|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, November 22, 2021

More on Halting

TCI — and the Increasingly Dysfunctional Legislature

Jump directly

to CLT's Commentary on the News

|

Most Relevant News

Excerpts

(Full news reports follow Commentary)

|

|

Gov. Charlie Baker

threw in the towel on his transportation climate

initiative on Thursday just days after Gov. Ned

Lamont of Connecticut did the same thing in his

state....

Lamont indicated he

might revisit joining the initiative after next

year’s election, but Baker’s statement indicated he

intends to move on and not look back. It’s a

stunning turnaround for a concept that once

attracted the interest of a dozen northeast and

mid-Atlantic states and became a linchpin of the

Baker administration’s plan for reaching net zero

greenhouse gas emissions by 2050....

Massachusetts was the

only state supporting the transportation climate

initiative until Thursday. The governors in Rhode

Island and Connecticut couldn’t get it through their

legislatures; Baker had the power to sign on because

of earlier legislation giving him the authority to

act on his own....

Paul Craney, a

spokesman for the Massachusetts Fiscal Alliance,

which opposed the transportation climate initiative,

said he was glad Massachusetts finally abandoned

what he called a “regressive gas tax scheme,” which

he said would have hurt the middle class and the

working poor the most. He thanked his allies in the

fight — Citizens for Limited Taxation, the

Beacon Hill Institute, the National Federation of

Independent Business, Massachusetts Republican Party

chairman Jim Lyons, and Boston Herald columnist

Howie Carr.

CommonWealth Magazine

Thursday, November 18, 2021

Baker pulls the plug on

transportation climate initiative

Abandons cap-and-invest plan after Lamont’s decision

to back away in CT

Providence, RI

— Just one day after

Governor Dan McKee's office confirmed that the

governor continues to support the Transportation and

Climate Initiative (TCI), his administration

reversed course and announced that it was dropping

its effort to adopt the initiative.

GoLocalProv

Friday, November 19, 2021

McKee Drops Support for

Transportation and Climate Initiative

After both

Massachusetts and Connecticut’s governors pulled out

of the Transportation and Climate Initiative, citing

waning support and higher gas prices, Rhode Island

has also has left, putting the nail in the coffin on

the multi-state partnership.

“The Transportation and

Climate Initiative depends upon the involvement of

at least three jurisdictions to go forward as a

program,” said Ocean State Department of

Environmental Management Acting Director Terrence

Gray in a statement. “Recent events in Connecticut

and Massachusetts, however, have made clear that at

least for the time being, Rhode Island must explore

other options in clean transportation.” ...

Paul Diego Craney of

the conservative watchdog organization Mass Fiscal

Alliance, one of the most vocal opponents of TCI,

praised the move.

“We are pleased to see

the TCI scheme completely surrendered,” he said in a

statement. “We would not have settled for anything

but an unconditional surrender of the scheme. Rhode

Island motorists don’t deserve to be on an island on

its own, so their state’s motorists can be thankful

this Thanksgiving holiday season.”

The

Boston Herald

Saturday, November 20, 2021

Rhode Island, the final

state, pulls out of TCI

Gov. Charlie Baker’s

surprise move to dump the unpopular climate

initiative compact could be the strongest signal yet

that he has his eyes on a third term.

The Transportation and

Climate Initiative, or TCI, would have raised

already skyrocketing gas prices and given fuel to

Baker’s potential Republican opponent, former Rep.

Geoff Diehl.

Now that the Republican

governor doesn’t have to contend with the impacts of

TCI, he can avoid getting blamed for gas tax hikes

and shortages, though he won’t rid his

administration of the stain of the failed

initiative.

“It’s a failed program

for him now,” said Paul Diego Craney of the

MassFiscal Alliance, the major opponent of TCI.

“Republican primary voters are not going to forget

that at all.”

TCI could still be a

potent issue for Diehl even though it’s on the scrap

heap....

“It doesn’t go away

just by dropping out,” Craney said. “I suspect

(Diehl) will use it all the way to the end of the

primary.”

Diehl also can gloat

his way through the campaign reminding voters that

he was always opposed to TCI and was protecting

motorists from massive gas tax hikes. And Democrats

may have an opening now to attack Baker for failing

to do enough to combat climate change.

The

Boston Herald

Friday, November 19, 2021

Charlie Baker jettisons failed

TCI, but will voters remember?

By Joe Battenfeld

Progressives say the

only way to achieve their climate goals is to raise

the price of fossil fuels. Their problem is that

consumers don’t want to pay more for energy, and as

the latest proof behold Connecticut Gov. Ned

Lamont’s retreat this week from a Northeast state

climate pact.

Last December the

Governors of Rhode Island, Connecticut and

Massachusetts and the mayor of Washington, D.C.,

joined a cap-and-trade scheme to reduce carbon

emissions from fuel....

Mr. Lamont finally gave

up trying to pass the scheme this week. “Look, I

couldn’t get it through when gas prices were at

historic lows. So I think the legislature has been

pretty clear it is a tough rock to push when gas

prices are so high,” he said. Massachusetts GOP Gov.

Charlie Baker then threw in the towel too, causing

the climate pact to effectively combust.

Mr. Lamont is running

for re-election next year, and perhaps the close

race this month in New Jersey gave him pause. Even

liberals don’t want to pay more for energy to make

an insignificant reduction in global emissions.

Washington State voters have twice shot down a

carbon tax. This summer the Swiss rejected higher

taxes on driving and flying in a referendum. Maybe

the death of fossil fuels that we’ve been told is

inevitable isn’t so inevitable.

The Wall

Street Journal

Friday, November 19, 2021

Opinion | Review & Outlook

The Northeast Climate Pact

Implodes

If state

representatives want to avoid allowing mail-in

voting and expanded early voting permission to lapse

next month, they will need to find a way to secure a

bipartisan agreement within the chamber, according

to the House's top elections expert.

And while House and

Senate leaders agree on some core election reform

proposals, there are "a lot of different moving

pieces" that they have not yet ironed out, Election

Laws Committee Co-chair Rep. Dan Ryan told the News

Service.

Ryan said Wednesday

that he did not expect action on temporary or

permanent voting reforms, and the Legislature indeed

adjourned its final formal lawmaking session of 2021

without tackling the issues and with the House

electing not to even open up debate on the

matter....

Failing to act by

Wednesday's end of formal sessions for the year

leaves the near-term fate of the reforms uncertain.

Supporters of the reforms could allow the policies

to lapse and attempt to revive them when formal

sessions resume in January, or try to enact either

an extension or a permanent authorization during

informal sessions, when a single member's objection

could stall progress.

"We could try to do

that, but of course, if one person decides they

don't want it to happen, then we have to go into

January and think of Plan B," Ryan said of tackling

election reforms in an informal session during the

holiday quiet period.

House Republicans voted

against the mail-in voting budget amendment in June,

at the time criticizing the process. Senate

Republicans have also objected to some voting

reforms.

House Minority Leader

Brad Jones signaled Wednesday that his caucus may be

open to another temporary extension of the COVID-19

voting policies.

State

House News Service

Wednesday, November 17, 2021

Beacon Hill Leaves Voting

Reforms Up In The Air

Gov. Charlie Baker is

among those disappointed that Beacon Hill Democrats

couldn't agree on a plan to put nearly $4 billion to

work throughout the economy before breaking for a

seven-week stretch of informal sessions, and is

blaming a legislative decision earlier this year for

causing delays.

Baker proposed spending

American Rescue Plan Act funds in June, but

legislative Democrats put the federal aid in a

lockbox that they control and opted for a long

public hearing process to gather feedback about the

state's needs. They then couldn't agree on a

consensus bill by Wednesday when formal sessions

ended for 2021.

"The Baker-Polito

Administration believes the Legislature's original

decision six months ago to freeze these funds and

subject them to the legislative process created a

massive delay in putting these taxpayer dollars to

work," Baker press secretary Terry MacCormack said.

"Massachusetts was already behind most of the

country in utilizing these funds before the latest

setback, and further delay will only continue to

leave residents, small businesses and hundreds of

organizations frozen out from the support the rest

of the country is now tapping into to recover from

this brutal pandemic."

Negotiations among six

members of a conference committee are continuing,

but any agreement they might reach in the next seven

weeks will require bipartisan and unanimous support

since any single lawmaker can stop a bill from

advancing in informal sessions. Formal sessions are

scheduled to resume on Jan. 5, but there's

uncertainty also about whether, under legislative

rules, the appropriations bills will die at the

start of the new annual session or carry over

intact....

While conference talks

are conducted in secret, there were some signs of

discord Wednesday night. When Michlewitz signaled a

deal was not within reach, Rodrigues appeared taken

aback and said he lacked a "dance partner" and that

"it takes two to tango." As the House abruptly

adjourned at 6:25 p.m., Sen. William Brownsberger

was telling senators to settle in for a lot more

work that evening. Once news of the House

adjournment reached the Senate, that chamber ended

its session at 6:38 p.m.

State

House News Service

Thursday, November 18, 2021

Baker Blames Legislature For ARPA

Spending Delays

Spox: Mass. Trails Other States In Using Relief

Funds

If there’s one thing

our state lawmakers have historically been good at,

it’s spending large pots of money.

And getting their rest.

So it’s astonishing

that they have been unable to reach an agreement to

spend more than $5 billion in funds, a federal

gift-in-hand intended to ease the effects of the

pandemic.

But it’s not

astonishing at all that lawmakers adjourned for the

year Thursday, leaving the issue hanging in

limbo....

As legislators headed

off into the sunset, Governor Charlie Baker made no

secret of his frustration with them. He’s absolutely

right to believe they’ve shirked their duty.

“The Legislature made a

commitment to get it done before they went home for

the holiday season and I can’t tell you how

frustrated I am,” Baker said. “Not just for me but

for all the mayors and small businesses and folks

who are looking for an opportunity to do something

other than what they were doing before, and getting

the skills that would be required to do that.”

The money in question

comes through the American Recovery Relief Act with

few, if any, strings attached. And that might be

part of the problem: so much flexibility allows

plenty of room for disagreement and delay — and

delay is an art form on Beacon Hill.

Other states have

managed to figure out how to spend the money.

Baker’s claim that Massachusetts lags behind other

states in spending the cash seems to check out.

What does Baker want to

do with the money? His wish list included spending

on housing, job training, environmental and

climate-related programs, and education. Those

priorities were placed on the table months ago.

The Legislature moved

quickly, back then, to ensure that the money could

only be spent with its approval. Legislative leaders

bemoaned a lack of process, and insisted that they,

not Baker, should decide how to spend the money.

That’s fine, but if

they were going to seize control, they own the

failure of that process. ... Impressive it is

not....

Lawmakers might argue

that this is just a delay, that a compromise will

eventually be reached.

In theory, that’s true.

But in practice, the Legislature is now stuck in

informal session, where nothing can pass without a

unanimous vote.

Nothing major happens

in informal session, and anyone who has spent any

time in the State House knows this package isn’t

likely to be an exception....

But as it stands now,

the Legislature is effectively on break. They’ll

pick this matter up in January, I guess. Or maybe

they’ll just hold a few more hearings, and squabble

for a little longer over who’s really in charge on

Beacon Hill — them or the governor.

The

Boston Globe

Friday, November 19, 2021

As billions hang in limbo,

lawmakers take a breather

By Adrian Walker

The Massachusetts High

Technology Council is likely to launch a court

challenge to the ballot language for the so-called

millionaires’ tax unless the ballot question says

the tax would not necessarily increase spending on

schools and transportation, it said in a letter this

week....

The missive from MHTC

raises the prospect of another clash before the

Massachusetts Supreme Judicial Court, which struck

down a previous version of the tax proposal in 2018.

The proposal is now poised to go before voters as a

ballot question in November 2022.

A court battle, should

it come to pass, would be limited to the proposal’s

language, not whether it should be on the ballot at

all. Still, the MHTC’s letter drew strong rebukes

from proponents of the tax on Wednesday.

In the letter, sent to

Attorney General Maura Healey and Secretary of the

Commonwealth William Galvin on Tuesday, the MHTC

took issue with the ballot language that was to be

used to describe the proposed tax in 2018. No such

materials have been made public so far this year.

Back then, a summary of

the proposal informed voters that revenue from the

tax, subject to appropriation by lawmakers, would be

used only for education- and transportation-related

purposes. A description of the meaning of a “yes”

vote used similar language.

The MHTC contended in

the letter that the proposal does not require

lawmakers to use millionaires-tax revenue to

increase spending in those two areas, since they can

reduce spending on education and transportation from

other revenue sources, and replace it with revenue

raised by the millionaires’ tax. Opponents to the

tax have made the argument for years, as a reason

not to pass the proposal....

The letter asks Healey

and Galvin to release the proposal language as soon

as possible, or at the latest by Jan. 12, so that

the MHTC has enough time to challenge the language,

if necessary, under guidelines previously issued by

the SJC....

In the letter, the MHTC

cited polling it conducted finding that when told

lawmakers need not increase spending on education

and transportation because of the millionaires’ tax,

72% of respondents replied that the 2018 ballot

language was misleading.

Boston

Business Journal

Wednesday, November 17, 2021

Business group threatens SJC

challenge to millionaires tax language

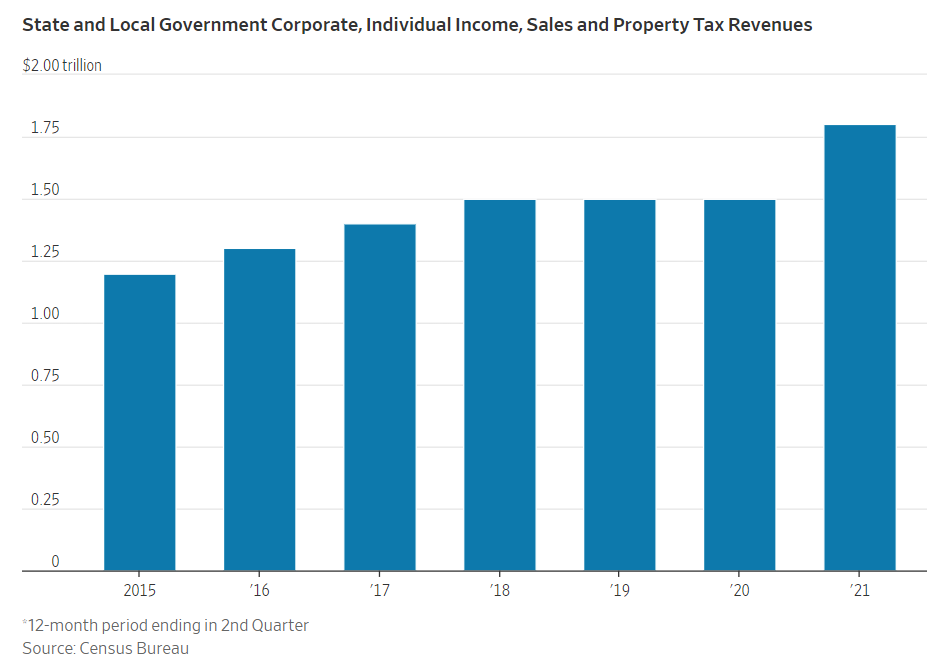

One irony of inflation

is that while it’s bad for working Americans, it’s

great for the government. Tax revenues soar as

nominal profits and incomes rise, and for evidence

simply look at the boom in state and local

government coffers. They’ve rarely had it so good,

but don’t expect them to be frugal spenders....

Progressive states with

higher tax rates are especially flush. State and

local tax revenue in New York—which raised taxes on

high earners this spring—is running $13.3 billion

(21.3%) higher for the current fiscal year that

began in April over the same period in 2019. Mind

you, 2019 was a very good year for state coffers.

(See nearby table.)

California continues to

report record monthly tax collections even after

Gov. Gavin Newsom boasted this spring of a $75

billion budget surplus. State tax revenue for the

fiscal year starting in July through October is

running nearly 25% over budget estimates and 33%

more than in 2019.

These rich states have

also received plenty of welfare from Washington.

Congress has given states and local governments $885

billion in direct aid through the various Covid

bills for schools, public transit, Medicaid and

more. Now they’re set to get another large helping

from the infrastructure deal for public transit,

broadband, water systems and electric grids....

Remember when the

states pleaded poverty last year? We told you they

didn’t need the money, and the current data proves

it. States could now be using this windfall to cut

taxes, and some are, but most are spending it on new

commitments that won’t vanish when the revenue boom

does. Democratic states in particular are building

in new structural spending in the form of higher pay

and pensions for public unions. Also popular are

climate-change boondoggles like New York’s “green

energy transmission superhighway.”

The $4 trillion

Democratic entitlement bill will put states on the

hook for new liabilities once the federal largesse

dries up.

The Wall

Street Journal

Friday, November 12, 2021

Review & Outlook

The Inflation Revenue

Dividend

State and local governments have never had so much

dough.

|

|

We were all shocked when

Gov. Charlie Baker abruptly withdrew from his TCI "boondoggle" the

day after we turned in the petitions to stop TCI to all the town

clerks for certification, dropped out two days after Connecticut

Gov. Lamont’s withdrawal the day before we submitted them. All

that remained of the TCI “multi-state compact” (among a dozen

Northeast and mid-Atlantic states) was the city of Washington D.C.

and tiny Rhode Island.

Then the final state

domino fell the following day, on Friday, when Rhode Island Governor

McKee announced his state's withdrawal as well. D.C. Mayor

Muriel Bowser will now have to save the planet and cripple her

city's motorists singlehanded.

In CLT's announcement on

Friday in my commentary I noted:

Whether or not the petition had any influence on their

decisions, we're still looking to go ahead with the ballot

question if we've qualified with enough signatures to move

forward. Just because a politician says something today doesn't

mean he'll say the same thing tomorrow. And there's no telling

what a new governor and administration will do.

In Rhode Island's

announcement of its withdrawal on Friday the state Department of

Environmental Management Acting Director Terrence Gray stated on

behalf of Gov. Mckee:

The Transportation

and Climate Initiative depends upon the involvement of at least

three jurisdictions to go forward as a program. Recent events in

Connecticut and Massachusetts, however, have made clear that at

least for the time being, Rhode Island must explore other

options in clean transportation. . . . I look forward to

remaining in contact with my counterparts in neighboring states

to continue our shared goal of tackling climate change.

When Connecticut Governor

Ned Lamont was asked on Tuesday whether there is a future for TCI,

the Hartford Courant

reported:

Asked whether the

proposal could be revived in 2023, Lamont said, “Yeah, let’s

see where we are.’'

On Thursday "The Best

Legislature Money Can Buy" for all intent ended this year's

legislative activities for the coming seven weeks. In

Massachusetts the Legislature never calls it quits, adjourns,

prorogues sine die like almost all other states

— it remains officially in session from

January through the next January. By remaining in "informal

session" legislators continue to collect their $20,000-plus annual

"travel stipend" even though nobody's moving from home and hasn't

for almost two years, working remotely from there. After

over 600 days closed down and counting, the Massachusetts State House is

the only state capitol besides Hawaii that prevents the public

from entering, and Hawaii allows its citizens access by appointment.

So what's the excuse for

these obscenely highly-paid legislators leaving so much of the

people's critical business uncompleted before racing off to their

latest extended paid vacation? (They just returned to work two

months ago from their taxpayer-paid month-plus summer vacation.)

On Wednesday the State House News Service reported

("Beacon Hill Leaves Voting Reforms Up In

The Air"):

If state representatives

want to avoid allowing mail-in voting and

expanded early voting permission to lapse next

month, they will need to find a way to secure a

bipartisan agreement within the chamber,

according to the House's top elections expert.

And while House and Senate

leaders agree on some core election reform

proposals, there are "a lot of different moving

pieces" that they have not yet ironed out,

Election Laws Committee Co-chair Rep. Dan Ryan

told the News Service.

Ryan said Wednesday that he

did not expect action on temporary or permanent

voting reforms, and the Legislature indeed

adjourned its final formal lawmaking session of

2021 without tackling the issues and with the

House electing not to even open up debate on the

matter....

Failing to act by

Wednesday's end of formal sessions for the year

leaves the near-term fate of the reforms

uncertain.

On Thursday the News Service reported ("Baker

Blames Legislature For ARPA Spending Delays —

Spox: Mass. Trails Other

States In Using Relief Funds"):

Baker proposed spending

American Rescue Plan Act funds in June, but

legislative Democrats put the federal aid in a

lockbox that they control and opted for a long

public hearing process to gather feedback about

the state's needs. They then couldn't agree on a

consensus bill by Wednesday when formal sessions

ended for 2021.

"The Baker-Polito

Administration believes the Legislature's

original decision six months ago to freeze these

funds and subject them to the legislative

process created a massive delay in putting these

taxpayer dollars to work," Baker press secretary

Terry MacCormack said. "Massachusetts was

already behind most of the country in utilizing

these funds before the latest setback, and

further delay will only continue to leave

residents, small businesses and hundreds of

organizations frozen out from the support the

rest of the country is now tapping into to

recover from this brutal pandemic."

Negotiations among six

members of a conference committee are

continuing, but any agreement they might reach

in the next seven weeks will require bipartisan

and unanimous support since any single lawmaker

can stop a bill from advancing in informal

sessions. Formal sessions are scheduled to

resume on Jan. 5, but there's uncertainty also

about whether, under legislative rules, the

appropriations bills will die at the start of

the new annual session or carry over intact....

While conference talks are

conducted in secret, there were some signs of

discord Wednesday night. When Michlewitz

signaled a deal was not within reach, Rodrigues

appeared taken aback and said he lacked a "dance

partner" and that "it takes two to tango." As

the House abruptly adjourned at 6:25 p.m., Sen.

William Brownsberger was telling senators to

settle in for a lot more work that evening. Once

news of the House adjournment reached the

Senate, that chamber ended its session at 6:38

p.m.

Even Liberal Boston Globe

columnist

Adrian Walker was having none of it. In his

Friday column he wrote ("As billions hang in

limbo, lawmakers take a breather"):

If there’s one thing our

state lawmakers have historically been good at,

it’s spending large pots of money.

And getting their rest.

So it’s astonishing that

they have been unable to reach an agreement to

spend more than $5 billion in funds, a federal

gift-in-hand intended to ease the effects of the

pandemic.

But it’s not astonishing at

all that lawmakers adjourned for the year

Thursday, leaving the issue hanging in limbo....

The money in question comes

through the American Recovery Relief Act with

few, if any, strings attached. And that might be

part of the problem: so much flexibility allows

plenty of room for disagreement and delay — and

delay is an art form on Beacon Hill.

Other states have managed

to figure out how to spend the money. Baker’s

claim that Massachusetts lags behind other

states in spending the cash seems to check out.

What does Baker want to do

with the money? His wish list included spending

on housing, job training, environmental and

climate-related programs, and education. Those

priorities were placed on the table months ago.

The Legislature moved

quickly, back then, to ensure that the money

could only be spent with its approval.

Legislative leaders bemoaned a lack of process,

and insisted that they, not Baker, should decide

how to spend the money.

That’s fine, but if they

were going to seize control, they own the

failure of that process. ... Impressive it is

not....

Lawmakers might argue that

this is just a delay, that a compromise will

eventually be reached.

In theory, that’s true. But

in practice, the Legislature is now stuck in

informal session, where nothing can pass without

a unanimous vote.

Nothing major happens in

informal session, and anyone who has spent any

time in the State House knows this package isn’t

likely to be an exception....

But as it stands now, the

Legislature is effectively on break. They’ll

pick this matter up in January, I guess. Or

maybe they’ll just hold a few more hearings, and

squabble for a little longer over who’s really

in charge on Beacon Hill — them or the governor.

With all the focus on TCI

and whether it and other petition drives will have enough signatures

to move forward to the 2022 ballot there's one ballot question

we know will be there: The latest incarnation of a

graduated income tax proposed constitutional amendment, the

so-called "Fair Share Amendment" or "Millionaires Tax." The

Mass. High Tech Council took the first attempt before the state

Supreme Judicial Court and the court threw it out as

unconstitutional (see our CLT Update for June 18, 2018: "SJC

kills Grad Tax — for the sixth time!").

The High Tech Council is threatening to take this reincarnation of

the same proposal to the SJC again and good for them.

The Boston Business Journal reported on Wednesday ("Business

group threatens SJC challenge to millionaires tax language"):

The Massachusetts High

Technology Council is likely to launch a court

challenge to the ballot language for the

so-called millionaires’ tax unless the ballot

question says the tax would not necessarily

increase spending on schools and transportation,

it said in a letter this week....

The missive from MHTC

raises the prospect of another clash before the

Massachusetts Supreme Judicial Court, which

struck down a previous version of the tax

proposal in 2018. The proposal is now poised to

go before voters as a ballot question in

November 2022.

A court battle, should it

come to pass, would be limited to the proposal’s

language, not whether it should be on the ballot

at all....

In the letter, sent to

Attorney General Maura Healey and Secretary of

the Commonwealth William Galvin on Tuesday, the

MHTC took issue with the ballot language that

was to be used to describe the proposed tax in

2018. No such materials have been made public so

far this year.

Back then, a summary of the

proposal informed voters that revenue from the

tax, subject to appropriation by lawmakers,

would be used only for education- and

transportation-related purposes. A description

of the meaning of a “yes” vote used similar

language.

The MHTC contended in the

letter that the proposal does not require

lawmakers to use millionaires-tax revenue to

increase spending in those two areas, since they

can reduce spending on education and

transportation from other revenue sources, and

replace it with revenue raised by the

millionaires’ tax. Opponents to the tax have

made the argument for years, as a reason not to

pass the proposal....

The letter asks Healey and

Galvin to release the proposal language as soon

as possible, or at the latest by Jan. 12, so

that the MHTC has enough time to challenge the

language, if necessary, under guidelines

previously issued by the SJC.

I've been perplexed

throughout the pandemic how the state has managed to steadily rake

in record-breaking tax revenue while businesses and employees have

been locked down and locked out — a surplus of over $5

Billion last year alone and heading for more of the same.

Baffled is probably a better word. Finally someone has

explained it.

In its Review & Outlook editorial on Friday the Wall

Street Journal noted ("The Inflation

Revenue Dividend — State and local

governments have never had so much dough"):

One irony of inflation is

that while it’s bad for working Americans, it’s

great for the government. Tax revenues soar as

nominal profits and incomes rise, and for

evidence simply look at the boom in state and

local government coffers. They’ve rarely had it

so good, but don’t expect them to be frugal

spenders....

Progressive states with

higher tax rates are especially flush. State and

local tax revenue in New York—which raised taxes

on high earners this spring—is running $13.3

billion (21.3%) higher for the current fiscal

year that began in April over the same period in

2019. Mind you, 2019 was a very good year for

state coffers. (See nearby table.)

California continues to

report record monthly tax collections even after

Gov. Gavin Newsom boasted this spring of a $75

billion budget surplus. State tax revenue for

the fiscal year starting in July through October

is running nearly 25% over budget estimates and

33% more than in 2019.

These rich states have also

received plenty of welfare from Washington.

Congress has given states and local governments

$885 billion in direct aid through the various

Covid bills for schools, public transit,

Medicaid and more. Now they’re set to get

another large helping from the infrastructure

deal for public transit, broadband, water

systems and electric grids....

Remember when the states

pleaded poverty last year? We told you they

didn’t need the money, and the current data

proves it. States could now be using this

windfall to cut taxes, and some are, but most

are spending it on new commitments that won’t

vanish when the revenue boom does. Democratic

states in particular are building in new

structural spending in the form of higher pay

and pensions for public unions. Also popular are

climate-change boondoggles like New York’s

“green energy transmission superhighway.”

The $4 trillion Democratic

entitlement bill will put states on the hook for

new liabilities once the federal largesse dries

up.

"States could now

be using this windfall to cut taxes, and some are,

but most are spending it on new commitments that

won’t vanish when the revenue boom does. Democratic

states in particular are building in new structural

spending in the form of higher pay and pensions for

public unions. Also popular are climate-change

boondoggles like New York’s “green energy

transmission superhighway.

"The $4 trillion Democratic

entitlement bill will put states on the hook for new liabilities

once the federal largesse dries up."

This perfectly describes The People's

Republic of Taxachusetts, explains the state revenue bonanza

— and warns of bad things to come.

|

|

|

|

Chip Ford

Executive Director |

|

|

CommonWealth Magazine

Thursday, November 18, 2021

Baker pulls the plug on transportation climate initiative

Abandons cap-and-invest plan after Lamont’s decision to back

away in CT

By Bruce Mohl

Gov. Charlie Baker threw in the towel on his transportation

climate initiative on Thursday just days after Gov. Ned

Lamont of Connecticut did the same thing in his state.

“The Baker-Polito Administration always maintained the

Commonwealth would only move forward with TCI if multiple

states committed, and, as that does not exist, the

transportation climate initiative is no longer the best

solution for the Commonwealth’s transportation and

environmental needs,” said Terry MacCormack, the governor’s

press secretary, in a statement.

Lamont indicated he might revisit joining the initiative

after next year’s election, but Baker’s statement indicated

he intends to move on and not look back. It’s a stunning

turnaround for a concept that once attracted the interest of

a dozen northeast and mid-Atlantic states and became a

linchpin of the Baker administration’s plan for reaching net

zero greenhouse gas emissions by 2050.

Katie Theoharides, the governor’s secretary of energy and

environmental affairs, said in December 2020, when

Massachusetts, Connecticut, Rhode Island, and the District

of Columbia announced they were moving forward with the

transportation climate initiative, that Massachusetts needed

the program if it was going to have a chance of reaching its

goal of net zero emissions. “We can’t get there without a

program like this,” she said.

She declined comment when asked about the initiative on

Thursday after a ceremonial groundbreaking on Cape Cod for

the Vineyard Wind offshore wind farm. She said the

administration would be issuing a statement on the

initiative later in the day.

Massachusetts was the only state supporting the

transportation climate initiative until Thursday. The

governors in Rhode Island and Connecticut couldn’t get it

through their legislatures; Baker had the power to sign on

because of earlier legislation giving him the authority to

act on his own.

The Transportation Climate Initiative was intended to be a

cap-and-invest program for automobile fuels. Fuel

wholesalers would purchase at auction allowances permitting

them to sell gasoline in Massachusetts and other

participating states. The number of allowances would be

reduced each year, ratcheting up the price of gasoline and

incentivizing drivers to switch to electric vehicles.

Opponents as well as some supporters called the

transportation climate initiative a disguised gas tax, but

backers said the approach was a nuanced, two-step approach

to dealing with climate change by making gasoline more

expensive while generating the revenues needed to build the

infrastructure needed to transition away from vehicles

running on gasoline.

In its statement Thursday, the Baker administration said the

federal infrastructure package, the American Rescue Plan Act

funding, and state tax revenue surpluses will now become the

financing mechanisms for building the infrastructure

necessary to reduce transportation emissions and meet the

state’s climate goals.

Paul Craney, a spokesman for the Massachusetts Fiscal

Alliance, which opposed the transportation climate

initiative, said he was glad Massachusetts finally abandoned

what he called a “regressive gas tax scheme,” which he said

would have hurt the middle class and the working poor the

most. He thanked his allies in the fight — Citizens for

Limited Taxation, the Beacon Hill Institute, the

National Federation of Independent Business, Massachusetts

Republican Party chairman Jim Lyons, and Boston Herald

columnist Howie Carr.

GoLocalProv

Friday, November 19, 2021

McKee Drops Support for Transportation and Climate

Initiative

By GoLocalProv News Team

Providence, RI -- Just one day after Governor Dan McKee's

office confirmed that the governor continues to support the

Transportation and Climate Initiative (TCI), his

administration reversed course and announced that it was

dropping its effort to adopt the initiative.

Department of Environmental Management Acting Director

Terrence Gray issued the following statement on behalf of

Mckee regarding the State of Rhode Island’s participation in

the TCI late on Friday.

“The Transportation and Climate Initiative depends upon the

involvement of at least three jurisdictions to go forward as

a program. Recent events in Connecticut and Massachusetts,

however, have made clear that at least for the time being,

Rhode Island must explore other options in clean

transportation. We must be clear: Rhode Island is on the

clock to combat climate change, and we must move forward

with a bold initiative to meet net-zero. The Act on Climate

law sets mandates, not goals, for the state to reduce

greenhouse gases economy-wide. And we will have serious

difficulty meeting the new law’s reduction mandates without

a strong commitment and plan to reduce emissions from the

transportation sector, which contributes nearly 40 percent

of carbon emissions in our area. The Executive Climate

Change Coordinating Council, which I chair, will be

analyzing the federal infrastructure bill and other possible

funding streams to ensure that Rhode Island makes progress

at replacing dirty, fuel-burning engines with clean, green,

zero-emissions transportation options. I look forward to

remaining in contact with my counterparts in neighboring

states to continue our shared goal of tackling climate

change. It demands action now.”

Legislators Call for Continued Support

In an opinion piece submitted to GoLocal earlier on Friday,

Sen. Alana DiMario and Rep. Terri Cortvriend wrote, "In the

decade-plus since the Transportation Climate Initiative

(TCI) was first developed under the [Donald] Carcieri

administration, there has been growing, bipartisan consensus

that we must end our dependence on fossil fuels for the

health of the people in our communities and our planet. No

one disputes that reality."

"And in that decade of work and planning and a worsening

climate crisis, no one has come up with a better solution to

reduce our greenhouse gas emissions from the transportation

sector. TCI would cut greenhouse gas pollution from motor

vehicles in the region by an estimated 26% and generate a

total of more than $3 billion dollars over 10 years for the

participating jurisdictions to invest in equitable,

less-polluting transportation options and to help energize

economic recovery," the legislators wrote.

They concluded, "As elected officials it is our duty to keep

the health and safety of our communities front and center in

the decisions that we make. Leading the region in

implementing the concepts of TCI does exactly that. For too

many decades we have deferred acting on climate change, and

there is no more time to waste. If we aren't here to fight

for the bold and necessary changes to address the most

pressing issues facing us and to reduce the burden on future

generations, then why are we here?"

The Boston

Herald

Saturday, November 20, 2021

Rhode Island, the final state, pulls out of TCI

By Amy Sokolow

After both Massachusetts and Connecticut’s governors pulled

out of the Transportation and Climate Initiative, citing

waning support and higher gas prices, Rhode Island has also

has left, putting the nail in the coffin on the multi-state

partnership.

“The Transportation and Climate Initiative depends upon the

involvement of at least three jurisdictions to go forward as

a program,” said Ocean State Department of Environmental

Management Acting Director Terrence Gray in a statement.

“Recent events in Connecticut and Massachusetts, however,

have made clear that at least for the time being, Rhode

Island must explore other options in clean transportation.”

Although the partnership was originally supposed to include

a dozen states and D.C., by the time a memorandum of

understanding was signed in 2020, only Massachusetts, Rhode

Island, Connecticut and D.C. were on board. As the Herald

previously reported, Connecticut Governor Ned Lamont pulled

out of the partnership designed to cut fuel emissions last

week, citing rising gas prices as his reason for the move.

“Look, I couldn’t get that through when gas prices were at a

historic low, so I think the legislature has been pretty

clear that it’s going to be a pretty tough rock to push when

gas prices are so high, so no,’’ Lamont told reporters

Tuesday. Under TCI, gas prices were projected to rise up to

9 cents per gallon more.

Shortly thereafter, Massachusetts Gov. Charlie Baker, once a

major proponent of TCI as a way to cut emissions by a

quarter over 10 years, also announced that the Bay State

would not be part of it.

“The Baker-Polito Administration always maintained the

Commonwealth would only move forward with TCI if multiple

states committed, and, as that does not exist, the

transportation climate initiative is no longer the best

solution for the Commonwealth’s transportation and

environmental needs,” Baker press secretary Terry MacCormack

said in a statement Thursday.

As Baker’s office said it would do in the Bay State, Rhode

Island plans to combat climate change using other financing

means. In Rhode Island’s case, the Executive Climate Change

Coordinating Council will analyze the federal infrastructure

bill that recently passed as well as “other possible funding

streams” to “(replace) dirty, fuel-burning engines with

clean, green, zero-emissions transportation options,” Gray

said.

Gray also called on the state’s transportation sector to

reduce emissions on their own, because the industry

contributes nearly 40% of carbon emissions in the state.

The Baker administration also hopes to use federal

infrastructure funds, as well as a statewide tax revenue

surplus, to attack the climate-change issue.

Paul Diego Craney of the conservative watchdog organization

Mass Fiscal Alliance, one of the most vocal opponents of

TCI, praised the move.

“We are pleased to see the TCI scheme completely

surrendered,” he said in a statement. “We would not have

settled for anything but an unconditional surrender of the

scheme. Rhode Island motorists don’t deserve to be on an

island on its own, so their state’s motorists can be

thankful this Thanksgiving holiday season.”

The Boston

Herald

Friday, November 19, 2021

Charlie Baker jettisons failed TCI, but will voters

remember?

By Joe Battenfeld

Gov. Charlie Baker’s surprise move to dump the unpopular

climate initiative compact could be the strongest signal yet

that he has his eyes on a third term.

The Transportation and Climate Initiative, or TCI, would

have raised already skyrocketing gas prices and given fuel

to Baker’s potential Republican opponent, former Rep. Geoff

Diehl.

Now that the Republican governor doesn’t have to contend

with the impacts of TCI, he can avoid getting blamed for gas

tax hikes and shortages, though he won’t rid his

administration of the stain of the failed initiative.

“It’s a failed program for him now,” said Paul Diego Craney

of the MassFiscal Alliance, the major opponent of TCI.

“Republican primary voters are not going to forget that at

all.”

TCI could still be a potent issue for Diehl even though it’s

on the scrap heap. Diehl will undoubtedly remind voters that

Baker was the “champion” of TCI — which sought to cut motor

vehicle emissions by 26% over the next 10 years — even as

other states like Connecticut were dropping out of the

compact, Craney said.

“It doesn’t go away just by dropping out,” Craney said. “I

suspect (Diehl) will use it all the way to the end of the

primary.”

Diehl also can gloat his way through the campaign reminding

voters that he was always opposed to TCI and was protecting

motorists from massive gas tax hikes. And Democrats may have

an opening now to attack Baker for failing to do enough to

combat climate change.

Baker has still not said whether he’ll seek a third term,

getting testy about repeated questions on the subject.

But his window for making a decision is closing fast.

Dumping TCI could be the final chess move he’ll make before

announcing he’s all in for another term.

This isn’t the only signal Baker is interested in running

again next year. The Republican governor has re-energized

his fundraising in the last few months, though he still lags

far behind his lieutenant governor, Karyn Polito.

And a new poll shows that Baker would be tough to beat in a

general election campaign. In the UMass Amherst poll of

nearly 700 voters, Baker holds wide leads over his declared

Democratic opponents, Ben Downing, state Sen. Sonia

Chang-Diaz and Danielle Allen, and a small lead over the one

big unannounced candidate, Attorney General Maura Healey.

But there’s some troubling news in the poll. Nearly half of

all voters are still unsure about who they will support —

indicating Baker hasn’t yet convinced them he should win

another term.

And the poll did not measure Baker’s strength against Diehl

among just Republican primary voters.

If early polls prove right, Baker in fact may face a much

tougher fight in his own party’s primary than in the general

election.

The Wall Street

Journal

Friday, November 19, 2021

Opinion | Review & Outlook

The Northeast Climate Pact Implodes

Connecticut Governor Lamont withdraws amid soaring fuel

prices.

Progressives say the only way to achieve their climate goals

is to raise the price of fossil fuels. Their problem is that

consumers don’t want to pay more for energy, and as the

latest proof behold Connecticut Gov. Ned Lamont’s retreat

this week from a Northeast state climate pact.

Last December the Governors of Rhode Island, Connecticut and

Massachusetts and the mayor of Washington, D.C., joined a

cap-and-trade scheme to reduce carbon emissions from fuel.

Wholesalers and distributors would have to buy emissions

credits at auction. The proceeds would be sent to the states

to spend on electric vehicles, public transportation and

“climate justice.”

Over time the cap on emissions would decline, and fuel

distributors would have to spend more to buy credits. This

would increase fuel prices. The Lamont administration

estimated the scheme would add about five to nine cents a

gallon to gasoline prices in the first year. Prices would

rise in the other states too.

Which is why all three Governors failed to pass the scheme

in their overwhelmingly Democratic legislatures this year.

“There are some people who are living on such a tight margin

that anything that adds to their regular expenses is going

to put a squeeze on them and put them in a tight hardship,”

Connecticut Senate President Pro Tem Martin Looney said.

Mr. Lamont finally gave up trying to pass the scheme this

week. “Look, I couldn’t get it through when gas prices were

at historic lows. So I think the legislature has been pretty

clear it is a tough rock to push when gas prices are so

high,” he said. Massachusetts GOP Gov. Charlie Baker then

threw in the towel too, causing the climate pact to

effectively combust.

Mr. Lamont is running for re-election next year, and perhaps

the close race this month in New Jersey gave him pause. Even

liberals don’t want to pay more for energy to make an

insignificant reduction in global emissions. Washington

State voters have twice shot down a carbon tax. This summer

the Swiss rejected higher taxes on driving and flying in a

referendum. Maybe the death of fossil fuels that we’ve been

told is inevitable isn’t so inevitable.

State House News

Service

Wednesday, November 17, 2021

Beacon Hill Leaves Voting Reforms Up In The Air

No Clear Timetable To Address Mail-In, Early Voting

By Chris Lisinski and Sam Doran

If state representatives want to avoid allowing mail-in

voting and expanded early voting permission to lapse next

month, they will need to find a way to secure a bipartisan

agreement within the chamber, according to the House's top

elections expert.

And while House and Senate leaders agree on some core

election reform proposals, there are "a lot of different

moving pieces" that they have not yet ironed out, Election

Laws Committee Co-chair Rep. Dan Ryan told the News Service.

Ryan said Wednesday that he did not expect action on

temporary or permanent voting reforms, and the Legislature

indeed adjourned its final formal lawmaking session of 2021

without tackling the issues and with the House electing not

to even open up debate on the matter.

The existing policies that have been in place for most of

the pandemic are set to expire Dec. 15. Although the COVID-era

voting reforms have proved popular and earned the support of

Republican Gov. Charlie Baker and Democrat Secretary of

State William Galvin, the Legislature has been unable to

find agreement and pass a bill making them permanent.

The Senate in October approved legislation known as the

VOTES Act along party lines (S 2545) that would enshrine

mail-in voting and expanded early voting as well as

implement same-day voter registration.

In June, the House added an amendment to a supplemental

budget that would have permanently authorized mail-in voting

and early voting before biennial elections, but that measure

was dropped in the ultimate version of the spending bill.

"There's some details on how much, how long should we do

early voting for and things like that, but we're in

agreement, we want to make it permanent. But I think with

the bigger VOTES Act going on, there's a lot of different

moving pieces that we're still not in agreement on, the two

chambers," Ryan said. "We can always just extend the voting

protections that we have now into next year if we don't get

something done. On those two big pieces, we're in agreement.

It's just getting kind of caught up in the bigger bill."

Failing to act by Wednesday's end of formal sessions for the

year leaves the near-term fate of the reforms uncertain.

Supporters of the reforms could allow the policies to lapse

and attempt to revive them when formal sessions resume in

January, or try to enact either an extension or a permanent

authorization during informal sessions, when a single

member's objection could stall progress.

"We could try to do that, but of course, if one person

decides they don't want it to happen, then we have to go

into January and think of Plan B," Ryan said of tackling

election reforms in an informal session during the holiday

quiet period.

House Republicans voted against the mail-in voting budget

amendment in June, at the time criticizing the process.

Senate Republicans have also objected to some voting

reforms.

House Minority Leader Brad Jones signaled Wednesday that his

caucus may be open to another temporary extension of the

COVID-19 voting policies.

"I think some people would be amenable to the idea of an

extension under the same terms we've done it the last few,"

Jones said in an interview. "I'll talk to the members and

see what the terms are and how long it's for, what exactly

the provisions are. I think there's some concerns about what

it entails and how long it's for."

Jabbing at Democrats who wield supermajority margins in both

chambers, Jones added, "But again, they've got the numbers.

It's something that would have been fairly easy to get out

here now."

Representatives also rejected a same-day voter registration

proposal last year, and it's unclear if House leaders have

come around to the idea -- which Baker opposes -- since the

Senate's action.

Voters in the First Suffolk and Middlesex District are set

to select a new senator this winter following the mid-term

resignation of former Sen. Joseph Boncore. The primary is

scheduled for Dec. 14, one day before the end of temporary

mail-in and early voting policies, and the general election

is scheduled for Jan. 11.

Jones also said lawmakers still do not know the final date

for the September 2022 state primary election, which could

complicate the process of pulling nomination papers for some

legislators.

Asked about the overall timeline for action on mail-in

voting and expanded early voting reforms, Ryan replied, "To

be honest, I really don't know."

"We're trying to get through tonight," he said. "I've been

meeting with the speaker and his staff on this. We're going

to follow up first thing tomorrow. It's not just those two

pieces. We have a bunch of other home rule petitions. A

bunch of cities and towns want to do election laws stuff.

But a lot of what they want to do for municipal elections is

also reflected in the VOTES Act, so we're trying to take it

all in."

State House News

Service

Thursday, November 18, 2021

Baker Blames Legislature For ARPA Spending Delays

Spox: Mass. Trails Other States In Using Relief Funds

By Michael P. Norton

Gov. Charlie Baker is among those disappointed that Beacon

Hill Democrats couldn't agree on a plan to put nearly $4

billion to work throughout the economy before breaking for a

seven-week stretch of informal sessions, and is blaming a

legislative decision earlier this year for causing delays.

Baker proposed spending American Rescue Plan Act funds in

June, but legislative Democrats put the federal aid in a

lockbox that they control and opted for a long public

hearing process to gather feedback about the state's needs.

They then couldn't agree on a consensus bill by Wednesday

when formal sessions ended for 2021.

"The Baker-Polito Administration believes the Legislature's

original decision six months ago to freeze these funds and

subject them to the legislative process created a massive

delay in putting these taxpayer dollars to work," Baker

press secretary Terry MacCormack said. "Massachusetts was

already behind most of the country in utilizing these funds

before the latest setback, and further delay will only

continue to leave residents, small businesses and hundreds

of organizations frozen out from the support the rest of the

country is now tapping into to recover from this brutal

pandemic."

Negotiations among six members of a conference committee are

continuing, but any agreement they might reach in the next

seven weeks will require bipartisan and unanimous support

since any single lawmaker can stop a bill from advancing in

informal sessions. Formal sessions are scheduled to resume

on Jan. 5, but there's uncertainty also about whether, under

legislative rules, the appropriations bills will die at the

start of the new annual session or carry over intact.

Baker's reaction came more than 12 hours after lawmakers cut

their last formal sessions of 2021 short once it became

clear that Rep. Aaron Michlewitz and Sen. Michael Rodrigues,

who are leading talks on behalf of branches that passed

their bills unanimously, would not be able to reach an

agreement.

While conference talks are conducted in secret, there were

some signs of discord Wednesday night. When Michlewitz

signaled a deal was not within reach, Rodrigues appeared

taken aback and said he lacked a "dance partner" and that

"it takes two to tango." As the House abruptly adjourned at

6:25 p.m., Sen. William Brownsberger was telling senators to

settle in for a lot more work that evening. Once news of the

House adjournment reached the Senate, that chamber ended its

session at 6:38 p.m.

Baker's concerns about a holdup in the use of federal

recovery funds are not new, and date back to June when the

House rejected his plan to immediately spend $2.8 billion in

federal COVID-19 relief money. The Legislature instead voted

to sweep $4.89 billion into a COVID-19 relief fund. At that

time, the governor's office worried about the potential for

"a process that would take years while the communities that

were hit hardest by the pandemic, including communities of

color, wait."

While there's widespread agreement on the need to put ARPA

funds to work as soon as possible, generally speaking, the

funds must be committed by the end of 2024 and spent by the

end of 2026.

The amounts differ and both bills feature scores of project

earmarks, but both the House (in October) and Senate (last

week) have passed plans to spend about $3.82 billion from a

combination of ARPA funds and surplus state tax dollars from

fiscal 2021 to stimulate the economy, support workers and

businesses, and invest in infrastructure projects, public

health and other priorities.

The Senate bill proposes to spend $250.9 million on public

health infrastructure, which is $100 million more than the

House. It would also increase investments in water and sewer

infrastructure by $75 million over the $100 million in the

House bill and boost mental health spending by $150 million,

to $400 million.

Meanwhile, the House proposed $40 million for youth summer

and school-year jobs, $75 million for capital projects on

public college and university campuses, and $20 million for

special education. The Senate proposal funds none of those

priorities.

The other members of the conference committee are Reps. Dan

Hunt (D-Dorchester) and Todd Smola (R-Warren), and Sens.

Cindy Friedman (D-Arlington) and Patrick O'Connor

(R-Weymouth).

The Boston

Globe

Friday, November 19, 2021

As billions hang in limbo, lawmakers take a breather

By Adrian Walker, Globe Columnist

If there’s one thing our state lawmakers have historically

been good at, it’s spending large pots of money.

And getting their rest.

So it’s astonishing that they have been unable to reach an

agreement to spend more than $5 billion in funds, a federal

gift-in-hand intended to ease the effects of the pandemic.

But it’s not astonishing at all that lawmakers adjourned for

the year Thursday, leaving the issue hanging in limbo. Both

the House and the Senate had passed spending plans for the

money, but those bills have to be reconciled into a single

document and signed into law.

As legislators headed off into the sunset, Governor Charlie

Baker made no secret of his frustration with them. He’s

absolutely right to believe they’ve shirked their duty.

“The Legislature made a commitment to get it done before

they went home for the holiday season and I can’t tell you

how frustrated I am,” Baker said. “Not just for me but for

all the mayors and small businesses and folks who are

looking for an opportunity to do something other than what

they were doing before, and getting the skills that would be

required to do that.”

The money in question comes through the American Recovery

Relief Act with few, if any, strings attached. And that

might be part of the problem: so much flexibility allows

plenty of room for disagreement and delay — and delay is an

art form on Beacon Hill.

Other states have managed to figure out how to spend the

money. Baker’s claim that Massachusetts lags behind other

states in spending the cash seems to check out.

What does Baker want to do with the money? His wish list

included spending on housing, job training, environmental

and climate-related programs, and education. Those

priorities were placed on the table months ago.

The Legislature moved quickly, back then, to ensure that the

money could only be spent with its approval. Legislative

leaders bemoaned a lack of process, and insisted that they,

not Baker, should decide how to spend the money.

That’s fine, but if they were going to seize control, they

own the failure of that process. Here’s what they have to

show for their muscle flexing: a half-dozen public hearings,

two substantially different bills, and no clear path to

moving forward.

Impressive it is not.

Let’s bear in mind that much is at stake here. The whole

promise of the American Rescue Plan Act is that the pandemic

has done major economic damage to families and workers, harm

that government should try to set right.

That is so obviously true that even red states and blue

states mostly agree on the basic premise.

Obviously, there are plenty of ways to spend a few billion

dollars. But it shouldn’t be hard to find plenty of common

ground.

Instead we’re doing nothing, while people who need help

aren’t getting it. That’s indefensible.

Lawmakers might argue that this is just a delay, that a

compromise will eventually be reached.

In theory, that’s true. But in practice, the Legislature is

now stuck in informal session, where nothing can pass

without a unanimous vote.

Nothing major happens in informal session, and anyone who

has spent any time in the State House knows this package

isn’t likely to be an exception.

When Baker says this legislation is “stuck in neutral”, he’s

telling the truth.

I wonder whether this would have been dealt with more

urgently if the State House were open to the public (as

other state houses are). If the constituencies for the many

urgent needs going unaddressed could have gone into the

building and talked to their so-called representatives,

might that have forced some action?

Maybe.

But as it stands now, the Legislature is effectively on

break. They’ll pick this matter up in January, I guess. Or

maybe they’ll just hold a few more hearings, and squabble

for a little longer over who’s really in charge on Beacon

Hill — them or the governor.

The thing is, that money could address a lot of issues for a

lot of people.

And none of those problems take a holiday break.

— Adrian Walker is a Globe

columnist.

Boston Business

Journal

Wednesday, November 17, 2021

Business group threatens SJC challenge to millionaires tax

language

By Greg Ryan

The Massachusetts High Technology Council is likely to

launch a court challenge to the ballot language for the

so-called millionaires’ tax unless the ballot question says

the tax would not necessarily increase spending on schools

and transportation, it said in

a letter this week.

The missive from MHTC raises the prospect of another clash

before the Massachusetts Supreme Judicial Court, which

struck down a previous version of the tax proposal in 2018.

The proposal is now poised to go before voters as a ballot

question in November 2022.

A court battle, should it come to pass, would be limited to

the proposal’s language, not whether it should be on the

ballot at all. Still, the MHTC’s letter drew strong rebukes

from proponents of the tax on Wednesday.

In the letter, sent to Attorney General Maura Healey and

Secretary of the Commonwealth William Galvin on Tuesday, the

MHTC took issue with the ballot language that was to be used

to describe the proposed tax in 2018. No such materials have

been made public so far this year.

Back then, a summary of the proposal informed voters that

revenue from the tax, subject to appropriation by lawmakers,

would be used only for education- and transportation-related

purposes. A description of the meaning of a “yes” vote used

similar language.

The MHTC contended in the letter that the proposal does not

require lawmakers to use millionaires-tax revenue to

increase spending in those two areas, since they can reduce

spending on education and transportation from other revenue

sources, and replace it with revenue raised by the

millionaires’ tax. Opponents to the tax have made the

argument for years, as a reason not to pass the proposal.

The business group is asking Healey and Galvin to make sure

that in 2022, the ballot language makes that point clear to

voters. If not, “our clients are likely to challenge the

summary and ‘yes’ statement before the Supreme Judicial

Court,” wrote Goodwin partner Kevin Martin on behalf of the

MHTC.

The letter asks Healey and Galvin to release the proposal

language as soon as possible, or at the latest by Jan. 12,

so that the MHTC has enough time to challenge the language,

if necessary, under guidelines previously issued by the SJC.

Debra O’Malley, a spokesperson for Galvin, told the Business

Journal that the attorney’s general office writes the

summaries of ballot questions. The “yes” and “no” statements

are required to be written jointly by the offices of the

attorney general and the secretary of the commonwealth by

May, she said. Those statements can be challenged in court

within 20 days of their publication, according to O’Malley.

A representative from Healey’s office declined comment,

other than to confirm the office received the letter.

In statements, both state Sen. Jason Lewis, one of the

sponsors of the proposal, and the Raise Up Massachusetts

coalition, one of its biggest supporters, took issue with

the MHTC’s characterization of the proposal.

“Unfortunately the Mass High Tech Council and other

big-business groups continue to pursue every tactic that

their lawyers can dream up in order to protect

multi-millionaires in the commonwealth from paying their

fair share of state income taxes,” Lewis said. “The

‘millionaires tax’ proposal is clear that all the new

revenue raised must be used for investments in public

education and transportation, both areas that lawmakers and

the public overwhelmingly agree need additional resources.”

Proponents and opponents of the tax are ramping up public

campaigns over the proposal. The Pioneer Institute released

a report Wednesday saying that pass-through businesses,

which are potentially subject to the tax, make up about 70%

of the state’s for-profit business entities. The

Massachusetts Budget and Policy Center, meanwhile, issued

its own report holding that less than 3% of those receiving

pass-through income from those entities would be subject to

the tax.

In the letter, the MHTC cited

polling it conducted finding that when told lawmakers

need not increase spending on education and transportation

because of the millionaires’ tax, 72% of respondents replied

that the 2018 ballot language was misleading.

The Wall Street

Journal

Friday, November 12, 2021

Review & Outlook

The Inflation Revenue Dividend

State and local governments have never had so much dough.

One irony of inflation is that while it’s bad for working

Americans, it’s great for the government. Tax revenues soar

as nominal profits and incomes rise, and for evidence simply

look at the boom in state and local government coffers.

They’ve rarely had it so good, but don’t expect them to be

frugal spenders.

Overall state and local government receipts including

federal aid were 23% above pre-pandemic levels in the third

quarter through September thanks to Congress’s gusher of

spending and the strong economic recovery, according to the

Committee for a Responsible Federal Budget.

Property, corporate, sales and individual tax revenue from

the third quarter of 2020 through the second quarter of this

year is running 18.3% above the same period two years ago,

according to Census Bureau data. How many Americans have

seen their incomes rise that much over the last two years?

Individual tax revenue has swelled thanks to frothy equity

markets as the affluent realize capital gains and inflation

pushes them into higher tax brackets. Sales tax revenue has

also surged thanks to federal transfer payments that have

boosted spending as well as corporate profits—which in turn

have inflated corporate tax revenue. Buoyant housing prices

are increasing property tax revenue that finances schools.

Progressive states with higher tax rates are especially

flush. State and local tax revenue in New York—which raised

taxes on high earners this spring—is running $13.3 billion

(21.3%) higher for the current fiscal year that began in

April over the same period in 2019. Mind you, 2019 was a

very good year for state coffers. (See nearby table.)

California continues to report record monthly tax

collections even after Gov. Gavin Newsom boasted this spring

of a $75 billion budget surplus. State tax revenue for the

fiscal year starting in July through October is running

nearly 25% over budget estimates and 33% more than in 2019.

These rich states have also received plenty of welfare from

Washington. Congress has given states and local governments

$885 billion in direct aid through the various Covid bills

for schools, public transit, Medicaid and more. Now they’re

set to get another large helping from the infrastructure

deal for public transit, broadband, water systems and

electric grids.

If the Democrats’ $4 trillion spending bill passes, they’ll

get even more. By our count, about $700 billion in the

Democrats’ new spending bill would go to the states for

programs such as child care, universal pre-K, home

healthcare and housing. Senate Majority Leader Chuck Schumer

demanded $65 billion for public housing—63% more than

President Biden proposed this spring—so there would be

enough money to bail out the wildly mismanaged New York City

Housing Authority.

Remember when the states pleaded poverty last year? We told

you they didn’t need the money, and the current data proves

it. States could now be using this windfall to cut taxes,

and some are, but most are spending it on new commitments

that won’t vanish when the revenue boom does. Democratic

states in particular are building in new structural spending

in the form of higher pay and pensions for public unions.

Also popular are climate-change boondoggles like New York’s

“green energy transmission superhighway.”

The $4 trillion Democratic entitlement bill will put states

on the hook for new liabilities once the federal largesse

dries up. In 2025 the feds will pay 95.4% of pre-K costs,

but only 63.6% in 2027. Republican governors would be wise

to opt out of the programs as many did with ObamaCare’s

Medicaid expansion.

But taxpayers in conservative states like West Virginia and

Arizona will still end up subsidizing expanded welfare

states in the likes of California and New York. Better to

call the whole thing off.

|

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

BACK TO CLT

HOMEPAGE

|