|

Post Office Box 1147

▪

Marblehead, Massachusetts 01945

▪ (781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

46 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Sunday, June 28, 2020

Latest Scheme to Kill Proposition 2˝

Jump directly

to CLT's Commentary on the News

Most Relevant News Excerpts

(Full news reports follow

Commentary)

|

Longmeadow Town

Meeting voters rejected a move by the town Selectboard and

the Finance Committee to begin the process of exempting the

town from Proposition 2˝ tax limitations. A request for

funds to cover initial engineering costs for a Longmeadow

Street rebuild was also voted down.

Tuesday’s outdoor

meeting on the grounds of Longmeadow High School Tuesday

evening allowed generous social distancing for the 277

registered voters who attended.

Article 14 asked

voters to allow the town to begin home rule legislation that

could eventually exempt town government from the 2.5 percent

tax cap mandated by Proposition 2˝.

The Chair of the

Select Board, Thomas Lachiusa said home rule legislation

would begin a process to allow the town to permanently

exempt itself from having to adhere to the 2.5 percent cap

on yearly property taxes.

“This is something

both the Select Board and the Finance Committee have been

looking at for a long time as a solution to protect the town

from a drastic property value decreases,” he said. If that

were to happen we would see a lot of cuts to education,

programs and services we have all come to expect. It would

be a progressive loss of services as each year we would have

to make more and more cuts."

Lachuisa said the

vote Tuesday would have allowed the town to approach the

state legislature for home rule legislation. Once the state

government approves, the town would have two more votes,

Town Meeting and the second a town-wide ballot initiative,

to either pass the measure or reject it.

The Springfield

Republican

Friday, June 26, 2020

Longmeadow Town Meeting rejects Prop. 2˝ cut and Route 5

rebuild

The pandemic

tables have turned, in many ways, with the coronavirus now

boiling over in southern and western states like Florida and

Texas, while in the Northeast the pot lid is only slightly

rattling.

But Bay Staters

just venturing out into the wild are doing so with great

trepidation, many still uncomfortable with the idea of

eating out or riding the T. Forget about getting on a plane.

New polling from

Suffolk University for WGBH News, the State House News

Service, The Boston Globe and MassLive found that more than

66 percent of residents are living with more than normal

levels of fear and anxiety. And perhaps that's to be

expected.

Not only are they

living through the worst pandemic in over a century, but

society is also struggling to come to terms with generations

of racism and the inequities that built into every system,

from housing to law enforcement.

Racism, in fact,

ranked among the biggest problems residents see facing the

state today, which helped to explain the sweeping support

found in the Suffolk/WGBH/SHNS poll for broad reforms to

policing....

Despite the fact

that 81 percent of residents still think Baker is doing a

good job handling the pandemic, there wasn't enough support

to sugarcoat a 174-page report that painted a hideous

portrait of the leadership at the Holyoke Soldiers' Home.

Mark Pearlstein, a

former federal prosecutor tapped by Baker to conduct an

independent investigation into the deaths of at least 76

veterans from COVID-19 at the home, found that a series of

"utterly baffling" decisions led to the creation of

conditions that allowed the virus to wreak havoc.

The Pearlstein

report focused on the decisions that were made that allowed

COVID-19 to flourish inside the walls of the veterans' home,

but it also laid out warning signs that Superintendent

Bennett Walsh may have been underqualified to run the

facility before the start of the pandemic....

Over 2,000

teachers in 47 school districts have also been informed that

they will be without a job in the fall, according to the

Massachusetts Teachers Association, which is the state's

largest teachers' union.

The layoff and

non-renewal notices signal the high level of uncertainty

under which local officials are operating as the Legislature

has yet to finalize a budget for the upcoming fiscal year,

and the Baker administration is currently level-funding

local aid to cities and towns in the short-term.

Schools did get a

bit more clarity about what the fall might look like,

though....

The governor said

it could be at least another month before the state is ready

to commit to Chapter 70 aid for the next school year. Baker

signed a $5.25 billion interim budget on Friday that will

keep government operating through at least July as budget

writers in the House, Senate and administration struggle to

peer into the future.

"We don't have a

good sort of vision into tax revenue for the next fiscal

year yet, and it's going to take a little while to get

there," Baker said.

House Ways and

Means Chairman Aaron Michlewitz said the target the House

set for his committee in May to release a fiscal 2021 budget

proposal by July 1 is no longer feasible, and not likely to

be met by next Wednesday.

Guessing exactly

what the Legislature will be able to accomplish by July 31

could be a fun parlor game.

House Speaker

Robert DeLeo has said policing reform is on that list, but

he has not yet surfaced a proposal to respond to the

legislation filed by Baker to create a police licensing

system that would give the state new power to hold cops to

standards of law enforcement and professionalism, including

bans on the use of forceful tactics like chokeholds.

The governor got

an earful on a visit this week to Mattapan from a woman

upset that Baker's bill proposed to pay police up to $5,000

to get the additional training they need to be sensitive to

racial biases. He was there to announce the selection of a

minority-owned firm to redevelop the last parcel on the

former Boston State Hospital campus....

The Senate passed

health care legislation Thursday to enshrine some of the

pandemic protocols that have led to massive growth in the

use of telemedicine, and to put an end to surprise billing

and expand the scope of practices for some medical

professionals.

The topic of

health care, however, was a sensitive one given the

accusation made by some House lawmakers -- namely House

Majority Leader Ron Mariano and Rep. Dan Cullinane -- that

the Senate has been a bad partner in trying to negotiate a

path forward with limited time until the end of the session.

With the House

seeking to extend the life of some health care bills, the

Senate responded to the criticism by rejecting their

extension request, initiating a parliamentary feud that

doesn't bode well for much of anything getting accomplished

in the health care space over the next month.

"At some point,

because we were being asked to extend and extend, how many

times does someone say no before you stop asking them out?"

Sen. Cindy Friedman said about the House.

Given the bad

blood, it was a small win that the House and Senate were

able to agree to a "compromise" over local road repair

funding and the future of the MBTA's oversight board....

Both branches

earlier this year had passed legislation to bump Chapter 90

funding to $300 million for the year, delighting cities and

towns after years of lobbying for more money.

But with the

pandemic crushing state finances and the Senate apparently

unwilling to take up the House's transportation tax bill,

the compromise was to punt.

State House News

Service

Friday, June 26, 2020

Weekly Roundup - Fear and Loathing in Massachusetts

Recap and analysis of the week in state government

Just as the

Legislature heads into crunch time on Beacon Hill, tensions

appear to be rising between the House and Senate over how

bills should emerge from a key committee.

Under the

Legislature’s rules, all bills dealing with health care are

supposed to be reviewed and voted on by the Joint Committee

on Health Care Financing before moving on to votes in the

two branches. But the two chairs of that committee – Sen.

Cindy Friedman of Arlington and Rep. Dan Cullinane of

Dorchester – are barely on speaking terms these days.

Cullinane says

Friedman has refused to work with him to schedule votes on

all but a few bills since he took over as acting chair of

the committee early this year. He said he is leaving the

Legislature at the end of this session and has no political

agenda other than moving forward good public policy.

“Plain and simple,

the Senate chair refuses to negotiate, refuses to engage in

any meaningful conversation,” he said. “The Senate did not

walk away from the negotiating table, they never showed up.”

...

On Thursday, the

Senate passed a major health care bill backed by Friedman

and Senate President Karen Spilka. The bill did not go

through the joint committee, but instead originated in the

Senate Ways and Means Committee, which Cullinane says is a

violation of the Legislature’s rules. He said the Senate has

bypassed the joint committee and passed other health care

measures in recent months....

On the Senate

floor Thursday, Friedman also urged the rejection of a House

measure that would have extended until the end of the year

the reporting date for the more than 300 bills remaining in

the Health Care Financing Committee. Cullinane said he filed

the extension because he didn’t want to see the bills die,

but Friedman indicated on the Senate floor that she didn’t

care....

Cullinane says

Friedman’s approach subverts the whole point of the

committee, which is to have members and staff with an

expertise in health care review all health care

legislation....

To an outsider, it

all sounds like much ado about nothing. After all, a Senate

bill can’t become law unless the House goes along, so it’s

not as if the two branches will never have to negotiate. But

the Senate’s attempt to bypass a key legislative committee

and gain more control of its legislation is stirring anger

in the House, anger that is likely to surface somewhere down

the road.

CommonWealth

Magazine

Friday, June 26, 2020

Tensions rising between House and Senate

Governors from

both major parties over the years have turned to midyear

budget cuts when it's become apparent that tax revenues are

not going to keep pace with spending. These 9C cuts are

named for the section of state finance law that authorizes

governors to take unilateral budget-fixing actions.

But since March,

in the face of the precedent-setting evaporation of tax

receipts brought on by forced business closures, the Baker

administration has not revised revenue expectations -- which

could have triggered 9C cuts -- or announced other specific

budget-balancing plans.

State laws require

the state Administration and Finance Secretary, in this case

Michael Heffernan, to notify the governor in writing

whenever he believes budgeted revenues will be insufficient

to meet expenditures.

Within five days

of that notification, the secretary must inform the governor

and legislative budget officials of the amount of the

probable deficiency of revenue and the governor is then

required, no more than 15 days after that notification, to

reduce spending and outline his or her reasons or submit to

the Legislature specific proposals to raise additional

revenues by an amount equal to such deficiency.

The law governing

actions in the face of a "deficiency of revenue" also

references the option to pull money from state reserves to

backfill funding gaps.

Tax collections

through May are running $1.73 billion or 6.5 percent less

than the same fiscal year-to-date period in 2019, and $2.25

billion or 8.3 percent behind the year-to-date benchmark, an

unprecedented decline and one that economic experts believe

will not quickly reverse itself.

Asked why the

Baker administration has not adjusted its revenue benchmarks

downward, Heffernan spokesman Patrick Marvin did not say.

State House News

Service

Monday, June 22, 2020

Facing $2.25B Shortfall,

Baker Admin Hasn’t Updated Revenue Expectations

Gov. Charlie Baker

on Friday morning signed an interim budget to keep state

government running when the new fiscal year begins on July 1

since the Legislature has not yet developed a fiscal 2021

spending plan.

The governor filed

the $5.25 billion interim budget a week ago and said Friday

that the amount is sufficient to fund government operations

through July and "will make it possible for the treasurer to

deliver local aid payments to cities and towns."

House and Senate

leaders have not laid out a timeline yet for completion of a

budget for the full fiscal year.

State House News

Service

Friday, June 26, 2020

Baker Signs Budget to Fund Government in July

The state's 6.25

percent sales tax will be waived on many purchases the

weekend of Saturday, Aug. 29 and Sunday, Aug. 30, the Baker

administration announced Tuesday. This summer's sales tax

holiday weekend will take place as retailers regain their

footing after weeks of government-forced shutdowns, and Gov.

Charlie Baker said he hopes people will take advantage of

the tax savings to support local businesses....

The annual tax

holiday, made a permanent fixture as part of a 2018 "grand

bargain" law addressing multiple topics, allows shoppers to

avoid paying the tax on most retail items -- excluding food

and drink at restaurants -- that cost less than $2,500. The

state agrees to give up tens of millions of dollars in taxes

in a bid to spur buying and consumer savings.

State House News

Service

Tuesday, June 23, 2020

State Sets Aug. 29-30 as Sales Tax Holiday Weekend

There is no

question that the pandemic has significantly altered agendas

and priorities in the Legislature, and with the time to

tackle big issues running out leaders are being pressed from

multiple directions to address bills dealing with climate

change.

Climate

legislation had figured to be a focus of the legislative

session's home stretch since the House and Senate had each

passed major climate-related bills before most business was

put on hold. Now, with five weeks to go in the session and

other hefty matters still incomplete, one key lawmaker is

trying to rally colleagues to finish the job before the July

31 end of formal sessions....

Towards the end of

January, it seemed almost certain that the governor would be

signing some kind of climate bill this summer. On the same

day that month, Gov. Charlie Baker, House Speaker Robert

DeLeo and Senate President Karen Spilka all declared their

support for net-zero carbon emissions by 2050, a policy that

climate change activists have been pushing for years. Both

branches have passed climate-related bills, but the shared

goal still hasn't been formalized.

The House last

July unanimously approved a roughly $1.3 billion bill -- the

so-called GreenWorks bill -- centered around grants to help

communities adapt to climate change impacts, and at the end

of January the Senate overwhelmingly passed a suite of

climate bills that called for net-zero carbon emissions by

2050, and set deadlines for the state to impose

carbon-pricing mechanisms for transportation, commercial

buildings and homes....

In a letter this

week to House leaders, a coalition of some of the most

powerful business and trade groups in the state made clear

that they do not want the House to follow the Senate's

radical and dramatic lead.

"Representing

twenty of the Commonwealth's largest business, employer,

housing, labor and trade associations we recognized [in

January], as now, the importance of advancing our climate

leadership and the urgent need for bold action," the Mass.

Coalition for Sustainable Energy wrote to DeLeo and House

Ways and Means Chairman Rep. Aaron Michlewitz. "However,

after reviewing in depth S2500, An Act Setting

Next-Generation Climate Policy -- and in light of the many

consequences of the ongoing pandemic -- we believe the bill

would have negative environmental consequences for the

Commonwealth while seriously exacerbating our housing costs

and affordability challenges at a moment when our economy

already faces a sharp downturn in productivity."

The coalition,

which includes the Greater Boston Chamber of Commerce, Mass.

Business Roundtable, and Associated Industries of

Massachusetts, has recently grown to now include the Home

Builders and Remodelers Association of Massachusetts, NAIOP

Massachusetts, and Plumbers & Gasfitters Local 12 Boston.

"Ultimately, we

believe this bill would harm consumers and businesses and

undermine our smart growth objectives at a time our economy

can least afford even the smallest step backwards without

making the meaningful emissions reductions we need to

reverse the effects of climate change," the coalition wrote.

The group

disagrees with the Senate's decision to leave critical

specifics of carbon pricing up to the executive branch,

claims the Senate bill makes unrealistic assumptions about

the future costs and availability of clean energy

technologies, and disapproves of the Senate leaving

business, employer and labor groups off of a Climate Policy

Commission proposed in a Senate bill.

On that last

point, the coalition was backed up Thursday by Jay Ash, the

former Baker administration economic development secretary

who now leads the the Massachusetts Competitive

Partnership....

Though there had

been talk months ago about the House and Senate agreeing to

hold formal sessions after the traditional July 31 end date

stipulated in the joint rules, that possibility seems to

have lost favor and lawmakers have repeatedly discussed July

31 as the hard deadline for major legislation.

With the clock

running down, the Legislature must still put a permanent

budget in place for the fiscal year that starts July 1 (a

process that typically takes months on Beacon Hill),

momentum is building around an economic development bill

that could respond to the financial pain the pandemic has

inflicted, and other major initiatives around transportation

revenue and health care remain under active consideration.

State House News

Service

Friday, June 26, 2020

Lawmakers Feeling Push and Pull on Climate Bills

Branches on Different Courses as Session Winds Down

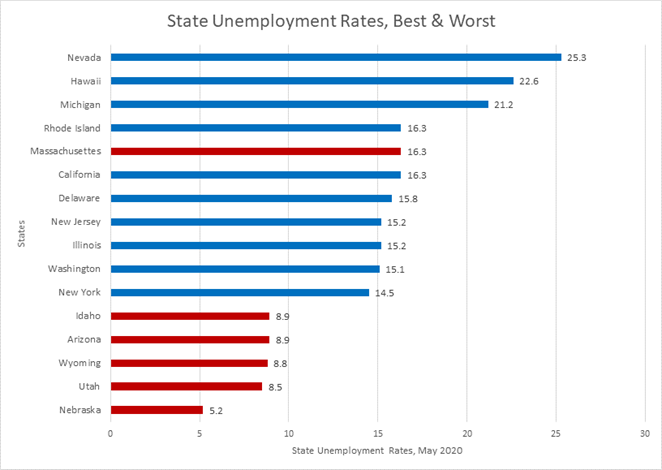

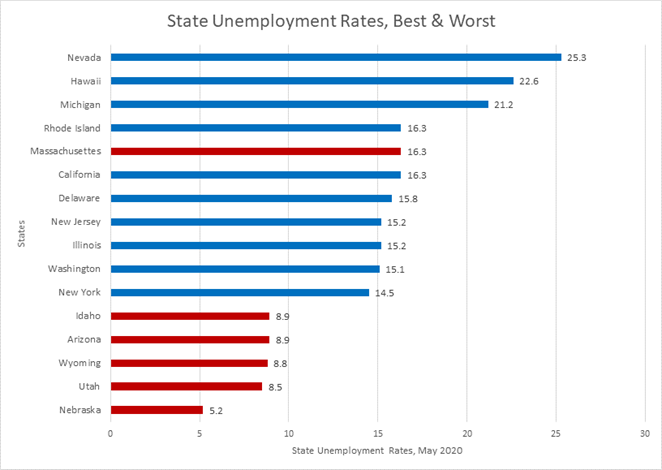

Ten states had

unemployment rates in May above 15 percent. They are all

states with Democratic governors, with the exception of Deep

Blue Massachusetts with its liberal Republican governor

Charlie Baker....

This is not a

coronavirus recession. It is a blue state lockdown

recession. Democrats say they have shut down their economies

for health reasons, but these are also the states that

generally have had the highest death rates and the highest

nursing home fatalities. So the blue states have not only

failed to keep their citizens safe, they’ve ruined their

economies as well.

Committee to

Unleash Prosperity Hotline

Issue #56

Monday, June 22, 2020

The Blue State Depression

We’re number four!

Gov. Charlie Baker

must be so proud – as of last month, only three of the 50

states had a higher unemployment rate than the Commonwealth

of Massachusetts’ 16.3%, according to the federal Bureau of

Labor Statistics.

I’ll bet you

hadn’t heard that until right now, had you? Odd how almost

all of Charlie Parker’s amen chorus in the Boston media gave

these appalling statistics a good leaving-alone for the

better part of a week.

I first read about

the Massachusetts Misery in the Wall Street Journal last

weekend, in an editorial pointing to the dire consequences

of assorted governors’ catastrophic overreactions to the

recent panic.

Headline:

“Lockdown States and the Jobless/Job gains are much greater

in states that reopened faster.”

Lockdown state?

That’s Maskachusetts, right.

But as you would

expect, the Boston media shrugged, as if to say, Nothing to

see here.

Move along, folks,

and pay no attention to all those boarded-up storefronts and

looted buildings in Downtown Crossing and Back Bay, not to

mention the thousands of shuttered mom-and-pop businesses on

every main street and state highway in Massachusetts.

But look on the

bright side, Governor – not only does the Mask State have

the most disastrously high unemployment rate in the country

among those run by “Republicans,” you’re the only GOP

governor, RINO or otherwise, who’s in the top 10 for

wrecking his state’s economy....

But there’s more

work yet for Charlie Parker et al. to do in finally

finishing off the MA economy once and for all. And so his

energy secretary, Climate Katie Theoharides, said last week

that she and her boss remain totally committed to doubling

the state’s gasoline tax next year – it’s an “investment,”

you see.

The hacks call it

the Transportation Climate Initiative (TCI) but it’s really

just a TAX.

The TCI will be

Baker’s next move to demolish what remains of the Dreaded

Private Sector, in order to enrich even further the bloated

hackerama, which, by the way, has suffered almost no

layoffs, and none whatsoever in the most worthless

payroll-patriot-infested agencies like UMass, Massport and

the courts....

C’mon Tall Deval,

we all know you can do an even worse job. Just concentrate

on those key industries – “indices,” as you called them

Tuesday. And you can encourage more rioting and looting –

excuse me, “large gatherings.”

Maskachusetts – we

can do better. We can get the unemployment rate up to 20%!

Well done, Tall

Deval.

The Boston Herald

Wednesday, June 24, 2020

Thanks Charlie Baker, jobless rate a national disgrace

By Howie Carr

A $1.1 billion

budget bill is on its way to the Senate after the House

passed the legislation Wednesday and added on an additional

$17.5 million in COVID-19 spending.

Passage of the

legislation comes as Gov. Charlie Baker has poked lawmakers

to quickly get it to his desk so that the state can take

advantage of federal reimbursements for costs related to the

respiratory virus. The House approved the bill on a 158-0

vote....

Rep. Tricia

Farley-Bouvier filed an unsuccessful amendment that would

have directed the commissioner of revenue to send stimulus

checks to state residents who file taxes using an Individual

Taxpayer Identification Number. People who have an ITIN are

disqualified from receiving unemployment benefits and

stimulus checks from the CARES Act. There was no direct vote

on the amendment, and it was dispensed with in a larger

amendment.

The Pittsfield

Democrat's amendment would have sent qualified ITIN

taxpayers $1,200 if filing individually or $2,400 if filing

jointly, with an additional $500 for each dependent. Farley-Bouvier

said if a U.S. citizen files their taxes with someone who is

an ITIN holder, they and their children will become

ineligible for unemployment benefits and stimulus checks.

"It's cruel and

it's stupid," she told the News Service after the session

ended. "The issue of how we treat immigrants justly and

fairly and how their wellbeing is connected to the rest of

the commonwealth's being is a conversation that needs to

keep happening." ...

Michlewitz said it

was important for the House to pass the bill Wednesday to

secure Massachusetts' place in line for federal

reimbursement of COVID-related costs.

"As the federal

government is inundated with reimbursement requests, it is

vital that we maximize our options and take advantage of the

FEMA funds while we can. That is why it is so critical that

we pass this today and get it closer to the governor's desk,

so that we do not fall far behind other states in the race

for federal reimbursement," Michlewitz said.

Last week, the

governor prodded lawmakers to act on the supplemental budget

bill he filed in May, saying that "the clock's ticking" and

his administration cannot seek money from available federal

pools to cover COVID-related expenses until the Legislature

finalizes the bill....

Separately

Wednesday, Michlewitz told the News Service that the House

Ways and Means Committee will not have a full-year budget

proposal ready by July 1, the deadline given to the

committee in a set of emergency rules adopted by the House

in May.

State House News

Service

Wednesday, June 24, 2020

House Passes $1.1 Bil Budget to Cover COVID-19 Costs

State in "Race" to Net Federal Reimbursements

Already behind

schedule in May, the House adopted emergency rules to govern

its operations during the pandemic, including a new target

date for Democratic leaders to produce an annual state

budget.

But with that new

July 1 deadline approaching, House Ways and Means Chairman

Aaron Michlewitz told the News Service Wednesday that his

committee does not expect to present a full-year spending

plan by next week.

The House will

have to "move off" that date as it continues to try to

anticipate how the economy will react to the slow reopening

of businesses and the threat of a second wave of the

coronavirus in the fall, Michlewitz said. There is also the

possibility that Congress will come up with additional

federal relief that could dramatically change the state's

fortunes, although the outcome of those talks remains

uncertain.

The rules package

adopted in May called for the Ways and Means Committee to

produce a fiscal 2021 budget bill by the time the new fiscal

year begins on July 1. Leaders are now looking into whether

that rule must be changed, or whether the House's passage of

a $5.25 billion interim budget filed by Gov. Charlie Baker

to keep government funded through July can be interpreted to

satisfy the requirement....

"We don't have a

good sort of vision into tax revenue for the next fiscal

year yet, and it's going to take a little while to get

there," [Gov.] Baker said. "The folks in the Legislature are

moving a one-twelfth budget, which we filed several days ago

to ensure that payments continue into July, but they and we

both recognize that we're not going to know exactly where we

are on the budget until we get a little more information."

Baker said he was

"optimistic" that Congress would come through with

additional aid for states, and described his administration

as "very engaged" with the state's Congressional delegation

and "others" on that front....

Despite collapsing

state tax revenues, the Baker administration opted against a

formal downward revision of fiscal 2020 tax collections,

which could have triggered the need for immediate spending

cuts or other budget-balancing plans. A revision to the

fiscal 2021 revenue estimate is expected, though, once an

annual budget bill starts to advance in the Legislature.

Baker in January

filed a $44.6 billion fiscal 2021 budget, which remains

under review in the House.

State House News

Service

Wednesday, June 24, 2020

House Budget Appears Unlikely by July 1 Deadline

Heffernan Sees "One or More" Interim Budgets

House and Senate

leaders reached an agreement Thursday to keep the MBTA's

Fiscal and Management Control Board in place for another

year and to scrap a planned increase in road and bridge

maintenance funding, effectively sealing the fate of the

annual reimbursement program.

After weeks of

disagreement between the two branches, the Senate adopted

what one top lawmaker called a "compromise" that will direct

$200 million toward the Chapter 90 program next fiscal year

and will extend the about-to-expire board tasked with

overseeing and managing the T until June 30, 2021.

Settling on a $200

million allocation toward road repairs represents a retreat

from the $300 million that both the House and Senate had

already approved in earlier legislation, reducing the

funding level to where it has remained almost every single

year for the past decade....

House leaders

appeared to be prodding the Senate to join them in passing a

major tax package, and it's unclear whether the Senate's

retreat on Chapter 90 funding means that branch has given up

on tax-raising initiatives to fund transportation this year.

State House News

Service

Wednesday, June 24, 2020

House, Senate Agree on Road Funding, MBTA Board

Chapter 90 Cut to $200 Mill, FMCB Extended One Year

COVID-19 continues

to run its invisible thread through the public health,

economic and racial justice crises that are raging across

the United States as summer gets underway. Three months into

the pandemic, case counts are exploding in big states like

California, Florida and Texas, threatening progress in

others, like Massachusetts, and influencing the constant

public, fiscal, and monetary policy responses to the

evolving situation.

Mask-wearing has

proven effective in slowing the spread of the deadly virus,

but many Americans have chosen not to cover up or practice

social distancing and the virus is leaping from one infected

person to the next at an alarming rate. Concerns over a

second wave in the fall have taken a backseat to the more

immediate responses to the outbreaks across the country that

are occurring right now.

In Massachusetts,

state officials are monitoring the situation nationally, and

reactions to it from Washington, while trying to focus on

their own agenda with five weeks left for formal legislative

sessions this year. The Senate plans next Thursday to pass

its own versions of a $1.1 billion, House-approved, COVID-19

spending bill and a long-term capital bill to invest in

technology upgrades that have become even more critical in

pandemic times when people are working together, but on

computers.

Here are some of

the issues to watch in the week ahead:

-- COVID - PHASE

3: Pressure will surely begin to mount on Gov. Baker next

week to announce whether Phase 3 of the state's economic

reopening plan will get underway on Monday, July 6. That's

the earliest possible date for the third phase, which will

include the return of gyms, sporting events, casinos,

museums, and movie theaters, but Baker has said that his

decisions will be driven by data and not arbitrary dates....

-- THE BUDGET:

Massachusetts begins fiscal 2021 on Wednesday with a $5.25

billion interim budget in place, a COVID-19 spending bill up

for consideration in the Senate on Thursday, and Gov.

Charlie Baker's $44.6 billion fiscal 2021 budget beginning

its sixth month under review in the House Ways and Means

Committee.

Before deciding on

how to proceed, Baker and legislative leaders are waiting to

see how tax collections perform in the wake of the decision

to push the annual tax-filing deadline forward from April 15

to July 15.

They are also

waiting to see when and whether Congress will pass another

major stimulus bill providing additional support to

individuals, businesses, and state and local governments

struggling due to the pandemic's impacts....

-- TRANSPORTATION

POLICY/FUNDING: At the start of 2020, transportation funding

and policy appeared to represent the largest and most

important topic that the Legislature would address this

year. The pandemic quickly changed that and heading down the

stretch toward July 31 it seems possible that lawmakers are

poised to just punt some of the once-critical issues into

2021.

The House in March

approved an $18 billion transportation bond bill and a $500

million tax and fee package designed, in part, to improve

MBTA, regional transit and other transportation services.

The Senate hasn't taken up either of those bills, although

Senate President Spilka has expressed interest in passing a

bond bill....

House leaders have

prodded the Senate to pass a transportation finance bill,

saying a $300 million local road and bridge repair agenda

could be supported with more revenues. This week, however,

in a response that might indicate where senators stand on

new taxes right now, the Senate opted to cut the Chapter 90

program authorization back to $200 million.

State House News

Service

Friday, June 26, 2020

Advances - Week of June 28, 2020

Massachusetts is

one of the most heavily Democratic states in the country.

What can Republicans do about it?

Not much, at the

moment. But some state Republican officials see a

longer-term strategy.

Before the GOP can

make meaningful inroads in state and federal offices, they

say, the party may need to make more meaningful inroads

closer to home.

“Running for local

office is the most effective activism a Republican can do,”

said Jim Lyons, chairman of the Massachusetts Republican

Party, in an email message to New Boston Post. “By running,

and winning, you create a team at the local level that can

fight against ill-conceived overrides, stifling zoning laws,

and useless plastic bag bans, just to name a few issues. And

it always helps for statewide candidates to have that

Republican selectman as a local contact, and eventually,

that Republican selectman could become a governor or a

United States senator, as has happened in the past.”

The party has

attracted a number of first-time candidates for relatively

high office in recent years, most of whom have lost. But

there is another way. As Lyons notes, prominent

Massachusetts Republicans got their start in local politics.

The New Boston

Post

Sunday, June 21, 2020

Want To Grow the Massachusetts Republican Party?

Run For Local Office, Politicians Say |

Chip Ford's CLT

Commentary

Another CLT Proposition 2˝

founding father left us this week. K. Heinz

Muehlmann passed away from cancer on June 17 at the age

of 81. While Warren T. Brookes, then a Boston

Herald business columnist who chronicled California's

Proposition 13, which revolutionized property taxes

eventually nationwide, advocated for a similar law in

Massachusetts, it was Boston economist Dr. K. Heinz

Muehlmann who crunched the numbers and created the

structure for property tax relief in Massachusetts.

It became CLT's Proposition 2˝

and was adopted by a vast majority of voters on the 1980

ballot — and Massachusetts became the second state to

adopt property tax limitations.

Proposition 2˝

will mark 40 years as CLT's property tax law of the land in November.

Heinz was born and

educated in Austria — an actual "Austrian

School" economist who followed in the footsteps of the great Ludwig

von Mises, Frederich von Hayek, and Murray Rothbard. As noted in

his obituary (full obit below):

Heinz’ signature public

accomplishment was creating the economics behind Massachusetts

Proposition 2˝, which limits property tax assessments and automobile

excise tax levies. The late Barbara Anderson, Executive

Director of Citizens for Limited Taxation, shepherded Proposition 2˝

to a ballot victory. They became life-long friends.

Barbara referred to Heinz as her “favorite local Austrian-born

economist” tutor, who supported small government, protection of

private property, and individualism in general.

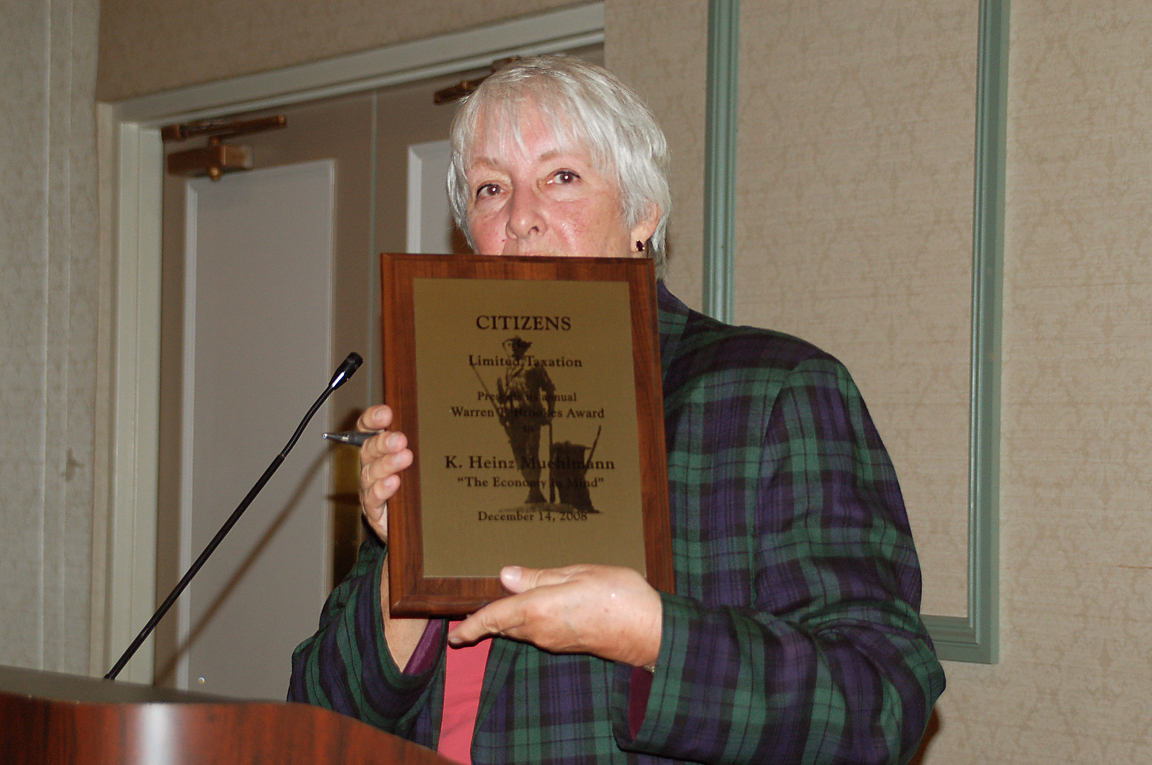

CLT

presented Heinz — a CLT member since 1979 — with its

most prestigious "Warren T. Brookes Award" at

CLT's 2008 Awards Brunch. Unfortunately

Barbara presented it to Heinz in absentia — as he

was in Austria visiting his family at the time of our

event. (Barbara and I delivered it to him when he

returned home.)

CLICK

IMAGE TO ENLARGE

Barbara Anderson, "director

emeritus,"

presents the 2008 Warren T. Brookes Award to the absent Heinz Muehlmann,

a longtime CLT member and true "Austrian Economist." (Dec. 14, 2008)

Barbara and I spent many evenings over the years as

guests of Heinz and his wife Brigitte for their

Christmas holiday dinners with us at their Waltham home;

they were excellent cooks and hosts. In turn, they

were our guests for a few summer cookouts in Barbara's

and my yard in Marblehead. I took Heinz out

sailing aboard "Chip Ahoy" on one of those occasions

upon discovering he was an accomplished sailor.

Farewell Heinz my

friend. May you have fair winds and following seas in your new

voyage.

Another stealth

assault on Proposition

2˝ arose last week, another

devious scheme that was fortunately defeated at town meeting by

residents of Longmeadow. They knew what was coming for them if it

ever passed. The Springfield Republican reported on Friday

("Longmeadow Town Meeting rejects Prop. 2˝ cut"):

Longmeadow Town Meeting voters rejected a move by

the town Selectboard and the Finance Committee to

begin the process of exempting the town from

Proposition 2˝ tax limitations. A request for

funds to cover initial engineering costs for a

Longmeadow Street rebuild was also voted down.

Tuesday’s outdoor meeting on the grounds of

Longmeadow High School Tuesday evening allowed

generous social distancing for the 277 registered

voters who attended.

Article 14 asked voters to allow the town to begin

home rule legislation that could eventually exempt

town government from the 2.5 percent tax cap

mandated by Proposition 2˝.

The Chair of the Select Board, Thomas Lachiusa said

home rule legislation would begin a process to allow

the town to permanently exempt itself from having to

adhere to the 2.5 percent cap on yearly property

taxes.

“This is something both the Select Board and the

Finance Committee have been looking at for a long

time as a solution to protect the town from a

drastic property value decreases,” he said. If that

were to happen we would see a lot of cuts to

education, programs and services we have all come to

expect. It would be a progressive loss of services

as each year we would have to make more and more

cuts."

Lachuisa said the vote Tuesday would have allowed

the town to approach the state legislature for home

rule legislation. Once the state government

approves, the town would have two more votes, Town

Meeting and the second a town-wide ballot

initiative, to either pass the measure or reject it.

A home rule petition,

if passed by voters at town meeting, would be sent to the Legislature

for permission to proceed. If adopted, it would apply only to that

municipality requesting it, in effect repealing Proposition 2˝ in that

town. But it wouldn't be long before elected officials in the

other 350 cities and towns demanded their own Prop. 2˝ "exemption,"

before Prop. 2˝ died a painful

death of a thousand cuts.

Caution: It

failed in Longmeadow among the 277 registered voters who attended town

meeting. The Takers have revealed their latest strategy. Expect the

teachers and public employee unions and their More Is Never Enough

(MINE) ilk to grab onto this

scheme and pack town meetings across the state in the future.

The State House

News Service reported on Friday ("Baker Signs Budget to Fund

Government in July"):

Gov.

Charlie Baker on Friday morning signed an interim budget to keep

state government running when the new fiscal year begins on July 1

since the Legislature has not yet developed a fiscal 2021 spending

plan.

The

governor filed the $5.25 billion interim budget a week ago and said

Friday that the amount is sufficient to fund government operations

through July and "will make it possible for the treasurer to deliver

local aid payments to cities and towns."

House

and Senate leaders have not laid out a timeline yet for completion

of a budget for the full fiscal year.

I still don't get

it. In the last CLT Update (June 21: "Another

Beacon Hill Helter-Skelter Week") in my commentary I

wrote:

Stop

and think about this. A $5.25 billion "interim spending bill" to

get the state through July, one month. Carried through the fiscal

year that would create a $63 billion FY2021 budget for the coming 12

months. That exceeds even the $44.6 billion Baker proposed in

January, which itself was $1.3 billion more than

last year's $43.3 budget.

On Wednesday the

State House News Service reported ("House Passes $1.1 Bil

Budget to Cover COVID-19 Costs; State in 'Race' to Net

Federal Reimbursements"):

A

$1.1 billion budget bill is on its way to the Senate after the House

passed the legislation Wednesday and added on an additional $17.5

million in COVID-19 spending.

Passage of the legislation comes as Gov. Charlie Baker has poked

lawmakers to quickly get it to his desk so that the state can take

advantage of federal reimbursements for costs related to the

respiratory virus. The House approved the bill on a 158-0 vote.

On Monday the

State House News Service reported ("Facing $2.25B Shortfall,

Baker Admin Hasn’t Updated Revenue Expectations"):

Governors from both major parties over the years have turned to

midyear budget cuts when it's become apparent that tax revenues are

not going to keep pace with spending. These 9C cuts are named for

the section of state finance law that authorizes governors to take

unilateral budget-fixing actions.

But

since March, in the face of the precedent-setting evaporation of tax

receipts brought on by forced business closures, the Baker

administration has not revised revenue expectations -- which could

have triggered 9C cuts -- or announced other specific

budget-balancing plans.

State

laws require the state Administration and Finance Secretary, in this

case Michael Heffernan, to notify the governor in writing whenever

he believes budgeted revenues will be insufficient to meet

expenditures.

Gov. Baker seems intent on spending more

and dodging required spending cuts due to the extreme revenue shortfall.

It appears that he's whistling past the graveyard, hoping the economic

depression he created isn't really happening, or will just go away

without consequences — or that the federal

government will ride to his rescue and bail out Massachusetts and the

other tax-and-spend progressive states.

On Beacon Hill they're winging it day by

day, changing rules on the fly. The News Service reported on

Wednesday ("House Budget Appears Unlikely by July 1 Deadline; Heffernan

Sees 'One or More' Interim Budgets:"):

Already behind schedule

in May, the House adopted emergency rules to govern its operations

during the pandemic, including a new target date for Democratic

leaders to produce an annual state budget.

But with that new July

1 deadline approaching, House Ways and Means Chairman Aaron

Michlewitz told the News Service Wednesday that his committee does

not expect to present a full-year spending plan by next week.

The House will have to

"move off" that date as it continues to try to anticipate how the

economy will react to the slow reopening of businesses and the

threat of a second wave of the coronavirus in the fall, Michlewitz

said. There is also the possibility that Congress will come up with

additional federal relief that could dramatically change the state's

fortunes, although the outcome of those talks remains uncertain.

The rules package

adopted in May called for the Ways and Means Committee to produce a

fiscal 2021 budget bill by the time the new fiscal year begins on

July 1. Leaders are now looking into whether that rule must be

changed, or whether the House's passage of a $5.25 billion interim

budget filed by Gov. Charlie Baker to keep government funded through

July can be interpreted to satisfy the requirement.

In another report on Wednesday ("House,

Senate Agree on Road Funding, MBTA Board; Chapter 90 Cut to $200 Mill,

FMCB Extended One Year") the News Service added:

House and Senate

leaders reached an agreement Thursday to keep the MBTA's Fiscal and

Management Control Board in place for another year and to scrap a

planned increase in road and bridge maintenance funding, effectively

sealing the fate of the annual reimbursement program....

Settling on a $200

million allocation toward road repairs represents a retreat from the

$300 million that both the House and Senate had already approved in

earlier legislation, reducing the funding level to where it has

remained almost every single year for the past decade....

House leaders appeared

to be prodding the Senate to join them in passing a major tax

package, and it's unclear whether the Senate's retreat on Chapter 90

funding means that branch has given up on tax-raising initiatives to

fund transportation this year.

On Friday CommonWealth Magazine took a deep

look into the ongoing rivalry and acrimony between the House and the

Senate in pushing each chamber's policy preferences, and why it's so

difficult to get anything accomplished. In "Tensions rising

between House and Senate" it reports:

Just as the Legislature

heads into crunch time on Beacon Hill, tensions appear to be rising

between the House and Senate over how bills should emerge from a key

committee.

Under the Legislature’s

rules, all bills dealing with health care are supposed to be

reviewed and voted on by the Joint Committee on Health Care

Financing before moving on to votes in the two branches. But the two

chairs of that committee – Sen. Cindy Friedman of Arlington and Rep.

Dan Cullinane of Dorchester – are barely on speaking terms these

days.

Cullinane says Friedman

has refused to work with him to schedule votes on all but a few

bills since he took over as acting chair of the committee early this

year. He said he is leaving the Legislature at the end of this

session and has no political agenda other than moving forward good

public policy.

“Plain and simple, the

Senate chair refuses to negotiate, refuses to engage in any

meaningful conversation,” he said. “The Senate did not walk away

from the negotiating table, they never showed up.” ...

On Thursday, the Senate

passed a major health care bill backed by Friedman and Senate

President Karen Spilka. The bill did not go through the joint

committee, but instead originated in the Senate Ways and Means

Committee, which Cullinane says is a violation of the Legislature’s

rules. He said the Senate has bypassed the joint committee and

passed other health care measures in recent months....

On the Senate floor

Thursday, Friedman also urged the rejection of a House measure that

would have extended until the end of the year the reporting date for

the more than 300 bills remaining in the Health Care Financing

Committee. Cullinane said he filed the extension because he didn’t

want to see the bills die, but Friedman indicated on the Senate

floor that she didn’t care....

Cullinane says

Friedman’s approach subverts the whole point of the committee, which

is to have members and staff with an expertise in health care review

all health care legislation....

To an outsider, it all

sounds like much ado about nothing. After all, a Senate bill can’t

become law unless the House goes along, so it’s not as if the two

branches will never have to negotiate. But the Senate’s attempt to

bypass a key legislative committee and gain more control of its

legislation is stirring anger in the House, anger that is likely to

surface somewhere down the road.

It's often considered beneficial for

taxpayers when the Legislature can't agree on legislating; for example,

the

Senate so far declining to take up and pass the House's $500 million

gas-and-diesel tax hike. Apparently that's just the tip of an

iceberg — the rancor appears to be rooted

much deeper.

Some good news, sort of. The date of

the annual sales tax holiday weekend has been announced: "The

state's 6.25 percent sales tax will be waived on many purchases the

weekend of Saturday, Aug. 29 and Sunday, Aug. 30, the Baker

administration announced Tuesday," State House News Service reported.

"The annual tax holiday, made a permanent fixture as part of a 2018

'grand bargain' law."

You may recall that this was part of the

Legislature's and Governor's agreement two years ago to eliminate a

couple of threatening ballot questions heading for the 2018 ballot.

The State House News Service at the time

reported:

"The Mass.

Retailers Association dropped its proposal for a sales tax increase,

but accepted an increase in the minimum wage, in return for which it

won an end to the state law requiring workers be paid

time-and-a-half for Sunday and holiday hours. The minimum wage

increase from $11 to $15 an hour will occur in five years, not four,

as the Raise Up ballot question proposes, and tipped workers won't

see their minimum rise as much as in the question. There will be a

permanent annual sales tax holiday on state lawbooks (again, if the

governor signs the compromise). Raise Up and the unions won their

long-sought paid leave program, covering sick time, family care,

maternity and paternity, and bereavement absences from the

workplace."

Instead of the sales tax being reduced from 6.25% to 5%

as the popular ballot question proposed (CLT members

helped get some of the signatures for it), the Retailers

Association got a permanent sales tax holiday weekend.

In my

CLT commentary back then I wrote:

The probable rollback

of the sales tax was eliminated from the ballot, but the statutory

sales tax holiday weekend every August it also sought was created

(until the Legislature next decides "the state can't afford it," I

presume).

So the good news is that

two years later the Legislature and Governor haven't

eliminated the sales tax holiday weekend yet. I'm

quite impressed and somewhat surprised.

The New Boston Post reported last Sunday

("Want To Grow the Massachusetts Republican Party? Run For Local

Office, Politicians Say"):

Massachusetts is one of the most heavily Democratic

states in the country. What can Republicans do about

it?

Not much, at the moment. But some state Republican

officials see a longer-term strategy.

Before the GOP can make meaningful inroads in state

and federal offices, they say, the party may need to

make more meaningful inroads closer to home.

“Running for local office is the most effective

activism a Republican can do,” said Jim Lyons,

chairman of the Massachusetts Republican Party, in

an email message to New Boston Post. “By running,

and winning, you create a team at the local level

that can fight against ill-conceived overrides,

stifling zoning laws, and useless plastic bag bans,

just to name a few issues. And it always helps for

statewide candidates to have that Republican

selectman as a local contact, and eventually, that

Republican selectman could become a governor or a

United States senator, as has happened in the past.”

The party has attracted a number of first-time

candidates for relatively high office in recent

years, most of whom have lost. But there is another

way. As Lyons notes, prominent Massachusetts

Republicans got their start in local politics. . . .

With Democrats crushing

Republicans in the Legislature by 137-31

in the House and 36-4 in

the Senate at last count, doing anything new is

better than doing what the GOP has done for much too

long in Massachusetts. As candidate Trump famously

chided, "What have you got to lose?"

|

|

|

|

Chip Ford

Executive Director |

|

|

K. Heinz Muehlmann

September 28, 1938 - June 17, 2020

Obituary

Wareham

— Karl Heinz Muehlmann, 81, of

Waltham, passed away at his summer home in Wareham on

Wednesday June 17, 2020. Wareham

— Karl Heinz Muehlmann, 81, of

Waltham, passed away at his summer home in Wareham on

Wednesday June 17, 2020.

During his career, Dr. Heinz Muehlmann was an economic

advisor to Massachusetts Governors Frank Sargent, Ed King,

Bill Weld, and Paul Cellucci. In addition, he was the Chief

Economist for Jobs for Massachusetts, Inc., and Associated

Industries of Massachusetts.

Early in his career, while teaching Economics at Bentley

University, Heinz consulted for the Department of Commerce

and Development. With assistance from Robert Kenney and Rena

Kottcamp, Heinz prepared an analysis of the Massachusetts

economy, which became known as “The Muehlmann Report on

Economic Strategy.”

Heinz’ signature public accomplishment was creating the

economics behind Massachusetts Proposition 2˝, which limits

property tax assessments and automobile excise tax levies.

The late Barbara Anderson, Executive Director of Citizens

for Limited Taxation, shepherded Proposition 2˝ to a ballot

victory. They became life-long friends. Barbara referred to

Heinz as her “favorite local Austrian-born economist” tutor,

who supported small government, protection of private

property, and individualism in general.

Economics was Heinz’ second career. When he arrived in the

U.S., he brought with him a nurtured childhood from his home

town Zell am See, a solid education from Salzburg, a degree

from the Vienna University of Economics and Business, and a

growth mindset and self-discipline. Heinz was also a

state-certified ski instructor, who had perfected his

signature “Follow me” pedagogy. For his students, this was

easier said than done, because Heinz negotiated any triple

black diamond slope gracefully in blue jeans, his favorite

ski pants.

Heinz’ first role in the U.S. was to coach the Northern

Michigan University ski team, where he also earned a Master

of Arts from the School of Graduate Studies, learned about

the regional economy as well as Midwestern values and life.

Heinz continued teaching skiing professionally in New

England, in the Sugarloaf and Stratton mountain resorts. He

abandoned his professional ski instructor career at age 33

and turned to what Richard Cunningham called “an economic

mountain top called Jobs.”

Besides skiing, Heinz was a lifelong competitive athlete,

who enjoyed playing tennis, sailing, fishing (especially

striped bass and bluefish), and lobstering. He liked flying

gliders in the Alps in earlier years. Heinz also became an

ice hockey referee, which led to a role at the 1964 Olympic

Games in Innsbruck. His trophies included the first place in

the Vienna Academic Championship slalom competition, mixed

doubles at Sippican Tennis Club and Mount Auburn Club,

arguably with the help of his infamous drop shot, as well as

Senior races at Bourne Cove Yacht Club.

Heinz’ favorite role was, however, being the father of his

three children Sonja, Martha, and Carl. A family man, he

loved teaching them sports, taking them out water skiing and

fishing on Buzzards Bay, going on ski trips and vacations

with them, and passing on to them what he knew. One of

Carl’s favorite memories is a day, which they started in

Wareham catching lobsters in Buzzard’s Bay before driving to

Killington, Vermont, for a day of skiing, and returning to

Wareham in the evening. In recent years, Heinz awaited his

grandchildren with his boat and fishing rods ready for

adventure when they visited Wareham in the summer.

Heinz welcomed opportunities to be creative, whether as an

economist or in the kitchen, initially cooking and baking

for his family, and later also for friends. A signature

three-course meal would start with his Manhattan Clam

Chowder, followed by a main course of Wiener Schnitzel from

turkey tenderloins with parsley fingerling potatoes and

cranberry sauce. Heinz’ popular Linzer Torte made from

scratch with walnuts and red currant jelly, often prepared

on Sunday afternoons during football season, would be served

for dessert. His last invention was the Linzer Cupcake, a

small Linzer Torte designed to serve one person.

A son of the late Hermann and Martha (Vorderegger) Muehlmann,

Heinz will be missed greatly by many. He is survived by

Brigitte Wudernitz Muehlmann, his second wife and soul mate,

whom he met in Boston after his first marriage had ended in

divorce, his children Sonja Fay Muehlmann and her husband

Philip Chu of Monrovia, CA, Martha Muehlmann of Mautern,

Austria, and Carl Eliot Muehlmann and his wife Amalia

Daskalakis of New York, NY, his grandchildren Amelia Mary

Chu, Collis Eliot Chu, Maya Juliana Muehlmann and Livio

Nikola Muehlmann, brothers Hermann and Hansjoerg Muehlmann,

loving nieces and nephews, cousins, and loyal friends near

and far.

Heinz was able to spend his final days at home and die in

his wife’s arms as he had wished, thanks to the

compassionate and open-minded continuous care provided by

Community Nurse Home Care of Fairhaven. Gifts to the agency

in Heinz’ memory would be appreciated. URL:

https://www.communitynurse.com/donate/

Funeral services in Mount Auburn Cemetery, Cambridge, and in

Zell am See, Austria, will be private. A celebration of

Heinz’ life will be held at Sippican Tennis Club at a later

date to be announced. Heinz’ memoir “Slalom Racer” is in

progress. To leave a message of condolence for the family,

please visit

www.warehamvillagefuneralhome.com.

Dear Brigitte and family,

It

was so sad to hear the bad news of Heinz' passing.

Heinz was so incredibly helpful in getting our

Proposition 2˝ drafted and passed into Massachusetts law

forty years ago. Barbara Anderson and I loved the

time we spent together with Heinz and Brigitte for the

excellent holiday dinners at their home, the occasional

cookouts at our place in Marblehead, and the sail aboard

my Catalina 22 in Salem Sound.

Heinz was a master of so many talents and skills.

He will be sorely missed.

Chip Ford

Executive Director

Citizens for Limited Taxation

Full News Reports Follow

(excerpted above)

The

Springfield

Republican

Friday, June 26, 2020

Longmeadow Town Meeting rejects Prop. 2˝ cut and Route 5

rebuild

By Dave Canton

Longmeadow Town Meeting voters rejected a move by the town

Selectboard and the Finance Committee to begin the process

of exempting the town from Proposition 2˝ tax limitations. A

request for funds to cover initial engineering costs for a

Longmeadow Street rebuild was also voted down.

Tuesday’s outdoor meeting on the grounds of Longmeadow High

School Tuesday evening allowed generous social distancing

for the 277 registered voters who attended.

Article 14 asked voters to allow the town to begin home rule

legislation that could eventually exempt town government

from the 2.5 percent tax cap mandated by Proposition 2˝.

The Chair of the Select Board, Thomas Lachiusa said home

rule legislation would begin a process to allow the town to

permanently exempt itself from having to adhere to the 2.5

percent cap on yearly property taxes.

“This is something both the Select Board and the Finance

Committee have been looking at for a long time as a solution

to protect the town from a drastic property value

decreases,” he said. If that were to happen we would see a

lot of cuts to education, programs and services we have all

come to expect. It would be a progressive loss of services

as each year we would have to make more and more cuts."

Lachuisa said the vote Tuesday would have allowed the town

to approach the state legislature for home rule legislation.

Once the state government approves, the town would have two

more votes, Town Meeting and the second a town-wide ballot

initiative, to either pass the measure or reject it.

Lachuisa pointed out that Longmeadow is pretty much limited

to residential property taxes for its operations. The town

does not have an industrial or commercial base to buffer

town residents.

“We are all optimistic that Springfield does well, that the

casino attracts a lot of attention to the city, Because

Longmeadow property values rise and far as Springfield

does,” he said. “But we need a plan beyond that.”

Town Meeting also rejected a proposed allocation of

$100,000, part of a $400,000 preliminary engineering package

on the reconstruction of Route 5, Longmeadow Street.

Selectman Marc Strange said the funding would include the

initial survey and engineering needed before the state would

consider funding the actual work.

“It’s needed he said. “The road is heavily used, and I don’t

see how you can not do it. It’s not a good time to ask but

it is necessary.”

The work would include bringing the roadway up to Department

of Transportation standards, improving drainage and

repaving.

Green Willow Drive resident John Friedson was concerned that

the Route 5 reconstruction was a step too far for many older

residents.

‘We have seniors here on fixed incomes. Those of us who

would like to keep our houses are getting increasingly

concerned about the town’s appetite for spending, the

appetite for debt, for increasing taxes at every possible

stage and not casting a strong, judicious eye on what the

requests are for expenditures in a time of economic collapse

and pandemic,” he said. “This particular case, Route 5 is

not perfect, and yeah, we’d like to get state money. But,

the last I noticed from my checkbook I pay state taxes, too.

This is not the year, this is not the time for spending on

things that are unnecessary, in my opinion.”

State House

News Service

Friday, June 26, 2020

Weekly Roundup - Fear and Loathing in Massachusetts

Recap and analysis of the week in state government

By Matt Murphy

The pandemic tables have turned, in many ways, with the

coronavirus now boiling over in southern and western states

like Florida and Texas, while in the Northeast the pot lid

is only slightly rattling.

But Bay Staters just venturing out into the wild are doing

so with great trepidation, many still uncomfortable with the

idea of eating out or riding the T. Forget about getting on

a plane.

New polling from Suffolk University for WGBH News, the State

House News Service, The Boston Globe and MassLive found that

more than 66 percent of residents are living with more than

normal levels of fear and anxiety. And perhaps that's to be

expected.

Not only are they living through the worst pandemic in over

a century, but society is also struggling to come to terms

with generations of racism and the inequities that built

into every system, from housing to law enforcement.

Racism, in fact, ranked among the biggest problems residents

see facing the state today, which helped to explain the

sweeping support found in the Suffolk/WGBH/SHNS poll for

broad reforms to policing.

House Speaker Robert DeLeo also got behind the idea of

making Juneteenth (June 19) a state holiday to mark the day

that the last slaves were freed in Texas. The amendment

filed by Rep. Bud Williams of Springfield was tacked onto a

$1.1 billion COVID-19 spending bill.

Facing up to a past of racism collided this week with the

need to confront a more recent history of injustice.

Despite the fact that 81 percent of residents still think

Baker is doing a good job handling the pandemic, there

wasn't enough support to sugarcoat a 174-page report that

painted a hideous portrait of the leadership at the Holyoke

Soldiers' Home.

Mark Pearlstein, a former federal prosecutor tapped by Baker

to conduct an independent investigation into the deaths of

at least 76 veterans from COVID-19 at the home, found that a

series of "utterly baffling" decisions led to the creation

of conditions that allowed the virus to wreak havoc.

The Pearlstein report focused on the decisions that were

made that allowed COVID-19 to flourish inside the walls of

the veterans' home, but it also laid out warning signs that

Superintendent Bennett Walsh may have been underqualified to

run the facility before the start of the pandemic.

Pearlstein raised questions about what qualifications

officials saw in Walsh to back up his hiring as

superintendent of a long-term care facility, and laid out in

detail his failings as a manager and the administration's

lack of vision into the Soldiers' Home that might have

prompted them to intervene.

"Veterans who deserve the best from state government got

exactly the opposite, and there's no excuse or plausible

explanation for that," Baker said.

The fallout from the report claimed the job of Veterans'

Affairs Secretary Francisco Urena, who was asked to resign

in light of Pearlstein's conclusions. He was replaced on an

acting basis by Cheryl Poppe, the superintendent of the

Chelsea Soldiers' Home. And Baker said he would move to

terminate Walsh, who has been on administrative leave.

Over 2,000 teachers in 47 school districts have also been

informed that they will be without a job in the fall,

according to the Massachusetts Teachers Association, which

is the state's largest teachers' union.

The layoff and non-renewal notices signal the high level of

uncertainty under which local officials are operating as the

Legislature has yet to finalize a budget for the upcoming

fiscal year, and the Baker administration is currently

level-funding local aid to cities and towns in the

short-term.

Schools did get a bit more clarity about what the fall might

look like, though.

The Department of Elementary and Secondary Education put out

new guidance this week for schools to contemplate as they

think about reopening in the fall, including a continuation

of remote learning, staggered in-person learning schedules

for students, or a full return with mandatory mask-wearing

and desks at least three feet, but preferably six, apart.

Lunches would be eaten in the classroom, but temperature

checks would not be required.

The guidelines for reopening gave school administrators a

lot to think about, and the Baker administration dangled a

little more than $200 million in federal relief funding that

would help districts buy the supplies they need to safely

reopen.

The governor said it could be at least another month before

the state is ready to commit to Chapter 70 aid for the next

school year. Baker signed a $5.25 billion interim budget on

Friday that will keep government operating through at least

July as budget writers in the House, Senate and

administration struggle to peer into the future.

"We don't have a good sort of vision into tax revenue for

the next fiscal year yet, and it's going to take a little

while to get there," Baker said.

House Ways and Means Chairman Aaron Michlewitz said the

target the House set for his committee in May to release a

fiscal 2021 budget proposal by July 1 is no longer feasible,

and not likely to be met by next Wednesday.

Guessing exactly what the Legislature will be able to

accomplish by July 31 could be a fun parlor game.

House Speaker Robert DeLeo has said policing reform is on

that list, but he has not yet surfaced a proposal to respond

to the legislation filed by Baker to create a police

licensing system that would give the state new power to hold

cops to standards of law enforcement and professionalism,

including bans on the use of forceful tactics like

chokeholds.

The governor got an earful on a visit this week to Mattapan

from a woman upset that Baker's bill proposed to pay police

up to $5,000 to get the additional training they need to be

sensitive to racial biases. He was there to announce the

selection of a minority-owned firm to redevelop the last

parcel on the former Boston State Hospital campus.

Rep. Russell Holmes, who has made no secret of his own

issues with the DeLeo, came to Baker's defense, crediting

him with at least putting a plan on paper.

Baker also put a plan on paper to implement the

recommendations of the Pearlstein report for improved

oversight of the state's two Soldiers' Homes. But DeLeo

signaled he's in no rush to put that bill on the floor,

signaling his own intent to ask House lawmakers next week to

support their own investigation through a Special

Legislative Oversight Committee.

Rep. Linda Dean Campbell, a veteran, recommended the

oversight committee to DeLeo, and envisions the probe to

last into next year, and to focus both on what happened in

Holyoke, as well as how the state can broadly improve care

for veterans.

The Senate has not yet signed on to the oversight committee

concept, and comity was something in short supply between

the branches to start the week.

The Senate passed health care legislation Thursday to

enshrine some of the pandemic protocols that have led to

massive growth in the use of telemedicine, and to put an end

to surprise billing and expand the scope of practices for

some medical professionals.

The topic of health care, however, was a sensitive one given

the accusation made by some House lawmakers -- namely House

Majority Leader Ron Mariano and Rep. Dan Cullinane -- that

the Senate has been a bad partner in trying to negotiate a

path forward with limited time until the end of the session.

With the House seeking to extend the life of some health

care bills, the Senate responded to the criticism by

rejecting their extension request, initiating a

parliamentary feud that doesn't bode well for much of

anything getting accomplished in the health care space over

the next month.

"At some point, because we were being asked to extend and

extend, how many times does someone say no before you stop

asking them out?" Sen. Cindy Friedman said about the House.

Given the bad blood, it was a small win that the House and

Senate were able to agree to a "compromise" over local road

repair funding and the future of the MBTA's oversight board.

Rather than remake the temporary Fiscal and Management

Control Board into something more permanent, Democratic

leaders agreed to simply extend its authorization for

another year. And on the issue of Chapter 90 funding, it's

also the status quo moving forward.

Both branches earlier this year had passed legislation to

bump Chapter 90 funding to $300 million for the year,

delighting cities and towns after years of lobbying for more

money.

But with the pandemic crushing state finances and the Senate

apparently unwilling to take up the House's transportation

tax bill, the compromise was to punt.

STORY OF THE WEEK: Report finds they served their country,

but in the end their state didn't do them a service.

CommonWealth

Magazine

Friday, June 26, 2020

Tensions rising between House and Senate

By Bruce Mohl - Editor

Just as the Legislature heads into crunch time on Beacon

Hill, tensions appear to be rising between the House and

Senate over how bills should emerge from a key committee.

Under the Legislature’s rules, all bills dealing with health

care are supposed to be reviewed and voted on by the Joint

Committee on Health Care Financing before moving on to votes

in the two branches. But the two chairs of that committee –

Sen. Cindy Friedman of Arlington and Rep. Dan Cullinane of

Dorchester – are barely on speaking terms these days.

Cullinane says Friedman has refused to work with him to

schedule votes on all but a few bills since he took over as

acting chair of the committee early this year. He said he is

leaving the Legislature at the end of this session and has

no political agenda other than moving forward good public

policy.

“Plain and simple, the Senate chair refuses to negotiate,

refuses to engage in any meaningful conversation,” he said.

“The Senate did not walk away from the negotiating table,

they never showed up.”

A similar dustup occurred in 2015, when then-Senate

President Stan Rosenberg complained that too many of the

Senate’s bills ended up stalled in joint House-Senate

committees which tend to be dominated by members of the

larger House. The tension became so high that the Senate

voted 39-0 to develop plans to pull members out of the joint

committees and establish its own panels, an approach that

came to be known as the “nuclear option.” House Speaker

Robert DeLeo at the time was dismissive of the Senate’s push

for change, calling it an “impolitic and manufactured

reaction to a non-existent problem.”

Eventually, cooler heads prevailed, some minor changes in

joint rules were approved, and the two branches went back to

doing business. But a new battle over the same issue seems

to be emerging again with the Health Care Financing

Committee.