|

Post Office Box 1147 ●

Marblehead, Massachusetts 01945 ●

(781) 639-9709

“Every Tax is a Pay Cut ... A Tax Cut is a Pay Raise”

45 years as “The Voice of Massachusetts Taxpayers”

— and

their Institutional Memory — |

|

CLT UPDATE

Saturday, November 16, 2019

Will

Proposition 2½ still stand next week or be

weakened?

|

House leaders this

week stripped off the fall agenda one of the most important

and controversial bills in the mix, and the agenda for the

close of formal sessions for 2019 is now a little clearer.

With

transportation tax and fee proposals idling in the breakdown

lane for now, lawmakers appear to instead be working toward

finishing work on legislation pledging $1.5 billion in new

state aid for K-12 education over seven years and wrapping

up work on a more than $700 million bill that spends most of

the fiscal 2019 surplus while making a big deposit into the

state rainy day fund.

Education bill

negotiators Rep. Alice Peisch and Sen. Jason Lewis face

pressure to deliver in the coming days on what would be the

largest major accomplishment for the Legislature in 2019.

Similarly, Rep. Aaron Michlewitz and Sen. Michael Rodrigues

are under the gun to reconcile their differences over fiscal

2019 spending before debate starts in a few weeks on fiscal

2021 spending plans....

The House and

Senate meet in informal sessions on Monday and under joint

rules, they will then have just Tuesday and Wednesday to

hold formal sessions.

Conference

committees are supposed to file compromise bills by 8 p.m.

the night before their proposals go before the House and

Senate, though lawmakers have suspended that fair-notice

rule in the past.

Starting on

Thursday and until January, the branches will meet in

informal sessions where important business is sometimes

still conducted, although any single member can block the

advancement of any bill during informals.

State House News Service

Friday, November 15, 2019

Advances - Week of Nov. 17, 2019

With just days

remaining until the Legislature recesses until 2020, House

Speaker Robert DeLeo said Thursday he's decided to push back

his timeline for a hotly anticipated debate over new revenue

for transportation until next year.

DeLeo and Ways and

Means Chairman Aaron Michlewitz told the News Service that

their commitment to passing legislation to raise new funding

for transportation infrastructure has not waned.

The goal set by

DeLeo for a fall debate, however, would require decisions on

how to generate and spend new revenues that the Democratic

leaders are not quite ready to make.

"After reviewing

this with myself, the chairman (Michlewitz), Chairman (Mark)

Cusack and Chairman (William) Straus, we decided that it's

better that we try to get this right than to try to comply

with, I guess you could say, a somewhat arbitrary deadline,"

DeLeo told the News Service.

The Legislature is

set to recess on Nov. 20, and resume formal sessions in

January. While the House and Senate will continue to meet in

informal sessions through December, anything that requires a

roll call vote must wait....

The Winthrop

Democrat said he's "shooting for January now" to produce and

vote on a revenue bill in the House, acknowledging that some

legislators will be unhappy about the prospect of voting for

tax increases in an election year....

DeLeo said he

knows some House members will say delaying the debate until

2020 "makes the whole thing a little more difficult," but

he's confident that the support for action will still be

there....

Second Assistant

Majority Leader Paul Donato presided over the House's brief

Thursday session.

After the House

adjourned until Monday, Donato said the education bill and a

more than $700 million fiscal 2019 surplus spending bill are

the two biggest priorities to get done by Wednesday.

"My understanding

from both chairs on the Senate and the House side is that

they're very very close," Donato said of the education

negotiations.

State House News Service

Thursday, November 14, 2019

House Kicking Transportation $$$ Debate Into 2020

House Speaker

Robert DeLeo is putting off a debate over tax legislation to

fund transportation improvements until next year, throwing

into doubt whether anything will happen in an area that

advocates and business groups say is in desperate need of

more funding.

After expressing

some uncertainty Wednesday about his plans to take up the

tax bill this fall and as word began to leak out on

Thursday, DeLeo and House Ways and Means Chairman Aaron

Michlewitz told the State House News Service that they were

postponing the debate.

“We decided that

it’s better that we try to get this right than to try to

comply with, I guess you could say, a somewhat arbitrary

deadline,” said DeLeo, who insisted most House lawmakers are

committed to addressing transportation needs.

The delay pushes

the entire legislative process into an election year, when

lawmakers tend to be more sensitive about taking politically

risky votes. It may also signal some reluctance to raise

taxes to finance transportation improvements overall....

DeLeo said his new

target is to put a bill out in January.

“Our commitment to

the issue is still very strong, is still there. Our timeline

is just going to be a little different than we initially

perceived it to be,” said Michlewitz....

After DeLeo’s

announcement, the [Mass.] High Tech Council issued a

statement saying it was wise “to avoid any rush to revenue…

The size of the tax, toll, and fee proposals advanced by

some advocates are too large and the scope of their

potential impact is too broad to move forward in anything

but a methodical and data-driven way....

Stephen Brewer,

who was chairman of the Senate Ways and Means Committee

during the last major tax debate in 2013, said in a phone

interview that legislative leaders will need to count votes,

and it is especially important to have adequate support to

override the governor if he is inclined to veto the bill.

“There’s nothing

worse than taking a tax vote and not having it become law,”

Brewer said. “It’s tough enough to take one. But if you take

one and you’re on record and you didn’t get the revenues for

it, then you lose twice.” ...

As the House put

off action on a transportation bill, a new poll indicates 71

percent of voters think “action is urgently needed to

improve the state’s transportation system” and 77 percent

support new revenues to invest in transportation.

CommonWealth Magazine

Thursday, November 14, 2019

DeLeo calls off transpo tax debate —

for now

Cities and towns

across Massachusetts are about to feel a real consequence of

the Legislature's inability to close the books on the fiscal

year that ended in June.

On Friday, the

Department of Revenue is due to make its annual distribution

of matching funds to cities and towns that raise revenue

through the Community Preservation Act but an extra $20

million that the Legislature directed to the CPA Trust Fund

won't be part of the payout.

When it passed a

compromise fiscal 2020 budget in July, the Legislature

included a provision directing the state comptroller to

transfer $20 million from the fiscal 2019 surplus to the CPA

Trust Fund as a way to bridge the gap until new, higher fees

funding the CPA Trust Fund kick in next year.

But because the

House and Senate have not been able to resolve their

differences on a supplemental budget that would allow the

comptroller to finalize surplus transfers, that $20 million

has not yet been deposited into the trust and CPA

communities will instead receive a state match of just 11

percent of what they raised in property tax surcharges....

The more-than-$700

million supplemental budget bill has been hung up between

the House and Senate for weeks and neither side has shed

insight on the holdups or when a final bill might emerge.

Whenever it does get done, this year's close-out bill will

be finalized later than any year since at least 1995.

State House News Service

Wednesday, November 13, 2019

Budget Holdup Blocking $20 Mil CPA Fund Distribution

Having watched

another week go by without finalizing budget work left over

from fiscal year 2019, the House and Senate now stand to

forfeit more than $1 million in interest that the state

could have earned had lawmakers completed their work on

time.

The Legislature's

inability to agree on a bill closing the books on the fiscal

year that ended in June is keeping Comptroller Andrew Maylor

from filing an annual report, which he was statutorily due

to file by Oct. 31. And with the branches at loggerheads

over the supplemental budget, hundreds of millions of

dollars in fiscal 2019 surplus funds are sitting in the

General Fund waiting to be transferred to the Stabilization

Fund.

In late October,

Maylor told the Legislature that if he was able to file his

report by Friday, Nov. 15, the state will have lost out on

more than $500,000 in interest and would lose out on at

least $30,000 more each day after the 15th until he is able

to file the report and make the transfer.

But it will take

Maylor's office about 14 days -- or $420,000 in foregone

interest -- from the time Gov. Charlie Baker eventually

signs the supplemental budget bill to be ready to file his

report, he said. So if the Legislature enacts the bill at

the next chance it has, Monday, and the governor signs it

immediately, Massachusetts will have lost out on $1.01

million in interest payments by the time all is said and

done.

"I realize that in

the context of the state government spending that this

amount may not seem important, but as a taxpayer and someone

who spent more than 25 years in local government, that sum

is meaningful," the comptroller wrote to the governor and

Legislature in late October, when the estimate of forfeited

interest was only $500,000....

Lawmakers have

appeared unfazed by the inability to wrap up the fiscal year

that ended 138 days ago, although the protracted process is

cutting into the amount of time legislative leaders have to

focus on other issues. The Legislature often procrastinates,

leaving many important decisions to be made in a frenzy

every other July.

State House News Service

Thursday, November 14, 2019

Cost of Budget Delay Surpassing $1 Million

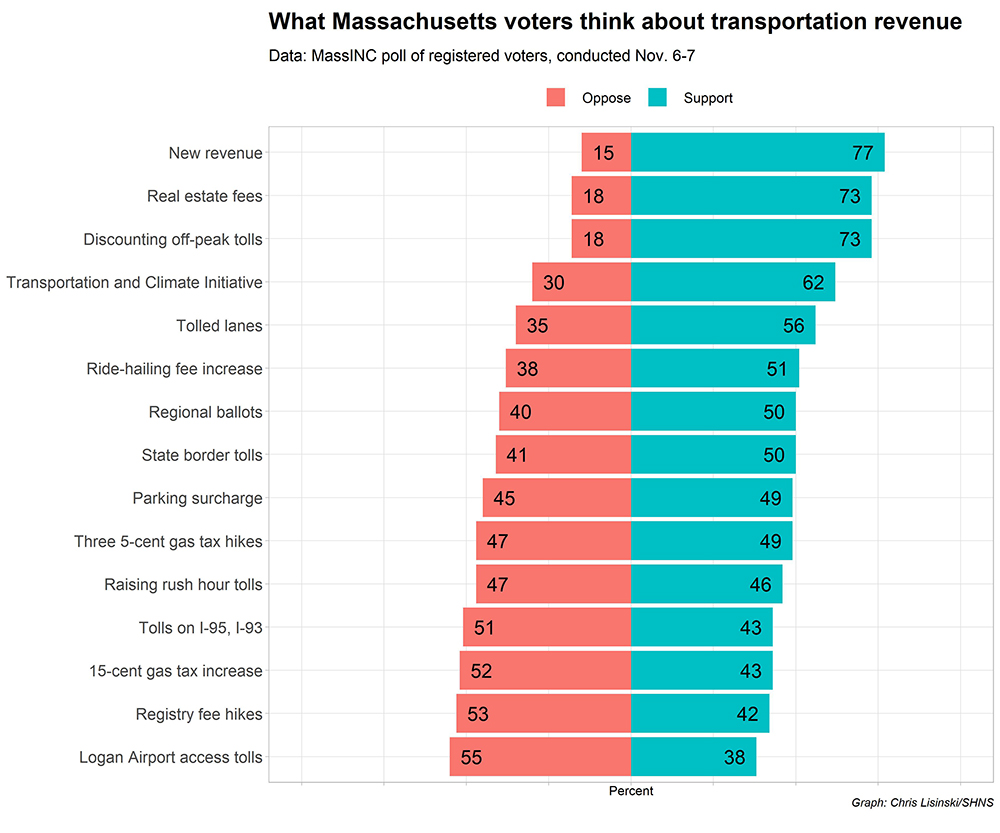

Massachusetts

voters support raising new revenue to make transportation

investments, but a new poll shows they are divided over some

of the key methods that lawmakers are weighing to generate

funding....

While registered

voters showed some support for other strategies such as

increasing fees on ride-share services, a poll of 600

registered voters, released Friday by the MassINC Polling

Group, revealed a split reception to a phased-in gas tax

hike and majority opposition for a larger, all-at-once

increase.

House leaders, who

this week agreed to delay their planned fall debate until at

least January, have said bumping up the state's

24-cent-per-gallon gas tax will likely be a central

component of the eventual package, arguing that every penny

increase leads to another $35 million in revenue....

Despite their lack

of enthusiasm for gas tax hikes and for expanding roadway

tolls to highways that do not currently have them, voters

surveyed backed several revenue-generating ideas that have

been floated on Beacon Hill....

MassINC's poll

found 71 percent of respondents agreed that "action is

urgently needed to improve the state's transportation

system." Seventy-seven percent strongly or somewhat

supported the general push for new transportation revenue

compared to 15 percent who were opposed.

However, 49

percent of respondents also said they believe the state has

the money it needs for transportation and only needs to

spend it well compared to 39 percent who said more money is

necessary regardless.

[See graphic below for poll

results]

State House News Service

Friday, November 15, 2019

Poll: Voters Split on Key Transpo Revenue Ideas

In the Veterans

Day shortened week, House and Senate Democrats got no closer

to agreeing on how to spend over $700 million in surplus

revenue from fiscal 2019, which ended July 1. But with three

days of sessions left, House Speaker Robert DeLeo did

lighten the pre-recess load in one big way.

The speaker said

he's decided to push off a debate over new transportation

revenues until January, requiring more time to take feedback

from members and outside interest groups before deciding on

a package that is widely expected to include a hike in the

gas tax....

State House News Service

Friday, November 15, 2019

Weekly Roundup - Changing Minds

Congratulations,

fellow Massachusetts taxpayers: We’re millionaires.

At least that’s

how state agencies see us — deep-pocketed and willing to

foot $75B worth of overhauling, repairing, maintenance and

improvement transportation projects.

As the Herald’s

Sean Philip Cotter reported, the state’s letter to Santa

includes a potential $28.5 billion option to overhaul the

Commuter Rail that already got a partial high sign from the

MBTA’s oversight board; the Green Line extension; and

billions in long-overdue maintenance fixes to get the

Department of Transportation and the MBTA up to a normal

state of repair. There’s a plan to straighten the Pike in

Allston for $1.2 billion, and other highway fixes aimed at

reducing congestion and repairing neglected roads and

bridges.

We’re Santa....

“There is no

foreseeable way that Massachusetts would be able to spend

$75 billion on transportation over the next decade,” said

former Inspector General Greg Sullivan, now of the Pioneer

Institute. “We have to be thinking about dollars and cents —

including common sense — in terms of how to ameliorate

traffic congestion.”

Paul Craney of the

Massachusetts Fiscal Alliance said, “The number is so high

that it’s hard to fathom — it’d make the Big Dig look

minuscule.”

The Boston

business group A Better City is pushing for $50 billion in

spending over the next 20 years, including several of the

above-mentioned projects — and they have ideas on how to get

the money.

A Better City is

advocating pumping up the gas tax by 11.5 cents a gallon — a

46% increase — along with new fees on ride-hailing services

and toll increases. The group also advocated for rising

Registry of Motor Vehicle fees and adding new taxes on

traded-in vehicles.

And where is the

plan to increase the paychecks of Massachusetts taxpayers?

Has someone devised a strategy to lower the cost of food,

rent, utilities and other expenses Bay State residents have

to pay, in addition to these new taxes and fees?

Santa doesn’t

always bring presents, and Massachusetts taxpayers can also

deliver our own lumps of coal — at the voting booth.

A Boston Herald editorial

Wednesday, November 13, 2019

Taxpayers shouldn’t be on hook for T plans

Massachusetts

voters have had enough of the corruption that exists on

Beacon Hill; therefore, it was a wise move by the

legislative leadership to delay a vote on a hefty gas tax

increase until after the holidays....

WBSM AM-1420

Friday, November 15, 2019

Vote on gas hike wisely delayed

By Barry Richards

Massachusetts lawmakers do the work of the

people — and we are very lenient employers, apparently.

Who else would let workers put in light days

and leave tasks unfinished?

The House has until next Wednesday to wrap

up pending legislation before it breaks for winter recess,

but you wouldn’t know an important deadline was looming if

you sat in at yesterday’s session....

The Legislature is set to recess on Nov. 20,

and resume formal sessions in January. And it’s possible

that when it meets early next week it could pull

all-nighters and hammer out significant legislation. You

never know....

Legislation isn’t like wine — it isn’t

supposed to age until its flavor develops. Doing the work of

the people means delivering results in a timely manner.

A Boston Herald editorial

Friday, November 15, 2019

Lawmakers in no rush to vote

|

|

Chip Ford's CLT

Commentary

The State

House News Service reported:

"Under joint

rules governing the branches, lawmakers must conclude

all formal business for 2019 by Wednesday, Nov. 20.

Informal sessions will continue through December, with

formal sessions resuming in January."

Major

legislation — languishing

on Beacon Hill for months with the clock running out

while the Legislature preoccupied itself with irrelevant

and whimsical feel-good bills —

has become so jammed up that House Speaker DeLeo had to

backtrack on his vow to pass his long-threatened

Transportation Revenue scheme before their end-of-year

recess. Months of do-nothing procrastination by

alleged "full-time" legislators of "The Best Legislature

Money Can Buy" has forced DeLeo's tax hike abomination

to be postponed. That astronomical tax grab is off

the table for now, awaiting the coming new year, 2020.

Now we can

fully focus our attention on the latest threat to

Proposition 2½ — the "mitigate

the constraints of Propositon 2½" amendment — and

whether the Education Finance Reform conference

committee put it back into the education funding bill.

(It was included in the Senate version but dropped from

the House's version.) In the

CLT letter delivered to the committee last week we

pointed out that it was completely unnecessary, beyond

the scope of the legislation, and should not be

included.

I've done a number of interviews

this week on the latest stealth assault on our

Proposition 2½. The latest

was this morning at 8:00 AM, a half hour with Brian

Thomas of WBSM AM-1420 in New Bedford. On Thursday

I was interviewed by Alan Zarek of WSAR AM-1480 in Fall

River for his daily "Newsroom" program at noon.

We're getting the word out but the clock is running

down.

In last week's

CLT Update (November 10), "The

Massive Tax Hikes Surge Is On," I wrote:

As

always, critically important votes on massive policy

changes and major tax hikes will come up in the last

moments of the eleventh hour in the middle of the

night in the final day or two before Beacon Hill

denizens again disappear on another extended

vacation. This has become increasingly more common,

an apparent leadership strategy. Treat the citizenry

like nuisance mushrooms: Keep them in the dark and

well-fertilized. And keep legislative sheep equally

in the dark until they must vote on whatever is

dropped in front of them just moments before. They

can be relied on to do as they are told — not by

their constituents, but by their leaders who sign

their pay checks.

That eleventh

hour marathon session will be upon us this week.

It will arrive on Wednesday night, probably around

midnight if not going into Thursday early morning.

Last year, a

day before the Legislature broke for its extended summer

vacation, we were still awaiting a vote to find out if

the last assault on Proposition 2½

would survive in the massive Economic Development bill,

or if we managed to defeat it. We didn't have an

answer until the following day.

We

managed to save Proposition 2½ from the threat of "Community Benefits Districts" in

that eleventh hour — actually twelfth hour-plus

despite the imposed deadline. The Legislature last

year simply ignored the deadline and didn't pass the law

(without assaulting Prop 2½)

until 1:12 AM the next morning. I know. I

was still awake and watching!

Let's all hope we can do it again.

|

|

|

|

Chip Ford

Executive Director |

|

|

|

|

|

State House News Service

Friday, November 15, 2019

Advances - Week of Nov. 17, 2019

House leaders this week stripped off the fall

agenda one of the most important and

controversial bills in the mix, and the agenda

for the close of formal sessions for 2019 is now

a little clearer.

With transportation tax and fee proposals idling

in the breakdown lane for now, lawmakers appear

to instead be working toward finishing work on

legislation pledging $1.5 billion in new state

aid for K-12 education over seven years and

wrapping up work on a more than $700 million

bill that spends most of the fiscal 2019 surplus

while making a big deposit into the state rainy

day fund.

Education bill negotiators Rep. Alice Peisch and

Sen. Jason Lewis face pressure to deliver in the

coming days on what would be the largest major

accomplishment for the Legislature in 2019.

Similarly, Rep. Aaron Michlewitz and Sen.

Michael Rodrigues are under the gun to reconcile

their differences over fiscal 2019 spending

before debate starts in a few weeks on fiscal

2021 spending plans.

Legislation banning flavored tobacco products

and taxing vaping products is making a late-2019

surge as well and is expected to clear the

Senate Wednesday after passing the House this

week on a 126-31 vote.

Also still in the mix: the stalled driving

safety bill, a children's wellness bill that's

in conference committee, and campaign finance

reporting legislation that has cleared both

branches in different forms.

The House and Senate meet in informal sessions

on Monday and under joint rules, they will then

have just Tuesday and Wednesday to hold formal

sessions.

Conference committees are supposed to file

compromise bills by 8 p.m. the night before

their proposals go before the House and Senate,

though lawmakers have suspended that fair-notice

rule in the past.

Starting on Thursday and until January, the

branches will meet in informal sessions where

important business is sometimes still conducted,

although any single member can block the

advancement of any bill during informals.

State House News Service

Thursday, November 14, 2019

House Kicking Transportation $$$ Debate Into

2020

By Matt Murphy

With just days remaining until the Legislature

recesses until 2020, House Speaker Robert DeLeo

said Thursday he's decided to push back his

timeline for a hotly anticipated debate over new

revenue for transportation until next year.

DeLeo and Ways and Means Chairman Aaron

Michlewitz told the News Service that their

commitment to passing legislation to raise new

funding for transportation infrastructure has

not waned.

The goal set by DeLeo for a fall debate,

however, would require decisions on how to

generate and spend new revenues that the

Democratic leaders are not quite ready to make.

"After reviewing this with myself, the chairman

(Michlewitz), Chairman (Mark) Cusack and

Chairman (William) Straus, we decided that it's

better that we try to get this right than to try

to comply with, I guess you could say, a

somewhat arbitrary deadline," DeLeo told the

News Service.

The Legislature is set to recess on Nov. 20, and

resume formal sessions in January. While the

House and Senate will continue to meet in

informal sessions through December, anything

that requires a roll call vote must wait.

DeLeo and House leaders in March and April

signaled plans for a fall debate on

transportation revenues, and the urgency

associated with that debate was heightened in

recent months by failures on the MBTA and

congestion conditions on the roads that drivers

are finding more and more intolerable.

Two weeks ago, DeLeo convened a group of his top

deputies to gauge where in the process House

leaders were in putting a package together.

Majority Leader Ronald Mariano said after the

meeting that they had started to "put some

numbers next to the strategies," but would

likely need a few more weeks.

"It makes it close, but the goal is to have

something at least on the floor of the House

before the end of the session," Mariano said.

Then two days later a coalition of business

groups, led by Greater Boston Chamber of

Commerce President Jim Rooney, shared the

results of a survey of major Massachusetts

employers on what types of new taxes or revenue

enhancers they could support to improve public

transit and reduce congestion.

The results were mixed, but DeLeo said the

release of the information, including the

chamber's support for a 15-cent gas tax

increase, sparked an intensified interest among

House members to share their opinions with

leadership.

"Quite frankly, I think it's very, very

important that we try to get this in the best

possible form as possible and I think it's going

to take more time for us to be talking with some

of the members, who are probably a little more

engaged now and want to talk a little more about

it," DeLeo said.

Straus said the team working on the revenue

package has ruled some options in and out, and

mentioned how just this week a coalition of

mayors and municipal leaders rallied behind a

15-cent gas tax increase.

"We got closer and more things to consider at

the same time," Straus said about the past few

weeks, suggesting the public attention paid to

the fact that leaders were zeroing in on a plan

"brought a number of the groups who had been

watching but not communicating from outside the

building into the discussion."

DeLeo said he's also given his commitment

previously to support transportation

improvements in all regions of the state, but

some members have been seeking reassurances.

"It's not only the money. Some people also want

to talk about the bill as a whole," DeLeo said.

"There's a concern I hear from other parts of

the state that with what's going on with the T

they're concerned that this is going to be more

T-centric than they want it to be."

The Winthrop Democrat said he's "shooting for

January now" to produce and vote on a revenue

bill in the House, acknowledging that some

legislators will be unhappy about the prospect

of voting for tax increases in an election year.

Rep. Paul Brodeur, who gave his farewell address

in the House Wednesday as he prepares to take

over as mayor of Melrose, sarcastically joked

about his good fortune of missing the revenue

debate.

"I will say I'm devastated to not be a part of

the upcoming revenue debate, but I know you will

all do quite well," Brodeur told his colleagues.

DeLeo said he knows some House members will say

delaying the debate until 2020 "makes the whole

thing a little more difficult," but he's

confident that the support for action will still

be there.

"I think that's always an issue, yes, but I

think there also seems to be a commitment I get

from most members, anyways, that something has

to be done, that we just can't keep on going in

the way we're going with our transportation

system," DeLeo said. "There seems to be more of

a commitment to making sure we get something

done as opposed to sitting on the sidelines and

just letting another year pass without doing

that."

"Our commitment to the issue is still very

strong, is still there. Our timeline is just

going to be a little different than we initially

perceived it to be," said Michlewitz, backing up

the speaker.

Gov. Charlie Baker, a Republican, has said that

he opposes increasing the gas tax, and would

rather see the Legislature simply pass his $18

billion, multi-year bond bill that invest

significant new funding into roads, bridges and

public transit.

The Baker administration is also pursuing a

multi-state initiative to cap carbon emissions

from vehicles and generate potentially hundreds

of millions of dollars for the state from the

sale of carbon allowances to invest in clean

transportation programs.

DeLeo said that he has spoken with Baker about

the Transportation Climate Initiative and would

also like to get a better idea of how it will

work and how many states will participate before

moving forward.

The TCI coalition plans to publish a draft memo

of understanding in December that will include a

proposed cap, and give states a better grasp of

how much revenue could be expected.

"We'll be anxiously seeing what does occur in

December, but at this point there isn't a TCI

number that you could plug in," Straus said.

"And then there's the practical matter of when

would that money become available."

With a revenue debate off the agenda for next

week, DeLeo said he's "anxiously awaiting some

of the conference committee reports," including

a ban on handheld cellphone use while driving, a

children's health bill, and major overhaul of

the state's education funding system.

Second Assistant Majority Leader Paul Donato

presided over the House's brief Thursday

session.

After the House adjourned until Monday, Donato

said the education bill and a more than $700

million fiscal 2019 surplus spending bill are

the two biggest priorities to get done by

Wednesday.

"My understanding from both chairs on the Senate

and the House side is that they're very very

close," Donato said of the education

negotiations.

The budget bill to close out the fiscal year

that ended on July 1 was never sent to

conference, but Michlewitz and Senate Ways and

Means Chairman Michael Rodrigues have been

negotiating for weeks.

"We're working on it," Michlewitz said.

The branches are also trying to iron out

differences in a bill that would require

legislative candidates to file more frequent

campaign finance reports, and potentially change

the way the state's top campaign finance

regulator is selected.

CommonWealth Magazine

Thursday, November 14, 2019

DeLeo calls off transpo tax debate – for now

Speaker says House will try again next year 'to

get this right'

By Bruce Mohl and Andy Metzger

House Speaker Robert DeLeo is putting off a

debate over tax legislation to fund

transportation improvements until next year,

throwing into doubt whether anything will happen

in an area that advocates and business groups

say is in desperate need of more funding.

After expressing some uncertainty Wednesday

about his plans to take up the tax bill this

fall and as word began to leak out on Thursday,

DeLeo and House Ways and Means Chairman Aaron

Michlewitz told the State House News Service

that they were postponing the debate.

“We decided that it’s better that we try to get

this right than to try to comply with, I guess

you could say, a somewhat arbitrary deadline,”

said DeLeo, who insisted most House lawmakers

are committed to addressing transportation

needs.

The delay pushes the entire legislative process

into an election year, when lawmakers tend to be

more sensitive about taking politically risky

votes. It may also signal some reluctance to

raise taxes to finance transportation

improvements overall. The Greater Boston Chamber

of Commerce and other groups have voiced support

for tax hikes, but the Associated Industries of

Massachusetts, the Massachusetts High Technology

Council, and the Massachusetts Competitive

Partnership have thrown cold water on the idea.

DeLeo signaled in March this year that he wanted

to have a debate on transportation revenues this

fall and then just a few weeks ago several

members of his leadership team indicated a vote

was being planned for next week. But as the date

drew closer the speaker and his leadership team

became more and more wary of moving forward.

Many factors figured into the decision.

Lawmakers from outside Boston expressed concerns

about whether the bill would be too focused on

the MBTA. Gov. Charlie Baker signaled no

willingness to back down on his opposition to a

package of new revenues. And Senate President

Karen Spilka just last week gave no assurances

that the Senate would take up a revenue package

passed by the House, which made lawmakers

already anxious about casting a tax vote even

more nervous that it could all be for naught.

One House lawmaker, who asked to remain

anonymous, welcomed the delay. The person said

lawmakers need more time to listen to the

concerns of their constituents and to deliver a

balanced revenue package that benefits and/or

hurts all parts of the state equally. The

lawmaker said the proposals put forward, dealing

with the gas tax, tolls, rideshare fees, and

other revenue-raising measures, were all fairly

complicated and required time to sort out.

“These things are much more complicated when you

get into the weeds,” the lawmaker said.

DeLeo said his new target is to put a bill out

in January.

“Our commitment to the issue is still very

strong, is still there. Our timeline is just

going to be a little different than we initially

perceived it to be,” said Michlewitz.

Chris Anderson, the president of the

Massachusetts High Technology Council, a

business group that sees no need for a major

transportation revenue bill, seemed to sense

early Thursday – before the speaker’s

announcement – that the wind was changing on

Beacon Hill.

“The legislative leadership is listening to a

lot of the perspectives that we and others have

been providing them,” he said on a taping of the

CommonWealth Codcast that will be posted Sunday.

“The key is a pending transportation bond bill

that has a nearly $20 billion, 5-year spend and

includes a revenue component that would be

targeted at some environmental benefit. That is

the message that’s causing the House to rethink

the timing of when they take up what otherwise

looks like a rush to judgment on a gas tax

bill.”

Anderson said waiting until next year to debate

transportation revenues would give lawmakers

time to act on the governor’s bond bill and to

see how much progress is being made on the

transportation climate initiative, a multistate

effort to place a charge on the carbon contained

in automobile fuels. The participating states

are expected to sign a memorandum of

understanding next month. Baker has pledged to

direct half of the money raised by the

initiative to public transit and the MBTA.

Anderson said lawmakers also need more time to

assess the political fallout of raising the gas

tax for lawmakers representing communities

bordering New Hampshire.

After DeLeo’s announcement, the High Tech

Council issued a statement saying it was wise

“to avoid any rush to revenue… The size of the

tax, toll, and fee proposals advanced by some

advocates are too large and the scope of their

potential impact is too broad to move forward in

anything but a methodical and data-driven way.

We look forward to working with the Speaker and

other legislative leaders to advance the most

innovative and impactful solutions to our

transportation challenges throughout the

remainder of the 2019-20 legislative session.”

Stephen Brewer, who was chairman of the Senate

Ways and Means Committee during the last major

tax debate in 2013, said in a phone interview

that legislative leaders will need to count

votes, and it is especially important to have

adequate support to override the governor if he

is inclined to veto the bill.

“There’s nothing worse than taking a tax vote

and not having it become law,” Brewer said.

“It’s tough enough to take one. But if you take

one and you’re on record and you didn’t get the

revenues for it, then you lose twice.”

Rep. William Straus, the House chairman of the

Transportation Committee, said the legislation

would likely provide a funding stream for the

annual disbursement of local road repair money

known as Chapter 90. Though he said there is no

set proposal yet, Straus said the bill is

unlikely to create a new governance structure

for the MBTA whose Fiscal and Management Control

Board is due to expire in less than a year.

Jim Rooney, the president and CEO of the Greater

Boston Chamber of Commerce, who coordinated a

discussion in the business community on

transportation revenues and supported a fairly

aggressive package of proposals, blamed the

House pullback on geographical politics. He said

support for a transportation revenue package is

fairly strong in and around Greater Boston but

less strong in other parts of the state.

“The selling of it is dealing with the

perception that it’s a Boston package, that it’s

all about the T,” he said.

Rooney said he still believes a transportation

bill will pass the House next year, but he says

it will be tougher to pass in an election year

and the likelihood is strong it will be far less

ambitious than if it was done this year.

Straus dismissed the notion that the delay would

result in a watering down of the proposal.

“I don’t think it does justice to the members or

their constituents to think that a vote-taking

in November versus a vote-taking in January

changes any of the underlying policy or even

political ramifications,” Straus said. “I think

that you have to give a lot more credit to

everybody in this.”

As the House put off action on a transportation

bill, a new poll indicates 71 percent of voters

think “action is urgently needed to improve the

state’s transportation system” and 77 percent

support new revenues to invest in

transportation. But there was little unanimity

among those polled for which revenues to use for

transportation investments. According to the

poll, 51 percent of voters support a hike in

ride-hailing fees, 50 percent back new tolls at

the state’s borders, and 43 percent support new

tolls on I-95 and I-93.

The poll indicated 62 percent of voters support

the so-called transportation climate initiative,

which would raise the price of gasoline by

assessing a fee on fuel wholesalers and using

the proceeds from the fee to make investments in

transportation. Only 49 percent of voters

favored raising the gas tax by 5 cents three

years in a row, and only 43 percent backed

raising the tax 15 cents all at once.

State House News Service

Wednesday, November 13, 2019

Budget Holdup Blocking $20 Mil CPA Fund

Distribution

By Colin A. Young

Cities and towns across Massachusetts are about

to feel a real consequence of the Legislature's

inability to close the books on the fiscal year

that ended in June.

On Friday, the Department of Revenue is due to

make its annual distribution of matching funds

to cities and towns that raise revenue through

the Community Preservation Act but an extra $20

million that the Legislature directed to the CPA

Trust Fund won't be part of the payout.

When it passed a compromise fiscal 2020 budget

in July, the Legislature included a provision

directing the state comptroller to transfer $20

million from the fiscal 2019 surplus to the CPA

Trust Fund as a way to bridge the gap until new,

higher fees funding the CPA Trust Fund kick in

next year.

But because the House and Senate have not been

able to resolve their differences on a

supplemental budget that would allow the

comptroller to finalize surplus transfers, that

$20 million has not yet been deposited into the

trust and CPA communities will instead receive a

state match of just 11 percent of what they

raised in property tax surcharges.

Instead, DOR said its Division of Local Services

will process the state match based on the money

currently available in the trust fund on Friday.

Whenever the surplus funds become available and

are transferred into the CPA Trust Fund, DOR

plans to recalculate the state match and provide

cities and towns with a second slice of the pie,

the department said.

The more-than-$700 million supplemental budget

bill has been hung up between the House and

Senate for weeks and neither side has shed

insight on the holdups or when a final bill

might emerge. Whenever it does get done, this

year's close-out bill will be finalized later

than any year since at least 1995.

State House News Service

Thursday, November 14, 2019

Cost of Budget Delay Surpassing $1 Million

By Colin A. Young

Having watched another week go by without

finalizing budget work left over from fiscal

year 2019, the House and Senate now stand to

forfeit more than $1 million in interest that

the state could have earned had lawmakers

completed their work on time.

The Legislature's inability to agree on a bill

closing the books on the fiscal year that ended

in June is keeping Comptroller Andrew Maylor

from filing an annual report, which he was

statutorily due to file by Oct. 31. And with the

branches at loggerheads over the supplemental

budget, hundreds of millions of dollars in

fiscal 2019 surplus funds are sitting in the

General Fund waiting to be transferred to the

Stabilization Fund.

In late October, Maylor told the Legislature

that if he was able to file his report by

Friday, Nov. 15, the state will have lost out on

more than $500,000 in interest and would lose

out on at least $30,000 more each day after the

15th until he is able to file the report and

make the transfer.

But it will take Maylor's office about 14 days

-- or $420,000 in foregone interest -- from the

time Gov. Charlie Baker eventually signs the

supplemental budget bill to be ready to file his

report, he said. So if the Legislature enacts

the bill at the next chance it has, Monday, and

the governor signs it immediately, Massachusetts

will have lost out on $1.01 million in interest

payments by the time all is said and done.

"I realize that in the context of the state

government spending that this amount may not

seem important, but as a taxpayer and someone

who spent more than 25 years in local

government, that sum is meaningful," the

comptroller wrote to the governor and

Legislature in late October, when the estimate

of forfeited interest was only $500,000.

The money is still earning interest in the

General Fund, Maylor's office told the News

Service, but the state is losing out on the

additional interest that money could be making

because a portion of the Stabilization Fund is

invested in CDs at local banks, which earn

higher yields than the General Fund.

Maylor's office said it plans to provide a more

precise estimate of the interest the state has

forgone once the supplemental budget bill is

enacted and the transfer is completed.

Among the spending being held up in the

supplemental budget is a $50 million outlay to

accelerate MBTA improvements, an additional $17

million in local scholarships, nearly $2 million

for special education circuit breaker costs,

$2.4 million for regional school transit and $2

million more for transportation costs for

homeless students.

With the books still open on fiscal 2019 the

Department of Revenue on Friday will make its

annual distribution of matching funds to cities

and towns that raise revenue through the

Community Preservation Act but the extra $20

million that the Legislature directed to the CPA

Trust Fund won't be part of the payout because

it is tied up in the budget bill. The same goes

for $10 million that the Legislature directed to

the Massachusetts Life Sciences Investment Fund.

That money will only become available once

fiscal 2019 is officially closed out.

The impasse raises questions about relations

between House Speaker Robert DeLeo and Senate

President Karen Spilka, whose first-time budget

chiefs, Rep. Aaron Michlewitz and Sen. Michael

Rodrigues, were the last in the nation to agree

on an annual state budget this summer. In

addition to disagreements over the content of

the bills, the two sides have been sniping over

a procedural issue delaying the already

late-arriving bill.

"We're waiting for them to deal with it. But the

urgency is there," Rodrigues said two weeks ago.

He later added, "Right now, we sent to the House

our version of the supp budget. So we're waiting

for them to figure out what they want to do with

it."

While both branches adopted a version of the

supplemental budget bill, the Senate used a

somewhat rare, but not unprecedented, procedure

of advancing the legislation in a new bill

rather than as a strike-and-replace amendment to

the House's existing version. Having two

vehicles (H 4132/S 2386) for the supplemental

budget means one of the branches would have to

bring it back to the floor for a second vote.

"I know that they have their thing, they've

added some, you know, almost like a new bill,"

House Second Assistant Majority Leader Paul

Donato said of the Senate two weeks ago. "We

have ours. So I'm not sure how we're going to

straighten it out."

Lawmakers have appeared unfazed by the inability

to wrap up the fiscal year that ended 138 days

ago, although the protracted process is cutting

into the amount of time legislative leaders have

to focus on other issues. The Legislature often

procrastinates, leaving many important decisions

to be made in a frenzy every other July.

State House News Service

Friday, November 15, 2019

Poll: Voters Split on Key Transpo Revenue Ideas

By Chris Lisinski

Massachusetts voters support raising new revenue

to make transportation investments, but a new

poll shows they are divided over some of the key

methods that lawmakers are weighing to generate

funding.

|

|

|

CLICK GRAPHIC TO ENLARGE |

While

registered voters showed some support for other

strategies such as increasing fees on ride-share

services, a poll of 600 registered voters,

released Friday by the MassINC Polling Group,

revealed a split reception to a phased-in gas

tax hike and majority opposition for a larger,

all-at-once increase.

House leaders, who this week agreed to delay

their planned fall debate until at least

January, have said bumping up the state's

24-cent-per-gallon gas tax will likely be a

central component of the eventual package,

arguing that every penny increase leads to

another $35 million in revenue.

Gov. Charlie Baker opposes any gas tax hike, and

the threat of his potential veto means

legislators will likely need two thirds majority

support in both chambers to enshrine an increase

in state law.

Lawmakers last increased the state's gas tax in

2013 by 3 cents. They also indexed it to

increase alongside inflation, but voters

repealed that measure by a ballot question one

year later.

Forty-nine percent of voters in MassINC's latest

poll, which was sponsored by the Barr

Foundation, supported raising the gas tax 5

cents three separate times over a six-year

period, compared to 47 percent who opposed the

idea and 5 percent who said they were undecided.

When asked about a single 15-cent increase, 52

percent opposed the idea and 43 percent

supported it.

A MassINC poll conducted in August found 68

percent of respondents against a gas tax

increase.

Despite their lack of enthusiasm for gas tax

hikes and for expanding roadway tolls to

highways that do not currently have them, voters

surveyed backed several revenue-generating ideas

that have been floated on Beacon Hill.

Nine of the 14 specific ideas researchers asked

about during the Nov. 6-7 polling period

received more support than opposition, seven of

those by double-digit margins.

"As lawmakers tackle transportation funding for

the second time this decade, most voters are on

board with the need for both action and more

revenue," MassINC researchers wrote in a report

explaining the poll results. "Despite different

regions experiencing transportation stresses in

different ways, there is widespread acceptance

of the need to do something — and support for

some ways, at least, of raising more money to do

it."

The most popular strategy in MassINC's latest

poll was collecting contributions from real

estate development projects that are located

near major highways or public transit and

directing the money toward the infrastructure.

There was 73 percent support for that idea and

only 18 percent opposition.

Voters were interested in the Transportation and

Climate Initiative, a cap-and-invest system

Massachusetts leaders are developing alongside a

dozen other states that will likely increase

prices at the pump and reduce carbon emissions.

Sixty-two percent said they support the program,

compared to 30 percent who do not.

Fifty-six percent of those polled backed a

"managed lane" system where existing lanes would

be converted to tolled so that some drivers

could pay for a faster trip. Thirty-five percent

opposed that proposal. Gov. Charlie Baker has

expressed interest in a similar idea, though

cautioned that it would not be possible to

convert free lanes into priced ones.

Voters also endorsed imposing tolls at state

borders 50 percent to 41 percent and, with 51

percent support and 38 percent opposition,

increasing trip fees on transportation network

companies such as Uber and Lyft.

They were split on the proposal of congestion

pricing, where tolls are altered to affect

commuting behavior: a large majority supported

reducing tolls at off-peak times, while only 46

percent supported increasing those prices at

rush hour.

A range of stakeholders have called on lawmakers

to address ubiquitous traffic congestion and an

aging transit network, particularly in the wake

of an MBTA derailment that imposed months of

delays and chronic traffic congestion problems

in Massachusetts.

MassINC's poll found 71 percent of respondents

agreed that "action is urgently needed to

improve the state's transportation system."

Seventy-seven percent strongly or somewhat

supported the general push for new

transportation revenue compared to 15 percent

who were opposed.

However, 49 percent of respondents also said

they believe the state has the money it needs

for transportation and only needs to spend it

well compared to 39 percent who said more money

is necessary regardless.

Democratic House leadership said for months they

planned to take up the topic this fall, but

House Speaker Robert DeLeo told the News Service

Thursday the debate would now take place in

early 2020.

Full MassINC Poll Results

State House News Service

Friday, November 15, 2019

Weekly Roundup - Changing Minds

Recap and analysis of the week in state

government

By Matt Murphy

In the Veterans Day shortened week, House and

Senate Democrats got no closer to agreeing on

how to spend over $700 million in surplus

revenue from fiscal 2019, which ended July 1.

But with three days of sessions left, House

Speaker Robert DeLeo did lighten the pre-recess

load in one big way.

The speaker said he's decided to push off a

debate over new transportation revenues until

January, requiring more time to take feedback

from members and outside interest groups before

deciding on a package that is widely expected to

include a hike in the gas tax.

"We decided that it's better that we try to get

this right than to try to comply with, I guess

you could say, a somewhat arbitrary deadline,"

DeLeo told the News Service.

DeLeo and Ways and Means Chairman Aaron

Michlewitz said the resolve to tackle taxes is

not wavering, but they just want more time to

listen to legislators who have suddenly become

more "engaged" in the debate.

The decision to postpone, however, is fraught

with political implications, as January turns

into February and lawmakers start pulling papers

to run for re-election and voting on tax hikes

starts to look less appealing.

A new MassINC poll, in some ways, backed up the

speaker, demonstrating how split 77 percent

support for new transportation revenue can

become when you start trying to parcel out how

that revenue will be generated.

Real estate fees topped the list, while Logan

Airport access tolls and increased registry fees

were the least popular options with voters.

A phased-in 15-cent gas tax hike, like the one

backed by the Greater Boston Chamber of

Commerce, polled 49-47.

"We got closer and more things to consider at

the same time," Transportation Committee

Chairman William Straus said about the past few

weeks.

The

Boston Herald

Wednesday, November 13, 2019

A Boston Herald editorial

Taxpayers shouldn’t be on hook for T plans

Congratulations, fellow Massachusetts taxpayers:

We’re millionaires.

At least that’s how state agencies see us —

deep-pocketed and willing to foot $75B worth of

overhauling, repairing, maintenance and

improvement transportation projects.

As the Herald’s Sean Philip Cotter reported, the

state’s letter to Santa includes a potential

$28.5 billion option to overhaul the Commuter

Rail that already got a partial high sign from

the MBTA’s oversight board; the Green Line

extension; and billions in long-overdue

maintenance fixes to get the Department of

Transportation and the MBTA up to a normal state

of repair. There’s a plan to straighten the Pike

in Allston for $1.2 billion, and other highway

fixes aimed at reducing congestion and repairing

neglected roads and bridges.

We’re Santa.

There’s nothing wrong with grand ideas, and some

of the proposed projects sound great — there’s

the North-South Rail Link tunnel that would run

under downtown, long talked about, and which

would be a boon to commuters. And the T plans to

knock down that state-of-good-repair backlog,

thank heaven.

But here is where the agencies voting “aye” on

these grand plans need to heed the advice of the

inestimable Mick Jagger and Keith Richards: “You

can’t always get want what you want.”

Jagger, for the record, attended the London

School of Economics.

According to the U.S. Census, the median per

capita income in Massachusetts from 2013 to 2017

was $39,913. Some make much more, some make much

less. But for most of us, life includes a

budget, which needs to be adhered to.

It’s never a case of “let’s take two luxury

vacations this year, and buy a new car, then put

a new roof on the house,” but we — and here’s a

concept transportation agencies might want to

acquaint themselves with — put things on the

back burner for when we can afford them. Maybe

that’s in a few years, maybe more. Maybe never,

sometimes a wish list is just a wish list.

That’s the tack taken by government watchers,

who say it’s time to start picking and choosing

transportation projects.

“There is no foreseeable way that Massachusetts

would be able to spend $75 billion on

transportation over the next decade,” said

former Inspector General Greg Sullivan, now of

the Pioneer Institute. “We have to be thinking

about dollars and cents — including common sense

— in terms of how to ameliorate traffic

congestion.”

Paul Craney of the Massachusetts Fiscal Alliance

said, “The number is so high that it’s hard to

fathom — it’d make the Big Dig look minuscule.”

The Boston business group A Better City is

pushing for $50 billion in spending over the

next 20 years, including several of the

above-mentioned projects — and they have ideas

on how to get the money.

A Better City is advocating pumping up the gas

tax by 11.5 cents a gallon — a 46% increase —

along with new fees on ride-hailing services and

toll increases. The group also advocated for

rising Registry of Motor Vehicle fees and adding

new taxes on traded-in vehicles.

And where is the plan to increase the paychecks

of Massachusetts taxpayers? Has someone devised

a strategy to lower the cost of food, rent,

utilities and other expenses Bay State residents

have to pay, in addition to these new taxes and

fees?

Santa doesn’t always bring presents, and

Massachusetts taxpayers can also deliver our own

lumps of coal — at the voting booth.

WBSM AM-1420

Friday, November 15, 2019

Vote on gas hike wisely delayed

By Barry Richards

Massachusetts voters have had enough of the

corruption that exists on Beacon Hill;

therefore, it was a wise move by the legislative

leadership to delay a vote on a hefty gas tax

increase until after the holidays.

Lawmakers are proposing several measures to

raise the gas tax. One would phase in a

15-cent-per-gallon increase in three equal

increments. Another would increase the 24-cent

tax by 15 cents per gallon all at once. I'll

take neither.

Governor Charlie Baker opposes any gas tax

increase. Perhaps he remembers that when the

Legislature raised the tax several years ago,

voters organized and immediately repealed it in

the very next election.

House Speaker Robert DeLeo and Senate President

Karen Spilka support the gas tax hike as a means

of funding transportation projects. Taxpayers,

meanwhile, see billions of dollars of their

hard-earned money being wasted annually and do

not support increasing the tax.

Those who commute into or out of Boston daily

are demanding something be done about the

failing subway, rail and highway systems as they

should. But most of us don't commute to Boston

or regularly use the rail, subway and highway

systems in the Boston area, and don't feel we

should have to share in the cost of upgrading

them. Boston doesn't share economic development

with the rest of the state, so why should we pay

for its infrastructure?

Southeastern Massachusetts is denied a casino.

We have no train connection to the state

capital. Hell, we were even called "the end of

the universe" when it came time to siting a

high-tech center.

The power brokers keep stuffing all of the

golden eggs into Boston at the expense of the

rest of the state, so let them figure out a way

to pay for the needed transportation upgrades.

We paid for the Tip O'Neil Tunnel with money

that was diverted away from local transportation

projects. What did we get in return? Nothing.

When they begin treating the rest of the

Commonwealth's citizens as equal partners, then

perhaps I'll listen to their calls for new taxes

to pay for their transportation needs. Until

then, you're on your own, bro.

— Barry Richard

is the host of The Barry Richard Show on 1420

WBSM New Bedford. He can be heard weekdays from

noon to 3 p.m.

The

Boston Herald

Friday, November 15, 2019

A Boston Herald editorial

Lawmakers in no rush to vote

Massachusetts lawmakers do the work of the

people — and we are very lenient employers,

apparently.

Who else would let workers put in light days and

leave tasks unfinished?

The House has until next Wednesday to wrap up

pending legislation before it breaks for winter

recess, but you wouldn’t know an important

deadline was looming if you sat in at

yesterday’s session. According to a State House

News Service session summary, the House convened

at 11:05 a.m., and members, staff and guests

recited the Pledge of Allegiance.

Good start.

Next they adopted several congratulatory

resolutions. Well, even the greatest singers

need to warm up.

Then they rolled up their sleeves and got to

work: concurring with a Senate referral from

June to the Committee on Public Health of a

petition relative to HIPAA standards; referring

a petition relative to motorized shopping carts

in food stores and shopping clubs to the

Committee on Consumer Protection and

Professional Licensure, and a petition naming

two bridges in Woburn to the Committee on

Transportation.

Dennis is closer to getting a Department of

Municipal Finance, ditto the tweaking of sewer

regulations in Auburn, and the Canvas n’ Cup in

Milford is getting an additional license for

wines and malt beverages to be drunk on the

premises.

And they were done for the day, in less time

than it takes to cook a frozen pizza.

There are three bills circling for a landing in

conference committee — on funding for education,

children’s health and a ban on driving with a

handheld cellphone.

But surely they took steps to advance

legislation on funding for transportation

infrastructure? House Speaker Robert DeLeo

himself earmarked fall as debate time for new

transportation revenue.

Not so fast. Actually, not fast at all.

According to State House News, DeLeo said he is

pushing the funding debate into the new year,

after consulting with his budget chief, Rep.

Aaron Michlewitz, and other key chairmen.

“After reviewing this with myself, the chairman

(Michlewitz), Chairman (Mark) Cusack and

Chairman (William) Straus, we decided that it’s

better that we try to get this right than to try

to comply with, I guess you could say, a

somewhat arbitrary deadline,” DeLeo said.

That “arbitrary” deadline was signaled by DeLeo

and other House leaders in the spring.

The Legislature is set to recess on Nov. 20, and

resume formal sessions in January. And it’s

possible that when it meets early next week it

could pull all-nighters and hammer out

significant legislation. You never know.

But with DeLeo’s brooming of the transportation

funding debate into, essentially, a new decade,

one can’t help but be struck by a certain lack

of urgency.

The House and Senate will meet in informal

sessions through December, but anything that

requires a roll call vote has to wait.

Winter won’t wait. Neither will snow, and

commuting on the T during storms, nor driving on

Boston’s congested streets, narrowed further by

freshly plowed drifts.

Legislation isn’t like wine — it isn’t supposed

to age until its flavor develops. Doing the work

of the people means delivering results in a

timely manner.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

BACK TO CLT

HOMEPAGE

|