|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

48 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, May 30, 2022

Memorial Day

New Tax Hikes Before

Dubious "Tax Relief"?

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

The Senate

on Thursday approved a nearly $50 billion state

budget, after adopting more than 500 amendments over

three days.

Senate

President Karen Spilka said prior to the unanimous

vote that she hopes House and Senate negotiators can

"quickly" resolve the differences between their

fiscal 2023 spending plans.

House and

Senate Democrats over the years have often been

unable to agree on a consensus budget by the July 1

start of the fiscal year. Failing to reach a timely

agreement this year, in particular, could be

consequential since legislative leaders are trying

to find common ground on other major bills and

formal sessions for the year, under legislative

rules, end on Sunday, July 31.

During

Thursday's session, Senate Minority Leader Bruce

Tarr noted the budget bill, passed as state tax

collections continue to crest, managed to jack up

spending by more than $2 billion but still enlarges

the state's significant rainy day savings account.

Still, Tarr said, the bill fails to meet the state's

statutory responsibility to fully fund regional

school transportation....

A Senate

Ways and Means spokesman said senators added more

than $93 million to the budget through amendments,

raising the bill's bottom line to $49.78 billion,

which is in the same ballpark as the bill that

cleared the House in April.

State

House News Service

Thursday, May 26, 2022

Senate Passes

Budget, Next Stop Conference Committee

The Senate

unanimously approved a $49.78 billion budget for the

fiscal year that starts July 1, after tacking on

more than $93 million in spending over the course of

three days of debate.

A

conference committee could be appointed as soon as

next week to hash out the Senate's differences with

the House, which passed its own version of the

budget in April, also in the nearly $50 billion

ballpark.

Also

Thursday, the Senate gave its final approval to a

bill opening up Massachusetts driver's license

access to undocumented immigrants. That measure

heads to Gov. Baker's desk with 80 percent of

senators voting in support, well above the

two-thirds needed to override a veto or potentially

defeat an amendment in the event Baker tosses it

back to the Legislature.

The Senate

returns on Tuesday morning, without a formal

calendar, following the Memorial Day weekend. The

big budget debate's over and there are around nine

weeks left in formal sessions if legislative

leadership want to push any further priorities onto

the floor before the term's end.

State

House News Service

Thursday, May 26, 2022

Senate Session Summary - Thursday, May 26, 2022

By Sam Doran

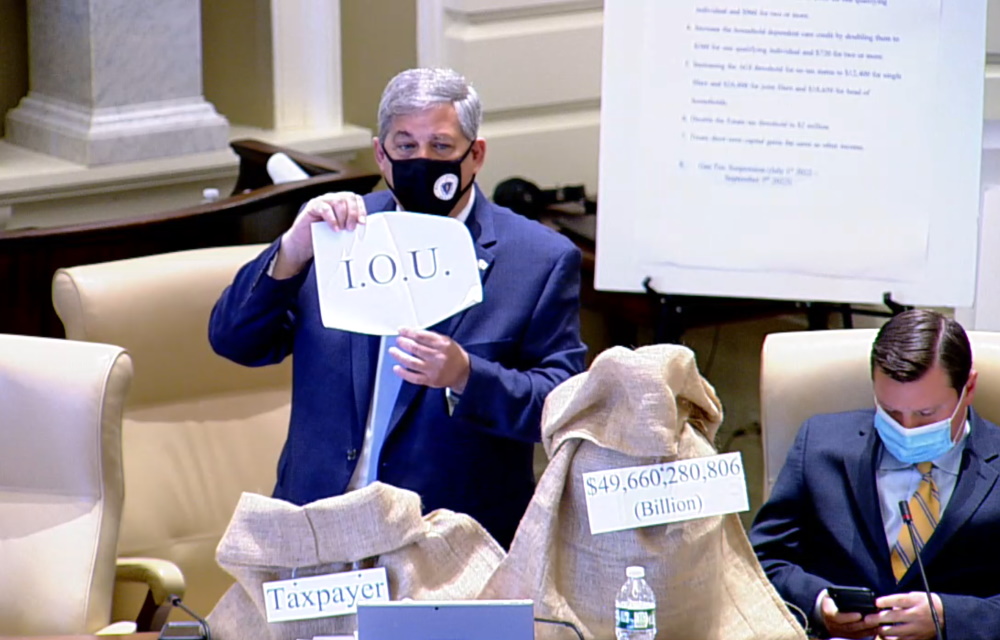

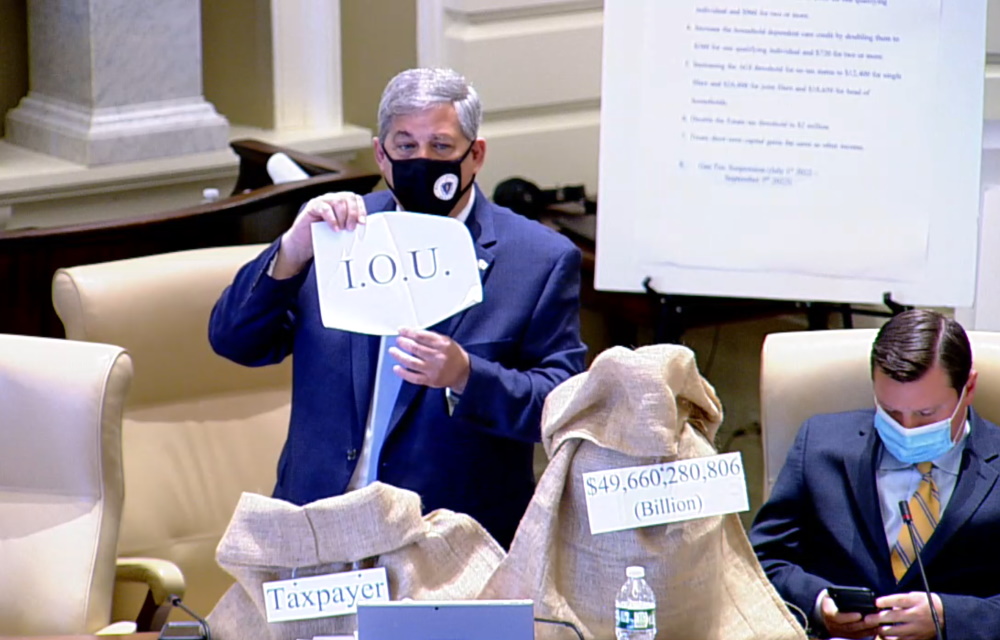

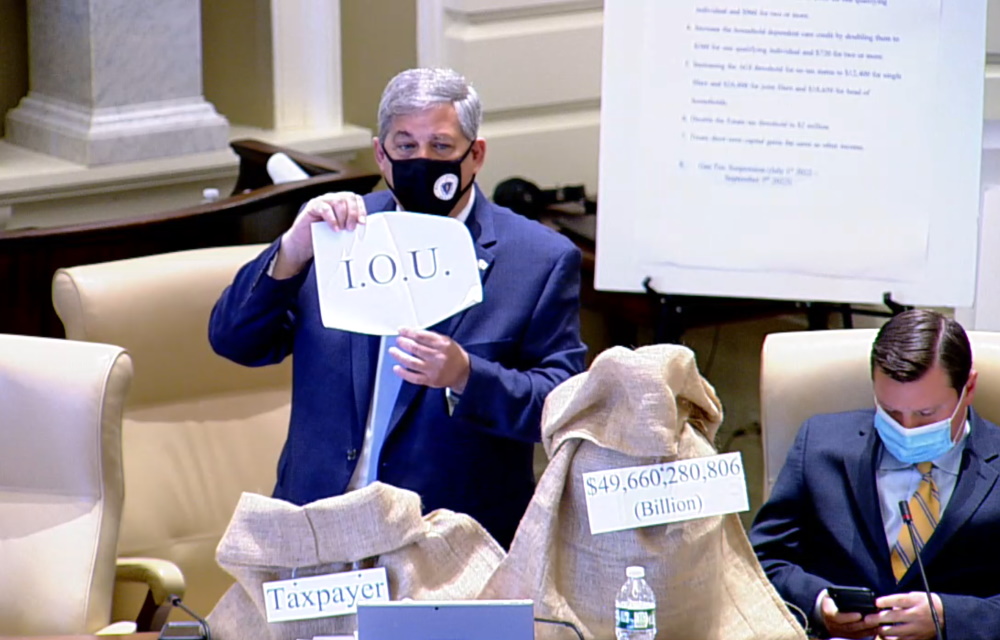

Minority Leader Bruce Tarr uses burlap moneybags to

illustrate components of the Senate's nearly $50

billion budget proposal during debate Wednesday.

Tarr's "taxpayer sack" was nearly empty, save for an

IOU representing Democratic leadership's promise of

a future debate on tax relief. [SHNS/Senate Broadcast]

When the

Senate Ways and Means Committee rolled out its $49.7

billion budget for fiscal 2023 earlier this month,

the bill was, in the eyes of Chairman Michael

Rodrigues, "pretty light on policy."

Three days

of debate and some 500 adopted amendments later,

it's gotten quite a bit heavier.

As is

typical for either branch, the Senate loaded its

spending bill up with earmarks, to the tune of tens

of millions of dollars. And senators were not afraid

to add in some policy heft, beefing up their budget

with what the Massachusetts Taxpayers Foundations

tallied as

104 new outside sections.

Those

policy pieces cover everything from protections for

providers and seekers of reproductive and

gender-affirming health care, to continued

permission for remote municipal meetings, to the

exoneration of the last woman convicted in the Salem

Witch Trials whose name has not yet been cleared.

A

substantial lift, sure, for the negotiators who will

ultimately come together to settle the differences

between the House and Senate. But, the glut of cash

in the Bay State's coffers means they'll have the

option of throwing money at some problems that may

arise -- why haggle over House versus Senate

spending priorities if the revenue's there to just

fund both? ...

Minority

Leader Bruce Tarr, never one to shy away from a

prop, illustrated his point with a series of burlap

moneybags. The biggest represented the budget's

billions in spending, while a smaller one, labeled

"Taxpayer," was nearly empty, save for an IOU.

Thursday

evening, with debate wrapped up, Tarr ceremoniously

presented Rodrigues with that Taxpayer Sack, saying

he hoped the chairman would find a way to fill it up

with tax breaks in the next two months.

Top Senate

Democrats have said they want to tackle tax relief

sometime after the budget. Since budget talks often

stretch into July and formal sessions this year end

on July 31, the timing question looms larger.

Tax

changes have to start in the House, and leadership

in that branch has also been sparse on details of

what might emerge, or when.

Speaker

Ronald Mariano said Thursday he's having the Revenue

Committee run some numbers, and that the House will

"try and put some things together" with the goal of

a "more equitable dispersal of the benefits and tax

benefits." ...

With

lawmakers still playing their cards close to the

vest on what future tax-relief efforts might look

like, an official opposition campaign to a potential

new tax launched on Monday. The Coalition to Stop

the Tax Hike Amendment kicked off its efforts to

defeat the November ballot question that would write

a 4 percent surtax on income over $1 million into

the state's Constitution.

While

opponents warn against the potential of writing

lawmakers a "blank check" with the new tax, the

money it would raise is intended to go toward

transportation and education needs.

State

House News Service

Friday, May 27, 2022

Weekly Roundup - In The Bag

The state

Senate approved a nearly $50 billion budget on

Thursday after plowing millions of dollars in new

spending into the package, but rejected a buffet of

proposed tax cuts and a temporary holiday from the

state's gas tax.

The

spending package, which passed unanimously, calls

for tapping the state's record surplus revenues to

make major investments in schools, child care,

workforce development and housing while boosting

state aid to communities.

"This is a

truly terrific budget," Senate President Karen

Spilka, D-Ashland, said in remarks ahead of its

passage. "From the start, this budget has been about

getting money, and keeping money, in the pockets of

people who keep this commonwealth moving forward."

...

While

there are no wholesale tax or fee increases in the

spending bill, the Senate's Democratic majority

rejected a $700 million buffet of proposed tax cuts

that were part of Baker’s preliminary budget package

filed in January.

Baker’s

proposal called for adjusting state income tax laws

and boosting rent deductions to provide relief for

low-income residents, expanding tax credits for

housing and child care, and a major overhaul of the

estate or "death" tax.

Senate

Republicans also made another push to suspend the

state's gas tax of 24 cents per gallon through Labor

Day as part of the budget deliberations, but the

proposed amendments were rejected by the Democratic

majority, who said they would affect the state’s

bond rating and provide minimal relief for

motorists.

Senate

Minority Leader Bruce Tarr, R-Gloucester, said the

state is awash with surplus revenue and can afford

to provide relief for consumers who are paying

higher prices for food, gas and other goods amid

supply chain disruptions and record-high inflation.

"We don't

know if that inflationary number will change but we

know it's going to have a significant detrimental

effect," Tarr said in remarks Wednesday. "We have an

obligation to take these reasonable actions — a

fraction of one month of excess revenue — to respond

and help them weather the storm and gain a little

bit of traction, survive and prosper."

Ahead of

this week's budget debate, Spilka said she wants to

pursue a tax relief package before the end of the

session but has not provided additional details.

On

Wednesday, Senate Ways & Means Chairman Michael

Rodrigues defended the Democratic majority's

rejection of the tax cuts and pointed out that the

Senate's spending plan includes funding to help

taxpayers struggling with higher costs.

"This body

has not stood by and done nothing. We have done

enormous things to help," Rodrigues said in remarks

during the budget debate. "Just the fact that we're

passing close to a $50 billion budget with money for

services that assist every resident in education,

child care, mental health, health care."

Rodrigues

argued that Baker's tax cuts are skewed toward the

state’s wealthiest and said the Senate intends to

hold a "comprehensive tax debate to ensure that

those residents that deserve it most will get the

largest share of tax breaks." ...

House

Republicans also sought to amend the spending

package to include parts of Baker’s tax cuts plan

and a gas tax holiday, but the proposals were

rejected.

During

closing remarks in the Senate budget debate, Tarr

walked across the chamber and handed Rodrigues a

burlap "taxpayer sack" with proposals to cut taxes.

"I'm

hoping, in giving this to you, that within the next

40 days you will find a way to fill it with tax

relief for the citizens of the commonwealth," Tarr

said.

The Salem

News

Friday, May 27, 2022

Senate approves nearly $50B state

budget

House

Speaker Ronald Mariano said the House is working to

assemble a tax relief package by the end of July and

that he has a willing dance partner in the Senate,

but he also indicated Thursday that relief is not

where the tax talk is likely to end.

"We're

gonna try and put some things together. There's

still two or three things that I'd like to do that

I'm having the numbers run through Revenue

[Committee]. I want a more equitable dispersal of

the benefits and tax benefits," Mariano told

reporters Thursday after addressing the Greater

Boston Chamber of Commerce.

The

speaker, who has said for months that he is open to

the idea of tax relief without having advanced Gov.

Charlie Baker's proposals or outlined his own, said

the idea of changing the threshold at which the

estate tax kicks in "was something that jumped out

at us right away," but otherwise did not get into

the details of what a House relief package might

look like.

Senate

President Karen Spilka has also said that she wants

to get a tax relief bill through her chamber and

said she will turn her attention to the issue after

the Senate budget debate is over. Mariano said his

conversations with Spilka give him "the impression

that she does want to do something."

But while

tax relief may dominate the tax-related talks

between now and the end of formal lawmaking in July,

Mariano said in his remarks to business groups

Thursday that "it's absolutely critical for the

Legislature to continue to look for new, smart ways

to generate more revenue for the commonwealth." ...

Asked by a

reporter if he has given any consideration to a tax

on services, the speaker said he had not "per se."

"But it's

an interesting avenue to look at though and I will

take a look at that. I don't know exactly how you

would structure that and how we would identify these

services, but there may be something there," Mariano

said.

State

House News Service

Thursday, May 26, 2022

Speaker Exploring New

Revenues, On Top Of Tax Relief

Opponents

of the proposed surtax on household income over $1

million launched their campaign Monday morning to

defeat the Constitutional amendment on November's

ballot, focusing on the potential impact on small

businesses and retirees as well as the possibility

that the Legislature treats the estimated $1.3

billion in annual surtax revenue as a "blank check."

The

Coalition to Stop the Tax Hike Amendment, a group of

small businesses, chambers of commerce, some of the

state's most influential trade organizations,

retirees and concerned citizens, formally kicked off

its anti-surtax efforts and said its members have

"united to communicate to voters the damage this

massive tax increase will have on our state's

economy."

"Proponents of the amendment claim that it will

raise taxes only on Massachusetts' highest earners,

but in practice, it will harm hardworking families

across the state," Dan Cence, a veteran lobbyist and

political strategist and spokesperson for the

Coalition to Stop the Tax Hike Amendment, said.

"Massachusetts already has a budget surplus of

billions of dollars. We must work together to

strengthen our economy and ensure Massachusetts

remains a place where small business owners can

thrive." ...

"The Tax

Hike Amendment is not just a tax on people making a

million dollars a year. It will also tax the nest

eggs of longtime homeowners and small business

owners whose retirement depends on their

investments," the coalition wrote on the fact

sheets. "That is because, unlike federal taxes, this

amendment would treat one-time gains from selling a

home or business as regular income, pushing many

retirees and small business owners into the new

higher tax bracket, and nearly doubling their

taxes." ...

In its

launch Monday, the coalition also called attention

to the fact that while the amendment itself would

require the surtax revenue to be spent on

transportation and education, it would not

necessarily lead to actual increases in spending on

transportation and education because future

Legislatures could stop appropriating money from

other revenue sources to those areas.

"As the

former head of the MBTA, I know there is zero

guarantee that the money raised from this amendment

will increase education and transportation spending.

Due to a loophole in the amendment, 'subject to

appropriation' means legislators can take this money

and use it for their own pet projects -- it means

giving Beacon Hill a blank check with no

accountability," Brian Shortsleeve, a former general

manager at the T who has since founded M33 Growth,

said.

Lisa

Alcock, a former public school teacher, echoed the

same sentiment in her comments on the coalition's

website. She said the amendment is "deceptive" and

that "the politicians who put this on the ballot are

giving themselves a blank check to redirect existing

funding for education and transportation to their

own pet projects, with no accountability."

State

House News Service

Monday, May 23, 2022

Surtax Opponents Warn

Against Beacon Hill “Blank Check”

Opposition Campaign Forms, Accelerating Debate

A newly

formed coalition of business groups launched a

campaign to defeat the proposed millionaires’ tax,

foreshadowing what could be a costly battle over the

proposed constitutional amendment ahead of the

November elections.

The

Coalition to Stop the Tax Hike Amendment, which

includes business groups, chambers of commerce,

hoteliers, developers and “concerned citizens,”

argues that the proposed 4% surtax on the state’s

top earners would be “one of the state’s highest

income tax increases in history,” affecting tens of

thousands of residents.

“Now, more

than ever, is not the right time to raise income

taxes,” Dan Cence, the coalition’s spokesman, said

in a statement. “Proponents of the amendment claim

that it will raise taxes only on Massachusetts’

highest earners, but in practice, it will harm

hardworking families across the state.” ...

“There is

nothing fair about subjecting small businesses who

serve as the backbone of the Massachusetts economy

to a constitutionally locked-in income tax

increase,” said Chris Carlozzi, state director of

the Massachusetts chapter of the National Federation

of Independent Business, a member of the coalition.

“Not only

does the income tax hike reduce a pass-through small

business’ ability to reinvest in their operation and

their employees, but it also taxes the owner at a

higher rate when they seek to sell their business

and retire,” Carlozzi said.

Members of

the coalition, which include Associated Industries

of Massachusetts, the Massachusetts Seafood

Collaborative, Retailers Association of

Massachusetts, and the Pioneer Institute, note that

the state’s voters have several times rejected

proposals to replace the state’s flat personal

income tax with a graduated rate....

The Raise

Up Massachusetts coalition, a coalition of labor

unions, community and faith groups behind the

referendum, dismissed the newly formed opposition

group and accused them of distorting details of the

proposed amendment.

“The

super-rich got richer during the pandemic, and a

small number of them will say anything to keep from

paying their fair share to build a better future for

Massachusetts families,” said Steve Crawford, the

coalition’s spokesman....

“The Fair

Share Amendment is simple: If you earn less than a

million dollars in a year you won’t pay a penny

more. Only the very rich will pay a little extra,”

he added. “And the money raised is constitutionally

required to be spent on making our kids’ schools

better and fixing our roads, bridges, and transit.”

The

referendum faces a challenge from a lawsuit filed by

Massachusetts High Technology Council and other

opponents who argue that backers of the surtax may

try to mislead voters by using an “inaccurate”

summary of the referendum.

They say

despite claims the money will be used for education

and transportation, lawmakers could divert the funds

for other purposes and voters should know that

before they go to the polls.

The

outcome of the legal challenge is pending a ruling

by the state Supreme Judicial Court, which heard

arguments in the case about three weeks ago.

The Salem

News

Tuesday, May 24, 2022

Coalition forms to oppose

millionaires' tax

Gov.

Charlie Baker on Friday vetoed a bill making

immigrants without legal status eligible to seek

state-issued driver's licenses, saying the Registry

of Motor Vehicles, an agency that he oversees,

doesn't have the ability to verify the identities of

potential applicants.

Following

years of advocacy for the bill, House and Senate

Democrats on Thursday enacted the legislation, which

supporters say will make the roads safer by granting

access to licenses for many undocumented immigrants

who are already living throughout the state.

Republican

opposition to the bill was steady throughout its

journey through the Legislature, and officeholders

and candidates at the GOP convention last weekend in

Springfield sporadically and pointedly expressed

their opposition to the proposal.

In his

veto message, Baker said the legislation

"significantly increases the risk that noncitizens

will be registered to vote," a possibility that bill

supporters have refuted. The governor said the bill

"restricts the Registry's ability to share

citizenship information with those entities

responsible for ensuring that only citizens register

for and vote in our elections."

The bill

cleared both branches with more than enough support

to override Baker's veto.

State

House News Service

Friday, May 27, 2022

Baker Vetoes Immigrant License

Access Bill

Voting, Verification Concerns Outlined In Veto

Message

One day

after state legislators approved a bill to allow

undocumented immigrants to get driver’s licenses in

Massachusetts, Governor Charlie Baker vetoed the

measure, saying it poses a risk to election

security.

In a

letter rejecting the legislation late Friday

afternoon, Baker said the bill requires the Registry

of Motor Vehicles “to issue state credentials to

people without the ability to verify their identity”

and “increases the risk that noncitizens will be

registered to vote.”

He also

expressed concern that the identification wouldn’t

distinguish an undocumented person from a documented

one.

“Consequently, a standard Massachusetts driver’s

license will no longer confirm that a person is who

they say they are,” Baker wrote.

The House

and the Senate voted overwhelmingly to approve the

bill Thursday, supporting it 118-36 and 32-8,

respectively.

Those

margins were large enough to override Baker’s veto.

A two-thirds vote is required in each branch to

override the governor’s veto and make the bill law.

A

spokesperson for Senate President Karen E. Spilka

said the chamber will override, but did not provide

a date. The House will override the veto during its

next formal session on June 8, according to a

spokeswoman for House Speaker Ronald J. Mariano.

In a

tweet, Spilka called Baker’s veto “misguided” and

said her chamber looks forward to overriding it.

The

Boston Globe

Friday, May 27, 2022

Governor Baker vetoes bill to give

driver’s licenses to undocumented residents

A big

winner in last weekend’s Republican convention was a

Democrat.

That would

be Attorney General Maura Healey, the two-term

progressive who is running for governor....

So, if

Diehl wins the GOP primary over fist time candidate

Doughty, as expected, he will face a well-funded

Healey, who may not even face a primary challenge.

Healey,

who has scored a series of Democrat and progressive

endorsements — but has not heard from Joe Biden —

has raised close to $5 million in campaign funds.

This

compares to the less than $400,000 that Diehl has

raised.

Doughty, a

successful manufacturer, has put $500,000 of his own

fortune — and perhaps more to come — into his

campaign, which makes one wonder what his six

children and four grandchildren are thinking.

Still,

Healey has easily raised more money than the two

Republicans combined, and you could throw in

Chang-Diaz as well, and the three do not come close

to equaling the cash Healey has on hand....

If the

convention vote is any indication, Diehl should beat

Doughty in the primary. In 2018 Diehl beat out two

other Republicans for the U.S. Senate nomination

only to lose to Democrat Elizabeth Warren. So he is

better known.

But that

is only the beginning. There are only 459,663

registered Republicans in Massachusetts, compared to

1,494,990 registered Democrats. Diehl could win

every Republican primary vote and he would still be

well behind Healey, both in votes and in money.

However,

there are 2,717,293 unenrolled voters, or

Independents, who normally do not vote in September

primaries. But they do vote in November.

Diehl is a

longshot, for sure, even if he wins the primary. But

we live in strange, angry and anything-can-happen

times.

Diehl

needs to nationalize the election. With Trump at his

back, needs to make the election about Joe Biden,

who Healey supports, even as Biden has brought the

country to its knees.

Gas

prices? Food costs? Crime? Drugs? Homelessness?

Illegal immigration? No baby formula? Empty shelves?

Hate? Divisiveness? Afghanistan? Joe Biden has

failed on every front.

Democrat

election officials are now treating Biden as though

he had monkeypox.

Yes, Biden

whipped Trump in Massachusetts in 2020 when 2,382,

202 people voted for him. He would not get that vote

today. Trump back then got 1,167,202 votes. Today he

would get those same votes and more.

Biden sold

out his supporters to a bunch or radicals. Now his

disenchanted supporters — Democrats and Independents

— are deserting him. These are the people Diehl must

go after if he has any chance at all. They are out

there; you just have to get them.

The

Boston Herald

Wednesday, May 25, 2022

Race for governor must be about

gas, crime and no baby formula

By Peter Lucas

The

perfect Donald Trump storm is brewing in

Massachusetts — an unabashed conservative taking on

the Democratic power structure, a liberal candidate

and the left-wing media.

So it’s no

surprise Trump is considering making an appearance

for gubernatorial candidate Geoff Diehl’s campaign.

A Trump

rally would take the Bay State gubernatorial race

national — which is just what Diehl wants — and

shine a spotlight on the former state rep and failed

U.S. Senate candidate.

It would

also bring in cash, notoriety and of course plenty

of criticism in the establishment media and in the

Democratic party.

Democratic

front-runner Attorney General Maura Healey is the

perfect Trump foil — she has sued the former

president dozens of times and at times seemed

obsessed by him.

Healey has

tried to hang the Trump label on Diehl and he seems

perfectly willing to embrace it.

Trump and

Diehl would also be running against the state

Democratic Party establishment, including the

super-liberal Legislature, which has resisted

passing tax cuts despite a huge state surplus and

just passed a bill allowing non-citizen immigrants

to get a drivers’ license....

The

question for Diehl is can he stitch together enough

of a coalition of staunch conservatives, veterans,

law enforcement, anti-vaxers and others to win the

primary and make it a contest against Healey or the

other Democrat, Sonia Chang-Diaz?

Trump may

be able to help fire up conservatives — more than a

million of them voted for him in 2020 in

Massachusetts — but he’ll also energize Democrats,

too.

Whether

the former president makes an actual visit to the

Bay State is in question — he’s promised to do

“something” for Diehl but he may not want to invest

too much time in a race he’s likely to lose.

The

Boston Herald

Saturday, May 28, 2022

Trump perfect political storm

brewing in Massachusetts

By Joe Battenfeld |

Chip Ford's CLT

Commentary |

|

The Salem News reported on Friday ("Senate

approves nearly $50B state budget"):

The state

Senate approved a nearly $50 billion budget on

Thursday after plowing millions of dollars in new

spending into the package, but rejected a buffet of

proposed tax cuts and a temporary holiday from the

state's gas tax.

The spending package,

which passed unanimously, calls for tapping the state's record

surplus revenues to make major investments in schools, child care,

workforce development and housing while boosting state aid to

communities.

"This is a truly terrific

budget," Senate President Karen Spilka, D-Ashland, said in remarks

ahead of its passage. "From the start, this budget has been about

getting money, and keeping money, in the pockets of people who keep

this commonwealth moving forward." ...

While there are no

wholesale tax or fee increases in the spending bill, the Senate's

Democratic majority rejected a $700 million buffet of proposed tax

cuts that were part of Baker’s preliminary budget package filed in

January....

On Wednesday, Senate Ways

& Means Chairman Michael Rodrigues defended the Democratic

majority's rejection of the tax cuts and pointed out that the

Senate's spending plan includes funding to help taxpayers struggling

with higher costs.

"This body has not stood

by and done nothing. We have done enormous things to help,"

Rodrigues said in remarks during the budget debate. "Just the fact

that we're passing close to a $50 billion budget with money for

services that assist every resident in education, child care, mental

health, health care."

Rodrigues argued that

Baker's tax cuts are skewed toward the state’s wealthiest and said

the Senate intends to hold a "comprehensive tax debate to ensure

that those residents that deserve it most will get the largest share

of tax breaks." ...

House Republicans also

sought to amend the spending package to include parts of Baker’s tax

cuts plan and a gas tax holiday, but the proposals were rejected.

During closing remarks in

the Senate budget debate, Tarr walked across the chamber and handed

Rodrigues a burlap "taxpayer sack" with proposals to cut taxes.

"I'm hoping, in giving

this to you, that within the next 40 days you will find a way to

fill it with tax relief for the citizens of the commonwealth," Tarr

said.

Minority Leader Bruce

Tarr uses burlap moneybags to illustrate components of the Senate's

nearly $50 billion budget proposal during debate Wednesday. Tarr's

"taxpayer sack" was nearly empty, save for an IOU representing

Democratic leadership's promise of a future debate on tax relief.

[SHNS/Senate Broadcast]

In its Weekly Roundup on

Friday, the State House News Service noted:

When the Senate Ways and

Means Committee rolled out its $49.7 billion

budget for fiscal 2023 earlier this month, the

bill was, in the eyes of Chairman Michael

Rodrigues, "pretty light on policy."

Three days of debate and

some 500 adopted amendments later, it's gotten

quite a bit heavier.

As

is typical for either branch, the Senate loaded

its spending bill up with earmarks, to the tune

of tens of millions of dollars. And senators

were not afraid to add in some policy heft,

beefing up their budget with what the

Massachusetts Taxpayers Foundations tallied as

104 new outside sections.

Those

policy pieces cover everything from protections

for providers and seekers of reproductive and

gender-affirming health care, to continued

permission for remote municipal meetings, to the

exoneration of the last woman convicted in the

Salem Witch Trials whose name has not yet been

cleared.

A

substantial lift, sure, for the negotiators who

will ultimately come together to settle the

differences between the House and Senate. But,

the glut of cash in the Bay State's coffers

means they'll have the option of throwing money

at some problems that may arise -- why haggle

over House versus Senate spending priorities if

the revenue's there to just fund both?

On Thursday the News Service reported ("Speaker Exploring New

Revenues, On Top Of Tax Relief"):

House

Speaker Ronald Mariano said the House is working to

assemble a tax relief package by the end of July and

that he has a willing dance partner in the Senate,

but he also indicated Thursday that relief is not

where the tax talk is likely to end.

"We're

gonna try and put some things together. There's

still two or three things that I'd like to do that

I'm having the numbers run through Revenue

[Committee]. I want a more equitable dispersal of

the benefits and tax benefits," Mariano told

reporters Thursday after addressing the Greater

Boston Chamber of Commerce.

The

speaker, who has said for months that he is open to

the idea of tax relief without having advanced Gov.

Charlie Baker's proposals or outlined his own, said

the idea of changing the threshold at which the

estate tax kicks in "was something that jumped out

at us right away," but otherwise did not get into

the details of what a House relief package might

look like.

Senate

President Karen Spilka has also said that she wants

to get a tax relief bill through her chamber and

said she will turn her attention to the issue after

the Senate budget debate is over. Mariano said his

conversations with Spilka give him "the impression

that she does want to do something."

But while

tax relief may dominate the tax-related talks

between now and the end of formal lawmaking in July,

Mariano said in his remarks to business groups

Thursday that "it's absolutely critical for the

Legislature to continue to look for new, smart ways

to generate more revenue for the commonwealth." ...

Asked by a

reporter if he has given any consideration to a tax

on services, the speaker said he had not "per se."

"But it's

an interesting avenue to look at though and I will

take a look at that. I don't know exactly how you

would structure that and how we would identify these

services, but there may be something there," Mariano

said.

"But while tax relief may

dominate the tax-related talks between now and the end of formal

lawmaking in July, Mariano said in his remarks to business groups

Thursday that 'it's absolutely critical for the Legislature to

continue to look for new, smart ways to generate more revenue for

the commonwealth.'"

I think I see where this

"tax relief" is going.

The House and Senate

budgets propose spending over $2 Billion more than last year's

budget, including pouring hundreds of millions more into the "rainy

day" fund bulging it to a record level of $6.74 billion. It's

become difficult for legislators to answer why none of this largesse

can be allocated back to those who earned and over-paid it, so

they've come up with a fig leaf response —

if they can't figure out a way to stall it into oblivion.

"I want a more equitable

dispersal of the benefits and tax benefits," House Speaker Ron

Mariano told reporters.

"From each according to

his ability to each according to his needs" seems to be the game

plan. Those who paid the least taxes will receive the most

"tax relief" benefits — if they can't

come up with a way to stall it into oblivion.

And if they can't come up

with a way to stall it into oblivion, they'll simply increase taxes

somewhere else to cover the cost — and

then some no doubt.

Need I remind you that

they're still counting on the additional bounty they hope will be

raked in by the proposed graduated income tax scheme that will be on

the November ballot, their "Fair Share Amendment," aka,

"Millionaire's Tax"?

In its Weekly Roundup on

Friday the News Service noted:

As is

typical for either branch, the Senate loaded its

spending bill up with earmarks, to the tune of tens

of millions of dollars. And senators were not afraid

to add in some policy heft, beefing up their budget

with what the Massachusetts Taxpayers Foundations

tallied as

104 new outside sections.

The Senate's budget as

passed is not yet available online so I haven't been able to scour

it yet to see if any of the stealth assaults on Proposition 2½

are contained in any of those policy change outside sections.

Hopefully, the unavailability yet of the Senate budget isn't the

pinnacle of stealth.

News on the graduated

income tax front was

reported by the News Service on Monday ("Surtax

Opponents Warn Against Beacon Hill “Blank Check”—Opposition Campaign Forms, Accelerating Debate")

Opponents of the proposed

surtax on household income over $1 million

launched their campaign Monday morning to defeat

the Constitutional amendment on November's

ballot, focusing on the potential impact on

small businesses and retirees as well as the

possibility that the Legislature treats the

estimated $1.3 billion in annual surtax revenue

as a "blank check."

The Coalition to Stop the

Tax Hike Amendment, a group of small businesses,

chambers of commerce, some of the state's most

influential trade organizations, retirees and

concerned citizens, formally kicked off its

anti-surtax efforts and said its members have

"united to communicate to voters the damage this

massive tax increase will have on our state's

economy." ...

"The Tax Hike Amendment is

not just a tax on people making a million

dollars a year. It will also tax the nest eggs

of longtime homeowners and small business owners

whose retirement depends on their investments,"

the coalition wrote on the fact sheets. "That is

because, unlike federal taxes, this amendment

would treat one-time gains from selling a home

or business as regular income, pushing many

retirees and small business owners into the new

higher tax bracket, and nearly doubling their

taxes." ...

In its launch Monday, the

coalition also called attention to the fact that

while the amendment itself would require the

surtax revenue to be spent on transportation and

education, it would not necessarily lead to

actual increases in spending on transportation

and education because future Legislatures could

stop appropriating money from other revenue

sources to those areas.

"As the former head of the

MBTA, I know there is zero guarantee that the

money raised from this amendment will increase

education and transportation spending. Due to a

loophole in the amendment, 'subject to

appropriation' means legislators can take this

money and use it for their own pet projects --

it means giving Beacon Hill a blank check with

no accountability," Brian Shortsleeve, a former

general manager at the T who has since founded

M33 Growth, said.

On Tuesday The Salem News added ("Coalition

forms to oppose millionaires' tax"):

The Coalition to Stop the

Tax Hike Amendment, which includes business

groups, chambers of commerce, hoteliers,

developers and “concerned citizens,” argues that

the proposed 4% surtax on the state’s top

earners would be “one of the state’s highest

income tax increases in history,” affecting tens

of thousands of residents.

“Now, more than ever, is

not the right time to raise income taxes,” Dan

Cence, the coalition’s spokesman, said in a

statement. “Proponents of the amendment claim

that it will raise taxes only on Massachusetts’

highest earners, but in practice, it will harm

hardworking families across the state.” ...

“There is nothing fair

about subjecting small businesses who serve as

the backbone of the Massachusetts economy to a

constitutionally locked-in income tax increase,”

said Chris Carlozzi, state director of the

Massachusetts chapter of the National Federation

of Independent Business, a member of the

coalition.

“Not only does the income

tax hike reduce a pass-through small business’

ability to reinvest in their operation and their

employees, but it also taxes the owner at a

higher rate when they seek to sell their

business and retire,” Carlozzi said....

The referendum faces a

challenge from a lawsuit filed by Massachusetts

High Technology Council and other opponents who

argue that backers of the surtax may try to

mislead voters by using an “inaccurate” summary

of the referendum.

They say despite claims the

money will be used for education and

transportation, lawmakers could divert the funds

for other purposes and voters should know that

before they go to the polls.

The outcome of the legal

challenge is pending a ruling by the state

Supreme Judicial Court, which heard arguments in

the case about three weeks ago.

It's game-on for the

opposition to this sixth attempt to impose a graduated income

tax in Massachusetts by amending the state constitution, forever.

Citizens for Limited Taxation led the opposition to the last two

attempts and defeated both on the ballots in 1976 and 1994.

I'm gratified to see others with much deeper pockets taking up the

leadership this time. CLT is behind their effort completely.

All my life as an activist I've heard "I'm behind you all the way!"

but when I turned and looked back there were so few. At least

this newly-minted group, The Coalition to Stop the Tax Hike

Amendment, starts out with numbers and financial backing.

Gov. Baker did the right

thing on Friday, vetoing the driver's license for illegal immigrants

bill overwhelmingly passed in both the House and Senate, but as with

most "right thing" vetoes he exercises, it's with the full knowledge

that his veto won't make any difference.

The

State

House News Service reported on Friday ("Baker Vetoes Immigrant License

Access Bill—Voting, Verification Concerns Outlined In Veto

Message"):

Gov.

Charlie Baker on Friday vetoed a bill making

immigrants without legal status eligible to seek

state-issued driver's licenses, saying the Registry

of Motor Vehicles, an agency that he oversees,

doesn't have the ability to verify the identities of

potential applicants.

Following

years of advocacy for the bill, House and Senate

Democrats on Thursday enacted the legislation, which

supporters say will make the roads safer by granting

access to licenses for many undocumented immigrants

who are already living throughout the state.

Republican

opposition to the bill was steady throughout its

journey through the Legislature, and officeholders

and candidates at the GOP convention last weekend in

Springfield sporadically and pointedly expressed

their opposition to the proposal.

In his

veto message, Baker said the legislation

"significantly increases the risk that noncitizens

will be registered to vote," a possibility that bill

supporters have refuted. The governor said the bill

"restricts the Registry's ability to share

citizenship information with those entities

responsible for ensuring that only citizens register

for and vote in our elections."

The bill

cleared both branches with more than enough support

to override Baker's veto.

Massachusetts is about to

create overnight tens of thousands of undocumented Democrats, and I

predict it's only a short matter of time before the first voting

"scandal" is revealed — maybe even by

November.

There were a couple of

interesting opinion perspectives in The Boston Herald over the past

week concerning the race for governor.

In his column on Wednesday

("Race for governor must be about

gas, crime and no baby formula") veteran

Massachusetts political reporter and columnist Peter Lucas offers:

. . . Diehl is a

longshot, for sure, even if he wins the primary. But

we live in strange, angry and anything-can-happen

times.

Diehl

needs to nationalize the election. With Trump at his

back, needs to make the election about Joe Biden,

who Healey supports, even as Biden has brought the

country to its knees.

Gas

prices? Food costs? Crime? Drugs? Homelessness?

Illegal immigration? No baby formula? Empty shelves?

Hate? Divisiveness? Afghanistan? Joe Biden has

failed on every front.

Democrat

election officials are now treating Biden as though

he had monkeypox.

Yes, Biden

whipped Trump in Massachusetts in 2020 when 2,382,

202 people voted for him. He would not get that vote

today. Trump back then got 1,167,202 votes. Today he

would get those same votes and more.

Biden sold

out his supporters to a bunch or radicals. Now his

disenchanted supporters — Democrats and Independents

— are deserting him. These are the people Diehl must

go after if he has any chance at all. They are out

there; you just have to get them.

This was followed up on

Saturday by Herald columnist

Joe Battenfeld ("Trump perfect political storm

brewing in Massachusetts") in which posits:

The perfect Donald Trump

storm is brewing in Massachusetts — an unabashed

conservative taking on the Democratic power

structure, a liberal candidate and the left-wing

media.

So it’s no surprise Trump

is considering making an appearance for

gubernatorial candidate Geoff Diehl’s

campaign....

The

question for Diehl is can he stitch together enough

of a coalition of staunch conservatives, veterans,

law enforcement, anti-vaxers and others to win the

primary and make it a contest against Healey or the

other Democrat, Sonia Chang-Diaz?

Trump may

be able to help fire up conservatives — more than a

million of them voted for him in 2020 in

Massachusetts — but he’ll also energize Democrats,

too.

Whether

the former president makes an actual visit to the

Bay State is in question — he’s promised to do

“something” for Diehl but he may not want to invest

too much time in a race he’s likely to lose.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

State House News

Service

Thursday, May 26, 2022

Senate Passes Budget, Next Stop Conference Committee

By Michael P. Norton

The Senate on Thursday approved a nearly $50 billion state

budget, after adopting more than 500 amendments over three

days.

Senate President Karen Spilka said prior to the unanimous

vote that she hopes House and Senate negotiators can

"quickly" resolve the differences between their fiscal 2023

spending plans.

House and Senate Democrats over the years have often been

unable to agree on a consensus budget by the July 1 start of

the fiscal year. Failing to reach a timely agreement this

year, in particular, could be consequential since

legislative leaders are trying to find common ground on

other major bills and formal sessions for the year, under

legislative rules, end on Sunday, July 31.

During Thursday's session, Senate Minority Leader Bruce Tarr

noted the budget bill, passed as state tax collections

continue to crest, managed to jack up spending by more than

$2 billion but still enlarges the state's significant rainy

day savings account. Still, Tarr said, the bill fails to

meet the state's statutory responsibility to fully fund

regional school transportation.

Senate budget chief Michael Rodrigues ticked off areas where

the Senate bill made investments, including early, K-12 and

higher education, health care, workforce accounts, housing

aid. Spilka said the bill fully funds the state's obligation

under the Student Opportunity Act, a landmark education bill

that seeks to plug gaps in local education budgets over a

seven-year stretch.

A Senate Ways and Means spokesman said senators added more

than $93 million to the budget through amendments, raising

the bill's bottom line to $49.78 billion, which is in the

same ballpark as the bill that cleared the House in April.

Rodrigues, of Westport, and House Ways and Means Chair Aaron

Michlewitz of Boston will lead budget negotiations in

conference. The two branches will name six conferees, and

the conference panel will almost certainly vote to conduct

its work entirely in private.

House conferees will be presented with a pair of major

Senate policy measures. Through amendments, the Senate

agreed on Thursday to a ban on non-disclosure agreements

across state government. On Wednesday, the Senate agreed to

licensing protections for doctors and other professionals

involved with the provision of reproductive care -- which

covers not just abortion but also contraception, miscarriage

management and other pregnancy-related services -- or many

supportive treatments for gender dysphoria.

State House News

Service

Friday, May 27, 2022

Weekly Roundup - In The Bag

Recap and analysis of the week in state government

By Katie Lannan

When the Senate Ways and Means Committee rolled out its

$49.7 billion budget for fiscal 2023 earlier this month, the

bill was, in the eyes of Chairman Michael Rodrigues, "pretty

light on policy."

Three days of debate and some 500 adopted amendments later,

it's gotten quite a bit heavier.

As is typical for either branch, the Senate loaded its

spending bill up with earmarks, to the tune of tens of

millions of dollars. And senators were not afraid to add in

some policy heft, beefing up their budget with what the

Massachusetts Taxpayers Foundations tallied as

104

new outside sections.

Those policy pieces cover everything from protections for

providers and seekers of reproductive and gender-affirming

health care, to continued permission for remote municipal

meetings, to the exoneration of the last woman convicted in

the Salem Witch Trials whose name has not yet been cleared.

A substantial lift, sure, for the negotiators who will

ultimately come together to settle the differences between

the House and Senate. But, the glut of cash in the Bay

State's coffers means they'll have the option of throwing

money at some problems that may arise -- why haggle over

House versus Senate spending priorities if the revenue's

there to just fund both?

The House and Senate don't just differ on what they put in

their budget, but how they formally build it.

While much of the work in House Budget Week goes unspoken as

consolidated amendment packages are cobbled together behind

the scenes and adopted with little to no debate, the

Senate's features an almost constant stream of speeches.

The Senate speeds up its process by bulk-voting "yes" or

"no" on bundles of amendments compiled by leadership, but

almost every amendment it adopts outside of that process --

and quite a few that are withdrawn or rejected -- comes with

a detailed introduction from its sponsor.

For the body's handful of statewide candidates, it's an

opportunity for facetime and potential headlines.

Lieutenant governor hopefuls Sens. Eric Lesser and Adam

Hinds and auditor contender Sen. Diana DiZoglio gave

multiple speeches, while gubernatorial candidate Sen. Sonia

Chang-Diaz was quieter.

As outgoing Gov. Charlie Baker was in Nashville Wednesday

for an election-year confab with other GOP governors, the

Senate's trio of Republicans took up his call for tax

breaks, unsuccessfully making the case that the budget

should return some of the state's surplus to the residents

who provided it in the first place.

Minority Leader Bruce Tarr, never one to shy away from a

prop, illustrated his point with a series of burlap

moneybags. The biggest represented the budget's billions in

spending, while a smaller one, labeled "Taxpayer," was

nearly empty, save for an IOU.

Minority Leader

Bruce Tarr uses burlap moneybags to illustrate components of

the Senate's nearly $50 billion budget proposal during

debate Wednesday. Tarr's "taxpayer sack" was nearly empty,

save for an IOU representing Democratic leadership's promise

of a future debate on tax relief. [SHNS/Senate Broadcast]

Thursday evening, with debate

wrapped up, Tarr ceremoniously presented Rodrigues with that

Taxpayer Sack, saying he hoped the chairman would find a way

to fill it up with tax breaks in the next two months.

Top Senate Democrats have said they want to tackle tax

relief sometime after the budget. Since budget talks often

stretch into July and formal sessions this year end on July

31, the timing question looms larger.

Tax changes have to start in the House, and leadership in

that branch has also been sparse on details of what might

emerge, or when.

Speaker Ronald Mariano said Thursday he's having the Revenue

Committee run some numbers, and that the House will "try and

put some things together" with the goal of a "more equitable

dispersal of the benefits and tax benefits."

Addressing the Greater Boston Chamber of Commerce, Mariano

identified ongoing conference talks involving offshore wind

and legalization of sports betting -- where he knocked the

Senate's approach as "paternalistic" -- as his areas of top

importance on the end-of-session agenda. Once those are

resolved, he said, lawmakers can "begin to start to tackle

some other things that we have that might be a little bit

less confrontational."

"Anyone who's been involved with the Legislature knows that

we operate best up against deadlines because it forces

people to take a realistic view of their position," Mariano

said.

The House added another bulletpoint to the Legislature's

pre-July 31 to-do list, sending the Senate a bill that would

have Massachusetts join the ranks of 48 other states with

some sort of ban on the sharing of sexually explicit images

without the subject's consent. The bill also creates new,

non-criminal options for responding to teen sexting cases.

Baker for years has been pushing lawmakers to take up

"revenge porn" legislation, and now that the House has, the

bill representatives passed goes a somewhat different route

than the governor has proposed. Rather than establishing a

new criminal offense, like Baker suggested, the House opted

to update existing criminal harassment laws.

Baker and legislative Democrats are much further apart on a

bill that would allow Massachusetts residents without legal

immigration status to apply for and obtain standard state

driver's licenses.

Over unanimous Republican opposition, the House and Senate

shipped Baker the final version of their license-access bill

on Thursday. Less than 24 hours later, he sent it back,

vetoed.

Baker's Friday afternoon veto message echoes many of the

concerns he raised while the bill, the subject of years of

impassioned advocacy, was working its way to his desk over

the past few months -- he says the Registry of Motor

Vehicles isn't equipped to verify foreign identify document

and worries about the risk of noncitizens ending up

registered to vote.

The veto is largely symbolic, as Democrats in both branches

have the numbers to override it.

Two of the Democrats running for attorney general this week

returned to an old friend of Massachusetts office-seekers,

reviving the "People's Pledge" for yet another campaign

season.

The latest incarnation, like the original version signed a

decade ago by then-Sen. Scott Brown and his challenger

Elizabeth Warren, aims to discourage outside spending by

super PACs. Unlike the Brown-Warren pledge, this one doesn't

have the signature of all candidates in the race.

Shannon Liss-Riordan and Quentin Palfrey signed their pledge

outside the State House Monday, calling on fellow Democrat

Andrea Campbell to do the same.

A day later, Environmental League of Massachusetts Action

Fund's independent expenditure political action committee

reported the contest's first super PAC spending -- about

$1,500 on mailers supporting Campbell.

The super PAC spent the same amount on its two other favored

statewide candidates, Chris Dempsey for auditor and Maura

Healey for governor. The committee's treasurer, Elizabeth

Henry, called the three Democrats "proven, effective

leaders, committed to making environmental and climate

action a top priority."

Healey, in her day job as attorney general, this week filed

suit against 13 manufacturers of the "forever chemicals"

known as PFAS, charging them with contaminating the state's

water sources and other resources.

Elsewhere in legal action, the Supreme Judicial Court

ordered a new round of fact-finding in a case involving the

Gaming Commission and the 2012 deal for the Everett land

that now hosts the Encore Boston Harbor casino.

With lawmakers still playing their cards close to the vest

on what future tax-relief efforts might look like, an

official opposition campaign to a potential new tax launched

on Monday. The Coalition to Stop the Tax Hike Amendment

kicked off its efforts to defeat the November ballot

question that would write a 4 percent surtax on income over

$1 million into the state's Constitution.

While opponents warn against the potential of writing

lawmakers a "blank check" with the new tax, the money it

would raise is intended to go toward transportation and

education needs.

A new pot of money for schools might sound pretty good right

now in Boston, where talk of a potential state receivership

has been bubbling for a while and hit a boiling point with a

new report from the Department of Elementary and Secondary

Education.

The department's report, a searing 188-page document, says

the Boston Public Schools are still falling short of an

"acceptable minimum standard" in key areas like

transportation and special education.

It calls for bold moves and immediate improvement, but

doesn't specifically recommend receivership. Mayor Michelle

Wu, one of a slew of local officials against the idea of

receivership, and state Education Commissioner Jeff Riley

have been talking about next steps.

Based on comments from Baker and Riley, a former Lawrence

receiver, the state will be looking for Wu to lay out

concrete steps and commit the city to taking them. If the

state does ultimately pursue receivership, Wu said Boston

will seek "a hearing and due process under the board's laws

and regulations to continue to make our case."

News at the state and city levels this week unfurled as the

nation coped with the horror of a school shooting in Uvalde,

Texas, which left 19 students and two adults dead.

"We must turn that anger into action. We must not lose

hope," Senate President Karen Spilka said as the Senate

paused its budget debate for a moment of silence honoring

the victims of that tragedy and other recent shootings in

New York and California.

STORY OF THE WEEK: The visual aids, speeches and earmarks

can only mean one thing -- another Senate Budget Week has

come and gone.

The Salem

News

Friday, May 27, 2022

Senate approves nearly $50B state budget

By Christian M. Wade | Statehouse Reporter

The state Senate approved a nearly $50 billion budget on

Thursday after plowing millions of dollars in new spending

into the package, but rejected a buffet of proposed tax cuts

and a temporary holiday from the state's gas tax.

The spending package, which passed unanimously, calls for

tapping the state's record surplus revenues to make major

investments in schools, child care, workforce development

and housing while boosting state aid to communities.

"This is a truly terrific budget," Senate President Karen

Spilka, D-Ashland, said in remarks ahead of its passage.

"From the start, this budget has been about getting money,

and keeping money, in the pockets of people who keep this

commonwealth moving forward."

The plan calls for increasing state aid to cities and towns

by more than $63 million to $1.23 billion in the next fiscal

year. Chapter 70 state funding for public schools would also

rise to more than $6 billion next fiscal year under the

plan.

The Senate also calls for pumping more money into the

state's reserves or "rainy day" fund, bringing the fund to a

record level of $6.74 billion.

A key provision of the plan calls for spending $250 million

for pandemic-related state grants to buoy early education

and child care providers.

The spending package also contains policy changes, such as

making phone calls at state prisons and correctional

facilities and creating a $20 million fund to reimburse

county sheriffs for the costs.

Another provision seeks to provide legal protections for

reproductive and "gender-affirming" health care providers in

Massachusetts to shield them from potential lawsuits over

providing abortions and other services to out-of-state

residents, if the U.S. Supreme Court overturns the Roe v.

Wade ruling.

Over three days of debate, senators slogged through more

than 1,100 amendments to the spending package seeking

additional funding or changes in state policy. Many of the

amendments were packaged into large bundles that were

approved or rejected on single voice votes. About 500 were

approved.

While there are no wholesale tax or fee increases in the

spending bill, the Senate's Democratic majority rejected a

$700 million buffet of proposed tax cuts that were part of

Baker’s preliminary budget package filed in January.

Baker’s proposal called for adjusting state income tax laws

and boosting rent deductions to provide relief for

low-income residents, expanding tax credits for housing and

child care, and a major overhaul of the estate or "death"

tax.

Senate Republicans also made another push to suspend the

state's gas tax of 24 cents per gallon through Labor Day as

part of the budget deliberations, but the proposed

amendments were rejected by the Democratic majority, who

said they would affect the state’s bond rating and provide

minimal relief for motorists.

Senate Minority Leader Bruce Tarr, R-Gloucester, said the

state is awash with surplus revenue and can afford to

provide relief for consumers who are paying higher prices

for food, gas and other goods amid supply chain disruptions

and record-high inflation.

"We don't know if that inflationary number will change but

we know it's going to have a significant detrimental

effect," Tarr said in remarks Wednesday. "We have an

obligation to take these reasonable actions — a fraction of

one month of excess revenue — to respond and help them

weather the storm and gain a little bit of traction, survive

and prosper."

Ahead of this week's budget debate, Spilka said she wants to

pursue a tax relief package before the end of the session

but has not provided additional details.

On Wednesday, Senate Ways & Means Chairman Michael Rodrigues

defended the Democratic majority's rejection of the tax cuts

and pointed out that the Senate's spending plan includes

funding to help taxpayers struggling with higher costs.

"This body has not stood by and done nothing. We have done

enormous things to help," Rodrigues said in remarks during

the budget debate. "Just the fact that we're passing close

to a $50 billion budget with money for services that assist

every resident in education, child care, mental health,

health care."

Rodrigues argued that Baker's tax cuts are skewed toward the

state’s wealthiest and said the Senate intends to hold a

"comprehensive tax debate to ensure that those residents

that deserve it most will get the largest share of tax

breaks."

The Democratic-controlled House approved its version of the

budget two weeks ago after adding $130 million more in

spending to the plan.

House Republicans also sought to amend the spending package

to include parts of Baker’s tax cuts plan and a gas tax

holiday, but the proposals were rejected.

During closing remarks in the Senate budget debate, Tarr

walked across the chamber and handed Rodrigues a burlap

"taxpayer sack" with proposals to cut taxes.

"I'm hoping, in giving this to you, that within the next 40

days you will find a way to fill it with tax relief for the

citizens of the commonwealth," Tarr said.

Differences between the House and Senate versions of the

budget must be worked out by a yet-to-be appointed

conference committee of six lawmakers before heading to

Baker's desk for his review.

— Christian M. Wade covers

the Massachusetts Statehouse for North of Boston Media

Group’s newspapers and websites.

State House News

Service

Thursday, May 26, 2022

Mariano Says Gig Economy Getting “Free Pass”

Speaker Exploring New Revenues, On Top Of Tax Relief

By Colin A. Young

House Speaker Ronald Mariano said the House is working to

assemble a tax relief package by the end of July and that he

has a willing dance partner in the Senate, but he also

indicated Thursday that relief is not where the tax talk is

likely to end.

"We're gonna try and put some things together. There's still

two or three things that I'd like to do that I'm having the

numbers run through Revenue [Committee]. I want a more

equitable dispersal of the benefits and tax benefits,"

Mariano told reporters Thursday after addressing the Greater

Boston Chamber of Commerce.

The speaker, who has said for months that he is open to the

idea of tax relief without having advanced Gov. Charlie

Baker's proposals or outlined his own, said the idea of

changing the threshold at which the estate tax kicks in "was

something that jumped out at us right away," but otherwise

did not get into the details of what a House relief package

might look like.

Senate President Karen Spilka has also said that she wants

to get a tax relief bill through her chamber and said she

will turn her attention to the issue after the Senate budget

debate is over. Mariano said his conversations with Spilka

give him "the impression that she does want to do

something."

But while tax relief may dominate the tax-related talks

between now and the end of formal lawmaking in July, Mariano

said in his remarks to business groups Thursday that "it's

absolutely critical for the Legislature to continue to look

for new, smart ways to generate more revenue for the

commonwealth." He spoke specifically about sports betting

and the money that could bring in for the state, but he told

reporters after his speech that he has his eyes on other new

revenue sources.

"Well, yeah. I don't know if I should tell you right now

what they are," he joked when asked if he's eying any other

sources of state revenue. "There's a whole gig economy issue

and how we deal with some of those things, I think that's

ripe for some examination. I think we'd be silly to just

give them a free pass without looking at it."

Asked by a reporter if he has given any consideration to a

tax on services, the speaker said he had not "per se."

"But it's an interesting avenue to look at though and I will

take a look at that. I don't know exactly how you would

structure that and how we would identify these services, but

there may be something there," Mariano said.

Five years ago, when state tax revenues were falling short

of expectations and budget writers resorted to one-time

revenues to balance the budget, then-Senate President

Stanley Rosenberg floated the idea of a sales tax on

services to better capture what is happening in a state

economy that's largely driven by services. Since then, the

idea that's deeply unpopular with the business sector has

seldom surfaced on Beacon Hill.

"As you may remember, we had a service tax in Massachusetts

and it didn't last long," Rosenberg said in 2017, alluding

to a state sales tax on business and professional services

that was passed in late 1990 in the waning days of the

Dukakis administration but repealed by the incoming Weld

administration before it ever took effect. "So it's very

controversial, but our economy is even more reliant now than

it was then on services and it is certainly worth looking

at."

The last attempt in Massachusetts at establishing a sales

tax on services was the Legislature's short-lived 2013 law

subjecting certain computer services to the sales tax.

Lawmakers wound up repealing their so-called tech tax amid

an outcry from businesses.

Though the Legislature's involvement with it is complete, a

major tax policy proposal is in line to go before voters on

November's ballot. The proposed 4 percent surtax on annual

household income above $1 million is projected to bring in

about $1.3 billion a year that the proposal calls to be

spent on transportation and education.

State House News

Service

Monday, May 23, 2022

Surtax Opponents Warn Against Beacon Hill “Blank Check”

Opposition Campaign Forms, Accelerating Debate

By Colin A. Young

Opponents of the proposed surtax on household income over $1

million launched their campaign Monday morning to defeat the

Constitutional amendment on November's ballot, focusing on

the potential impact on small businesses and retirees as

well as the possibility that the Legislature treats the

estimated $1.3 billion in annual surtax revenue as a "blank

check."

The Coalition to Stop the Tax Hike Amendment, a group of

small businesses, chambers of commerce, some of the state's

most influential trade organizations, retirees and concerned

citizens, formally kicked off its anti-surtax efforts and

said its members have "united to communicate to voters the

damage this massive tax increase will have on our state's

economy."

"Proponents of the amendment claim that it will raise taxes

only on Massachusetts' highest earners, but in practice, it

will harm hardworking families across the state," Dan Cence,

a veteran lobbyist and political strategist and spokesperson

for the Coalition to Stop the Tax Hike Amendment, said.

"Massachusetts already has a budget surplus of billions of

dollars. We must work together to strengthen our economy and

ensure Massachusetts remains a place where small business

owners can thrive."

Massachusetts voters will be asked in November whether the

Massachusetts Constitution should be amended to impose a new

4 percent surtax on annual household income in excess of $1

million to raise money for education and transportation. The

change is proposed as a Constitutional amendment because the

state Constitution currently requires that a tax on income

be applied evenly to all residents.

If the surtax is approved, the first $1 million of household

income would still be taxed at the current 5 percent rate

and all household income above and beyond that first $1

million would be taxed at an effective rate of 9 percent.

Estimates put the annual revenue that could be generated by

the surtax at about $1.3 billion and supporters pitch the

idea as a way to provide a sustainable revenue source for

education and transportation without dipping further into

the pockets of most residents.

But the Coalition to Stop the Tax Hike Amendment and other

opponents have repeatedly highlighted how the so-called

millionaire's tax could affect people who might not

typically be thought of as millionaires, like small business

owners that file as pass-through entities for tax purposes

or people who plan to sell their company to support their

own retirement.

On its new website www.StopTheMATaxHike.com, the coalition

links to fact sheets targeted at two particular industries

-- real estate and construction -- with reasons those fields

should oppose the surtax ballot question.

"The Tax Hike Amendment is not just a tax on people making a

million dollars a year. It will also tax the nest eggs of

longtime homeowners and small business owners whose

retirement depends on their investments," the coalition

wrote on the fact sheets. "That is because, unlike federal

taxes, this amendment would treat one-time gains from

selling a home or business as regular income, pushing many

retirees and small business owners into the new higher tax

bracket, and nearly doubling their taxes."

Supporters of the surtax have said that concerns about its

effects on small business sales are overblown, pointing to a

March analysis from the left-leaning Massachusetts Budget

and Policy Center that said taxes would only be due on the

capital gain -- the increase in value over time -- rather

than the total price.

Rep. Jim O'Day, the House sponsor of the proposed

Constitutional amendment, last June rejected opponents'

claims that the surtax would unduly harm small businesses in

the Bay State by asserting that "businesses earning over a

million dollars, in my estimation, are not small

businesses."

In its launch Monday, the coalition also called attention to

the fact that while the amendment itself would require the

surtax revenue to be spent on transportation and education,

it would not necessarily lead to actual increases in

spending on transportation and education because future

Legislatures could stop appropriating money from other

revenue sources to those areas.

"As the former head of the MBTA, I know there is zero

guarantee that the money raised from this amendment will

increase education and transportation spending. Due to a

loophole in the amendment, 'subject to appropriation' means

legislators can take this money and use it for their own pet

projects -- it means giving Beacon Hill a blank check with

no accountability," Brian Shortsleeve, a former general

manager at the T who has since founded M33 Growth, said.

Lisa Alcock, a former public school teacher, echoed the same

sentiment in her comments on the coalition's website. She

said the amendment is "deceptive" and that "the politicians

who put this on the ballot are giving themselves a blank