|

Help save yourself

— join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

Make a contribution to support

CLT's work by clicking the button above

Ask your friends to join too |

Visit CLT on Facebook |

Barbara Anderson's Great Moments |

Follow CLT on Twitter |

CLT UPDATE

Friday, July 14, 2017

New Report:

How our heavy tax burden is being squandered

|

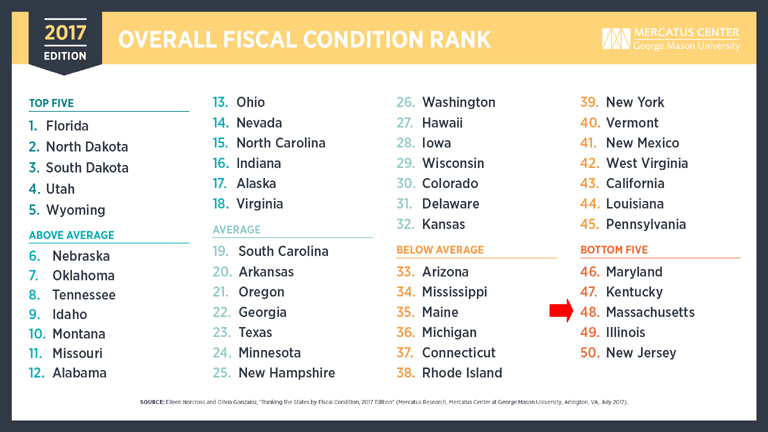

State government in Massachusetts has

exhibited "serious signs of fiscal distress" and in fiscal

2015 posted an overall condition that was better than only

Illinois and New Jersey, according to a new study that

compared states.

The fourth annual study ranked states based

on short- and long-term debt, unfunded pension and health

care benefits, revenues and expenditures, cash on hand and

other assets. Researchers at George Mason University's

Mercatus Center used information from audited financial

reports, and said the rankings this year were influenced by

new accounting standards that require states to report their

net pension liabilities....

States with the lowest rankings, including

Massachusetts, were flagged for "the low amounts of cash

they have on hand and their large debt obligations."

"Kentucky, Massachusetts, Illinois, and New

Jersey have three commonalities: weak levels of cash

solvency, large liabilities relative to assets, and unfunded

pension and OPEB (other post-employment benefit) liabilities

that are large relative to the income of state residents,"

the study said. "On a cash-solvency basis and using the

strictest measure of cash solvency, all four states have

insufficient cash to cover short-term liabilities. When

including less liquid forms of cash, Massachusetts and

Illinois have the weakest measures of cash solvency ... "

Total primary government debt in

Massachusetts of $28.43 billion, or 6.9 percent of personal

income, is "nearly twice the average in the states," the

study said. In other states, some debt absorbed at the state

level in Massachusetts is incurred at the county government

level.

The study pegged the unfunded public pension

liability in Massachusetts at $31.13 billion, compared to a

national average of $20.62 billion.

Researchers concluded that Massachusetts is

among a few states with budgets featuring revenues that fall

short of expenses during the fiscal year.

"Kentucky's net position moved in a positive

direction with the state reporting a per capita surplus of

$122.13," the study said. "Massachusetts, Illinois, and New

Jersey each moved in a negative direction in net position,

with per capita deficits of $319.43, $27.65, and $677.88,

respectively."

State House News Service

Tuesday, July 11, 2017

Study gives Mass. poor ranking for fiscal health

Several states, including Republican states,

have decided to raise taxes this year to cover budget

shortfalls. But a new study suggests that the states might

find themselves in worse financial shape after the money

starts rolling in.

According to the latest ranking of states by

the Mercatus Center at George Mason University, the most

fiscally sound states in the nation are all low-tax, GOP

strongholds, while the 10 least-solvent states are almost

all high-tax and heavily Democratic....

The Mercatus report doesn't include data on

the states' political leanings or tax burdens, but the

implication is clear.

Of the 25 most-solvent states, all but four

are solidly Republican. Of the bottom 25 states, all but

five are solidly Democratic.

The most fiscally sound states also tend to

have the lowest tax burdens, according to a separate

analysis by the Tax Foundation, which measures state and

local tax burdens as a percentage of state income.

The average tax burden among the 10 most

fiscally sound states is 8.5%, according to the Tax

Foundation's 2017 report. The average tax burden among the

10 least fiscally sound states: 10.2%.

Here's another way to look at it: Of the 15

least-solvent states, 10 are among the 15 states with the

highest tax burdens.

Only one of the worst performing states —

Louisiana — has a tax burden that is below 8% of income. And

not one of the best performing states has a tax burden above

9.6%.

Of the nine states that raised taxes this

year, four of them are bottom ranked — none are in the top

10.

The bottom line is that the more money the

state government takes from taxpayers, the worse it handles

it.

This should serve as a flashing warning to

any state that thinks it can tax its way out of its fiscal

problems.

Investor's Business Daily

Tuesday, July 11, 2017

Best-Run States Are Low-Tax Republican,

Worst-Run Are High-Tax Democratic, Study Finds

|

|

Chip Ford's CLT

Commentary

On May 4th CLT issued a news release, "Tax

Freedom Day in Mass. arrives tomorrow — 12 days late; Only

NY, NJ and CT arrive later." In it we noted:

The non-partisan Tax

Foundation recently released its annual Tax Freedom

Day report. This year Tax Freedom Day nationwide

fell on April 23rd, 113 days into the year.

In Massachusetts it arrives

12 days later, tomorrow on May 5th — ahead of only

New York (May 11), New Jersey (May 13), and

Connecticut (May 21).

According to the Tax

Foundation, this "is a significant date for

taxpayers and lawmakers because it represents how

long Americans as a whole have to work in order to

pay the nation’s tax burden."

Taxpayers of Massachusetts

ranked 47th-latest in how long Americans as a whole

have to work in order to just pay their federal,

state, and local tax burdens....

Massachusetts taxpayers will

work 125 days just to pay their taxes — 12 days

longer than the national average.

This again proves that

Massachusetts does NOT have a revenue problem.

Beacon Hill has an

INSATIABLE SPENDING ADDICTION.

The Legislature's recent

obscene $18 million pay grab is clear and undeniable

evidence.

Taxpayers in Massachusetts and only three other states

were still paying toward their Tax Freedom Day

when

taxpayers

in

all other states in the nation but ours were done

satisfying

their personal tax burdens.

Our Tax Freedom Day arrived at least twelve days

later than the rest of the nation.

This week a

new study — the fourth

annual study of overall fiscal conditions in all fifty

states — was released by

George Mason University's Mercatus Center.

Massachusetts now has the distinction of not only having

the fourth-latest Tax Freedom Day, but also of being

the third-worst fiscally managed, insolvent state in

the nation,

ahead of only Illinois and New Jersey.

Why does this not surprise me?

I'll repeat what we said in our Tax Freedom Day news

release:

This again proves that Massachusetts does

NOT have a revenue problem.

Beacon Hill has an INSATIABLE SPENDING ADDICTION.

The Legislature's recent obscene $18 million pay

grab is clear and undeniable evidence.

We thought you ought to know.

The Investor's Business Daily conclusion

from this report sums it up succinctly:

The bottom line is that the more money the state

government takes from taxpayers, the worse it

handles it.

This should serve as a flashing warning to any

state that thinks it can tax its way out of its

fiscal problems.

Massachusetts is a living, still-breathing

demonstrable example of that —

and Beacon Hill hopes to tax and spend even more unless we

can stop them.

More news for comparison, perhaps of interest:

The Fiscal Times

Monday, June 12, 2017

Could Illinois Be the First State to Go Bankrupt?

By Eric Pianin

Illinois has long been the poster

child for a dysfunctional state fiscal policy.

The state’s Republican governor, a

formerly wealthy businessman, and the

Democratic-controlled legislature have been

perpetually locked in a race to the bottom as the

Land of Lincoln has repeatedly flirted with

near-bankruptcy and junk-bond level credit

ratings....

Unlike city and county governments,

states cannot legally declare bankruptcy as a means

of shedding debt by forcing creditors, bondholders,

and government retirees to absorb some of the loss.

The last time a state declared bankruptcy was in

1933, in the throes of the Great Depression, when

Arkansas defaulted on its debts....

The New Jersey Star-Ledger

May 7, 2017

Editorial:

As Christie flees, we're left in budget crisis.

By now, most people know New Jersey

has the second lowest bond rating in the nation -

aside from being wrongfully mocked as "the armpit of

America," it's our least honorable distinction.

The bond rating is not just a

letter. It means we can't pay our bills unless we

make painful changes, and the pressures are more

urgent in New Jersey than in any other state, save

Illinois.

It's a fantasy to think this can be

solved with spending cuts alone, as some

conservatives hope, or with tax increases alone, as

some liberals hope. Time to put aside those

ideological reflexes, and face the daunting math.

New Jersey needs both....

USA Today

May 22, 2017

How much to address Kentucky's pension crisis?

That's the $700 million question

By Tom Loftus

Kentucky needs to boost its pension funding about

$700 million a year to responsibly tackle its

crisis, state budget director John Chilton said

Monday.

That sort of increase would be on top of a huge

boost for pensions provided in 2016 for the current

state budget. And it would force lawmakers to

consider a list of unpopular options to deal with

the pension systems' needs including spending cuts

for other state programs and tax increases.

Chilton's comments about the grim pension funding

outlook came at a meeting of the legislature's

Public Pension Oversight Board and were based on the

findings in a new report by the PFM Group, a

consulting firm hired by the Bevin administration to

study the pension crisis.

The report analyzed the reasons why Kentucky's

pension problem has become one of the worst –

perhaps the worst – among all 50 states.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

State House News Service

Tuesday, July 11, 2017

Study gives Mass. poor ranking for fiscal health

By Michael P. Norton

State government in Massachusetts has exhibited

"serious signs of fiscal distress" and in fiscal

2015 posted an overall condition that was better

than only Illinois and New Jersey, according to

a new study that compared states.

The fourth annual study ranked states based on

short- and long-term debt, unfunded pension and

health care benefits, revenues and expenditures,

cash on hand and other assets. Researchers at

George Mason University's Mercatus Center used

information from audited financial reports, and

said the rankings this year were influenced by

new accounting standards that require states to

report their net pension liabilities.

Mercatus Center at George Mason University’s

“Ranking the States by Fiscal Condition”

https://www.mercatus.org/statefiscalrankings

The state's with the strongest overall fiscal

condition, in order of ranking, were Florida,

North Dakota, South Dakota, Utah and Wyoming.

States with the lowest rankings, including

Massachusetts, were flagged for "the low amounts

of cash they have on hand and their large debt

obligations."

"Kentucky, Massachusetts, Illinois, and New

Jersey have three commonalities: weak levels of

cash solvency, large liabilities relative to

assets, and unfunded pension and OPEB (other

post-employment benefit) liabilities that are

large relative to the income of state

residents," the study said. "On a cash-solvency

basis and using the strictest measure of cash

solvency, all four states have insufficient cash

to cover short-term liabilities. When including

less liquid forms of cash, Massachusetts and

Illinois have the weakest measures of cash

solvency ... "

Massachusetts has long issued short-term debt to

meet its cash needs, paying off that debt before

the end of each fiscal year. Credit rating

agencies over the years have cited a high debt

load as a negative factor in Massachusetts,

contrasting that with the state's high median

income and stable economic base.

Total primary government debt in Massachusetts

of $28.43 billion, or 6.9 percent of personal

income, is "nearly twice the average in the

states," the study said. In other states, some

debt absorbed at the state level in

Massachusetts is incurred at the county

government level.

The study pegged the unfunded public pension

liability in Massachusetts at $31.13 billion,

compared to a national average of $20.62

billion.

Researchers concluded that Massachusetts is

among a few states with budgets featuring

revenues that fall short of expenses during the

fiscal year.

"Kentucky's net position moved in a positive

direction with the state reporting a per capita

surplus of $122.13," the study said.

"Massachusetts, Illinois, and New Jersey each

moved in a negative direction in net position,

with per capita deficits of $319.43, $27.65, and

$677.88, respectively."

With super-majorities in both branches,

Democrats in the Legislature have long

controlled the state's finances, which are

managed on a day-to-day basis by governors and

the executive branches. The study covered a

fiscal year during which Gov. Deval Patrick was

in charge for the first six-plus months before

giving way to Gov. Charlie Baker and Lt. Gov.

Karyn Polito, who took office midway through

fiscal 2015.

"The Baker-Polito Administration is committed to

continuing the progress we have made to get the

Commonwealth's fiscal house in order, starting

with eliminating the structural deficit we

inherited to invest in critical priorities like

public education, transportation and combatting

the opioid epidemic without raising taxes on the

people of Massachusetts," Sarah Finlaw,

Executive Office of Administration and Finance

spokeswoman, said in a statement.

Communicating on background, a Baker

administration official said the study had not

taken into account the long-term impacts of the

state's well-regarded education system and its

workforce and did not adjust adequately for low

levels of local government debt. The official

also said the state's major health care and

education sectors are better equipped than other

industries to handle recessions.

The state budget on Gov. Baker's desk calls for

a roughly $100 million deposit into the state's

rainy day fund, which would bring its balance up

to $1.4 billion.

Rating agency officials have urged Massachusetts

to shore up its reserves, but freeing up funds

for major deposits has been difficult since the

state's tax collections grew by less than 1.5

percent over most of last fiscal year. The $40.2

billion annual spending bill approved by the

Legislature last week required major spending

reductions - compared to the bills worked on all

spring - to line up with a downwardly revised

estimate of tax revenues.

Investor's Business Daily

Tuesday, July 11, 2017

Best-Run States Are Low-Tax Republican,

Worst-Run Are High-Tax Democratic, Study Finds

By John Merline

Several states, including Republican states,

have decided to raise taxes this year to cover

budget shortfalls. But a new study suggests that

the states might find themselves in worse

financial shape after the money starts rolling

in.

According to the latest ranking of states by the

Mercatus Center at George Mason University, the

most fiscally sound states in the nation are all

low-tax, GOP strongholds, while the 10

least-solvent states are almost all high-tax and

heavily Democratic.

The rankings in the fourth-annual "Ranking of

the States by Fiscal Condition" report, which

was released this morning, are based on a review

of audited financial statements for 2015

covering five measures that gauge the states'

ability to pay bills, avoid budget deficits, and

meet long-term spending needs and cover pension

liabilities.

Cash solvency, for example, measures a state's

ability to pay immediate bills. Budget solvency

focuses on whether states will end the year with

a surplus or deficit. Service-level solvency

gauges a state's ability to meet a demand for

increased spending. Long-run solvency looks at a

state's ability to meet longer-term spending

commitments. Trust-fund solvency looks at the

states' unfunded pension liabilities and state

debt.

There were several changes in the rankings from

last year. Florida moved from sixth place to

first, while Alaska dropped from first place

last year to 17th this year, driven mainly by

the fall in oil prices. Idaho moved into the top

10.

At the bottom of the heap, Louisiana and West

Virginia both dropped down in the 10-worst list,

while Hawaii greatly improved, going from 45th

place last year 27th this year. Connecticut,

Maine and New York also climbed out of the

bottom 10 list. But New Jersey fell to dead last

from last year's 48th place.

The report also includes rankings for each

individual measure of fiscal solvency, in

addition to the overall ranking. Some states do

well on some measures, and bad on others. New

Jersey, for example, is last on long-run

solvency and second to last on budget solvency,

but ranks 24 on service-level solvency.

Nearly bankrupt Illinois is in the bottom in all

but one of the five individual measures —

service-level solvency.

The Mercatus report doesn't include data on the

states' political leanings or tax burdens, but

the implication is clear.

Of the 25 most-solvent states, all but four are

solidly Republican. Of the bottom 25 states, all

but five are solidly Democratic.

The most fiscally sound states also tend to have

the lowest tax burdens, according to a separate

analysis by the Tax Foundation, which measures

state and local tax burdens as a percentage of

state income.

The average tax burden among the 10 most

fiscally sound states is 8.5%, according to the

Tax Foundation's 2017 report. The average tax

burden among the 10 least fiscally sound states:

10.2%.

Here's another way to look at it: Of the 15

least-solvent states, 10 are among the 15 states

with the highest tax burdens.

Only one of the worst performing states —

Louisiana — has a tax burden that is below 8% of

income. And not one of the best performing

states has a tax burden above 9.6%.

Of the nine states that raised taxes this year,

four of them are bottom ranked — none are in the

top 10.

The bottom line is that the more money the state

government takes from taxpayers, the worse it

handles it.

This should serve as a flashing warning to any

state that thinks it can tax its way out of its

fiscal problems.

The entire Mercatus Center report can be found

here.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

BACK TO CLT

HOMEPAGE

|