CLT

UPDATE

Friday, May 13, 2005

Anyone buying another "temporary"

tax hike?

State Sen. Richard T. Moore, D-Uxbridge, is sounding

an alarm on the skyrocketing cost of new schools, suggesting yesterday

that the state may have to consider a "temporary" sales tax increase to

overcome cost overruns totaling $1.3 billion for 420 local school

projects across the state.

Mr. Moore said the estimated cost for schools on the waiting list of

approved projects has risen from an initial $4.2 billion to $5.5

billion, prompting the state school building assistance bureau to

consider extending a moratorium on new approvals beyond the current date

of July 2007....

Raising the sales tax temporarily, he said, is one way the state could

reduce the funding backlog, so the current 40 percent to 80 percent

state share of new school costs could be extended more quickly to school

districts that need new facilities....

In a comment directed at Gov. Mitt Romney’s call for a tax rollback

funded by increasing state revenues, Mr. Moore wrote in his letter to

the Senate budget leader, "Clearly the discovery of an additional

obligation of $1.3 billion for school buildings and the need to increase

local aid to avoid further property taxes makes any discussion of using

a 'surplus' for income tax reduction moot at this time."

The Telegram & Gazette

Wednesday, May 11, 2005

Sales tax hike is idea to hasten school building

Moratorium extension is opposed

The suggestion from state Sen. Richard T. Moore,

D-Uxbridge, that the sales tax may have to be jacked up to cover $1.3

billion in cost overruns for local school projects was all too

predictable.

The $4.2 billion price tag for 420 backlogged projects, it seems, now

has grown to $5.5 billion.

So much for the Legislature’s plan, enacted with much fanfare last year,

to earmark one-fifth of the 5 percent sales tax to wipe out the backlog.

Now, Mr. Moore hints, the existing tax isn’t enough, so a "temporary" 6

percent rate may be needed.

The suggestion might not be so ominous if legislators knew the meaning

of the word temporary. However, for nearly 16 years, Massachusetts

taxpayers have been paying a "temporary" increase in the state income

tax. Even after a 2000 referendum calling for the rollback was approved

overwhelmingly, the Legislature has yet to make good on its pledge.

A Telegram & Gazette editorial

Thursday, May 12, 2005

No sale, Sen. Moore

Suggested tax hike no solution to school problem

State officials have discovered that it will cost them $1.3

billion more than expected to complete some 420 school construction projects

underway in Massachusetts....

The state now believes that the cost of the 420 school construction projects in

Massachusetts will reach $5.5 billion, higher than the nearly $4.2 billion that

state officials had initially anticipated....

State Treasurer Timothy P. Cahill, chairman of the authority's board, said

Friday he was surprised when analysts told him about the $5.5 billion estimate.

"We knew that the problem was much bigger than it was reported," Cahill said.

"We didn't know it was this big." ...

Newton, for instance, has not yet begun construction of a new Newton North High

School, but the price tag has already soared from $39 million to $104.5 million,

after local officials changed their plan from a simple renovation project into a

plan for a new high school....

Mayor David Cohen of Newton declined to be interviewed for this story. But Cohen

issued a statement saying that the city had decided it was more cost-effective

to build a new school ...

Despite the $5.5 billion figure, Michael Widmer -- president of the

Massachusetts Taxpayers Foundation, a fiscal watchdog organization -- expressed

relief that the state had come up with a firm estimate of school building costs.

He said that costs would probably not spiral out of control in future.

The Boston Globe

Sunday, May 8, 2005

School building projects to cost an extra $1.3b

New proposals may face delay

Parents and teachers can march on the Statehouse demanding

more money for their schools, while other special-interest groups will tell you

they can find plenty of ways to spend the record $2 billion the state collected

in tax revenues last month....

The last time voters were actually asked, in 2000, 56 percent voted in favor of

rolling the rate back to 5 percent. (In Essex County, the figure was even higher

— more than 60 percent wanted the rate reduced.)

But their will was ignored by legislative leaders who felt they knew better. And

the new leadership team in the House and Senate, along with a majority of the

North of Boston delegation, continue to insist the state can't afford to lower

the rate from its current 5.3 percent....

But the stirrings of another possible tax revolt were heard just last week in

tiny Topsfield where voters, by overwhelming margins in all but one case,

replaced an incumbent selectman with an ardent tax foe, rejected a Community

Preservation Act surcharge that would have added 3 percent to their property tax

bills, and shot down three overrides.

The fact is that many people struggling with fiscal limitations of their own are

still not convinced government is doing its best to wring waste out of the

system. And when school officials threaten to close schools, as they have in

Beverly, or lay off teachers, as has been the case in North Andover, the

reaction is more often one of skepticism than alarm.

Some may say there's no more fat to cut. But taxpayers, who see state and local

spending continue to increase despite multiple warnings of impending doom, just

don't believe it.

A Salem News editorial

Tuesday, May 10, 2005

Tax advocates have credibility problem

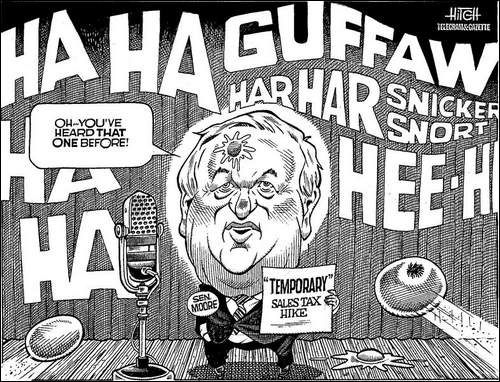

Editorial cartoon by David

Hitch

May 12, 2005

Worcester Telegram

& Gazette

Chip Ford's CLT Commentary

Either Sen. Richard Moore (D-Uxbridge) is daft,

joking in very poor taste, or "temporary tax hike" is a generational

thing.

He can't possibly be serious, so he's just blown it

as a comedian.

Or he calculates that another generation has come of

age which hasn't yet been personally burned by political lies; one that

is still gullible enough to believe that "temporary" means the same

thing to conniving politicians as it means to everyone else.

We're expected to never mind that the Legislature --

in its infinite political generosity with our money -- has dug itself

another bottomless well for taxpayers to bail out: the School Building

Assistance boondoggle. "We knew that the problem was much bigger than it

was reported," state Treasurer Tim Cahill admitted, sounding much like

an "embattled" spokesman for the disastrous Big Dig.

Another program generously provided by the

Legislature with our tax surplus during the roaring 90s that climbs from

$4.2 to 5.5 billion surely is a problem, but is anyone really shocked?

After construction of the Newton North High School

escalated from $39 million to $104.5 million, that city's tax-and-spend

mayor, David Cohen, declared it "more cost-effective to build a new

school." Remember that the next time your home needs a new roof! (Of

course, if you have to pay for the roof, but the state will pay you for a

new house, he's right.)

And count on Michael Widmer, president of the

so-called Massachusetts Taxpayers Foundation, to run interference as usual for

the tax-and-spend crowd. Again providing cover at the expense of

credibility, he's now assured us "that costs would probably not spiral

out of control in future."

"Probably" isn't very reassuring. The SBA boondoggle

is sounding more like another Big Dig every day.

What the Salem News calls "the stirrings of another

possible tax revolt" is long overdue.

Sen. Moore surely must recognize that another

"temporary" tax hike has no wings, especially while at the very same

time he's called for keeping the last promise of "temporary" broken.

Before promising a new one with a straight face, he and his cabal at the

very least must first make that last one "temporary" by ending it

-- even if it's almost a generation late.

|

|

Chip Ford |

The CLT

"Where Would You

Cut?" cash register just went ka-ching again this morning when we

learned that our state

police were just given a $5/hour raise for "paid details," bringing

their total hourly salary for minding construction holes from $32 to $37

an hour. Got any holes you need watching and can afford? The running

total of wasted taxpayers' money we've discovered and accumulated now

stands at $1.734 Billion -- and that doesn't include the SBA boondoggle.

The Telegram & Gazette

Wednesday, May 11, 2005

Sales tax hike is idea to hasten school building

Moratorium extension is opposed

By John J. Monahan, Staff Writer

State Sen. Richard T. Moore, D-Uxbridge, is sounding an alarm on the

skyrocketing cost of new schools, suggesting yesterday that the state

may have to consider a "temporary" sales tax increase to overcome cost

overruns totaling $1.3 billion for 420 local school projects across the

state.

Mr. Moore said the estimated cost for schools on the waiting list of

approved projects has risen from an initial $4.2 billion to $5.5

billion, prompting the state school building assistance bureau to

consider extending a moratorium on new approvals beyond the current date

of July 2007.

Extension of the moratorium, he said, may force many communities in his

district that are ready to build new schools, such as Milford, Uxbridge,

Northbridge and Southbridge, to wait even longer to apply for state

funding.

In a letter to Senate Ways and Means Chairman Therese Murray,

D-Plymouth, Mr. Moore said he opposed any extension of the moratorium,

which the school building assistance bureau is considering to deal with

the $1.3 billion in additional costs it is facing. He said a temporary

sales tax hike may be an unpopular option, but so, too, will be other

options such as funding the cost increases through direct

appropriations, which would reduce funding for other state programs.

"What I’ve suggested is looking at the options to solve this problem,"

Mr. Moore said yesterday, and a temporary sales tax hike from 5 percent

to 6 percent, he said, "shouldn’t be off the table."

Extending the moratorium, he said, would only result in higher

construction costs being passed on to taxpayers when new projects are

finally approved. Moreover, he said, the rising costs of the projects

"should not become a penalty for those school districts that face urgent

need for new or renovated school facilities" now waiting for the

moratorium to end.

Mr. Moore said an "obvious lack of oversight by the Department of

Education" of construction, and the failure of many school districts to

protect taxpayers through professional construction management, created

the growing funding backlog. The multiyear delays faced by new school

projects, he said, come as the pressure for new schools or school

renovations is growing "exponentially" across the state. He said he

believes better student grades are linked to building new schools and

renovating old ones.

Raising the sales tax temporarily, he said, is one way the state could

reduce the funding backlog, so the current 40 percent to 80 percent

state share of new school costs could be extended more quickly to school

districts that need new facilities.

Mr. Moore outlined several alternatives to extending the moratorium, in

addition to the sales tax hike proposal, which he described as a

"limited duration surcharge." The other options include accelerating the

timetable for the state to begin dedicating one-fifth of the state sales

tax revenues to new schools, now set to go into effect in 2010; covering

the $1.3 billion in cost overruns by direct appropriation over the next

four years; or immediately increasing the share of the state sales tax

dedicated to school construction beyond 20 percent on a temporary basis.

In a comment directed at Gov. Mitt Romney’s call for a tax rollback

funded by increasing state revenues, Mr. Moore wrote in his letter to

the Senate budget leader, "Clearly the discovery of an additional

obligation of $1.3 billion for school buildings and the need to increase

local aid to avoid further property taxes makes any discussion of using

a 'surplus' for income tax reduction moot at this time."

"We need to be looking at a way out of this besides extending the

moratorium," Mr. Moore said, adding that the option of reducing the

level of state reimbursement for new schools would only make it harder

for communities to get local approval for new school buildings.

Return to top

The Telegram & Gazette

Thursday, May 12, 2005

A Telegram & Gazette editorial

No sale, Sen. Moore

Suggested tax hike no solution to school problem

The suggestion from state Sen. Richard T. Moore, D-Uxbridge, that the

sales tax may have to be jacked up to cover $1.3 billion in cost

overruns for local school projects was all too predictable.

The $4.2 billion price tag for 420 backlogged projects, it seems, now

has grown to $5.5 billion.

So much for the Legislature’s plan, enacted with much fanfare last year,

to earmark one-fifth of the 5 percent sales tax to wipe out the backlog.

Now, Mr. Moore hints, the existing tax isn’t enough, so a "temporary" 6

percent rate may be needed.

The suggestion might not be so ominous if legislators knew the meaning

of the word temporary. However, for nearly 16 years, Massachusetts

taxpayers have been paying a "temporary" increase in the state income

tax. Even after a 2000 referendum calling for the rollback was approved

overwhelmingly, the Legislature has yet to make good on its pledge.

All too often when a fiscal snafu arises in the commonwealth, lawmakers’

solution is to pounce on their constituents’ wallets.

The shortcomings of the sales-tax earmark were clear from the start.

"The 20 percent reduction in available sales-tax revenue would have an

insidious ripple effect," we wrote last July, "pitting government

agencies against each other and setting the stage for a

counterproductive increase in the sales tax rate."

It would be self-defeating to shovel more money into the school-funding

program without addressing its underlying problems.

One problem is that current aid policy often makes it less expensive for

a community to build a new school than to maintain, modernize and

upgrade an existing building. That is both a waste of tax money and a

perverse incentive to abandon serviceable schools.

Also needed is more stringent oversight. In the past, aid has been

disbursed largely on the honor system. A September 2004 state auditor’s

report estimated the state overpaid cities and towns by $20.5 million

for school construction and renovation.

Better project planning also could yield savings. A pre-construction

review of Worcester’s $89.9 million vocational school was credited with

shaving millions of dollars from the cost.

Mr. Moore is right to sound the alarm about looming overruns on school

construction projects. He’s wrong to suggest the solution is another

"temporary" tax.

Return to top

The Boston Globe

Sunday, May 8, 2005

School building projects to cost an extra $1.3b

New proposals may face delay

By Maria Sacchetti, Globe Staff

State officials have discovered that it will cost them $1.3 billion more

than expected to complete some 420 school construction projects underway

in Massachusetts. The discovery, state officials say, means that dozens

more cities and towns hoping to start school building projects might

have to wait beyond 2007, so that the state can pay off the growing

bill.

The state now believes that the cost of the 420 school construction

projects in Massachusetts will reach $5.5 billion, higher than the

nearly $4.2 billion that state officials had initially anticipated. The

higher cost estimate comes from an analysis conducted by the

Massachusetts School Building Authority, an agency created by the

Legislature last year to tackle the growing cost of school construction

projects.

State Treasurer Timothy P. Cahill, chairman of the authority's board,

said Friday he was surprised when analysts told him about the $5.5

billion estimate. "We knew that the problem was much bigger than it was

reported," Cahill said. "We didn't know it was this big."

In 2003, the state declared a moratorium on new school construction

projects, to allow current projects to be paid for and completed.

State officials had planned to lift the moratorium in 2007. But

Katherine P. Craven, executive director of the authority, said the

latest financial analysis means that when the moratorium is lifted, some

cities and towns may have to wait longer to start school building

projects.

"Our office has been besieged by cities and towns across the state who

are anxious to get an application in to us," Craven said. "The authority

cannot fund projects that it doesn't have the money to fund."

Local officials reacted with dismay to the possibility of further

delays.

Arlington has at least two 1950s-era elementary schools that it would

like to rebuild as soon as possible, said Paul Schlichtman, a member of

the School Committee. The heating systems are worn out, and the

electrical system is outdated, he said.

"They're a big concern," Schlichtman said. "We've got the plans all

drawn. We're ready to submit at a moment's notice."

Pittsfield is also hoping to begin school building projects. The town

has expanded six schools, but has five more schools that need fixing,

city officials said. Because of the delay caused by the moratorium, six

of the city's schools have fast, new Internet cables, security systems,

and new cafeterias or gymnasiums, while five others are making do with

slower Internet lines and doors that stay unlocked during the day.

Craven said school construction costs rose for a variety of reasons. The

price of steel and other building materials increased, as did the cost

of manual labor. Some projects became vastly more expensive when work

crews stumbled upon unexpected costs, such as structural damage.

Newton, for instance, has not yet begun construction of a new Newton

North High School, but the price tag has already soared from $39 million

to $104.5 million, after local officials changed their plan from a

simple renovation project into a plan for a new high school.

Newton officials say the change was necessary because the contractor

could not ensure the safety of students while renovations went on.

Mayor David Cohen of Newton declined to be interviewed for this story.

But Cohen issued a statement saying that the city had decided it was

more cost-effective to build a new school and that the state Department

of Education agreed.

"Renovating Newton North would be throwing good state and city money

after bad," Cohen's statement said. "The current building hasn't worked

right since the day it opened, over 30 years ago."

Some say the state must work harder to rein in school construction

costs. The Newton Taxpayers Association is pushing to get voters to

force the city to renovate the current Newton North High School at a

cost of $65 million, instead of paying for a new school.

"The state's job is not to be Santa Claus," said Jeff Seideman,

president of the association.

Stephen J. Adams -- president of the Pioneer Institute, a think tank in

Boston -- said the state should pay a lower share of the costs of school

construction. On average, the state shoulders 70 percent of school

building costs, Adams said.

"The program is far more expensive than the state can afford," he said.

Cahill said he would try to finance as many school projects as possible,

within the authority's budget. Over the next several years, the state

will finance the authority with revenue generated by the sales tax,

authority officials said.

The authority plans to sell bonds to raise money for school construction

projects and use the sales tax to pay the debt.

Before it could sell bonds, the authority had to disclose its debts,

which is why it conducted the analysis that produced the $5.5 billion

estimate.

The authority also wants to complete a series of audits within 18 months

to determine the exact cost of the school building projects it inherited

from the Department of Education, Craven said.

For decades, the Department of Education oversaw school building

projects in Massachusetts. But a construction boom in the 1990s

overwhelmed the department; it took years to audit projects, and the

department was criticized for lax oversight.

Despite the $5.5 billion figure, Michael Widmer -- president of the

Massachusetts Taxpayers Foundation, a fiscal watchdog organization --

expressed relief that the state had come up with a firm estimate of

school building costs. He said that costs would probably not spiral out

of control in future.

State Auditor A. Joseph DeNucci, a member of the authority's advisory

board, said he would try to maintain strict oversight of school building

costs. DeNucci had often been critical of the Department of Education's

handling of the school building program.

"We have to keep closer tabs on these projects," DeNucci said. "We have

to make sure that they're well managed."

Globe correspondent Michael Levenson contributed to this report.

Return to top

The Salem News

Tuesday, May 10, 2005

A Salem News editorial

Tax advocates have credibility problem

Parents and teachers can march on the Statehouse demanding more money

for their schools, while other special-interest groups will tell you

they can find plenty of ways to spend the record $2 billion the state

collected in tax revenues last month.

But the tax-and-spend crowd shouldn't get too giddy over the fact Bay

State Republicans actually lost seats in the Legislature last year and

their leader, Mitt Romney, appears to be losing popularity. For there is

still considerable dismay among voters over the excesses of state and

local government, particularly in the area of public employee salaries

and benefits; and we suspect that if put to an up-or-down vote, many

would support the governor's demand that lawmakers repeal the

"temporary" income tax implemented in the darkest days of the Dukakis

administration prior to 1990.

The last time voters were actually asked, in 2000, 56 percent voted in

favor of rolling the rate back to 5 percent. (In Essex County, the

figure was even higher — more than 60 percent wanted the rate reduced.)

But their will was ignored by legislative leaders who felt they knew

better. And the new leadership team in the House and Senate, along with

a majority of the North of Boston delegation, continue to insist the

state can't afford to lower the rate from its current 5.3 percent. This

despite the fact revenues are being generated at a record pace — April's

take of $2 billion was the highest for any month or record and a

whopping 11.2 percent more than what was collected the previous April.

Yes, there have been a number of successful Proposition 2˝

override efforts this spring, and most of those who ignored the 2000

vote in favor of lowering taxes were returned to office.

But the stirrings of another possible tax revolt were heard just last

week in tiny Topsfield where voters, by overwhelming margins in all but

one case, replaced an incumbent selectman with an ardent tax foe,

rejected a Community Preservation Act surcharge that would have added 3

percent to their property tax bills, and shot down three overrides.

The fact is that many people struggling with fiscal limitations of their

own are still not convinced government is doing its best to wring waste

out of the system. And when school officials threaten to close schools,

as they have in Beverly, or lay off teachers, as has been the case in

North Andover, the reaction is more often one of skepticism than alarm.

Some may say there's no more fat to cut. But taxpayers, who see state

and local spending continue to increase despite multiple warnings of

impending doom, just don't believe it.

Return to top

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

|