|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

48 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Sunday, January 9, 2022

Record-Shattering

Revenue Haul Still Not Enough

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

State tax revenues have

defied expectations throughout the pandemic and

federal aid has helped to keep Massachusetts

fiscally healthy over the last two years. But

uncertainty about the sustainability of recent

positive economic trends and unknowns surrounding

the latest mutated form of the coronavirus made

trying to predict tax collections for the next 18

months a daunting task Tuesday.

House Ways and Means

Chairman Aaron Michlewitz, Senate Ways and Means

Chairman Michael Rodrigues and Administration and

Finance Secretary Michael Heffernan called

economists and budget experts to testify on what

they expect to see in fiscal year 2023 from state

tax collections, the first step in building a

spending plan for the budget year that begins July

1, 2022....

Despite all pointing to

a number of factors that could undermine their

estimates -- like yet another COVID-19 surge,

ongoing labor shortages and supply chain glitches,

and persistently high inflation -- the experts

assembled Tuesday largely agreed that Massachusetts

can expect to collect at least about $36.48 billion

and possibly as much as nearly $40.8 billion in tax

revenue next budget cycle, which would be between 6

percent and 18.6 percent more than the Baker

administration's official expectation for the

current budget year....

Five months in, fiscal

year 2022 tax collections are more than $900 million

ahead of consensus revenue expectations to this

point in the year and are trending more than $2

billion ahead of actual fiscal 2021 collections

through the same period of time.

State

House News Service

Tuesday, December 21, 2021

Analysts See State Tax Revenue

Growth Rolling Along

The grand total of

state revenues collected by the end of fiscal year

2021 exceeded that year's budget estimates by more

than $13 billion, including a surplus of more than

$5.86 billion in tax revenue, according to a new

report from the state comptroller.

Fiscal year 2021

revenues from all sources totaled $56,867,366,700 as

of June 30, 2021, Comptroller William McNamara's

office said in an accounting report typically

required by the Legislature in each year's budget.

That was 30 percent more than the $43,641,100,000

revenue grand total estimated in the fiscal year

2021 budget....

Income tax revenue, the

single largest bucket of state tax revenue, came in

at more than $19.61 billion -- outpacing the

budget's underlying estimate of $15.93 billion by

nearly 25 percent.

State

House News Service

Monday, January 3, 2022

Comptroller: FY '21 Revenues

Smashed Estimates By $13 Billion

December tax

collections of $4.24 billion shattered last year's

mark for the final month of the year and exceed

estimates by more than 40 percent, but the windfall

is likely temporary with state revenue officials

attributing much of gains to a change in state law

that allows certain businesses to avoid federal

limits on state and local tax deductions.

The Department of

Revenue reported Wednesday that the state in

December 2021 collected $1.4 billion more than in

December 2020 and $1.23 billion more than estimates

for the month. But DOR also said much of that money

will be returned through refunds.

Still, even after

adjusting for the business tax changes, the

department said December tax collections exceeded

last year's haul by $520 million, or 18.3 percent,

and beat estimates by $635 million.

"December 2021 revenue

collections increased in all major tax types in

comparison to December 2020 collections and the

December 2021 monthly benchmark, including

withholding, non-withholding, sales and use tax,

corporate and business tax, and 'all other' tax,"

Revenue Commissioner Geoffrey Snyder said. "The

increase in withholding is likely related to

improvements in labor market conditions."

State

House News Service

Wednesday, January 5, 2022

Change in Law Leads to Massive

December Tax Haul

The last week of 2021

was the best one on record for Massachusetts Lottery

sales as weekly sales records for scratch tickets

and Keno combined with a rising Powerball jackpot to

contribute to more than $145.3 million in sales....

The Lottery produced a

record $1.112 billion in profit in fiscal 2021 for

the Legislature to use as local aid to cities and

towns and through five months of fiscal 2022 is

running roughly $38.5 million ahead of the fiscal

2021 profit pace.

[State Treasurer

Deborah] Goldberg told lawmakers and Baker

administration officials last month that she expects

the Lottery will generate about $995 million in

revenue for the state this fiscal year and roughly

$1 billion in fiscal year 2023.

State

House News Service

Wednesday, January 5, 2022

Bettors Dump Record Amounts Into

Lottery

Democratic lawmakers

are pitching plans to ratchet up taxes on

corporations to support the state’s recovery from

the economic impacts of the pandemic.

Several proposals heard

by the Legislature’s Revenue Committee Wednesday

would increase the state’s corporate tax and set

other new levies to squeeze more money out of

corporations they say have reaped profits during the

pandemic.

One proposal filed by

Rep. Mary Keefe, D-Worcester, would raise the

current corporate tax rate of 8% to the pre-2010

rate of 9.5%, which backers say would generate $375

million to $500 million annually....

Another proposal, filed

by Rep. Mike Connolly, D-Cambridge, would establish

a tiered alternative minimum tax charging

corporations from $456 to $150,000 a year depending

on sales. Businesses that report less than $1

million in sales a year would only pay $456, which

is the current flat rate for all businesses.

Connolly told the

committee that the changes would bring more

“fairness” into the state’s corporate tax

structure....

Last year, a coalition

of labor unions, community groups and faith groups

called on Beacon Hill to increase taxes on

corporations and wealthy shareholders to drum up

money to offset pandemic-related budget cuts that

were being predicted at the time.

Increasing the tax on

corporate profits from 8% to 9.5%, advocates say,

could generate another $450 million to $525 million

a year for the state’s coffers.

The group, Raise Up

Massachusetts, is also behind a “millionaires tax”

referendum cleared for the 2022 ballot that will ask

voters to amend the state constitution to set a 4%

surtax on the portion of an individual’s annual

income above $1 million....

Business leaders say

raising corporate taxes would be a mistake for the

state as it tries to recover from the economic

impacts of the coronavirus.

“The idea of piling on

new taxes at a time when businesses are trying

desperately to recover would be folly,” said Chris

Carlozzi, state director of the Massachusetts

chapter of the National Federation of Independent

Businesses. “For lawmakers to say that the state

needs more tax revenue from businesses at a time

when billions of dollars in pandemic relief has come

into the state is disingenuous.”

The Salem

News

Thursday, December 23, 2021

Lawmakers want to

increase corporate taxes

While the federal

government has pumped billions of one-time dollars

into state economies, some legislative Democrats

believe the state still should be looking to wealthy

corporations for additional revenue to fund

education, transportation and other priorities when

those funds inevitably dry up.

The Joint Committee on

Revenue held a hearing Wednesday on dozens of bills

related to corporate tax structures, including

proposals to return the state's corporate tax rate

to pre-2010 levels and to increase the minimum tax

companies without other liabilities must pay.

State

House News Service

Wednesday, December 21, 2021

Dems Push For Higher Taxes On

Businesses

When is a tax hike not

a tax hike?

When Massachusetts

Democrats maneuver definitions with the skill of a

three-card monte dealer....

According to the State

House News Service, some legislative Democrats

believe the state still should set its sights on

wealthy corporations for additional revenue to fund

education, transportation and other priorities.

Corporations are the

go-to villain for Democrats, aghast at their

job-creating, worker-employing, economic growth

boosting gall.

It’s time for them to

pay for all that success....

Rep. Mary Keefe, a

Worcester Democrat, proposed increasing the

corporate tax rate from 8% to 9.5%, the same level

it sat at more than a decade ago. She said there are

only eight other states where businesses pay a

smaller share of state and local taxes than they do

in Massachusetts....

“We need to generate

more progressive revenue,” Keefe said.

Corporate tax reform,

she said, would also improve equity in the tax code

because she said business taxes are paid

disproportionately by white, high-income households

who are more likely to own stock.

“I don’t like to use

the word raising taxes,” she said. “This is about

restoring the tax to where it was before 2010.”

So making a tax higher

isn’t raising it, it’s just reverting the tax to

where it was 21 years ago. When it was higher.

Sorry, but up is up....

The problem with

corporate tax hikes is that businesses go where the

tax environment is friendly. And there are many

states who openly court big businesses to boost

their local economy.

Businesses don’t have

to make it in Massachusetts. Nor do they have to

spend it here.

We do need to consider

a future when the federal gravy train pulls out of

the station, but eyeing Massachusetts’ corporations

as giant ATMs who must stand in for D.C.’s coffers

is the best way to send these companies packing.

A Boston

Herald editorial

Friday, December 24, 2021

Raise taxes, say

goodbye to businesses

A tax deduction for

charitable donations approved by voters more than

two decades ago will be delayed again after

lawmakers failed to authorize the changes before

recessing for a seven-week winter break.

Under the law, people

would be allowed to claim charitable contributions

against their Part B adjusted gross income on their

state taxes. The deduction could not be used for

donations of household goods or clothing.

Voters approved the

deduction in 2000 as part of a referendum rolling

back the state’s personal income tax rate to 5%. The

referendum was approved by more than 70% of voters.

Two years after its

approval, the Legislature froze the personal income

tax at 5.3% to plug budget shortfalls and created a

mechanism to reduce the tax rate as revenue growth

allowed.

As part of the changes,

lawmakers froze the charitable deduction until the

state’s income tax rate fell to 5%.

The state had planned

to allow the deductions starting this year since the

income tax rate finally dropped to 5%. But lawmakers

postponed it, citing the financial impact of the

pandemic....

Senate Minority Leader

Bruce Tarr, R-Gloucester, a chief proponent of

bringing back the tax deduction, said he is

“disappointed” that the Legislature didn’t take

action on it before breaking for a long winter

recess.

Tarr likens the delay

to a move by the Legislature years ago to postpone a

reduction in the personal income tax rate that was

approved by voters by a referendum.

“It’s another example

of something that the voters overwhelmingly mandated

that has continued to be short on Beacon Hill,” he

said. “I think it promotes distrust in government to

have that kind of a situation and it’s hard to

defend given the financial situation we find

ourselves in.”

Massachusetts has

benefited from an influx of billions of dollars in

federal pandemic relief, as well as

better-than-expected tax collections in recent years

that have given Beacon Hill policymakers a pile of

surplus money.

Tarr sought to

implement the voter-approved tax break as part of

the $4 billion plan to spend American Rescue Plan

Act funds and state surplus revenue.

But the

Democratic-controlled Legislature rejected his

amendment, ensuring that the charitable deduction

won’t be available for income tax filers next year.

The Salem

News

Monday, December 27, 2021

Beacon Hill punts on

charitable deductions law, again

With some of the

highest property values in the country, some older

Massachusetts homeowners possess sizable wealth. But

those high values carry high taxes, and many seniors

on fixed incomes find themselves in a state that one

local assessor called "house rich and cash poor."

That contrast was a

central theme before the Revenue Committee on

Tuesday, where supporters of legislation to update

senior tax relief programs pushed for measures that

would increase the value of local exemptions or make

more residents above the age of 65 eligible to defer

property taxes....

Older Bay Staters can

seek property tax relief in several ways, including

via the state-administered circuit breaker tax

credit, local exemptions, and deferral of the taxes

owed at the local level.

The deferral option

allows residents 65 or older with low annual incomes

to push back a portion or all of the property taxes

they owe. According to a Department of Revenue

taxpayer guide, the taxes plus interest cannot

exceed more than 50 percent of the homeowner's

"proportional ownership share of the fair cash value

of the property." ...

Their bill would also

amend the 8 percent default interest rate on the

deferred property tax value to a lower figure based

on recent state or local bond rates, which Vitolo

estimated is about 3 percent.

Another obstacle the

deferral program poses, Vitolo said, is a sharp and

sudden increase in the interest rate when a

recipient dies.

Current law doubles the

rate from 8 percent to 16 percent "on the day of

that senior citizen's passing," Vitolo, a Brookline

Democrat, said. His bill would delay that increase

by one year to give surviving family members or an

estate time to respond.

State

House News Service

Tuesday, December 28, 2021

Lawmakers Urged To Join

Senior Tax Relief Movement

Wednesday, Jan. 12,

2022:

REVENUE COMMITTEE:

Joint Committee on Revenue holds a virtual hearing

to consider 13 bills related to estates and another

37 bills concerning income taxes. As voters prepare

to consider a ballot question in November that would

impose a 4 percent surtax on household income above

$1 million, several of the bills seek changes to

other sections of tax law.

A bill from Cambridge

Democrat Rep. Connolly and Northampton Democrat Sen.

Comerford (H 2851) would increase the tax rate on

Part A taxable income consisting of interest and

dividends and the tax on Part C income from 5.3

percent to 9 percent.

Other bills include

proposals to cap the statewide income tax at 6.25

percent (S 2002) and to create tax credits for rent

paid on personal residences (H 3078). Also,

officials from Children's HealthWatch plan to

testify on a bill (S 1852) expanding the earned

income tax credit to certain immigrants who file

taxes. (Wednesday, 10 a.m.)

https://malegislature.gov/Events/Hearings/Detail/4137

State

House News Service

Friday, January 7, 2022

Advances - Week of Jan. 9, 2022

Legislators pushing for

estate tax reform aimed at raising an outdated

threshold that burdens middle class families are on

the right track.

But it won’t solve the

state’s “snowbird” problem....

It’s that $1M bar that

needs to go.

“If you’re a middle

class family who’s just sitting on property, the

valuation has just increased,” said state Sen.

Julian Cyr (D-Truro), who authored the Senate

version of the bill. “Those are the folks who’re

being adversely affected by the state tax, not the

ultra-rich, who frankly are savvy and well-resourced

enough to avoid it in the first place.”

According to Zillow,

the average Massachusetts home costs $541,834, a

16.6% increase from a year ago. “That means that a

lot of middle-income families really quickly hit

that $1 million threshold,” said State Rep. Daniel

Fernandes (D-Falmouth), who filed the House version

of the bill. “If they just have a home that is

slightly over half a million dollars, and they have

some money in a 401k and maybe a car and a life

insurance policy.”

The bill would double

the threshold from $1 million to $2 million.

“The estate tax in

Massachusetts was always intended to be a rather

progressive tax, meaning that you’re focusing on

folks who are wealthy and super-wealthy, but I think

that the million dollar threshold feels out of

date,” Cyr said.

Eileen McAnneny,

president of the Massachusetts Taxpayers Foundation,

noted that the risk of losing the state’s aging

population to other states like Florida and New

Hampshire already has a ripple effect on the state’s

other revenues, including capital gains taxes,

interest, dividends, sales tax and more. The Herald

reported earlier this year that the state lost $20.7

billion in adjusted gross income between 1993 and

2018....

Massachusetts has many

wonderful attributes — a balmy winter isn’t one of

them. Florida and other points south have appealed

to retirees since the first grandpa wore socks with

sandals and declared it a fashion statement.

Things are less

expensive the farther south you go. A visit to

NerdWallet’s cost of living calculator finds that

compared to Boston, the cost of living in Tampa is

40% lower. The cost of food is 4% lower, and the

price of entertainment is 11% lower. Healthcare

costs are 13% lower.

So while the lawmakers’

reform bill is a much-needed piece of legislation to

bring the estate tax code up to date, it doesn’t

reform the weather nor the prices in our beautiful,

cold, expensive state.

A Boston

Herald editorial

Thursday, December 30, 2021

High temps, low prices lure

snowbirds to FL

A friend of mine who

lived for many years on the North Shore relocated to

Kentucky in 2018 and has rejoiced ever since that it

was among the best decisions he ever made. Compared

with the Bay State, he reports, the housing where he

lives now is more affordable, the taxes are lower,

the winters are milder, the people are friendlier,

and the politics are more congenial. Not even the

tornadoes that tore up Western Kentucky last month

have dampened his satisfaction in no longer having

to put up with all the things that he found so

irksome about life in Massachusetts.

My friend’s experience

isn’t anomalous. Each year, more people leave

Massachusetts for other states than move to

Massachusetts from other states. According to the US

Census Bureau, between April 2020 and July 2021, the

population of Massachusetts shrank by more than

45,000. Only three other states — California, New

York, and Illinois — experienced a greater net

outflow of residents....

Massachusetts certainly

has its charms and advantages; countless Bay Staters

would never consider moving anywhere else. But

plenty of their neighbors feel differently. Year in,

year out, tens of thousands of Massachusetts

residents leave for good, and their numbers aren’t

replenished by newcomers from other states. My

friend in Kentucky is happy he left, and he’s

clearly not alone.

The

Boston Globe

Wednesday, January 5, 2022

Bye-bye, Bay State

By Jeff Jacoby

Lawmakers pocketed a

pricey pay bump last year, sending salaries for most

state senators and representatives north of six

figures as the pandemic surged.

State Sen. Cynthia

Friedman was the highest-earning lawmaker of 2021,

taking home $220,544, state payroll data shows. The

Arlington Democrat earned more than $41,000 more

than the next highest earner, Speaker of the House

Ronald Mariano.

Mariano, D-Quincy,

collected $179,276. His counterpart in the Senate

and the Legislature’s third-highest earner Senate

President Karen Spilka, D-Ashland, was paid

$178,276.

Base pay for all 200

state lawmakers climbed from $66,250 to $70,530 last

year thanks to a 4.89% raise that was made available

to them by a 2017 law that tied biennial increases

in their salaries to changes in wages over the

previous two years.

Office expense accounts

and lucrative stipends for those serving on

committees also saw increases, further padding the

pockets of lawmakers like Friedman....

The state comptroller’s

office lists Friedman’s base pay at $135,331.

Expense accounts range

from $16,245 and $21,660 depending on how far

lawmakers live from the State House.

The

Boston Herald

Tuesday, January 4, 2022

Many Massachusetts state

lawmakers earning six-figure pay, one tops $220,000

The United States Labor

Department recently confirmed what ordinary

Massachusetts residents already knew; inflation is

having a crushing impact on millions of low-income

and middle-class Massachusetts residents. What they

may not know is that while this is devastating news

for almost all of us, for our state’s 200 lawmakers,

it means they are eligible for a significant pay

raise....

While this is horrible

news for ordinary, working-class Massachusetts

taxpayers, it’s great news for our part-time, “full

time” legislature. In January, Massachusetts

lawmakers received a scheduled automatic pay raise

which is tied to the rate of inflation. As the rate

of inflation reaches a 40-year high, lawmakers’ next

eligible automatic pay bump will be their biggest

yet if it stays on pace.

As we head into 2022,

inflation and economic anxiety are at the forefront

of the minds of most Massachusetts residents —

except those at the State House. And why would it

be? For lawmakers, inflation means automatic pay

raises and higher wages. As for Massachusetts

Speaker Ron Mariano and Senate President Karen

Spilka, they still want more....

Despite their automatic

pay increases, and their proposed ballot question

plan to increase the income tax rate by 80%, Speaker

Mariano and Senate President Spilka are sitting on a

pile of dough. These legislative leaders currently

control billions of dollars in excess taxpayer money

and federal COVID relief money. Even with billions

of dollars of taxpayer money going unspent, these

enriched legislative leaders will try to fool enough

voters into thinking they don’t have enough money

next year.

The public often

wonders why their paychecks don’t get any bigger

while politicians get rich when they get elected.

It’s really simple. Politicians propose gimmicks to

raise taxes, which take more out of ordinary

people’s paychecks and politicians give themselves

automatic pay raises when everyone else is

suffering. That is a theme Massachusetts Fiscal

Alliance will remind the public throughout the New

Year until the legislature’s 80% income tax hike

gimmick fails next November.

The

Boston Herald

Wednesday, December 22, 2021

As

inflation crushes taxpayers, Legislature sees riches

ahead

Massachusetts is

preparing to enact some of the most stringent

regulations for truck emissions in the nation, as

the Baker administration seeks to curb tailpipe

pollution to meet its ambitious environmental goals.

The new regulations,

unveiled by the state Department of Environmental

Protection this week, would adopt California’s

accelerated truck standards requiring an increasing

percentage of all medium- and heavy-duty trucks sold

to be zero-emission starting in 2025.

The regulations, once

finalized, will require manufacturers increase

zero-emission truck sales in the state between 30

and 50% by 2030 and 40 and 75% by 2035....

The move will make

Massachusetts one of five states -- including

Washington, Oregon, New York, New Jersey -- to adopt

California's stringent rules....

"Major policies that

ban the sale of entire categories of vehicles is a

decision that should be debated by the Legislature

and not rushed through by unelected bureaucrats

before a major holiday," said Paul Craney, spokesman

for the Massachusetts Fiscal Alliance, a

conservative, pro-business group....

Massachusetts adopted

California's Low Emission Vehicle program

regulations in 1991 and has updated it to remain in

sync with the West Coast state's regulations. The

new regulations involves emission standards for

vehicles built in 2025 and also medium- and

heavy-duty vehicles and engines.

The move follows the

collapse of a multi-state pact aimed at reducing

regional vehicle emissions for both trucks and

passenger vehicles.

Last month, Gov.

Charlie Baker pulled the plug on the Transportation

Climate Initiative after the agreement failed to

gain traction among other states.

Baker had been one of

the most vocal proponents of TCI, touting it as key

to the state’s effort to reduce the largest source

of greenhouse gas emissions.

But most of the

original dozen states that were included in the

initiative had backed away, and when Connecticut

Gov. Ned Lamont announced that he won't be joining

the pact, Baker had no choice but to pull

Massachusetts out.

The

Eagle-Tribune

Thursday, January 6, 2022

State to adopt stringent truck

emissions rules

As it aims for

Massachusetts to phase out sales of traditional

gas-powered medium- and heavy-duty vehicles over the

next three decades, the Baker administration is

adopting greenhouse gas emissions standards and

regulations from California meant to accelerate the

switch to electric vehicles.

The Department of

Environmental Protection last week filed emergency

regulations and amendments to immediately adopt the

Golden State's Advanced Clean Trucks (ACT) policy,

which requires an increasing percentage of trucks

sold between model year 2025 and model year 2035 to

be zero-emissions vehicles....

The administration said

the adoption of California's regulations, which is

required in certain circumstances under

Massachusetts law, will help reduce pollution that

harms the environment, promote the adoption of

electric trucks and "lead to reduced fuel

consumption and fuel costs and maintenance due to

more fuel-efficient engines and vehicles and

next-generation zero-emission trucks."

"Massachusetts

continues to take aggressive action to reduce

emissions from the transportation sector, and

addressing pollution from medium- and heavy-duty

vehicles and advancing the market for clean trucks

is an essential part of this effort," Energy and

Environmental Affairs Secretary Kathleen Theoharides

said....

The Massachusetts Clean

Air Act requires that the Bay State "shall adopt

motor vehicle emissions standards based on the

California's [sic] duly promulgated motor vehicle

emissions standards" unless DEP determines, after a

public hearing and based on "substantial" evidence

that emissions standards and a compliance program

similar to California's "will not achieve, in the

aggregate, greater motor vehicle pollution

reductions than the federal standards and compliance

program."

DEP said that its

analysis of the California regulations concluded

that they "are clearly more stringent and provide,

in the aggregate, greater emission reductions than

the current federal program, and therefore must be

adopted by MassDEP." The regulations were filed Dec.

30 on an emergency basis, the agency said, because

they must be in place two years before the first

affected model year begins. Model year 2025 starts

Jan. 1, 2024....

In all, the changes are

projected to lead to costs of $1.054 billion by

2050, the agency said....

Zero-emission vehicles

are a major part of the Baker administration's

strategy to meet reduced greenhouse gas emissions

goals. The 2050 decarbonization plan the

administration released in late 2020 said that

reducing greenhouse gas emissions by 45 percent from

1990 levels by 2030 -- the administration's goal

before a climate law set the required 2030 reduction

at 50 percent -- would "require that about 1 million

of the 5.5 million [passenger vehicles] projected to

be registered in the Commonwealth in 2030 be"

zero-emission vehicles.

In coordination with

more than a dozen other states, Massachusetts has

already set a goal that at least 30 percent of all

trucks sold by 2030 and 100 percent of trucks sold

by 2050 be zero-emission vehicles.

State

House News Service

Monday, January 3, 2022

State Borrows from California to Speed Transition to

Electric Trucks

The second leg of the

Legislature's two-year session officially kicked off

on Wednesday marking the start of a seven-month

stretch that will test the ability of lawmakers to

juggle predictable duties like the passage of an

annual budget with the challenges of reaching

compromise on leadership priorities like voting

reform, mental health access and the acceleration of

offshore wind energy....

But while COVID-19 will

continue to occupy the attention of lawmakers, many

legislators, operating with newly drawn districts,

have already begun thinking about reelection or

running for another office and will be looking to

make progress on myriad issues that would provide

grist for their campaigns later in the year....

On the Legislature's

side of the State House, most committees face a Feb.

2 deadline to report out any bills currently before

them for consideration and lawmakers will most

likely want to pass legislation as soon as possible

setting a date for the primary elections later this

year.

"Just in general, I

would like to see committees start releasing more

bills for us to act upon," Sen. Michael Moore said

after Wednesday's session.

State

House News Service

Wednesday, January 5, 2022

Slow Start To Busy Seven-Month Session Stretch |

|

On December 21 the

State House News Service reported ("Analysts See State Tax Revenue

Growth Rolling Along"):

. . . House Ways and Means

Chairman Aaron Michlewitz, Senate Ways and Means

Chairman Michael Rodrigues and Administration and

Finance Secretary Michael Heffernan called

economists and budget experts to testify on what

they expect to see in fiscal year 2023 from state

tax collections, the first step in building a

spending plan for the budget year that begins July

1, 2022....

Despite all pointing to

a number of factors that could undermine their

estimates -- like yet another COVID-19 surge,

ongoing labor shortages and supply chain glitches,

and persistently high inflation -- the experts

assembled Tuesday largely agreed that Massachusetts

can expect to collect at least about $36.48 billion

and possibly as much as nearly $40.8 billion in tax

revenue next budget cycle, which would be between 6

percent and 18.6 percent more than the Baker

administration's official expectation for the

current budget year....

Five months in, fiscal

year 2022 tax collections are more than $900 million

ahead of consensus revenue expectations to this

point in the year and are trending more than $2

billion ahead of actual fiscal 2021 collections

through the same period of time.

Reporting on the state

comptroller's annual report, On January 3 the News

Service noted: ("Comptroller: FY '21 Revenues

Smashed Estimates By $13 Billion'):

The grand total of

state revenues collected by the end of fiscal year

2021 exceeded that year's budget estimates by more

than $13 billion, including a surplus of more than

$5.86 billion in tax revenue, according to a new

report from the state comptroller.

Fiscal year 2021

revenues from all sources totaled $56,867,366,700 as

of June 30, 2021, Comptroller William McNamara's

office said in an accounting report typically

required by the Legislature in each year's budget.

That was 30 percent more than the $43,641,100,000

revenue grand total estimated in the fiscal year

2021 budget....

Income tax revenue, the

single largest bucket of state tax revenue, came in

at more than $19.61 billion -- outpacing the

budget's underlying estimate of $15.93 billion by

nearly 25 percent.

Two days later on

January 5 the State House News Service reported ("Change in Law Leads to Massive

December Tax Haul"):

December tax

collections of $4.24 billion shattered last year's

mark for the final month of the year and exceed

estimates by more than 40 percent, but the windfall

is likely temporary with state revenue officials

attributing much of gains to a change in state law

that allows certain businesses to avoid federal

limits on state and local tax deductions.

The Department of

Revenue reported Wednesday that the state in

December 2021 collected $1.4 billion more than in

December 2020 and $1.23 billion more than estimates

for the month. But DOR also said much of that money

will be returned through refunds.

Still, even after

adjusting for the business tax changes, the

department said December tax collections exceeded

last year's haul by $520 million, or 18.3 percent,

and beat estimates by $635 million.

"December 2021 revenue

collections increased in all major tax types in

comparison to December 2020 collections and the

December 2021 monthly benchmark, including

withholding, non-withholding, sales and use tax,

corporate and business tax, and 'all other' tax,"

Revenue Commissioner Geoffrey Snyder said. "The

increase in withholding is likely related to

improvements in labor market conditions."

And it is not just tax

revenue that has broken all-time records. Even

in Year Two of the worldwide Chinese Pandemic the

Massachusetts Lottery is doing the same, according

to the State Treasurer who oversees it. The

News Service added ("Bettors Dump Record Amounts Into

Lottery"):

The last week of 2021

was the best one on record for Massachusetts Lottery

sales as weekly sales records for scratch tickets

and Keno combined with a rising Powerball jackpot to

contribute to more than $145.3 million in sales....

The Lottery produced a

record $1.112 billion in profit in fiscal 2021 for

the Legislature to use as local aid to cities and

towns and through five months of fiscal 2022 is

running roughly $38.5 million ahead of the fiscal

2021 profit pace.

[State Treasurer

Deborah] Goldberg told lawmakers and Baker

administration officials last month that she expects

the Lottery will generate about $995 million in

revenue for the state this fiscal year and roughly

$1 billion in fiscal year 2023.

Let us stipulate the

obvious right here and now: Massachusetts does not have

a revenue problem of any sort by any stretch. Massachusetts

does not need to raise taxes —

any taxes in any shape or form —

another cent for any reason. Massachusetts needs to rein in

spending fast and Beacon Hill denizens need to seriously consider

returning at least some of those billions of excess

taxpayer-dollars to their rightful owners. This is now no

longer honestly arguable.

For a start, there are two

simple solutions immediately available that have been too long

denied — perennially blocked by an

intransigent Legislature with an insatiable lust for always more

taxpayer's cash to squander: Restoring the charitable

deduction approved overwhelmingly by the voters in 2000 (alongside

CLT's income tax rollback ballot question), and; Updating the

state's onerous estate tax on the deceased.

Regarding the charitable

donations tax deduction, The Salem

News on December 27 reported ("Beacon Hill punts on

charitable deductions law, again"):

A tax deduction for

charitable donations approved by voters more than

two decades ago will be delayed again after

lawmakers failed to authorize the changes before

recessing for a seven-week winter break....

Voters approved the

deduction in 2000 as part of a referendum rolling

back the state’s personal income tax rate to 5%. The

referendum was approved by more than 70% of voters.

Two years after its

approval, the Legislature froze the personal income

tax at 5.3% to plug budget shortfalls and created a

mechanism to reduce the tax rate as revenue growth

allowed.

As part of the changes,

lawmakers froze the charitable deduction until the

state’s income tax rate fell to 5%.

Massachusetts has

benefited from an influx of billions of dollars in

federal pandemic relief, as well as

better-than-expected tax collections in recent years

that have given Beacon Hill policymakers a pile of

surplus money.

[Sen. Bruce Tarr,

R-Gloucester] sought to

implement the voter-approved tax break as part of

the $4 billion plan to spend American Rescue Plan

Act funds and state surplus revenue.

But the

Democratic-controlled Legislature rejected his

amendment, ensuring that the charitable deduction

won’t be available for income tax filers next year.

State Rep.

Shawn Dooley (R-Norfolk) has again introduce a bill

to update and reform the Massachusetts estate tax,

H-2881.

In part it states:

SECTION 6. Chapter

65C of the General Laws is hereby amended by striking out

Section 1(k), as appearing in the 2012 Official Edition, and

inserting in place thereof the following section:-

(k) “Basic

exclusion amount”, $2,750,000 which shall be annually adjusted

for inflation based on the US Department of Labor’s Consumer

Price Index (CPI) for All Urban Consumers. If the amount as

adjusted under the preceding sentence is not a multiple of

$10,000, such amount shall be rounded to the nearest multiple of

$10,000.

I was

contacted by Rep. Dooley's chief of staff last week

inviting CLT to provide testimony before the Joint

Committee on Revenue this coming Wednesday, which we

will be doing. Rep. Dooley attempted to update

and revise the estate tax in 2019 but was

unsuccessful so he's trying again. We were

invited to provide testimony again as CLT did in

September of 2019 ("CLT

Supports Estate Tax Revision"). That CLT

testimony in part noted the key considerations as we

see it:

. . . Bill Harris,

then-president of the Financial Planning Association of

Massachusetts, noted in his December 2017 Wicked Local Plymouth

column:

"Massachusetts implemented the current estate tax rules back

in 2001. Unlike other states, it’s never been indexed

for inflation. In the past three years, nine states

have eliminated or lowered their estate taxes. Many

more states are raising their lifetime exemptions (the

amount that is excluded from estate tax calculation).

New Jersey is scheduled to eliminate its estate tax

altogether, joining about a half-dozen others that have

ended their estate taxes over the past decade."

New Jersey repealed

its estate tax last year, leaving only eleven states that tax

the estates of its deceased citizens. Currently

Massachusetts is tied with Oregon as the most onerous, with the

lowest exemption of $1,000,000.

Mr. Harris further

noted:

"If you think the estate tax is only for the wealthy, think

again. The Massachusetts estate tax is regularly

entrapping unsuspecting middle-class families. If you

own a modest house on the South Shore and you’ve funded your

IRA for an adequate retirement, your estate may get hit with

the death tax. In estate planning circles,

Massachusetts is the least desirable state in which to

reside if you want to pass assets to your heirs. . . .

"The Massachusetts exemption threshold is only $1 million,

much less than the current federal estate taxes. But

unlike the federal estate tax, which only taxes the excess

over the threshold, in Massachusetts the threshold is a

trigger, and the majority of estate becomes taxable . . .

snaring lots of taxpayers at death.

"The tax on a $1 million estate is approximately $36,000,

however the tax on an estate that is $999,999 is zero.

If you are a Massachusetts resident and all of your assets

combined are just a bit above $1 million, get below that

threshold or change your residency before you die.

Otherwise, death taxes will be due."

Citizens for

Limited Taxation supports H-2446, "An Act relative to the

Massachusetts estate tax code" sponsored by Rep. Shawn Dooley

and others. It is a well-considered proposal that will

help ameliorate the currently excessive state estate tax

situation.

When the

Legislature takes good care of itself with generous

salaries, "stipends," expense accounts, etc., all

are indexed for inflation through the Consumer Price

Index. If it's good for them it ought to be

provided for estate taxpayers as well. Let's

call it "equity" and "social justice" and just get

it done.

See:

As

inflation crushes taxpayers, Legislature sees riches

ahead and

Many Massachusetts state

lawmakers earning six-figure pay, one tops $220,000

If not now, when?

Instead of seeking ways in

which to return some of taxpayers' involuntary largess the

Legislature — as always

— is looking for ways to suck even more

cash from the productive.

The State

House News Service on December 21 noted ("Dems Push For Higher Taxes On

Businesses"):

While the federal

government has pumped billions of one-time dollars

into state economies, some legislative Democrats

believe the state still should be looking to wealthy

corporations for additional revenue to fund

education, transportation and other priorities when

those funds inevitably dry up.

The Joint Committee on

Revenue held a hearing Wednesday on dozens of bills

related to corporate tax structures, including

proposals to return the state's corporate tax rate

to pre-2010 levels and to increase the minimum tax

companies without other liabilities must pay.

The Salem

News on December 23 reported ("Lawmakers want to

increase corporate taxes"):

Democratic lawmakers

are pitching plans to ratchet up taxes on

corporations to support the state’s recovery from

the economic impacts of the pandemic.

Several proposals heard

by the Legislature’s Revenue Committee Wednesday

would increase the state’s corporate tax and set

other new levies to squeeze more money out of

corporations they say have reaped profits during the

pandemic.

One proposal filed by

Rep. Mary Keefe, D-Worcester, would raise the

current corporate tax rate of 8% to the pre-2010

rate of 9.5%, which backers say would generate $375

million to $500 million annually....

Another proposal, filed

by Rep. Mike Connolly, D-Cambridge, would establish

a tiered alternative minimum tax charging

corporations from $456 to $150,000 a year depending

on sales. Businesses that report less than $1

million in sales a year would only pay $456, which

is the current flat rate for all businesses.

Connolly told the

committee that the changes would bring more

“fairness” into the state’s corporate tax

structure....

Increasing the tax on

corporate profits from 8% to 9.5%, advocates say,

could generate another $450 million to $525 million

a year for the state’s coffers.

The group, Raise Up

Massachusetts, is also behind a “millionaires tax”

referendum cleared for the 2022 ballot that will ask

voters to amend the state constitution to set a 4%

surtax on the portion of an individual’s annual

income above $1 million....

Business leaders say

raising corporate taxes would be a mistake for the

state as it tries to recover from the economic

impacts of the coronavirus.

“The idea of piling on

new taxes at a time when businesses are trying

desperately to recover would be folly,” said Chris

Carlozzi, state director of the Massachusetts

chapter of the National Federation of Independent

Businesses. “For lawmakers to say that the state

needs more tax revenue from businesses at a time

when billions of dollars in pandemic relief has come

into the state is disingenuous.”

The Boston

Herald opined in its December 24 editorial ("Raise taxes, say

goodbye to businesses"):

When is a tax hike not

a tax hike?

When Massachusetts

Democrats maneuver definitions with the skill of a

three-card monte dealer....

According to the State

House News Service, some legislative Democrats

believe the state still should set its sights on

wealthy corporations for additional revenue to fund

education, transportation and other priorities.

Corporations are the

go-to villain for Democrats, aghast at their

job-creating, worker-employing, economic growth

boosting gall.

It’s time for them to

pay for all that success....

Rep. Mary Keefe, a

Worcester Democrat, proposed increasing the

corporate tax rate from 8% to 9.5%, the same level

it sat at more than a decade ago. She said there are

only eight other states where businesses pay a

smaller share of state and local taxes than they do

in Massachusetts....

“We need to generate

more progressive revenue,” Keefe said.

Corporate tax reform,

she said, would also improve equity in the tax code

because she said business taxes are paid

disproportionately by white, high-income households

who are more likely to own stock.

“I don’t like to use

the word raising taxes,” she said. “This is about

restoring the tax to where it was before 2010.”

So making a tax higher

isn’t raising it, it’s just reverting the tax to

where it was 21 years ago. When it was higher.

Sorry, but up is up....

The problem with

corporate tax hikes is that businesses go where the

tax environment is friendly. And there are many

states who openly court big businesses to boost

their local economy.

Businesses don’t have

to make it in Massachusetts. Nor do they have to

spend it here.

We do need to consider

a future when the federal gravy train pulls out of

the station, but eyeing Massachusetts’ corporations

as giant ATMs who must stand in for D.C.’s coffers

is the best way to send these companies packing.

In another Boston

Herald editorial, this one on December 30 regarding

the estate tax revision and the exodus of productive taxpayers out

of Massachusetts ("High temps, low prices lure

snowbirds to FL") noted:

Legislators pushing for

estate tax reform aimed at raising an outdated

threshold that burdens middle class families are on

the right track.

But it won’t solve the

state’s “snowbird” problem....

It’s that $1M bar that

needs to go.

“If you’re a middle

class family who’s just sitting on property, the

valuation has just increased,” said state Sen.

Julian Cyr (D-Truro), who authored the Senate

version of the bill. “Those are the folks who’re

being adversely affected by the state tax, not the

ultra-rich, who frankly are savvy and well-resourced

enough to avoid it in the first place.”

According to Zillow,

the average Massachusetts home costs $541,834, a

16.6% increase from a year ago. “That means that a

lot of middle-income families really quickly hit

that $1 million threshold,” said State Rep. Daniel

Fernandes (D-Falmouth), who filed the House version

of the bill. “If they just have a home that is

slightly over half a million dollars, and they have

some money in a 401k and maybe a car and a life

insurance policy.”

The bill would double

the threshold from $1 million to $2 million.

“The estate tax in

Massachusetts was always intended to be a rather

progressive tax, meaning that you’re focusing on

folks who are wealthy and super-wealthy, but I think

that the million dollar threshold feels out of

date,” Cyr said.

Eileen McAnneny,

president of the Massachusetts Taxpayers Foundation,

noted that the risk of losing the state’s aging

population to other states like Florida and New

Hampshire already has a ripple effect on the state’s

other revenues, including capital gains taxes,

interest, dividends, sales tax and more. The Herald

reported earlier this year that the state lost $20.7

billion in adjusted gross income between 1993 and

2018....

Massachusetts has many

wonderful attributes — a balmy winter isn’t one of

them. Florida and other points south have appealed

to retirees since the first grandpa wore socks with

sandals and declared it a fashion statement.

Things are less

expensive the farther south you go. A visit to

NerdWallet’s cost of living calculator finds that

compared to Boston, the cost of living in Tampa is

40% lower. The cost of food is 4% lower, and the

price of entertainment is 11% lower. Healthcare

costs are 13% lower.

So while the lawmakers’

reform bill is a much-needed piece of legislation to

bring the estate tax code up to date, it doesn’t

reform the weather nor the prices in our beautiful,

cold, expensive state.

The

Committee to Unleash Prosperity on December 27 noted

("The

Great Escape"):

Americans continue to vote

with their feet, in an acceleration of pre-COVID trends away from

California and the Northeast and to the South.

The Census Bureau reported

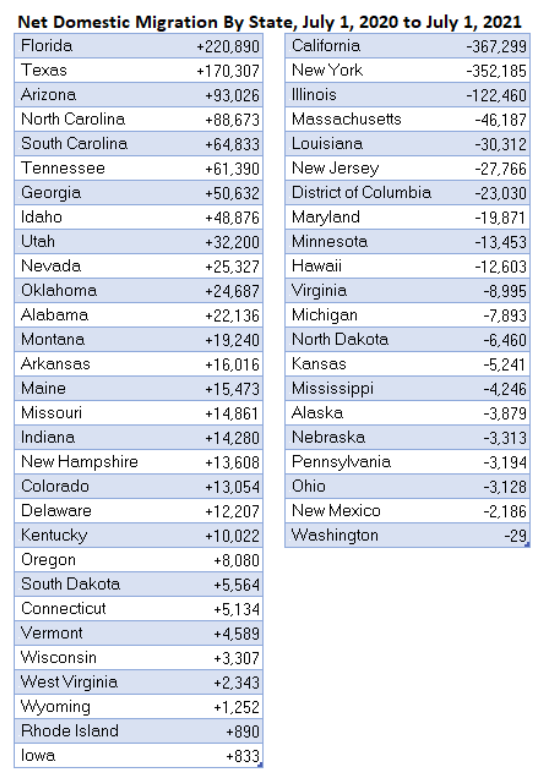

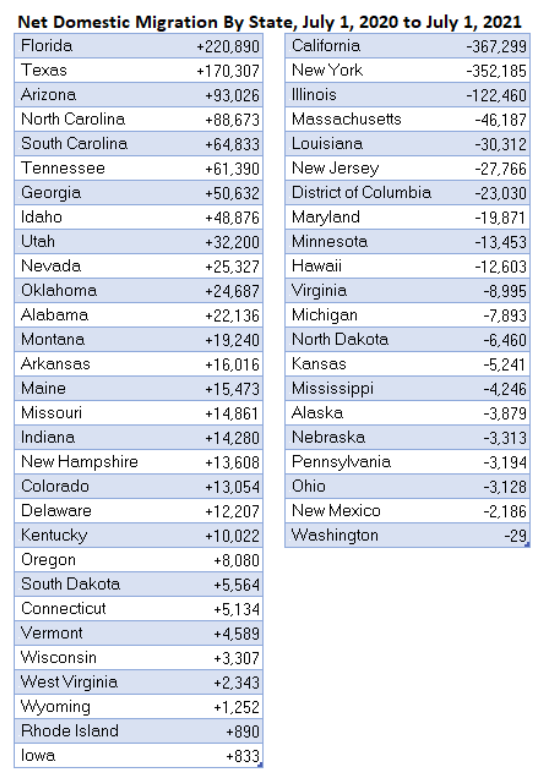

Net Domestic Migration by Region July 1 2020 to July 1 2021:

Northeast -389,638

West -144,941

Midwest -123,103

South +657,682

And here is 2021 by state:

In his

Boston Globe column last Wednesday ("Bye-bye, Bay State") Jeff Jacoby

wrote (excerpts):

A friend of mine who

lived for many years on the North Shore relocated to

Kentucky in 2018 and has rejoiced ever since that it

was among the best decisions he ever made. Compared

with the Bay State, he reports, the housing where he

lives now is more affordable, the taxes are lower,

the winters are milder, the people are friendlier,

and the politics are more congenial. Not even the

tornadoes that tore up Western Kentucky last month

have dampened his satisfaction in no longer having

to put up with all the things that he found so

irksome about life in Massachusetts.

My friend’s experience

isn’t anomalous. Each year, more people leave

Massachusetts for other states than move to

Massachusetts from other states. According to the US

Census Bureau, between April 2020 and July 2021, the

population of Massachusetts shrank by more than

45,000. Only three other states — California, New

York, and Illinois — experienced a greater net

outflow of residents....

Massachusetts certainly

has its charms and advantages; countless Bay Staters

would never consider moving anywhere else. But

plenty of their neighbors feel differently. Year in,

year out, tens of thousands of Massachusetts

residents leave for good, and their numbers aren’t

replenished by newcomers from other states. My

friend in Kentucky is happy he left, and he’s

clearly not alone.

I'll leave it to you to

figure out who that friend of Jeff's is!

Not only can Bay

State residents and taxpayers vote with their feet and wallets

— they are and they have been,

in large numbers. U-Haul produces an annual report on the out-

and in-migration numbers based on its moving rentals. Its

latest report ("2020

Migration Trends: U-Haul Ranks 50 States by Migration Growth")

ranks Massachusetts #47 in migration outflow, better than only New

Jersey, Illinois, and California which have lost the most

population.

Massachusetts politicians

seem not to care in the least that they're chasing out the golden

goose that provides every cent the state has to spend. Will

they never wake up, ever step outside their Beacon

Hill Bubble?

Spoiler Alert!

Just when we thought we had dodged Gov. Baker's TCI bullet here

comes the end-run work-around that likely will be even worse for

motorists and residents.

On Monday the State

House News Service reported ("State Borrows from California to Speed Transition to

Electric Trucks"):

As it aims for

Massachusetts to phase out sales of traditional

gas-powered medium- and heavy-duty vehicles over the

next three decades, the Baker administration is

adopting greenhouse gas emissions standards and

regulations from California meant to accelerate the

switch to electric vehicles.

The Department of

Environmental Protection last week filed emergency

regulations and amendments to immediately adopt the

Golden State's Advanced Clean Trucks (ACT) policy,

which requires an increasing percentage of trucks

sold between model year 2025 and model year 2035 to

be zero-emissions vehicles....

The Massachusetts Clean

Air Act requires that the Bay State "shall adopt

motor vehicle emissions standards based on the

California's [sic] duly promulgated motor vehicle

emissions standards" unless DEP determines, after a

public hearing and based on "substantial" evidence

that emissions standards and a compliance program

similar to California's "will not achieve, in the

aggregate, greater motor vehicle pollution

reductions than the federal standards and compliance

program."

The

Eagle-Tribune reported on Thursday ("State to adopt stringent truck

emissions rules"):

The move will make

Massachusetts one of five states -- including

Washington, Oregon, New York, New Jersey -- to adopt

California's stringent rules....

"Major policies that

ban the sale of entire categories of vehicles is a

decision that should be debated by the Legislature

and not rushed through by unelected bureaucrats

before a major holiday," said Paul Craney, spokesman

for the Massachusetts Fiscal Alliance, a

conservative, pro-business group....

Massachusetts adopted

California's Low Emission Vehicle program

regulations in 1991 and has updated it to remain in

sync with the West Coast state's regulations. The

new regulations involves emission standards for

vehicles built in 2025 and also medium- and

heavy-duty vehicles and engines.

The move follows the

collapse of a multi-state pact aimed at reducing

regional vehicle emissions for both trucks and

passenger vehicles.

Last month, Gov.

Charlie Baker pulled the plug on the Transportation

Climate Initiative after the agreement failed to

gain traction among other states.

Baker had been one of

the most vocal proponents of TCI, touting it as key

to the state’s effort to reduce the largest source

of greenhouse gas emissions.

But most of the

original dozen states that were included in the

initiative had backed away, and when Connecticut

Gov. Ned Lamont announced that he won't be joining

the pact, Baker had no choice but to pull

Massachusetts out.

On a final closing note,

my politically astute friends in the Bluegrass State often think I'm

exaggerating when I relate how bad government is in Massachusetts

"where everything that is not banned is mandated by law." In

my news search this week I stumbled across a headline even I

couldn't comprehend, I word I'd never come across: "stealthing."

With the hours required for my daily research I strictly narrow my

focus to only headlines which indicate an article that might be of

interest to taxpayers — but this one

I had to read, then send around to my friends here. They now

believe me without hesitation and are stunned that this is what

Massachusetts politicians waste time on — and

are probably still laughing. I don't know whether to

laugh or cry.

The Boston Globe

January 5, 2022

Massachusetts lawmakers look to outlaw ‘stealthing’

Though “stealthing” is common, state law is silent

|

|

|

|

Chip Ford

Executive Director |

|

|

State House News

Service

Tuesday, December 21, 2021

Analysts See State Tax Revenue Growth Rolling Along

Experts Return After Missing Mark Last Cycle

By Colin A. Young and Katie Lannan

State tax revenues have defied expectations throughout the

pandemic and federal aid has helped to keep Massachusetts

fiscally healthy over the last two years. But uncertainty

about the sustainability of recent positive economic trends

and unknowns surrounding the latest mutated form of the

coronavirus made trying to predict tax collections for the

next 18 months a daunting task Tuesday.

House Ways and Means Chairman Aaron Michlewitz, Senate Ways

and Means Chairman Michael Rodrigues and Administration and

Finance Secretary Michael Heffernan called economists and

budget experts to testify on what they expect to see in

fiscal year 2023 from state tax collections, the first step

in building a spending plan for the budget year that begins

July 1, 2022.

Trying to predict something as fickle as tax revenue seven

months to a year-and-a-half out is inherently challenging,

and Beacon Hill has so far struggled to wrap its arms around

the changes brought upon by the pandemic. At one point early

in the pandemic, some state budget watchers predicted that

tax revenues could end up as much as $8 billion short of

expectations. Instead, Massachusetts generated a surplus of

about $5 billion in fiscal year 2021 and is on track to

significantly exceed revenue expectations this budget year

as well.

"For nearly two years, the commonwealth has gone through

some of the most turbulent budgets that this building has

ever seen. Throughout these unprecedented times, the

commonwealth has seen historic highs in terms of our revenue

numbers. One of the main drivers of this has been the

unprecedented amount of assistance the federal government

has given," Michlewitz said. "Unfortunately, this level of

support is not permanent and, going forward, we must keep

that in mind as we plan for the future of the commonwealth."

Despite all pointing to a number of factors that could

undermine their estimates -- like yet another COVID-19

surge, ongoing labor shortages and supply chain glitches,

and persistently high inflation -- the experts assembled

Tuesday largely agreed that Massachusetts can expect to

collect at least about $36.48 billion and possibly as much

as nearly $40.8 billion in tax revenue next budget cycle,

which would be between 6 percent and 18.6 percent more than

the Baker administration's official expectation for the

current budget year.

Department of Revenue

Revenue Commissioner Geoffrey Snyder said Tuesday that the

current year's tax collections have been solid enough so far

that he now projects fiscal year 2022 will end with DOR

having collected between $35.726 billion and $36.623 billion

-- between $1.325 billion and $2.222 billion more than the

consensus revenue agreement reached a year ago. The fiscal

2022 benchmark could be updated when the fiscal 2023

agreement is announced.

For fiscal year 2023, the primary focus of Tuesday's

hearing, Snyder said that DOR forecasts that state tax

revenue will land in the range of $36.484 billion to $37.684

billion, which would be between 2.1 percent and 2.9 percent

higher than the agency's revised fiscal 2022 forecast.

Snyder also flagged for the budget managers DOR's

expectation that capital gains taxes, a source of revenue

that has helped Massachusetts bulk up its reserves during

the recent years of strong stock market performance, will

tail off in fiscal 2023.

"Capital gains taxes are a volatile revenue source. With

years of rising capital markets, we recognize the potential

for growing reserves of unrealized gains. However, capital

gains revenue collections have been very strong over the

past several years, hitting an all-time high in FY21, which

leads to uncertainty about how much more unrealized gains

remain," he said, referring to the $2.584 billion in capital

gains tax revenue last fiscal year.

DOR is forecasting that fiscal year 2022 capital gains will

be between $2.409 billion and $2.713 billion, roughly in

line with the capital gains-specific benchmark of $2.615

billion. For fiscal year 2023, however, Snyder said that DOR

is projecting that capital gains revenue will sink to

between $2.198 billion and $2.356 billion.

As did most of the experts who testified Tuesday, Snyder

said DOR's forecast is clouded with "a significant degree of

uncertainty" related to the future course of COVID-19, labor

and supply chain constraints, and inflation's impacts on the

global economy.

Mass. Taxpayers Foundation

The Massachusetts Taxpayers Foundation offered a mixed

outlook, with President Eileen McAnneny forecasting that

revenue growth will "remain robust" this fiscal year before

flipping to a "completely different story" next year when

the situation will revert "back to a period of stalled

growth."

McAnneny projected the state will end fiscal 2022 with $37.2

billion in tax collections -- $3.1 billion or 9 percent

above last year, growth that she said would be fueled by

"employment bouncing back, wage increases, asset value

spikes, increased spending on durable goods and motor

vehicles with higher prices due to inflation, and healthy

profits for corporations."

After that, though, McAnneny said revenues would grow only

1.1 percent or $411 million in fiscal 2023, giving

budget-writers $37.6 billion to work with. She said more

workers, earning higher wages as employers compete for

labor, will drive up withholding income tax revenues by

nearly $600 million next year, but those gains will be

offset by a "steep decline" in capital gains and other

non-withholding income tax revenues.

Sales tax growth will moderate to 1 percent in fiscal 2023

as spending shifts back from durable goods to services and

inflation rates slowly decline over the next 18 months,

McAnneny said.

Alan Clayton-Matthews

Northeastern University economist Alan Clayton-Matthews had

the rosiest forecast for fiscal year 2023, projecting that

Massachusetts could collect as much as $40.795 billion based

on "a very sanguine economic outlook." That would represent

6.5 percent growth over his fiscal year 2022 forecast of

$38.301 billion, he said.

Clayton-Matthews reviewed how withholdings from unemployment

insurance programs helped prop up state tax revenues during

the pandemic. He said that impact is tailing off and should

get back down to normal pre-pandemic levels during fiscal

2023.

Withholding from unemployment insurance added $258 million

to fiscal year 2020 revenues and $557 million to revenues in

fiscal year 2021, he said, and is expected to contribute

$137 million to state revenues in fiscal year 2022. For

fiscal year 2023, he projected that unemployment insurance

withholdings would provide about $58 million to state

coffers.

"That's a normal level, $58 million. So we are seeing the

waning effects of unemployment assistance support to

revenues," Clayton-Matthews said. "On the other hand, of

course, if unemployment is falling, employment and therefore

wage and salary income and income revenues are rising."

Center for State Policy Analysis

Higher-than-expected inflation creates a "dark cloud" over

the state's revenue picture, cautioned Evan Horowitz,

executive director of the Center for State Policy Analysis

at Tufts University.

Horowitz is projecting $36.5 billion in revenue collections

for fiscal 2023, and said he thinks it makes sense to raise

this year's benchmark by $1 billion, to $35.4 billion.

Accounting for inflation, Horowitz said next year's growth

could actually work out to "a slight decline in revenue,

meaning the state could have fewer real dollars to work with

for FY23."

Because the cost "of running state government has risen more

rapidly than we've seen in a generation," he said that even

a "maintenance budget" for next year "will have to reckon

with the fast-growing cost of hiring people, procuring

materials, providing housing support, and a great deal

besides."

Horowitz said the uncertainties arising from the pandemic

have created a mix of risks and "hopeful possibilities" on

the economic front. Right now, he said, consumer spending

levels above long-term trends, the job market near its

pre-pandemic highs, "extremely" high valuations for asset

prices and the Federal Reserve's plans to raise rates

combine to mean "there are a lot more ways for our economy

to stumble and a lot fewer chances to accelerate from here."

"In terms of state tax revenue, Massachusetts may already be

overdue for a correction, with the volatile parts of our tax

system, like capital gains and estimated taxes, having

outrun the more stable parts, like income withholding and

the sales tax," he said.

Monitoring Fiscal Year 2022 and Next Steps

When the same trio assembled last year to forecast fiscal

year 2022 revenues, they settled on an estimate of $30.12

billion. At the time, they said it represented 3.5 percent

growth in state tax revenue compared to their then-current

estimate of $29.09 billion in fiscal 2021 revenue.

About six months later, fiscal year 2021 ended with DOR

having collected $34.137 billion -- well in excess of the

initial pre-pandemic estimate of $31.15 billion.

Five months in, fiscal year 2022 tax collections are more

than $900 million ahead of consensus revenue expectations to

this point in the year and are trending more than $2 billion

ahead of actual fiscal 2021 collections through the same

period of time.

"I certainly appreciate the difficulty of projecting tax

revenues over the past two years, and for the upcoming one

as well," MTF's McAnneny said Tuesday. "We were talking

prior to the start of this, some of the presenters, and we

were all saying just how difficult it has been. I liken it

to a roller coaster ride, complete with dips and turns, and

unfortunately I think we have one more loop before this ride

is over."

After the hearing, the Joint Ways and Means Committee and

Heffernan will work up an agreed-upon tax revenue forecast

for fiscal year 2023. They have until Jan. 15 to arrive at

that number. The figure will become the state revenue-side

anchor in Gov. Charlie Baker's final budget filing, which is

due to the Legislature by Jan. 26.

The House will roll out and debate its own version of a

fiscal year 2023 budget in April and the Senate will follow

suit in May. Because it is their "consensus" number, both

branches generally rely upon the same revenue estimate when

they assemble their budgets even though the estimate is

months old by that point.

June is typically when a six-member conference committee

hammers out an agreement between the branches on a single

budget bill before the governor gets his chance to sign,

amend or veto its provisions. Fiscal year 2023 starts July

1, 2022.

Still Having Technical Difficulties

Tuesday's hearing got off to a dubious start when the

chairmen of the House and Senate Ways and Means committees

and Baker administration finance officials huddled to go

over their tax revenue forecasts without providing access to

the public, press or even to lawmakers assigned to sit on

the Ways and Means committees.

Rodrigues' office said a technical glitch kept the start of

the hearing from being broadcast on the Legislature's

website. Only Rodrigues, Michlewitz and Heffernan were

allowed to participate in the hearing in person from the

State House, which remains wholly closed to the public.

By the time the public broadcast became available at about

10:20 a.m., Revenue Commissioner Geoffrey Snyder was already

partway through his testimony, which generally follows

opening remarks from the chairmen and secretary, comments

that sometimes set the tone for the upcoming budget cycle.

A Rodrigues aide said that the committee staff was not

alerted to the fact that the hearing was not available to

the public or press until about five minutes in.

"As an unintended consequence, Chair Rodrigues commenced the

hearing without this knowledge and opening remarks were well

underway before he was informed by staff that we were

experiencing technical difficulties," the aide said.

"Fortunately though, the technical difficulties with the

live feed were resolved and public access has been preserved

thanks to the fact the hearing is being recorded."

Michlewitz's office did not respond to questions from the

News Service.

Early in the pandemic, when virtual hearings were still

relatively new to lawmakers, Rodrigues and Michlewitz had to

postpone a virtual summit with many of the same economic

experts they heard from Tuesday because they were not able

to livestream the proceedings.

"We could have held this but for it to not be broadcast

live, for it to not be transparent, it's not worth it. We'd

rather do it the right way," Michlewitz said at the time.

State House News

Service

Monday, January 3, 2022

Comptroller: FY '21 Revenues Smashed Estimates By $13

Billion

By Colin A. Young

The grand total of state revenues collected by the end of

fiscal year 2021 exceeded that year's budget estimates by

more than $13 billion, including a surplus of more than

$5.86 billion in tax revenue, according to a new report from

the state comptroller.

Fiscal year 2021 revenues from all sources totaled

$56,867,366,700 as of June 30, 2021, Comptroller William

McNamara's office said in an accounting report typically

required by the Legislature in each year's budget. That was

30 percent more than the $43,641,100,000 revenue grand total

estimated in the fiscal year 2021 budget.

After required transfers to specific accounts, the fiscal

2021 budget document assumed $22.793 billion in tax revenue

but the fiscal year ended with more than $28.656 billion in

tax revenue after the transfers, the report said. Income tax

revenue, the single largest bucket of state tax revenue,

came in at more than $19.61 billion -- outpacing the

budget's underlying estimate of $15.93 billion by nearly 25

percent.

Non-tax revenue -- things like federal reimbursements and

departmental revenue -- came in even further above

expectations. At more than $28.21 billion, actual fiscal

2021 non-tax revenue was more than 35 percent more than the

$20.85 billion expectation built into the fiscal 2021

budget.

The report also sheds light on the specific revenue sources

that outperformed (or underperformed) their budget bill

expectations. For example, the report shows that the fiscal

2021 budget was built with an expectation of $54.5 million

in marijuana excise tax revenue but the year actually

generated more than twice that amount -- $112.37 million. As

the pandemic lingered, revenue from room occupancy taxes

came in at about $88.72 million -- about 25 percent short of

the $117.9 million estimate.

The comptroller's office said the "comparison of Actual

Revenue Collections to Budget" is traditionally submitted

pursuant to sections of the annual appropriations act. But

when lawmakers in December 2020 passed the conference

committee budget for fiscal year 2021, the language "was

inadvertently omitted" and the office instead prepared the

fiscal 2021 report based on language provided by legislative

staff.

State House News

Service

Wednesday, January 5, 2022

Change in Law Leads to Massive December Tax Haul

By Matt Murphy

December tax collections of $4.24 billion shattered last

year's mark for the final month of the year and exceed

estimates by more than 40 percent, but the windfall is

likely temporary with state revenue officials attributing

much of gains to a change in state law that allows certain

businesses to avoid federal limits on state and local tax

deductions.