|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

48 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Tuesday, August 23, 2022

Attorneys for

MassFiscal, CLT Notify Auditor Bump of Pending Taxpayers Lawsuit

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

The

Massachusetts Fiscal Alliance, the Fiscal Alliance

Foundation, and Citizens for Limited Taxation

announced today that they have partnered with the

New England Legal Foundation and the Goldwater

Institute to prepare to bring suit to enforce

Chapter 62F of Massachusetts law, should such action

be necessary. Jon Riches is the lead attorney at the

Goldwater Institute and his co-counsel in

Massachusetts are Dan Winslow and Ben Robbins of the

New England Legal Foundation....

Massachusetts Fiscal Alliance

Monday, August 22, 2022

News Release

Taxpayer Organizations United

and Prepared to Go to Court to

Protect the Will of the Voters and Rebate Taxpayers

Billions of Dollars

Letter from the Goldwater Institute / New England

Legal Foundation

to State Auditor Suzanne Bump

August 22, 2022

CLICK HERE

Massachusetts taxpayer groups say they’re ready to

sue within a month if the state fails to make good

on a 1986 tax revenue cap law that could require

almost $3 billion in excess funds to be returned to

nearly 5 million taxpayers.

In a

virtual news conference Monday hosted by the

conservative-leaning Massachusetts Fiscal Alliance,

several tax and legal groups said they’re poised to

take state Auditor Suzanne Bump to court on Sept.

21, the day after she’s set to announce whether

state tax revenues exceeded the threshold under

Chapter 62F....

“This

could arguably be the biggest benefit for the people

of Massachusetts,” Paul Craney, spokesman for the

Massachusetts Fiscal Alliance, said Monday. Craney

added that the lawmakers’ $1 billion tax relief

“didn’t cross the finish line, so providing relief

in early winter would be well received by the

taxpayers of Massachusetts.”

Chip

Ford, executive director of Citizens for

Limited Taxation, argued that the sooner

taxpayers are reimbursed, the better.

“With this

legislature, anything’s possible. They could drag

this out forever," he said.

Boston

Business Journal

Monday, August 22, 2022

Taxpayer groups braced to sue if

Massachusetts doesn’t follow refund law

Should

Beacon Hill officials try to duck the tax relief

requirements of Chapter 62F over the next month, at

least two groups of taxpayers, newly including one

supported by major right-leaning groups like

Citizens for Limited Taxation, have organized

themselves to be prepared to ask the state's court

system to step in.

"The

taxpayers have lawyered up," Dan Winslow, a former

judge, Romney administration official and state

representative who now leads the New England Legal

Foundation, said Monday.

A 1986

ballot question initiated by Citizens for Limited

Taxation and its subsequent law, Chapter 62F,

created an annual state tax revenue growth limit

based on the level of growth in total wages and

salaries of Massachusetts citizens. If the state

collects more than the allowed amount of tax revenue

in any one fiscal year, the law says that the

overage is to be returned to taxpayers. The

late-July revelation that 62F could eat up some of

the state's $5-plus billion surplus from fiscal 2022

derailed the Legislature's own tax relief plan and a

massive economic development bill....

Republican

auditor candidate Anthony Amore announced on Aug. 4

that he had lined up at least 24 taxpayers "who

stand ready to file a petition with the state's

highest court should Auditor Suzanne Bump fail to

act with urgency in certifying billions of dollars

in tax rebates under the state's Chapter 62F law."

On Monday,

Amore announced that former U.S. attorney Michael

Sullivan will provide legal representation to his

taxpayer petition effort....

The latest

group of more than 24 individuals lined up as

plaintiffs includes people from each Massachusetts

county and is made up of representatives of Citizens

for Limited Taxation, Mass Fiscal, Beacon Hill

Institute, the local chapter of the National

Federation of Independent Businesses, and the Mass.

High Technology Council....

Chip

Ford, executive director of Citizens for

Limited Taxation, said Monday that the

difference between Amore's effort and the one he is

involved with "is [that] ours is comprised of the

original supporters, the original organizations who

went to the ballot in 1986, put it on the ballot,

ran a campaign, and won the surtax repeal and the

tax cap. And that's Citizens for Limited Taxation,

my organization, and the Mass. High Tech Council."

Paul

Craney, a spokesman for Mass Fiscal, said the group

wanted to hold its press conference Monday because

they are about one month out from when they would

expect to file a lawsuit, if necessary.

Winslow

said his organization is particularly interested in

exploring the idea that the relief afforded by

Chapter 62F "could already be a vested property

right in the hands of the taxpayers to which they're

entitled" regardless of any attempts to amend the

law.

"There's a

significant question that this actually may already

be a done deal as a matter of law," he said. Winslow

added later, "Basically, what remains at this point

is what we call a ministerial act. It's simply

almost an automatic kind of a certification because

the close of the fiscal year was June 30 and so the

condition that this statute applies to already

existed as a matter of fact." ...

Ford, who

was part of the 1986 ballot push, said Citizens for

Limited Taxation had to make sure that its

initiative petition did not appropriate funds, or

else it would have been deemed unconstitutional and

wouldn't have made it to the ballot.

"So we

used the term credit. We didn't use it in the

accepted sense that it can only be returned as a tax

credit in future years, though that was the way it

was interpreted in 1987. Nonetheless, our use of

credit was that the taxpayers would receive a

refund," he said.

State

House News Service

Monday, August 22, 2022

Legal Teams Ready To

Defend Tax Relief Law

Three

conservative watchdog organizations are accusing

lawmakers of attempting to subvert a rare $3 billion

tax refund legally mandated this year at a press

event Monday, saying taxpayers are ready to take the

issue to court.

“The tax

cap has been on the books 36 years,” said Chip

Ford, executive director of Citizens for

Limited Taxation. “It’s been triggered. And now

it’s time for the tax rebate.” ...

But,

representatives from Massachusetts Fiscal Alliance,

the Fiscal Alliance Foundation, Citizens for Limited

Taxation and their legal partners said, they’re

concerned the government will stall or repeal the

requirement....

Speakers

also noted Gov. Charlie Baker has suggested the

money may be distributed as checks rather than tax

credits, saying they would support the relief in

either form.

The

Boston Herald

Monday, August 22, 2022

Watchdog groups argue $3B in tax

relief is under threat in Massachusetts

State

Auditor Suzanne Bump on Monday strongly denied

suggestions that she was under any pressure to delay

calculating how much money should be returned to

taxpayers under the tax cap passed by voters in

1986.

“This is

not and it never has been a political process,” she

said in a telephone interview. “This is a matter of

financial accounting and the wording of the law. No

one is pressuring any office to do anything.”

Bump was

responding to a letter sent on Monday to her office

by the New England Legal Foundation and the

Goldwater Institute. The letter threatened a lawsuit

if Bump fails to carry out her duties under the law

to calculate how much money should be returned to

taxpayers under the tax cap.

“We’re

aware that the auditor is receiving significant

political pressure to delay the certification with

the thought that the Legislature would repeal the

statute when they come back into session,” said Dan

Winslow, president of the New England Legal

Foundation. “There’s even talk of possibly having

the Legislature come into session now.” ...

Winslow’s

organization is working closely with the drafters of

the original tax cap law – Citizens for Limited

Taxation and the Massachusetts High Technology

Council. The law was approved by voters in 1986.

While the

groups don’t want anyone messing with the tax cap

law, they indicated they have no problem if the

Baker administration changes the regulations

governing how the money is returned if the net

result is that the money is returned to taxpayers

more quickly.

Gov.

Charlie Baker has said he hopes to return the money

via rebate checks to taxpayers in late November or

early December, before he leaves office. Under

existing regulations, the money would be returned

next year in the form of a credit on 2022 tax

returns.

Winslow

said he wouldn’t object to how and when the money is

returned as long as it is returned in some fashion.

“As long as the law is being followed, that’s our

interest,” he said.

Chip

Ford of Citizens for Limited Taxation

said he approves of the governor’s efforts to speed

up the return of the money.

“A bird in

the hand is better than two in the bush,” he said.

“With this Legislature, anything is possible. They

could drag this out forever so the sooner the

taxpayers are fully reimbursed the better.”

CommonWealth Magazine

Monday, August 22, 2022

Bump dismisses claim

of tax cap pressure on her office

Escalating

their pressure on Bump earlier Monday, lawyers

supporting the coalition of plaintiffs sent her

office a letter recapping the parameters of the tax

cap law — enacted through a 1986 ballot question to

voters — known as Chapter 62F.

“We trust

that your office will conduct that review process

fairly, accurately, and according to the statutory

deadline, to ensure that Massachusetts taxpayers

receive the tax relief to which they are entitled

under chapter 62F,” the letter to Bump from the

Goldwater Institute and the New England Legal

Foundation states.

But the

firms also outlined their own authority to bring a

lawsuit before the Supreme Judicial Court or

Superior Court to enforce the tax cap law, which has

only been triggered once before in 1987.

“If such

an action is necessary and successful, the plaintiff

taxpayers can seek the tax credits to which they are

entitled under the statute, as well as an award of

reasonable attorneys’ fees and other costs incurred

for bringing suit ...” the letter continues. “We

hope and expect that state officials will comply

with the law and provide greatly needed tax relief

to its citizens. Should it become clear, however,

that Massachusetts officials seek to evade the plain

requirements of chapter 62F, we will uphold the will

of Massachusetts voters by seeking to enforce these

critically important, and statutorily guaranteed,

fiscal safeguards.

The

plaintiffs on Monday would not delineate how likely

it is that Bump will sidestep the tax cap law. Bump

herself, in a statement to MassLive, emphasized

Monday her office’s report will be published on or

before Sept. 20.

Daniel

Winslow, president of the New England Legal

Foundation, expressed worry that the Massachusetts

Legislature may repeal Chapter 62F if they return to

session to finalize a nearly $4 billion economic

development and tax relief bill that failed to

emerge from closed-door negotiations during the end

of formal lawmaking earlier this month.

The

Springfield Republican

Monday, August 22, 2022

Tax relief: Massachusetts

officials face threat of lawsuit

if they don’t comply with state cap tax law

returning excess revenues to Bay Staters

The

Electoral College caught Hillary Clinton off-guard

in 2016. In 2022, it’s the Democrats in charge of

the Massachusetts statehouse who have found

themselves caught flat-footed. What has surprised

leading politicians on Beacon Hill this year is a

state spending cap enacted in 1986.

Governor

Charlie Baker (R) estimates that the 36-year-old

spending cap, which hasn’t come into play since

1987, could result in approximately $3 billion being

refunded to taxpayers. The revelation in late July

that the spending cap would likely be hit prompted

leadership in the Massachusetts Legislature to

shelve a host of temporary and permanent tax cuts

they had planned to pass before adjourning this

summer. Governor Baker asserts that the commonwealth

could afford both the tax relief package tabled by

lawmakers, as well as the taxpayer refunds mandated

by the spending cap.

Many have

pointed to this potential multi-billion dollar

taxpayer refund as another example of how Barbara

Anderson, the longtime executive director of

Citizens for Limited Taxation (CLT) who passed

away in 2016, left behind a legacy whose impact will

continue to be felt long past her time on Earth.

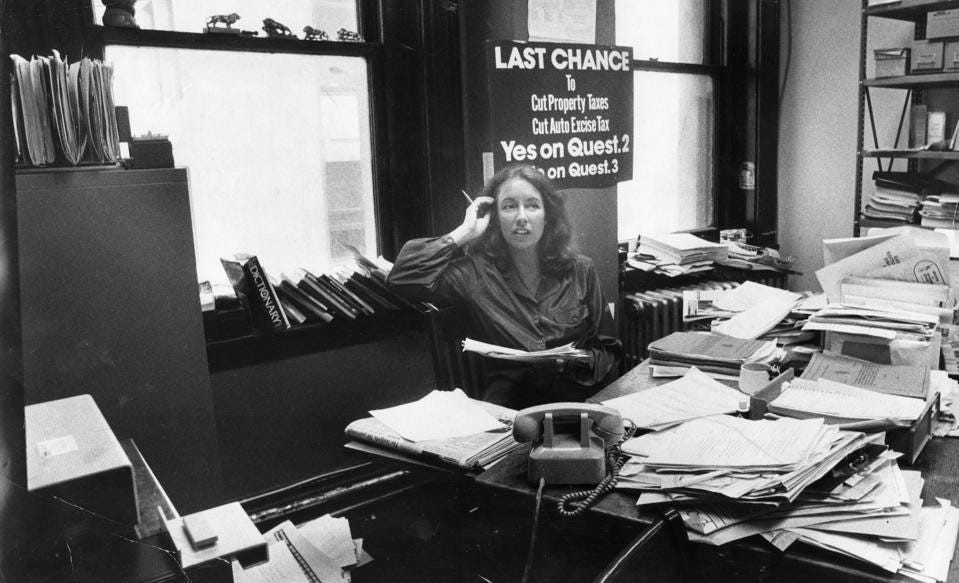

BOSTON:

Executive director of the Citizens for Limited

Taxation Barbara Anderson sits at her desk in their

office

in Boston on July 2, 1981. (Photo by Ly Y/The Boston

Globe via Getty Images)

“She's the

reason property tax increases are capped at 2.5% of

fair market value and the state's income tax was

rolled back from 5.85%,” WBUR-Boston reported in the

days following Anderson’s passing. Six years later,

Anderson’s work is poised to once again benefit

Massachusetts residents, saving them billions of

dollars at a time when many can use the extra cash

to deal with the highest inflation since 62F was

enacted.

“I'm sure

Barbara Anderson is up there looking down on us with

a grin pumping her fist in the heavens,” Chip

Ford, executive director of CLT, said of

Anderson’s legacy. Paul Craney, spokesman for the

Massachusetts Fiscal Alliance, says that Anderson’s

legacy and the organization she left behind “are so

strong that they are still providing protections to

Massachusetts taxpayers four decades on.” ...

Some are

concerned that unless legal action is taken, the

state auditor could find an excuse for why the

surplus money should not be refunded to taxpayers in

accordance with state law. If that doesn’t happen,

legislators could still act to either block or

reduce the size of refunds due under 62F. Although

Governor Baker estimates as much as $3 billion could

be refunded to taxpayers, a final determination on

the refund and its size won’t come for a few more

weeks.

Forbes

Magazine

Friday, August 19, 2022

Six Years After Her Passing,

One Woman’s Life’s Work Continues To Save Taxpayers

Billions

By Patrick Gleason

House

Speaker Ron Mariano raised concerns on Tuesday about

whether the state can afford a $3 billion tax cap

giveback and the $3.5 billion in spending contained

in the economic development bill, which stalled at

the end of the legislative session.

Gov.

Charlie Baker and Senate President Karen Spilka say

the state can afford both, but Mariano is not so

sure.

“If we

continue to have robust revenues, then we can go

ahead and fill all the needs that have been

identified,” he said at a press scrum outside his

office. “But if the economy slows down, which it

could, and we don’t get the revenues that we have

been getting, we may be wise to hold back on some of

these things, save some of the ARPA money that was

committed in this bill.”

The

economic development bill provides funding for a lot

of key priorities and it also includes a $500

million tax relief package and $500 million worth of

$250 payments to most taxpayers.

The bill

passed unanimously in both branches, but it stalled

at the end of the legislative session amid concerns

about the triggering of a 1986 law called 62F that

caps how much tax revenue the state can take in each

year. The law hasn’t been triggered in 35 years, but

the Baker administration estimates the tax cap could

send $3 billion back to taxpayers later this year.

Mariano

said he would like more specificity about the size

of the tax cap giveback and how that money will be

returned to taxpayers.

The 62F

law authorizes the state auditor to certify the size

of the giveback next month and it requires the money

to go back as a tax credit on 2022 tax returns,

although Gov. Charlie Baker is moving to change that

process so refund checks could be mailed out later

this fall before he leaves office....

[Senate

President Karen] Spilka said she wouldn’t be

surprised if the governor proposed funding for some

of the provisions in the economic development bill

in a separate supplemental budget.

But she

acknowledged that the House would need to go along

to get anything done, and it doesn’t seem like

Mariano is ready to do that yet. The speaker said he

wants to see how the 62F money plays out and how

state tax revenues hold up.

“One of

the reasons we have this surplus is because we have

been fiscally prudent and very protective of how we

spend our money,” Mariano said.

CommonWealth Magazine

Tuesday, August 16, 2022

Mariano tapping brakes on

economic development bill

Speaker questions whether state can afford it and

tax cap giveback

In the

extended back-and-forth over the economic

development and tax relief bill stuck in legislative

purgatory, Senate President Karen Spilka has

repeatedly said her chamber wants to act now but

can't without the House doing so first. But on

Tuesday, she gave voice to the possibility that the

Senate could deploy procedural tactics to bring

something to the Senate floor without the House

acting first.

Any

legislation deemed a "money bill" is required by the

Massachusetts Constitution to originate in the

House, meaning that the Senate cannot introduce a

bill that would either increase or decrease the

overall amount of state tax revenue unless the House

has already processed it.

Asked

Tuesday if the Senate Ways and Means Committee had

possession of a "money bill" that it could use as a

vehicle to go around the House and bring the stalled

tax relief plan or other measures of the economic

development bill onto the Senate floor, Spilka made

clear that it was not her preferred course of

action. But she also did not shoot down the

suggestion.

"Possibly,

but if there's no action from the House, it may not

be helpful or productive," Spilka, a former chair of

the Senate Ways and Means Committee, said Tuesday

when asked if the idea was a possibility. She did

not say whether the committee has any such bill in

its possession. "I still think that the best route

is for us to be working together with the

administration. And I am very hopeful about that."

Spilka and

House Speaker Ronald Mariano remain at loggerheads

over whether to move ahead with their agreed-to $1

billion tax rebate and reform plan in light of the

late July realization that the 1986 tax relief law

known as Chapter 62F might require the state to

return about $3 billion to taxpayers.

State

House News Service

Wednesday, August 17, 2022

Senate Acting First on Tax

Bill Not Preferred, But Not Impossible

Lawmakers

love to deflect questions about conference committee

talks by saying their rules require them to keep the

negotiations private among the three representative

and three senators tasked with finding a compromise.

But no one is making any bones about the fact that

the conference committee still negotiating an

economic development bill has looped in an informal

seventh member: Gov. Charlie Baker.

The

Legislature ended its formal sessions for the year

on Aug. 1 without coming to agreement on a

compromise version of a $4 billion economic

development package that was to include $1 billion

in tax rebates and reforms. The economic development

bills (H 5034 / S 3030) are pending before a

six-person, House-Senate conference committee that

meets only in private, but Baker said Thursday on

GBH's Boston Public Radio that his office is also

involved in the talks.

"We've had

conversations with both the House and the Senate

about this and are trying to figure out some ground

everybody can stand on," he said. "I got asked this

the other day about am I optimistic that this will

still happen? And actually, I am kind of optimistic.

I mean, I don't know exactly what it will look like,

but I do believe that there will be a piece of

legislation that gets to my desk that has a lot of

the elements of this, and I really do believe that."

Baker said

he sees "a couple of possibilities" for getting some

form of an economic development bill done, but did

not say how he thinks it should get done. Senate

President Karen Spilka alluded to Baker's

involvement in the economic development talks

earlier this week when she suggested that Baker

might file a supplemental budget that includes some

of the spending called for in the stalled jobs

bill....

While

Baker and Spilka would like to see the Legislature

pass some form of tax relief now, House Speaker

Ronald Mariano said this week he is "hesitant" to

commit to all of the spending (including the tax

relief) in the economic development bills without

first knowing just how much of its excess tax

revenue the state may have to return to taxpayers

under a 1980s voter law known as Chapter 62F.

State

House News Service

Thursday, August 18, 2022

Baker Figures

Prominently in Talks About Legislature’s Return

Enacting Two-Thirds of Eco Dev Bill "Fine With Me,"

Guv Says

Gov.

Charlie Baker apparently has not given up hope that

some version of his tax cut proposal will clear the

Legislature in time for him to sign it before he

leaves office.

“I got

asked this the other day about am I optimistic that

this will still happen and actually, I am kind of

optimistic,” he said. “I mean, I don’t know exactly

what it will look like, but I do believe that there

will be a piece of legislation that gets to my

desk.”

Baker was

making an appearance on GBH’s Boston Public Radio

for an ‘Ask the Governor’ session with hosts Margery

Eagan and Jim Braude.

The

Legislature wrapped its formal sessions this year

after passing a number of landmark pieces of

legislation, but failed to advance a $4 billion

economic development bill which would have sent $250

back to taxpayers and codified several of Baker’s

tax priorities before they ran out of time to act in

formal session.

Also at

issue were the ghost of 1986 and the efforts of the

late Barbara Anderson to control the

legislature’s taxing authority.

A law

passed then, used once after passage but never

since, was triggered by the state’s unexpected boom

in tax revenue last year, potentially sending $3

billion back to taxpayers. Legislators balked at the

potential cost of both occuring at once, with some

claiming Baker had blindsided them with the laws’

requirements.

Baker has

maintained that both tax rebates — the 1986 law and

the Legislature’s plan to send money to low income

taxpayers — are affordable. He stressed again

Thursday the state had the funds to do both.

Further,

Baker pointed out, the law has been on the books and

reported to lawmakers for 35 years.

The

Boston Herald

Thursday, August 18, 2022

Charlie Baker holds out

hope for tax cuts, maintains state can afford it

|

Chip Ford's CLT

Commentary |

After a straight month of

20-hour workdays seven days a week I'm pretty much wiped out so I'll let the

news reports speak for themselves. One important point left

out of all the reports is well worth highlighting. Mike Hruby of New Jobs America, one of the plaintiffs in our lawsuit,

noted the effect of Bidenflation on our tax cap's mandated refund

(watch 21:10 minutes into the

news conference video):

"In a situation

involving ten percent inflation, a payment made promptly is not

going to be degraded in value, but a payment that turns into a

credit on the 2023 tax returns is not going to be due and

payable until 2024, which is nearly two years from now.

Ten percent inflation compounded for two years, you can figure

it out. That's a great degradation on the amount the

taxpayers will receive."

This is another critical

reason for CLT's Tax Cap refund to be expedited, returned to the

taxpayers who made their unnecessary overpayments by the quickest means possible

— as Gov. Baker has recommended.

The"excess revenue" that needs to be returned to taxpayers is piled

up in the state treasury today collecting interest.

Who knows for how long before it too is spent, "invested"? Refund payments

can and should be sent out in November-December, as Gov. Baker

recommended, to every taxpayer who

filed a 2021 state tax return in 2022 and paid that "excess."

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Massachusetts Fiscal

Alliance

Monday, August 22, 2022

News Release

Taxpayer Organizations United and Prepared to Go to Court to

Protect the Will of the Voters and Rebate Taxpayers Billions

of Dollars

The Massachusetts Fiscal Alliance, the Fiscal Alliance

Foundation, and Citizens for Limited Taxation

announced today that they have partnered with the New

England Legal Foundation and the Goldwater Institute to

prepare to bring suit to enforce Chapter 62F of

Massachusetts law, should such action be necessary. Jon

Riches is the lead attorney at the Goldwater Institute and

his co-counsel in Massachusetts are Dan Winslow and Ben

Robbins of the New England Legal Foundation.

The voters of the Commonwealth enacted Chapter 62F in 1986

to implement hard limits on the amount Massachusetts can tax

its residents and on government spending. If revenues exceed

legally applicable limits, the state “shall” issue “tax

credits equal to the total amount of such excess” to all

Massachusetts taxpayers. The revenue growth limit was

spearheaded by Citizens for Limited Taxation and the

Massachusetts High Technology Council. Chapter 62F permits

24 named taxpayers in the Commonwealth to bring an action in

the Supreme Judicial Court or Superior Court to enforce the

provisions of that law. The State Auditor must comply by her

statutory deadline of September 20 to certify the Department

of Revenue’s numbers.

Earlier today, the Goldwater Institute and the New England

Legal Foundation sent a letter on behalf of Massachusetts

taxpayers to Auditor Suzanne Bump. While we expect the

Auditor to continue to comply with the certification

requirements, taxpayers have promised to uphold the will of

Massachusetts voters by seeking to enforce these critically

important and statutorily guaranteed fiscal safeguards,

demanding the government follow the law. Should it become

clear that Massachusetts officials are seeking to sidestep

the plainly laid out requirements of Chapter 62F, taxpayers

have promised to uphold the will of Massachusetts voters by

seeking to enforce these critically important and

statutorily guaranteed fiscal safeguards.

“This is a once-in-a-generation opportunity to make sure

Massachusetts taxpayers get back billions of dollars of

their hard-earned money. We will do everything in our power

to make sure this happens, and to hold politicians

accountable if they try to evade this law,” said Paul Diego

Craney, spokesman for the Massachusetts Fiscal Alliance.

“Some State House politicians would like nothing more right

now than for us to fail to ease their insatiable appetite to

spend, but we are committed and prepared to bring them to

court if they think they can delay this process for even one

minute.”

“In 1986 Citizens for Limited Taxation put forth this ballot

question with the recognition that Massachusetts taxpayers

would one day need this law to kick into action. That it

took this long isn’t a bug but a design feature. I’m proud

to partner with CLT’s allies and colleagues to ensure that

everything is done to protect the voters’ mandate and help

protect taxpayers from an insatiable state government,”

added Chip Ford, Executive Director of Citizens

for Limited Taxation.

“The tax limit is a prudent fiscal policy safeguard that

helps prevent over commitments of extraordinary revenue by

the Legislature during periods of strong private sector

performance,” said Mass. High Tech Council president Chris

Anderson.

“NELF’s mission includes standing for the rule of law,” said

Daniel B. Winslow, President of the New England Legal

Foundation. “Now, more than ever, we must ensure that

citizens and public servants alike respect the rule of law.

We are hopeful the Auditor will set an example by upholding

her oath of office.”

“Massachusetts voters passed Chapter 62F for a reason: to

protect working families and individuals from runaway

tax-and-spend practices that lead to financial turmoil,”

said Jon Riches, Vice President for Litigation at the

Goldwater Institute. “As Americans come to terms with

skyrocketing inflation, it’s imperative that the

Massachusetts government follow the law. If it refuses to do

so, we won’t hesitate to bring necessary action to protect

Massachusetts taxpayers.”

“This return of taxpayer money will become seed money for

job growth and self-employment,” said Mike Hruby, President

of New Jobs for Massachusetts. “Many will pay down household

debt with it, some will invest it, and the most determined

will use it to start a new business with a flexible schedule

and greater income potential. Returning taxpayer money will

benefit every resident.”

Letter from

the Goldwater Institute / New England Legal Foundation

to State Auditor Suzanne Bump

August 22, 2022

CLICK

HERE

Boston Business

Journal

Monday, August 22, 2022

Taxpayer groups braced to sue if Massachusetts doesn’t

follow refund law

By Benjamin Kail

Massachusetts taxpayer groups say they’re ready to sue

within a month if the state fails to make good on a 1986 tax

revenue cap law that could require almost $3 billion in

excess funds to be returned to nearly 5 million taxpayers.

In a virtual news conference Monday hosted by the

conservative-leaning Massachusetts Fiscal Alliance, several

tax and legal groups said they’re poised to take state

Auditor Suzanne Bump to court on Sept. 21, the day after

she’s set to announce whether state tax revenues exceeded

the threshold under Chapter 62F. The law, triggered for the

first time in decades by the state’s fiscal 2022 surplus,

was approved in a referendum in 1986 and required that

revenue exceeding growth in wages and salaries must make its

way to taxpayers’ pockets.

In a statement, Bump told the Business Journal Monday that

her office will make a determination on whether net state

tax revenues “exceeded allowable state tax revenues in

fiscal year 2022,” and release the determination on or

before Sept. 20. She shrugged off the talk of lawsuits,

saying the law is cut-and-dry and will be followed.

In late July, Gov. Charlie Baker’s office estimated that

roughly 7% of the income taxes residents paid in 2021 should

be returned, State House News Service reported. For

taxpayers who earn $75,000, that means about $250 — which is

about the same amount that Baker and lawmakers had attempted

to deliver in the form of rebate checks to middle-income

taxpayers as part of a sweeping economic development bill as

they closed out the legislative session. However, the

re-emergence of the 1986 law pushed that bill into a state

of limbo.

The Goldwater Institute, a public policy and research group,

and New England Legal Foundation, a nonprofit public

interest law firm, wrote to Bump Monday, threatening to

bring action to Superior Court or the Supreme Judicial

Court. The groups argued that 62F represented a

voter-mandated “hard limit on the amount Massachusetts can

tax its residents and a hard limit on government spending.

We hope and expect that state officials will comply with the

law and provide greatly needed tax relief to its citizens.”

“This could arguably be the biggest benefit for the people

of Massachusetts,” Paul Craney, spokesman for the

Massachusetts Fiscal Alliance, said Monday. Craney added

that the lawmakers’ $1 billion tax relief “didn’t cross the

finish line, so providing relief in early winter would be

well received by the taxpayers of Massachusetts.”

Chip Ford, executive director of Citizens for Limited

Taxation, argued that the sooner taxpayers are reimbursed,

the better.

“With this legislature, anything’s possible. They could drag

this out forever," he said.

Dan Winslow, NELF’s president, suggested Monday that Bump

was under “political pressure to delay the certification

with the thought that the legislature would repeal the

statute when they come back into session.”

Bump told the Business Journal that her role is “clearly

defined and we will comply with all statutory requirements

as we have every year.”

“Despite the histrionics of some parties, this determination

is not a political one,” she said. “It is based on

verifiable numbers and the law.”

State House News

Service

Monday, August 22, 2022

Legal Teams Ready To Defend Tax Relief Law

62F Supporters Working With Former GOP Reps. Winslow,

Sullivan

By Colin A. Young

Should Beacon Hill officials try to duck the tax relief

requirements of Chapter 62F over the next month, at least

two groups of taxpayers, newly including one supported by

major right-leaning groups like Citizens for Limited

Taxation, have organized themselves to be prepared to ask

the state's court system to step in.

"The taxpayers have lawyered up," Dan Winslow, a former

judge, Romney administration official and state

representative who now leads the New England Legal

Foundation, said Monday.

A 1986 ballot question initiated by Citizens for Limited

Taxation and its subsequent law, Chapter 62F, created an

annual state tax revenue growth limit based on the level of

growth in total wages and salaries of Massachusetts

citizens. If the state collects more than the allowed amount

of tax revenue in any one fiscal year, the law says that the

overage is to be returned to taxpayers. The late-July

revelation that 62F could eat up some of the state's $5-plus

billion surplus from fiscal 2022 derailed the Legislature's

own tax relief plan and a massive economic development bill.

The law allows a group of at least 24 "taxable inhabitants"

of Massachusetts to petition the Supreme Judicial Court or

Superior Court to enforce the provisions of Chapter 62F, and

at least two parallel efforts are afoot on that front in the

event that officials attempt to evade the requirements of

the law.

"We're aware that the auditor is receiving significant

political pressure to delay the certification with the

thought that the Legislature would repeal the statute when

they come back into session at the top of the new session

and there's even talk about possibly having the Legislature

come into session now to repeal the law as part of another

package," Winslow said during a press conference Monday to

announce that the Massachusetts Fiscal Alliance, the Fiscal

Alliance Foundation and Citizens for Limited Taxation had

partnered with the New England Legal Foundation and the

Goldwater Institute to prepare to bring suit to enforce

Chapter 62F.

The commissioner of revenue is required by Sept. 1 to send

the state auditor a report of the net state tax revenue and

the allowable state tax revenue for the fiscal year that

ended June 30. By the third Tuesday of September -- Sept. 20

this year -- the auditor must "independently determine"

whether tax collections exceeded that allowable amount and

then notify the executive branch, House and Senate of the

amount of the overage. The auditor's determination "shall be

conclusive," the law states.

There has been no indication from Auditor Suzanne Bump that

she intends to depart from the required timeline and her

office has said it cannot prepare its report until it

receives the necessary information from DOR. But lawmakers,

chiefly House Speaker Ronald Mariano, have suggested that

they might try to tinker with Chapter 62F in some fashion.

Mariano also, however, has called 62F "the law of the land

and it's going to happen."

Republican auditor candidate Anthony Amore announced on Aug.

4 that he had lined up at least 24 taxpayers "who stand

ready to file a petition with the state's highest court

should Auditor Suzanne Bump fail to act with urgency in

certifying billions of dollars in tax rebates under the

state's Chapter 62F law."

On Monday, Amore announced that former U.S. attorney Michael

Sullivan will provide legal representation to his taxpayer

petition effort. Sullivan and Winslow ran against each other

(and both came up short against Gabriel Gomez) in the 2013

Republican primary for the U.S. Senate seat that John Kerry

resigned.

"With record inflation straining the budgets of working

families, I share Anthony's belief that our state government

must respect the decision of the voters across the

Commonwealth to quickly get tax rebate checks in the hands

of residents," Sullivan, the father of Rep. Alyson Sullivan,

said. "If the State Auditor does not do her job and move

swiftly and accurately through this certification process,

our coalition will file an enforcement action with the

Supreme Judicial Court."

The latest group of more than 24 individuals lined up as

plaintiffs includes people from each Massachusetts county

and is made up of representatives of Citizens for Limited

Taxation, Mass Fiscal, Beacon Hill Institute, the local

chapter of the National Federation of Independent

Businesses, and the Mass. High Technology Council.

"While we expect the Auditor to continue to comply with the

certification requirements, taxpayers have promised to

uphold the will of Massachusetts voters by seeking to

enforce these critically important and statutorily

guaranteed fiscal safeguards, demanding the government

follow the law," MassFiscal said in a press release. "Should

it become clear that Massachusetts officials are seeking to

sidestep the plainly laid out requirements of Chapter 62F,

taxpayers have promised to uphold the will of Massachusetts

voters by seeking to enforce these critically important and

statutorily guaranteed fiscal safeguards."

Chip Ford, executive director of Citizens for Limited

Taxation, said Monday that the difference between Amore's

effort and the one he is involved with "is [that] ours is

comprised of the original supporters, the original

organizations who went to the ballot in 1986, put it on the

ballot, ran a campaign, and won the surtax repeal and the

tax cap. And that's Citizens for Limited Taxation, my

organization, and the Mass. High Tech Council."

Paul Craney, a spokesman for Mass Fiscal, said the group

wanted to hold its press conference Monday because they are

about one month out from when they would expect to file a

lawsuit, if necessary.

Winslow said his organization is particularly interested in

exploring the idea that the relief afforded by Chapter 62F

"could already be a vested property right in the hands of

the taxpayers to which they're entitled" regardless of any

attempts to amend the law.

"There's a significant question that this actually may

already be a done deal as a matter of law," he said. Winslow

added later, "Basically, what remains at this point is what

we call a ministerial act. It's simply almost an automatic

kind of a certification because the close of the fiscal year

was June 30 and so the condition that this statute applies

to already existed as a matter of fact."

Chapter 62F also requires that the auditor's determination

that net state tax revenue exceed the allowable amount

"shall result in a credit equal to the total amount of such

excess" and that the "credit shall be applied to the then

current personal income tax liability of all taxpayers on a

proportional basis to the personal income tax liability

incurred by all taxpayers in the immediately preceding

taxable year."

But that may not be how things play out. The Baker

administration has been quietly working behind the scenes to

change the regulations around Chapter 62F since this spring

and his budget chief said when the 36-year-old law's impact

on the fiscal year 2022 surplus came to light that he was

already "looking at what's the quickest and most efficient

way to get that money back to the taxpayers." Baker said two

weeks ago that he "expect[s] that people will be receiving

their refund sometime between the end of November and the

beginning of December," which wouldn't line up with a credit

applied to personal income tax liability but would mean the

money would go out before he leaves office.

During a press conference Monday, representatives of some of

the groups prepared to sue to make sure that Chapter 62F is

followed to the letter of the law did not express strong

opinions one way or another as to how the money is returned

to taxpayers and even suggested they would be open to some

Legislative alterations to 62F.

"If the law were to change to give money back directly

rather than a credit for future taxes, you know, as long as

the law is being followed, that's our interest," Winslow

said. He then added, "We care that the law on the books is

followed ... if the law is amended by the Legislature to

change the form of the payment, you know, that's the law."

Ford, who was part of the 1986 ballot push, said Citizens

for Limited Taxation had to make sure that its initiative

petition did not appropriate funds, or else it would have

been deemed unconstitutional and wouldn't have made it to

the ballot.

"So we used the term credit. We didn't use it in the

accepted sense that it can only be returned as a tax credit

in future years, though that was the way it was interpreted

in 1987. Nonetheless, our use of credit was that the

taxpayers would receive a refund," he said.

The only time the excess revenue cap was hit, in fiscal

1987, the $29.22 million in credits was made available to

taxpayers through the addition of a line on the 1987

Massachusetts individual income tax return "upon which each

individual taxpayer could insert their individually

calculated share of the $29,221,675 credit," the auditor's

office said.

DOR this spring began the process of repealing the

regulation that governs how a taxpayer obtains a credit

toward personal income tax liability under Chapter 62F with

the agency saying that it is "obsolete" because no credit

had been required since 1987.

The Executive Office of Administration and Finance said

Monday that the regulation had not yet been officially

rescinded. A Baker administration official previously said

that DOR will "issue relevant guidance or regulations for

this year's implementation" if Chapter 62F is triggered.

The Boston

Herald

Monday, August 22, 2022

Watchdog groups argue $3B in tax relief is under threat in

Massachusetts

Auditor Bump said she will make her determination on the tax

cap based on numbers and the law

By Grace Zokovitch

Three conservative watchdog organizations are accusing

lawmakers of attempting to subvert a rare $3 billion tax

refund legally mandated this year at a press event Monday,

saying taxpayers are ready to take the issue to court.

“The tax cap has been on the books 36 years,” said Chip

Ford, executive director of Citizens for Limited Taxation.

“It’s been triggered. And now it’s time for the tax rebate.”

The law in question, Chapter 62F, establishes limits on

Massachusetts taxation and government spending. It has been

triggered just two times, in 1987 and this year.

When triggered, it requires the distribution of “tax credits

equal to the total amount of such excess” to taxpayers in

the state. This year, with Massachusetts’s over $5 billion

revenue surplus, the rebate would equal around $3 billion.

But, representatives from Massachusetts Fiscal Alliance, the

Fiscal Alliance Foundation, Citizens for Limited Taxation

and their legal partners said, they’re concerned the

government will stall or repeal the requirement.

The organizations sent a letter to State Auditor Suzanne

Bump on Monday notifying the official they are ready to file

a lawsuit if the overage is not certified by the statutory

deadline of Sept. 20. The auditor is required to

independently determine if tax collections exceed the law’s

cap and notify other branches so the process may proceed.

Bump has not indicated an intent to ignore the law.

“Despite the histrionics of some parties, this determination

is not a political one,” Bump wrote in response to the

organizations’ message Monday. “It is based on verifiable

numbers and the law.”

New England Legal Foundation President Dan Winslow alleged:

“the auditor is receiving significant political pressure to

delay the certification” in order to give the Legislature

time to repeal the law, without giving specifics.

“Our hope of course is the public officials involved will

carry out their oath of office and follow the law as it’s

written,” said Winslow. “But if that doesn’t happen, we’re

prepared to go forward with a lawsuit to compel compliance.”

If the auditor deadline is missed, the provisions allow 24

taxpayers to petition the Supreme Judicial Court or Superior

Court to enforce the law. Both the organizations and

Republican auditor candidate Anthony Amore, who made a

similar announcement on Aug. 4, have said they have

residents ready to file the petition.

Speakers also noted Gov. Charlie Baker has suggested the

money may be distributed as checks rather than tax credits,

saying they would support the relief in either form.

CommonWealth

Magazine

Monday, August 22, 2022

Bump dismisses claim of tax cap pressure on her office

‘This is not and never has been a political process,’ she

says

By Bruce Mohl

State Auditor Suzanne Bump on Monday strongly denied

suggestions that she was under any pressure to delay

calculating how much money should be returned to taxpayers

under the tax cap passed by voters in 1986.

“This is not and it never has been a political process,” she

said in a telephone interview. “This is a matter of

financial accounting and the wording of the law. No one is

pressuring any office to do anything.”

Bump was responding to a letter sent on Monday to her office

by the New England Legal Foundation and the Goldwater

Institute. The letter threatened a lawsuit if Bump fails to

carry out her duties under the law to calculate how much

money should be returned to taxpayers under the tax cap.

“We’re aware that the auditor is receiving significant

political pressure to delay the certification with the

thought that the Legislature would repeal the statute when

they come back into session,” said Dan Winslow, president of

the New England Legal Foundation. “There’s even talk of

possibly having the Legislature come into session now.”

Bump said her office is handling the tax cap the way it has

every other year. She said the Legislature isn’t pressuring

her office and the office will calculate how much money

should go back to taxpayers in September.

The big difference with the calculation this year is that

the tax cap, which has not been triggered since 1987, is

expected to return roughly $3 billion to taxpayers.

Winslow said he believes the $3 billion may already have

vested with taxpayers, meaning that, legally, any future

change in the tax cap law would not affect the return of the

money.

Winslow’s organization is working closely with the drafters

of the original tax cap law – Citizens for Limited Taxation

and the Massachusetts High Technology Council. The law was

approved by voters in 1986.

While the groups don’t want anyone messing with the tax cap

law, they indicated they have no problem if the Baker

administration changes the regulations governing how the

money is returned if the net result is that the money is

returned to taxpayers more quickly.

Gov. Charlie Baker has said he hopes to return the money via

rebate checks to taxpayers in late November or early

December, before he leaves office. Under existing

regulations, the money would be returned next year in the

form of a credit on 2022 tax returns.

Winslow said he wouldn’t object to how and when the money is

returned as long as it is returned in some fashion. “As long

as the law is being followed, that’s our interest,” he said.

Chip Ford of Citizens for Limited Taxation said he approves

of the governor’s efforts to speed up the return of the

money.

“A bird in the hand is better than two in the bush,” he

said. “With this Legislature, anything is possible. They

could drag this out forever so the sooner the taxpayers are

fully reimbursed the better.”

The

Springfield Republican

Monday, August 22, 2022

Tax relief: Massachusetts officials face threat of lawsuit

if they don’t comply with state cap tax law returning excess

revenues to Bay Staters

By Alison Kuznitz

More than two dozen potential plaintiffs across the

commonwealth, including the conservative-leaning

Massachusetts Fiscal Alliance, claim they are ready to sue

state officials if they refuse to comply with a 1980s law

poised to return some $3 billion in excess tax revenues to

cash-strapped Bay Staters this fall.

The tax groups, in partnership with law firms, intend to

file the lawsuit on Sept. 21 if needed — should state

Auditor Suzanne Bump not abide by her statutory requirement

the day prior, with her office due to release a report on

whether a to-be-determined state tax revenue threshold has

been eclipsed.

If the threshold is exceeded, pending calculations tied to

annual wage and salary growth as Massachusetts remains awash

in surplus tax dollars, the state Department of Revenue

would be responsible for distributing tax credits or rebates

to Bay Staters. The Baker administration expects 7% of 2021

income taxes could be returned to residents, translating

into $250 for individuals who earned $75,000.

“This could arguably be the biggest benefit for the people

of Massachusetts — close to $3 billion going back to about

4.7 million taxpayers,” Paul Diego Craney, spokesman for the

Massachusetts Fiscal Alliance, said during a virtual press

conference Monday morning. “Anyone that pays an income tax

will receive a refund, so we’re really happy and honored to

be part of this.”

Escalating their pressure on Bump earlier Monday, lawyers

supporting the coalition of plaintiffs sent her office a

letter recapping the parameters of the tax cap law — enacted

through a 1986 ballot question to voters — known as Chapter

62F.

“We trust that your office will conduct that review process

fairly, accurately, and according to the statutory deadline,

to ensure that Massachusetts taxpayers receive the tax

relief to which they are entitled under chapter 62F,” the

letter to Bump from the Goldwater Institute and the New

England Legal Foundation states.

But the firms also outlined their own authority to bring a

lawsuit before the Supreme Judicial Court or Superior Court

to enforce the tax cap law, which has only been triggered

once before in 1987.

“If such an action is necessary and successful, the

plaintiff taxpayers can seek the tax credits to which they

are entitled under the statute, as well as an award of

reasonable attorneys’ fees and other costs incurred for

bringing suit ...” the letter continues. “We hope and expect

that state officials will comply with the law and provide

greatly needed tax relief to its citizens. Should it become

clear, however, that Massachusetts officials seek to evade

the plain requirements of chapter 62F, we will uphold the

will of Massachusetts voters by seeking to enforce these

critically important, and statutorily guaranteed, fiscal

safeguards.

The plaintiffs on Monday would not delineate how likely it

is that Bump will sidestep the tax cap law. Bump herself, in

a statement to MassLive, emphasized Monday her office’s

report will be published on or before Sept. 20.

Daniel Winslow, president of the New England Legal

Foundation, expressed worry that the Massachusetts

Legislature may repeal Chapter 62F if they return to session

to finalize a nearly $4 billion economic development and tax

relief bill that failed to emerge from closed-door

negotiations during the end of formal lawmaking earlier this

month.

“We’re aware that the auditor is receiving significant

political pressure to delay the certification with the

thought that the Legislature would repeal the statute when

they come back into session at the top of the new session,”

Winslow said as he mulled over another problematic scenario

during the press conference.

Lawmakers had struggled to reconcile how they could afford

their initial $1 billion tax relief plan, including sending

$250 stimulus checks to middle-income residents, on top of

the $3 billion required by the forgotten tax cap law that

came as a shock to Beacon Hill at the end of July.

House Speaker Ron Mariano briefly floated the possibility of

delaying the tax rebates or scrapping Chapter 62F

altogether, though by Aug. 1 he deferred to Gov. Charlie

Baker’s stance and called it “the law of the land.”

Bump’s office has received the letter about potential legal

action tied to 62F, a spokeswoman confirmed to MassLive.

“Despite the histrionics of some parties, this determination

is not a political one,” Bump said in her statement. “It is

based on verifiable numbers and the law. Per MGL c. 62f

section 5, the Auditor’s role is clearly defined and we will

comply with all statutory requirements as we have every

year.”

In a memo to lawmakers on Aug. 5, Bump also gave no

indication the Office of the State Auditor would skirt the

law. The memo, rather, offered a detailed explanation of

what Bump’s pending analysis of state tax revenues would

entail, such as calculating “allowable state tax growth”

under 62F and comparing the net state tax revenue to the

allowable state tax revenue for fiscal 2022.

“OSA is conducting this annual review in accordance with

generally accepted government auditing standards, which

require that we have sufficient, appropriate evidence to

provide a reasonable basis for finding and conclusions ...”

the memo, which Bump shared on Twitter, states. “OSA’s

analysis is overseen by State Auditor Suzanne M. Bump and

four senior CPAs with thirty eight years combined service in

the State Auditor’s Office.”

Monday’s legal challenge comes a week after Anthony Amore, a

Republican candidate for state auditor, announced his own

taxpayer coalition aiming to enforce 62F. Amore’s campaign

expects up to 84 taxpayers — or six individuals from all 14

Massachusetts counties — may join onto his push to pursue a

lawsuit if necessary.

Amore’s campaign on Monday tapped former U.S. Attorney

Michael Sullivan to provide legal representation.

“With record inflation straining the budgets of working

families, I share Anthony’s belief that our state government

must respect the decision of the voters across the

Commonwealth to quickly get tax rebate checks in the hands

of residents,” Sullivan said in a statement. “If the State

Auditor does not do her job and move swiftly and accurately

through this certification process, our coalition will file

an enforcement action with the Supreme Judicial Court.”

Friday, August 19, 2022

Six Years After Her Passing,

One Woman’s Life’s Work Continues To Save Taxpayers Billions

By Patrick Gleason

The Electoral College caught Hillary Clinton off-guard in

2016. In 2022, it’s the Democrats in charge of the

Massachusetts statehouse who have found themselves caught

flat-footed. What has surprised leading politicians on

Beacon Hill this year is a state spending cap enacted in

1986.

Governor Charlie Baker (R) estimates that the 36-year-old

spending cap, which hasn’t come into play since 1987, could

result in approximately $3 billion being refunded to

taxpayers. The revelation in late July that the spending cap

would likely be hit prompted leadership in the Massachusetts

Legislature to shelve a host of temporary and permanent tax

cuts they had planned to pass before adjourning this summer.

Governor Baker asserts that the commonwealth could afford

both the tax relief package tabled by lawmakers, as well as

the taxpayer refunds mandated by the spending cap.

"The tax breaks that are currently pending before the

Legislature are eminently affordable within the context of

the rest of this,” Governor Baker said in early August. “I

mean, you're talking about a tax year this past year in

which tax revenue went up by over 20%, which came on the

heels of a tax revenue increase in the previous year that

went up by 15%…I mean, these are sort of unprecedented

increases in tax revenue, which is in some ways exactly what

this thing was designed (to do), to ensure that people in

Massachusetts participated in that windfall.”

The Massachusetts spending cap is commonly referred to as

62F, after the chapter in which it is found in the state tax

code. 62F stipulates that state revenue collections in

excess of the rate of wage and salary growth must be

refunded to taxpayers. The prospective triggering of 62F

this year was first reported in CommonWealth Magazine in

late July, where it was described as “one of those laws that

has largely faded from memory.”

“It was passed by voters in 1986, in the midst of the

so-called Massachusetts Miracle,” writes CommonWealth’s

Bruce Mohl. “Put forward by Citizens for Limited Taxation

and the Massachusetts High Technology Council, the ballot

question sought to restrict how much tax revenue the state

could take in, limiting the growth in revenues to no more

than the growth in total wages and salaries.”

The state auditor is in charge of reviewing the numbers and

making a determination as to whether and how much money must

be refunded to taxpayers. The refund, if one is due, would

be applied as a credit counting against this year’s income

tax liability. Massachusetts taxpayers are poised to get

back billions of dollars when they do their taxes next year

if the state auditor confirms next month, as Governor Baker

expects, that a refund is owed.

Many have pointed to this potential multi-billion dollar

taxpayer refund as another example of how Barbara Anderson,

the longtime executive director of Citizens for Limited

Taxation (CLT) who passed away in 2016, left behind a legacy

whose impact will continue to be felt long past her time on

Earth.

BOSTON:

Executive director of the Citizens for Limited Taxation

Barbara Anderson sits at her desk

in their office in Boston on July 2, 1981. (Photo by Ly

Y/The Boston Globe via Getty Images)

“She's the reason property tax

increases are capped at 2.5% of fair market value and the

state's income tax was rolled back from 5.85%,” WBUR-Boston

reported in the days following Anderson’s passing. Six years

later, Anderson’s work is poised to once again benefit

Massachusetts residents, saving them billions of dollars at

a time when many can use the extra cash to deal with the

highest inflation since 62F was enacted.

“I'm sure Barbara Anderson is up there looking down on us

with a grin pumping her fist in the heavens,” Chip Ford,

executive director of CLT, said of Anderson’s legacy. Paul

Craney, spokesman for the Massachusetts Fiscal Alliance,

says that Anderson’s legacy and the organization she left

behind “are so strong that they are still providing

protections to Massachusetts taxpayers four decades on.”

While Governor Baker and others are hopeful that 62F will

result in billions going back to taxpayers, it’s still too

early for refund supporters to spike the football. In fact,

there is now concern that leadership in the Massachusetts

House and Senate may take action to prevent the issuance of

taxpayer refunds in accordance with 62F. "Frankly, I often

say rule number one: you have to know all the rules,”

Representative Michael Connolly (D) said of the situation.

“Rule number two: there are no rules.”

“Sure, it’s an option,” Massachusetts House Speaker Ron

Mariano (D) said of the prospect that he and his colleagues

would consider repealing or modifying 62F so as to prevent

taxpayer refunds. “Everything’s on the table. We could undo

the law, we could change it, we could postpone.”

“We haven't gotten to that point to make any decisions yet,”

Senator Michael Rodrigues (D), chairman of the Ways & Means

Committee, said when asked about potential changes to or

repeal of 62F. “Remember, the administration just discovered

and informed us about this…we're still trying to understand,

and working with some outside folks that know the tax codes

even better.”

Some are concerned that unless legal action is taken, the

state auditor could find an excuse for why the surplus money

should not be refunded to taxpayers in accordance with state

law. If that doesn’t happen, legislators could still act to

either block or reduce the size of refunds due under 62F.

Although Governor Baker estimates as much as $3 billion

could be refunded to taxpayers, a final determination on the

refund and its size won’t come for a few more weeks.

“That’s hanging out there with a lot of questions that I’d

like to see answered before we make major, major decisions

about taxes and everything else,” Speaker Mariano said

earlier this week. We’ll find out by mid-September whether

Massachusetts Auditor Suzanne Bump, a lame duck Democrat,

certifies that the tax cap has been hit and how much surplus

revenue must be refunded to taxpayers.

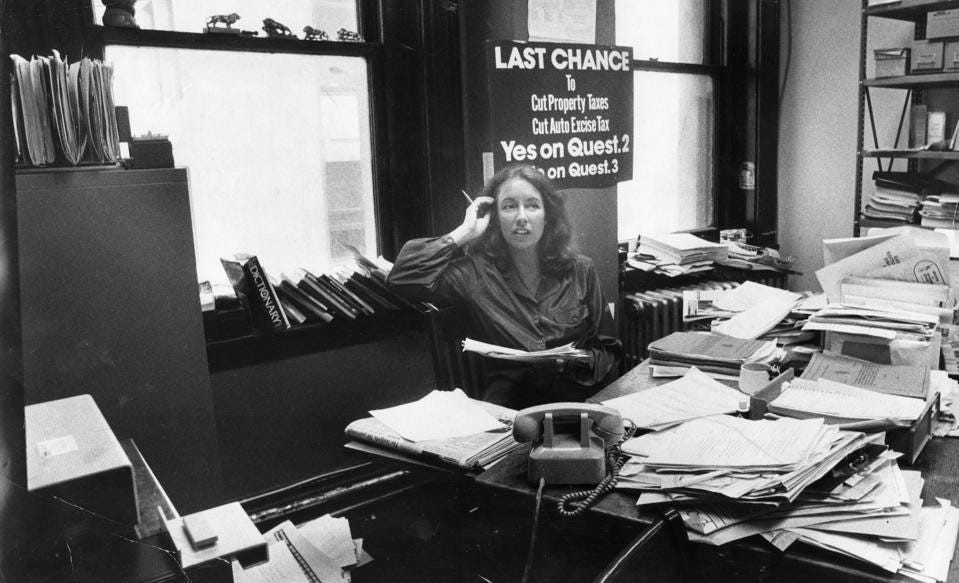

BOSTON -

Barbara Anderson speaks during the Citizens for Limited

Taxation at the Mass. State

House in Boston on Feb. 5, 1981. (Photo by David L. Ryan/The

Boston Globe via Getty Images)

CommonWealth Magazine

Tuesday, August 16, 2022

Mariano tapping brakes on economic development bill

Speaker questions whether state can afford it and tax cap

giveback

By Bruce Mohl

House Speaker Ron Mariano raised concerns on Tuesday about

whether the state can afford a $3 billion tax cap giveback

and the $3.5 billion in spending contained in the economic

development bill, which stalled at the end of the

legislative session.

Gov. Charlie Baker and Senate President Karen Spilka say the

state can afford both, but Mariano is not so sure.

“If we continue to have robust revenues, then we can go

ahead and fill all the needs that have been identified,” he

said at a press scrum outside his office. “But if the

economy slows down, which it could, and we don’t get the

revenues that we have been getting, we may be wise to hold

back on some of these things, save some of the ARPA money

that was committed in this bill.”

The economic development bill provides funding for a lot of

key priorities and it also includes a $500 million tax

relief package and $500 million worth of $250 payments to

most taxpayers.

The bill passed unanimously in both branches, but it stalled

at the end of the legislative session amid concerns about

the triggering of a 1986 law called 62F that caps how much

tax revenue the state can take in each year. The law hasn’t

been triggered in 35 years, but the Baker administration

estimates the tax cap could send $3 billion back to

taxpayers later this year.

Mariano said he would like more specificity about the size

of the tax cap giveback and how that money will be returned

to taxpayers.

“That’s hanging out there with a lot of questions that I’d

like to see answered before we make major, major decisions

about taxes and everything else,” Mariano said.

The 62F law authorizes the state auditor to certify the size

of the giveback next month and it requires the money to go

back as a tax credit on 2022 tax returns, although Gov.

Charlie Baker is moving to change that process so refund

checks could be mailed out later this fall before he leaves

office.

Senate President Karen Spilka said the state can afford both

the tax cap giveback and the economic development bill. The

problem is the Legislature recessed for the year at the end

of July, but Spilka believes lawmakers could pass the

economic development bill in informal sessions where one

lawmaker could prevent legislation from moving forward.

“We can do tax relief and the spending of the economic

development bill in an informal session,” she said. “It was

unanimous in the House. It was unanimous in the Senate. We

should be able to get it through in an informal.”

Spilka said she wouldn’t be surprised if the governor

proposed funding for some of the provisions in the economic

development bill in a separate supplemental budget.

But she acknowledged that the House would need to go along

to get anything done, and it doesn’t seem like Mariano is

ready to do that yet. The speaker said he wants to see how

the 62F money plays out and how state tax revenues hold up.

“One of the reasons we have this surplus is because we have

been fiscally prudent and very protective of how we spend

our money,” Mariano said.

State House News

Service

Wednesday, August 17, 2022

Senate Acting First on Tax Bill Not Preferred, But Not

Impossible

By Colin A. Young

In the extended back-and-forth over the economic development

and tax relief bill stuck in legislative purgatory, Senate

President Karen Spilka has repeatedly said her chamber wants

to act now but can't without the House doing so first. But

on Tuesday, she gave voice to the possibility that the

Senate could deploy procedural tactics to bring something to

the Senate floor without the House acting first.

Any legislation deemed a "money bill" is required by the

Massachusetts Constitution to originate in the House,

meaning that the Senate cannot introduce a bill that would

either increase or decrease the overall amount of state tax

revenue unless the House has already processed it.

Asked Tuesday if the Senate Ways and Means Committee had

possession of a "money bill" that it could use as a vehicle

to go around the House and bring the stalled tax relief plan

or other measures of the economic development bill onto the

Senate floor, Spilka made clear that it was not her

preferred course of action. But she also did not shoot down

the suggestion.

"Possibly, but if there's no action from the House, it may

not be helpful or productive," Spilka, a former chair of the

Senate Ways and Means Committee, said Tuesday when asked if

the idea was a possibility. She did not say whether the

committee has any such bill in its possession. "I still

think that the best route is for us to be working together

with the administration. And I am very hopeful about that."

Spilka and House Speaker Ronald Mariano remain at

loggerheads over whether to move ahead with their agreed-to

$1 billion tax rebate and reform plan in light of the late

July realization that the 1986 tax relief law known as

Chapter 62F might require the state to return about $3

billion to taxpayers.

The economic development bills that passed the House and

Senate unanimously also include spending for key areas like

housing and hospitals. Spilka reminded reporters again

Tuesday that the Senate "cannot initiate a budget, a money

bill. We are dependent upon either the governor or the

House." She said she expects that Gov. Charlie Baker will

include some of the economic development bill funding in an

eventual supplemental budget.

State House News

Service

Thursday, August 18, 2022

Baker Figures Prominently in Talks About Legislature’s

Return

Enacting Two-Thirds of Eco Dev Bill "Fine With Me," Guv Says

By Colin A. Young

Lawmakers love to deflect questions about conference

committee talks by saying their rules require them to keep

the negotiations private among the three representative and

three senators tasked with finding a compromise. But no one

is making any bones about the fact that the conference

committee still negotiating an economic development bill has

looped in an informal seventh member: Gov. Charlie Baker.

The Legislature ended its formal sessions for the year on

Aug. 1 without coming to agreement on a compromise version

of a $4 billion economic development package that was to

include $1 billion in tax rebates and reforms. The economic

development bills (H 5034 / S 3030) are pending before a

six-person, House-Senate conference committee that meets

only in private, but Baker said Thursday on GBH's Boston

Public Radio that his office is also involved in the talks.

"We've had conversations with both the House and the Senate

about this and are trying to figure out some ground

everybody can stand on," he said. "I got asked this the

other day about am I optimistic that this will still happen?

And actually, I am kind of optimistic. I mean, I don't know

exactly what it will look like, but I do believe that there

will be a piece of legislation that gets to my desk that has

a lot of the elements of this, and I really do believe

that."

Baker said he sees "a couple of possibilities" for getting

some form of an economic development bill done, but did not

say how he thinks it should get done. Senate President Karen

Spilka alluded to Baker's involvement in the economic

development talks earlier this week when she suggested that

Baker might file a supplemental budget that includes some of

the spending called for in the stalled jobs bill.

One part of the original bill that is basically certain not

to be included in anything that reaches Baker's desk is the

bonding that the Legislature intended to approve.

Authorizing bonding requires roll call votes, which can only

take place during the formal sessions that ended Aug. 1.

"If I can get an informal session on two-thirds of what's in

the eco dev bill, that'd be fine with me," Baker said,

referring to the American Rescue Plan Act and fiscal year

2022 surplus spending contemplated in the House and Senate

bills. Baker said he thinks it is realistic to expect that a

bonding-less bill could sail through the Legislature during

informal sessions.

"One member can object, but the eco dev bill passed both

branches unanimously. So ... I think those two pieces,

honestly would, I mean, I do think the so-called votes are

there to get that to our desk," Baker said.

And the governor even suggested on GBH that he's a bit

skeptical of the idea of the House and Senate returning for

formal sessions without having a narrow scope of work,

referencing the controversial lame-duck session developments

decades ago that prompted legislators to set a deadline for

major business of July 31 in election years.

"The issue with coming back in formal session is they would

have to figure out how to come back in formal session in a

way that doesn't turn it into like a whole new session, when

in fact, part of the reason they stopped doing this stuff,

as you may recall, was a whole bunch of things that happened

in late formal sessions after the elections that made

everybody including a lot of people in the Legislature

crazy, which is why they created this 7/31 deadline in the

first place," he said.

While Baker and Spilka would like to see the Legislature

pass some form of tax relief now, House Speaker Ronald

Mariano said this week he is "hesitant" to commit to all of

the spending (including the tax relief) in the economic

development bills without first knowing just how much of its

excess tax revenue the state may have to return to taxpayers