|

Help save yourself

— join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

Ask your friends to join too |

Visit CLT on Facebook |

CLT UPDATE

Monday, March 25, 2013

Tax hikes: Which ones, by how much?

|

Richard A. Davey, the state’s transportation

secretary, has done a lot of traveling in the last few weeks. He’ll

tell you that himself, as he did at a Department of Transportation

meeting earlier this month.

“North Andover, Woburn, Arlington, Hyannis,”

Davey began. “Medford, Worcester, Framingham, Fall River, Wakefield,

Burlington, and Plymouth.”

Since Governor Deval Patrick announced in January

his plan to use new tax revenue to inject $13 billion into the

state’s transportation system over the next decade, Davey has been

crisscrossing the state.

His message: There’s something in the governor’s

bill for everyone....

Of course, Davey’s campaign to sell the funding

plan around the state has had its critics, perhaps none more biting

than the Marblehead-based Citizens for Limited Taxation. A

recent post on the organization’s website calls the efforts “a

dog-and-pony show lining up interests who thrive off government

spending.”

Barbara Anderson, the group’s executive

director, said Patrick’s and Davey’s efforts to inspire enthusiasm

in Massachusetts residents is part of a plan to raise expectations

of how much taxes could rise, so a more modest increase would come

as a relief.

“If they do something less than that, we’re all

supposed to be incredibly grateful,” Anderson said.

Anderson argues the campaign has not convinced

voters, and has instead targeted transportation advocacy groups who

do not adequately represent the views of most Massachusetts

residents.

“They go to every little group, and every little

group is added to their long list of supporters who want a tax

increase,” Anderson said, “even if some of these groups might be

three AARP members in the far corner of the state.”

Promising large-scale products like South Coast

Rail and trains from Boston to Springfield, she said, are gifts that

may shore up support in communities outside of Boston, but will

probably become mired in bureaucracy before they ever become a

reality.

“You have a better chance of getting on a train

to Hogwarts,” Anderson said, “than getting on a train to Fall

River.”

The Boston Globe

Sunday, March 24, 2013

Richard Davey hits road to pitch transportation plan

Massachusetts Gov. Deval Patrick has an

off-putting habit of talking down to the very people he’s trying to

talk into forking over more of their hard-earned money.

Whenever the governor is attempting to schmooze

Bay State taxpayers into opening their wallets — which is frequently

— he casts himself as the smartest guy in the room, the one who gets

it and who has been trying ever so patiently to explain things to

the rubes who just refuse to understand.

Like when Patrick was stumping in 2009 for a

19-cents-per-gallon hike in the state’s gas tax — which would have

made ours the highest in the nation — he told an audience in

Haverhill that “grown-ups” understand we “can’t have something for

nothing.” At the time, the state budget was something around $28

billion — which is a whole lot of “nothing.”

Patrick rolled out his condescending attitude

again in 2011 when he said we need to have “an adult conversation”

about raising revenues to fund improvements to the state’s aging

transportation infrastructure.

Now Patrick is again trying to con Massachusetts

taxpayers out of their money — $1.9 billion this time, which he

plans to raise largely by hiking the state income tax rate from 5.25

percent to 6.25 percent while dropping the sales tax to 4 percent.

Even as Democratic leaders of the Legislature are scuttling away

from Patrick’s revenue proposals like crabs along the tide line, the

governor proclaims he thinks the $1.9 billion figure is the “right

number” to fund his transportation and education plans.

This time, Patrick isn’t messing around. He’s

rolling out the big guns on which Democrats depend when they really

need to extract more money from the citizenry — kids, or as they are

known in political hack-speak, “utes.”

So much for adult conversations.

Last week, the governor appeared on the

Statehouse steps surrounded by 100 teenagers affiliated with a

coalition of youth groups and advocates calling itself “Youth of

Massachusetts Organizing for a Reformed Economy,” or “YMORE.” Their

mission, according to their press release, is “to raise teen voices

for fair revenue.” Word to the wise: “Fair” never means “less.”

As they surrounded the governor, the young people

held signs, some with one-word slogans such as “compassion,”

“equity” and “courage.”

These impressionable young people are trained to

parrot whatever their mentors in the advocacy industry tell them.

Then they are marched off to serve as props for Democratic

politicians trying to sell their latest brand of “progressive”

pablum. ...

An Eagle-Tribune editorial

Sunday, March 24, 2013

Patrick loses interest in ‘adult conversation’ as he rolls out the

kids

With the economy recovering and state finances

stabilizing, many in the business community expected a relatively

quiet session on Beacon Hill this year. But those expectations were

dashed when Governor Deval Patrick proposed $1.9 billion in tax

increases — including about $500 million in new corporate taxes — to

help pay for education, transportation, and other state programs.

Those proposed increases — which have particular

implications for the high tech, real estate, and retail industries —

top the policy agenda for business advocacy groups. But they are far

from the only issues that could have far-reaching effects on the

Massachusetts business climate and economy.

Lawmakers will also decide how much to spend on

the state’s aging transportation system and how to finance it; how

to reconcile the state’s universal health care law with a similar

federal law without boosting costs for thousands of small businesses

here; and whether to overhaul the state’s unemployment insurance

system.

The Boston Globe

Sunday, March 24, 2013

Proposed tax increases a concern for Mass. businesses

Governor Patrick deserves credit for producing a

budget proposal that not only lays out the choices, but is flexible

enough to serve as a template for reasoned compromise. The governor

released his plan about four months before the budget was due to be

finished, and invited all citizens, not merely the usual actors on

Beacon Hill, to participate in the debate.

The governor’s plan includes four components: A

sizable funding increase for transportation; a guarantee of

early-childhood education for low-income toddlers; a sizable

increase in Mass. grant funding for income-eligible college

students; and a dramatic reordering of state income-tax deductions

to make it more progressive — that is, less burdensome to low-income

people and more so to those earning above $62,000.

Not all of these plans are equally necessary.

A Boston Globe editorial

Sunday, March 24, 2013

Patrick’s ambitious tax plan offers basis for compromise

Gov. Deval Patrick’s latest education plan is all

about new spending — much of it with no strings attached. But

administration officials, as they rush from one staged rally with

their tax hike boosters to another, don’t particularly like it when

critics point that out.

Just ask the Massachusetts Business Alliance for

Education, which has raised a legitimate concern — that Patrick’s

plan to spend $1 billion more on education over the next four years,

fueled

by a massive increase in taxes, lacks sufficient

accountability measures and isn’t the ironclad guarantee of success

the administration is painting it to be....

A Boston Herald editorial

Sunday, March 24, 2013

Test of a tax plan

Almost a decade after the Big Dig’s

completion, the toxic legacy of the bloated highway project

still haunts the state. Debt from Central Artery-related

projects gnaws away at the MBTA’s budget, forcing fare hikes and

service cuts; residual public distrust over the mishandling of

the project undercuts efforts to build political support for

roads and bridges.

It is time, though, to move on. The state is

making progress at reform....

As the Legislature weighs the transportation

plan against the education components of Patrick’s plan, the

need to catch up on overdue transportation investments should be

the most urgent....

Lawmakers can’t let the ghost of the Big Dig

continue to thwart the state’s needs forever....

Raiding the capital budget for salaries was

merely a symptom of the profligate Big Dig culture. Lawmakers

should certainly never forget the lessons of that debacle. But

nor can they let its ghost continue to thwart the state’s needs

forever.

A Boston Globe editorial

Monday, March 25, 2013

Transportation needs are clear; reforms help justify funding

hike

Every time we turn over the rock that is Gov.

Deval Patrick’s $2 billion tax hike plan, another foul smell

emerges.

This time we have the Massachusetts Taxpayers

Foundation to thank for analyzing what the governor’s plan calls

a tax on “custom modifications to software and other computer

services,” expected to bring in $265 million in new revenue a

year. Currently software is taxable but computer services are

not. But, the governor’s office insists, “with the migration of

software first to the ‘web’ and now to the ‘cloud,’ the line”

between the two is becoming “untenable.” And so, in the spirit

of “fairness” he wants to tax the beejesus out of both.

A Boston Herald editorial

Monday, March 25, 2013

Taxing even the cloud

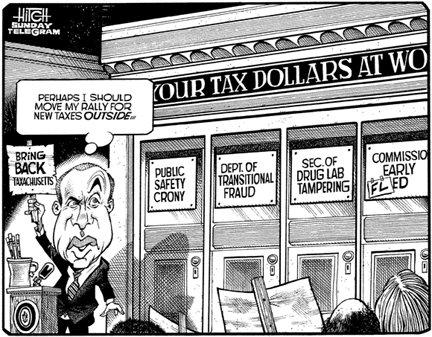

The Telegram & Gazette

Editorial cartoon by David Hitch

Sunday, March 17, 2013

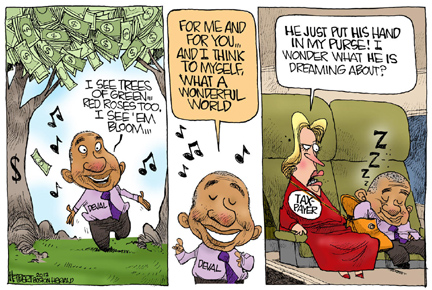

The Boston Herald

Editorial cartoon by Jerry Holbert

Sunday, March 24, 2013

|

|

Chip Ford's CLT

Commentary

Gov. Patrick's administration road show to

promote his huge $1.9 Billion tax hike hasn't been noticed by only

us (as referenced in yesterday's Boston Globe report ("Richard Davey hits road to pitch transportation plan").

It's becoming actually a laughingstock across the state; a blatant

political campaign right down to staged rallies and using "the

children" as his human shields.

In our Memo to the Legislature (Mar. 12

— "The

Tax Hike Circus Comes to Town") we wrote:

"Taking the lead from President Barack Obama,

our governor is running his own permanent political campaign, a

dog-and-pony show lining up interests who thrive off government

spending entirely funded by taxpayers.

"He has spent weeks now campaigning among his constituency:

Those who live off and benefit most from the largess of

Massachusetts taxpayers. His efforts are intended to encourage

them to rally for more from productive taxpayers to support

their self-interests.

"Meanwhile, we productive taxpayers who pay already too much of

what we earn to support their comforts are too engaged in

working and surviving to attend rallies, public circuses for the

entertainment of those at the State House – even in defense of

our own survival interests...."

It doesn't appear to be helping his cause very

much — in fact may have backfired as it

becomes a bigger and bigger joke among legislators and the public at

large.

Note that both the House and Senate leadership

have been keeping a safe distance from his toxic stew; a smorgasbord

of tax and fee hikes accompanied by an abundant side order of the

elimination of popular tax deductions. It's becoming clear that Gov.

Patrick reached for too much too soon with nothing at risk to

himself but "his legacy." Legislators have a two-year shelf life;

they must run for re-election in a mere twenty months. They

recognize who will bear the blame when voters are feeling the pain

of even more lost income. In its Weekly Roundup on Friday, the State

House News Service reported:

"[House Speaker Robert] DeLeo, by those

around him, is said to be deeply conflicted, not just on how

much revenue he can ask taxpayers to shoulder and from where it

should come, but also what those votes will mean for his

membership come election time next year." ... "It’s usually at

this point that Senate President Therese Murray tends to get

antsy, and orders her Ways and Means chairman to advance

something, anything, that senators can vote up or down – okay,

up.... That’s not the case, yet."

The Globe is applauded by the “progressive”

liberal choir, but we hope not reaching other readers. The statewide

ridicule of the Governor’s plan should cause its demise, but we fear

that less dramatic tax hikes are still in the works in the House and

Senate: they’re trying to decide which ones, how much they can take

from us and still get re-elected.

|

|

|

|

Chip Ford |

|

|

|

|

|

The Boston Globe

Sunday, March 24, 2013

Richard Davey hits road to pitch transportation plan

By Martine Powers

Richard A. Davey, the state’s transportation secretary, has done a

lot of traveling in the last few weeks. He’ll tell you that himself,

as he did at a Department of Transportation meeting earlier this

month.

“North Andover, Woburn, Arlington, Hyannis,” Davey began. “Medford,

Worcester, Framingham, Fall River, Wakefield, Burlington, and

Plymouth.”

Since Governor Deval Patrick announced in January his plan to use

new tax revenue to inject $13 billion into the state’s

transportation system over the next decade, Davey has been

crisscrossing the state.

His message: There’s something in the governor’s bill for everyone.

Patrick’s plan and a critical mass of political will has presented

an opportunity to put the state’s roads, bridges, and public transit

systems on solid footing for generations to come, proponents say.

While it appears the Legislature will fund some, but not all, of

Patrick’s proposed projects, what ends up on the cutting-room floor

may be a direct product of how well Davey and other transportation

officials are able to deliver their message. Their aggressive

outreach efforts have reached the feverish tone of an all-out

election campaign, and has a Twitter hashtag: #ChooseGrowth.

“It’s really unprecedented,” said Michael Widmer, president of the

Massachusetts Taxpayers Foundation, on Davey’s crusade. “In all my

years, I don’t recall such a single-minded campaign by a nonelected

state official.”

Some critics view the campaigning as a political ploy meant to

convince residents with far-fetched transportation promises.

But others, like Marc Draisen, believe Davey’s strategy makes sense.

Draisen, executive director of the Metropolitan Area Planning

Council, an organization focused on city planning and

transportation, said taxpayers need to be convinced that their tax

dollars will translate into meaningful improvements — especially in

a state still stinging from the legacy of the Big Dig and

mistrustful of massive, costly transportation projects.

“They’ll go anywhere to talk about this subject,” Draisen said.

“We’ve heard their basic line over and over: We can’t afford the

transportation system we have, much less the transportation system

we want.”

Davey must boil down an elaborate, 63-page report into simple

selling points, tailor-made for each community he visits.

In Northampton: Want better regional bus service? Tell your

representative you want tax increases.

In Stockbridge: Want a train running from the Berkshires to New York

City? Ask your legislators for tax increases.

And in late January, at a transportation forum for the Metro-West

region, Davey came prepared with numbers on how each town could

tackle more bread-and-butter road repairs and pothole fixes.

A Wayland selectman in the audience raised his hand, asking how his

town would benefit.

“I happen to have a Wayland statistic in front of me — how about

that?” Davey said, prompting chuckles. Wayland’s funding for road

projects, he said, would more than double to $700,000 per year.

And when Southborough’s economic development officer asked what his

town stands to gain, Davey had an answer for him, too. Last year,

Davey said, the town got $231,000 for road and bridge projects.

With Patrick’s plan, he said, the town would receive $650,000 per

year.

“This is not just transportation dollars that are going to evaporate

into the air,” Davey said. “These are specific projects and specific

resources that we are going to deliver.”

Other transportation officials have also worked to deliver the

message. After a frayed cable caused a large span of the Green Line

to shut down on one of the coldest mornings of the year, Beverly A.

Scott, MBTA general manager, asked technicians to save a portion of

the frayed wire.

“I am going to take it on the road with me,” she said.

Sure enough, she appeared on TV a few days later, the corroded,

mangled cable in hand.

“Literally, when you have something as old as this . . . the old

girl just gave out,” Scott told Fox 25’s Doug “VB” Goudie . “You

can’t sit up and have 5 or 6 billion dollars in terms of deferral of

maintenance and infrastructure, and just have the expectation that

these systems are going to operate with no additional investment.”

Stephanie Pollack, associate director at Northeastern University’s

Dukakis Center for Urban and Regional Policy, said the campaign

efforts could be criticized for focusing too heavily on grandiose

new projects — expensive investments like the South Coast Rail —

rather than the roughly 80 percent of the plan that will go toward

bridge and road repair, paying off debts, and much-needed transit

maintenance.

“In transportation, there is a long history of attracting support

for new revenue by promising shiny new things and ribbon-cuttings,”

Pollack said. “There probably was a bit of an emphasis on what

[transportation officials] perceived would make people excited.”

Davey said he believes people are willing to pay more for better

transportation opportunities — and according to research, he might

be right.

A poll released March 14 by MassINC , a nonpartisan research group,

estimated that just more than 60 percent of voters would be willing

to pay $50 per year to fund long-term fixes for roads and public

transportation, based on polls and focus groups over the past six

months.

Of course, Davey’s campaign to sell the funding plan around the

state has had its critics, perhaps none more biting than the

Marblehead-based Citizens for Limited Taxation. A recent post

on the organization’s website calls the efforts “a dog-and-pony show

lining up interests who thrive off government spending.”

Barbara Anderson, the group’s executive director, said

Patrick’s and Davey’s efforts to inspire enthusiasm in Massachusetts

residents is part of a plan to raise expectations of how much taxes

could rise, so a more modest increase would come as a relief.

“If they do something less than that, we’re all supposed to be

incredibly grateful,” Anderson said.

Anderson argues the campaign has not convinced voters, and has

instead targeted transportation advocacy groups who do not

adequately represent the views of most Massachusetts residents.

“They go to every little group, and every little group is added to

their long list of supporters who want a tax increase,” Anderson

said, “even if some of these groups might be three AARP members in

the far corner of the state.”

Promising large-scale products like South Coast Rail and trains from

Boston to Springfield, she said, are gifts that may shore up support

in communities outside of Boston, but will probably become mired in

bureaucracy before they ever become a reality.

“You have a better chance of getting on a train to Hogwarts,”

Anderson said, “than getting on a train to Fall River.”

The Eagle-Tribune

Sunday, March 24, 2013

An Eagle-Tribune editorial

Patrick loses interest in ‘adult conversation’ as he rolls out the

kids

Massachusetts Gov. Deval Patrick has an off-putting habit of talking

down to the very people he’s trying to talk into forking over more

of their hard-earned money.

Whenever the governor is attempting to schmooze Bay State taxpayers

into opening their wallets — which is frequently — he casts himself

as the smartest guy in the room, the one who gets it and who has

been trying ever so patiently to explain things to the rubes who

just refuse to understand.

Like when Patrick was stumping in 2009 for a 19-cents-per-gallon

hike in the state’s gas tax — which would have made ours the highest

in the nation — he told an audience in Haverhill that “grown-ups”

understand we “can’t have something for nothing.” At the time, the

state budget was something around $28 billion — which is a whole lot

of “nothing.”

Patrick rolled out his condescending attitude again in 2011 when he

said we need to have “an adult conversation” about raising revenues

to fund improvements to the state’s aging transportation

infrastructure.

Now Patrick is again trying to con Massachusetts taxpayers out of

their money — $1.9 billion this time, which he plans to raise

largely by hiking the state income tax rate from 5.25 percent to

6.25 percent while dropping the sales tax to 4 percent. Even as

Democratic leaders of the Legislature are scuttling away from

Patrick’s revenue proposals like crabs along the tide line, the

governor proclaims he thinks the $1.9 billion figure is the “right

number” to fund his transportation and education plans.

This time, Patrick isn’t messing around. He’s rolling out the big

guns on which Democrats depend when they really need to extract more

money from the citizenry — kids, or as they are known in political

hack-speak, “utes.”

So much for adult conversations.

Last week, the governor appeared on the Statehouse steps surrounded

by 100 teenagers affiliated with a coalition of youth groups and

advocates calling itself “Youth of Massachusetts Organizing for a

Reformed Economy,” or “YMORE.” Their mission, according to their

press release, is “to raise teen voices for fair revenue.” Word to

the wise: “Fair” never means “less.”

As they surrounded the governor, the young people held signs, some

with one-word slogans such as “compassion,” “equity” and “courage.”

These impressionable young people are trained to parrot whatever

their mentors in the advocacy industry tell them. Then they are

marched off to serve as props for Democratic politicians trying to

sell their latest brand of “progressive” pablum.

It’s a pity no one has the “courage” to tell these young people the

truth: The politicians they so willingly serve are bankrupting their

futures. There is no free lunch. Someone, someday will have to pay

for all the marvelous programs and initiatives purchased today with

borrowed or squandered money. Guess who, kids!

Massachusetts is struggling to claw its way out of a recession. The

state’s tax-supported debt is among the highest in the nation. Its

pension system is woefully underfunded. Yet Patrick wants to raise

taxes on every wage-earner in the state not to reduce debt or meet

prior commitments but so he can spend $1.9 billion per year more.

By all means, let’s have an adult conversation. Let’s send the kids

home and talk about the wisdom and propriety of a state spending

away its future and making promises it can never keep.

The Boston Globe

Sunday, March 24, 2013

Proposed tax increases a concern for Mass. businesses

By Jay Fitzgerald

For much of the past several months, local businesses have had their

eyes on Washington, as Congress and the Obama administration faced

off in one showdown after another. But as federal officials lurch

from fiscal cliffs to sequesters to debt ceilings, big issues with

big stakes for Massachusetts businesses are being debated in the

Legislature.

With the economy recovering and state finances stabilizing, many in

the business community expected a relatively quiet session on Beacon

Hill this year. But those expectations were dashed when Governor

Deval Patrick proposed $1.9 billion in tax increases — including

about $500 million in new corporate taxes — to help pay for

education, transportation, and other state programs.

Those proposed increases — which have particular implications for

the high tech, real estate, and retail industries — top the policy

agenda for business advocacy groups. But they are far from the only

issues that could have far-reaching effects on the Massachusetts

business climate and economy.

Lawmakers will also decide how much to spend on the state’s aging

transportation system and how to finance it; how to reconcile the

state’s universal health care law with a similar federal law without

boosting costs for thousands of small businesses here; and whether

to overhaul the state’s unemployment insurance system.

Here are some of the issues that businesses groups are closely

monitoring this session:

High tech tax blues. Of the governor’s proposed $500 million in new

corporate taxes, more than half would come from applying the state

sales tax to customized software and computer and data processing

services, which are now exempt.

Tech firms say the tax would make their products less competitive at

a time when global competition is fiercer than ever. They also say

such a tax couldn’t come at worse time. Many firms do work for the

Defense Department and other federal agencies, and their contracts

could be cut or eliminated as automatic federal budget reductions

know as the sequester go into effect.

“It’s a really bad idea,” said Chris Anderson, president of the

Massachusetts High Technology Council, an industry group in Waltham.

“This is not a good time to destabilize the [tech] business

climate.”

Anderson added that taxing computer services could open the door to

broaden the sales tax to a wide range of business and professional

services, from accounting to consulting.

Home-sale capital gains taxes. Under state law, homeowners don’t

have to pay taxes on the first $500,000 in capital gains that they

realize from the sale of primary residences. The governor wants to

eliminate that exemption to raise up to $285 million in new

revenues, according to estimates by the Massachusetts Taxpayers

Foundation, a business financed research group in Boston.

Rob Authier, chief executive of the Massachusetts Association of

Realtors, said raising the capital gains taxes could discourage many

people from putting their homes on the market, undermining the

housing market when it has only recently begun to rebound from the

collapse of the housing bubble several years ago.

There’s already a shortage of homes on the market, which is holding

back the housing recovery, analysts say. “This proposal came as a

real shocker to us,” said Authier.

The governor’s other proposals to eliminate a septic system repair

credit (up to $15 million) and lead-paint removal credit ($3

million) could also add costs to buying a home and slow sales,

Authier said.

Candy, soda, and tobacco. Patrick has proposed offsetting an

increase in the state income tax to 6.25 percent from 5.25 percent

by cutting the state sales tax to 4.5 percent from 6.25 percent. But

Patrick would also apply the sales tax to sodas and candy, and raise

taxes on tobacco products.

Those proposals have retailers divided.

Jon Hurst, president of the Retailers Association of Massachusetts,

said larger retailers – such as electronics, appliance, and

furniture stores — welcome an overall cut in the tax, which they say

would make their products more competitive with retailers in nearby

states.

But he noted that proposals could harm small grocers in border

communities who must also compete against nearby retailers in other

states, particularly New Hampshire.

“We have such a broad, diverse membership that different members

have different attitudes toward the governor’s plans,” said Hurst.

Unemployment insurance overhaul. Massachusetts provides some of the

most generous unemployment benefits in the country and businesses

pay some of the highest unemployment insurance premiums.

For years, the business community has called for the Legislature to

reduce some of those benefits to lower costs and make businesses

here more competitive. And for years, lawmakers have resisted such

changes, amid vehement opposition from organized labor.

House Speaker Robert DeLeo recently signaled that he’s open to some

change in order to reduce costs to employers, although he didn’t

provide details.

Business groups have subsequently proposed a number of changes,

including reducing the number of weeks unemployed workers can

collect benefits to 26 weeks from 30, which would bring

Massachusetts’ rules in line with most other states. That and other

changes could save employers, who now pay an average $745 a year per

worker for unemployment insurance, as much as $260 million in

one-time and annual savings, according to Associated Industries of

Massachusetts, the state’s largest employers’ group.

A spokesman for the AFL-CIO of Massachusetts, the state’s largest

labor organization, declined comment until specific proposals are

unveiled by lawmakers.

Obamacare mandates. Federal regulators have served notice that they

intend to implement new health insurance rules under the Patient

Protection and Affordable Care Act, known as Obamacare.

But some of those rules clash with current state laws, including how

insurers set premiums for small businesses and their workers, via

rating factors such as the age of covered employees. Lora Pellegrini,

president of the Massachusetts Association of Health Plans, said the

net effect of the federal changes could be unspecified premium

increases for many small business owners and the 640,000 employees

their plans cover.

If federal regulators refuse to budge, there’s technically nothing

that Massachusetts lawmakers can do to overrule those specific

decisions. But if premiums rise as a result of Obamacare, political

pressure could build on state lawmakers to eliminate some mandated

services to lower costs.

Transportation improvements. There’s widespread consensus that the

state needs to come up with more money to address operating deficits

at the Massachusetts Bay Transportation Authority and pay for

highway and other projects elsewhere in the state.

The Patrick administration has pegged the number at nearly $1

billion per year and proposed financing the work with the income tax

increase.

But business groups and many lawmakers say if higher taxes are

needed, the state should increase the gas tax, which is dedicated

for transportation. The state’s gas tax, now 23.5 cents per gallon,

hasn’t been raised since 1991.

The Massachusetts Taxpayers Foundation has proposed a 9-cent

increase in the gas tax and an average $10 increase in various

vehicle registration fees to raise $800 million per year for

transportation projects by 2018.

John Regan, executive vice president at Associated Industries of

Massachusetts, said his and other business groups tentatively

support a gas tax increase. “But it can’t be a blank check,” he

said. “We have to know where the money is going.”

The Boston Globe

Sunday, March 24, 2013

A Boston Globe editorial

Patrick’s ambitious tax plan offers basis for compromise

Far too often in public life important choices get reduced to sound

bites, tradeoffs between interest groups, or ideological reflexes.

Only rarely do political leaders challenge the community to look at

the full picture, to engage in a rigorous discussion about the

connection between today’s choices and tomorrow’s results — to think

bigger, but also pay closer attention to the details: How the bills

will be paid, which outcomes are desired, how progress can be

measured.

Governor Patrick deserves credit for producing a budget proposal

that not only lays out the choices, but is flexible enough to serve

as a template for reasoned compromise. The governor released his

plan about four months before the budget was due to be finished, and

invited all citizens, not merely the usual actors on Beacon Hill, to

participate in the debate.

The governor’s plan includes four components: A sizable funding

increase for transportation; a guarantee of early-childhood

education for low-income toddlers; a sizable increase in Mass. grant

funding for income-eligible college students; and a dramatic

reordering of state income-tax deductions to make it more

progressive — that is, less burdensome to low-income people and more

so to those earning above $62,000.

Not all of these plans are equally necessary. Some of Patrick’s tax

proposals place a heavier burden on the middle class in order to

help those one rung lower on the income ladder. But there should be

no question that Patrick has his priorities in order: Even those

investments that might appear to be discretionary — items that can

be put off for a better day — are closely tied to the state’s

economic future. This isn’t a politician’s wish list.

The plan shouldn’t be viewed as an up-or-down, all-or-nothing

proposition. The Legislature, sensibly, has begun a rigorous review,

leaving nothing off the table. But there is still time for many more

voices to be heard, and the final product will, by necessity, be

born of a spirit of compromise. Over each of the next four days, we

will address a key aspect of Patrick’s proposal on its own merits,

to provide a frame for the debate. Hopefully, the state’s leaders

can then find agreement on a spending plan that addresses at least

the most urgent of Patrick’s priorities — transportation — and his

most transformative — the guarantee of early education for

low-income children.

The plan shouldn’t be viewed as an up-or-down, all-or-nothing

proposition.

While the state’s transportation agencies have been combined in a

dramatic restructuring, and efforts have been made to cut costs by

removing redundancies, there have been fewer like-minded reforms in

public higher education. The state’s community colleges and

universities have had their state aid cut severely in recent years.

But their request for more taxpayer support would be more acceptable

if they had already exhausted the alternatives — such as limiting

aid for students who stay beyond four years, and finally

centralizing the administrative functions of the nation’s most

decentralized university system.

These cost-cutting measures could bring down costs for most students

without the hundreds of millions of dollars in additional funding

that Patrick proposes.

By contrast, there is no viable alternative for the T’s debt-laden

operating budget, or to fund long-planned priorities such as the

Green Line extension into Somerville. And there are no dollars

available to take advantage of new technologies to enable

self-propelled, diesel-powered railcars to run on commuter-rail

tracks, thereby providing more convenient service at a lower cost.

There is no similar breakdown or looming threat to require an

expansion of early-childhood education. That’s why some people on

Beacon Hill are simply willing to put it off for another day. That

would relieve a little pressure on today’s budget, but at the cost

of a generation of toddlers who are already falling behind their

peers. Studies show that learning gaps are apparent as early as 24

months, meaning that when disadvantaged children finally get to

school, many lack the skills to succeed. Then, teachers end up

spending more time on students who are unprepared than on those who

are ready to learn.

Support for early-childhood education crosses the usual political

boundaries. Many conservatives embrace the idea that early

intervention is far cheaper and more effective than the huge amounts

spent on special-ed programs in later grades; if receiving earlier

enrichment enabled even a small percentage of students to bypass

special ed, the state would, on balance, save money. Patrick’s

proposal also would require preschools to adopt rigorous new

standards, essentially transforming daycare centers into learning

centers, which would benefit almost every child in the Commonwealth.

The Legislature should strive to maintain the ambition of the

proposal, while cutting back modestly on its price tag to limit the

tax bite.

Any such bite will feel sharp, especially to families who’ve yet to

feel the benefits of a rebounding economy, but are already feeling

the effects of the end of the federal payroll-tax cut. Patrick’s

plan attempts to shield the most vulnerable families by adding

deductions that benefit those with lower incomes while removing

loopholes that are valuable to those with higher incomes. He calls

for a big increase in the income tax — a full 1 percent, from the

current 5.25 to 6.25 — coupled with a big cut in the sales tax, from

the current 6.25 to 4.5 percent.

But Massachusetts’s sales tax carries so many exemptions that it is

already quite low — 42d out of the 46 states with a sales tax, in

terms of sales-tax revenue as a percentage of income. With food,

clothing, and other necessities exempted, the sales-tax burden falls

more on those buying new cars and luxury consumer goods than on

struggling parents tending to their kids. Without the sales-tax cut,

the Legislature could fund the state’s priorities with a far lower

hike in the income tax while preserving those deductions that are

most important to the middle class. Adding to the gas tax — a

favored alternative for some state representatives — would impose an

immediate burden on lower-income families with long commutes; but

indexing the current tax to inflation — which would mean adding a

penny per gallon every three years or so — would obviate the need

for future tax hikes for transportation funding.

Good government requires a mix of pragmatism and idealism, of rigid

cost management and responsiveness to new opportunities. Patrick has

put forward an impressive agenda; the Legislature now must turn it

into a blueprint. The state government has shown itself to be

capable of major initiatives. Its willingness to rise to the

occasion and take on big challenges — such as education reform and

health care coverage — have made it a model for other states. This

is another opportunity to demonstrate Massachusetts’s capacity for

leadership, to build the physical and programmatic infrastructure

necessary to compete for the next generation of jobs. From the

options that Patrick has spelled out, the Legislature should strive

to find an equitable mix of revenue sources to enact policies that

will put the state on stronger footing for the future.

TOMORROW: A look at the state’s transportation

needs

The Boston Herald

Sunday, March 24, 2013

A Boston Herald editorial

Test of a tax plan

Gov. Deval Patrick’s latest education plan is all about new spending

— much of it with no strings attached. But administration officials,

as they rush from one staged rally with their tax hike boosters to

another, don’t particularly like it when critics point that out.

Just ask the Massachusetts Business Alliance for Education, which

has raised a legitimate concern — that Patrick’s plan to spend $1

billion more on education over the next four years, fueled

by a

massive increase in taxes, lacks sufficient accountability measures

and isn’t the ironclad guarantee of success the administration is

painting it to be.

The MBAE’s concerns have been dismissed by both Patrick and

Education Secretary Matthew Malone, who told the State House News

Service “they’re wrong, and they need to get their facts straight.”

The “investments,” he noted, are indeed “targeted.”

Oh, well in that case ...

Malone also suggested the group is linked to charter school support

— as if that makes their concerns about the plan any less credible.

Malone, a charter school opponent who was superintendent in Brockton

until late last year, clearly hasn’t gotten the memo that this

administration claims to support expanding access to charter

schools.

But back to Patrick’s big education plan.

The governor says he needs $350 million over four years to eliminate

the waiting list for low-income families for pre-school and day

care. He is of course asking families who may be struggling to pay

their own pre-school and day care bills to pay higher taxes to

achieve that end. We suspect those taxpayers might also have a few

reservations about the $60 million they’d have to pay to send

pre-school teachers back to school.

Patrick’s plan also increases state education aid to cities and

towns by $226 million — a straight increase in the current funding

formula, which is where the business group centers most of its

concern since the funds are unrestricted.

The plan also calls for millions to allow for longer school days,

and earmarks much of the new funding for 24 “gateway cities” where

the achievement gap is the highest. Sounds great, until you realize

this is the same administration that has refused to support a

wholesale lifting of the cap on public charter schools, many of

which offer expanded learning time for students. That’s free of

charge, Gov.

We agree with the governor that education is the key to opportunity

and economic success. What we don’t want is a return to the days

when just throwing more money at the system passed for real

“reform.”

The Boston Globe

Monday, March 25, 2013

A Boston Globe editorial

Transportation needs are clear; reforms help justify funding hike

Almost a decade after the Big Dig’s completion, the toxic legacy of

the bloated highway project still haunts the state. Debt from

Central Artery-related projects gnaws away at the MBTA’s budget,

forcing fare hikes and service cuts; residual public distrust over

the mishandling of the project undercuts efforts to build political

support for roads and bridges.

It is time, though, to move on. The state is making progress at

reform. A 2009 law consolidated the transportation agencies, and the

organizational culture is changing. In one of the most visible signs

of change, the Turnpike is even phasing out costly toll collectors

in favor of open-road tolling. There is always room to improve, and

the state should never stop seeking savings, but the administration

and MassDOT secretary Richard Davey are taking meaningful steps to

restore public confidence.

Now, as part of his ambitious budget plan, Governor Deval Patrick

has asked the Legislature to approve roughly $1 billion in

additional revenue for the Commonwealth’s roads, bridges, and

transit systems. It would be the biggest infusion of cash into

transportation in years. Most of the funds, though, would just go

toward clearing the backlog of pent-up needs: new cars for the Red

Line and Orange Line, where equipment is decades old and

increasingly unreliable; repairs to roadway bridges across the

state; a new highway viaduct in Springfield; and the long-promised

extension of the Green Line into Somerville.

These are critical investments that will bolster the state’s

competitiveness. A dependable transportation system is key to

attracting and retaining workers, opening up new neighborhoods for

transit-oriented housing, and creating a more environmentally sound

economy. As the Legislature weighs the transportation plan against

the education components of Patrick’s plan, the need to catch up on

overdue transportation investments should be the most urgent.

Patrick has also asked for money for several expansion projects,

with a laudable emphasis on underserved areas. The plan would fund

commuter rail to New Bedford and Fall River, which would link a

struggling region to Boston’s more vigorous economy. He also wants

the state to buy smaller trainsets of self-propelled rail cars

called “diesel multiple units,” which would permit more frequent,

subway-like service on commuter rail tracks near Boston. These DMUs

could improve service on the busy routes through close-in suburbs,

but also on the Fairmount Line through some neglected parts of

Dorchester. Patrick is also proposing passenger rail service to

Springfield and the Berkshires — projects that seem like second-tier

priorities but still hold promise, especially if the state can forge

a partnership with Connecticut to share the costs of rail expansion.

Lawmakers can’t let the ghost of the Big Dig continue to thwart the

state’s needs forever.

Finally, Patrick’s plan would also end one of the more irresponsible

fiscal practices inherited from the Big Dig era. Since the 1990s,

the state has been paying some transportation employees with

borrowed money. MassDOT has already taken steps toward eliminating

that practice. Taxpayers won’t notice any difference when the rest

of the agency’s employees move off the capital budget, but it will

save money in the long run.

Raiding the capital budget for salaries was merely a symptom of the

profligate Big Dig culture. Lawmakers should certainly never forget

the lessons of that debacle. But nor can they let its ghost continue

to thwart the state’s needs forever.

Tomorrow: A look at early childhood education

The Boston Herald

Monday, March 25, 2013

A Boston Herald editorial

Taxing even the cloud

Every time we turn over the rock that is Gov. Deval Patrick’s $2

billion tax hike plan, another foul smell emerges.

This time we have the Massachusetts Taxpayers Foundation to thank

for analyzing what the governor’s plan calls a tax on “custom

modifications to software and other computer services,” expected to

bring in $265 million in new revenue a year. Currently software is

taxable but computer services are not. But, the governor’s office

insists, “with the migration of software first to the ‘web’ and now

to the ‘cloud,’ the line” between the two is becoming “untenable.”

And so, in the spirit of “fairness” he wants to tax the beejesus out

of both.

The Taxpayers Foundation called the tax a “Pandora’s Box” that is so

“unclear and complex” that it would tax everything from a

custom-designed website to cloud computing, data storage, virtually

all computer programming and even health care diagnostics (so much

for health care cost containment).

The proposed tax “targets industries that drive innovation,

productivity and economic growth and makes locating or expanding in

Massachusetts that much more expensive and unattractive for all

businesses seeking to compete in the 21st century,” the Foundation’s

report said.

Associated Industries of Massachusetts noted in a separate statement

to legislators, “Targeting taxes on the tools of efficiency will

throw sand in the gears of an economy already struggling to build up

steam.”

In all, according to AIM, the governor proposes to hit businesses

with about $500 million in new taxes. And that is, of course, on top

of additional costs related to Obamacare.

In attempting to counter the Taxpayers Foundation’s charges, Alex

Zaroulis, spokesperson for the Office of Administration and Finance,

only managed to confirm everyone’s worst suspicions.

“The governor’s proposal makes our tax system fairer by making sure

that business taxes are paid not just by established or declining

industries but by newer, growing ones.”

Precisely. Others would call that “killing the goose that lays the

golden eggs.”

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

|