by Jeff Jacoby

The Boston Globe

October 25, 2009

From his website at:

http://www.jeffjacoby.com/6477/clts-last-hurrah

TIME AND AGAIN,

Citizens for Limited Taxation has come to the

rescue of Massachusetts taxpayers. Will taxpayers

come to the rescue of CLT?

|

CLT's happy warrior:

Executive Director Barbara Anderson

|

For 35 years, CLT has been an

unwavering foe of high taxes and government

arrogance, two commodities for which Massachusetts

is well-known. It was created in 1974 to fight a

proposal for steeply graduated income-tax rates,

a proposal it defeated in the 1976 election.

When the grad-tax

returned to the state ballot in 1994, CLT led

the fight to

defeat it once again.

In 1980, CLT stunned the

Massachusetts political establishment with its

successful crusade to slash property and auto-excise

taxes, which were then among the highest in America.

CLT's weapon was

Proposition 2½, a ballot question vehemently

denounced by the state's liberal elite, including

the League of Women Voters, the Massachusetts League

of Cities and Towns, and the Massachusetts Teachers

Association. In an editorial, the Boston Globe

blasted the measure's "meat-ax approach" and

condemned its proponents as "fanatical critics of

municipal government" who were oblivious to the

devastation they would cause.

But the voters followed CLT, and

approved Proposition 2½ by a wide margin. Far from

wreaking havoc across the commonwealth, the law

became "the most powerful engine of change in recent

Massachusetts political history,"

as even the Globe would later acknowledge -- the

single greatest factor in "the state's amazing

turnaround."

In 1996, the nonpartisan

civic-affairs journal CommonWealth

described Proposition 2½ as "the most sweeping

public policy reform in recent Massachusetts history

-- and one that did not come about from the efforts

of 'progressive' reformers." Nevertheless, it

pointed out, CLT accomplished much that even

"good-government liberals might well applaud,"

including a decreased reliance on regressive

property taxes, a more sensible real-estate

assessment system, better management of municipal

budgets, and -- since Prop 2½ allows local

communities to

override the statutory levy limit with voter

approval -- more democratic decision-making, at

least when it comes to property taxes.

CLT is almost preposterously

tiny, and it has always operated on a shoestring.

Its four paid staffers make far less than many of

their opponents -- the legislators, lobbyists, and

union officials whose appetite for higher taxes and

more government spending never seems to diminish.

Barbara Anderson, the incorruptible happy warrior

who became CLT's executive director in 1980, earns

just $10 an hour.

But even a shoestring budget

needs to pay for shoestring, and CLT is no longer

sure it can do so. Between the recession and the

exodus of fed-up citizens from Massachusetts,

CLT's membership has shrunk dramatically, from

10,000 in the mid-1990s to only around 3,000 today.

CLT has also lost some of its most generous donors

-- among them Richard Egan, the founder of EMC

Corp., who died in August. As a result,

CLT announced last week, "we are hurting

financially more than ever before." The group's

annual fundraising brunch on Nov. 15 may be its last

hurrah: If turnout is low, says co-director Chip

Ford, CLT will shut down on Nov. 16.

|

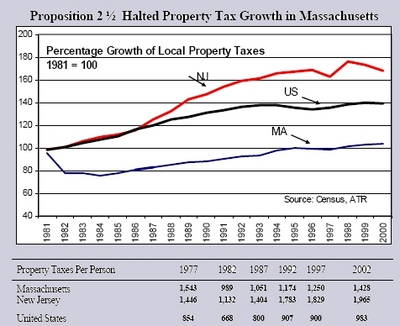

Property taxes in

Massachusetts aren't cheap -- but they are

far lower than they would have been without

Proposition 2½

|

No organization lasts forever,

and at 35 CLT has already outlived many advocacy

groups. No doubt diehard welfare-statists and

big-government lefties would be happy to attend

CLT's funeral. No doubt many Massachusetts residents

have more pressing personal concerns.

But with state government once

more a wholly-owned subsidiary of the Massachusetts

Democratic Party,

with the state's sales tax rate now up to 6.25

percent, and with Beacon Hill hungrily seeking

more revenue, the prospect of CLT's demise should be

setting off alarms.

Were it not for CLT,

Massachusetts taxpayers and businesses would be

forking over far

more of their wealth to the tax man than they

do. In addition to blocking graduated tax rates and

reining in property taxes, CLT forced the repeal in

1986 of an income surtax enacted under Governor

Michael Dukakis and led a successful ballot campaign

in 2000 to roll back state income taxes. Though it

hasn't won every battle, it has never shied from the

battlefield.

"Without the benefit of paid

signature-gatherers or the large advertising budgets

deployed against them by the public-employee unions

who fought their every move," wrote Jon Keller in

The Bluest State, his acclaimed 2007 study

of Massachusetts politics, "Barbara Anderson and CLT

… established themselves as the state's most

effective check on runaway taxation, far more

formidable than the toothless handful of Republicans

in the legislature."

With hard work and good humor,

Citizens for Limited Taxation has made

Massachusetts a much better place than it would

otherwise be. It has survived a lot in the past 35

years, but it cannot survive indifference. If you're

free on Nov. 15, you might want to

have brunch with Barbara Anderson.

(Jeff Jacoby is a columnist

for The Boston Globe.)

Article URL:

http://www.jeffjacoby.com/6477/clts-last-hurrah