|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

48 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, April 4, 2022

Death and Taxes in

Mass.

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

They say

only death and taxes are certain, but in

Massachusetts the former doesn’t necessarily stop

the latter.

That

should change, though, according to the

Massachusetts Taxpayers Foundation, which issued a

brief Thursday in support of Gov. Charlie Baker’s

proposal to alter the estate tax.

“Massachusetts should change its estate state

because we currently have the highest tax burden of

any state in the nation for estates between $1-3

million,” Eileen McAnneny, foundation president,

said in an emailed statement.

Currently,

Massachusetts is one of 12 states that taxes an

estate after a person’s death.

Among the

states that do so, Massachusetts is tied with Oregon

for the lowest threshold at which an estate tax

kicks in, at $1 million.

Massachusetts also employs a so-called “cliff

effect,” whereby an estate worth just $1 less than

the threshold is free of a tax burden, while that

dollar results in substantial tax liability.

This may

not seem like it would be a problem for too many

people, but that’s not the case for anyone who owns

real estate in Massachusetts. When it comes to the

estate tax, the value of your home is included....

Baker

proposes raising the threshold to $2 million and

eliminating the cliff effect with an estate

exclusion at $2 million.

Even that

proposal, if agreed to by the legislature, would

mean Massachusetts would have the third-highest

estate tax, behind Rhode Island and Oregon.

The

Boston Herald

Thursday, March 31, 2022

Death and taxes front and

center in Massachusetts

Estate tax should be changed, says tax group

MARCH

REVENUES [Tuesday, April 5, 2022]: Department of

Revenue is due to report on tax collections for

March, which the department said tends to be "a

mid-size month for revenue collections, ranking #6

of the twelve months in nine of the last ten years."

DOR has

set the monthly benchmark at $3.43 billion and as of

March 15 had already collected $2.1 billion, up

about 23 percent from the same half-month period in

2021. Most of that increase, DOR said in its

mid-month report, came from income taxes, including

withholding, but much of the increase is due to the

recently-enacted elective pass-through entity excise

and is therefore temporary.

Through

February, fiscal 2022 tax collections have totaled

about $23.673 billion, more than $4 billion above

the same period in fiscal 2021 and more than $1.7

billion above year-to-date benchmarks.

State

House News Service

Friday, April 1, 2022

Advances - Week of April 3

Gov.

Charlie Baker on Friday signed the multi-faceted

$1.67 billion midyear spending bill that lawmakers

sent to his desk Thursday night, approving all of

the bill's spending while sending back one veto and

one amendment.

The fiscal

year 2022 supplemental budget allocates money toward

the ongoing COVID-19 response ($700 million), rate

enhancements to human service providers ($401

million), winter road repair ($100 million), rental

assistance ($100 million) and more, extends popular

pandemic-era restaurant policies for a year, and

directs state officials to divest public pension

funds from Russia-involved companies.

State

House News Service

Friday, April 1, 2022

Baker Signs $1.67 Bil

Midyear Budget

The mood

in the Legislature this week was more collegial.

The House

and Senate found common ground on a $1.67 billion

spending bill that includes money for COVID-19

relief, and extends popular pandemic accommodations

like to-go cocktails and outdoor dining as Boston

Mayor Michelle Wu tried to put out the kitchen fire

she started in the North End by proposing to charge

restaurants a $7,500 impact fee for al fresco

dining.

Lawmakers

also agreed on a strategy to divest pension funds

from Russian companies sanctioned by the United

States or incorporated in that country, and both

branches extended their remote voting protocols,

allowing at least for the remainder of this session

legislators to call in their votes.

Home

offices are the workplaces of the future, after all,

right?

A special

legislative commission co-chaired by Sen. Eric

Lesser and Rep. Josh Cutler released their report on

the "Future of Work" this week, and while it may not

have contained any shocking findings, it did

reinforce the way everyone has understood the impact

of the pandemic.

Hybrid and

remote working models, the report found...

Multiple

rounds of applause were heard outside the private

meeting before lawmakers made their way to the House

chamber to pass a $350 million road and

infrastructure maintenance bill that included $200

million for Chapter 90 and $150 million spread

across multiple other programs.

Rep.

William Straus, the co-chair of the Transportation

Committee, said the House wasn't quite ready to

reform the formula for Chapter 90 to more equitably

distribute aid to rural communities with many roads

and few people, but he said it's still a possibility

in the coming months....

STORY OF

THE WEEK: People bet on sports. They like to work

remotely. And they enjoy eating outside. That's just

the way it is.

State

House News Service

Friday, April 1, 2022

Weekly Roundup

The future

of natural gas, a core component of the existing

energy mix but one that the state needs to become

less dependent on to meet its climate goals, is

front and center for debate at a Senate hearing on

Monday. Just as gasoline remains the most common way

to power vehicles, natural gas continues to serve as

a dominant fuel.

The Senate

Global Warming and Climate Change Committee hearing

will be followed up later in the week with hearings

that examine some of the tough choices that will be

necessary to meet near-term emission reduction

requirements in 2025 and 2030 as Massachusetts

slowly implements plans to bring offshore wind

energy into the mix, and to build upon solar and

other renewable energy sources.

State

House News Service

Friday, April 1, 2022

Advances - Week of April 3

Here is

one thing Republican gubernatorial candidate Chris

Doughty can brag about: He has created more jobs

than anyone else running for governor.

In fact,

he has created more jobs in his successful business

career than have all the candidates seeking to

become governor combined.

That

includes Democrats Maura Healey, the attorney

general, and state Sen. Sonia Chang-Diaz.

It also

includes fellow Republican Geoff Diehl, 52, who is

considered the frontrunner in the two-man battle for

the Republican nomination for governor.

One of the

four will succeed outgoing Republican Gov. Charlie

Baker, who after two terms is not seeking

re-election.

Of the

four, Doughty, a Wrentham father and grandfather, is

the only candidate who has not run for office

before. So, he does not talk or act like a

politician, but more like an executive who knows how

to run an entity like a business....

He said

his skill set as a hands-on executive would come in

handy if he were governor. “I know how to read and

balance a budget,” he said. “I know how to create

jobs.”

Before he

can do that, however, he must defeat Diehl, a former

state representative from Whitman, and then become

the Republican nominee.

Diehl has

a strong head start. He already has one statewide

campaign under his belt. He was defeated for the

U.S. Senate in 2018 by Democrat Elizabeth Warren.

The

conservative Diehl, in the fractured Massachusetts

Republican Party, is supported by Jim Lyons, the

party chairman, and has been endorsed by former

President Donald Trump.

While that

may not be sound like a big deal in progressive,

anti-Trump Massachusetts, Diehl’s conservative

backing will play a major role in winning the party

convention endorsement and the September primary....

While

Doughty discourages being pigeonholed, he is

considered a moderate in the fashion of Charlie

Baker.

So, the

GOP campaign between the two is shaping up as a

battle over the future of the Republican Party in

Massachusetts.

Will it

continue along the moderate/liberal path traveled by

former Govs. Bill Weld, Paul Cellucci, Mitt Romney

and Charlie Baker — and now Chris Doughty — or will

it go the way of conservative Geoff Diehl and Jim

Lyons?

The

Boston Herald

Saturday, April 2, 2022

Creating jobs high on GOP candidate

for governor Chris Doughty’s to-do list

By Peter Lucas

When Sonia

Chang-Diaz challenged Maura Healey to agree to a

series of three televised debates prior to the

Democratic state convention in June, some political

analysts dismissed the move as an attempt by a

struggling candidate to gain ground on a better

known and better financed rival.

There may

be some truth to that analysis, but Chang-Diaz puts

forward another theory -- that voters deserve to

know where the two Democratic candidates for

governor stand on the major issues of the day.

“This is

standard-issue stuff,” Chang-Diaz said of her call

for debates. “There are real differences between the

attorney general and me.”

Chang-Diaz, a state senator from Jamaica Plain,

points out that Healey herself called for monthly

primary debates when she first ran for attorney

general in 2014. And the Democratic gubernatorial

primary race in 2018 featured three debates as well.

Healey’s

campaign responded to Chang-Diaz’s challenge with a

vague promise to debate, but didn’t say when she

would debate or how many times she would debate.

Chang-Diaz’s campaign called the response a dodge.

The back

and forth exchanges were fairly standard stuff in a

race between a clear frontrunner and a challenger.

But they also underscored the cautious campaign that

Healey appears to be running....

After

nearly eight years as attorney general, Healey is a

known commodity, to some extent. We know she sued

former president Donald Trump a lot. We know she

went after the Sackler family and Purdue Pharma in

court. And we know she suggested the protests

sweeping the nation after George Floyd’s killing in

2020 might yield long-term benefits. “Yes, America

is burning. But that’s how forests grow,” she said.

Those

stances and comments reveal a lot about Healey, but

voters need more from a candidate for governor.

Commonwealth Magazine

Tuesday, March 29, 2022

Waiting for the governor's

race to get going

By Bruce Mohl

Attorney

General Maura Healey doesn't seem to be about

reliving the past.

Not when

it comes to pot. Not when it comes to gambling. And

certainly not when it comes to her 2014 campaign for

attorney general.

That was

the year the new-on-the-political scene prosecutor

defied the odds to beat an insider with a well-known

last name in her first statewide race for public

office. In that campaign, Healey backed a ballot

question that would have repealed the state's casino

legalization law.

Eight

years later Healey is seeking a new office and

another gambling issue is in the headlines.

"Sports

betting, it is the way now," Healey said this week,

an acknowledgment that the whistle on this match has

already blown in other states. It may not have been

a ringing endorsement of gambling on athletics, but

it sounded an awful lot like the answer she gave

earlier this month when asked if she regretted

opposing the legalization of marijuana.

No

regrets. Just reality.

"I just

want to make sure that everybody is able to share in

the benefits and the gains of that industry," she

said about marijuana. "And I think we still have

more work to do when it comes to the social justice

issues that were in fact driving a lot of proponents

of that law."

State

House News Service

Friday, April 1, 2022

Weekly Roundup

Lieutenant

gubernatorial candidate Eric Lesser raised over

$153,000 in March alone — bringing his campaign war

chest to over $1 million. Since announcing his

campaign in January, Lesser has raised over

$437,412, according to his campaign.

Lesser, a

liberal Democratic state senator from East

Longmeadow, has received donations from 1,188

individual donors from 145 municipalities. A total

of 70% of donors came from Massachusetts.

With $1

million in the bank, Lesser has separated himself

from the crowded pack for lieutenant governor. Even

before filing March’s totals, Lesser had almost

$900,000 in the bank. The next-closest current

candidate was state Sen. Adam Hinds, a Democrat from

Pittsfield, who has banked almost $300,000 before

his March filing.

The

Boston Herald

Friday, April 1, 2022

Lt. gov. candidate Eric Lesser brings fundraising

totals over $1 million

By Amy Sokolow |

Chip Ford's CLT

Commentary |

|

The Boston Herald reported on Thursday ("Death

and taxes front and center in Massachusetts; Estate tax should be

changed, says tax group"):

They say only death and

taxes are certain, but in Massachusetts the

former doesn’t necessarily stop the latter.

That should change, though,

according to the Massachusetts Taxpayers

Foundation, which issued a brief Thursday in

support of Gov. Charlie Baker’s proposal to

alter the estate tax.

“Massachusetts should

change its estate state because we currently

have the highest tax burden of any state in the

nation for estates between $1-3 million,” Eileen

McAnneny, foundation president, said in an

emailed statement.

Currently, Massachusetts is

one of 12 states that taxes an estate after a

person’s death.

Among the states that do

so, Massachusetts is tied with Oregon for the

lowest threshold at which an estate tax kicks

in, at $1 million.

Massachusetts also employs

a so-called “cliff effect,” whereby an estate

worth just $1 less than the threshold is free of

a tax burden, while that dollar results in

substantial tax liability.

This may not seem like it

would be a problem for too many people, but

that’s not the case for anyone who owns real

estate in Massachusetts. When it comes to the

estate tax, the value of your home is

included....

Baker proposes raising the

threshold to $2 million and eliminating the

cliff effect with an estate exclusion at $2

million.

Even that proposal, if

agreed to by the legislature, would mean

Massachusetts would have the third-highest

estate tax, behind Rhode Island and Oregon.

As it has for many years, CLT

testified in support of long-overdue estate tax reform on January 12

("CLT

Again Supports Estate Tax Revision").

On Friday the State House News Service reported ("Baker

Signs $1.67 Bil Midyear Budget"):

Gov. Charlie Baker on

Friday signed the multi-faceted $1.67 billion

midyear spending bill that lawmakers sent to his

desk Thursday night, approving all of the bill's

spending while sending back one veto and one

amendment.

The fiscal year 2022

supplemental budget allocates money toward the

ongoing COVID-19 response ($700 million), rate

enhancements to human service providers ($401

million), winter road repair ($100 million),

rental assistance ($100 million) and more,

extends popular pandemic-era restaurant policies

for a year, and directs state officials to

divest public pension funds from Russia-involved

companies.

In the CLT Update of March

21 ("Inconsistencies

and Absurdities Abound") I noted, and it's worth reminding:

.

. . Bear in mind that on July 16, 2021 Gov. Baker signed this

year's annual fiscal budget of $47.6 Billion. With just three

months to go in the remainder of this fiscal year Beacon Hill is

adding on another $1.6 Billion in "supplemental" (additional)

spending, bring the total spending for FY2022 to over $50

Billion. (How many earlier "supplemental" bills have passed

since July is anyone's guess, but

here's one from December 13 that added $1.45 Billion from

the state's revenue "surplus.")

For perspective, on January 26, Gov.

Baker filed his fiscal year 2023 budget, which begins on

July 1, for $48.5 Billion. (This was accompanied by legislation

proposing tax breaks for renters, seniors, parents and

low-income workers, and changes to how Massachusetts handles

estate and capital gains taxes.) Beacon Hill soon will exceeded

that $48.5 Billion amount already in this fiscal year by

over $1.5 Billion — and still not a word on any tax

relief for those who pay for every cent of state revenue

surplus.

While the Legislature

continues looking for new ways and excuses to increase revenue and

raise taxes to increase spending, the bonanza of riches continues to

pile up almost faster than Beacon Hill can spend the growing

windfall. In is Advances for the

coming week, the State House News

reported on Friday:

[The] Department of Revenue

is due to report on tax collections for March

... DOR has set the monthly benchmark at $3.43

billion and as of March 15 had already

collected $2.1 billion, up about 23 percent from

the same half-month period in 2021....

Through February, fiscal

2022 tax collections have totaled about $23.673

billion, more than $4 billion above the same

period in fiscal 2021 and more than $1.7

billion above year-to-date benchmarks.

You may recall that total

revenue taken from taxpayers by the state for the previous

fiscal year (FY2021) was over $5 Billion more than extracted from

them the year before

that (FY2020) — so the historic bonanza

continues unabated. Still that's not enough; they scheme and

plot to return none of the embarrassing surplus, to instead

take even more — because More

Is Never Enough (MINE) so long as even a cent remains in your

pocket.

In a relatively quiet week

on Beacon Hill, much was made of the campaigns for the next

governor. The Boston Herald's Peter Lucas, in his column

Creating jobs high on GOP candidate

for governor Chris Doughty’s to-do list, focused

on Republican gubernatorial candidate Chris Doughty, summarized the

contestants succinctly:

. . . That

includes Democrats Maura Healey, the attorney

general, and state Sen. Sonia Chang-Diaz.

It also

includes fellow Republican Geoff Diehl, 52, who is

considered the frontrunner in the two-man battle for

the Republican nomination for governor.

One of the

four will succeed outgoing Republican Gov. Charlie

Baker, who after two terms is not seeking

re-election.

Waiting for the governor's

race to get going

Weekly Roundup

I can imagine only one

thing worse, more disastrous for Massachusetts taxpayers, than Maura

Healey managing to become the state's next governor. That one

thing would be state Sen. Eric Lesser (D-Longmeadow) being elected

as Lt. Governor as her running mate.

Lesser has been persistent

in his relentless assaults on CLT's Proposition 2˝

for many years, obsessed with eroding and weakening it if not

outright killing it, yet. Currently he is the primary sponsor

of S.1899

(An Act relative to regional transportation

ballot initiatives) — which was favorably reported out of The Joint

Committee on Revenue on March 10, sent on to the

Senate Committee on Ways and Means — on which, conveniently,

Sen. Lesser sits as a member.

During his previous attack on Prop 2˝ (in 2020), in the CLT Update

of July 26, 2020 ("Taxpayers

— Stand and Defend Proposition 2˝") I asked the question:

Question of the Week:

Just

who does State Senator Eric Lesser (D-Longmeadow) represent?

Just

three weeks before his debate speech on the Senate floor advancing

his (at that time) latest assault on Prop 2˝,

Lesser's own Longmeadow neighbors and constituents at Town Meeting

rejected the town Selectboard's and Finance Committee's proposal

to begin the process of exempting Longmeadow from Proposition 2˝ tax

limits. Regardless, he chased his obsession.

State Senator Eric Lesser — now candidate for Lt. Governor —

obviously represents his own ambitions and nothing else.

On Friday The

Boston Herald's Amy Sokolow reported ("Lt. gov. candidate Eric Lesser brings fundraising

totals over $1 million"):

Lieutenant

gubernatorial candidate Eric Lesser raised over

$153,000 in March alone — bringing his campaign war

chest to over $1 million. Since announcing his

campaign in January, Lesser has raised over

$437,412, according to his campaign.

Lesser, a

liberal Democratic state senator from East

Longmeadow, has received donations from 1,188

individual donors from 145 municipalities. A total

of 70% of donors came from Massachusetts.

With $1

million in the bank, Lesser has separated himself

from the crowded pack for lieutenant governor. Even

before filing March’s totals, Lesser had almost

$900,000 in the bank. The next-closest current

candidate was state Sen. Adam Hinds, a Democrat from

Pittsfield, who has banked almost $300,000 before

his March filing.

Maura Healey becoming the

next governor is a thought almost too nauseating to contemplate, but

in Massachusetts, just when you think things can't possibly get any

worse, Bay State politics proves you wrong again. In

Massachusetts, things for now can still get worse, and they usually

do. But if Lesser and Healey are defeated then he will be

effectively banished from elected office in Massachusetts

— at least for a while — so hope

remains.

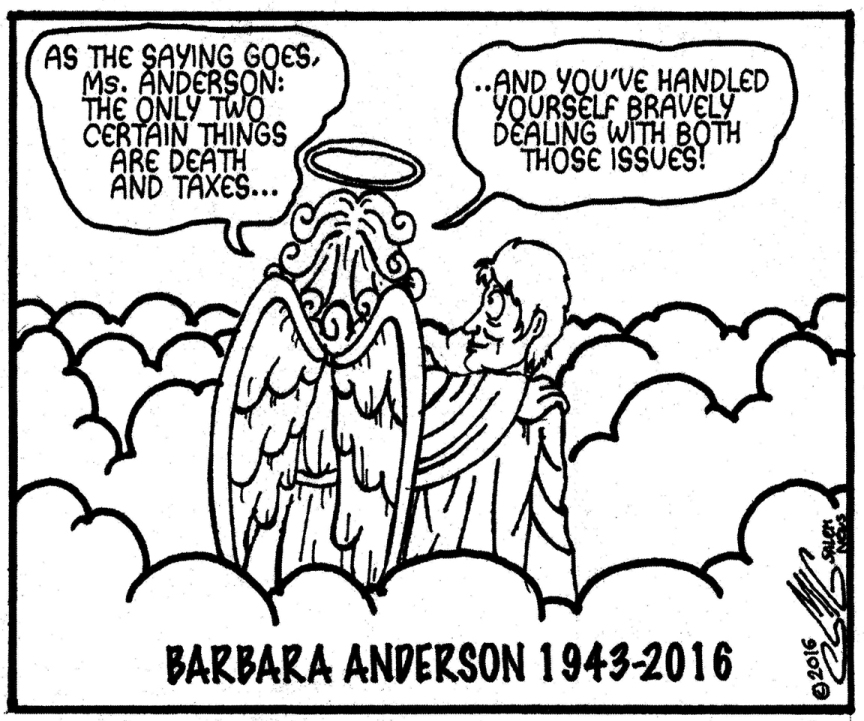

The

opening sentence of The Boston Herald story on

reforming the Massachusetts

estate tax ("They say only death and taxes are

certain, but in Massachusetts the former doesn’t

necessarily stop the latter.") reminded me of the

Salem News editorial cartoon a few days after

Barbara Anderson passed away —

it's hard to believe it'll be six years ago come

Friday at 2:40 p.m.

The Salem News

Editorial Cartoon by Christopher Smigliano

Wednesday, April 13, 2016

Barbara fought for Bay

State taxpayers with everything she had for over three decades of

her life right

up to her end, leaving nothing on the table when she was taken from

us. You might remember her final Salem News column ("Fighting

pirates with the Lost Boys"), published posthumously a few days

after she was gone, or the multitude of

tributes that came in from across the country. (If you're

wondering, no, Gov. Charlie Baker has not yet granted Barbara her

dying wish that he keep his promise — her plea

made in the final two sentences of the last paragraph Barbara

wrote before her death. His promise remains broken and he has only nine months

remaining to keep it.)

If you think of it come

Friday I hope you'll remember all she did with her life for so many.

Assuredly I will. She is the reason why I'm still doing this.

It Doesn't

Need To Be "The Massachusetts Way"

Recall that the

Legislature temporarily "froze" CLT's successful 2000 ballot

question to roll back the "temporary" income tax hike of 1989, just

two years after it was approved by the voters. In 2002 the

income tax rate stood at 5.3 percent, down from 5.75 percent when

CLT and voters ordered it be rolled back. The Legislature

substituted "economic triggers" back then that took eighteen more

years to finally get the income tax rate back down to 5 percent

— just two years ago, in 2020.

That's twenty years after the voters' mandate to drop the

income tax by less than one percentage point (from 5.75 to 5

percent).

Last week the Kentucky

General Assembly passed a bill to cut its state income tax by a

full percentage point, from 5 percent to 4 percent.

The (Louisville, KY) Courier

Journal reported on Thursday ("Lowering Kentucky's income tax," by

Morgan Watkins and Joe Sonka):

[Excerpt]:

The Kentucky

General Assembly gave final passage to more than 100 bills in a

lawmaking blitz across two long days this week, with the

Republican supermajority working to veto-proof as much

legislation as possible before [Democrat] Gov. Andy Beshear's

veto period began Thursday.

The GOP-dominated

legislature can likely override any vetoes issued by Beshear

when they return for the final two days of the 2022 session

April 13-14, but will not be able to override a veto of any bill

passed in those final two days....

Republicans quickly

passed an amended version of House Bill 8 to lower the

individual income tax rate from 5% to 4% and end the state sales

tax exemption for more than a dozen services.

[Majority Floor

Leader Damon Thayer, R-Georgetown, praised HB 8 as fulfilling

Republicans' longstanding goal of "moving away from taxes on

production and moving to taxes on consumption."]

The tax reform bill

now creates a more complex process of incrementally decreasing

the individual income tax rate by .5% until it is eventually

eliminated, with decreases requiring a sufficient fiscal year

surplus and the state's rainy day fund amounting to at least 10%

of general fund revenue for that year.

A fiscal note for

HB 8 projected it would decrease tax revenue by nearly $1.1

billion over the biennium — roughly $300 million less than the

original bill — with Democrats and opponents calling it a

giveaway to the wealthy and a missed opportunity to make

historic investments in education.

A proposal included

in Senate Bill 194, which would have given nearly $1.1 billion

of rebates to tax filers by this summer, was left on the cutting

room floor this session.

Kentucky and Massachusetts

have a similar challenge: Both are bordered by a state with no

income tax whatsoever. Massachusetts has New Hampshire to its

north to compete with; Kentucky has Tennessee to its south (just

thirty miles from me).

I don't expect it will

take Kentucky twenty years — two entire

decades — to entirely eliminate its state

income tax, which it took Massachusetts to reduce its own by

considerably less than one

percent.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

The Boston

Herald

Thursday, March 31, 2022

Death and taxes front and center in Massachusetts

Estate tax should be changed, says tax group

By Matthew Medsger

They say only death and taxes are certain, but in

Massachusetts the former doesn’t necessarily stop the

latter.

That should change, though, according to the Massachusetts

Taxpayers Foundation, which issued a brief Thursday in

support of Gov. Charlie Baker’s proposal to alter the estate

tax.

“Massachusetts should change its estate state because we

currently have the highest tax burden of any state in the

nation for estates between $1-3 million,” Eileen McAnneny,

foundation president, said in an emailed statement.

Currently, Massachusetts is one of 12 states that taxes an

estate after a person’s death.

Among the states that do so, Massachusetts is tied with

Oregon for the lowest threshold at which an estate tax kicks

in, at $1 million.

Massachusetts also employs a so-called “cliff effect,”

whereby an estate worth just $1 less than the threshold is

free of a tax burden, while that dollar results in

substantial tax liability.

This may not seem like it would be a problem for too many

people, but that’s not the case for anyone who owns real

estate in Massachusetts. When it comes to the estate tax,

the value of your home is included.

Considering then, the foundation says, that the current

median value of a single-family home in working class

Somerville is nearly $900,000, it wouldn’t take much more

than a small 401(k) account to put a working family into tax

liability.

“The current tax regime punishes people for working hard,

saving and acquiring wealth,” McAnneny said.

Baker proposes raising the threshold to $2 million and

eliminating the cliff effect with an estate exclusion at $2

million.

Even that proposal, if agreed to by the legislature, would

mean Massachusetts would have the third-highest estate tax,

behind Rhode Island and Oregon. Baker’s estate tax proposal

carries a price tag of $231 million in lost tax revenue, his

administration said.

Baker previously indicated that our economy cannot retain

people through retirement if the rate is not changed to be

competitive. McAnneny agrees.

“Changing our estate tax would make Massachusetts less of an

outlier, more competitive and help to retain people nearing

retirement, small business owners and others that are

adversely impacted,” she said.

State House News

Service

Friday, April 1, 2022

Advances - Week of April 3

The future of natural gas, a core component of the existing

energy mix but one that the state needs to become less

dependent on to meet its climate goals, is front and center

for debate at a Senate hearing on Monday. Just as gasoline

remains the most common way to power vehicles, natural gas

continues to serve as a dominant fuel.

The Senate Global Warming and Climate Change Committee

hearing will be followed up later in the week with hearings

that examine some of the tough choices that will be

necessary to meet near-term emission reduction requirements

in 2025 and 2030 as Massachusetts slowly implements plans to

bring offshore wind energy into the mix, and to build upon

solar and other renewable energy sources.

Another sector that state officials are trying to build out

comes into focus on Thursday, when the Senate is set to act

on legislation to facilitate cannabis cafes and enable more

people affected by the War on Drugs to become entrepreneurs

in the growing legal marijuana market. The rare legislative

push on the marijuana front has a friend in the House too

where Speaker Ron Mariano has given voice to the need to act

on a similar bill.

Gov. Charlie Baker also has decisions to make on an

important bill that landed on his desk Thursday night, a

$1.67 billion midyear budget that includes measures

important to the restaurant industry and divestment efforts

designed to weaken the Russian economy while that country

continues its invasion of Ukraine.

— KEY BILLS LOCKED UP IN

CONFERENCE:

Candidates running for district and county offices have just

more than one month left to collect and submit signatures

for their nomination papers, but while election season

churns along, it's still not clear what tools will be

available to voters this fall with a major reform bill tied

up in closed-door talks.

Legislative leaders tapped a six-lawmaker conference

committee on Feb. 3 to resolve differences between House and

Senate bills (H 4359 / S 2545), both of which would restore

and make permanent mail-in voting and expanded early voting

options that proved popular and successful during the

pandemic. The Senate legislation would also allow

prospective voters to register and cast a ballot in a single

trip to the polls on Election Day or during an early voting

period, while the House bill instead orders Secretary of

State William Galvin to study that reform and its costs -- a

step Galvin says is unnecessary.

Pressure to reach a consensus and finalize the legislation

was lower in the winter but has been growing amid the spring

local election season. Some cities and towns have already

conducted their local races in recent weeks using

pre-pandemic voting models, and many others are set to do

the same over the next month-plus. Conferees tasked with

voting reforms are Reps. Michael Moran, Dan Ryan and Shawn

Dooley and Sens. Barry Finegold, Cynthia Creem and Ryan

Fattman.

Another conference committee -- Reps. Joseph Wagner, Paul

McMurtry and David DeCoste and Sens. Michael Rush, John

Velis and Bruce Tarr -- is negotiating a soldiers' home

reform bill two years after the deadly COVID-19 outbreak at

the Holyoke Soldiers' Home (H 4441 / S 2761).

A separate conference committee technically remains on the

books to finalize a package of joint legislative rules for

the 2021-2022 session, but that panel appears effectively

dead with no compromise offered more than a year after it

started its work and two members, former Rep. Claire Cronin

and former Sen. Joseph Boncore, now resigned.

The number of conference committees will likely grow this

spring once the House and Senate complete their work on the

annual state budget and whenever the House tackles a mental

health bill and the Senate advances a climate bill. - Chris

Lisinski

[ . . . ]

Tuesday, April 5, 2022

MARCH REVENUES: Department of Revenue is due to report on

tax collections for March, which the department said tends

to be "a mid-size month for revenue collections, ranking #6

of the twelve months in nine of the last ten years."

DOR has set the monthly benchmark at $3.43 billion and as of

March 15 had already collected $2.1 billion, up about 23

percent from the same half-month period in 2021. Most of

that increase, DOR said in its mid-month report, came from

income taxes, including withholding, but much of the

increase is due to the recently-enacted elective

pass-through entity excise and is therefore temporary.

Through February, fiscal 2022 tax collections have totaled

about $23.673 billion, more than $4 billion above the same

period in fiscal 2021 and more than $1.7 billion above

year-to-date benchmarks.

[ . . . ]

Thursday, April 7, 2022

CLEAN ENERGY AND CLIMATE PLAN -- DAY ONE: Executive Office

of Energy and Environmental Affairs hosts a public hearing

on its Clean Energy and Climate Plan proposals for 2025 and

2030, including economy-wide emissions limits, emissions

sublimits for specific sectors, and policies to achieve the

emissions limits, sublimits, and other goals.

The hearing will focus specifically on the electric power,

transportation and non-energy sectors. The hearing will

begin with a presentation from the administration followed

by a period of public comment.

The administration's interim plan for 2030 and its 2050

Decarbonization Roadmap, both released at the end of 2020,

laid out possible pathways towards the 2050 net-zero target

as the administration set a new goal of reducing greenhouse

gas emissions by 45 percent from 1990 levels by 2030 (the

2021 climate roadmap law later set a requirement for a 50

percent reduction by 2030).

The 2025 and 2030 emission limits, sublimits and plans must

be finalized by July 1 per the climate roadmap law. In the

fall, the administration said it planned in March 2022 to

present and gather feedback on "proposed emissions limits

and sublimits for 2025 and 2030; proposed goals for reducing

emissions from and increasing carbon sequestration on

natural and working lands (NWL) [and] proposed policy

portfolio that aim to achieve these emission limits,

sublimits, and NWL goals." Following the hearing, written

feedback on the proposals will be accepted at gwsa@mass.gov

until April 30.

Friday, April 8, 2022

CLEAN ENERGY AND CLIMATE PLAN -- DAY TWO:

State House News

Service

Friday, April 1, 2022

Baker Signs $1.67 Bil Midyear Budget

By Colin A. Young

Gov. Charlie Baker on Friday signed the multi-faceted $1.67

billion midyear spending bill that lawmakers sent to his

desk Thursday night, approving all of the bill's spending

while sending back one veto and one amendment.

The fiscal year 2022 supplemental budget allocates money

toward the ongoing COVID-19 response ($700 million), rate

enhancements to human service providers ($401 million),

winter road repair ($100 million), rental assistance ($100

million) and more, extends popular pandemic-era restaurant

policies for a year, and directs state officials to divest

public pension funds from Russia-involved companies.

Baker vetoed one section of the bill, which he said would

"prevent the Department of Early Education and Care (EEC)

from entering into any contracts exceeding one year in

length between March 1, 2022 and June 30, 2023." Baker said

he was vetoing the "restriction" because it "impermissibly

interferes with executive decision making, as well as the

efficient delivery of essential childcare services"

The governor also sent back with an amendment a section of

the bill that allocates supplemental early intervention

staffing recovery payments "disproportionately in favor of

large providers at the expense of smaller providers." Baker

said he supports the funding but the distribution formula

the section established "can and should be improved."

Though he signed the section "to indicate support for the

intent of the appropriation," Baker told lawmakers in a

letter that he wants to work with them to "effectuate a

technical fix to an item authorizing spending for refugee

resettlement." The bill includes $10 million for Ukrainian

refugee and immigrant resettlement efforts.

State House News

Service

Friday, April 1, 2022

Weekly Roundup - This Is The Way

Recap and analysis of the week in state government

By Matt Murphy

Attorney General Maura Healey doesn't seem to be about

reliving the past.

Not when it comes to pot. Not when it comes to gambling. And

certainly not when it comes to her 2014 campaign for

attorney general.

That was the year the new-on-the-political scene prosecutor

defied the odds to beat an insider with a well-known last

name in her first statewide race for public office. In that

campaign, Healey backed a ballot question that would have

repealed the state's casino legalization law.

Eight years later Healey is seeking a new office and another

gambling issue is in the headlines.

"Sports betting, it is the way now," Healey said this week,

an acknowledgment that the whistle on this match has already

blown in other states. It may not have been a ringing

endorsement of gambling on athletics, but it sounded an

awful lot like the answer she gave earlier this month when

asked if she regretted opposing the legalization of

marijuana.

No regrets. Just reality.

"I just want to make sure that everybody is able to share in

the benefits and the gains of that industry," she said about

marijuana. "And I think we still have more work to do when

it comes to the social justice issues that were in fact

driving a lot of proponents of that law."

Incidentally, Senate leaders this week signaled their intent

to take up marijuana industry equity next week. But more on

that another time.

Sen. Sonia Chang-Diaz, Healey's rival for the Democratic

nomination for governor, told the News Service last week she

was "open" to sports betting, but stressed that "specifics

will matter." That's been Senate President Karen Spilka's

mantra as well, insisting on Monday that despite majority

support in her chamber for legislation she is seeking

"consensus" on the details before calling for a vote.

Chang-Diaz also spent this week trying to remind Healey

about her 2014 campaign challenge to primary opponent Warren

Tolman that they debate once a month until the September

primary. That didn't happen, and it doesn't appear

Chang-Diaz will get her wish for three pre-convention

debates either.

The shoe is on the other foot this year with Healey not

seeking, or needing, the exposure that would come from

multiple debates, while that's exactly what Chang-Diaz

wants. Healey said she would agree to two televised debates

between the June 4 convention and the Sept. 6 primary,

prompting Chang-Diaz to call her arrogant.

The mood in the Legislature this

week was more collegial.

The House and Senate found common ground on a $1.67 billion

spending bill that includes money for COVID-19 relief, and

extends popular pandemic accommodations like to-go cocktails

and outdoor dining as Boston Mayor Michelle Wu tried to put

out the kitchen fire she started in the North End by

proposing to charge restaurants a $7,500 impact fee for al

fresco dining.

Lawmakers also agreed on a strategy to divest pension funds

from Russian companies sanctioned by the United States or

incorporated in that country, and both branches extended

their remote voting protocols, allowing at least for the

remainder of this session legislators to call in their

votes.

Home offices are the workplaces of the future, after all,

right?

A special legislative commission co-chaired by Sen. Eric

Lesser and Rep. Josh Cutler released their report on the

"Future of Work" this week, and while it may not have

contained any shocking findings, it did reinforce the way

everyone has understood the impact of the pandemic.

Hybrid and remote working models, the report found, are here

to stay with ramifications for commercial real estate and

downtowns and requiring a renewed commitment to workforce

training and ensuring supports like child care and elder

care are affordable and accessible to families.

Hybrid participation is how the Legislature continues to

operate these days, but House Democrats were positively

giddy about another step toward normalcy when they caucused

together in-person for the first time in two years.

Multiple rounds of applause were heard outside the private

meeting before lawmakers made their way to the House chamber

to pass a $350 million road and infrastructure maintenance

bill that included $200 million for Chapter 90 and $150

million spread across multiple other programs.

Rep. William Straus, the co-chair of the Transportation

Committee, said the House wasn't quite ready to reform the

formula for Chapter 90 to more equitably distribute aid to

rural communities with many roads and few people, but he

said it's still a possibility in the coming months.

Rep. Thomas Golden will likely be on the receiving, rather

than the giving, end of Chapter 90 by that time as Golden

was offered the position of Lowell city manager on Wednesday

and is expected to soon depart Beacon Hill.

Gov. Charlie Baker's longtime chief of staff Kristen Lepore

is also leaving the State House, but for where she wasn't

ready to say. Lepore is just Baker's second chief of staff

in more than seven years, and has held down the job since

the summer of 2017 when she moved over from being secretary

of administration and finance.

When she departs on April 15, Baker's senior advisor and

steady sounding board Tim Buckley will take over to steer

the ship for the remaining nine months. Among Buckley's

tasks will be to try to get the governor's pre-trial

detention bill through the Legislature on the

administration's third attempt.

Baker and Lt. Gov. Karyn Polito were in Worcester this week

to again hear from survivors of abuse about the fear they

experienced knowing their abusers were free on bail during

the duration of a case, or would face no criminal

repercussions when they cut off their court-ordered GPS

tracking device.

The amplification of these survivor stories has been the

strategy Baker and his team have been using to build public

pressure on Democrats to consider his bill, which sits

before the Judiciary Committee and faces a deadline of April

15 for the panel to make a recommendation.

The Legislature and the Committee on Financial Services has

longer than that - probably until around early July - to

make a call on whether to intervene and try to pass a bill

that would negate the need for app-based transportation

companies like Uber and Lyft to take their employment case

to the voters in November.

These tech companies are seeking legal permission to

classify their drivers as independent contractors in

exchange for some wage and benefit guarantees, while

opponents believe drivers should be treated as full-time

employees.

If the committee's hearing on this issue this week showed

anything, it's that the two sides are far apart and digging

in deeper.

STORY OF THE WEEK: People bet on sports. They like to work

remotely. And they enjoy eating outside. That's just the way

it is ...

The Boston

Herald

Saturday, April 2, 2022

Creating jobs high on GOP candidate for governor Chris

Doughty’s to-do list

By Peter Lucas

Here is one thing Republican gubernatorial candidate Chris

Doughty can brag about: He has created more jobs than anyone

else running for governor.

In fact, he has created more jobs in his successful business

career than have all the candidates seeking to become

governor combined.

That includes Democrats Maura Healey, the attorney general,

and state Sen. Sonia Chang-Diaz.

It also includes fellow Republican Geoff Diehl, 52, who is

considered the frontrunner in the two-man battle for the

Republican nomination for governor.

One of the four will succeed outgoing Republican Gov.

Charlie Baker, who after two terms is not seeking

re-election.

Of the four, Doughty, a Wrentham father and grandfather, is

the only candidate who has not run for office before. So, he

does not talk or act like a politician, but more like an

executive who knows how to run an entity like a business.

Asked why he was running, Doughty said, “I want to give back

to a country that has blessed me.” He also wants to create

jobs in Massachusetts along the way, which is something he

knows about.

Doughty, before taking a leave, was president of Capstan

Atlantic, a metal gear manufacturing company he began as a

start-up. It makes parts for cars, trucks and washing

machines, among other things. It now employs 700 skilled

workers at two facilities, one of which is in Wrentham. Half

of the workers are immigrants.

Doughty, who is fluent in Spanish, having spent two years in

Argentina as [a] youthful Mormon missionary, said he is

familiar with the views and needs of workers, having worked

beside them for years.

He is a graduate of Brigham Young University and received a

master’s degree from Harvard Business School. In 2016 the

Massachusetts Economic Council awarded Capstan its gold

medal for growth and economic expansion.

Doughty said he has turned down several lucrative offers of

tax breaks from other states wanting him to relocate.

He said his skill set as a hands-on executive would come in

handy if he were governor. “I know how to read and balance a

budget,” he said. “I know how to create jobs.”

Before he can do that, however, he must defeat Diehl, a

former state representative from Whitman, and then become

the Republican nominee.

Diehl has a strong head start. He already has one statewide

campaign under his belt. He was defeated for the U.S. Senate

in 2018 by Democrat Elizabeth Warren.

The conservative Diehl, in the fractured Massachusetts

Republican Party, is supported by Jim Lyons, the party

chairman, and has been endorsed by former President Donald

Trump.

While that may not be sound like a big deal in progressive,

anti-Trump Massachusetts, Diehl’s conservative backing will

play a major role in winning the party convention

endorsement and the September primary.

Doughty must get 15% of the convention delegate vote to

appear on the September primary ballot, which, for a person

who has not even been to a convention, is a tall order.

He said he was confident he can do it. And toward that end

he has come up with $500,000 of his own money to seed his

campaign.

While Doughty discourages being pigeonholed, he is

considered a moderate in the fashion of Charlie Baker.

So, the GOP campaign between the two is shaping up as a

battle over the future of the Republican Party in

Massachusetts.

Will it continue along the moderate/liberal path traveled by

former Govs. Bill Weld, Paul Cellucci, Mitt Romney and

Charlie Baker — and now Chris Doughty — or will it go the

way of conservative Geoff Diehl and Jim Lyons?

“I am not beholden to any political machine,” Doughty said.

“I don’t come from that world. I come from the

entrepreneurial world, where we take complex problems and

solve them.”

The governor is the state’s chief executive officer. Doughty

said, “The CEO’s job is creating jobs. We need a to elect a

governor who is compatible with creating jobs.”

“I’ll shake things up.”

— Peter Lucas is a veteran

Massachusetts political reporter and columnist.

Commonwealth Magazine

Tuesday, March 29, 2022

Waiting for the governor's race to get going

By Bruce Mohl, CommonWealth editor

When Sonia Chang-Diaz challenged Maura Healey to agree to a

series of three televised debates prior to the Democratic

state convention in June, some political analysts dismissed

the move as an attempt by a struggling candidate to gain

ground on a better known and better financed rival.

There may be some truth to that analysis, but Chang-Diaz

puts forward another theory -- that voters deserve to know

where the two Democratic candidates for governor stand on

the major issues of the day.

“This is standard-issue stuff,” Chang-Diaz said of her call

for debates. “There are real differences between the

attorney general and me.”

Chang-Diaz, a state senator from Jamaica Plain, points out

that Healey herself called for monthly primary debates when

she first ran for attorney general in 2014. And the

Democratic gubernatorial primary race in 2018 featured three

debates as well.

Healey’s campaign responded to Chang-Diaz’s challenge with a

vague promise to debate, but didn’t say when she would

debate or how many times she would debate. Chang-Diaz’s

campaign called the response a dodge.

The back and forth exchanges were fairly standard stuff in a

race between a clear frontrunner and a challenger. But they

also underscored the cautious campaign that Healey appears

to be running.

Chang-Diaz is fond of pointing out that she jumped into the

race for governor before Gov. Charlie Baker made his

decision not to seek reelection, while Healey waited until

the popular Republican governor bowed out before declaring

her candidacy.

Chang-Diaz’s candidacy is all about introducing herself to

voters, but Healey is acting as if everybody already knows

where she stands. A recent Boston Globe story noted Healey’s

campaign is “long on advantages” and “short on specifics.”

After nearly eight years as attorney general, Healey is a

known commodity, to some extent. We know she sued former

president Donald Trump a lot. We know she went after the

Sackler family and Purdue Pharma in court. And we know she

suggested the protests sweeping the nation after George

Floyd’s killing in 2020 might yield long-term benefits.

“Yes, America is burning. But that’s how forests grow,” she

said.

Those stances and comments reveal a lot about Healey, but

voters need more from a candidate for governor. A governor

deals with a multitude of issues, from education funding to

public transportation, from prisons to the State Police,

from public health to climate change. Sorting out where

candidates stand is what campaigns are all about.

Chang-Diaz’s campaign website has the standard issues page,

where you can read about the candidate’s stances on

education, climate change, racial justice, housing, economic

justice, health care, transportation, policing, gender

equality, LGBTQ+ rights, and voting rights.

Healey’s campaign website, by contrast, includes the video

announcing her candidacy for governor and sections devoted

to fundraising and recruiting supporters. With a little over

two months to go until the Democratic state convention in

Worcester, there is no tab yet for issues on Healey’s

campaign website.

|

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

BACK TO CLT

HOMEPAGE

|