|

Help save yourself

— join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

|

Visit CLT on Facebook

|

CLT UPDATE

Wednesday, April 24, 2013

Tax hikes and more spending are happening suddenly and quickly

|

A political operative who represents the MBTA’s

secret pension fund also does public relations for a union-backed

group that has pushed Gov. Deval Patrick’s massive tax hike plan to

boost transportation spending.

Steve Crawford, an independent public relations

flack working for the MBTA Retirement Fund, would not say who pays

his salary at Campaign for Our Communities, an organization which

corralled the endorsements of various unions and groups to support

boosting the state income tax rate to funnel more money to MBTA

projects and education.

“I’m not going to tell you that,” Crawford told

the Herald when asked who funds the Campaign for Out Communities.

Crawford said “there is no connection” between

the union-backed group and the MBTA Retirement Fund, which he called

“a longtime client.” He did not respond to questions about who hired

him for the campaign....

Crawford, who worked as a spokesman for Patrick’s

political committee and U.S. Rep. William R. Keating’s (D-Bourne)

campaign, also declined to respond to questions about who founded

Campaign for Our Communities, which is not registered with the state

as a lobbying group despite the organization’s political maneuvering

to convince lawmakers to raise taxes.

“If they’re lobbying, they should register,” said

secretary of state spokesman Brian McNiff.

McNiff said the campaign’s director, Andi Mullin,

is registered as a lobbyist for SEIU Local 509 — not Campaign for

Our Communities.

Mullin told the Herald she still works for the

human service workers union and is “appropriately registered” with

the state.

She said the Campaign for Our Communities

includes funding from the Massachusetts Teachers Association and

SEIU, but she declined to list all sponsors or answer questions

about who pays her salary, Crawford’s salary and the organization’s

expenses.

The campaign’s website was registered by

Boston-based digital media strategy firm Alipes, which was

co-founded by former Patrick new media political operative Charles

SteelFisher. The Alipes worker who registered the site declined to

say who hired the company and SteelFisher did not return a call

seeking comment yesterday.

The Boston Herald

Saturday, April 13, 2013

Pushing tax hike, shielding T fund

Operative works for pension firm, group backing gov

The bargaining has indeed begun — or at least

that’s what Gov. Deval Patrick would have the Legislature’s leftier

Democrats believe.

The House has passed a $500 million tax hike to

support transportation needs in the state — not everything on the

governor’s $1 billion wish list — but enough to bail out the MBTA

and put toward road and bridge repairs. It increases gas, cigarette

and corporate taxes.

The Senate is scheduled to take up the

transportation package today in a rare Saturday session — made

necessary by those doing the governor’s bidding in that chamber.

The Senate version of the bill rapidly ramps up

new transportation spending to $805 million by fiscal 2018,

including the diversion of a tax on underground storage tanks and

some $40 million from leasing rights of way — always a rather

problematic fudge factor....

Yes, the taxpayers will be totally screwed, and

still it won’t be enough, because Patrick will want another $1

billion for his other non-transportation pet projects.

This is no time for the more sensible members of

the Senate to be drinking the Kool-Aid.

Deval Patrick is as good as gone. Lawmakers

shouldn’t allow him to bankrupt us all on his way out.

A Boston Herald editorial

Saturday, April 13, 2013

Tax hikes on the line

The one credible issue on the table for

lawmakers to wrestle with is the budgetary hole the MBTA has

created for itself. That does indeed need to be addressed, but a

new report out from the Pioneer Institute is a sobering look at

how the system got that way.

And unless its wild spending ways are curbed,

no amount of tax hikes or fare increases will fix the system for

very long....

So that’s where all those new taxes will be

going — to support a bloated system desperately in need of

reform.

A Boston Herald editorial

Saturday, April 13, 2013

... To support bloated T

Legislation raising gas, tobacco and business

taxes in Massachusetts by $500 million and eventually dedicating

up to $800 million a year in new revenues for transportation

cleared the Senate 30 to 5 during a rare Saturday session.

With the absence of the contingent of media

and lobbyists that would normally be attracted to a debate on a

tax bill, Senate President Therese Murray led the charge to pass

the tax bill, presiding as the Senate roared through more than

100 amendments to the legislation before approving it with all

but two Democratic votes. Senators said differences over

amendments had been talked through during a long private caucus.

Gov. Deval Patrick, who chastised the House

for a similar tax bill that he vowed to veto, had more

congratulatory words for the Senate following the final vote a

few minutes before 8 p.m....

Critics of the bill said the Patrick

administration was failing to meet cost saving benchmarks under

a 2009 transportation reform law and argued the legislation

would further burden taxpayers by pulling more of their money

into a transportation system that they said is rife with

problems and inefficiencies. Without reforms, they said, the new

revenues will not be enough to keep up with MBTA spending

patterns.

The push to pass the bill, which cleared the

House just before midnight Monday on a 97-55 vote, underscored

the pressure that Murray and House Speaker Robert DeLeo are

under since the House has already proposed a budget spending

revenues from the still unapproved tax hikes and the Senate

plans to do the same in May. Differences in the House and Senate

tax bill remain to be ironed out by the branches....

[Sen. Robert Hedlund, R-Weymouth] said

reforms included in a 2009 law were intended to produce $6.5

billion in savings over 20 years, but so far had delivered only

$500 million. Of that, Hedlund said, $320 million was

attributable to ending interest rate swap practices that were

not a focus of the 2009 law.

“Obviously we have discarded the concept of

reform before revenue,” said Hedlund.

State House News Service

Saturday, April 13, 2013

Senate adopts $500 mil tax plan, steers more $$$ to

transportation

The Senate voted overwhelmingly Saturday to

approve a transportation finance bill that would funnel more

than $800 million into the state’s transit agencies by fiscal

2018 in what seemed a compromise between packages proposed by

House legislators and Governor Deval Patrick in recent weeks....

After the 30-5 vote, Patrick expressed mixed

feelings on the bill.

“Today’s Senate bill is a significant step in

that direction and I commend them for their work,” he said in a

statement. But, he continued, “it is concerning that some of the

resources in this bill are diverted from current spending on

other needs.” ...

The transportation finance package is far

from settled. The bill will move on to a joint conference

committee before it makes its way to the governor’s desk. But

it’s a coup for Patrick, who was angered when the House proposed

a package he deemed too small, threatening a veto and urging

legislators to tack other sources of revenue onto the bill.

Patrick suggested earlier this week that he

would not veto a transportation finance package close to the

halfway point between his and the House’s proposals.

The Boston Globe

Sunday, April 14, 2013

Mass. Senate OKs $800 million transportation bill

Four days after the House named three

representatives to a transportation tax bill conference

committee, the Senate appointed its negotiators on Monday

morning.

Senate Ways and Means Chairman Stephen Brewer

(D-Barre), Senate Chairman of the Joint Committee on

Transportation Thomas McGee (D-Lynn) and Sen. Robert Hedlund of

Weymouth, the ranking Republican member of the Transportation

Committee, were appointed before the Senate recessed on Monday.

The Senate is waiting to determine whether a

Thursday formal session will take place, according to an agenda

distributed to members. The six-member committee will attempt to

reconcile two versions (H 3415/ S 1770) of a $500 million tax

bill that would fund transportation.

On Thursday, the House appointed House Ways

and Means Chairman Brian Dempsey (D-Haverhill), House Chairman

of the Joint Committee on Transportation William Straus

(D-Mattapoisett) and Rep. Steven Howitt (R-Seekonk), a member of

the Transportation Committee, to the conference committee.

State House News Service

Monday, April 22, 2013

State Capitol Briefs - Lunch Edition

Tax bill negotiating committee fully named

The House on Monday commenced debate on a

$33.8 billion annual state budget proposal with consideration of

a plan to reduce the sales and income tax rates to 5 percent

over five years, an initiative voted down by the Democratic

majority.

“I would call it the death by a thousand cuts

proposal,” said Rep. Jay Kaufman, a Lexington Democrat and

co-chairman of the Revenue Committee.

House Minority Leader Bradley Jones (R-North

Reading) said that under the Republican-sponsored amendment, the

5 percent income tax rate would be achieved 19 years after

voters approved reducing the income tax rate to 5 percent

through a ballot initiative.

Invoking last week’s Boston Marathon

bombings, Kaufman argued that the amendment would deprive the

state government of $2 billion in revenue critical to providing

funding for public safety and other programs. The amendment

failed on largely party-line, with 35 representatives supporting

it and 118 voting against the proposal.

“I’m a little disappointed that it only took

until the third speaker of the day to bring up the events of

last week as to why we should or shouldn’t do things this week

and frankly I think it’s disappointing,” Jones said.

Rep. Timothy Toomey, a Cambridge Democrat,

called it “fundamentally irresponsible” to lower taxes, worried

that it would impact job training used to support technology

start-ups in Cambridge.

The fiscal 2014 budget debate, expected to

continue through much of the week, started with debate over

revenue and tax amendments plucked from the 888 amendments filed

to the budget bill....

The Legislature and Gov. Deval Patrick raised

the sales tax rate to 6.25 percent from 5 percent in 2009. A

ballot question calling for a 5 percent income tax rate passed

in 2000, but was not fully implemented — the income tax rate is

currently 5.25 percent.

State House News Service

Monday, April 22, 2013

House turns down plan to phase in income, sales tax cuts

House lawmakers tacked on close to $27

million in additional spending for education and local aid on

the first night of debate on a $33.8 billion fiscal 2014 budget

Monday, engaging in sporadic debate, including a fiery

back-and-forth over in-state tuition for undocumented

immigrants....

In a testy exchange over in-state tuition for

undocumented immigrants, the House voted 107-46 to study the

issues around tuition rates for immigrants and returning

veterans, avoiding a direct vote on a budget amendment offered

by Rep. Marc Lombardo (R-Billerica) that would have reversed

Gov. Deval Patrick's directive extending the tuition break to

immigrants who qualify for legal status under a new federal

program.

Lombardo, Rep. James Lyons and Rep. Shaunna

O'Connell argued taxpayers are being asked to subsidize tuition

for immigrants who broke the law by coming to the United States.

Lombardo said the policy forced taxpayers to subsidize tuition

for immigrants who “break the rules,” while Lyons accused

Patrick of circumventing the Legislature. “This is about

fairness,” said Lyons, noting a 2006 roll call vote the House

took to limit in-state tuition.

The Patrick administration last November

determined under existing state policy that immigrants granted

deferred status by the federal government are eligible for

in-state tuition rates, which are lower than rates paid by

out-of-state students. The ruling was not a new policy, but an

application of the new federal rules established by executive

order by President Barack Obama, the administration said....

State House News Service

Monday, April 22, 2013

House adds $27 mil to budget, sends immigrant tuition issue to

study

|

|

Chip Ford's CLT

Commentary

We should have known —

at least have suspected — that Steve

Crawford had his fingers in Deval's massive tax hike, and the

so-called "Campaign for Our Communities" organization of state hacks

and takers. Steve has always been there for the tax-borrow-and-spend

cabal. His reaction to being exposed it so typical of Democrat

political operatives that it didn't surprise even me.

CLT — "39-Years as

The Voice of Massachusetts Taxpayers —

and It's Institutional Memory"!

Ah memories. The last time I debated

Crawford was in defense of Carla Howell's outright repeal of the

state income tax. This wasn't a CLT initiative, and CLT didn't

think it was the best means of limited taxation in the short term,

but the question made it onto the 2008 ballot — Question 1. We needed to defend it. The debate

sponsor, The Salem News, didn't want to hear Carla's regurgitated 'mantras' any

more. I was invited to fill in, to oppose Crawford, if I was

willing to accept. Of course I did, rather than risk leaving

taxpayers with no voice against the special-interests' opposition to

it, and the principal of limited

taxation.

Back then

I wrote:

Barbara was off-camera as an observer and

Salem News columnist, gathering information for a forthcoming

column on the ballot questions. She wrote to [Howell's]

Committee for Small Government, "Crawford was taken aback by

this; he had come to debate Carla [Howell] and thought he'd be

dealing with her talking points, was totally unprepared for [my]

'union attack'."

WATCH THE 2008 DEBATE HERE

As with most the political operatives, Steve

Crawford has probably made more just recently in his latest role than CLT

has been able to afford paying me, or Barbara, or Chip Faulkner,

over our entire lifetimes.

As long as we're around —

we're such a fantastic deal for you lunch-bucket taxpayers!

Regardless, the so-called "Campaign for Our

Communities" which we've been exposing for years for the sham it is,

has become — or is becoming

— recognized at last: the latest incarnation

of the public employees' union bully front. It's about time. If CLT

is ever able to attach salaries, dragoon union dues into its

coffers, mandate the state to administer collections into our

treasury like them, we could probably become more competitive, an

equally fearsome threat — not that we'd ever even consider

such extortion. Nonetheless, underfunded as CLT is, we've so far

managed to hold our own for us and you taxpayers against the Gimme

hordes.

Believe it or not — there

are some among our "lapsed members" who assume we are somehow

state-funded or state-subsidized, like the unions! They honestly

believe we can survive without voluntary contributions! To

them I say, we taxpayers defend ourselves and stand on our own.

That's why we're not too

disappointed if we lose their drag.

Even with the State House News Service, news from

Bacon Hill has been sparse since the despicable Boston Marathon

bombings. I've done my usual diligent news searches seven days a

week, but there's been nothing to pass on for a week, since the state

Senate vote on April 11th on the transportation tax hike, while

Barbara and I were on Boston Common at the

Greater Boston Tea Party rally.

It's been like waiting for white smoke over the

Vatican, but finally yesterday some news emerged.

We're back in full swing. School vacation

week coincided with the bombings; legislators were apparently more

or less on vacation for the week too. (Is there some

significant metaphor there?) They're back to work again and

seemingly moving fast — which is their

usual method.

We're on top of things, and will be moving just

as fast to stay on top over the next few days, and the weeks

ahead.

Stay tuned. We'll have more for you

— and them —

soon . . .

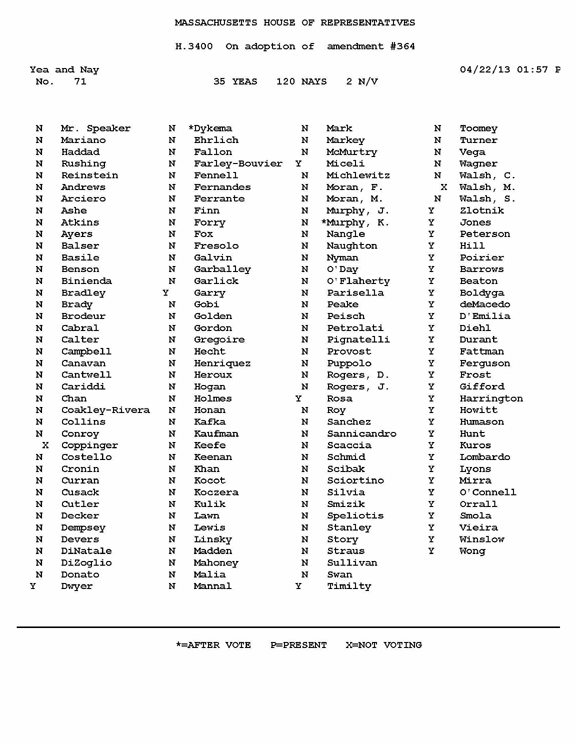

Again the "temporary" income tax rollback was

killed by the majority Democrats. Below is the House roll call vote on rolling back

the income and sales tax to their historic 5%.

This year, the Republicans offered a reduction of

the income tax to 5%, the sales tax to 5%, over five years.

(We'll never give Bacon Hill any wiggle-room again like we allowed

on our 2000 ballot question; "now or never" can't work any worse!)

Remember when you

vote in the coming year how these alleged "representatives" voted on

respecting the voters' mandate —

YOUR vote — thirteen years ago

— after a promise "our" Legislature made

twenty-four years ago when it hiked the tax

"temporarily." Remember this typical MIDDLE-FINGER

BEACON HILL SALUTE!

Mark down how your "representative" voted

— then remember and badger your friends

and neighbors from now till then! Then keep badgering them.

For a printable, downloadable PDF file

CLICK HERE

The House voted 107-46 to "study" the issues

around in-state tuition rates for illegal immigrants

— killing it. The budget amendment

offered by Rep. Marc Lombardo (R-Billerica) would have reversed Gov.

Deval Patrick's unilateral directive extending the tuition break to

immigrants. It was backed voraciously by Rep. James Lyons and Rep.

Shaunna O'Connell. It would have reversed taxpayers' responsibility

for subsidizing tuition for immigrants who broke the law by coming

to the United States illegally. Sending it to "study" is the

bureaucratic death knell of any legislation —

a dodge for any legislator who dares not vote or be caught on record,

who intends to stand for re-election and must ultimately answer to

the voters in their district.

|

|

|

|

Chip Ford |

|

|

|

|

|

|

|

The Boston Herald

Saturday, April 13, 2013

Pushing tax hike, shielding T fund

Operative works for pension firm, group backing gov

By Erin Smith

A political operative who represents the MBTA’s secret pension fund

also does public relations for a union-backed group that has pushed

Gov. Deval Patrick’s massive tax hike plan to boost transportation

spending.

Steve Crawford, an independent public relations flack working for

the MBTA Retirement Fund, would not say who pays his salary at

Campaign for Our Communities, an organization which corralled the

endorsements of various unions and groups to support boosting the

state income tax rate to funnel more money to MBTA projects and

education.

“I’m not going to tell you that,” Crawford told the Herald when

asked who funds the Campaign for Our Communities.

Crawford said “there is no connection” between the union-backed

group and the MBTA Retirement Fund, which he called “a longtime

client.” He did not respond to questions about who hired him for the

campaign.

Critics have called for transparency in MBTA pensions, but Patrick,

who has been seeking nearly $2 billion in new taxes for

transportation and education, said he accepts that pensions for the

publicly funded authority should remain secret — even as the MBTA’s

share of pension contributions skyrocketed 42 percent from $30

million in 2007 to $52.3 million in 2011.

Three of the pension fund’s seven-member board are also appointed by

the MBTA.

Crawford has declined the Herald’s request to release MBTA pensions

and state courts have sided in the past with the agency, which

argues its pension information isn’t public because the fund was set

up as a private trust by the agency’s predecessor, the Metropolitan

Transit Authority, in 1948.

Crawford, who worked as a spokesman for Patrick’s political

committee and U.S. Rep. William R. Keating’s (D-Bourne) campaign,

also declined to respond to questions about who founded Campaign for

Our Communities, which is not registered with the state as a

lobbying group despite the organization’s political maneuvering to

convince lawmakers to raise taxes.

“If they’re lobbying, they should register,” said secretary of state

spokesman Brian McNiff.

McNiff said the campaign’s director, Andi Mullin, is registered as a

lobbyist for SEIU Local 509 — not Campaign for Our Communities.

Mullin told the Herald she still works for the human service workers

union and is “appropriately registered” with the state.

She said the Campaign for Our Communities includes funding from the

Massachusetts Teachers Association and SEIU, but she declined to

list all sponsors or answer questions about who pays her salary,

Crawford’s salary and the organization’s expenses.

The campaign’s website was registered by Boston-based digital media

strategy firm Alipes, which was co-founded by former Patrick new

media political operative Charles SteelFisher. The Alipes worker who

registered the site declined to say who hired the company and

SteelFisher did not return a call seeking comment yesterday.

The Boston Herald

Saturday, April 13, 2013

A Boston Herald editorial

Tax hikes on the line

Ah, we should have known ...

The bargaining has indeed begun — or at least that’s what Gov. Deval

Patrick would have the Legislature’s leftier Democrats believe.

The House has passed a $500 million tax hike to support

transportation needs in the state — not everything on the governor’s

$1 billion wish list — but enough to bail out the MBTA and put

toward road and bridge repairs. It increases gas, cigarette and

corporate taxes.

The Senate is scheduled to take up the transportation package today

in a rare Saturday session — made necessary by those doing the

governor’s bidding in that chamber.

The Senate version of the bill rapidly ramps up new transportation

spending to $805 million by fiscal 2018, including the diversion of

a tax on underground storage tanks and some $40 million from leasing

rights of way — always a rather problematic fudge factor.

Now the governor, who had been taking the my-way-or-the-highway

approach on Beacon Hill — which so impresses legislative leaders,

calling the House tax hike a “pretend fix” — got down to the serious

business of dealing by mid-week. Oh, yes, he’s such a sly devil.

“If the Senate can get to the seven-fifty, eight hundred number, net

of fees, fares and tolls — not including fee, fares and tolls,” he

told State House News Service, “we can take care of that, and

reforms. We can take care of that. If they can get in that range,

then we will have done something important for transportation. We

still need to deal with education.”

Another 24 hours after that and he was still trying to assess

whether the Senate plan would accommodate his must-have boondoggles

like rail service from Pittsfield to New York City.

“We’re trying to see whether the [Senate] dollars are real,” he

said.

Yes, the taxpayers will be totally screwed, and still it won’t be

enough, because Patrick will want another $1 billion for his other

non-transportation pet projects.

This is no time for the more sensible members of the Senate to be

drinking the Kool-Aid.

Deval Patrick is as good as gone. Lawmakers shouldn’t allow him to

bankrupt us all on his way out.

The Boston Herald

Saturday, April 13, 2013

A Boston Herald editorial

... To support bloated T

The one credible issue on the table for lawmakers to wrestle with is

the budgetary hole the MBTA has created for itself. That does indeed

need to be addressed, but a new report out from the Pioneer

Institute is a sobering look at how the system got that way.

And unless its wild spending ways are curbed, no amount of tax hikes

or fare increases will fix the system for very long.

Pioneer focuses on two aspects of T spending that cry out for

reform. First, its workers are paid substantially more than other

state workers for the same job. An assistant attorney general makes

about $65,000 a year, but an assistant general counsel at the T

makes $85,000. A painter for the state makes $46,742; a painter for

the T $79,279. Customer service workers at the Registry top out at

$45,117, but at the T they get $61,110.

The other huge chunk of change goes for commuter rail service — the

next five-year contract is expected to cost about $1 billion. The

real problem is that at the beginning of that procurement process 25

commuter rail operators expressed an interest in bidding. However,

when the time came for actual bidding, there were only two — the

current operator, Massachusetts Bay Commuter Rail (MBCR) and Keolis,

which is still struggling to get accurate information from their

only competitor.

The Pioneer report also notes that over the past few years MBCR has

been negotiating higher and higher labor costs (a 13.7 percent boost

through June 2013) and eased work rules that will mean more

overtime. Those contract elements will make it difficult for any

other bidder to roll back costs, making it less attractive to bid

and further burdening taxpayers.

So that’s where all those new taxes will be going — to support a

bloated system desperately in need of reform.

State House News Service

Saturday, April 13, 2013

Senate adopts $500 mil tax plan, steers more $$$ to transportation

By Michael Norton and Andy Metzger

Legislation raising gas, tobacco and business taxes in Massachusetts

by $500 million and eventually dedicating up to $800 million a year

in new revenues for transportation cleared the Senate 30 to 5 during

a rare Saturday session.

With the absence of the contingent of media and lobbyists that would

normally be attracted to a debate on a tax bill, Senate President

Therese Murray led the charge to pass the tax bill, presiding as the

Senate roared through more than 100 amendments to the legislation

before approving it with all but two Democratic votes. Senators said

differences over amendments had been talked through during a long

private caucus.

Gov. Deval Patrick, who chastised the House for a similar tax bill

that he vowed to veto, had more congratulatory words for the Senate

following the final vote a few minutes before 8 p.m.

“Experts agree that we need approximately $1 billion more a year --

in addition to further operating efficiencies -- to give our

citizens a safe, functional, modern transportation system to keep

pace with a growing economy,” Patrick said in a statement. “Today's

Senate bill is a significant step in that direction and I commend

them for their work.”

Supporters of the bill said it would prevent a second major MBTA

fare hike in as many years, deliver funds to address regional

transportation needs and expedite construction projects, and over

three years end the longstanding practice of paying about 1,900

state transportation employees with borrowed funds.

Critics of the bill said the Patrick administration was failing to

meet cost saving benchmarks under a 2009 transportation reform law

and argued the legislation would further burden taxpayers by pulling

more of their money into a transportation system that they said is

rife with problems and inefficiencies. Without reforms, they said,

the new revenues will not be enough to keep up with MBTA spending

patterns.

The push to pass the bill, which cleared the House just before

midnight Monday on a 97-55 vote, underscored the pressure that

Murray and House Speaker Robert DeLeo are under since the House has

already proposed a budget spending revenues from the still

unapproved tax hikes and the Senate plans to do the same in May.

Differences in the House and Senate tax bill remain to be ironed out

by the branches.

The House bill fell just short of the vote required to override a

potential veto. The resounding vote in the Senate well cleared the

two-thirds threshold required.

After Patrick threatened to veto the original bill offered by DeLeo

and Murray, saying it didn’t provide enough new revenues to meet

transportation system needs, the Senate pulled money from other

areas of state government into the bill to bolster planned new

revenues closer to the $1 billion sought by Patrick, who spoke

favorably about the Senate plan late this week.

On the tax front, the House and Senate bills raise new revenue from

a $1 per pack increase in the cigarette tax and increases on cigar

and smokeless tobacco products, new sales taxes on computer design

services and software modifications, the removal of a tax exemption

for utilities, and a three-cent increase in the gas tax, which would

also be indexed to inflation under the legislation (S 1766).

A contingent of liberal senators attempted to include a trigger that

would raise the gas tax an additional three cents if projected

revenue falls short in 2015, but that vote garnered the support of

only 10 members.

“The rest of the body was very careful in how much they wanted to

raise, and how much they wanted to tax,” Murray told reporters after

the final vote. Asked how it would match up with the House version,

Murray said, “It’s the same framework as the House, for taxes, and

we just did other revenues that we moved over from other accounts,

so I’m hoping that the House will look on this favorably. Hey, the

House did the heavy lifting first, and they are our partners, and

hopefully the governor will be our partner in this also.”

During a speech in opposition to the gas tax trigger, applause

erupted from the gallery, and Murray directed court officers to

clear the crowd, during which time “Don’t tread on me” flags were

displayed and criticism rained down on the senators as some chanted

“No new taxes.”

On her way out, a woman wagged her finger at the chamber below and

said, “Think about your children and your grandchildren when you

take these votes, you idiots.”

“You might not have seen what was going on, but we were getting Nazi

salutes from the people in the corner and some really vulgar

language before they disrupted,” Murray told reporters afterwards.

Another amendment, sponsored by Sen. Karen Spilka (D-Ashland)

enabling state officials to start discussing with the federal

government the idea of establishing tolls on the state’s borders,

won approval by a 19 to 15 margin, with some senators who represent

border areas saying tolls would hurt their constituents.

Spilka had said that removing increases in current tolls from the

formula the Legislature is using to move the transportation

department toward more fiscal self-sufficiency was an essential

condition to win her vote on the bill. That amendment passed on a

voice vote after the Senate voted down on a voice vote a Sen. Sonia

Chang-Diaz (D-Jamaica Plain) further amendment that would have also

exempted fares for MBTA riders.

“So we can have perpetual gas tax increases, but we can’t look at

tolls,” said Sen. Robert Hedlund (R-Weymouth).

Senate Ways and Means Committee Chairman Sen. Stephen Brewer (D-Barre)

said the bill also makes $160 million in new tax revenues available

to spend in the fiscal 2014 budget he plans to roll out next month.

The House budget plan unveiled on Wednesday steers some of those new

revenues to education and local aid.

Hedlund said reforms included in a 2009 law were intended to produce

$6.5 billion in savings over 20 years, but so far had delivered only

$500 million. Of that, Hedlund said, $320 million was attributable

to ending interest rate swap practices that were not a focus of the

2009 law.

“Obviously we have discarded the concept of reform before revenue,”

said Hedlund.

Rafael Mares, staff attorney at the Conservation Law Foundation,

said that the final Senate version devoted more money to

transportation than what Senate Ways and Means had proposed by

indexing a 2.5-cent-per-gallon underground storage tank gas tax to

inflation, and devoting those revenues to transportation.

On Friday night, before some changes were made to the bill in

session, Mares calculated that the average amount of money over five

years designated for transportation in the Senate bill was $602

million, compared to $504 million in the House plan and $858 million

in the governor’s plan.

Kristina Egan, executive director of Transportation for

Massachusetts, said the roughly $800 million in transportation

revenues the Senate projected to raise by 2018 is “optimistic,” and

hoped the bill would be modified to include more gas-tax hikes

before reaching the governor.

Six of the more liberal members of the Senate, who all supported the

final bill, praised the process and signaled that if substantially

changed it would lose their support.

“Through both the work of the Senate Ways and Means Committee and

the amendment process, the transportation finance bill passed by the

Senate today reaches a level of revenue that allows for meaningful

investments in a fiscally-sound, 21st century transportation system.

It is for this reason that we vote yes on this bill today,” the six

senators wrote in a joint-statement. “We look forward to the bill

continuing to the joint House-Senate conference committee. Should

the bill be reported out of the conference committee having lost the

revenue gains we made, it will also lose our support.”

“There’s definitely more money in this bill,” Somerville Mayor Joe

Curtatone told the News Service. “I appreciate the work the House

did. A week before the House bill, we were at zero. We went from

zero to a half a billion. While I appreciate that work it wasn’t

enough… This is a huge step forward in that direction.”

Curtatone said he was hopeful that the revenue would be enough to

enable matching federal funds for the Green Line Extension to his

city, and said it would provide a needed investment for

transportation through the whole state.

Among amendments adopted by the Senate were proposals to enable

transportation agencies to collect more property taxes from private

parties using public land, to require better reporting by the MBTA

on its capital projects, and requiring the MBTA to gather

information from 23 companies that opted against bidding on the

commuter rail operations contract after submitting statements of

interest.

Among the amendments rejected by the Senate were calls for a larger

gas tax hike, for universities to play a greater role in funding

transportation through student pass programs, and to eliminate the

indexing of the gas tax to inflation. While Hedlund argued against

locking the state into incremental gas tax hikes, Senate

Transportation Committee Chairman Thomas McGee said the gas tax

would be 9 cents higher per gallon if an indexing measure had been

adopted in 1991, with each penny of tax worth $32 million.

Sen. Michael Rush (D-West Roxbury), in a floor speech highly

critical of the MBTA and calling for a long menu of reforms, came up

short in his bid to prevent the gas tax hike from taking effect

until a task force recommended reforms and the Legislature adopted

them. His amendment failed 7-24.

During debate, Murray said a proposal calling on the MBTA to

contract with taxi companies to deliver RIDE services at lower costs

would be dealt with by the Senate in separate legislation. An

amendment pushing that reform was offered by Sen. Patricia Jehlen

(D-Somerville) but was withdrawn.

A Republican alternative, which Senate Minority Leader Bruce Tarr

said would include potential new revenues from an overhaul of how

taxi medallions are administered, fell along party lines with

Hedlund, Tarr and the only other Republican in the chamber, Sen.

Richard Ross (R-Wrentham) supporting it.

The six senators who said they would not support a final bill with

less revenue were Chang-Diaz, Jehlen, Katherine Clark (D-Melrose),

Ken Donnelly (D-Arlington), Jamie Eldridge (D-Acton), Mark Montigny

(D-New Bedford) and Dan Wolf (D-Barnstable).

The Boston Globe

Sunday, April 14, 2013

Mass. Senate OKs $800 million transportation bill

By Martine Powers

The Senate voted overwhelmingly Saturday to approve a transportation

finance bill that would funnel more than $800 million into the

state’s transit agencies by fiscal 2018 in what seemed a compromise

between packages proposed by House legislators and Governor Deval

Patrick in recent weeks.

Democrat legislators who voted for the bill sought to offer a more

amped-up version of the $500 million House bill, passed Monday, by

finding revenue sources that would not require further tax

increases.

In addition to redirecting money from a little-known gas tax fund

for underground storage tanks and requiring contracts between the

state Transportation Department and utility companies, the Senate

also voted Saturday to require that transportation and MBTA

officials issue a request for proposals on licensing the naming

rights to subway, bus, and commuter rail stations.

After the 30-5 vote, Patrick expressed mixed feelings on the bill.

“Today’s Senate bill is a significant step in that direction and I

commend them for their work,” he said in a statement. But, he

continued, “it is concerning that some of the resources in this bill

are diverted from current spending on other needs.”

But Senator Thomas M. McGee, cochairman of the Joint Transportation

Committee, said he considered the bill a success.

“I feel good about what we’ve done today,” McGee said, “but it’s an

ongoing issue that we need to focus on every year.”

The transportation finance package is far from settled. The bill

will move on to a joint conference committee before it makes its way

to the governor’s desk. But it’s a coup for Patrick, who was angered

when the House proposed a package he deemed too small, threatening a

veto and urging legislators to tack other sources of revenue onto

the bill.

Patrick suggested earlier this week that he would not veto a

transportation finance package close to the halfway point between

his and the House’s proposals.

The Senate bill, which was debated in a rare Saturday session

because many legislators will be on vacation next week, called for

the same revenue sources in the House version: a 3-cent gas tax, a

$1 tax on cigarettes, and $244 million in utility and

business-related computer fees.

But the Senate version also rerouted a little-known 2.5-cent gas tax

originally dedicated to underground storage tank cleanups. And the

bill established a consistent process for the Transportation

Department and the MBTA to enter into leases with telecommunications

and utility companies that use their property.

Those additional funds could be used for capital projects such as

the South Coast Rail, a South Station expansion, the extension of

the Green Line, and new cars to replace the MBTA’s aging fleet —

though the extra cash would not be nearly enough to fund all of

them.

According to a study by Northeastern University’s Dukakis Center for

Urban and Regional Policy, the Senate version provides about $265

million in fiscal 2014 — just $5 million less than Patrick’s

proposal prescribed — but ramps up less steeply than the governor’s

plan, reaching $805 million per year in 2018, rather than the

governor’s $1.1 billion.

Over the next five years, the Senate’s plan would allocate $600

million per year on average in new revenue to transportation, short

of the average $800 million Patrick’s plan would have provided,

according to the Dukakis Center.

Some transportation advocates worry that legislators’ estimates on

the measures included in the Senate plan could prove to be less

lucrative than suggested on the Senate floor.

“The difference between the Senate and the House bill is really not

that huge,” said Rafael Mares, staff attorney at the Conservation

Law Foundation, a transportation and environmental advocacy

organization. “It’s a little bit like a blanket that’s too small,

and you’re not sure what part of the body is going to be covered.”

Senator Stephen M. Brewer, a Democrat of Barre and chairman of the

Senate Ways and Means Committee, praised members of the Senate for

their work on trying to find a compromise in a politically tense

environment.

“There’s been a lot of emotion and a serious case of hard-ball

politics during the last couple of weeks,” Brewer said.

That combustible environment became evident when dozens of antitax

protesters, fired up from a rally on Boston Common, filed into the

State House and burst into applause and hoots when Senate minority

leader Bruce E. Tarr lambasted his fellow legislators for supporting

tax increases.

“But the question is, Madam President, what is enough, and when will

it ever be enough?” Tarr yelled.

The protesters erupted into chants of “No more taxes!” and were

escorted out of the gallery by State House police.

The Senate’s bill closes operating budget gaps for the MBTA next

year, and requires that the Department of Transportation transfer

personnel costs from its capital budget to its operating budget in

the next three years.

The bill would allow the state’s 15 regional transit authorities —

bus systems that serve communities outside of the MBTA’s reach — to

pay their yearly budgets in advance, rather than borrowing their

operating costs each year. The regional transit authorities would

also receive an additional $12 million per year in funding — an 18

percent increase over what they currently receive.

Senators also voted to pass an amendment that would reinstate tolls

on the western portion of the Massachusetts Turnpike, which had been

eliminated in the 1990s. The revenue would be directed exclusively

to transportation projects in that part of the state.

Many of the amendments focused on pushing for accountability within

the state’s transportation agencies.

The legislation mandates that the MBTA conduct a review of fare

collection policies; the Transportation Department publish job

titles and salaries of employees moved onto the operating budget;

regional transit authorities publish annual ridership data; and

officials interview the 23 companies that expressed interest in

bidding on the state’s gargantuan commuter rail contract, but did

not ultimately submit.

The Senate rejected a proposal to establish a special legislative

task force to hunt for cost-saving measures within the MBTA.

One of the most heated debates came on a further increase to the gas

tax, as well as MBTA naming rights, with legislators arguing that

they were fearful the amendment would result in “Dunkin’ Donuts

Copley Station.”

“What is the price tag that we can appropriately put on our history,

on our identity as a state, and on our identity as a public sector?”

asked Senator Sonia Chang-Diaz, a Democrat of Boston.

Others, such as Senator Michael F. Rush, a West Roxbury Democrat,

maintained that considering the dire financial situation of the

state Transportation Department and the T, every possible revenue

source that did not tax residents had to be pursued — even the

painful options.

Rush said naming rights contracts would be pursued at the

less-historic stations and stops within the T and commuter rail

system.

“We do not have the luxury of turning our back on easy money,” Rush

said.

The Senate voted down two amendments, one to increase and one to

decrease the growth rate of the 3-cent gas tax, and rebuffed a

proposal that would legalize fireworks in Massachusetts.

State House News Service

Monday, April 22, 2013

State Capitol Briefs - Lunch Edition

Tax bill negotiating committee fully named

By Andy Metzger and Michael Norton

Four days after the House named three representatives to a

transportation tax bill conference committee, the Senate appointed

its negotiators on Monday morning.

Senate Ways and Means Chairman Stephen Brewer (D-Barre), Senate

Chairman of the Joint Committee on Transportation Thomas McGee

(D-Lynn) and Sen. Robert Hedlund of Weymouth, the ranking Republican

member of the Transportation Committee, were appointed before the

Senate recessed on Monday.

The Senate is waiting to determine whether a Thursday formal session

will take place, according to an agenda distributed to members. The

six-member committee will attempt to reconcile two versions (H 3415/

S 1770) of a $500 million tax bill that would fund transportation.

On Thursday, the House appointed House Ways and Means Chairman Brian

Dempsey (D-Haverhill), House Chairman of the Joint Committee on

Transportation William Straus (D-Mattapoisett) and Rep. Steven

Howitt (R-Seekonk), a member of the Transportation Committee, to the

conference committee.

The House will be busy Monday and later this week debating the

annual budget, which spends some of the revenues lawmakers

anticipate raising by boosting taxes on tobacco, gas and businesses,

as is proposed by the bill that is in conference. Conference

committees usually, but not always, vote to conduct their

deliberations in private.

Gov. Deval Patrick denounced the original bill put together by House

and Senate leaders and approved 97-55 by the House, threatening to

veto it. The Senate padded the proposed investments in

transportation in its version of the bill, drawing some praise from

the governor who said he remained concerned that the Senate plan

pulls revenues from other areas of government.

State House News Service

Monday, April 22, 2013

House turns down plan to phase in income, sales tax cuts

By Matt Murphy

The House on Monday commenced debate on a $33.8 billion annual state

budget proposal with consideration of a plan to reduce the sales and

income tax rates to 5 percent over five years, an initiative voted

down by the Democratic majority.

“I would call it the death by a thousand cuts proposal,” said Rep.

Jay Kaufman, a Lexington Democrat and co-chairman of the Revenue

Committee.

House Minority Leader Bradley Jones (R-North Reading) said that

under the Republican-sponsored amendment, the 5 percent income tax

rate would be achieved 19 years after voters approved reducing the

income tax rate to 5 percent through a ballot initiative.

Invoking last week’s Boston Marathon bombings, Kaufman argued that

the amendment would deprive the state government of $2 billion in

revenue critical to providing funding for public safety and other

programs. The amendment failed on largely party-line, with 35

representatives supporting it and 118 voting against the proposal.

“I’m a little disappointed that it only took until the third speaker

of the day to bring up the events of last week as to why we should

or shouldn’t do things this week and frankly I think it’s

disappointing,” Jones said.

Rep. Timothy Toomey, a Cambridge Democrat, called it “fundamentally

irresponsible” to lower taxes, worried that it would impact job

training used to support technology start-ups in Cambridge.

The fiscal 2014 budget debate, expected to continue through much of

the week, started with debate over revenue and tax amendments

plucked from the 888 amendments filed to the budget bill.

The House earlier this month approved a package of $500 million in

new taxes for transportation, a proposal now being worked out in

conference committee with an alternative proposal okayed in the

Senate.

The Legislature and Gov. Deval Patrick raised the sales tax rate to

6.25 percent from 5 percent in 2009. A ballot question calling for a

5 percent income tax rate passed in 2000, but was not fully

implemented — the income tax rate is currently 5.25 percent.

House Ways and Means Chairman Brian Dempsey, of Haverhill, started

Monday’s deliberations with an introduction of the bill that he said

increased spending by 3.9 percent over last year’s budget, and comes

in about $1 billion lower than Gov. Deval Patrick’s budget filed in

January.

Dempsey called the budget a “fiscally prudent” spending plan that

recognizes the “economic difficulties facing our Commonwealth and

our nation.”

While relying on $350 million in reserves to balance the bottom

line, Dempsey the budget proposed by the Ways and Means would

increase unrestricted local aid to cities and towns for the first

time since 2010 and make significant investments in higher education

to avoid fee and tuition hikes at UMass and public universities and

community colleges.

“These investments reflect our belief that higher ed is important to

the future of the Commonwealth and important to our workforce,”

Dempsey said.

Dempsey said the House leadership’s budget also increases spending

on child and adolescent mental health services, community-based

adult day and work programs and family assistance.

In addition to spending, the Ways and Means budget also proposes

some reforms, including photo IDs for electronic benefit transfer

card recipients to crack down on card trafficking and a task force

established to standardize the benefit eligibility determination

process across state agencies.

“One of the themes of the Ways and Means proposal this year is one

that focuses on accountability and oversight,” Dempsey said, adding

that before the state considers greater investment in early

education as pressed by Gov. Patrick the state must “get back to

basics” to ensure the proper oversight of the early education

waiting list.

House Democrats also prevented votes on Republican-sponsored

amendments to exempt municipalities from the gas tax offered by Rep.

Marc Lombardo (R-Billerica) and to extend a five-day meals tax

holiday to benefit restaurant worker this summer by Rep. Shaunna

O’Connell (D-Taunton).

The House voted to study both issues, adopting amendments that

prevented votes on the underlying proposals.

In his maiden speech in House Monday afternoon, Rep. Steven Howitt

made his colleagues laugh when he said he wanted to give them the

“poop” on Title 5 septic system tax credits.

Howitt, a Republican from Seekonk, proposed an amendment that would

have increased a tax credit for homeowners who repair or and replace

septic systems, allowing them to deduct 40 percent of the costs, up

to $25,000 over five years. Currently homeowners can deduct 40

percent of the costs up to $15,000.

Howitt said the tax credit, instituted in 1991, has not kept pace

with the rising costs of repairing septic systems. Increasing the

credit would spur economic activity by encouraging homeowners to

repair or replace old systems, and provide jobs for the workers

involved, Howitt said.

“This bill is a royal flush for everyone involved,” he said.

Rep. Jay Kaufman, (D-Lexington) co-chair of the Revenue Committee,

argued against it. Making a case he has often used to help turn back

tax-related amendments, Kaufman said the committee was looking at

the idea, and needed to study the tax implications further. The

amendment failed 33 to 114.

House Democrats plan to start debate on amendments dealing with

education and local aid, constitutional officers and housing by

holding private meetings on the many amendments.

Rep. Thomas Sannicandro, co-chair of the Committee on Higher

Education, tweeted that he was discussing education amendments with

colleagues in advance of the released of a consolidated amendment.

Colleen Quinn contributed reporting

State House News Service

Monday, April 22, 2013

House adds $27 mil to budget, sends immigrant tuition issue to study

By Matt Murphy

House lawmakers tacked on close to $27 million in additional

spending for education and local aid on the first night of debate on

a $33.8 billion fiscal 2014 budget Monday, engaging in sporadic

debate, including a fiery back-and-forth over in-state tuition for

undocumented immigrants.

Rep. Alice Peisch, the co-chair of the Committee on Education, said

the boost in education and local aid spending added money to the

Metco, Head Start, libraries, YouthBuild and universal

pre-kindergarten programs, as well as $5.3 million in additional

Chapter 70 spending for some districts well below their so-called

foundation levels.

The House also adopted a bundle of amendments relating to the

state’s six constitutional officers and state administration issues

that added $851,000 to the budget’s bottom line, boosting funding

for the Secretary of State to administer elections and for the

Office of Campaign and Police Finance.

When the House returns on Tuesday at 10 a.m., amendments relating to

housing and social services are expected to be on tap first,

including those dealing with welfare programs and the administration

of electronic benefits transfer cards. House Democrats who wrote the

budget bill have proposed requiring photo IDs on EBT cards to

prevent trafficking of public assistance benefits, but some members

would like to see further reforms.

Members also met behind closed doors throughout the evening Monday

discussing bundled amendments on the energy and environmental

matters and transportation. A meeting is scheduled for 10:30 a.m.

Tuesday in the Members Lounge, a room off the House floor, on

amendments related to veterans’ services and soldiers’ homes.

During the first day of budget deliberations, the House gaveled in

at 11 a.m. and met until just after midnight, adopting two

consolidated amendments hashed out privately and dispensing with

nearly 200 of the 888 amendments filed in two unanimous roll call

votes.

Through the day, representatives engaged in debates over amendments

sponsored by lawmakers who sought floor debate and votes on their

specific proposals.

In a testy exchange over in-state tuition for undocumented

immigrants, the House voted 107-46 to study the issues around

tuition rates for immigrants and returning veterans, avoiding a

direct vote on a budget amendment offered by Rep. Marc Lombardo

(R-Billerica) that would have reversed Gov. Deval Patrick's

directive extending the tuition break to immigrants who qualify for

legal status under a new federal program.

Lombardo, Rep. James Lyons and Rep. Shaunna O'Connell argued

taxpayers are being asked to subsidize tuition for immigrants who

broke the law by coming to the United States. Lombardo said the

policy forced taxpayers to subsidize tuition for immigrants who

“break the rules,” while Lyons accused Patrick of circumventing the

Legislature. “This is about fairness,” said Lyons, noting a 2006

roll call vote the House took to limit in-state tuition.

The Patrick administration last November determined under existing

state policy that immigrants granted deferred status by the federal

government are eligible for in-state tuition rates, which are lower

than rates paid by out-of-state students. The ruling was not a new

policy, but an application of the new federal rules established by

executive order by President Barack Obama, the administration said.

Rep. Carl Sciortino (D-Medford) accused Republicans of trying to

restrict access to higher education for immigrant children brought

to the United States through no fault of their own, and Rep. Denise

Provost called the GOP amendment “preposterous and offensive.”

Rep. Steven Walsh, of Lynn, delivered a thunderous defense from the

podium of the Patrick policy. He called it "ludicrous" that

Republicans would bring up a 2006 vote to restrict in-state tuition

given the turnover in the House the past three elections.

Walsh said the tuition break would apply to just 400 students who

otherwise would not go to college, thereby costing the state

nothing. He also noted that the executive order extended only to

those immigrants who spent at least three years at a Massachusetts

high school, passed the MCAS and were applying for citizenship under

the new Obama administration policy.

Democrat Reps. James Arciero, Bruce Ayers, Tom Calter, Linda Dean

Campbell, Josh Cutler, Stephen DiNatale, Jim Dwyer, John Fresolo,

Colleen Garry, Thomas Golden, James Miceli, Kevin Murphy, David

Nangle, Dennis Rosa, Thomas Stanley and Walter Timilty voted with

the Republican caucus against the study amendment.

While boosting school aid for local public school districts,

Democrats rejected an amendment offered by Rep. Paul Frost

(R-Auburn) to create a $20 million grant program to pay for school

supplies like textbooks and computers.

Rep. Brad Hill (R-Ipswich) also tried to add even more money to

Chapter 70 to bring underfunded districts that receive less than

17.5 percent of their budget from the state to the foundation

threshold within two years. The proposal was rejected, with

Democratic leadership arguing that the state didn’t have the

resources to ramp up spending that quickly.

Earlier Monday, Democrats beat back the annual attempt by

Republicans to roll the income and sales tax down to five percent.

Republicans pointed out that voters in 2000 passing a binding ballot

law calling for a 5 percent income tax rate. The income tax rests

currently at 5.25 percent.

The House also rejected an amendment offered by Rep. Angelo Scaccia

that would have capped the film tax credit program at $40 million, a

step proposed by Gov. Deval Patrick and shot down on a voice vote.

Scaccia said tax credits “drive me nuts,” and the film tax credit in

particular has taken taxpayer money and given it to film producers.

Majority Leader Ronald Mariano said the film tax credit doesn’t just

benefits movie producers, but creates jobs in the local economy at

production houses and in the trades that work on film and television

sets. Rep. Sheila Harrington, a Groton Republican, noted the jobs

that will come from the construction of a sound studio at Devens.

Scaccia also proposed to levy a 2.5 percent excise tax on college

endowments over $5 billion, effectively taxing Harvard University

and the Massachusetts Institute of Technology. The amendment was

voted down 11-144.

Rep. Denise Andrews, an Orange Democrat, backed the amendment. “It’s

time we redistribute wealth and take care of raising revenue,” she

said.

Rep. Thomas Sannicandro, the co-chairman of the Higher Education

Committee, questioned the constitutionality of the amendment, and

Republican Rep. Elizabeth Poirier called it a “slippery slope,”

concerned the idea could spread to charitable organizations.

Republican Rep. Geoff Diehl’s proposal to create a tax amnesty plan

to collect overdue taxes by waiving the penalties for delinquent

taxpayers was also defeated 39-110.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

|