|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

47 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Monday, May 31, 2021

Senate Unanimously Passed $47.7

Billion "Bundled" Budget

Jump directly

to CLT's Commentary on the News

|

Most Relevant News Excerpts

(Full news reports follow Commentary)

|

|

The Senate unanimously passed a $47.7 billion budget for

next year after three days of debate over how best to invest

state resources as Massachusetts looks to recover from the

hardships of the past year of the COVID-19 pandemic....

The vote sets the stage for negotiations with the House over

a range of issues, from the film tax credit to fees on Uber

and Lyft rides, but perhaps most consequential will be the

decision the two branches will have to make about revenues.

Both the House and Senate relied on revenue projections of

just over $30 billion in taxes for the fiscal year that

begins July 1. But with revenue continuing to pour in at a

clip that has exceeded expectations month after month,

Democratic leaders have said they could consider increasing

the projection.

The budget also did not tap into any of the $5.3 billion in

discretionary federal dollars the state is expecting to

receive from the American Rescue Plan Act, which Democratic

leaders have said they want to allocate through a separate

spending bill.

In keeping with that approach, senators rejected amendments

that would have steered federal funds to the unemployment

solvency fund to reduce the burden on business owners....

The budget that passed the Senate would increase spending by

close to $1.3 billion over fiscal 2021 after senators added

$63.7 million to the bottom line through amendments, putting

the final total on par with what was approved last month by

the House....

The Senate budget also relies on $1.55 billion in reserves,

which would leave the balance of the state's stabilization

account at $1.15 billion if all the funds authorized for use

are needed.

All three Republicans in the Senate voted for the budget and

Senate Minority Bruce Tarr lavished praise on Spilka and

Rodrigues for leading what he described as an inclusive

process that incorporated the ideas of the minority party

into a budget that did not raise taxes or wipe out reserves.

The Gloucester Republican said the Senate "should stand as a

beacon for how democracy should operate in this country,

which has seen too much division and too much rancor."

State House News Service

Thursday, May 27, 2021 (6:21 PM)

$47.7 Billion Senate Budget Passes Unanimously

Beacon Hill Roll Call records local senators’ votes on roll

calls from the week of May 24-28. All Senate roll calls are

on proposed amendments to the $47.72 billion fiscal 2022

budget. There were no roll calls in the House last week.

This was the Senate’s second state budget in the COVID-19

era and most senators participated virtually from their

homes or offices.

Of the of the 923 amendments filed by senators only 15 came

to a roll call vote. Many others were simply approved or

rejected one at a time on voice votes without debate.

To move things along even faster, the Senate also did its

usual “bundling” of many amendments. Instead of acting on

all the amendments one at a time, hundreds of the proposed

amendments are bundled and put into two piles—one pile that

will be approved and the other that will be rejected-with a

single vote on each pile.

Senate President Karen Spilka, or the senator who is filling

in for her at the podium, orchestrates the approval and

rejection of the bundled amendments with a simple: “All

those in favor say ‘aye,’ those opposed say ‘no.’ The ayes

have it and the amendments are approved.” Or “All those in

favor say ‘aye,’ those opposed say ‘no.’ The no’s have it

and the amendments are rejected.”

Senators don’t actually vote yes or no, and, in fact, they

don't say a word. The outcome was predetermined earlier

behind closed doors.

"The efficient Senate budget process this year reflected

lots of careful work by our Ways and Means Chair, Michael

Rodriques, and our Senate President, Karen Spilka, to build

consensus in the weeks before the budget," said Senate

President Pro Tempore Sen. Will Brownsberger (D-Belmont)....

[The process] more accurately highlights the increasingly

efficient use of the legislative rubber stamp,” said Chip

Ford, executive director of Citizens for Limited

Taxation. “Massachusetts doesn't need the cost of 200

legislators when a handful decide all legislation before it

comes for a vote. If the three token 'loyal opposition'

Republican senators weren’t taking up space taxpayers could

at least save the ‘leadership stipends’ they collect.”

“This type of process was not the norm only several years

ago." said said Massachusetts Fiscal Alliance Executive

Director Paul Craney. "Over the last few years, with new

legislative leadership, they rush through votes, often don’t

record the votes and don’t allow the public to gain access

to what is happening because most of the important work is

done behind closed doors. With that being said, the state

Senate is much more transparent than Speaker Ron Mariano and

Republican Brad Jones in the House. The House is arguably

the most opaque legislature in America.”

Beacon Hill Roll Call

Week of May 24-28, 2021

By Bob Katzen

State Senate Republicans want to pay jobless workers a

$1,200 get-back-to-work bonus over the next year to take a

job and get off unemployment by Sep. 4.

The pitch comes as one of the 923 amendments to the $47.6

billion Senate budget for fiscal 2022 that lawmakers will

debate starting Tuesday....

While nearly two dozen Republican-led states have moved to

cancel the federal unemployment boost in their states, Gov.

Charlie Baker told a Herald reporter earlier this month that

he had no plans to do so in Massachusetts....

Retailers Association of Massachusetts President Jon Hurst

said [Sen. Ryan] Fattman’s plan is “a terrific idea” but one

that’s unlikely to pass in a Legislature where Democrats

hold a supermajority....

Hurst did, however, take issue with Fattman’s plan for

paying for the sign-on bonus.

“The first cut in (American Rescue Plan) money has to be to

roll back the $7 billion tax increase on employers because

of a crisis that was not their fault. That should be the

first priority,” Hurst said, referencing massive increases

in unemployment taxes small businesses around the state are

facing as a result of the massive number of claims borne out

of the pandemic.

The Boston Herald

Tuesday, May 25, 2021

Lawmakers want to pay Massachusetts jobless $1,200 to go

back to work

The three-man Senate Republican caucus wants to give

unemployed people in Massachusetts taxpayer-funded bonuses

to return to work, but Senate Democrats swept their idea

into the dustbin of failed budget amendments.

Sens. Ryan Fattman, Patrick O'Connor and Bruce Tarr proposed

granting a $1,200 bonus to anyone collecting unemployment

benefits who returns to work between the adoption of the

fiscal 2022 budget and Aug. 7, 2021.

An aide to Sen. Fattman said the senator viewed his proposal

as a "decent incentive to get people back to work and off

unemployment" and a way to help the state address labor

shortages that are frustrating employers.

Senate Democrats this week have been dispensing with more

than 900 budget amendments in large part through private

talks that lead to the adoption of bundles of amendments,

and the rejection of other bundles. The Fattman amendment

(811) - dubbed the Time For The Commonwealth To Get Back To

Work Bonus - was dumped into a bundle of amendments that was

rejected on a voice vote without debate on Wednesday

afternoon.

State House News Service

Thursday, May 27, 2021

Senate Dems Reject GOP Bid for Return-to-Work Bonuses

The scam is over.

It’s time for all you freeloaders to get back to work.

I’m pleading with you, no more crackpot grifts to keep your

yearlong-plus vacations going — and $174,000-a-year state

judges, I’m most assuredly including you in the list of

layabouts.

Please, no more handouts. Right now in Maskachusetts the

gainfully unemployed are grabbing an extra $300 a week for

snoozing on their mom’s couch. And now these same COVID

grifters may be offered $1,200 to get off their fat

rear-ends and start looking for work.

Good luck with that, especially now that weed has been

legalized.

And spare us the charade of this phony-baloney

you-have-to-apply-for-three-jobs-every-week nonsense either.

That’s a bigger scam than the Earned Income Tax Credit.

The goal with this whole Panic was to get rid of President

Donald J. Trump. Mission accomplished, OK? Move on,

everybody....

Last week, a Rasmussen poll showed that 44% of respondents

said the increased unemployment benefits “are making it too

easy for unemployed Americans not to work.”

This no-work scam has produced endless spinoff grifts. Think

about the Payroll Protection Program — bailouts for

businesses that didn’t exist. The PPP was like blowing a dog

whistle for every convicted fraudster and paroled embezzler

in the country, and apparently every last one of them heard

it.

How about the eviction “moratorium?” As if the non-working

classes grabbing an extra $600 or $300 a week in welfare, er,

unemployment, were suddenly destitute.

By the way, did the landlords get a moratorium on paying

their property taxes? Or utilities? ...

This is the War on Poverty on steroids. The lesson of that

disaster was that you get more of whatever you subsidize,

and the U.S. subsidized all kinds of social dysfunction,

including family dissolution and out-of-wedlock pregnancies.

Guess what we got more of....

Have you tried to get in any government buildings lately –

like, in the last 15 months? The problem is, if they

actually truly reopened the buildings again, all the hacks

would be expected to come back to work, not just a “skeleton

crew.”

And that ain’t happening.

Thank God for Charlie Parker, though. There’s a reason why

he’s the Pope of Panic Porn. He defends his indolent public

sector workforce – the ones who’ve been on vacation since

March 2020.

Monday, he filed legislation “providing for a temporary

suspension of certain open-meeting law requirements.”

In other words, all Charlie Parker’s buildings can remain

closed!

The scam is over. Long live the scam.

The Boston Herald

Tuesday, May 25, 2021

Time to get off the couch and earn a paycheck

By Howie Carr

State budget managers can probably use about $1.5 billion of

the incoming American Rescue Plan Act funding to replace

revenue the state lost in 2020 due to the pandemic but will

not be able to use it to replenish the state's rainy day

fund, a Massachusetts Taxpayers Foundation analyst said last

week.

One of the four primary buckets of allowable uses of the

ARPA money being sent to states and local governments is

revenue replacement, but until the U.S. Treasury issued its

guidance on how ARPA funds can and cannot be used it was

unclear just how much of the roughly $5.3 billion in state

fiscal relief headed for Massachusetts could be used to,

essentially, help balance the budget.

"You could come up with some pretty reasonable scenarios in

which your ability to use revenue replacement was

essentially nil, and you can come up with scenarios in which

you could use almost the entire award for revenue

replacement. So that's why this guidance was so key," Doug

Howgate, the executive vice president of the Massachusetts

Taxpayers Foundation, said....

Using tax revenue, which is going to be the bulk of how

revenue replacement is calculated, you can come up with a

ballpark, and my estimate for the first calculation of

revenue replacement is it will probably allow us to use

about call it $1.3 to $1.6 billion in revenue replacement in

this first time period," he said as he presented a slide

that estimated about $1.563 billion in allowed revenue

replacement in calendar year 2020....

But states cannot just run the calculation once -- the

Treasury guidelines require state and local governments to

calculate their allowed revenue replacement once upon

receiving the ARPA money, then again on Jan. 1 of 2022, 2023

and 2024.

"It's going to make planning this money somewhat challenging

because we're not going to know exactly how much revenue

replacement we can bring to bear until later on in the

process," Howgate said....

"There was some feeling before that maybe we could fund some

spending with the stabilization fund and then rebuild it

with federal resources. You can't do that," he said,

highlighting one of the "hiccups" in the Treasury rules. "So

the order of operations of how we use these resources to

balance the budget, it really matters because once that

money's out of the stabilization fund these fiscal recovery

funds cannot be used to replenish that." ...

Administration officials and legislative leaders have said

they would like to limit draws against the state's

stabilization fund, which has a balance of $3.52 billion

before accounting for potential spending from that fund of

up to $1.7 billion this budget year. Gov. Charlie Baker

proposed a withdrawal of up to $1.6 billion from the fund in

fiscal 2022, the House passed a budget that proposes pulling

$1.875 billion from the fund, and the Senate on Tuesday will

begin debating a fiscal 2022 budget that would draw up to

$1.55 billion from the fund....

The months-long and ongoing pattern of state tax collections

obliterating expectations could also help limit what is

actually taken out of the rainy day fund and provide

lawmakers with a source of funds to start to build the

reserve account's balance back up. Through 10 months of

fiscal 2021, state government has collected $26.449 billion

in tax revenue, up $3.405 billion or 14.8 percent over the

same period in fiscal 2020 and $1.83 billion or 7.4 percent

over the Department of Revenue's expectations.

Through May 14, DOR had collected $1.190 billion from

taxpayers -- about 63 percent of the $1.893 billion the

agency expects to bring in by the end of this month.

State House News Service

Monday, May 24, 2021

Fed Guidance Limits ARPA Use for Revenue Replacement

Howgate: You Can't Use ARPA to Rebuild Rainy Day Fund

As the new normal dawns and the state budget dips into the

darkness of closed House-Senate negotiations, lawmakers are

under pressure in early June to decide which pandemic-era

policies to save before the COVID-19 state of emergency

lifts on June 15 and to come up with ways to put to work

some of the federal stimulus funds that the federal

government has showered on the states.

Budget bills topping $47.7 billion in spending are headed

for a conference committee to be led by Rep. Aaron

Michlewitz and Sen. Michael Rodrigues.

A critical report on May tax receipts is due out next week.

Since January alone, tax collections have exceeded budget

estimates by $1.8 billion, according to the Massachusetts

Taxpayers Foundation.

The state of play means the budget conference could mark up

revenue expectations to sharply reduce their planned raid of

the state's rainy day fund at a time when the economy is

accelerating and they are not permitted to use special

federal aid to backfill the state's stabilization reserve.

The conferees must also settle House-Senate differences over

transportation network company fee increases and tax

incentives to encourage film industry work in Massachusetts.

The Senate this week also loaded its budget with policy

proposals unrelated to spending. The foundation late

Thursday reported that 455 budget amendments were adopted

over three days, including 83 policy proposals that were

added to the 60 policy riders already in the Senate budget.

The advancement of the policy proposals comes at a time in

the session when most bills calling for new policies have

not been vetted and have yet to even advance to the public

hearing stage. The House and Senate also also have yet to

agree on basic ground rules governing the transparency of

committee testimony and voting.

State House News Service

Friday, May 28, 2021

Advances - Week of May 30, 2021

House and Senate employees received raises of 6 percent this

month and one-time stipends of $500 to defray the cost of

working from home over the last year as employees have

become increasingly vocal about the challenge of supporting

themselves in Greater Boston on a legislative staff

salary....

Speaker Ron Mariano said House employees went "above and

beyond" over the past year and thanked them for the

"commitment and their service," while Senate President Karen

Spilka said the Senate "has always valued feedback from its

employees and will continue to look for ways to improve the

work environment and compensation for staff." ...

Staffers in both branches got identical 6 percent

cost-of-living adjustments in their paychecks this month,

plus the $500 stipend, according to Mariano and Spilka's

office. Raises are typically handed out every two years. The

Senate has also expanded its parental leave program from

eight to 16 weeks of full pay for the birth, adoption or

foster placement of a child.

State House News Service

Monday, May 24, 2021

Legislative Staffers Got Raises, $500 Stipends

|

Chip Ford's CLT

Commentary

On Memorial Day we

remember all those who gave the ultimate sacrifice defending these

United States of America and its citizens from all enemies foreign and

domestic. After events of the past few years with so many trying

to tear down that which the fallen defended and protected with their

lives we must pray that in the end those countless heroes' lives were

not given in vain. Our duty is to do all that we are able to

insure that their legacies were not wasted nor will be forgotten.

On Thursday at 6:21 PM the State House News Service reported

("$47.7 Billion Senate Budget Passes Unanimously"):

The Senate unanimously passed a $47.7 billion

budget for next year after three days of debate over how best to

invest state resources as Massachusetts looks to recover from the

hardships of the past year of the COVID-19 pandemic....

The vote sets the stage for negotiations with

the House over a range of issues, from the film tax credit to fees

on Uber and Lyft rides, but perhaps most consequential will be the

decision the two branches will have to make about revenues.

Both the House and Senate relied on revenue

projections of just over $30 billion in taxes for the fiscal year

that begins July 1. But with revenue continuing to pour in at a clip

that has exceeded expectations month after month, Democratic leaders

have said they could consider increasing the projection.

The budget also did not tap into any of the

$5.3 billion in discretionary federal dollars the state is expecting

to receive from the American Rescue Plan Act, which Democratic

leaders have said they want to allocate through a separate spending

bill.

In keeping with that approach, senators

rejected amendments that would have steered federal funds to the

unemployment solvency fund to reduce the burden on business

owners....

The budget that passed the Senate would

increase spending by close to $1.3 billion over fiscal 2021 after

senators added $63.7 million to the bottom line through amendments,

putting the final total on par with what was approved last month by

the House....

The Senate budget also relies on $1.55 billion

in reserves, which would leave the balance of the state's

stabilization account at $1.15 billion if all the funds authorized

for use are needed.

All three Republicans in the Senate voted for

the budget and Senate Minority Bruce Tarr lavished praise on Spilka

and Rodrigues for leading what he described as an inclusive process

that incorporated the ideas of the minority party into a budget that

did not raise taxes or wipe out reserves.

The Gloucester Republican said the Senate

"should stand as a beacon for how democracy should operate in this

country, which has seen too much division and too much rancor."

On Friday Beacon Hill Roll Call reported ("Week of May

24-28, 2021"):

Beacon Hill Roll Call records local senators’

votes on roll calls from the week of May 24-28. All Senate roll

calls are on proposed amendments to the $47.72 billion fiscal 2022

budget. There were no roll calls in the House last week.

This was the Senate’s second state budget in

the COVID-19 era and most senators participated virtually from their

homes or offices.

Of the of the 923 amendments filed by senators

only 15 came to a roll call vote. Many others were simply approved

or rejected one at a time on voice votes without debate.

To move things along even faster, the Senate

also did its usual “bundling” of many amendments. Instead of acting

on all the amendments one at a time, hundreds of the proposed

amendments are bundled and put into two piles—one pile that will be

approved and the other that will be rejected-with a single vote on

each pile.

Senate President Karen Spilka, or the senator

who is filling in for her at the podium, orchestrates the approval

and rejection of the bundled amendments with a simple: “All those in

favor say ‘aye,’ those opposed say ‘no.’ The ayes have it and the

amendments are approved.” Or “All those in favor say ‘aye,’ those

opposed say ‘no.’ The no’s have it and the amendments are rejected.”

Senators don’t actually vote yes or no, and, in

fact, they don't say a word. The outcome was predetermined earlier

behind closed doors.

"The efficient Senate budget process this year

reflected lots of careful work by our Ways and Means Chair, Michael

Rodriques, and our Senate President, Karen Spilka, to build

consensus in the weeks before the budget," said Senate President Pro

Tempore Sen. Will Brownsberger (D-Belmont)....

[The process] more accurately highlights the

increasingly efficient use of the legislative rubber stamp,” said

Chip Ford, executive director of Citizens for Limited

Taxation. “Massachusetts doesn't need the cost of 200

legislators when a handful decide all legislation before it comes

for a vote. If the three token 'loyal opposition' Republican

senators weren’t taking up space taxpayers could at least save the

‘leadership stipends’ they collect.”

“This type of process was not the norm only

several years ago." said said Massachusetts Fiscal Alliance

Executive Director Paul Craney. "Over the last few years, with new

legislative leadership, they rush through votes, often don’t record

the votes and don’t allow the public to gain access to what is

happening because most of the important work is done behind closed

doors. With that being said, the state Senate is much more

transparent than Speaker Ron Mariano and Republican Brad Jones in

the House. The House is arguably the most opaque legislature in

America.”

Much of the focus

behind closed doors in the Senate last week

was on the 923 amendments to their budget

— which ones did and which didn't get

included in one of the "bundles," all but 15 amendments and bundles

adopted on voice votes leaving no fingerprints behind. This is

where I suspected the next attack on Proposition 2½

if there is to be one could be buried, but finding those amendments was

impossible. Just yesterday (Sunday) morning — three days after the

vote — I finally discovered them available on the Legislature's website

[here]

and am in the process of reading through them to see if anything

threatening was snuck into the Senate's budget.

On Friday in its

Advances for the coming week the State House News Service

reported:

A critical report on May tax receipts is due

out next week. Since January alone, tax collections have exceeded

budget estimates by $1.8 billion, according to the Massachusetts

Taxpayers Foundation.

The state of play means the budget conference

could mark up revenue expectations to sharply reduce their planned

raid of the state's rainy day fund at a time when the economy is

accelerating and they are not permitted to use special federal aid

to backfill the state's stabilization reserve.

The conferees must also settle House-Senate

differences over transportation network company fee increases and

tax incentives to encourage film industry work in Massachusetts.

The Senate this week also loaded its budget

with policy proposals unrelated to spending. The foundation late

Thursday reported that 455 budget amendments were adopted over three

days, including 83 policy proposals that were added to the 60 policy

riders already in the Senate budget.

The advancement of the policy proposals comes

at a time in the session when most bills calling for new policies

have not been vetted and have yet to even advance to the public

hearing stage. The House and Senate also have yet to agree on basic

ground rules governing the transparency of committee testimony and

voting.

"455 budget amendments were adopted over three days,

including 83 policy proposals that were added to the 60

policy riders already in the Senate budget."

Does

anyone actually know what was included among that flurry of last-minute

remote activity, what was voted on and passed unanimously? I'm

still digging for any hint of another stealth attack on Proposition 2½

or some other subterfuge.

The State House News Service reported on Thursday ("Senate

Dems Reject GOP Bid for Return-to-Work Bonuses"):

"The three-man Senate

Republican caucus wants to give unemployed people in Massachusetts

taxpayer-funded bonuses to return to work"

The Boston Herald reported on the proposal earlier in the

week on Tuesday ("Lawmakers want to pay Massachusetts

jobless $1,200 to go back to work"), adding :

. . . While nearly two dozen Republican-led

states have moved to cancel the federal unemployment boost in their

states, Gov. Charlie Baker told a Herald reporter earlier this month

that he had no plans to do so in Massachusetts....

Retailers Association of Massachusetts

President Jon Hurst said [Sen. Ryan] Fattman’s plan is “a terrific

idea” but one that’s unlikely to pass in a Legislature where

Democrats hold a supermajority....

Hurst did, however, take issue with Fattman’s

plan for paying for the sign-on bonus.

“The first cut in (American Rescue Plan) money

has to be to roll back the $7 billion tax increase on employers

because of a crisis that was not their fault. That should be the

first priority,” Hurst said, referencing massive increases in

unemployment taxes small businesses around the state are facing as a

result of the massive number of claims borne out of the pandemic.

To motivate

former-workers who are now enjoying better compensation for doing

nothing but sitting home and collecting enhanced unemployment benefits,

while employers can't find willing help to hire to keep their businesses

afloat, the solution is not for the state (actually its taxpayers) to

pay the willfully unemployed more to come back to work.

The solution is to stop

handing them those excessive unemployment benefits that pay them more

than working and save taxpayers money on both ends! Once the free

government spigot is shut off they'll find their way back into the labor

force, killing two birds with one stone —

three birds if you consider that they'll then begin contributing

into the bankrupt state unemployment trust fund.

Read Howie Carr's

Boston Herald column below, "Time to get off the couch and earn a

paycheck."

In the News Service's

report on passage of the Senate budget ("$47.7 Billion Senate Budget

Passes Unanimously") it noted:

The Senate

budget also relies on $1.55 billion in reserves, which would leave

the balance of the state's stabilization account at $1.15 billion if

all the funds authorized for use are needed.

On Monday it noted in its earlier report ("Fed Guidance

Limits ARPA Use for Revenue Replacement

— Howgate: You Can't Use ARPA

to Rebuild Rainy Day Fund"):

State budget managers can probably use about

$1.5 billion of the incoming American Rescue Plan Act funding to

replace revenue the state lost in 2020 due to the pandemic but will

not be able to use it to replenish the state's rainy day fund, a

Massachusetts Taxpayers Foundation analyst said last week.

One of the four primary buckets of allowable

uses of the ARPA money being sent to states and local governments is

revenue replacement, but until the U.S. Treasury issued its guidance

on how ARPA funds can and cannot be used it was unclear just how

much of the roughly $5.3 billion in state fiscal relief headed for

Massachusetts could be used to, essentially, help balance the

budget.

"You could come up with some pretty reasonable

scenarios in which your ability to use revenue replacement was

essentially nil, and you can come up with scenarios in which you

could use almost the entire award for revenue replacement. So that's

why this guidance was so key," Doug Howgate, the executive vice

president of the Massachusetts Taxpayers Foundation, said....

Using tax revenue, which is going to be the

bulk of how revenue replacement is calculated, you can come up with

a ballpark, and my estimate for the first calculation of revenue

replacement is it will probably allow us to use about call it $1.3

to $1.6 billion in revenue replacement in this first time period,"

he said as he presented a slide that estimated about $1.563 billion

in allowed revenue replacement in calendar year 2020....

"There was some feeling before that maybe we

could fund some spending with the stabilization fund and then

rebuild it with federal resources. You can't do that," he said,

highlighting one of the "hiccups" in the Treasury rules. "So the

order of operations of how we use these resources to balance the

budget, it really matters because once that money's out of the

stabilization fund these fiscal recovery funds cannot be used to

replenish that." ...

Administration officials and legislative

leaders have said they would like to limit draws against the state's

stabilization fund, which has a balance of $3.52 billion before

accounting for potential spending from that fund of up to $1.7

billion this budget year. Gov. Charlie Baker proposed a withdrawal

of up to $1.6 billion from the fund in fiscal 2022, the House passed

a budget that proposes pulling $1.875 billion from the fund, and the

Senate on Tuesday will begin debating a fiscal 2022 budget that

would draw up to $1.55 billion from the fund....

The months-long and ongoing pattern of state

tax collections obliterating expectations could also help limit what

is actually taken out of the rainy day fund and provide lawmakers

with a source of funds to start to build the reserve account's

balance back up. Through 10 months of fiscal 2021, state government

has collected $26.449 billion in tax revenue, up $3.405 billion or

14.8 percent over the same period in fiscal 2020 and $1.83 billion

or 7.4 percent over the Department of Revenue's expectations.

Through May 14, DOR had collected $1.190

billion from taxpayers -- about 63 percent of the $1.893 billion the

agency expects to bring in by the end of this month.

Assuming the

Massachusetts Taxpayers Foundation's assessment is accurate, the state

can use a good amount of that American Rescue Act federal bailout

funding to balance the budget — but it

cannot use any of it to replenish the state's weakened "rainy day"

stabilization fund. It would seem prudent to not raid what remains

in that emergency fund and base state spending on what revenue is

available to spend — which has been

overflowing the state's coffers by billions of dollars more than was

anticipated.

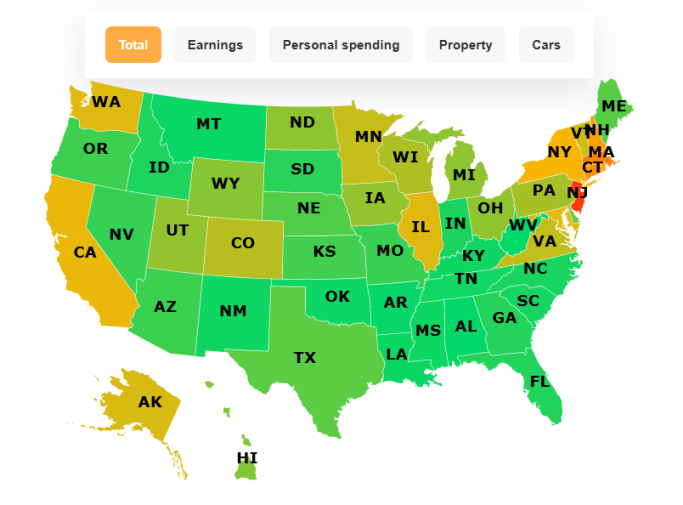

During my research last

week I happened across a report that presents an intriguing perspective

on comparisons of state taxation. As the Bay State this weekend

finally sheds its legend as "Maskachusetts" fear not. It can fall

back on its longstanding mantle of "Taxachusetts! This report was

presented by Self, Inc., which describes itself:

About Self.

Inc.

"We're helping hundreds of thousands of people build a strong financial

future.

"We are hardworking, passionate, financial geeks. Building credit and

building savings used to be mutually exclusive goals. With Self, we've

created a responsible way for people to build credit and savings at the

same time."

Self, Inc.

| Money

What Americans Will Pay in Taxes Over a Lifetime

Website/Interactive

Chart:

https://www.self.inc/info/life-of-tax/

The US government collects over $5.3 trillion in taxes each year, but

how much will the average American pay in taxes throughout their

lifetime?

We used the Bureau of Labor Statistics’ expenditure numbers to see what

we as Americans were spending each day to work out what taxes we would

be paying until we’re no longer able to contribute financially. It’s a

lot.

We’ve analyzed this data specific to each state so you can see what you

may be giving to your local government in taxes across your entire life.

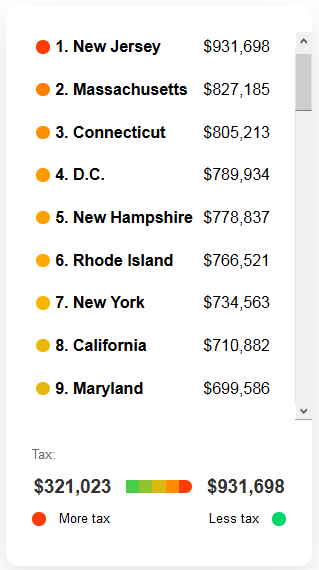

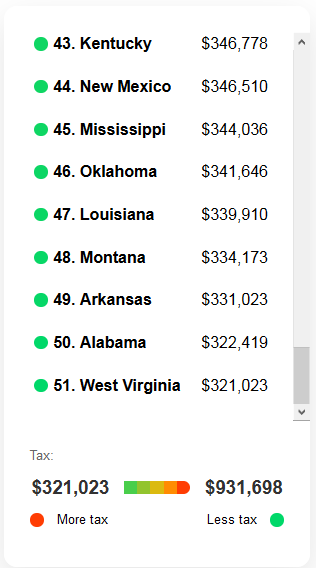

Key statistics:

• The average American will pay $525,037 in taxes throughout their

lifetime

• That’s an average of 34.3% of all lifetime earnings spent on taxes

• Residents of New Jersey will pay the most in lifetime taxes ($931,000)

and people in West Virginia will pay the least ($321,000)

• Tax on earnings is where most tax will come from, with the average

American paying $339,173 in a lifetime

• Owning a car will cost an additional $29,521 in tax payments alone

• Tax on property will set you back an additional $128,581 above the

property price and maintenance

• Taxpayers in California will pay the most on everyday expenses

($40,084), followed by New Yorkers ($39,745)

How much tax will the average American pay in their lifetime?

Using our state averages, we can see that the average American will pay

$525,037 over their lifetime, almost 65% of this will purely be tax on

earnings. This amount varies drastically by state but uses averages for

earnings, expenditures, property and auto taxes.

What

Americans Will Pay in Taxes Over a Lifetime

|

HIGHEST

TAXED STATES |

LOWEST TAXED

STATES |

|

|

|

Comparing states by taxes

paid over a lifetime is a new perspective for me. I'm not sure

it's plausible to calculate such based on living in one state over

an entire lifetime but it's an intriguing measurement. The

results aren't shocking. Though its footnoted sources are

respectable I do have some questions about what they consider "Tax on

Earnings" in this report as New Hampshire, Florida, Tennessee and

other income tax-free states seem to rank too high in costs in that

category, but aside from that it's an interesting snapshot.

Whenever comparisons such

as this are available I can't help but compare what I know from my

own experience — though I'm one of

those who disproves that "lifetime" in any one state criteria.

Getting to a lower-cost state at my age isn't going to lower my

lifetime average tax payment by very much, but it does make

me feel good.

|

"IT

DOESN'T HAVE TO BE THE MASSACHUSETTS WAY"

A COMPARISON OF TWO STATES I KNOW

BY THE "LIFETIME TAXES" PAID TO EACH |

MASSACHUSETTS

TOTAL COMBINED LIFETIME TAXES

#2. Massachusetts —

$827,185 |

KENTUCKY

TOTAL COMBINED LIFETIME TAXES

#43. Kentucky — $346,778 |

TAX ON EARNINGS

#3. Massachusetts —

$508,045 |

TAX ON EARNINGS

#39. Kentucky

—

$225,828 |

TAX ON PERSONAL SPENDING

#25. Massachusetts —

$29,156 |

TAX ON PERSONAL SPENDING

#42. Kentucky —

$23,671 |

TAX ON PROPERTY

#3. Massachusetts —

$244,044 |

TAX ON PROPERTY

#44. Kentucky —

$63,278 |

TAX ON CARS

#11. Massachusetts —

$45,940 |

TAX ON CARS

#19. Kentucky —

$34,002 |

|

|

|

|

|

|

|

Chip Ford

Executive Director |

|

|

|

Full News Reports Follow

(excerpted above) |

|

State House News Service

Thursday, May 27, 2021 (6:21 PM)

$47.7 Billion Senate Budget Passes Unanimously

Revenue Markup, Film Tax Credit and Rideshare Fees Bound for

Conference Talks

By Matt Murphy

The Senate unanimously passed a $47.7 billion budget for

next year after three days of debate over how best to invest

state resources as Massachusetts looks to recover from the

hardships of the past year of the COVID-19 pandemic.

Senate President Karen Spilka said the budget that passed

40-0 would put Massachusetts on "stable fiscal footing" and

begin to restitch the fabric of society that had frayed over

the last year, while Senate Ways and Means Chairman Michael

Rodrigues said the bill would help get the state "back to

better."

"Overall, we have charted a hopeful path forward," Rodrigues

said.

The vote sets the stage for negotiations with the House over

a range of issues, from the film tax credit to fees on Uber

and Lyft rides, but perhaps most consequential will be the

decision the two branches will have to make about revenues.

Both the House and Senate relied on revenue projections of

just over $30 billion in taxes for the fiscal year that

begins July 1. But with revenue continuing to pour in at a

clip that has exceeded expectations month after month,

Democratic leaders have said they could consider increasing

the projection.

The budget also did not tap into any of the $5.3 billion in

discretionary federal dollars the state is expecting to

receive from the American Rescue Plan Act, which Democratic

leaders have said they want to allocate through a separate

spending bill.

In keeping with that approach, senators rejected amendments

that would have steered federal funds to the unemployment

solvency fund to reduce the burden on business owners. They

also turned aside amendments to extend the authorization for

restaurants to serve to-go cocktails beyond the COVID-19

state of emergency as House and Senate leaders are working

on a separate review of pandemic policies they might want to

extend.

The budget that passed the Senate would increase spending by

close to $1.3 billion over fiscal 2021 after senators added

$63.7 million to the bottom line through amendments, putting

the final total on par with what was approved last month by

the House.

Both branches are in agreement on a $219.6 million increase

in Chapter 70 funding for public schools that lawmakers said

would finance one-sixth of the 2019 school finance reform

law and put the funding schedule back on track after 2020.

The Senate budget also relies on $1.55 billion in reserves,

which would leave the balance of the state's stabilization

account at $1.15 billion if all the funds authorized for use

are needed.

All three Republicans in the Senate voted for the budget and

Senate Minority Bruce Tarr lavished praise on Spilka and

Rodrigues for leading what he described as an inclusive

process that incorporated the ideas of the minority party

into a budget that did not raise taxes or wipe out reserves.

The Gloucester Republican said the Senate "should stand as a

beacon for how democracy should operate in this country,

which has seen too much division and too much rancor."

New spending approved through amendments bulked up support

for everything from the METCO school desegregation program

and a $50,000 Senate internship program geared toward

under-represented students to funding for the Executive

Office of Energy and Environmental Affairs to hire new staff

to implement this year's climate law.

The Senate waded through 923 amendments over the course of

three days and avoided the late nights that are typically a

hallmark of budget debates in both chambers of the

Legislature.

Rodrigues will almost certainly be tasked with leading

negotiations for the Senate opposite House Ways and Means

Chairman Aaron Michlewitz as the branches' competing budget

bills move before a six-member conference committee.

One of the more high-profile issues to be ironed out is the

future of the film tax credit. The House voted to eliminate

the program's January 2023 sunset date, while the Senate

budget extends the sunset by four years and reforms the

program by requiring a production company to spend at least

75 percent of its filming budget or conduct at least 75

percent of principal photography days in Massachusetts,

capping salaries eligible for the credit at $1 million, and

banning the transfer of the credits.

House Speaker Ron Mariano has been an ardent defender of the

film tax credit as a local job producer, but Senate leaders

have questioned the cost and support it gives to wealthy

actors and out-of-state production companies.

The Senate also voted this week to scrap three additional

tax credits and exemptions for harbor maintenance, medical

device company user fees and certain patent-related income

that were not part of the House budget.

With COVID-19 restrictions being lifted and many workers and

residents returning to their daily commutes and travel

schedules, the Senate's vote this week to add increased fees

on ride-hailing services to the budget also stands out as a

major difference with the House.

Sen. Joseph Boncore's proposal would increase the current

flat 20 cent fee per trip to 40 cents for a shared ride,

$1.20 for a non-shared ride and $2.20 for a luxury ride. It

would also put an additional 20-cent fee on rides that start

and end in the MBTA's service area.

The House has voted in the past for higher fees on ride

services as a way to address traffic congestion, but the

pandemic changed a lot of the nature of the debate about how

people were using those services.

Beacon Hill Roll Call

Volume 46-Report No. 22

Week of May 24-28, 2021

By Bob Katzen

THE HOUSE AND SENATE: Beacon Hill Roll Call records local

senators’ votes on roll calls from the week of May 24-28.

All Senate roll calls are on proposed amendments to the

$47.72 billion fiscal 2022 budget. There were no roll calls

in the House last week.

This was the Senate’s second state budget in the COVID-19

era and most senators participated virtually from their

homes or offices.

Of the of the 923 amendments filed by senators only 15 came

to a roll call vote. Many others were simply approved or

rejected one at a time on voice votes without debate.

To move things along even faster, the Senate also did its

usual “bundling” of many amendments. Instead of acting on

all the amendments one at a time, hundreds of the proposed

amendments are bundled and put into two piles—one pile that

will be approved and the other that will be rejected-with a

single vote on each pile.

Senate President Karen Spilka, or the senator who is filling

in for her at the podium, orchestrates the approval and

rejection of the bundled amendments with a simple: “All

those in favor say ‘aye,’ those opposed say ‘no.’ The ayes

have it and the amendments are approved.” Or “All those in

favor say ‘aye,’ those opposed say ‘no.’ The no’s have it

and the amendments are rejected.”

Senators don’t actually vote yes or no, and, in fact, they

don't say a word. The outcome was predetermined earlier

behind closed doors.

"The efficient Senate budget process this year reflected

lots of careful work by our Ways and Means Chair, Michael

Rodriques, and our Senate President, Karen Spilka, to build

consensus in the weeks before the budget," said Senate

President Pro Tempore Sen. Will Brownsberger (D-Belmont).

Despite repeated requests from Beacon Hill Roll Call, Senate

President Karen Spilka's office did not respond to a request

to comment on the bundled amendments and the small number of

roll calls. And no response was received from Spilka's

leadership team of Sens. Cindy Creem (D-Newton), Joan Lovely

(D-Salem), Mike Barrett (D-Lexington) and Sal DiDomenico

(D-Everett).

"Roll call requests are based on a number of factors that

are the subject of both continuing and contemporaneous

discussions within the caucus based on specific issues,"

said GOP Minority Leader Bruce Tarr (R-North Reading).

[The process] more accurately highlights the increasingly

efficient use of the legislative rubber stamp,” said Chip

Ford, executive director of Citizens for Limited

Taxation. “Massachusetts doesn't need the cost of 200

legislators when a handful decide all legislation before it

comes for a vote. If the three token 'loyal opposition'

Republican senators weren’t taking up space taxpayers could

at least save the ‘leadership stipends’ they collect.”

“This type of process was not the norm only several years

ago." said said Massachusetts Fiscal Alliance Executive

Director Paul Craney. "Over the last few years, with new

legislative leadership, they rush through votes, often don’t

record the votes and don’t allow the public to gain access

to what is happening because most of the important work is

done behind closed doors. With that being said, the state

Senate is much more transparent than Speaker Ron Mariano and

Republican Brad Jones in the House. The House is arguably

the most opaque legislature in America.”

The Boston Herald

Tuesday, May 25, 2021

Lawmakers want to pay Massachusetts jobless $1,200 to go

back to work

By Erin Tiernan

State Senate Republicans want to pay jobless workers a

$1,200 get-back-to-work bonus over the next year to take a

job and get off unemployment by Sep. 4.

The pitch comes as one of the 923 amendments to the $47.6

billion Senate budget for fiscal 2022 that lawmakers will

debate starting Tuesday.

“For several weeks, I’ve heard from employers in my district

— whether they are restaurants or seasonal-type businesses

like a drive-in movie theater, the trucking industry and

others — that they are having trouble finding people to come

back to work,” said state Sen. Ryan Fattman, R-Webster, who

submitted the amendment. “The No.1 hurdle is that wages are

maybe a little more competitive or on par with unemployment

benefits.”

Fattman says his “sign-on bonus” of up to $1,200 would serve

as an incentive to get people back to work and encourage

them to keep their jobs. The bonus would be paid out in

three increments: $400 for securing a job before Sept. 4,

$400 upon proof of employment after six months and the final

$400 payment would come after a full year of continuous

employment.

His proposal would rely on a portion of the $5.3 billion in

coronavirus aid headed to the state from President Biden’s

$1.9 trillion American Rescue Plan.

The federal government has been supplementing unemployment

benefits since the beginning of the pandemic, first by $600

in additional assistance per week, now $300 per week.

Fattman said it’s time to put an end to the “unusually

generous” unemployment benefits that “made a lot of sense

back at the height of the pandemic.”

While nearly two dozen Republican-led states have moved to

cancel the federal unemployment boost in their states, Gov.

Charlie Baker told a Herald reporter earlier this month that

he had no plans to do so in Massachusetts.

His comments came despite an outcry from employers over a

shortage of workers and as the unemployment rate — hovering

at 6.5% as of April — remains more than double what it was

at the outset of the coronavirus pandemic.

Retailers Association of Massachusetts President Jon Hurst

said Fattman’s plan is “a terrific idea” but one that’s

unlikely to pass in a Legislature where Democrats hold a

supermajority.

So far, the Senate’s two other Republicans — Sens. Patrick

O’Connor of Weymouth and Sen. Bruce Tarr of Gloucester —

have signed on. House lawmakers also declined to draw on any

of the American Rescue Plan funds in their 2022 budget.

Hurst did, however, take issue with Fattman’s plan for

paying for the sign-on bonus.

“The first cut in (American Rescue Plan) money has to be to

roll back the $7 billion tax increase on employers because

of a crisis that was not their fault. That should be the

first priority,” Hurst said, referencing massive increases

in unemployment taxes small businesses around the state are

facing as a result of the massive number of claims borne out

of the pandemic.

State lawmakers are considering a separate bill that would

allow pandemic claims to paid off over 20 years, including

interest.

Fattman argued the best way to serve small businesses is “to

get people back to work.”

State House News Service

Thursday, May 27, 2021

Senate Dems Reject GOP Bid for Return-to-Work Bonuses

By Michael P. Norton

The three-man Senate Republican caucus wants to give

unemployed people in Massachusetts taxpayer-funded bonuses

to return to work, but Senate Democrats swept their idea

into the dustbin of failed budget amendments.

Sens. Ryan Fattman, Patrick O'Connor and Bruce Tarr proposed

granting a $1,200 bonus to anyone collecting unemployment

benefits who returns to work between the adoption of the

fiscal 2022 budget and Aug. 7, 2021.

An aide to Sen. Fattman said the senator viewed his proposal

as a "decent incentive to get people back to work and off

unemployment" and a way to help the state address labor

shortages that are frustrating employers.

Senate Democrats this week have been dispensing with more

than 900 budget amendments in large part through private

talks that lead to the adoption of bundles of amendments,

and the rejection of other bundles. The Fattman amendment

(811) - dubbed the Time For The Commonwealth To Get Back To

Work Bonus - was dumped into a bundle of amendments that was

rejected on a voice vote without debate on Wednesday

afternoon.

Under the proposal, the bonus would have been allocated in

three $400 increments, with an initial payment made upon

verification of an individual's return to work, a second

payment after six months of verified continuous employment,

and the last payment delivered upon verification of one year

of continuous employment.

The GOP senators hoped their proposal would be paid for with

funding included in the federal American Rescue Plan (ARPA),

which was adopted in Congress over the objections of

Republicans. House Speaker Ron Mariano has said he hopes

ARPA spending plans will emerge in June, in a vehicle

separate from the annual state budget.

The Boston Herald

Tuesday, May 25, 2021

Time to get off the couch and earn a paycheck

By Howie Carr

The scam is over.

It’s time for all you freeloaders to get back to work.

I’m pleading with you, no more crackpot grifts to keep your

yearlong-plus vacations going — and $174,000-a-year state

judges, I’m most assuredly including you in the list of

layabouts.

Please, no more handouts. Right now in Maskachusetts the

gainfully unemployed are grabbing an extra $300 a week for

snoozing on their mom’s couch. And now these same COVID

grifters may be offered $1,200 to get off their fat

rear-ends and start looking for work.

Good luck with that, especially now that weed has been

legalized.

And spare us the charade of this phony-baloney

you-have-to-apply-for-three-jobs-every-week nonsense either.

That’s a bigger scam than the Earned Income Tax Credit.

The goal with this whole Panic was to get rid of President

Donald J. Trump. Mission accomplished, OK? Move on,

everybody.

It’s time to go back to work — whether it’s punching a time

clock, or making cold calls, or (if I can get personal)

answering the Herald’s FOIA requests for information about

crooked cops and civil sexual-harassment lawsuits against

local politicians.

No more sob stories about how people are “afraid” to go back

to work. No kidding they’re frightened, but it’s not the

virus they’re afraid of, it’s the job itself.

Oh, you say you have in fact still been working. You’re

“telecommuting?” Yeah, right.

Last week, a Rasmussen poll showed that 44% of respondents

said the increased unemployment benefits “are making it too

easy for unemployed Americans not to work.”

This no-work scam has produced endless spinoff grifts. Think

about the Payroll Protection Program — bailouts for

businesses that didn’t exist. The PPP was like blowing a dog

whistle for every convicted fraudster and paroled embezzler

in the country, and apparently every last one of them heard

it.

How about the eviction “moratorium?” As if the non-working

classes grabbing an extra $600 or $300 a week in welfare, er,

unemployment, were suddenly destitute.

By the way, did the landlords get a moratorium on paying

their property taxes? Or utilities?

Then there was the proposed “forgiveness” of student-loan

debt because of the … emergency. Thankfully, that proposal

turned out to be a bridge too far even for Dementia Joe

Biden.

But now the new Leisure Class is complaining about that too

— and never mind that the government hasn’t been requiring

student-loan repayments since the Fauci flim-flam started,

and won’t again until at least the fall.

Monday I saw a giant sign hanging outside the Needham Post

Office — “We Are Hiring.” And it’s not even Christmas. When

the Post Office can’t find anybody for government work, you

know you’ve got a problem.

The two coffee shops I used to walk to from my house were

both killed off last year by Gov. Charlie Parker’s idiotic

lockdowns. So I went to a different place the other morning.

The line was out the door — the only person behind the

counter was the manager. She apologized that she couldn’t

get any of her help to come in for the morning rush.

On the Cape, the bigger restaurants and resorts are openly

poaching workers from the smaller places, even more so than

usual.

When Obamacare was passed more than a decade ago, Nancy

Pelosi said it would free her shiftless constituents from

“job lock.” Everybody laughed, but now, it’s apparently a

human right, not to have to worry about “job lock.”

This is the War on Poverty on steroids. The lesson of that

disaster was that you get more of whatever you subsidize,

and the U.S. subsidized all kinds of social dysfunction,

including family dissolution and out-of-wedlock pregnancies.

Guess what we got more of.

Then there was “job training.” That scam was, as long as you

were being trained, you didn’t have to get off welfare. Mike

Dukakis used to brag about Massachusetts’ job training

programs — a national model, he said.

Then a Democrat state senator got the list of trainees — as

I recall about 5,000 teen moms and illegal aliens had been

“trained” for approximately 50,000 jobs, maybe 100 of which

they’d actually taken.

I see much more job training in the near future.

Have you tried to get in any government buildings lately –

like, in the last 15 months? The problem is, if they

actually truly reopened the buildings again, all the hacks

would be expected to come back to work, not just a “skeleton

crew.”

And that ain’t happening.

Thank God for Charlie Parker, though. There’s a reason why

he’s the Pope of Panic Porn. He defends his indolent public

sector workforce – the ones who’ve been on vacation since

March 2020.

Monday, he filed legislation “providing for a temporary

suspension of certain open-meeting law requirements.”

In other words, all Charlie Parker’s buildings can remain

closed!

The scam is over. Long live the scam.

State House News Service

Friday, May 28, 2021

Advances - Week of May 30, 2021

As the new normal dawns and the state budget dips into the

darkness of closed House-Senate negotiations, lawmakers are

under pressure in early June to decide which pandemic-era

policies to save before the COVID-19 state of emergency

lifts on June 15 and to come up with ways to put to work

some of the federal stimulus funds that the federal

government has showered on the states.

Budget bills topping $47.7 billion in spending are headed

for a conference committee to be led by Rep. Aaron

Michlewitz and Sen. Michael Rodrigues.

A critical report on May tax receipts is due out next week.

Since January alone, tax collections have exceeded budget

estimates by $1.8 billion, according to the Massachusetts

Taxpayers Foundation.

The state of play means the budget conference could mark up

revenue expectations to sharply reduce their planned raid of

the state's rainy day fund at a time when the economy is

accelerating and they are not permitted to use special

federal aid to backfill the state's stabilization reserve.

The conferees must also settle House-Senate differences over

transportation network company fee increases and tax

incentives to encourage film industry work in Massachusetts.

The Senate this week also loaded its budget with policy

proposals unrelated to spending. The foundation late

Thursday reported that 455 budget amendments were adopted

over three days, including 83 policy proposals that were

added to the 60 policy riders already in the Senate budget.

The advancement of the policy proposals comes at a time in

the session when most bills calling for new policies have

not been vetted and have yet to even advance to the public

hearing stage. The House and Senate also also have yet to

agree on basic ground rules governing the transparency of

committee testimony and voting.

Storylines in Progress

The Baker administration heads into the last 19 months of

Baker's term with an acting transportation secretary (Jamey

Tesler), an acting public health commissioner (Margret

Cooke) and a public safety secretary (Tom Turco) who is

staying on the job even though he had planned to retire last

year

... The Legislature's new committee focused on emergency

preparedness examines a non-COVID-19 issue on Friday:

readiness for hurricane season

... The State House is fast becoming one of the last places

in Massachusetts without a reopening plan

... Pandemic-era voting reforms are expiring next month and

legislative leaders have yet to coalesce around a single

plan to extend mail-in and early voting, or to decide on

same-day registration, a reform that could be in place for

this year's elections if lawmakers were to act soon

... Changes to the governance and management structure of

the Holyoke Soldiers' Home appear inevitable, but 15 months

after the deadly COVID-19 outbreak there is still no

agreement among lawmakers and Gov. Baker on a path forward

... Unions are closely monitoring House Speaker Ron Mariano

to see whether he'll initiate an override vote to ensure a

project labor agreement is in place for the construction of

a new Holyoke Home

... Gov. Baker and Lt. Gov. Polito, along with their family

members, plan to talk about a possible re-election effort,

Gov. Baker said Friday, as the next governor's race gathers

more momentum. Like Baker, Sen. Sonia Chang-Diaz and Harvard

professor Danielle Allen haven't committed to running for

governor, but are thinking about it....

FULL REOPENING ARRIVES: Virtually all remaining COVID-19

restrictions will lift on Saturday and the state's face

covering order will be replaced with an advisory as the

Baker administration fully reopens Massachusetts after more

than a year.

All industries will be allowed to open and operate at 100

percent capacity, industry-specific restrictions will end,

and the state will no longer place a limit on gathering

sizes.

The new face covering advisory will encourage those who are

not yet vaccinated to continue wearing masks and distancing

in most settings. Masks will still be required for everyone

regardless of vaccination status on public and private

transportation such as MBTA and rideshares, in health care

facilities, congregate care settings, rehabilitative day

services, and for both students and staff indoors at K-12

schools and early education providers. (Saturday, May 29)

State House News Service

Monday, May 24, 2021

Fed Guidance Limits ARPA Use for Revenue Replacement

Howgate: You Can't Use ARPA to Rebuild Rainy Day Fund

By Colin A. Young

State budget managers can probably use about $1.5 billion of

the incoming American Rescue Plan Act funding to replace

revenue the state lost in 2020 due to the pandemic but will

not be able to use it to replenish the state's rainy day

fund, a Massachusetts Taxpayers Foundation analyst said last

week.

One of the four primary buckets of allowable uses of the

ARPA money being sent to states and local governments is

revenue replacement, but until the U.S. Treasury issued its

guidance on how ARPA funds can and cannot be used it was

unclear just how much of the roughly $5.3 billion in state

fiscal relief headed for Massachusetts could be used to,

essentially, help balance the budget.

"You could come up with some pretty reasonable scenarios in

which your ability to use revenue replacement was

essentially nil, and you can come up with scenarios in which

you could use almost the entire award for revenue

replacement. So that's why this guidance was so key," Doug

Howgate, the executive vice president of the Massachusetts

Taxpayers Foundation, said.

And the Treasury's guidance, though it also presents a few

"hiccups" for budget overseers, also "allows for probably

some pretty significant revenue replacement" for

Massachusetts, Howgate told the House Committee on Federal

Stimulus and Census Oversight on Friday.

"Using tax revenue, which is going to be the bulk of how

revenue replacement is calculated, you can come up with a

ballpark, and my estimate for the first calculation of

revenue replacement is it will probably allow us to use

about call it $1.3 to $1.6 billion in revenue replacement in

this first time period," he said as he presented a slide

that estimated about $1.563 billion in allowed revenue

replacement in calendar year 2020.

The Treasury guidance calls for revenue replacement to be

calculated by comparing actual collected revenue to "an

alternative representing what could have been expected to

occur in the absence of the pandemic."

Howgate explained that a state's allowed revenue replacement

could be calculated by starting with actual fiscal year 2019

collections (the last full fiscal year before the pandemic)

and increasing them by the 4.1 percent annual growth rate

prescribed in the Treasury guidance. The difference between

what a state could have collected under the 4.1 percent

annual growth scenario and what the state actually collected

is the amount of ARPA money that can be used for revenue

replacement.

But states cannot just run the calculation once -- the

Treasury guidelines require state and local governments to

calculate their allowed revenue replacement once upon

receiving the ARPA money, then again on Jan. 1 of 2022, 2023

and 2024.

"It's going to make planning this money somewhat challenging

because we're not going to know exactly how much revenue

replacement we can bring to bear until later on in the

process," Howgate said. "I think that was intentional,

probably, to make sure that states are a little deliberate

in how they're using this money."

Zeroing in on the first calculation for Massachusetts could

take some time and cooperation between the Legislature,

governor's office and the comptroller's office, he said. For

one thing, revenue replacement is done on a calendar year

basis and Massachusetts doesn't typically do financial

reporting on a calendar year basis.

Lawmakers will also have to be mindful of the restrictions

on revenue replacement when they wrap up the accounting on

fiscal year 2021 and put a fiscal year 2022 budget into

place, Howgate told them.

"There was some feeling before that maybe we could fund some

spending with the stabilization fund and then rebuild it

with federal resources. You can't do that," he said,

highlighting one of the "hiccups" in the Treasury rules. "So

the order of operations of how we use these resources to

balance the budget, it really matters because once that

money's out of the stabilization fund these fiscal recovery

funds cannot be used to replenish that."

Administration officials and legislative leaders have said

they would like to limit draws against the state's

stabilization fund, which has a balance of $3.52 billion

before accounting for potential spending from that fund of

up to $1.7 billion this budget year. Gov. Charlie Baker

proposed a withdrawal of up to $1.6 billion from the fund in

fiscal 2022, the House passed a budget that proposes pulling

$1.875 billion from the fund, and the Senate on Tuesday will

begin debating a fiscal 2022 budget that would draw up to

$1.55 billion from the fund.

The months-long and ongoing pattern of state tax collections

obliterating expectations could also help limit what is

actually taken out of the rainy day fund and provide

lawmakers with a source of funds to start to build the

reserve account's balance back up. Through 10 months of

fiscal 2021, state government has collected $26.449 billion

in tax revenue, up $3.405 billion or 14.8 percent over the

same period in fiscal 2020 and $1.83 billion or 7.4 percent

over the Department of Revenue's expectations.

Through May 14, DOR had collected $1.190 billion from

taxpayers -- about 63 percent of the $1.893 billion the

agency expects to bring in by the end of this month.

State House News Service

Monday, May 24, 2021

Legislative Staffers Got Raises, $500 Stipends

By Matt Murphy

House and Senate employees received raises of 6 percent this

month and one-time stipends of $500 to defray the cost of

working from home over the last year as employees have

become increasingly vocal about the challenge of supporting

themselves in Greater Boston on a legislative staff salary.

The group Beacon B.L.O.C. on Monday released the results of

the survey it publicized in early May that found just about

10 percent of legislative staffers felt they were fairly

paid for the hours and responsibilities that come with the

job.

Speaker Ron Mariano said House employees went "above and

beyond" over the past year and thanked them for the

"commitment and their service," while Senate President Karen

Spilka said the Senate "has always valued feedback from its

employees and will continue to look for ways to improve the

work environment and compensation for staff."

The survey was based on responses from what Beacon B.L.O.C,

a coalition of Black staffers and allies, described as 210

anonymous staffers, or about a quarter of State House

workforce. It was unclear based on the survey whether the

respondents worked in the House or Senate, which operate

separate human resources departments.

Staffers in both branches got identical 6 percent

cost-of-living adjustments in their paychecks this month,

plus the $500 stipend, according to Mariano and Spilka's

office. Raises are typically handed out every two years. The

Senate has also expanded its parental leave program from

eight to 16 weeks of full pay for the birth, adoption or

foster placement of a child.

"As Senate President, I will never stop working to make the

Massachusetts State Senate a safe, inclusive and responsive

workplace where our employees are valued and appreciated,"

Spilka said in a statement.

Mariano said the House recently updated its human resources

operation, including new rules and the establishment of an

employee engagement officer position to work with employees

on ways to improve the professional environment of the

House.

"The House is committed to fostering an open and inclusive

environment for all employees, and we are open to

suggestions on how we can improve our efforts," Mariano

said. |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

BACK TO CLT

HOMEPAGE

|