|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

48 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Sunday, November 6, 2022

Appreciation of

Barbara Anderson and CLT as Its End Arrives

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

Call it

Gov. Charlie Baker’s early Thanksgiving Day present

— even though it is not a gift at all.

But when

the State of Taxachusetts is willing to send you

money, take it and run.

The tax

cap was a novel ideal at the time. It was proposed

and pushed by the Citizens for Limited Taxation

in a 1980s referendum drive headed by the late

Barbara Anderson and Chip Ford, both CLT

anti-tax leaders....

The tax

cap law in the parlance of state government is

called Chapter 62F of the General Laws.

But it

should be called the Anderson Act because it was a

dedicated and untiring Barbara Anderson who brought

it about. She spent years lobbying for taxpayers at

the State House.

And when

the Legislature would not approve the tax cap

concept, she went to the public and got it on the

ballot and won. She did more to help the

Massachusetts taxpayer than any politician around.

She showed

that even under a growing statist society, it was

still possible — although rare — for average

citizens to take on big government by banding

together to work for the common good.

She died

in 2016 at age 73.

However,

were she alive today, you can bet she would be

campaigning against Question One on Tuesday’s

ballot, which is the so-called millionaire’s tax, a

4% graduated income tax on people earning $1

million.

Anderson

was around long enough to know that the proposed tax

increase on $1 million earners would soon trickle

down to include everybody else. That is the way

stealth government works....

Baker

deserves credit for riding herd on the tax rebate.

The Republican governor stood firm on his insistence

that the money be sent to the taxpayers, despite

opposition from some legislators in the

Democrat-controlled Legislature who had other plans

for the funds.

Cynics

might have pointed out that Baker sending money back

to the taxpayers was simply an election eve ploy to

get votes. But Baker is not on the ballot. His

motive was simply to give the money back to the

people who earned it. So he did.

That was

also Barbara Anderson’s goal. And she did it, too.

The

Boston Herald

Saturday, November 5, 2022

In blue Taxachusetts, refund offers

rare relief

By Peter Lucas

Citizens For Limited Taxation (CLT) is ending with a

historic win. It appears now the $3 billion tax

refund due Massachusetts taxpayers will actually be

paid to us – as the law (Chapter 62F) requires. We,

the people of Massachusetts, created that law by

vote, after a 1986 referendum effort sponsored by

CLT....

Then a

cabal of ultra-left Democrats led by Rep. Connolly

(D-Cambridge) tried to reconfigure the refund –

redistributing more to some, less to others. They

don’t understand: it’s not their money. They have no

right to redistribute or redirect it. The money

belongs to the taxpayers who paid it. The law

requires that it be refunded – that is, returned to

the taxpayers who originally funded it. That’s the

meaning of “re-funded.” (Reasoning must be

elementary when explaining to left-wing

politicians.)...

Fortunately, those obstructionist and redistribution

schemes appear to be dead-ended – for now. But

beware when the legislature reconvenes. In this

one-party state, we can expect renewed efforts to

sabotage the Tax Cap law. For those voters planning

to again vote the straight Democrat line, another

reason to reconsider.

The late

taxpayer champion Barbara Anderson led CLT in

1986. She and CLT (aided by the Massachusetts High

Tech Council) were the driving force that secured

voter approval of the refund law. Then, as now, the

opposition came from Democrat leftist politicians. I

still have the editorials I wrote and broadcast in

1986 supporting the referendum, and then in 1987,

criticizing then Gov. Michael Dukakis’ attempt to

maneuver around the law. This year’s refund is 100

times that of 1987’s.

The

commonwealth is swimming in money. As Gov. Baker

noted, this past year, tax revenue grew by over 20%,

on top of the previous year’s 15% increase. And this

year, revenues are running 5% ($450 million) higher

than last year. Chip Ford, CLT executive

director, has aptly observed this isn’t a surplus,

it’s over-taxation. But Democrat politicians are

insatiable. They not only balked at the refund, but

they actually want to raise taxes.

On this

year’s ballot is a graduated income tax proposal –

again. After five defeats, this is the sixth time

that maneuver is being tried. It is pitched, as

usual, as targeting the wealthy. But that’s untrue.

Many not-so-wealthy would also be hit with higher

taxes.

CLT, once

again, and some other civic minded groups have

organized in opposition. We hope the ever-more-taxes

crowd will be rejected again on election day. Vote

‘no’ on Question 1.

But

there is a sad postscript to this tax story. After

this election, CLT is closing down. For over 47

years CLT has fought for the taxpayers and has saved

Mass. citizens uncounted billions in taxes. But

there’s insufficient financial support from these

same citizens to keep the organization going. So,

Citizens for Limited Taxation will pass into

history, and we taxpayers will endure higher taxes

because CLT is no longer here.

The

Boston Herald

Thursday, November 3, 2022

CLT exits scene with tax refund

victory

By Avi Nelson

“The

Department of Revenue will begin sending out refunds

via checks and direct deposits to taxpayers under

Chapter 62F on Tuesday, November 1. These refunds

will be sent out on a rolling basis through December

15. An estimated 3 million taxpayers will receive a

refund of approximately 14% of their 2021

Massachusetts income tax liability,” a spokesperson

for the Executive Office of Administration and

Finance said Friday....

The group

that passed the law back in the 80s hailed the

announcement as a victory, despite the passing of

the law’s original proponent.

“I’m sure

Barbara Anderson is up there looking down on

us with a grin pumping her fist in the heavens,”

Chip Ford, executive director of Citizens for

Limited Taxation, the group behind the law, said

in July when the news was announced Chapter 62F had

been triggered.

The law,

put into place due in large part to the activism of

Anderson, says that if the commonwealth takes more

in taxes than it’s supposed to under a cap

established by the same statute, it must send some

of it back to taxpayers. In 1986, rebates amounted

to just under two dimes. Now, depending on your

income, it could be hundreds or thousands.

The

Boston Herald

Sunday, October 30, 2022

Tax rebates head out

starting Tuesday, here’s how to see how much you get

Former

Gov. Paul Cellucci thanks supporters of

tax-reduction ballot question in 2000 during a

Republican Party election night gathering in Woburn

as Barbara Anderson, from the group Citizens for

Limited Taxation, looks on. (Herald file photo)

If you’re

a taxpayer in Massachusetts, keep an eye on your

bank account or mail box these next few days.

An

amazing, once-in-a-lifetime occurrence is about to

happen.

You are

going to get a kiss in the mail from the Department

of Revenue (DOR) – about 14% of whatever you paid in

state income taxes for 2021.

About

500,000 of these unprecedented refunds should be out

by the end of the week. I wish the DOR had been able

to get the money back to all 3 million of us in the

state who actually work for a living before the

election six days from now, but hey, that’s the

hackerama for you.

The good

news is, if the electorate is paying attention, even

these first half-million or so refunds should

disprove once and for all the lie that is propelling

referendum Question 1 – that the hacks need another

billion-plus in tax money to pay for “education” and

“transportation.”

If ever

there was a reason to vote NO on Question 1, it’s

the fact that the state is now so historically flush

with cash that it is required under law to return

almost $3 billion to the taxpayers.

Get the

word out! Let your neighbors know about the money

that’s coming their way, and why....

Here’s how

this week’s DOR refunds work.

The state

income tax rate is 5%. So if you made $100,000 last

year, you paid $5,000 in taxes to the Commonwealth

of Massachusetts.

So now,

under the formula, you will soon be getting back 14%

of that $5,000 — $700.

If you

made $200,000, you will get back $1,400. And so on.

It’s

important to remember that this isn’t a handout,

which is what Democrats get. It’s not welfare. It’s

a refund, because it’s your money that the state

stole from you and is now being forced to return.

(And God, are the Democrats angry about it!) ...

For those

who haven’t been paying attention, this windfall for

the working classes (and tragedy for Democrats) is

occurring because of the late Barbara Anderson

of Citizens for Limited Taxation (CLT). In

1986, her group sponsored its own referendum

question, requiring the return of any

over-collections of tax revenue, based on a

complicated formula.

It was a

big surprise when 62F finally kicked in, and no one

was more surprised than the hacks who are pushing

their graduated-income tax con at the ballot box for

the sixth time since 1962....

Question 1

would give the local hacks billions more for their

own clean school bus rebates.

Anyway,

the check’s in the mail. When you get it, just

remember Barbara Anderson fondly for a moment, and

then explain Question 1 to a low-info voter or two.

Vote No on

Question 1.

The

Boston Herald

Wednesday, November 2, 2022

500,000 refunds coming your way

means Question 1 is a joke!

By Howie Carr

Department

of Revenue tax collectors raked in $2.359 billion

last month, almost $300 million or 14 percent more

than expected but a drop of $85 million or 3.5

percent compared with actual collections in October

2021.

Revenue

Commissioner Geoffrey Snyder said Thursday that DOR

has collected $11.565 billion in tax receipts

through four months of fiscal year 2023. That's $369

million or 3.3 percent more than collections through

the same period of fiscal 2022 and $529 million or

4.8 percent more than what the administration was

expecting to have brought in by this point in the

year....

The

benchmarks are all based on the assumption -- agreed

to by legislative leaders and the Baker

administration -- that fiscal 2023 revenue will

total $39.618 billion. Without an adjustment, that

would be a drop of almost 4 percent from the $41.105

billion that was hauled in during fiscal year 2022,

a year in which state tax revenue surged so high

compared to wage growth that it triggered a

long-forgotten tax relief law.

State

House News Service

Thursday, November 3, 2022

October Tax Revenues Surge Above

Projections

Halloween

is finally here and today taxpayers are in for a

treat. Starting as early as this week, taxpayers are

set to see their bank account get a little bigger.

Thanks to the 1986 voter approved “rebate” law known

as Chapter 62F, which was spearheaded by Citizens

for Limited Taxation (CLT) and the

Massachusetts High Tech Council (MHTC),

taxpayers are expected to see their rebates start to

arrive this week and roll on throughout the month of

November. Taxpayers owe a great deal of gratitude to

CLT and MHTC for their important work in 1986.

MassFiscal partnered with the New England Legal

Foundation, the Goldwater Institute, CLT, MHTC, and

plaintiffs from several pro-taxpayer organizations

to prepare a lawsuit against the state Auditor if

the Auditor stalled the certification of the rebate

law. Luckily, our lawsuit was not needed because the

Auditor followed the law....

“Taxpayers

are in for a treat this Halloween but the tricks are

still lurking around the State House,” stated Paul

Diego Craney, spokesperson for Massachusetts Fiscal

Alliance.

“Governor

Charlie Baker, a Republican, has promised to

dispatch Chapter 62F rebates as soon as possible,

totaling $3 billion dollars. Meanwhile, Democrat

Speaker Ron Mariano and Senate President Karen

Spilka cannot seem to agree to a measly $500M in

taxpayer rebates and $500M in tax reform. Then there

is Democratic Boston Mayor Michelle Wu, and many

other ambitious Democratic politicians, who over the

weekend attended a press event in support of

Question 1, which would increase the income tax by

80% on some small businesses, retirees, home sales,

and high-income earners. The contrast couldn’t be

any clearer,” continued Craney.

“Taxpayers

are getting a nice treat with Chapter 62F’s $3

billion in rebates, but they need to watch out for

the tricks at the State House, and with Question 1,

they are lurking around the corner,” concluded

Craney.

Massachusetts Fiscal Alliance

Monday, October 31, 2022

Press Release

Taxpayers are in for a Treat

this Halloween but

the Tricks are Still Lurking Around the State House

How is it

that teachers are making gazillionaires John Fish,

Bob Kraft, and Jim Davis look like cheapskates?

For those

keeping score at home, teachers unions ― led by the

Massachusetts Teachers Association and the National

Education Association ― have bankrolled much of the

campaign to pass Question 1, which would increase

taxes on households making more than $1 million

annually. The revenue would be designated for

education and transportation.

The

teachers groups account for an eye-popping $22

million of the more than $26 million raised by

proponents, according to the latest state campaign

filings.

Compare

that with the $13.8 million opponents have generated

through the business community and wealthy

individuals....

Since

2015, the Massachusetts Teachers Association has

been working with a broad coalition of labor unions,

community organizations, and religious groups to get

the surtax on the ballot.

The MTA

has coughed up $13.3 million for the so-called Fair

Share Amendment, while its national counterpart,

NEA, has doled out $7.2 million. Which begs the

question: What do the teachers want?

MTA

President Max Page tells me Question 1 has been a

priority because teachers are tired of living in

wealthy state that doesn’t adequately fund public

education....

Where does

the MTA get all of its money? Page proudly tells me

it comes from the union dues of its 115,000 members

who work in public schools and universities. He

won’t say how much more the teachers are willing to

spend on the ballot question, but they are prepared

to go the distance....

We learned

last time having more money doesn’t always guarantee

a victory but combine that with the force of 115,000

voting teachers, the business leaders who want to

defeat Question 1 have their work cut out for them.

If

Question 1 passes, teachers no doubt will want a

return on their investment. What will that be?

The

Boston Globe

Tuesday, November 1, 2022

How is it that teachers

unions are outspending millionaires on Question 1?

On

Election Day in November 1915, the men of

Massachusetts went to the polls and made two

mistakes. First, they voted overwhelmingly against

extending voting rights to women. Second, they

inserted tax language into the state constitution

that forbade the Legislature from enacting a

graduated income tax. Ever.

The

suffrage vote soon became moot when the 19th

Amendment to the US Constitution overrode state

laws. The tax amendment, though — a century later,

that’s still with us.

As a

result of that misguided amendment, Massachusetts

can’t have what 32 states and the federal government

take for granted: an income tax code that expects

wealthy people to carry a heavier burden. The state

income tax rate (currently 5 percent) is the same

for everyone, regardless of individual

circumstances.

In an

ideal world, Massachusetts would simply get rid of

the flat-tax requirement enshrined in 1915. That

would allow our Legislature to do what most

legislatures do: set and change tax rates and tax

brackets in a fair way, and in response to the

state’s needs and economic conditions.

Question

1, the only constitutional amendment on the November

ballot, does not do that. Instead, it’s a much more

complicated approach to making the income tax

progressive, one that runs the risk of creating

unintended consequences that may be difficult to

undo. Still, for all its faults, Question 1 would

make the income tax better than it is now, and for

that reason the Globe endorses a yes vote on

Question 1....

Opponents,

mainly business groups, fear the higher tax will

make the state less economically competitive,

driving away some employers and scaring others from

coming here in the first place.... Getting rid of

the amendment, if the worst-case warnings of its

opponents come to pass, would require a lengthy

process that can stretch out over four years.

Those are

valid objections — and all the more reason why a

straight-up repeal of the uniformity rule, which

would take the minutiae of tax policy out of the

constitution entirely, would have been

preferable....

It is also

the case that advocates of Yes on Question 1 are

deceiving voters in one respect. Despite their

insistence to the contrary, it is not possible to

guarantee that the money raised by the surcharge

will, in fact, be added atop the existing

transportation and education budgets. There is

nothing to stop legislators from shifting existing

transportation and education funding into other

parts of the budget, then backfilling with the

proceeds of Question 1. The only recourse if the

Legislature fails to spend the money as promised is

political: voters would have to vote out legislators

who don’t heed the voters’ will....

The

reality is that the state has plenty of needs — in

education and transportation, but also other areas —

that the extra money could either pay for directly,

or free space in the budget for through some

legislative sleight of hand. The Commonwealth has a

backlog of bridges that need repair. It has

notoriously high child care costs. It has a housing

affordability crisis. It has a vulnerable coastline

that will need costly protection against rising sea

levels....

As is

often the case with ballot questions, voters on

Question 1 are being asked to choose between two

less-than-optimal choices. Overall, though, a yes

vote would move Massachusetts a step away from the

unfair income tax system created in 1915 and toward

a fairer Commonwealth that’s capable of making the

investments it needs.

A Boston

Globe editorial

Tuesday, November 1, 2022

Yes on Question 1

Several

reasons exist to vote “No,” on Question 1 on

Tuesday’s statewide election ballot, but the best

might be that there’s no assurance extra tax revenue

would even go where it’s supposed to go.

Question 1

is known colloquially as the “Fair Share Amendment,”

or the “millionaire’s tax.” It would change the

Massachusetts Constitution - a risky practice to

undertake by referendum in the first place - by

placing a 9% tax on persons with $1 million or more

in income....

It’s all

too easy for high-wage earners to be looked upon as

the enemy, but this amendment will have its most

devastating effect on the middle class. Question 1

is believed to be the only referendum question in

the nation that calls for a tax increase.

It comes

with giant pitfalls and no guarantee that its stated

purpose will even be honored. The Republican

strongly recommends a “No” vote on Question 1.

A

Springfield Republican editorial

Thursday, November 3, 2022

Question 1 has pitfalls,

no guarantees

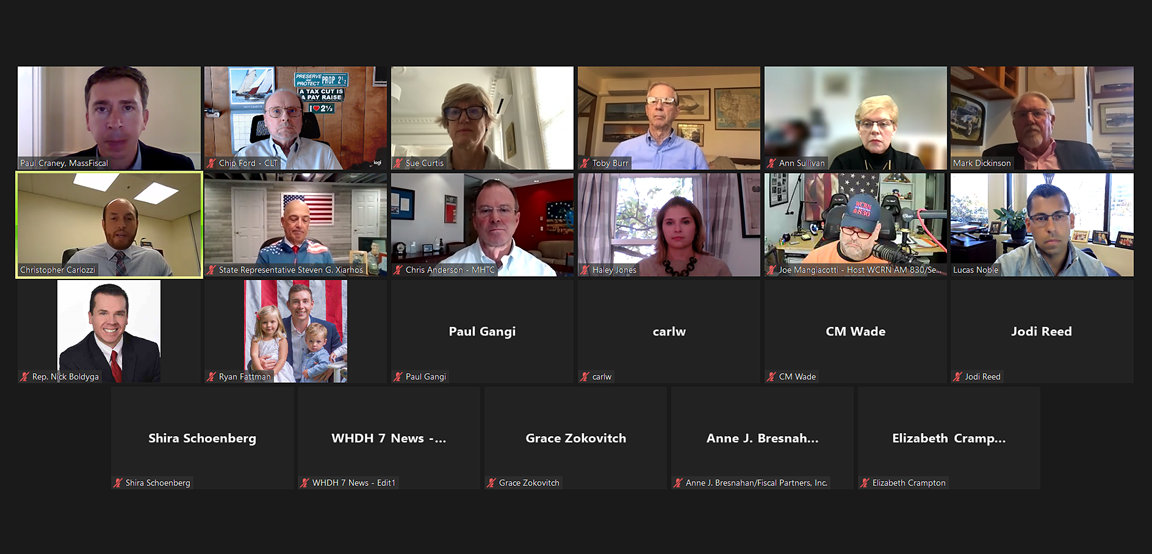

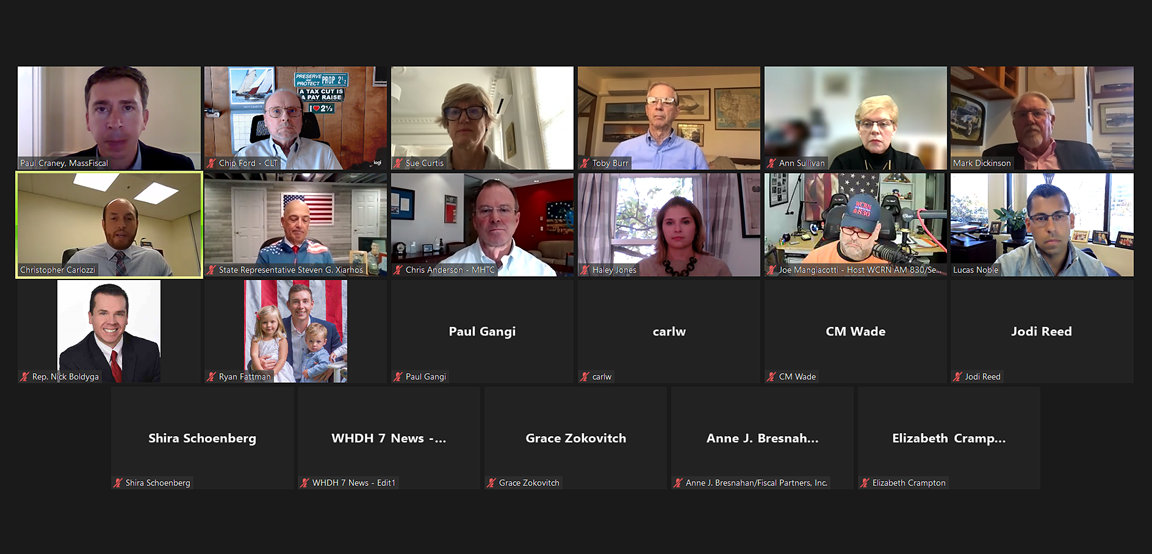

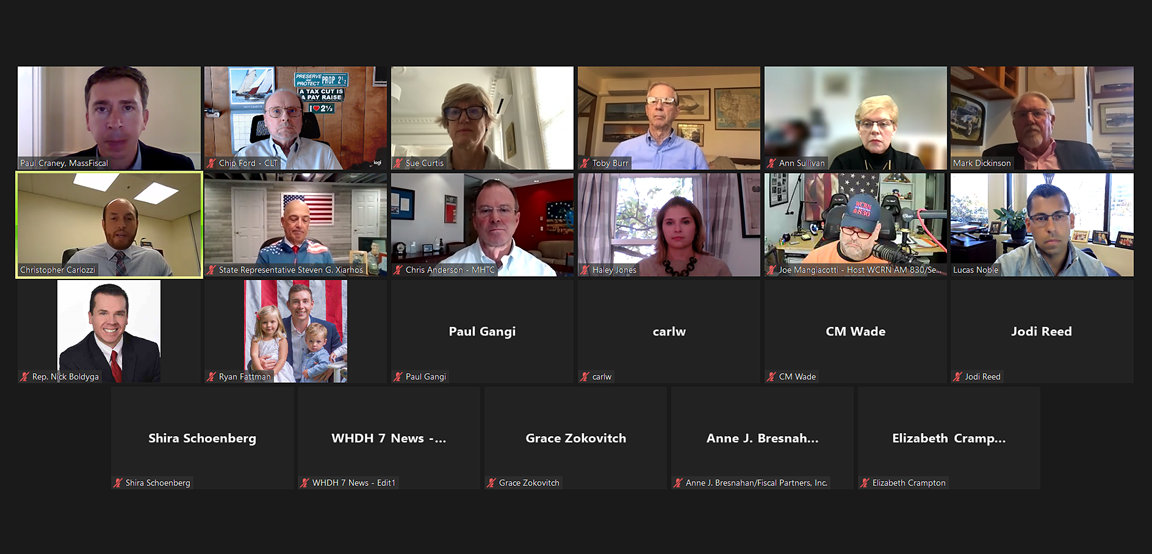

The

Massachusetts Fiscal Alliance hosted a virtual press

conference with various people of different

political ideologies, parties, and interests to make

their case to the media and the public to vote No on

Question 1 and No on Question 4 ahead of Tuesday’s

Election.

MassFiscal

hosted Chip Ford of the Citizens for

Limited Taxation, and Chris Anderson of

the Massachusetts High Tech Council. Chip and

Chris worked together during the last graduated

income tax ballot question in 1994, and they shared

the warning that applied in 1994 election for next

week’s ballot Question 1.

“What can

be more fair than every taxpayer paying the same

rate – the very definition of fairness?” asked

Chip Ford, executive director of Citizens for

Limited Taxation, which was founded in 1975 to

oppose and defeat the fourth graduated income tax

constitutional amendment on the 1976 ballot, then

led the opposition that defeated the fifth attempt

on the 1994 ballot. “It seems that deception is

often a part of these proposals and this sixth

attempt is no different,” Ford added. “Five times

now, voters have not been fooled and resoundingly

defeated all past assaults on the flat tax. Let’s

defeat it once again and keep the income tax fair

and equal,” said Chip Ford.

“The

Mass. High Tech Council’s mission is to create

and protect conditions that support investment, job

growth, and a strong quality of life for

Massachusetts employers and their employees. This

led us to support retaining the flat tax requirement

in the Massachusetts Constitution in 1994 and

further compels us to oppose Question 1 this year.

The voters were right to say no to the idea of

abandoning our constitutional protection in 1994 and

they should do the same next week. The consequences

of an 80% income tax surcharge on nest egg

retirement investments like the sale of a home, or

on small businesses in Massachusetts will never be a

good idea and would be a reality if Question 1 is

passed. As the voters did in 1994, we hope they say

no next week,” said Chris Anderson.

Mass

Fiscal Alliance

Thursday, November 3, 2022

Press Release

Defenders of MA’s Flat

Tax Remind Voters of

the Lessons of 1994 Ballot Question Fight Before

They Vote on Question 1

Business

groups on either side of the proposed millionaires

tax are making final pitches to undecided voters

with less than two weeks until the election.

Question 1

on the Nov. 8 ballot will ask Massachusetts voters

to amend the state Constitution to set a 4% surtax

on the portion of an individual’s annual income

above $1 million. The money would be earmarked for

education and transportation projects.

On

Wednesday, several business groups opposed to the

ballot question held a live-streamed briefing where

they talked about the potential impact on businesses

from the proposed surtax.

The No on

1 coalition, which includes business groups,

chambers of commerce, hoteliers, developers and tax

watchdog groups, argues that the proposed surtax on

the state’s top earners would be “one of the state’s

highest income tax increases in history,” affecting

tens of thousands of residents and business owners.

They said

it would also impact “pass-through” businesses —

such as limited liability and “S” corporations —

where profits are passed to the owners’ personal tax

filings and business income is taxed at personal

rates, not just millionaires.

“Roughly

80% of our small business members are pass-through

entities,” said Chris Carlozzi, state director of

the Massachusetts chapter of the National Federation

of Independent Business, a member of the coalition.

“And despite what proponents claim, this tax hike

will indeed impact those businesses.”

Jon Hurst,

president of the Retailers Association of

Massachusetts, said the proposed surtax would

discourage entrepreneurship and add to the mounting

financial burden of business owners who are dealing

with rising labor costs, higher unemployment

insurance and health care costs and other economic

pressures.

“I’m

concerned not only with impact of this tax on the

state’s current small businesses, but the future

entrepreneurs and risk-takers,” Hurst said.

The Salem

News

Tuesday, November 1, 2022

Groups spar over impact of

'fair share' tax

Days ahead

of the election, Republican Gov. Charlie Baker is

urging voters to reject a proposed millionaires' tax

after Democratic leaders pulled the plug on his

tax-cut plan.

On

Thursday, Baker and Lt. Gov. Karyn Polito sent an

email blast to supporters urging that they "join

them" in voting against Question 1 on Tuesday's

ballot, which asks Massachusetts voters to amend the

state Constitution to set a 4% surtax on the portion

of an individual’s annual income above $1 million.

Baker

called the plan to tax the state's wealthiest a

"misguided" effort that would "impose an immediate

tax hike on tens of thousands of homeowners, small

businesses owners, and retirees." He said there is

no guarantee that the money would be devoted to

transportation and education, as proponents claim.

"In a time

of economic uncertainty and rising prices, taxpayers

should not be asked to give a blank check to Beacon

Hill," Baker said.

Baker has

previously stated his opposition to a millionaires'

tax, but his forceful statement urging voters to

reject Question 1 came less than a day after

Democratic legislative leaders said they were

pulling a buffet of tax cuts he proposed from a $3.7

billion economic development bill.

Baker

accused lawmakers of reneging on a "promise" to pass

the tax cuts, and suggests the state doesn't need

the extra revenue from a millionaires' tax.

"In other

words, Beacon Hill has plenty of money to spend, and

the tax raised by Question 1 is unnecessary," he

said.

The Salem

News

Friday, November 4, 2022

Baker urges voters to reject

millionaires' tax

Lawmakers

sent a large and long-overdue closeout budget and

economic development bill to Gov. Charlie Baker's

desk Thursday, winning support for the scaled-down

measure from Republicans who agreed to the new

spending while lamenting the death of tax relief top

Democrats long promised.

A day

after negotiators announced a resolution to their

months-long impasse, both branches gave final

approval to the nearly $3.8 billion bill that will

deploy money remaining from an enormous tax surplus

on health care needs, affordable housing, MBTA

safety improvements and other needs while also

allowing the comptroller to close the state's books

for fiscal year 2022.

Legislative leaders opted to weave the closeout

components, which typically feature in a standalone

budget bill, into an updated version of the economic

development bill that cleared both branches

unanimously in July.

Any

objection from a single representative or senator

could have halted the progress of the bill (H 5374)

because lawmakers punted the measure into the

election-season stretch of informal sessions, but

the bill sailed through easily over the course of

the day.

The House

accepted the bill with no commentary delivered in

the chamber, and the Senate followed suit after its

top Republican said he was displeased with the

demise of previously approved tax relief measures

but was unwilling to hold up the billions of dollars

of spending designed to support Bay Staters and

employers in need.

"At this

important point, when one member could stop this

process from moving forward, we will not jeopardize

those important priorities," Tarr said in a speech

on the Senate floor. "Too often, we see sometimes

obstruction of someone else's agenda because someone

isn't able to get all of their agenda. This is a

time that requires statespersonship on behalf of all

of us, so we will not stand in the way of helping

all of those that need our help that will be the

beneficiaries of some of the important

appropriations in this bill. But what we will do is

insist on a commitment to this IOU."

The House

and Senate dropped from the bill $500 million in

one-time tax rebates that Democrats had said would

help middle-income families deal with inflation and

rising costs, and authorization for another roughly

$500 million annually in estate tax reforms and

permanent tax breaks for renters, seniors,

caregivers and others.

Democrats

said they opted against keeping those measures due

to "financial uncertainty in the year ahead" and the

costs of nearly $3 billion in checks that started

flowing out to taxpayers this week, as required

under the 1986 voter-approved law setting a cap on

allowable tax revenues. They pledged to return to

the topic of tax relief next year, when a new

governor will be in office....

House

Minority Leader Brad Jones called the lack of tax

reform in the bill after months of negotiations

"disappointing," particularly because both branches

had agreed to the idea unanimously this summer

before Democrats became aware the state owed nearly

$3 billion back to taxpayers under Chapter 62F.

"The 62F

money is great, but it's not permanent," Jones told

the News Service. "People need it with everything

going up across the board and winter and cold

weather coming upon us, but that's not permanent."

...

Baker, who

proposed a similar package of tax relief in January,

did not make clear Thursday whether he would try to

revive any of those measures by returning the bill

with an amendment, saying he needs first to "read it

and talk about it and figure it out."

He voiced

disappointment in the death-for-now of the tax

measures, particularly with revenues continuing to

surge through the first few months of fiscal year

2023.

"I feel

bad for renters, I feel really bad for all those

low-income taxpayers of Massachusetts who don't pay

federal taxes, and there are a lot of people who

have dependent care issues, some of which relate to

the pandemic and some of which are just life," Baker

told reporters after a State House event on

Thursday. "The House and Senate basically reached an

agreement on that, and I'm sorry it didn't make it

through to the finals because with the cost of

everything being what it is right now, that would've

been a real benefit to a lot of those folks going

forward."

"I hope

they come back and do it next year, but that's a

year lost and a year's worth of 6 percent increases

on practically everything that people wouldn't have

gotten the benefit of the tax relief for," he

added....

The

failure to reform the Massachusetts estate tax

particularly stung Massachusetts Taxpayers

Foundation President Eileen McAnneny, who said the

Bay State is an "outlier" in how it imposes that

levy.

"It's a

missed opportunity and I hope they will revisit this

in the new year," McAnneny said. She added, "A lot

of people care about this."

State

House News Service

Thursday, November 3, 2022

House, Senate Spend

Surplus After Cutting Tax Relief

It was a

warm 60-degree day on Beacon Hill, and under the

Golden Dome senators were engaged in a miniature

debate on taxes and spending. What month is it

again? ...

At the

center of the action was a nearly $3.8 billion

spending package that Democratic leaders brought to

life a couple days after Halloween, stitching

together a long-stalled economic development bill

with a spending bill to close the books on fiscal

2022. They chopped the head off their own tax reform

plans in the process, with some Democrats instead

looking to grab some of the limelight associated

with the automatically-triggered tax relief that's

underway, with checks and direct deposits beginning

to flow on Tuesday....

Some State

House folks call it the "Christmas in July" bill

because of all the money for communities that

individual reps and senators can point to as a proud

accomplishment with direct local impact. And, the

bill would normally have been wrapped up in July.

Now it's

Christmas in July, in November. Should make for some

good campaign stops over the weekend if the subject

is local projects, but the timing is awkward if

constituents want to know about once-promised

reforms to the estate tax, or increases to child tax

credits or the renter's tax deduction cap....

Democratic

leaders have said they were caught offguard when the

state hit its revenue cap under a 1986 law known as

Chapter 62F, to the tune of around $3 billion which

started flowing back to taxpayers this week in the

form of rebate checks.

Under 62F,

those rebates are issued in an amount proportional

with a person's 2021 tax bill, meaning wealthier

taxpayers are seeing heftier checks than low-income

people. They're rebates, not exactly the "relief"

for average citizens that legislative Democrats

proposed earlier this year in their tax plan.

"I feel

bad for renters, I feel really bad for all those

low-income taxpayers of Massachusetts who don't pay

federal taxes, and there are a lot of people who

have dependent care issues, some of which relate to

the pandemic and some of which are just life," Gov.

Charlie Baker said Thursday.

The

narrative seemed a bit different between the House

and Senate on the topic of 62F this week.

Asked what

sort of relief could now flow to lower-income folks,

Mariano responded by saying Chapter 62F was "the

system that the governor chose to use, and we

philosophically raised some questions about this."

On the

Senate floor, Rodrigues trumpeted the fact that the

compromise bill accounted for the $3 billion in

"historic levels of tax relief to over 3 million tax

filers," although that was already underway before

the bill was even filed.

Senate

Minority Leader Bruce Tarr, the lone Republican

senator to attend the session in person, sounded

like he objected at heart -- at least to the

cleaving of tax reforms that were dangled in front

of Bay Staters for months. But in the interest of "statespersonship,"

he said, he wouldn't derail the train for want of

one car.

After the

branches adjourned Thursday, the Department of

Revenue sent out another report of

bulkier-than-expected revenues for the month of

October -- $2.359 billion, which was nearly $300

million over the Baker administration's benchmarks.

State

House News Service

Friday, November 5, 2022

Weekly Roundup - Christmas In

July, In November

|

Chip Ford's CLT

Commentary |

|

Citizens for

Limited Taxation has been recognized by some as the provider

and genesis of what since July became termed "62F"

— an arcane chapter among a

multitude within Massachusetts General Laws. It has

become a sloppy shorthand reference meaning nothing to most

but adopted by many reporters who either don't know or care,

don't remember, or weren't even born yet when it was

commonly known as CLT's Tax Cap refund.

One of the veteran

news reporters who was there in 1986 is Boston Herald

columnist

Peter Lucas, whose column yesterday ("In blue Taxachusetts, refund offers

rare relief") in part noted:

Call it

Gov. Charlie Baker’s early Thanksgiving Day present

— even though it is not a gift at all.

But when

the State of Taxachusetts is willing to send you

money, take it and run.

The tax

cap was a novel ideal at the time. It was proposed

and pushed by the Citizens for Limited Taxation

in a 1980s referendum drive headed by the late Barbara Anderson and

Chip Ford, both CLT

anti-tax leaders....

The tax

cap law in the parlance of state government is

called Chapter 62F of the General Laws.

But it

should be called the Anderson Act because it was a

dedicated and untiring Barbara Anderson who brought

it about. She spent years lobbying for taxpayers at

the State House.

And when

the Legislature would not approve the tax cap

concept, she went to the public and got it on the

ballot and won. She did more to help the

Massachusetts taxpayer than any politician around.

She showed

that even under a growing statist society, it was

still possible — although rare — for average

citizens to take on big government by banding

together to work for the common good.

She died

in 2016 at age 73.

However,

were she alive today, you can bet she would be

campaigning against Question One on Tuesday’s

ballot, which is the so-called millionaire’s tax, a

4% graduated income tax on people earning $1

million.

Anderson

was around long enough to know that the proposed tax

increase on $1 million earners would soon trickle

down to include everybody else. That is the way

stealth government works....

Baker

deserves credit for riding herd on the tax rebate.

The Republican governor stood firm on his insistence

that the money be sent to the taxpayers, despite

opposition from some legislators in the

Democrat-controlled Legislature who had other plans

for the funds.

Cynics

might have pointed out that Baker sending money back

to the taxpayers was simply an election eve ploy to

get votes. But Baker is not on the ballot. His

motive was simply to give the money back to the

people who earned it. So he did.

That was

also Barbara Anderson’s goal. And she did it, too.

Avi Nelson's

Boston Herald Thursday column ("CLT exits scene with tax refund

victory") preceded yesterday's Lucas column. Avi is a regular contributing columnist to The

Boston Herald and for decades has been a familiar

radio and TV talk show host as well as a forever

supporter of CLT. In it he wrote:

Citizens For Limited Taxation (CLT) is ending with a

historic win. It appears now the $3 billion tax

refund due Massachusetts taxpayers will actually be

paid to us – as the law (Chapter 62F) requires. We,

the people of Massachusetts, created that law by

vote, after a 1986 referendum effort sponsored by

CLT....

Then a

cabal of ultra-left Democrats led by Rep. Connolly

(D-Cambridge) tried to reconfigure the refund –

redistributing more to some, less to others. They

don’t understand: it’s not their money. They have no

right to redistribute or redirect it. The money

belongs to the taxpayers who paid it. The law

requires that it be refunded – that is, returned to

the taxpayers who originally funded it. That’s the

meaning of “re-funded.” (Reasoning must be

elementary when explaining to left-wing

politicians.)...

Fortunately, those obstructionist and redistribution

schemes appear to be dead-ended – for now. But

beware when the legislature reconvenes. In this

one-party state, we can expect renewed efforts to

sabotage the Tax Cap law. For those voters planning

to again vote the straight Democrat line, another

reason to reconsider.

The late

taxpayer champion Barbara Anderson led CLT in

1986. She and CLT (aided by the Massachusetts High

Tech Council) were the driving force that secured

voter approval of the refund law. Then, as now, the

opposition came from Democrat leftist politicians. I

still have the editorials I wrote and broadcast in

1986 supporting the referendum, and then in 1987,

criticizing then Gov. Michael Dukakis’ attempt to

maneuver around the law. This year’s refund is 100

times that of 1987’s.

The

commonwealth is swimming in money. As Gov. Baker

noted, this past year, tax revenue grew by over 20%,

on top of the previous year’s 15% increase. And this

year, revenues are running 5% ($450 million) higher

than last year. Chip Ford, CLT executive

director, has aptly observed this isn’t a surplus,

it’s over-taxation. But Democrat politicians are

insatiable. They not only balked at the refund, but

they actually want to raise taxes.

On this

year’s ballot is a graduated income tax proposal –

again. After five defeats, this is the sixth time

that maneuver is being tried. It is pitched, as

usual, as targeting the wealthy. But that’s untrue.

Many not-so-wealthy would also be hit with higher

taxes.

CLT, once

again, and some other civic minded groups have

organized in opposition. We hope the ever-more-taxes

crowd will be rejected again on election day. Vote

‘no’ on Question 1.

But

there is a sad postscript to this tax story. After

this election, CLT is closing down. For over 47

years CLT has fought for the taxpayers and has saved

Mass. citizens uncounted billions in taxes. But

there’s insufficient financial support from these

same citizens to keep the organization going. So,

Citizens for Limited Taxation will pass into

history, and we taxpayers will endure higher taxes

because CLT is no longer here.

Then, of

course, there is Howie Carr, iconic Boston Herald

columnist and syndicated radio talk show host

— who got his talk radio debut

as one of "The Governors" along with Barbara Anderson

on WRKO's Jerry William Show back in the mid-80s

and early-90s.

All three of these columnists were right there

paying attention when CLT's successful Tax Cap petition drive was

undertaken and won on the 1986 ballot after an

exhausting ballot campaign. In his

500,000 refunds coming your way

means Question 1 is a joke! column on Wednesday

Howie wrote:

If you’re

a taxpayer in Massachusetts, keep an eye on your

bank account or mail box these next few days.

An

amazing, once-in-a-lifetime occurrence is about to

happen.

You are

going to get a kiss in the mail from the Department

of Revenue (DOR) – about 14% of whatever you paid in

state income taxes for 2021.

About

500,000 of these unprecedented refunds should be out

by the end of the week. I wish the DOR had been able

to get the money back to all 3 million of us in the

state who actually work for a living before the

election six days from now, but hey, that’s the

hackerama for you.

The good

news is, if the electorate is paying attention, even

these first half-million or so refunds should

disprove once and for all the lie that is propelling

referendum Question 1 – that the hacks need another

billion-plus in tax money to pay for “education” and

“transportation.”

If ever

there was a reason to vote NO on Question 1, it’s

the fact that the state is now so historically flush

with cash that it is required under law to return

almost $3 billion to the taxpayers.

Get the

word out! Let your neighbors know about the money

that’s coming their way, and why....

Here’s how

this week’s DOR refunds work.

The state

income tax rate is 5%. So if you made $100,000 last

year, you paid $5,000 in taxes to the Commonwealth

of Massachusetts.

So now,

under the formula, you will soon be getting back 14%

of that $5,000 — $700.

If you

made $200,000, you will get back $1,400. And so on.

It’s

important to remember that this isn’t a handout,

which is what Democrats get. It’s not welfare. It’s

a refund, because it’s your money that the state

stole from you and is now being forced to return.

(And God, are the Democrats angry about it!) ...

For those

who haven’t been paying attention, this windfall for

the working classes (and tragedy for Democrats) is

occurring because of the late Barbara Anderson

of Citizens for Limited Taxation (CLT). In

1986, her group sponsored its own referendum

question, requiring the return of any

over-collections of tax revenue, based on a

complicated formula.

It was a

big surprise when 62F finally kicked in, and no one

was more surprised than the hacks who are pushing

their graduated-income tax con at the ballot box for

the sixth time since 1962....

Question 1

would give the local hacks billions more for their

own clean school bus rebates.

Anyway,

the check’s in the mail. When you get it, just

remember Barbara Anderson fondly for a moment, and

then explain Question 1 to a low-info voter or two.

Vote No on

Question 1.

500,000

refunds reportedly have been sent out over the past

week of the 1.4 million total refunds that should

reach qualified taxpayers within the month ahead.

(Imagine if just 1% of those beneficiaries

had supported CLT — it

wouldn't be shutting down next week!)

Last Sunday The

Boston Herald reported ("Tax rebates head out

starting Tuesday, here’s how to see how much you get"):

“The

Department of Revenue will begin sending out refunds

via checks and direct deposits to taxpayers under

Chapter 62F on Tuesday, November 1. These refunds

will be sent out on a rolling basis through December

15. An estimated 3 million taxpayers will receive a

refund of approximately 14% of their 2021

Massachusetts income tax liability,” a spokesperson

for the Executive Office of Administration and

Finance said Friday....

The group

that passed the law back in the 80s hailed the

announcement as a victory, despite the passing of

the law’s original proponent.

“I’m sure

Barbara Anderson is up there looking down on

us with a grin pumping her fist in the heavens,” Chip Ford, executive director of

Citizens for

Limited Taxation, the group behind the law, said

in July when the news was announced Chapter 62F had

been triggered.

The law,

put into place due in large part to the activism of

Anderson, says that if the commonwealth takes more

in taxes than it’s supposed to under a cap

established by the same statute, it must send some

of it back to taxpayers. In 1986, rebates amounted

to just under two dimes. Now, depending on your

income, it could be hundreds or thousands.

The CLT Tax Cap

refunds are underway, mission accomplished. One down,

one to go. Next we moved on to defending the state's

flat income tax by defeating Question One on Tuesday's

ballot — the sixth

attempt by The Takers cabal to amend the state

constitution with its first step toward imposing a graduated

income tax. They've lusted for that power to divide

and conquer taxpayers one income bracket at a time for

six decades (1962, 1968, 1972, 1976, 1994 and now).

Even when and if we defeat them again this time

— they'll be back. They

never give up trying to extract more from the productive.

More Is Never Enough (MINE) until they have it all.

On Monday the

Massachusetts Fiscal Alliance issued a news release

("Taxpayers are in for a Treat

this Halloween but

the Tricks are Still Lurking Around the State House"):

Halloween

is finally here and today taxpayers are in for a

treat. Starting as early as this week, taxpayers are

set to see their bank account get a little bigger.

Thanks to the 1986 voter approved “rebate” law known

as Chapter 62F, which was spearheaded by Citizens

for Limited Taxation (CLT) and the Massachusetts High Tech Council (MHTC),

taxpayers are expected to see their rebates start to

arrive this week and roll on throughout the month of

November. Taxpayers owe a great deal of gratitude to

CLT and MHTC for their important work in 1986.

MassFiscal partnered with the New England Legal

Foundation, the Goldwater Institute, CLT, MHTC, and

plaintiffs from several pro-taxpayer organizations

to prepare a lawsuit against the state Auditor if

the Auditor stalled the certification of the rebate

law. Luckily, our lawsuit was not needed because the

Auditor followed the law....

“Taxpayers

are in for a treat this Halloween but the tricks are

still lurking around the State House,” stated Paul

Diego Craney, spokesperson for Massachusetts Fiscal

Alliance.

“Governor

Charlie Baker, a Republican, has promised to

dispatch Chapter 62F rebates as soon as possible,

totaling $3 billion dollars. Meanwhile, Democrat

Speaker Ron Mariano and Senate President Karen

Spilka cannot seem to agree to a measly $500M in

taxpayer rebates and $500M in tax reform. Then there

is Democratic Boston Mayor Michelle Wu, and many

other ambitious Democratic politicians, who over the

weekend attended a press event in support of

Question 1, which would increase the income tax by

80% on some small businesses, retirees, home sales,

and high-income earners. The contrast couldn’t be

any clearer,” continued Craney.

“Taxpayers

are getting a nice treat with Chapter 62F’s $3

billion in rebates, but they need to watch out for

the tricks at the State House, and with Question 1,

they are lurking around the corner,” concluded

Craney.

On Tuesday The

Boston Globe, of all places, asked some

uncomfortable questions of the Question One backers in a

column by business writer Shirley Leung ("How is it that teachers

unions are outspending millionaires on Question 1?"):

How is it

that teachers are making gazillionaires John Fish,

Bob Kraft, and Jim Davis look like cheapskates?

For those

keeping score at home, teachers unions ― led by the

Massachusetts Teachers Association and the National

Education Association ― have bankrolled much of the

campaign to pass Question 1, which would increase

taxes on households making more than $1 million

annually. The revenue would be designated for

education and transportation.

The

teachers groups account for an eye-popping $22

million of the more than $26 million raised by

proponents, according to the latest state campaign

filings.

Compare

that with the $13.8 million opponents have generated

through the business community and wealthy

individuals....

Since

2015, the Massachusetts Teachers Association has

been working with a broad coalition of labor unions,

community organizations, and religious groups to get

the surtax on the ballot.

The MTA

has coughed up $13.3 million for the so-called Fair

Share Amendment, while its national counterpart,

NEA, has doled out $7.2 million. Which begs the

question: What do the teachers want?

MTA

President Max Page tells me Question 1 has been a

priority because teachers are tired of living in

wealthy state that doesn’t adequately fund public

education....

Where does

the MTA get all of its money? Page proudly tells me

it comes from the union dues of its 115,000 members

who work in public schools and universities. He

won’t say how much more the teachers are willing to

spend on the ballot question, but they are prepared

to go the distance....

We learned

last time having more money doesn’t always guarantee

a victory but combine that with the force of 115,000

voting teachers, the business leaders who want to

defeat Question 1 have their work cut out for them.

If

Question 1 passes, teachers no doubt will want a

return on their investment. What will that be?

"What will that

be?" indeed. Doing it "for the children" doesn't

fly anymore, does it? I can't believe anyone is

so ignorant, uninformed, low-information to still buy that

worn-out claptrap — at least I

hope not.

Even The Boston

Globe's expected editorial endorsing Question One had to

struggle and contort mightily on Tuesday in an attempt to

justify its support in "Yes on Question 1":

In an

ideal world, Massachusetts would simply get rid of

the flat-tax requirement enshrined in 1915. That

would allow our Legislature to do what most

legislatures do: set and change tax rates and tax

brackets in a fair way, and in response to the

state’s needs and economic conditions.

Question

1, the only constitutional amendment on the November

ballot, does not do that. Instead, it’s a much more

complicated approach to making the income tax

progressive, one that runs the risk of creating

unintended consequences that may be difficult to

undo. Still, for all its faults, Question 1 would

make the income tax better than it is now, and for

that reason the Globe endorses a yes vote on

Question 1....

Opponents,

mainly business groups, fear the higher tax will

make the state less economically competitive,

driving away some employers and scaring others from

coming here in the first place.... Getting rid of

the amendment, if the worst-case warnings of its

opponents come to pass, would require a lengthy

process that can stretch out over four years.

Those are

valid objections — and all the more reason why a

straight-up repeal of the uniformity rule, which

would take the minutiae of tax policy out of the

constitution entirely, would have been

preferable....

It is also

the case that advocates of Yes on Question 1 are

deceiving voters in one respect. Despite their

insistence to the contrary, it is not possible to

guarantee that the money raised by the surcharge

will, in fact, be added atop the existing

transportation and education budgets. There is

nothing to stop legislators from shifting existing

transportation and education funding into other

parts of the budget, then backfilling with the

proceeds of Question 1. The only recourse if the

Legislature fails to spend the money as promised is

political: voters would have to vote out legislators

who don’t heed the voters’ will....

The

reality is that the state has plenty of needs — in

education and transportation, but also other areas —

that the extra money could either pay for directly,

or free space in the budget for through some

legislative sleight of hand. The Commonwealth has a

backlog of bridges that need repair. It has

notoriously high child care costs. It has a housing

affordability crisis. It has a vulnerable coastline

that will need costly protection against rising sea

levels....

As is

often the case with ballot questions, voters on

Question 1 are being asked to choose between two

less-than-optimal choices. Overall, though, a yes

vote would move Massachusetts a step away from the

unfair income tax system created in 1915 and toward

a fairer Commonwealth that’s capable of making the

investments it needs.

One of the usual

newspapers one would expect to support Question One

published a surprising reversal. The Springfield

Republican on Thursday recommended it be defeated in its

editorial "Question 1 has pitfalls,

no guarantees":

Several

reasons exist to vote “No,” on Question 1 on

Tuesday’s statewide election ballot, but the best

might be that there’s no assurance extra tax revenue

would even go where it’s supposed to go.

Question 1

is known colloquially as the “Fair Share Amendment,”

or the “millionaire’s tax.” It would change the

Massachusetts Constitution - a risky practice to

undertake by referendum in the first place - by

placing a 9% tax on persons with $1 million or more

in income....

It’s all

too easy for high-wage earners to be looked upon as

the enemy, but this amendment will have its most

devastating effect on the middle class. Question 1

is believed to be the only referendum question in

the nation that calls for a tax increase.

It comes

with giant pitfalls and no guarantee that its stated

purpose will even be honored. The Republican

strongly recommends a “No” vote on Question 1.

On Thursday the Mass

Fiscal Alliance hosted a virtual press conference in

which I participated representing CLT among other Question

One opponents. Its news release ("Defenders of MA’s Flat

Tax Remind Voters of

the Lessons of 1994 Ballot Question Fight Before

They Vote on Question 1") noted:

MassFiscal

hosted Chip Ford of the Citizens for

Limited Taxation, and Chris Anderson of

the Massachusetts High Tech Council. Chip and

Chris worked together during the last graduated

income tax ballot question in 1994, and they shared

the warning that applied in 1994 election for next

week’s ballot Question 1.

“What can

be more fair than every taxpayer paying the same

rate – the very definition of fairness?” asked Chip Ford, executive director of

Citizens for

Limited Taxation, which was founded in 1975 to

oppose and defeat the fourth graduated income tax

constitutional amendment on the 1976 ballot, then

led the opposition that defeated the fifth attempt

on the 1994 ballot. “It seems that deception is

often a part of these proposals and this sixth

attempt is no different,” Ford added. “Five times

now, voters have not been fooled and resoundingly

defeated all past assaults on the flat tax. Let’s

defeat it once again and keep the income tax fair

and equal,” said Chip Ford.

“The Mass. High Tech Council’s mission is to create

and protect conditions that support investment, job

growth, and a strong quality of life for

Massachusetts employers and their employees. This

led us to support retaining the flat tax requirement

in the Massachusetts Constitution in 1994 and

further compels us to oppose Question 1 this year.

The voters were right to say no to the idea of

abandoning our constitutional protection in 1994 and

they should do the same next week. The consequences

of an 80% income tax surcharge on nest egg

retirement investments like the sale of a home, or

on small businesses in Massachusetts will never be a

good idea and would be a reality if Question 1 is

passed. As the voters did in 1994, we hope they say

no next week,” said Chris Anderson (president

of the Mass. High Tech Council).

THE FULL PRESS RELEASE IS AVAILABLE HERE

Even Gov. Baker

finally came out in opposition to Question One,

The Salem

News reported on Friday ("Baker urges voters to reject

millionaires' tax"):

Days ahead

of the election, Republican Gov. Charlie Baker is

urging voters to reject a proposed millionaires' tax

after Democratic leaders pulled the plug on his

tax-cut plan.

On

Thursday, Baker and Lt. Gov. Karyn Polito sent an

email blast to supporters urging that they "join

them" in voting against Question 1 on Tuesday's

ballot, which asks Massachusetts voters to amend the

state Constitution to set a 4% surtax on the portion

of an individual’s annual income above $1 million.

Baker

called the plan to tax the state's wealthiest a

"misguided" effort that would "impose an immediate

tax hike on tens of thousands of homeowners, small

businesses owners, and retirees." He said there is

no guarantee that the money would be devoted to

transportation and education, as proponents claim.

"In a time

of economic uncertainty and rising prices, taxpayers

should not be asked to give a blank check to Beacon

Hill," Baker said.

Baker has

previously stated his opposition to a millionaires'

tax, but his forceful statement urging voters to

reject Question 1 came less than a day after

Democratic legislative leaders said they were

pulling a buffet of tax cuts he proposed from a $3.7

billion economic development bill.

Baker

accused lawmakers of reneging on a "promise" to pass

the tax cuts, and suggests the state doesn't need

the extra revenue from a millionaires' tax.

"In other

words, Beacon Hill has plenty of money to spend, and

the tax raised by Question 1 is unnecessary," he

said.

Gov. Baker was

referring to the

$3.8 billion Economic Development Bill that

raced through virtually empty House and Senate chambers with

no recorded votes in either chamber, passing only on a

"voice vote" with no objections

— after stripping out all promised

tax relief and tax reforms.

The State House News Service on Friday reported ("Weekly

Roundup - Christmas In July, In November")

. . . At the center of the

action was a nearly $3.8 billion spending

package that Democratic leaders brought to life

a couple days after Halloween, stitching

together a long-stalled economic development

bill with a spending bill to close the books on

fiscal 2022. They chopped the head off their own

tax reform plans in the process, with some

Democrats instead looking to grab some of the

limelight associated with the

automatically-triggered tax relief that's

underway, with checks and direct deposits

beginning to flow on Tuesday....

Some State House folks call

it the "Christmas in July" bill because of all

the money for communities that individual reps

and senators can point to as a proud

accomplishment with direct local impact. And,

the bill would normally have been wrapped up in

July.

Now it's Christmas in July,

in November. Should make for some good campaign

stops over the weekend if the subject is local

projects, but the timing is awkward if

constituents want to know about once-promised

reforms to the estate tax, or increases to child

tax credits or the renter's tax deduction

cap....

Democratic leaders have

said they were caught offguard when the state

hit its revenue cap under a 1986 law known as

Chapter 62F, to the tune of around $3 billion

which started flowing back to taxpayers this

week in the form of rebate checks.

Under 62F, those rebates

are issued in an amount proportional with a

person's 2021 tax bill, meaning wealthier

taxpayers are seeing heftier checks than

low-income people. They're rebates, not exactly

the "relief" for average citizens that

legislative Democrats proposed earlier this year

in their tax plan.

"I feel bad for renters, I

feel really bad for all those low-income

taxpayers of Massachusetts who don't pay federal

taxes, and there are a lot of people who have

dependent care issues, some of which relate to

the pandemic and some of which are just life,"

Gov. Charlie Baker said Thursday.

The narrative seemed a bit

different between the House and Senate on the

topic of 62F this week.

Asked what sort of relief

could now flow to lower-income folks, Mariano

responded by saying Chapter 62F was "the system

that the governor chose to use, and we

philosophically raised some questions about

this."

On the Senate floor,

Rodrigues trumpeted the fact that the compromise

bill accounted for the $3 billion in "historic

levels of tax relief to over 3 million tax

filers," although that was already underway

before the bill was even filed.

Senate Minority Leader

Bruce Tarr, the lone Republican senator to

attend the session in person, sounded like he

objected at heart -- at least to the cleaving of

tax reforms that were dangled in front of Bay

Staters for months. But in the interest of "statespersonship,"

he said, he wouldn't derail the train for want

of one car.

After the branches

adjourned Thursday, the Department of Revenue

sent out another report of bulkier-than-expected

revenues for the month of October -- $2.359

billion, which was nearly $300 million over the

Baker administration's benchmarks.

The Legislature

screwed taxpayers once again —

even with still billions in surplus and yet

more surpluses pouring in. This goes to prove once

again why CLT's Tax Cap is so critically important.

Now if only you can keep it.

REMEMBER

TO VOTE ON TUESDAY!

|

|

|

|

Chip Ford

Executive Director |

|

|

|

The Boston

Herald

Saturday, November 5, 2022

In blue Taxachusetts, refund offers rare relief

By Peter Lucas

Call it Gov. Charlie Baker’s early Thanksgiving Day present

— even though it is not a gift at all.

But when the State of Taxachusetts is willing to send you

money, take it and run.

The “gift” is a $3 billion tax refund that is being sent to

Massachusetts taxpayers as result of the tax cap law passed

in 1986 requiring the state to return money to taxpayers if

it raises more than the tax cap allows.

The tax cap was a novel ideal at the time. It was proposed

and pushed by the Citizens for Limited Taxation in a

1980s referendum drive headed by the late Barbara

Anderson and Chip Ford, both CLT anti-tax

leaders.

What is remarkable about their achievement is that they —

private citizens — were able to override the big spending

and big taxing Massachusetts Democrat political

establishment that thrives on tax hikes.

Their accomplishment forced the state to give money it did

not need, and should not have raised in the first place,

back to overtaxed Massachusetts citizens.

The tax cap law in the parlance of state government is

called Chapter 62F of the General Laws.

But it should be called the Anderson Act because it was a

dedicated and untiring Barbara Anderson who brought it

about. She spent years lobbying for taxpayers at the State

House.

And when the Legislature would not approve the tax cap

concept, she went to the public and got it on the ballot and

won. She did more to help the Massachusetts taxpayer than

any politician around.

She showed that even under a growing statist society, it was

still possible — although rare — for average citizens to

take on big government by banding together to work for the

common good.

She died in 2016 at age 73.

However, were she alive today, you can bet she would be

campaigning against Question One on Tuesday’s ballot, which

is the so-called millionaire’s tax, a 4% graduated income

tax on people earning $1 million.

Anderson was around long enough to know that the proposed

tax increase on $1 million earners would soon trickle down

to include everybody else. That is the way stealth

government works.

She would be the first to point out the irony of the state

so awash in money that it is returning some of it to the

taxpayers, while at the same time it has a group of

progressive and woke lobbyists seeking to raise taxes even

more.

This sounds like progressive Democratic candidate for

governor Maura Healey who has promised not to raise taxes,

but at the same time supports Question One that raises taxes

on people earning $1 million.

Her opponent, Republican Geoff Diehl, the underdog in the

race, is not only opposed to Question One, but has fought

tax increases, including hikes in the state tax gas tax, for

years.

About three million taxpayers are expected to receive

refunds either through direct deposit or by mailed checks

that have already begun to go out. The refund is estimated

to be 14% of what the taxpayer paid in taxes in 2021

While it is no windfall, it is welcomed by households faced

with rising food and gasoline prices, not to mention pending

hikes in home heating oil and natural gas.

Baker deserves credit for riding herd on the tax rebate. The

Republican governor stood firm on his insistence that the

money be sent to the taxpayers, despite opposition from some

legislators in the Democrat-controlled Legislature who had

other plans for the funds.,

Cynics might have pointed out that Baker sending money back

to the taxpayers was simply an election eve ploy to get

votes. But Baker is not on the ballot. His motive was simply

to give the money back to the people who earned it. So he

did.

That was also Barbara Anderson’s goal. And she did it, too.

— Peter Lucas is a veteran Massachusetts political

reporter and columnist.

The Boston

Herald

Thursday, November 3, 2022

CLT exits scene with tax refund victory

By Avi Nelson

Citizens For Limited Taxation (CLT) is ending with a

historic win. It appears now the $3 billion tax refund

due Massachusetts taxpayers will actually be paid to us – as

the law (Chapter 62F) requires. We, the people of

Massachusetts, created that law by vote, after a 1986

referendum effort sponsored by CLT.

When it became apparent last summer that a tax refund was

legally required, however, some prominent Democrat

politicians immediately connived to undercut the law. House

Speaker Mariano (D-Quincy) said, “We could undo the law, we

could change it, we could postpone,” later adding, “This is

a stunt that was triggered by a law made in 1986 that gives

people a one-time opportunity to get money.” Note how the

speaker considers a law passed by the people (us) a “stunt;”

and he disparagingly implies we’re money-grubbing because we

want our own money back, as the law stipulates.

Then a cabal of ultra-left Democrats led by Rep. Connolly

(D-Cambridge) tried to reconfigure the refund –

redistributing more to some, less to others. They don’t

understand: it’s not their money. They have no right to

redistribute or redirect it. The money belongs to the

taxpayers who paid it. The law requires that it be refunded

– that is, returned to the taxpayers who originally funded

it. That’s the meaning of “re-funded.” (Reasoning must be

elementary when explaining to left-wing politicians.)

Connolly self-describes as “proud . . . DSA member.” DSA is

Democratic Socialists of America. Socialists don’t believe

in private property, so they have no respect for your

private property and no hesitation about taking it and

giving it to favored others.

Fortunately, those obstructionist and redistribution schemes

appear to be dead-ended – for now. But beware when the

legislature reconvenes. In this one-party state, we can

expect renewed efforts to sabotage the Tax Cap law. For

those voters planning to again vote the straight Democrat

line, another reason to reconsider.

The late taxpayer champion Barbara Anderson led CLT

in 1986. She and CLT (aided by the Massachusetts High Tech

Council) were the driving force that secured voter approval

of the refund law. Then, as now, the opposition came from

Democrat leftist politicians. I still have the editorials I

wrote and broadcast in 1986 supporting the referendum, and

then in 1987, criticizing then Gov. Michael Dukakis’ attempt

to maneuver around the law. This year’s refund is 100 times

that of 1987’s.

The commonwealth is swimming in money. As Gov. Baker noted,

this past year, tax revenue grew by over 20%, on top of the

previous year’s 15% increase. And this year, revenues are

running 5% ($450 million) higher than last year. Chip

Ford, CLT executive director, has aptly observed this

isn’t a surplus, it’s over-taxation. But Democrat

politicians are insatiable. They not only balked at the

refund, but they actually want to raise taxes.

On this year’s ballot is a graduated income tax proposal –

again. After five defeats, this is the sixth time that

maneuver is being tried. It is pitched, as usual, as

targeting the wealthy. But that’s untrue. Many

not-so-wealthy would also be hit with higher taxes.

CLT, once again, and some other civic minded groups have

organized in opposition. We hope the ever-more-taxes crowd

will be rejected again on election day. Vote ‘no’ on

Question 1.

But there is a sad postscript to this tax story. After

this election, CLT is closing down. For over 47 years

CLT has fought for the taxpayers and has saved Mass.

citizens uncounted billions in taxes. But there’s

insufficient financial support from these same citizens to

keep the organization going. So, Citizens for Limited

Taxation will pass into history, and we taxpayers will

endure higher taxes because CLT is no longer here.

— Avi Nelson is a

Boston-based political analyst and talk-show host.

The Boston

Herald

Sunday, October 30, 2022

Tax rebates head out starting Tuesday, here’s how to see how

much you get

By Matthew Medsger

True to their word to get the money out the door fast, the

Baker administration said residents will begin to see tax

rebates stemming from a near-forgotten law hit mailboxes and

bank accounts this week.