|

Help save yourself -- join CLT

today! |

CLT introduction and membership application |

What CLT saves you from the auto excise tax alone |

Ask your friends to join too |

CLT UPDATE

Saturday, May 26, 2012

Senate Dems duck serious reform, spend more on EBT card fraud

|

A majority of the Senate on Thursday night

brushed aside attempts to further stiffen restrictions on how

electronic and cash welfare benefits are spent by recipients,

agreeing in large part to the reforms already outlined by Senate

leaders in the budget and eschewing tougher limits sought by the

House....

The Senate’s plan, however, did not go as far as

that adopted by the House in its budget, which included a longer

list of prohibited uses, including on travel and spending outside

Massachusetts and its border states, and calls for a study on what

it would take to move toward a cashless system.

“The crux of the issue surrounding EBT and the

abuse of EBT cards has to do with the fact that the cards are easily

transferable to cash,” said Sen. Robert Hedlund, a Weymouth

Republican, who proposed three different amendments to the budget

all of which failed on successive roll calls with no more than 13

votes of support....

“This is not too far on the left and not too far

on the right and carves out a very solid, logical middle,” Ways and

Means Chairman Stephen Brewer [D-Barre] said.

Hedlund first attempted to restrict cash

withdrawals on EBT cards from ATM machines to $20 a day for

incidentals, but that amendment was defeated 11-25.

The second proposal adopted the language from the

House plus the $20-per-day cash limit. That amendment failed 8-29.

The final amendment offered by Hedlund

essentially mirrored the House proposal banning ATM machines that

accept EBT cards from bars, liquor stores and adult entertainment

facilities adding items such as concert tickets, political donations

and travel to the list of prohibited uses. The amendment failed

13-24....

[Sen. Jennifer Flanagan, D-Leominster] said. “The

issue that we are trying to really go after is the issue of fraud,

and in the Senate budget we did that.”

State House News Service

Friday, May 25, 2012

Senate seeks out "logical middle" in EBT reform debate

The handwriting was on the wall . . .

By David Hitch

Worcester Telegram & Gazette

Sunday, April 8, 2012

|

|

Chip Ford's CLT

Commentary

Professing “The issue that we are trying to

really go after is the issue of fraud, and in the Senate budget we

did that,” state Senator Jennifer Flanagan (D-Leominster) celebrated

the amendment which did no such thing.

But such is life on Bacon Hill where one party

rules.

The day before (Wednesday) when the small band of

four Senate Republicans tried to introduce their budget amendments

to roll back the state income and sales taxes, Senate President

Theresa Murray (D-Plymouth) ruled that tax reductions are out of

order, as the state budget is "not a money bill within the meaning

of the constitution." When challenged by the Minority Leader,

Senator Bruce Tarr (R-Gloucester), she would not relent.

According to the State House News Service

transcript of the debate:

| |

CLICK

IMAGE TO ENLARGE |

| |

|

| |

CLICK

IMAGE TO ENLARGE |

| |

|

Sen. Tarr said: "My inquiry was as to

whether a change that reduced taxation, in accordance to court

rulings, would make it a money bill. Could the chair clarify?"

Sen. Murray replied: "It is the

position of the chair that this is not a money bill, whether we

increase or decrease."

By a roll call vote of 33-4, the Senate

Democrat majority stood with her, determined that tax cuts

cannot be contained

within the Senate budget.

Sen. Tarr later added:

"Is this real or is this just something we

are going to carry on the books, sort of like the reduction in

the income tax

that the voters approved that we have not enacted

yet either.

"I know we can’t talk about the income tax. The budget, the

largest spending document in the Commonwealth, is not a money

bill. Only in this chamber would that definition prevail. Only

in this chamber could we have a reverse sunset. The sun is held

in the hands of the chair of Ways and Means."

So tax reductions were simply swept out of the

budget debate by a party-line vote (33-4) and the Senate steamrolled

on.

It was more of the same when it came to EBT card

reforms: The small band of Republicans proposing honest reforms,

Democrats

(with rare exceptions) voting them down and sticking in a fig leaf for cover

— a distraction that will accomplish

even less than the watered-down reforms adopted by the Democrat

majority in the House version.

Here are the three serious reforms offered by

Senator Robert Hedlund (R-Weymouth) and the results:

Amendment #139.1 —

Establishment of Taxpayer Accountability Office

Roll Call #218 — [YEAS

11 - NAYS 25] — (Further)

GOV Robert L. Hedlund —

Establishment of Taxpayer Accountability Office

— Rejected

Amendment #144.2 —

EBT Reform Twenty Dollar Limit

Roll Call #219 —

[YEAS 8 - NAYS 29] —

(Further) GOV Robert L. Hedlund —

EBT Reform Twenty Dollar Limit —

Rejected (Image Right-Top)

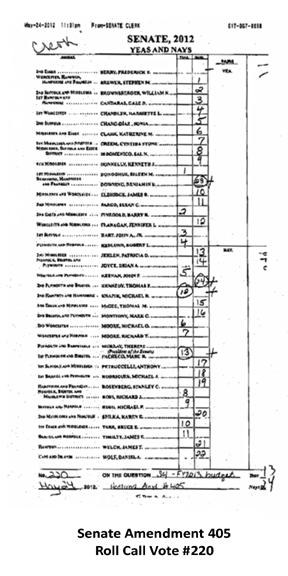

Amendment #405 —

EBT Reform

Roll Call #220 —

[YEAS 13 - NAYS 24] —

(Redraft) EPS Robert L. Hedlund —

EBT Reform —

Rejected (Image

Right-Bottom)

Sen. Jennifer Flanagan's (D-Leominster) EBT card

"reform"

amendment was all that remained as even an attempt to improve

the Senate Ways & Means

Committee recommendation. But it offered little but camouflage,

protective coloration — so she

and her Democrat majority could disingenuously announce: “The issue

that we are trying to really go after is the issue of fraud, and in

the Senate budget we did that.” The only game in town was adopted

unanimously (34-0).

Taxpayers will still be funding EBT card cash

withdrawals from ATM machines. Taxpayers will now also be funding

and additional $750,000 for a special State Police unit to

investigate EBT abuse and fraud —

then the additional cost of courts, public defenders,

mandated translators, and incarceration (1-2 years) if an abuser is

found guilty of violating one of the restrictions. Of course any

hope of collecting a court-ordered fine or restitution will be

futile.

One of the "reforms" I get a kick out of is

intended to address all those "missing" ETB cards the state keeps

replacing free of charge — reportedly

20,000 each month. The Senate addresses this ridiculous abuse with:

[The state will] "send a notice to any

benefit recipient who requests more than 3 replacement

electronic benefit transfer cards in a calendar year and monitor

future requests for replacement cards; provided that the notice

shall state that the department has noted an unusual number of

requests for replacement electronic benefits cards and will be

monitoring all future requests for replacement cards."

Yeah, I usually lose my credit card three or four

times a year — don't you?

The next step in this budget procedure is the

appointment of a six-member House-Senate conference committee to

resolve differences between the Senate budget and the one previously

passed by the House. Unfortunately, any compromise would only weaken

the already anemic House version of EBT card reform; at best the

House version would prevail.

After the massive amount of exposure and outrage

of the past few months over EBT card abuse and outright theft [e.g.,

CLT UPDATE, April 15 —

Stop the EBT Card Rip-Off Now], with all eyes across the state

focused on Beacon Hill for a solution to such an obvious rip-off,

all the sound and fury again signified nothing, very little at best.

As long as the ruling Democrat Party reigns imperiously nothing will

change. They don't feel any need to be accountable to the taxpayers

and will keep steamrolling over the minority party with arrogance

and self-assured impunity.

The only salvation against such domination is to

elect more responsive legislators, and that opportunity is coming.

Check the roll call votes (click on the above

images to be taken to enlargements) on this "reform" sham, see how

your senator voted.

Then if necessary consider supporting a

replacement this fall, and remember in November when you vote.

|

|

|

|

Chip Ford |

|

|

|

|

State House News Service

Friday, May 25, 2012

Senate seeks out "logical middle" in EBT reform debate

By Matt Murphy

A majority of the Senate on Thursday night brushed aside attempts to

further stiffen restrictions on how electronic and cash welfare

benefits are spent by recipients, agreeing in large part to the

reforms already outlined by Senate leaders in the budget and

eschewing tougher limits sought by the House.

The debate over EBT card benefits capped the second day of debate on

the Senate’s fiscal 2013 budget proposal that saw resolutions

reached to keep Taunton Hospital open with 72 beds, to fund the

Community Preservation Act with an additional $5 million and to

allow for the expansion of hotels on the South Boston waterfront.

The Senate plans to resume its debate at 9 a.m. on Friday morning

with the long Memorial Day holiday weekend looming and 43 of the 694

amendments filed to the budget still pending. Amendments dealing

with immigration, stricter financial reporting for mutual companies

and a repeal of the pharmaceutical gift ban still await action.

“Hopefully, we’ll finish tomorrow,” Senate President Therese Murray

said.

The Senate budget, as proposed by Ways and Means, would prohibit the

use of cash assistance for pornography, firearms, tattoos,

piercings, gambling, fines, fees and bail. The budget bill would

also create a new unit in the State Police to investigate EBT fraud,

establish a crime of food stamp trafficking, and add a fee for lost

cards.

The Senate’s plan, however, did not go as far as that adopted by the

House in its budget, which included a longer list of prohibited

uses, including on travel and spending outside Massachusetts and its

border states, and calls for a study on what it would take to move

toward a cashless system.

“The crux of the issue surrounding EBT and the abuse of EBT cards

has to do with the fact that the cards are easily transferable to

cash,” said Sen. Robert Hedlund, a Weymouth Republican, who proposed

three different amendments to the budget all of which failed on

successive roll calls with no more than 13 votes of support.

The Senate did, however, modify its EBT reform plan unanimously

adopting an amendment filed Ways and Means Vice Chairwoman Jennifer

Flanagan that would prevent cash from being withdrawn in liquor

stores, casinos and strip clubs, require the MBTA and each regional

transit authority to move toward acceptance of EBT cards for fares,

and directs the Department of Transitional Assistance to work toward

a vendor payment system would allow the department to directly pay

landlords and utilities if it is determined that cash benefits are

being spent inappropriately on other things.

“This is not too far on the left and not too far on the right and

carves out a very solid, logical middle,” Ways and Means Chairman

Stephen Brewer said.

Hedlund first attempted to restrict cash withdrawals on EBT cards

from ATM machines to $20 a day for incidentals, but that amendment

was defeated 11-25.

The second proposal adopted the language from the House plus the

$20-per-day cash limit. That amendment failed 8-29.

The final amendment offered by Hedlund essentially mirrored the

House proposal banning ATM machines that accept EBT cards from bars,

liquor stores and adult entertainment facilities adding items such

as concert tickets, political donations and travel to the list of

prohibited uses. The amendment failed 13-24.

While the debate over EBT abuse did not generate quite the level of

tension in the Senate as it did in the House where some members

accused their colleagues of attacking the poor, the discussion had

its moments of intensity.

While urging her colleagues to reject Hedlund’s proposal to limit

cash withdrawals, Sen. Jennifer Flanagan called out Hedlund for his

poor attendance at the EBT reform commission on which they both

served.

“When we have five meetings and the gentleman showed up for one and

a half of them, it really pains me to stand here at 9:30 at night

and talk about how we need to revamp the EBT system…,” Flanagan

said. “The issue that we are trying to really go after is the issue

of fraud, and in the Senate budget we did that.”

Hedlund said that being a member of a minority caucus of four with

multiple committee assignments and other obligations made it

impossible for him to attend all the meeting, but he said he can

account for every minute he was not there.

Sen. Sonia Chang-Diaz also tried to muddy the waters with a further

amendment that would have applied all the spending restrictions and

fines being proposed for welfare recipients to corporate entities

that receive tax breaks or subsidies. The Boston Democrat used the

example of David Long, the CEO of Liberty Mutual, who reportedly

spent $4.5 million to renovate the executive suit with luxury

accommodations to illustrate her point.

“They shouldn’t be not be knocking on the taxpayers door with their

hand out making the argument they can’t possibly create more jobs in

Massachusetts without this help and turn around spend those dollars

on categories like alcohol, entertainment venues, pornography, and

luxury fixtures for office suites,” Chang-Diaz said.

Suggesting that Chang-Diaz’s amendment would nullify programs such

as the film tax credit, Senate Minority Leader Bruce Tarr adamantly

questioned whether the proposal violated Senate President Therese

Murray’s previous ruling that tax changes were out of order during

the budget debate.

Though the clerk disagreed, Tarr protested prompting Murray to slam

the gavel and recess the session. After huddling at the rostrum with

Tarr and members of the clerk’s staff, Murray left the chamber with

her chief of staff, Chang-Diaz and the assistant clerk of the

Senate, only to have Chang-Diaz withdraw the amendment when they

returned 20 minutes later.

On Thursday, the Senate also increased funding for the METCO

education diversity program by $1 million, and supported Sen. Brian

Joyce’s amendment to ban “any procedure which causes obvious signs

of physical pain, including, but not limited to, hitting, pinching

or electric shock for the purposes of changing the behavior of such

person” by programs or facilities treating a person with a

disability.

|

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

|