|

Help save yourself

— join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

Ask your friends to join too |

CLT UPDATE

Friday, January 18, 2013

A reawakened state’s antitax movement

|

Mass. Governor Deval Patrick was making his case

Thursday following announcing his plans to raise the state's income

tax, but the proposal might a tough sell to lawmakers and business

owners.

Governor Patrick says his tax code reform would

keep Massachusetts competitive with other states and put the state's

tax rates in about the mid-range compared to other states.

The first stop on Governor Patrick's tour

promoting his controversial income tax hike was to a friendly crowd

of businessmen and women interested in improving transportation and

education in the Middlesex 3 Corridor....

But not all businesses are as welcoming of the

Governor's plan that would raise the income tax from 5.25 percent to

6.25 percent, raise corporate taxes all while lowering the sales tax

to 4.5 percent.

"So it's very mixed, and I think some businesses

are probably going to be pleased by it, others not at all," Michael

Widmer of the Mass. Taxpayers Foundation said.

And there are anti-tax groups like Citizens

for Limited Taxation which are skeptical of the entire plan.

"He's trying to do a graduated income tax by

increasing the personal exemption. Large enough so that the rich

have to pay more. You're not allowed to do that," said Barbara

Anderson, executive director of Citizens for Limited Taxation.

Anderson says the state's Constitution doesn't

allow for a graduated income tax. She says it's been put on the

ballot three times and defeated each time.

"He just thinks he can do whatever Obama does and

Obama is saying get the rich, so he's going after the rich,"

Anderson said.

"That's not a bad way to go," Governor Patrick

said Thursday. "I mean, I'd like a graduated income tax. It takes

longer to do that. We've tried a bit because you have to change the

Constitution, but we built in the doubling of personal exemptions to

bring that progressivity into our model."

New England Cable News

Thursday, January 17, 2013

Mass. Gov. pitches tax plan to business leaders

VIDEO

VIDEO

Governor Deval Patrick unveiled more elements of

his tax plans Thursday, including proposals to gradually raise the

gas tax, MBTA fares, turnpike tolls, and Registry fees, plans he

says will stabilize the transportation system long into the future.

Patrick’s blueprints would also eliminate 45

personal tax deductions worth $1.3 billion annually, including

deductions for T passes, college scholarships, and dependents under

12.

The new elements follow Patrick’s announcement

Wednesday of what is the core of his tax plan: raising the income

tax from 5.25 percent to 6.25 percent while cutting the sales tax

from 6.25 percent to 4.5 percent. The changes, if approved, would

take effect in 2014 and would result in higher taxes for about 50

percent of residents, with the biggest burden on higher-income

earners....

Shor countered that even though Patrick’s plan

represents an overall tax increase, roughly half of taxpayers would

see either a cut or no change in their taxes.

That is because Patrick is seeking to double the

amount of earnings that are exempt from income taxes, going from the

current $4,400 for a single person to $8,800. That means workers who

earn $50,000 a year would pay income taxes on $41,200 of their

income, exempting a larger share of their paychecks from taxation

than workers who earn, say, $150,000 a year.

The goal, Shor said, is to push more tax burden

onto higher-income earners and reduce it for those earning less.

“You increase the fairness of the tax system

overall,” said Noah Berger, executive director of the Massachusetts

Budget and Policy Center, a liberal research group....

The overall tax increase of $1.9 billion is the

result of several changes to the tax code. Raising the income tax

rate and cutting the 45 deductions raises $2.8 billion, while

lowering the sales tax costs the state $1.1 billion. And eliminating

three corporate tax benefits raises $194 million.

The list of 45 deductions that Patrick is

targeting for elimination would affect a wide range of residents.

They include deductions and other existing benefits for removing

lead paint in a home and adoption fees, as well as capital gains on

home sales.

Some said the call for higher taxes could

reawaken the state’s antitax movement, which has scored notable

policy victories in the past but has been quiet in recent years.

One of those victories was passage in 2000 of a

ballot question to cut the income tax from 5.95 percent to 5

percent. In 2002, the Legislature effectively froze the rate at 5.3

percent, while adding triggers that would lower rates further only

if benchmarks were met.

Citizens for Limited Taxation, an antitax

group that helped push the ballot question, said it is clear that

Patrick is now trying to “tax the rich” disproportionately.

The Boston Globe

Friday, January 18, 2013

More tax hikes in Patrick’s blueprint

Gov. Deval Patrick’s top budget officials drilled

deeper into the governor’s tax reform proposal on Thursday,

revealing how the plan to be filed with the governor’s budget next

week would eliminate 45 personal tax exemptions and tie the 21-cent

gas tax to inflation, costing drivers an extra half penny per gallon

at the pump starting in July.

The proposal, which would begin dedicating all

state sales tax revenue to transportation and infrastructure, would

also rely on periodic increases in MBTA fares, highway tolls and

Registry of Motor Vehicle fees to fund an administration-identified

$1 billion a year gap in needed transportation improvements and

available resources....

“The proposal, in its entirety improves the

fairness of the tax code. It takes a tax code that right now imposes

a higher effective tax rate on lower-income tax filers, and a lower

effective tax rate on higher-income tax filers, and flips that,”

Administration and Finance Secretary Glen Shor said.

While the state’s Constitution prohibits a

graduated income tax, Shor explained how the blend of tax policies

recommended by Patrick, in their estimation, would fall

disproportionately on wealthier individuals....

Shor said the governor favors “periodic and

consistent fare, fee and toll increases,” and supporting

documentation shows how Patrick will recommend 5 percent fare

increases at the MBTA every two years starting in fiscal 2015, 10

percent RMV fee increases every five years starting in fiscal 2016,

and 5 percent toll increases every two years starting in fiscal

2015.

State House News Service

Thursday, January 17, 2013

Patrick seeking regular increases in gas tax, tolls, MBTA fares, RMV

fees

Lawmakers fielding an

onslaught of calls over

Gov.

Deval Patrick’s tax-hike proposal danced around making a

commitment to the controversial plan yesterday, realizing that when

taxes go up, lawmakers often get voted out.

“Members on either side aren’t immune to public

pressure. We’re keen observers of our district,” said state Sen.

Mike Knapik (R-Westfield),

referring to the 1990 statewide election

just months after Gov. Michael Dukakis inked the largest tax

increase in state history where 57 legislators lost their jobs....

More details of Patrick’s plan came out yesterday

as budget officials announced the 21-cent gas tax could be tied to

inflation if the governor gets his way, costing drivers an extra

half-penny per gallon at the pump starting in July. This means the

gas tax could rise from 21 cents to 24.6 cents in 2021.

The Boston Herald

Friday, January 18, 2013

Cautious pols not quick to back Gov. Deval Patrick

Last night Gov. Deval Patrick declared war on the

taxpayers of Massachusetts, proposing the largest tax hike in state

history — nearly $2 billion.

Today it’s time for voters to demand that their

elected representatives choose up sides. They can give in to this

lame duck governor intent on bringing taxpayers to their knees and

economic growth to a standstill, or they can side with their

hard-pressed constituents.

A Boston Herald editorial

Thursday, January 17, 2013

Gov, this is WAR!

Deval said the “T” word — taxes — and the sheeple

in the Legislature applauded. They cheered. They clapped like

trained seals.

What more do you need to know? We’re screwed....

“Let’s have a serious, respectful, fact-based

debate.”

In moonbat parlance, that means Deval wants a

“dialogue.” The Beautiful People are always “willing to listen.”

After which they tell you to shut up. If you try to get in a word

edgewise, it’s “hate speech.” They have “facts,” you have

“anecdotes.”

The door is open, the mind is closed.

The Boston Herald

Friday, January 18, 2013

Hacks cheer

By Howie Carr

Well, well — it turns out Charlie Baker was

right after all!

In the heat of his 2010 campaign for

re-election Gov. Deval Patrick — whose record at the time

included signing a 25 percent sales tax hike into law, OK’ing

tax increases on restaurant meals, proposing a gas tax increase,

and routinely pitching new taxes on candy and soda — denied any

interest in raising the state’s *income* tax. In fact, Patrick’s

spokesman at the time accused Baker of resorting to “distortion

and demagoguery” by even suggesting Patrick would raise income

taxes in a second term.

“You’ve never heard that proposal from me,”

the governor huffed during a debate a week before the election.

Well, now we have....

Patrick wants a “fact-based” debate, so here

are a few facts taxpayers should know. At $32.5 billion the

state budget today is nearly 30 percent larger than the final

budget signed by Mitt Romney. The state expects to collect

nearly $13 billion in revenue from income taxes alone this year,

$1.1 billion more than when Patrick took over in 2007, even

after the huge drop that came in the recession years and with a

state unemployment rate that is climbing.

But surely Massachusetts taxpayers know that

when it comes to “revenue” — also known as your income — “more”

is never enough.

The Boston Herald

Friday, January 18, 2013

Taxachusetts, here we go again

By Julie Mehegan

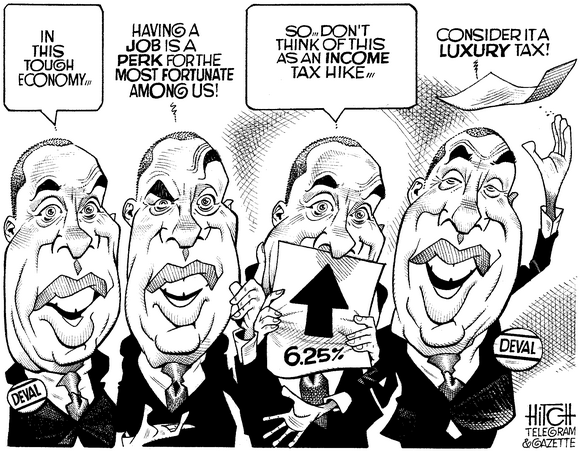

The Worcester Telegram & Gazette

Thursday, January 17, 2013

Editorial cartoon by David Hitch

The Boston Herald

Friday, January 18, 2013

Editorial cartoon by Jerry Holbert

The Worcester Telegram & Gazette

Friday, January 18, 2013

Editorial cartoon by David Hitch

|

|

Chip Ford's CLT

Commentary

"Some said the call for higher taxes could

reawaken the state’s antitax movement, which has scored notable

policy victories in the past but has been quiet in recent

years."

Do you think, maybe?

". . . But surely Massachusetts taxpayers know

that when it comes to 'revenue' — also known as your income — 'more'

is never enough."

I've heard that before —

here. Thank you Julie Mehegan of the Boston Herald for

spreading the word!

More Is Never Enough (MINE), and never will

be.

By now this is obvious. Too obvious.

Every day we all learn more about what's packed

inside Gov. Patrick's taxpayer assault —

dribble by dribble. Each day his transformation proposal becomes

scarier.

Apparently he has nothing to lose, as he's not

running for re-election again. He may have his sights on

higher office, but not here in just Taxachusetts.

Incrementally taxes, tolls, and fees creep upward

— relentlessly. Even when we citizens

demand by our vote that they go down, they go up regardless.

There are two hundred souls in the Legislature

who don't have Patrick's luxury. They will each be up for

re-election next year. Potentially we can rid ourselves of them.

Look at the shocked reaction when Obama voters

just discovered the "Fiscal Cliff" deal hiked their (payroll)

taxes too.

We "high-information" taxpayers must stop this

assault there, in our state Legislature.

I'd really prefer to not do another

petition drive, and I expect you feel the same. But it is

always an option.

Imagine having the repeal of a massive tax

hike on the 2014 ballot — while each of

those legislators who voted for it are campaigning to keep their

sinecures?

It's a consideration we may need to confront this

year.

If we put a repeal on the ballot, we also must

reject those who'll have made it necessary —

our otherwise-unnecessary time and money to make it happen.

We will advocate for whatever is necessary.

"The call for higher taxes could reawaken the

state’s antitax movement."

Do you think?

What choice do we have —

but picking up and moving to some state that's more rational?

|

|

|

|

Chip Ford |

|

|

|

|

New England Cable News

Thursday, January 17, 2013

Mass. Gov. pitches tax plan to business leaders

By Alison King

Mass. Governor Deval Patrick was making his case

Thursday following announcing his plans to raise the state's income

tax, but the proposal might a tough sell to lawmakers and business

owners.

Governor Patrick says his tax code reform would keep Massachusetts

competitive with other states and put the state's tax rates in about

the mid-range compared to other states.

The first stop on Governor Patrick's tour promoting his

controversial income tax hike was to a friendly crowd of businessmen

and women interested in improving transportation and education in

the Middlesex 3 Corridor.

"I think the Governor is absolutely right that the private sector

has to have a voice and has to carry many of these issues forward in

conjunction with the administration because it is the future of the

Commonwealth," Bob Buckey, a Middlesex 3 board member, said.

But not all businesses are as welcoming of the Governor's plan that

would raise the income tax from 5.25 percent to 6.25 percent, raise

corporate taxes all while lowering the sales tax to 4.5 percent.

"So it's very mixed, and I think some businesses are probably going

to be pleased by it, others not at all," Michael Widmer of the Mass.

Taxpayers Foundation said.

And there are anti-tax groups like Citizens for Limited Taxation

which are skeptical of the entire plan.

"He's trying to do a graduated income tax by increasing the personal

exemption. Large enough so that the rich have to pay more. You're

not allowed to do that," said Barbara Anderson, executive director

of Citizens for Limited Taxation.

Anderson says the state's Constitution doesn't allow for a graduated

income tax. She says it's been put on the ballot three times and

defeated each time.

"He just thinks he can do whatever Obama does and Obama is saying

get the rich, so he's going after the rich," Anderson said.

"That's not a bad way to go," Governor Patrick said Thursday. "I

mean, I'd like a graduated income tax. It takes longer to do that.

We've tried a bit because you have to change the Constitution, but

we built in the doubling of personal exemptions to bring that

progressivity into our model."

Widmer feels the bigger issue for the majority of the business

community is whether the Governor's tax plan is the best one for

such a fragile economy.

"I think in the end the question is just does this basic structure

hold together with changes of individual pieces of it or does the

Legislature start from scratch?" Widmer said.

Governor Patrick concedes his plan is going to take some significant

lobbying and promoting on his part, and knows full well he's not

going to get everything he wants, but he does say he's convinced

that his plan is the right thing for the Commonwealth.

The Boston Globe

Friday, January 18, 2013

More tax hikes in Patrick’s blueprint

By Michael Levenson and Noah Bierman

Governor Deval Patrick unveiled more elements of his tax plans

Thursday, including proposals to gradually raise the gas tax, MBTA

fares, turnpike tolls, and Registry fees, plans he says will

stabilize the transportation system long into the future.

Patrick’s blueprints would also eliminate 45 personal tax deductions

worth $1.3 billion annually, including deductions for T passes,

college scholarships, and dependents under 12.

The new elements follow Patrick’s announcement Wednesday of what is

the core of his tax plan: raising the income tax from 5.25 percent

to 6.25 percent while cutting the sales tax from 6.25 percent to 4.5

percent. The changes, if approved, would take effect in 2014 and

would result in higher taxes for about 50 percent of residents, with

the biggest burden on higher-income earners.

The new elements help bring into focus the sweeping ambition of

Patrick’s final two-year agenda.

But the plan carries some risk for the governor. While it could

cement his legacy, it could also anger voters and reignite the

once-powerful antitax movement in Massachusetts.

All told, Patrick’s changes, which also call for the elimination of

some corporate tax benefits, would raise taxes by $1.9 billion

annually, money the governor wants to use to shore up and expand

transportation systems and broaden education programs.

“If we want jobs, we have to invest,” Patrick said in an interview

Thursday, after promoting the plan on television and radio and in

visits with business executives and lawmakers. “We are trying to

think of a way to accomplish that that really moves the needle.”

The governor’s proposal to tie the gas tax to inflation would add a

half-penny to the state’s $.21-per-gallon levy, starting next year,

and would trigger automatic increases in the future, as the cost of

goods and services rise.

Patrick’s plan also depends on increasing MBTA fares, as well as

turnpike, tunnel and bridge tolls, by 5 percent every two years,

beginning in July 2014. Registry fees would jump by 10 percent every

five years, beginning in July 2015.

Administration aides argued the periodic increases are needed

because, over time, inflation erodes the value of fares, tolls and

fees. “We’re just trying to keep their purchasing power constant,”

said Glen Shor, the governor’s new budget chief.

Such regular hikes have been previously recommended by

transportation policy specialists. But pushing for them now, along

with the other tax changes Patrick is seeking, could strike

commuters as a double whammy.

“I’ve been one who’s written a lot about the need for new revenue

for transportation,” said Charles D. Chieppo, a former budget aide

in the Romney administration. “Yet as much as I believe that, what

the governor has proposed is so extravagant in my view it runs the

risk of . . . inspiring a backlash.”

Shor countered that even though Patrick’s plan represents an overall

tax increase, roughly half of taxpayers would see either a cut or no

change in their taxes.

That is because Patrick is seeking to double the amount of earnings

that are exempt from income taxes, going from the current $4,400 for

a single person to $8,800. That means workers who earn $50,000 a

year would pay income taxes on $41,200 of their income, exempting a

larger share of their paychecks from taxation than workers who earn,

say, $150,000 a year.

The goal, Shor said, is to push more tax burden onto higher-income

earners and reduce it for those earning less.

“You increase the fairness of the tax system overall,” said Noah

Berger, executive director of the Massachusetts Budget and Policy

Center, a liberal research group.

But Jim Stergios — executive director of the Pioneer Institute, a

conservative think tank — said Patrick’s plans would hit many

middle-class taxpayers, who are facing stagnant household income and

rising federal payroll taxes. Individuals who make more than $50,000

a year and families who make over $60,000 a year would all see a tax

hike under Patrick’s plan.

“That’s not the 1 percent,” Stergios said.

Patrick aides argued, however, that the increases are relatively

small for the middle class. For example, a family of four earning

$60,000 would pay $91 in additional taxes each year, while a family

earning $160,000 would pay $957 more.

The overall tax increase of $1.9 billion is the result of several

changes to the tax code. Raising the income tax rate and cutting the

45 deductions raises $2.8 billion, while lowering the sales tax

costs the state $1.1 billion. And eliminating three corporate tax

benefits raises $194 million.

The list of 45 deductions that Patrick is targeting for elimination

would affect a wide range of residents. They include deductions and

other existing benefits for removing lead paint in a home and

adoption fees, as well as capital gains on home sales.

Some said the call for higher taxes could reawaken the state’s

antitax movement, which has scored notable policy victories in the

past but has been quiet in recent years.

One of those victories was passage in 2000 of a ballot question to

cut the income tax from 5.95 percent to 5 percent. In 2002, the

Legislature effectively froze the rate at 5.3 percent, while adding

triggers that would lower rates further only if benchmarks were met.

Citizens for Limited Taxation, an antitax group that helped

push the ballot question, said it is clear that Patrick is now

trying to “tax the rich” disproportionately.

Representative Daniel B. Winslow, a Norfolk Republican, said

Patrick’s move could energize the GOP. He recalled how Republicans

picked up seats in the House after the governor signed a sales tax

increase in 2009.

Winslow said voters do not believe that state government has

eliminated enough waste and fraud to warrant the infusion of $1.9

billion in fresh tax money. “A part of the problem is that there is

a lack of confidence,” he said.

Some business groups are also on edge.

The Greater Boston Chamber of Commerce, which had initially released

a noncommittal statement about Patrick’s plans, expressed deeper

reservations Thursday.

“The chamber has concerns about the potential impact of the revenue

proposals on our economy and competitiveness,” said Charles Rudnick,

a chamber spokesman. “We are taking a hard look at the proposals,

and consulting with our members, in light of these concerns.”

State House News Service

Thursday, January 17, 2013

Patrick seeking regular increases in gas tax, tolls, MBTA fares, RMV

fees

By Matt Murphy

Gov. Deval Patrick’s top budget officials drilled deeper into the

governor’s tax reform proposal on Thursday, revealing how the plan

to be filed with the governor’s budget next week would eliminate 45

personal tax exemptions and tie the 21-cent gas tax to inflation,

costing drivers an extra half penny per gallon at the pump starting

in July.

The proposal, which would begin dedicating all state sales tax

revenue to transportation and infrastructure, would also rely on

periodic increases in MBTA fares, highway tolls and Registry of

Motor Vehicle fees to fund an administration-identified $1 billion a

year gap in needed transportation improvements and available

resources.

“The proposal, in its entirety improves the fairness of the tax

code. It takes a tax code that right now imposes a higher effective

tax rate on lower-income tax filers, and a lower effective tax rate

on higher-income tax filers, and flips that,” Administration and

Finance Secretary Glen Shor said.

While the state’s Constitution prohibits a graduated income tax,

Shor explained how the blend of tax policies recommended by Patrick,

in their estimation, would fall disproportionately on wealthier

individuals.

For instance, individuals earning $50,000 or less, and families of

four with an income of $60,000 would see their tax burden stay the

same or decrease, while those earning between $100,000 and $200,000

would pay roughly $1,000 more a year in taxes, and the wealthiest 5

percent earning above $200,000 would pay an additional 1 percent of

their income. Additionally, the 270,000 individuals that don’t pay

income tax because they earn too little would realize the benefit of

a sales tax decrease without the additional income tax burden.

Patrick, in his State of the State address Wednesday, sketched out

broad details of his proposal to generate $1.9 billion in new

revenue for transportation and education with an increase in the

income tax to 6.25 percent, and a decrease in the sales tax to 4.5

percent. He said the investments were critical to the state’s future

economic strength.

Shor said, “We think even with these tax changes we are strong with

our economic competitors,” noting how the new tax structure would

increase the state’s tax burden as a percent of personal income, but

push it higher than only one new competitor state – Pennsylvania –

and leave Massachusetts positioned in the middle of states competing

for similar business.

While the sales and income tax changes constitute the core of

Patrick’s revenue proposal, the full plan contains a number of other

changes to the personal and corporate tax code that will impact the

bottom lines of businesses and families across Massachusetts.

Patrick plans to file his fiscal 2014 budget with the House next

Wednesday. The tax changes contained would not go into effect until

Jan. 1, 2014, decreasing the amount of new revenue that would be

available to spend in the fiscal year that starts on July 1.

Left alone, the administration estimates the state would realize

about $780 million in new revenue in fiscal 2014 from the changes,

but officials are proposing to borrow against anticipated future

revenue to net $1.1 billion in new revenue next year. The strategy

would decrease the gains in future years, netting the state $1.6

billion in fiscal 2015, $1.7 billion in fiscal 2016 and the full

$1.9 billion in fiscal 2017.

Shor said the borrowing strategy is a “commonly used” tool that

would give the administration more money to spend next year, while

also matching the state’s plan and ability to ramp up spending on

transportation projects and education programs than can’t be started

all at once.

By indexing the gas tax to inflation, Administration and Finance

General Counsel David Sullivan said the state will generate about

$13 million in new revenue next year. Documents provided by the

administration show they anticipate the gas tax to rise from 21

cents to 24.6 cents in 2021, generating $118 million in additional

revenue.

Though sales tax revenue alone will not be enough to cover what the

governor thinks is needed for transportation and infrastructure, his

budget plan will rely on the gas tax, contributions from Massport,

the Boston Convention Center and gaming revenue to close the divide.

Shor said the governor favors “periodic and consistent fare, fee and

toll increases,” and supporting documentation shows how Patrick will

recommend 5 percent fare increases at the MBTA every two years

starting in fiscal 2015, 10 percent RMV fee increases every five

years starting in fiscal 2016, and 5 percent toll increases every

two years starting in fiscal 2015.

Shor said these increases will ensure that the value of the fares,

fees, and tolls don’t erode over time with inflation.

Unlike in past years when Patrick has called for applying the sales

tax to candy and soda, Shor said the proposal does not change what

is subject to the sales tax, except for software solutions and

computer services that will be taxed as a good, instead of a

service.

The governor’s proposal calls for 45 personal tax exemptions to be

eliminated, including the deduction for Social Security and railroad

retirement contributions and the tuition tax deduction.

Asked how eliminating the tuition tax break fit with the governor’s

vision for expanded college tuition grants programs and making

higher education more affordable, Sullivan said, “You can’t look at

each of these in isolation. They are being replaced by an

all-purpose doubling of the personal exemption that will benefit all

taxpayers.”

The personal tax exemption would be doubled under Patrick’s plan

from $4,400 to $8,800 for most individual filers, and to $17,600 for

couples.

On the business tax side, the corporate excise tax would remain at 8

percent, but the administration is proposing to eliminate special

classifications for security and utility corporations that Sullivan

said are “no longer relevant in the modern world” and used only as

tax shelters.

Sullivan also said the governor will propose eliminating the FAS 109

deduction, a component of a 2008 corporate tax reform law giving

certain large multi-state corporations a deduction to help absorb

the additional costs incurred by a new combined reporting tax law

requirement.

The deduction has been postponed by the Legislature since its

passage, never taking effect, and Sullivan said there has never been

a solid justification for its existence.

Finally, the plan would also make a change to the sales factor used

to calculate taxable profit for companies that do business in

multiple states. The change would tax profits on goods and services

based on where they are delivered instead of where they are

produced, benefiting home-state companies over out-of-state

businesses that operate in Massachusetts.

The Boston Herald

Friday, January 18, 2013

Cautious pols not quick to back Gov. Deval Patrick

By Chris Cassidy and O’Ryan Johnson

Lawmakers fielding an

onslaught of calls over Gov.

Deval Patrick’s

tax-hike proposal danced around making a commitment to the

controversial plan yesterday, realizing that when taxes go up,

lawmakers often get voted out.

“Members on either side aren’t immune to public pressure. We’re keen

observers of our district,” said state Sen. Mike Knapik

(R-Westfield),

referring to the 1990 statewide election just months

after Gov. Michael Dukakis inked the largest tax increase in state

history where 57 legislators lost their jobs.

While Knapik predicted Patrick’s plan wouldn’t make it out of the

House, others said they’d keep an open mind, even if the options are

painful. Plus, voters already have voted to repeal an income tax

hike in 2000 — which was never adopted.

“Raising taxes is not a popular thing to do,” said state Rep. Marty

Walsh (D-Dorchester). “When you raise taxes, you’re taking away from

people some of their salary. It’s not something you do easily.”

More details of Patrick’s plan came out yesterday as budget

officials announced the 21-cent gas tax could be tied to inflation

if the governor gets his way, costing drivers an extra half-penny

per gallon at the pump starting in July. This means the gas tax

could rise from 21 cents to 24.6 cents in 2021.

The governor also will

recommend 5 percent fare increases at the

MBTA every two years starting in fiscal 2015,

10 percent RMV fee

increases every five years starting in fiscal 2016 and 5 percent

toll

increases every two years starting in fiscal 2015,

administration officials said last night.

State Rep. William Straus

(D-Mattapoisett), Transportation

Committee co-chairman, said he needed more time to look at Patrick’s

plan — which would raise the income tax 1 percentage point, to 6.25

percent, and drop the sales tax to 4.5 percent from 6.25.

“It is a dramatic change,” Straus said. “I’m willing to admit I’m

surprised by it. ... It requires us to consider it carefully before

making a collective conclusion.”

Even when pressed — and while standing next to Patrick at an event

in Lynn yesterday — state Sen. Thomas McGee

(D-Lynn) withheld his

support.

“We’re going to take a look at the governor’s plan, and we need to

make sure that we find a consensus in the House and Senate to pass

something that is going to address what, I think we all agree on, is

a crisis that has been coming for a long time,” said McGee,

co-chairman of the state’s Transportation Committee.

State House News Service contributed to this report.

The Boston Herald

Thursday, January 17, 2013

A Boston Herald editorial

Gov, this is WAR!

Last night Gov. Deval Patrick declared war on the taxpayers of

Massachusetts, proposing the largest tax hike in state history —

nearly $2 billion.

Today it’s time for voters to demand that their elected

representatives choose up sides. They can give in to this lame duck

governor intent on bringing taxpayers to their knees and economic

growth to a standstill, or they can side with their hard-pressed

constituents.

The worst part is that this is a “crisis” of the governor’s own

making. MBTA debt and deferred maintenance on it and state highways

would be manageable with some reforms and a modest hike in the gas

tax. But no, Patrick wants to give taxpayers rail lines no one needs

at a price we can’t afford so he can justify an ongoing $1 billion a

year raid on their wallets.

But wait, there’s more. There’s the education proposal he rolled out

Tuesday, calling for another $550 million this year and $1 billion

annually over the next four years. Among other things the governor

wants “universal access to high quality early education for all

infants, toddlers, and pre-schoolers.”

This isn’t merely reckless spending, it’s nuts.

“The people we work for want the schools I have described; they want

the rail and road services we have laid out,” Patrick assured

lawmakers last night. “And above all they want the opportunity and

growth these investments will bring.”

Growth? There’s not a tax hike on the planet that *creates* growth.

But it’s what we have come to expect from a governor who can’t tax

us enough. Patrick wants to increase the current 5.25 percent tax

rate to a record high 6.25 percent (and eliminate some deductions)

in return for which he’ll agree to cut the sales tax to a little

less than it was when he agreed to *raise it* in 2009.

It’s too late to fire him, but it won’t be too late to fire any

lawmakers who go along with this shameful scheme.

The Boston Herald

Friday, January 18, 2013

Hacks cheer

Deval’s ‘vision’

By Howie Carr

Deval said the “T” word — taxes — and the sheeple in the Legislature

applauded. They cheered. They clapped like trained seals.

What more do you need to know? We’re screwed.

And now the tax-fattened hyenas of the hackerama ramp up their

campaign of lies and cliches. All the nonprofits who pay no taxes

themselves want to pick your pocket.

Yes, the seals all agree, Gov. Patrick has shown “vision.” What kind

of vision?

Bold vision.

Why has he shown bold vision? Because there’s a problem with the

infrastructure — the “crumbling” infrastructure. And we need an

expansion of the transportation system — a “sweeping” expansion.

Decisions must be made — tough decisions. Thank God, Gov. Mini-Me

has come up with a plan — a long-term plan.

Stop me if you’ve heard this before.

“The people,” Deval said, “want the rail and road services we have

laid out.”

So true. How often have you heard people wistfully saying, “If only

we had trains running between Pittsfield and New York ...”

As the moonbat gazette gushed yesterday, Deval is trying to “achieve

the vision he first presented when he burst onto the political scene

... in 2006.”

You recall Deval’s vision of 2006. He was going to cut everybody’s

property taxes. How’d that one work out for you? Apparently that

vision wasn’t bold or sweeping enough, so it’s crumbled, you might

say, just like the infrastructure. The only bold new vision on

display Wednesday night was to raising the income tax a dizzying 19

percent — from 5.25 percent to 6.25 percent.

The same people who’ve already been robbed this month of between 2

and 6 percent of their income by the feds are now looking at another

1 percent paycut. For what? Police details, $130,000-a-year judges

who work less than 37 weeks a year, 19,000 EBT cardholders who are

about as real as Manti Te’o’s girlfriend ...

The hacks at the State House need your money. It’s not cheap, you

know, giving free in-state college tuition to all those illegal

aliens. Not to mention the sex-change operations for wife-killers.

And Billy Bulger’s $200,000 pension.

And don’t forget the pensions and full health benefits for all those

T employees who retired before they were 45 and then went on to

start working on a second hack pension ... in the Probation

Department.

“Let’s have a serious, respectful, fact-based debate.”

In moonbat parlance, that means Deval wants a “dialogue.” The

Beautiful People are always “willing to listen.” After which they

tell you to shut up. If you try to get in a word edgewise, it’s

“hate speech.” They have “facts,” you have “anecdotes.”

The door is open, the mind is closed.

The Boston Herald

Friday, January 18, 2013

Taxachusetts, here we go again

By Julie Mehegan

Well, well — it turns out Charlie Baker was right after all!

In the heat of his 2010 campaign for re-election Gov. Deval Patrick

— whose record at the time included signing a 25 percent sales tax

hike into law, OK’ing tax increases on restaurant meals, proposing a

gas tax increase, and routinely pitching new taxes on candy and soda

— denied any interest in raising the state’s *income* tax. In fact,

Patrick’s spokesman at the time accused Baker of resorting to

“distortion and demagoguery” by even suggesting Patrick would raise

income taxes in a second term.

“You’ve never heard that proposal from me,” the governor huffed

during a debate a week before the election.

Well, now we have.

The lame duck governor has stopped pretending that he could be

satisfied with baby tax increases and has embraced a $2 billion raid

on taxpayer earnings — part of yet another campaign to cement his

legacy.

Yes, the state has a major problem when it comes to financing its

transportation system, having expanded service beyond a point

taxpayers can support and incurring billions in unsustainable debt.

There are ways to balance the transportation budget that don’t

involve a hike in the income tax, of course. A couple of smart guys

from the Pioneer Institute detailed some of them, including a modest

increase in the gas tax, in this space on Wednesday.

Ah, but the only way to achieve *Patrick’s* vision — which

dramatically *expands* the transportation system — is to go where

the most money is. So he wants to raise the income tax by 20

percent.

Politically speaking it was clever of Patrick to use education as

the third leg of this wobbly stool. The $2 billion tax hike would

also expand education funding dramatically. All he needed during his

speech Wednesday was an array of adorable child props to complete

the campaign picture.

But while we all support strong financial supports for education,

the last time the state invested billions in new school funding it

came with important strings attached, including new measures of

accountability, which we’ve seen no sign of here.

Meanwhile the governor has tempered his income tax hike by pitching

a cut in the *sales* tax from 6.25 percent to 4.5 percent for which

we are supposed to be grateful. But the current rate reflects an

“emergency” increase

adopted at the height of the recession that

should be repealed anyway.

Patrick wants a “fact-based” debate, so here are a few facts

taxpayers should know. At $32.5 billion the state budget today is

nearly 30 percent larger than the final budget signed by Mitt

Romney. The state expects to collect nearly $13 billion in revenue

from income taxes alone this year, $1.1 billion more than when

Patrick took over in 2007, even after the huge drop that came in the

recession years and with a state unemployment rate that is climbing.

But surely Massachusetts taxpayers know that when it comes to

“revenue” — also known as your income — “more” is never enough.

Julie Mehegan is the Herald’s deputy editorial page editor.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

|