|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

48 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Sunday, May 15, 2022

Proposed $49.68

Billion Senate Budget — Still No Tax Relief

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

The state

Senate, not to be outdone by their colleagues in the

House, unveiled a budget just slightly closer to $50

billion on Tuesday, which senators said focused on

fiscal matters and was light on policy.

“I’m happy

to say the commonwealth remains in a strong fiscal

position at this time,” Senate President Karen

Spilka said as the Ways and Means Committee unveiled

their spending plan.

Coming in

at a total of $49.68 billion, the Senate’s fiscal

plan for 2023 tops Gov. Charlie Baker’s January

proposal by over $1 billion and last year’s spending

by $2 billion....

Senators

have until next week to submit amendments and

Rodrigues said he hopes a vote to approve the budget

will occur the Thursday after debate begins on May

24.

The

Boston Herald

Tuesday, May 10, 2022

Senate budget approaches $50

billion

Gov.

Charlie Baker’s tax cuts aren’t necessarily dead in

the Senate, but the Ways and Means Committee on

Tuesday revealed a budget that ignored them.

“We

haven’t had serious discussions about tax changes,”

Chairman Michael Rodrigues said. “We’ll have a

holistic discussion and debate on that in the

future.” ...

Baker’s

January budget was filed alongside a tax cut

proposal his administration expects would cost about

$700 million.

The

Legislature hasn’t let the plan leave committee, but

an April tax revenue report showing a $2 billion tax

surplus had Senate President Karen Spilka suddenly

calling on members to pursue tax relief this

legislative session, which ends July 31.

“While the

details remain to be worked out, I believe we can

safely balance targeted spending investments to a

number of crucial areas, such as housing, childcare

and higher education, with tax relief for

individuals and families who are feeling the effects

of inflation and continued economic disruption,”

Spilka said in a statement following the revenue

report.

Tuesday’s

budget could have been a good place to start the tax

relief process, but Rodrigues said his committee

didn’t consider the governor’s plan.

The

Boston Herald

Tuesday, May 10, 2022

Senate passes on tax relief,

may consider before session end

Senate

leaders on Tuesday rolled out a $49.68 billion state

budget proposal for the fiscal year that begins in

July, touting investments they said would help

families living in deep poverty and share the

state's influx of cash with cities and towns.

The Senate

Ways and Means Committee's fiscal 2023 budget clocks

in below the $49.73 billion version the House passed

last month after adding millions in spending through

the amendment process. It represents a $2.07 billion

increase over this fiscal year's budget, and

proposes to spend $1.45 billion more than the budget

Gov. Charlie Baker filed in January.

The

committee approved the bill on a voice vote during a

virtual executive session Tuesday afternoon, with

Minority Leader Bruce Tarr reserving his rights and

not taking a stance for or against the budget. Tarr

said his lack of a vote was "not an indication of

disapproval" but that he was still wading through

the document to understand its nuances.

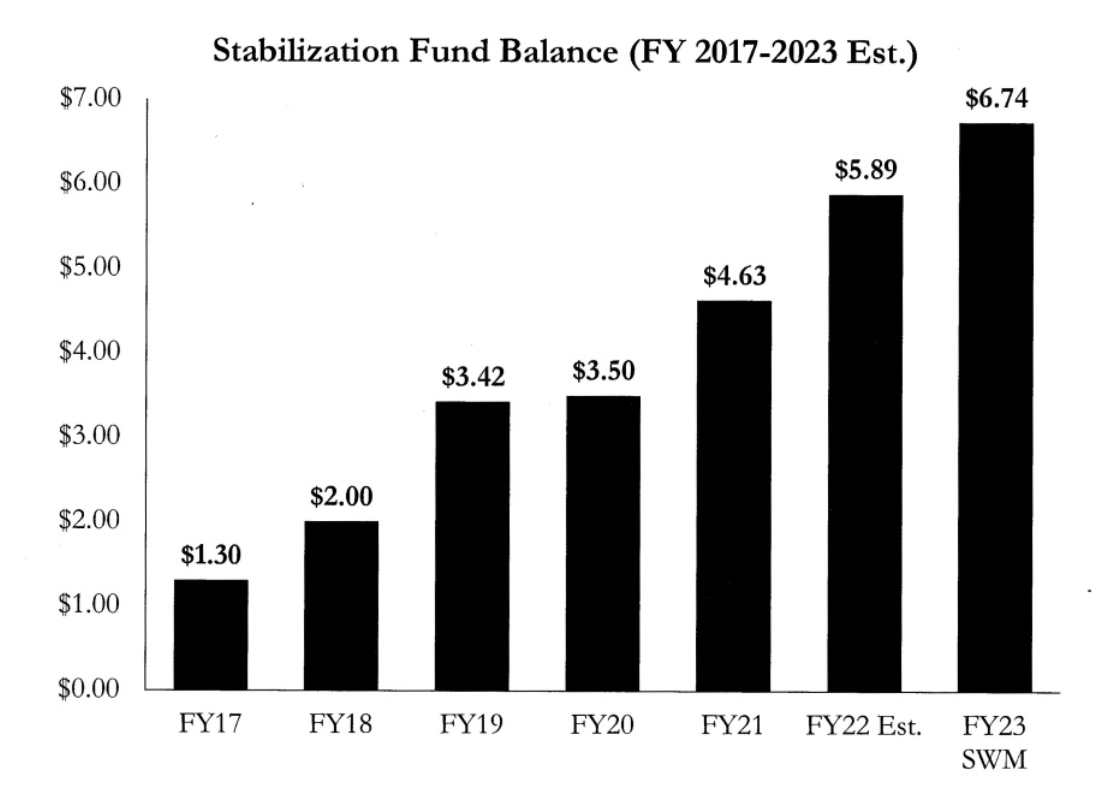

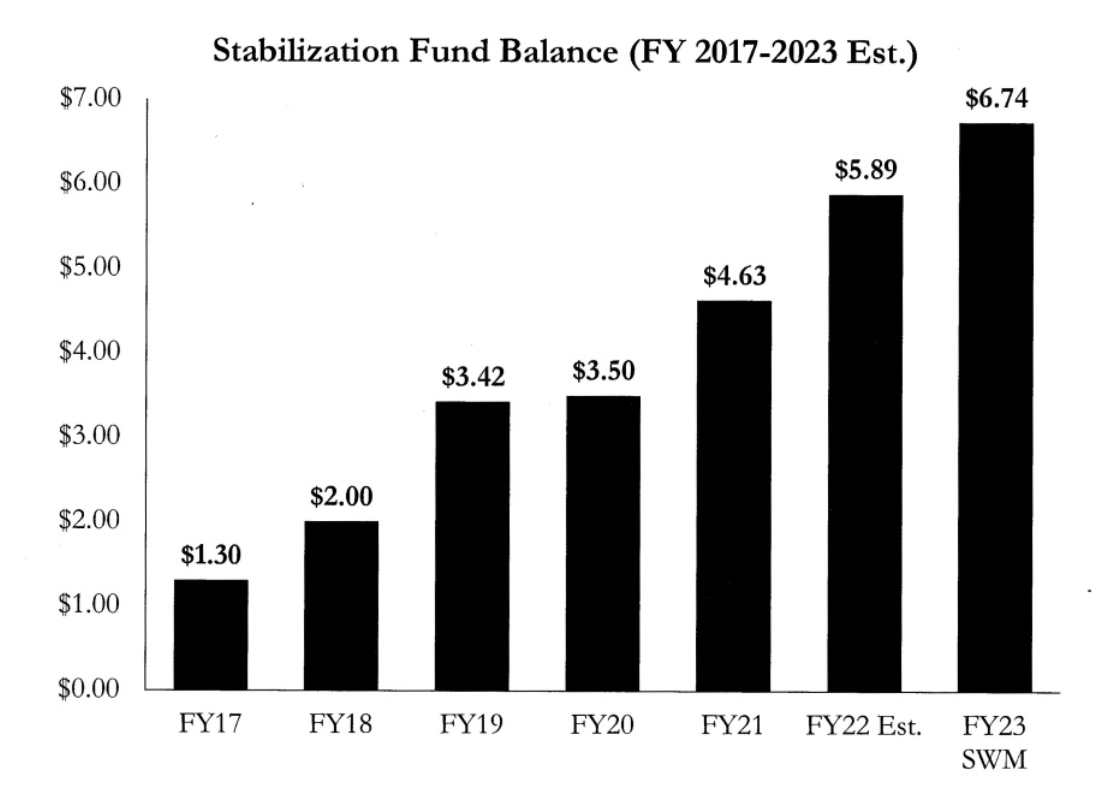

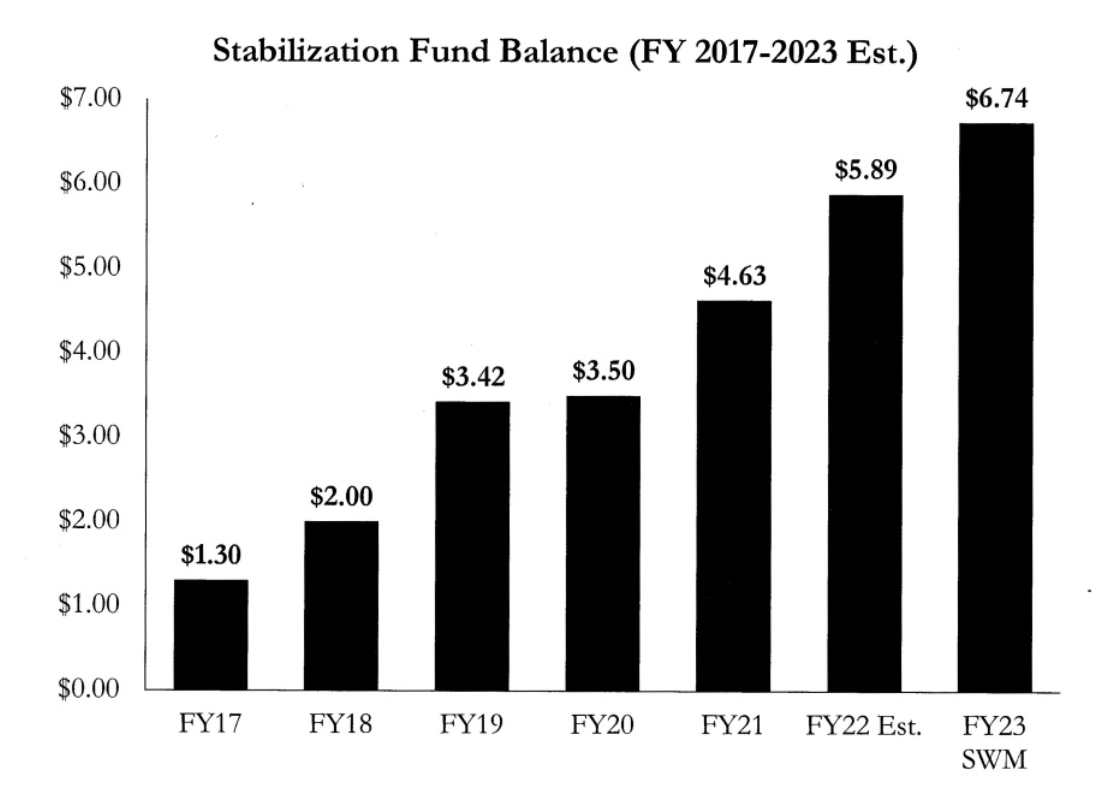

The

Senate's bill would boost the balance of the state's

stabilization fund to $6.74 billion by the end of

fiscal 2023, above the $6.55 billion envisioned in

the House's plan.

Senate

Ways and Means Chairman Michael Rodrigues said one

of his goals when he stepped into the helm of the

budget-writing committee in 2019 was to ensure the

rainy day fund's balance "rises to a point that will

sustain us throughout the next recession." ...

Like the

House, the Senate Ways and Means Committee did not

pursue Baker's nearly $700 million tax relief

package inside its budget.

Senate

President Karen Spilka said last week that she had

directed Senate leaders to work on a tax relief

package for this session, and that she looked

forward to working with the House to explore that

"after the conclusion of the Senate budget."

Spilka's

comments came after the state in April took in more

than $2 billion above what was expected in revenue

collections for that month alone, bolstering what is

on track to be a major surplus for fiscal 2022.

State

House News Service

Tuesday, May 10, 2022

Senate Dems Double Planned

Boost To Local Aid Pot

$49.7 Billion Budget Envisions $6.74 Bil Rainy Day

Fund

The

Senate's three Republicans plan to propose adding

"targeted tax relief" measures into next year's

budget, Minority Leader Bruce Tarr said after top

Democrats unveiled a $49.7 billion spending plan

Tuesday.

The Senate

plans to debate its fiscal year 2023 budget starting

May 23. Like the spending bill the House passed in

March, it does not include any broad-based tax hikes

or the nearly $700 million in tax breaks that Gov.

Charlie Baker proposed alongside his budget

recommendations.

Tarr, a

Gloucester Republican, serves on the Ways and Means

Committee but reserved his rights when the committee

voted to advance the bill, meaning he did not stake

out a position for or against it. He said he wanted

more time to wade through the bill's details....

Senate

President Karen Spilka has said she wants to pursue

some sort of tax relief after the late May budget

debate.

Asked

Tuesday if the Senate would consider revenue-related

amendments or if senators will be asked to hold

their ideas for the later discussion, Ways and Means

Chairman Sen. Michael Rodrigues said, "We will

consider every and any amendment that a senator

files, but at this point in time, we're going to

stick with the same consensus revenue number as the

House and the governor used to compile the FY '23

budget."

State

House News Service

Tuesday, May 10, 2022

Senate GOP Plans Tax

Relief Budget Push

Massachusetts Senate leaders on Tuesday released a

$50 billion budget plan that pours hundreds of

millions of more state dollars into child care but,

like their House counterparts, included no proposed

tax breaks or cuts. Amid surging inflation, one top

senator said his colleagues have not yet had

“serious discussions” about the contours of a

potential package.

Senate

President Karen E. Spilka last week called for the

Senate to pursue a tax relief bill following its

budget debate, indicating any plan, should it

emerge, would likely not surface until at least

June. But the prospect of one continues to hover

over Beacon Hill’s annual budget, a version of which

the House passed last month and typically isn’t

finalized until after the next fiscal year begins on

July 1.

Senator

Michael J. Rodrigues, the chamber’s budget chief,

told reporters Tuesday that the Senate would focus

any proposal on putting “money back into the pockets

of our working families.” Still, the Westport

Democrat gave no indication how closely a proposal

could hew to the more than $700 million in tax

breaks Governor Charlie Baker has sought amid both

record state revenues and 40-year highs in

inflation....

In the

wake of a leaked Supreme Court draft opinion that

indicated the court is poised to overturn Roe v.

Wade, the Senate budget also creates a new line item

to support abortion services with $2 million in new

funding. The House had set aside $500,000 in its

plan.

The Senate

is expected to debate and add to its budget plan in

two weeks, when its bottom line will likely grow

further. The version released Tuesday did not

include several policy proposals the House had

sought, including one requiring all jails and

prisons make phone calls free for prisoners and

their families — something only one other state

currently mandates — or another dedicating $110

million to extend a free school meals initiative

currently covered by an expiring federal program.

But it

doesn’t mean those provisions will not ultimately

survive. The state is awash in money, with tax

revenues in April alone surging past predictions by

more than $2 billion, potentially giving lawmakers

flexibility to adopt the chambers’ different

priorities, should they opt to, instead of having to

choose some Senate and some House favorites.

Rodrigues,

who will likely lead the chamber’s budget

negotiations with the House, said he, too, has “no

objection” to those House proposals, but rather said

he sought to limit the number of policy changes his

office tucked into the spending plan.

The

Boston Globe

Tuesday, May 10, 2022

Mass. Senate

leaders unveil $50 billion budget;

tax break talks in ‘near future’

By Matt Stout

Massachusetts budget writers are planning to push

the balance of the state's rainy day fund well

beyond the rule of thumb that says a state should

keep 10 percent of budgeted funds in reserve, part

of a trend that Pew analysts have seen across the

country since the start of the pandemic.

There was

$4.63 billion in the state's stabilization fund at

the end of fiscal year 2021 and that balance is

expected to grow to between $5.76 billion and $5.89

billion by the end of the current fiscal 2022 budget

year. The House budget for fiscal 2023 would see the

state's savings account rise to $6.55 billion while

the Senate's plan would boost the fund up to $6.74

billion.

In either

case, Massachusetts would have more than 13 percent

of annual budget spending stashed away in case of

economic calamity.

While

there is no one-size-fits-all rule for how much a

state should hold in reserve, 10 percent of budgeted

spending has long been considered an ideal target.

Before the

pandemic, Massachusetts was short of that target. At

the end of fiscal 2020, the stabilization fund

balance of $3.5 billion was only 8 percent of that

year's $43.321 billion budget....

The

alternatives to socking so much money away include

spending it to address unmet needs or adopting tax

relief or incentives to help Massachusetts residents

or make the state more competitive with other

states.

State

House News Service

Wednesday, May 11, 2022

Mass. Not Alone In Bulking Up

Its Savings

State

House News Service Graph

If you’re

waiting for Democrats in the Legislature to send a

tax cut to Gov. Charlie Baker, you’re going to have

to wait a little longer.

Like eight

months.

That’s

when the lame duck Baker will be gone and the new

governor — most likely a Democrat — will take over

and get credit for the accomplishments.

Sound

petty and political?

Of course.

But that’s how the Legislature has always operated.

Baker — to

his credit — has been aggressively pushing his

agenda for the last few months despite the fact that

he’ll soon be relegated to some high-paying job in

the private sector.

But it’s

clear the Democratic-led Legislature wants nothing

to do with giving Baker — who is essentially a

Democrat in all but name — any parting gifts on the

way out the door.

Instead,

Baker is going out presiding over steep inflation

and sky-high gas prices, despite the fact the

Legislature is holding onto billions of dollars in

federal COVID relief and a massive budget surplus

that could be helping people pay bills right now....

It’s

self-imposed gridlock....

“We’re

still in May, but it looks like we’re going to have

a very large surplus for the close of the year. That

certainly gives us an opportunity to not have to be

completely in a rush to spend all the ARPA money,”

House Ways and Means Chairman Aaron Michlewitz told

State House News Service.

As far as

a tax cut goes, don’t hold your breath for lawmakers

to pass what Baker has proposed or anything like it.

A gas tax cut like Republicans have proposed? Ha.

Good one.

“All

options are going to be considered,” said Michlewitz,

who may or may not have been laughing when he

uttered that....

It’s a

perfect example of why the Massachusetts Legislature

has too much power and the governor has to kowtow to

them. Speaker of the House Ronald Mariano has much

more power than Baker. He controls all his

Democratic House members who do what they’re told.

And the

Republican governor sits waiting and waiting for

action. It’s something he’s gotten good at.

The

Boston Herald

Saturday, May 14, 2022

Lame duck Charlie Baker waits

for petty Legislature to act

By Joe Battenfeld

Charlie

Baker won't be giving up the corner office until

early next year, but it takes two to tango and the

governor's lawmaking dance partners in the

Legislature are going to put a lid on major work in

less than three months. So what's his top priority?

"I don't

really think I have a top priority here. I have a

lot of priorities," Baker told WBUR's "Radio Boston"

on Thursday.

The

chaotic dash to the end of Baker's first legislative

session, in 2016, featured what the governor dubbed

the "Big Six" bills. This year's sprint to July 31,

Baker's last as governor, might come closer to

fitting the "Baker's Dozen" label. (Not to be

confused with 2010 candidate Baker's reform

proposals.)

His $3.5

billion economic development bill, his $9.7 billion

infrastructure package meant to maximize the impact

of significant federal funding, and a tax cut

package were the few pieces of legislation that

Baker mentioned specifically on WBUR, but there's

plenty more that could hit his desk in the coming

months....

Oh, and

there will be all the fun associated with the annual

state budget, which is supposed to be done by June

30 but has lately lingered into July.

Senate

Democrats unfurled their spending plan for fiscal

year 2023 this week, seeking to double the increase

in local aid and further pump up the state's rainy

day fund while tax collections are surging. The

$49.68 billion state budget proposal is likely to

swell as senators work through the 1,178 amendments

filed for consideration when debate starts on May

24.

Democrats

in both branches are keeping those tax cuts that

Baker wants to sign into law on the back burner

during budget season, but expect the Senate's

"Minority Crescent" to make another push to include

taxpayer relief in the annual spending bill.

Another

group this week launched its own tax policy effort:

the ballot campaign to convince voters to impose a

new 4 percent surtax on households that earn more

than $1 million a year. The surtax is projected to

raise about $1.3 billion a year, which the

Constitutional amendment calls for spending on

education and transportation....

The

Department of Transportation raked in $306.5 million

from roadway tolls through the first three quarters

of fiscal year 222, almost $70 million more than was

collected during the same period a year earlier.

MassDOT officials now expect to bring in about 95

percent as much toll revenue this year as they did

in the last year before the pandemic upended driving

habits.

State

House News Service

Friday, May 13, 2022

Weekly Roundup - Baker’s Last

Legislative Laundry List

Come

November, Republicans in Massachusetts are at risk

of being swept in statewide races, including the

contest for governor, and seeing their minority

ranks in the Legislature shrink even further.

With that

backdrop, party members will spend next week gearing

up for their election-year nominating convention in

Springfield and testing out messages they hope will

resonate with voters. Only two of the statewide

races that will feature at the convention have

multiple Republican candidates: the contest for

governor, which involves former Rep. Geoff Diehl and

businessman Chris Doughty, and for lieutenant

governor, where a pair of former reps, Leah Cole

Allen and Kate Campanale, will face off.

The other

hopefuls -- attorney general candidate Jay McMahon,

secretary of state candidate Rayla Campbell, and

auditor candidate Anthony Amore -- are all

positioned as presumptive Republican nominees.

GOP Gov.

Charlie Baker and Lt. Gov. Karyn Polito are calling

it quits this year, and Democrats are feeling good

about retaking the governor's office....

In a WBUR

radio interview Thursday, Baker took an apolitical

approach when asked about the future of his party.

Instead of talking up Republicans, Baker, without

mentioning any party, said he would support

candidates he believes in and urged a place at

policymaking tables in Massachusetts and nationwide

for "moderates." ...

Back on

Beacon Hill, top Democrats appear in no rush to wrap

up work on multiple bills they have already passed

in some form or named as priorities. Most of the

major pieces on the Legislature's board for the

final two and a half months of formal sessions,

including tax breaks and a pair of

multibillion-dollar bills targeting infrastructure

and economic development, did not move at all over

the past week. As Speaker Ronald Mariano put it in

February: "There's 'legislative' quickly and then

there's 'press' quickly."

Something

is brewing in the House, which plans to meet in

back-to-back formal sessions on Wednesday and

Thursday, but Mariano's office did not make clear by

the end of the day Friday what bills it would bring

forward. Senators will have a light workload next

week, allowing the Ways and Means Committee and

Senate leaders to work through the 1,178 amendments

filed to the chamber's $49.68 billion fiscal 2023

budget bill ahead of the start of debate on May 24.

State

House News Service

Friday, May 13, 2022

Advances - Week of May 15, 2022

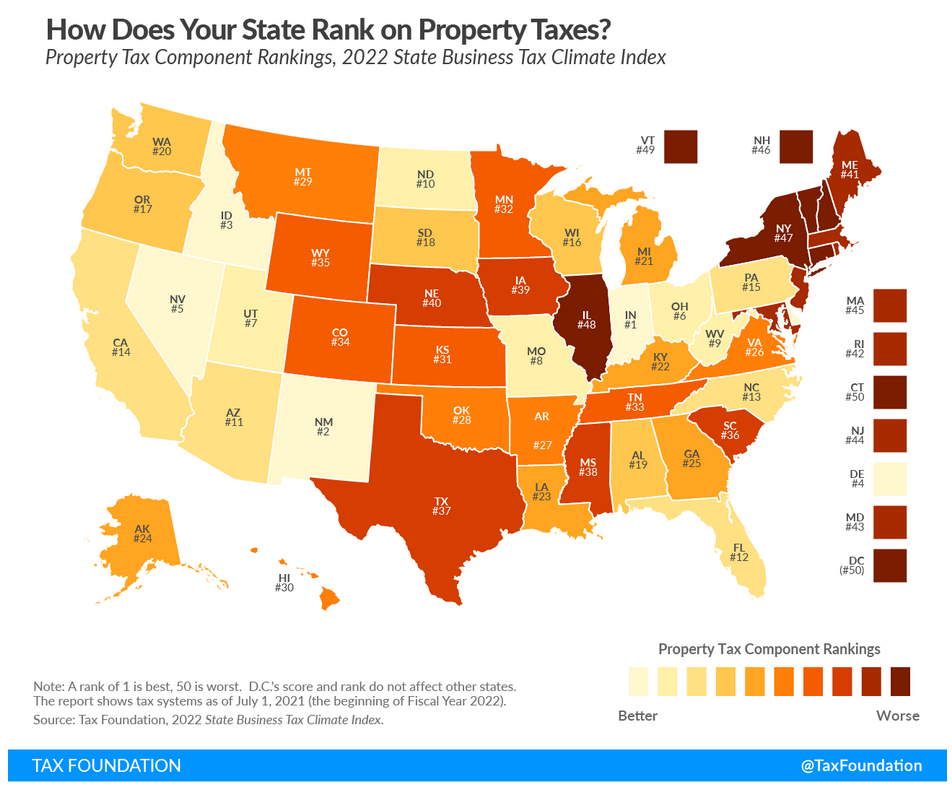

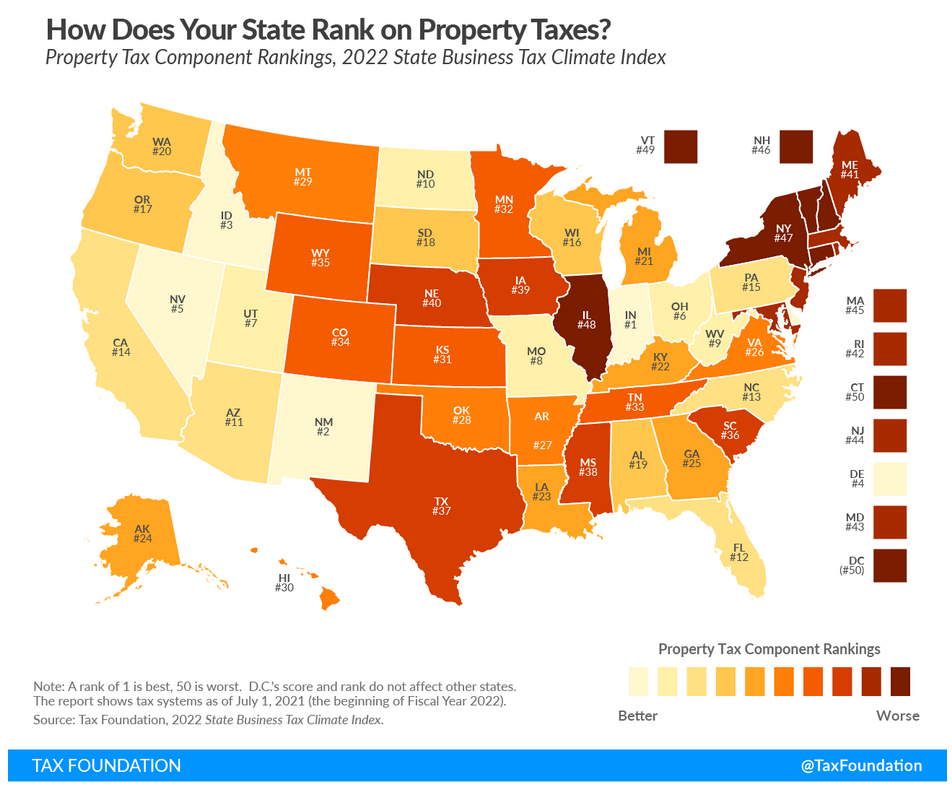

Massachusetts ranked among the worst states in the

country on property tax competitiveness, according

to an assessment released Tuesday by a group that

favors tax policies that it says will spur economic

growth.

The new

map

released by the nonprofit Tax Foundation ranks

states on the property tax, which is one component

of the group's 2022 State Business Tax Climate

Index. The property tax component evaluates state

and local taxes on real and personal property, net

worth, and asset transfers.

"The

states with the best scores on the property tax

component are Indiana, New Mexico, Idaho, Delaware,

Nevada, and Ohio," the foundation said. "States with

the worst scores on this component are Connecticut,

Vermont, Illinois, New York, New Hampshire,

Massachusetts, New Jersey, plus the District of

Columbia."

Along with

income and sales taxes, property taxes account for a

big share of government tax revenue in Massachusetts

and growth in property taxes is limited by a ballot

law approved in 1980.

State

House News Service

Tuesday, May 10, 2022

Tax Foundation: Mass.

Among “Worst States” For Property Taxes

Speaker

after speaker told a joint legislative committee

considering an economic development proposal which

would also grab billions in federal funding the same

thing Monday morning: the bill needs to pass and it

must pass now.

“Right now

we have the ability to create the building blocks of

success,” Brockton Mayor Robert Sullivan told the

committee. “We need to make sure that the money is

spent wisely, and that we get the biggest bang for

the buck. That’s what my nana used to say.”

Under

consideration is Gov. Charlie Baker’s Future

Opportunities for Resiliency, Workforce, and

Revitalized Downtowns Act, or FORWARD, a $3.5

billion investment plan he says the hundreds of

cities and towns across the commonwealth need to

compete in the future and in a world where the

nature of where people work has changed entirely.

Time, the

Governor and nearly every other speaker before the

Joint Committee on Economic Development and Emerging

Technologies said, is not on anyone’s side.

“If we

don’t get those dollars into the hands of cities and

towns across the state – now so that they can begin

the process associated with planning, designing and

reimagining and jump-starting their local economies

and their downtowns – we’ll continue to see empty

storefronts and quiet main streets for years to

come,” Gov. Charlie Baker said.

That’s not

the only problem.

A huge

portion of that $3.5 billion would be funded by $2.3

billion from the American Rescue Plan Act, with the

balance covered by $1.2 billion in capital bond

authorizations.

ARPA funds

must be committed by states by the end of 2024 and

spent by the end of 2026. The law prioritizes

investing in projects that are defined and narrow in

scope so they can be completed on time.

The

Boston Herald

Monday, May 9, 2022

Charlie Baker’s $3.5

billion development plan moves forward

Reproductive health funding that state lawmakers are

proposing in next year's state budget is a "good

place to start," according to Gov. Charlie Baker,

who said Thursday that he has talked with lawmakers

about how to support women in other states if the

Supreme Court overturns Roe v. Wade....

On

Thursday, Baker said he had "talked to colleagues of

mine in the Legislature about what, if anything, we

need to do to be able to support people who are

seeking those kinds of services and can't get them

where they live."

The budget

the House passed in April includes $500,000 toward

"improving reproductive health care access,

infrastructure and security," including grants to

three abortion funds. Senate Democrats this week

rolled out a $49.7 billion spending plan that bumps

that amount to $2 million and creates a dedicated

line item for it.

"And I

think that's a good place to start but we need to

see a decision before we decide what else we might

be able to help with," Baker said of two funding

proposals. "But I think this is something that

should be a high priority for us."

State

House News Service

Thursday, May 12, 2022

Baker, Lawmakers In Talks

About Abortion Action

Aid To People Arriving From Out Of State Under

Discussion |

Chip Ford's CLT

Commentary |

|

The State House News Service reported on Tuesday ("Senate

Dems Double Planned Boost To Local Aid Pot; $49.7 Billion Budget

Envisions $6.74 Bil Rainy Day Fund"):

Senate leaders on Tuesday

rolled out a $49.68 billion state budget

proposal for the fiscal year that begins in

July, touting investments they said would help

families living in deep poverty and share the

state's influx of cash with cities and towns.

The Senate Ways and Means

Committee's fiscal 2023 budget clocks in below

the $49.73 billion version the House passed last

month after adding millions in spending through

the amendment process. It represents a $2.07

billion increase over this fiscal year's budget,

and proposes to spend $1.45 billion more than

the budget Gov. Charlie Baker filed in

January....

Like the House, the Senate

Ways and Means Committee did not pursue Baker's

nearly $700 million tax relief package inside

its budget.

Senate President Karen

Spilka said last week that she had directed

Senate leaders to work on a tax relief package

for this session, and that she looked forward to

working with the House to explore that "after

the conclusion of the Senate budget."

Spilka's comments came

after the state in April took in more than $2

billion above what was expected in revenue

collections for that month alone, bolstering

what is on track to be a major surplus for

fiscal 2022.

In its Weekly Roundup on Friday the

News Service added:

"The

$49.68 billion state budget proposal is likely to swell as

senators work through the 1,178 amendments filed for

consideration when debate starts on May 24."

The Boston Globe in its report on Tuesday ("Mass.

Senate leaders unveil $50 billion budget; tax break talks in ‘near

future’") further noted:

The Senate is expected to

debate and add to its budget plan in two weeks,

when its bottom line will likely grow further.

The version released Tuesday did not include

several policy proposals the House had sought,

including one requiring all jails and prisons

make phone calls free for prisoners and their

families — something only one other state

currently mandates — or another dedicating $110

million to extend a free school meals initiative

currently covered by an expiring federal

program.

But it doesn’t mean those

provisions will not ultimately survive. The

state is awash in money, with tax revenues in

April alone surging past predictions by more

than $2 billion, potentially giving lawmakers

flexibility to adopt the chambers’ different

priorities, should they opt to, instead of

having to choose some Senate and some House

favorites.

Rodrigues, who will likely

lead the chamber’s budget negotiations with the

House, said he, too, has “no objection” to those

House proposals, but rather said he sought to

limit the number of policy changes his office

tucked into the spending plan.

There is little if any

doubt that the next fiscal year's final budget will exceed $50

Billion. The only real question I see is, by how much?

The House approved its

$49.7 Billion budget on April 27. The Senate will begin debate

on its own $49.68 Billion FY 2023 budget on May 24. $49.7

Billion, $49.68 Billion: call it a tiny rounding error. This

Senate budget starts off with spending $2.07 billion more than this

fiscal year's budget, $1.45 billion more than the budget Gov. Baker

presented in January.

With the state choking on

the historic over-taxation revenue surplus, don't expect much

compromising to happen when the House and Senate budgets are

completed and go to a joint conference committee. The State

House News Service reported on Tuesday ("Senate

Dems Double Planned Boost To Local Aid Pot; $49.7 Billion Budget

Envisions $6.74 Bil Rainy Day Fund"):

The Senate budget also does not

include House measures extending free, universal school meals

for another year, making phone calls free for incarcerated

people and banning child marriage.

Senators could

propose any of those House-backed policy measures as amendments,

and Rodrigues noted that the Senate has previously voted to

outlaw child marriage.

The Westport

Democrat said he had no objection to the school meals and prison

call sections but "just haven't included them" in the spending

bill.

"We focus on fiscal

matters in our budget," he said, saying the committee goes

"very, very light" on policy sections in the spending bill.

One policy section the

Senate included proposes "one narrowly

focused tax relief measure," according to the News Service. "It

would permanently exempt forgiven student loans from being treated

as taxable income."

It's not easy spending

$2.07 billion more than the current fiscal year's budget but "The

Best Legislature Money Can Buy" has managed to pull it off.

The House budget proposed spending $500,000 and

the Senate upped that to $2 million

to welcome and subsidize out-of-state "birthing persons" (or would

that be un-birthing persons?) if Roe vs. Wade is overturned

by the U.S. Supreme Court. Along with the generosity of the

Massachusetts Legislature (funded entirely by taxpayers) having

successfully made the commonwealth a magnet for illegal immigrants,

it now intends to do the same for a potentially more restrictive

abortion market.

Even legislators are

struggling to spend it all, so what they're unable to squander now

they will stash away for a "rainy day" —

meaning a time when they can come up with a way to spend

more. It's not as if the state's stabilization fund is running

on empty. The fact is it is burgeoning fatter than ever

before, even as spending is being increased by $2 Billion. Has

there ever been a starker example of "More Is Never Enough (MINE)

and never will be"?

State

House News Service Graph

They will do whatever it

takes to avoid returning any of that obscene over-taxation surplus

to its rightful owners, the over-taxed producers.

“While the details remain

to be worked out, I believe we can safely balance targeted spending

investments to a number of crucial areas, such as housing, childcare

and higher education, with tax relief for individuals and families

who are feeling the effects of inflation and continued economic

disruption.” — Senate President

Karen Spilka

“I think when we talk about tax relief we’re going to talk about

working families and what puts money in the pockets of working

families.” — Senate Ways and Means

Committee Chairman Michael Rodrigues

That's not tax relief to

the rightful owners, the producers of most if not all of that

over-taxation. That is classic redistribution of wealth

— more spending, not tax relief.

For example, permanent exemption of forgiven student loans being

taxed as income is not tax relief — it is the

productive taxpayer paying twice for the benefit of all those

college student deadbeats.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

The Boston

Herald

Tuesday, May 10, 2022

Senate budget approaches $50 billion

By Matthew Medsger

The state Senate, not to be outdone by their colleagues in

the House, unveiled a budget just slightly closer to $50

billion on Tuesday, which senators said focused on fiscal

matters and was light on policy.

“I’m happy to say the commonwealth remains in a strong

fiscal position at this time,” Senate President Karen Spilka

said as the Ways and Means Committee unveiled their spending

plan.

Coming in at a total of $49.68 billion, the Senate’s fiscal

plan for 2023 tops Gov. Charlie Baker’s January proposal by

over $1 billion and last year’s spending by $2 billion.

“This budget makes meaningful investments in early education

and child care, K-12 schools, public higher education,

mental health and substance use disorder treatment, housing,

and individuals and families living in deep poverty. We will

only succeed as a commonwealth if we all rise together, and

this budget ensures that no one gets left behind,” Spilka

said.

About $18.5 billion will go to fund MassHealth, half a

billion of which will go to the Department of Mental Health

to combat substance abuse disorders and mental health

broadly.

“Simply put, this will save lives,” Spilka said.

The Senate’s budget does not include some provisions

included by the House, like funding for prisoners’ phone

calls, or other wedge issues like free school lunches.

Chairman Michael Rodrigues said he isn’t against those

programs, but that those sorts of things weren’t under

consideration right now.

“We are pretty light on policy; I focused on the budget, on

fiscal matters,” he said.

The budget does include increased spending on reproductive

health, $2 million, which Rodrigues said would be used for

security and infrastructure at reproductive health

facilities, not direct funding of abortions.

The funding was added as a line item to the budget,

suggesting it may receive funding in future budgets.

Rodrigues acknowledged that may be the case.

“It is something that we think there is going to be

continual requirements for – hope not – but we think it’s a

very strong possibility these funds will be needed in the

future,” he said.

The budget invests $1.35 billion in the care economy, with

$300 million earmarked for child care initiatives and spends

$900 million on affordable housing programs.

Senators have until next week to submit amendments and

Rodrigues said he hopes a vote to approve the budget will

occur the Thursday after debate begins on May 24.

The Boston

Herald

Tuesday, May 10, 2022

Senate passes on tax relief, may consider before session end

By Matthew Medsger

Gov. Charlie Baker’s tax cuts aren’t necessarily dead in the

Senate, but the Ways and Means Committee on Tuesday revealed

a budget that ignored them.

“We haven’t had serious discussions about tax changes,”

Chairman Michael Rodrigues said. “We’ll have a holistic

discussion and debate on that in the future.”

The Senate’s budget proposal, all $49.68 billion of it,

focuses more on matters of money than on political

priorities, Rodriguez said.

“We focus on fiscal matters in our budget, we are very light

on policy,” he said.

Baker’s January budget was filed alongside a tax cut

proposal his administration expects would cost about $700

million.

The Legislature hasn’t let the plan leave committee, but an

April tax revenue report showing a $2 billion tax surplus

had Senate President Karen Spilka suddenly calling on

members to pursue tax relief this legislative session, which

ends July 31.

“While the details remain to be worked out, I believe we can

safely balance targeted spending investments to a number of

crucial areas, such as housing, childcare and higher

education, with tax relief for individuals and families who

are feeling the effects of inflation and continued economic

disruption,” Spilka said in a statement following the

revenue report.

Tuesday’s budget could have been a good place to start the

tax relief process, but Rodrigues said his committee didn’t

consider the governor’s plan.

“I haven’t analyzed the good, the bad and the ugly of the

governor’s tax proposals,” he said.

“I think when we talk about tax relief we’re going to talk

about working families and what puts money in the pockets of

working families,” he said.

Baker had proposed tax relief for renters, a lowering of the

property tax ‘circuit breaker’ for seniors, adoption of

no-tax status to match federal levels for low earners, and a

lowering of the state’s capital gains and estate taxes.

The Massachusetts Taxpayers Foundation, a nonpartisan

watchdog group, endorsed Baker’s plan, calling it the right

move to keep the commonwealth competitive.

Rodrigues seemed to indicate the Senate would have plans of

its own for tax relief.

“The governor has submitted a number of good ideas,” he

said. “But the governor doesn’t have a monopoly on good

ideas.”

The House’s budget also left that chamber without any tax

relief plans.

The two chambers will need to work out their differences

before sending the budget to Baker. The Senate will begin

debate on amendments on May 24, Rodrigues said.

State House News

Service

Tuesday, May 10, 2022

Senate Dems Double Planned Boost To Local Aid Pot

$49.7 Billion Budget Envisions $6.74 Bil Rainy Day Fund

By Katie Lannan

Senate leaders on Tuesday rolled out a $49.68 billion state

budget proposal for the fiscal year that begins in July,

touting investments they said would help families living in

deep poverty and share the state's influx of cash with

cities and towns.

The Senate Ways and Means Committee's fiscal 2023 budget

clocks in below the $49.73 billion version the House passed

last month after adding millions in spending through the

amendment process. It represents a $2.07 billion increase

over this fiscal year's budget, and proposes to spend $1.45

billion more than the budget Gov. Charlie Baker filed in

January.

The committee approved the bill on a voice vote during a

virtual executive session Tuesday afternoon, with Minority

Leader Bruce Tarr reserving his rights and not taking a

stance for or against the budget. Tarr said his lack of a

vote was "not an indication of disapproval" but that he was

still wading through the document to understand its nuances.

The Senate's bill would boost the balance of the state's

stabilization fund to $6.74 billion by the end of fiscal

2023, above the $6.55 billion envisioned in the House's

plan.

Senate Ways and Means Chairman Michael Rodrigues said one of

his goals when he stepped into the helm of the

budget-writing committee in 2019 was to ensure the rainy day

fund's balance "rises to a point that will sustain us

throughout the next recession."

"We all know these economies are cyclical and we're riding a

very good wave right now of revenues, but there are

certainly storm clouds on the horizon and every economist

that we speak to warned of, you know, the r-word in the next

calendar year," he said.

Major investments that Rodrigues and Senate President Karen

Spilka highlighted include $250 million to continue the

Commonwealth Cares for Children stabilization grant program

for early education providers through the end of this year,

and a boost in unrestricted general government aid beyond

the level proposed by both Baker and the House.

Baker has made a practice of raising unrestricted local

government aid at a level that matches the anticipated

growth in state revenues.

His bill and the House's budget both use that approach, with

a $31.5 million or 2.7 percent increase in the unrestricted

general government aid line item. The Senate's bill doubles

that increase to $63.1 million, for a total $1.23 billion in

UGGA money.

"I think if I had words to describe this budget it would be

'inclusiveness' and 'sharing,'" Rodrigues said. "Because of

the fact that we have seen some robust revenues over the

last year or so, we wanted to ensure that we share those

with our local communities, many of whom are struggling at

their level."

The Senate budget matches the House with $6 billion in

Chapter 70 aid to local schools and an increase in the

per-pupil minimum aid amount from $30 to $60. On the higher

education front, it includes $175 million for scholarships,

$648 million for the University of Massachusetts system,

$337.8 million for community colleges and $327.1 million for

state universities.

Like the House, the Senate Ways and Means Committee did not

pursue Baker's nearly $700 million tax relief package inside

its budget.

Senate President Karen Spilka said last week that she had

directed Senate leaders to work on a tax relief package for

this session, and that she looked forward to working with

the House to explore that "after the conclusion of the

Senate budget."

Spilka's comments came after the state in April took in more

than $2 billion above what was expected in revenue

collections for that month alone, bolstering what is on

track to be a major surplus for fiscal 2022.

The Senate budget also does not include House measures

extending free, universal school meals for another year,

making phone calls free for incarcerated people and banning

child marriage.

Senators could propose any of those House-backed policy

measures as amendments, and Rodrigues noted that the Senate

has previously voted to outlaw child marriage.

The Westport Democrat said he had no objection to the school

meals and prison call sections but "just haven't included

them" in the spending bill.

"We focus on fiscal matters in our budget," he said, saying

the committee goes "very, very light" on policy sections in

the spending bill.

Amendments to the Senate budget will be due this Friday, and

the bill is teed up for debate starting Tuesday, May 24

after senators caucus that Monday.

The House's budget debate featured Republican-led efforts to

add tax changes like Baker's to the spending bill, and the

Senate's three-man minority caucus could take a similar

approach.

"We will consider every and any amendment that a senator

files but at this point of time, we're going to stick with

the same consensus revenue number as the House and the

governor used to compile their FY '23 budget," Rodrigues

said.

Broadly speaking, Rodrigues said that when the Senate does

pursue tax relief, the body will "focus on working families,

and what provides the greatest amount of money back into the

pockets of working families." He said he had not "analyzed

the good, the bad, the ugly of any of the governor's tax

proposals" and expected to also hear many ideas from his

colleagues.

"The governor doesn't have a monopoly on good ideas,"

Rodrigues said.

The Senate budget does include one narrowly focused tax

relief measure. It would permanently exempt forgiven student

loans from being treated as taxable income.

Another outside section added in by the Senate Ways and

Means Committee would require, starting in January, that the

Group Insurance Commission allow a state employer to offer

health coverage to a new employee the day they start work.

Eliminating the waiting period for health insurance has been

one of the goals of Senate staffers who are seeking to

unionize.

Like the House's budget and Baker's proposal, the Senate

Ways and Means bill would eliminate probation and parole

fees.

After a leaked Supreme Court draft opinion last week threw

the future of national abortion rights into question, the

Senate budget adds a new line item to support access,

infrastructure and security for reproductive health

services. The House similarly allocated $500,000 to that

area.

The Senate Ways and Means budget also includes $15 million

for local and regional boards of health, more than $200

million for substance-use treatment, and $15 million for

initiatives aimed at building staff and bed capacity so that

behavioral health patients are not left waiting in emergency

departments for beds.

It funds MassHealth at $18.56 billion and proposes $453.3

million for the Department of Transportation. Rodrigues said

the budget's $187 million for the MBTA, a $60 million

increase over fiscal 2022, would support operational costs

and rider-safety improvements at the transit agency.

The budget recommends 10 percent increases to benefit levels

in the Transitional Aid to Families with Dependent Children

and Emergency Aid to the Elderly, Disabled and Children

programs. Senate officials said that move would provide an

additional $83 a month for a family of four.

The Senate Ways and Means Committee is also seeking to boost

to $400 the clothing allowance for families receiving TAFDC

benefits, a $50 increase over this year's level.

State House News

Service

Tuesday, May 10, 2022

Senate GOP Plans Tax Relief Budget Push

By Katie Lannan

The Senate's three Republicans plan to propose adding

"targeted tax relief" measures into next year's budget,

Minority Leader Bruce Tarr said after top Democrats unveiled

a $49.7 billion spending plan Tuesday.

The Senate plans to debate its fiscal year 2023 budget

starting May 23. Like the spending bill the House passed in

March, it does not include any broad-based tax hikes or the

nearly $700 million in tax breaks that Gov. Charlie Baker

proposed alongside his budget recommendations.

Tarr, a Gloucester Republican, serves on the Ways and Means

Committee but reserved his rights when the committee voted

to advance the bill, meaning he did not stake out a position

for or against it. He said he wanted more time to wade

through the bill's details.

"Senate Republicans will carefully scrutinize the new

proposal, we will draft and file amendments that build on

the good start the committee gave us, and we will encourage

our colleagues to support our efforts to capture

opportunities for: families and those who create economic

opportunities for others, and we will invite our colleagues

to vote with us to enact targeted tax relief to lessen the

burdens on people across the Commonwealth," Tarr said in a

statement later Tuesday.

Senate President Karen Spilka has said she wants to pursue

some sort of tax relief after the late May budget debate.

Asked Tuesday if the Senate would consider revenue-related

amendments or if senators will be asked to hold their ideas

for the later discussion, Ways and Means Chairman Sen.

Michael Rodrigues said, "We will consider every and any

amendment that a senator files, but at this point in time,

we're going to stick with the same consensus revenue number

as the House and the governor used to compile the FY '23

budget."

The Boston

Globe

Tuesday, May 10, 2022

Mass. Senate leaders unveil $50 billion budget; tax break

talks in ‘near future’

By Matt Stout

Massachusetts Senate leaders on Tuesday released a $50

billion budget plan that pours hundreds of millions of more

state dollars into child care but, like their House

counterparts, included no proposed tax breaks or cuts. Amid

surging inflation, one top senator said his colleagues have

not yet had “serious discussions” about the contours of a

potential package.

Senate President Karen E. Spilka last week called for the

Senate to pursue a tax relief bill following its budget

debate, indicating any plan, should it emerge, would likely

not surface until at least June. But the prospect of one

continues to hover over Beacon Hill’s annual budget, a

version of which the House passed last month and typically

isn’t finalized until after the next fiscal year begins on

July 1.

Senator Michael J. Rodrigues, the chamber’s budget chief,

told reporters Tuesday that the Senate would focus any

proposal on putting “money back into the pockets of our

working families.” Still, the Westport Democrat gave no

indication how closely a proposal could hew to the more than

$700 million in tax breaks Governor Charlie Baker has sought

amid both record state revenues and 40-year highs in

inflation.

“I really haven’t analyzed the good, the bad, the ugly of

any of the governor’s tax proposals,” Rodrigues said. He

added that he expects to begin discussing potential

legislation “in the near future" but said senators have yet

to have “serious discussions about any sort of tax changes.”

“The governor doesn’t have a monopoly on good ideas,”

Rodrigues said.

In its place, the Senate unveiled a $49.7 billion spending

plan that Spilka said seeks to ensure that “no one gets left

behind.” It increases direct aid to local school districts

by nearly $500 million, helping to fulfill the promises made

under the state’s new school funding formula passed in 2019,

while hiking spending by tens of millions of dollars on

state colleges, substance use treatment, and transportation.

Similar to the House’s initial proposal, the Senate seeks to

spend at least $1.4 billion more than what Baker proposed in

January.

The increases include what Senate leaders called an

additional $60 million for the MBTA, which would receive

$187 million on top of revenue it collects from a portion of

the state’s sales tax and would go to support “necessary

improvements for rider safety,” according to Senate leaders.

The Federal Transit Administration told MBTA officials last

month that it is “extremely concerned with the ongoing

safety issues” at the T and will take on an “increased

safety oversight role” of the transit system following a

rash of passenger deaths and injuries on the system.

How the additional money the Senate proposed is spent would

be left to the MBTA’s board, Rodrigues said.

One of the largest increases in the Senate plan is reserved

for the state’s child-care system, with nearly $310 million

in new state spending over the current fiscal year. The vast

majority of the increase — $250 million — would go toward

the Commonwealth Cares for Children program, which makes

grants available to all child-care providers, regardless of

whether they receive other public subsidies. Senate

officials said Tuesday that to date, the program has been

funded by federal aid.

The extra state spending the Senate proposed would partly

replenish the program, ensuring grants run through at least

the end of December, according to Rodrigues’ office.

Yet, it also falls short of the $450 million in full-year

funding that Baker had pushed lawmakers to embrace. And

despite Senate leaders promising that the funding would help

“transform the child care system,” Rodrigues acknowledged it

effectively is a “continuation” of one-time help on which

many providers are already leaning but would end in June

without additional funding.

The House did not include a similar proposal in its budget

plan, opting instead to hike spending by roughly $70

million, including tens of millions more aid to help bolster

child-care worker salaries.

A recent legislative commission’s study of Massachusetts

child care that estimated it would cost $1.5 billion

annually to put a raft of recommendations into place to

overhaul the state’s early education system, which already

has some of the most expensive child-care costs of any state

in the country.

In the wake of a leaked Supreme Court draft opinion that

indicated the court is poised to overturn Roe v. Wade, the

Senate budget also creates a new line item to support

abortion services with $2 million in new funding. The House

had set aside $500,000 in its plan.

The Senate is expected to debate and add to its budget plan

in two weeks, when its bottom line will likely grow further.

The version released Tuesday did not include several policy

proposals the House had sought, including one requiring all

jails and prisons make phone calls free for prisoners and

their families — something only one other state currently

mandates — or another dedicating $110 million to extend a

free school meals initiative currently covered by an

expiring federal program.

But it doesn’t mean those provisions will not ultimately

survive. The state is awash in money, with tax revenues in

April alone surging past predictions by more than $2

billion, potentially giving lawmakers flexibility to adopt

the chambers’ different priorities, should they opt to,

instead of having to choose some Senate and some House

favorites.

Rodrigues, who will likely lead the chamber’s budget

negotiations with the House, said he, too, has “no

objection” to those House proposals, but rather said he

sought to limit the number of policy changes his office

tucked into the spending plan.

“It is pretty thin,” he said of its policy package.

State House News

Service

Wednesday, May 11, 2022

Mass. Not Alone In Bulking Up Its Savings

By Colin A. Young

Massachusetts budget writers are planning to push the

balance of the state's rainy day fund well beyond the rule

of thumb that says a state should keep 10 percent of

budgeted funds in reserve, part of a trend that Pew analysts

have seen across the country since the start of the

pandemic.

There was $4.63 billion in the state's stabilization fund at

the end of fiscal year 2021 and that balance is expected to

grow to between $5.76 billion and $5.89 billion by the end

of the current fiscal 2022 budget year. The House budget for

fiscal 2023 would see the state's savings account rise to

$6.55 billion while the Senate's plan would boost the fund

up to $6.74 billion.

In either case, Massachusetts would have more than 13

percent of annual budget spending stashed away in case of

economic calamity.

While there is no one-size-fits-all rule for how much a

state should hold in reserve, 10 percent of budgeted

spending has long been considered an ideal target.

Before the pandemic, Massachusetts was short of that target.

At the end of fiscal 2020, the stabilization fund balance of

$3.5 billion was only 8 percent of that year's $43.321

billion budget. But the Bay State was not alone in watching

its reserves rise significantly despite the economic

upheaval of the pandemic.

The Pew Charitable Trusts found that states during fiscal

2021 collectively grew their rainy day funds by $37.7

billion or roughly 50 percent from a year earlier, helping

to drive the total amount held in reserve among all states

to a record high of $114.6 billion. In Massachusetts, fiscal

2021 meant a $1.13 billion increase in the rainy day fund

balance, from $3.5 billion to $4.63 billion, clearing the 10

percent threshold based on the $45.9 billion fiscal 2021

budget.

While Massachusetts's rainy day fund balance might satisfy

the informal 10 percent requirement, it remains short of the

balance recommended by the Government Finance Officers

Association. That group says states should have "at a

minimum ... no less than two months of regular general fund

operating revenues or regular general fund operating

expenditures."

As of the end of fiscal 2021, Massachusetts had enough money

socked away to run government operations for 45.6 days,

better than the nationwide median of 34.4 days but still

short of the GFOA recommendation of two months.

The alternatives to socking so much money away include

spending it to address unmet needs or adopting tax relief or

incentives to help Massachusetts residents or make the state

more competitive with other states.

State House News

Service Graph

The Boston

Herald

Saturday, May 14, 2022

Lame duck Charlie Baker waits for petty Legislature to act

By Joe Battenfeld

If you’re waiting for Democrats in the Legislature to send a

tax cut to Gov. Charlie Baker, you’re going to have to wait

a little longer.

Like eight months.

That’s when the lame duck Baker will be gone and the new

governor — most likely a Democrat — will take over and get

credit for the accomplishments.

Sound petty and political?

Of course. But that’s how the Legislature has always

operated.

Baker — to his credit — has been aggressively pushing his

agenda for the last few months despite the fact that he’ll

soon be relegated to some high-paying job in the private

sector.

But it’s clear the Democratic-led Legislature wants nothing

to do with giving Baker — who is essentially a Democrat in

all but name — any parting gifts on the way out the door.

Instead, Baker is going out presiding over steep inflation

and sky-high gas prices, despite the fact the Legislature is

holding onto billions of dollars in federal COVID relief and

a massive budget surplus that could be helping people pay

bills right now.

Baker has proposed a massive jobs and economic development

bill using several billion dollars in American Rescue Plan (ARPA)

funds. But lawmakers are holding onto most of the money

while Baker stews. And it sounds like they’re in no hurry to

get anything done this year.

It’s self-imposed gridlock.

“We’re still in May, but it looks like we’re going to have a

very large surplus for the close of the year. That certainly

gives us an opportunity to not have to be completely in a

rush to spend all the ARPA money,” House Ways and Means

Chairman Aaron Michlewitz told State House News Service.

As far as a tax cut goes, don’t hold your breath for

lawmakers to pass what Baker has proposed or anything like

it. A gas tax cut like Republicans have proposed? Ha. Good

one.

“All options are going to be considered,” said Michlewitz,

who may or may not have been laughing when he uttered that.

Instead, Baker is leaving office presiding over the ongoing

disaster and federal takeover of the MBTA and embarrassments

like the expensive, $56 million payout to families of lost

loved ones at the Holyoke Soldiers’ Home.

That’s what his final-year legacy will be — not a

taxpayer-friendly tax cut.

It’s a perfect example of why the Massachusetts Legislature

has too much power and the governor has to kowtow to them.

Speaker of the House Ronald Mariano has much more power than

Baker. He controls all his Democratic House members who do

what they’re told.

And the Republican governor sits waiting and waiting for

action. It’s something he’s gotten good at.

State House News

Service

Friday, May 13, 2022

Weekly Roundup - Baker’s Last Legislative Laundry List

Recap and analysis of the week in state government

By Colin A. Young

Charlie Baker won't be giving up the corner office until

early next year, but it takes two to tango and the

governor's lawmaking dance partners in the Legislature are

going to put a lid on major work in less than three months.

So what's his top priority?

"I don't really think I have a top priority here. I have a

lot of priorities," Baker told WBUR's "Radio Boston" on

Thursday.

The chaotic dash to the end of Baker's first legislative

session, in 2016, featured what the governor dubbed the "Big

Six" bills. This year's sprint to July 31, Baker's last as

governor, might come closer to fitting the "Baker's Dozen"

label. (Not to be confused with 2010 candidate Baker's

reform proposals.)

His $3.5 billion economic development bill, his $9.7 billion

infrastructure package meant to maximize the impact of

significant federal funding, and a tax cut package were the

few pieces of legislation that Baker mentioned specifically

on WBUR, but there's plenty more that could hit his desk in

the coming months.

Baker's been beating the drum for years to expand the list

of offenses considered grounds for a dangerousness hearing

and to update the state's laws around impaired driving, the

former health insurance executive would surely like to sign

major health care legislation once more before leaving

office, another energy and climate law could add to the

governor's considerable resume on that front, and this could

finally be the year that Baker gets to sign legal sports

betting into law.

Oh, and there will be all the fun associated with the annual

state budget, which is supposed to be done by June 30 but

has lately lingered into July.

Senate Democrats unfurled their spending plan for fiscal

year 2023 this week, seeking to double the increase in local

aid and further pump up the state's rainy day fund while tax

collections are surging. The $49.68 billion state budget

proposal is likely to swell as senators work through the

1,178 amendments filed for consideration when debate starts

on May 24.

Democrats in both branches are keeping those tax cuts that

Baker wants to sign into law on the back burner during

budget season, but expect the Senate's "Minority Crescent"

to make another push to include taxpayer relief in the

annual spending bill.

Another group this week launched its own tax policy effort:

the ballot campaign to convince voters to impose a new 4

percent surtax on households that earn more than $1 million

a year. The surtax is projected to raise about $1.3 billion

a year, which the Constitutional amendment calls for

spending on education and transportation.

"And while millionaires are taking joyrides into outer

space, our educators are digging into their pockets to buy

school supplies and other resources for their students,"

Saúl Ramos, a one-on-one paraeducator in Worcester Public

Schools, said during the Fair Share for Massachusetts

campaign kick-off. "This is a problem and we have the chance

to change it."

The campaign is making the case that the surtax will help

improve transportation infrastructure across the Bay State,

and the problems with greater Boston's public transportation

system were magnified this week with word that the Federal

Transit Administration is "extremely concerned with the

ongoing safety issues" at the MBTA.

Recent crashes, derailments and malfunctions -- including

the death of a Red Line passenger who was dragged by a train

when his arm became trapped in the door of the car he was

exiting -- have drawn renewed scrutiny in the form of a

nearly unprecedented federal safety management

investigation. The only other time the FTA has launched this

kind of probe, it led to a three-year federal takeover of

safety oversight of the Washington, D.C. Metro.

That the T has safety issues is not news to anyone. A safety

review panel was put together in 2019 after a spate of

incidents -- including a Red Line car that derailed and took

out a signal shack, leading to months of delays for

commuters -- said that making safety a priority for the T

was a matter of money.

"The T is safe. But the T can be safer, like all forms of

transportation," Ray LaHood, a former Republican congressman

from Illinois who served as President Barack Obama's

transportation secretary from 2009 to 2013, said in December

2019. "And if you want your transportation to be safe, and

you want it to work efficiently, it takes money. It costs

money to do that."

A few months later, the House passed a transportation

revenue bill and the topic seemed poised to be a central

focus of the Legislature's work in 2020. That House bill

died in the Senate once COVID-19 hit, and there's been no

real appetite for rethinking how Massachusetts funds public

transportation since.

Drivers are doing their part, though. The Department of

Transportation raked in $306.5 million from roadway tolls

through the first three quarters of fiscal year 222, almost

$70 million more than was collected during the same period a

year earlier. MassDOT officials now expect to bring in about

95 percent as much toll revenue this year as they did in the

last year before the pandemic upended driving habits.

The governor added one more item to Beacon Hill's to-do list

Thursday when he announced that he had given his approval to

an agreement to settle the civil lawsuit related to the

COVID-19 outbreak that killed at least 76 veterans at the

Holyoke Soldiers' Home. Baker said he'll soon file a

supplemental budget to process that payment.

The critical threat COVID-19 posed for residents in

long-term care settings generally, like the veterans in the

state-run Holyoke and Chelsea soldiers' homes, was "probably

the single biggest thing we were slow to respond to" during

the pandemic's early days, Baker said this week.

"That would probably be the thing that I would've liked to

have gotten to faster," the governor said, reflecting on the

start of the pandemic.

More than two years since that point, COVID is still a fact

of life and the pesky virus is again complicating normal

business on Beacon Hill.

Despite publishing eight notifications about COVID-19

exposures representing at least 25 cases since April 25,

House Speaker Ronald Mariano and Senate President Karen

Spilka are not planning any changes to their chambers'

protocols, their offices said this week. The uptick in State

House virus cases matches the rise in infections across the

state since March, but it's hitting right as the House and

Senate gear up for crunch time.

Baker was right last May when he said, "COVID's a little bit

like Michael Myers."

State House News

Service

Friday, May 13, 2022

Advances - Week of May 15, 2022

Come November, Republicans in Massachusetts are at risk of

being swept in statewide races, including the contest for

governor, and seeing their minority ranks in the Legislature

shrink even further.

With that backdrop, party members will spend next week

gearing up for their election-year nominating convention in

Springfield and testing out messages they hope will resonate

with voters. Only two of the statewide races that will

feature at the convention have multiple Republican

candidates: the contest for governor, which involves former

Rep. Geoff Diehl and businessman Chris Doughty, and for

lieutenant governor, where a pair of former reps, Leah Cole

Allen and Kate Campanale, will face off.

The other hopefuls -- attorney general candidate Jay

McMahon, secretary of state candidate Rayla Campbell, and

auditor candidate Anthony Amore -- are all positioned as

presumptive Republican nominees.

GOP Gov. Charlie Baker and Lt. Gov. Karyn Polito are calling

it quits this year, and Democrats are feeling good about

retaking the governor's office.

Under party chairman James Lyons, the Republican Party in

Massachusetts has embraced the model created by former

President Donald Trump, leaving Baker on the outs within his

own party. The model hasn't worked well so far for

Republicans, but party leaders appear poised to double down

on it this year and are featuring an anti-abortion advocate

and Trump administration immigration law enforcement

official at their convention.

In a WBUR radio interview Thursday, Baker took an apolitical

approach when asked about the future of his party. Instead

of talking up Republicans, Baker, without mentioning any

party, said he would support candidates he believes in and

urged a place at policymaking tables in Massachusetts and

nationwide for "moderates."

Baker's roots as a moderate Republican extend back to the

1990s with GOP Govs. William Weld and Paul Cellucci. Gov.

Jane Swift, also a moderate, gave way to Mitt Romney, who

brought his own Republican brand to Beacon Hill. By

defeating former Lt. Gov. Kerry Healey, Democrat Deval

Patrick broke the GOP's run in the governor's office for

eight years before Baker and Polito grabbed the key office

back for Republicans.

But Baker and Polito are not attempting to pass the torch to

a successor. Perhaps the biggest surprise when the duo

announced their plans this year was the fact that Polito

would not run for governor. Baker and Polito, who would have

faced strong intraparty opposition had they run, won't be in

Springfield when party delegates choose a nominee for

governor. Their exits from the political stage leave the

party's future in the hands of candidates who face long

uphill climbs in their attempts to lure voters from across

the political spectrum into their corners.

While Democrats hold a roughly three-to-one voter

registration advantage over Republicans in Massachusetts,

the GOP has always banked on grabbing votes from independent

voters, who are the largest voting bloc in the state.

The convention is scheduled to gavel in at 9 a.m. May 21 at

the MassMutual Center. According to the party, more than

3,000 delegates were qualified at caucuses in February to

consider candidates for governor, lieutenant governor,

attorney general, secretary of state, treasurer and auditor.

The guest speakers include Congressman Byron Donalds of

Florida, former Acting Director of Immigration and Customs

Enforcement Thomas Homan, and former 40 Days For Life leader

David Bereit.

Back on Beacon Hill, top Democrats appear in no rush to wrap

up work on multiple bills they have already passed in some

form or named as priorities. Most of the major pieces on the

Legislature's board for the final two and a half months of

formal sessions, including tax breaks and a pair of

multibillion-dollar bills targeting infrastructure and

economic development, did not move at all over the past

week. As Speaker Ronald Mariano put it in February: "There's

'legislative' quickly and then there's 'press' quickly."

Something is brewing in the House, which plans to meet in

back-to-back formal sessions on Wednesday and Thursday, but

Mariano's office did not make clear by the end of the day

Friday what bills it would bring forward. Senators will have

a light workload next week, allowing the Ways and Means

Committee and Senate leaders to work through the 1,178

amendments filed to the chamber's $49.68 billion fiscal 2023

budget bill ahead of the start of debate on May 24.

The House and Senate still have not officially named a

conference committee that will be tasked with closing the

significant distance between the two branches' approaches to

legalizing sports wagering, though Senate President Karen

Spilka said Friday the measure is "going to conference right

now."

After keeping constituents in the dark on her personal views

about sports betting, Spilka -- who also committed to

ensuring each senator's position gets recorded if and when a

final proposal emerges from negotiations -- told GBH's

"Boston Public Radio" that she is "not a fan of gambling"

but "would have voted yes on this particular bill based on

the very strong pieces of consumer protection (and) problem

gaming" it included.

State House News

Service

Tuesday, May 10, 2022

Tax Foundation: Mass. Among “Worst States” For Property

Taxes

By Michael P. Norton

Massachusetts ranked among the worst states in the country

on property tax competitiveness, according to an assessment

released Tuesday by a group that favors tax policies that it

says will spur economic growth.

The new map released

by the nonprofit Tax Foundation ranks states on the

property tax, which is one component of the group's 2022

State Business Tax Climate Index. The property tax component

evaluates state and local taxes on real and personal

property, net worth, and asset transfers.

"The states with the best scores on the property tax

component are Indiana, New Mexico, Idaho, Delaware, Nevada,

and Ohio," the foundation said. "States with the worst

scores on this component are Connecticut, Vermont, Illinois,

New York, New Hampshire, Massachusetts, New Jersey, plus the

District of Columbia."

Along with income and sales taxes, property taxes account

for a big share of government tax revenue in Massachusetts

and growth in property taxes is limited by a ballot law

approved in 1980. Property taxes are a major funding source

for basic services, such as local education, public safety

and public works.

The Massachusetts Fiscal Alliance, which favors reductions

in tax rates, said Tuesday that relatively high property

taxes in Massachusetts, combined with high inflation and a

proposed surtax on household income above $1 million per

year, show Democrats are on a path to drive the state

economy into a "brick wall."

While opponents of the income surtax say it will push

affluent taxpayers and small businesses out of state,

supporters say the measure will ensure that wealthier

taxpayers contribute their "fair share" and anticipate a

flood of new revenue will flow and be put toward education

and transportation initiatives.

The Boston

Herald

Monday, May 9, 2022

Charlie Baker’s $3.5 billion development plan moves forward

By Matthew Medsger

Speaker after speaker told a joint legislative committee

considering an economic development proposal which would

also grab billions in federal funding the same thing Monday

morning: the bill needs to pass and it must pass now.

“Right now we have the ability to create the building blocks

of success,” Brockton Mayor Robert Sullivan told the

committee. “We need to make sure that the money is spent

wisely, and that we get the biggest bang for the buck.

That’s what my nana used to say.”

Under consideration is Gov. Charlie Baker’s Future

Opportunities for Resiliency, Workforce, and Revitalized

Downtowns Act, or FORWARD, a $3.5 billion investment plan he

says the hundreds of cities and towns across the

commonwealth need to compete in the future and in a world

where the nature of where people work has changed entirely.

Time, the Governor and nearly every other speaker before the

Joint Committee on Economic Development and Emerging

Technologies said, is not on anyone’s side.

“If we don’t get those dollars into the hands of cities and

towns across the state – now so that they can begin the

process associated with planning, designing and reimagining

and jump-starting their local economies and their downtowns

– we’ll continue to see empty storefronts and quiet main

streets for years to come,” Gov. Charlie Baker said.

That’s not the only problem.

A huge portion of that $3.5 billion would be funded by $2.3

billion from the American Rescue Plan Act, with the balance

covered by $1.2 billion in capital bond authorizations.

ARPA funds must be committed by states by the end of 2024

and spent by the end of 2026. The law prioritizes investing

in projects that are defined and narrow in scope so they can

be completed on time.

Pittsfield Mayor Linda Tyer said her city has shovel ready

projects just waiting for the money to move along.

“The FORWARD act has the potential to transform my city and

all of your communities, please pass the FORWARD act,” she

said.

The bill sets aside $750 million for clean energy projects,