It seemed like only yesterday. Actually it was exactly

three months since

I last testified against a bill expanding tolls onto

more highways in Massachusetts. But there I was,

testifying once again, against a bill proposing more toll

roads in the Bay State, again. This bill,

S.1987, sponsored by Senator Karen Spilka (D-Ashland)

was eerily similar to the one proposed last year by then

Senator McGee (D-Lynn). Yep, it was like “Groundhog

Day” appearing before the same Joint Committee on

Transportation in the same location deep in the bowels of

the State House.

Apparently the committee had forgotten the arguments I had

presented last October 24th, so I had to hit them on the

head (apologies to the Gronk) with these same arguments

again. My testimony included a recitation of expenses

already incurred by motorists. There’s the sales tax

on purchase of a car, annual auto excise, driver’s license

fees, vehicle registration, inspection fees and tolls.

The Legislature added three cents per gallon to the gas tax

in 2013 for our enjoyment.

I pointed out that motorists don’t care for added taxes

and/or tolls as evidenced by their behavior in 2014.

That year Massachusetts voters defeated, on the ballot, a

proposal to tie any increase in the gas tax to inflation

automatically — with no roll call vote needed by the

Legislature. The folks pushing for a “No” vote on this

tax increase were outspent 30-to-1 by special interest

big-spenders and still won!

Using statistics gleaned from the

Reason Foundation’s 22nd Annual Highway Report, we found

that Massachusetts spends far more on highways,

bridges, etc. than the national average on each

state-controlled mile. For example, on maintenance

disbursements the national average is $25,996 per mile while

Massachusetts spends $78,313. On administrative

disbursements the national average is $10,051 per mile,

while Massachusetts comes in at an astounding seven times

higher figure of $74,924. The most irritating

aspect of these revelations: the committee didn’t

appear to be disturbed by these statistics whatsoever, or

even interested.

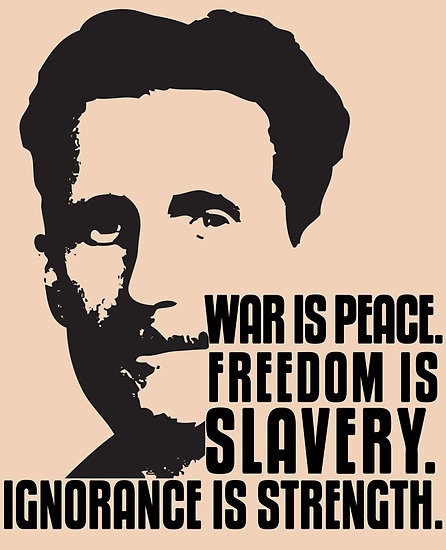

The other bill that received our attention was

H.1828. Its description in a nutshell: a

task force would study ways to impose a “user fee that is

based on the number of miles traveled on roads in this state

by those motor vehicles.” Immediately I described this

as a “Big Brother” move reminiscent of a page from Orwell’s

“1984.” The sponsors had the audacity to state in one

section of the bill that it would “…ensure drivers’

privacy…” Orwellian double-speak at its finest!

"How is this even remotely possible when the state is

tracking every one of your miles driven?" I asked the

committee! The

CLT News Release captures this bill’s essence perfectly:

quoting the musical group The Police, “Every

breath you take, every move you make, I’ll be watching you.”As usual, I received no questions from the committee — not

one — carrying on a tradition similar to several committees

I testified before last year. I’ll say one thing for

this Transportation Committee. Of the twenty

committee members, half of them showed up for this hearing —

10 out of 20. Believe it or not, this represents a

high attendance rate compared to most of the committees I’ve

appeared before in the last few years. I guess maybe

the no-shows were doing other things to justify the obscene

$18 million dollar pay hike they voted for themselves last

year.