|

Help save yourself -- join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

Ask your friends to join too

|

CLT UPDATE

Saturday, November 17, 2012

Promised income tax rollback "snuffed out" again

After 23 years — "met last year for the

first time" and gone again

|

As Congress considers whether U.S. taxpayers will

get hit with major federal tax increases in 2013, Patrick

administration officials confirmed Thursday that the next scheduled

dose of broad-based state tax relief will not be delivered on Jan.

1, 2013.

In a letter to Administration and Finance

Secretary Jay Gonzalez obtained by the News Service, Department of

Revenue Commissioner Amy Pitter said recent tax collection levels

didn’t satisfy legal requirements to trigger a reduction in the

income tax on Jan. 1 to 5.2 percent from 5.25 percent....

Massachusetts voters in 2000 approved a ballot

question calling for the income tax to be reduced from 5.95 percent

to 5 percent by 2003. But in 2002, in order to raise $215 million as

part of a larger tax hike package, the Democrat-controlled state

Legislature froze the income tax rate at 5.3 percent and conditioned

further reductions on triggers that were met last year for the first

time precipitating a reduction in the income tax rate this year to

5.25 percent....

“The fact that positive revenue growth should

have been a relatively easy hurdle to clear further proves how the

Commonwealth’s economy remains extremely fragile,” [House Minority

Leader Brad Jones] said in a statement. “Unfortunately, hard-working

taxpayers and struggling families have just been dealt another blow

during these trying economic times. As such, it is imperative that

Governor Patrick and Democratic leaders on Beacon Hill see this as a

clear signal that any statewide tax increase would be disastrous.”

State House News Service

Thursday, November 15, 2012

State income tax cut scheduled for Jan. 1 snuffed out

– State tax collections are running more than a

quarter billion dollars behind projections only four months into

fiscal 2013 and Gov. Deval Patrick’s budget aides say mid-year

spending cuts are more likely, and sooner rather than later.

State House News Service

Advances – Week of November 11, 2012

A special commission looking into ways to

eliminate cash benefits from the scandal-plagued EBT system is

trying to cram its work into a tight two-month window, raising

questions over how serious top state officials are about

reforming the debit-style welfare card program.

“There’s not enough time to make a

comprehensive study of a very complicated system, and I think

we’re doing a disservice to the taxpayers and the recipients

because we’re not taking the time we should be to evaluate how

to set up a cashless system,” said state Rep. Shaunna O’Connell

(R-Taunton), a frustrated member of the Cashless System

Commission.

The reform board was created in late July but

just held its first meeting in mid-October....

Attempts to extend the commission deadline,

which would require a legislative vote, have failed with

O’Connell being the only commissioner in favor....

Police raided five Brockton stores and busted

eight people last week in a long-running EBT scam.

The Boston Herald

Friday, November 16, 2012

Time is slipping away to reform sick EBT system

Pols promised to fix scandal magnet

The state labor chief — caught off-guard last

spring by a series of Herald exposes that showed retired cops,

vacationing teachers, election officials and others pocketing

unemployment pay — is vowing to close loopholes and push a new

law to stop city and town workers from “gaming the system.”

The Boston Herald

Thursday, November 15, 2012

Labor boss pledges to close jobless benefits loopholes

The voter repeal of the state’s sales tax on

alcohol has factored into efforts to fight drug abuse, some

lawmakers and Lt. Gov. Timothy Murray said Tuesday in the wake

of a report detailing an epidemic of emergency rooms visits

involving drug overdoses and heroin use in eastern

Massachusetts....

Those charged with addressing the problem say

prevention and abuse programs lost a big source of potential

revenue when voters in 2010 repealed lawmakers’ efforts to apply

the state’s 6.25 percent sales tax to alcohol purchases.

Lawmakers planned to earmark roughly $100 million raised from

the tax to substance abuse programs. Months after it passed,

voters repealed it in a ballot initiative.

Critics of the tax said it represented double

taxation on alcohol and warned of higher consumer prices....

Vic DiGravio, whose organization Association

for Behavioral Healthcare, pushed for the sales tax on alcohol,

said “it is an issue that deserves to be revisited.” ...

“We have a ton of unmet needs in

Massachusetts in terms of treatment. We had a ton of unmet needs

before the alcohol tax was put in place. It is still there now,”

DiGravio said.

Rep. James O’Day, a Worcester Democrat who is

a member of the Joint Committee on Substance Abuse and Mental

Health, said it is unfortunate that voters repealed the alcohol

sales tax.

State House News Service

Tuesday, November 13, 2012

2010 tax repeal seen in new light with report on substance abuse

in Mass.

Already facing the "strong likelihood" of

midyear budget cuts due to slow economic growth, Gov. Deval

Patrick's budget chief told local leaders Wednesday that a

failure by Congress to avert the "fiscal cliff" would cost the

state up to $300 million this fiscal year and $1 billion over

the next full fiscal year.

Secretary of Administration and Finance Jay

Gonzalez provided the projection to town and city officials

Wednesday at a meeting of the Local Government Advisory

Commission, advising them that hundreds of millions of dollars

in grants that flow through the state to municipalities could be

at risk, as well as almost $1.5 billion in defense and health

spending....

Following a dismal month for tax collections

in October that saw the state fall to $256 million below revenue

projections for the year, Gonzalez said no final decisions have

been made but reported a "strong likelihood" that the

administration would revise downward its revenue projections and

announce mid-year budget cuts soon....

The Department of Revenue estimates tax

collections in Massachusetts would decline up to $300 million

over the second half of fiscal 2013 and the first quarter of

fiscal 2014, and could total $1 billion in reduced revenue over

the next full calendar year, according to Gonzalez.

Cuts to defense and health spending, both

cornerstones of the state's economy, would also siphon money out

of the economy. The Patrick administration estimates federal

spending in the defense sector could be reduced by $1.2 billion

annually, while National Institutes of Health funding to the

state would fall by $188 million a year....

Alluding to the long-term transportation

financing plan the administration is planning to roll out in

January, [Lt. Gov. Timothy Murray, who chaired the meeting] also

suggested putting pressure now on lawmakers to support

infrastructure funding.

State House News Service

Tuesday, November 13, 2012

Fed cuts would slash $1 billion in tax receipts in FY '14, state

budget chief says

I don’t know exactly how Washington’s fiscal

cliff drama will eventually end, but it’s clear some substantial

federal spending cuts are going to be part of the solution.

The details of those cuts — who loses how

much and when — will have a big impact on the economy of

Massachusetts. The politics of the fiscal cliff may pit two of

the state’s biggest economic engines — the defense industry and

the Massachusetts health care establishment — against each

other....

Few other industries mean as much to the

Massachusetts economy. Sure, there are also education and

financial services. Technology companies splinter into so many

different industries — defense high among them — that it’s hard

to call them a single, unified economic force.

But defense and health care both employ tens

of thousands of people and contribute billions to the

Massachusetts economy. Anything that happens to them will be

felt by all....

So what would happen to those Massachusetts

jobs if automatic federal budget cuts do occur? Massachusetts

would lose about 41,000 jobs — the fifth most among states —

over the next two fiscal years, according to a study prepared at

George Mason University for the Aerospace Industries

Association.

The Boston Globe

Tuesday, November 13, 2012

Big Bay State players may face showdown

By Steven Syre

In the midst of the big national story on

Tuesday's election results, there is a much more local - and

revealing - story that played itself out in races for the

Massachusetts state legislature. You may recall that I wrote in

this space after the primary election in September about the

victory of Democrat Mary Keefe in the 15th Worcester district.

Keefe ran in a hotly contested primary election for an open

House seat as an unapologetic supporter of "An Act to Invest in

Our Communities," which would raise $1.4 billion in new revenue

in a way that holds down increases for low- and middle-income

families. Despite being attacked relentlessly by every other

candidate in the race, Keefe won her primary by 9 points....

Rep. Jim O'Day (D-West Boylston) is the House

sponsor of "An Act to Invest in our Communities," and he faced a

Republican challenger who made O'Day's leadership on this bill

the very basis of his campaign.... Rep. O'Day won his race by

over 30 points! ...

Voters in Massachusetts care about their

communities and about the services that state and local

government provide. Schools, roads, bridges, public safety,

parks and libraries are all critical to our quality of life, and

voters know it. When presented with a fair and reasonable

solution to the funding problems that are causing our cities and

towns to continually decimate these critical services, voters

like that solution!

Campaign

for Our Communities

Wednesday, November 8, 2012

Voters Repeat Themselves: Invest in our Community!

The elections are over, and voters have

embraced a vision of people working together to confront the

large challenges we face. It is time to turn that vision into

action! In Massachusetts, we have the opportunity to strengthen

our under-funded schools, rebuild our crumbling transportation

infrastructure, and provide the kinds of support that all of our

people need to lead productive and economically secure lives.

Building public will to support the revenue

increases needed to meet these challenges requires all of us to

deliver consistent and effective messages, using language that

builds on the idea of working together.

Massachusetts Jobs With Justice

Wednesday, November 8, 2012

Campaign for Our Communities Message Training

|

|

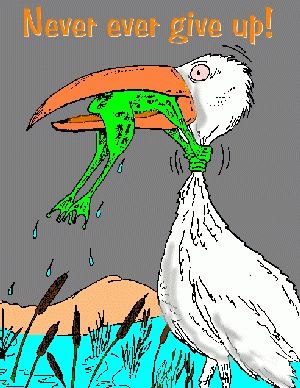

Chip Ford's CLT

Commentary

After hiking the income tax rate in 1989

— with the promise that it'd be only

"temporary," then revert to its historic 5% —

and even after the voters in 2000 mandated that it finally be rolled

back to 5% — twenty-three years later and

going into Year Twenty-Four, that false promise again will not be

kept.

Never mind that last year

the Bacon Hill pols couldn't wiggle out of the arcane, convoluted

formula they created, had to reduce it by 5/100ths of one percent

(from 5.3% to 5.25%). Two years in a row of even such a miniscule

reduction was too much for them to allow. Two years in a row might

create expectations, hope that even twenty-five years later we

taxpayers could possibly be closing in on their long-broken promise,

approaching what voters demanded a dozen years ago which the pols

simply refused to honor and accept.

Why am I not surprised?

On Oct. 17 ("Another

plot to stall our income tax rollback?") I wrote:

Already the trial

balloon is airborne in the first step to again deny

taxpayers a rollback of the 23-year old "temporary" income

tax hike of 1989.

The Commonwealth of Massachusetts again doesn't think it can

"afford" what 59 percent of the voters ordered the state to

do — but which the Legislature "froze" two years later at

5.3 percent.

At this rate — a .05% decrease each nine years — the voters'

2000 mandate might finally be accomplished, the 5 percent

historic rate might eventually be reached — forty-five years

from now, in the year 2057.

Will any of us be alive to see it?

Instead the waste-and-fraud

circuses continue unabated on Bacon Hill. The EBT Card scandals

continue without even a speed bump. We were promised the abuses

would be corrected, but now are told only when they get around to

it, some day. And with the government workers' unemployment payments

scam exposed, now we get another 'vow' "to close loopholes

and push a new law to stop city and town workers from 'gaming the

system.'”

I wonder when they'll ever get around to that

reform?

Largely due to this utterly incapable administration, circumstances

are only worsening, fast. While the state budget has

continued to increase by over a billion of our dollars annually, the

money extracted from us is alarmingly squandered still.

Yet we voting taxpayers are lectured for

repealing the double-tax on alcohol. Somehow, by demonstrating such

greedy self-interest, we have become responsible for increased drug

abuse — as if less taxation on alcohol

somehow is a direct causation of increased drug abuse. The voters

spoke, but at least one tax-borrow-and-spend advocate has expressed

the usual resolution to a disagreement with the voter majority:

“It is an issue that deserves to be revisited.”

They "revisited" the voters' income tax rollback

mandate in 2002 and they "froze" it "temporarily" at 5.3%.

For the never satisfied, More Is Never Enough

(MINE) crowd. Here is a translation of the liberal lexicon:

"Investment" = Spending more

"Revenue" = Tax increases

. . . and now comes . . .

"Revisit" = Overturn the legitimate vote.

And if all else fails for the

tax-borrow-and-spend cabal, they'll just keep pushing for straight

forward tax hikes — even while voters

are still waiting for their promised then demanded tax rollback.

This direct assault is exactly what's been going on in the nether

precincts just beneath the radar for

over a year now, quietly but doggedly building support among the

insatiable cohort of takers.

It's going to be a busy year ahead, with even

fewer taxpayer-advocates in the Legislature. We'd better be

prepared.

We three at CLT can't do it alone

— that's why we're glad you're there

manning the barricades alongside us.

|

|

|

|

Chip Ford |

|

If you still haven't renewed your membership this year,

and you want CLT to be around to keep saving you money,

there's still time to help keep CLT alive.

You should have received

our latest appeal in the mail by now.

We hope you've already made a contribution, and thank

you if you have.

If you haven't, please respond quickly —

help CLT survive to keep fighting for you.

You can make a contribution by

credit card right now by clicking the "Join US!" link

below

|

Our new bumper stickers arrived

in the mail yesterday!

Barbara and I will be putting them on our cars

today.

CLICK GRAPHIC TO ORDER YOURS

|

|

|

|

State House News Service

Thursday, November 15, 2012

State income tax cut scheduled for Jan. 1 snuffed out

By Michael P. Norton

As Congress considers whether U.S. taxpayers will get hit with major

federal tax increases in 2013, Patrick administration officials

confirmed Thursday that the next scheduled dose of broad-based state

tax relief will not be delivered on Jan. 1, 2013.

In a letter to Administration and Finance Secretary Jay Gonzalez

obtained by the News Service, Department of Revenue Commissioner Amy

Pitter said recent tax collection levels didn’t satisfy legal

requirements to trigger a reduction in the income tax on Jan. 1 to

5.2 percent from 5.25 percent.

State officials have estimated the cut would have been worth $110

million to $124 million annualized, tax relief that a disappointed

House Minority Leader Brad Jones described Thursday as “thwarted” by

negative tax revenue growth over the past three months..

Massachusetts voters in 2000 approved a ballot question calling for

the income tax to be reduced from 5.95 percent to 5 percent by 2003.

But in 2002, in order to raise $215 million as part of a larger tax

hike package, the Democrat-controlled state Legislature froze the

income tax rate at 5.3 percent and conditioned further reductions on

triggers that were met last year for the first time precipitating a

reduction in the income tax rate this year to 5.25 percent.

Under the formula, the income tax rate would fall to 5.2 percent on

Jan. 1, 2013 if growth in fiscal 2012 inflation-adjusted baseline

revenues over fiscal 2011 exceeds 2.5 percent and if, for each

consecutive three-month period starting in August and ending in

November 2012, there is positive inflation-adjusted baseline revenue

growth as compared to the same consecutive three-month period in

2011.

According to state finance documents, Pitter in September certified

that fiscal 2012 inflation-adjusted baseline revenues grew by 2.77

percent from fiscal 2011, exceeding the initial trigger for the tax

cut.

But in a letter dated Thursday, Pitter said that after revenue

growth exceeded triggers for two straight months, baseline revenue

fell by 1.29 percent for the three-month period ending on Oct. 31,

2012.

“Therefore, I hereby certify that the thresholds for lowering the

Part B income tax rate as set forth in the Act have not been met,

and that the Part B income tax rate will be kept unchanged at 5.25%

for the tax years 2013 and thereafter,” Pitter wrote in her letter

to Gonzalez. She added, “This statement should be considered as my

final statement with respect to the Part B income tax rate and that

no further certifications are necessary on this matter.”

The news comes as the Patrick administration eyes mid-year spending

cuts with tax collections running more than $250 million behind

budget benchmarks. State officials are also bracing for federal aid

reductions that are contingent on ongoing talks in Washington D.C.

over deep spending cuts and tax increases scheduled to take effect

in 2013.

In a statement, Rep. Jones said the stalled income tax cut reflected

the current state of the economy.

“The fact that positive revenue growth should have been a relatively

easy hurdle to clear further proves how the Commonwealth’s economy

remains extremely fragile,” Jones said in a statement.

“Unfortunately, hard-working taxpayers and struggling families have

just been dealt another blow during these trying economic times. As

such, it is imperative that Governor Patrick and Democratic leaders

on Beacon Hill see this as a clear signal that any statewide tax

increase would be disastrous.”

The Boston Herald

Friday, November 16, 2012

Time is slipping away to reform sick EBT system

Pols promised to fix scandal magnet

By Chris Cassidy

A special commission looking into ways to eliminate cash benefits

from the scandal-plagued EBT system is trying to cram its work into

a tight two-month window, raising questions over how serious top

state officials are about reforming the debit-style welfare card

program.

“There’s not enough time to make a comprehensive study of a very

complicated system, and I think we’re doing a disservice to the

taxpayers and the recipients because we’re not taking the time we

should be to evaluate how to set up a cashless system,” said state

Rep. Shaunna O’Connell (R-Taunton), a frustrated member of the

Cashless System Commission.

The reform board was created in late July but just held its first

meeting in mid-October. It hired The Ripples Group — at a price tag

of $100,000 — as an independent consultant on Oct. 22 and issued a

Dec. 15 deadline for a full report. The commission by law must make

its recommendations Dec. 31.

Even Atilla Habip of The Ripples Group admitted that the timeline,

while doable, is “a bit rushed,” according to minutes.

Meanwhile, House Speaker Robert DeLeo, who claimed to be outraged

over Herald stories detailing EBT abuse earlier this year, snubbed

state Rep. Russell Holmes (D-Roxbury) — an outspoken critic of EBT

abuse and previous commissioner — and appointed state Rep. Kathi-Anne

Reinstein (D-Revere), an assistant majority leader, instead.

“I’m disappointed,” Holmes said. “Clearly between the commission and

I there were some confrontations, and it may have been felt it was

better for me not to be on the team this time.”

Reinstein did not return a message for comment yesterday, and DeLeo

is traveling through Italy this week. His spokesman had no comment.

Department of Transitional Assistance Commissioner Daniel Curley,

who is a member of the commission, insisted it’s a group of open

minds.

“I’ve been really struck by the membership of the commission and

their willingness to look at all of the options and to weigh them,”

Curley said.

Attempts to extend the commission deadline, which would require a

legislative vote, have failed with O’Connell being the only

commissioner in favor.

One commissioner, state Sen. Jennifer Flanagan (D-Leominster), said

if the work is incomplete by the Dec. 31 deadline, the Legislature

can still address it next year. Another member, Tiziana Dearing, CEO

of Boston Rising, said the group is working feverishly.

“There is a difference between moving with alacrity and not being

serious,” Dearing said.

Police raided five Brockton stores and busted eight people last week

in a long-running EBT scam.

The Boston Herald

Thursday, November 15, 2012

Labor boss pledges to close jobless benefits loopholes

By John Zaremba

The state labor chief — caught off-guard last spring by a series of

Herald exposes that showed retired cops, vacationing teachers,

election officials and others pocketing unemployment pay — is vowing

to close loopholes and push a new law to stop city and town workers

from “gaming the system.”

“To taxpayers, we have a message that we hear your concerns. We

share that you should be paying only (unemployment) costs for those

individuals who are entitled to it,” state labor secretary Joanne

Goldstein told the Herald yesterday.

“To those people who are gaming the system, we would say you need to

stop. Because that’s not what this is about. This is an important

social safety net for people who are eligible for it and need it. We

don’t have a lot of interest in or tolerance of people who are

collecting and should not be.”

In a report to be released today, and obtained exclusively by the

Herald, a blue-ribbon panel recommends a broad array of reforms,

including:

• slashing jobless benefits for public- and private-sector retirees

who return to work and file for unemployment pay after reaching

income caps outlined in their pension, effectively eliminating

unemployment pay for those with pensions greater than $53,920;

• ensuring that the state cuts off summertime jobless pay to

laid-off teachers the moment they get word they’ll be rehired;

• ending jobless pay to town-bankrolled school bus drivers and

crossing guards who claim they’re out of work during vacation when

they know they’ll be back on the job when classes resume;

• forbidding election officials and workers from listing their

stipends on unemployment claims; and

• allowing the state to intercept federal tax returns for those who

receive unemployment pay improperly.

Gov. Deval Patrick proposed the nine-member Municipal Unemployment

Insurance Task Force in March after the Herald reported complaints

lodged by two dozen town officials who said they were fed up with

paying for questionable jobless claims.

That story led the paper to uncover outrageous unemployment claims

across the state, including a Cape Cod cop who collected $16,000

after resigning under suspicion of dealing drugs in uniform, a

Quincy cop who was awarded unemployment while on suspension for

faking an injury and a town secretary who received jobless pay after

quitting and moving to New York.

“We appreciate the Herald bringing this to our attention so that we

can look at the whole system ... to lower (unemployment) costs for

municipalities,” Goldstein said. “It’s a good example of the power

of the press to the extent that you were able to raise awareness of

this issue.”

The task force included Goldstein, two mayors, two lawmakers, two

union heads, a retired judge and the president of the Massachusetts

Taxpayers Foundation. Several of the panel’s recommendations — such

as cutting off jobless pay to pensioners and going after abusers’

tax returns — will require legislation. The already-drafted bill

does not yet have a sponsor, and Goldstein said it most likely will

be filed only after the Legislature resumes formal session next

year.

State House News Service

Tuesday, November 13, 2012

2010 tax repeal seen in new light with report on substance abuse in

Mass.

By Colleen Quinn

The voter repeal of the state’s sales tax on alcohol has factored

into efforts to fight drug abuse, some lawmakers and Lt. Gov.

Timothy Murray said Tuesday in the wake of a report detailing an

epidemic of emergency rooms visits involving drug overdoses and

heroin use in eastern Massachusetts.

Drug overdoses on the South Shore and the problems associated with

lifetime heroin use in Worcester have reached “critical numbers,”

according to Susan Servais, executive director of the Massachusetts

Health Council, which released a report Tuesday detailing health

trends around the state.

“The drugs are here. They are impacting our families and our

friends, and it is an issue that we really need to realize that we

are worse in some areas than the whole country,” Servais said after

the report was released Tuesday. “So we cannot just sit back and say

‘Well, there is a drug problem everywhere.’ ”

The report’s authors hope it will serve as a reference for policy

makers and health professionals as they look at the state’s progress

on public health issues. “We can resolve this problem, and we are

committed to doing that,” Servais said.

The report pointed out that overdose rates and deaths due to

substance abuse are higher in eastern Massachusetts than any other

large metropolitan area, including New York, Chicago and Detroit.

And the report noted that “contrary to the national pattern,” more

Massachusetts treatment seekers in fiscal 2011 specified heroin,

rather than alcohol, as the primary substance for which they were

seeking treatment.

The problem is particularly pronounced in Worcester, where the city

ranks as the place with the number one heroin addiction problem in

the country, according to the report.

“It has been something I have seen and grappled with,” Murray, the

former mayor of Worcester, told the News Service. “It is something

we were aware of.”

Asked about the report Tuesday, Gov. Deval Patrick said, “As long as

we have a problem and a problem of the scope that was reported on

there’s more to be done, not just at the state level but at other

levels of government and civic organizations and most especially in

the public education that’s a part of public health. Heroin in

particular is more readily available and much more potent than it

has ever been and there are other narcotics, Oxycontin and so forth,

that have continued to be a problem.”

Patrick added, “It’s obviously concerning and I’m sure that the

public health folks in Boston and I would suspect and indeed

encourage our team at the state level to see what those other cities

are doing that might teach us some things.”

Sen. John Keenan, a Quincy Democrat who co-chairs the Substance

Abuse and Mental Health Committee, said the report paints an

accurate picture. Keenan said he sees the problem on the South Shore

when he picks up the newspaper to read local obituaries.

“You look at the obituaries and you will see pictures of these young

kids and it says they passed away unexpectedly” and then the obit

asks people to donate to a substance abuse program in lieu of

flowers.

Keenan said to continue fighting the problem, lawmakers need to make

sure the prescription drug monitoring law passed this year is fully

implemented, as well as make sure people have access to treatment

programs.

Law enforcement officials have different theories about why

Worcester is plagued with heroin addiction, ranging from its

location and proximity to several highways to the relative cheap

cost of heroin, Murray said.

Murray, who chairs the state’s interagency council on substance

abuse and prevention, said fighting drug addiction and substance

abuse across the state became more challenging during the recession

as state budgets tightened and program supporters fought for fewer

resources.

The Legislature boosted funding to substance abuse programs in this

year’s state budget by $2.4 million, bringing the total to $77.2

million. Lawmakers also restored funding to programs that went

without funds during fiscal 2012, including substance abuse

step-down recovery services and secure treatment facilities for

opiate addiction.

Those charged with addressing the problem say prevention and abuse

programs lost a big source of potential revenue when voters in 2010

repealed lawmakers’ efforts to apply the state’s 6.25 percent sales

tax to alcohol purchases. Lawmakers planned to earmark roughly $100

million raised from the tax to substance abuse programs. Months

after it passed, voters repealed it in a ballot initiative.

Critics of the tax said it represented double taxation on alcohol

and warned of higher consumer prices.

“Losing some of that funding on alcohol has challenged our ability

to do as much as we would like to and tailor programs,” Murray told

the News Service.

The impact of losing the tax on alcohol is difficult to quantify,

Murray said, “but it certainly hurts because you’ve got less

resources in a tough economy and increasing demand.”

“Resources do make a difference in terms of getting people sober,

dried out, and then on a path to recovery. It has been more

challenging,” Murray said.

After the tax was repealed, Gov. Deval Patrick and other state

officials said they would look at ways to address substance abuse

funding needs with other revenue sources. House Speaker Robert

DeLeo’s opposition to new taxes over the past few years has raised a

barrier for tax hike proponents.

Vic DiGravio, whose organization Association for Behavioral

Healthcare, pushed for the sales tax on alcohol, said “it is an

issue that deserves to be revisited.”

DiGravio said it is difficult to say how much of the money for

substance abuse programs was lost because of the repeal. Backers of

the measure estimated approximately $100 million each year would be

earmarked for substance abuse programs by taxing alcohol.

“We have a ton of unmet needs in Massachusetts in terms of

treatment. We had a ton of unmet needs before the alcohol tax was

put in place. It is still there now,” DiGravio said.

Rep. James O’Day, a Worcester Democrat who is a member of the Joint

Committee on Substance Abuse and Mental Health, said it is

unfortunate that voters repealed the alcohol sales tax.

“We were never able to see the fruits of it. In that particular

budget, we felt very confident it would have been a huge shot in the

arm for things like education, for prevention,” O’Day said.

Sen. Harriette Chandler, another Worcester lawmaker, said Tuesday

she was aware of the problem, but surprised to learn heroin

addiction is a bigger problem in the city than prescription drug

abuse.

“I thought that was more of a problem than heroin,” she said.

Chandler said the state has “work to do” to solve the issue.

“What this does is make it clear what the problem is. How great the

problem is, and gives us a roadmap of what needs to be done,” she

said.

[Matt Murphy contributed reporting]

State House News Service

Tuesday, November 13, 2012

Fed cuts would slash $1 billion in tax receipts in FY '14, state

budget chief says

By Matt Murphy

Already facing the "strong likelihood" of midyear budget cuts due to

slow economic growth, Gov. Deval Patrick's budget chief told local

leaders Wednesday that a failure by Congress to avert the "fiscal

cliff" would cost the state up to $300 million this fiscal year and

$1 billion over the next full fiscal year.

Secretary of Administration and Finance Jay Gonzalez provided the

projection to town and city officials Wednesday at a meeting of the

Local Government Advisory Commission, advising them that hundreds of

millions of dollars in grants that flow through the state to

municipalities could be at risk, as well as almost $1.5 billion in

defense and health spending.

"The consequences of this are pretty dire. I think we've seen some

positive statements coming out of Washington about a commitment to

try to address this in a responsible way before January," Gonzalez

said.

Following a dismal month for tax collections in October that saw the

state fall to $256 million below revenue projections for the year,

Gonzalez said no final decisions have been made but reported a

"strong likelihood" that the administration would revise downward

its revenue projections and announce mid-year budget cuts soon.

"I'm sorry to not have better news," Gonzalez said. While the

economic growth rate of 1.9 percent in the third quarter was slower

than anticipated due, in part, to uncertainty over federal deficit

negotiations and economic turmoil in Europe, Gonzalez said the

failure to address the fiscal cliff could have a further chilling

effect on growth.

Come January a number of federal tax breaks are due to expire and

$1.2 trillion in budget cuts spread over nine years will go into

effect unless the lame-duck Congress can find common ground on an

alternative approach to deficit reduction.

Gonzalez said economic forecasters have estimated that the economy

across the country, including in Massachusetts, could slow by

another 1 percent to 1.5 percent if sequestration cuts are allowed

to go into effect. The Department of Revenue estimates tax

collections in Massachusetts would decline up to $300 million over

the second half of fiscal 2013 and the first quarter of fiscal 2014,

and could total $1 billion in reduced revenue over the next full

calendar year, according to Gonzalez.

Cuts to defense and health spending, both cornerstones of the

state's economy, would also siphon money out of the economy. The

Patrick administration estimates federal spending in the defense

sector could be reduced by $1.2 billion annually, while National

Institutes of Health funding to the state would fall by $188 million

a year.

Formula and discretionary grants that flow through the state to

municipalities could also be slashed by $200 million, impacting

special education, Title 1 grants, low-income home energy

assistance, child care and small city and neighborhood stabilization

block grants.

Gardner Mayor Mike Hawke said cities would bear the brunt of going

over the "fiscal cliff," projecting that unemployment in his city

would "tumble back" to 11 percent or 12 percent from its current

level of 8.7 percent, well above the state average. "This is obvious

that as a Massachusetts Republican none of this is my fault," Hawke

said.

Lt. Gov. Timothy Murray, who chaired the meeting, said the Patrick

administration has initiated conversations with the White House and

Congressional delegations about the importance of reaching a

bipartisan compromise, and said some "belt tightening" would be

needed, but there's a more responsible way to do it.

"It's all muscle and bone we're talking about here," Murray said.

The Massachusetts Association of School Committees is also urging

members to write articles and op-eds for local newspapers describing

the risks.

Braintree Mayor Joseph Sullivan suggested that an early commitment

to Chapter 90 local transportation infrastructure funding from the

state could be a "stimulus" for cities and towns and help to create

economic growth to offset loss in tax revenue. "This is our number

one priority," Sullivan said.

Danvers Assistant Town Manager Diane Norris noted that for the past

two years Chapter 90 funding has not been available for

municipalities to spend until July, costing half the construction

season despite cities and towns getting their notification letters

in April as mandated by law.

"It wasn't worth the paper it was written on because we couldn't

take it to the bank," she said.

Norris floated the idea of doing a three-year, $1 billion bond that

would guarantee at least $300 million a year in Chapter 90 funding

for municipalities and allow them to plan accordingly.

Murray made a point of noting that the delay in Chapter 90 approval

this year was "an issue between the House and Senate. I just want to

be clear on that. We agree with you we want to put the money out

sooner rather than later."

Alluding to the long-term transportation financing plan the

administration is planning to roll out in January, Murray also

suggested putting pressure now on lawmakers to support

infrastructure funding.

"I don't think it's too early for all of you to sit down with your

legislative delegations, your reps and senators, now to talk about

what this means. There are certain communities in the state and

delegations where they're good at asking but when we make some of

these tough votes that you're talking about we don't always see them

out front in terms of making the case that some level of revenue is

needed," Murray said.

Labor Secretary Joanne Goldstein also informed municipal leaders

that a task force charged with reviewing the state's unemployment

insurance system would be ready to release its policy

recommendations in the next couple of weeks that would "address all

of the systematic issues raised by municipalities."

Almost two weeks after "Superstorm Sandy" caused widespread power

outages around the state, some local leaders gave mixed reviews to

the performance of utility companies.

Paul DeRensis, a selectman from Sherborn, said he thought the

utilities made "considerable improvement" from their response to

major storms last year that led to record fines. His town is

serviced by NStar, Comcast and Verizon.

Still, he said there was room for improvement, complaining that

NStar pulled its crews from the town because it deemed conditions

too dangerous for crews while Sherborn town crews worked through the

storm trying to clear 25 downed trees blocking roads.

Donna VanderClock, the town manager of Weston, said the liaison

appointed to communicate with her town was unable to provide updates

on when roads would be cleared, and said NStar was robo-calling

customers informing them that their power had been restored when it

hadn't.

Attleboro Mayor Kevin Dumas reported similar communication problems

and poor coordination of line and tree clearing crews by utilities.

The officials called for passage of legislation to make it easier to

start up municipally owned utilities, and Murray suggested setting

up a further meeting to explore the lingering issues encountered by

some towns with storm response.

The Boston Globe

Tuesday, November 13, 2012

Boston Capital

Big Bay State players may face showdown

By Steven Syre

I don’t know exactly how Washington’s fiscal cliff drama will

eventually end, but it’s clear some substantial federal spending

cuts are going to be part of the solution.

The details of those cuts — who loses how much and when — will have

a big impact on the economy of Massachusetts. The politics of the

fiscal cliff may pit two of the state’s biggest economic engines —

the defense industry and the Massachusetts health care establishment

— against each other.

Defense contractors are at a disadvantage coming out of the gate.

Military budgets are targeted for half of the $110 billion in total

federal cuts that could go into effect automatically next year — in

theory, at least — if Congress fails to come up with an alternative

plan by January.

Budget planners looking for other places to spread some of those

cuts as an alternative couldn’t possibly miss health care spending

as a huge discretionary expense.

The conflict between defense and medical budgets transcends the

immediate fiscal cliff theater. Federal spending is a long-term

fiscal problem that will demand action over time. Defense companies

and health care organizations will be natural targets every time the

subject comes up.

Few other industries mean as much to the Massachusetts economy.

Sure, there are also education and financial services. Technology

companies splinter into so many different industries — defense high

among them — that it’s hard to call them a single, unified economic

force.

But defense and health care both employ tens of thousands of people

and contribute billions to the Massachusetts economy. Anything that

happens to them will be felt by all.

Like all big industries, defense contractors and health care leaders

have lots of handy facts and figures proving they are essential.

Most of those numbers come from reputable places, but a little

skepticism is advised.

The defense industry directly employs more than 130,000 people in

Massachusetts and affects many more state jobs, according to a

Defense Technology Initiative report prepared by the University of

Massachusetts Donahue Institute.

That report calculates the total value of Department of Defense

contracts awarded to local companies last year at $13.9 billion.

That work produces indirect economic activity worth another $11

billion. By way of context, the entire state domestic product in

Massachusetts is about $350 billion.

So what would happen to those Massachusetts jobs if automatic

federal budget cuts do occur? Massachusetts would lose about 41,000

jobs — the fifth most among states — over the next two fiscal years,

according to a study prepared at George Mason University for the

Aerospace Industries Association.

Defense contractors don’t rely on job security alone when they

defend their government business. The common alternative theme is

all about the essential work they do.

Health care executives operate with a similar game plan. They too

manage huge workforces but also talk about important things like

saving lives and curing disease.

The state’s health care industry is so sprawling — encompassing

hospitals, medical schools, biotechnology, and medical device

companies among others — it’s hard to get your head around it.

In Boston, medical research touches most of those fields and it,

too, is under pressure. The National Institutes of Health will be

required to cut its budget by 8.2 percent — or about $2.5 billion —

next year without an alternative cost-cutting plan from Congress.

NIH spends as much as 10 percent of its money in Massachusetts.

Federal dollars flow through the health care industry in many other

ways. Protecting all of them is a tall order.

One simple example: Indirect Medicare support for teaching hospitals

— extra payments that help defray the added cost of training new

doctors on the job. Those payments were targeted for deep cuts by

the National Commission on Fiscal Responsibility and Reform last

year.

A report prepared for the Association of American Teaching Hospitals

estimated those cuts would cost Massachusetts facilities more than

$200 million and 5,000 jobs. Only two other states would get hit

harder.

Plans to constrain federal spending will remain on the front burner

long after the fiscal cliff approaches in January. Industries that

depend on government will try harder to preserve their slice of the

pie. The best strategy: Make someone else sacrifice.

In Massachusetts, that could put two of our most important

industries at odds with one another.

Campaign for

Our Communities

Wednesday, November 8, 2012

Voters Repeat Themselves: Invest in our Community!

By Andi Mullin

In the midst of the big national story on Tuesday's election

results, there is a much more local - and revealing - story that

played itself out in races for the Massachusetts state legislature.

You may recall that I wrote in this space after the primary election

in September about the victory of Democrat Mary Keefe in the 15th

Worcester district. Keefe ran in a hotly contested primary election

for an open House seat as an unapologetic supporter of "An Act to

Invest in Our Communities," which would raise $1.4 billion in new

revenue in a way that holds down increases for low- and

middle-income families. Despite being attacked relentlessly by every

other candidate in the race, Keefe won her primary by 9 points.

The general election on Tuesday has provided us with a similar

story. Rep. Jim O'Day (D-West Boylston) is the House sponsor of "An

Act to Invest in our Communities," and he faced a Republican

challenger who made O'Day's leadership on this bill the very basis

of his campaign. The Republican attacked O'Day relentlessly on this

issue through billboards, newspaper advertisements and mailings. It

was quite the bombardment.

The result: Rep. O'Day won his race by over 30 points!

While I am of course delighted that Rep. O'Day defended his seat, I

think that both of these races prove a wider point. Voters in

Massachusetts care about their communities and about the services

that state and local government provide. Schools, roads, bridges,

public safety, parks and libraries are all critical to our quality

of life, and voters know it. When presented with a fair and

reasonable solution to the funding problems that are causing our

cities and towns to continually decimate these critical services,

voters like that solution!

Congratulations both to Rep. Jim O'Day and to Rep-Elect Mary Keefe!

http://ourcommunities.org/entries/118

* *

*

Andi Mullin is the Director of the

Campaign for Our Communities. Previously, Andi was the Director

of Legislation and Governmental Affairs at the Massachusetts

Nurses Association, a labor union and professional association

representing 23,000 nurses and health care professionals across

Massachusetts. At the MNA, Andi successfully designed and

implemented a legislative and communications campaign focused on

reducing violence against nurses and other hospital workers.

That campaign resulted in the passage of a bill in 2010 that

increased penalties for those convicted of such assaults. Andi

also served on the Steering Committee of the successful NO on

Question 1 (2006) and NO on Question 3 (2008) ballot campaigns,

which defeated two different anti-tax measures.

Prior to her work at the MNA, Andi was the Legislative Agent for

AFSCME Council 93, a labor union representing 35,000 public

sector employees throughout Massachusetts and northern New

England. In that position, she chaired the 2002 Stop the Cuts

Coalition, which helped to pass a $1.2 billion progressive tax

package that included a provision that increased taxes on

capital gains. She also chaired a coalition of public sector

unions that fought a package of anti-union legislation pushed by

then newly-elected Massachusetts Governor Mitt Romney. That

coalition successfully defeated each of then-Governor Romney's

proposals.

Massachusetts Jobs

With Justice

Wednesday, November 8, 2012

Campaign for Our Communities Message Training

Thursday, December 13, 2012 - 10:00am to 12:30pm

1199 SEIU, 150 Mt. Vernon St. 2nd Floor

Dorchester, MA

The elections are over, and voters have embraced a vision of people

working together to confront the large challenges we face. It is

time to turn that vision into action! In Massachusetts, we have the

opportunity to strengthen our under-funded schools, rebuild our

crumbling transportation infrastructure, and provide the kinds of

support that all of our people need to lead productive and

economically secure lives.

Building public will to support the revenue increases needed to meet

these challenges requires all of us to deliver consistent and

effective messages, using language that builds on the idea of

working together.

This training will help us to do just that! The CFOC is bringing

Patrick Bresette from Public Works to Massachusetts to talk with a

select group of our supporters about messaging for the Campaign.

Public Works is a national non-profit organization that has done

extensive research about how to communicate effectively with the

public about government, the economy, budgets, and taxes. Patrick

Bresette is Public Works Director of Programs and is an expert at

translating this research into practical applications.

Questions? Contact Campaign Director Andi Mullin

at 617/878-8316 or at Andi@ourcommunities.org

http://www.massjwj.net/events/campaign-our-communities-message-training

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

|