a

housing bond bill and action in the House on

Wednesday left two more borrowing bills -- one

dealing with capital needs and the other focused

on the life sciences industry -- a Senate vote

away from Gov. Charlie Baker's desk.

The borrowing blitz began when the House and

Senate approved a housing bond bill on May 23,

authorizing $1.8 billion over five years to

finance affordable housing development and

improvements at public housing facilities. Baker

signed that into law May 31.

On Wednesday, the House and Senate each accepted

a compromise bill (H 4549) that would approve

$3.87 billion in borrowing and spending on state

facility repairs and other capital needs. The

House also enacted that bond bill, but the

Senate adjourned Wednesday without enacting the

bill and sending it to the governor.

The House also enacted a $473 million bond bill

aimed at supporting the life sciences sector (H

4501) Wednesday. Similarly, the Senate adjourned

without enacting that bill but the branch is

back in a formal session on Thursday.

Thursday is the last day that lawmakers would be

able to tout their action directly to attendees

at the four-day Biotechnology Innovation

Organization International Convention, which

wraps up in Boston on Thursday.

After the Senate votes on the two outstanding

bond bills, the legislation would need Baker's

signature to become law. Baker had filed his own

versions of life sciences and capital needs bond

bills and is expected to sign both when they

reach his desk.

If Baker signs both Thursday, he and the

Legislature will have OK'ed $6.14 billion in

borrowing in about 15 days.

State House News Service

Thursday, June 7, 2018

Facing July 1 deadline, negotiators embark on

state budget talks

By Katie Lannan

The two different versions of $41 billion

spending plans for fiscal 2019 are now

officially in the hands of six lawmakers, who

voted Thursday morning to take their

negotiations behind closed doors.

Senate Ways and Means Committee Chair Karen

Spilka, who helms the conference committee with

House Ways and Means Chair Jeffrey Sánchez, said

she hopes the negotiations on the budget for the

fiscal year that starts in 24 days will be "very

fruitful, productive and somewhat swift."

"I look forward to working with Chairman Sánchez

and the whole conference committee to iron out

the differences -- there are many more

similarities, I believe, and some differences --

between our budgets to produce a fiscally

responsible spending plan for fiscal year 2019,"

said Spilka, an Ashland Democrat.

Spilka briefly hosted Sánchez and fellow

conferees Sens. Joan Lovely and Vinny deMacedo

and Reps. Stephen Kulik and Todd Smola, along

with several staffers, in a conference room in

her office. The panel met in open session for

less than 10 minutes before agreeing to continue

their talks in private.

Sánchez, a Jamaica Plain Democrat, said each

branch wrote a budget that is "focused on people

where they're at."

"They're budgets that celebrate people's lives,

and also recognizes what role that we have in

making sure that everybody can benefit from the

prosperity of this great commonwealth," he said.

Spilka said education and "regional empowerment"

were among main priorities in the Senate's plan.

The Massachusetts Budget and Policy Center on

Wendesday flagged differences between the

branches on health care, housing and education,

noting that the House proposed larger

investments in early education and care, while

the Senate proposed greater funding for K-12

schools.

The House also added $5 million for a new

program to help homeless individuals move into

housing, and the Senate increased Registry of

Deeds fees to bolster the Community Preservation

Act Trust Fund, which supports affordable

housing, open space and historic preservation.

On health care, the Senate included language

allowing the state to negotiate drug prices

directly with manufacturers, a proposal

MassBudget said is similar to one introduced by

Gov. Charlie Baker. The House, meanwhile,

included more funding for pediatric hospitals,

adult foster care, and adult day health rates

than the Senate, according to MassBudget.

The Senate, on a 25-13 vote, also agreed to a

Sen. Jamie Eldridge amendment prohibiting law

enforcement officers from asking about

immigration status and limiting local law

enforcement's cooperation with federal

immigration enforcement. The House budget does

not address immigration enforcement.

Jonathan Paz, a member of Progressive

Massachusetts and the Safe Communities

Coalition, dropped off a painting of the Statue

of Liberty at Spilka's office Thursday morning.

He said his goal was to highlight that the

conferees were meeting in private, leaving

observers with little insight into how they were

discussing the immigration policy attached to

the budget.

"This is a back-room meeting, and immigrant

lives are being leveraged," he told the News

Service.

Speaker Robert DeLeo elevated Sanchez to the

Ways and Means chairmanship last July -- the

same day Baker signed this year's budget into

law -- following the resignation of former House

budget chief Brian Dempsey, who left for a

lobbying job.

The fiscal 2019 budget is likely the only annual

spending plan that will be finalized with Spilka

and Sanchez serving as lead negotiators.

Spilka is expected to ascend to the Senate

presidency later this session, a fact that

appeared to be on her vice chair's mind Thursday

morning.

"Madam president, I mean Madam President-elect,

Madam Chair," Sen. Lovely said, addressing

Spilka as she introduced a motion that the

committee close its negotiations to the public.

"Chair's good," Spilka responded.

Boston Business Journal

Thursday, June 7, 2018

Ballot talks at ‘standstill’ as labor group

holds firm on minimum wage

By Greg Ryan

Raise Up Massachusetts said Thursday it has

reached an impasse in its negotiations with

business lobbying groups over a $15-per-hour

minimum wage, throwing the possibility of a

“grand bargain” compromise on multiple ballot

proposals into doubt.

Raise Up, a coalition of labor unions and their

allies, has been in talks with lawmakers and

organizations like the Retailers Association of

Massachusetts and Associated Industries of

Massachusetts to find middle ground on three

ballot questions: a minimum wage increase,

required paid family and medical leave, and a

cut to the state sales tax. Raise Up supports

the wage and paid-leave proposals, while the

retailers group is pushing the sales tax

measure. The two sides are seeking to reach a

legislative compromise, rather than allow the

proposals to go directly to voters in November.

On Thursday, Raise Up sent a letter to House

Speaker Robert DeLeo and Senate President

Harriette Chandler, saying that the minimum-wage

talks had hit a “standstill.” The retailers want

a special minimum wage for teenagers, as well as

the elimination of an existing requirement that

businesses pay workers 1.5 times their normal

wages on Sundays and holidays. But Raise Up said

it wouldn’t budge on those issues.

“Policies such as a sub-minimum wage for teens

or the elimination of Sunday time-and-a-half pay

would hurt some of our most vulnerable workers

and their families, and we cannot support or

accept them,” the group said in its letter.

Raise Up criticized the tactics of RAM President

Jon Hurst. “Clearly the Retailers Association is

using its sales tax cut ballot question as a

threat to gain concessions on regressive

policies that would never pass in the

legislature, or on the ballot, on their own,”

the coalition said.

Hurst said in an emailed statement that the

retailers group is still working toward a middle

ground.

"Although our ballot proposal has the support of

almost 70 percent of voters in a recent public

poll, we remain committed to working with

legislators, other employer organizations, and

other negotiators to see if a legislative

solution can be reached," he said.

On the other hand, Raise Up believes a

compromise is close on the paid-leave proposal,

saying the two sides have mostly agreed on a new

paid-leave program, with the remaining points of

contention “very close” to being resolved. Two

other sources familiar with the paid-leave

talks, who wished to remain anonymous, have told

the Business Journal that the two sides are

close.

One source said that the two sides have

discussed reducing the amount of time off given

to workers as proposed in Raise Up’s ballot

initiative. The ballot proposal would give

workers up to 26 weeks of medical leave, but

negotiators are discussing whether to cut that

to 20 weeks, according to the source. Similarly,

the ballot proposal would give employees up to

16 weeks of family leave, but a compromise could

reduce that to 12 weeks, the source said.

Negotiators have also discussed allowing

companies to opt out of the state-run paid-leave

program if they offer policies that meet a

certain threshold, according to the source.

There may also be a carve-out for small

employers, the source said.

The so-called millionaires’ tax, which would

raise income taxes on those who earn $1 million

or more annually, is not on the table during the

negotiations. Because the proposal is a

constitutional amendment, the legislature cannot

pass it into law. Instead, the proposal must be

approved by voters.

However, the Supreme Judicial Court is

considering whether the tax is constitutional.

Its ruling, which is expected any day now, could

affect the “grand bargain” negotiations, since

it could change the leverage both sides believe

they have.

The effective deadline for any legislative

compromise in July 3, the date by which the

sponsors of the ballot questions must submit

their final round of signatures in support of

the initiatives to the state. |

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

BACK TO CLT

HOMEPAGE

|