CLT

UPDATE

Monday, March 14, 2005

Forgotten intent of Prop 2½

overrides: Emergencies

What the State House really needs is an H & R Block office down in the basement.

Maybe that way at least some of these deadbeat Democrats in the Legislature could get around to filing their taxes on time....

Oh, and by the way, Citizens for Limited Taxation (CLT) discovered that, back in 2002, Linsky said he was "absolutely convinced" state taxes had to be raised.

On everyone except himself, of course....

Liberals don't worry about that. The rules, like the harassment, are only for people who work for a living, not for the Beautiful People.

Next up, Rep. Colleen Garry (D-Methuen). CLT recalled that in 2001 she proposed a 5 percent sales tax on beer, wine and booze. (But not Twinkies.)

Barbara Anderson's crew also resurrected one of Garry's old quotes in opposition to cutting the state's income tax rate, as the Legislature promised to do back in 1989:

"There's only so much to go around."

Garry claims she doesn't owe the state any dough, and she doesn't mean cookie dough either - not that she'd ever part with a tollhouse cookie. Pass the crullers, Colleen, and save two for the Blocks, H & R.

The Boston Herald

Sunday, March 13, 2005

Deadbeat Donkeys refuse to pony up on their tax bill

By Howie Carr

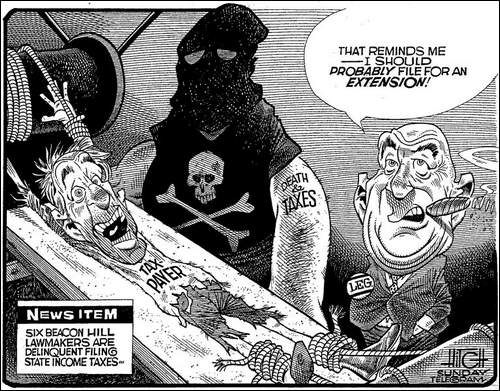

Editorial cartoon by David Hitch

The Telegram & Gazette l

March 13, 2005

It's budget season, and as municipal officials take on the annual ritual of hammering out finances for the coming year, many are finding themselves up against familiar choices: making cuts in services -- which usually means eliminating staff -- or asking voters to agree to higher taxes.

Several of Boston's western suburbs are likely to consider measures this spring to override the state law known as Proposition 2½, which limits how much communities can raise taxes in a given year.

Override requests, typically less common when the economy is booming, have become more routine in recent years as towns have grappled with a double whammy of cuts in state money and skyrocketing expenses.

"It's no longer an alien thing in many communities," said John Robertson, deputy legislative director for the Massachusetts Municipal Association....

The prospect of a tax increase invariably leads to concerns -- and often heated debate -- about whether residents can bear the higher bills.

Barbara Anderson, who directs Citizens for Limited Taxation, the group that lobbied for Proposition 2½

[sic - put it on the ballot] in the early 1980s, notes that those debates take on more urgency during times when more people are out of work.

Anderson's group is pushing legislation that would ask communities to wait a year before seeking an override if an earlier attempt

fails, and would also make it easier to seek an "underride" to lower taxes. That legislation is being sponsored by state Senator Scott Brown and state Representative Richard Ross, both Wrentham Republicans.

Anderson said her group never intended overrides to be used to cover ongoing municipal expenses, and only foresaw them being sought for local emergencies -- to pay for a broken-down

firetruck, for example, or to cover a court settlement against the community.

"It was never intended to be what it's become, which is a habit in some towns," she said.

The Boston Globe - West

Sunday, March 13, 2005

Override requests becoming routine

High costs, less aid straining budgets

All municipalities should commit themselves to supporting the efforts of elderly residents to live out their retirements in dignity. But it is not necessary to pile on tax breaks, which come at the expense of others in the community, in order to meet that obligation....

Many communities already provide relief from property taxes for those elderly of limited means who have become "house poor" in a heated real estate market. But that is not the only relief available to them....

Most people hope to pass along their homes to their heirs unencumbered by debt. But it is dangerous and divisive public policy to require other taxpayers to subsidize that desire.

Some of those taxpayers may be struggling to raise families on what amounts to a fixed income themselves. Some may work for companies that have imposed wage freezes while also requiring employees to pay more for health insurance. Some may be apartment dwellers who have never owned a home, but still pay property taxes indirectly through their rent.

The obligation of a community is to help elders remain in their homes, not to give their children a debt-free asset at taxpayer expense.

A community should help those in need regardless of age. But it must do so in a way that is fair, and that balances those needs with the ability of others in the community to pay the difference.

A Salem News editorial

Thursday, March 10, 2005

Caution required in giving tax breaks

Chip Ford's CLT Commentary

"It was never intended to be what it's become, which is a habit in some towns,"

Barbara summarized the recent frequency of Proposition 2½ overrides.

The override was included as a provision of Prop 2½

in 1980, when the state provided municipalities with far less local aid

than it does today. The provision was intended to be available for

municipal emergencies, not to fund bloated operating budgets and overly

generous public employee pay raises and benefits, for which it too often

is being abused today.

Over the past 25 years since Proposition 2½ was

adopted by the voters, the state has significantly increased local aid,

"revenue sharing" state funds going directly to cities and

towns. In the late-90s' municipalities were rolling in so much cash they

couldn't spend fast enough, socking the excess millions away in

"free cash" stashes (see "Embarrassment

of riches"), while expanding local government spending to a

level that would be unsustainable when the next economic downturn inevitably

came knocking.

Since that knock on the door sounded, too many

taxpayers have gotten used to proposed overrides every year or two and

don't find them surprising any more. They've become almost inured to

them, expecting one override after another to solve one constructed

"fiscal crisis" after another.

These alleged fiscal crises are the direct result of

overspending in the good years. That spending is now built into the

mindset of municipal officials and the tax-and-spend crowd. State local

aid has slowed while their spending continues to increase unabated.

When the tax-and-spend crowd wants something, they

simply push for another override. Using the override provision of Prop

2½ for needs instead of wants has been forgotten. Budgeting for what

they want, and they want only the best, is too old-fashioned a concept to

fulfill their need for immediate gratification. They want it now,

regardless of the expense both in dollars and in human terms, the burden

they selfishly put on taxpayers of lesser means, especially seniors on

fixed incomes.

But it's not just seniors who are on fixed incomes,

as the Salem News editorial pointed out. Most of those working in the

private sector are and have been on fixed incomes since the most recent

recession struck, their income stagnant if not diminished while the cost

of living continues to rise. (Barbara recognized this in her column of

Feb. 27, 2004, "Tax overrides get quiet assist from House bill")

Most private sector employees haven't seen generous annual pay raises

such as taxpayer-funded government workers expect as a birthright and

receive. Private sector working stiffs are making do with less while

the tax-and-spend crowd demands more, more, always more from us.

This is a zero sum game. Remember, "Every

tax is a pay cut; a tax cut is a pay raise." When public employees

get fatter, we get poorer.

When municipal officials justify overrides by citing

"the rising cost of health insurance," as if this is some

immutable law, remember who that health insurance covers: public

employees. Remember also who gave it to them: those whining municipal

officials. Those sweatheart deals have the municipalities (taxpayers)

paying some 80-90 percent of the premium. They fail to appreciate that

the cost for private sector workers who have health insurance at all is

also going up, and their employers are often cutting back on the

company's contribution to it just to stay in business. But private

enterprise lives or dies on a budget; it doesn't have an override

provision to tap when its cash flow slows.

The override provision was intended for municipal

emergencies. The biggest municipal emergency we have today is how to

choke off the overspending. The solution doesn't require higher taxes.

|

|

|

Chip Ford |

The Boston Herald

Sunday, March 13, 2005

Deadbeat Donkeys refuse to pony up on their tax bill

By Howie Carr

What the State House really needs is an H & R Block office down in the basement.

Maybe that way at least some of these deadbeat Democrats in the Legislature could get around to filing their taxes on time.

I reached Rep. Ben Swan (D-Springfield) on Friday. He seems to believe the "filing deadline" is when he gets a call from a reporter telling him he's in arrears. He got one such call last week ... and paid up. I asked him why he never pays on time.

"I don't know whether you paid your taxes, Howie."

Oh, but I do. Under Dukakis, the state DOR once sent a dirty-tricks squad to the Registry of Deeds in East Cambridge to see if I was laundering cash by using straws to buy

three-deckers in Somerville. Those DOR hacks were suspended, but that's how they treat you if you're not a solon.

So, Ben, did you finally file your state returns?

"That's not your business."

How about your city property taxes? Until recently you were in the hole for $32,000.

"That's not your business either."

How about your federal income taxes?

"My taxes ain't none of your business."

Of course, Swan comes from a city long represented in the Senate by one Linda

Melconian. She once had to file an "amendment" to her federal income taxes because she'd claimed a $780 deduction on Springfield real-estate taxes that she hadn't bothered to pay.

Then there's Rep. Byron Rushing (D-South End). He says his problem is that he does his own tax returns. Judging from his recidivist record of

nonfiling, it appears his real problem is that he doesn't do his own returns.

Meet deadbeat Rep. David Linsky of Natick. This dim-bulb Democrat posted a press release on his Web site Jan. 27 announcing that "reductions in the state's income taxes are on the way."

They certainly are, if you don't bother to pay them. Oh, and by the way,

Citizens for Limited Taxation (CLT) discovered that, back in 2002, Linsky said he was "absolutely convinced" state taxes had to be raised.

On everyone except himself, of course.

Then there's Rep. Matthew "Landslide" Patrick (D-Falmouth). Another moron - he was apparently too busy recharging the batteries on his electric car to file his income-tax returns. First he said he had filed. Then he said, oops, he found the unmailed returns at his house. I'm guessing most of his constituents would have noticed sooner, either when the check to the DOR didn't clear or when the refund didn't arrive. Some of us even send in our tax returns via certified mail - so we won't be harassed later.

Liberals don't worry about that. The rules, like the harassment, are only for people who work for a living, not for the Beautiful People.

Next up, Rep. Colleen Garry (D-Methuen). CLT recalled that in 2001 she proposed a 5 percent sales tax on beer, wine and booze. (But not Twinkies.)

Barbara Anderson's crew also resurrected one of Garry's old quotes in opposition to cutting the state's income tax rate, as the Legislature promised to do back in 1989:

"There's only so much to go around."

Garry claims she doesn't owe the state any dough, and she doesn't mean cookie dough either - not that she'd ever part with a tollhouse cookie. Pass the crullers, Colleen, and save two for the Blocks, H & R.

Howie Carr's radio show can be heard weekday afternoons on WRKO AM 680, WHYN AM 560, WGAN AM 560, WEIM AM 1280 and WXTK 95.1 FM.

Return to top

The Boston Globe - West

Sunday, March 13, 2005

Override requests becoming routine

High costs, less aid straining budgets

By Emily Shartin, Globe Staff

Lincoln residents may soon be asked to cough up an additional $270 a year in property taxes. In Holliston, it could be $440. And in Sudbury, it might be almost $500.

It's budget season, and as municipal officials take on the annual ritual of hammering out finances for the coming year, many are finding themselves up against familiar choices: making cuts in services -- which usually means eliminating staff -- or asking voters to agree to higher taxes.

Several of Boston's western suburbs are likely to consider measures this spring to override the state law known as Proposition 2½, which limits how much communities can raise taxes in a given year.

Override requests, typically less common when the economy is booming, have become more routine in recent years as towns have grappled with a double whammy of cuts in state money and skyrocketing expenses.

"It's no longer an alien thing in many communities," said John Robertson, deputy legislative director for the Massachusetts Municipal Association.

According to the association, 53 communities sought overrides last year and measures passed in 25. The previous year, 81 communities sought overrides and 46 passed them. Robertson said the group is already tracking about 30 communities that are discussing overrides this year.

In the Globe West circulation area, overrides are also likely to be on the ballot in Wellesley, Weston, and Wayland. Several other communities are considering whether they will pursue tax increases above and beyond the normal increases allowed under Proposition 2½ to cover anticipated budget gaps. Some are also considering a type of tax increase called a debt exclusion, which typically helps cover a specific town building project and is not permanent.

The prospect of a tax increase invariably leads to concerns -- and often heated debate -- about whether residents can bear the higher bills.

Barbara Anderson, who directs Citizens for Limited Taxation, the group that lobbied for Proposition 2½

[sic - put it on the ballot] in the early 1980s, notes that those debates take on more urgency during times when more people are out of work.

Anderson's group is pushing legislation that would ask communities to wait a year before seeking an override if an earlier attempt

fails, and would also make it easier to seek an "underride" to lower taxes. That legislation is being sponsored by state Senator Scott Brown and state Representative Richard Ross, both Wrentham Republicans.

Anderson said her group never intended overrides to be used to cover ongoing municipal expenses, and only foresaw them being sought for local emergencies -- to pay for a broken-down

firetruck, for example, or to cover a court settlement against the community.

"It was never intended to be what it's become, which is a habit in some towns," she said.

Lincoln will seek its fifth consecutive override this year. The town is looking for $490,000 to cover both municipal and school expenses. Town Administrator Timothy S. Higgins said Lincoln has been able to pare down expenses by reorganizing the town's solid waste and recycling program, by sharing some services with neighboring Concord, and by leasing town land for cell towers.

But with insurance and pension costs rising by 12 percent, Lincoln officials say they have little choice but to ask for the additional money.

"You're left with no degrees of freedom," said Gary Taylor, who chairs the town's Board of Selectmen.

Lincoln and several of the other communities seeking overrides are well-to-do towns that already have some of the highest average property tax bills in the state, according to the state Department of Revenue, and all of them have passed other overrides in recent years.

Some local officials say there's hardly any commercial development in their communities, so when costs increase, residential taxpayers feel the brunt.

Some officials also say residents of wealthier communities may be less willing to endure cuts in services, and less concerned about higher tax bills.

Weston Town Manager Carl Valente noted that override requests are a way of keeping local governments in check.

"It forces the community to go to the voters and make its case," Valente said. "It's a good way of keeping us close to our residents."

Weston will seek between $1 million and $2 million to cover expenses this spring, which could mean as much as $412 in property taxes added to the tax bill for the median-value single-family home, Valente said.

Neighboring Wayland is likely to seek an increase of at least $2 million. Executive Secretary Jeff Ritter said the town had not determined how that would affect the average tax bill. Bob Lentz, who chairs the town Finance Committee, estimated it would translate to a 6 percent increase.

Some towns are trying to close their budget gaps as much as possible before bringing an override request forward.

Norfolk is looking at a $1 million shortfall, said Jack Hathaway, who serves as the town's interim town administrator and finance director. He said it would be difficult for the town to maintain services without the additional money.

Sudbury is looking at a proposed override of $3 million and planning a second one for capital expenses. Town Manager Maureen Valente said a chunk of that money would support the school system, which is dealing with growth in student enrollment.

Holliston is considering its first override since 1993, said Town Administrator Paul

LeBeau. The town may eliminate its trash fee and seek about $2.2 million to cover both the trash fee revenue and a budget gap. (Because an earlier tax increase is about to fall off the books, LeBeau noted that the net increase if the override were to pass would be close to $300.)

LeBeau said Holliston has had difficulty making up for a $1 million loss in state aid during the recent economic downturn.

"You try to hold the line and maintain expenses," said LeBeau, "and you can do that for a certain period of time."

Return to top

The Salem News

Thursday, March 10, 2005

A Salem News editorial

Caution required in giving tax breaks

All municipalities should commit themselves to supporting the efforts of elderly residents to live out their retirements in dignity. But it is not necessary to pile on tax breaks, which come at the expense of others in the community, in order to meet that obligation.

Gloucester recently rejected a proposal to lower from 70 to 65 the age at which low-income elders can begin receiving a city property tax exemption, and increase the amount of the exemption from $500 to $1,000 in $100 increments a year, beginning at age 65.

Many communities already provide relief from property taxes for those elderly of limited means who have become "house poor" in a heated real estate market. But that is not the only relief available to them.

Indeed, no elder is at risk of being thrown out of his or her home because of a state program under which those 65 or older can defer a portion or all of their property taxes until they sell their property or until their death, at which time the bill can be paid out of the person's estate, with 8 percent interest.

Most people hope to pass along their homes to their heirs unencumbered by debt. But it is dangerous and divisive public policy to require other taxpayers to subsidize that desire.

Some of those taxpayers may be struggling to raise families on what amounts to a fixed income themselves. Some may work for companies that have imposed wage freezes while also requiring employees to pay more for health insurance. Some may be apartment dwellers who have never owned a home, but still pay property taxes indirectly through their rent.

The obligation of a community is to help elders remain in their homes, not to give their children a debt-free asset at taxpayer expense.

A community should help those in need regardless of age. But it must do so in a way that is fair, and that balances those needs with the ability of others in the community to pay the difference.

Return to top

NOTE: In accordance with Title 17

U.S.C. section 107, this material is distributed without profit or

payment to those who have expressed a prior interest in receiving this

information for non-profit research and educational purposes only. For

more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

|