Today at 1:00 p.m.

(State House Hearing Room B-1) CLT Communications Director

Chip Faulkner will appear and testify before the Joint

Committee on Revenue in opposition to H1618,

"An Act relative to income tax rates." It is sponsored

by Reps. Denise Provost (D-Somerville), Jonathan Hecht

(D-Watertown), Mary Keefe (D-Worcester), and Mike Connolly

(D-Cambridge). The sponsors hope to halt the income tax

rollback where it is, at 5.1 percent.

Chip Faulkner will deliver the following opposition

testimony to members of the committee.

Déjà vu all over again

Tuesday, June 6, 2017

To: Members of the Joint Committee on Revenue

Re: H1618, "An Act relative to income tax rates"

How many times must taxpayers shout “NO!” before those who claim to

“represent” finally hear their constituents?

Yet here we are, again, needing to remind – or introduce – some of them

of what passed before, that which they either missed or have chosen to

ignore.

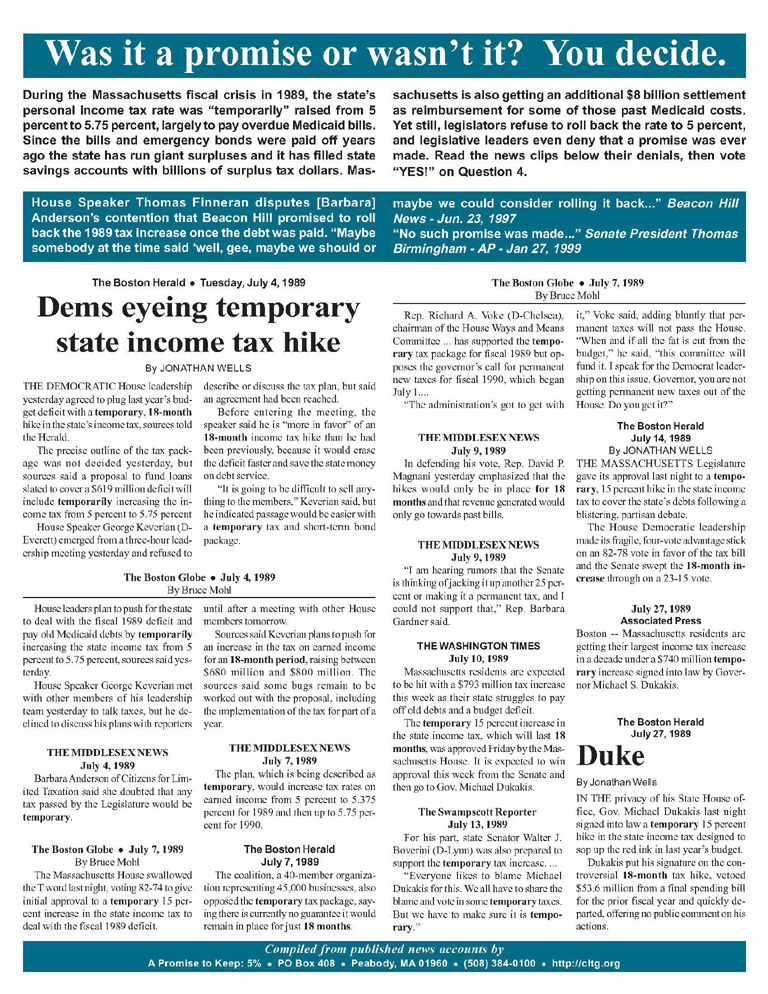

In

1989, following the failed Dukakis for President campaign, he and the

Legislature recognized it had led the state into a “fiscal crisis.” The

solution of course was a massive tax hike. The only palatable way to

accomplish this was to promise it was “temporary,” for “only 18 months.”

(See attached contemporaneous news quotes, and Telegram & Gazette

editorial.)

That legislative promise went unfulfilled, unkept for a decade, until

CLT and fed up taxpayers took the matter into our own hands. We

collected the signatures and put the promised rollback on the 2000

ballot. Voters mandated — by an overwhelming vote of 59% — that the

income tax would be incrementally rolled back in three steps by 2003 to

its historic 5%.

But in 2002 legislative over-spending had driven the state into

another “fiscal crisis.” The solution to fund its $23 billion

budget (just fifteen years ago!) was to defy the voters and “freeze”

their mandate at 5.3%, and instead create an arcane formula based on

economic “triggers” that would continue the rollback – eventually.

Over the ensuing fifteen years, that formula unavoidably rolled

back the income tax rate to its current 5.1% – twenty-eight years

after the Legislature promised the income tax hike would be “temporary,”

would last “only 18 months.”

And here we are, again, with the latest scheme to deny taxpayers and

voters what was promised by the Legislature TWENTY-EIGHT YEARS AGO –

what was mandated by the voters SIXTEEN YEARS AGO.

We

wonder what part of the Legislature’s promise and the voters’ mandate

the sponsors don’t comprehend? We hope you do, and reject this affront.

Download “The Promise” PDF

here:

The

Worcester Telegram & Gazette

June 12, 2002

Editorial: Tax talk

Unlike the Massachusetts Legislature, lawmakers in most states

are addressing the post-recession revenue crunch without massive

tax hikes.

The $23.2 billion spending plan the Senate is debating this week

makes significant cuts in some areas, but its centerpiece is the

$1.2 billion increase in taxes and fees, the biggest in state

history. In a year of budget austerity, the Senate proposes a

$332 million rise in spending.

The recession has affected virtually every state. Yet all but a

handful of the 20 most populous states have avoided broad-based

tax hikes, according to the Nelson A. Rockefeller Institute,

which tracks local and state government policy. It reports that

governors and legislatures elsewhere are finding other ways to

close revenue gaps.

A case in point: California -- with a budget four times as large

as Massachusetts' and a revenue gap 10 times as large -- seeks a

comparatively modest $2 billion in tax hikes.

The Massachusetts Legislature, compounding the offense, is

nullifying two tax-relief referendums: the rollback of the

"temporary" income tax rate hike and the deduction for

charitable giving. It is counterproductive to raid taxpayers'

pocketbooks just as the economy begins to recover. Moreover,

taxes have a way of lingering in Massachusetts long after their

justification has vanished.

Quizzed by reporters, gubernatorial candidate Thomas M.

Birmingham, who as Senate president is the chief architect of

the tax package, replied deadpan that lawmakers intend to

resume the income-tax rollback and other cuts when the economy

recovers.

Bay State taxpayers, who were fooled when the Legislature

boosted the tax rate by 20 percent during the last downturn, are

justifiably skeptical.