|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

48 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, February 7, 2022

Stunning

Over-Taxation Marches On

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

As Gov.

Charlie Baker embarks on a push for tax relief

proposals, the Department of Revenue

reported

Thursday that it collected $4.026 billion in state

tax revenue from people and businesses last month, a

haul that surpassed expectations by $856 million or

27 percent and has helped to put the state nearly

$1.5 billion ahead of its end-of-fiscal-year

target....

"January

2022 revenue collections increased in most major tax

types, in comparison to January 2021 collections,

including withholding, non-withholding, sales and

use tax, and corporate and business tax," Revenue

Commissioner Geoffrey Snyder said....

In the

first seven months of fiscal year 2022, DOR has so

far collected approximately $21.872 billion --

$4.219 billion or about 24 percent more than actual

collections during the same period of fiscal 2021

and $1.45 billion or about 7 percent more than the

department's year-to-date benchmark....

"We ended

last year with a surplus and tax collections

continue to exceed projections in a big way. It's

time to enact tax breaks for families, seniors and

more," Baker tweeted Thursday just after DOR

reported on January revenues. In his fiscal 2023

budget plan, the governor proposed tax breaks for

renters, seniors, parents and low-income workers, a

cut to the tax rate on short-term capital gains, and

two changes to the estate tax.

State

House News Service

Thursday, February 3, 2022

Tax Receipts Already Running

$1.5 Bil Above Revised Estimate

After

state tax revenues came in wildly above projections

last month, Gov. Charlie Baker took to Twitter to

tout his plan to slash taxes for a broad swath of

Bay Staters.

“We ended

last year with a surplus and tax collections

continue to exceed projections in a big way,” Baker

tweeted Thursday evening. “It’s time to enact tax

breaks for families, seniors and more. Last week I

proposed doing just that.”

As the

Herald previously reported, Baker has proposed

almost $700 million in tax breaks as part of his

last budget as governor, including doubling the

maximum Senior Circuit Breaker Credit to lower the

tax burden for many low-income senior homeowners,

increasing the rental deduction cap for renters, and

giving other breaks to parents, low-income

households and those filing estate taxes.

The

Boston Herald

Saturday, February 5, 2022

Charlie Baker pushes tax

cuts

as January tax revenues soar above projections

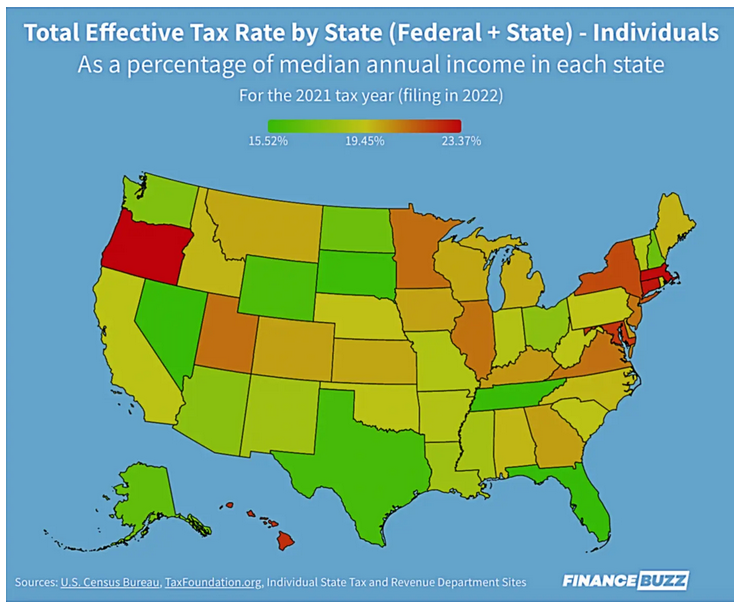

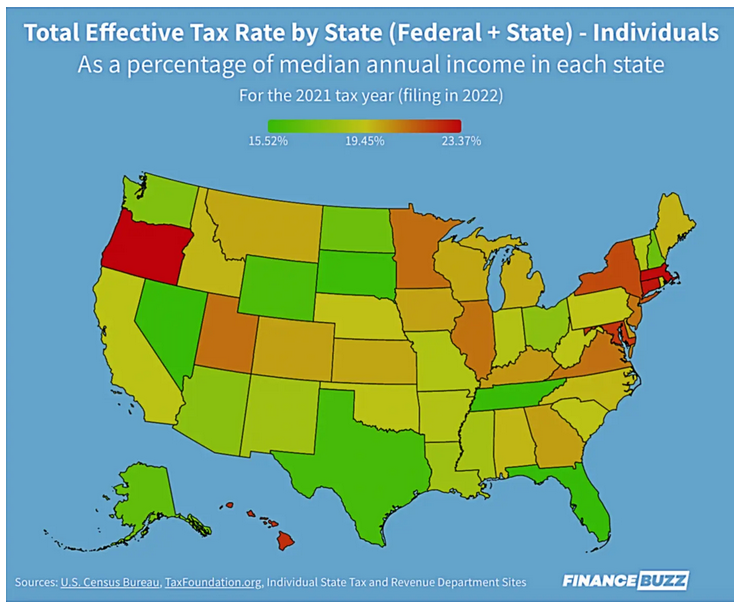

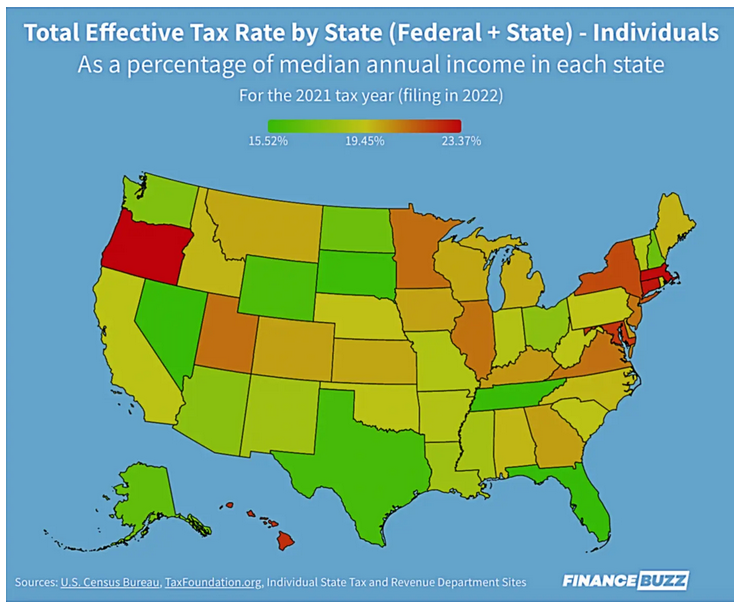

It’s tax

season, and in news perhaps unsurprising to Bay

State taxpayers, couples living here have to shell

out the highest percentage of their income on taxes.

“The

biggest takeaway for me was just how vast the spread

can be across the country,” said Josh Koebert, who

authored the study on

FinanceBuzz.com, in an email.

He noted

that the difference between states like Florida and

Massachusetts was 50%. “That is a huge difference,”

he said, “50% more paid in taxes annually, almost

all of which comes down to state-level income tax

laws.”

The study

compared the median income for full-time workers in

each state, derived from the U.S. Census Bureau,

against the federal and state tax rates for the 2021

tax year.

Massachusetts took the top spot for couples filing

jointly, with couples paying 23.51% of their income

in taxes. Close behind is Oregon, at 23.24%, Hawaii,

at 23.05%, and Connecticut, at 22.99%. The lowest

rate was in Tennessee, with taxpaying couples owing

just 15.54% of their income to taxes.

For single

filers, Massachusetts earned the number two spot, at

23.23%. Oregon edged out Massachusetts at 23.37% to

take the top spot. Connecticut and Hawaii fell not

far behind, and Florida singles took the bottom

spot, with 15.52% of their median income owed to

taxes....

Paul Diego

Craney, of the conservative Mass. Fiscal Alliance,

reminded the Herald that state lawmakers are

proposing a ballot measure that would raise the

income tax on the wealthiest earners, as well as

some businesses.

“The

public needs to realize that when they send part of

their paycheck to the legislators at the Statehouse

to spend, they are already the most generous in the

country and yet lawmakers still want more,” he said.

The

Boston Herald

Wednesday, February 3, 2022

Massachusetts couples

pay the highest percentage of income in taxes

in the country, report says

Are you

having a hard time making ends meet in this

inflationary Biden malaise?

Could you

use an extra $70,530 a year — for a “job” where you

never, ever have to show up, where the actual place

where you would theoretically “work” hasn’t even

been open to the public for two years now?

And that

$70,530 a year — that’s minimum wage for a state

legislator, you understand. They’re all also

grabbing at least $16,245 for “travel expenses,”

even though they’re not traveling to Boston anymore.

And most

of them have also been handed even more money for

some phony-baloney so-called leadership position,

running committees that just rubber-stamp what

they’re ordered to do.

Did I

mention that if a legislator lives more than 50

miles from the State House, he or she can write off

most of their federal income taxes, just like almost

all members of Congress do?

And then

there’s the campaign committee you can set up, which

allows you to write off almost all your expenses.

You can even buy gift cards for your constituents,

who might very well happen to be your parents … or

your girlfriend. You can charge all your bar tabs –

just ask Rep. Mark Cusack, D-Braintree.

If you

could use a little – actually, a lot of — free

money, no strings attached, perhaps you should

consider running for the Massachusetts state

Legislature. It’s the easiest gig this side of being

an illegal immigrant....

The solons

used to get reimbursed for every day they drove to

work, on a scale — $5 if you lived around the

corner, $50 if you were from, say, Berkshire County.

It went up and up and up … but these “per diems”

were always embarrassing, because the statesmen had

to file paperwork with the treasurer for their

dough. And reporters could check up....

So the

hacks got rid of the per diems and just gave

everybody a set amount per year — $15,000 if you

lived within 50 miles, or $20,000 if you lived more

than 50 miles away....

And behind

the money comes the pension. Billy Bulger has been

grabbing a kiss in the mail of what is now $272,719

a year since 2003. David Bartley, who last won an

election in 1974, has been pocketing $157,666 since

2004.

Nice

“work” if you can get it.

The reason

I bring this up, other than the Feb. 15 date to pull

papers, is that more and more this election year

seems to be shaping up as a once-in-a-generation

cycle, when a fed-up electorate throws the bums out

in larger-than-normal numbers.

I’m

starting to pick up that 1990 vibe around here

again. That was the year in Massachusetts when

dozens of Democrats retired due to ill health — the

voters got sick of them....

The pay

now is at least four times what it was during that

tidal wave election of 1990.

The

Boston Herald

Friday, February 4, 2022

The easiest $70,530 you’ll ever make

— with perks that add up, and up

Massachusetts lawmakers laughing all the way to the

bank

By Howie Carr

No rules

are hard and fast on Beacon Hill, but the

Legislature's Joint Rule 10 required committees to

render a verdict on thousands of bills filed this

session, or at the very least request an extension.

The soft

deadline on Wednesday breathed life into some ideas,

like retrofitting 1 million homes over the next

decade to be energy efficient and giving consumers

more control over their data privacy online. Others

- i.e. giving drivers' licenses to undocumented

immigrants, and allowing municipalities to raise

money for housing through new fees on real estate

transfers - remain stuck in limbo as their

committees requested more time.

But only

opponents were toasting the demise of a bill to

remove the ban on Happy Hour drink specials, as

legislators referred that concept for "further

study" - the bureaucratic equivalent of a bartender

saying, "You're cut off."

State

House News Service

Friday, February 4, 2022

Weekly Roundup - Building Bridges

Eight

bills that would allow individual municipalities to

add a new fee to certain real estate transactions

advanced from one legislative committee, while

another is taking more time to decide on a proposal

that would allow cities and towns to take such a

step without first getting Beacon Hill's approval.

As of

Wednesday's deadline for most committees to act on

bills, the Housing Committee had put forward an

order extending until May 9 its window to advance or

reject legislation that would enable municipalities

to impose a fee of between 0.5 percent and 2 percent

of the price of certain housing transactions in

order to generate revenue to preserve affordable

housing and fund new home construction.

The fee

rate and any exemptions would be set locally, and

the bills (H 1377, S 868) call for the new fees to

be applied only on transactions featuring prices

that are above the statewide or county median

single-family home price.

While the

decision could bottle the bills up for three more

months, Rep. Mike Connolly, who filed the House

version and serves on the Housing Committee, said he

viewed the extension as an "encouraging sign." ...

Amid a

lack of housing inventory, the state's median home

sale price in 2021 surpassed $500,000, the Warren

Group reported Tuesday. The new annual median of

$510,000 represents an increase of more than 14

percent from 2020....

Bills

proposing transfer fees in Somerville (H 3938),

Provincetown (H 3966), Concord (S 2437), Boston (H

2942), Arlington (H 4295), Cambridge (H 4282),

Nantucket (H 4201) and Chatham (H 4060) all earned

favorable reports from the Revenue Committee, moving

them along them in the legislative process.

A

favorable report doesn't guarantee a bill will pass,

or even make it to the floor for a vote. Similarly,

the Housing Committee's extension order doesn't

carve May 9 in stone as a final deadline for action

on its bills, as committees can seek further

extensions and lawmakers may opt to advance policies

as attachments to other vehicles including the

annual state budget.

State

House News Service

Wednesday, February 2, 2022

Housing Panel Holding On To

Transfer Fee Bill

Revenue Committee Backs Local Transfer Fee Proposals

Almost two

years ago to the day, the Transportation Committee

voted along party lines to endorse legislation that

would allow undocumented immigrants in Massachusetts

to access driver's licenses.

Now, with

a deadline looming to take a position on the latest

version of the bill, the same panel decided it needs

more time, just as it did with a long-debated

proposal to expand enforcement of the state's

seatbelt law.

Neither

the measure that supporters dubbed the Work and

Family Mobility Act (H 3456 / S 2289) nor Gov.

Charlie Baker's refiled bill allowing police to stop

motorists solely for failing to buckle up (H 3706)

will be subject to this week's biennial culling of

the bills under the Legislature's Joint Rule 10.

Both bills

had been pending before the committee for more than

nine months before its members sought an additional

one-month extension. The licensing bill featured at

a public hearing in June, while lawmakers heard

testimony on Baker's road safety bill in

December....

That move

frustrated supporters of the seatbelt proposal, who

cautioned the extension further delays action on a

potential life-saving measure at a time when roadway

deaths are soaring in Massachusetts and nationally.

Among

supporters of the licensing bill, who have been

unsuccessfully pushing some form of the change for

more than a decade, the delay was interpreted as

"very good news."

"I think

we're all in agreement at the coalition that this

was very good news because we know how, with COVID

especially, this has been an incredibly difficult

and rushed legislative session," said Franklin

Soults, a 32BJ SEIU spokesperson who works with the

Driving Families Forward Coalition. "We had a very

great hearing. It seems like communication is really

good between the committees and the sponsors of the

bill and everybody, so we feel very confident this

is actually a really great sign."

State

House News Service

Tuesday, February 1, 2022

Committee Keeps Lock On

Popular Licensing Bill

Deadline Also Extended On Seatbelt Enforcement

Proposal

Chris

Doughty wants to make sure both major political

parties have a voice on Beacon Hill next year.

The

59-year-old Republican from Wrentham understands

that the Democratic Party will control both chambers

of the legislature, but sees an opportunity for his

side of the aisle to maintain the governorship.

Doughty,

the president of Capstan Atlantic, a gear

manufacturer in Wrentham, announced last week he’s

running for governor. He spoke with NewBostonPost in

a telephone interview this past Friday and explained

why he is running to replace Charlie Baker, 65, a

Republican who is planning to step down after two

four-year terms.

“There’s

really two reasons,” Doughty said. “One is to keep

the balance in the State House. I think that’s part

of the miracle of Massachusetts is that we

consistently elect governors from the private sector

that are conservative to keep the balance in the

State House. The other reason is: I want to fix the

affordability problems in the state, particularly

for our citizens and also for our businesses.”

Doughty

(the “o” in the first syllable is long, and rhymes

with “go”) said that he thinks his experience in the

private sector would be helpful as governor....

One major

legislative priority for Doughty would be lowering

taxes.

“On day

one, I would say to everyone that I would like to

see us begin the process of lowering our tax burdens

on our citizens–slowly over time because it takes

awhile–and to improve,” he said. “In my business, I

have to do both. I have to become more affordable

and better every day, and I’d bring that to the

State House.”

When asked

if he would support the kinds of tax breaks that

Massachusetts Governor Charlie Baker proposed during

last week’s State of the Commonwealth address,

Doughty said yes.

“Yeah I

think lowering taxes is wise. It puts more money in

everyone’s pocket and lets them decide how they want

to spend their hard-earned dollars. I grew up mowing

lawns, so I know the value of a dollar. Every dollar

we can leave in the citizens’ pocketbook and say

‘You keep it. You’re better at making decisions on

how to spend your money than the government.’ I

think that’s always good.”

Some of

the tax cuts Baker proposed last week included:

raising the floor at which Bay Staters begin paying

state income tax (from $8,000 to $12,400 for single

filers, from $16,400 to $24,800 for joint filers and

from $14,400 to $18,650 for heads of household);

increasing the senior circuit breaker property tax

credit for seniors earning less than $63,000 per

year ($93,000 for married couples) from $1,170 to

$2,340; allowing renters to deduct 50 percent of

their annual rent from their tax bill up to $5,000

(it’s currently at $3,000); and doubling the state’s

dependent care tax credit for people with children

under 12, a disabled dependent, or a dependent over

65 years old (making it $480 for single filers with

one dependent, $960 if a filer has two or more

dependents, $360 for households with one dependent,

and $720 for households with two ore more

dependents).

The New

Boston Post

Monday, January 31, 2022

Republican Chris Doughty Weighs In On Taxes,

Business Climate, Abortion

In Bid For Governor of Massachusetts

Wealthy

businessmen do not fare well in Massachusetts

politics. Often, they think that because they can

run a successful business as Doughty has, they can

get elected to high office or run a government.

In lieu of

a campaign organization or campaign contributors,

they spend a fortune of their own money hiring

political consultants who tell them what to say, how

to say it and who to say it to....

This is

not to say that Doughty will go down that path. But

he has attracted some attention by promising to

spend $500,000 of his own money to defeat Diehl in

the primary. Diehl so far has raised some $325,000

from contributors.

A

Republican primary is small beer and far less costly

when compared to the Democrats, and Doughty’s half

million for starters will go a long way.

While

there are 1.2 million registered Democrats and 2.7

million Independents, who normally don’t vote in

primaries, there are only 459,663 registered

Republicans, many of whom don’t vote anyway.

The

Boston Herald

Sunday, January 30, 2022

Consultants the only sure winners

as Doughty looks for moderate votes

By Peter Lucas

Given

Baker’s high approval ratings, it’s easy to see why

some Democrats might have celebrated his decision

not to seek a third term. But the complacency

Downing described also suggests a low regard for

Geoff Diehl, the former state representative from

Whitman who announced his run for governor last

July.

Diehl

served in the Legislature from 2011 to 2018, and in

2014, he helped lead a successful ballot-question

campaign to end automatic hikes to the state’s gas

tax. Lately, though, Diehl’s electoral fortunes have

foundered. In 2015, he ran unsuccessfully in a

special election for state Senate. In 2016, when he

helped lead Donald Trump’s presidential campaign in

Massachusetts, Trump lost the state to Hillary

Clinton by 27 percentage points. And in 2018, after

winning the Republican nomination for U.S. Senate,

Diehl was routed by Elizabeth Warren in the general

election, winning 36 percent of the vote to Warren’s

60.

Despite

those setbacks, however, dismissing Diehl as

unelectable would be a mistake. Thanks to the

idiosyncrasies of Massachusetts politics, the 2022

governor’s race will offer him structural advantages

the 2018 Senate race didn’t. And while Diehl’s

strengths as a campaigner and candidate are

debatable, he possesses one invaluable skill: an

ability to intuit what various constituencies want

to hear and to shape his message accordingly — even

if that means, on occasion, saying different things

to different people....

But

Democratic strategist Doug Rubin, who helped Deval

Patrick make the jump from unknown to governor in

2006, has a very different take on Diehl’s

prospects.

“The most

important thing in Massachusetts politics for

governor — separate from every other race in the

state — is that, for whatever reason, voters for

governor don’t seem to see Democrat and Republican,”

Rubin said. “They see insider-outsider. And they

want an outsider in that governor’s office.”

In the

past three decades, Rubin points out, that dynamic

has resulted in just one Democrat, Patrick serving

as governor. Every other occupant of the corner

office has been a Republican.

“One

reason Deval Patrick was able to break that

Republican streak is because he was perceived as an

outsider who was willing to stand up to the

Legislature and fight for the people of

Massachusetts,” Rubin said. “And look, if Geoff

Diehl is able to paint the Democratic nominee as an

insider, and is able to paint himself credibly as an

outsider … that’s the path to victory for

Republicans. It’s a pretty simple path.”

That

outsider-insider narrative might be tough for Diehl

to push if he’s the nominee and his opponent is

Harvard political theorist Danielle Allen, who’s

never held elected office. But against Sonia Chang-Díaz,

an incumbent state Senator in the Democrat-dominated

Legislature, it would be considerably easier.

Against new entry Maura Healey — who’s in her second

term as attorney general, and is widely seen as the

preferred candidate of the Democratic establishment

— it might be easiest of all....

Of course,

for Diehl to fully emulate [Virginia Gov. Glenn]

Youngkin, he’ll have to get through the Republican

primary. As of last week, he has some competition:

Chris Doughty, a Wrentham businessman, announced his

own bid for governor Wednesday, touting himself as a

process-oriented job-creator in a kickoff video. But

Doughty, who’s never run for office before, may find

that the appetite for his political profile is

limited these days. In an interview with the Boston

Globe, Doughty acknowledged voting for Hillary

Clinton in 2016, which is unlikely to please the

Republican base. He also said he voted for Trump in

2020, which is unlikely to please moderate

Republicans and Republican-leaning unenrolled voters

concerned with the party’s ongoing shift rightward.

In

addition, even if Doughty proves to be a quick

study, Diehl has already forged a strong

relationship with the voters who’ll choose the next

Republican nominee. In October 2021, a poll

commissioned by the Democratic Governors Association

showed Diehl leading Baker by 21 points in a

hypothetical primary matchup — with the margin

growing to 32 points when respondents were told of

Trump’s endorsement.

WGBH -

Greater Boston

Wednesday, February 2, 2022

Is everyone underestimating Geoff

Diehl?

Maura

Healey said she’s ready to break a supposed “curse”

that’s blocked six past attorneys general from

running successful bids for the governor’s seat and

and she pushed back on her “anti-business” label

while making the rounds on Sunday morning political

shows.

“Business

benefits when every family is doing well

economically,” Healey said on WBZ’s “Keller @ Large”

when host Jon Keller said establishment Democrats

and Republicans consider the two-term attorney

general “anti-business.” ...

Healey

highlighted her “record of demonstrated results” as

the state’s top law enforcement official, winning

lawsuits and going after predatory lenders and

businesses — including several who capitalized off

of the pandemic by slinging subpar masks and hand

sanitizer....

Asked by

“On the Record” host Ed Harding whether she believes

in a supposed “curse” blocking attorneys general

from taking the corner office, Healey said,

“Obviously we don’t because we’re running for

governor.”

“During my

time I’m lucky to have seen some curses broken here,

and I sure hope that we can break this,” the

two-term attorney general said.

The

Boston Herald

Sunday, January 30, 2022

Maura Healey ready to break attorney general

“curse,” hits back “anti-business” label

Returning

to an issue that was at the center of her first

campaign, Attorney General Maura Healey led a

coalition of state prosecutors on Tuesday in the

filing of a brief in U.S. District Court supporting

Mexico in its consumer protection case against seven

gun manufacturers and a Massachusetts-based gun

distributor.

Healey led

a group of 14 attorneys general in their argument

that federal law does not shield gun manufacturers

and dealers from consumer laws governing the

marketing and sale firearms.

The

Mexican governor has alleged that Springfield-based

Smith & Wesson, Barrett Firearms, Beretta, Century

Arms, Colt, Glock, Ruger and Massachusetts-based

distributor Interstate Arms designs, markets and

distributes guns in a manner they know appeal to

Mexican drug cartels and violent gangs....

Smith &

Wesson recently announced last fall that it planned

to relocate its headquarters and a large portion of

its operations to Tennessee in 2023 after 169 years

being based in Springfield. Corporate executives

sited the "changing business climate" for firearm

manufacturers in Massachusetts as a motivating

factor.

Healey

announced last month that she was running for

governor in 2022.

State

House News Service

Tuesday, February 1, 2022

Healey: Fed Law Should

Not “Shield” Gun Manufacturers |

|

MASSterList Job Board

Beacon Hill’s hottest new job postings

Wednesday, February 2, 2022

Recent postings to the

MASSterList

Job Board from last Week:

Communications Director, Massachusetts Fair Share Amendment

Digital Director, Massachusetts Fair Share Amendment

Field Director, Massachusetts Fair Share Amendment

Raise Up Massachusetts

— the radical leftwing progressive

cabal behind the latest push for a graduated income tax

— is advertising job openings with

minimum salaries starting at $100,000-$110,000. I’ve been

working for CLT for 26 years, have done all those jobs and more,

usually simultaneously especially for the past six years, and I

still don’t earn close to that “starting salary” even for the

100-plus hours a week I put in. Before Barbara Anderson passed

away in 2016 she was paid $600 a week, $31,000 a year. Just

one of those $110,000 salaries would cover a full year of what

CLT now raises and spends — its

entire annual operating budget. We’ve been on the wrong

political side all

along if our goal was to make money. We at CLT have always

recognized and accepted this.

Nonetheless, it

must be satisfying to be a deep-pockets leftwing self-interest group

(aren't they all?) with

unlimited resources to toss around in the insatiable pursuit of

taking more for themselves from the productive others.

Last week I

informed you of

the Legislature's Joint Rule 10 and its "deadline"

on the past Wednesday. The deadline came and went but there

doesn't seem to have been any movement on the five bills which seek

to stealthily attack our Proposition 2½.

Apparently this rule is like so many others on Beacon Hill — more a

suggestion than a mandate especially if it becomes inconvenient to

other priorities or conveniences.

The legislative History

for each of the following bills indicates that

they remain in the secretive Joint Committee on Revenue — have not

been rejected for this session, not been reported out favorably, not

been condemned to the graveyard of "further study." This again

explains why it continually takes "The Best Legislature Money Can

Buy" a full year to blindly pass important legislation in the dark

of night in the final moments of its annual session.

H.2978,

S.1899,

H.3086,

S.1804, and

H.3039 remain where they have been since the

public hearing six months ago, four months ago for H.3039, "An

Act establishing a local option gas tax." We'll keep watching

closely for any movement in any direction.

The state revenue gravy

train just keeps chugging along. On Thursday the

State

House News Service reported ("Tax Receipts Already Running

$1.5 Bil Above Revised Estimate"):

As Gov.

Charlie Baker embarks on a push for tax relief

proposals, the Department of Revenue

reported

Thursday that it collected $4.026 billion in state

tax revenue from people and businesses last month, a

haul that surpassed expectations by $856 million or

27 percent and has helped to put the state nearly

$1.5 billion ahead of its end-of-fiscal-year

target....

"January

2022 revenue collections increased in most major tax

types, in comparison to January 2021 collections,

including withholding, non-withholding, sales and

use tax, and corporate and business tax," Revenue

Commissioner Geoffrey Snyder said....

In the

first seven months of fiscal year 2022, DOR has so

far collected approximately $21.872 billion --

$4.219 billion or about 24 percent more than actual

collections during the same period of fiscal 2021

and $1.45 billion or about 7 percent more than the

department's year-to-date benchmark....

"We ended

last year with a surplus and tax collections

continue to exceed projections in a big way. It's

time to enact tax breaks for families, seniors and

more," Baker tweeted Thursday just after DOR

reported on January revenues. In his fiscal 2023

budget plan, the governor proposed tax breaks for

renters, seniors, parents and low-income workers, a

cut to the tax rate on short-term capital gains, and

two changes to the estate tax.

You may recall that Fiscal

Year 2021's revenue story of a bonanza of dizzying riches is much

the same. The State House News Service reported on January 3

("Comptroller:

FY '21 Revenues Smashed Estimates By $13 Billion"):

The grand total of

state revenues collected by the end of fiscal year 2021 exceeded

that year's budget estimates by more than $13 billion, including

a surplus of more than $5.86 billion in tax revenue, according

to a new report from the state comptroller.

From July 1, 2020 through

June 30, 2021 the state raked in $5.86 Billion in surplus tax

revenue — then quickly spent it.

From July 1, 2021

— the start of this fiscal year

— the state has so far raked in

an additional $4.219 Billion more than the prior fiscal

year.

Is there even the lamest

argument from any insatiable legislator opposed to a return of at

least some if not most or all of this extraordinary tax

surplus to its rightful owners — the taxpayers

from whom it is being unnecessarily extracted? Return it to

the taxpayers — before the temptation to spend it all once again

becomes overwhelming. Those multiple-billions of over-taxation

do not belong to government, and with a straight face it can't even

be argued that it is needed for government to function.

How

can those massive revenue surpluses be explained?

In a word, "Taxachusetts." The

Boston Herald reported on Wednesday ("Massachusetts couples

pay the highest percentage of income in taxes

in the country, report says"):

It’s tax

season, and in news perhaps unsurprising to Bay

State taxpayers, couples living here have to shell

out the highest percentage of their income on taxes.

“The

biggest takeaway for me was just how vast the spread

can be across the country,” said Josh Koebert, who

authored the study on

FinanceBuzz.com, in an email.

He noted

that the difference between states like Florida and

Massachusetts was 50%. “That is a huge difference,”

he said, “50% more paid in taxes annually, almost

all of which comes down to state-level income tax

laws.”

The study

compared the median income for full-time workers in

each state, derived from the U.S. Census Bureau,

against the federal and state tax rates for the 2021

tax year.

Massachusetts took the top spot for couples filing

jointly, with couples paying 23.51% of their income

in taxes. Close behind is Oregon, at 23.24%, Hawaii,

at 23.05%, and Connecticut, at 22.99%. The lowest

rate was in Tennessee, with taxpaying couples owing

just 15.54% of their income to taxes.

For single

filers, Massachusetts earned the number two spot, at

23.23%. Oregon edged out Massachusetts at 23.37% to

take the top spot. Connecticut and Hawaii fell not

far behind, and Florida singles took the bottom

spot, with 15.52% of their median income owed to

taxes....

Paul Diego

Craney, of the conservative Mass. Fiscal Alliance,

reminded the Herald that state lawmakers are

proposing a ballot measure that would raise the

income tax on the wealthiest earners, as well as

some businesses.

“The

public needs to realize that when they send part of

their paycheck to the legislators at the Statehouse

to spend, they are already the most generous in the

country and yet lawmakers still want more,” he said.

Massachusetts has the distinction of ranking Number 1 in yet another

new category: Bay State couples pay the highest percentage of

income in taxes in the country. With the multitude of these

Number 1 "honors" is there any wonder that multi-billion dollar

annual surpluses have become the norm in Taxachusetts?

And

still the Legislature is hell-bent on extracting even more

from the productive — until none remain. Who will The

Takers feed off then?

In

his

Boston Herald column on Friday Howie Carr reminds us

of how fat and happy Massachusetts legislators are, by their own

hand. In The easiest $70,530 you’ll ever make

— with perks that add up, and up

Massachusetts lawmakers laughing all the way to the

bank he wrote:

Are you

having a hard time making ends meet in this

inflationary Biden malaise?

Could you

use an extra $70,530 a year — for a “job” where you

never, ever have to show up, where the actual place

where you would theoretically “work” hasn’t even

been open to the public for two years now?

And that

$70,530 a year — that’s minimum wage for a state

legislator, you understand. They’re all also

grabbing at least $16,245 for “travel expenses,”

even though they’re not traveling to Boston anymore.

And most

of them have also been handed even more money for

some phony-baloney so-called leadership position,

running committees that just rubber-stamp what

they’re ordered to do.

Did I

mention that if a legislator lives more than 50

miles from the State House, he or she can write off

most of their federal income taxes, just like almost

all members of Congress do?

And then

there’s the campaign committee you can set up, which

allows you to write off almost all your expenses.

You can even buy gift cards for your constituents,

who might very well happen to be your parents … or

your girlfriend. You can charge all your bar tabs –

just ask Rep. Mark Cusack, D-Braintree.

If you

could use a little – actually, a lot of — free

money, no strings attached, perhaps you should

consider running for the Massachusetts state

Legislature. It’s the easiest gig this side of being

an illegal immigrant....

There's some interesting news on the race for governor that's begun

to take form, some useful insights and some stuff of nightmares.

I'll leave those for you to read and digest but will provide my

impression: It's going to be quite an interesting eight months

ahead leading up to November. After that, you might want to be

prepared to break out and run for your lives.

|

|

|

|

Chip Ford

Executive Director |

|

|

State House News

Service

Thursday, February 3, 2022

Tax Receipts Already Running $1.5 Bil Above Revised Estimate

By Colin A. Young

As Gov. Charlie Baker embarks on a push for tax relief

proposals, the Department of Revenue

reported Thursday that

it collected $4.026 billion in state tax revenue from people

and businesses last month, a haul that surpassed

expectations by $856 million or 27 percent and has helped to

put the state nearly $1.5 billion ahead of its

end-of-fiscal-year target.

As it did last month when it reported December revenues, DOR

said Thursday that much of January's windfall is likely

temporary because many of the gains are attributed to a

change in state law that allows certain businesses to avoid

federal limits on state and local tax deductions. Still,

even after adjusting for the business tax changes, the

tax-collecting department said January receipts exceeded

January 2021 collections by $315 million or 9.4 percent and

topped the monthly benchmark by $791 million.

"January 2022 revenue collections increased in most major

tax types, in comparison to January 2021 collections,

including withholding, non-withholding, sales and use tax,

and corporate and business tax," Revenue Commissioner

Geoffrey Snyder said. "The increase in withholding is likely

related to improvements in labor market conditions. The

non-withholding income tax increase is primarily due to the

recently enacted [pass-through entity] excise; as mentioned

above, most of this increase is temporary. The sales and use

tax increase in part reflects continued strength in retail

sales and meals taxes, which in turn were impacted by rising

inflation."

In the first seven months of fiscal year 2022, DOR has so

far collected approximately $21.872 billion -- $4.219

billion or about 24 percent more than actual collections

during the same period of fiscal 2021 and $1.45 billion or

about 7 percent more than the department's year-to-date

benchmark.

After accounting for the pass-through entity excise

payments, DOR said that year-to-date collections are $2.982

billion or about 17 percent more than collections in the

same period of fiscal 2021 and $794 billion or 4 percent

more than the year-to-date benchmark.

"We ended last year with a surplus and tax collections

continue to exceed projections in a big way. It's time to

enact tax breaks for families, seniors and more," Baker

tweeted Thursday just after DOR reported on January

revenues. In his fiscal 2023 budget plan, the governor

proposed tax breaks for renters, seniors, parents and

low-income workers, a cut to the tax rate on short-term

capital gains, and two changes to the estate tax.

Snyder said DOR will "closely monitor how the recent surge

in COVID-19 cases and the revised restrictions on economic

activities" could impact state revenue collections for the

remaining five months of the fiscal year.

The Baker administration in January raised its estimate of

fiscal 2022 tax collections by about $1.5 billion, and

January's tax haul puts the $1.5 billion above that newly

revised fiscal year-end target.

The Boston

Herald

Saturday, February 5, 2022

Charlie Baker pushes tax cuts

as January tax revenues soar above projections

By Amy Sokolow

After state tax revenues came in wildly above projections

last month, Gov. Charlie Baker took to Twitter to tout his

plan to slash taxes for a broad swath of Bay Staters.

“We ended last year with a surplus and tax collections

continue to exceed projections in a big way,” Baker tweeted

Thursday evening. “It’s time to enact tax breaks for

families, seniors and more. Last week I proposed doing just

that.”

As the Herald previously reported, Baker has proposed almost

$700 million in tax breaks as part of his last budget as

governor, including doubling the maximum Senior Circuit

Breaker Credit to lower the tax burden for many low-income

senior homeowners, increasing the rental deduction cap for

renters, and giving other breaks to parents, low-income

households and those filing estate taxes.

The Department of Revenue collected $4.026 billion in state

tax revenue from individuals and businesses last month,

exceeding expectations by $856 million, or 27%.

The Department of Revenue said the boost could be partially

attributed to a change in state law that allowed some

businesses to avoid federal limits on state and local tax

deductions, but even accounting for that, the year-over-year

revenues increased by $315 million, or 9.4%.

“January 2022 revenue collections increased in most major

tax types, in comparison to January 2021 collections,

including withholding, non-withholding, sales and use tax,

and corporate and business tax,” Revenue Commissioner

Geoffrey Snyder said.

Snyder attributed much of the increase to improvements in

labor market conditions, and strengths in retail sales and

meal taxes, “which in turn were impacted by rising

inflation,” he said.

In response to Baker’s budget requests, Senate President

Karen Spilka previously told the Herald that “we’ll take a

look. We realize that people are still hurting from COVID,

so we’ll take a hard look,” the Ashland Democrat said.

Speaker of the House Ronald Mariano, D-Quincy, previously

said, that “the devil is always in the details in these

things.”

— State House News Service

contributed.

The Boston

Herald

Wednesday, February 3, 2022

Massachusetts couples pay the highest percentage of income

in taxes

in the country, report says

By Amy Sokolow

It’s tax season, and in news perhaps unsurprising to Bay

State taxpayers, couples living here have to shell out the

highest percentage of their income on taxes.

“The biggest takeaway for me was just how vast the spread

can be across the country,” said Josh Koebert, who authored

the study on

FinanceBuzz.com, in an email.

He noted that the difference between states like Florida and

Massachusetts was 50%. “That is a huge difference,” he said,

“50% more paid in taxes annually, almost all of which comes

down to state-level income tax laws.”

The study compared the median income for full-time workers

in each state, derived from the U.S. Census Bureau, against

the federal and state tax rates for the 2021 tax year.

Massachusetts took the top spot for couples filing jointly,

with couples paying 23.51% of their income in taxes. Close

behind is Oregon, at 23.24%, Hawaii, at 23.05%, and

Connecticut, at 22.99%. The lowest rate was in Tennessee,

with taxpaying couples owing just 15.54% of their income to

taxes.

For single filers, Massachusetts earned the number two spot,

at 23.23%. Oregon edged out Massachusetts at 23.37% to take

the top spot. Connecticut and Hawaii fell not far behind,

and Florida singles took the bottom spot, with 15.52% of

their median income owed to taxes.

The report notes that Massachusetts residents pay the

highest federal tax rate in the country, at 18.58%, which is

attributable to having the highest median annual income in

the country.

Eileen McAnneny, of the Massachusetts Taxpayers Foundation,

made the same observation, but also noted that our expensive

real estate also contributes to a high property tax.

Massachusetts also has an income tax,

Paul Diego Craney, of the conservative Mass. Fiscal

Alliance, reminded the Herald that state lawmakers are

proposing a ballot measure that would raise the income tax

on the wealthiest earners, as well as some businesses.

“The public needs to realize that when they send part of

their paycheck to the legislators at the Statehouse to

spend, they are already the most generous in the country and

yet lawmakers still want more,” he said.

The Boston

Herald

Friday, February 4, 2022

The easiest $70,530 you’ll ever make — with perks that add

up, and up

Massachusetts lawmakers laughing all the way to the bank

By Howie Carr

Are you having a hard time making ends meet in this

inflationary Biden malaise?

Could you use an extra $70,530 a year — for a “job” where

you never, ever have to show up, where the actual place

where you would theoretically “work” hasn’t even been open

to the public for two years now?

And that $70,530 a year — that’s minimum wage for a state

legislator, you understand. They’re all also grabbing at

least $16,245 for “travel expenses,” even though they’re not

traveling to Boston anymore.

And most of them have also been handed even more money for

some phony-baloney so-called leadership position, running

committees that just rubber-stamp what they’re ordered to

do.

Did I mention that if a legislator lives more than 50 miles

from the State House, he or she can write off most of their

federal income taxes, just like almost all members of

Congress do?

And then there’s the campaign committee you can set up,

which allows you to write off almost all your expenses. You

can even buy gift cards for your constituents, who might

very well happen to be your parents … or your girlfriend.

You can charge all your bar tabs – just ask Rep. Mark

Cusack, D-Braintree.

If you could use a little – actually, a lot of — free money,

no strings attached, perhaps you should consider running for

the Massachusetts state Legislature. It’s the easiest gig

this side of being an illegal immigrant.

Right now the state Republicans are looking for a few good

men and women who’d like to grab some free money, I mean,

enter public service.

Consider the State House – people used to joke that it was

the only place in the world where people said, “Have a nice

weekend” on Wednesdays. Another saying was that you could

fire a cannon down the halls on Thursdays and Fridays and

not hit anyone.

Now those jokes apply 365 days a year. Sometime in February

or March 2020, everyone at the State House looked around at

their fellow payroll patriots and said, “Have a nice life!”

The building has been closed ever since. And no one has

missed a single paycheck.

Massfiscal.org has been trying to recruit Republican

candidates, even advertising on my radio show. They’ve been

stressing the “part-time” state senator from Arlington who

made $220,544 last year. She said it was an accounting error

— wink wink nudge nudge.

But I think an even better poster gal for the rewards, shall

we say, of public service might be Sen. Harriette Chandler

of Worcester, who last week announced her impending

retirement at the tender age of 84.

The solons used to get reimbursed for every day they drove

to work, on a scale — $5 if you lived around the corner, $50

if you were from, say, Berkshire County. It went up and up

and up … but these “per diems” were always embarrassing,

because the statesmen had to file paperwork with the

treasurer for their dough. And reporters could check up.

Years ago, the Herald discovered that the solon from East

Boston had filed for his $5 per diem while he was in Rome —

Italy, not New York. The rep couldn’t believe he was being

called out.

“For five bucks,” he told the reporter, “you’re going to

croak me?”

So the hacks got rid of the per diems and just gave

everybody a set amount per year — $15,000 if you lived

within 50 miles, or $20,000 if you lived more than 50 miles

away.

Which brings us back to Harriette Chandler. When the shift

was made, she realized she was on the edge of the 50-mile

line. Her local newspaper did a check of Google Maps. The

quickest route from her home to the State House came in at

49.7 miles.

The alternate route, adding I-495 to her commute, came in at

53.1 miles.

Care to guess which route one Madame President (for indeed

she was briefly the Senate president after Stanley Rosenberg

resigned in disgrace) claimed. You are correct, sir. She

filed for $20,000 rather than $15,000.

And behind the money comes the pension. Billy Bulger has

been grabbing a kiss in the mail of what is now $272,719 a

year since 2003. David Bartley, who last won an election in

1974, has been pocketing $157,666 since 2004.

Nice “work” if you can get it.

The reason I bring this up, other than the Feb. 15 date to

pull papers, is that more and more this election year seems

to be shaping up as a once-in-a-generation cycle, when a

fed-up electorate throws the bums out in larger-than-normal

numbers.

I’m starting to pick up that 1990 vibe around here again.

That was the year in Massachusetts when dozens of Democrats

retired due to ill health — the voters got sick of them.

The GOP elected both the governor and treasurer, and came

within a few thousand votes of seizing control of the state

Senate from Whitey Bulger’s younger brother.

All kinds of unlikely Republicans were elected in 1990. A

56-year-old factory worker on unemployment ousted the hack

Middlesex County register of probate – by 40,000 votes. In

Taunton, Sen. Teddy Aleixo was upset by a Republican whose

day job was selling Bibles. His name was Erv Wall.

After his stinging 4,000-vote defeat, Sen. Aleixo was

philosophical:

“Tell Erv he won’t sell too many Bibles in the state

Senate.”

The pay now is at least four times what it was during that

tidal wave election of 1990. Candidates, if you win this

year, you won’t have to moonlight selling Bibles or anything

else.

Hell, you wouldn’t even be able to if you wanted. The State

House is closed, and that’s just the way the hacks like it.

And you’ll learn to like it too – a lot.

State House News

Service

Friday, February 4, 2022

Weekly Roundup - Building Bridges

Recap and analysis of the week in state government

By Matt Murphy

Six more weeks of winter, but only five for Democrats to

select delegates to the June convention in Worcester when,

presumably, the weather will be a little more pleasant.

The furry weatherman from Punxsutawney saw his shadow

Wednesday, presaging another wintery blast of precipitation

leading into the weekend as Democrats kicked off the caucus

season and candidates begin the battle for delegates.

The field, at least on the Democratic side, appears close to

set as this week brought the formal entries of former Boston

City Councilor Andrea Campbell and 2018 lieutenant governor

nominee Quentin Palfrey to a now three-way race for attorney

general.

Gubernatorial candidate Danielle Allen also gave voters

something to chew on as she marked the start of Black

History Month with a proposal to decriminalize the personal

use and possession of drugs, including heroin and cocaine,

to shift the focus away from punishment to treatment.

Her competitors for the nomination shied away from endorsing

or rejecting Allen's idea, but this is one that will likely

come up often over the course of the next seven months as

Allen, Attorney General Maura Healey and Sen. Sonia

Chang-Diaz looks for ways to differentiate themselves.

Healey was far more clear when it came to her thoughts (not

positive) on Republican Geoff Diehl hiring former Trump

campaign manager Corey Lewandowski, a Lowell native, as a

senior advisor on his gubernatorial campaign. Diehl said he

welcomed Lewandowski's wealth of experience, but by leaning

in on the Trump brand he will also have to accept some of

the blowback in a state where Trump is not and never was

popular with the general electorate.

As it stands, Healey holds a sizable lead over her rivals at

the outset of the campaign with 48 percent of likely voters

indicating they would support the attorney general compared

to 12 percent for Chang-Diaz and 3 percent for Allen,

according to a new MassINC Polling Group survey. Yet, 38

percent said they still don't know, wouldn't vote or are

looking for someone else.

Those voters will have until Sept. 6 to make up their mind,

assuming Gov. Charlie Baker signs off on that date for the

primaries, included as part of a $101 million COVID-19

relief bill that would direct funds towards rapid testing,

masks, and vaccination equity. The bill's bottom line grew

in each iteration, with House and Senate leaders tacking on

$25 million in the final deal to replenish the COVID-19 paid

sick leave reserve.

The pandemic relief bill reached the governor's desk

Thursday, while legislation known as "Nero's Law" came

within a whisker. The House voted in support of the bill

that would allow medical personnel to treat and provide

transport to police dogs injured in the line of duty.

The bill's namesake is the K9 injured during a 2018 incident

during which Yarmouth Police Sergeant Sean Gannon was killed

as he attempted to serve a warrant.

For other legislation, however, this week turned out to be

the end of the line.

No rules are hard and fast on Beacon Hill, but the

Legislature's Joint Rule 10 required committees to render a

verdict on thousands of bills filed this session, or at the

very least request an extension.

The soft deadline on Wednesday breathed life into some

ideas, like retrofitting 1 million homes over the next

decade to be energy efficient and giving consumers more

control over their data privacy online. Others - i.e. giving

drivers' licenses to undocumented immigrants, and allowing

municipalities to raise money for housing through new fees

on real estate transfers - remain stuck in limbo as their

committees requested more time.

But only opponents were toasting the demise of a bill to

remove the ban on Happy Hour drink specials, as legislators

referred that concept for "further study" - the bureaucratic

equivalent of a bartender saying, "You're cut off."

Baker was in Washington, D.C. to start the week, meeting

alongside other governors with President Joe Biden and

members of his Cabinet during the National Governors

Association winter meeting. He later had one-on-ones at the

Pentagon where he said he basically secured a deal for the

Army Corps of Engineers to replace the two bridges spanning

the Cape Cod Canal, and hopes to have a financing plan in

place by the end of the year.

The money will come, in large part, from the bipartisan

infrastructure bill signed last year by Biden - the same

bill that will deliver $9.5 billion to Massachusetts.

Baker visited the campus of UMass Lowell on Thursday to

detail how he intends to spend much of the rest of the

federal infrastructure funding, though the Legislature will

have its say too once the administration files a new

transportation bond bill.

Baker has his eyes set on spending billions to repair

highways, electrify bus fleets and replace or rehabilitate

146 bridges in need of repair.

The visit to the UMass campus came as the governor's team

urged higher education institutions to help lead the way out

of the COVID-19 pandemic, urging them to begin thinking

about ways to relax restrictions that require remote

learning, discourage group activities or mandate "overly

aggressive surveillance testing; and mask type

requirements."

Health and Human Services Secretary Marylou Sudders and

Education Secretary Jim Peyser said the negative social and

emotional effects of lasting restrictions are taking a toll

on youth, and they see colleges as the place to start the

transition "into an endemic, a highly contagious virus that

is manageable and allows us to regain a sense of normalcy."

William Allen, who has spent the past 27 years behind bars

after being an accomplice to murder, went before the

Governor's Council this week also asking them to restore a

sense of normalcy to his life.

Allen is under consideration for his first-degree murder

conviction to be commuted to second degree murder, making

him eligible for parole. He's the second convicted felon to

appear before the council in as many weeks after Baker made

the first two commutation recommendations of his tenure.

"I promise I will make you proud by doing good and being

good and that I won't let my fellow prisoners down either,"

Allen told the council.

Councilor Robert Jubinville, his attorney at trial in the

1990s, predicted Allen would soon be a free man.

"You're a good man and you're gonna get a commutation,"

Jubinville told him.

STORY OF THE WEEK: "For those of us in the infrastructure

business, today is like Christmas," state Highway

Administrator Jonathan Gulliver said about putting together

a $9.5 billion highway and bridge spending plan.

State House News

Service

Wednesday, February 2, 2022

Housing Panel Holding On To Transfer Fee Bill

Revenue Committee Backs Local Transfer Fee Proposals

By Katie Lannan

Eight bills that would allow individual municipalities to

add a new fee to certain real estate transactions advanced

from one legislative committee, while another is taking more

time to decide on a proposal that would allow cities and

towns to take such a step without first getting Beacon

Hill's approval.

As of Wednesday's deadline for most committees to act on

bills, the Housing Committee had put forward an order

extending until May 9 its window to advance or reject

legislation that would enable municipalities to impose a fee

of between 0.5 percent and 2 percent of the price of certain

housing transactions in order to generate revenue to

preserve affordable housing and fund new home construction.

The fee rate and any exemptions would be set locally, and

the bills (H 1377, S 868) call for the new fees to be

applied only on transactions featuring prices that are above

the statewide or county median single-family home price.

While the decision could bottle the bills up for three more

months, Rep. Mike Connolly, who filed the House version and

serves on the Housing Committee, said he viewed the

extension as an "encouraging sign."

"I'm grateful that we have the opportunity to continue the

conversation and look to build consensus around it," he

said.

Connolly, a Cambridge Democrat, said he sees momentum

gathering behind the idea of transfer fees, with Boston

Mayor Michelle Wu this week filing a home-rule petition that

would allow her city to impose a fee on sales of $2 million

or more and major employer Mass General Brigham earlier this

month voicing support for the bills filed by Connolly and

Sen. Jo Comerford.

"I think the momentum is a product of the ongoing affordable

housing emergency, and I'm cognizant of sort of the unique

trajectory of this legislative session," Connolly told the

News Service. "When the legislative session started, the

real housing advocacy focus was on stopping evictions and

foreclosures, in a way where those immediate COVID housing

concerns were really dominating a lot of our bandwidth and

our advocacy attention."

A little more than a year into the two-year session,

Connolly said there's now "a chance to focus more on the

regular agenda," though pandemic response activity

continues.

"Those underlying issues of housing costs haven't gone

away," he said.

High costs in Massachusetts can burden renters and present a

barrier to homeownership for many.

Amid a lack of housing inventory, the state's median home

sale price in 2021 surpassed $500,000, the Warren Group

reported Tuesday. The new annual median of $510,000

represents an increase of more than 14 percent from 2020.

The Connolly/Comerford bills are backed by a collection of

community organizations, planning agencies and other groups,

the Local Option for Housing Affordability coalition, which

also supports a handful of bills filed by individual

municipalities where local officials have already backed

proposed transfer fees.

"We look forward to continuing to work with the legislature

on this extremely important issue. It is a vital measure to

have enacted this session for communities from Nantucket, to

Boston, to Western Massachusetts," Nantucket housing

director Tucker Holland said in a statement offered by the

coalition.

Bills proposing transfer fees in Somerville (H 3938),

Provincetown (H 3966), Concord (S 2437), Boston (H 2942),

Arlington (H 4295), Cambridge (H 4282), Nantucket (H 4201)

and Chatham (H 4060) all earned favorable reports from the

Revenue Committee, moving them along them in the legislative

process.

A favorable report doesn't guarantee a bill will pass, or

even make it to the floor for a vote. Similarly, the Housing

Committee's extension order doesn't carve May 9 in stone as

a final deadline for action on its bills, as committees can

seek further extensions and lawmakers may opt to advance

policies as attachments to other vehicles including the

annual state budget.

State House News

Service

Tuesday, February 1, 2022

Committee Keeps Lock On Popular Licensing Bill

Deadline Also Extended On Seatbelt Enforcement Proposal

By Chris Lisinski

Almost two years ago to the day, the Transportation

Committee voted along party lines to endorse legislation

that would allow undocumented immigrants in Massachusetts to

access driver's licenses.

Now, with a deadline looming to take a position on the

latest version of the bill, the same panel decided it needs

more time, just as it did with a long-debated proposal to

expand enforcement of the state's seatbelt law.

Neither the measure that supporters dubbed the Work and

Family Mobility Act (H 3456 / S 2289) nor Gov. Charlie

Baker's refiled bill allowing police to stop motorists

solely for failing to buckle up (H 3706) will be subject to

this week's biennial culling of the bills under the

Legislature's Joint Rule 10.

Both bills had been pending before the committee for more

than nine months before its members sought an additional

one-month extension. The licensing bill featured at a public

hearing in June, while lawmakers heard testimony on Baker's

road safety bill in December.

The codified-yet-malleable deadline in Joint Rule 10, which

falls on the first Wednesday of February in even years, is

designed to push bills forward in the process with enough

time remaining for the Legislature to tackle big topics

before it transitions to holding only lightly attended

informal sessions after July 31.

The House on Monday quietly adopted an extension order

pushing the deadline for the Transportation Committee to

produce an up-or-down report on eight bills from Feb. 2 to

March 4, giving the panel -- which has functioned without a

Senate chair since September -- another month to work.

That move frustrated supporters of the seatbelt proposal,

who cautioned the extension further delays action on a

potential life-saving measure at a time when roadway deaths

are soaring in Massachusetts and nationally.

Among supporters of the licensing bill, who have been

unsuccessfully pushing some form of the change for more than

a decade, the delay was interpreted as "very good news."

"I think we're all in agreement at the coalition that this

was very good news because we know how, with COVID

especially, this has been an incredibly difficult and rushed

legislative session," said Franklin Soults, a 32BJ SEIU

spokesperson who works with the Driving Families Forward

Coalition. "We had a very great hearing. It seems like

communication is really good between the committees and the

sponsors of the bill and everybody, so we feel very

confident this is actually a really great sign."

In February 2020, on the most recent iteration of Joint Rule

10 Day, the Transportation Committee voted 14-4 to advance a

redrafted version of the bill that would authorize

undocumented immigrants to apply for standard, but not REAL

ID-enhanced, licenses. All four votes against the measure

came from Republicans. House Co-chair Rep. William Straus of

Mattapoisett and Rep. Paul Tucker of Salem, both Democrats,

did not cast votes.

The measure later died without action in the Senate Ways and

Means Committee, despite public support from Senate

President Karen Spilka.

House Speaker Ronald Mariano has been less vocal, though he

said in March that he "recognize(s) the value in bringing

all drivers under the same public safety, licensing and

insurance structures."

At a virtual event highlighting business and health care

sector support for the bill, its backers noted that the

latest version has the highest number of cosponsors in the

history of the campaign, including majorities in the

160-member House and the 40-member Senate.

As of Tuesday, 84 representatives and 21 senators --

excluding former Transportation Committee Co-chair Sen. Joe

Boncore, who resigned last year -- added their names in

support of the bill.

The latest version differs from the version that earned the

Transportation Committee's support last session in two main

ways: it has a slightly different set of identification

standards required to acquire a standard license, and it

would limit the state Registry of Motor Vehicles from

sharing many documents involved in the applications,

including with federal immigration authorities.

Laura Rotolo, staff counsel and community advocate at the

American Civil Liberties Union of Massachusetts, said the

latest version is "tighter" than its predecessor.

"This session, we had a lot of support and co-drafting with

our law enforcement leaders," Rotolo said. "We have worked

together with them and other partners like insurers to make

sure that the bill makes sense, that the bill is workable

for many different stakeholders."

Sixteen other states and Washington, D.C. already have laws

on the books allowing undocumented immigrants to acquire

some form of a driver's license, according to supporters.

"Our neighbors in Connecticut enacted a similar law

permitting the issuance of driver's licenses back in 2015,

and as of 2019, over 50,000 undocumented immigrants in

Connecticut have taken written tests, vision tests, and road

tests to obtain driver's licenses," said Roberta

Fitzpatrick, senior vice president and CIO at Arbella

Insurance. "Since that time, Connecticut has seen a

reduction in hit-and-run crashes and a steep decline in the

number of people found guilty of unlicensed driving."

If legislative leaders opt to pursue the bill this session,

they will likely need to line up two-thirds majorities in

both chambers to overcome opposition from Gov. Charlie

Baker.

The Republican governor said in February 2020 that he does

not support the bill because he believes "it's really hard

to build the kind of safeguards into that kind of process

that would create the kind of security that would be hard to

live up to some of the federal and state standards with

respect to security and identification."

Asked if he has vocalized an opinion on the topic more

recently, a Baker spokesperson replied, "Governor Baker

supports existing laws in Massachusetts, enacted on a

bipartisan basis, that ensure Massachusetts' compliance with

federal REAL ID requirements and enable those who

demonstrate lawful presence in the United States to obtain a

license."

Baker, now in the lame-duck stretch of his final term, has

been ramping up pressure on Democrat leaders to tackle some

of his stalled proposals. His push to reform the state's

seatbelt law so far has failed to gather momentum.

Lawmakers have been hesitant to convert the Bay State from

its current secondary enforcement system, in which police

can only cite motorists for driving unbuckled if they first

observe another traffic violation, to primary enforcement,

in which cops could pull someone over solely for not wearing

a seatbelt.

Supporters of the change say it would help increase the Bay

State's seatbelt use rate, which lags behind the 35 other

states where police can enforce the restraints without

requiring an additional offense.

Mary Maguire, AAA Northeast Director of Public Affairs, said

81.6 percent of Bay State drivers and passengers buckled up

before the pandemic, a rate that has since dropped to 77.5

percent. At the same time, roadway deaths in Massachusetts

have surged from 327 in 2020 to at least 415 in 2021, she

said.

"Each one of those people is an individual who's part of a

family, a school, a football team, a church, a committee.

The ripple effect of that is really extraordinary," Maguire

said. "We know that the drop in seatbelt use has been one of

the key factors in this increase in the number of deaths in

Massachusetts and across the country."

AAA Northeast also backs other primary seatbelt bills

pending before different legislative committees, but Maguire

said she believes it is "really important" for the

Transportation Committee to send Baker's road safety bill

forward into the larger legislative arena.

Mariano remains skeptical about the idea, saying via a

spokesperson in the fall that he has "long been concerned

about potential racial profiling with primary enforcement

measures."

The Vision Zero Coalition, a group of road safety and

transportation advocates, also opposes the push, arguing

that converting seatbelt laws would be an ineffectual use of

state resources and could wreak disproportionate harm on

communities of color.

Boston Cyclists Union Executive Director Becca Wolfson,

whose group is a member of the coalition, said the

Transportation Committee extending its review period on

Baker's bill is "a little bit troubling."

"It means we're going to be doubling down on our

communication and activating folks to reach out to the

committee members to know how serious the consequences would

be if we passed this," Wolfson said. "We've activated folks

and have a lot of support for our opposition to this bill."

Baker's wide-ranging bill would also allow municipalities to

post red-light cameras at select intersections, add

penalties for driving recklessly, causing injury or causing

death with a suspended license, and reform the commercial

licensing process.

The New Boston

Post

Monday, January 31, 2022

Republican Chris Doughty Weighs In On Taxes, Business

Climate, Abortion

In Bid For Governor of Massachusetts

By Tom Joyce

Chris Doughty wants to make sure both major political

parties have a voice on Beacon Hill next year.

The 59-year-old Republican from Wrentham understands that

the Democratic Party will control both chambers of the

legislature, but sees an opportunity for his side of the

aisle to maintain the governorship.

Doughty, the president of Capstan Atlantic, a gear

manufacturer in Wrentham, announced last week he’s running

for governor. He spoke with NewBostonPost in a telephone

interview this past Friday and explained why he is running

to replace Charlie Baker, 65, a Republican who is planning

to step down after two four-year terms.

“There’s really two reasons,” Doughty said. “One is to keep

the balance in the State House. I think that’s part of the

miracle of Massachusetts is that we consistently elect

governors from the private sector that are conservative to

keep the balance in the State House. The other reason is: I

want to fix the affordability problems in the state,

particularly for our citizens and also for our businesses.”

Doughty (the “o” in the first syllable is long, and rhymes

with “go”) said that he thinks his experience in the private

sector would be helpful as governor.

“I think there’s several elements to that one,” he said.

“One is that I have lived with both good and bad policies

that have come from the State House, so I know what it feels

like at the end of the row. I think because of that, I’ll be

sensitive to what policies we put in place and what we do in

the State House and how that will impact businesses and

their employees. Also, I think the attributes of running a

business are similar to some aspects of running a State

House. Teamwork, being fiscally aware, making sure you can

meet the budgets, being centered on the needs of the

citizens.

“You know, in a business, you become centered on the needs

of the customer. In this case, the citizens become your

customer and you’re kind of being focused on their needs and

make sure that you’re fulfilling them.”

He also noted that this experience would help him work

across the aisle. He said in his line of work, it doesn’t

matter if someone is a Democrat or a Republican. Asked how

he would work with state legislators on the other side of

the party divide, Doughty responded:

“The way I have my whole life in the business sector. We

never ask ‘Hey, which party are you in?”‘ We just start out

with ‘What’s the mission? What’s the task that we’re all

trying to solve?’ And I think it’s healthy to have different

opinions. In business, that’s how progress is made. You have

different life experiences and different perspectives and

you bring them to the table and you kind of find the right

direction with that tension of different thoughts and

different opinions.

“It’ll be a huge loss in our state, I believe, if we don’t

have both voices at the table.”

One major legislative priority for Doughty would be lowering

taxes.

“On day one, I would say to everyone that I would like to

see us begin the process of lowering our tax burdens on our

citizens–slowly over time because it takes awhile–and to

improve,” he said. “In my business, I have to do both. I

have to become more affordable and better every day, and I’d

bring that to the State House.”