CLT

UPDATE

Tuesday, May 3, 2005

IF NOT NOW, WHEN?

Wrong as usual and despite $1B

surplus

MTF still fights against rollback

Revenue collections for April totaled $2.024 billion,

the largest single monthly total ever in the Commonwealth, Revenue

Commissioner Alan LeBovidge announced today....

"The biggest month we've ever had is due mainly to personal income tax

payments with returns and estimated payments on personal income,"

LaBovidge said.

Commonwealth of Massachusetts

Department of Revenue

Monday, May 2, 2005

April revenues set record, surpass $2 Billion mark

The state collected more tax revenue in April than in any

single month ever, prompting Gov. Mitt Romney on Monday morning to predict a

budget surplus of hundreds of millions of dollars and claim there's now no

reason not to deliver on an income tax cut approved by voters in 2000....

At a press conference to announce John Cogliano as the state's new

transportation secretary, Romney broke the news, saying receipts in April were

$318 million above a benchmark revised upwards just two weeks ago. Tax

collections are running $950 million ahead of the revenue forecast used to

assemble this year's state budget, and Romney predicted they'll total about $1

billion above the original forecast by the end of the fiscal year June 30....

The governor says he expects Democrats will propose many ways to spend the

unexpected tax revenues. "The voters have told us that that's not our right,

that instead we are to return to them this money," he said. "The surplus is

large. We'll either spend it or give it back to the citizens and I say it's time

to give it back to the citizens. There's no question but that we as a state can

afford to honor the will of the votes and return their tax rate to 5 percent."

...

Opponents of the tax rollback say the unanticipated revenue should be used to

return some of the $3 billion cut from the state budget during the fiscal

crisis.

House Majority Leader John Rogers (D-Norwood), former Ways and Means chairman,

argued during the House's budget debate last week that the budget remains

structurally imbalanced due to the state's continued reliance on one-time

revenues.... Approving a tax cut at this time would be "fiscally reckless."

State House News Service

Monday, May 2, 2005

Romney predicts big surplus,

calls for tax cut after record $2 billion month

Massachusetts collected more than $2 billion in taxes in

April, breaking the state's all-time record for a single month and prompting

Governor Mitt Romney to renew his call for a cut in the state income tax.

The $2.024 billion tax total for April 2005 was 11.2 percent higher than the

April 2004 figure. With two months remaining in the fiscal year, the state has

collected a total of $13.9 billion, an increase of $963 million, or 7.4 percent,

over the first 10 months of last year.

Governor Mitt Romney said the figures the Department of Revenue released

yesterday should spur lawmakers to reduce the income tax rate from 5.3 percent

to 5 percent, a change approved by voters in 2000, but delayed by the

Legislature in 2002 during the state's fiscal crisis....

"We as a state can afford to honor the will of the voters and return their tax

rate to 5 percent," Romney said yesterday at a press conference called to

announce his appointment of a new transportation secretary. "The surplus is

large. We'll either spend it or give it back to citizens, and I say it's time to

give it back to the citizens." ...

"I think it's very encouraging, but in terms of making a major policy decision

like cutting taxes, I think it's really premature," said Representative Robert

A. DeLeo, a Winthrop Democrat who is in his first year as chairman of the House

Ways and Means Committee....

The new revenue numbers will probably spark calls from advocates for more

spending....

Michael J. Widmer of the Massachusetts Taxpayers Foundation, a business-funded

nonprofit that monitors taxes and government spending, said the April revenue

growth probably will allow the state to have a structurally balanced budget in

the current fiscal year and in fiscal 2006. Nevertheless, he said the state

cannot afford the tax cut when its mandatory spending is growing at a faster

rate than reliable revenue, such as income-tax withholding....

"It's heavily cyclical and volatile by nature," Widmer said, "and so we should

treat it with caution, in terms of building in tax cuts or spending increases

based on it." ...

But David G. Tuerck, executive director of the Beacon Hill Institute at Suffolk

University, said he doubted that Democrats on Beacon Hill would be willing to

cut taxes.

"There will always be a reason," Tuerck said of the Democrats' refusal.

The Boston Globe

Tuesday, May 3, 2005

Record receipts fuel call for tax cut

State tax revenues are booming again, with April setting an

all-time monthly record and annual revenues coming in at nearly $1 billion more

than forecasts at the start of the fiscal year, fueling Republican calls for a

long-sought rollback of the state income tax rate to 5 percent....

At this point, the governor said, "There is no good reason," not to honor a

5-year-old voter referendum that called for a rollback of the income tax rate

from 5.9 percent to 5 percent. The income tax rate was rolled back to the

current 5.3 percent before the recession created a major fiscal crisis for the

state, with sagging revenues creating a multi-billion dollar state budget

deficit....

"We don’t have any excuse to keep spending people’s money above the amount

people voted for," Mr. Romney said, adding, "This is still a democracy." He said

he expects calls to use the additional money for pay raises and new programs,

but that he wants to hold the line on spending until the income tax rate

rollback is enacted.

The Telegram & Gazette

Tuesday, May 3, 2005

State tax revenues are surging

Romney wants tax rate cut back to 5 percent

"Don't even think of investing in Massachusetts because you

don't know from one hour to the next what your capital gains tax is going to

be." - Barbara Anderson, Citizens for Limited Taxation.

Taxpayer advocate Barbara Anderson's bottom line about the message sent to

investors by the twists and turns in the capital gains tax saga - the

implementation of the 2002 increase has now twice been ruled unconstitutional by

the Supreme Judicial Court - best frames the argument for changing the effective

date of the new tax rate from Jan. 1, 2002, to Jan. 1, 2003. Otherwise, to the

outside world, Anderson said, Massachusetts' tax policy looks "certifiable."

A Boston Herald editorial

Tuesday, May 3, 2005

Romney on taxes: What side is he on?

Facing state aid shortfalls of more than $500 million

compared to three years ago, communities more often than ever are considering

raising their own property taxes to pay for services like schools, police and

fire protection, according to state and local officials.

Voters in almost half the towns in the region will consider -- or have already

-- Proposition 2˝ overrides on their ballots this spring....

Barbara Anderson, executive director of the group Citizens for Limited

Taxation, said towns were too liberal in their spending during the 1990s.

Communities were "getting a lot of money in local aid and spending it like there

was no tomorrow," Anderson said. "Yes, they're in trouble. But it's their own

fault."

The MetroWest Daily News

Sunday, May 1, 2005

Overrides: A taxing choice

In 2004, thousands of voters in many states still had

problems with faulty registration records. Extremely long lines in Ohio and

other states deterred thousands more, and there were serious technical glitches

and errors, including 4,438 computer votes that simply disappeared in North

Carolina....

Congress owes much greater commitment to the mechanics of democracy, and voters

should demand it.

A Boston Globe editorial

Monday, May 2, 2005

Voting devalued

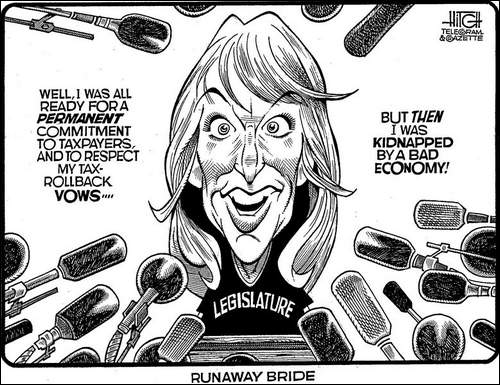

Editorial cartoon by David Hitch

May 3, 2005

Worcester Telegram

& Gazette

A CLT Blast from the Past

Some Democratic senators, saying that a proposed $1.2

billion tax and fee package doesn't go far enough to shore up state finances,

are backing a move to raise more taxes by increasing the state income tax from

5.3 percent to 5.6 percent....

Michael J. Widmer, president of the nonpartisan Massachusetts

Taxpayers Foundation, said he supports [Sen.] Berry's idea of using

a tax increase to replenish reserves.

The Boston Globe, Jun. 7, 2002

Some eye

hike in income tax rate

Michael Widmer, president of the business-backed

Massachusetts Taxpayers Foundation, said the state should restore spending

cuts from the last few years, and reduce the structural budget deficit before

looking to cut taxes.... "Until we're out of the fiscal woods, which may

be another 24 months, we should be focusing on eliminating the

structural deficit and restoring programs," Widmer said.

State House News Service, May 3, 2004

Chip Ford's CLT Commentary

"Revenue collections for April totaled $2.024

billion, the largest single monthly total ever in the Commonwealth."

If not now, when?

"Tax collections are running $950 million ahead of

the revenue forecast used to assemble this year's state budget."

If not now, when?

"State tax revenues are booming again, with April

setting an all-time monthly record and annual revenues coming in at

nearly $1 billion more than forecasts at the start of the fiscal year."

If not now, when?

Never, if the decision is left to Michael Widmer of

the so-called Massachusetts Taxpayers Foundation, and the other tax-and-spend

liberals of his ilk for whom he provides cover.

If Widmer had his way in 2002 and ever since, the

income tax rate would have been jacked up to 5.6 percent and the state

would be rolling in even more of our cash -- unless he and his protégés

had already spent it.

As David Tuerck of the Beacon Hill Institute astutely

noted, "There will always be a reason" to forestall the voters' mandate.

The time is either "heavily cyclical and volatile," as Widmer calls it

when our money is pouring in, else the state is in the midst of a

"fiscal crisis" -- in between there's always a "fiscal crisis"

looming just around the corner as they squander the surplus on unmet

wants and new programs that never go away.

We watched this transparent diversion throughout the

Roaring '90s with the years of billion dollar revenue surpluses. This

was when state spending managed to double since the previous

self-imposed "fiscal crisis" -- but a good time to keep the promise and

roll back the "temporary" income tax rate was never found. That

unsustainable spending created the most recent "fiscal crisis." If

Widmer and the rest of the tax-and-spend cabal have their way, they'll

happily pave the way for the next one and then demand another tax hike.

We've been there, done that. A couple of times now.

If not now, when?

"We as a state can afford to honor the will of the

voters and return their tax rate to 5 percent," Governor Romney

honorably recognized. "The surplus is large. We'll either spend it or

give it back to citizens, and I say it's time to give it back to the

citizens."

Sixteen years after the promise was made that it'd be

only temporary. Sixteen years that it's remained a broken promise. Yes

governor, we too say it's time to keep that promise, to finally honor

the voters' mandate of 2000.

And this just might be the year for it to finally be

kept!

Barbara's pretty upbeat that it will be, considering

the changes in the House and Senate leadership, especially the latter.

Senate President Travaglini seems to be sincerely attempting to change

the public's negative impression of the Legislature in general, the

senate in particular. He seems more respectful of voters and the ballot

question process, she believes.

The senate is next to propose its version of the

state's FY06 budget. An amendment to keep the promise and return the

income tax rate to 5 percent will be offered by senate Republicans.

That's where our next effort must be directed. Be prepared to act when

it's time to pull the trigger -- be prepared to call your state senator

and tell him or her that you want the 16-year old promise finally kept:

no excuses, no stalls, no "study," just kept.

If not now, when?

We'll keep you posted, and let you know when it's

time to act.

On a lighter note, all I can do is grin and shake my

head in awe at the Boston Globe editorial elites' schizophrenic

ramblings. Yesterday's editorial pontification urged a "much greater

commitment to the mechanics of democracy, and voters should demand it."

But just last Thursday ("Fixated

on 5 percent") this very same editorial board urged that the

2000 election result be thrown out, the voters ignored. How can even

they with their situational ethics be on opposite sides of an issue

in the span of only five days?

I often marvel that the Globe's editorial board

obviously doesn't read its own newspaper, the often excellent reports

about government waste and corruption. Apparently they don't read

their own editorials from day to day either, or else they suffer

extreme short-term memory loss.

What else can you do but laugh as whatever

credibility they have becomes victim to self-immolation.

|

|

Chip Ford |

Commonwealth of Massachusetts

Department of Revenue

Monthly Revenue Report

Monday, May 2, 2005

April revenues set record, surpass $2 Billion mark

Revenue collections for April totaled $2.024 billion, the largest single

monthly total ever in the Commonwealth, Revenue Commissioner Alan

LeBovidge announced today.

The monthly collections increased by $203 million or 11.2 percent over

last April. Year-to-date revenue collections totaled $13.937 billion, an

increase of $963 million or 7.4 percent. Receipts for April were $318

million above the monthly benchmark, which was revised upward just two

weeks ago. Year-to-date revenues were $316 million above the new April

15 benchmark for the first 10 months of fiscal 2005.

"The biggest month we've ever had is due mainly to personal income tax

payments with returns and estimated payments on personal income,"

LaBovidge said.

Income tax collections for April totaled $1.532 billion, an increase of

$240 million or 18.5 percent from last April. Withholding tax

collections totaled $611 million, an increase of $11 million or 1.8

percent. Sales and use tax collections were $317 million, up $10 million

or 3.2 percent. Corporate and business tax collections in April were $38

million, a decrease of $33 million or 46.6 percent over last April.

Year-to-date income tax collections were $7.982 billion, an increase of

$724 million over last year at this time. Year-to-date withholding tax

collections were $6.442 billion, up $254 million or 4.1 percent over

last year. Sales and use tax collections for the first 10 months of

fiscal '05 were $3.198 billion, up $124 million or 4.0 percent over the

same period last year. Year-to-date corporate and business tax

collections were $1.282 billion, an increase of $11 million or 0.9

percent over last year at this time.

Return to top

State House News Service

Monday, May 2, 2005

Romney predicts big surplus,

calls for tax cut after record $2 billion month

By Michael Norton, Amy Lambiaso and Cyndi Roy

The state collected more tax revenue in April than in any single month

ever, prompting Gov. Mitt Romney on Monday morning to predict a budget

surplus of hundreds of millions of dollars and claim there's now no

reason not to deliver on an income tax cut approved by voters in 2000.

At a press conference to announce John Cogliano as the state's new

transportation secretary, Romney broke the news, saying receipts in

April were $318 million above a benchmark revised upwards just two weeks

ago. Tax collections are running $950 million ahead of the revenue

forecast used to assemble this year's state budget, and Romney predicted

they'll total about $1 billion above the original forecast by the end of

the fiscal year June 30.

"It's an extraordinary amount of good news," Romney said.

When this fiscal years ends, Romney said, state government will have a

surplus "in the hundreds of millions of dollars." Romney declined to

more specifically estimate a projected surplus because it's too early to

say how much supplemental spending and budgetary reversions will be

recorded in the next two months.

Romney earlier this year proposed reducing the state income tax rate

from 5.3 percent to 5 percent. The House, in the budget it approved on

Friday, did not include the tax cut, with Democrats saying structural

budget imbalances and unmet spending needs make it premature to cut

taxes. The House voted to study the issue instead.

The governor says he expects Democrats will propose many ways to spend

the unexpected tax revenues. "The voters have told us that that's not

our right, that instead we are to return to them this money," he said.

"The surplus is large. We'll either spend it or give it back to the

citizens and I say it's time to give it back to the citizens. There's no

question but that we as a state can afford to honor the will of the

votes and return their tax rate to 5 percent."

The Senate budget is due out in mid-May.

Those with an eye on Beacon Hill said the unexpected revenue surge was

good news for the state's economy, but cautioned the governor and

lawmakers against implementing any tax cuts or new permanent program

spending.

"Clearly, this is unexpected good news," said Michael Widmer, president

of the business-backed Massachusetts Taxpayers Foundation. "But there

are several cautionary points to emphasize."

Much of the increased revenue is from capital gains taxes, one of the

most volatile sources of state revenues, Widmer said. He also pointed

out that the state is subject to losing millions of dollars in the long

and short term through the potential elimination of federal Medicaid

reimbursements due to budget cuts and rules interpretation.

Romney said the revenue surge also means this year's state budget is

structurally balanced. "We will not need to rely upon reserves or rainy

day funds in order to balance the budget for the '05 fiscal year,"

Romney said.

But Senate Ways and Means Chairwoman Sen. Therese Murray (D-Plymouth)

says a structural deficit remains.

"April's revenue figures certainly come as good news," Murray said in a

statement. "However, a structural deficit for FY '05 of approximately

$735 million remains. This is something that we have to address as we

prepare the Senate Ways and Means FY '06 budget recommendations."

Murray was not available to elaborate.

Senate Minority Leader Brian Lees (R-East Longmeadow), asked today if

the income tax cut would be proposed during Senate budget debate, said:

"Oh yeah."

Sen. Robert O'Leary (D-Barnstable) said the state ought to spend the

excess money in areas that have been cut or neglected during the last

several years, such as health care and higher education. "When all is

said and done, I don't think the dollars are there" for the tax cut, he

said.

State budget writers since 2001 have relied on one-time revenues and

reserve funds to keep the budget balanced in the face of a recession

that cut deeply into the state's tax base, prompting spending cuts and

tax and fee increases.

A spokesman for House Ways and Means Chairman Robert DeLeo (D-Winthrop)

said the chairman is "encouraged by the numbers," but wants to learn

more.

"DOR isn't able to tell us right now what exactly is driving those

numbers, whether it's capital gains or real growth in wages," said

spokesman James Eisenberg. "We need to see what's behind those numbers

so that we don't commit the sins of the last economic downturn."

The implosion of capital gains tax revenues was a major factor in the

budget deficits that accrued in the early 90s.

The Department of Revenue reported Monday that tax collections in April

were up 11.2 percent over April 2004. Income tax receipts were up 18.5

percent for the month, withholding taxes were up 1.8 percent, sales and

use tax receipts nudged upwards by 3.2 percent, and business tax

collections in April plummeted 47 percent for the month.

The state collected more than $2 billion in tax receipts during April.

Opponents of the tax rollback say the unanticipated revenue should be

used to return some of the $3 billion cut from the state budget during

the fiscal crisis.

House Majority Leader John Rogers (D-Norwood), former Ways and Means

chairman, argued during the House's budget debate last week that the

budget remains structurally imbalanced due to the state's continued

reliance on one-time revenues. He said the revenue spike is due mainly

to increases in capital gains taxes, estate taxes and bonus payments.

Approving a tax cut at this time would be "fiscally reckless."

Return to top

The Boston Globe

Tuesday, May 3, 2005

Record receipts fuel call for tax cut

By Scott S. Greenberger, Globe Staff

Massachusetts collected more than $2 billion in taxes in April, breaking

the state's all-time record for a single month and prompting Governor

Mitt Romney to renew his call for a cut in the state income tax.

The $2.024 billion tax total for April 2005 was 11.2 percent higher than

the April 2004 figure. With two months remaining in the fiscal year, the

state has collected a total of $13.9 billion, an increase of $963

million, or 7.4 percent, over the first 10 months of last year.

Governor Mitt Romney said the figures the Department of Revenue released

yesterday should spur lawmakers to reduce the income tax rate from 5.3

percent to 5 percent, a change approved by voters in 2000, but delayed

by the Legislature in 2002 during the state's fiscal crisis. During its

budget debate last week, the House rejected an amendment that would have

lowered the tax rate to 5 percent. The Republican governor has been

calling for the tax cut for almost a year.

"We as a state can afford to honor the will of the voters and return

their tax rate to 5 percent," Romney said yesterday at a press

conference called to announce his appointment of a new transportation

secretary. "The surplus is large. We'll either spend it or give it back

to citizens, and I say it's time to give it back to the citizens."

The state has about $900 million more than budget specialists on Beacon

Hill had predicted the state would have at this point when the fiscal

year began last July.

But Democrats pointed out that most of last month's windfall came from

capital gains taxes, which are highly volatile and, they say, an

inaccurate barometer of the state's overall economic health. In

contrast, a jump in revenue from income withholding would signal job

growth, and that figure went up only 1.8 percent, compared to April

2004. Sales taxes were up only 3.2 percent, and corporate and business

tax collections were down 46.6 percent, compared to April of last year.

Those drops were offset by an increase of roughly 25 percent in capital

gains tax revenues.

For the fiscal year thus far, income withholding is up 4.1 percent,

sales taxes are up 4 percent, and corporate and business taxes are up

0.9 percent, compared to the same point in 2004.

"I think it's very encouraging, but in terms of making a major policy

decision like cutting taxes, I think it's really premature," said

Representative Robert A. DeLeo, a Winthrop Democrat who is in his first

year as chairman of the House Ways and Means Committee. "The big

economic indicator that we're getting out of the problem we're in is job

growth."

Economists have called the state's job picture mediocre. In March, the

last month for which figures are available, employers added 5,600 jobs,

the most since October 2004 and the state's seventh consecutive month of

employment growth. The state has 175,000 fewer jobs than in February

2001, the peak prior to the recession, and 25,000 fewer than when Romney

took office in January 2003, the Globe reported last month.

April's $2 billion in revenue breaks the previous record set in January

2001, when the state pulled in about $1.937 billion at the peak of the

economic boom. Within months, the economy slowed, and state tax revenues

began to drop, eventually forcing about $3 billion in cuts in state

spending during the fiscal crisis of 2002-2004.

The new revenue numbers will probably spark calls from advocates for

more spending.

"This is good news for the Commonwealth," said Geoff Wilkinson,

executive director of the Massachusetts Public Health Association.

"Public health suffered disproportionate cuts, and we hope the

Legislature will take advantage of this revenue to restore, and make

sure the restorations are proportionate to the damage that was

suffered."

Many advocates and other observers expected DeLeo and House Speaker

Salvatore F. DiMasi to be less fiscally conservative than their

predecessors, former House speaker Thomas M. Finneran and former Ways

and Means chairman and current House majority leader John H. Rogers, who

were famously tight-fisted.

But DiMasi and DeLeo kept a tight rein on new spending during last

week's budget debate, allowing lawmakers to add about $100 million to

the original spending plan that the House had crafted earlier this year.

Michael J. Widmer of the Massachusetts Taxpayers Foundation, a

business-funded nonprofit that monitors taxes and government spending,

said the April revenue growth probably will allow the state to have a

structurally balanced budget in the current fiscal year and in fiscal

2006. Nevertheless, he said the state cannot afford the tax cut when its

mandatory spending is growing at a faster rate than reliable revenue,

such as income-tax withholding.

"The strong April, the very strong April, seems to be tied principally

to capital gains," Widmer said. "It's good news to see this kind of

revenue increase, but as we saw in 2002, it can very quickly evaporate."

He referred to the stock market slump that followed the bursting of the

Internet bubble and the Sept. 11, 2001, terrorist attacks.

"It's heavily cyclical and volatile by nature," Widmer said, "and so we

should treat it with caution, in terms of building in tax cuts or

spending increases based on it."

Cutting the tax rate from 5.3 percent to 5 percent would cost $225

million in fiscal 2006. But it would cost more than twice that much in

fiscal 2007, when it would be in effect for the entire calendar year.

In a full year, the cut would be worth about $146 to a married couple

earning $60,000 a year and $133 to a single person earning $50,000.

But David G. Tuerck, executive director of the Beacon Hill Institute at

Suffolk University, said he doubted that Democrats on Beacon Hill would

be willing to cut taxes.

"There will always be a reason," Tuerck said of the Democrats' refusal.

"The point is, the state's economy is in recovery, and we shouldn't be

surprised to see revenues regaining strength at the current rate."

Globe correspondent Janette Neuwahl contributed to this report.

Return to top

The Telegram & Gazette

Tuesday, May 3, 2005

State tax revenues are surging

Romney wants tax rate cut back to 5 percent

By John J. Monahan, Staff writer

State tax revenues are booming again, with April setting an all-time

monthly record and annual revenues coming in at nearly $1 billion more

than forecasts at the start of the fiscal year, fueling Republican calls

for a long-sought rollback of the state income tax rate to 5 percent.

Gov. Mitt Romney wasted no time yesterday announcing the monthly revenue

spike, $318 million above the most recent revenue forecasts for April,

and letting the public and legislators know he wants some of it used for

the income tax rollback.

In all, the state brought in just over $2 billion in revenues in April.

Revenue Commissioner Alan LeBovidge said it was the largest single

monthly revenue total in the history of the state, an 11 percent

increase over April 2003.

Just last week, House Democrats rejected a call by Republican lawmakers

during budget discussions to roll back the income tax rate from the

current 5.3 percent to 5 percent, saying available funds were still

needed for schools, health care and local aid after three years of state

budget cutbacks.

Mr. Romney said he sees the one month record as an indicator that state

revenues are recovering strongly with income tax, sales tax and capital

gains tax receipts surging along with signs of an economy on the move.

Mr. Romney said 5,400 jobs were added in the state in March and that

retailers are reporting "better" sales while stock market stabilization

has increased tax revenues on capital gains.

At this point, the governor said, "There is no good reason," not to

honor a 5-year-old voter referendum that called for a rollback of the

income tax rate from 5.9 percent to 5 percent. The income tax rate was

rolled back to the current 5.3 percent before the recession created a

major fiscal crisis for the state, with sagging revenues creating a

multi-billion dollar state budget deficit.

Mr. Romney said while some of the surplus building in the fiscal year

that ends June 30 will be needed for supplemental appropriations, the

state can afford the rollback.

"We don’t have any excuse to keep spending people’s money above the

amount people voted for," Mr. Romney said, adding, "This is still a

democracy." He said he expects calls to use the additional money for pay

raises and new programs, but that he wants to hold the line on spending

until the income tax rate rollback is enacted.

Return to top

The Boston Herald

Tuesday, May 3, 2005

A Boston Herald editorial

Romney on taxes: What side is he on?

"Don't even think of investing in Massachusetts because you don't know

from one hour to the next what your capital gains tax is going to be." -

Barbara Anderson, Citizens for Limited Taxation.

News that April was a revenue "record-breaker" prompted Gov. Mitt Romney

yesterday to point out there's "no reason" for lawmakers to oppose

returning the income tax rate to 5 percent. Since turnabout is fair

play, lawmakers - or rival gubernatorial contenders - now have the rare

opportunity to one-up the governor on tax policy by pointing out there's

no reason for Romney to oppose returning some $250 million in wrongly

collected capital gains taxes, either.

Taxpayer advocate Barbara Anderson's bottom line about the message sent

to investors by the twists and turns in the capital gains tax saga - the

implementation of the 2002 increase has now twice been ruled

unconstitutional by the Supreme Judicial Court - best frames the

argument for changing the effective date of the new tax rate from Jan.

1, 2002, to Jan. 1, 2003. Otherwise, to the outside world, Anderson

said, Massachusetts' tax policy looks "certifiable."

Romney's proposal to provide a tax credit to those forced by the most

recent SJC decision to pay some $160 million more for capital gains

realized from January to May of 2002 does nothing to change that

perception. It just adds to the confusion.

Tax collections are running about $1 billion ahead of the revenue

forecast used to assemble this year's state budget, according to the

Department of Revenue. April collections alone were some $318 million

above the monthly benchmark.

"The surplus is large. We'll either spend it or give it back to the

citizens," Romney said in support of the income tax cut.

The choice is just as clear on the capital gains tax. If Romney's not

going to be on the side of giving back the unconstitutional increase,

who will be?

Return to top

The MetroWest Daily News

Sunday, May 1, 2005

Overrides: A taxing choice

By Tyler B. Reed, Daily News Staff

Facing state aid shortfalls of more than $500 million compared to three

years ago, communities more often than ever are considering raising

their own property taxes to pay for services like schools, police and

fire protection, according to state and local officials.

Voters in almost half the towns in the region will consider -- or have

already -- Proposition 2˝ overrides on their ballots this spring.

Wayland, Sudbury and Acton have already approved operational overrides,

which permanently raise property taxes. Westwood voters rejected by a

2-to-1 margin a $4.5 million override, which would have raised the

average homeowner's taxes by $663.

With no significant replenishment of state aid planned for this year,

towns are forced to fill budget gaps in excess of $1 million that have

opened because of the rising costs of health care, employee pensions and

fuel.

"Without adequate state aid, cities and towns have to cut to the bone.

They have exhausted their reserves, and they're forced to rely more and

more on the property tax," said Geoffrey Beckwith, the executive

director of the Massachusetts Municipal Association. "When the state

gets a cold, cities and towns get the flu."

Sudbury just approved a $3.05 million override, which increases the

average homeowner's yearly property taxes by $494.

Some towns have approved one override after another, said Sudbury's

Finance Director Sue Petersen. Others "are very slow to go after

overrides, like some of the bigger cities."

Wellesley, a medium-sized, wealthy town with an average home value of

$548,000, has considered at least three overrides in the last several

years. This year, residents will weigh in on one for $3.55 million.

"We haven't had one in a couple years, so we felt pretty good about

that," Petersen said of Sudbury's override.

In Holliston, where voters have not approved a Proposition 2˝ tax hike

since 1993, town officials say they need a $1.85 million override to

avoid almost two dozen teacher layoffs and $250 school bus fees.

Holliston Finance Committee Chairman William McColl said, "It all stems

from the state's local aid numbers." The state took away 20 percent of

local aid funding three years ago, he said. "We have all the obligations

increasing every year, but no follow through from the state."

Both Gov. Mitt Romney and the House of Representatives proposed budgets

that would send $177 million more to cities and towns this year. But

McColl said that will only mean a 1.3 percent increase in Holliston.

Larger cities get the bulk of the money, Beckwith said. In some cities,

education aid has even increased, he said.

"Local aid still goes to the big cities," said Rep. Susan Pope,

R-Wayland, whose district also includes Sudbury. "I think the city

representatives have a lot more clout."

Besides cuts in state aid, communities are also stuck covering the

escalating costs of health insurance, pensions and salary increases.

Medway faces a $2.7 million budget gap, the largest portion of which

comes from health insurance, Finance Committee Chairman Jay Leader said.

Town officials say there are considering a Proposition 2˝

override.

Barbara Anderson, executive director of the group Citizens for

Limited Taxation, said towns were too liberal in their spending

during the 1990s.

Communities were "getting a lot of money in local aid and spending it

like there was no tomorrow," Anderson said. "Yes, they're in trouble.

But it's their own fault."

Since state aid numbers were cut, towns have fired 14,500 employees,

including teachers, police officers and librarians, Beckwith said.

"Unless and until in future years we see a significant infusion and

reinvestment in state aid, we will continue to see the necessary

reliance on the Proposition 2˝ override."

Return to top

The Boston Globe

Monday, May 2, 2005

A Boston Globe editorial

Voting devalued

Voters frustrated by Florida's recount debacle in 2000 got better

results last year -- but not much. Congress will lower voter confidence

again if it fails to confront the problem.

After the Florida recount, Congress responded far too slowly. In 2002 it

finally created the US Election Assistance Commission, but gave it too

weak a mandate, and then underfunded it. The commission was unable to

start operations for 10 months, and then, as its own annual report says,

"had no offices, equipment, or staff." President Bush has not helped; he

has proposed $600 million less than the agreed-upon target budget for

the agency, even as he pushes more tax cuts.

In 2004, thousands of voters in many states still had problems with

faulty registration records. Extremely long lines in Ohio and other

states deterred thousands more, and there were serious technical

glitches and errors, including 4,438 computer votes that simply

disappeared in North Carolina.

One explanation for the lassitude in Washington comes from an easily

understood congressional mind-set: Any system that elected us can't be

too bad. But it is bad. The members of Congress should be embarrassed by

the continued problems last year, and also by the recent resignation of

the commission's first chairman, DeForest Soaries, who complained to the

Associated Press: "You have to beg Congress for money as if the

commission were your idea." Soaries said citizens should expect high

voting standards, but "there doesn't seem to be a corresponding sense of

urgency among policymakers in Washington."

The current chair, Gracia Hillman, emphasizes the progress that has been

made. In a visit with Globe editors last week, she noted that

provisional voting is now required nationwide, so thousands of people

who might have been excluded in the past were able to vote provisionally

in 2004, and two-thirds were counted. Also, nearly $2 billion in federal

grants helped most states upgrade their voting machinery. And the

commission, she said, is pushing states to maintain statewide voter

registration lists, as required by the 2002 Help America Vote Act.

Still, there are major gaps. In most cases, the commission was empowered

by Congress only to offer guidelines rather than set standards. Also,

many states are jealous of their historical role as masters or their own

voting systems, and they resist the uniformity that would make sense --

at least for national elections. Likewise, the commission has no power

to require that new voting machines make a paper record, even though the

technology is simple and inexpensive -- millions of ATMs do it every

day.

Congress owes much greater commitment to the mechanics of democracy, and

voters should demand it.

Return to top

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

|