Speaker DeLeo

ascended the rostrum at 12:56 p.m. and greeted Reps. Donato, Garballey

and F. Moran.

QUORUM DOUBTED: Rep. Donato doubted the presence of a quorum and Speaker

DeLeo ascertained a quorum was not present.

QUORUM CALL: The speaker opened a quorum roll call at 12:57 p.m.

Speaker DeLeo said, Under Rule 49 the clerk will vote for Reps. Miceli

and Ferguson.

Rep. Donato asked to withdraw his request for a quorum roll call. There

was no objection.

The sergeant at arms led the Senate into the chamber at 1:02 p.m.

Members of the House stood and applauded the arrival.

RETURNS: President Rosenberg called the joint session to order at 1:04

p.m.

PLEDGE: Members and guests stood and recited the pledge of allegiance.

Sen. Tarr asked to make a statement. There was no objection.

President Rosenberg asked members to pay due attention to the statement

about an event in the news this morning.

ALEXANDRIA SHOOTING: Sen. Tarr said, Thank you. It's an honor to be here

again in this historic chamber. Today throughout the afternoon we're

likely to have vigorous debate about public policy upon which there is

divergent opinions. That is exactly what the framers intended. As we

gather today I believe it is important to realize the context. Many

awoke to the news from the nation's capital about the tragic attack by a

shooter on members of the Congress practicing for a charity baseball

game. That should all give us cause, cause us to pay attention to the

need for civility and respect. We have a long and valuable and cherished

history in the House and Senate, such that no matter how divisive an

issue, we always maintain civility and respect in our dealings on policy

and interactions with each other. While we anticipate a spirited debate,

I hope we all reflect on the importance of those values to each of us in

our role representing those things in the communities and the nation we

hope to lead by example. I would ask that we entertain a moment of

silence to reflect on the news of this day so we can recommit ourselves

to the leadership we have always shown.

MOMENT OF SILENCE: Members and guests stood and bowed their heads in a

moment of silence.

INCOME SURTAX: Question came on S 10 an initiative amendment to the

Constitution to provide resources for education and transportation

through an additional tax on incomes in excess of one million dollars.

President Rosenberg said, The votes required are the affirmative votes

of one fourth of the members elected.

Rep. Kaufman said, Let me begin by thanking the minority leader from the

Senate for his very eloquent remarks for speaking to us and more

importantly speaking for us. "I don't think there is a soul in this room

who doesn't ache for the experience of this nation." I applaud us in

being vigorous.

President Rosenberg said, We had a duet of people having difficulty

hearing the gentleman. Kindly subdue your conversation.

Rep. Kaufman said, It's not every day we debate an amendment to the

constitution. It's a privilege to do so and to consider the Fair Share

we voted on last session. If we do so again, the members of the

Commonwealth 510 days from today will address two fundamental

challenges. One is the lack of adequate funds for education, and the

other is the lack of adequate funds for transportation. They will be

able to address those basic needs of a decent commonwealth. It's not

only a matter of fairness, it's also a matter of sustainability. "We owe

a debt of gratitude to the Raise Up coalition." They understood that in

order to raise any funds, as our tax system is structured, there is no

way to do that without adding to the weight of inequities built into

that. The net effect is a very regressive system, where the lowest

income pay 10 percent in state and local taxes. Most of us are paying 9

percent, and the wealthiest are paying under 5 percent. "That is the

classic definition of a regressive tax system." They saw transportation

and education needs and in each of those cases there have been multiple

studies that say we need about one billion per year in both of those

pockets. Mr. President, you don't need to take my word for this, that

was the conclusion of the tax fairness commission.

Sen. Tarr said, I'm having difficulty hearing him. I'm not more than 30

feet away. I hope the convention will be brought to order.

President Rosenberg asked members to go outside the chamber to engage in

conversation.

Rep. Kaufman said, I appreciate his attention. So what is this

amendment? It's very simple. It would add a 4 percent tax on income over

$1 million. It's an income tax, not a wealth tax, not a property tax,

not a corporate tax. 99.5 percent of us will not be impacted save for

the better services from the revenue that comes. For those, there's a

slight bit of comfort that it only amounts to $40,000 on $1 million of

income, and after the federal offset it's more like $30,000. I wish I

could pay that. I'm dreaming. It will be adjusted for inflation as

incomes rise. And it will be dedicated to education and transportation.

We'll hear arguments rooted in a different philosophical approach:

trickle down economics or bad information. I think we will hear there is

compelling reason that millionaire migration - that is specious. There's

no evidence of that from other states. In any event, even if some do the

effect of their departure is accounted for in the range of projections.

The projection is it will raise $2 billion. We hate to see anyone leave

the commonwealth. We will not be a high-tax state. We'll also hear about

the constitutionality of this. As I understand it, the constitutionality

is not in doubt. That was the opinion of the attorney general who OK'd

this for the ballot some time ago. I know facts are sometimes not an

attractive antidote to strongly held beliefs, but we're going to try to

stick to the facts. It confounds me and disappoints me that much of the

opposition has come from business groups who have championed the need

for new investments in education and transportation. And yet when we

have a chance to do that, they are simply saying no. A no vote

translates into a failure to make our tax system more fair and address

our needs. It is asking those with the highest income to pay their fair

share. We're just asking them to step up and pay their fair share. So my

colleagues, Mr. president, I ask that we say yes to this amendment, yes

to new revenue.

Sen. Tarr said: I thank the gentleman for his focus on tax policy

and the insight he brings to this matter. It's for that very reason that

I hope the gentleman will concur with me that we would first recess the

convention and further investigate the claims both sides are making.

Some of the assertions that have been made are at odds with what appears

to be the case.

Sen. deMacedo said: This is a very important issue we're going to

be addressing. It's a significant change in tax policy, and I think we

should all hear what he has to say.

Sen. Tarr said: Thank you to the gentleman. We're dealing with

first and foremost something that would change the Massachusetts

constitution. This measure is different. It's different because of its

long-lasting impact, it comes to us from petition-signers. It comes to

us when there is a particular thirst for more revenue but when the

volatility of revenue makes it all the more important that we study this

first.

The gentleman chaired the tax fairness commission. Of all the

recommendations, including EITC, one of the most significant was that of

all the taxes in Massachusetts, the one that is not regressive is the

income tax. It suggests the sales and property taxes are regressive. The

income tax is not. It's certainly not as aggressive as others.

There has been a discussion at the microphone about the fact that the

millionaires, which is certainly by anyone's definition arbitrary. There

has been no explanation of why $1 million was chosen, no graduation.

The explanation comes from history. Voters have five times rejected

graduation. So we have this divide and conquer resort. It says on the

shoulders of the very small group of filers, we're going to depend on

them for education and transportation.

For the filers, a significant portion of their income comes from capital

gains. And we've learned about the volatility of the capital gains tax.

Revenues that would allegedly become available would not be available

for anything else when we know we are struggling to meet the cost of

health care. This would place outside our reach the revenue for needs

other than transportation and education.

If this is an appropriation then the question is unconstitutional. It is

not properly before us. It's been asserted that the words subject to

appropriation somehow change that. If it is subject to appropriation

then there is no guarantee. If that is not the case, the question is not

properly before us.

It's been suggested that because the attorney general certified it, then

its constitutionality is without question. There are cases where

certification was made and then overturned by the Supreme Judicial

Court. This list is available for all. That is exactly what is likely to

happen here.

When you look at the relevant case law, in 1987 the Tax Equity case -

and I'll quote: Article 48 does not exclude a measure raising public

revenue, but excludes a measure making a specific appropriation of

money. The proponents say, it's not. So we read further.

A measure intended to limit the use of state revenues solely for highway

purposes is excluded for making a specific appropriation. The word

specific does not necessarily refer to an exact dollar amount and should

not be interpreted in any narrow or constricted sense.

We take 20,000 taxpayers and say they'll be responsible for funding

education and transportation. Their income is derived from the volatile

source of capital gains. We all agree on transportation and education,

so we'll exclude the revenue from health care. And in doing that we

violate the constitution according to three decisions by the Supreme

Judicial Court.

We say we need to fund education and transportation. We're going to

abdicate that responsibility such that we have a question dependant on a

small and mobile group of taxpayers. That supposedly is how we will

express our commitment to transportation and education.

There's been discussion about the issue of out-migration. We've seen

that in states that have attempted this. Look at the revenue lost.

Connecticut, Maryland, New Jersey, we've seen crystal clear evidence, so

the governor of Connecticut said he would never try to introduce such a

measure ever again.

With statutes, it can be altered to prevent the damage. We all know what

kind of damage could be done.

So now we say we'll target 20,000 people and rely on volatile income,

we're also going to take the chance that we don't have significant

out-migration.

Putting all that aside, if we were to make that commitment. Let's say

we're not going to do that, then let's turn to regressivity.

The commission I served on identified things we could do statutorily,

but also identified income as the least regressive tax. The top 20

percent of filers contribute 73 percent of the revenue. I would ask the

proponents if 73 percent is insufficient, what do you hope to get to?

There is no doubt we have an obligation to fund these measures. We also

have an obligation to make sure the most vulnerable have access to

health care, and an obligation to confront the opioid crisis. I suspect

that's why the Supreme Judicial Court said these measures are

impermissible.

We can say that we will undertake this gesture of moving forward a

question that presents extreme volatility for the whole state budget, or

we can take a "time out."

The tax fairness commission recommended a graduated income tax. That was

the chosen measure to address this issue - excluded from consideration

because voters rejected it five times. So now we use this gymnastics to

do a divide and conquer strategy.

There is clearly a better way to honor the work that has been put into

this issue and move forward on a constitutional and sustainable path. I

hope that we will take a time out and we will think carefully about

this.

Sen. Brady said, I appreciate the remarks. He brought up some important

points we have to also address. This isn't the only source of revenue.

This is a citizens petition and our role is to make sure voters get to

vote on it. We need to address the opioid crisis. But when we traveled

the Commonwealth - education and transportation were two of the top

priorities. We have huge needs. "There's no other realistic revenue

sources." We're facing major potential layoffs in places such as

Brockton. The top 1 percent, incomes rose 47 percent, while for most

other residents, it has been stagnant.

Rep. Jones said: I read material my friend from Lexington sent

out last week. I almost replied but I thought I'd wait until today.

I understand the assertions, but if you're wrong on those assertions,

what do you do to fix it? My understanding is it's a four-year process

to fix that mistake.

You only need to go back to 2013 when this Legislature passed the tech

tax. I believe the gentleman from Lexington supported that measure. The

assertions were wrong. In fairly quick order, the Legislature could beat

a hasty retreat. Unfortunately that opportunity will not exist if any

assertion is inaccurate.

The gentleman from Lexington said the attorney general signed off on

this, but this attorney general signed off on two others that the SJC

disagreed about. I don't need to go that far back. I only need to go

back about 10 years.

The SJC said, if you're spending money you can earmark it. I think the

court said if you spend as much as you take in, it's sufficient. Take

the gas tax. If you look through your state budget that the conference

is working on, we spent in excess of $7 billion on education and

transportation. If you read those SJC decisions, you'd say we're already

in compliance with spending well in excess of $2 billion. This is a bait

and switch. It is poll-tested, focus-group approved public policy. The

proponents say, once we hit a million, they were very attractive to go

after.

This money will be a jump ball wherever it goes. If you look at the

language, it says quality education and affordable higher education. Who

determines that? It's not going to be us. Anyone who disagrees will go

litigate it. So we may spend some of the money on universal pre-K, so

someone might say that's not where it should go. The SJC might say

that's not compliant. So again, we're abdicating our responsibility.

Now let's talk about trust. Trust on taxes. In the year 2000 voters said

they want income tax at 5 percent and two years later the Legislature

said, We're going to do what we want.

This is poll-driven approach. It's the wrong thing, Mr. President. It's

the wrong thing.

Sen. Spilka said, I stand today in full support of the proposal. I could

speak at great length about our need to build a more resilient

commonwealth by investing in our children, and infrastructure. I'll

defer to the gentleman from Lexington and others about our needs, our

quality of life. And I would talk about basically the technical language

that some speakers addressed. The proposal says its revenues shall be

expended only for quality education and affordable colleges, and roads,

bridges and public transportation. The language that will be on the

election ballot says revenues would only be used for public education,

the repair and maintenance of transportation. The words subject to

appropriation do not imply - as some may have you believe - that the

Legislature can spend the revenue on anything it wants. It simply

cannot. The funds cannot be spent until the Legislature passes an

appropriation bill. This proposal is very similar to Article 104

ratified by voters in 1974. That article limited expenditure of the gas

tax to highway and mass transportation purposes. On at least three

separate occasions since, the SJC said the legislature can appropriate

those only for transportation purposes. So the court ruled on similar

language. The Legislature cannot just go in and change our constitution.

"Once it's in the constitution it is binding." It will be directed to

education and transportation only. The language subject to appropriation

says there must be affirmative action by the legislature to release

those funds. They would sit in the account until they are appropriated.

There is no indication that we can change the purposes of education and

transportation. The clear language and the clear message of the voters

will be fully understood. Spending from these new resources will be

solely for education and transportation. Move this to the voters so that

they may decide.

Sen. deMacedo said: I rise here to ask that this measure do not

go forward. I am concerned about the message we would be sending. I know

in 2013 I echoed the same concerns when we were dealing with tax policy.

The gentleman from North Reading alluded to that particular debate.

A short passage from July 24, 2013. "We didn't need to go after a

thriving industry that has been a lifeblood. We are successful in

computer software. And now we're saying you would do better doing

business in New Hampshire." We all know what happened. We did it anyway.

But what happened? We found out very quickly. These industries started

leaving. Three months later we repealed that bill because we found out

about the unintended consequences.

I believe there will be unintended consequences with this legislation.

We can't go back and three months later turn the dial back, because it

will be in our constitution, enshrined, and that is something we can't

change.

Connecticut is seeing people leaving. GE is leaving. AETNA is leaving.

That is because of tax policy. The governor of New Jersey talked about

the wealthy people who left.

They can go to New Hampshire, where there's zero tax. I don't want them

to leave because they bring resources and job creation. This revenue may

not be realized. I just ask you to think about this tax policy. We're

turning over our ability to address this.

We fixed it in 2013. Think about this because the decision you make

today you will not be able to turn back around. I think we should all be

concerned. I might be right like in 2013. We are not going to have a

recourse. If we're serious about addressing this, let's do a

constitutional amendment to allow for a graudated income tax rather than

this where we lose total control.

Sen. Eldridge said, I want to commend the gentleman from Lexington for

marshalling this amendment and dozens of advocacy organizations, many in

the gallery today. Mr. President, this morning I was with the gentleman

from Lexington and a few other colleagues at the groundbreaking of

Minuteman Tech. The chairman of MSBA said it took two treasurers to

upgrade the high school. It took almost two decades. In the district I

represent, there are other needs. The commuter rail remains broken.

There is a lack of access for people to get to work. I can't tell you

the dozens of constituents, many new parents, trying to figure out how

to pay for universal pre-K. This will address many of these problems by

raising about $2 billion. That is a tax on the wealthiest 1 percent, in

fact I think it's the wealthiest .1 percent. It's going to critical

causes. The last robust debate like this was about same sex marriage

rights. I raise that because the debate that ended in 2007 was about

civil rights. I know we're proud to protect same-sex marriage. Today's

debate is in many ways just as important and is about a civil right to a

great quality education. The right to public education is in our

constitution. It led to the effort to increase state funding in 1993. I

think we can agree that state investments, whether talking about pre-K

or higher education i insufficient. We have a chapter 70 formula that is

deeply behind schedule. Or addressing ELL students, we are dramatically

behind. The amendment will invest in public education. The minority

leader raised volatility. We have that now because we don't have taxes.

If we raise taxes on the wealthiest we will be able to invest in two key

areas. The minority leader also said 20 percent pay about 70 percent of

the income tax revenue. Doesn't that speak to the deeply troubling level

of inequality. The top 1 percent are increasing their incomes and wealth

at a dramatically faster pace. The bottom 50 percent, revenues are

stagnating or falling behind. One of the key tools is a progressive

income tax. This has been tried five times before.

Rep. Kaufman said he was having difficulty hearing.

Sen. Eldridge said, Inequality is deeply disturbing. I want to respond

to the gentleman from Plymouth about millionaires leaving. One of my

strongest memories as a senator was at Post Audit where CEOs said they

came to Massachusetts because of the educated workforce and quality of

life, not because of the tax environment. Companies are coming because

of education, because of the excellent quality of life. The fair share

amendment takes strides to invest for future generations, many of whom

are up in the gallery. I ask my colleagues to move the Commonwealth

forward.

Senate President Rosenberg said, The chair recognizes the gentleman from

Boston, Mr. Hunt. The chair has been informed it is the gentleman from

Sandwich, Mr. Hunt.

Rep. R. Hunt said: I rise in opposition to this constitutional

amendment before us for a number of reasons. When national debate is

filled with proposals to simplify the tax code, we are in the enviable

position of having a constitution that ensures a fair flat tax with

relief for residents who are struggling. The Tax Fairness Commission

determined our income tax is the least regressive of any tax levied by

the state. When I asked why we should make changes to our fairest tax

rather than the most regressive, like gasoline and sales taxes, the

answer I got was that it's easier to change the income tax.

Using the constitution to implement specific tax rates is unwise because

it encroaches on legislators' duties. Aside from California, no other

state embeds tax rates in its constitution, and for good reason.

Correcting a tax rate via constitutional amendment is cumbersome and

time-consuming.

The constitution is not the appropriate place to memorialize tax

brackets and rates. The proper way to create a graduated income tax is

to give the Legislature the power to do so. This has been tried but

voters rejected it five times.

What about the people leaving or not coming here because of this 80

percent tax increase? Proponents point to studies from California and

New Jersey. Why would Massachusetts be different? Because of proximity.

A move from Los Angeles to Nevada is 300 miles. But a company in Boston

can relocate less than 50 miles to Nashua, New Hampshire. It would be a

shorter drive than I make to the State House. To think people of means

would not move 50 miles to save $100,000 a year --

Senate President Rosenberg recognized Rep. Poirier, who said she was

having trouble hearing. He asked members to subdue their conversations

or take them outside. The time was 2:15 p.m.

Rep. R. Hunt said: To think people of means would not move $50

miles to save $100,00 a year is naive. Are there alternatives? Here's

one. If Massachusetts maintained its transportation infrastructure at

the same cost per road mile as other New England states do, we would

save $1.4 billion a year, money that could be spent on education and

transportation. Thank you for the time. I urge my colleagues to vote no.

Rep. Durant said: I rise in opposition. Our country's democracy has

often been described on two wolves and a sheep voting on what to have to

dinner. It's one of the reasons we have a republic and representative

democracy. It's our job to make these decisions and represent the

minority.

We've questioned a number of different aspects of this but

really the question is should we allow this to go to the ballot. What

we're doing is shirking our responsibilities and abdicating our ability

to make these policies. In fact tomorrow this House will most likely

take up the marijuana initiative passed last year. We're going to take

it up because we need to fix it because the ballot question wasn't

appropriate.

Instead of allowing these decisions to go forward, it's our

job to decide what we want. What we want for tax policy. Let's do our

job here.

I don't think anybody has any doubt the people this doesn't

affect, we'll be able to find at least 51 percent to vote in favor of

this action.

These ballot initiatives are bumper sticker campaigns. I

remember back in the 90s or 80s the Question 2 Bad For You bumper

stickers. I don't remember what it was, but I remember it was bad for me

somehow. We remember regulate marijuana like alcohol and death with

dignity. And now we have The Fair Share Amendment. Darn it, who doesn't

think people should pay their fair share?

The reality is we are asking

the public to make complex tax policy decisions because we won't. I urge

you to reject this.

Rep. Frost said: I rise opposed to this amendment not because I

don't think people should have the right to vote. My concern is the way

this is worded.

We've heard two different accounts, different rulings and this is a very

complicated matter that is being worded and delivered to the general

public in a very simple fashion to gain public support.

My concern here is the history of the Legislature when it deals with

so-called dedicated revenues. We have seen in the past when times get

tough that trust funds and dedicated revenues for certain programs get

raided to be put elsewhere in the budget.

For example, the storage tanks part of the gas tax, that's supposed to

go towards removing old storage tanks at gas stations. I don't remember

the last time that was fully funded. Remember the tobacco trust fund,

when we raised taxes on cigarettes and received money from a settlement?

When times got tough, the House and Senate raided those funds.

I truly believe that's what will happen with this. I truly believe

someday down the line the money supposed to go to education and

transportation will be diverted elsewhere.

We offered an amendment, the Republican members here, the last time we

took this up last session, that said any funds raised through this tax

should be on top of, not replacing, any existing spending on education

and transportation. That amendment failed.

That tells me a lot, and I'm sure that won't necessarily get shared in

any sort of public service announcement when it goes to the ballot, if

the Supreme Court doesn't rule it out of order before then. But it's

something we need to remember. I expect this amendment will pass but we

should remember how we voted today and what was said at today's debate

so that when it comes back, you can't say you didn't know. It's going to

take four years or more to fix it.

We've talked about high-wage earners leaving the state but whether or

not they leave, what happens to their spending power? Will they give

less to charity? If charities suffer, who's going to make up that

difference?

The senator from Middlesex Worcester addressed some of the comments from

the senator from Gloucester on the imbalance. But he didn't say how much

would be fair and no speaker since has said how much revenue is

considered fair that we take away from high-wage earners. I was hoping

someone would answer.

Finally, the GE debate came up. The comment was made they didn't come

for the tax incentives but for quality of life. But it's my

understanding GE still got some tax incentives to come. Did they take

it? Did GE take the tax break or did GE say no, we don't need tax

breaks, we're coming here just for the workforce? Please don't give us

anything else. Because I don't think that's what happened.

If you raise taxes too much, people have less to spend and they're not

going to create jobs and if they have the ability to leave, then they

will. I hope this amendment does not pass.

Rep. Poirier said: I had not planned to speak but after

listening to my colleagues I must tell you I am so impressed with the

expertise you all have on the nuances of this proposal and others that

have passed over time, as well as tax policy. I have great respect for

the people who sit in this chamber. You're all very learned. We are

asking the people of the commonwealth to be just as learned as you all

are and unfortunately most of them are busy trying to get through their

day and I do believe the great majority of people are not millionaires,

and when they look at this proposal, they certainly are going to think

it's wonderful because it will help their families, and they're not

looking at the bigger picture.

I fear for the part of our state so close to the New Hampshire line, it

will be very tempting to go over that line.

The other thing I worry about is the many vulnerable populations and the

many wonderful charitable organizations that help the vulnerable among

us. People who earn over a million dollars for the most part are those

who fund those charities. We will be taking away an incentive for them

to do that. It's a tax deduction, but it's a way for them to give back.

I'm involved with many local charities and quite frankly I do solicit

the people who live in my local area who are the business owners and the

employers who make the large salaries because they're the ones that can

afford to support the causes so close to our hearts. I think that is a

huge danger. You're taking away an incentive for them.

I think it's going to end up being a huge disappointment. I think it

takes some of the shine off our commonwealth, that you can come here,

work hard, earn a magnificent living, support your family, have a fair

tax rate and plenty of charitable work you can do if you earn over a

million dollars.

I wouldn't know because I'm not there but I'd love to be. I don't think

we should take the incentive away from people who can take other

citizens under their arms and help them with their hard work.

I don't think the large majority of people who vote on this issue will

have the knowledge and expertise to see the wider impact. I think

they'll look at it very narrowly, that it will help them and not what it

will do to the greater good. I ask you to think long and hard about what

you're putting before our population.

Sen. Lewis said, It's an honor to take part in this important debate.

Our colleagues will be happy to hear I'm the last speaker and then we'll

be voting. I urge you to vote in favor. This will make our tax system

fairer and strengthen our economy, and provide greater opportunity for

our constituents. Working families are struggling to get by every day.

For them, the American dream seems ever more elusive if not downright

impossible. People are working longer hours, they're working multiple

jobs and since 1979 worker productivity in our country and our state has

increased an astonishing 65 percent but workers are not getting ahead

and they're not getting their fair share. This has taken an astonishing

effect on our children. There are a number of factors that have

contributed to stagnating incomes. Our state tax policy is one of these

factors. Unlike globalization or technological change, state policy is

in our direct control. We can and must fix it. Our current tax system is

regressive. It's simply not fair. Furthermore ,our current tax structure

is unable to support the needs of our commonwealth. In 2001, we invested

11 percent of the state's economic output in our budget. Today that has

fallen to 9.5 percent. Virtually every area of our state budget is

underfunded, especially education and transportation that are so

critical to our economic growth. The opponents of the fair share

amendment have claimed it will drive illionaires out of Massachusetts.

Yes I acknowledge some very wealthy people may move. Perhaps they were

already thinking about retiring to Florida or Arizona where it doesn't

snow. The overwhelming evidence from studies of state tax policy

strongly suggests the vast majority will not leave the state simply

because of a higher marginal tax rate. We know there are many good

reasons to stay. In fact the investments the amendment will enable will

make Massachusetts an even more desirable place to live and grow a

business. The fair share amendment is the best opportunity we have today

to make our tax system fairer, invest in education and transportation,

and begin to restore the American dream for families across the

commonwealth. I hope my colleagues will vote in favor.

Sen. O'Connor (R-Weymouth) said: The day I was sworn into office just

over a year ago, the first vote I took was to put the millionaire's tax

on the ballot. I voted because I wanted to see Massachusetts pioneer its

progress. I couldn't withhold taxpayers the option. I respect my

colleagues' opposition. It's an extremely unique circumstance and I

believe Massachusetts is uniquely positioned to take action. We are not

Connecticut, New Jersey or New York. We've set ourselves apart in almost

every way. We're a leader in educating children and thanking veterans

and serving the developmentally disabled. This is a state the world

comes to when they are sick and it's where awkward dreamers find

purpose. I'm voting in favor of this so this conversation can happen.

Some legitimate arguments have been made about the constitutionality of

this amendment. We could be infringing on our constitution's

prohibitions of a ballot question expending funds for specific programs.

I think the ideal vehicle instead of a ballot question would have been a

debate in the House and Senate bringing in stakeholders in education and

transportation as well as the millionaires themselves. But residents of

this great state were able to collect signatures and who am I to stand

in the way of this going forward. I fundamentally believe in the

initiative petition process and I believe we go down a slippery slope if

we don't go forward. A small number of wealthy taxpayers may move, but

most will not. State taxes are not typically the reason individuals

leave the state where they reside. We have an extremely unique

citizenry. Schools are generating ap operation that cares more about

making a difference than making money. Massachusetts is one of the

wealthiest and most unequal states. Our municipalities are resting on

shaky foundations, and we are seeing uneven growth statewide. The

finances of our communities are not stable, when you look at OPEB

breathing down their neck and rising health insurance. The piece of the

pie for essential services is getting smaller. We need to have a

conversation on how can we resolve the underlying issues while

reinvesting in our economy. What is the economic cost if we don't have

this conversation and we lose our standing in the nation and the world?

Will that compare to the number of millionaires who leave the greatest

state in the nation?

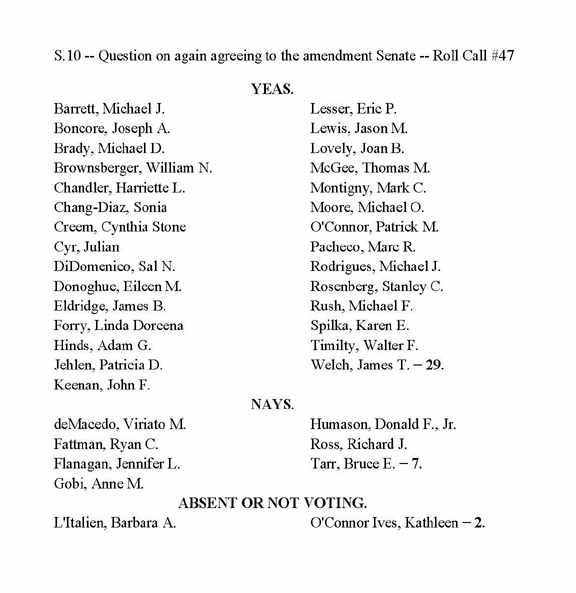

INCOME SURTAX VOTE: The Senate clerk called the roll for senators.

Senators deMacedo, Fattman, Flanagan, Gobi, Humason, Ross and Tarr voted

no.

Download PDF file

version

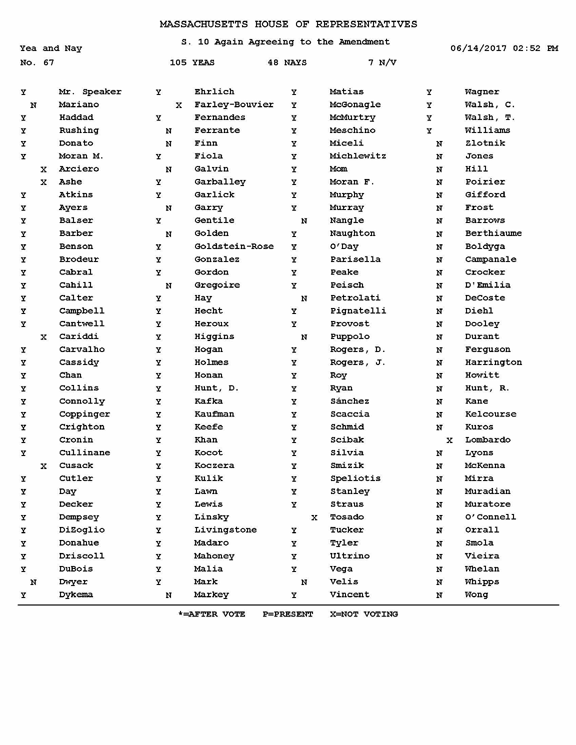

At 2:48 p.m. Speaker DeLeo said the roll call would be open for three

minutes for House members. The House roll call was 105-48.

Download PDF file

version

BY A ROLL CALL VOTE of 134-55 the amendment was AGREED TO.

Senate President Rosenberg said the papers will be sent to the secretary

of state for inclusion on the ballot.

RECESS: The Constitutional Convention at 2:53 p.m. recessed until 1 p.m.

on Nov. 8, 2017.