CLT UPDATE

Thursday, May 8, 2008

State's "fiscal crisis"

From boom to bust in a week

Revenue Commissioner Navjeet K. Bal today announced

that preliminary revenue collections for April 2008 totaled $2.737

billion, up $400 million or 17.1 percent from last April....

FY08 year-to-date tax collections total $17.126 billion, up $1.219

billion or 7.7 percent ahead of the same period a year ago, and are $702

million above the FY08 year-to-date benchmark corresponding to the FY08

tax revenue estimate of $20.225 billion.

Department of Revenue

Monday, May 5, 2008

April Collections of $2.737 Billion

Exceed Benchmark

State tax collections shot up by more than 17 percent

in April, shattering the monthly benchmark by $333 million and adding a

layer of complexity as the state Senate prepares to take up a bill

sponsored by Democrats that raises taxes by nearly $500 million.

The April tax haul put overall tax collections for fiscal 2008 at more

than $1.1 billion above the original numbers used to build this year's

$26.8 billion state budget....

Senate Republicans called the numbers "embarrassing" for supporters of

tax increases and claimed that with revenues pouring in at record

levels, state government leaders must address spending patterns. Senate

Minority Leader Richard Tisei said the state's new health care law was

one of the main reasons behind rising spending and also pointed to

"exploding" personnel costs at state agencies.

Noting that even as lawmakers consider tax increases – in what the

administration terms a way of closing “loopholes” – tax collections are

on pace to trigger an income tax reduction, Tisei said, “We don’t have a

revenue problem in this state. We have a spending problem.” ...

The share of the state's workforce funded through the annual operating

budget . . . rose 2.6 percent from June through December last year....

Senators said they are anticipating a vigorous effort to generate new

revenue by increasing the taxes on alcohol, along with cigarettes....

With the tax increase, Tisei said, a carton of cigarettes will cost $68

in Massachusetts, compared to $35 in New Hampshire.

State House News Service

Monday, May 5, 2008

April tax revenues set new record

The state raked in more than $156 million in gasoline taxes

last summer from June through August, according to the Department of Revenue,

and will collect an estimated $674.6 million in taxes at the pump next year.

"The amount of dollars is so small per household, like pennies a week, and we

have a huge infrastructure problem that would be exacerbated," said Michael

Widmer, president of the Massachusetts Taxpayers Association. "The only

responsible approach here is to retain the gas tax because we have huge

infrastructure needs."

The Patrick administration announced yesterday that state revenue for the month

of April has exceed benchmark expectations by $333 million, growing more than 17

percent over last April's figures....

The state has collected about $484 million more than projected in fiscal 2008,

not counting about $218 million in one-time revenue from settlements....

Widmer agreed with Patrick and his administration that the good tax news from

April should no be interpreted as a sign that the state is now flush with cash

that can be spent in years to come.

"The size of the number, in one sense, is stunning. It's quite large. But

looking forward, sales taxes and other indicators that affect the economy are

flat," Widmer said. "We might see this pace through May and June, but then I

suspect we might see a slowdown."

The Lowell Sun

Tuesday, May 6, 2008

Mass. gas tax holiday called a gimmick

The House voted Friday night to tack $45 million back onto

the state budget that leadership was initially hoping to save by tiering health

insurance premium payments from state workers.

The 144-10 vote, stripping a major provision out of the Ways and Means Committee

budget, occurred without debate.

State House News Service

Friday, May 2, 2008

House retreats from state worker health reform

The House early Saturday morning voted 136-19 to approve a

$28.2 billion budget, fattened throughout the week with spending amendments.

The party line vote occurred after the quick adoption, without debate, of a

long, earmark-laden economic development that was put together behind closed

doors throughout Friday night.

House Minority Leader Brad Jones said the House had added $210 million in

spending during the week and expanded its draw from state reserves to pay for

the budget to $412 million at a time when "warning signals abound" over a soft

economy.

Jones said the House had overspent all week without citing new revenue sources

and may turn to higher taxes to eventually foot the bill.

State House News Service

Saturday, May 5, 2008

House okays $28.2 billion budget early Saturday morning

Local lawmakers added hundreds of thousands of dollars for

pet projects to the $28.2 billion budget approved by the House last week,

including money for Haverhill veterans, a school for autistic children in

Andover, and the YMCA of Greater Lawrence.

The budget now goes to the Senate and requires the governor's signature before

any of the spending requests become law....

But Michael Widmer, president of the Massachusetts Taxpayers Foundation, said

the mix of new spending and increased reliance on the state's rainy day fund is

troubling.

"This is not a realistic budget," said Widmer, who believes the Senate would

have to reduce spending by "hundreds of millions" of dollars to be prepared for

a drop in state revenues caused by an expected recession.

Rep. Bradley Jones Jr., R-North Reading, said he thinks the Senate is poised to

add, not subtract, from the House budget. He pointed to Senate plans to vote on

a $472 million tax increase tomorrow that expands upon the $392 million tax

increase the House passed in April.

He also noted yesterday's state revenue report that showed collections bested

expectations by more than $2 billion in April. Patrick administration officials

cautioned the figure reflected the year on which the taxes were paid, 2007, and

not the coming year. But Jones said it supports his contention that the

Democratic-controlled Legislature has its priorities wrong.

"I think clearly there's much more data to suggest we have a spending problem

and not a revenue problem," Jones said.

The Eagle-Tribune

Tuesday, May 6, 2008

House adds hundreds of thousands

for local projects

As we feared, our tentative nod to the Massachusetts House a

couple of weeks ago for keeping the 2009 state budget under $28 billion was

premature....

But the proposal to hold spending growth to 4 percent, about $1.1 billion,

seemed to signal an awareness of the need for restraint. The committee even

embraced a provision, endorsed by the governor and House leaders, to raise the

employee contribution for health insurance slightly, to a modest 20 percent for

those with salaries over $30,000, 25 percent for those over $50,000.

Subsequently, however, the House loaded the committee plan with $200 million in

spending for lawmakers’ pet projects. Members rejected the insurance reform and,

on a party-line vote, crushed a Republican proposal to increase state aid to

cash-strapped municipalities by $200 million. The cost of the earmarked spending

was almost double the $109 million Ways and Means had chopped from spending

requests....

Taxpayers’ last hope evidently is to persuade senators it is

their duty to pass a sustainable, fiscally responsible spending plan.

A Telegram & Gazette editorial

Thursday, May 8, 2008

Hey, big spenders

House goes on $200 million earmarking spree

Massachusetts tax collections in April soared 17.1 percent

compared with a year ago. But this news, announced yesterday, shouldn't cause

the Legislature to abandon all restraint on spending....

The House, perhaps sensing the good news, voted Saturday to increase the $28

billion budget proposed by the Ways and Means Committee by $200 million before

sending it on to the Senate....

The growth in revenue last month probably means that the state will end the 2008

fiscal year without a shortfall. The budget under consideration by the

Legislature is for fiscal '09, which begins July 1, when projections become

murky....

Because of the revenue surge, the state income tax rate will be going down

slightly, from 5.3 to 5.25 percent, the result of a law intended to blunt voter

anger over the Legislature's decision in 2002 not to drop the rate to 5 percent.

Given its commitments, the state can't afford 5 percent.

But a business-as-usual budget, full of local goodies, invites a voter backlash,

and an initiative petition to abolish the income tax is expected to be on the

budget this November. The Senate needs to devise a more responsible budget.

A Boston Globe editorial

Tuesday, May 6, 2008

A business-as-usual budget

The state Senate is poised today to approve a $472 million

tax package despite new data showing the state is hauling in far more tax

revenue than anticipated this year....

The expected Senate action comes after the Department of Revenue yesterday said

April tax collections were up $400 million, for a 17.1 percent increase over the

same period last year.

Meanwhile, tax collections so far this fiscal year are running $1.2 billion, or

7.7 percent, above last year’s levels.

The Boston Herald

Tuesday, May 6, 2008

Senate set to OK tax plan

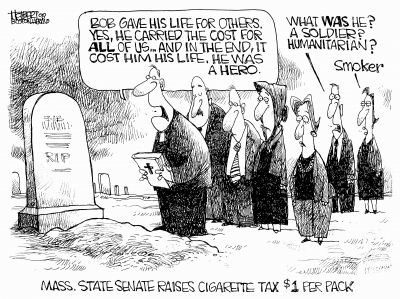

The state Senate’s move to raise the cigarette tax by

$1-a-pack, making Massachusetts one of the most expensive states to buy

cigarettes, has smoker’s rights groups puffing mad and health advocates

applauding....

The $1-a-pack tax was included in a nearly $500 million tax package that the

Senate approved yesterday....

The Senate and House still need to agree on the tobacco tax hike and Gov. Deval

Patrick must sign off on it....

Massachusetts already has one of the highest cigarette taxes in the nation.

The current state cigarette tax is $1.51 a pack, but once federal taxes, sales

tax and tobacco settlement surcharges are included the tax is $2.76 a pack, said

[Stephen Helfer, founder of the defunct Cambridge Citizens for Smoker’s Rights],

who actively lobbied against the tax increase.

The Boston Herald

Wednesday, May 7, 2008

Senate’s cigarette price hike has smokers fuming

The Boston Herald - May 8, 2008

Editorial cartoon by Jerry Holbert

Chip Ford's CLT Commentary

Beacon Hill Politics 101: If you don't have a "fiscal

crisis" to blame for raising taxes and thwarting the voters' 2000 tax

rollback mandate, then by god create one quick!

Despite months of doom-and-gloom about budget gaps

and revenue shortfalls, when the latest announcement of

record-shattering tax revenue could no longer be hidden, it had to be

spent immediately on anything. $1.2 billion more than last year's

take couldn't be left unspent, a temptation to taxpayers and voters who

in 2000 demanded the income tax rate be rolled back to its traditional 5

percent.

So the Beacon Hill feeding frenzy went into

overdrive, burned the midnight oil until an additional $210 million in

spending could be added to the 2009 budget and $412 million was spent

from the alleged "rainy day" stabilization fund.

Michael Widmer, president of the Big-Business

Fat-Cats' so-called

Massachusetts Taxpayers Foundation, quickly jumped in and ran his

usual tax-spend-borrow cover. Addressing the record state tax take

it was, "The size of the number, in one sense, is stunning. It's quite

large." Then came his cover-thy-butt caveats: "We might see

this pace through May and June, but then I suspect we might see a

slowdown." With MTF's long and proven

track record of unreliable revenue forecasts who can blame him?

In one sentence he managed to fit in the qualifiers "might" and

"suspect."

He further pontificated that "the mix of new spending

and increased reliance on the state's rainy day fund is troubling.

This is not a realistic budget," he declared of the House's feeding

frenzy, adding that the Senate would have to cut the House budget by

"hundreds of millions" of dollars. That, of course, didn't happen.

Widmer's advice is never heeded, never has been. He's just a

useful idiot for wasteful government growth. We can't help but

wonder after all these years if he even realizes he's simply a tool.

Typically, when it comes to a tax break for average

citizens, Widmer as always is vehemently opposed. To a proposal

for a gas tax holiday over the summer his response was, "The amount of

dollars is so small per household, like pennies a week . . . The only

responsible approach here is to retain the gas tax because we have huge

infrastructure needs."

And how about that Boston Globe editorial board?

"Given its commitments, the state can't afford 5 percent," the

all-knowing elitists decree from on high.

What happened to the "commitment" of 1989 that the

income tax hike would be only "temporary"? The Globe has always railed

for shattering that one, and did again before concluding this editorial.

A case of selective commitments for sure. Instead of titling it "A

business-as-usual budget," it more appropriately should have been "A

business-as-usual editorial."

First come the "investments," such as "investment in

our future" or "investment in our children." This of course means more

proposed government spending. It must be government spending

because surely nobody cares what you have left to spend on

your future or your kids'. Once the spending is larded

into the budget, now come the "commitments." This congenital

Doublespeak is akin to "unmet needs" that are really endless unmet

wants.

Give us our tax rollback to 5 percent now!

It only amounts to "a cup of coffee a week," right? The

Legislature's token reduction from 5.3 to 5.25 percent won't even pay

for the empty paper cup.

|

|

Chip Ford |

Department of Revenue

May 5, 2008

April Collections of $2.737 Billion Exceed

Benchmark

Revenue Commissioner Bal signals caution

on future revenue growth as economy slows

Revenue Commissioner Navjeet K. Bal today announced that preliminary

revenue collections for April 2008 totaled $2.737 billion, up $400

million or 17.1 percent from last April.

Total tax collections were $333 million above the April monthly

benchmark based on the FY08 revenue estimate of $20.225 billion, due

almost entirely to growth in income tax payments with returns and

extensions, both of which reflect past economic activity rather than

future economic growth.

FY08 year-to-date tax collections total $17.126 billion, up $1.219

billion or 7.7 percent ahead of the same period a year ago, and are $702

million above the FY08 year-to-date benchmark corresponding to the FY08

tax revenue estimate of $20.225 billion.

Commissioner Bal said it was necessary to exercise caution in analyzing

the robust April collections which were largely fueled by investors who

apparently experienced sizable income growth in tax year 2007. “As

history has proven, this kind of revenue growth is extremely volatile

and not likely to carry forward given current economic indicators. The

decline in withholding tax and the minimal growth in sales and use tax

revenues, which are current indicators of the state of the economy, are

sobering” she said.

Bal also noted that faster processing of tax returns, due in part to

heightened use of electronic filing, had probably netted $60 million to

$70 million in income that otherwise would have been counted in May. “We

could then see a corresponding decrease in our next month’s report,” she

said.

Corporate/business tax collections of $48 million for April 2008 were

down $7 million or 12.2 percent from a year ago and were $6 million

below the monthly benchmark. Sales and use tax collections of $336

million in April 2008 were up $9 million or 2.7 percent from a year ago

and met the monthly benchmark.

April income tax collections totaled $2.223 billion, up $401 million or

22.0 percent and $346 million above the monthly benchmark. Withholding

taxes totaled $686 million, down $5 million or 0.8 percent from a year

ago, $43 million below the benchmark. Income tax refunds totaled $305

million, down $16 million or 5.0 percent from a year ago, $9 million

below the benchmark. Income tax payments with returns and bills totaled

$1.545 billion, up $355 million or 29.8 percent from a year ago, $355

million above the benchmark.

On a fiscal 2008 year-to-date basis, sales and use tax collections are

$29 million or 0.9 percent ahead of the same period a year ago, $38

million below the benchmark. Corporate/business taxes are $88 million or

4.6 percent ahead of the same period a year ago and $218 million above

the benchmark mainly due to large one-time payments received in February

and March. Income taxes are $1.122 billion or 12.3 percent ahead of a

year ago and $540 million above the benchmark.

State House News Service

Monday, May 5, 2008

April tax revenues set new record,

beat benchmark by $333M as tax vote nears

State tax collections shot up by more than 17 percent in April,

shattering the monthly benchmark by $333 million and adding a layer of

complexity as the state Senate prepares to take up a bill sponsored by

Democrats that raises taxes by nearly $500 million.

The April tax haul put overall tax collections for fiscal 2008 at more

than $1.1 billion above the original numbers used to build this year's

$26.8 billion state budget. The big surge in April revenues, which

officials said constituted a one-month record for receipts at $2.737

billion, was announced on the eve of the Senate's consideration of

legislation targeting corporations and smokers with new levies, while

reducing some business tax rates.

Senate Republicans called the numbers "embarrassing" for supporters of

tax increases and claimed that with revenues pouring in at record

levels, state government leaders must address spending patterns. Senate

Minority Leader Richard Tisei said the state's new health care law was

one of the main reasons behind rising spending and also pointed to

"exploding" personnel costs at state agencies.

Noting that even as lawmakers consider tax increases – in what the

administration terms a way of closing “loopholes” – tax collections are

on pace to trigger an income tax reduction, Tisei said, “We don’t have a

revenue problem in this state. We have a spending problem.”

Gov. Deval Patrick said, “You don’t make a tax vote based on a snapshot

in time. We’re looking at the long-term strength of the state’s economy,

the long-term needs to support the services that people want.” Patrick

added that “small- and medium-sized companies deserve to have those

loopholes closed.”

Talking with reporters, Patrick said he would not consider a summer gas

tax holiday, which he called “a wonderful gimmick,” saying the potential

savings would not offset the “tradeoff” in lost bridge and road

maintenance funds.

In a briefing with reporters Monday afternoon, Patrick aides downplayed

the excess revenues as indicative of economic health or budgetary

strength. They pointed to supplementary spending demands and the current

fiscal year budget’s reliance on more than $600 million in reserves for

structural balance. Administration and Finance Secretary Leslie Kirwan

said the state would likely still have to draw from its reserve funds at

the end of the year.

Total state tax collections heading into the last two months of fiscal

2008 are up 7.7 percent. In a press release, the Department of Revenue

characterized the April revenue growth as "robust" but urged caution,

saying collections "were largely fueled by investors who apparently

experienced sizable income growth in tax year 2007."

Navjeet Bal, the state revenue commissioner, said a decline in

withholding taxes and minimal growth in sales and use tax revenues were

"sobering" because those taxes are "current indicators" of the state of

the economy.

The most recent jobs figures, released in mid-April, showed the state

adding 4,500 jobs in the first three months of calendar 2008. While

bracing for a downturn, state leaders say Massachusetts is positioned

better than other states.

Bal also said faster processing of returns netted $60 million to $70

million that might otherwise have been captured in May and instead

helped push the April collection figure up to $2.737 billion. April

revenues were up $400 million over April 2007, about $346 million ahead

of the monthly benchmark. Patrick aides said $218 million in onetime

payments had also driven up receipts, and accounted for nearly all the

over-benchmark corporate receipts.

Administration and Finance Secretary Leslie Kirwan said the April

numbers mean there will be no mid-year "9C" spending cuts but that the

administration would maintain fiscal 2008 spending controls.

Kirwan dismissed Tisei’s claims of soaring hiring as inaccurate, saying

growth had been “very minimal,” but said she did not have the numbers

available. The share of the state's workforce funded through the annual

operating budget - which excludes those paid through capital budgets,

federal grants, seasonal help, boards and commissions, and

semi-independent authorities - rose 2.6 percent from June through

December last year.

The House last week added about $210 million to its proposed $28 billion

fiscal 2008 budget. Supporters of the additional spending said it would

fuel worthwhile government programs and services while critics said

Democrats had failed to cite a funding source for the spending and

questioned whether taxpayers could afford it.

Monthly revenue collection numbers are usually released with a press

release but Monday’s numbers were outlined by Kirwan and Revenue

Commissioner Navjeet Bal at a State House press briefing. House and

Senate Republicans have ripped the department for departing from the

usual process of announcing revenue on the first or second business day

of the month, alleging that the revenue information was intentionally

not announced during last week's House budget debate and pushing for the

announcement prior to Tuesday's Senate tax debate.

Kirwan dismissed concerns about the timing of the numbers’ release,

attributing the delay to the importance and complexity of April tax

collections, and saying the figures weren’t ready until Monday morning.

Tisei said April tax collections have been released on the first

business day in May during each of the past ten years, until this year.

In a statement, Bal said, “DOR sought to ensure accurate and complete

revenue numbers before releasing them, and that is what we did today.”

The Senate tax bill, polled out of the Senate Ways and Means Committee

over the weekend, will generate $472 million in fiscal 2009, according

to a summary of the bill obtained by the News Service.

Tisei, during an unusual floor speech in Monday's informal session, said

Senate Republicans were prepared to block consideration of the tax bill,

unless the department released the numbers. Tisei said leaders at the

highest levels of government had the numbers but the public should know

them as well in advance of Tuesday's planned floor debate. The Wakefield

Republican said the administration's handling of the tax figures lacked

the transparency Patrick promised to bring to state government.

The Senate tax bill includes the "check the box" and "combined

reporting" reforms sought by Gov. Patrick; reduces the corporate

business excise rate from 9.5 percent to 8 percent over three years,

beginning Jan. 2, 2010; includes financial institutions in the combined

reporting regime; reduces the corporate excise rate for financial

institutions from 10.5 percent to 9 percent over three years, beginning

in 2010; clarifies that recipients of the personal earned income tax

credit must live or work in Massachusetts; and increases the cigarette

tax by $1 per pack and makes the increase applicable to the wholesaler's

inventory, effective July 1, 2008.

The committee endorsed the bill on a 10-0 vote, according to an aide.

Its passage is expected in the Senate.

The Senate tax bill also reduces the excise rate for "S" corporations

over three years starting in 2010. The rate for S corporations with

gross sales between $6 million and $9 million moves from 3 percent to

1.8 percent and the rate for S corporations with gross sales above $9

million moves from 4.5 percent to 2.7 percent.

The Senate committee version proposes a softer rate cut than the House

plan, which would reduce the corporate excise rate from 9.5 percent to

8.75 percent next year, tying future reductions in the rate to economic

growth triggers with an eventual floor of 7.5 percent. While the Senate

paring would begin in 2010, the House opted to start next year.

Senators said they are anticipating a vigorous effort to generate new

revenue by increasing the taxes on alcohol, along with cigarettes. "I

think that's going to be one of the most contentious parts," Sen.

Stephen Buoniconti (D-Springfield) told the News Service Friday.

The Senate bill also requires businesses that resell hotel/motel rooms

to collect taxes on the difference between the retail price of the room

paid by the consumer and the discounted prices the reseller pays to

acquire the room.

Senate Republicans on Tuesday plan to push budget amendments that Tisei

said would wipe out a 1946 law that he said subsidized the tobacco

industry by protecting it against competition. The amendment, if passed,

would negate the impact of the cigarette tax increase, he said. With the

tax increase, Tisei said, a carton of cigarettes will cost $68 in

Massachusetts, compared to $35 in New Hampshire. Senate Republicans are

also mulling amendments to increased tax revenue towards cities and

towns in the form of local aid.

The Lowell Sun

Tuesday, May 6, 2008

Mass. gas tax holiday called a gimmick

By Matt Murphy

Gov. Deval L. Patrick said he is sensitive to the impact of rising gas

prices on families and commuters, but shot down the idea that a gas tax

holiday should be considered as a short-term solution.

"It's a wonderful gimmick, but it's a patch. It doesn't solve our

long-term interests and the trade off in the short term is an unwise

one," Patrick said when asked about the topic that has been gaining

steam nationally.

Democratic presidential candidates Sens. Barack Obama and Hillary

Clinton spent the weekend feuding over the idea of a federal gas tax

reprieve during the summer travel months to help ease the burden on

citizen's wallets. The federal tax is 18.4 cents a gallon.

Massachusetts levies a 23.5 cent tax on a gallon of gas. Meanwhile,

state Rep. Paul Frost, an Auburn Republican, is considering filing

legislation that would put the state tax at 2.5 cents a gallon — a

reduction of 21 cents — from July 1 to Sept. 1.

It would not be the first time a gas tax holiday was considered by the

state Legislature, proposed last by House Minority Leader Brad Jones,

R-North Reading, in 2006.

Obama on Sunday called the concept, first proposed by Republican nominee

Sen. John McCain, a typical ploy used by Washington politicians to score

points with the public without addressing the underlying problem.

Clinton, meanwhile, supports the idea and intends to file her own

legislation in Congress despite a majority of economists calling it a

foolhardy plan.

She says she would pay for it with a windfall tax on major oil company

profits.

Patrick, an Obama supporter, said he doesn't believe drivers would see

an enough savings to justify the impact to state infrastructure

projects.

"The trade-off, and there would be a trade-off in terms of maintenance

and upkeep of our roads and bridges, is unwise," Patrick said.

An independent, bipartisan commission reported last year that the state

faced a $20 billion shortfall over the next 20 years to keep up with

aging bridge and road repair projects.

Patrick's comments came on a day when his administration announced that

state revenue this year has surpassed budget expectations by $702

million, while gas prices across the state climbed 2 cents on average to

$3.56. Massachusetts gas is selling below the national average of $3.61,

according to AAA Southern New England.

"Today's revenue figures probably lend some support with revenue coming

in much higher than expectations," Jones said. "I'd certainly be open to

it, but it's important to back fill the accounts that will pay (for the

holiday) from somewhere."

The state raked in more than $156 million in gasoline taxes last summer

from June through August, according to the Department of Revenue, and

will collect an estimated $674.6 million in taxes at the pump next year.

"The amount of dollars is so small per household, like pennies a week,

and we have a huge infrastructure problem that would be exacerbated,"

said Michael Widmer, president of the Massachusetts Taxpayers

Association. "The only responsible approach here is to retain the gas

tax because we have huge infrastructure needs."

The Patrick administration announced yesterday that state revenue for

the month of April has exceed benchmark expectations by $333 million,

growing more than 17 percent over last April's figures.

Secretary of Administration and Finance Leslie Kirwin and Department of

Revenue Commissioner Navjeet Bal, however, cautioned that the strong

revenue collections were reflective of the strength of the financial

market in 2007, and not a bellwether for fiscal 2009.

Kirwin also said the excess revenue is already spoken for and will be

needed to cover the rising cost of health care, snow and ice removal

from the winter, lottery shortfalls and to pay back some of the $604

million in reserves used to balance this year's budget.

"What this news does is possibly puts us in a better position to weather

any economic downturn that might come in 2009," Kirwin said, cautioning

that the $1.3 billion structural deficit that forces the state to tap

reserves each year still exists.

The state has collected about $484 million more than projected in fiscal

2008, not counting about $218 million in one-time revenue from

settlements.

Bal said the strength of collections from large investors and capital

gains were offset by minimal 2.7 percent growth in the sales tax that

she described as "fairly anemic" and "sobering."

Widmer agreed with Patrick and his administration that the good tax news

from April should no be interpreted as a sign that the state is now

flush with cash that can be spent in years to come.

"The size of the number, in one sense, is stunning. It's quite large.

But looking forward, sales taxes and other indicators that affect the

economy are flat," Widmer said. "We might see this pace through May and

June, but then I suspect we might see a slowdown."

State House News Service

Friday, May 2, 2008

House retreats from state worker health reform

The House voted Friday night to tack $45 million back onto the state

budget that leadership was initially hoping to save by tiering health

insurance premium payments from state workers.

The 144-10 vote, stripping a major provision out of the Ways and Means

Committee budget, occurred without debate.

A consolidated amendment relative to constitutional officers shifted the

$45 million burden back to the state. The amendment also moved a $23

million salary reserve for human services workers out of the Executive

Office of Health and Human Services, reduced by $3.2 million the amount

of money transferred from the general fund to the State Retiree Benefits

Trust Fund and extended to 2010 a provision in the general laws that

pays state employees on leave for service in the armed forces the

difference between their military salary and their work salary.

Including this amendment, lawmakers have increased spending by nearly

$170 million since budget debate began. Many House lawmakers indicated

after the House Ways and Means Committee budget was released that they

were not willing to raise health premiums paid by state workers, which

Gov. Patrick had also proposed in his fiscal 2009 budget.

State House News Service

Saturday, May 5, 2008

House okays $28.2 billion budget early Saturday morning

The House early Saturday morning voted 136-19 to

approve a $28.2 billion budget, fattened throughout the week with

spending amendments.

The party line vote occurred after the quick adoption, without debate,

of a long, earmark-laden economic development that was put together

behind closed doors throughout Friday night.

House Minority Leader Brad Jones said the House had added $210 million

in spending during the week and expanded its draw from state reserves to

pay for the budget to $412 million at a time when "warning signals

abound" over a soft economy.

Jones said the House had overspent all week without citing new revenue

sources and may turn to higher taxes to eventually foot the bill.

In his closing remarks, House Ways and Means Committee Chairman Rep.

Robert DeLeo (D-Winthrop) didn't address the complaints about

overspending or revenue sources and said the budget is about more than

just numbers.

"This is the budget of our constituents, those who need services," DeLeo

said just after midnight. "That is what we did in this particular

budget."

The Eagle-Tribune

Tuesday, May 6, 2008

House adds hundreds of thousands

for local projects

By Edward Mason

Local lawmakers added hundreds of thousands of dollars for pet projects

to the $28.2 billion budget approved by the House last week, including

money for Haverhill veterans, a school for autistic children in Andover,

and the YMCA of Greater Lawrence.

The budget now goes to the Senate and requires the governor's signature

before any of the spending requests become law.

Rep. Brian Dempsey, D-Haverhill, went into budget week saying it would

be hard to do better than the $2.4 million he secured for Hale Hospital

debt relief in an early version of the House budget.

Yet, last week he secured $100,000 for the Veterans Northeast Outreach

Center in Haverhill, $80,000 for a homeless veterans shelter in

Haverhill, and $50,000 for the YWCA of Haverhill. He also got $75,000

for Link House Inc., a Salisbury drug and alcohol rehabilitation center

in Rep. Michael Costello's district.

Rep. William Lantigua, D-Lawrence, had a number of his $4.2 million in

earmarks approved, including $100,000 for the YWCA of Greater Lawrence,

$165,000 for Arlington Community Trabajando, a Lawrence affordable

housing and economic development nonprofit group, and $115,000 for Food

for the World Pantry.

But a number of his earmarks were rejected, including a request for more

than $58,000 for a Hispanic performance troupe.

Lawmakers had limited success on plans to overhaul special education

funding.

Rep. Barbara L'Italien, D-Andover, got $2 million to help cities and

towns pay to transport special education students to other school

districts. She originally had pushed more ambitious plans to change the

funding formulas that would have sent at least $12.8 million a year to

local schools.

L'Italien said she didn't expect all of her special education requests

to be approved during a tight budget year.

"We were trying to strike a balance between need to do this and the

economic realities," L'Italien said.

However, L'Italien won a $2 million increase for the state Division of

Autism. The House also approved her request for $200,000 for Melmark

School in Andover for autistic children.

Costello, a Newburyport Democrat, won earmarks in excess of $600,000.

Among the items he won was $330,000 for the Newburyport shellfish

purification plant, $100,000 for the Newburyport YWCA, $40,000 for the

Newburyport Office of Economic Development, and $75,000 for Pettingill

House, a Salisbury social service agency.

Costello also wrangled $2 million more for a state program to fund local

police hires statewide.

Overall, the House budget included $210 million in new spending, despite

warnings from budget watchdogs that the state couldn't afford it.

Dempsey said the House budget reflected necessary spending.

"It's always a balancing act between meeting the demands of education,

public safety and special ed and balancing the budget," Dempsey said.

But Michael Widmer, president of the Massachusetts Taxpayers Foundation,

said the mix of new spending and increased reliance on the state's rainy

day fund is troubling.

"This is not a realistic budget," said Widmer, who believes the Senate

would have to reduce spending by "hundreds of millions" of dollars to be

prepared for a drop in state revenues caused by an expected recession.

Rep. Bradley Jones Jr., R-North Reading, said he thinks the Senate is

poised to add, not subtract, from the House budget. He pointed to Senate

plans to vote on a $472 million tax increase tomorrow that expands upon

the $392 million tax increase the House passed in April.

He also noted yesterday's state revenue report that showed collections

bested expectations by more than $2 billion in April. Patrick

administration officials cautioned the figure reflected the year on

which the taxes were paid, 2007, and not the coming year. But Jones said

it supports his contention that the Democratic-controlled Legislature

has its priorities wrong.

"I think clearly there's much more data to suggest we have a spending

problem and not a revenue problem," Jones said.

The Telegram & Gazette

Thursday, May 8, 2008

A Telegram & Gazette editorial

Hey, big spenders

House goes on $200 million earmarking spree

As we feared, our tentative nod to the Massachusetts House a couple of

weeks ago for keeping the 2009 state budget under $28 billion was

premature.

The spending plan proposed by the Ways and Means Committee was not

exactly lean. And few of the efficiencies and reforms recommended by

task forces, taxpayer advocates and the Patrick administration over the

past year were in evidence.

But the proposal to hold spending growth to 4 percent, about $1.1

billion, seemed to signal an awareness of the need for restraint. The

committee even embraced a provision, endorsed by the governor and House

leaders, to raise the employee contribution for health insurance

slightly, to a modest 20 percent for those with salaries over $30,000,

25 percent for those over $50,000.

Subsequently, however, the House loaded the committee plan with $200

million in spending for lawmakers’ pet projects. Members rejected the

insurance reform and, on a party-line vote, crushed a Republican

proposal to increase state aid to cash-strapped municipalities by $200

million. The cost of the earmarked spending was almost double the $109

million Ways and Means had chopped from spending requests.

The failure of the leadership to rein in the spree may not be surprising

in view of the behind-the-scenes maneuvering for the speaker’s seat.

While Speaker Salvatore F. DiMasi says he has no intention of vacating

it, he may be leery of eroding rank-and-file support by saying “no” to

members’ election-year wish lists.

Taxpayers’ last hope evidently is to persuade senators it is their duty

to pass a sustainable, fiscally responsible spending plan.

The Boston Globe

Tuesday, May 6, 2008

A Boston Globe editorial

A business-as-usual budget

Massachusetts tax collections in April soared 17.1 percent compared with

a year ago. But this news, announced yesterday, shouldn't cause the

Legislature to abandon all restraint on spending. The figures largely

reflect the strength of the economy last year, before the full impact of

the housing loan crisis. And the extra money that flowed to the

Department of Revenue is needed for long-term commitments, including

education aid and health-insurance expansion.

The House, perhaps sensing the good news, voted Saturday to increase the

$28 billion budget proposed by the Ways and Means Committee by $200

million before sending it on to the Senate. A $12.4 million tourism line

item in the committee budget ballooned to $34.2 million, thanks to

spending on such attractions as the Boston Symphony Orchestra summer

home at Tanglewood ($200,000), the Basketball Hall of Fame in

Springfield ($300,000), the Grand Army of the Republic Museum in Lynn

($100,000), the Waltham Tourism Council ($100,000), and the Central

Square Theater in Cambridge ($100,000). The state has more pressing

responsibilities.

The growth in revenue last month probably means that the state will end

the 2008 fiscal year without a shortfall. The budget under consideration

by the Legislature is for fiscal '09, which begins July 1, when

projections become murky. The Legislature is right to revise the

corporate tax code to remove loopholes, but these may not generate all

the anticipated money, lottery revenues are uncertain, and the

snow-plowing accounts for next winter will no doubt be too low. Health

insurance funding is also a concern.

Given these worries, it was disappointing that the House missed a chance

to make a long-term improvement in the way the state allocates its

resources. It rejected a plan supported by Governor Patrick and the Ways

and Means Committee to ask higher-paid state workers to contribute a

higher percentage toward their health insurance. The $45 million in

savings could have been spent on education or healthcare for the needy.

Because of the revenue surge, the state income tax rate will be going

down slightly, from 5.3 to 5.25 percent, the result of a law intended to

blunt voter anger over the Legislature's decision in 2002 not to drop

the rate to 5 percent. Given its commitments, the state can't afford 5

percent.

But a business-as-usual budget, full of local goodies, invites a voter

backlash, and an initiative petition to abolish the income tax is

expected to be on the budget this November. The Senate needs to devise a

more responsible budget.

The Boston Herald

Tuesday, May 6, 2008

Senate set to OK tax plan

Bill closes corporate ‘loopholes’

By Jay Fitzgerald and Casey Ross

The state Senate is poised today to approve a $472 million tax package

despite new data showing the state is hauling in far more tax revenue

than anticipated this year.

Republicans blasted Senate Democrats for pushing ahead with hikes in

cigarette and corporate taxes - but they acknowledged the tax proposals

will almost surely pass today in the Democratic-led Senate.

The Senate bill, which would raise taxes by about $75 million more a

year than a plan already OK’d by the House, would raise the cigarette

tax by $1 a pack, close so-called corporate “loopholes” to the tune of

$290 million and bump up taxes elsewhere.

In a significant break with the House’s tax bill, the Senate package

would lower the corporate income tax rate over three years from 9.5

percent to 8 percent, starting in 2010, according to senators. The House

bill would cut the rate to 7.5 percent over three years, starting in

2009.

The Senate bill also waters down, though doesn’t eliminate, a

controversial House amendment that would give offshore tax breaks for

some corporations.

The expected Senate action comes after the Department of Revenue

yesterday said April tax collections were up $400 million, for a 17.1

percent increase over the same period last year.

Meanwhile, tax collections so far this fiscal year are running $1.2

billion, or 7.7 percent, above last year’s levels.

Senate Minority Leader Richard Tisei (R-Wakefield) said the higher tax

revenue is proof that the state is facing a spending crisis - not a

revenue crisis.

But Gov. Deval Patrick’s administration said the higher-than-projected

tax revenue was mostly a “one-time” increase amid an “extremely

volatile” economy.

Patrick, who acknowledged higher tax revenue could forestall some

emergency spending cuts, said the state needs to push ahead with the tax

package due to a projected $1 billion-plus budget shortfall.

“We’re looking at the long-term strength of the state’s economy and the

long-term needs to support the services that people want,” he said.

The Boston Herald

Wednesday, May 7, 2008

Senate’s cigarette price hike has smokers fuming

By Jessica Fargen

The state Senate’s move to raise the cigarette tax by $1-a-pack, making

Massachusetts one of the most expensive states to buy cigarettes, has

smoker’s rights groups puffing mad and health advocates applauding.

“This is a very cowardly way to balance the state’s budget on the backs

of a vilified minority,” said Stephen Helfer, founder of the defunct

Cambridge Citizens for Smoker’s Rights, and a staunch opponent of

increasing the tax. “Smokers are disproportionately more likely to be

poor and low-income than well-off.”

The $1-a-pack tax was included in a nearly $500 million tax package that

the Senate approved yesterday. The Senate also voted to lift the

state-mandated minimum price for a pack of cigarettes.

The Senate and House still need to agree on the tobacco tax hike and

Gov. Deval Patrick must sign off on it.

Kevin O’Flaherty, director of advocacy for the Northeast Region’s

Campaign for Tobacco Free Kids, said the higher a state makes the

cigarette tax, the lower the number of kids who start smoking.

“This is the strongest intervention a state can do to decrease kid’s

smoking,” he said.

Smoking rates in Massachusetts and nationwide have been on the decline

for years as states boost taxes, implement aggressive smoking prevention

programs and prohibit smoking in workplaces.

Massachusetts already has one of the highest cigarette taxes in the

nation.

The current state cigarette tax is $1.51 a pack, but once federal taxes,

sales tax and tobacco settlement surcharges are included the tax is

$2.76 a pack, said Helfer, who actively lobbied against the tax

increase.

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

|