|

Post Office Box 1147 ●

Marblehead, Massachusetts 01945 ●

(781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

45 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Tuesday, November 26, 2019

"A new

review is coming for an old law, Prop 2½"

Gov. Baker sells out taxpayers

|

Here in

Massachusetts, Proposition 2½ is not just the law of the

land. It’s become a tradition, maybe almost a religion for

some.

But changes could

be coming now that the Legislature has decided it’s time to

give a fresh look to this four-decade-old cap on municipal

property taxes.

Nestled deep

within the educational funding bill that Governor Charlie

Baker signed on Tuesday is a proposal that is modest in

description but ambitious in scope: a requirement for the

administration to analyze the impact Proposition 2½ has had

on municipal budgets and potentially make recommendations to

mitigate those constraints....

A wave of antitax

sentiment pushed Prop 2½ onto the ballot in 1980, and then

into the law books. The two basic tenets: Municipalities

can’t increase tax collections by more than 2.5 percent a

year (not including new development), and overall

collections are capped at 2.5 percent of the value of all

taxable property within their borders.

It’s this second

element of Prop 2½ that has officials in slow-growth

communities particularly concerned. The annual spending

threshold can be overridden by voters. The ceiling can be

temporarily surpassed as well, by excluding new debt for

projects such as school buildings. But those votes can be

tough: Just ask the folks in Holyoke, where a debt-exclusion

vote on Nov. 5 for two new middle schools failed,

jeopardizing roughly $75 million in state school building

aid....

Many of the

communities with the highest tax rates are west of

Worcester. In fact, five of the top 10 are in the district

of new state senator Jo Comerford.

During her

campaign last year, the Northampton Democrat regularly heard

from towns approaching the ceiling and she wondered why they

were clustered together, in Western Mass. The reason?

Because economic prosperity has passed them by.

So she convinced

her Senate colleagues to include a Prop 2½ analysis in their

version of the ed-funding bill. The measure survived

House-Senate negotiations, and landed on Baker’s desk for

his signature.

Senator Eric

Lesser welcomes the review. The Democrat from Longfellow is

seeing many of the same issues in his district. The new ed-funding

bill helps school districts with many low-income families,

but Lesser worries many middle-class communities are being

left out.

Comerford and

Lesser say they simply want to make sure regional inequities

get reflected in future state aid formulas. They’re not,

they say, looking to open up the property-tax spigot.

But Chip Ford

isn’t so sure about that. Ford waves the Prop 2½ flag as

executive director for Citizens for Limited Taxation,

the antitax group that helped make the original levy limits

a reality four decades ago. Ford wrote to Baker on Sunday,

urging him to amend the bill and send it back to the

Legislature with the Prop 2½ language excised. (Baker

declined to do so.) Ford said reforms to Prop 2½ should be

discussed openly, not moved along in the back of an

education funding bill....

Mark Gold, a

member of Longmeadow’s select board ... would like the

option to move past the 2½ percent ceiling, to avoid

compromising valuable services, although that might be a

tough sell at the State House.

The Boston Globe

Tuesday, November 26, 2019

A new review is coming for an old law, Prop 2½

By Jon Chesto

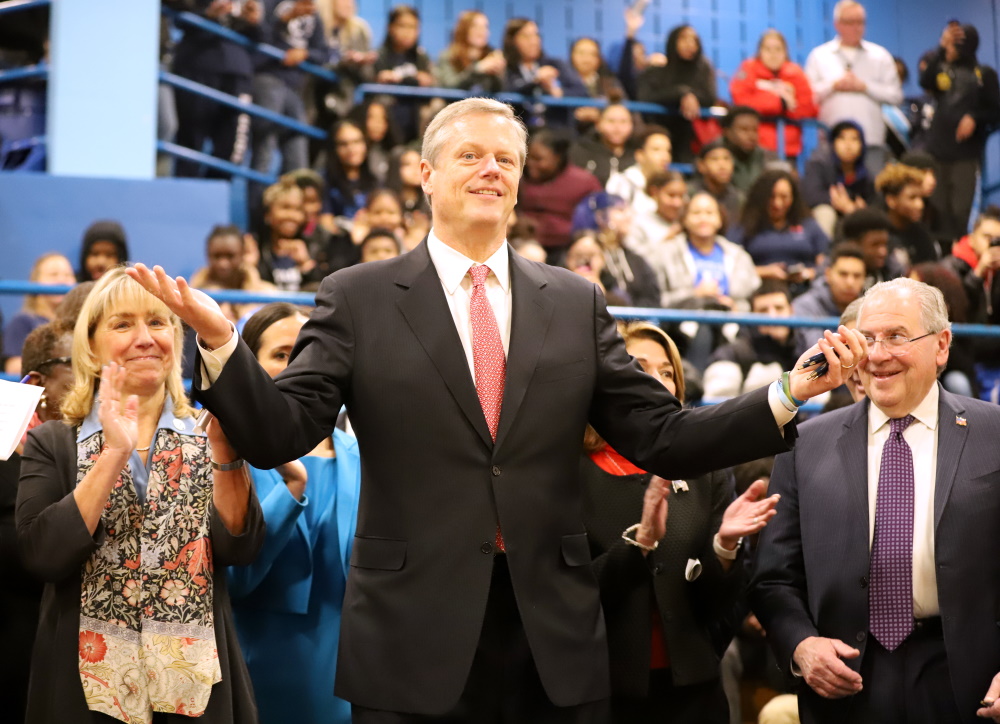

Gov. Charlie Baker gestured to the

audience in the gymnasium of Boston's English High School

after signing a landmark education funding reform law on

Tuesday. [Photo: Sam Doran/SHNS]

Massachusetts will

invest an additional $1.5 billion in K-12 public education

over the next seven years after Gov. Charlie Baker signed a

funding reform bill, touted by supporters as a generational

change, into law Tuesday.

The legislation

directs the bulk of new funding toward districts weighed

down by cost drivers, aiming to close opportunity gaps that

for years have led to disparate educational outcomes across

the state.

The law comes four

years after a commission warned that Massachusetts was

underestimating the actual cost of education by $1 billion

annually and more than a year after the last attempt to

update the system fell short. Now the focus shifts to a

different challenge: following through on the commitment to

ramp up funding for schools starting next year.

"If there's one

thing I've learned in my 63 years, it's that talent is

evenly distributed. What's not evenly distributed is

opportunity, and there's a reason why this is the Student

Opportunity Act," Baker said at a bill-signing ceremony

hosted at English High School. "This legislation is about

making sure every kid in the commonwealth of Mass.,

regardless of where they live or where they're from or where

they go to school, has the opportunity to get the education

they need to be great."

The law requires

the state to spend an additional $1.4 billion — before

inflation — on Chapter 70 aid paid to districts, another $90

million on a special education circuit breaker and $10

million for an education innovation trust fund. It does not

outline a year-by-year funding schedule, but requires the

full investment to be made by fiscal year 2027.

"While we have

much to celebrate today and the signing of this piece of

legislation is historic, I'd like to point out that this is

just the first step down what I predict is going to be not

an easy road," Education Committee Co-chair Rep. Alice

Peisch said at Tuesday's ceremony....

"Every single

child deserves access to an excellent public education,"

Sen. Jason Lewis, co-chair of the Education Committee, said

during the ceremony. "Massachusetts will now have the most

progressive school funding formula in the nation, designed

to meaningfully address the troubling, very troubling,

opportunity and achievement gaps that persist in our public

education system." ...

After praising

passage of the bill, some education advocates turned their

attention to higher education as the next target.

Massachusetts Teachers Association President Merrie Najimy

said that group would renew its focus on a $500 million bill

increasing funding for state colleges and university and

freezing tuition.

"When that is

achieved, Massachusetts really will deserve to be called

'the education state,'" Najimy said in a statement.

Baker signed the

bill alongside legislative leaders and Boston Mayor Martin

Walsh at Jamaica Plain's English High School, within

Chang-Diaz's district.

State House News Service

Tuesday, November 26, 2019

Baker Signs $1.5 Billion Education Bill

|

|

Chip Ford's CLT

Commentary

Nobody can say

we didn't fight with everything we had at our disposal

to the last man standing. Thank you to those CLT

members who called their state reps, senators, and the

governor's office yesterday as we requested, and thank

you to those who let me know they'd done so. It

wasn't enough, but the powers-that-be know we're still

out here willing and ready to fight. And that CLT

is watching every step they take, every move they make,

and we are catching them at it —

even their obscure little schemes buried deeply out of

sight.

Frankly, I

didn't expect much from Gov. Baker

— but it was worth the attempt by bringing it to

his attention. I recall his strong affirmation of

Proposition 2½ when

he spoke his high praise for Barbara Anderson at

the

celebration of life service we held in memory of her soon after

she passed away. Those who attended might remember

Charlie's words as well:

“Prop 2½ was probably the single most important

thing to happen to fiscal and economic policy in the

Commonwealth of Mass in my lifetime. Period.

Anyone who suggests otherwise is just kidding

themselves.”

I thought he

meant those words. I really did, and hoped

he'd reflect on them; that, with the current attack on

Proposition 2½ brought to

his personal attention, he'd stand up and defend it.

Charlie's rosy oratory really meant nothing to him,

especially when it counted. His high praise of

Barbara and her greatest accomplishment was

little more than the usual blather from another

insincere politician.

I had intended

to send out the letter, which we delivered to his senior

staff to pass on to him, as a news release early

yesterday morning. Then it was decided that we

should give Gov. Baker some time to consider our request

before turning the media loose on him. (It was

published on the

CLT website on Sunday evening.) Maybe that was

a mistake; maybe it made no difference.

Jon Chesto, a

business reporter at The Boston Globe, called

yesterday morning to interview me about our opposition

to the conference committee bill. I mentioned that

CLT had sent a letter to the governor requesting he

strike the sentence weakening our Proposition 2½.

He asked for a

copy of our letter; I sent it to him.

We lost this one, so now what?

Buried deeply in the new law Governor Baker

proudly signed

today in part it states:

Not later than December 1,

2020, the division of local services within the

department of revenue and the department of

elementary and secondary education shall file a

report with the clerks of the senate and the house

of representatives, the chairs of the joint

committee on education and the chairs of the senate

and house committees on ways and means.

The report shall include, but

not be limited to:

(vi) an analysis of the impact

of Proposition 2½ on the ability of municipalities

to make their required local contributions in the

short-term and long-term and recommendations to

mitigate the constraints of Proposition 2½;

Next December

CLT will be watching and

awaiting the creation and filing of the required report

composed by the Division of Local Services and the

Department of Elementary and Secondary Education.

And then a new battle will likely need to be launched to

preserve and protect Proposition 2½.

This one is over. The next

one has yet to begin.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

|

The Boston Globe

Tuesday, November 26, 2019

A new review is coming for an

old law, Prop 2½

By Jon Chesto

Here in Massachusetts, Proposition 2½ is not

just the law of the land. It’s become a

tradition, maybe almost a religion for some.

But changes could be coming now that the

Legislature has decided it’s time to give a

fresh look to this four-decade-old cap on

municipal property taxes.

Nestled deep within the educational funding bill

that Governor Charlie Baker signed on Tuesday is

a proposal that is modest in description but

ambitious in scope: a requirement for the

administration to analyze the impact Proposition

2½ has had on municipal budgets and potentially

make recommendations to mitigate those

constraints.

The driving force behind the measure: the vast

economic disparity between the western and

eastern parts of the state. Growth continues

unabated on the eastern end, as Boston booms and

prospers. Out west, though, many cities and

towns struggle to raise enough money to pay

their bills; property values and new

construction simply have not kept pace with

municipal expenses.

A wave of antitax sentiment pushed Prop 2½ onto

the ballot in 1980, and then into the law books.

The two basic tenets: Municipalities can’t

increase tax collections by more than 2.5

percent a year (not including new development),

and overall collections are capped at 2.5

percent of the value of all taxable property

within their borders.

It’s this second element of Prop 2½ that has

officials in slow-growth communities

particularly concerned. The annual spending

threshold can be overridden by voters. The

ceiling can be temporarily surpassed as well, by

excluding new debt for projects such as school

buildings. But those votes can be tough: Just

ask the folks in Holyoke, where a debt-exclusion

vote on Nov. 5 for two new middle schools

failed, jeopardizing roughly $75 million in

state school building aid.

Even successful debt overrides can only go so

far, though. Operating budgets keep rising.

Sooner or later, the inexorable ceiling looms:

$25 per $1,000 of a municipality’s total

property value.

Many of the communities with the highest tax

rates are west of Worcester. In fact, five of

the top 10 are in the district of new state

senator Jo Comerford.

During her campaign last year, the Northampton

Democrat regularly heard from towns approaching

the ceiling and she wondered why they were

clustered together, in Western Mass. The reason?

Because economic prosperity has passed them by.

So she convinced her Senate colleagues to

include a Prop 2½ analysis in their version of

the ed-funding bill. The measure survived

House-Senate negotiations, and landed on Baker’s

desk for his signature.

Senator Eric Lesser welcomes the review. The

Democrat from Longfellow is seeing many of the

same issues in his district. The new ed-funding

bill helps school districts with many low-income

families, but Lesser worries many middle-class

communities are being left out.

Comerford and Lesser say they simply want to

make sure regional inequities get reflected in

future state aid formulas. They’re not, they

say, looking to open up the property-tax spigot.

But Chip Ford isn’t so sure about that.

Ford waves the Prop 2½ flag as executive

director for Citizens for Limited Taxation,

the antitax group that helped make the original

levy limits a reality four decades ago. Ford

wrote to Baker on Sunday, urging him to amend

the bill and send it back to the Legislature

with the Prop 2½ language excised. (Baker

declined to do so.) Ford said reforms to Prop 2½

should be discussed openly, not moved along in

the back of an education funding bill.

For Mark Gold, a member of Longmeadow’s select

board, there’s no time to waste. At $24.09 per

$1,000, Longmeadow had the highest residential

property tax rate of any town in the last fiscal

year, reflecting the area’s stalled economic

growth. By Gold’s estimates, Longmeadow will hit

the dreaded ceiling in four years. Town

officials can delay the inevitable by moving

some services, such as trash collection, off the

budget books and charging fees for them. There’s

a surplus property Longmeadow could sell. But

steps like those only buy momentary relief.

Longmeadow could be on a collision course with

its finances that could lead to layoffs of

teachers and firefighters.

Gold would like the option to move past the 2½

percent ceiling, to avoid compromising valuable

services, although that might be a tough sell at

the State House.

Local business leaders are also watching the

situation closely. Tricia Canavan, who runs a

Springfield-based staffing service and is vice

chair of the Western Massachusetts Economic

Development Council, says the outcome in Holyoke

underscores the precarious school funding

situation many communities in the region face.

Maybe, she says, this review of Prop 2½ could

eventually bring more state aid to the region.

Boston’s rising tide is only so powerful. It’s

the Tale of Two States, again. Western Mass.

might seem far away from policymakers on Beacon

Hill. But this latest development should remind

them why they can’t ignore the region’s

persistent economic challenges.

State House News

Service

Tuesday, November 26, 2019

Baker Signs $1.5 Billion Education Bill

By Chris Lisinski

Massachusetts will invest an additional $1.5

billion in K-12 public education over the next

seven years after Gov. Charlie Baker signed a

funding reform bill, touted by supporters as a

generational change, into law Tuesday.

The legislation directs the bulk of new funding

toward districts weighed down by cost drivers,

aiming to close opportunity gaps that for years

have led to disparate educational outcomes

across the state.

The law comes four years after a commission

warned that Massachusetts was underestimating

the actual cost of education by $1 billion

annually and more than a year after the last

attempt to update the system fell short. Now the

focus shifts to a different challenge: following

through on the commitment to ramp up funding for

schools starting next year.

"If there's one thing I've learned in my 63

years, it's that talent is evenly distributed.

What's not evenly distributed is opportunity,

and there's a reason why this is the Student

Opportunity Act," Baker said at a bill-signing

ceremony hosted at English High School. "This

legislation is about making sure every kid in

the commonwealth of Mass., regardless of where

they live or where they're from or where they go

to school, has the opportunity to get the

education they need to be great."

The law requires the state to spend an

additional $1.4 billion — before inflation — on

Chapter 70 aid paid to districts, another $90

million on a special education circuit breaker

and $10 million for an education innovation

trust fund. It does not outline a year-by-year

funding schedule, but requires the full

investment to be made by fiscal year 2027.

Under the law, the state will also ramp up its

reimbursement paid to communities to cover 100

percent of charter school tuition within three

years. Charter school funding been a divisive

issue over the years.

"While we have much to celebrate today and the

signing of this piece of legislation is

historic, I'd like to point out that this is

just the first step down what I predict is going

to be not an easy road," Education Committee

Co-chair Rep. Alice Peisch said at Tuesday's

ceremony.

Authors believe the updated formula will

properly account for four areas of cost

underestimated by the current system: employee

health care, special education, and high numbers

of both low-income students and English language

learners.

By properly funding those areas, officials hope

to help close persistent gaps that exist between

districts.

"Every single child deserves access to an

excellent public education," Sen. Jason Lewis,

co-chair of the Education Committee, said during

the ceremony. "Massachusetts will now have the

most progressive school funding formula in the

nation, designed to meaningfully address the

troubling, very troubling, opportunity and

achievement gaps that persist in our public

education system."

The path to updating the foundation budget —

implemented in 1993 in the wake of a court

ruling that Massachusetts had a constitutional

duty to provide sufficient education for all

students — has been rocky.

A commission in 2015 identified the four major

cost drivers and warned about the chronic

underinvestment. Since then, lawmakers had been

unable to get a compromise bill over the finish

line, even as advocates continued pressure and

lawsuits were threatened or filed, until this

year.

The version they sent Baker last week closely

mirrors the bill that emerged from the Joint

Education Committee, including language on

accountability to ensure the money is spent on

student-centric purposes as intended.

American Federation of Teachers Massachusetts

President Beth Kontos said the new law is "a

true game-changer for low-income students and

their communities."

"The Student Opportunity Act will deliver

increased state funding to every district, but

the greatest increases, rightfully, will go to

low-income districts whose students have the

greatest needs," Kontos said. "This means that

students of all backgrounds will finally be able

to enjoy the benefits that their peers in

wealthier districts take for granted —

everything from smaller classes and additional

counselors to up-to-date classroom supplies and

more art, music and enrichment."

Lawmakers did not include any new taxes or fees

to fund the steady investment increase, so the

funding will have to come from existing revenue

streams unless a future Legislature revisits the

topic.

The education funding will not receive a

carveout in the annual consensus revenue process

as other transfers such as the MBTA and pension

funds do, but Baker said last week schools will

"have to be sort of first-in when we make

decisions about what the budget looks like."

The full scale of the law may not be felt for

several years, but some impacts will be quick:

districts must complete their accountability

plans for how to use additional funding by

April.

"I expect it will be a handful of years, but the

good news is there is a real sense of urgency

baked into this bill," said Sen. Sonia

Chang-Diaz, who served as Education Committee

chair last session and has long been an advocate

of school funding changes. "The plans from

districts are due on April 1, just a few months

from now. That will be our first look at how

districts intend to use these new resources.

Particularly for those higher-poverty

communities, significant money is going to start

hitting the ground right away, within a year."

After praising passage of the bill, some

education advocates turned their attention to

higher education as the next target.

Massachusetts Teachers Association President

Merrie Najimy said that group would renew its

focus on a $500 million bill increasing funding

for state colleges and university and freezing

tuition.

"When that is achieved, Massachusetts really

will deserve to be called 'the education

state,'" Najimy said in a statement.

Baker signed the bill alongside legislative

leaders and Boston Mayor Martin Walsh at Jamaica

Plain's English High School, within Chang-Diaz's

district.

Chang-Diaz told reporters she did not play a

role in selecting where the ceremony would take

place, but she said the school is a fitting

representation of where the impact will be felt

most strongly.

"It's really meaningful, certainly for me

personally, but really for many of the advocates

who held this bill high for so many years,"

Chang-Diaz said. "To have it be right here in a

district that's a high-impact district at a

school that predominantly serves disadvantaged

students, low-income students, students of

color, English learners — everything this bill

is about targeting."

In a common ceremonial step, Baker handed out

pens to about a dozen lawmakers right after

signing the bill.

When Chang-Diaz received hers, she thrust it

straight into the air in celebration.

Said Lewis, "This moment for me ranks right up

there with my wedding day and the birth of my

two daughters."

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

BACK TO CLT

HOMEPAGE

|