CLT UPDATE

Wednesday, December 7, 2006

Is the next "Massachusetts Miracle"

upon us?

MTF gives state borrowing the green light, again

The state has to borrow an additional $600 million

this month to address a short-term cash-flow shortage and meet

end-of-the-year local aid payments to cities and towns, prompting

warnings from the Romney administration and the state treasurer that the

Commonwealth is spending at a perilous pace.

Treasurer Timothy P. Cahill and Thomas H. Trimarco, the secretary of

administration and finance, sent a joint letter to lawmakers late

yesterday outlining a plan to borrow the $600 million, which would be in

addition to $300 million the state borrowed last month for the same

purpose.

The $900 million total the state is borrowing to cover its current

obligations is the highest such amount in at least six years and will

cost taxpayers $12 million in borrowing costs....

News of the borrowing follows Governor Mitt Romney's decision last month

to cut about $425 million in spending, which he cast as a corrective

measure made necessary by overspending by the largely Democratic

Legislature....

Yesterday, Romney's communications director, Eric Fehrnstrom, said

short-term borrowing is a step the state takes annually, but that the

high amount the Commonwealth is borrowing this year "underscores the

wisdom" of Romney's spending reductions last month.

"There is a now-typical pattern of tightening in the Commonwealth's cash

position in the second and third quarters of the fiscal year, but this

year it has been exacerbated by the fact that the Legislature is

spending at a high rate," Fehrnstrom said....

In their letter to DeLeo and Murray, Cahill and Trimarco cite as a

reason for the borrowing $935 million in spending that the Legislature

authorized in the prior fiscal year but that was carried forward to this

fiscal year and is projected to be spent by June....

Michael Widmer of the Massachusetts Taxpayers Foundation, one of the

state's leading fiscal watchdogs, said he thinks the amount of borrowing

should result in a "cautionary note" but is no cause for alarm.

"It's certainly a yellow flag, and it reflects the fact that the

spending increases in [fiscal year] 2007 were ... larger than they

should have been," he said. "But at the same time, tax revenues are

likely to cover the spending increases in 2007 when the year ends."

The Boston Globe

Tuesday, December 5, 2006

Spending by state prompts warnings

Further loan of $600m needed for year's end

Two documents released this week ought to temper the urge

towards irrational exuberance exhibited by those looking forward to the new era

of Democratic hegemony on Beacon Hill.

The governor-elect, Deval Patrick, continues to keep his own

counsel regarding the budget. But some of those who were in his camp, along with

certain members of the Legislature, seem poised to embark on a spending spree

the likes of which has not been seen since William Weld took office in 1991.

But Monday the outgoing Republican administration and Democratic State Treasurer

Timothy Cahill warned in an unusual joint letter to lawmakers that the amount of

short-term borrowing required in order for the state to meet its obligations so

far this year is reason for concern. In contrast to the $200 million the state

had borrowed to this point in 2005, it's already had to go to the short-term

market for $900 million in order to pay its bills through December....

It appears that in the wake of Patrick's victory, talk of an income-tax rollback

has gone by the wayside. But we don't sense any appetite for a tax increase. On

the other hand, there are those clamoring for the state to spend more on

everything from local aid to park maintenance.

A Salem News editorial

Wednesday, December 6, 2006

Now's not time to take lid off state spending

Over-exuberant spending on Beacon Hill hasnít yet put

Massachusetts on the brink of fiscal disaster, but the extraordinary level of

borrowing this year to keep the government afloat should be a wake-up call.

While short-term loans in anticipation of tax collections are not unusual, the

amount of borrowing this year is the biggest this decade....

Moderate economic growth in recent years has resulted in billions of dollars in

revenue surpluses, but the unanticipated collections largely have evaporated in

a series of "supplementary spending" sprees.

The budgetary brinksmanship continued this fiscal year. Lawmakers balanced the

budget, but only by reneging on the income tax rollback and drawing deeply on

"rainy-day" funds ó while overriding Gov. Mitt Romneyís efforts to rein in

spending.

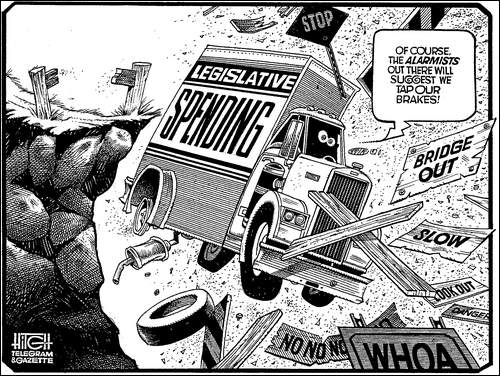

A Telegram & Gazette editorial

Wednesday, December 6, 2006

Cash crunch

Stateís short-term borrowing hits $900 million mark

The Telegram & Gazette

December 6, 2006

Editorial Cartoon by David Hitch

Voters in Massachusetts cities and towns have

rejected two-thirds of proposed property tax overrides this year,

reflecting widespread distaste for higher property taxes, according to a

Globe review of state property tax records.

The rejections marked the first time this decade that more proposed

Proposition 2Ĺ overrides failed than passed....

Approximately 59 override votes have been rejected, while 30 have been

approved, the lowest rate since at least 1999....

"In times of fiscal distress, where communities are making cuts and

increasing their reliance on property tax, you do hit a point of voter

fatigue, where the voter passage rates start to decline," said Geoffrey

Beckwith, executive director of the Massachusetts Municipal

Association....

A town official in Newbury -- where a number of overrides have been

struck down in recent years, including two this year -- said tax

increases are a tough sell, politically.

"I've been approached on the street by citizens saying, 'How many times

do we have to tell you no? Stop asking us to raise our taxes,'" said

Vincent J. Russo, chairman of the Board of Selectmen. "We are at the end

of our ropes here as far as overrides." ...

Critics, however, say that local officials became overly accustomed to

the economic prosperity of the 1990s and expanded services too rapidly

and signed off on overly generous collective bargaining agreements

during the boom....

But, as a further sign that taxpayers are squeamish about raising taxes,

debt exclusions also failed far more frequently this year. Less than

half of the 219 debt exclusions on the ballot this year were approved,

while 85 percent were approved in 2001, according to the Globe analysis.

"We've seen a broad decline in local services across the Commonwealth

over the last several years, first with cuts to local aid and then

voters' reluctance to approve overrides," said Michael J. Widmer,

president of the Massachusetts Taxpayers Foundation....

The average override attempt this year was $630,160, highest in three

years, according to the Globe analysis.

The Boston Globe

Saturday, December 2, 2006

Voters saying enough to Proposition 2Ĺ overrides

More localities now reject efforts

My first reaction to Gov.-elect Deval Patrickís plan to use

his grassroots organization to influence debate on Beacon Hill is akin to my

reaction when I come across a particularly explicit medical documentary on TV --

equal parts revulsion and fascination.

The idea of all those drivers with the "Together, we can" bumper stickers still

on their cars using their hands-free cellphones to call the State House operator

should be enough to make every taxpayer left off Patrickís e-mail list queasy.

For one thing, the Democratic convention delegates, caucus-goers, union local

leaders, town meeting goers and coat-holders of mayors and selectman arenít

really "grassroots," or the voice of the people, in the way, say, the 170,000

voters who want a vote on gay marriage or majority of voters who supported the

income tax rollback are grassroots.

The Patrick enthusiasts are activists. And they are just as likely to influence

policy debates for their own purposes as any well-heeled lobbying group such as

the trial lawyers or teachersí unions....

Call me a cynic but I have goose bumps, too, for a far different reason. The

incoming administration which said "grassroots is not just a strategy for

winning but a strategy for governing" is in danger of using the grassroots as a

strategy for manipulating.

The Boston Herald

Tuesday, December 5, 2006

Devalís grassroots more like AstroTurf:

Silent majority remains silenced

By Virginia Buckingham

President Bush recently signed into law the Pension

Protective Act of 2006 in an effort to strengthen the financial health of

corporate defined benefit pension plans. However, little attention is paid to a

retirement sector in even greater financial straits: state government pension

plans. These plans are facing a $1.3 trillion shortfall that presents a serious

threat to their very survival -- as well as to every taxpayer in the country....

At first glance, state plans seem to be nearly as healthy as their corporate

counterparts: they face a shortfall of $348 billion under current accounting

rules, according to the National Association of State Retirement Administrators.

This implies they are 86 percent funded, versus 90 percent for corporate plans.

However, these projections are misleading. The real shortfall of state-defined

benefit pension programs is closer to $1.3 trillion, which translates into the

plans being 64 percent funded. This alarming gap could set off a crisis whose

magnitude would dwarf the $200 billion government bailout of the savings and

loan industry in the 1980s. Just as disturbing, this threat is largely ignored

because of opaque accounting....

States must be honest about their pension liabilities and the true value of plan

underfunding.

The Boston Globe

Tuesday, November 28, 2006

The ticking time bomb in state pensions

By Thomas J. Healey

When Michael Travaglini [brother of Senate President Robert]

received a $42,000 pay raise in August, upping his annual salary to $322,000, it

made for big headlines in The Boston Herald, which alleged that Travaglini, even

without the raise, was already receiving a fatter annual paycheck than everyone

else in state government....

Travaglini had compensation on his mind again and publicly informed state

Treasurer Timothy Cahill and the other eight members of the state pension fund

board that he plans to weigh their "appetite" and look for a "consensus" about

changes in the compensation packages of 22 other employees at the $45 billion

pension fund....

Outgoing board member Peter Schwarzenbach, a Romney appointee, encouraged the

board to make sure any changes in compensation structures incorporate incentives

based on performance. "You donít want a bonus to be a slam dunk every year,"

said Schwarzenbach. "The challenge is to do it right." ...

The board today signed off on an expansion of employee family and medical leave

benefits that fund officials said would bring those benefits on par with

benefits received by most state employees.

State House News Service

Tuesday, December 5, 2006

From top of pay ladder, Travaglini goes to bat

for pension fund employees

Chip Ford's CLT Commentary

Aw geez, here we go again, already -- and the

incoming Democrat governor hasn't even been sworn it yet.

The state -- the Legislature -- is already

intent on borrowing almost another billion taxpayers' bucks, just to get

through this fiscal year after its revenue surplus feeding

frenzy.

"It's certainly a yellow flag, and it reflects the

fact that the spending increases in [fiscal year] 2007 were ... larger

than they should have been," said Michael Widmer, president of the

so-called Massachusetts Taxpayers Foundation, before again providing

cover for more increased spending -- and borrowing. "But at the same

time, tax revenues are likely to cover the spending increases in 2007

when the year ends," he concluded, optimistically.

But Widmer and MTF have always opposed our tax

rollback -- because the state can't possibly afford the revenue loss.

Hey, borrow away Beacon Hill -- Widmer and MTF,

"one of the state's leading fiscal watchdogs," just gave you the

green light, as usual. Just make sure that the $12 million

taxpayer dollars in interest payments makes it into the bankers'

coffers. I wonder why nobody mentioned that MTF's fat-cat members

include major banking corporations across the state?

C'mon Michael, tell us when state borrowing is too

much -- is there such a limit at MTF?

Who could possibly imagine? "Voters in

Massachusetts cities and towns have rejected two-thirds of proposed

property tax overrides this year, reflecting widespread distaste for

higher property taxes." Perhaps they've reached their taxation

saturation point -- when they can't feed and house themselves, their

families, and continue paying for government spending sprees at

all levels? The nice thing about Proposition 2Ĺ

tax increases is, taxpayers can say no to them.

"Critics, however, say that local officials became

overly accustomed to the economic prosperity of the 1990s and expanded

services too rapidly and signed off on overly generous collective

bargaining agreements during the boom...." Uh huh, gee whiz

what a surprise! [See: "Embarrassment

of Riches" from 1999] It's not like overspending snuck up on

municipal "leaders," or even that they learned anything from past

profligacy since their state taxpayer-funded gravy train slowed down.

Is there any wonder why voters have said no in

record numbers lately?

And there it is again, another "ticking

time bomb" warning about public sector pensions. But nobody

receiving a public pension gives a whit -- it's just "Gimme more, more,

more; I'm special, and protected!"

"States must be honest about their pension

liabilities and the true value of plan underfunding," wrote Thomas J.

Healey, currently a senior fellow at Harvard University's Kennedy School

of Government, with many other credentials as an economist within

government.

Meanwhile, here in Taxachusetts (and please,

nobody tell me again that this term is obsolete), the Senate President's

brother, Michael Travaglini -- as executive director of the state

pension fund, one of the two highest-paid state employees in

Massachusetts ($322,000/year) -- "signed off on an expansion of employee

family and medical leave benefits that fund officials said would bring

those benefits on par with benefits received by most state employees."

"On par"? Lucky them. Your less fortunate grandchildren will be paying for

that and much more by then at this rate -- but they can't

vote yet.

|

|

Chip Ford |

The Boston Globe

Tuesday, December 5, 2006

Spending by state prompts warnings

Further loan of $600m needed for year's end

By Scott Helman, Globe Staff

The state has to borrow an additional $600 million this month to address

a short-term cash-flow shortage and meet end-of-the-year local aid

payments to cities and towns, prompting warnings from the Romney

administration and the state treasurer that the Commonwealth is spending

at a perilous pace.

Treasurer Timothy P. Cahill and Thomas H. Trimarco, the secretary of

administration and finance, sent a joint letter to lawmakers late

yesterday outlining a plan to borrow the $600 million, which would be in

addition to $300 million the state borrowed last month for the same

purpose.

The $900 million total the state is borrowing to cover its current

obligations is the highest such amount in at least six years and will

cost taxpayers $12 million in borrowing costs. The reason for the

borrowing is that the state has bills due now, but won't receive much of

its revenue until the first six months of 2007.

Still, state officials expect to pay off the debt as tax payments come

in over the next several months, and they anticipate ending the fiscal

year on June 30 with a balanced budget.

But that assumes that 2007 revenues will meet or exceed expectations,

Cahill said, and the unusually high amount of borrowing this year should

send a message to the Legislature and Governor-elect Deval L. Patrick

that they need to be cautious in approving new spending.

"I want to prepare the incoming administration and the Legislature for

what could be some tough times," Cahill said in an interview yesterday.

"They need to know the truth, and the truth is we have a cash-flow

crunch, maybe not a crisis, but certainly a cash-flow shortage. It's not

good for a household, and it's not good for government."

News of the borrowing follows Governor Mitt Romney's decision last month

to cut about $425 million in spending, which he cast as a corrective

measure made necessary by overspending by the largely Democratic

Legislature. Romney restored $42 million of the cuts last week after tax

revenues for November came in well above expectations.

The cuts Romney made to the budget last month affect the overall amount

the state will spend this fiscal year. The amount of borrowing outlined

yesterday pertains only to a short-term gap between expenditures and

revenues and does not change the bottom line, beyond the $12 million in

borrowing costs.

Yesterday, Romney's communications director, Eric Fehrnstrom, said

short-term borrowing is a step the state takes annually, but that the

high amount the Commonwealth is borrowing this year "underscores the

wisdom" of Romney's spending reductions last month.

"There is a now-typical pattern of tightening in the Commonwealth's cash

position in the second and third quarters of the fiscal year, but this

year it has been exacerbated by the fact that the Legislature is

spending at a high rate," Fehrnstrom said.

The strain on the state budget usually occurs at this point in the year.

Last fiscal year, according to figures provided by Fehrnstrom, the state

borrowed $200 million at this point in the year. In fiscal year 2005,

the state borrowed $700 million, and in fiscal year 2004 it borrowed

$450 million. In fiscal years 2003 and 2002, the state borrowed $700

million and $800 million, respectively.

A spokesman for House Ways and Means chairman Robert A. DeLeo said

yesterday that the borrowing was standard operating procedure and does

not portend anything ominous.

"In order to make the payments, we do some short-term borrowing, but it

all evens out in the end," said the spokesman, James Eisenberg. "In

short, the fact that we are doing cash-flow management borrowing is not

an indicator of a cash-flow problem."

A spokeswoman for the Senate Ways and Means chairwoman, Therese Murray,

declined to comment.

Cyndi Roy, a spokeswoman for Patrick's transition team, said: "We would

appreciate the treasurer's counsel, but we reserve any comment until we

see a letter and have further discussions about the budget."

Cahill, a Democrat, supported Patrick in the gubernatorial campaign.

In their letter to DeLeo and Murray, Cahill and Trimarco cite as a

reason for the borrowing $935 million in spending that the Legislature

authorized in the prior fiscal year but that was carried forward to this

fiscal year and is projected to be spent by June.

The cash shortage, according to Cahill and Trimarco, also stems in part

from a transfer last month of $354 million to the stabilization fund and

more than $100 million in payments the state has to make on the Big Dig

until the US government releases more federal funds.

At the same time, the state owes cities and towns another $1.2 billion

in quarterly local aid payments by the end of the month.

"It seems to be that we're spending more money than we're bringing in,"

Cahill said in the interview.

Cahill pointed out that during the state's last recession, in 2001, the

state saw a large drop-off in capital gains revenue after the stock

market suffered major losses. While he doesn't expect that to happen

again, a significant reduction in real estate values could produce a

similar result, he said, and it is important to be cautious about

spending.

Michael Widmer of the Massachusetts Taxpayers Foundation, one of the

state's leading fiscal watchdogs, said he thinks the amount of borrowing

should result in a "cautionary note" but is no cause for alarm.

"It's certainly a yellow flag, and it reflects the fact that the

spending increases in [fiscal year] 2007 were ... larger than they

should have been," he said. "But at the same time, tax revenues are

likely to cover the spending increases in 2007 when the year ends."

Patrick is already under pressure from the Massachusetts Municipal

Association, which represents cities and towns, to commit to providing

more local aid. The state boosted local aid about 9 percent overall this

year, said Geoffrey Beckwith, the group's executive director, but

communities are still receiving 13 percent, or about $680 million, less

than they received in 2001-2002, after inflation is taken into account.

Cahill said he believes it's important for state officials to tread

carefully.

"I don't want to sound like an alarmist, but at the same time I don't

want to paper over it," Cahill said. "I'm here as the state's chief

financial officer to make sure that both the Legislature and incoming

administration understand that we're not out of the woods yet."

The Salem News

Wednesday, December 6, 2006

A Salem News editorial

Now's not time to take lid off state spending

Two documents released this week ought to temper the urge towards

irrational exuberance exhibited by those looking forward to the new era

of Democratic hegemony on Beacon Hill.

The governor-elect, Deval Patrick, continues to keep

his own counsel regarding the budget. But some of those who were in his

camp, along with certain members of the Legislature, seem poised to

embark on a spending spree the likes of which has not been seen since

William Weld took office in 1991.

But Monday the outgoing Republican administration and Democratic State

Treasurer Timothy Cahill warned in an unusual joint letter to lawmakers

that the amount of short-term borrowing required in order for the state

to meet its obligations so far this year is reason for concern. In

contrast to the $200 million the state had borrowed to this point in

2005, it's already had to go to the short-term market for $900 million

in order to pay its bills through December.

Now most, if not all, of that money will be repaid as tax payments flow

into state coffers after the first of the year. But that's the most the

state has had to borrow in six years which, even if it does not result

in a deficit, adds to the cost of doing business. (Interest on those

short-term loans is expected to total about $12 million.)

Healthy tax revenues are a function of a robust economy, and on that

score the Associated Industries of Massachusetts had some sobering news

in a report also issued Monday. Its Business Confidence Index was down

four-tenths of a point from the previous month -- not terribly ominous,

but disappointing after having gone up significantly in three of the

previous five months.

More encouraging was some of the narrative accompanying the latest A.I.M.

report in which members of its board of economists predicted a fairly

smooth ride for the regional and national economy over the next six

months.

"Survey respondents expected Massachusetts conditions to improve

slightly in the six months ahead," noted John Bitner, chief economist

for Eastern Bank.

Richard Lord, A.I.M.'s president and CEO, said the outcome of last

month's election appeared to have had little impact on business

confidence, adding, "The Index's performance over the past two months

suggests that the state's employer community is not alarmed by the

prospect of a Democratic governor and one-party government. In his

campaign, Governor-elect Patrick accurately identified the key economic

issues facing the commonwealth and pledged to address them cooperatively

-- a challenge that is now before him."

It appears that in the wake of Patrick's victory, talk of an income-tax

rollback has gone by the wayside. But we don't sense any appetite for a

tax increase. On the other hand, there are those clamoring for the state

to spend more on everything from local aid to park maintenance. And

certainly the new governor will face some difficult decisions come

January such as whether to restore the $380 million worth of spending

cuts imposed the Romney administration last month.

With the state's economy still in a precarious state, this is a

difficult balancing act on which Patrick is about to embark.

The Telegram & Gazette

Wednesday, December 6, 2006

A Telegram & Gazette editorial

Cash crunch

Stateís short-term borrowing hits $900 million mark

Over-exuberant spending on Beacon Hill hasnít yet put Massachusetts on

the brink of fiscal disaster, but the extraordinary level of borrowing

this year to keep the government afloat should be a wake-up call.

While short-term loans in anticipation of tax collections are not

unusual, the amount of borrowing this year is the biggest this decade.

In a letter to the Legislature on Monday, Treasurer Timothy P. Cahill

and Thomas H. Trimarco, secretary of administration and finance,

outlined a plan to borrow $600 million ó in addition to the $300 million

the state had to borrow last month.

Mr. Cahill told the Boston Globe the joint letter was intended to

prepare lawmakers and the new administration for a period of

belt-tightening. "They need to know the truth, and the truth is we have

a cash-flow crunch," he said. "That's not good for a household and itís

not good for government."

The warning is warranted.

Moderate economic growth in recent years has resulted in billions of

dollars in revenue surpluses, but the unanticipated collections largely

have evaporated in a series of "supplementary spending" sprees.

The budgetary brinksmanship continued this fiscal year. Lawmakers

balanced the budget, but only by reneging on the income tax rollback and

drawing deeply on "rainy-day" funds ó while overriding Gov. Mitt

Romneyís efforts to rein in spending.

Fiscal prudence should always be the watchword. The fact that the full

budgetary impact of the stateís new health insurance law is yet unknown

makes restraint especially important now.

Moreover, there will be little progress on Gov.-elect Deval L. Patrickís

ambitious agenda ó such as the aid boost he envisions to reduce local

property tax bills ó if his administration arrives on Beacon Hill only

to find the state coffers have been drained.

The Boston Globe

Saturday, December 2, 2006

Voters saying enough to Proposition 2Ĺ overrides

More localities now reject efforts

By Matt Viser, Globe Staff

Voters in Massachusetts cities and towns have rejected two-thirds of

proposed property tax overrides this year, reflecting widespread

distaste for higher property taxes, according to a Globe review of state

property tax records.

The rejections marked the first time this decade that more proposed

Proposition 2Ĺ overrides failed than passed. In previous years, the

votes had been far more successful, with residents agreeing to increase

their property taxes in order to avoid cutting positions for teachers,

police officers, and firefighters or to pay for renovating

municipal-owned buildings.

This year, one-third of the Proposition 2Ĺ overrides passed.

Approximately 59 override votes have been rejected, while 30 have been

approved, the lowest rate since at least 1999. In 2005, 94 proposals

passed, and 79 failed. In 2001, two-thirds of the proposed overrides

were approved. Some muncipalities put more than one question before

voters.

"In times of fiscal distress, where communities are making cuts and

increasing their reliance on property tax, you do hit a point of voter

fatigue, where the voter passage rates start to decline," said Geoffrey

Beckwith, executive director of the Massachusetts Municipal Association.

Twice -- once in May and later in September -- voters in Granby, in

Western Massachusetts, were asked to provide $19,390 to pay for a town

dog officer. Both times they rejected it.

In Northfield, a rural community in central Massachusetts, a request for

$3,540 for emergency medical technician salaries failed by five votes.

And in Lexington, an affluent community with a prized school system that

rarely votes against overrides, two overrides worth $3.2 million that

would have gone toward education failed this year. As a result, 31

teaching positions were cut, along with several other programs.

"This is a community that's had it up to its eyeballs with residential

property taxes," said Jed Snyder, chairman of the "No -- The Best For

Lexington 2006" committee in Lexington. "When you've had these huge

increases in recent years, something has to give." A town official in

Newbury -- where a number of overrides have been struck down in recent

years, including two this year -- said tax increases are a tough sell,

politically.

"I've been approached on the street by citizens saying, 'How many times

do we have to tell you no? Stop asking us to raise our taxes,'" said

Vincent J. Russo, chairman of the Board of Selectmen. "We are at the end

of our ropes here as far as overrides."

Governor-elect Deval L. Patrick made the state's tax situation one of

his campaign themes, arguing that a cut in the state income tax proposed

by Republicans would increase pressure on cities and towns to increase

property taxes. His running mate, Timothy P. Murray, also argued that

because he was the mayor of Worcester, he would be a better advocate for

cash-strapped municipalities.

Patrick has said that he would look to reap savings for communities by

taking a more regional approach to municipal services.

Property tax specialists say cities and towns are still recovering from

the state's fiscal crisis four years ago, when the annual money that the

state provides to municipalities was cut, causing them to become more

reliant on property taxes. The state has since increased aid, but not

enough to offset the years of cutbacks.

Critics, however, say that local officials became overly accustomed to

the economic prosperity of the 1990s and expanded services too rapidly

and signed off on overly generous collective bargaining agreements

during the boom.

Property taxes, which vary widely and range from about $1,000 to

$13,000, go toward paying for all types of municipal services, from

teacher salaries to trash pickup. The state's Proposition 2Ĺ law, which

was approved by voters in 1980, restricts cities and towns from raising

the overall tax levy by more than 2 percent in one year unless voters

approve a local override.

Municipalities have also used the Community Preservation Act, another

way to put a surcharge on tax bills and use the money for certain local

projects. Voters can also consider another type of override called a

debt exclusion, which usually goes to a specific project, such as a new

school or renovations of town hall, and does not permanently affect the

tax levy.

But, as a further sign that taxpayers are squeamish about raising taxes,

debt exclusions also failed far more frequently this year. Less than

half of the 219 debt exclusions on the ballot this year were approved,

while 85 percent were approved in 2001, according to the Globe analysis.

"We've seen a broad decline in local services across the Commonwealth

over the last several years, first with cuts to local aid and then

voters' reluctance to approve overrides," said Michael J. Widmer,

president of the Massachusetts Taxpayers Foundation.

In Dover, voters approved a $900,000 Proposition 2Ĺ override last year.

But this year, a request for $800,000 failed by 67 votes, which meant

putting off the purchase of a new fire engine and dipping into reserve

accounts to balance the budget.

Still, in several communities, mostly more affluent ones, voters

continue to approve overrides. Wellesley approved a $3.1 million

override in May after approving a $2.6 million override last year. Two

smaller override requests failed this year.

The average override attempt this year was $630,160, highest in three

years, according to the Globe analysis. The Globe examined figures

submitted to the Department of Revenue. Cities and towns are not

required to provide the data.

The Boston Herald

Tuesday, December 5, 2006

Devalís grassroots more like AstroTurf:

Silent majority remains silenced

By Virginia Buckingham

My first reaction to Gov.-elect Deval Patrickís plan to use his

grassroots organization to influence debate on Beacon Hill is akin to my

reaction when I come across a particularly explicit medical documentary

on TV -- equal parts revulsion and fascination.

The idea of all those drivers with the "Together, we can" bumper

stickers still on their cars using their hands-free cellphones to call

the State House operator should be enough to make every taxpayer left

off Patrickís e-mail list queasy.

For one thing, the Democratic convention delegates, caucus-goers, union

local leaders, town meeting goers and coat-holders of mayors and

selectman arenít really "grassroots," or the voice of the people, in the

way, say, the 170,000 voters who want a vote on gay marriage or majority

of voters who supported the income tax rollback are grassroots.

The Patrick enthusiasts are activists. And they are just as likely to

influence policy debates for their own purposes as any well-heeled

lobbying group such as the trial lawyers or teachersí unions.

Under Patrickís strategy, the silent majority will still be silent. And

since the pulse of this unorganized bloc of voters really only gets

taken in the voting booth on Election Day, the Globe story over the

weekend pointing out that Proposition 2Ĺ overrides are being rejected in

ever-increasing numbers is a much better indicator for lawmakers of the

vox populi on the tax issue, just to pick one, than artificial pressure

generated by the Patrick machine.

This doesnít diminish that Patrick won the election by a huge margin.

But polls showed that even most voters supporting him disagreed with his

stances on taxes and illegal immigration, for example. Thus, neither the

media nor an inundated legislator should mistake a cascade of calls,

e-mails or postcards generated by Patrick maestro John Walsh as any more

representative of public opinion than a badly constructed poll which

oversamples one segment of voters.

Similarly, the Patrick camp is relying on the perception that its

transition process is all about the "power of the people" rather than

insiders to shape a sense of mission or mandate for the new

administration.

In a conference call with reporters yesterday Walsh and Patrick

transition committee co-chair Gloria Larson touted the "most inclusive

process in modern times" in describing some 43 community meetings around

the state designed not only to "welcome input, but solicit it."

But they overstate their success when hyping the turnout of 100 people

in Worcester or 200 in Boston as indicative that "people are hungry" to

participate. It is surely not the Patrick teamís fault that most voters

are too busy getting flu shots or getting a jump on their Christmas

shopping to show up and give their 2 centsí worth on the "creative

economy." But neither should they pretend that their efforts, thus far,

have been some kind of breakthrough in civic engagement.

To his credit, Walsh acknowledged that even though he defines

"grassroots" as going "where people are," the Patrick team is still

trying to understand other ways to broaden involvement. He asked for

suggestions, so hereís one: Link Patrickís grassroots website to other

sites which are not a natural part of the Patrick base, whether that be

taxpayers advocates, free market think tanks, business groups or

conservative bloggers. Prominently post their feedback on various

Patrick initiatives. Invite their participation in community meetings or

State House hearings. Show thereís substance to the statement: "We love

the critics."

When asked whether the assembly of an Internet-based grassroots network

was really, essentially, a propaganda tool, Walsh said, "Communication

is a two-way street." And "what people really want is to be heard."

Larson went so far as to say the enthusiasm she senses for participating

in the Patrick transition gives her goose bumps.

Call me a cynic but I have goose bumps, too, for a far different reason.

The incoming administration which said "grassroots is not just a

strategy for winning but a strategy for governing" is in danger of using

the grassroots as a strategy for manipulating.

The Boston Globe

Tuesday, November 28, 2006

The ticking time bomb in state pensions

By Thomas J. Healey

President Bush recently signed into law the Pension Protective Act of

2006 in an effort to strengthen the financial health of corporate

defined benefit pension plans. However, little attention is paid to a

retirement sector in even greater financial straits: state government

pension plans. These plans are facing a $1.3 trillion shortfall that

presents a serious threat to their very survival -- as well as to every

taxpayer in the country.

State pension programs -- which cover 12.8 million Americans and manage

assets worth $2.3 trillion -- are a pillar of the nation's retirement

system. By comparison, corporate defined benefit pension plans cover

44.1 million participants but possess fewer assets -- about $1.7

trillion.

At first glance, state plans seem to be nearly as healthy as their

corporate counterparts: they face a shortfall of $348 billion under

current accounting rules, according to the National Association of State

Retirement Administrators. This implies they are 86 percent funded,

versus 90 percent for corporate plans.

However, these projections are misleading. The real shortfall of

state-defined benefit pension programs is closer to $1.3 trillion, which

translates into the plans being 64 percent funded. This alarming gap

could set off a crisis whose magnitude would dwarf the $200 billion

government bailout of the savings and loan industry in the 1980s. Just

as disturbing, this threat is largely ignored because of opaque

accounting.

Opaque accounting dramatically distorts the liability side of the

pension ledger. The key question is whether pension plan liabilities are

being properly measured. The liabilities of defined benefit pension

plans are measured by using a discount -- or interest -- rate.

Unlike corporate plans, which must use high-quality corporate bond rates

as their discount rate, state pension plans are allowed to use the much

higher expected return on the assets they manage, artificially shrinking

their liabilities.

This practice perniciously disguises the actual health of state-funded

pension programs. As with corporate plans, state plans should be

discounted using long-term corporate bond rates instead of the expected

rate of return on assets, which is the current practice of most state

governments.

Consider how distorting this practice is. Specifically, the average

expected return on assets across state pension plans today is about 7.89

percent, according to the NASRA. Based on this return, their liabilities

are estimated at $2.5 trillion. If, however, the plans use as their

discount rate the more credible 10-year Treasury rate, at about 4.9

percent, their liabilities would weigh in at $3.5 trillion -- a whopping

42 percent increase.

Startling as this finding is, it simply stems from applying to

state-defined benefit pension plans the same accounting principles that

corporate plans must live by.

In New York City, the chief actuary recently released supplemental

financial projections that show that instead of its public pension plan

being 100 percent funded, the level is only 60 percent if the more

realistic accounting principles of corporations are used. This would

leave New York City with a pension deficit of $49 billion.

States must be honest about their pension liabilities and the true value

of plan underfunding. They must then take assertive steps to close the

gap through a combination of benefit reductions, tax increases, and

tapping other sources of non recurring revenues. Issuing bonds to fund

pension liabilities, for example, doesn't solve the problem, but it

makes it more visible by moving the obligation onto the state's balance

sheet, thus encouraging more responsible management.

Longer term, states will probably follow in the footsteps of the

corporate sector and both freeze their defined benefit plans and shift

employees to defined contribution plans.

While not as economically advantageous in the long term, the latter are

often more popular among workers and are more transparent. Under defined

contribution programs, politicians would not have the luxury of granting

employees generous pension allowances that state plans are ill-equipped

to afford, or to consistently defer contributions.

And that would be a relief to taxpayers, once they become aware of the

$1 trillion pension bombshell headed their way.

Thomas J. Healey is a retired partner of Goldman Sachs & Co., and

currently a senior fellow at Harvard University's Kennedy School of

Government. He served as assistant secretary of the Treasury under

President Reagan.

State House News Service

Tuesday, December 5, 2006

From top of pay ladder, Travaglini goes to bat

for pension fund employees

By Michael P. Norton

When Michael Travaglini [brother of Senate President Robert] received a

$42,000 pay raise in August, upping his annual salary to $322,000, it

made for big headlines in The Boston Herald, which alleged that

Travaglini, even without the raise, was already receiving a fatter

annual paycheck than everyone else in state government.

It turns out UMass President Jack Wilsonís base salary of $350,000 is

north of Travagliniís, but thatís beside the point of todayís

development and, in the eyes of most taxpayers, merely means that both

men make a lot of money.

Travaglini had compensation on his mind again and publicly informed

state Treasurer Timothy Cahill and the other eight members of the state

pension fund board that he plans to weigh their "appetite" and look for

a "consensus" about changes in the compensation packages of 22 other

employees at the $45 billion pension fund.

"There are people I know whose phones have been ringing," said

Travaglini, referring to pension fund employees being enticed by more

lucrative salaries offered by other pension funds or private sector

companies. He mentioned chief investment officer Stanley Mavromates and

senior investment officer Wayne Smith by their first names.

Describing himself as "frustrated," Travaglini said salaries of some

fund employees, compared to their peers, may be artificially low due to

"headline risk" and suggested that comparative salary data would be

helpful to the board.

He recommended comparing salaries to private corporations, large state

pension funds, and some endowments. "The problem here from a recruitment

and retention perspective is making the total compensation more in line

with sort of the industry standard, not so much the public sector per

se," Travaglini said after the meeting.

Travaglini told the News Service he plans to discuss changes in the

fundís existing bonus program, which permits bonuses of up to 20 percent

of an employeeís salary when pension fund investments exceed policy

benchmarks, something that occurs only through active fund management.

"What Iím going to talk to the board about is revisiting that 20 percent

cap, creating more opportunities for incentives if the fund performs and

meets or exceeds performance expectations," said Travaglini, who also

speculated that UMass President Jack Wilson makes more than him.

At the end of the board meeting, Travaglini broached the salary topic,

which was not on the boardís agenda, by pointing out that fund staffers

had made him aware that the chief investment officer of the South Dakota

pension fund had recently received a $216,000 bonus on top of his

$293,000 annual salary.

He later said he raised the subject in the wake of concerns from two

board members about "sensitivity" to the impact of salary increases on

pensions Ė state employees may receive pensions equaling 80 percent of

their highest salary over three years, a provision that some would like

to rein in. "I literally sprung this on them today and itís an offshoot

from my last salary review," Travaglini said after the meeting.

Board member Robert Brousseau raised the idea of hiring an independent

consultant to look at compensation, but Travaglini, and Cahill, batted

down the idea. "I donít like independent studies," Travaglini said.

Cahill said other boards have used independent consultants primarily to

deflect attention away from their own plans to raise salaries.

Cahill said he was comfortable, both with not hiring an independent

consultant and with Travaglini soliciting input from board members. "I

donít think we need to pay an outside firm," Cahill told the board.

"Itís us making the decision as a group."

Outgoing board member Peter Schwarzenbach, a Romney appointee,

encouraged the board to make sure any changes in compensation structures

incorporate incentives based on performance. "You donít want a bonus to

be a slam dunk every year," said Schwarzenbach. "The challenge is to do

it right."

"Weíre comfortable with pay for performance," Travaglini said after the

board concluded a meeting where members discussed the likelihood of

double-digit returns for the fourth straight year.

At another point in the meeting, as the board discussed non-monetary

benefits to supplement compensation, Travaglini earned a round of

laughter from staffers who lined the conference room when he said, "We

prefer the compensation compensation."

The board today signed off on an expansion of employee family and

medical leave benefits that fund officials said would bring those

benefits on par with benefits received by most state employees.

After serving as senior vice president at Putnam Investments and before

that as first deputy under Treasurer Shannon OíBrien, Travaglini was

appointed in February 2004 by Cahill as executive director of the state

pension fund. The brother of Senate President Robert Travaglini

graduated from Harvard University in 1985 and Georgetown University Law

Center in 1990. He began his career at the Boston law firm Goodwin,

Procter & Hoar.

NOTE: In accordance with Title 17 U.S.C. section 107, this

material is distributed without profit or payment to those who have expressed a prior

interest in receiving this information for non-profit research and educational purposes

only. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

|