CLT UPDATE

Thursday, February 14, 2013

Huge tax hike needed to fund Gov's malfeasance

|

Perhaps the powers that be on Beacon Hill think

that if they employ the language of fiscal discipline the taxpayers

will continue to buy what they’re selling, even if it’s more

spending amid a “crisis.”

Officials say that because of shortfalls in state

tax collections the fiscal 2013 budget, signed into law last July,

is $540 million out of whack. Gov. Deval Patrick has made

across-the-board cuts in the executive branch, asked other state

agencies to trim their budgets and called for drawing $200 million

out of the rainy-day account (on top of an earlier, $350 million

withdrawal) to make the budget balance.

That’s an accounting problem — not a budget

crisis. Officials overestimated how much revenue they’d collect in

the current fiscal year and underestimated how much they would need

to (or would like to) spend. Such a heavy reliance on reserves is

risky, too.

But there was hopeful news from the Department of

Revenue this week. The state collected $249 million more in January

than it did last year — and $173 million more than forecasters

projected, even after revenues were revised downward in December.

A Boston Herald editorial

Thursday, February 7, 2013

More to the story

Gov. Deval Patrick's ambitious plan to raise $1.9

billion in new taxes is not generating much enthusiasm among

Lowell-area lawmakers who want to reform inefficient programs

instead of raising taxes.

"We need to continue a discussion on reform

before we have a discussion on revenue, and that's the consensus

between my constituents and colleagues," said Rep. Tom Golden,

D-Lowell....

Golden said a top priority for reform should be

eliminating welfare fraud, including EBT card and food-stamp-program

fraud.

"We want to see that every person who needs

assistance gets it, and anyone gaming system gets punished," Golden

said....

Rep. Marc Lombardo, R-Billerica, said the

governor's plan was "absolutely ridiculous," particularly a 19

percent income-tax hike.

"It will hurt hardworking, struggling families,

and it shows how out of touch the governor is with my district," he

said.

Lombardo said the response from his Billerica

constituents was overwhelmingly negative toward the plan.

"The message is clear from my district that

people can't afford any more of a tax increase," Lombardo said....

Sen. Jamie Eldridge, D-Acton, supported the

governor's tax reforms, saying the income-tax increase would mostly

affect wealthy citizens while the sales tax cut would benefit lower

and middle-class citizens....

"There have been cuts across the board, and we

need to restore that with new revenue," Eldridge said.

The Lowell Sun

Thursday, February 7, 2013

Legislators react to Patrick tax plan

With a nearly unanimous vote in the Senate early

Tuesday evening, a $115 million supplemental budget has passed both

chambers, and could be laid before the governor as early as

Thursday.

In addition to shoring up revenues to support

spending and allocating $30 million to deal with the fallout from an

evidence tampering scandal at a state drug testing lab, the bill

also cuts funding to some agencies to help bridge a mid-year budget

gap. The legislation also freezes unemployment insurance rates, an

idea supported by Gov. Deval Patrick.

After voting down several proposals brought up by

Senate Republicans, the Senate passed the bill 36 to 1, with Sen.

Robert Hedlund (R-Weymouth) casting the lone dissenting vote.

Republicans used the bill's journey through the

upper chamber as an opportunity to seek policy changes, including

more stringent residency requirements for people seeking public

benefits, a ban on in-state tuition for people who are not citizens

or permanent residents of the United States, and transferring fraud

prevention efforts at the Department of Transitional Assistance to

the Inspector General’s office.

While the Republican-sponsored amendments were batted down, some

Democrats crossed the aisle on different measures. The proposal to

undo a recent Patrick policy allowing certain students who are not

in the country legally to access in-state tuition rates, was

defeated by a 12 to 25 vote.

State House News Service

State Capitol Briefs

Wednesday, February 13, 2013

Senate approves $115 Mil budget, $200 Mil "rainy day fund" draw

Taxpayers doled out a stunning $3.4 million in

overtime to state workers to fix a massive, multimillion-dollar

glitch in the scandal-plagued welfare department — a revelation

critics say adds insult to injury as the state negotiates with the

feds over how to pay back $27 million in food-stamp overpayments.

More than 900 employees in the Department of

Transitional Assistance — mostly caseworkers — shared in the $3.4

million OT bonanza between November 2010 and May 2011, the

department acknowledged after a Herald public records request.

DTA authorized the wages — an average of roughly

$3,500 each — so staff could address a backlog of 30,000 clients

whose eligibility had to be recertified after the agency overpaid

food-stamp clients by $27 million in federal money....

State Rep. Bruce Ayers (D-Quincy) said, “My

constituents are angry. A lot of them are working two jobs, trying

to make ends meet. ... It shows that the system is broken, and that

steps need to be taken to correct these measures.”

The U.S. Department of Agriculture, which funds

food stamps, has accused DTA of violating federal rules, and the two

agencies are about to enter talks over how to make up the $27

million difference....

Welfare department critics — who failed last week

to strip DTA of fraud-prevention powers and give them instead to the

inspector general, attorney general and state auditor — said

earmarking some of the overspent money to protect taxpayers’

interests is the least DTA can do....

“The governor recently called this leakage — I

would call this an avalanche,” said state Rep. Shaunna O’Connell

(R-Taunton). “This is an astronomical number to pay out in overtime

for outright mismanagement.”

The Boston Herald

Thursday, February 14, 2013

DTA glitch led to OT free-for-all

Records: Taxpayers on the hook for $3.4M

Gov. Deval Patrick challenged Beacon Hill

lawmakers on Wednesday to muster the “political courage” to support

his proposed tax reforms to generate new revenue for transportation

and education investments, casting the decision as one of

generational responsibility.

“We must each of us sacrifice a little today so

that we may all share in a better and stronger tomorrow,” Patrick

told a crowd gathered at the State House for Transportation Day,

sounding a theme he has emphasized often over his six years as

governor and one echoed Tuesday night by President Barack Obama in

his State of the Union address.

The event, designed to introduce the various

state transportation agencies and their programs to lawmakers, comes

as skeptical legislators are being asked by the governor to approve

a menu of tax reform proposals designed to generate $1.9 billion in

new revenue and slightly shift the state’s tax burden off

lower-to-middle income families....

Rep. Colleen Garry, a conservative Democrat from

the New Hampshire border town of Dracut, told a local radio station

this week that she believes the middle class would get “hit again”

by Patrick’s tax proposal, adding that she’s worried Patrick’s plan

is stoking “class warfare.”

“I’ve heard from numerous people and I’m very,

kind of, afraid of the class warfare in the regards to the proposal.

I’ve heard a lot of people say, “Why am I working? The people who

aren’t working are going to have their taxes lowered by the sales

tax,’” Garry said.

Garry said that even though economy is

recovering, many families haven’t fully rebounded from the recession

after draining their savings and, in some cases, tapping into their

retirement funds. “He wants to leave a legacy of improving the

transportation system, improving education, but I don’t think the

average person has the finances at this point to do that,” Garry

said during her appearance Tuesday on WCAP in Lowell....

Patrick indicated that he was open to

compromising on taxes, but suggested he might look unfavorably on a

plan that ratchets down the scope of his proposal should the House

in April come back with a more modest tax hike targeted at just

certain transportation needs....

Rep. Matthew Beaton, a Shrewsbury Republican,

said the conversation about reforming the transportation system

“gets shelved a little too easily.”

“If you want to talk about political courage, why

are we just seeing these proposals for the first time now that he’s

not running for re-election? Why didn’t he run on this?” Beaton

asked.

State House News Service

Wednesday, February 13, 2013

Patrick frames tax, invest plan as proposal requiring "political

courage"

The opening for Gov. Deval Patrick to sell

skeptical lawmakers on his ambitious new tax-and-spending plan

narrowed on Thursday as key House and Senate lawmakers from both

parties seemed to wave the caution flag in front of the governor’s

budget chief.

The House and Senate Ways and Means committees

kicked off public hearings on the fiscal 2014 budget with testimony

from the administration, Constitutional officers and the inspector

general.

But even as Secretary of Administration and

Finance Glen Shor emphasized the urgency of making the governor’s

recommended investments in transportation and education with $1.9

billion in higher taxes, the message emanating from lawmakers was

that Patrick might be pushing for too much, too fast.

“We’re not feeling the ability terribly so much

that everybody can dig even deeper, and quite honestly we hear from

our constituents in that regard, so as we balance this, balance the

spending and revenue, these are the challenges,” Senate Ways and

Means Chairman Stephen Brewer told Shor....

Shor continued, “Simply relying on cuts to

address the challenges of today and tomorrow will not get us there.”

He said reform remains an “enduring focus” of the governor.

House Ways and Means Chairman Rep. Brian Dempsey,

however, expressed reluctance, defending the way the Legislature

navigated the recession with a blend of spending cuts, reserves and

revenue increases, reminding those in the audience that it was only

four years ago that the Legislature approved an increase in the

sales tax.

“I love the governor’s passion around education.

It’s infectious. He has a compelling personal life story….I would

say, however, that over the years we have spent considerable

resources on Chapter 70,” Dempsey said.

Sen. Michael Knapik, a Westfield Republican and

the ranking minority member on the Senate Ways and Means Committee

... also raised the issue of wasted resources from fraud, abuse and

lax oversight in the state’s welfare system, an increasingly common

counter-argument to Patrick’s call for higher taxes.

“I think we’re hard pressed to just hand over

more money unless we’re doing a better job of policing what we

have,” Knapik said, saying his constituents are tired of reading

stories about people getting benefits they don’t deserve....

Dempsey called the DTA report “very troubling for

a variety of reasons,” and said the Legislature felt a sense of

urgency to take corrective action to improve the eligibility

oversight.

Rep. Angelo D’Emilia, a Bridgewater Republican,

said, “I’m glad to hear the chair understands what a problem this

is, because we’re all hearing from constituents.”

State House News Service

Thursday, February 14, 2013

As Patrick presses tax plan, lawmakers wave caution flags

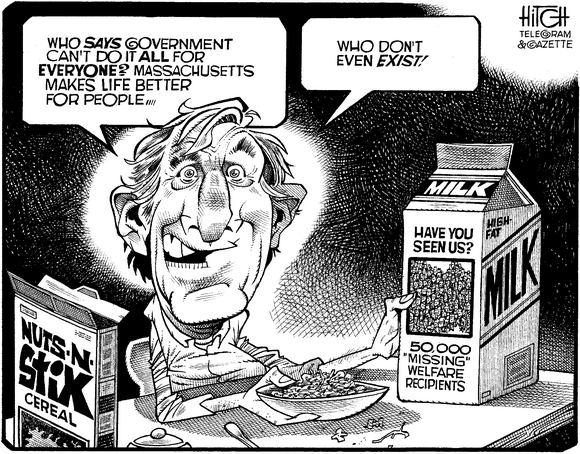

Editorial cartoon by David

Hitch

The Telegram & Gazette

Thursday, February 7, 2013

|

|

Chip Ford's CLT

Commentary

The state welfare program scandal keeps growing,

the cost mounting by the day. The fraud and waste continues

escalating as more is revealed or dragged out kicking and screaming.

It now adds up to well over $200 million — that we now know

about, including:

•

$27 million in food-stamp

overpayments.

• $25

million in taxpayer money is going to welfare recipients who

aren’t eligible.

• $3.4

million in overtime to state workers to fix the mess they

created.

•

$178 million paid through the state’s Health Safety Net

program for patients who failed to prove legal residency,

including illegal aliens, out-of-staters and others who failed

to produce proof of Massachusetts residency.

"The state collected $249 million more in January

than it did last year — and $173 million more than forecasters

projected, even after revenues were revised downward in December,"

the Boston Herald reported. The state took in a quarter-of-a-billion

dollars more from us taxpayers last month than it did in January a

year ago — but still it's not

enough. The governor wants more, more, more — More Is Never Enough

and never will be.

That unexpected $249 million isn't a windfall.

It's maybe enough to pay for just the welfare fraud and

mismanagement.

Then there's the further cost of more scandalous

malfeasance. This week the Legislature appropriated a $30 million

down-payment to begin addressing the evidence-tampering scandal at a

state drug testing laboratory. The state’s taxpayer-funded public

defender agency, the Committee for Public Counsel Services, "estimates

it could need up to $332 million to represent thousands of people

who faced criminal penalties or civil sanctions based on evidence

potentially tainted at the now-closed state drug laboratory in

Jamaica Plain." That's just the cost for defense.

To re-prosecute will require more of our money

too. The Massachusetts District Attorneys Association "said

prosecutors have finalized their budget request and believe they

need $12.7 million for more prosecutors, support staff, and in some

cases, office space and computers, for all Dookhan-related cases."

"Gov. Deval Patrick challenged Beacon Hill

lawmakers on Wednesday to muster the 'political courage' to support

his proposed tax reforms to generate new revenue for transportation

and education investments, casting the decision as one of

generational responsibility," the State House News Service reported

yesterday.

I call it political suicide, and it looks like

many legislators on Bacon Hill —

feeling constituent heat — wouldn't

argue too strenuously with me.

All Patrick left out was "I dare you, I

double-dare you. What are you, too chicken?"

Again Gov. Mini-Me seems to be taking his lead

from President Obama, reading from the same script.

But even many Democrat legislators are distancing

themselves, looking for cover. 'Maybe he's not running for

reelection,' they recognize, 'but we will be next year."

Some Democrat legislators are even reflecting

on the rampant and systemic welfare fraud and abuse, if belatedly.

Again, obviously necessary and effective reforms proposed my

Republicans in the House and Senate earlier this week were crushed by the overwhelming

Democrat majority in both branches. Talk is cheap. When they had the

chance to make a real difference last year, the Democrats defended

EBT card abuse and the welfare system —

in both the

House and the

Senate.

Below is contact information for members of the

House and Senate Joint Committee on Ways and Means. That's where

Patrick's tax-hike bill is now, the first stop in the legislative

process.

I think they'd like to hear of your "grave

concerns" with the governor's proposed Largest Tax Hike in State

History.

Just tell them "Not one dime more."

|

|

|

|

Chip Ford |

|

|

|

|

The Boston Herald

Thursday, February 7, 2013

A Boston Herald editorial

More to the story

Perhaps the powers that be on Beacon Hill think that if they employ

the language of fiscal discipline the taxpayers will continue to buy

what they’re selling, even if it’s more spending amid a “crisis.”

Officials say that because of shortfalls in state tax collections

the fiscal 2013 budget, signed into law last July, is $540 million

out of whack. Gov. Deval Patrick has made across-the-board cuts in

the executive branch, asked other state agencies to trim their

budgets and called for drawing $200 million out of the rainy-day

account (on top of an earlier, $350 million withdrawal) to make the

budget balance.

That’s an accounting problem — not a budget crisis. Officials

overestimated how much revenue they’d collect in the current fiscal

year and underestimated how much they would need to (or would like

to) spend. Such a heavy reliance on reserves is risky, too.

But there was hopeful news from the Department of Revenue this week.

The state collected $249 million more in January than it did last

year — and $173 million more than forecasters projected, even after

revenues were revised downward in December.

Might as well cancel that withdrawal from reserves, right?

Cue the raucous laughter ...

No, yesterday the House went forward with its version of a

supplemental budget, making spending cuts and going along with

Patrick’s call to draw down reserves by $200 million — and calling

for *new* spending of $115 million.

House Ways & Means Chairman Brian Dempsey (D-Haverhill) made a

reasonable case that if officials don’t act now to solve the

shortfall on paper then the problem could worsen. And he cited the

importance of the big-ticket spending items, including $30 million

to defray costs associated with the drug lab scandal.

But there was scant explanation for why funding for homeless

families was $45 million short of the need, or why the agency that

represents indigent criminal defendants is shy $25 million, with the

fiscal year only halfway over.

We respect leadership’s interest in staying on top of a volatile

budget situation.

But if ever there were a time for that rule floated by Republicans

and rejected by Democrats — the one that would require a two-thirds

vote to approve withdrawals from the rainy-day fund — this would be

it.

The Lowell Sun

Thursday, February 7, 2013

Legislators react to Patrick tax plan

By Allison Thomasseau, Statehouse Correspondent

Gov. Deval Patrick's ambitious plan to raise $1.9 billion in new

taxes is not generating much enthusiasm among Lowell-area lawmakers

who want to reform inefficient programs instead of raising taxes.

"We need to continue a discussion on reform before we have a

discussion on revenue, and that's the consensus between my

constituents and colleagues," said Rep. Tom Golden, D-Lowell.

Patrick's plan includes raising the income tax from 5.25 percent to

6.25 percent and doubling personal-tax exemptions while cutting the

sales tax from 6.25 percent to 4.5 percent.

He also wants to raise taxes on cigarettes and gasoline, eliminate

the tax exemption on candy and soda, and extend redemptions on

recycled bottles.

The additional revenue would go toward expanding early-childhood

education, Chapter 70 aid to local schools, and transportation,

including roads and MBTA service and expansion.

After holding a Democratic caucus Tuesday, House Speaker Robert

DeLeo said he has heard "grave concerns" about the plan from his

membership and constituents. Many, he said, feel the changes go

further than what the governor outlined in his State of the State

address last month.

Most Lowell-area legislators fit into that group.

Golden said a top priority for reform should be eliminating welfare

fraud, including EBT card and food-stamp-program fraud.

"We want to see that every person who needs assistance gets it, and

anyone gaming system gets punished," Golden said.

To fix this problem, Golden supports legislation to update the

software that performs background checks on food-stamp applicants.

Rep. Kevin Murphy, D-Lowell, says all reforms need to be exhausted

before raising taxes.

"We have to make sure citizens are convinced that we have done

everything to curb spending," Murphy said.

Murphy supports consolidating agencies, such as housing, education

and the Department of Corrections, to save money and make government

agencies more efficient.

Rep. Marc Lombardo, R-Billerica, said the governor's plan was

"absolutely ridiculous," particularly a 19 percent income-tax hike.

"It will hurt hardworking, struggling families, and it shows how out

of touch the governor is with my district," he said.

Lombardo said the response from his Billerica constituents was

overwhelmingly negative toward the plan.

"The message is clear from my district that people can't afford any

more of a tax increase," Lombardo said.

Sen. Jamie Eldridge, D-Acton, supported the governor's tax reforms,

saying the income-tax increase would mostly affect wealthy citizens

while the sales tax cut would benefit lower and middle-class

citizens.

"Right now Massachusetts is fairly regressive, with the largest tax

burden for working class families. We need to shift up," he said.

Eldridge said the revenue was necessary for transportation reforms

his district needed, such as commuter-rail service, bike and walking

paths and road repairs.

"There have been cuts across the board, and we need to restore that

with new revenue," Eldridge said.

State House News Service

State Capitol Briefs - Lunch Edition

Wednesday, February 13, 2013

Senate approves $115 Mil budget, $200 Mil "rainy day fund" draw

By Andy Metzger

With a nearly unanimous vote in the Senate early Tuesday evening, a

$115 million supplemental budget has passed both chambers, and could

be laid before the governor as early as Thursday.

In addition to shoring up revenues to support spending and

allocating $30 million to deal with the fallout from an evidence

tampering scandal at a state drug testing lab, the bill also cuts

funding to some agencies to help bridge a mid-year budget gap. The

legislation also freezes unemployment insurance rates, an idea

supported by Gov. Deval Patrick.

After voting down several proposals brought up by Senate

Republicans, the Senate passed the bill 36 to 1, with Sen. Robert

Hedlund (R-Weymouth) casting the lone dissenting vote.

Republicans used the bill's journey through the upper chamber as an

opportunity to seek policy changes, including more stringent

residency requirements for people seeking public benefits, a ban on

in-state tuition for people who are not citizens or permanent

residents of the United States, and transferring fraud prevention

efforts at the Department of Transitional Assistance to the

Inspector General’s office.

While the Republican-sponsored amendments were batted down, some

Democrats crossed the aisle on different measures. The proposal to

undo a recent Patrick policy allowing certain students who are not

in the country legally to access in-state tuition rates, was

defeated by a 12 to 25 vote.

The House had sent a similar Republican-sponsored in-state tuition

amendment to study, and the Senate removed the study language from

budget that was passed on Tuesday night. The House and Senate plan

informal sessions on Thursday morning.

The Boston Herald

Thursday, February 14, 2013

DTA glitch led to OT free-for-all

Records: Taxpayers on the hook for $3.4M

By Chris Cassidy

Taxpayers doled out a stunning $3.4 million in overtime to state

workers to fix a massive, multimillion-dollar glitch in the

scandal-plagued welfare department — a revelation critics say adds

insult to injury as the state negotiates with the feds over how to

pay back $27 million in food-stamp overpayments.

More than 900 employees in the Department of Transitional Assistance

— mostly caseworkers — shared in the $3.4 million OT bonanza between

November 2010 and May 2011, the department acknowledged after a

Herald public records request.

DTA authorized the wages — an average of roughly $3,500 each — so

staff could address a backlog of 30,000 clients whose eligibility

had to be recertified after the agency overpaid food-stamp clients

by $27 million in federal money.

“When it costs that much money to correct the problem, that’s an

affront to the taxpayers of the commonwealth of Massachusetts,

frankly,” said state Rep. Jim Dwyer (D-Woburn).

State Rep. Bruce Ayers (D-Quincy) said, “My constituents are angry.

A lot of them are working two jobs, trying to make ends meet. ... It

shows that the system is broken, and that steps need to be taken to

correct these measures.”

The U.S. Department of Agriculture, which funds food stamps, has

accused DTA of violating federal rules, and the two agencies are

about to enter talks over how to make up the $27 million difference.

New Health and Human Services Secretary John Polanowicz has said

they’re working on a settlement that might allow the money to be

reinvested in “additional resources,” including “integrity programs”

to prevent abuse and mismanagement of the welfare system.

Welfare department critics — who failed last week to strip DTA of

fraud-prevention powers and give them instead to the inspector

general, attorney general and state auditor — said earmarking some

of the overspent money to protect taxpayers’ interests is the least

DTA can do.

“Investing those dollars into prevention — that would be something

I’d support,” Dwyer said. “Anything we can do to prevent this from

happening again. We’re at a point right now where it’s total chaos.”

The welfare department has been undergoing a shake-up since

ex-Commissioner Daniel Curley was forced to resign on Jan 31, after

a devastating inspector general’s report claiming another $25

million in taxpayer money is going to welfare recipients who aren’t

eligible.

During the recession, an inundated DTA was overrun by a doubling of

cases and administered food-stamp benefits that jumped by more than

$70 million a month, according to Assistant Health and Human

Services Secretary Marilyn Chase.

But the union representing DTA’s caseworkers said the agency still

hasn’t fixed the problem of overburdened workers.

“We need to increase staffing levels at DTA,” said Susan Tousignant,

the president of SEIU Local 509.

“The governor recently called this leakage — I would call this an

avalanche,” said state Rep. Shaunna O’Connell (R-Taunton). “This is

an astronomical number to pay out in overtime for outright

mismanagement.”

State House News Service

Wednesday, February 13, 2013

Patrick frames tax, invest plan as proposal requiring "political

courage"

By Matt Murphy

Gov. Deval Patrick challenged Beacon Hill lawmakers on Wednesday to

muster the “political courage” to support his proposed tax reforms

to generate new revenue for transportation and education

investments, casting the decision as one of generational

responsibility.

“We must each of us sacrifice a little today so that we may all

share in a better and stronger tomorrow,” Patrick told a crowd

gathered at the State House for Transportation Day, sounding a theme

he has emphasized often over his six years as governor and one

echoed Tuesday night by President Barack Obama in his State of the

Union address.

The event, designed to introduce the various state transportation

agencies and their programs to lawmakers, comes as skeptical

legislators are being asked by the governor to approve a menu of tax

reform proposals designed to generate $1.9 billion in new revenue

and slightly shift the state’s tax burden off lower-to-middle income

families.

He urged people to talk to their neighbors and representatives in

the Legislature about the importance of investing in transportation

and education, suggesting “reform alone” will not deliver for

Massachusetts the type of transportation he says the state needs to

remain economically competitive.

“Help them see the generational urgency of this moment and help them

find the political courage to choose what’s right for our long-term

good instead of just what’s easy for short-term politics,” Patrick

said.

House and Senate leaders are taking a wait-and-see approach toward

the governor’s tax plan as they review the intricacies of his budget

proposal, but few have fully embraced the whole of his plan and some

have knocked it.

Rep. Colleen Garry, a conservative Democrat from the New Hampshire

border town of Dracut, told a local radio station this week that she

believes the middle class would get “hit again” by Patrick’s tax

proposal, adding that she’s worried Patrick’s plan is stoking “class

warfare.”

“I’ve heard from numerous people and I’m very, kind of, afraid of

the class warfare in the regards to the proposal. I’ve heard a lot

of people say, “Why am I working? The people who aren’t working are

going to have their taxes lowered by the sales tax,’” Garry said.

Garry said that even though economy is recovering, many families

haven’t fully rebounded from the recession after draining their

savings and, in some cases, tapping into their retirement funds. “He

wants to leave a legacy of improving the transportation system,

improving education, but I don’t think the average person has the

finances at this point to do that,” Garry said during her appearance

Tuesday on WCAP in Lowell.

Patrick indicated that he was open to compromising on taxes, but

suggested he might look unfavorably on a plan that ratchets down the

scope of his proposal should the House in April come back with a

more modest tax hike targeted at just certain transportation needs.

With the MBTA staring at a $140 million budget gap without another

infusion of funding, the governor and his transportation team have

called for up to $1 billion a year in new funding to be poured into

the system for upkeep and maintenance as well as expansion projects

like the Green Line extension to Medford, South Coast rail, and the

expansion of South Station in Boston.

“The question is, ‘Are we going to do what’s necessary to accomplish

the ends?’ The means, you know, there are a whole host of different

ways of doing it. I’ve proposed one series of ideas and I’m open to

others, but what I’m not open to is doing less than what’s necessary

to assure ourselves a 21st century transportation network and

schools that reach every child,” Patrick told reporters after

delivering his remarks.

When the governor presented his fiscal 2014 budget in January, he

said he would not be willing to accept an increase in the income tax

to 6.25 percent, as he proposed, if it was not packaged with a

decrease in the sales tax to 4.5 percent.

Still, Patrick said on Wednesday it was too early to start drawing

lines in the sand with legislative leaders.

“It’s too soon for that. It’s a fair question but it’s really too

soon for that. I have to respect the legislative process. They have

their process, both on the House and the Senate side. I think what

I’m trying to do is get the members, the leadership and the general

public to focus first and foremost on what it is we all need to

accomplish in transportation and education and not start where we

often do, which is at our rhetorical corners hurling slogans back

and forth.”

Patrick said his generation – the Baby Boom generation – had “lost

our grip” on the idea of building and investing for future

generations. “We started governing for the short term, for the next

election cycle or news cycle. If we are to keep our leading edge

economically we in our time have got to turn that around,” Patrick

said.

Rep. Matthew Beaton, a Shrewsbury Republican, said the conversation

about reforming the transportation system “gets shelved a little too

easily.”

“If you want to talk about political courage, why are we just seeing

these proposals for the first time now that he’s not running for

re-election? Why didn’t he run on this?” Beaton asked.

As a resident who pays tolls on the Massachusetts Turnpike every day

to commute to Boston, Beaton said there are other ways to raise

revenue to fix the broken public transit system without asking

taxpayers to pay more for expansion projects that aren’t needed

right now.

“What about open road tolling on the I-93 corridor to help pay for

the Big Dig debt? There are other reforms and ways to raise revenue

and fix what’s broken before looking at higher taxes,” Beaton said.

MBTA General Manager Beverly Scott, described by Transportation

Secretary Richard Davey as a transit “superstar,” said the rail,

subway and bus system is at a “critical juncture.” “We have parts of

this system that are 100 years old. When things get old, they need

to be replaced,” Scott said.

The new MBTA chief said two-thirds of the new revenue for

transportation would be put toward repairs, maintenance and upgrades

to the existing transit system, promising a “renaissance” in the

quality of service the agency will be able to provide.

Facing a $140 million budget gap that must be solved by April 15,

Scott said the alternative is reduced service, higher fares, or both

– a repeat of the controversial MBTA budget-balancing debate of last

year that led to a one-time bailout from the Legislature and fare

hikes averaging 23 percent.

“We will not shirk from reform,” Scott also promised.

State House News Service

Thursday, February 14, 2013

As Patrick presses tax plan, lawmakers wave caution flags

By Matt Murphy

The opening for Gov. Deval Patrick to sell skeptical lawmakers on

his ambitious new tax-and-spending plan narrowed on Thursday as key

House and Senate lawmakers from both parties seemed to wave the

caution flag in front of the governor’s budget chief.

The House and Senate Ways and Means committees kicked off public

hearings on the fiscal 2014 budget with testimony from the

administration, Constitutional officers and the inspector general.

But even as Secretary of Administration and Finance Glen Shor

emphasized the urgency of making the governor’s recommended

investments in transportation and education with $1.9 billion in

higher taxes, the message emanating from lawmakers was that Patrick

might be pushing for too much, too fast.

“We’re not feeling the ability terribly so much that everybody can

dig even deeper, and quite honestly we hear from our constituents in

that regard, so as we balance this, balance the spending and

revenue, these are the challenges,” Senate Ways and Means Chairman

Stephen Brewer told Shor.

Brewer was careful to make the distinction that he was speaking only

for himself and not the committee, but he highlighted the fact that

lawmakers in January took a $1,100 pay cut because median family

incomes are declining.

“We will wrestle with all the substantive issues here. They are long

and they are complicated,” Brewer said.

Patrick has proposed raising the income tax to 6.25 percent and

lowering the sales tax to 4.5 percent. Combined with other measures

to alter the tax code, Shor said half of Massachusetts residents

would see no change or a reduction in their tax burden, while

wealthier residents would pay more.

The new revenue would be dedicated to repairing and modernizing the

state’s transportation infrastructure and transit system, and

boosting funding for education to extend early education

opportunities to all children and increase spending on public

universities and community colleges.

“The changes in our tax laws do not leave us with a tax system that

leaves us anything less than competitive with our neighboring states

and states we compete most with,” Shor said, adding that investing

in education and infrastructure will make the state “infinitely more

competitive” for business.

Some Republicans have suggested that Patrick’s budget plan is about

building his legacy with only two years left in office, and Shor did

little to dispel the feeling that Patrick has grown frustrated by

the limitations the global recession put on his ability to

accomplish the goals he imagined when he first ran for governor.

“This budget reflects the governor’s and the lieutenant governor’s

restlessness to tackle the unfinished business of promoting

opportunity and prosperity in every corner of the Commonwealth. This

budget would begin a course of groundbreaking new investments in

education, transportation and innovation that will transform

Massachusetts’s economy in the short-term and over the long haul,”

Shor told lawmakers.

Shor continued, “Simply relying on cuts to address the challenges of

today and tomorrow will not get us there.” He said reform remains an

“enduring focus” of the governor.

House Ways and Means Chairman Rep. Brian Dempsey, however, expressed

reluctance, defending the way the Legislature navigated the

recession with a blend of spending cuts, reserves and revenue

increases, reminding those in the audience that it was only four

years ago that the Legislature approved an increase in the sales

tax.

“I love the governor’s passion around education. It’s infectious. He

has a compelling personal life story….I would say, however, that

over the years we have spent considerable resources on Chapter 70,”

Dempsey said.

Sen. Michael Knapik, a Westfield Republican and the ranking minority

member on the Senate Ways and Means Committee, gave kudos to the

Patrick administration for the way it managed through the lean

recession years with the support of the Legislature. But Knapik

questioned the rush to raise new revenue to support transportation

expansion projects and massive new funding for education when casino

gaming revenues are just a few years away.

“Shouldn’t we wait for the gaming revenue to start to coming?

Wouldn’t that be a more prudent course?” Knapik said.

Knapik also raised the issue of wasted resources from fraud, abuse

and lax oversight in the state’s welfare system, an increasingly

common counter-argument to Patrick’s call for higher taxes.

“I think we’re hard pressed to just hand over more money unless

we’re doing a better job of policing what we have,” Knapik said,

saying his constituents are tired of reading stories about people

getting benefits they don’t deserve.

Inspector General Glenn Cuhna, going through his first budget

process in his new job, faced questions from the budget panel about

a recent report published by his office that identified serious

concerns about the Department of Transitional Assistance’s processes

for verifying the eligibility of recipients of benefits under a

program known as Transitional Aid to Families with Dependent

Children, designed to provide assistance to the poorest residents.

The report suggested as much as $25 million in public benefits might

have been paid to individuals and families that do not qualify for

assistance, or at the very least failed to document their

eligibility.

“The DTA really needs to at this point follow its own regulations

and understand that their role, one of their roles, is to make

eligibility determinations. If someone isn’t eligible, even if they

received emergency benefits, benefits must be suspended or

terminated once the file isn’t complete,” Cuhna said.

Asked by Brewer if a lack of staffing was to blame for the failures

at DTA that led to the firing of Commissioner Dan Curley, Cuhna

said, “Some of it is a lack of staffing, a lack of resources…but

it’s also a lack of training too.”

Rep. Carl Sciortino asked Cuhna whether it was possible the $25

million identified by the inspector general’s office actually went

to eligible families, and it wasn’t waste so much as a failure on

the DTA’s end to verify that eligibility. “I think it’s disingenuous

to say that is wasted money if we just haven’t followed up on these

people,” Sciortino said.

Cuhna agreed with Sciortino, but called it “irresponsible” for the

state to be spending taxpayer money on public benefits without

verifying that the benefits are deserved.

Dempsey called the DTA report “very troubling for a variety of

reasons,” and said the Legislature felt a sense of urgency to take

corrective action to improve the eligibility oversight.

Rep. Angelo D’Emilia, a Bridgewater Republican, said, “I’m glad to

hear the chair understands what a problem this is, because we’re all

hearing from constituents.” |

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

|