CLT UPDATE

Thursday, June 17, 2010

All 10 Marblehead Prop 2˝

overrides defeated;

Revolution 2010 is in the air!

| |

|

Fearful Marblehead voters rejected all 10 debt

exclusion overrides in Tuesday's special election....

Voter turnout was high - 5,880 or roughly 32 percent....

Tuesday's ballot featured a record-setting 10 debt exclusion

overrides with a total value of $56.9 million....

The Lynn Daily Item

Wednesday, June 16, 2010

Marblehead voters reject all overrides

The Marblehead rejection follows

similar news in Belmont on Monday, where residents rejected a $2

million Proposition 2˝ override that would have allowed the town to

restore police and fire positions and avoid some significant cuts in

the schools next year....

Marblehead voters in recent years had been

supportive of Proposition 2˝ tax increases, approving six debt

exclusions and an operational override between 2005-2009.

The Boston Globe - North Edition

Wednesday, June 16, 2010

Marblehead voters reject all 10 ballot measures to hike taxes

"It's a loss for the town," School Committee

Chairwoman Patricia Blackmer [who also chairs the Glover School

Building Committee] said of the outcome. "It's a missed

opportunity." ...

If all 10 overrides passed, it would have cost the average

Marblehead taxpayer roughly $500 more a year. Voters, however,

clearly had no appetite for a tax increase.

"Maybe there was too big a menu, too many items," said Phil

Sweeney, chairman of Marblehead's library trustees....

The Glover project has to be funded with an override, Blackmer

said. "We don't have the money in the operating budget," she

said....

"We'll be back before the town," Blackmer said.

The Salem News

Wednesday, June 16, 2010

Voters lack inclination to override Prop. 2˝

Vote Totals

|

|

Chip Ford's CLT

Commentary

If it can happen here in Marblehead, it can

happen anywhere.

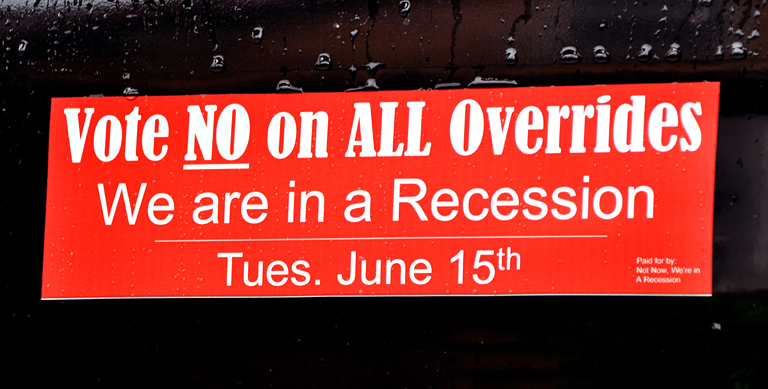

Longtime CLT member Jack Buba did an incredible

job organizing the opposition to a $500 (average home) tax hike with

signs, bumper stickers, yard signs, and robo-calls to turn out the

vote. This incredible success for Marblehead taxpayers wouldn't have

happened without his remarkable, tireless efforts -- and that of so

many others in his "Not Now, We're In A Recession" committee.

[Barbara's Salem News column:

Seeking a cure for override fever in Marblehead]

| |

|

|

Bumper sticker on my

SUV |

"Marblehead voters in recent years had been

supportive of Proposition 2˝ tax increases, approving six debt

exclusions and an operational override between 2005-2009," the

Boston Globe North edition's John Laidler reported, and that's the

truth. Barbara and I hoped for the best but prepared for the usual

-- the Beautiful People and Trustafarians who have controlled town

meeting for years outvoting the stretched and struggling oldtime

Townies, as usual.

For a Boston Globe "Override Central" blog on May

7, 2008, regional editor David Dahl asked Barbara to write a short

column, which was titled "From

Barbara Anderson, a little history." In it she described a scene

from a recent Marblehead town meeting we'd attended:

"This year, forced to recognize that some people

can’t afford to pay more, override proponents are stating their

sympathy before arguing for the override anyhow. Clearly they don’t

care that a tax increase is a pay cut for people on fixed incomes,

or who are unemployed; sometimes they suggest that such people might

want to live somewhere else that is more affordable for them. At a

Marblehead Town Meeting several years ago, a woman responded to a

senior citizen’s concern that 'if you can’t afford this,

perhaps you aren’t managing your portfolio properly.'"

After the recent stock market plunge, perhaps

that woman -- and many of the other Beautiful People and

Trustafarians -- have discovered that neither have they!

When the voting returns came in on Tuesday night,

we were stunned: Ten defeats, every override shot down in flames --

here!

"Disappointed" School Committee and Glover School

Building Committee chairwoman Patricia Blackmer vowed that, despite

the voters' decision, "the effort to get the school built will

continue."

"We will regroup and do what we need to do to

gain support for the project," she said . . . "We'll be back before

the town."

Unfortunately, "Eternal vigilance is the price of

liberty" and of course tax-and-spenders -- like The Terminator --

will be back, until they wear taxpayers down or get lucky with a low

turnout when nobody's looking or away on vacation.

This is why CLT filed a bill in 2007 (S-1702)

to require a year's interval between similar overrides; again in 2009 (S-1232)

to restrict overrides to biennial state elections -- not incessantly

as soon as one is defeated. Neither has become law.

|

|

|

Chip Ford |

|

|

|

|

The Boston Globe - North Edition

Wednesday, June 16, 2010

Marblehead voters reject all 10 ballot measures to hike taxes

By John Laidler

In a sweeping rejection of higher taxes, Marblehead voters on

Tuesday defeated 10 ballot measures to exceed the town’s property

tax limits for various capital projects.

Among the defeated tax proposals were measures to fund the $28.8

million cost of building a new elementary school, and the $22.2

million cost of capping the former town landfill and building a new

transfer station on the site.

All of the questions were soundly defeated except for the school

construction measure, which lost by 2,953 to 2,882.

The Marblehead rejection follows

similar news in Belmont on Monday, where residents rejected a $2

million Proposition 2˝ override that would have allowed the town to

restore police and fire positions and avoid some significant cuts in

the schools next year.

Marblehead Board of Selectmen chairman James E. Nye said he was not

surprised by the outcome, attributing it to the difficult economy.

"I work at a bank and I know things are tight," said Nye, who is

president of the National Grand Bank, in Marblehead.

If all 10 ballot questions had passed, they would have added $423 to

the tax bill of a median home valued at $512,000 this fiscal year.

The annual town meeting in May authorized funding for the projects

contingent on passage of the ballot questions, eight of which were

debt exclusions, or temporary tax increases to repay debt, and two

of which were capital exclusions, or one-year tax hikes.

Marblehead voters in recent years had been supportive of Proposition

2˝ tax increases, approving six debt exclusions and an operational

override between 2005-2009.

The proposed new elementary school would be built on the site of the

Glover School and serve as a consolidation of the Glover and Eveleth

schools. The proposal assumes state reimbursement, tentatively set

at 40 percent of the cost.

School Committee chairwoman Patricia Blackmer said the committee is

disappointed, but that the effort to get the school built will

continue.

"It’s still a 90-year-old building that has significant deficiencies

and is not handicap accessible," she said of the original section of

the Glover. "We will regroup and do what we need to do to gain

support for the project."

A residents’ group calling itself, "Not Now, We’re in a Recession,"

campaigned actively to defeat all 10 ballot questions.

"The people of Marblehead sounded a resounding "Not now, we’re in a

recession" to our town leaders today. Many residents, including

those on fixed incomes, those who have lost their jobs or are

worried about losing their jobs, will rest a little easier tonight,"

Jack Buba, a spokesman for the group, said in a statement released

after the outcome was announced Tuesday night.

The Lynn Daily Item

Wednesday, June 16, 2010

Marblehead voters reject all overrides

By Jack Butterworth

MARBLEHEAD - Fearful Marblehead voters rejected all 10 debt

exclusion overrides in Tuesday's special election.

The one that came closest to passing was the new $28.8 million

Glover-Eveleth School, which garnered 2,953 "No" votes and 2,882

"Yes" votes - a 71-vote loss.

All the other questions, including the state-required $22.2 million

landfill cap and transfer station construction project, failed by

margins of about 2-1.

Voter turnout was high - 5,880 or roughly 32 percent.

Tuesday's ballot featured a record-setting 10 debt exclusion

overrides with a total value of $56.9 million. A simple majority was

required to pass each of the questions. Funded by bond issues, the

borrowing required for all 10 questions would have added 83 cents to

the town's $9.57 tax rate, or $423.27 to the $4,900 annual tax bill

for a $512,000 median home, an 8.6 percent hike for the first year.

"It's back to the drawing board," Director of Public Health Wayne

Attridge said about the landfill and transfer station plan. "I'll

have to talk about this with the Board of Health."

School Committee Chairman Patricia Blackmer, who also chairs the

Glover School Building Committee, called the school vote "incredibly

disappointing" and "a loss for the town."

Obviously emotional, she declined to rule out a request for a

recount.

"We have to retrench," she said. "We will come back and ask again.

We can't do nothing so we will be back."

The $28.8 million new building cost included $11.18 million in

Massachusetts School Building Authority reimbursement, or 40

percent. The town was grandfathered in at 40 percent because the

state is no longer offering that much.

The school figure would have been funded with a 20-year bond issue,

adding 24.7 cents to the tax rate and $126.55 to the annual median

home tax bill.

Blackmer admitted that the 10-question ballot "could feel

overwhelming."

"But I would hope that people could take a look at each question and

vote on them individually," she said.

Jack Buba, leader of the group "Not Now, We're in a Recession" that

opposed all the overrides, offered a prepared statement Tuesday

evening:

"The people of Marblehead sounded a resounding 'Not now, we're in a

recession' to our town leaders today. Many residents, including

those on fixed incomes, those who have lost their jobs or are

worried about losing their jobs, will rest a little easier tonight."

"I hope the town leaders will listen to the voice of the people. The

Board of Health should go back to the drawing board and come to the

voters with a much more modest and total solution to the dump issues

so we can comply with the state mandate."

"I also hope that the town leaders do not show disrespect to the

citizens who voted today and begin a tedious round of 'do-over

overrides.' Our selectmen should ensure that the will of the people

is heard and wait at least until next year's Town Meeting before

reconsidering any other articles."

The other questions included a $706,961 landfill monitoring program,

the $899,955 purchase of a landfill-contaminated home at 57 Stony

Brook Road, $100,000 for additional sidewalk repair, purchase of a

vacant 195 Pleasant St. gas station, the $1.64 million Pleasant

Street traffic safety program (including a $400,000 Massachusetts

Highway Department grant), $292,394 for access improvements at Abbot

Public Library, $1.5 million for Astro-turf at the Marblehead High

football field and $450,000 for furniture and technology purchases

for the new Marblehead Village School.

The Salem News

Wednesday, June 16, 2010

Voters lack inclination to override Prop. 2˝

By Matthew K. Roy

MARBLEHEAD — Voters yesterday rejected all 10 Proposition 2˝

overrides on the ballot here, including a proposal to fund

construction of a new Glover School.

The $29 million school project failed by 71 votes, 2,953 to 2,882.

"It's a loss for the town," School Committee Chairwoman Patricia

Blackmer said of the outcome. "It's a missed opportunity."

The state promised to reimburse the town for 40 percent of the

school project's costs, and school officials last night were hoping

the result at the polls did not put that in jeopardy.

If all 10 overrides passed, it would have cost the average

Marblehead taxpayer roughly $500 more a year. Voters, however,

clearly had no appetite for a tax increase.

They shot down a plan to cap the old landfill and build a new

transfer station. They said no to the installation of artificial

turf at the high school's Piper Field, and no to technology upgrades

and new classroom furniture at Village School.

Proposed renovations of Abbot Public Library; the redesign,

including traffic light upgrades, of the Pleasant Street corridor;

and the purchase of two properties, 195 Pleasant St. and 57 Stony

Brook Road, failed. Voters also would not support a tax increase to

fund continued environmental testing at the old landfill or $100,000

to repair sidewalks throughout town.

"Maybe there was too big a menu, too many items," said Phil Sweeney,

chairman of Marblehead's library trustees.

With all the choices before them, Blackmer was counting on voters to

be "discriminating consumers."

"I think if you invest in your schools and your community, you

invest in your property values," she said.

The Glover project has to be funded with an override, Blackmer said.

"We don't have the money in the operating budget," she said.

"It's a project that needs to happen," former School Committee

member Amy Drinker said.

That means voters will likely have their say again next spring.

"We'll be back before the town," Blackmer said.

By question, vote totals were

as follows:

Question 1: Landfill Closure and Transfer Station

YES: 1,956

NO: 3,875

Question 2: Monitoring, Assessment, Engineering Old Landfill

YES: 2,424

NO: 3,372

Question 3: Stony Brook Road Land Acquisition

YES: 2,386

NO: 3,383

Question 4: Sidewalk Repair and Reconstruction

YES: 1,639

NO: 4,184

Question 5: Pleasant Street Land Acquisition

YES: 1,869

NO: 3,896

Question 6: Pleasant Street Corridor Improvements

YES: 1,867

NO: 3,930

Question 7: Abbot Public Library Renovations

YES: 2,097

NO: 3,705

Question 8: Artificial Turf, Piper Field

YES: 1,723

NO: 4,097

Question 9: Glover School Construction

YES: 2,882

NO: 2,953

Question 10: Village School Technology and Furniture

YES: 2,375

NO: 3,432

(Source: The Marblehead Reporter, "Marblehead

voters say 'Not Now,' reject all 10 overrides") |

| |

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

Citizens for Limited Taxation ▪

PO Box 1147 ▪ Marblehead, MA 01945

▪ 508-915-3665

|