|

Post Office Box 1147 ●

Marblehead, Massachusetts 01945 ●

(781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

45 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Wednesday, June 19, 2019

Billions

more is 'Not enough yet'

|

House and Senate held a Constitutional

convention and approved 145-48, (House approved 112-43,

Senate approved 33-5), a proposed constitutional amendment

that would allow a graduated income tax in Massachusetts and

impose an additional 4 percent income tax, in addition to

the current flat 5.1 percent one, on taxpayers' earnings of

more than $1 million. Language in the amendment requires

that "subject to appropriation" the revenue will go to fund

quality public education, affordable public colleges and

universities, and for the repair and maintenance of roads,

bridges and public transportation....

"Another election must intervene before the

second and final vote occurs, in the 2021-22 legislative

session, before this constitutional amendment can appear on

the 2022 statewide ballot for voters to ultimately decide,"

said Chip Ford, executive director of Citizens for

Limited Taxation. "Though in Massachusetts it's highly

unlikely, there remains a distant possibility that a

turnover in the Legislature in the 2020 election can derail

this abomination. Unfortunately, Massachusetts being 'The

Bluest State,' pigs will likely need to fly first and Hell

freeze over."

Beacon Hill Roll Call

Saturday, June 15, 2019

Constitutional convention approves millionaires tax

[Excerpt]

By Bob Katzen

Massachusetts legislators approved the

“millionaire tax” without a single adjustment, voting down

amendments that would specify that the new money be spent on

what proponents of the measure have said it will be spent on

— education and transportation.

“This question is about a bait-and-switch.

It’s about raising money,” Minority Leader Rep. Bradley

Jones (R-North Reading) told the Herald, “and then we will

spend it however we damn well please.” ...

Rep. Marc Lombardo (R-Billerica) noted that

the voters have rejected a graduated income tax six times,

that the state took in $1.1 billion in extra revenue in 2018

and referenced a Herald report that found almost $3 billion

has gone uncollected.

“Massachusetts does not have a revenue

problem. Massachusetts has a spending and a priority

problem,” Lombardo said. “We need reform in our spending, in

our priorities and not a divisive class warfare tax

increase.”

The Boston Herald

Thursday, June 13, 2019

Massachusetts millionaire tax proposal moves forward

minus amendments to earmark funds

The Massachusetts Legislature on Wednesday

passed a constitutional amendment to raise taxes on income

over $1 million, the first step in a process that will take

until 2022.

It is, in effect, a do-over of the last

three-year battle over the “millionaire’s tax,” which ended

in 2018 when the proposed constitutional amendment was

struck down by the Supreme Judicial Court before it went on

the ballot.

“We’re like junkyard dogs. We don’t give up.

We are back,” said Lew Finfer, an organizer with Raise Up

Massachusetts, the coalition of labor, religious and

community groups pushing for the amendment.

The vote was 147-48. The vote was mostly

along party lines, with Democrats supporting the amendment

and Republicans opposing it.

The Springfield Republican

Thursday, June 13, 2019

Massachusetts Legislature — again — passes

constitutional amendment to create ‘millionaire’s tax’

State Rep. Marc T Lombardo, R-Billerica,

opposed a renewed effort to amend the state Constitution by

creating a graduated income tax.

According to a release from Lombardo’s

office, the so-called “Millionaires Tax” – which is being

billed by proponents as an opportunity to boost spending on

education and transportation – does not include sufficient

safeguards to ensure the money raised will actually result

in any significant funding increases in these two areas. He

also expressed concerns about creating a two-tiered tax

system....

To ensure that current state spending in

these areas is not diverted for other purposes, Lombardo

supported an amendment stipulating any revenues generated by

the surtax will be used “in addition to and not in lieu of

funds” that are already being appropriated for education and

transportation. That amendment failed on a vote of 40-156.

Lombardo also expressed concerns about the

Legislature’s ability to revisit the surtax if it does not

work out as planned. By placing language in the state

Constitution, any effort to repeal the surtax would have to

go through a time-consuming four-year process that would

prevent any repeal question from appearing on the state

ballot until November of 2026 at the earliest.

Lombardo also noted that the amendment calls

for the new revenues to be used “for quality public

education and affordable public colleges and universities,”

but does not define what actually constitutes a “quality”

education, or an “affordable” education. This ambiguity

could open the Commonwealth to costly litigation moving

forward.

According to Lombardo, the commonwealth

doesn’t have a revenue problem but rather a spending and

priority problem. Massachusetts collected $1.1 billion in

revenues surplus last year all while the state spends over

$2 billion annually for benefits for illegal immigrants.

MassHealth’s line item has more than doubled in the last 10

years, now consuming more than 40 percent of the state

budget.

“It’s time for reforms in state government,

not unfair and divisive class warfare tax increases” said

Lombardo.

The Billerica Minuteman

Friday, June 14, 2019

Billerica’s Rep. Lombardo opposes effort to institute

graduated income tax

It’s not about raising taxes, you must

understand. It’s about investments — investments in the

future.

That’s what the greed-crazed hacks at the

State House always say whenever they’re talking about

robbing you … I mean, investing in the future.

The kleptocrats on Beacon Hill were up to

their old tricks again last week, taking the initial steps

toward an 80% hike in the “millionaire tax.” But the next

day, they instantly gave away the game when we discovered

what the Democrats really care about “investing” your

hard-earned money in....

In the debate over the so-called millionaire

tax on Beacon Hill last week, the moonbats repeated over and

over again that the additional billions would only be spent

on “education” and infrastructure, which of course they

described as crumbling.

OK, said the outnumbered Republicans. Would

the leadership be willing to put that in writing — that none

of the extra money will be spent on, say, paying for the

lawyers of criminal state judges, or another three dozen or

so associate deputy vice chancellors at UMass?

Oh no, the handful of pro-taxpayer solons

were told, we can’t assure you of anything like that. But

what’s the problem, we’re just talking about … investments.

What the hacks want to do is tack on an

additional 4% tax on any income over $1 million, thus, the

“millionaire tax.” Of course it won’t work, it never has in

any of the other states that have tried it. So as revenue

falls, and taxpayers flee, everyone’s taxes will go up … and

up … and up....

The Boston Herald

Saturday, June 15, 2019

Hacks invested in protecting their own

By Howie Carr

While a conference committee weighs the

idea, more than 100 municipal chief executives wrote to the

House speaker and Senate president Wednesday asking that

part of any potential fiscal year 2019 budget surplus be

transferred to help the Community Preservation Act

program....

Though the House and Senate budget both

authorized an increase in CPA funding starting next year,

the conference committee is considering whether to include

in the final budget the Senate's authorization of a transfer

up to $20 million from any potential fiscal 2019 surplus to

help towns that have adopted the CPA before the new funding

is available in 2020....

The idea of the CPA was for the state to

match 100 percent of what each participating municipality

raised through its own property tax surcharge to preserve

open space, renovate historic buildings and parks and to

build new playgrounds and athletic fields. But as more

communities adopt the CPA, each town's share of the pie has

become smaller.

The Senate last month followed the House's

lead and voted to raise the fees that are used to fund the

Community Preservation Act in hopes of making what is

supposed to be a state-local partnership more equitable. The

Senate voted 38-2 to increase the recording fees that feed

the CPA Trust Fund from $20 to $50 for most documents and

from $10 to $25 for municipal lien certificates, a change

that the Community Preservation Coalition estimates will

provide the trust fund with an infusion of $36 million in

new money each year. The House did the same in its budget in

April.

State House News Service

Thursday, June 13, 2019

Muni leaders want piece of surplus

Governor Charlie Baker on Tuesday promoted

his plan to sharply increase taxes on real estate transfers

to generate $1 billion for cities and towns to confront

climate change, telling lawmakers the revenue would help

“make important investments in cost-effective and

data-driven solutions.”

The bill would raise the tax on real estate

transfers by 50 percent, with revenue going toward

infrastructure and climate resiliency programs.

“Our role is not only to protect our own

communities, but to develop solutions and policy approaches

that can be shared outside the borders of our Commonwealth,”

Baker said in testimony before the Legislature’s Joint

Committee on Revenue.

The Republican governor filed the measure as

part of his state budget proposal in January and has said

the tax increase could raise about $137 million a year

toward a trust fund. The money would help cities and towns

fund projects like modernizing public buildings or improving

drainage....

The proposal would raise the transfer tax

from $2 per $500 of value to $3 per $500 of value, which

would tack on almost $1,200 in additional taxes to the sale

of a $500,000 home. Sellers would take on those costs.

“This increase provides a sustainable,

dedicated funding revenue stream that will be available to

invest directly in local and state climate change work, year

after year, without further appropriation,” Baker testified.

House Speaker Robert DeLeo, a Suffolk

Democrat, has also proposed a bill aimed at building

renewable-energy infrastructure and funding resiliency

programs to combat climate change. Representative Thomas

Golden filed the bill in the House.

Golden’s bill would draw the proposed $1

billion from state bonds and create a grant program in which

cities and towns could apply for funds to go toward

climate-conscious projects.

The bill also calls for allocating $295

million for energy infrastructure. The effort could include

funding electric vehicles for municipal fleets and systems

aimed at increasing the resiliency of the power grid.

Golden, a Lowell Democrat, said he was

confident both parties could collaborate and agree on a

single bill.

The Boston Globe

Tuesday, June 18, 2019

Baker touts climate resiliency bill in testimony before

lawmakers

The governor and the speaker of the House --

two of Beacon Hill's most powerful figures -- saw their

competing proposals to spend $1 billion or more over the

next decade fighting the effects of climate change go

head-to-head Tuesday for the attention of lawmakers.

Gov. Charlie Baker's bill would raise the

state's real estate transfer tax to generate as much as $137

million a year to help cities and towns prepare for and

adjust to climate change, while Speaker Robert DeLeo's bill

would borrow the money.

The contrasting approaches to the same

problem will create a choice for legislators over the coming

months, but on Tuesday it was welcome friction for

environmental advocates who relished the focus on climate

issues....

Baker's plan is to generate new revenue to

help cities and towns address their climate vulnerabilities

by raising the state's deeds excise from $2.28 to $3.42 for

every $500 of the price of a property sale. The money would

go into a Global Warming Solutions Trust Fund created last

year as part of a $2.4 billion bond bill, and augment the

work already being done through the Municipal Vulnerability

Preparedness program.

DeLeo's bill, filed by Telecommunications,

Utilities and Energy Committee House Chair Thomas Golden,

would create the GreenWorks infrastructure program and

allocate $1 billion over 10 years. Communities could apply

for grants through the Executive Office of Energy and

Environmental Affairs to fund installation of solar grids,

electric vehicle charging stations, resiliency

infrastructure and more....

Baker said he proposed to create an

"expendable trust" because it allows more flexibility than

borrowing would in how the money is used. For instance,

Baker said trust fund money from a real estate tax could be

combined with private money or federal money to pay for

multi-year projects or spent to protect private property,

such as privately-owned dams.

Borrowed money, Baker said, has "very

defined terms in state finance law with respect to what you

can use it for."...

A coalition of environmental and community

groups urged the Revenue Committee to consider doubling

Baker's real estate transfer tax and split the funding

between climate change preparedness and affordable housing.

"Our bold new Coalition reflects the broad

consensus throughout the Commonwealth that we need to take

immediate, comprehensive, and significant action to address

both our housing crisis and climate crisis," said Joe

Kriesberg, president of the Massachusetts Association of

Community Development Corporations....

Greg Vasil of the Greater Boston Real Estate

Board and Jonathan Schreiber of the Massachusetts

Association of Realtors testified together on DeLeo's plan,

which Schreiber said "provides the best avenue to fund and

operate climate resiliency programs in the commonwealth."

"Everyone will feel the negative effects of

climate change, therefore everyone should contribute to

remedying the problem," Schreiber said. "Contrary to Senate

Bill 10, paying for this ubiquitous problem should not rest

solely on the backs of home buyers and sellers."...

Rep. Mark Cusack, the co-chair of the

Revenue Committee, asked the governor if all of the funding

generated under Baker's bill would be used for competitive

grants. Theoharides told him that the bill was "agnostic" on

that issue, but the administration envisions a mix of grants

and loans. Baker also told Cusack that he would be open to

discussing whether the lawmakers wanted to create specific

buckets of funding for different types of projects to

preserve the Legislature's appropriating authority.

Baker told Co-Chair Sen. Adam Hinds he

didn't know how the $1 billion in estimated revenue over 10

years stacked up against the need in cities and towns, but

offered to come back before the committee in the fall to

provide an update as the administration gets deeper into the

resiliency planning process with cities and towns.

"I don't see us ever getting out of the

business of doing this," Baker said.

State House News Service

Wednesday, June 18, 2019

Climate bills hinge on $1 Bil in taxes, or borrowing

The state's "rainy day" fund has eclipsed

the $2.6 billion mark, according to the Baker

administration, growing by more than $1 billion in less than

five years fueled by growth in tax collections on capital

gains income.

Revenue Commissioner Christopher Harding

wrote a letter to state Comptroller Andrew Maylor on Tuesday

certifying that capital gains revenues for the fiscal year

through May totaled more than $1.8 billion, resulting in a

transfer of $636 million to the stabilization fund.

The transfer is made automatically, under

state law, based on capital gains revenues collected in

excess of $1.2 billion. About $64 million of the money being

transferred will be split and used to pay down the state's

pension and other post-retirement benefit obligations....

Through May, tax revenues for the fiscal

year were running $952 million ahead of estimates used to

the build the state budget, creating anticipation for an

end-of-year surplus that Gov. Charlie Baker and the

Legislature will have to decide how to spend....

The stabilization fund hit its previous high

with a $2.33 billion balance in fiscal 2007, when the state

budget was about $25.2 billion. The fiscal 2019 budget

signed by Gov. Baker last July authorized about $41.2

billion in spending.

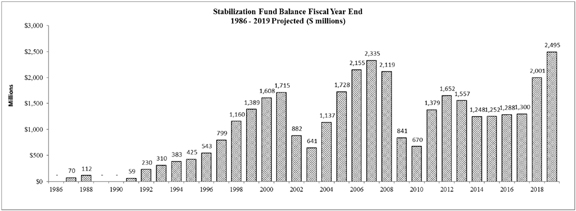

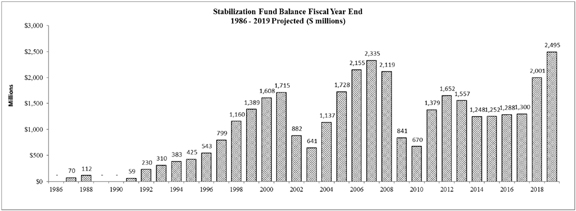

Click above image/graph

to enlarge

End-of-fiscal-year balances of

the state's "rainy day" fund,

from fiscal 1986 to the projected close of fiscal 2019.

[Comptroller's Office; ANF]

State House News Service

Tuesday, June 18, 2019

Big deposit pushes rainy day fund past $2.6 Billion

Beacon Hill is approaching the six-month

mark in the Legislature's two-year session sitting on a

potentially fat budget surplus, still mired in uncertainty

over education and transportation challenges ...

To help address two of those problems (MBTA

unreliability and school funding) the House and Senate voted

147-48 in favor of increasing taxes on people earning over

$1 million....

The margin for the so-called "millionaires

tax" well exceeded the 101 votes needed to advance the

constitutional amendment to the next session in 2021-2022,

but for some that timeline just doesn't work.

After the Supreme Judicial Court last summer

invalidated a basically identical surtax proposal and

stopped it from going on the ballot, the four-year wait to

try again means four more years without additional

revenue....

House Speaker Robert DeLeo reiterated his

intention not to wait that long, writing on Facebook that

"in the coming months the House will debate a comprehensive

package of revenue enhancements that will allow us to more

immediately invest in infrastructure and other programs -

prior to voters making a decision on the Fair Share

amendment in 2022." ...

Corporate tax hikes? Gas tax increase?

Still, nobody has any idea what that revenue package will

look like.

State House News Service

Friday, June 14, 2019

Recap and analysis of the week in state government

Transportation officials took a key step

toward implementing promised improvements Monday by

approving a five-year, $18.3 billion capital investment

plan.

The plan, which covers fiscal years 2020

through 2024, outlines about $10.1 billion in Department of

Transportation projects and $8.3 billion in MBTA projects

for the next half decade.

State House News Service

Monday, June 17, 2019

Plan approved to spend $18B on transpo over next five years

The illegal migrant population grew more in

Massachusetts than any other state from 2007 to 2017 — a

60,000 spike that costs Massachusetts taxpayers and risks

public safety, legal immigration advocates say.

“This is very concerning,” said Jessica

Vaughan of the Center for Immigration Studies, after a Pew

Research Center report detailing the increase was released

Wednesday. “Besides the cost to taxpayers, there are public

safety implications when you fail to control illegal

immigration. And the continuing high levels of illegal

immigrants undermine the integrity of our legal immigration

system.”

Illegal immigrants annually cost

Massachusetts taxpayers an estimated $2 billion for welfare,

education and other costs, she said — a price that will only

rise as the illegal immigrant population goes up, she said.

“They’re a net fiscal drain because they

don’t pay enough in taxes to cover the cost of the social

services they use,” Vaughan said. “So the more illegal

immigrants, the higher costs to taxpayers. It’s just common

sense.” ...

The Bay State’s illegal immigrant population

increased to 275,000 in 2017, according to the Pew Research

Center’s report based on government data. The 60,000 growth

in Massachusetts since 2007 led the nation....

“Because there are already a lot of illegal

immigrants from Central America in Massachusetts, it has

become a magnet for people arriving here,” Vaughan said. “It

also doesn’t hurt that Massachusetts has sanctuary policies,

but that’s not the biggest reason they’re here because other

states also have sanctuary policies.”

The Boston Herald

Wednesday, June 12, 2019

Massachusetts illegal immigrant population spikes,

increase since ’07 leads nation

So Massachusetts is now the most desirable

resort destination in the Union for illegal freeloading

foreigners, at least according to one new survey.

The attraction of the Bay State for all

these Third World beggars can be summed up in two words:

Free stuff. ....

The Bruins may have lost, but when it comes to migrants

arriving to go on welfare, the Bay State can still claim

U.S. bragging rights.

We’re No. 1! We’re No. 1!

The Boston Herald

Friday, June 14, 2019

Massachusetts, the land of the free (stuff)

By Howie Carr

Lawmakers agreed Thursday to implement this

year's sales tax holiday on the weekend of Saturday, Aug. 17

and Sunday, Aug. 18....

It was the first time lawmakers established the annual

sales-tax holiday dates through a process established under

a 2018 law [the "grand bargain"] that calls for legislators

to choose by June 15 a weekend in August to designate as the

holiday. If legislators missed that deadline, the Department

of Revenue would have had until July 1 to announce dates for

the holiday.

State House News Service

Thursday, June 13, 2019

Legislature sets Aug. 17-18 sales tax holiday weekend

|

|

Chip Ford's CLT

Commentary

Is your head spinning yet?

"Unanticipated" billions are pouring into the state's

coffers; more billions upon billions are being

squandered in every direction. The Beacon Hill

response is "More revenue is needed, taxes must be

increased fast!"

Massachusetts state government has never

extracted more taxes and raked in more revenue than it

does today. The state's "rainy day fund" has never

been so flush and overflowing. Spending has never

been greater, as extravagant and unrestrained

― billion dollar spending

increases year after year for decades.

Yet all the Democrats, especially the

liberals (I'm repeating myself) and worse, the

progressives ― and an alleged

Republican governor ― can think about is how to

extract more, more, ever more from taxpayers.

Endlessly more is necessary to continue squandering more

on perpetually-expanding state government, funding

endless "unmet needs," self-serving wish lists, and

foolish pipe dreams.

The financial future

― the very survival

― of Massachusetts

taxpayers has never been more insanely threatened.

The plight of beleaguered taxpayers has never been so

irrelevant in the minds of decision-makers.

Absorb for a moment just some snippets

from the news gathered over just the past week:

According to [state Rep. Marc] Lombardo, the

commonwealth doesn’t have a revenue problem but

rather a spending and priority problem.

Massachusetts collected $1.1 billion in revenues

surplus last year all while the state spends

over $2 billion annually for benefits for

illegal immigrants. MassHealth’s line item has

more than doubled in the last 10 years, now

consuming more than 40 percent of the state

budget.

The

Senate last month followed the House's lead and

voted to raise the fees that are used to fund

the Community Preservation Act in hopes of

making what is supposed to be a state-local

partnership more equitable. The Senate voted

38-2 to increase the recording fees that feed

the CPA Trust Fund from $20 to $50 for most

documents and from $10 to $25 for municipal lien

certificates, a change that the Community

Preservation Coalition estimates will provide

the trust fund with an infusion of $36 million

in new money each year. The House did the same

in its budget in April.

The

Republican governor filed the measure as part of

his state budget proposal in January and has

said the tax increase could raise about $137

million a year toward a trust fund. The money

would help cities and towns fund projects like

modernizing public buildings or improving

drainage....

The

proposal would raise the transfer tax from $2

per $500 of value to $3 per $500 of value, which

would tack on almost $1,200 in additional taxes

to the sale of a $500,000 home. Sellers would

take on those costs.

A

coalition of environmental and community groups

urged the Revenue Committee to consider doubling

Baker's real estate transfer tax and split the

funding between climate change preparedness and

affordable housing.

The

state's "rainy day" fund has eclipsed the $2.6

billion mark, according to the Baker

administration, growing by more than $1 billion

in less than five years fueled by growth in tax

collections on capital gains income. . . .

Through May, tax revenues for the fiscal year

were running $952 million ahead of estimates

used to the build the state budget, creating

anticipation for an end-of-year surplus that

Gov. Charlie Baker and the Legislature will have

to decide how to spend....

The stabilization fund hit its previous high

with a $2.33 billion balance in fiscal 2007, when the state

budget was about $25.2 billion. The fiscal 2019 budget

signed by Gov. Baker last July authorized about $41.2

billion in spending.

After the Supreme Judicial Court last summer

invalidated a basically identical surtax

proposal and stopped it from going on the

ballot, the four-year wait to try again means

four more years without additional revenue....

House Speaker Robert DeLeo reiterated his

intention not to wait that long, writing on

Facebook that "in the coming months the House

will debate a comprehensive package of revenue

enhancements that will allow us to more

immediately invest in infrastructure and other

programs - prior to voters making a decision on

the Fair Share amendment in 2022."

The illegal

migrant population grew more in Massachusetts

than any other state from 2007 to 2017 — a

60,000 spike that costs Massachusetts taxpayers

and risks public safety, legal immigration

advocates say....

Illegal

immigrants annually cost Massachusetts taxpayers

an estimated $2 billion for welfare, education

and other costs, [Jessica Vaughan of the Center

for Immigration Studies] said — a price that

will only rise as the illegal immigrant

population goes up, she said.

“They’re a

net fiscal drain because they don’t pay enough

in taxes to cover the cost of the social

services they use,” Vaughan said. “So the more

illegal immigrants, the higher costs to

taxpayers. It’s just common sense.”

Any debate whatsoever over spending a

proposed additional billion taxpayer dollars on "climate

resiliency" is reduced to Gov. Baker's proposal to

raise taxes to fund his scheme, and House Speaker

DeLeo's preference to borrow (with interest) to

fund his scheme. This is what passes for debate

today on Beacon Hill. What now passes for

Massachusetts "leadership" has reached a frightening

place.

“Massachusetts does not have a revenue

problem. Massachusetts has a spending and a priority

problem” state Rep. Marc Lombardo (R-Billerica)

― one of the few rational good

guys left standing ― said, stating the obvious

which any sentient taxpayer has recognized for a long

time. “We need reform in our spending, in our priorities

and not a divisive class warfare tax increase,” he

concluded. To which I say Amen!

Instead, the vast Democrat majority,

liberals and progressives, and the alleged Republican

governor are crashing headlong through the fiscal

guardrails at breakneck speed and plunging the state off

the roadway and over a cliff.

With no checks or balances on Beacon

Hill this is the craziest I've ever seen things spin out

of control, coming at taxpayers relentlessly from every

direction.

$1.1 Billion in "unexpected" revenue

surplus was collected last fiscal year. Through

last month in this current fiscal year ending this month

the state has already raked in

$952 million ahead of expectations, almost another

addition billion dollars more than last year.

In most places that's recognized as over-taxation.

In Massachusetts it's called 'Not enough

yet.'

We've been saying for decades, for

The Takers "More Is Never Enough (MINE)

― and never will be until they've

taken it all.

They are

moving

closer to their ultimate goal.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

|

The Boston Herald

Thursday, June 13, 2019

Massachusetts millionaire tax proposal moves

forward minus amendments to earmark funds

Constitutional amendment approved by the House

and Senate

By Mary Markos

Massachusetts legislators approved the

“millionaire tax” without a single adjustment,

voting down amendments that would specify that

the new money be spent on what proponents of the

measure have said it will be spent on —

education and transportation.

“This question is about a bait-and-switch. It’s

about raising money,” Minority Leader Rep.

Bradley Jones (R-North Reading) told the Herald,

“and then we will spend it however we damn well

please.”

The Fair Share amendment, filed by Rep. James

O’Day (D-West Boylston), would add a 4% surtax

on household incomes over $1 million. It was

voted on favorably during a constitutional

convention Wednesday, moving the long process of

changing the state constitution another step

forward. At least half of the Legislature will

need to vote for it again in the 2021-2022

legislative session before the question can be

put to voters in 2022.

“I think the 4% is fair, I think a million

dollars is a lot of money,” O’Day told reporters

yesterday. “We have truly identified some

resources that will go to fill some tremendous

needs that the commonwealth has.”

Every single proposal filed to adjust the

amendment failed, including some intended to

ensure that the estimated $2 billion in annual

revenue the tax is expected to raise would be

spent on education and transportation, that the

money currently being spent in those areas isn’t

spent elsewhere, and to allow the Legislature to

reverse the measure without having to wait

years.

O’Day said that he was concerned the proposals

could throw the amendment “out of whack,” or

“out of balance.”

Some legislators warned of dire impacts the tax

would have on small- to mid-sized businesses,

the risk of high earners leaving Massachusetts,

and losing more revenue than they would gain as

a result. Sen. Bruce Tarr (R-Gloucester) pointed

to other states that have adopted similar

high-level taxes and lost significant amounts of

revenue, including New York’s $8.4 billion loss,

New Jersey’s $3.4 billion loss and Connecticut’s

$2.6 billion loss.

“Do we want to take a risk that we would see

what other states have seen — a tremendous

outflow of tax revenue,” Tarr posed.

Rep. Marc Lombardo (R-Billerica) noted that the

voters have rejected a graduated income tax six

times, that the state took in $1.1 billion in

extra revenue in 2018 and referenced a Herald

report that found almost $3 billion has gone

uncollected.

“Massachusetts does not have a revenue problem.

Massachusetts has a spending and a priority

problem,” Lombardo said. “We need reform in our

spending, in our priorities and not a divisive

class warfare tax increase.”

The Springfield Republican

Thursday, June 13, 2019

Massachusetts Legislature — again — passes

constitutional amendment to create

‘millionaire’s tax’

By Shira Schoenberg

The Massachusetts Legislature on Wednesday

passed a constitutional amendment to raise taxes

on income over $1 million, the first step in a

process that will take until 2022.

It is, in effect, a do-over of the last

three-year battle over the “millionaire’s tax,”

which ended in 2018 when the proposed

constitutional amendment was struck down by the

Supreme Judicial Court before it went on the

ballot.

“We’re like junkyard dogs. We don’t give up. We

are back,” said Lew Finfer, an organizer with

Raise Up Massachusetts, the coalition of labor,

religious and community groups pushing for the

amendment.

The vote was 147-48. The vote was mostly along

party lines, with Democrats supporting the

amendment and Republicans opposing it.

In the House, 10 Democrats broke with their

party and voted against the amendment, including

Western Massachusetts Reps. John Velis of

Westfield, Angelo Puppolo of Springfield, Thomas

Petrolati of Ludlow, Brian Ashe of Longmeadow,

and Michael Finn of West Springfield. In the

Senate, Republican Patrick O’Connor of Weymouth

broke with his party to vote for the amendment.

The constitutional amendment would raise the tax

rate by an additional 4 percentage points on

income above $1 million, from the flat 5% rate

to 9%, beginning in 2023. The $1 million income

level would be adjusted annually to reflect

inflation.

The Department of Revenue estimates that this

would raise an additional $1.9 billion a year

from 19,600 tax filers. The money would be

earmarked for education and transportation.

The amendment must pass with a majority vote of

the House and Senate at Constitutional

Conventions in two consecutive legislative

sessions. Wednesday was the first passage, and

lawmakers will consider it again in the

2021-2022 session. If it passes, it would go on

the ballot in November 2022.

In advance of the 2018 election, the

constitutional amendment was introduced through

a citizens’ petition. Advocates gathered 150,000

signatures and got support from two

Legislatures. But the SJC struck it down because

it contained two subjects that are not “related

or mutually dependent” - it would both set the

tax rate and earmark money for education and

transportation.

This time, the amendment was introduced by two

lawmakers - Sen. Jason Lewis, D-Winchester, and

Rep. James O’Day, D-Worcester. An amendment

introduced by lawmakers does not have the same

legal requirement that all parts of the question

be related.

O’Day said each day more revenue is not

forthcoming, “children’s educational needs are

left in the balance,” and transportation needs

are unmet. He noted Tuesday’s derailment of an

MBTA train that caused major transit delays.

“The Massachusetts economy is working great for

those in the upper 1%,” O’Day said. “The time is

now for all Massachusetts residents to reap the

benefits of what this great state can accomplish

with the revenue of the Fair Share Amendment.”

Lewis called the vote “another step forward in

supporting the critical needs of residents of

our commonwealth.” “We have tremendous unmet

needs in Massachusetts that are hurting our

families and our communities and our state’s

economic future,” Lewis said.

Business-backed groups oppose the increased tax.

Christopher Carlozzi, state director of NFIB in

Massachusetts, the National Federation of

Independent Business, said the higher tax rate

would hurt small businesses. Many small

businesses are set up in a way that the owner

pays business taxes through their personal tax

return, which would be subject to the higher

rate.

“A millionaire’s tax could also send wealthy

people fleeing the state and leave Massachusetts

with less revenue, which would place a financial

burden upon the remaining residents who would

see taxes go up, small business owners

included,” Carlozzi said.

Massachusetts Republican Party Chairman and

former State Rep. Jim Lyons criticized the

amendment as “a blatant cash grab masquerading

as class warfare.”

“Massachusetts doesn’t have a revenue problem,”

Lyons said. “It has a spending problem.”

During debate in the House chamber, Rep. Marc

Lombardo, R-Billerica, said after Connecticut

raised taxes, “an exodus of the most mobile

taxpayers has had a devastating effect on

revenue and job creation.”

Lombardo warned that increasing taxes in

Massachusetts would hurt small businesses and

vilify successful residents. He said wealthy

taxpayers are already paying taxes equivalent to

the average income in Massachusetts “These

taxpayers are paying their fair share, they’re

paying more dollars than any other taxpaying

class in the commonwealth,” Lombardo said.

Supporters of the amendment say wealthy

taxpayers will remain in the state because of

social ties, good schools and other reasons, and

improved education and transportation will

actually draw business owners.

Rep. Alice Peisch, D-Wellesley, introduced an

amendment that would have allowed for a

graduated income tax. But she withdrew the

amendment before debate started. Massachusetts

voters rejected a graduated income tax five

times previously, between 1962 and 1994.

On the floor, lawmakers defeated amendments that

would exempt certain types of business income;

ensure new money is not used to replace existing

funds; allow lawmakers to adjust the tax rate

without another constitutional amendment;

earmark money for the state’s rainy day fund and

for regional school transportation; and others.

Lewis said sponsors of the constitutional

amendment want to ensure that the amendment that

passes is the same language that gathered

150,000 signatures and received prior support

from the Legislature. “The reason this proposal

has gotten the support it has from the

Legislature is because it’s very clear, it’s

simple, everybody can understand exactly what is

going to happen,” Lewis said.

The Billerica Minuteman

Friday, June 14, 2019

Billerica’s Rep. Lombardo opposes effort to

institute graduated income tax

State Rep. Marc T Lombardo, R-Billerica, opposed

a renewed effort to amend the state Constitution

by creating a graduated income tax.

According to a release from Lombardo’s office,

the so-called “Millionaires Tax” – which is

being billed by proponents as an opportunity to

boost spending on education and transportation –

does not include sufficient safeguards to ensure

the money raised will actually result in any

significant funding increases in these two

areas. He also expressed concerns about creating

a two-tiered tax system.

Meeting in a joint Constitutional Convention on

June 12, the House and Senate gave initial

approval to the “Millionaires Tax” on a vote of

147-48, with Lombardo voting against the

proposed amendment. A second vote of the

Legislature is required during the 2021-2022

legislative session before the measure can be

placed on the November 2022 ballot for voter

approval.

Massachusetts currently imposes a uniform tax

rate of 5.05 percent on personal income. Under

the proposed amendment, the state would assess

an additional surtax of 4 percent on income in

excess of $1 million, beginning Jan. 1, 2023,

with the revenues generated to be expended for

education and transportation, subject to

appropriation by the Legislature.

To ensure that current state spending in these

areas is not diverted for other purposes,

Lombardo supported an amendment stipulating any

revenues generated by the surtax will be used

“in addition to and not in lieu of funds” that

are already being appropriated for education and

transportation. That amendment failed on a vote

of 40-156.

Lombardo also expressed concerns about the

Legislature’s ability to revisit the surtax if

it does not work out as planned. By placing

language in the state Constitution, any effort

to repeal the surtax would have to go through a

time-consuming four-year process that would

prevent any repeal question from appearing on

the state ballot until November of 2026 at the

earliest.

Lombardo also noted that the amendment calls for

the new revenues to be used “for quality public

education and affordable public colleges and

universities,” but does not define what actually

constitutes a “quality” education, or an

“affordable” education. This ambiguity could

open the Commonwealth to costly litigation

moving forward.

According to Lombardo, the commonwealth doesn’t

have a revenue problem but rather a spending and

priority problem. Massachusetts collected $1.1

billion in revenues surplus last year all while

the state spends over $2 billion annually for

benefits for illegal immigrants. MassHealth’s

line item has more than doubled in the last 10

years, now consuming more than 40 percent of the

state budget.

“It’s time for reforms in state government, not

unfair and divisive class warfare tax increases”

said Lombardo.

The Boston Herald

Saturday, June 15, 2019

Hacks invested in protecting their own

By Howie Carr

It’s not about raising taxes, you must

understand. It’s about investments — investments

in the future.

That’s what the greed-crazed hacks at the State

House always say whenever they’re talking about

robbing you … I mean, investing in the future.

The kleptocrats on Beacon Hill were up to their

old tricks again last week, taking the initial

steps toward an 80% hike in the “millionaire

tax.” But the next day, they instantly gave away

the game when we discovered what the Democrats

really care about “investing” your hard-earned

money in.

Namely, the $127,000 in lawyers’ fees for

corrupt District Court judge Shelley Joseph,

indicted by the feds for allegedly letting a

Dominican illegal immigrant career criminal

abscond from her suburban courthouse before an

ICE agent could pick him up for deportation.

Imagine — $127,000 to provide free legal

services to a former member of the Democrat

State Committee from Brookline who is charged

with committing a criminal felony that could

land her in prison for 20 years.

How is paying off this hack’s legal tab an

“investment” in anyone’s future except hers …

and maybe all the other illegal immigrant

Dominican fentanyl dealers and their enabling

judges who realize they have carte blanche to

commit whatever crimes they so desire, and that

no one will ever pay the price, any price?

When the Democrat judge first stood outside the

courthouse on Northern Avenue after her

indictment, weeping buckets, her TV lawyer

Thomas Hoopes sanctimoniously told the press

that he would be representing Judge Joseph “pro

bono.”

Now it turns out that before she was indicted,

the taxpayers had already paid some lawyer

$127,000 in an attempt to help the scofflaw

judge ward off the long arm of the law. (Hoopes

did not return calls asking him if he was the

recipient of the $127 large.)

In the debate over the so-called millionaire tax

on Beacon Hill last week, the moonbats repeated

over and over again that the additional billions

would only be spent on “education” and

infrastructure, which of course they described

as crumbling.

OK, said the outnumbered Republicans. Would the

leadership be willing to put that in writing —

that none of the extra money will be spent on,

say, paying for the lawyers of criminal state

judges, or another three dozen or so associate

deputy vice chancellors at UMass?

Oh no, the handful of pro-taxpayer solons were

told, we can’t assure you of anything like that.

But what’s the problem, we’re just talking about

… investments.

What the hacks want to do is tack on an

additional 4% tax on any income over $1 million,

thus, the “millionaire tax.” Of course it won’t

work, it never has in any of the other states

that have tried it. So as revenue falls, and

taxpayers flee, everyone’s taxes will go up …

and up … and up.

Hey, somebody’s gonna have to pay when the next

Shelley Joseph gets it into her empty blond head

to go on another PC crime spree?

Carrying the ball for the Beacon Hill banditos

was Sen. Jason Lewis, who was born in South

Africa. Here is a selection from this woke pol’s

remarks on the “need” to beggar the native-born

population:

“We have needs, tremendous unmet needs … a $10

billion investment … important investments …

greater investments … fund such investment …

these investments … we desperately need to

invest … .”

At the beginning, this latest soak-the-rich

scheme would single out approximately 20,000

citizens. At the earliest, it would go into

effect in 2023, giving all the alleged

plutocrats plenty of time to flee, or to take

some other measures to get their reportable

income under $1 million.

Rep. Randy Hunt, a Republican from Sandwich,

pointed out how much this latest insanity would

cost — an average of $178,000 per victim.

Granted, disproportionate amounts would be

assessed from local billionaires like, say, Bob

Kraft, or Abigail Johnson of Fidelity.

“For $178,000,” Hunt said, “people will find a

way to avoid paying the tax, by paying family

members, by deferring taxable income, sheltering

income in irrevocable trusts or, as has been

mentioned, simply moving to New Hampshire.”

Or they could just decide to stop working — you

know, like all the Democrats in the Legislature,

not to mention 98% of their constituents.

Making people who work pay even more to support

those who don’t — many of whom are in the

country illegally, living on welfare — it’s the

“fairest way possible,” we were assured by the

senator from South Africa.

How many krugerrands can you buy with $178,000?

Do you suppose Judge Joseph knows?

State House News

Service

Thursday, June 13, 2019

Muni leaders want piece of surplus

By Colin A. Young

While a conference committee weighs the idea,

more than 100 municipal chief executives wrote

to the House speaker and Senate president

Wednesday asking that part of any potential

fiscal year 2019 budget surplus be transferred

to help the Community Preservation Act program.

Leaders from Boston, Quincy, Somerville,

Braintree, West Springfield, New Bedford, Salem,

Newton, Northampton and more said that the CPA

is "no longer the state-local partnership it was

designed to be" and highlighted the fact that

while the 175 cities and towns that have adopted

the CPA have collectively raised approximately

$160 million in local revenue each year, the

match from the statewide CPA Trust Fund has

dropped to $24 million.

Though the House and Senate budget both

authorized an increase in CPA funding starting

next year, the conference committee is

considering whether to include in the final

budget the Senate's authorization of a transfer

up to $20 million from any potential fiscal 2019

surplus to help towns that have adopted the CPA

before the new funding is available in 2020.

"Without this money, the statewide match will be

an estimated 11 percent," the 101 municipal

officials wrote in the letter coordinated by the

Community Preservation Coalition and the

Metropolitan Area Planning Council. "This

short-term solution for 2019, coupled with the

long-term fix for 2020 and beyond, will ensure a

viable, vibrant, and enduring CPA."

Through 11 months of fiscal 2019, state tax

collections were running $952 million above

year-to-date expectations, the Department of

Revenue reported earlier this month.

The idea of the CPA was for the state to match

100 percent of what each participating

municipality raised through its own property tax

surcharge to preserve open space, renovate

historic buildings and parks and to build new

playgrounds and athletic fields. But as more

communities adopt the CPA, each town's share of

the pie has become smaller.

The Senate last month followed the House's lead

and voted to raise the fees that are used to

fund the Community Preservation Act in hopes of

making what is supposed to be a state-local

partnership more equitable. The Senate voted

38-2 to increase the recording fees that feed

the CPA Trust Fund from $20 to $50 for most

documents and from $10 to $25 for municipal lien

certificates, a change that the Community

Preservation Coalition estimates will provide

the trust fund with an infusion of $36 million

in new money each year. The House did the same

in its budget in April.

The Boston Globe

Tuesday, June 18, 2019

Baker touts climate resiliency bill in testimony

before lawmakers

By Aidan Ryan

Governor Charlie Baker on Tuesday promoted his

plan to sharply increase taxes on real estate

transfers to generate $1 billion for cities and

towns to confront climate change, telling

lawmakers the revenue would help “make important

investments in cost-effective and data-driven

solutions.”

The bill would raise the tax on real estate

transfers by 50 percent, with revenue going

toward infrastructure and climate resiliency

programs.

“Our role is not only to protect our own

communities, but to develop solutions and policy

approaches that can be shared outside the

borders of our Commonwealth,” Baker said in

testimony before the Legislature’s Joint

Committee on Revenue.

The Republican governor filed the measure as

part of his state budget proposal in January and

has said the tax increase could raise about $137

million a year toward a trust fund. The money

would help cities and towns fund projects like

modernizing public buildings or improving

drainage.

Baker does not often testify on legislation he

has filed. He testified last in May on a number

of bills related to housing and criminal

dangerousness.

Speaking in front of a packed hearing room,

Baker thanked the Legislature as well as cities

and towns across the state for their efforts to

address climate change.

Environmental Affairs Secretary Kathleen

Theoharides also testified Tuesday, saying

Baker’s administration expects the demand for

resources to mitigate climate change will

increase in the coming years.

“We’ve heard loud and clear that communities

want to be engaged in the work of designing the

climate-resilient communities of tomorrow, and

this partnership between state and local

government gives us a way to do just that,” she

testified.

The proposal would raise the transfer tax from

$2 per $500 of value to $3 per $500 of value,

which would tack on almost $1,200 in additional

taxes to the sale of a $500,000 home. Sellers

would take on those costs.

“This increase provides a sustainable, dedicated

funding revenue stream that will be available to

invest directly in local and state climate

change work, year after year, without further

appropriation,” Baker testified.

House Speaker Robert DeLeo, a Suffolk Democrat,

has also proposed a bill aimed at building

renewable-energy infrastructure and funding

resiliency programs to combat climate change.

Representative Thomas Golden filed the bill in

the House.

Golden’s bill would draw the proposed $1 billion

from state bonds and create a grant program in

which cities and towns could apply for funds to

go toward climate-conscious projects.

The bill also calls for allocating $295 million

for energy infrastructure. The effort could

include funding electric vehicles for municipal

fleets and systems aimed at increasing the

resiliency of the power grid.

Golden, a Lowell Democrat, said he was confident

both parties could collaborate and agree on a

single bill.

“Everybody — the governor, Speaker DeLeo — we

are pushing to make this a priority,” he said.

“The word of the day on Beacon Hill is always

collaboration.”

Catherine Williams, a spokeswoman for DeLeo,

wrote in an e-mail that the speaker’s office

began conversations with Representative Mark

Cusack — chairman of the Joint Committee on

Revenue — after Baker’s testimony. Williams said

it was the House’s understanding that the

committee had remaining questions on the

Legislature’s role in the bill.

“The House will continue to monitor the

governor’s bill as those details are made

available and as it goes through the Committee

process,” Williams wrote.

After the hearing, Baker defended his plan by

arguing money from an expendable trust can be

used alongside other sources of funding, but

declined to criticize Golden’s bill.

“First of all, good for him for stepping up and

proposing this significant program,” Baker said.

“In some respects, that’s important. It’s really

important.”

State House News

Service

Wednesday, June 18, 2019

Climate bills hinge on $1 Bil in taxes, or

borrowing

By Matt Murphy and Katie Lannan

The governor and the speaker of the House -- two

of Beacon Hill's most powerful figures -- saw

their competing proposals to spend $1 billion or

more over the next decade fighting the effects

of climate change go head-to-head Tuesday for

the attention of lawmakers.

Gov. Charlie Baker's bill would raise the

state's real estate transfer tax to generate as

much as $137 million a year to help cities and

towns prepare for and adjust to climate change,

while Speaker Robert DeLeo's bill would borrow

the money.

The contrasting approaches to the same problem

will create a choice for legislators over the

coming months, but on Tuesday it was welcome

friction for environmental advocates who

relished the focus on climate issues.

"Today, I think, is a momentous day for

addressing the climate crisis in Massachusetts,

where we've got two committee hearings -- I

won't call them competing, they're just

contemporaneous -- at this hour in this building

on far-reaching climate legislation for the

commonwealth of Massachusetts," Keith Bergman,

retired Littleton town administrator and former

president of the Metropolitan Area Planning

Council, said at the hearing on the House bill.

"Massachusetts is poised to become an example

for the rest of the nation by crafting a truly

bipartisan approach to combating the climate

crisis, and boy, do we ever need a bold,

bipartisan example of something here, and why

not the most important issue facing humankind?"

Bergman said.

The two bills had simultaneous hearings at the

State House on Tuesday before two different

committees. The Telecommunications, Utilities

and Energy Committee heard testimony on the

speaker's bill (H 3846), while Baker went before

the Revenue Committee with Energy and

Environmental Affairs Secretary Kathleen

Theoharides to testify for his plan (S 10).

"We are committed to substantially expanding our

investment in resilient infrastructure and other

adaptation strategies across the Commonwealth,"

Baker said.

Baker's plan is to generate new revenue to help

cities and towns address their climate

vulnerabilities by raising the state's deeds

excise from $2.28 to $3.42 for every $500 of the

price of a property sale. The money would go

into a Global Warming Solutions Trust Fund

created last year as part of a $2.4 billion bond

bill, and augment the work already being done

through the Municipal Vulnerability Preparedness

program.

DeLeo's bill, filed by Telecommunications,

Utilities and Energy Committee House Chair

Thomas Golden, would create the GreenWorks

infrastructure program and allocate $1 billion

over 10 years. Communities could apply for

grants through the Executive Office of Energy

and Environmental Affairs to fund installation

of solar grids, electric vehicle charging

stations, resiliency infrastructure and more.

Baker refused to get drawn into any competition

with the speaker, telling reporters he was happy

to see DeLeo put forward a climate plan and to

have both bills get hearings relatively early in

the two-year session.

"First of all, I would never say that anything I

propose is necessarily any better than anything

that's proposed by anyone else in this building

because in the end we are all working on best

estimates with respect to what we think the

right way to deal with something like this, and

what will ultimately prove that out will be time

and experience," Baker said.

"Good for him," the governor said of DeLeo.

David Queeley, the director of eco-innovation

for the Codman Square Neighborhood Development

Corporation, said the Baker and DeLeo bills

complement each other and could perhaps lead to

a "more comprehensive approach."

"We stand with other organizations that

recognize that we need to protect communities we

serve from climate change, sea level rise and

extreme heat, and we recognize that we must

especially protect the residents of low-income

communities from displacement and housing

instability while also providing them with

economic opportunity," he said.

Baker and Theoharides testified before the

Revenue Committee for close to 45 minutes, with

the governor detailing the steps his

administration has taken to address climate

change and the role the state could play as a

national leader in the conversation.

"As we continue to prioritize emission

reductions to address the causes of climate

change, we must also implement strategies to

prepare for a rapidly changing climate, and once

again our role is not only to protect our own

communities, but to develop solutions and policy

approaches that can be shared outside the

borders of our Commonwealth," Baker said.

Theoharides said the state has 370 miles of

seawall along the coast, 25,000 culverts and

small bridges that are aging, and 3,000 dams, of

which 300 are considered "high hazard" and will

require $15 million to $20 million in repairs

over the next four years. So far, 249 of the

state's 351 cities and towns have started the

vulnerability planning process through the MVP

program, and Baker said some are already

pursuing projects, like Pittsfield where the

city is replacing a "high-priority culvert" that

causes flooding.

Baker said he proposed to create an "expendable

trust" because it allows more flexibility than

borrowing would in how the money is used. For

instance, Baker said trust fund money from a

real estate tax could be combined with private

money or federal money to pay for multi-year

projects or spent to protect private property,

such as privately-owned dams.

Borrowed money, Baker said, has "very defined

terms in state finance law with respect to what

you can use it for."

A coalition of environmental and community

groups urged the Revenue Committee to consider

doubling Baker's real estate transfer tax and

split the funding between climate change

preparedness and affordable housing.

"Our bold new Coalition reflects the broad

consensus throughout the Commonwealth that we

need to take immediate, comprehensive, and

significant action to address both our housing

crisis and climate crisis," said Joe Kriesberg,

president of the Massachusetts Association of

Community Development Corporations.

At the Energy Committee hearing, real estate

groups and municipal officials from communities

including Boston and Lexington offered support

for the House bill.

Greg Vasil of the Greater Boston Real Estate

Board and Jonathan Schreiber of the

Massachusetts Association of Realtors testified

together on DeLeo's plan, which Schreiber said

"provides the best avenue to fund and operate

climate resiliency programs in the

commonwealth."

"Everyone will feel the negative effects of

climate change, therefore everyone should

contribute to remedying the problem," Schreiber

said. "Contrary to Senate Bill 10, paying for

this ubiquitous problem should not rest solely

on the backs of home buyers and sellers."

Dave Sweeney, chief of staff to Boston Mayor

Marty Walsh, said one challenge facing many

municipalities is how to make "equitable

decisions" on climate resiliency without

"driving up the cost of housing," and urged the

committee to report out the House bill

"favorably and expeditiously."

Representatives from environmental groups also

spoke in support of the House bill and made

suggestions they said would strengthen it. Casey

Bowers of the Environmental League of

Massachusetts said the Greenworks program should

take environmental justice into consideration

and Deanna Morgan of the Conservation Law

Foundation asked lawmakers to consider allowing

municipalities to apply for grants under the

umbrella of regional entities.

Rep. Mark Cusack, the co-chair of the Revenue

Committee, asked the governor if all of the

funding generated under Baker's bill would be

used for competitive grants. Theoharides told

him that the bill was "agnostic" on that issue,

but the administration envisions a mix of grants

and loans. Baker also told Cusack that he would

be open to discussing whether the lawmakers

wanted to create specific buckets of funding for

different types of projects to preserve the

Legislature's appropriating authority.

Baker told Co-Chair Sen. Adam Hinds he didn't

know how the $1 billion in estimated revenue

over 10 years stacked up against the need in

cities and towns, but offered to come back

before the committee in the fall to provide an

update as the administration gets deeper into

the resiliency planning process with cities and

towns.

"I don't see us ever getting out of the business

of doing this," Baker said.

State House News

Service

Tuesday, June 18, 2019

Big deposit pushes rainy day fund past $2.6

Billion

By Matt Murphy

The state's "rainy day" fund has eclipsed the

$2.6 billion mark, according to the Baker

administration, growing by more than $1 billion

in less than five years fueled by growth in tax

collections on capital gains income.

Revenue Commissioner Christopher Harding wrote a

letter to state Comptroller Andrew Maylor on

Tuesday certifying that capital gains revenues

for the fiscal year through May totaled more

than $1.8 billion, resulting in a transfer of

$636 million to the stabilization fund.

The transfer is made automatically, under state

law, based on capital gains revenues collected

in excess of $1.2 billion. About $64 million of

the money being transferred will be split and

used to pay down the state's pension and other

post-retirement benefit obligations.

"This is very good news for Massachusetts

taxpayers," Administration and Finance Secretary

Mike Heffernan said in a statement, explaining

that it would give "further protection against

any future downturn in the economy."

The capital gains revenues reported by Harding

to the comptroller's office does not account for

any additional tax money from investment income

that might be collected in June, which could

result in a further deposit into reserves.

Through May, tax revenues for the fiscal year

were running $952 million ahead of estimates

used to the build the state budget, creating

anticipation for an end-of-year surplus that

Gov. Charlie Baker and the Legislature will have

to decide how to spend.

The automatic deposit into reserves reduces that

potential revenue surplus for the moment to $316

million.

The balance in the "rainy day" fund, which has

grown amidst the state's economic expansion, is

now up 135 percent since Baker took office in

January 2015, according to the administration.

The governor and Legislature have historically

used the fund to preserve state services during

time of economic slowdowns, and in fiscal 2015

and fiscal 2016 the automatic deposit of excess

capital gains revenues was suspended.

There were no excess capital gains revenues in

2017, and in fiscal 2018 a $514 million deposit

was made of capital gains taxes in excess of

$1.17 billion.

The stabilization fund hit its previous high

with a $2.33 billion balance in fiscal 2007,

when the state budget was about $25.2 billion.

The fiscal 2019 budget signed by Gov. Baker last

July authorized about $41.2 billion in spending.

Click above

image/graph to enlarge

End-of-fiscal-year

balances of the state's "rainy day" fund,

from fiscal 1986 to the projected close of

fiscal 2019. [Comptroller's Office; ANF]

State House News

Service

Friday, June 14, 2019

Weekly Roundup - Experiencing Delays

Recap and analysis of the week in state

government

By Matt Murphy

Beacon Hill is approaching the six-month mark in

the Legislature's two-year session sitting on a

potentially fat budget surplus, still mired in

uncertainty over education and transportation

challenges ...

To help address two of those problems (MBTA

unreliability and school funding) the House and

Senate voted 147-48 in favor of increasing taxes

on people earning over $1 million.

By slapping a 4 percent surtax on annual

household income over $1 million, supporters are

hoping to raise billions in new tax revenue for

education and transportation, and dismissed

arguments of opponents that it would drive

employers, small business owners and the wealthy

out of state.

Only 11 of the 161 elected Democrats in the

Legislature voted against the measure, with a

concentration of those no votes hailing from the

suburbs of Springfield.

The margin for the so-called "millionaires tax"

well exceeded the 101 votes needed to advance

the constitutional amendment to the next session

in 2021-2022, but for some that timeline just

doesn't work.

After the Supreme Judicial Court last summer

invalidated a basically identical surtax

proposal and stopped it from going on the

ballot, the four-year wait to try again means

four more years without additional revenue....

House Speaker Robert DeLeo reiterated his

intention not to wait that long, writing on

Facebook that "in the coming months the House

will debate a comprehensive package of revenue

enhancements that will allow us to more

immediately invest in infrastructure and other

programs - prior to voters making a decision on

the Fair Share amendment in 2022."

"This two-step approach is designed to ensure

that time sensitive investments can be made

immediately: a need that has been highlighted by

recent and unacceptable failures of our

transportation system," DeLeo said.

Corporate tax hikes? Gas tax increase? Still,

nobody has any idea what that revenue package

will look like.

What tax accountants did learn this week is when

the sales tax will be suspended this summer.

The annual sales tax holiday was set by the

Legislature for Aug. 17-18, a scheduling

decision made just under the wire of the June 15

deadline established by last year's "grand

bargain" law.

State House News

Service

Monday, June 17, 2019

Plan approved to spend $18B on transpo over next

five years

By Chris Lisinski

Transportation officials took a key step toward

implementing promised improvements Monday by

approving a five-year, $18.3 billion capital

investment plan.

The plan, which covers fiscal years 2020 through

2024, outlines about $10.1 billion in Department

of Transportation projects and $8.3 billion in

MBTA projects for the next half decade.

About 45 percent of that spending will focus on

reliability and resiliency efforts, while close

to 30 percent will go toward modernizing

outdated parts of the system.

Funding will also go toward long-discussed

modernization projects, such as the Green Line

Transformation, which will add new trains and

upgraded stations along the line, and the first

phase in the South Coast Rail expansion.

Following a public comment period that saw more

than four times as many responses as the FY19-23

capital investment plan, the MassDOT and MBTA

oversight boards voted during a joint meeting

Monday to approve the latest five-year rolling

plan.

Gov. Charlie Baker and other officials have

often pointed to funding planned in the CIP when

asked about conditions at the MBTA. The more

than $8 billion planned over the next five

years, they say, is a record investment for the

authority.

The Boston Herald

Wednesday, June 12, 2019

Massachusetts illegal immigrant population

spikes, increase since ’07 leads nation

By Rick Sobey

The illegal migrant population grew more in

Massachusetts than any other state from 2007 to

2017 — a 60,000 spike that costs Massachusetts

taxpayers and risks public safety, legal

immigration advocates say.

“This is very concerning,” said Jessica Vaughan

of the Center for Immigration Studies, after a

Pew Research Center report detailing the

increase was released Wednesday. “Besides the

cost to taxpayers, there are public safety

implications when you fail to control illegal

immigration. And the continuing high levels of

illegal immigrants undermine the integrity of

our legal immigration system.”

Illegal immigrants annually cost Massachusetts

taxpayers an estimated $2 billion for welfare,

education and other costs, she said — a price

that will only rise as the illegal immigrant

population goes up, she said.

“They’re a net fiscal drain because they don’t

pay enough in taxes to cover the cost of the

social services they use,” Vaughan said. “So the

more illegal immigrants, the higher costs to

taxpayers. It’s just common sense.”

But an advocate for illegal immigrants argued

that Massachusetts is a welcoming state that has

not been negatively impacted by the increase.

Illegal immigrants are making “very, very

substantial contributions to our society and to

our economy,” said Marion Davis, director of

communications for Massachusetts Immigrant and

Refugee Advocacy Coalition. “The increase has

not made a dent in public safety or anything

like that. And they all contribute a lot more to

taxes than any value they get out of it.”

The Bay State’s illegal immigrant population

increased to 275,000 in 2017, according to the

Pew Research Center’s report based on government

data. The 60,000 growth in Massachusetts since

2007 led the nation.

The other states with rising illegal immigrant

populations were Maryland, up 45,000; Louisiana,

up 15,000; and North and South Dakota, each up

5,000.

States that saw declines included five of the

six states with the largest illegal immigrant

populations: California, down 775,000; New York,

down 375,000; Florida, down 210,000; Illinois,

down 120,000; and New Jersey, down 110,000. A

sharp decrease in Mexican migration was the

major factor driving down the overall population

of illegal immigrants in the U.S.

That Massachusetts led the nation is

“fascinating,” Vaughan said.

“I never would have predicted that,” she said.

“Texas or Florida I would have thought, but I

guess Massachusetts makes sense because there is

now less illegal migration from Mexico and

Massachusetts has never had as much illegal

migration from Mexico to begin with.”

The illegal immigrant population in

Massachusetts mostly includes people from

Central America, Brazil, the Dominican Republic,

Haiti and China.

“Because there are already a lot of illegal

immigrants from Central America in

Massachusetts, it has become a magnet for people

arriving here,” Vaughan said. “It also doesn’t

hurt that Massachusetts has sanctuary policies,

but that’s not the biggest reason they’re here

because other states also have sanctuary

policies.”

The Boston Herald

Friday, June 14, 2019

Massachusetts, the land of the free (stuff)

By Howie Carr

So Massachusetts is now the most desirable

resort destination in the Union for illegal