CLT News Release

Monday, April 22, 2019

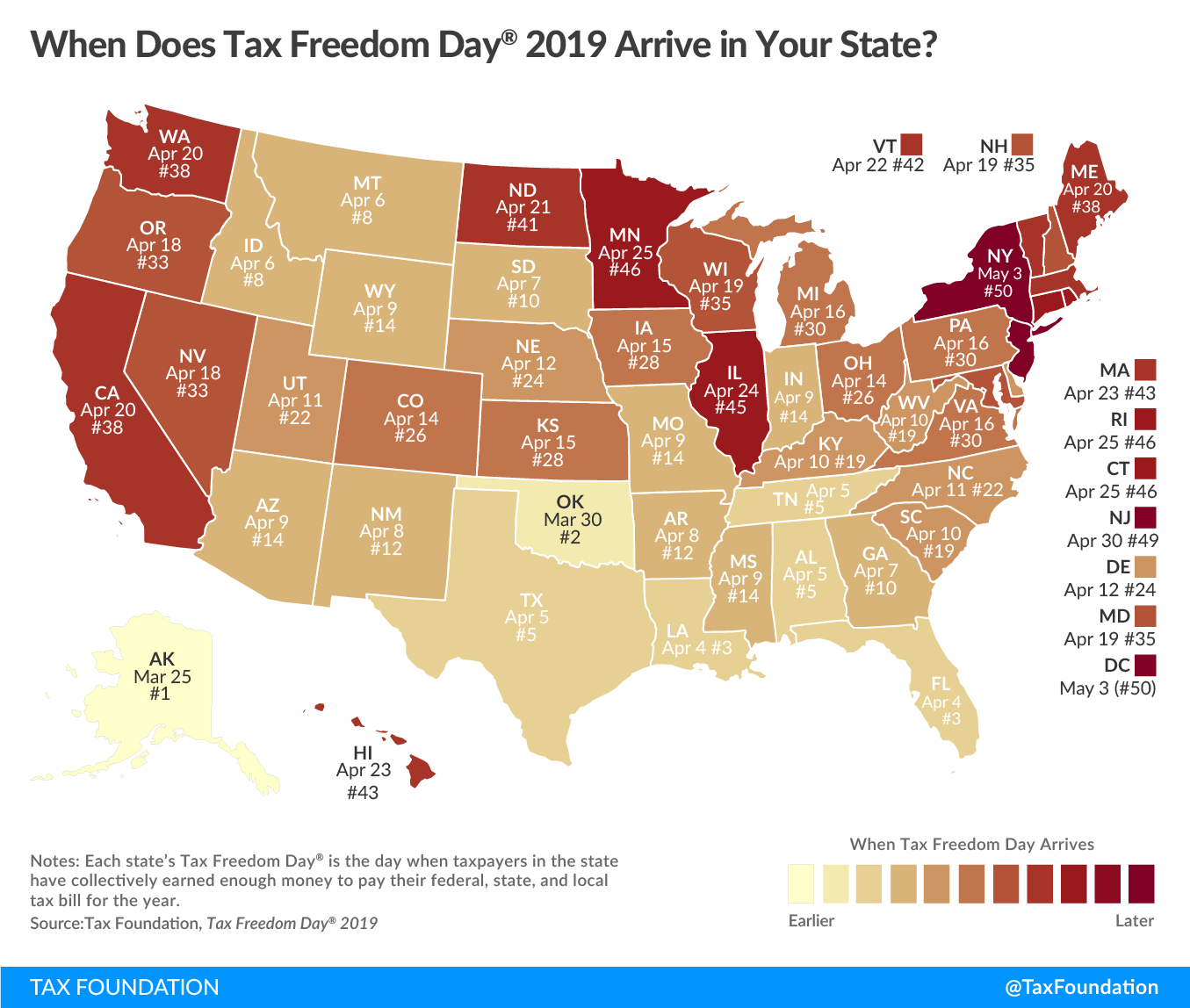

Tomorrow is Tax Freedom Day in Massachusetts

(#43 nationally)

|

Background

What Is Tax Freedom

Day?

Tax Freedom Day® is the day

when the nation as a whole has earned enough money to pay

its total tax bill for the year. Tax Freedom Day takes all

federal, state, and local taxes and divides them by the

nation’s income. In 2019, Americans will pay $3.42 trillion

in federal taxes and $1.86 trillion in state and local

taxes, for a total tax bill of $5.29 trillion, or 29 percent

of national income. This year, Tax Freedom Day falls on

April 16, or 105 days into the year.

Tax Freedom Day 2019 is April 16th

Tax Foundation - April 10, 2019

When Is My State’s Tax

Freedom Day?

The total tax burden borne by

residents of different states varies considerably due to

differing state tax policies and the progressivity of the

federal tax system. This means that states with higher

incomes and higher taxes celebrate TFD later: New York (May

3), New Jersey (April 30), and Connecticut (April 25).

Residents of Alaska will bear the lowest average tax burden

in 2019, with Tax Freedom Day arriving on March 25. Also

early are Oklahoma (March 30), Florida (April 4), and

Louisiana (April 4).

Tax Freedom Day 2019 is April 16th

Tax Foundation - April 10, 2019

Tax Freedom Day in 2018 and

2019 was five days earlier than it was in 2017, in large

part due to the recent federal tax law, the Tax Cuts and

Jobs Act.

Tax Freedom Day 2019 is April 16th

Tax Foundation - April 10, 2019 |

|

CLT News Release

Tomorrow, April 23, is finally Tax Freedom

Day in Massachusetts.

According to the Washington, DC-based Tax

Foundation, nationally on average this year taxpayers worked

just to pay the costs of government the entire first 105

days.

Massachusetts taxpayers will work an

additional week – 112 days – just to fund the costs

of government. This extra week of laboring to satisfy

government demands is due to higher state and municipal

taxes.

As always, Massachusetts ranks at near-bottom

of the 50 states, with one of the latest dates taxpayers

cease working entirely for government and begin working for

themselves and their families. This year’s report ranks the

Bay State tied with Hawaii at 43rd-latest. Only taxpayers

in six states (and the District of Columbia) are liberated

from tax confiscation even later than in the Massachusetts.

The Tax Foundation annually calculates the

day taxpayers stop working entirely just to pay off their

tax burdens. The Foundation produces both a national

average and a breakdown by each state for comparison.

The Tax Foundation states: "In calculating

Tax Freedom Day for each state, we look at taxes borne by

residents of that state, whether paid to the federal

government, their own state or local governments, or

governments of other states. Where possible, we allocate tax

burdens to each taxpayer’s state of residence."

|

Latest State Tax

Freedom Day 2019 |

|

Ranking |

State |

Date |

|

#43 (tied) |

Hawaii |

Apr 23 |

|

#43 (tied) |

Massachusetts |

Apr 23 |

|

#45 |

Illinois |

Apr 24 |

|

#46 (tied) |

Connecticut |

Apr 25 |

|

#46 (tied) |

Minnesota |

Apr 25 |

|

#46 (tied) |

Rhode Island |

Apr 25 |

|

#49 |

New Jersey |

Apr 30 |

|

#50 (tied) |

District of Columbia |

May 3 |

|

#50 (tied) |

New York |

May 3 |

CLICK IMAGE

BELOW TO ENLARGE

Tax Foundation

Tax Freedom Day 2019 is April 16th

FULL REPORT

|

While some in the Legislature want to increase taxes or add more during

the House budget debate this week and beyond, it is most important to

recognize that the commonwealth does not have a lack of revenue.

The problem is an insatiable spending addiction. One stark example is

the indefensible over-spending on transportation infrastructure.

The latest Reason Foundation

Annual Highway Report ranks Massachusetts as 44th worst state for

profligate highway spending — 390% above the national average.

In the table below, using data from

the Reason Foundation report, CLT selected and compared Massachusetts

with New Hampshire (and included the national average). They are New

England states which share a common border and a similar climate.

It should be recognized that New

Hampshire has neither a state income tax nor sales tax.

|

Capital and Bridges Disbursements per

State-Controlled Mile |

|

Massachusetts |

$299,246 |

|

New Hampshire |

$77,762 |

|

National Average |

$91,992 |

|

Maintenance Disbursements per

State-Controlled Mile |

|

Massachusetts |

$80,573 |

|

New Hampshire |

$59,215 |

|

National Average |

$28,020 |

|

Administrative Disbursements per

State-Controlled Mile |

|

Massachusetts |

$77,086 |

|

New Hampshire |

$21,594 |

|

National Average |

$10,864 |

|

Total Disbursements (including bond principal

and interest, etc.)

per State-Controlled Mile |

|

Massachusetts |

$695,443 |

|

New Hampshire |

$197,468 |

|

National Average |

$178,116 |

|

Source: Reason Foundation Policy Study No.

457, February 8, 2018, "23rd Annual Highway Report — The

Performance of State Highway Systems"

https://reason.org/wp-content/uploads/2018/01/23rd_annual_highway_report.pdf |

CLT executive director Chip Ford noted: “’Tax Freedom Day’ arrives late

as usual in Massachusetts, this year a week after the national average.

Objective evidence such as the Reason Foundation’s annual highway report

dispassionately proves that Massachusetts doesn't have a revenue

problem ― it doesn't need to keep raising taxes and creating new ones.

The players on Beacon Hill have an insatiable appetite for spending ever

more with abandon, without consideration of taxpayers who provide every

cent.”

#

# #

Citizens for Limited Taxation ▪ PO

Box 1147 ▪ Marblehead, MA 01945

▪ (781) 639-9709

|