|

Post Office Box 1147 ●

Marblehead, Massachusetts 01945 ●

(781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

45 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Wednesday, July 17, 2019

Mass.

set to win dead last state budget trophy, again

|

It's only Tuesday and hopes are already

fading for a deal this week on the overdue state budget.

Breaking a two-week pattern, the House

adjourned Tuesday morning without plans to meet on

Wednesday. Since July 1, the budget's due date, both

branches have been holding near-daily sessions while they

await a report from the six lawmakers charged in early June

with coming up with the final fiscal 2020 spending plan.

A day after he expressed hope for a budget

"by the end of this week," Second Assistant Majority Leader

Paul Donato, who presided over Tuesday's session, pushed out

expectations another seven days.

"You know [conferees are] going to work the

weekend, so we might as well just let them do their thing,

come back, tell us when, and hopefully we can meet formally

one day next week and put this budget to bed," Donato told

the News Service. There's "no sense" in continuing daily

sessions when it's "kind of obvious" there will be no

imminent report, he said.

With reports that the Ohio Legislature was

advancing its budget deal Tuesday, it appears that one year

after Massachusetts was the last state in the country to

pass its budget, it will be last again this year, and the

tentative timeline for action is growing longer not

shorter....

With their closed-door meetings now in their

47th day, this is the longest state budget negotiation

without a resolution in at least a decade. Lawmakers refuse

to say what's holding up the budget and the conference

committee met publicly only once, voting immediately to

close the meetings....

This year marks the 20th anniversary of the

famous late state budget of 1999, which also featured a test

of wills among House and Senate Democrats.

Former House Speaker Thomas Finneran, former

Senate President Thomas Birmingham and their Ways and Means

chairs Rep. Paul Haley and Sen. Mark Montigny got so dug in

on budget differences that they didn't agree to a fiscal

2000 budget bill until November.

In 1999, as former Gov. Paul Cellucci

awaited the spending bill, budget negotiators scrapped over

issues ranging from early childhood education to K-12

education funding, asset maintenance, the use of the tobacco

settlement funds, MBTA funding, senior pharmacy benefits,

and economic/tax policies.

The fiscal 2000 budget totaled $20.9

billion. The spending bills currently in conference

committee authorize $42.8 billion in spending.

State House News Service

Tuesday, July 16, 2019

New Mass. budget timeline is next week, "hopefully"

The fiscal year 2020 budget is not the only

long-expected Beacon Hill legislation running late: after

initially suggesting a K-12 education funding bill would be

released in June, Education Committee co-chair Sen. Jason

Lewis said Tuesday that he now expects the work to be

completed "in the near future."

Lewis and his fellow chair, Rep. Alice

Peisch, did not offer specific details on the legislation

following an unrelated committee hearing Tuesday, almost

four months after members heard hours of testimony about

funding reform and exactly two months after the Senate chair

targeted June as a possible goal....

Last year, legislative leaders failed to

reach an agreement at the end of formal lawmaking sessions

in July. Activists this year are frustrated that an

education funding bill has not progressed, and the state

faces a lawsuit over the issue.

State House News Service

Tuesday, July 16, 2019

Ed funding bill timeline now "the near future"

Anti-poverty advocates are making a major

push to expand welfare benefits as part of a campaign to

lift tens of thousands of children out of "deep poverty."

One proposal, backed by more than 80 mostly

Democratic lawmakers, would increase welfare benefits

through the state’s primary cash assistance program, known

as Transitional Aid to Families with Dependent Children, by

10% every year until the payments reach 50% of the federal

poverty level. That would raise the benefits for an average

family of three to $889 a month....

Lawmakers behind the proposal say $50

million more in state aid over a four-year period will only

bring families up to what is considered "deep poverty," or

half the federal poverty level. For a family of four, "deep

poverty" is considered $10,665 or less....

Combined the state spends roughly $16

million a month on the programs.

Under current law, a recipient is limited to

receiving welfare for two years in any five-year period. The

family of three in the program collects a maximum of $593

per month.

Last year, lawmakers pushed through a repeal

of state rules that denied additional benefits for children

born into families already receiving assistance from the

state.

Repealing the so-called "cap on kids" means

that a parent receiving benefits now gets an additional $100

in monthly benefits for each child, regardless of whether

the child is born before or after the parent became eligible

for benefits. Families also receive an additional $300

yearly clothing allowance per child....

Lawmakers are weighing a separate proposal,

also heard by the committee on Tuesday, to create a pilot

project extending benefits for families that reach a "cliff"

when they hit the two-year limit on receiving benefits.

Another proposal, filed by Sen. Joan Lovely,

D-Salem, asks health officials to study creating a diaper

subsidy for low-income families with children under 2 years

old....

If the plan takes shape and is approved,

Massachusetts would be the first state to provide diaper

subsidies to welfare beneficiaries.

In 2016, California lawmakers passed a bill

giving a $50 monthly diaper voucher to families on welfare

with children. Then-Gov. Jerry Brown vetoed the plan, citing

its fiscal impact.

The (Gloucester) Daily Times

Wednesday, July 17, 2019

Expanded welfare benefits pushed

Group says hike would lift thousands out of 'deep' poverty

After helping this year to repeal a law

preventing families on public assistance from receiving

additional benefits when they have another child, activists

now want to secure further changes through a bill (S 36 / H

102) that increases support offered through the Transitional

Aid to Families with Dependent Children program.

Rep. Marjorie Decker, who authored the House

bill, called it the "next step" for lawmakers after lifted

the so-called "cap on kids" law in April....

The legislation, which already has more than

100 sponsors across the House and Senate, would increase the

value of the aid every year until it reaches 50 percent of

the federal poverty line, the threshold marking "deep

poverty."

The welfare cap repeal drew bipartisan

support earlier this year, passing 155-1 in the House and

37-1 in the Senate before the Legislature overrode

Republican Gov. Charlie Baker's veto.

During Tuesday's hearing, the new proposal

also had Republican backing: Rep. Michael Soter, the

committee's ranking minority member, said he "proudly"

supports the bill, even after taking "a lot of heat" for his

vote in favor of the cap repeal.

State House News Service

Tuesday, July 16, 2019

Broad support for welfare cash assistance increase

Carbon emissions are soon to become the

latest portal the state uses to reach the wallets of

Massachusetts taxpayers. A bill is gaining momentum on

Beacon Hill that would place a fee on carbon emissions

produced by fossil fuels.

The carbon tax would start at $20 per ton

and increase every year by $5, allegedly until the fee

reaches $40 per ton. Thirty percent of the collected revenue

— estimated to be between $400M and $600M per year — would

be siphoned off for state and local government to embark on

renewable energy projects....

Something we know such a tax would do is

punish the people and businesses in the commonwealth.

As the Herald’s Mary Markos reported, a

Beacon Hill Institute study found that the average

Massachusetts household would see its tax bill increase by

$755 in the first year. By the fifth year, that annual tax

load would increase to $1,263. In addition, Massachusetts

would see a loss of 11,090 private sector jobs in its first

year, increasing to 18,240 by its fifth, according to the

study.

The analysis laid out in the study is stark:

“The tax would also, in the first year, reduce business

investment by $925 million, disposable income by $1,950

million, and private employment by 11,090 jobs. As time

passed and the tax rate rose, the carbon tax would produce

more substantial economic effects. By 2026, investment would

fall by $1,585 million, disposable income by $3,266 million,

and private employment by 18,240 jobs.”

Those are staggering numbers and all for

what?

To what degree will reducing the carbon

emissions in a small state with a population of under 7

million affect a globe full of 7.53 billion people?

The answer is, likely not at all....

No to the carbon tax. It’s just another tax

under a trendy name.

A Boston Herald editorial

Tuesday, July 16, 2019

Carbon tax just another painful fee

Bay Staters will feel the pain

|

|

Chip Ford's CLT

Commentary

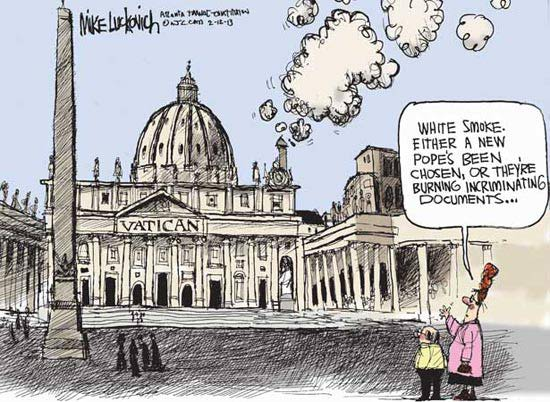

“When the cardinals failed to elect a pope for

more than two years after the death of Clement

IV (1265–68), the local magistrate locked the

electors in the episcopal palace, removed the

roof (subjecting the cardinals to the elements),

and allowed the cardinals nothing but bread and

water until they made their selection, Gregory X

(1271–76).”

https://www.britannica.com/topic/conclave

Maybe locking

them up, shutting off the air-conditioning, and putting

them on bread and water rations might be productive for

intransigent Massachusetts legislators who don't seem

able to agree on a budget?

Yesterday "The

Best Legislature Money Can Buy" punted again. The

"full-time" Legislature gave up the ghost of passing a

state budget until possibly next week

— "hopefully" that is.

"hopefully" that is.

It appears

that Massachusetts will once again win the distinction

of the state with the last budget in the nation, as Ohio

— the other state legislature that

has yet to pass one — apparently will pass its

two-year budget later today. Note that Ohio has a

two-year budget (as does Maine, Kentucky and a dozen

other states) so will not waste time going through the

same budget circus again next year. A one-and-done

state budget per two-year election cycle, until a new

legislature is elected and sworn in.

According to

The Vindicator (Youngstown, Ohio) yesterday ("Ohio

lawmakers hashing out state budget are set to reconvene"):

. . .

Many of [GOP Gov. Mike DeWine's] spending priorities

were reflected in the chambers’ budget proposals,

though legislative leaders and the conference

committee still had to sort out hundreds of

differences, including on tax cuts.

Among the sticking points was a $250,000 business

deduction that DeWine favors keeping. GOP Senate

President Larry Obhof wanted to retain the $250,000

deduction and also raise a 3 percent limit on income

above $250,000. Republican House Speaker Larry

Householder agreed with raising that limit but

wanted to reduce the deduction to $100,000.

For personal income taxes, the Senate version would

have eliminated the bottom two tax brackets and

decreased tax rates for the others by 8% over two

years. The House proposed a 6.6 percent cut.

Today, The

Columbus (Ohio) Dispatch reports ("$69B

state budget with tax cuts, health-care transparency on

way to approval"):

Ohio’s

$69 billion operating budget won approval 75-15 — 17

days after it was due — Wednesday afternoon from the

House.

The two-year spending plan now goes to the Senate,

whose anticipated OK would send the budget to Gov.

Mike DeWine, who must sign the measure and issue

line-item vetoes by the end of the day....

The key takeaway for most Ohioans is an

across-the-board state income tax cut of 4 percent,

along with elimination of the lowest two brackets.

That means workers earning less than $21,750 a year

would pay no state income taxes.

The income-tax reduction was even higher initially,

but had to be trimmed after lawmakers restored $1.2

billion in annual tax breaks for many smaller

businesses — beating back a House attempt to cut it

almost in half.

Don't abused

taxpayers wish the Massachusetts Legislature's most-holy

conclave of its six Cardinals of the Conference

Committee were hobbled by such disagreements!

The

Legislature is not doing much better with what has been

promoted as an alleged big priority: K-12

education funding bill. On Tuesday Education

Committee co-chair Sen. Jason Lewis said that he now

expects the work to be completed "in the near future."

Co-chair Rep. Alice Peisch said the senator's earlier

mention of June was "never a deadline" and, asked when a

final proposal might be released, responded, "We're

working on it."

The State

House News Service noted: "Last year, legislative

leaders failed to reach an agreement at the end of

formal lawmaking sessions in July."

This is what

happens when an alleged "full-time legislature" has far

too much time on its hands for mischief and far too many

irons in the fire.

Now that

they've overturned the so-called "Cap

on Kids" of course The Takers are back for

more, more, always more.

Rep. Marjorie

Decker, who authored the House bill (S-36 / H-102),

called it the "next step." Everything they do is

just one step toward the "next step," and the "next

step" is never enough.

If this

taxpayer handout also passes it would raise the benefits

for an average family of three to $889 a month.

Advocates estimate it will cost taxpayers $50 million

more in state aid over a four-year period

— but if that "average

family" increases to four, five, or more under repeal of

the "Cap on Kids" then expect that estimate to become

inoperative and the cost to steadily increase. I

wonder if a beneficiary must be a Massachusetts citizen

to qualify, or just a resident?

Meanwhile, "A

bill is gaining momentum on Beacon Hill that would place

a fee on carbon emissions produced by fossil fuels,"

according to The Boston Herald. The

study released by the Beacon Hill Institute projects

that "the average Massachusetts household would see its

tax bill increase by $755 in the first year. By the

fifth year, that annual tax load would increase to

$1,263. In addition, Massachusetts would see a loss of

11,090 private sector jobs in its first year, increasing

to 18,240 by its fifth."

This is above,

beyond, and on top of the schemes to tax-and-spend, or

borrow-then-tax, additional billions to fund "climate

mitigation, "climate resiliency," or whatever we're

calling it today.

Now 48 days

late, the Legislature still can't decide how to spend

$42.8 billion. Where do they think the funds for

all this additional spending is going to come

from?

Obviously this

is why the Legislature intends to take up "revenue

enhancement" in the coming months.

And why we

must all be prepared to act when the inevitable

onslaught arrives.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

|

State House News

Service

Tuesday, July 16, 2019

New Mass. budget timeline is next week,

"hopefully"

By Sam Doran and Michael P. Norton

It's only Tuesday and hopes are already fading

for a deal this week on the overdue state

budget.

Breaking a two-week pattern, the House adjourned

Tuesday morning without plans to meet on

Wednesday. Since July 1, the budget's due date,

both branches have been holding near-daily

sessions while they await a report from the six

lawmakers charged in early June with coming up

with the final fiscal 2020 spending plan.

A day after he expressed hope for a budget "by

the end of this week," Second Assistant Majority

Leader Paul Donato, who presided over Tuesday's

session, pushed out expectations another seven

days.

"You know [conferees are] going to work the

weekend, so we might as well just let them do

their thing, come back, tell us when, and

hopefully we can meet formally one day next week

and put this budget to bed," Donato told the

News Service. There's "no sense" in continuing

daily sessions when it's "kind of obvious" there

will be no imminent report, he said.

With reports that the Ohio Legislature was

advancing its budget deal Tuesday, it appears

that one year after Massachusetts was the last

state in the country to pass its budget, it will

be last again this year, and the tentative

timeline for action is growing longer not

shorter.

Leading House and Senate Democrats have

repeatedly said talks are progressing and that

negotiators are "pretty close" to a deal, but

negotiating teams led by Rep. Aaron Michlewitz

of Boston and Sen. Michael Rodrigues of Westport

continue to bump heads on unspecified topics.

Michlewitz and Rodrigues are both new to their

posts and it's not clear how deeply their

supervisors, House Speaker Robert DeLeo and

Senate President Karen Spilka, both former Ways

and Means chairs, are involved in the talks.

Expressing concern about the situation, DeLeo

late Monday asked Gov. Charlie Baker to file

another "one-twelfth" interim budget to keep

state paychecks and services flowing without

interruption in August in case House and Senate

Democrats prolong the negotiations.

In the absence of a completed budget, the state

is paying its bills based on a $5 billion

interim budget that lawmakers quickly passed

after it was offered by Baker.

With their closed-door meetings now in their

47th day, this is the longest state budget

negotiation without a resolution in at least a

decade. Lawmakers refuse to say what's holding

up the budget and the conference committee met

publicly only once, voting immediately to close

the meetings.

Asked Tuesday if a speedbump popped up in

conference that made the optimism suddenly fade,

Donato said, "No, they're still focusing in on

the same issues that they've been dealing with

from the beginning, and that's been the

problem."

Some issues holding up the talks are

"philosophical" while some are "very technical,"

said Donato, who is not one of the six

conference committee members.

At this time last year, Spilka, then Ways and

Means chair, was closing in on a late budget

deal with former House Ways and Means Chair

Jeffrey Sanchez, a $41.9 billion agreement that

was ratified by both branches on July 18, 2018.

That negotiation was punctuated by a big markup

in expected tax revenues, a $667 million

increase over the revenue estimate that had been

used when the fiscal 2019 spending plan was

first developed. Tax revenues in fiscal 2019 are

way up, casting doubt on the fiscal 2020

estimate's accuracy.

On July 26, 2018, the same day Baker signed the

fiscal 2019 budget, the Senate elected Spilka as

its new president.

The Spilka-DeLeo era got off to an awkward start

when Spilka gaveled the Senate out for a long

summer weekend at a time when DeLeo was

expecting lawmakers to work through the weekend.

At that late point in formal sessions, lawmakers

faced a huge workload and ultimately failed to

wrap up key education and health care bills.

The Legislature rode out the last five months of

2018 in informal sessions and in the new

2019-2020 session the branches have yet to

connect on an array of big issues, from the

budget to the leftover health care and education

bills, to housing production legislation and

more.

After meeting with legislative leaders last

week, Baker was unfazed by the late budget,

saying he had "tremendous confidence" in DeLeo

and Spilka and noting they'd both chaired Ways

and Means before.

"They know what this drill is about and I have

tremendous confidence that they'll get a budget

done and we'll be able to implement it

effectively," Baker said.

Baker and Beacon Hill Democrats often hold up

their working relationships as a contrast to

their partisan bickering in Washington.

This year marks the 20th anniversary of the

famous late state budget of 1999, which also

featured a test of wills among House and Senate

Democrats.

Former House Speaker Thomas Finneran, former

Senate President Thomas Birmingham and their

Ways and Means chairs Rep. Paul Haley and Sen.

Mark Montigny got so dug in on budget

differences that they didn't agree to a fiscal

2000 budget bill until November.

In 1999, as former Gov. Paul Cellucci awaited

the spending bill, budget negotiators scrapped

over issues ranging from early childhood

education to K-12 education funding, asset

maintenance, the use of the tobacco settlement

funds, MBTA funding, senior pharmacy benefits,

and economic/tax policies.

The fiscal 2000 budget totaled $20.9 billion.

The spending bills currently in conference

committee authorize $42.8 billion in spending.

State House News

Service

Tuesday, July 16, 2019

Ed funding bill timeline now "the near future"

By Chris Lisinski

The fiscal year 2020 budget is not the only

long-expected Beacon Hill legislation running

late: after initially suggesting a K-12

education funding bill would be released in

June, Education Committee co-chair Sen. Jason

Lewis said Tuesday that he now expects the work

to be completed "in the near future."

Lewis and his fellow chair, Rep. Alice Peisch,

did not offer specific details on the

legislation following an unrelated committee

hearing Tuesday, almost four months after

members heard hours of testimony about funding

reform and exactly two months after the Senate

chair targeted June as a possible goal.

"Chairwoman Peisch and I and our committee

members and stakeholders have been devoting a

lot of time to working on this bill," Lewis

said. "I'm confident we'll have a bill out of

the committee in the near future."

Peisch said the senator's earlier mention of

June was "never a deadline" and, asked when a

final proposal might be released, responded,

"We're working on it."

"We've been working very hard on various aspects

of the bill," she said. "I don't think we'll be

releasing it piecemeal. When we have reached an

agreement on a comprehensive bill, it will be

released."

Last year, legislative leaders failed to reach

an agreement at the end of formal lawmaking

sessions in July. Activists this year are

frustrated that an education funding bill has

not progressed, and the state faces a lawsuit

over the issue.

The (Gloucester) Daily Times

Wednesday, July 17, 2019

Expanded welfare benefits pushed

Group says hike would lift thousands out of

'deep' poverty

By Christian M. Wade, Statehouse Reporter

Anti-poverty advocates are making a major push

to expand welfare benefits as part of a campaign

to lift tens of thousands of children out of

"deep poverty."

One proposal, backed by more than 80 mostly

Democratic lawmakers, would increase welfare

benefits through the state’s primary cash

assistance program, known as Transitional Aid to

Families with Dependent Children, by 10% every

year until the payments reach 50% of the federal

poverty level. That would raise the benefits for

an average family of three to $889 a month.

Supporters of the measure say benefits haven't

increased in nearly two decades, while the cost

of living has skyrocketed.

"It is simply unconscionable that we have

children living in deep poverty in our

commonwealth," state Sen. Sal DiDomenico,

D-Everett, the bill's primary sponsor, told

members of the Legislature's Committee on

Children, Families and Persons with Disabilities

on Tuesday. "These families need help, they are

on the edge of despair and have no where else to

turn."

Lawmakers behind the proposal say $50 million

more in state aid over a four-year period will

only bring families up to what is considered

"deep poverty," or half the federal poverty

level. For a family of four, "deep poverty" is

considered $10,665 or less.

"People are treading water, some people are even

drowning," said Rep. Marjorie Decker,

D-Cambridge, the bill's primary sponsor in the

state House of Representatives. "Bringing them

up to the deep poverty level is really about

throwing them a life-jacket and letting them

hold on and take a breath."

Overall, the number of families on the state’s

primary cash assistance program has declined by

half since the 1990s, to about 30,000 per month,

according to the state Department of

Transitional Assistance.

Combined the state spends roughly $16 million a

month on the programs.

Under current law, a recipient is limited to

receiving welfare for two years in any five-year

period. The family of three in the program

collects a maximum of $593 per month.

Last year, lawmakers pushed through a repeal of

state rules that denied additional benefits for

children born into families already receiving

assistance from the state.

Repealing the so-called "cap on kids" means that

a parent receiving benefits now gets an

additional $100 in monthly benefits for each

child, regardless of whether the child is born

before or after the parent became eligible for

benefits. Families also receive an additional

$300 yearly clothing allowance per child.

Anti-poverty advocates say overall the state's

welfare programs have failed to keep pace with

the rising cost of living, forcing families to

scrimp on basic necessities.

"Thirty years ago these grants at least lifted

families out of poverty," said Deborah Harris, a

staff attorney at the Massachusetts Law Reform

Institute, one of several anti-poverty groups

backing the proposal. "But now families can't

afford to meet their basic needs. That includes

buying food, when food stamps run out, and

paying for things like laundry and diapers."

Lawmakers are weighing a separate proposal, also

heard by the committee on Tuesday, to create a

pilot project extending benefits for families

that reach a "cliff" when they hit the two-year

limit on receiving benefits.

Another proposal, filed by Sen. Joan Lovely,

D-Salem, asks health officials to study creating

a diaper subsidy for low-income families with

children under 2 years old.

Diapers aren’t covered by federal food stamps,

known as the Supplemental Nutrition Assistance

Program. Nor are they provided by the Women,

Infants and Children nutrition program, which

classifies them with cigarettes and alcohol as

invalid items.

Welfare assistance can be applied to anything a

family needs. But advocates say only 23 percent

of poor families with children nationally

receive benefits.

If the plan takes shape and is approved,

Massachusetts would be the first state to

provide diaper subsidies to welfare

beneficiaries.

In 2016, California lawmakers passed a bill

giving a $50 monthly diaper voucher to families

on welfare with children. Then-Gov. Jerry Brown

vetoed the plan, citing its fiscal impact.

Lovely said parents who can't afford diapers may

decide to stay home with their children and not

work, contributing to the "cycle of poverty."

"A parent who stays home with a child because

the child lacks diapers forfeits the opportunity

to hold a job, go to school or pursue job

training," she told the panel on Tuesday.

Medical professionals say families scraping by

on the federal poverty line experience negative

health and educational impacts that affect not

just the children but their parents as well.

"Lifting families out of deep poverty not only

makes it possible for parents to meet the basic

needs of food, shelter and education, it also

reduces parents' anxiety and depression that

also harms children," Dr. Ann Easterbooks, a

child psychologist and professor at Tufts

University, told the panel. "Even a small

increase in funds ... makes a difference in the

life of a family."

State House News

Service

Tuesday, July 16, 2019

Broad support for welfare cash assistance

increase

By Chris Lisinski

Activists, physicians and social workers urged

lawmakers Tuesday to expand a state welfare

program helping low-income parents, arguing

existing cash grants are insufficient to meet

growing costs and leave many children stuck in

poverty.

After helping this year to repeal a law

preventing families on public assistance from

receiving additional benefits when they have

another child, activists now want to secure

further changes through a bill (S 36 / H 102)

that increases support offered through the

Transitional Aid to Families with Dependent

Children program.

Rep. Marjorie Decker, who authored the House

bill, called it the "next step" for lawmakers

after lifted the so-called "cap on kids" law in

April.

"With the grants we provide, people are really

treading, they're treading water," Decker told

the Joint Committee on Children, Families and

Persons with Disabilities. "And let's be honest:

some people aren't treading, they're drowning.

This is really just about throwing them a life

jacket and letting them hold on and take a

breath."

The grant amounts have not changed since 2000,

Decker said, and their value has declined since

1989 due to inflation. An average family of

three currently $593 a month, just a third of

the federal poverty level.

"We talk to families all the time who are

struggling to survive on this," Naomi Meyer, an

attorney at Greater Boston Legal Services who

helps lead the Lift Our Kids coalition, told the

News Service ahead of the hearing. "It is simply

not enough."

The legislation, which already has more than 100

sponsors across the House and Senate, would

increase the value of the aid every year until

it reaches 50 percent of the federal poverty

line, the threshold marking "deep poverty."

Decker said the change would cost the state

about $15 million per year, but said the

investment would also help avoid higher costs

down the line because it would ensure better

outcomes — and therefore fewer urgent services

needed — for recipients.

About 29,000 Massachusetts families, including

52,000 children, currently live in deep poverty,

a number that bill co-author Sen. Sal DiDomenico

called "staggering."

"These families need our help," he said. "These

families have nowhere else to turn. These

families are on the edge of despair. And these

children who are in these families are growing

up in a way where they have no other idea of

what living a normal life looks like."

Advocates rallied at the State House Tuesday

morning before the bill came up for a committee

hearing, where they packed the room wearing

matching Lift Our Kids vests.

Pediatricians and psychologists focused closely

on the children who would benefit from greater

state aid to low-income families. Seth Kleinman,

a Danvers school social worker, said children

who live in poverty are often "completely

unavailable" for education because of hunger,

stress and other social and emotional issues.

"Being focused on the classroom is far from

their top priority," he said. "(Poverty) really

has myriad impacts on them."

The welfare cap repeal drew bipartisan support

earlier this year, passing 155-1 in the House

and 37-1 in the Senate before the Legislature

overrode Republican Gov. Charlie Baker's veto.

During Tuesday's hearing, the new proposal also

had Republican backing: Rep. Michael Soter, the

committee's ranking minority member, said he

"proudly" supports the bill, even after taking

"a lot of heat" for his vote in favor of the cap

repeal.

"As somebody who is pro-life, bringing a child

into life, into this world, and the fact that

they would be tied down in poverty — I'd be an

absolute hypocrite to oppose this bill," Soter

said.

The Boston Herald

Tuesday, July 16, 2019

A Boston Herald editorial

Carbon tax just another painful fee

Bay Staters will feel the pain

Carbon emissions are soon to become the latest

portal the state uses to reach the wallets of

Massachusetts taxpayers. A bill is gaining

momentum on Beacon Hill that would place a fee

on carbon emissions produced by fossil fuels.

The carbon tax would start at $20 per ton and

increase every year by $5, allegedly until the

fee reaches $40 per ton. Thirty percent of the

collected revenue — estimated to be between

$400M and $600M per year — would be siphoned off

for state and local government to embark on

renewable energy projects.

Among other goals, advocates of the bill hope to

incentivize people to move off of fossil fuel

consumption and on to more green options, which

would be comparable in price due to the carbon

tax.

Something we know such a tax would do is punish

the people and businesses in the commonwealth.

As the Herald’s Mary Markos reported, a

Beacon Hill Institute study found that the

average Massachusetts household would see its

tax bill increase by $755 in the first year. By

the fifth year, that annual tax load would

increase to $1,263. In addition, Massachusetts

would see a loss of 11,090 private sector jobs

in its first year, increasing to 18,240 by its

fifth, according to the study.

The analysis laid out in the study is stark:

“The tax would also, in the first year, reduce

business investment by $925 million, disposable

income by $1,950 million, and private employment

by 11,090 jobs. As time passed and the tax rate

rose, the carbon tax would produce more

substantial economic effects. By 2026,

investment would fall by $1,585 million,

disposable income by $3,266 million, and private

employment by 18,240 jobs.”

Those are staggering numbers and all for what?

To what degree will reducing the carbon

emissions in a small state with a population of

under 7 million affect a globe full of 7.53

billion people?

The answer is, likely not at all. The people of

Massachusetts will be fleeced once again with

nothing to show for it, while progressives in

upscale neighborhoods pat themselves on the back

for our sacrifices. Failed green energy

businesses and initiatives will litter the land

until the next green think tank presents our

lawmakers with another feel-good project on

which to spend our hard-earned money.

The bill at hand, An Act to Promote Green

Infrastructure and Reduce Carbon Emissions,

filed by Rep. Jennifer Benson (D-Lunenburg), is

cut from the same cloth as the Green New Deal.

It is aspirational, maybe even inspirational,

but also wholly impractical.

Proponents cannot be bothered by the facts,

though. Executive Director Michael Green of

Climate XChange, a non-profit with a mission to

fight climate change, countered that the study

doesn’t include the cost of “climate inaction.”

In other words, doing a dumb thing is still

better than doing nothing and those are

absolutely our only two choices. You either want

a carbon tax, straw ban, water bottle ban and

styrofoam ban or you are a climate denier.

Furthermore, since climate change is purportedly

the new World War II, if you are not all in you

are allied with the Axis forces.

Straight out of the AOC playbook.

No to the carbon tax. It’s just another tax

under a trendy name.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

BACK TO CLT

HOMEPAGE

|