|

Help save yourself

— join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

Make a contribution to support

CLT's work by clicking the button above

Ask your friends to join too |

Visit CLT on Facebook |

CLT UPDATE

Thursday, May 5, 2016

Tax Freedom Day finally arrives

in Mass.

Today, at long last, you start keeping what you earn

|

Saying state spending had risen 50 percent since 2006, Andover

Rep. James Lyons appealed to his colleagues Monday to pass a budget

amendment reducing the sales tax to 5 percent from 6.25 percent. The

House instead voted 112-42 to study the idea.

Rep. Stephen Kulik argued for an amendment to study the proposal,

saying its passage would reduce state revenues by $1 billion. "It's

critical funding," he said, noting the proposed House budget

increases state spending by $1.1 billion.

Lyons suggested tax policy studies favored by Democrats over the

years have not been conducted. "I've been in here five years, I

haven't seen a study yet," said Lyons, who, with Rep. Brad Hill of

Ipswich, said northern Massachusetts residents have long spent their

shopping dollars in sales tax-free New Hampshire.

"At some point, if we are serious about economic growth, we have

to reduce the tax burden," Lyons said.

State House News Service

Monday, April 25, 2016

Sales tax cut runs into resistance in Mass. House

House Democrats successfully moved Monday to study a proposal to

exempt cities and towns from paying 24 cents a gallon in gas taxes,

avoiding a direct vote on the proposal.

State House News Service

Monday, April 25, 2016

House Dems cool to muni gas tax exemption

The Massachusetts House on Monday shot down proposals to increase

the gas tax and put a cap on the state's film tax credit program as

they began to dispense with more than 1,300 amendments to the annual

state budget bill.

The House swiftly took care of more than 30 revenue-related

amendments to the $39.48 billion budget, rejecting four and voting

to study two others. The rest were withdrawn by their sponsors after

behind the scenes talks.

State House News Service

Monday, April 25, 2016

House protects film tax credit, rejects gas tax increase

After rousing debates Monday night wherein Democrats roundly

defeated two Republican local aid amendments, House lawmakers

unanimously passed two rafts of amendments tacking nearly $22

million onto the annual budget bill.

Republicans first sought to devote to local government coffers

any state tax revenues that exceed budget-writers expectations for

fiscal 2016....

Rep. James Lyons, an Andover Republican, and other members of the

minority caucus, next turned their attention restricting local aid

for so-called sanctuary cities, claiming their stance towards

immigrants in the country illegally flouts federal immigration law.

"Does the rule of law even matter in this state?" Lyons asked.

The amendment would prohibit unrestricted local aid from going to

cities or towns found to be in violation of a particular section of

federal law.

"I find this interesting that the amendment is trying to take

discretion away from municipalities," said Attleboro Democrat Rep.

Paul Heroux, noting the earlier amendment sought to give local

governments more control over spending.

The Lyons amendment failed on a straight 34 to 118 party-line

vote....

Democrats and Republicans came together to unanimously pass two

consolidated amendments, adding $19.9 million in spending on a local

aid and education amendment, and $1.8 million in spending through an

amendment dealing with transportation, state administration and

constitutional offices.

State House News Service

Monday, April 25, 2016

House adds early ed spending after debates over local aid

The Massachusetts House passed a $39.56 billion fiscal 2017

budget Wednesday afternoon, shipping its spending plan to the Senate

which plans in May to debate its vision of what state spending

should look like beginning July 1.

The budget was approved after two-plus days of deliberations

marked by light and sporadic debates, with most of the decisions

made in a House ante-room where lawmakers were instructed to go and

talk to Ways and Means Chairman Brian Dempsey about their thousands

of amendments.

Lawmakers added $86 million in spending to the bottom line

through nine "consolidated" amendments compiled by House leadership

and passed unanimously.

The final budget passed 156 to 0 with three Democrats not

recorded.

In closing remarks where he thanked members and staff as votes

were being tallied, House Speaker Robert DeLeo boasted at the

House's record of producing budgets that are "on time and in

balance." ...

House members agreed to pack into the budget scores of earmark

amendments designed to pay for local projects. If the Senate does

not agree to those earmarks, they could still be included in the

final budget if a six-member conference committee is amenable....

Aside from what industry officials describe as a hospital tax and

lawmakers classify as an assessment, the budget does not include any

new taxes or tax increases. The House rejected an amendment to raise

the gas tax by 3 cents per gallon and avoided a vote on reducing the

sales tax to 5 percent by voting to study that issue instead.

On Wednesday, the House added to the budget a measure sponsored

by Republican leadership that would bring Massachusetts into

compliance with the federal Real ID Act. Some Democrats objected

saying they were caught off guard by the major policy decision....

The budget provides "targeted investments" to support the early

education workforce, including a $15 million salary reserve, $2

million for access to early education programs and $18.6 million for

kindergarten expansion grants.

The spending plan approved Wednesday also includes $159 million

more in local aid than the current year's budget.

"I think it's a good document, local aid was prioritized in a way

that satisfied a lot of members on my side of the aisle. That was

one of the number one priorities across the board," House Minority

Leader Bradley Jones said. "It goes off to the Senate now and we'll

see what the Senate does. Hopefully we continue to make progress

toward having a budget to the governor's desk in time so he can

exercise his judgment."

State House News Service

Wednesday, April 27, 2018

House unanimously approves $39.56 billion budget

We finally get to celebrate on Thursday.

What’s Thursday? It’s Tax Freedom Day. It is the day we are no

longer working to pay our tax burden.

Since Jan. 1 we have yet to work one day for ourselves. All of

the hard work has gone to pay our federal, state and local taxes.

Of course, Tax Freedom Day comes later in Massachusetts than most

other states. We work an extra 11 days for the government. That’s

why we have earned the nickname Taxachusetts. And it’s

well-deserved.

During last week’s 2½-day House budget debate over spending $40

billion of our tax dollars, there was an attempt to raise the gas

tax once again. Memories are short on Beacon Hill. In 2013 the gas

tax was raised three cents and linked to inflation. Fortunately,

voters rejected taxation without representation and repealed the

linkage in November 2014.

The Boston Herald

Monday, May 2, 2016

Living up to the nickname Taxachusetts

By Holly Robichaud

This year, Tax Freedom Day falls on April 24, or 114 days into

the year (excluding Leap Day).

Americans will pay $3.3 trillion in federal taxes and $1.6

trillion in state and local taxes, for a total bill of almost $5.0

trillion, or 31 percent of the nation’s income.

Tax Freedom Day is one day earlier than last year, due to

slightly lower federal tax collections as a proportion of the

economy.

Americans will collectively spend more on taxes in 2016 than they

will on food, clothing, and housing combined.

If you include annual federal borrowing, which represents future

taxes owed, Tax Freedom Day would occur 16 days later, on May 10.

Tax Freedom Day is a significant date for taxpayers and lawmakers

because it represents how long Americans as a whole have to work in

order to pay the nation’s tax burden....

Tax Freedom Day Arrives on May 5th in Massachusetts

Tax Freedom Day is the day when Americans have finally earned

enough money to pay off their total tax bill for the year. In 2016,

Massachusetts taxpayers have to work until May 5th (47th earliest

nationally) to pay their total tax bill.

The Tax Foundation

Wednesday, April 6, 2016

Tax Freedom Day Arrives on May 5th in Massachusetts

|

|

Chip Ford's CLT

Commentary

One week after the Massachusetts House of

Representatives passed its $39.56 billion FY 2017 budget and sent it

on to the Senate, Massachusetts taxpayers today at long last celebrate

our Tax Freedom Day.

Tax Freedom Day is when taxpayers begin working for

themselves, if all income since January 1st was used to pay just each of

our individual federal, state, and local tax burden. That's 125

days (17 weeks and 6 days) that every cent we earned has been

taken by government on all levels to feed itself. Now we can start keeping what

we earn, thank you Big Government.

Americans will spend more on taxes in 2016 that it

will on food, clothing, and housing combined.

Then there's the annual federal budget deficit.

The Tax Foundation reports:

Since 2002, federal

expenses have surpassed federal revenues, with the budget

deficit exceeding $1 trillion annually from 2009 to 2012. In

calendar year 2016, the deficit will grow significantly, from

$592 billion to $698 billion. If we include this annual federal

borrowing, which represents future taxes owed, Tax Freedom Day

would occur on May 10, 16 days later. The latest ever

deficit-inclusive Tax Freedom Day occurred during World War II

on May 25, 1945.

That's just the annual federal deficit —

not the $19 TRILLION and growing accumulated federal debt!

Never mind the off-the-charts federal and state unfunded liabilities!

According to the Washington DC-based

Tax Foundation, on average Tax Freedom Day nationally

occurred on April 24th, eleven days before Massachusetts, which is the

47th state to reach its Tax Freedom Day. The only states behind us and still waiting are

New York (#48), New Jersey (#49), and Connecticut (#50).

The next time someone tells you Taxachusetts doesn't

tax us enough, ask "What's enough?" — there

are only three states in the nation that tax its citizens more than

Massachusetts. Are any of them taxing "enough" yet?

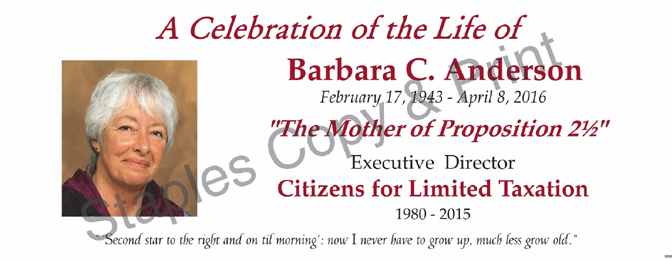

As you can imagine, I've been running ragged

here at CLT since Barbara's passing —

there's so much to do and only so much time in a week to get

it done before the next week starts the following day. The

around-the-clock caring for her is behind me but time

remains insufficient. There's just not enough of it in a

day, a week. I moved on to the daunting process of

clearing out her home and home office of all the CLT records, paperwork,

files, and office equipment, moving everything into my rooms

and office — while

simultaneously taking over all her duties, learning my many

additional new responsibilities such as CLT's accounting, bookkeeping,

and banking systems and methods. It's coming together

day by day and we hope you'll bear with us during this

period of adjustment.

Chip Faulkner and I are also planning a "celebration

of life" remembrance for Barbara — as

so many friends, members, and even some of her opponents have suggested.

Personal invitations to our event will be sent out soon. If you wish to

attend, reserve the afternoon of Sunday, June 5th in your date book, and

watch your mailbox at home for the arrival of your invitation.

It's at the printer now.

— Banner (under

construction) for our June 5th remembrance event —

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

|

State House News Service

Monday, April 25, 2016

Sales tax cut runs into resistance in Mass. House

By Michael Norton

Saying state spending had risen 50 percent since 2006,

Andover Rep. James Lyons appealed to his colleagues Monday

to pass a budget amendment reducing the sales tax to 5

percent from 6.25 percent. The House instead voted 112-42 to

study the idea.

Rep. Stephen Kulik argued for an amendment to study the

proposal, saying its passage would reduce state revenues by

$1 billion. "It's critical funding," he said, noting the

proposed House budget increases state spending by $1.1

billion.

Lyons suggested tax policy studies favored by Democrats over

the years have not been conducted. "I've been in here five

years, I haven't seen a study yet," said Lyons, who, with

Rep. Brad Hill of Ipswich, said northern Massachusetts

residents have long spent their shopping dollars in sales

tax-free New Hampshire.

"At some point, if we are serious about economic growth, we

have to reduce the tax burden," Lyons said.

Led by House Speaker Robert DeLeo, the Legislature and

former Gov. Deval Patrick raised the sales tax in 2009 from

5 percent to 6.25 percent.

Rep. Angelo Scaccia said Speaker DeLeo was a fiscal

conservative, despite increases in the gas and sales taxes

under his watch.

"I don't think anybody in this world can call you a

tax-spender," he said, referring to DeLeo.

As a gubernatorial candidate in 2010, Charlie Baker favored

reducing the sales tax rate to 5 percent.

State officials have routinely relied on one-time revenues

to support state spending, and this year's budget proposals

take steps to reduce reliance on non-recurring revenues

while building the state's rainy day account to nearly $1.5

billion.

State House News Service

Monday, April 25, 2016

House Dems cool to muni gas tax exemption

By Michael Norton

House Democrats successfully moved Monday to study a proposal to exempt

cities and towns from paying 24 cents a gallon in gas taxes, avoiding a

direct vote on the proposal.

Rep. Brad Hill said Massport and the MBTA are already exempt from paying

the tax and told his colleagues the issue doesn't require additional

study. If passed, the amendment would be tantamount to a local aid

increase, he said. "The further amendment will once against disallow our

cities and towns from being exempt from this gas tax," Hill said.

Rep. Stephen Kulik, recommending a study, said the amendment was a

"perennial" and called investments in local aid a "hallmark" of the

House's $39.5 billion budget. Cities and towns deploy many vehicles that

use public roads and the gas taxes they pay come back to communities in

the form of public investments, he said.

The study amendment prevailed on a vote of 114-38.

State House News Service

Monday, April 25, 2016

House protects film tax credit, rejects gas tax increase

By Katie Lannan

The Massachusetts House on Monday shot down proposals to increase the

gas tax and put a cap on the state's film tax credit program as they

began to dispense with more than 1,300 amendments to the annual state

budget bill.

The House swiftly took care of more than 30 revenue-related amendments

to the $39.48 billion budget, rejecting four and voting to study two

others. The rest were withdrawn by their sponsors after behind the

scenes talks.

The gas tax and film tax credit amendments, both filed by Rep. Angelo

Scaccia, were rejected on voice votes.

Calling it the "biggest boondoggle" he has seen in his long legislative

career, Scaccia argued for Massachusetts to cap its film tax credit at

$40 million. Gov. Charlie Baker has also targeted the credit, which

supporters say has enabled the state to grow its film industry sector.

"We have to get rid of this boondoggle," said Scaccia.

House leadership has traditionally provided strong support for the tax

credit. House Majority Leader Ronald Mariano opposed Scaccia's

amendment, noting a Braintree company employs 14 accountants who work in

the sector and "wouldn't be here if we didn't have a film tax credit."

Rep. Ann-Margaret Ferrante described the credit as a benefit for parts

of the state that miss out on programs geared toward urban areas or

specific industries. She pointed to several movies filmed in her North

Shore district, including The Proposal, The Perfect Storm and Joy.

"I don't begrudge gateway cities and larger cities for the amount of

money they get, I do not begrudge Boston from having a whole MBTA travel

system," Ferrante said. "However, it is upsetting to me when I hear

folks from larger cities complain about a program that directly results

in a benefit for my district and to other districts that simply do not

qualify for the benefits that larger cities get. I also am concerned and

upset when I see tax credits go mainly to the businesses of white collar

workers, because once again those aren't the tax credits that benefit my

district."

Scaccia had also sought to increase the state's tax on gasoline from 24

cents per gallon to 27 cents per gallon, saying during debate on the

amendment that he was "not here to raise taxes per se" but wanted to

address the way the state pays for transportation. The gas tax increase

could help the MBTA move away from using capital funds to pay for

operating expenses, which "does not make financial sense" Scaccia said.

Rep. Geoff Diehl, a chief proponent of the 2014 ballot campaign that

repealed automatic gas tax increases, countered that the MBTA has

sufficient revenue to cover its personnel expenses and road construction

but must manage its money better. He said Massachusetts spends over four

times the national average to repair roads, and 49 percent of the gas

tax revenues go to the T.

During his arguments for an amendment to study reducing the state sales

tax to 5 percent, Scaccia noted the MBTA was one of the few areas

targeted for major investments in the budget, with $93 million more.

—Michael Norton contributed reporting

State House News Service

Monday, April 25, 2016

House adds early ed spending after debates over local aid

By Andy Metzger

After rousing debates Monday night wherein Democrats roundly

defeated two Republican local aid amendments, House

lawmakers unanimously passed two rafts of amendments tacking

nearly $22 million onto the annual budget bill.

Republicans first sought to devote to local government

coffers any state tax revenues that exceed budget-writers

expectations for fiscal 2016.

Mansfield Republican Rep. Jay Barrows and others argued the

transfer of up to $100 million received in excess of the

expected $26.8 billion tax haul could be used to provide

some relief for local taxpayers through their local

government.

Democrats countered that the amendment would tie lawmakers'

hands, claimed the budget already contributes substantially

to local aid and foreshadowed unanticipated needs cropping

up later in the year.

"It's our job, let's just do it," Dartmouth Democrat Rep.

Chris Markey urged his colleagues ahead of the 37 to 118

vote rejecting the amendment. Democrat Reps. James Dwyer,

Colleen Garry and Tom Stanley voted with the Republicans to

sequester the money for local aid.

Rep. James Lyons, an Andover Republican, and other members

of the minority caucus, next turned their attention

restricting local aid for so-called sanctuary cities,

claiming their stance towards immigrants in the country

illegally flouts federal immigration law.

"Does the rule of law even matter in this state?" Lyons

asked. The amendment would prohibit unrestricted local aid

from going to cities or towns found to be in violation of a

particular section of federal law.

"I find this interesting that the amendment is trying to

take discretion away from municipalities," said Attleboro

Democrat Rep. Paul Heroux, noting the earlier amendment

sought to give local governments more control over spending.

The Lyons amendment failed on a straight 34 to 118

party-line vote.

Paul Craney, executive director of the conservative

Massachusetts Fiscal Alliance, opined on Monday's floor

action that those concerned with local control "lost

tonight" as "the majority of lawmakers refuse to assert

themselves."

Democrats and Republicans came together to unanimously pass

two consolidated amendments, adding $19.9 million in

spending on a local aid and education amendment, and $1.8

million in spending through an amendment dealing with

transportation, state administration and constitutional

offices.

Amalgamations of various legislative proposals filed by

members of the House, the consolidated amendments are

assembled by House leadership, generally receive scant

public discussion and usually pass overwhelmingly.

One provision adopted by the House would temporarily

increase the amount of time when someone can vote in a city

or town after moving from that municipality to elsewhere

within the state.

Originally filed by Rep. Angelo Scaccia, a Boston Democrat

from the Readville neighborhood, the amendment would extend

to a year and a half the grace period when citizens can vote

at their old residence after moving to a different part of

the state - reverting it back to a six-month grace period

right after November's election.

The House also added requirements for the Massachusetts

Department of Transportation to assemble a working group

charged with expediting high-speed passenger rail service

from Springfield to Boston and included language about

pedestrian and cyclist safety to the state's driving

learner's permit statute.

The House also moved to increase by 50 percent a proposed

salary reserve for early education and care providers - a

profession that lawmakers have said suffers from high

turnover because of low wages.

The provision adopted Monday night would boost the size of

the fund from the $10 million proposed in the initial Ways

and Means budget to $15 million.

Lawmakers plan to return to the House chamber to resume

debate over the budget Tuesday with roll calls set to begin

at 11 a.m. A consolidated amendment covering social services

and veterans affairs is scheduled to be available in the

chamber an hour earlier.

State House News Service

Wednesday, April 27, 2018

House unanimously approves $39.56 billion budget

By Michael P. Norton, Andy Metzger and Colin A. Young

The Massachusetts House passed a $39.56 billion fiscal 2017 budget

Wednesday afternoon, shipping its spending plan to the Senate which

plans in May to debate its vision of what state spending should look

like beginning July 1.

The budget was approved after two-plus days of deliberations marked by

light and sporadic debates, with most of the decisions made in a House

ante-room where lawmakers were instructed to go and talk to Ways and

Means Chairman Brian Dempsey about their thousands of amendments.

Lawmakers added $86 million in spending to the bottom line through nine

"consolidated" amendments compiled by House leadership and passed

unanimously.

The final budget passed 156 to 0 with three Democrats not recorded.

In closing remarks where he thanked members and staff as votes were

being tallied, House Speaker Robert DeLeo boasted at the House's record

of producing budgets that are "on time and in balance."

Last year, House and Senate members agreed on a final budget a full week

into the fiscal year and Gov. Charlie Baker vetoed $162 million, as the

legislative and executive branches differed on the bottom line.

With the additional state spending tacked on through the consolidated

amendments, the House budget finished the week about $10 million higher

than the $39.55 billion spending bill submitted by Baker in January.

This year the House was about $4.7 million more frugal than last year in

adding to the Ways and Means bottom line through consolidated

amendments.

Massachusetts Fiscal Alliance Executive Director Paul Craney, whose

organization has frequently used budget-week roll call votes to target

incumbent Democratic lawmakers, criticized the process.

"If you blinked, you could have missed it. In just about a week's time,

House leadership unveiled its version of the 2017 budget, 160 house

members submitted more than 1300 amendments, no more than 20 meaningful

roll call votes were taken, and the budget was passed on to the Senate.

Seems like a little more deliberation is due for a $40 billion budget,"

Craney said.

House members agreed to pack into the budget scores of earmark

amendments designed to pay for local projects. If the Senate does not

agree to those earmarks, they could still be included in the final

budget if a six-member conference committee is amenable.

Governors over the years have often frowned on earmarks, which limit the

discretion of executive branch officials to make spending decisions.

Aside from what industry officials describe as a hospital tax and

lawmakers classify as an assessment, the budget does not include any new

taxes or tax increases. The House rejected an amendment to raise the gas

tax by 3 cents per gallon and avoided a vote on reducing the sales tax

to 5 percent by voting to study that issue instead.

On Wednesday, the House added to the budget a measure sponsored by

Republican leadership that would bring Massachusetts into compliance

with the federal Real ID Act. Some Democrats objected saying they were

caught off guard by the major policy decision.

The Real ID Act, a federal post-2001 anti-terrorism initiative, requires

states to begin issuing secure and compliant forms of identification

that for many residents will replace their current drivers' licenses.

Baker administration officials briefed legislative leaders last month on

a bill the governor filed last October to bring Massachusetts into

compliance, warning that without action this year residents might have

to start carrying their passports to access federal buildings or travel

through domestic airports by January.

The budget provides "targeted investments" to support the early

education workforce, including a $15 million salary reserve, $2 million

for access to early education programs and $18.6 million for

kindergarten expansion grants.

The spending plan approved Wednesday also includes $159 million more in

local aid than the current year's budget.

"I think it's a good document, local aid was prioritized in a way that

satisfied a lot of members on my side of the aisle. That was one of the

number one priorities across the board," House Minority Leader Bradley

Jones said. "It goes off to the Senate now and we'll see what the Senate

does. Hopefully we continue to make progress toward having a budget to

the governor's desk in time so he can exercise his judgment."

House Republicans sought to sequester up to $100 million in excess state

tax revenues to send to cities and towns, but were rebuffed by

Democrats.

The fiscal 2017 budget approved Wednesday will fund 45 new addiction

treatment beds at Taunton State Hospital.

The Legislature has increased funding for substance addiction services

by more than 65 percent since fiscal 2012, according to the speaker's

office.

The Massachusetts Cultural Council expressed disappointment that the

budget, in the end, funded the MCC at $12 million, down $2 million from

fiscal 2016. The council said more than 100 lawmakers had signed on to

an amendment to boost support to $17 million, but were rebuffed by House

leaders who added a more modest $2 million through the amendment

process.

"Once again citizens across the Commonwealth joined a broad-based

campaign to restore state support for the arts, humanities, and

sciences," said MCC Executive Director Anita Walker. "We came up short

in the House. But we know that increased state investment is the only

way to truly capitalize on the economic, social, and educational

potential of the nonprofit cultural sector. So we will redouble our

advocacy efforts through the Senate budget debate and beyond."

—Matt Murphy contributed reporting

The Boston Herald

Monday, May 2, 2016

Living up to the nickname Taxachusetts

By Holly Robichaud

We finally get to celebrate on Thursday.

What’s Thursday? It’s Tax Freedom Day. It is the day we are no longer

working to pay our tax burden.

Since Jan. 1 we have yet to work one day for ourselves. All of the hard

work has gone to pay our federal, state and local taxes.

Of course, Tax Freedom Day comes later in Massachusetts than most other

states. We work an extra 11 days for the government. That’s why we have

earned the nickname Taxachusetts. And it’s well-deserved.

During last week’s 2½-day House budget debate over spending $40 billion

of our tax dollars, there was an attempt to raise the gas tax once

again. Memories are short on Beacon Hill. In 2013 the gas tax was raised

three cents and linked to inflation. Fortunately, voters rejected

taxation without representation and repealed the linkage in November

2014.

Earlier this year, the state Senate passed a new tax on paint, giving

shoppers another reason to abandon the commonwealth.

It doesn’t end there. Beacon Hill politicians are also working on

legislation to allow new local option taxes on gas and other items as if

we don’t pay enough in property taxes.

Another reason for our state’s nickname is that, no matter what, you

cannot escape taxes. During the Patrick administration, the Department

of Revenue started collecting taxes on trucks and trailers stored here

even if the sales tax on the vehicles was paid in another state. What

sort of tax is this? It is called a “use” tax.

This usage tax doesn’t just apply to trucks. It can be applied to

furniture and boats. If items are used in Massachusetts within six

months of purchase, DOR has the right to collect a

6-percent use tax.

Who knew? I guess John Kerry did when he docked his yacht in Rhode

Island. The DOR even has a boat unit to collect these taxes.

Why are we Taxachusetts?

It might be due to our professional politicians.

New Hampshire operates with no sales or income taxes and they only pay

legislators $200 per year. On the other hand, we pay legislators $65,000

per year and get a hefty tax burden in return. If representatives cannot

spend more than 2½ days debating spending $40 billion, maybe we should

pay them the same salary as their New Hampshire counterparts. It would

force them to get other jobs instead of thinking of new ways to tax us.

Holly Robichaud is a Republican strategist and a six-time Pollie

Award winner.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

BACK TO CLT

HOMEPAGE

|