CLT UPDATE

Friday, May 122 2009

Senate hikes taxes: Time to replace tax hike

senators

The Tax Stealers - aka, our

legislators - just did again what they do best: Tell us taxpayers to

drop dead.

And we taxpayers just did what we do best: play dead.

Reform before revenue! That’s been Senate President Terry Murray’s

mantra.

Guess that’s gone by the boards....

Anti-tax Czarina Barbara Anderson corrected me yesterday when I

said voters should throw all The Stealers out. “Support good guys.

Otherwise why would anyone bother to be good?”

Point taken. Support the good guys. It’s easy, really. It’s just such a

short list.

The Boston Herald

Thursday, May 21, 2009

Are taxpayers content to let sleeping dogs lie?

By Margery Eagan

Taxpayers could be forced to fork over an additional $1

billion a year to pay a series of new taxes adopted by the Senate Tuesday night.

Senators agreed to new levies on commerce, meals, hotels and alcohol and warned

that without substantial revenue, services for the most vulnerable in

Massachusetts could be eviscerated....

Senate President Therese Murray (D-Plymouth) said the new taxes didn't betray

her "reform before revenue mantra" because the local option taxes were

accompanied by proposals to tamp down health care costs and encourage

regionalization of services. She said a proposal to restrain pension costs by

stemming abuses of the existing laws was nearing release from a conference

committee.

Backers of the sales tax, including Murray, pointed out that Massachusetts, by

several measures ranks toward the bottom of states in terms of tax burden on

residents....

"Maybe we should call it the New Hampshire stimulus bill," said Sen. Robert

Hedlund (R-Weymouth).

State House News Service

Tuesday, May 19, 2009

Senate approves tax hikes that could reach $1 Billion

The Senate plan, which cleared the House in April, would push

the sales tax from 5 percent to 6.25 percent, while generating an estimated $633

million to offset deep cuts in services for the poor, elderly, and disabled.

Lifting the sales tax exemption on alcohol sold at package stores would raise

another $80 million for those services, senators said. Allowing cities and towns

to impose a 2 percentage point increase in taxes on hotels and restaurant meals

will help offset cuts in state aid to municipalities, senators said.

At 6.25 percent, Massachusetts would have the second highest sales tax rate of

the six New England states plus New York. Only eight states nationwide have a

higher rate.

The Boston Globe

Wednesday, May 20, 2009

Senate approves sales tax hike

6.25% levy would include alcohol;

margin veto-proof in both chambers

Ten years from now, the economic gods willing, Massachusetts

will have recovered from this recession/depression. But even if the economy is

going gangbusters in 2019 you can bet we will still be paying that extra 1.25

percentage point on most every consumer good we buy....

But the sales tax won’t come back to 5 percent, not once lawmakers become

addicted to the new revenue. Voters who OK’d the income tax rollback know this

to be true....

Taxpayers understand that desperate times sometimes call for desperate measures.

But they also know that, once on board, Beacon Hill will never willingly step

off the gravy train.

A Boston Herald editorial

Wednesday, May 20, 2009

Truth about taxes

Gov. Deval Patrick, who has said he would veto a sales tax if

the Legislature does not present him with adequate reforms, turned up the heat

on lawmakers this afternoon, accusing those voting for higher taxes of

disrespecting voters.

State House News Service

Wednesday, May 20, 2009

Patrick: Higher taxes and no reform

‘is thumbing our nose’ at taxpayers

In this recession, workers in the private sector are being

squeezed harder than ever.

Many are seeing their pay reduced through furlough programs or wage freezes.

Pension benefits are reduced, their share of health costs keeps going up.

It gets no better for these workers when they arrive home. There they face

increases in their utility bills, rising credit-card rates, declining home

values and higher property taxes.

But for workers in the public sector, especially those who are members of public

employee unions, the picture is much different....

Remember those numbers as your state legislators hammer through tax increases

and local officials negotiate contracts that continue to isolate public-sector

workers from economic reality.

An Eagle-Tribune editorial

Monday, May 18, 2009

Public-private gap still growing

Despite scathing criticism from the GOP, top Beacon Hill

leaders yesterday continued to stonewall requests for lists of their

taxpayer-funded staff.

The Herald initially requested the information in March but more than 75 percent

of the state’s 200 lawmakers have refused to release staff rosters - including

Senate President Therese Murray (D-Plymouth) and House Speaker Robert A. DeLeo

(D-Winthrop).

Murray and DeLeo, who determine the personnel budgets of individual lawmakers,

refused again yesterday to release their own staff rosters.

The Boston Herald

Thursday, May 21, 2009

State House pols stay mum on staff rosters

When it comes to taxes, especially in Massachusetts, what

goes up usually continues to go up. So don’t be fooled into believing that the

dreaded cheeseburger tax approved by the Senate this week would be held to the

maximum 7 percent.

A Boston Herald editorial

Thursday, May 21, 2009

Taxing burgers...

Raising so-called “sin taxes” is such an easy way out, no? So

why not make booze subject to the sales tax - especially a new, higher sales

tax. Of course, alcohol is already subject to an excise tax. (You didn’t think

earlier lawmakers “exempted” it from the sales tax out of the goodness of their

hearts, did you?) But since that tax is factored into the retail price of every

bottle of beer, wine and hard liquor, we don’t notice it.

A Boston Herald editorial

Thursday, May 21, 2009

...And those six-packs

It never made any sense that drinkers at Massachusetts

restaurants pay a 5 percent tax on their beer and wine while someone buying a

six-pack or a fine Pinot Noir at a package store does not. The state Senate is

to be commended for subjecting retail alcohol purchases to the new 6.25 percent

sales tax it adopted Tuesday. Better yet is the decision to target the roughly

$80 million the tax is expected to raise to desperately needed substance abuse

and court interdiction programs that have been sorely neglected.

A Boston Globe editorial

Thursday, May 21. 2009

Toward a saner state tax policy

Gov. Deval Patrick should keep his promise and veto that huge

sales tax hike if it’s not accompanied by the reforms he’s urged - even if the

wise guys on Beacon Hill are declaring the tax “veto proof.” ...

The governor’s staff still hopes his reform agenda - close to being wiped out in

Senate and House floor votes - can be restored in conference committee. But

getting pension reform through a Legislature intent on protecting its own

pensions could be very tough. Same for the MBTA and MassPike shakeups that

Patrick proposed, but which the Legislature seems ready to dispose. And if the

House conferees should yield to the Senate - which just gutted the Ethics

Commission - bye-bye to cleanup there.

So wielding that veto pen and switching those five senators (he’d need too many

switches in the House) may be the gov’s last best move.

The Boston Herald

Thursday, May 21, 2009

Gov mustn’t sell out his tax opposition

By Wayne Woodlief

A report by The Beacon Hill Institute this month estimates

that the sales tax hike to 6.25 percent will reduce net employment by more than

6,500 jobs, and lead to a decrease of $51.35 million in investment.

No one on Beacon Hill is asserting that the new revenue — whatever it proves to

be — can bridge a multibillion-dollar shortfall. But supporters do claim the new

revenues will help blunt the impact of cuts on social service programs and local

aid.

Even that claim is suspect. While the Senate did set aside a portion of the new

revenue for transportation, it did not follow the House in designating any

portion for local aid. Cities and towns will remain at the mercy of the

Legislature.

A Telegram & Gazette editorial

Thursday, May 21, 2009

Senate gamble

Revenues may not materialize

Tax increases come out of your wallet immediately. But will

the reforms we were promised before new revenues come at all?

The House took less than three hours to debate and pass a 25 percent increase in

the sales tax. Contrast that with the extended agony that accompanied

incremental pension and transportation reforms, most of which were swept away in

seconds of closed-door lobbying.

Yes, we will see some reforms this legislative session, but they threaten to be

more sizzle than steak....

The House passed a 25 percent increase in the sales tax during the worst

recession in a generation. They did it quickly, with minimal debate, and by a

veto-proof margin. Keep an eye on the reform promises and ask yourself if they

save real money, or fit into one of the categories listed above. Then ask your

representative and senator the same question.

The MetroWest Daily News

Thursday, May 21, 2009

How to tell the 'reform' sizzle from the steak

By Steve Poftak

The Senate made a major misstep by voting Tuesday for hefty

tax increases a day before even beginning debate on reform measures. We find it

particularly egregious that, despite the dire fiscal forecast, there have been

no real reductions to state government itself, including positions and

benefits....

Shouldn't legislators have approved pension reform, privatization measures, wage

freezes and health-insurance reductions before placing a heavier burden on the

backs of struggling taxpayers, small-business owners and local government?

Nothing has been done to repair the structural flaws in state government.

Formulas regarding education aid and charter schools have not been revised, the

Quinn Bill remains in place and state workers are still slated to receive salary

increases.

Instead, Senate lawmakers joined their House colleagues in approving an increase

in the sales tax to 6.25 percent, garnering a veto-proof majority that renders

meaningless Gov. Deval Patrick's repeated threats to reject it.

A Lowell Sun editorial

Thursday, May 21, 2009

Senate disservice

Governor Deval Patrick this afternoon stood by his threat to

veto the sales tax passed by House and Senate lawmakers unless they first

approve a series of reforms that he finds acceptable.

“I will support the sales tax, and have said so all along -- provided we deliver

on the reforms,” Patrick told reporters after swearing in a judge at the John

Adams Courthouse. “Doing the right thing isn’t that difficult. Everybody knows

what the right thing is to do; now let’s get that done before the budget comes

to me next month.”’ ...

“The legislature, to their credit, has done what they believe is the hard work

now by taking the votes on the budget and on the sales tax,” Patrick said. “Now

let’s do what I think is the easy stuff and deliver some real and lasting

reforms.”

“It’s not complicated,” he added. “They know what the right thing is to get

done.”

The Boston Globe

Thursday, May 21, 2009

Patrick stands firm on pledge to veto tax hike

A veteran lawmaker who said his region near the New

Hampshire border would be decimated by the 25 percent sales tax hike

believes Gov. Deval Patrick - who vowed to veto the increase - still has

time to erode a thin veto-proof majority.

“This governor is a great politician. He could change it if he wants

to,” said Rep. James R. Miceli (D-Wilmington) of the vote by which the

tax hike passed in the House. “That vote isn’t as solid as it appears to

be.” ...

Outraged small businesses and tax watchdogs promised yesterday they’ll

be heard on the hikes, be it at a rally planned for the State House

steps today or at the voting booth in November.

“It’s completely out of control,” said Barbara Anderson,

executive director of Citizens for Limited Taxation. “The only

thing they care about is not getting re-elected. We have to throw them

out.”

Corie Whalen, who organized the conservative anti-tax Tea Party in

Boston last month, invited anti-tax citizens to gather at the State

House starting at 11 a.m. today.

“They’re misleading people when they act like necessary cuts have to be

made when they haven’t worked to clear up real waste,” Whalen said.

The Boston Herald

Thursday, May 21, 2009

Veto urged as resistance to tax hike grows

Six months after a ballot question to repeal the state’s

income tax was crushed by voters, Libertarians are considering a vote to repeal

the sales tax.

“The only difference between Bernie Madoff and the government is that what

Madoff did was illegal and what the government is doing is legal,” said Carla

Howell, president of the Center for Small Government....

“No decisions have been made, but the possibility of a ballot question to

eliminate the sales tax is definitely on the table,” she said.

Barbara Anderson, president of Citizens for Limited Taxation, said

while she supports the elimination of the sales tax, her members will not gather

signatures.

“We cannot ask our members to put all this effort and money into something that

can only work if the Legislature respects the voters’ decision - and they

don’t,” she said. “Instead, we are focused on defeating legislators who vote for

these tax increases. That’s the only thing that matters.”

The Boston Herald

Friday, May 22, 2009

Libertarian eyes sales-tax ballot battle

Chip Ford's CLT

Commentary

I know. It's so

discouraging. Nothing we say or do has any effect on Bacon Hill

any more. Discouraging -- but not defeat. Not yet.

Is surrender even an option

if we are to survive here?

We've been getting calls

from the media since the Senate's late evening vote to rip us off even

more. They want to know if we're going to do another petition

drive to repeal the sales tax hike.

Of course we're not!

Why bother? This is Taxachusetts!

Not after all we went

through, twice, to get the signatures to put 1989 "temporary"

income tax hike rollback of the "temporary" income tax on the ballot;

all that time, labor, and money we expended to convince voters to

approve it finally in 2000. Only to have the Legislature give them

and us all the big Beacon Hill Middle-Finger Salute. Really

-- the definition of insanity is, doing the same thing over and over

again expecting a different result!

|

|

|

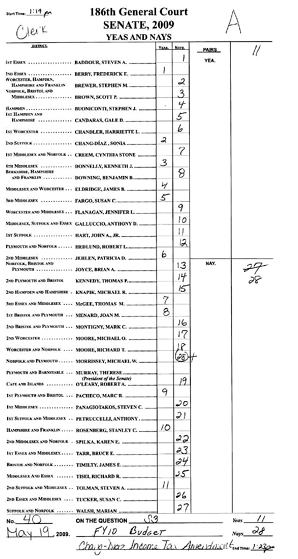

Senate vote

on increasing the income tax:

Yea - 11 / Nay - 28 |

|

Click above

rollcall vote for a larger image

CLICK HERE for a printable PDF version |

Nope, not this time.

It's time to focus on the real problem, the root problem.

Nothing the people do,

nothing the media says and writes, has any effect on the

Legislature. "Entrenched" is too mild a description. They

fear nothing any more. They own us -- lock, stock and barrel.

We work for Them and that's just the way it is today.

This time we must

overthrow the Legislature; overthrow the tax-hikers in 2010. We

must start this commonwealth anew, with fresh blood and new

perspectives.

Short of that, reserve a

moving van -- resign to bailing out of this misbegotten state while

exodus is still an option.

From now until November

2010, the battle cry must be: "No Reelection for Tax Hikers"!

One of the early amendments

to the Senate's budget was to hike the income tax to 5.95 percent, to

raise an additional $1.3 Billion. When asked about a possible hike in

the income tax on Jon Keller's WBZ-TV4 Sunday morning "Keller@Large,"

Senate Ways and Means Committee Chairman Steve Panagiotakos (D-Lowell)

replied:

“I don't, I think, talking

personally from my point of view, the income tax, the voters have

preempted us on the income tax. We have to get down to 5-point-oh at

some point. Until we do that, I can't see us even touching the income

tax.”

Apparently he was not

alone. That appears to have been a line most senators for whatever

reason dared not cross. The amendment sponsored by Sen. Sonia Chang-Diaz

(D-Boston) was shot down by a vote of 11 yeas, 28 nays. Don't be

surprised if it comes up again in the fall. It was reported that

backers of an income tax hike were "encouraged" by the eleven votes.

After voting to extend the

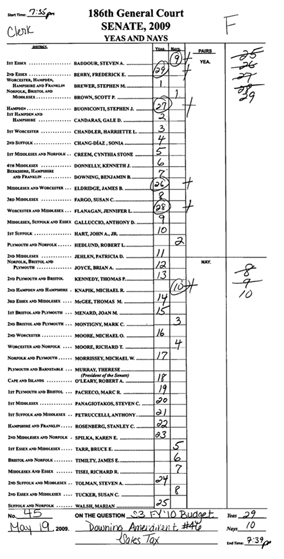

legislative day, on Tuesday night (if course, night as usual),

the Senate voted 29-10 to follow the House and hike the sales tax by 25

percent to 6.25%.

This is on top of last

year's tax increases of

$392 million; and don't forget the 2002 "Largest

Tax Increase in State History" of $1.14 Billion.

With the votes for more tax

hikes, an additional billion dollars will be taken out of our pockets

this and every year forever more. According to some, its time is

somehow due. We just don't pay enough to sustain our state

government and its expenses.

One Democrat senator during

the debate tried to make some kind of point which he somehow thought was

relevant; that the state sales tax hasn't been increased for years,

decades -- as if the rate should be revisited from time to time.

He failed to mention that the sales tax is a static percentage -- it

rides on the back of inflation. As prices for taxable purchases

increase, so does the state's revenue take. This hike in the sales

tax percentage leaps ahead of inflation -- which is surely coming

thanks to Washington's unprecedented borrowing and money printing

policies.

|

|

Senate vote on increasing the

sales tax:

Yea - 29 / Nay - 10 |

Click above rollcall vote for a

larger image

CLICK HERE for a printable PDF version |

Another interesting

argument for increasing the state sales tax was that the Massachusetts

percentage is among the lowest in the nation among states which impose a

sales tax. Nobody asked how many states with a sales tax also have

an income, auto excise, and the myriad of other taxes piled one atop

another, as we do. If someone has thought of a tax, Taxachusetts

has it: Now we're jacking them up one by one.

But depend on "The Best

Legislature Money Can Buy" to come up with an even more creative new way

to dig even deeper into our pockets. By removing the sales tax

exemption on beer, wine, and liquors, Bacon Hill is now going to impose

a tax on a tax! Beer, wine, and liquors already bear a

hefty excise tax built into the cost of each product. Under this

"exemption" repeal, the new sales tax likely to become law will be

charged on top of the alcoholic beverages excise tax. A tax

on a tax -- an "Only in Taxachusetts" first.

There were numerous other

Senate tax hike amendments. They and the votes can be found

HERE.

As the Boston Herald

editorial pointed out, "Ten years from now, the economic gods willing,

Massachusetts will have recovered from this recession/depression. But

even if the economy is going gangbusters in 2019 you can bet we will

still be paying that extra 1.25 percentage point on most every consumer

good we buy."

Just reflect on the two

decade fight we've had trying to return the "temporary" income tax hike

of 1989 -- despite even a voter referendum in 2000 -- to its historical

5 percent. Once the pols grab a tax hike they never let it go.

When this economic downturn

recedes, when revenues again pour in almost faster than Bacon Hill can

spend the surplus, almost, the spending frenzy on Bacon Hill will

resume. The pols will again dig the state deeper into

unsustainable costs. Come the inevitable next cyclical economic

downturn they will be back demanding more from us to continue the new

spending programs, all over again.

Already legislators are

backfilling programs cut by the House and Senate budget committees, now

that they expect another billion of our dollars to flow from our pockets

into their treasury.

"Reform before Revenue"?

Don't hold your breath. Once they have our cash the pressure to

cut waste and abuse will evaporate like fog on a desert. Even the

"reform" that's been proposed and touted is meaningless, little more

than nibbling around the edges of our outrage -- just enough to stick a

"reform" label onto it and call it done. Nothing that threatens

the insider overlords' standard of living at taxpayers' expense is going

to happen. And now, with another billion bucks of our money

pouring in, why should they worry? They expect to run for

reelection unopposed as usual, or to crush any petty citizen insolent

enough to challenge their sinecure.

That's why the only

solution that remains for us serfs short of torches, pitchforks, and

tar-and-feathers is -- "No Reelection for Tax Hikers"!

That's why we're putting

everything we have into a desperate last-ditch effort to throw out of

office at least some of those who feel their position is an entitlement

for life, who feel they can thumb their noses at those they were elected

to represent.

The problem is the

Legislature. The only remaining solution is to throw the bums out.

|

|

Chip Ford |

|

The Boston Herald

Thursday, May 21, 2009

Are taxpayers content to let sleeping dogs lie?

By Margery Eagan

The Tax Stealers - aka, our legislators - just did again what they do

best: Tell us taxpayers to drop dead.

And we taxpayers just did what we do best: play dead.

Reform before revenue! That’s been Senate President Terry Murray’s

mantra.

Guess that’s gone by the boards.

Several dutiful taxpayers told me yesterday they’re doing all they can

to fight back: e-mailing and calling to harass The Stealers.

Either The Stealers ask for lots of personal information before

responding, or they don’t respond. Or they send a form letter answering

nothing. Or they do call back, and lie.

Ron Belling of West Brookfield e-mailed Rep. Anne Gobi and Sen. Stephen

Brewer. Both voted for the sales tax after telling Belling “that reform

was coming before new revenue,” he said. “Apparently they both lied.”

Asked how he felt about this, Belling said, “I’m (expletive)!”

But neither Brewer nor Gobi see it this way, of course. Both say reform

is moving apace with revenue, which is The Stealers’ line, see. Just

yesterday they debated reform. But are their proposed reforms really

serious?

To mention a few:

Did they outlaw double dipping (collecting a state salary and pension

simultaneously)?

Cap pensions - even at, say $150,000 a year?

Outlaw early retirements and pension collecting?

End special legislative boondoggles?

Make town and city workers join the state health insurer, thus saving

billions?

No, no, no, no, and no.

I asked Brewer what he thinks about the latest double dipper, state Sen.

Ken Donnelly. As Howie Carr reported, Donnelly collects his Arlington

firefighter’s $51,187 pension plus his $61,440 State House salary. When

we’re raising taxes and slashing services to the halt, the lame, the

blind, isn’t this a problem?

“I’m not going to make a value judgment on it,” Brewer said.

OK, if you can’t see what’s wrong with Donnelly’s deal, you’ve been

working too long on Beacon Hill. But as promised, Sen. Brewer, I will

write in this story what I said to you on the phone: You’re extremely

charming in your wrongheaded, entitled ways.

Are you happy now?

Anti-tax Czarina Barbara Anderson corrected me yesterday when I

said voters should throw all The Stealers out. “Support good guys.

Otherwise why would anyone bother to be good?”

Point taken. Support the good guys. It’s easy, really. It’s just such a

short list.

State House News Service

Tuesday, May 19, 2009

Senate approves tax hikes that could reach $1 Billion

By Kyle Cheney

Taxpayers could be forced to fork over an additional $1 billion a year

to pay a series of new taxes adopted by the Senate Tuesday night.

Senators agreed to new levies on commerce, meals, hotels and alcohol and

warned that without substantial revenue, services for the most

vulnerable in Massachusetts could be eviscerated.

After rejecting higher income and gas taxes, senators took the

inevitably unpopular tax votes with an acknowledgement that many popular

programs would still likely face cuts as tax revenue projections had

eroded in recent weeks, creating a larger gap between projected spending

and revenues. The potential tax increases came in the form of amendments

to the Senate's budget for fiscal 2010, which begins July 1.

Members voted 29-10 to adopt a 25 percent hike in the state's 5 percent

sales tax, which Senate leaders say will add $633 million to the bottom

line. Senators voted on a voice vote, rather than a recorded roll call,

to approve the elimination of a sales tax exemption for alcoholic

beverages, estimated to bring $98 million. They similarly approved on a

voice vote a proposal to allow city and town governments to tack on up

to two percentage points the state's 5 percent sales tax on meals and

hotel or motel stays, which proponents said would bring in $190 million

to $250 million in the first year of implementation.

Senate President Therese Murray (D-Plymouth) said the new taxes didn't

betray her "reform before revenue mantra" because the local option taxes

were accompanied by proposals to tamp down health care costs and

encourage regionalization of services. She said a proposal to restrain

pension costs by stemming abuses of the existing laws was nearing

release from a conference committee.

Backers of the sales tax, including Murray, pointed out that

Massachusetts, by several measures ranks toward the bottom of states in

terms of tax burden on residents. They said that while Massachusetts 5

percent sales tax is relatively substantial, numerous exemptions on

food, services and clothing up to $175 made the increase to 6.25 percent

more palatable than, say, an income tax hike, which senators rejected

earlier in the day. Senate Ways and Means Committee Chairman Steven

Panagiotakos ticked off a list of programs that the sales tax would be

directed to fund: $6.5 million for a popular anti-gang program, $50.7

million for day services for developmentally disabled adults, $3.5

million for emergency food assistance.

In addition, $275 million of the expected new taxes would be earmarked

for transportation spending. Unlike the House, the Senate's sales tax

proposal does not boost local aid for cities and towns and is instead

accompanied by a plan to allow local government leaders to unleash their

own tax hikes.

"I think we all know that voting for taxes in times like these is

difficult. It's also true that sometimes in the deck you're dealt,

there's absolutely no good card," said Sen. Gale Candaras (D-Wilbraham).

"This sales tax increase will fund a lot of very important programs for

some of the most vulnerable people in our commonwealth. The sick, the

needy and the handicapped ... our first duty as a government is to

protect those people who cannot speak for themselves."

Opponents, who included the five-member GOP and five Democrats,

contended that the sales tax is regressive - those who can least afford

goods affected by the sales tax will have to devote a higher share of

their income to pay for them, they said - and that it would drive more

Massachusetts residents over the border to New Hampshire, which lacks a

sales tax, or onto the internet to go shopping.

"Maybe we should call it the New Hampshire stimulus bill," said Sen.

Robert Hedlund (R-Weymouth).

Sen. Mark Montigny, one of the five Democrats to vote against the sales

tax increase, said the state had not taken a look at more fundamental

reforms first. He said he "agonized right up to the vote" but decided to

vote against the proposal because it comes at a time that the state is

also doling out tax credits to "flavor of the month" industries like

biotech and film production.

Supporters of supplying cities and towns with the ability to raise meal

and hotel taxes said the state kept too tight a stranglehold on revenue

raising options for municipalities. Sen. Stanley Rosenberg, the

amendment's sponsor, said that with local aid reductions, cities and

towns need additional tools to balance their budgets.

"We must give communities some assistance," he said.

Republicans, however, painted the measure as an undemocratic attempt to

squeeze more tax dollars from state residents. Under the proposal, city

and town governing bodies - town councils, selectmen, aldermen or city

councilors - would be empowered to vote on whether to increase the meal

and hotel taxes. Republicans proposed a trio of amendments to the

proposal - all rejected - that would have required voters to approve

such local option taxes or eliminated the taxes altogether.

"In a branch where we have said we will concentrate on reform before

revenue, this amendment is inconsistent with that message because we are

considering revenue and leaving reform items for another day," said Sen.

Bruce Tarr (R-Gloucester). "Madame President, we applaud the effort but

we are concerned that this amendment leaves the cost saving items behind

and focuses on ways to increase local tax burdens."

Backers of eliminating the exemption of alcohol from the sales tax said

the funds generated would be targeted at substance abuse and jail

diversion programs, helping to save money in the long run.

Hedlund, the Weymouth Republican, argued that the tax "sends the wrong

message" to working class people who want to buy a six-pack on their way

home.

Supporters of the new tax on alcohol, long fought by package store

owners, said it would generate $98 million. But a coalition of 60 groups

pushing the plan estimated that in conjunction with the 6.25 percent

sales tax, revenues from the alcohol tax would total $115 million.

"Senators made a courageous choice in eliminating the alcohol tax

exemption, and it was the right choice," said Vic DiGravio, Co-Chair of

the Campaign for Addiction Prevention, Treatment and Recovery and

President and CEO of the Mental Health and Substance Abuse Corporations

of Massachusetts. "Now we need to work with the Legislature to ensure

funds are dedicated to the prevention and treatment of alcohol and drug

abuse as the Senate intended."

Earlier Tuesday, four members of Murray's leadership team, Majority

Leader Frederick Berry, Senate President Pro Tem Stanley Rosenberg,

Majority Whip Joan Menard and Assistant Majority Whip Steven Tolman,

joined seven other Senate Democrats in supporting a $1.3 billion

increase in the income tax, a plan that fell short on an 11-28 vote but

which left income tax hike backers encouraged.

Last month, the House swept aside most tax amendments during its budget

debate and approved the 25 percent hike in the sales tax by a veto-proof

margin. The House did not address the alcohol tax or the local options

taxes in its budget.

Gov. Deval Patrick has threatened to veto the sales tax hike if he's not

satisfied with pension, transportation and ethics reform bills that

remain under development but which lawmakers promise will be

substantial.

The Boston Globe

Wednesday, May 20, 2009

Senate approves sales tax hike

6.25% levy would include alcohol;

margin veto-proof in both chambers

By Michael Levenson

The state Senate voted last night to increase the sales tax, lift the

sales tax exemption on alcohol, and allow cities and towns to raise

meals and hotel taxes, brushing aside criticism that higher taxes would

hurt Massachusetts businesses by driving consumers over the border,

particularly to tax-free New Hampshire.

The Senate plan, which cleared the House in April, would push the sales

tax from 5 percent to 6.25 percent, while generating an estimated $633

million to offset deep cuts in services for the poor, elderly, and

disabled.

Lifting the sales tax exemption on alcohol sold at package stores would

raise another $80 million for those services, senators said. Allowing

cities and towns to impose a 2 percentage point increase in taxes on

hotels and restaurant meals will help offset cuts in state aid to

municipalities, senators said.

At 6.25 percent, Massachusetts would have the second highest sales tax

rate of the six New England states plus New York. Only eight states

nationwide have a higher rate.

Governor Deval Patrick has threatened to veto any broad-based tax

increases, unless the Legislature also overhauls the state

transportation agencies, pension system, and ethics laws.

His aides were not available for comment last night, but his threat

carries little weight because of the vote tallies.

The Senate voted 29-10 in favor of the sales tax increase, joining the

House in mustering a veto-proof majority. Senate President Therese

Murray described the sales tax increase as the least punitive of tax

options needed to restore services for the most vulnerable.

"I think this is probably the more fair way to go if we have to raise

revenue and, unfortunately, we have to raise revenue," she told

reporters after the vote. She said that although the budget's proposed

cuts will not be completely reversed, there will at least be "some money

put back into those programs."

Money from the sales tax increase, senators said, would be spent on a

multitude of services. Among them: $4 million for summer jobs for

at-risk youth, $5 million for workforce training, $6 million for

regional tourist councils, $36 million for special education, and $10

million for rental housing assistance to enable 1,700 families to stay

in their homes.

Senator Gale D. Candaras, a Wilbraham Democrat, seemed to speak for the

Democratic majority when she declared on the floor that there was

"absolutely no good card in the hand," when it came to raising taxes.

Still, she said, "this sales tax will fund a lot of very important

programs, at least in part for some of the most vulnerable citizens."

Opponents warned that a higher sales tax would hurt the state's ability

to recover from the recession.

"Maybe we should call this the New Hampshire economic stimulus bill,"

Senator Robert L. Hedlund, a Weymouth Republican, said with sarcasm.

Of the five sates bordering Massachusetts, only Rhode Island, at 7

percent, has a sales tax rate above 6.25 percent. Massachusetts,

however, does not impose sales taxes on groceries, clothing under $175,

and prescription drugs.

The Retailers Association of Massachusetts cited a study by the Beacon

Hill Institute in warning that a 6.25 percent rate would cost the state

12,600 jobs.

"What you get right now are actually a lot of consumers from Rhode

Island, Connecticut, and New York coming into Massachusetts and

purchasing here," said Jon B. Hurst, president of the Retailers

Association. "Not only is that incentive going to be gone, but we're

going to create an incentive for our own consumers to head to New

Hampshire and, just with a couple clicks of the mouse, go on the

Internet, all tax-free."

Mayor Thomas M. Menino applauded the Senate for voting to allow cities

and towns to raise taxes on hotel rooms and restaurant meals.

He said the measure, which has not cleared the House, could raise $47

million to help Boston reduce its reliance on property taxes and state

aid.

"We need different, more innovative tools to manage costs and diversify

revenues at the local level," Menino said in a statement after the

Senate vote. "I hope that members of the House will also support this

crucial reform."

Earlier in the day, a proposal to raise the state income tax from 5.3

percent to 5.95 percent was defeated. Supporters argued it was fairer

than the sales tax and would raise $1.3 billion annually.

Opponents said the measure would drain household budgets and hurt small

businesses.

The Senate also voted 33 to 6 against the governor's proposal to raise

the gas tax by 19 cents and later defeated an 11-cent increase in the

same tax.

The alcohol tax was approved with support from lawmakers who said it

would raise $15 million to ameliorate what they described as a heroin

epidemic in Massachusetts.

"When we have an addict, we'll have a bed for them," said Senator Steven

A. Tolman, a Boston Democrat. "This money will help us put these beds on

line."

The Senate approved the tax increases on a day of furious lobbying and

wrangling behind closed doors.

Hundreds of demonstrators, including many in motorized wheelchairs, with

developmental delays, and using guide dogs and canes, jammed Beacon

Street early in the day, calling on legislators to raise taxes and "save

our services."

"Families will be devastated if this budget passes!" declared Gary

Blumenthal, executive director of the Association of Developmental

Disability Providers, eliciting cheers and applause from the crowd.

The Boston Herald

Wednesday, May 20, 2009

A Boston Herald editorial

Truth about taxes

Ten years from now, the economic gods willing, Massachusetts will have

recovered from this recession/depression. But even if the economy is

going gangbusters in 2019 you can bet we will still be paying that extra

1.25 percentage point on most every consumer good we buy.

Yes, with the Senate beginning budget debate today and likely to match

what the House did last month - a sales tax hike to 6.25 percent -

Beacon Hill is poised to adopt a permanent solution to a temporary

problem.

The truth is that Bay State taxpayers might have been talked into

supporting a modest, temporary tax increase - if it were welded to deep

spending cuts and government reforms. But that is not what will happen.

No, lawmakers will instead OK a sales tax hike and justify it with fear,

of the “hospitals will close and gangs will rule the streets” variety.

(They will leave out the part about cops having to take only half their

extra education pay or state workers possibly delaying a wage hike).

But the sales tax won’t come back to 5 percent, not once lawmakers

become addicted to the new revenue. Voters who OK’d the income tax

rollback know this to be true.

Meanwhile the Democratic majority in Massachusetts - including those

select few senators who will today beg for an income tax hike -

continues to ignore evidence that our tax burden is directly linked to

our economic productivity and is a credible factor in out-migration.

A study published for the American Legislative Exchange Council and

described in yesterday’s Wall Street Journal draws the comparison

between high taxes and the loss of wealthier residents (also known as

the job creators). And yes, low-tax New Hampshire is one of the

“destination states” where folks from high-tax states are taking refuge.

Taxpayers understand that desperate times sometimes call for desperate

measures. But they also know that, once on board, Beacon Hill will never

willingly step off the gravy train.

State House News Service

Wednesday, May 20, 2009

Patrick: Higher taxes and no reform ‘is thumbing our nose’ at taxpayers

Gov. Deval Patrick, who has said he would veto a sales tax if the

Legislature does not present him with adequate reforms, turned up the

heat on lawmakers this afternoon, accusing those voting for higher taxes

of disrespecting voters.

“This really isn’t about State House dynamics between the Governor and

the Legislature – the public could care less about that,” Patrick said

in an emailed statement. “What they do care about – particularly those

families struggling to find a job or keep one, or pay for their home or

their kids’ education – is being asked to pay more for the status quo.

To ask them to dig deeper into their pockets for higher taxes without

first adopting meaningful reforms is thumbing our nose at them.”

Patrick two years ago asked for higher corporate and local options taxes

and in January proposed a 19-cent per gallon gas tax, calling the

revenue urgently needed, along with a passel of reforms.

The Eagle-Tribune

Monday, May 18, 2009

An Eagle-Tribune editorial

Public-private gap still growing

In this recession, workers in the private sector are being squeezed

harder than ever.

Many are seeing their pay reduced through furlough programs or wage

freezes. Pension benefits are reduced, their share of health costs keeps

going up.

It gets no better for these workers when they arrive home. There they

face increases in their utility bills, rising credit-card rates,

declining home values and higher property taxes.

But for workers in the public sector, especially those who are members

of public employee unions, the picture is much different.

To be sure, some of these unions — the latest being four representing

MBTA workers — have accepted increases in their benefit costs and limits

on their annual raises. Good for them.

But too often when government leaders ask employees to share in the

sacrifices taxpayers are making, the answer is simply "No," even when

the concessions sought are but a shadow of those already accepted by

those who pay their wages.

Switch to a state-managed health care plan? No.

Accept a few days off without pay — even if that pay will be returned at

retirement? No.

Writing recently in The Wall Street Journal, Steve Malanga of the

Manhattan Institute highlights how the public-private gap has grown. The

numbers he cites are staggering.

According a 2005 study by the Employee Benefit Research Institute, the

average public-sector worker earned 46 percent more in salary and

benefits than comparable private-sector workers.

Last year, pay and benefits for state and local workers rose 3.1

percent, compared to 1.9 percent in the private sector, according to the

Bureau of Labor Statistics.

And five million private-sector workers lost their jobs last year,

according to the BLS, while public-sector employment has increased in

nearly every month of the recession.

Remember those numbers as your state legislators hammer through tax

increases and local officials negotiate contracts that continue to

isolate public-sector workers from economic reality.

The Boston Herald

Thursday, May 21, 2009

State House pols stay mum on staff rosters

By Dave Wedge

Despite scathing criticism from the GOP, top Beacon Hill leaders

yesterday continued to stonewall requests for lists of their

taxpayer-funded staff.

The Herald initially requested the information in March but more than 75

percent of the state’s 200 lawmakers have refused to release staff

rosters - including Senate President Therese Murray (D-Plymouth) and

House Speaker Robert A. DeLeo (D-Winthrop).

Murray and DeLeo, who determine the personnel budgets of individual

lawmakers, refused again yesterday to release their own staff rosters.

Spokesmen for both claimed the information is available on the state

payroll. However, the payroll lists all State House employees and

salaries, yet there is no way to determine who works for which lawmaker.

Staffing and budgets are much-coveted perks on Beacon Hill, as

leadership allies are often rewarded with more money to pay employees.

Yesterday, House Minority Leader Rep. Bradley H. Jones (R-N. Reading)

called on his colleagues across the aisle to release the information, as

all GOP House lawmakers have done.

“It is infuriating, to say the least,” Jones said. “The lack of

transparency on Beacon Hill has ultimately led to the lack of public

trust, all at a time when there is a mad dash to raise taxes. This was a

simple request for information that is expected to be available to the

public. Why wouldn’t an elected official want to be open and forthcoming

about his or her staff?”

Just two Democratic senators - Sens. Jamie Eldridge (D-Belmont) and

Sonia Chang-Diaz (D-Roxbury) - complied with the Herald’s request. A

complete list of who released the data is at

www.bostonherald.com.

The Boston Herald

Thursday, May 21, 2009

A Boston Herald editorial

Taxing burgers...

When it comes to taxes, especially in Massachusetts, what goes up

usually continues to go up. So don’t be fooled into believing that the

dreaded cheeseburger tax approved by the Senate this week would be held

to the maximum 7 percent.

Yes, the Senate on Tuesday night approved a measure long sought by the

tax-and-spend crowd that will give cities and towns the option of

tacking a 2 percent local tax on restaurant meals onto the 5 percent

that is already charged by the state.

Senators hailed their own benevolence in holding the state sales tax on

meals to 5 percent, while jacking up the tax on goods to 6.25 percent.

Otherwise diners could have been looking at an 8.25 percent tax on meals

in some communities.

Um . . . thanks?

Face it, in tough times dining out is one of the first things to go, so

restaurants are already in trouble. But now waiters, cooks and

dishwashers lucky enough to still have jobs will have to help shoulder

the burden of local government spending.

“To subject (the restaurant industry) to the fiscal woes of 351 cities

and towns is a real mistake,” said Peter Christie, president of the

Massachusetts Restaurant Association. “Because they’ll just keep

coming.”

Indeed, if the Senate version of the budget prevails cities and towns

will be back next year, probably pounding the table to demand that meals

be subject to the 6.25 percent sales tax, or that the local option be

increased to 3 or 4 percent.

And if the House version - which excluded the local option tax - goes

through, well, same crowd, different script.

Makes you want to run out and make reservations, no?

The Boston Herald

Thursday, May 21, 2009

A Boston Herald editorial

...And those six-packs

Nothing happens in a vacuum, although you’d never know that from the

actions of the Massachusetts Senate.

Raising so-called “sin taxes” is such an easy way out, no? So why not

make booze subject to the sales tax - especially a new, higher sales

tax. Of course, alcohol is already subject to an excise tax. (You didn’t

think earlier lawmakers “exempted” it from the sales tax out of the

goodness of their hearts, did you?) But since that tax is factored into

the retail price of every bottle of beer, wine and hard liquor, we don’t

notice it.

This new six-pack tax, well, that one will sting. Senate leaders insist

the anticipated $80 million it will bring in will be used for addiction

treatment - a worthy use indeed - but we also know that’s not how the

state budget works. There’s no little donation box every time you pick

up a six-pack into which those coins will go. And make no mistake,

package stores in border communities will really feel the brunt of this.

But wait, it gets worse. This sin tax thing is so very trendy that the

U.S. Senate is looking at a 48 cent per six-pack tax hike on beer (49

cents on a bottle of wine and 40 cents on a fifth of hard liquor) to

help pay the cost of insuring those who don’t have health insurance.

It’s enough to drive a person to drink - that is, if we can still afford

it.

The Boston Globe

Thursday, May 21. 2009

A Boston Globe editorial

Toward a saner state tax policy

It never made any sense that drinkers at Massachusetts restaurants pay a

5 percent tax on their beer and wine while someone buying a six-pack or

a fine Pinot Noir at a package store does not. The state Senate is to be

commended for subjecting retail alcohol purchases to the new 6.25

percent sales tax it adopted Tuesday. Better yet is the decision to

target the roughly $80 million the tax is expected to raise to

desperately needed substance abuse and court interdiction programs that

have been sorely neglected.

The Senate still has a ways to go to complete work on a $26.6 billion

budget for the fiscal year beginning July 1. But the new revenue will

help close a yawning budget gap and save services that are essential to

needy families. The Senate budget restores $50.7 million for day

services for developmentally disabled adults, for example, and $3.5

million for emergency food assistance.

Also laudable is the Senate's adoption of local option taxes for

hard-pressed cities and towns. This would allow localities to raise the

5 percent meals tax to 7 percent, with half the added revenue going back

to the Legislature to redistribute to communities without commercial

restaurants or hotels. Communities have been under the thumb of Beacon

Hill for too long, and need the tools to master their own fates.

Governor Patrick's threat to veto the sales tax hike if it doesn't come

with significant reforms in state pension, ethics, and transportation

policy may be moot, since both branches passed the tax hike by a

veto-proof margin. But unless the Legislature beefs up its anemic reform

proposals, Patrick ought to make the gesture anyway. We support

additional revenues to help vulnerable citizens. But Beacon Hill can

still do more to save money and restore the public trust.

The Boston Herald

Thursday, May 21, 2009

Gov mustn’t sell out his tax opposition

By Wayne Woodlief

Gov. Deval Patrick should keep his promise and veto that huge sales tax

hike if it’s not accompanied by the reforms he’s urged - even if the

wise guys on Beacon Hill are declaring the tax “veto proof.”

The gov could show he has some steel by defying the legislative leaders

of his own party (Lord knows they’ve been defying him big time) and at

least make an effort to switch the five Senate votes necessary to

sustain a veto.

It also would be a dramatic chance - especially important for a gov in a

popularity slump - to prove he’s a man of his word.

Patrick made the strongest possible pledge in a letter to legislators

April 27. “Without final and satisfactory action on the several reform

proposals before you, I cannot support a sales tax increase and will

veto it.” Not “I might.” Not that wishy-washy phrase he used recently,

that he’s “not adamantly against it” if reforms are included. But “I

will.”

If he doesn’t, he’ll look like a guy who doesn’t keep his promises or

threats. Dems would keep rolling him.

The governor’s staff still hopes his reform agenda - close to being

wiped out in Senate and House floor votes - can be restored in

conference committee. But getting pension reform through a Legislature

intent on protecting its own pensions could be very tough. Same for the

MBTA and MassPike shakeups that Patrick proposed, but which the

Legislature seems ready to dispose. And if the House conferees should

yield to the Senate - which just gutted the Ethics Commission - bye-bye

to cleanup there.

So wielding that veto pen and switching those five senators (he’d need

too many switches in the House) may be the gov’s last best move.

It might not be so hard after all to reach that one-third margin. He

might even, behind the scenes, throw a bit of re-election fear into

senators who live near bordering states.

Not just because they’d have to shell out more of their own money, but

over the prospect of some of their favorite package stores or

restaurants or shops going belly-up if Massachusetts motorists head en

masse to New Hampshire to duck a 25 percent sales tax hike.

Republicans have scored upsets before in Worcester County, the Cape and

South Shore, the Merrimack Valley (yep, abutting New Hampshire) among

other places. Election 2010 more and more resembles election 1990, the

last time the state faced this big a mess. That swept William Weld into

office, with enough GOP senators to sustain his vetoes.

Sure, we need more revenue, and Patrick proposed a gas tax increase

(quickly and thoroughly shot down) and some targeted sale tax hikes

(booze among them). But the Retailers Association of Massachusetts

argues persuasively that raising the sales tax to 6.25 percent could

cost 12,600 jobs.

And a guy who knows his way around Massachusetts said in April, “I have

deep reservations about imposing a higher sales tax during these

difficult economic times, especially at the risk of costing the

commonwealth jobs at a time we can least afford that tradeoff.”

That fellow’s name is Deval Patrick. He was right then and he’s right

now.

The Telegram & Gazette

Thursday, May 21, 2009

A Telegram & Gazette editorial

Senate gamble

Revenues may not materialize

Tuesday’s Senate vote to raise the state’s sales tax to 6.25 percent —

by a veto-proof margin of 29-10 — makes it all-but-certain that

consumers and businesses will be digging deeper this summer. What is far

from certain is how much additional revenue they will be able to

provide, and whether local communities will see any of it.

Senate backers of the increase asserted this week that it will garner an

additional $633 million in fiscal 2010. But less than a month ago, House

legislators touted $900 million in new revenue.

No one lost $267 million in the last month. It’s just that lawmakers

have no firm idea what effect the tax hike will have, because changes in

consumer and business behavior as a result of any tax hike are never

fully calculable in advance. Some will take their business to New

Hampshire; others will turn to online commerce; still others will reduce

their consumption, forcing businesses to reduce employment and output.

A report by The Beacon Hill Institute this month estimates that the

sales tax hike to 6.25 percent will reduce net employment by more than

6,500 jobs, and lead to a decrease of $51.35 million in investment.

No one on Beacon Hill is asserting that the new revenue — whatever it

proves to be — can bridge a multibillion-dollar shortfall. But

supporters do claim the new revenues will help blunt the impact of cuts

on social service programs and local aid.

Even that claim is suspect. While the Senate did set aside a portion of

the new revenue for transportation, it did not follow the House in

designating any portion for local aid. Cities and towns will remain at

the mercy of the Legislature.

More generally, the entire “restoration” of services depends upon funds

that have not yet been collected and may never be, depending upon the

course of the economy and the unpredictable nature of consumer spending

and business activity in response to tax hikes. The Senate’s action

represents a multi-part gamble, of the kind that makes economists

blanch: that the national economy will improve, that the governor will

be unable to make good on his veto threat (if he issues a veto at all),

and that Massachusetts residents won’t take even more of their dollars

to cyberspace and the Granite State.

With stakes like those in play, who needs a casino?

The MetroWest Daily News

Thursday, May 21, 2009

How to tell the 'reform' sizzle from the steak

By Steve Poftak/ Guest columnist

Tax increases come out of your wallet immediately. But will the reforms

we were promised before new revenues come at all?

The House took less than three hours to debate and pass a 25 percent

increase in the sales tax. Contrast that with the extended agony that

accompanied incremental pension and transportation reforms, most of

which were swept away in seconds of closed-door lobbying.

Yes, we will see some reforms this legislative session, but they

threaten to be more sizzle than steak. As a public service, here's how

to identify various categories of sizzle:

= Plugging

small leaks as the dam collapses: The several variations of pension

reform floating around the Legislature take an incremental approach to a

few of the most obvious abuses. Unfortunately, they fail to get at the

root of the problem - a system governed by those who benefit from it is

an invitation to create new loopholes.

= Rube

Goldberg contraptions: It has been generally acknowledged that the

state's health insurance plan, also known as the Group Insurance

Commission, has controlled health care costs better than the smaller

plans operated by independent state authorities, such as the MBTA. Yet,

rather than requiring MBTA employees to join the GIC, the Senate's

transportation reform plan calls for a state agency to pass regulations

that set up the framework for a study, including a savings threshold,

then conduct the study to see if savings meet the threshold. Only then

would it be decided if workers and retirees at the MBTA would be forced

to join the state health insurance plan. Got that?

= Take

credit now, pay much, much later: Proposed MBTA pension reforms would

only affect new employees. This means that savings won't be achieved

until the new employees pass the old retirement age threshold, sometime

in the 2030s. The sales tax hike will kick in this year.

= Be For It,

Until You Are Against It: The House Ways & Means Committee released its

budget proposal with the very high profile elimination of funding for

the Quinn Bill. A majority of the committee then signed onto amendments

restoring the funding.

= Not Enough

Time in this Session: This is the last resort. Despite the House's

voting to raise the sales tax in three hours, it seems reform measures

require multiple hard-to-schedule hearings, committee votes, special

caucuses, and an eternity in the purgatory of first, second and third

readings. Why don't we consider revenue increases last on the calendar?

If we run out of time to consider reforms, then new taxes should be off

the table.

The House passed a 25 percent increase in the sales tax during the worst

recession in a generation. They did it quickly, with minimal debate, and

by a veto-proof margin. Keep an eye on the reform promises and ask

yourself if they save real money, or fit into one of the categories

listed above. Then ask your representative and senator the same

question.

Steve Poftak is research director at

Pioneer

Institute, a non-partisan, Massachusetts public policy think tank.

The Lowell Sun

Thursday, May 21, 2009

A Lowell Sun editorial

Senate disservice

The Senate made a major misstep by voting Tuesday for hefty tax

increases a day before even beginning debate on reform measures. We find

it particularly egregious that, despite the dire fiscal forecast, there

have been no real reductions to state government itself, including

positions and benefits.

Shouldn't legislators have approved pension reform, privatization

measures, wage freezes and health-insurance reductions before placing a

heavier burden on the backs of struggling taxpayers, small-business

owners and local government?

Nothing has been done to repair the structural flaws in state

government. Formulas regarding education aid and charter schools have

not been revised, the Quinn Bill remains in place and state workers are

still slated to receive salary increases.

Currently, Massachusetts' monthly payroll is approximately $268 million.

If the state cut 10 percent of its workforce, it would save nearly $27

million a month. That's about $324 million a year. A 5 percent reduction

in the state payroll would net about $162 million a year. Shouldn't at

least some employee cuts occur at the state level?

Instead, Senate lawmakers joined their House colleagues in approving an

increase in the sales tax to 6.25 percent, garnering a veto-proof

majority that renders meaningless Gov. Deval Patrick's repeated threats

to reject it.

Instead of making the truly tough decisions, the ones that could anger

union leaders, lawmakers have placed the burden solidly on the backs of

taxpayers and local government. Residents will not only have to pay the

increased taxes approved by lawmakers, they will also have to suffer

reduced municipal services necessitated by local-aid cuts and, quite

possibly, pay higher property, meals and hotel taxes that may be raised

to offset the state's cuts to local aid.

Small businesses will also suffer. The higher sales and alcohol taxes

will divert millions of dollars in sales from Bay Staters to tax-free

New Hampshire, resulting in more job losses. The Retailers Association

of Massachusetts estimates the sales-tax increase will result in the

loss of 12,000 jobs.

State lawmakers did their constituents a grave disservice by not making

substantial reforms before raising taxes. It's an injustice that may

well be remembered on Election Day.

The Boston Globe

Thursday, May 21, 2009

Patrick stands firm on pledge to veto tax hike

By Matt Viser

Governor Deval Patrick this afternoon stood by his threat to veto the

sales tax passed by House and Senate lawmakers unless they first approve

a series of reforms that he finds acceptable.

“I will support the sales tax, and have said so all along -- provided we

deliver on the reforms,” Patrick told reporters after swearing in a

judge at the John Adams Courthouse. “Doing the right thing isn’t that

difficult. Everybody knows what the right thing is to do; now let’s get

that done before the budget comes to me next month.”’

When asked if he would veto the entire budget, or just the sales tax

increase, he said: “I’m going to take that part when we come to it. But

there are no good reasons why we can’t get these reforms done.”

The Senate voted this week to raise the sales tax from 5 percent to 6.25

percent, following a similar move by the House last month. Patrick has

threatened to veto the proposal unless several reforms are approved

first, although the House and Senate both achieved veto-proof majorities

in the initial votes.

Today, the governor highlighted several changes he wants lawmakers to

make in the current legislation. On pension reform, he wants the changes

to apply to both current and future employees, while the Legislature has

maintained that they should only apply to future employees.

On ethics reform, he wants the overhaul to the state ethics laws to

strengthen the state Ethics Commission; the Senate version of the bill

would weaken that agency.

Patrick also said he would also keep pushing for a 19-cent-per-gallon

increase in the state’s gas tax, which lawmakers have dismissed. “I

still think it’s the best way,” Patrick said.

Patrick’s public stance on the sales tax has aggravated lawmakers and

caused a rift among top Democrats on Beacon Hill.

“This ought not be so hard,” Patrick said. “And it’s not about anything

personal. All I’m asking is that we change a few things, and that we

change them in ways that I care about and I think the public cares

about.”

“The legislature, to their credit, has done what they believe is the

hard work now by taking the votes on the budget and on the sales tax,”

Patrick said. “Now let’s do what I think is the easy stuff and deliver

some real and lasting reforms.”

“It’s not complicated,” he added. “They know what the right thing is to

get done.”

The Boston Herald

Thursday, May 21, 2009

Veto urged as resistance to tax hike grows

By Hillary Chabot

A veteran lawmaker who said his region near the New Hampshire border

would be decimated by the 25 percent sales tax hike believes Gov. Deval

Patrick - who vowed to veto the increase - still has time to erode a

thin veto-proof majority.

“This governor is a great politician. He could change it if he wants

to,” said Rep. James R. Miceli (D-Wilmington) of the vote by which the

tax hike passed in the House. “That vote isn’t as solid as it appears to

be.”

Patrick went on the offensive again yesterday, calling Tuesday’s vote in

the state Senate to hike the sales and booze taxes a slap in the face to

working-class families.

“To ask them to dig deeper into their pockets for higher taxes without

first adopting meaningful reforms is thumbing our nose at them,” Patrick

said in a statement.

Patrick met with a group of House lawmakers shortly after they passed

the 25 percent sales tax hike in April by a veto-proof margin of two

votes, and indicated to reporters the votes were soft. Patrick would

need only three votes to uphold his veto in the Senate.

The Senate approved a total of nearly $1 billion in tax hikes Tuesday

night, increasing sales tax to 6.25 percent on the dollar, removing the

sales tax exemption on alcohol, and allowing cities and towns to

increase meals and hotels taxes by 2 percent.

Outraged small businesses and tax watchdogs promised yesterday they’ll

be heard on the hikes, be it at a rally planned for the State House

steps today or at the voting booth in November.

“It’s completely out of control,” said Barbara Anderson,

executive director of Citizens for Limited Taxation. “The only

thing they care about is not getting re-elected. We have to throw them

out.”

Corie Whalen, who organized the conservative anti-tax Tea Party in

Boston last month, invited anti-tax citizens to gather at the State

House starting at 11 a.m. today.

“They’re misleading people when they act like necessary cuts have to be

made when they haven’t worked to clear up real waste,” Whalen said.

Jeff Golden, a buyer at Downtown Wine & Spirits in Somerville, said the

vote to remove the sales tax exemption from liquor at package stores

means many smaller shops would close their doors.

“It’s frustrating for a smaller place. We’re operating on the margins

already,” said Golden. “We’re going to have a hard time convincing

people to come here when they can get it for less in New Hampshire.”

The Boston Herald

Friday, May 22, 2009

Libertarian eyes sales-tax ballot battle

By Thomas Grillo

Six months after a ballot question to repeal the state’s income tax was

crushed by voters, Libertarians are considering a vote to repeal the

sales tax.

“The only difference between Bernie Madoff and the government is that

what Madoff did was illegal and what the government is doing is legal,”

said Carla Howell, president of the Center for Small Government.

The group will hold a summit at the Marriott in Newton on Sat., June 6,

to discuss ways to shrink government.

“No decisions have been made, but the possibility of a ballot question

to eliminate the sales tax is definitely on the table,” she said.

Earlier this week, the Senate voted to raise the state’s 5 percent sales

tax to 6.25 percent, generating an extra $633 million for the next

fiscal year. The House approved a similar measure last month. Both votes

passed by veto-proof margin. Still, Gov. Deval Patrick has threatened to

veto the increase unless the Legislature approves reforms.

If Howell’s group decides to try to gather the thousands of signatures

to get the question on the ballot, it will have to do it alone.

Barbara Anderson, president of Citizens for Limited Taxation,

said while she supports the elimination of the sales tax, her members

will not gather signatures.

“We cannot ask our members to put all this effort and money into

something that can only work if the Legislature respects the voters’

decision - and they don’t,” she said. “Instead, we are focused on

defeating legislators who vote for these tax increases. That’s the only

thing that matters.”

Harris Gruman - chairman of Stop the Cuts Coalition that helped defeat

the proposed elimination of the income tax last year - said he opposes

repealing the sales tax.

“It’s a risky idea,” he said. “The sales tax increase is part of a

necessary response to a crisis. If we only cut our way out we will leave

the state in a shambles.”

Last November, Howell pushed Question 1 which would have repealed the

state income tax. But the measure failed by a 70 percent to 30 percent

margin leaving nearly $13 billion in revenues for the state

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

|