|

Help save yourself

— join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

Make a contribution to support

CLT's work by clicking the button above

Ask your friends to join too |

Visit CLT on Facebook |

Barbara Anderson's Great Moments |

Follow CLT on Twitter |

CLT UPDATE

Thursday, June 15, 2017

Sixth Grad Tax scheme headed to

2018 ballot

|

For the second year in a row Massachusetts

lawmakers on Wednesday endorsed a proposal to extract an

estimated $2 billion from the state's roughly 20,000 highest

earners, setting up a 2018 ballot question campaign, a legal

dispute in the state's highest court, or both.

Rep. Jay Kaufman, a Lexington Democrat and

House chairman of the Revenue Committee, said establishing a

4 percent surtax on incomes over $1 million would give

Massachusetts a fairer system of government funding and

inject money into public education and transportation.

The state's constitution requires income

taxes be levied uniformly, so activists have backed the tax

measure as a constitutional amendment. Wednesday's vote of

134-55 means that voters will have the ultimate say on the

proposed tax unless the Supreme Judicial Court determines

the question is unconstitutional.

If it reaches the ballot and is approved,

the proposal would facilitate a major tax increase without

lawmakers having to vote directly on the proposal, or having

to deal with possible objections from Republican Gov.

Charlie Baker.

The top senators of both parties agreed that

the amendment is likely to be taken up by the Supreme

Judicial Court but they are of different minds about how the

court would likely decide the matter....

Senate Minority Leader Bruce Tarr, a

Gloucester Republican, suggested the question would run

afoul of the constitutional prohibition against initiative

petitions making a "specific appropriation of money."

"I'm fairly confident that there will be a

case about its constitutionality," Tarr told the News

Service. He said his analysis is that the question is "not

properly before us" but that it would be "for the court to

decide."

"The opponents have a right to challenge it,

and I am expecting that they will," Senate President Stan

Rosenberg, an Amherst Democrat, told reporters after the

vote. He said, "The proponents worked closely with

constitutional experts and they believe this will stand up

to constitutional muster."

Seeking to undercut Tarr's contention that

the amendment appropriates money, Senate Ways and Means

Chairwoman Karen Spilka said the money raised under the

proposal could not be spent without passage of an

appropriations bill.

Less than three years into his term in

office, Gov. Baker has appointed four of the seven Supreme

Judicial Court justices, and Geraldine Hines will hit the

mandatory retirement age of 70 later this year....

Weymouth Sen. Patrick O'Connor was the only

Republican to support the measure. House Majority Leader Ron

Mariano, of Quincy, was one of 12 House Democrats to oppose

the measure. Jennifer Flanagan, of Leominster, and Anne

Gobi, of Spencer, were the only Senate Democrats to vote

against it. Wilmington Rep. James Miceli, a Democrat, was

the only lawmaker to change his vote, opposing it in 2016

and supporting it this year.

The measure on Wednesday passed the

constitutional convention by a slightly higher margin than

last year when it passed 135-57.

State House News Service

Wednesday, June 14, 2017

Income surtax clears major hurdle, but legal challenge

likely

Could a tax on the rich be the political

kryptonite that weakens Charlie Baker’s seemingly invincible

status as one of the most popular governors in the country?

Some Democrats seem to think so.

Lawmakers on Wednesday voted to place a

constitutional amendment calling for the so-called

millionaire’s tax on the 2018 ballot, and Democrats

immediately pounced on the issue as a political weapon that

could be wielded against Baker and other Republicans running

for state office next year.

Early polling has found that more than

two-thirds of voters support the amendment, which would

increase taxes on earnings above $1 million and direct the

money to transportation and education. A WBUR poll in

January indicated even a slim majority of Republicans would

vote for the tax....

“It sets a significant platform for us: do

you stand for the middle class or not?” said Gus Bickford,

chairman of the Massachusetts Democratic Party. “That’s what

this question is about.”

But Republicans, in turn, hope to defuse the

potential political land mine by portraying the amendment as

yet another attempt by Democrats to increase the state’s tax

burden and drive away businesses.

“It’s hard to imagine something more

predictable than the chairman of the Democratic Party

calling for tax increases,” said Terry MacCormack, a

spokesman for the state Republican Party. “Instead of going

back to taxpayers with their hands out once again,

Massachusetts Democrats should start by joining Governor

Baker in leading a state government that lives within its

means.”

The amendment, backed by labor, religious,

and community groups, would scrap the state’s flat income

tax rate of 5.1 percent and create a two-tiered system.

Starting in 2019, earnings over $1 million would be taxed at

a rate 4 percentage points higher....

Backers say the money must be spent on

transportation and education, although opponents assert the

language in the amendment is not binding and that lawmakers

could spend the revenue on other uses.

So far, Baker has sounded cool to the

amendment, without taking a concrete stance....

House minority leader Bradley H. Jones Jr.,

a North Reading Republican, said even if the amendment is

ratified, there is no guarantee it will lead to an

additional $2 billion for education and transportation

because lawmakers could simply shift money to other

priorities or pet projects.

“Do you really trust Democrats on Beacon

Hill?” he said. “Look at the track record.”

Business groups have threatened to challenge

the amendment in court, asserting it violates the

Legislature’s constitutional power to make spending

decisions. If they were to file a successful lawsuit, it

could knock the amendment off the ballot, derailing it as a

political issue for Democrats. Lawyers who drafted the

amendment say they’re confident the measure passes

constitutional muster.

The Boston Globe

Thursday, June 15, 2017

State lawmakers approve tax on top earners for 2018 ballot

One of the state’s most powerful business

groups expects to spend more than $1 million to try to

prevent the proposed “millionaire’s tax” from getting on the

ballot.

At the annual meeting of the Massachusetts

High Technology Council yesterday, outgoing Chairman Bill

Achtmeyer estimated it will cost $1.1 million to wage a

legal challenge to a proposed amendment to the state’s

constitution that would add a 4 percent surtax on incomes

over $1 million to pay for education and transportation.

“In fact, (the money) will go to the general

fund, which is not constitutional,” said Achtmeyer, founder

of Parthenon and senior managing director of Parthenon-EY, a

Boston-based business management consulting firm.

“We believe we will be able to defeat it

before it gets to the ballot ... We’re going to go

gangbusters against this constitutional amendment,” he

added.

The Boston Herald

Wednesday, June 7, 2017

‘Millionaire’s tax’ in cross hairs of big biz group

|

|

Chip Ford's CLT

Commentary

As expected, the House and Senate convening in

constitutional convention yesterday easily passed the sixth

attempt to impose a graduated income tax. By a vote of

134-55 the Legislature sent

The Takers' — and now

their — proposal to the

2018 ballot.Thanks goodness someone has the

resources to take this abomination of special interest

Takers Lust to the courts. CLT certainly can't afford

to do it. The

Massachusetts High Technology Council (MHTC)

estimates it's going to cost their organization more than a

million bucks to pursue that remedy —

which is close to ten times CLT's entire income and

operating budget for a year!

On the merits I think the MHTC has a very good case to

have the ballot question ruled unconstitutional by the

courts. This initiative amendment proposes: "To

provide the resources for quality public education and

affordable public colleges and universities, and for the

repair and maintenance of roads, bridges and public

transportation, all revenues received in accordance with

this paragraph shall be expended, subject to appropriation,

only for these purposes."

Never mind who ultimately gets to decide the definitional

vagaries of "quality" public education and

"affordable" public colleges and universities (the

courts will upon later challenge by the teachers unions, one

of the proposal's deep-pockets sponsors)

—

appropriations of money directed to specific spending is not

constitutionally permissible by initiative petition:

The Massachusetts Constitution, Article 48, Section

2. Excluded

Matters. -

No measure that relates to religion, religious

practices or religious institutions; or to the

appointment, qualification, tenure, removal, recall

or compensation of judges; or to the reversal of a

judicial decision; or to the powers, creation or

abolition of courts; or the operation of which is

restricted to a particular town, city or other

political division or to particular districts or

localities of the commonwealth;

or that makes a specific appropriation of money from

the treasury of the commonwealth,

shall be proposed by an initiative petition; but if

a law approved by the people is not repealed, the

general court shall raise by taxation or otherwise

and shall appropriate such money as may be necessary

to carry such law into effect.

As Sen. Bruce Tarr (R-Gloucester), the Senate minority

leader, eloquently pointed out during the debate:

If

this is an appropriation then the question is

unconstitutional. It is not properly before us. It's

been asserted that the words subject to

appropriation somehow change that. If it is subject

to appropriation then there is no guarantee. If that

is not the case, the question is not properly before

us.

It's been suggested that because the attorney

general certified it, then its constitutionality is

without question. There are cases where

certification was made and then overturned by the

Supreme Judicial Court. This list is available for

all. That is exactly what is likely to happen here.

When you look at the relevant case law, in 1987 the

Tax Equity case - and I'll quote: Article 48 does

not exclude a measure raising public revenue, but

excludes a measure making a specific appropriation

of money. The proponents say, it's not. So we read

further.

A measure intended to limit the use of state

revenues solely for highway purposes is excluded for

making a specific appropriation. The word specific

does not necessarily refer to an exact dollar amount

and should not be interpreted in any narrow or

constricted sense.

We take 20,000 taxpayers and say they'll be

responsible for funding education and

transportation. Their income is derived from the

volatile source of capital gains. We all agree on

transportation and education, so we'll exclude the

revenue from health care. And in doing that we

violate the constitution according to three

decisions by the Supreme Judicial Court.

Next it will be up to the courts —

up to the state Supreme Judicial Court

— to decide whether another Grad Tax scheme goes

before the voters, for the sixth time. I'd like to

think the SJC will rule impartially using the words in the

constitution and previous courts' precedent. But this

is the Massachusetts court system, funded by the

Legislature —

and as I've noted before, no constitutional amendment gets

onto the ballot unless the Legislature wants it to pass.

Long ago and on numerous occasions I labeled our state's

highest court the "Supreme

Judicial Kangaroo Court." There were righteous

reasons from experience for that.

For those who didn't have the opportunity to

watch it live, as we did, if you're interested you can

read the text of yesterday constitutional convention debate

here.

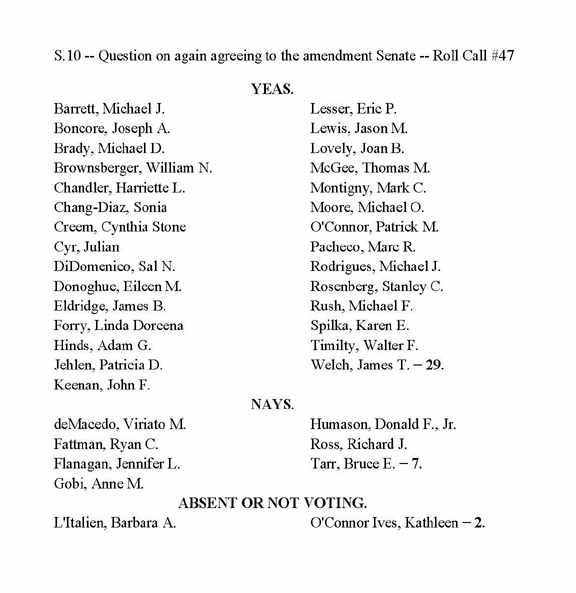

Constitutional Convention —

June 14, 2017

Senate Roll Call Vote

Download PDF version

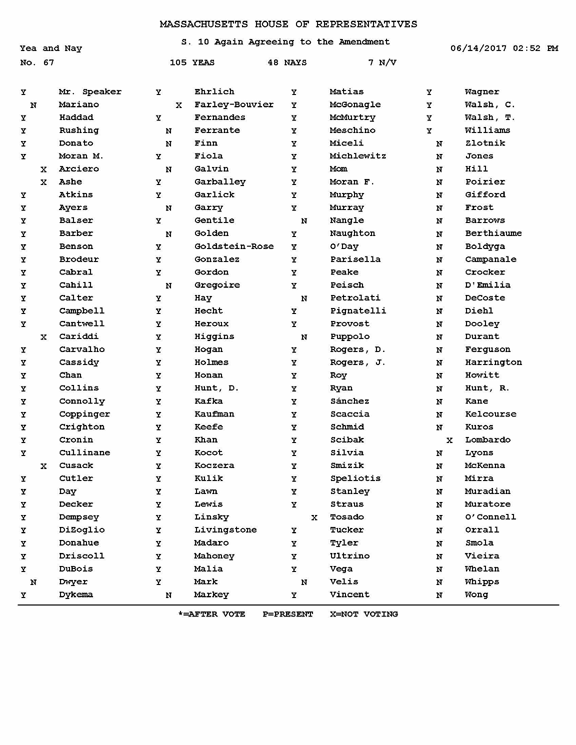

House Roll Call Vote

Download PDF version

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

State House News Service

Wednesday, June 14, 2017

Income surtax clears major hurdle, but legal

challenge likely

By Andy Metzger

For the second year in a row Massachusetts

lawmakers on Wednesday endorsed a proposal to

extract an estimated $2 billion from the state's

roughly 20,000 highest earners, setting up a

2018 ballot question campaign, a legal dispute

in the state's highest court, or both.

Rep. Jay Kaufman, a Lexington Democrat and House

chairman of the Revenue Committee, said

establishing a 4 percent surtax on incomes over

$1 million would give Massachusetts a fairer

system of government funding and inject money

into public education and transportation.

The state's constitution requires income taxes

be levied uniformly, so activists have backed

the tax measure as a constitutional amendment.

Wednesday's vote of 134-55 means that voters

will have the ultimate say on the proposed tax

unless the Supreme Judicial Court determines the

question is unconstitutional.

If it reaches the ballot and is approved, the

proposal would facilitate a major tax increase

without lawmakers having to vote directly on the

proposal, or having to deal with possible

objections from Republican Gov. Charlie Baker.

The top senators of both parties agreed that the

amendment is likely to be taken up by the

Supreme Judicial Court but they are of different

minds about how the court would likely decide

the matter.

The proposed amendment (S 10) specifies that the

revenues collected could "only" be spent to

provide "quality public education and affordable

public colleges and universities, and for the

repair and maintenance of roads, bridges and

public transportation."

Senate Minority Leader Bruce Tarr, a Gloucester

Republican, suggested the question would run

afoul of the constitutional prohibition against

initiative petitions making a "specific

appropriation of money."

"I'm fairly confident that there will be a case

about its constitutionality," Tarr told the News

Service. He said his analysis is that the

question is "not properly before us" but that it

would be "for the court to decide."

"The opponents have a right to challenge it, and

I am expecting that they will," Senate President

Stan Rosenberg, an Amherst Democrat, told

reporters after the vote. He said, "The

proponents worked closely with constitutional

experts and they believe this will stand up to

constitutional muster."

Seeking to undercut Tarr's contention that the

amendment appropriates money, Senate Ways and

Means Chairwoman Karen Spilka said the money

raised under the proposal could not be spent

without passage of an appropriations bill.

Less than three years into his term in office,

Gov. Baker has appointed four of the seven

Supreme Judicial Court justices, and Geraldine

Hines will hit the mandatory retirement age of

70 later this year.

The first-term Republican has hinted at

disapproval of the tax proposal but has yet to

stake out a firm position on a proposal

overwhelingly opposed by Republicans in the

Legislature. Widely expected to seek

re-election, Baker could share space on the 2018

ballot with the referendum.

Weymouth Sen. Patrick O'Connor was the only

Republican to support the measure. House

Majority Leader Ron Mariano, of Quincy, was one

of 12 House Democrats to oppose the measure.

Jennifer Flanagan, of Leominster, and Anne Gobi,

of Spencer, were the only Senate Democrats to

vote against it. Wilmington Rep. James Miceli, a

Democrat, was the only lawmaker to change his

vote, opposing it in 2016 and supporting it this

year.

The measure on Wednesday passed the

constitutional convention by a slightly higher

margin than last year when it passed 135-57.

O'Connor said he believed some "legitimate

arguments" had been raised about whether the

measure was constitutional. He said he would

have preferred that tax policy be debated and

settled by the Legislature after hearing from

stakeholders, including people earning more than

$1 million, but that he believed not letting the

question go to the ballot would be a "slippery

slope."

The Weymouth Republican said he did not expect a

large number of wealthy residents to leave the

state, repeatedly describing Massachusetts as

"unique" in terms of its economy and the

services it provides to residents.

"I ask, what is the economic cost if we don't

have this conversation and we lose our standing

in the nation and in the world?" O'Connor asked.

"Will that compare to the number of millionaires

who decide to leave the greatest state in the

nation? I think that this is a necessary step to

keeping up the momentum that has brought us here

today."

House Minority Leader Brad Jones harkened to

2013 when the Legislature passed a bill applying

the sales tax to certain computer services

before repealing the law a few months later. The

North Reading Republican wondered aloud what

lawmakers would do if they determined the income

surtax was ill-conceived.

"What do you do to fix it? My understanding is

it's a four-year process to fix that mistake,"

said Jones, who called the proposal a

"poll-tested, focus-group approved public

policy."

"We can't go back and three months later turn

the dial back, because it will be in our

constitution, enshrined, and that is something

we can't change," said Plymouth Republican Sen.

Vinny deMacdeo.

The tax proposal is a citizen petition backed by

Raise Up Massachusetts, a progressive group that

has scored wins at the ballot and in the

Legislature on raising the minimum wage and

guaranteeing workers earned sick time.

Saying lawmakers "owe a debt of gratitude" to

Raise Up, Kaufman told his colleagues that

people on the lower rungs of the income scale

expend 10 percent of their earnings in state and

local taxes, while the wealthiest Bay Staters

pay less than 5 percent of their income in state

and local taxes.

"That is the classic definition of a regressive

tax system," said Kaufman. Kaufman said that

99.5 percent of state residents would be

unaffected by the new tax, except for what he

said would be an enhancement in state services.

He said for incomes over $1 million, the tax

would cost $40,000, which he said would be about

$30,000 after a federal offset.

Republicans countered that the income tax is the

least regressive of the state's taxes, and that

relying on such a small number of the highest

earners to fund transportation and educational

needs would put state finances in a precarious

position. Speaking over the din of the crowded

chamber, Republicans also accused their

colleagues of abdicating their responsibility to

decide questions of taxation.

Brockton Democrat Sen. Michael Brady, the Senate

chair of the Revenue Committee, said lawmakers'

role is to give voters a chance to vote on the

plan. While lawmakers are actively working to

raise marijuana taxes and impose taxes on

short-term rentals, he said there are "no other

realistic revenue sources."

Tax revenues counted on to support the state's

roughly $40 billion fiscal 2017 budget have

fallen short by almost $500 million.

"With the Fair Share Amendment on the ballot, we

now have a once-in-a-generation chance to make

critical investments in transportation and

public education that increase economic

opportunity for the people of Massachusetts,"

said Lew Finfer, co-chair of Raise Up

Massachusetts, in a statement. Massachusetts

Teachers Association President Barbara Madeloni

said, "Our public schools and colleges are

drastically underfunded."

Rep. Paul Frost, an Auburn Republican,

highlighted a GOP-backed amendment to the

question that was shot down last session and

would have specified that any funds raised

through the surtax would be allocated on top of

-- not in place of -- existing spending. He said

he expects that any money generated will be

diverted to other purposes.

"We have seen in the past when times get tough

that trust funds and dedicated revenues for

certain programs get raided to be put elsewhere

in the budget," he said.

"The proposed historic tax increase represents

an unprecedented move to shelter elected

politicians from accountability for taxation and

spending policies," Massachusetts High

Technology Council President Chris Anderson said

in a statement. "But before the special-interest

backed measure, which would prove disastrous to

our goals of economic growth and job creation,

heads to the ballot - it must first pass

constitutional muster. We believe it will fail

that test."

Tarr told the News Service he believes the High

Tech Council has a "consortium of folks that are

contemplating who is the best plaintiff group

and how to move forward" with a legal challenge

to the proposal.

—Katie Lannan

contributed reporting.

The Boston Globe

Thursday, June 15, 2017

State lawmakers approve tax on top earners for

2018 ballot

By Michael Levenson

Could a tax on the rich be the political

kryptonite that weakens Charlie Baker’s

seemingly invincible status as one of the most

popular governors in the country? Some Democrats

seem to think so.

Lawmakers on Wednesday voted to place a

constitutional amendment calling for the

so-called millionaire’s tax on the 2018 ballot,

and Democrats immediately pounced on the issue

as a political weapon that could be wielded

against Baker and other Republicans running for

state office next year.

Early polling has found that more than

two-thirds of voters support the amendment,

which would increase taxes on earnings above $1

million and direct the money to transportation

and education. A WBUR poll in January indicated

even a slim majority of Republicans would vote

for the tax.

Such broad support for the measure could give

Democrats an opening to depict Baker, who has

declined to take a firm stand on the issue, as

an ally of the wealthy, a tactic they hope will

begin to deflate his sky-high popularity.

“It sets a significant platform for us: do you

stand for the middle class or not?” said Gus

Bickford, chairman of the Massachusetts

Democratic Party. “That’s what this question is

about.”

But Republicans, in turn, hope to defuse the

potential political land mine by portraying the

amendment as yet another attempt by Democrats to

increase the state’s tax burden and drive away

businesses.

“It’s hard to imagine something more predictable

than the chairman of the Democratic Party

calling for tax increases,” said Terry

MacCormack, a spokesman for the state Republican

Party. “Instead of going back to taxpayers with

their hands out once again, Massachusetts

Democrats should start by joining Governor Baker

in leading a state government that lives within

its means.”

The amendment, backed by labor, religious, and

community groups, would scrap the state’s flat

income tax rate of 5.1 percent and create a

two-tiered system. Starting in 2019, earnings

over $1 million would be taxed at a rate 4

percentage points higher.

State officials say about 19,600 people, or 0.5

percent of all filers in Massachusetts, would

pay the higher tax, which would raise about $2

billion annually.

Backers say the money must be spent on

transportation and education, although opponents

assert the language in the amendment is not

binding and that lawmakers could spend the

revenue on other uses.

So far, Baker has sounded cool to the amendment,

without taking a concrete stance.

“Governor Baker does not support tax increases

on our hard-working families, and was pleased to

sign a balanced budget last year that reflects

the administration’s priorities to create better

communities, schools, and jobs with no new

taxes,” said his spokeswoman, Lizzy Guyton, in a

statement Wednesday.

Peter Ubertaccio, a Stonehill College political

scientist, said under normal circumstances

voters might not think twice about a Republican

governor opposing a tax increase. But

Massachusetts has faced repeated budget gaps and

one Wall Street rating agency recently

downgraded the state’s creditworthiness. The

budget problems indicate that state leaders will

need to either cut spending or increase taxes to

balance the budget, he said.

“It puts the governor in a tight spot,” he said.

“I’m not sure it’s necessarily fatal.”

Baker, after all, was rated the nation’s most

poplar governor, with a 75 percent approval

rating in an April survey by Morning Consult.

The Legislature’s vote to place the amendment on

the ballot could also increase pressure on Baker

to take a stand. The vote was 134 to 55.

“Today, Governor Baker has an opportunity to get

off the sidelines and lead,” Jay Gonzalez and

Bob Massie, two Democrats running for governor,

said in a joint statement Wednesday.

Mayor Setti Warren of Newton, another Democratic

candidate for governor, also seized on the

issue, saying supporters of the amendment “must

prepare to defeat Governor Baker on this

question.”

But the issue may not be so clear-cut. Voters in

Massachusetts, who have a history of electing

Democratic legislators and Republican governors,

could choose to support the tax and then reelect

Baker to oversee the new revenue and ensure it

is spent wisely.

House minority leader Bradley H. Jones Jr., a

North Reading Republican, said even if the

amendment is ratified, there is no guarantee it

will lead to an additional $2 billion for

education and transportation because lawmakers

could simply shift money to other priorities or

pet projects.

“Do you really trust Democrats on Beacon Hill?”

he said. “Look at the track record.”

Business groups have threatened to challenge the

amendment in court, asserting it violates the

Legislature’s constitutional power to make

spending decisions. If they were to file a

successful lawsuit, it could knock the amendment

off the ballot, derailing it as a political

issue for Democrats. Lawyers who drafted the

amendment say they’re confident the measure

passes constitutional muster.

The amendment, supporters said, simply asks the

wealthiest residents to pay a higher tax to

improve schools, make public higher education

more affordable, and maintain and repair the

state’s crumbling roads and rails.

“Everybody knows, in this current system, the

wealthy are doing extremely well, and that’s not

a problem,” Bickford said. “But we need to have

them pay their fair share.”

The Boston Herald

Wednesday, June 7, 2017

‘Millionaire’s tax’ in cross hairs of big biz

group

By Marie Szaniszlo

One of the state’s most powerful business groups

expects to spend more than $1 million to try to

prevent the proposed “millionaire’s tax” from

getting on the ballot.

At the annual meeting of the Massachusetts High

Technology Council yesterday, outgoing Chairman

Bill Achtmeyer estimated it will cost $1.1

million to wage a legal challenge to a proposed

amendment to the state’s constitution that would

add a 4 percent surtax on incomes over $1

million to pay for education and transportation.

“In fact, (the money) will go to the general

fund, which is not constitutional,” said

Achtmeyer, founder of Parthenon and senior

managing director of Parthenon-EY, a

Boston-based business management consulting

firm.

“We believe we will be able to defeat it before

it gets to the ballot ... We’re going to go

gangbusters against this constitutional

amendment,” he added.

In a statement yesterday, Lizzy Guyton, a

spokeswoman for Gov. Charlie Baker, said he

“does not support tax increases on our

hardworking families.”

House Speaker Robert A. DeLeo said there is a

“good possibility” that the Legislature will

vote at the June 14 constitutional convention on

advancing the income tax measure to draw $1.6

billion to $2.2 billion from the state’s highest

earners.

The proposed amendment cleared the joint

convention by a 135-57 vote in May 2016. If

lawmakers pass the proposal again this session,

it will be placed before voters in 2018 to

ratify or reject it.

Herald wire services contributed to this

report.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

BACK TO CLT

HOMEPAGE

|